International Price Comparisons of Anticancer Drugs: A Scheme for Improving Patient Accessibility

Abstract

1. Introduction

2. Materials and Methods

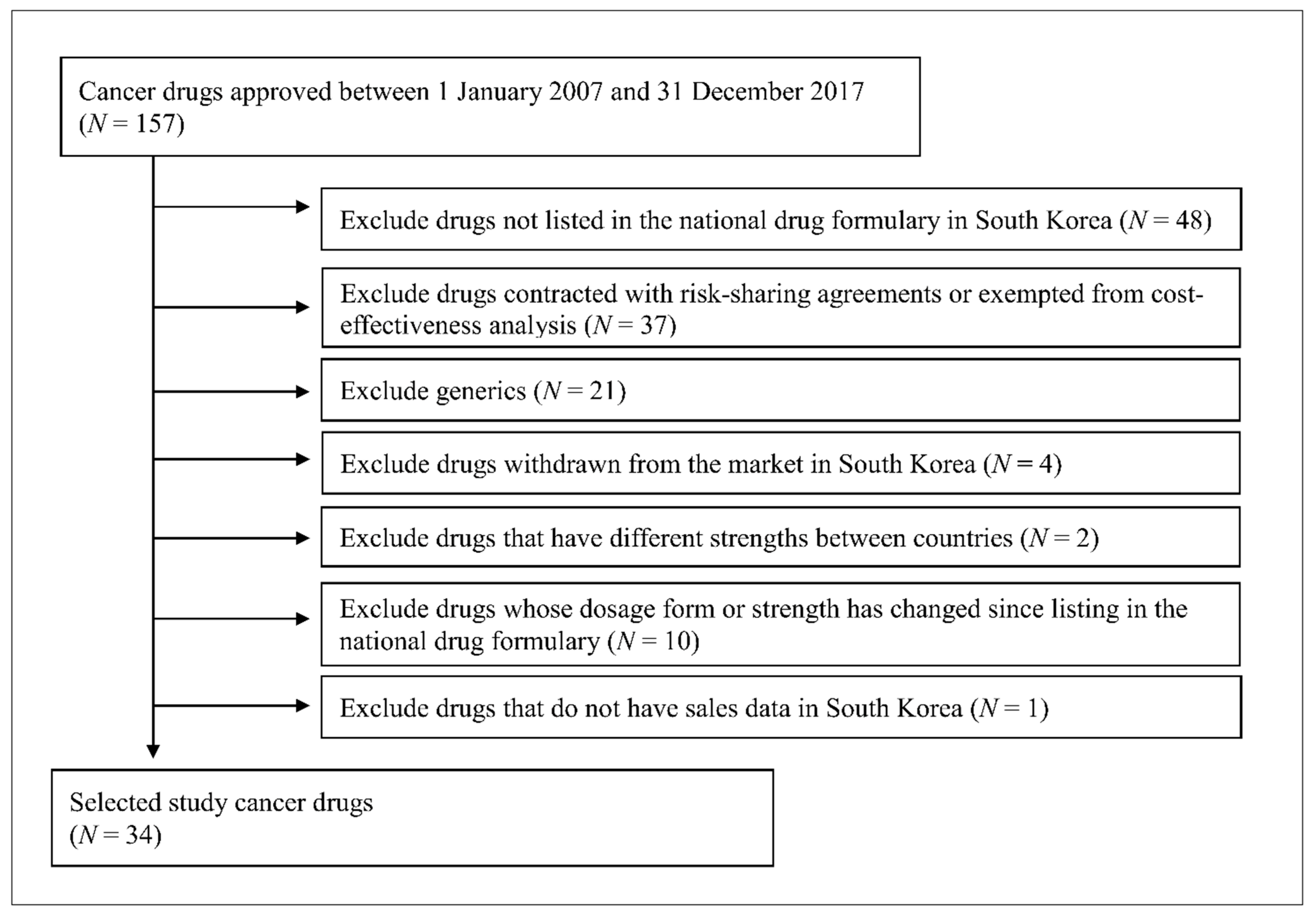

2.1. Selection of Anticancer Drugs and Countries

2.2. Data Sources

2.3. Price Comparison According to Price Indices

2.4. Budget Impact Analysis

3. Results

4. Discussion

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- World Health Organization. Cancer: Key Facts. 2018. Available online: https://www.who.int/news-room/fact-sheets/detail/cancer (accessed on 20 November 2020).

- NIH National Cancer Institute. Cancer Statistics. 2020. Available online: https://www.cancer.gov/about-cancer/understanding/statistics (accessed on 15 November 2020).

- Ministry of Health and Welfare. Korea Central Cancer Registry National Cancer Center. Annual Report of Cancer Statistics in Korea in 2017. 2019. Available online: https://ncc.re.kr/cancerStatsList.ncc?sea (accessed on 15 October 2020).

- Lichtenberg, F.R. Has medical innovation reduced cancer mortality? CESifo Econ. Stud. 2014, 60, 135–177. [Google Scholar] [CrossRef]

- US Food & Drug Administration. Advancing Health Through Innovation: New Drug Therapy Approvals 2019. 2020. Available online: https://www.fda.gov/drugs/new-drugs-fda-cders-new-molecular-entities-and-new-therapeutic-biological-products/new-drug-therapy-approvals-2019 (accessed on 15 November 2020).

- Ministry of Food and Drug Safety. Report of New Drug Approvals in 2019. 2020. Available online: https://www.mfds.go.kr/brd/m_218/view.do?seq=33322 (accessed on 15 November 2020).

- Ferrario, A.; Kanavos, P. Dealing with uncertainty and high prices of new medicines: A comparative analysis of the use of managed entry agreements in Belgium, England, the Netherlands and Sweden. Soc. Sci. Med. 2015, 124, 39–47. [Google Scholar] [CrossRef] [PubMed]

- Klemp, M.; Frønsdal, K.B.; Facey, K. What principles should govern the use of managed entry agreements? Int. J. Technol. Assess. Health Care 2011, 27, 77–83. [Google Scholar] [CrossRef] [PubMed]

- Wenzl, M.; Chapman, S. OECD: Performance-based managed entry agreements for new medicinesin OECD countries and EU member states: How they work and possible improvements going forward. In OECD Health Working Paper: No 15; OECD Publishing: Paris, France, 2019; Available online: https://www.oecd.org/els/health-systems/pharma-managed-entry-agreements.htmbs (accessed on 15 October 2020).

- Pauwels, K.; Huys, I.; Vogler, S.; Casteels, M.; Simoens, S. Managed entry agreements for oncology drugs: Lessons from the European experience to inform the future. Front. Pharmacol. 2017, 8, 1–8. [Google Scholar] [CrossRef] [PubMed]

- Health Insurance Review & Assessment Service. Revised Assessment Standards for Improving Patient Access to Orphan Drugs. In Health Insurance Review & Assessment Service; Health Insurance Review & Assessment Service: Seoul, Korea, 2015. [Google Scholar]

- Korea Cancer Care Alliance. The Current Health Care Coverage for the Cancer Treatments in Korea; Korea Cancer Care Alliance: Seoul, Korea, 2016. [Google Scholar]

- Prada, M.; Berard, I.; Walzer, S.; Darba, J.; Greenwood, B. PCN225: Time to reimbursement for oncology drugs in EU5. Value Health 2018, 21, S47. [Google Scholar] [CrossRef]

- Salek, S.M.; Hoskyn, S.L.; Johns, J.; Allen, N.; Sehgal, C. Pan-Canadian Pharmaceutical Alliance (pCPA): Timeline analysis and policy implications. Front. Pharmacol. 2019, 9, 1578. [Google Scholar] [CrossRef]

- Wouters, O.J.; Kanavos, P.G. A comparison of generic drug prices in seven European countries: A methodological analysis. BMC Health Serv. Res. 2017, 17, 242–248. [Google Scholar] [CrossRef]

- Kos, M. Medicine Prices in European Countries. In Medicine Price Surveys, Analyses and Comparisons; Elsevier: London, UK, 2019; pp. 11–29. [Google Scholar]

- Goldstein, D.A.; Clark, J.; Tu, Y.; Zhang, J.; Fang, F.; Goldstein, R.; Stemmer, S.M.; Rosenbaum, E. A global comparison of the cost of patented cancer drugs in relation to global differences in wealth. Oncotarget 2017, 9, 71548. [Google Scholar] [CrossRef]

- Health Insurance Review & Assessment Service. Revised Evaluation Criteria for Drugs Subject to Negotiation including New Drugs; Health Insurance Review & Assessment Service: Seoul, Korea, 2017. [Google Scholar]

- Ministry of Health & Welfare. Article 9 (4) 5: Guidelines for Adjusting the Upper Limit Drugs Pricing. 2009. Available online: https://www.law.go.kr/flDownload.do?flSeq=3809335&flNm=%5B%EB%B3%84%ED%91%9C+3%5D+%EC%9E%AC%ED%8F%89%EA%B0%80+%EB%8C%80%EC%83%81+%EC%95%BD%EC%A0%9C+%EC%83%81%ED%95%9C%EA%B8%88%EC%95%A1+%EC%A1%B0%EC%A0%95%EA%B8%B0%EC%A4%80%28%EC%A0%9C9%EC%A1%B0%EC%A0%9C4%ED%95%AD%EC%A0%9C5%ED%98%B8+%EA%B4%80%EB%A0%A8%29 (accessed on 15 October 2018).

- ABDA-Federal Union of German Associations of Pharmacists. In German Pharmacies: Figures, Data, Facts 2019; Federal Union of German: Berlin, Germany, 2019.

- Ministry of Health and Welfare. Adoption of Positive List System for Pharmaceuticals; Ministry of Health and Welfare: Seoul, Korea, 2006.

- OECD. Purchasing Power Parities. 2019. Available online: https://data.oecd.org/conversion/purchasing-power-parities-ppp.htm (accessed on 20 February 2020).

- Shi, L.; Hodges, M.; Drummond, M.; Ahn, J.; Li, S.C.; Hu, S.; Augustovski, F.; Hay, J.W.; Smeeding, J. Good research practices for measuring drug costs in cost-effectiveness analyses: An international perspective: The ISPOR drug cost task force report—Part VI. Value Health 2010, 13, 28–33. [Google Scholar] [CrossRef]

- Choi, S.E. Evaluation and Development of Guidelines for International Drug Price Comparisons; Health Insurance Review & Assessment: Seoul, Korea, 2017. [Google Scholar]

- Kanavos, P.; Ferrario, A.; Vandoros, S.; Anderson, G.F. Higher US branded drug prices and spending compared to other countries may stem partly from quick uptake of new drugs. Health Aff. 2013, 32, 753–761. [Google Scholar] [CrossRef]

- Danzon, P.M.; Kim, J.D. International price comparisons for pharmaceuticals: Measurement and policy issues. Pharmacoeconomics 1998, 14 (Suppl. 1), 115–128. [Google Scholar] [CrossRef]

- Vogler, S.; Schneider, P.; Zimmermann, N. Evolution of average European medicine prices: Implications for the methodology of external price referencing. Pharmacoecon. Open. 2019, 3, 303–309. [Google Scholar] [CrossRef] [PubMed]

- Rémuzat, C.; Urbinati, D.; Mzoughi, O.; El Hammi, E.; Belgaied, W.; Toumi, M. Overview of external reference pricing systems in Europe. J. Mark. Access Health Policy 2015, 3, 27675. [Google Scholar] [CrossRef] [PubMed]

- Vachris, M.A.; Thomas, J.J.M.L.R. International price comparisons based on purchasing power parity. Mon. Labor Rev. 1999, 122, 3–12. [Google Scholar]

- Kanavos, P.G.; Vandoros, S. Determinants of branded prescription medicine prices in OECD countries. Health Econ. Policy Law 2011, 6, 337–367. [Google Scholar] [CrossRef]

- Danzon, P.M.; Chao, L.-W. Cross-national price differences for pharmaceuticals: How large, and why? J. Health Econ. 2000, 19, 159–195. [Google Scholar] [CrossRef]

- Danzon, P.M. Drug Pricing and Value in Oncology. In Regulatory and Economic Aspects in Oncology; Springer: Cham, Switzerland, 2019; pp. 153–167. [Google Scholar]

- Savage, P.; Mahmoud, S.; Patel, Y.; Kantarjian, H. Cancer drugs: An international comparison of postlicensing price inflation. J. Oncol. Pract. 2017, 13, 538–541. [Google Scholar] [CrossRef]

- Vogler, S.; Vitry, A.; Babar, Z.-U. Cancer drugs in 16 European countries, Australia, and New Zealand: A cross-country price comparison study. Lancet Oncol. 2016, 17, 39–47. [Google Scholar] [CrossRef]

- Iyengar, S.; Tay-Teo, K.; Vogler, S.; Beyer, P.; Wiktor, S.; de Joncheere, K.; Hill, S. Prices, costs, and affordability of new medicines for hepatitis C in 30 countries: An economic analysis. PLoS Med. 2016, 13, e1002032. [Google Scholar] [CrossRef]

- Suh, G.H.; Wimo, A.; Gauthier, S.; O’Connor, D.; Ikeda, M.; Homma, A.; Dominguez, J.; Yang, B.M. International price comparisons of Alzheimer’s drugs: A way to close the affordability gap. Int. Psychogeriatr. 2009, 21, 1116–1126. [Google Scholar] [CrossRef]

- Ko, S.-K. Industry perspective on current HTA system in Korea. J. Korean Acad. Manag. Care Pharm. 2015, 4, 14–22. [Google Scholar]

- Adamski, J.; Godman, B.; Ofierska-Sujkowska, G.; Osińska, B.; Herholz, H.; Wendykowska, K.; Laius, O.; Jan, S.; Sermet, C.; Zara, C.; et al. Risk sharing arrangements for pharmaceuticals: Potential considerations and recommendations for European payers. BMC Health Serv. Res. 2010, 10, 153. [Google Scholar] [CrossRef] [PubMed]

- Rotar, A.M.; Preda, A.; Löblová, O.; Benkovic, V.; Zawodnik, S.; Gulacsi, L.; Niewada, M.; Boncz, I.; Petrova, G.; Dimitrova, M.; et al. Rationalizing the introduction and use of pharmaceutical products: The role of managed entry agreements in Central and Eastern European countries. Health Policy 2018, 122, 230–236. [Google Scholar] [CrossRef] [PubMed]

- Vitry, A.; Roughead, E. Managed entry agreements for pharmaceuticals in Australia. Health Policy 2014, 117, 345–352. [Google Scholar] [CrossRef]

- Nazareth, T.; Ko, J.J.; Sasane, R.; Frois, C.; Carpenter, S.; Demean, S.; Vegesna, A.; Wu, E.; Navarro, R.P. Outcomes-based contracting experience: Research findings from U.S. and European stakeholders. J. Manag. Care Spec. Pharm. 2017, 23, 1018–1026. [Google Scholar] [CrossRef]

- Yoo, S.L.; Kim, D.J.; Lee, S.M.; Kang, W.G.; Kim, S.Y.; Lee, J.H.; Suh, D.C. Improving patient access to new drugs in South Korea: Evaluation of the national drug formulary system. Int. J. Environ. Res. Public Health 2019, 16, 288. [Google Scholar] [CrossRef]

- Leverkus, F.; Chuang-Stein, C. Implementation of AMNOG: An industry perspective. Biom. J. 2016, 58, 76–88. [Google Scholar] [CrossRef]

- Taylor, C.; Jan, S.; Thompson, K. Funding therapies for rare diseases: An ethical dilemma with a potential solution. Aust. Health Rev. 2018, 42, 117–119. [Google Scholar] [CrossRef]

- NHS England Cancer Drugs Fund Team. Appraisal and Funding of Cancer Drugs from July 2016 (including the new Cancer DRugs Fund)—A New Deal for Patients, Taxpayers and Industry. NHS England Standard Operating Procedures: The Cancer Drugs Fund 2014–15. 2016. Available online: https://www.england.nhs.uk/publication/cdf-sop-16/ (accessed on 15 November 2020).

- Dillon, A.; Landells, L.J. NICE, the NHS, and cancer drugs. JAMA 2018, 319, 767–768. [Google Scholar] [CrossRef]

- Australian Government-Department of Health. Life Saving Drugs Program-Infromation for Patients, Prescribers, and Pharmacists. 2020. Available online: http://www.health.gov.au/internet/main/publishing.nsf/Content/lsdp-criteria (accessed on 13 December 2020).

- Folino-Gallo, P.; Montilla, S.; Bruzzone, M.; Martini, N. Pricing and reimbursement of pharmaceuticals in Italy. Eur. J. Health Econ. 2008, 9, 305–310. [Google Scholar] [CrossRef]

- Spoors, J. Patient access schemes in the new NHS. Br. J. Health Care Manag. 2012, 18, 412–418. [Google Scholar] [CrossRef]

| Generic Name (Brand Name) | Initial Indication | Manufacturer | Strength | Approval Date in Korea | Listing Date for Reimbursement | Price at Listing date (US$) | Duration for Listing * (Months) |

|---|---|---|---|---|---|---|---|

| Dasatinib (Sprycel®) | Leukemia | Bristol-Myers Squibb | 20 mg | 25/1/2007 | 6/2008 | 20.60 | 16 |

| 50 mg | 25/1/2007 | 6/2008 | 39.50 | 16 | |||

| 70 mg | 25/1/2007 | 6/2008 | 47.22 | 16 | |||

| 80 mg | 27/10/2016 | 2/2017 | 47.97 | 4 | |||

| 100 mg | 14/4/2011 | 10/2011 | 57.14 | 6 | |||

| Lapatinib (Tykerb®) | Metastatic breast cancer | Novartis | 250 mg | 30/7/2007 | 3/2010 | 11.65 | 31 |

| Bevacizumab (Avastin®) | Metastatic colorectal cancer | Roche | 100 mg/4 mL | 12/9/2007 | 3/2014 | 340.95 | 77 |

| 400 mg/16 mL | 12/9/2007 | 3/2014 | 1108.10 | 77 | |||

| Nilotinib (Tasigna®) | Chronic myeloid leukemia | Novartis | 150 mg | 24/12/2010 | 7/2012 | 16.92 | 18 |

| 200 mg | 26/10/2007 | 12/2011 | 19.79 | 49 | |||

| Sorafenib (Nexavar®) | Advanced renal cell carcinoma | Bayer | 200 mg | 7/1/2008 | 5/2008 | 21.88 | 4 |

| Fludarabine (Fludara®) | Chronic lymphocytic leukemia | Sanofi | 10 mg tablet | 4/2/2008 | 4/2010 | 24.79 | 26 |

| 50 mg vial | 4/2/2008 | 4/2010 | 203.14 | 26 | |||

| Paclitaxel (Abraxane®) | Metastatic breast cancer | Celgene | 100 mg | 31/3/2008 | 8/2009 | 261.01 | 16 |

| Exemestane (Aromasin®) | Metastatic breast cancer | Pfizer | 25 mg | 24/7/2008 | 6/2009 | 4.24 | 10 |

| Temsirolimus (Torisel®) | Advanced renal cell carcinoma | Pfizer | 30 mg/1.2 mL | 24/10/2008 | 6/2011 | 680.87 | 32 |

| Everolimus (Afinitor®) | Metastatic breast cancer | Novartis | 2.5 mg | 10/6/2011 | 2/2012 | 26.90 | 8 |

| 5 mg | 26/6/2009 | 8/2011 | 53.81 | 25 | |||

| 10 mg | 26/6/2009 | 8/2011 | 80.70 | 25 | |||

| Decitabine (Dacogen®) | Myelodysplastic syndrome | Janssen | 50 mg | 27/6/2007 | 8/2008 | 663.02 | 13 |

| Pazopanib (Votrient®) | Advanced renal cell carcinoma | Novartis | 200 mg | 11/8/2010 | 5/2011 | 24.47 | 9 |

| 400 mg | 11/8/2010 | 5/2011 | 38.64 | 9 | |||

| Eribulin (Halaven®) | Metastatic breast cancer | Eisai | 1 mg/2 mL | 17/8/2012 | 6/2014 | 159.70 | 22 |

| Ruxolitinib (Jakavi®) | Myelofibrosis | Novartis | 5 mg | 21/1/2013 | 5/2015 | 24.08 | 25 |

| 15 mg | 21/1/2013 | 5/2015 | 48.17 | 25 | |||

| 20 mg | 21/1/2013 | 5/2015 | 48.17 | 25 | |||

| Degarelix (Firmagon®) | Advanced prostate cancer | Ferring | 80 mg | 18/4/2013 | 11/2015 | 117.10 | 30 |

| 120 mg | 18/4/2013 | 11/2015 | 146.38 | 30 | |||

| Afatinib (Giotrif®) | Metastatic non-small cell lung cancer | Boehringer Ingelheim | 20 mg | 29/1/2014 | 10/2014 | 28.49 | 8 |

| 30 mg | 29/1/2014 | 10/2014 | 35.61 | 8 | |||

| 40 mg | 29/1/2014 | 10/2014 | 41.55 | 8 | |||

| Obinutuzumab (Gazyva®) | Chronic lymphocytic leukemia | Roche | 1000 mg/40 mL | 22/9/2014 | 4/2017 | 3586.86 | 30 |

| Lenvatinib (Lenvima®) | Thyroid cancer | Eisai | 4 mg | 7/10/2015 | 8/2017 | 27.39 | 22 |

| 10 mg | 7/10/2015 | 8/2017 | 27.39 | 22 |

| Generic Name (Brand Name) | Strength | S. Korea | U.S. | U.K. | Germany | France | Italy | Switzerland | Japan |

|---|---|---|---|---|---|---|---|---|---|

| Dasatinib (Sprycel®) | 20 mg | 18.84 | 134.03 | 27.26 | 41.54 | 33.80 | NA | 40.42 | 36.69 |

| 50 mg | 38.40 | 268.07 | 54.52 | 83.69 | 65.20 | 122.71 | 85.69 | 86.74 | |

| 70 mg | 44.83 | 223.39 | NA | NA | 65.20 | NA | 85.69 | NA | |

| 80 mg | 47.97 | 483.15 | 109.03 | 167.40 | NA | 245.40 | NA | NA | |

| 100 mg | 56.98 | 483.15 | 109.03 | 167.40 | 130.39 | 245.40 | 175.90 | NA | |

| Lapatinib (Tykerb®) | 250 mg | 11.30 | 54.37 | 15.00 | 21.03 | 17.95 | 28.96 | 23.87 | 15.26 |

| Bevacizumab (Avastin®) | 100 mg/4 mL | 297.35 | 910.25 | 316.87 | 395.49 | NA | 560.60 | 501.47 | 381.99 |

| 400 mg/16 mL | 966.43 | 3034.16 | 1207.09 | 1435.33 | NA | 2242.40 | 1792.44 | 1454.67 | |

| Nilotinib (Tasigna®) | 150 mg | 16.84 | 124.15 | 28.36 | 29.73 | 26.49 | 45.91 | 35.03 | 33.10 |

| 200 mg | 19.72 | 124.15 | 28.36 | 42.77 | 34.88 | 61.22 | 51.60 | 43.37 | |

| Sorafenib (Nexavar®) | 200 mg | 16.32 | 164.79 | 41.69 | 38.65 | 29.74 | 58.31 | 43.82 | 42.80 |

| Fludarabine (Fludara®) | 10 mg tablet | 24.79 | NA | 26.34 | NA | 32.05 | 35.34 | NA | 34.25 |

| 50 mg vial | 162.50 | 350 | 195.77 | 91.66 | NA | 282.10 | 211.51 | 313.48 | |

| Paclitaxel (Abraxane®) | 100 mg | 250.79 | 1508.68 | 321.23 | 346.61 | NA | 405.40 | 423.60 | 449.40 |

| Exemestane (Aromasin®) | 25 mg | 4.02 | 40.26 | 3.86 | 5.48 | 2.43 | 2.65 | 4.97 | 3.96 |

| Temsirolimus (Torisel®) | 30 mg/1.2 mL | 626.77 | 2061.66 | 809.60 | 970.88 | NA | 1807.84 | 1300.29 | 1251.21 |

| Everolimus (Afinitor®) | 2.5 mg | 24.21 | 506.06 | 52.23 | 48.10 | 52.18 | NA | NA | 64.00 |

| 5 mg | 47.17 | 529.33 | 97.93 | 97.43 | 100.59 | 148.92 | 105.15 | 123.99 | |

| 10 mg | 69.95 | 529.33 | 116.34 | 140.52 | 129.61 | 211.80 | 139.33 | NA | |

| Decitabine (Dacogen®) | 50 mg | 578.59 | 2155.86 | 1267.76 | 1695.75 | NA | 2035.31 | 1605.88 | NA |

| Pazopanib (Votrient®) | 200 mg | 23.33 | 110.19 | 24.39 | 33.82 | 27.75 | 50.11 | 36.95 | 37.91 |

| 400 mg | 35.92 | NA | 48.80 | 67.86 | 52.10 | 100.20 | 69.35 | NA | |

| Eribulin (Halaven®) | 1 mg/2 mL | 154.38 | 1279.2 | 471.40 | 438.24 | NA | 661.88 | 520.22 | 603.14 |

| Ruxolitinib (Jakavi®) | 5 mg | 23.27 | NA | 33.29 | 44.89 | 38.84 | 65.15 | 39.41 | 33.93 |

| 15 mg | 46.53 | NA | 66.60 | 90.43 | 75.25 | 130.29 | 75.48 | NA | |

| 20 mg | 46.53 | NA | 66.60 | 90.43 | 75.25 | 130.29 | 75.48 | NA | |

| Degarelix (Firmagon®) | 80 mg | 117.10 | 584.14 | 168.93 | 152.81 | 162.47 | 236.52 | 233.95 | NA |

| 120 mg | 146.38 | 914.51 | 169.76 | 138.41 | 145.28 | 224.48 | 231.42 | NA | |

| Afatinib (Giotrif®) | 20 mg | 26.97 | 325.22 | 94.36 | 101.45 | 74.21 | 133.87 | 108.17 | 53.45 |

| 30 mg | 33.71 | 325.22 | 94.36 | 101.45 | 74.21 | 133.87 | 108.17 | 78.23 | |

| 40 mg | 39.33 | 325.22 | 94.36 | 101.45 | 74.21 | 133.87 | 108.17 | 102.49 | |

| Obinutuzumab (Gazyva®) | 1000 mg/40 mL | 3,586.86 | 7,160.71 | 4,324.84 | 4,373.64 | NA | 6,569.26 | 3,566.49 | NA |

| Lenvatinib (Lenvima®) | 4 mg | 27.39 | 290.5 | 62.58 | 78.38 | 63.67 | 103.40 | 80.35 | 36.21 |

| 10 mg | 27.39 | 309 | 62.58 | 78.38 | 63.65 | 103.52 | 80.35 | 85.61 |

| Based on | Price Index in Each Country | |||||||

|---|---|---|---|---|---|---|---|---|

| S. Korea | U.S. | U.K. | Germany | France | Italy | Switzerland | Japan | |

| Currency Exchange Rate | ||||||||

| Laspeyres PI | 1.00 | 2.78 | 1.17 | 2.20 | 1.29 | 2.17 | 1.45 | 1.47 |

| Paasche PI | 1.00 | 2.47 | 1.05 | 1.90 | 1.43 | 1.99 | 1.33 | 1.49 |

| Fisher PI | 1.00 | 2.62 | 1.11 | 2.04 | 1.36 | 2.07 | 1.39 | 1.48 |

| Unweighted PI | 1.00 | 3.88 | 1.24 | 2.36 | 1.39 | 2.18 | 1.51 | 1.98 |

| Purchasing Power Parity | ||||||||

| Laspeyres PI | 1.00 | 2.13 | 0.78 | 1.59 | 0.99 | 1.64 | 0.80 | 1.11 |

| Paasche PI | 1.00 | 1.92 | 0.72 | 1.47 | 0.95 | 1.58 | 0.74 | 1.09 |

| Fisher PI | 1.00 | 2.02 | 0.75 | 1.53 | 0.97 | 1.61 | 0.77 | 1.10 |

| Unweighted PI | 1.00 | 2.93 | 0.85 | 1.67 | 0.98 | 1.69 | 0.82 | 1.31 |

| 2013 | 2014 | 2015 | 2016 | 2017 | Average Annual Sales for 2013–2017 | |

|---|---|---|---|---|---|---|

| Actual total sales of all cancer drugs 1 ($: thousand) | $792,270 | $844,509 | $973,498 | $1,093,892 | $1,192,540 | $979,342 |

| Actual sales of 34 study drugs ($: thousand) | $84,572 | $110,190 | $162,546 | $224,399 | $257,275 | $167,424 |

| Budget Impact for One Year | ||||||

| Based on the Average Price Among A7 | ||||||

| Sales value in 2017 ($127,687,000) | ||||||

| % of total cancer drug sales | 16.12% | 15.12% | 13.12% | 11.67% | 10.71% | 13.04% |

| Based on the Lowest Price Among A7 | ||||||

| Sales value in 2017 ($8,134,000) | ||||||

| % of total cancer drug sales | 1.03% | 0.96% | 0.84% | 0.74% | 0.68% | 0.83% |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Jung, J.H.; Kim, D.J.; Suh, K.; You, J.; Lee, J.H.; Joung, K.I.; Suh, D.C. International Price Comparisons of Anticancer Drugs: A Scheme for Improving Patient Accessibility. Int. J. Environ. Res. Public Health 2021, 18, 670. https://doi.org/10.3390/ijerph18020670

Jung JH, Kim DJ, Suh K, You J, Lee JH, Joung KI, Suh DC. International Price Comparisons of Anticancer Drugs: A Scheme for Improving Patient Accessibility. International Journal of Environmental Research and Public Health. 2021; 18(2):670. https://doi.org/10.3390/ijerph18020670

Chicago/Turabian StyleJung, Jae Ho, Dae Jung Kim, Kangho Suh, Jaeeun You, Je Ho Lee, Kyung In Joung, and Dong Churl Suh. 2021. "International Price Comparisons of Anticancer Drugs: A Scheme for Improving Patient Accessibility" International Journal of Environmental Research and Public Health 18, no. 2: 670. https://doi.org/10.3390/ijerph18020670

APA StyleJung, J. H., Kim, D. J., Suh, K., You, J., Lee, J. H., Joung, K. I., & Suh, D. C. (2021). International Price Comparisons of Anticancer Drugs: A Scheme for Improving Patient Accessibility. International Journal of Environmental Research and Public Health, 18(2), 670. https://doi.org/10.3390/ijerph18020670