Drugs Becoming Generics—The Impact of Genericization on the Market Performance of Antihypertensive Active Pharmaceutical Ingredients

Abstract

:1. Introduction

1.1. Introduction

- ○

- In terms of long-term trends, how does clinical evidence affect market performance?

- ○

- Have preferences for groups of drugs and for active ingredients been affected by the genericization of ARBs and ACE inhibitors in European markets?

- ○

- Can international or country-specific interrelationships be identified based on long-term prescribing trends?

1.2. The Life Cycle of Drugs and the Market Characteristics of Generic Drugs

1.3. Factors Influencing the Choice of Drug Therapies and Drug Sales

2. Materials and Methods

2.1. Data Used in the Investigations

2.2. Multidimensional Scaling and Indicators for Interpretation

- ARB: ACEI price level ratio: ratio of ARB price level and ACE inhibitor price level, calculated as the quotient of manufacturer sales revenue and sales volume;

- ARB: ACEI volume ratio: ratio of ARB sales volume and ACE inhibitor volume;

- ARB: ACEI sales revenue ratio: manufacturer sales revenue of ARBs and ACE inhibitors;

- ARB preference index: ‘ARB: ACEI volume ratio’ (2) multiplied by ‘ARB: ACEI sales revenue ratio’ (3). We used this variable as a composite index to estimate the bias towards ARB use in relation to ACEIs despite the higher price levels.

2.3. Approach to Analysing Changes in ACE Inhibitor and Arbs Sales Data over Time

3. Results: Development of Preferences for ARBs and ACE Inhibitors in Nine European Countries

3.1. Market Features of ARBs and ACE Inhibitors in 2016, 2009 and 2001

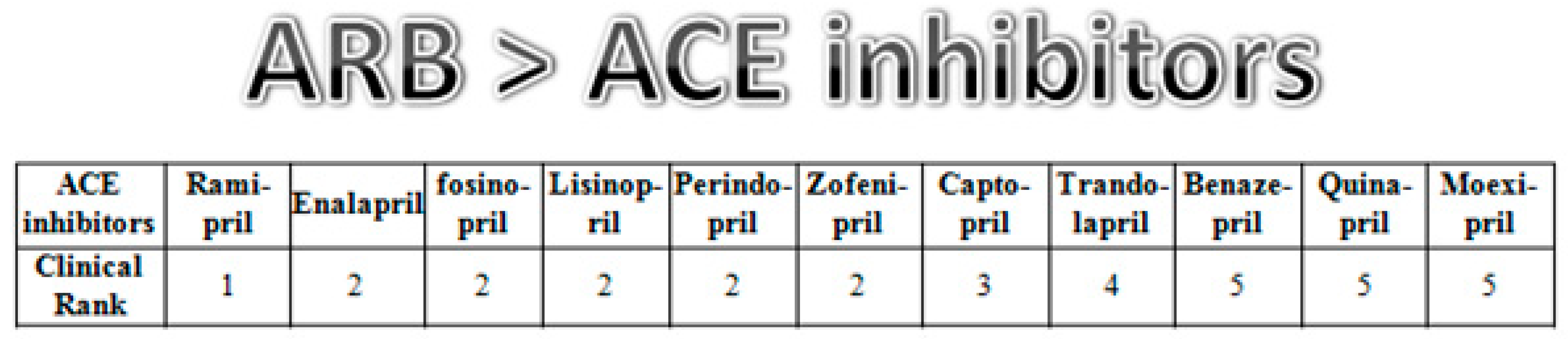

3.2. Preferences for ACE Inhibitor Active Ingredients in Six European Countries

4. Discussion, Conclusions, Practical Implications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

References

- Decsi, T. Evidence-Based Medicine. [A Bizonyítékokon Alapuló Orvoslás]; Medicina Kiadó: Budapest, Hungary, 2011. [Google Scholar]

- Sackett, D.L.; Rosenberg, W.M.; Gray, J.A.; Haynes, R.B.; Richardson, W.S. Evidence based medicine: What it is and what it isn’t. BMJ 1996, 312, 71–72. [Google Scholar] [CrossRef] [Green Version]

- Mamdani, M.; Ching, A.; Golden, B.; Melo, M.; Menzefricke, U. Challenges to evidence-based prescribing in clinical practice. Ann. Pharmacother. 2008, 42, 704–707. [Google Scholar] [CrossRef]

- Zwolsman, S.; Pas, E.T.; Hooft, L.; Waard, M.W.-D.; Van Dijk, N. Barriers to GPs’ use of evidence-based medicine: A systematic review. Br. J. Gen. Pract. 2012, 62, 511–521. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Kovács, B.; Simon, J. The impact of scientific evidence and price level of hypertension drug therapies on their market performance—A Europe based analysis. Vez. Bp. Manag. Rev. 2017, 48, 49–63. [Google Scholar] [CrossRef] [Green Version]

- Sara, B.; Jonathan, D.Q.; Germán, V. Public-Private Roles in the Pharmaceutical Sector. Implications for Equitable Access and Rational Drug Use; WHO: Geneva, Switzerland, 1997. [Google Scholar]

- Ding, M.; Eliashberg, J.; Stremersch, S. The pharmaceutical industry: Specificity, challenges, and what you can learn from this book. In Innovation and Marketing in the Pharmaceutical Industry; Ding, M., Eliashberg, J., Stremersch, S., Eds.; Springer: New York, NY, USA, 2014; pp. 1–18. [Google Scholar]

- Panteli, D.; Arickx, F.; Cleemput, I.; Dedet, G.; Eckhardt, H.; Fogarty, E.; Gerkens, S.; Henschke, C.; Hislop, J.; Jommi, C. Pharmaceutical regulation in 15 European countries. Health Syst. Transit 2016, 18, 1–118. [Google Scholar] [PubMed]

- Petrova, E. Innovation in the Pharmaceutical Industry: The Process of Drug Discovery and Development. In Innovation and Marketing in the Pharmaceutical Industry; Ding, M., Eliashberg, J., Stremersch, S., Eds.; Springer: New York, NY, USA, 2014; pp. 19–81. [Google Scholar]

- Arcidiacono, P.; Ellickson, P.; Landry, P.; Ridley, D. Pharmaceutical followers. Pharm. Follow. 2013, 31, 538–553. [Google Scholar] [CrossRef]

- Bergua, L.; Cartier, T.; Célant, N.; Pichetti, S.; Sermet, C.; Sorasith, C. How to explain price gaps between me-too Drugs. Quest. Économie St. 2012, 168, 1–6. [Google Scholar]

- Morgan, S.G.; Bassett, K.L.; Wright, J.M.; Evans, R.G.; Barer, M.L.; Caetano, P.A.; Black, C.D. “Breakthrough” drugs and growth in expenditure on prescription drugs in Canada. BMJ 2005, 331, 815–816. [Google Scholar] [CrossRef] [Green Version]

- Grabowski, H.; Vernon, J.; DiMasi, J.A. Returns on research and development for 1990s new drug introductions. Pharmacoeconomics 2002, 20 (Suppl. 3), 11–29. [Google Scholar] [CrossRef]

- Van der Gronde, T.; Groot, C.A.U.-D.; Pieters, T. Addressing the challenge of high-priced prescription drugs in the era of precision medicine: A systematic review of drug life cycles, therapeutic drug markets and regulatory frameworks. PLoS ONE 2017. [Google Scholar] [CrossRef]

- European Commission. Pharmaceutical Sector Inquiry Final Report; European Commission: Brussels, Belgium, 2009. [Google Scholar]

- Conti, R.; Berndt, E. Specialty Drug Prices and Utilization after Loss of U.S. Patent Exclusivity, 2001–2007; NBER: Cambridge, MA, USA, 2014. [Google Scholar] [CrossRef]

- Kanavos, P.; Costa-Font, J.; Seeley, E. Competition in off-patent drug markets: Issues, regulation and evidence. Econ. Policy 2008, 23, 499–544. [Google Scholar] [CrossRef]

- Hudson, J. Generic take-up in the pharmaceutical market following patent expiry. Int. Rev. Law Econ. 2000, 20, 205–221. [Google Scholar] [CrossRef]

- Grabowski, H.G.; Kyle, M. Generic competition and market exclusivity periods in pharmaceuticals. Manag. Decis. Econ. 2007, 28, 491–502. [Google Scholar] [CrossRef] [Green Version]

- Kanavos, P. Measuring performance in off-patent drug markets: A methodological framework and empirical evidence from twelve EU Member States. Health Policy 2004, 118, 229–241. [Google Scholar] [CrossRef] [Green Version]

- Alpern, J.D.; Stauffer, W.M.; Kesselheim, A.S. High-cost generic drugs—Implications for patients and policymakers. N. Engl. J. Med. 2014, 371, 1859–1862. [Google Scholar] [CrossRef] [Green Version]

- Jones, G.H.; Carrier, M.A.; Silver, R.T.; Kantarjian, H. Strategies that delay or prevent the timely availability of affordable generic drugs in the United States. Blood 2016, 127, 1398–1402. [Google Scholar] [CrossRef] [Green Version]

- Hess, J.; Litalien, S. Battle for the market: Branded drug companies’ secret weapons generic drug makers must know. J. Generic Med. 2005, 3, 20–29. [Google Scholar] [CrossRef]

- Summary of Commission Decision of 9 July 2014 relating to a proceeding under Articles 101 and 102 of the Treaty on the Functioning of the European Union (Case AT.39612—Perindopril (Servier)) (notified under document C(2014) 4955). Off. J. Eur. Union 2016, 393, 7–12. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:52016XC1025(01)&from=EN (accessed on 27 March 2018).

- Carone, G.; Schwierz, C.; Xavier, A. Cost-containment policies in public pharmaceutical spending in the EU. Econ. Financ. Aff. 2012. [Google Scholar] [CrossRef] [Green Version]

- Belloni, A.; Morgan, D.; Paris, V. Pharmaceutical expenditure and policies. OECD Health Work. Pap. 2016. [Google Scholar] [CrossRef]

- Danzon, P.M.; Furukawa, M.F. Cross-National Evidence on Generic Pharmaceuticals: Pharmacy vs. Physician-Driven Markets; No. w17226; National Bureau of Economic Research: Cambridge, MA, USA, 2011. [Google Scholar]

- Leopold, C.; Mantel-Teeuwisse, A.K.; Vogler, S.; Valkova, S.; de Joncheere, K.; Leufkens, H.G.M.; Wagner, A.K.; Ross-Degnan, D.; Laing, R. Effect of the economic recession on pharmaceutical policy and medicine sales in eight European countries. Bull. World Health Organ. 2014, 92, 630–640. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Vogler, S.; Paris, V.; Ferrario, A.; Wirtz, V.J.; de Joncheere, K.; Schneider, P.; Pedersen, H.B.; Dedet, G.; Babar, Z.-U.-D. How can pricing and reimbursement policies improve affordable access to medicines? Lessons learned from European countries. Appl Health Econ Health Policy 2017, 15, 307–321. [Google Scholar] [CrossRef] [PubMed]

- Lublóy, Á. Managing the diffusion of pharmaceutical innovations: Conclusions from a literature review. Pannon. Manag. Rev. 2013, 2, 55–85. [Google Scholar]

- Keresztúri, J.L.; Lublóy, Á.; Benedek, G. Gyógyszerek terjedésének vizsgálata Cox-regresszióval. Stat. Szle. 2014, 92, 792–819. [Google Scholar]

- Lublóy, Á. Factors affecting the uptake of new medicines: A systematic literature review. BMC Health Serv. Res. 2014, 14, 469. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Haider, M.; Kreps, G.L. Forty years of diffusion of innovations: Utility and value in public health. J. Health Commun. 2004, 9, 3–11. [Google Scholar] [CrossRef]

- Rogers, E.M. Diffusion of Innovations, 3rd ed.; Free Press: New York, NY, USA, 1983. [Google Scholar]

- Denig, P. Drug Choice in Medical Practice: Rationales, Routines and Remedies; University of Groningen: Groningen, The Netherlands, 1994. [Google Scholar]

- Peny, J.-M. ACE-inhibitors—An analysis of marketing strategy. Scrip. Mag. 1994, 28, 18–21. [Google Scholar]

- Furberg, C.D.; Psaty, B.M. Should evidence-based proof of drug efficacy be extrapolated to a “Class of Agents”? Circulation 2003, 108, 2608–2610. [Google Scholar] [CrossRef] [Green Version]

- Furberg, C.D.; Pitt, B. Are all angiotensin-converting enzyme inhibitors interchangeable? J. Am. Coll. Cardiol. 2001, 37, 1456–1460. [Google Scholar] [CrossRef] [Green Version]

- Dinicolantonio, J.J.; Lavie, C.J.; O’Keefe, J.H. Not all angiotensin-converting enzyme inhibitors are equal: Focus on ramipril and perindopril. Postgrad. Med. 2013, 125, 154–168. [Google Scholar] [CrossRef]

- Maggioni, A.P.; Van Gool, K.; Biondi, N.; Urso, R.; Klazinga, N.; Ferrari, R.; Maniadakis, N.; Tavazzi, L. Appropriateness of prescriptions of recommended treatments in organisation for economic co-operation and development health systems: Findings based on the long-term registry of the European society of cardiology on heart failure. Value Health 2015, 18, 1098–1104. [Google Scholar] [CrossRef] [Green Version]

- Othman, N.; Vitry, A.; Roughead, E.E. Quality of pharmaceutical advertisements in medical journals: A systematic review. PLoS ONE 2009, 4, e6350. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Heimans, L.; Van Hylckama Vlieg, A.; Dekker, F.W. Are claims of advertisements in medical journals supported by RCts? Neth. J. Med. 2010, 68, 46–49. [Google Scholar] [PubMed]

- Villanueva, P.; Peiró, S.; Librero, J.; Pereiró, I. Accuracy of pharmaceutical advertisements in medical journals. Lancet 2003, 361, 27–32. [Google Scholar] [CrossRef]

- Kesselheim, A.S.; Robertson, C.T.; Myers, J.A.; Rose, S.L.; Gillet, V.; Ross, K.M.; Glynn, R.J.; Joffe, S.; Avorn, J. A Randomized Study of How Physicians Interpret Research Funding Disclosures. N. Engl. J. Med. 2012, 367, 1119–1127. [Google Scholar] [CrossRef] [Green Version]

- Fickweiler, F.; Fickweiler, W.; Urbach, E. Interactions between physicians and the pharmaceutical industry generally and sales representatives specifically and their association with physicians’ attitudes and prescribing habits: A systematic review. BMJ Open 2017. [Google Scholar] [CrossRef] [Green Version]

- Spurling, G.K.; Mansfield, P.R.; Montgomery, B.D.; Lexchin, J.; Doust, J.; Othman, N.; Vitry, A.I. Information from pharmaceutical companies and the quality, quantity, and cost of physicians’ prescribing: A systematic review. PLoS Med. 2010, 7, e1000352. [Google Scholar] [CrossRef] [Green Version]

- Greving, J.P.; Denig, P.; van der Veen, W.J.; Beltman, F.W.; Sturkenboom, M.C.J.M.; Haaijer-Ruskamp, F.M. Determinants for the adoption of angiotensin II receptor blockers by general practitioners. Soc. Sci. Med. 2006, 63, 2890–2898. [Google Scholar] [CrossRef] [Green Version]

- Venkataraman, S.; Stremersch, S. The debate on influencing doctors’ decisions: Are drug characteristics the missing link? Manag. Sci. 2007, 53, 1688–1701. [Google Scholar] [CrossRef] [Green Version]

- Kappe, E.; Stremersch, S. Drug Detailing and Doctors’ Prescription Decisions: The Role of Information Content in the Face of Competitive Entry. Mark. Sci. 2016, 35, 915–933. [Google Scholar] [CrossRef] [Green Version]

- Crawford, G.S.; Shum, M. Uncertainty and learning in pharmaceutical demand. Econometrica 2005, 73, 1137–1173. [Google Scholar] [CrossRef] [Green Version]

- WHOCC—ATC/DDD. Index. Available online: https://www.whocc.no/atc_ddd_index/?code=C09 (accessed on 29 March 2018).

- WHO—DDD. Definition. Available online: https://www.who.int/tools/atc-ddd-toolkit/about-ddd (accessed on 3 August 2021).

- Malhotra, N.K.; Jain, A.K.; Patil, A.; Pinson, C.; Wu, L. Consumer cognitive Complexity and the Dimensionality of Multidimensional Scaling Configurations; Emerald Group Publishing Limited: Bradford, UK, 2010. [Google Scholar]

- Tan, P.N.; Steinbach, M.; Kumar, V. Introduction to Data Mining; Pearson Education: London, UK, 2006. [Google Scholar]

- Avanzas, P.; Pascual, I.; Moris, C. The great challenge of the public health system in Spain. J. Thorac. Dis. 2017, 9, S430–S433. [Google Scholar] [CrossRef] [PubMed]

- Chevreul, K.; Berg Brigham, K.; Durand-Zaleski, I.; Hernandez-Quevedo, C. France: Health system review. Health Syst. Transit. 2015, 17, 1–218. [Google Scholar] [PubMed]

- NICE. Hypertension in Adults: Diagnosis and Management. Guidance and Guidelines; NICE: London, UK, 2016; Available online: https://www.nice.org.uk/guidance/cg127 (accessed on 4 May 2018).

- North of England Hypertension Guideline Development Group. Essential Hypertension: Managing Adult Patients in Primary Care; National Institute for Health and Clinical Excellence: Tyne, UK, 2004. [Google Scholar]

- McCormack, T.; Krause, T.; O’Flynn, N. Management of hypertension in adults in primary care: NICE guideline. Br. J. Gen. Pract. J. R. Coll. Gen. Pract. 2021, 62, 163–164. [Google Scholar] [CrossRef] [PubMed] [Green Version]

| ARB Price Level (EUR/DDD) | ACEI Price Level (EUR/DDD) | ARB Volume (DDD. %) | ARB Sales Revenue (EUR. %) | ACEI Volume (DDD. %) | ACEI Sales Revenue (EUR. %) | ARB: ACEI Price Level Ratio | ARB: ACEI Volume Ratio | ARB: ACEI Revenue Ratio | ARB Preference Index | |

|---|---|---|---|---|---|---|---|---|---|---|

| FR | 0.59 | 0.43 | 37.34 | 44.85 | 62.66 | 55.15 | 1.36 | 0.60 | 0.81 | 0.48 |

| GE | 0.57 | 0.27 | 21.61 | 36.81 | 78.39 | 63.19 | 2.11 | 0.28 | 0.58 | 0.16 |

| HU | 0.52 | 0.12 | 1.03 | 4.31 | 98.97 | 95.69 | 4.32 | 0.01 | 0.05 | 0.00 |

| IT | 0.53 | 0.38 | 24.75 | 31.56 | 75.25 | 68.44 | 1.40 | 0.33 | 0.46 | 0.15 |

| PO | 0.56 | 0.09 | 0.19 | 1.16 | 99.81 | 98.84 | 6.01 | 0.00 | 0.01 | 0.00 |

| RO | 0.82 | 0.10 | 0.09 | 0.69 | 99.91 | 99.31 | 8.16 | 0.00 | 0.01 | 0.00 |

| SP | 0.46 | 0.24 | 29.99 | 45.47 | 70.01 | 54.53 | 1.95 | 0.43 | 0.83 | 0.36 |

| UK | 0.81 | 0.36 | 14.23 | 27.11 | 85.77 | 72.89 | 2.24 | 0.17 | 0.37 | 0.06 |

| ARB Price Level (EUR/DDD) | ACEI Price Level (EUR/DDD) | ARB Volume (DDD. %) | ARB Sales Revenue (EUR. %) | ACEI Volume (DDD. %) | ACEI Sales Revenue (EUR. %) | ARB: ACEI Price Level Ratio | ARB: ACEI Volume Ratio | ARB: ACEI Revenue Ratio | ARB Preference Index | |

|---|---|---|---|---|---|---|---|---|---|---|

| FR | 0.54 | 0.29 | 54.79 | 68.92 | 45.21 | 31.08 | 1.83 | 1.21 | 2.22 | 2.69 |

| GE | 0.54 | 0.05 | 26.35 | 79.20 | 73.65 | 20.80 | 10.64 | 0.36 | 3.81 | 1.36 |

| HU | 0.36 | 0.10 | 14.32 | 37.93 | 85.68 | 62.07 | 3.66 | 0.17 | 0.61 | 0.10 |

| IT | 0.45 | 0.16 | 41.44 | 65.94 | 58.56 | 34.06 | 2.74 | 0.71 | 1.94 | 1.37 |

| NE | 0.51 | 0.07 | 43.55 | 85.52 | 56.45 | 14.48 | 7.66 | 0.77 | 5.91 | 4.56 |

| PO | 0.17 | 0.06 | 11.30 | 26.86 | 88.70 | 73.14 | 2.88 | 0.13 | 0.37 | 0.05 |

| RO | 0.28 | 0.08 | 13.35 | 34.06 | 86.65 | 65.94 | 3.35 | 0.15 | 0.52 | 0.08 |

| SP | 0.48 | 0.10 | 55.30 | 85.05 | 44.70 | 14.95 | 4.60 | 1.24 | 5.69 | 7.04 |

| UK | 0.37 | 0.04 | 22.32 | 74.76 | 77.68 | 25.24 | 10.31 | 0.29 | 2.96 | 0.85 |

| ARB Price Level (EUR/DDD) | ACEI Price Level (EUR/DDD) | ARB Volume (DDD, %) | ARB Sales Revenue (EUR, %) | ACEI Volume (DDD, %) | ACEI Sales Revenue (EUR, %) | ARB: ACEI Price Level Ratio | ARB: ACEI Volume Ratio | ARB: ACEI Sales Revenue Ratio | ARB Preference Index | |

|---|---|---|---|---|---|---|---|---|---|---|

| FR | 0.20 | 0.15 | 50.63 | 57.04 | 49.37 | 42.96 | 1.29 | 1.03 | 1.33 | 1.36 |

| GE | 0.19 | 0.04 | 37.56 | 76.44 | 62.44 | 23.56 | 5.39 | 0.60 | 3.24 | 1.95 |

| HU | 0.10 | 0.09 | 27.07 | 29.48 | 72.93 | 70.52 | 1.13 | 0.37 | 0.42 | 0.16 |

| IT | 0.22 | 0.12 | 43.85 | 58.65 | 56.15 | 41.35 | 1.82 | 0.78 | 1.42 | 1.11 |

| NE | 0.07 | 0.04 | 45.42 | 59.88 | 54.58 | 40.12 | 1.79 | 0.83 | 1.49 | 1.24 |

| PO | 0.11 | 0.05 | 25.04 | 40.69 | 74.96 | 59.31 | 2.05 | 0.33 | 0.69 | 0.23 |

| RO | 0.12 | 0.07 | 28.44 | 40.61 | 71.56 | 59.39 | 1.72 | 0.40 | 0.68 | 0.27 |

| SP | 0.31 | 0.06 | 51.66 | 84.52 | 48.34 | 15.48 | 5.11 | 1.07 | 5.46 | 5.83 |

| UK | 0.10 | 0.03 | 22.71 | 52.12 | 77.29 | 47.88 | 3.70 | 0.29 | 1.09 | 0.32 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kovács, B.; Darida, M.; Simon, J. Drugs Becoming Generics—The Impact of Genericization on the Market Performance of Antihypertensive Active Pharmaceutical Ingredients. Int. J. Environ. Res. Public Health 2021, 18, 9429. https://doi.org/10.3390/ijerph18189429

Kovács B, Darida M, Simon J. Drugs Becoming Generics—The Impact of Genericization on the Market Performance of Antihypertensive Active Pharmaceutical Ingredients. International Journal of Environmental Research and Public Health. 2021; 18(18):9429. https://doi.org/10.3390/ijerph18189429

Chicago/Turabian StyleKovács, Bence, Miklós Darida, and Judit Simon. 2021. "Drugs Becoming Generics—The Impact of Genericization on the Market Performance of Antihypertensive Active Pharmaceutical Ingredients" International Journal of Environmental Research and Public Health 18, no. 18: 9429. https://doi.org/10.3390/ijerph18189429

APA StyleKovács, B., Darida, M., & Simon, J. (2021). Drugs Becoming Generics—The Impact of Genericization on the Market Performance of Antihypertensive Active Pharmaceutical Ingredients. International Journal of Environmental Research and Public Health, 18(18), 9429. https://doi.org/10.3390/ijerph18189429