The Effect of Additional Private Health Insurance on Mortality in the Context of Universal Public Health Insurance

Abstract

:1. Introduction

2. Materials and Methods

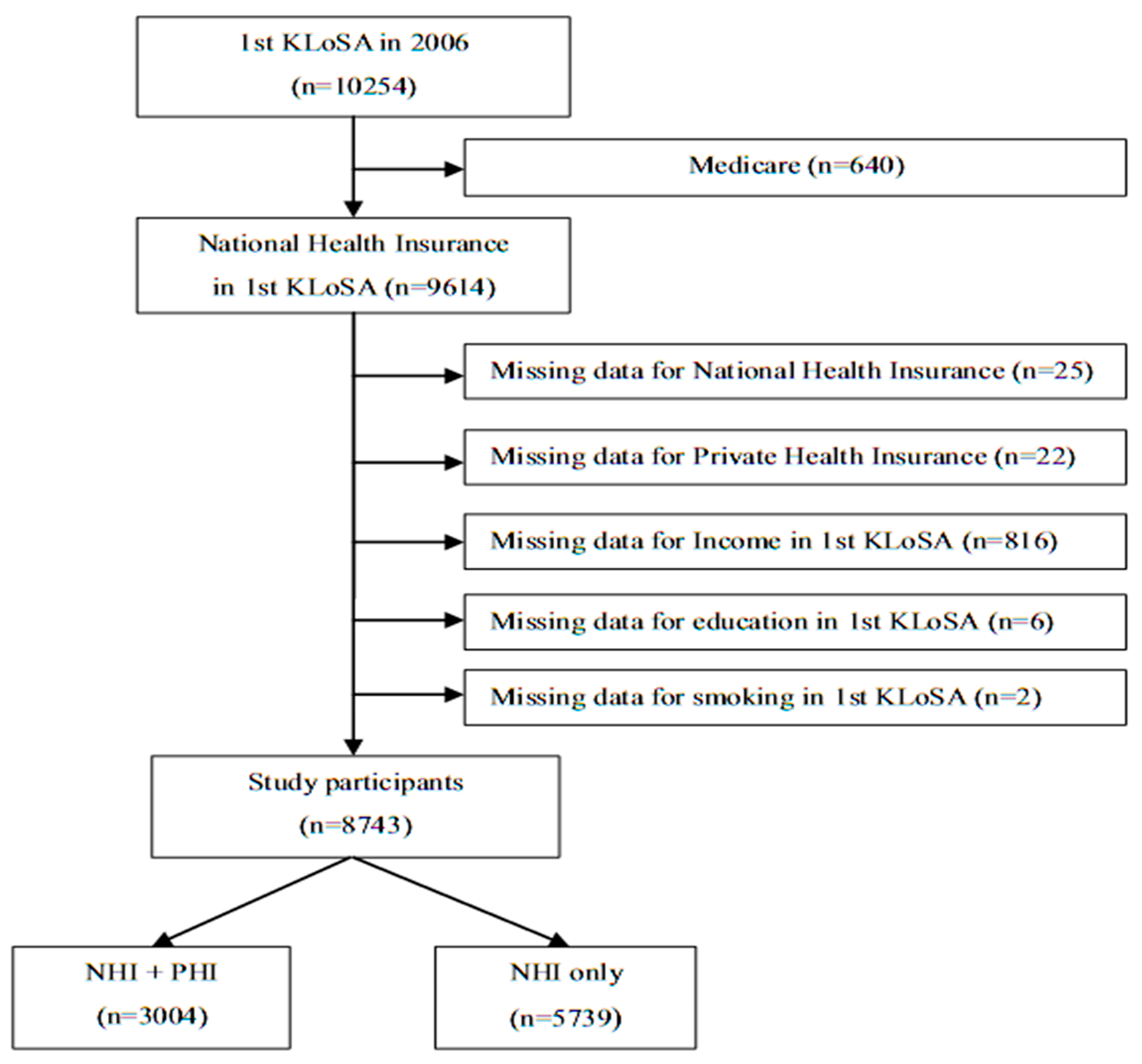

2.1. Study Population

2.2. Follow-Up Period and All-Cause Mortality

2.3. Assessment of Covariates

2.4. Statistical Analysis

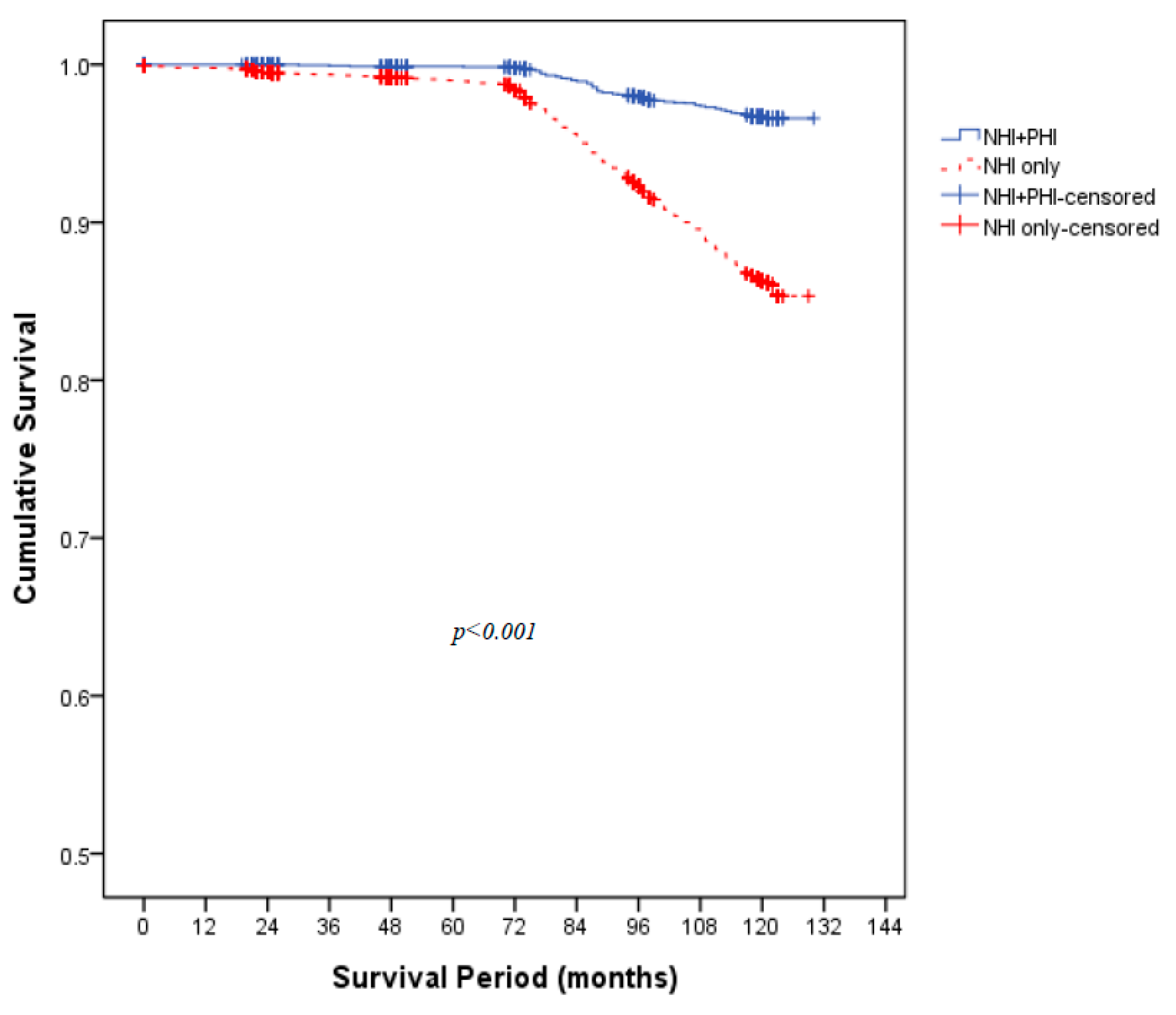

3. Results

4. Discussion

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Sasaki, T.; Izawa, M.; Okada, Y. Current trends in health insurance systems: OECD countries vs. Japan. Neurol. Med. Chir. 2015, 55, 267–275. [Google Scholar] [CrossRef] [Green Version]

- Dronina, Y.; Yoon, Y.M.; Sakamaki, H.; Nam, E.W. Health system development and performance in Korea and Japan: A comparative study of 2000–2013. J. Lifestyle Med. 2016, 6, 16–26. [Google Scholar] [CrossRef] [Green Version]

- Sustainable Health Financing, Universal Coverage and Social Health Insurance. Available online: https://apps.who.int/iris/handle/10665/20383 (accessed on 30 June 2021).

- Baggio, S.; Dupuis, M.; Wolff, H.; Bodenmann, P. Associations of lack of voluntary private insurance and out-of-pocket expenditures with health inequalities. Evidence from an international longitudinal survey in countries with universal health coverage. PLoS ONE 2018, 13, e0204666. [Google Scholar] [CrossRef] [Green Version]

- Kim, S.W. Policy Review of Health Insurance Coverage Expansion; National Assembly Budget Office: Seoul, Korea, 2016.

- Jin, Y.; Hou, Z.; Zhang, D. Determinants of health insurance coverage among people aged 45 and over in China: Who buys public, private and multiple insurance. PLoS ONE 2016, 11, e0161774. [Google Scholar] [CrossRef] [Green Version]

- LaPar, D.J.; Bhamidipati, C.M.; Mery, C.M.; Stukenborg, G.J.; Jones, D.R.; Schirmer, B.D.; Kron, I.L.; Ailawadi, G. Primary payer status affects mortality for major surgical operations. Ann. Surg. 2010, 252, 544–550, discussion 550–551. [Google Scholar] [CrossRef] [Green Version]

- Gabriel, L.E.; Bailey, M.J.; Bellomo, R.; Stow, P.; Orford, N.; McGain, F.; Santamaria, J.; Scheinkestel, C.; Pilcher, D.V. Insurance status and mortality in critically ill patients. Crit. Care Resusc. 2016, 18, 43–49. [Google Scholar]

- Sobotka, L.A.; Hinton, A.; Conteh, L.F. Insurance status impacts treatment for hepatocellular carcinoma. Ann. Hepatol. 2019, 18, 461–465. [Google Scholar] [CrossRef]

- Singh, J.A.; Cleveland, J.D. Insurance payer type and patient income are associated with outcomes after total shoulder arthroplasty. J. Rheumatol. 2020, 47, 589–596. [Google Scholar] [CrossRef]

- Sriravindrarajah, A.; Kotwal, S.S.; Sen, S.; McDonald, S.; Jardine, M.; Cass, A.; Gallagher, M. Impact of supplemental private health insurance on dialysis and outcomes. Intern. Med. J. 2020, 50, 542–549. [Google Scholar] [CrossRef]

- Cheung, M.R. Lack of health insurance increases all cause and all cancer mortality in adults: An analysis of national health and nutrition examination survey (NHANES III) data. Asian Pac. J. Cancer Prev. 2013, 14, 2259–2263. [Google Scholar] [CrossRef] [Green Version]

- Lyon, S.M.; Benson, N.M.; Cooke, C.R.; Iwashyna, T.J.; Ratcliffe, S.J.; Kahn, J.M. The effect of insurance status on mortality and procedural use in critically ill patients. Am. J. Respir. Crit. Care Med. 2011, 184, 809–815. [Google Scholar] [CrossRef] [Green Version]

- Younossi, Z.M.; Otgonsuren, M.; Henry, L.; Arsalla, Z.; Stepnaova, M.; Mishra, A.; Venkatesan, C.; Hunt, S. Inpatient resource utilization, disease severity, mortality and insurance coverage for patients hospitalized for hepatitis C virus in the United States. J. Viral Hepat. 2015, 22, 137–145. [Google Scholar] [CrossRef] [PubMed]

- Jabs, A.W.; Jabs, D.A.; Van Natta, M.L.; Palella, F.J.; Meinert, C.L. Insurance status and mortality among patients with aids. HIV Med. 2018, 19, 7–17. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Bittoni, M.A.; Wexler, R.; Spees, C.K.; Clinton, S.K.; Taylor, C.A. Lack of private health insurance is associated with higher mortality from cancer and other chronic diseases, poor diet quality, and inflammatory biomarkers in the United States. Prev. Med. 2015, 81, 420–426. [Google Scholar] [CrossRef]

- Saunders, M.R.; Ricardo, A.C.; Chen, J.; Chin, M.H.; Lash, J.P. Association between insurance status and mortality in individuals with albuminuria: An observational cohort study. BMC Nephrol. 2016, 17, 27. [Google Scholar] [CrossRef] [Green Version]

- Hoffmeister, L.; Lavados, P.M.; Murta-Nascimento, C.; Araujo, M.; Olavarría, V.V.; Castells, X. Short- and long-term survival after stroke in hospitalized patients in Chile: A nationwide 5-year study. J. Stroke Cerebrovasc. Dis. 2013, 22, e463–e469. [Google Scholar] [CrossRef]

- McManus, M.; Ovbiagele, B.; Markovic, D.; Towfighi, A. Association of insurance status with stroke-related mortality and long-term survival after stroke. J. Stroke Cerebrovasc. Dis. 2015, 24, 1924–1930. [Google Scholar] [CrossRef] [PubMed]

- LaPar, D.J.; Stukenborg, G.J.; Guyer, R.A.; Stone, M.L.; Bhamidipati, C.M.; Lau, C.L.; Kron, I.L.; Ailawadi, G. Primary payer status is associated with mortality and resource utilization for coronary artery bypass grafting. Circulation 2012, 126, S132–S139. [Google Scholar] [CrossRef] [Green Version]

- Ng, D.K.; Brotman, D.J.; Lau, B.; Young, J.H. Insurance status, not race, is associated with mortality after an acute cardiovascular event in Maryland. J. Gen. Intern. Med. 2012, 27, 1368–1376. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Ellis, L.; Canchola, A.J.; Spiegel, D.; Ladabaum, U.; Haile, R.; Gomez, S.L. Trends in cancer survival by health insurance status in California from 1997 to 2014. JAMA Oncol. 2018, 4, 317–323. [Google Scholar] [CrossRef] [PubMed]

- Hsu, C.D.; Wang, X.; Habif, D.V., Jr.; Ma, C.X.; Johnson, K.J. Breast cancer stage variation and survival in association with insurance status and sociodemographic factors in US women 18 to 64 years old. Cancer 2017, 123, 3125–3131. [Google Scholar] [CrossRef] [Green Version]

- Jalloul, R.J.; Sharma, S.; Tung, C.S.; O’Donnell, B.; Ludwig, M. Pattern of care, health care disparities, and their impact on survival outcomes in stage IVB cervical cancer: A nationwide retrospective cohort study. Int. J. Gynecol. Cancer 2018, 28, 1003–1012. [Google Scholar] [CrossRef]

- Han, X.; Jemal, A.; Flowers, C.R.; Sineshaw, H.; Nastoupil, L.J.; Ward, E. Insurance status is related to diffuse large B-cell lymphoma survival. Cancer 2014, 120, 1220–1227. [Google Scholar] [CrossRef]

- Hoehn, R.S.; Hanseman, D.J.; Jernigan, P.L.; Wima, K.; Ertel, A.E.; Abbott, D.E.; Shah, S.A. Disparities in care for patients with curable hepatocellular carcinoma. HPB 2015, 17, 747–752. [Google Scholar] [CrossRef] [Green Version]

- Balli, S.; Fey, M.F.; Hänggi, W.; Zwahlen, D.; Berclaz, G.; Dreher, E.; Aebi, S. Ovarian cancer. An institutional review of patterns of care, health insurance and prognosis. Eur. J. Cancer 2000, 36, 2061–2068. [Google Scholar] [CrossRef]

- Mehra, T.; Moos, R.M.; Seifert, B.; Bopp, M.; Senn, O.; Simmen, H.P.; Neuhaus, V.; Ciritsis, B. Impact of structural and economic factors on hospitalization costs, inpatient mortality, and treatment type of traumatic hip fractures in Switzerland. Arch. Osteoporos. 2017, 12, 7. [Google Scholar] [CrossRef] [PubMed]

- Jentzsch, T.; Neuhaus, V.; Seifert, B.; Osterhoff, G.; Simmen, H.P.; Werner, C.M.; Moos, R. The impact of public versus private insurance on trauma patients. J. Surg. Res. 2016, 200, 236–241. [Google Scholar] [CrossRef] [PubMed]

- National Health Insurance Statistics. 2017. Available online: https://www.hira.or.kr/bbsDummy.do?pgmid=HIRAA020045020000&brdScnBltNo=4&brdBltNo=2310 (accessed on 30 June 2021).

- OECD Health Statistics. Definitions, Sources and Methods. 2018. Available online: https://www.oecd.org/els/health-systems/Table-of-Content-Metadata-OECD-Health-Statistics-2018.pdf (accessed on 30 June 2021).

- Fang, J.; Alderman, M.H. Does supplemental private insurance affect care of medicare recipients hospitalized for myocardial infarction? Am. J. Public Health 2004, 94, 778–782. [Google Scholar] [CrossRef] [PubMed]

- Buchmueller, T.C.; Couffinhal, A.; Grignon, M.; Perronnin, M. Access to physician services: Does supplemental insurance matter? Evidence from France. Health Econ. 2004, 13, 669–687. [Google Scholar] [CrossRef]

- Rocha, K.B.; Rodríguez-Sanz, M.; Pérez, K.; Obiols, J.E.; Borrell, C. Inequalities in the utilization of psychiatric and psychological services in Catalonia: A multilevel approach. Adm. Policy Ment. Health 2013, 40, 355–363. [Google Scholar] [CrossRef]

- Kim, J.M. The Analysis of Disparity in Private Health Insurance and Normalization Methods; 2017 Policy Report; National Assembly Inspection of State Affairs: Seoul, Korea, 2017.

- Liu, T.C.; Chen, C.S. An analysis of private health insurance purchasing decisions with national health insurance in Taiwan. Soc. Sci. Med. 2002, 55, 755–774. [Google Scholar] [CrossRef]

- Shin, H.W.; Lim, J.W. Current state of private insurance management in OECD member states—Focusing on the relationship between public and private insurances. HIRA 2018, 12, 13–17. [Google Scholar]

| Variables | Total | NHI + PHI | NHI Only | p-Value |

|---|---|---|---|---|

| (n = 8743) | (n = 3004) | (n = 5739) | ||

| Follow-up period (months) | 94.5 ± 43.0 | 99.3 ± 41.1 | 92.0 ± 43.7 | <0.001 |

| Sex | 0.005 | |||

| Male | 3892 (44.5) | 1275 (42.4) | 2617 (45.6) | |

| Female | 4851 (55.5) | 1729 (57.6) | 3122 (54.4) | |

| Age (years) | <0.001 | |||

| ≥65 | 3276 (37.5) | 273 (9.1) | 3003 (52.3) | |

| 55–64 | 2497 (28.6) | 911 (30.3) | 1586 (27.6) | |

| 45–54 | 2970 (34.0) | 1820 (60.6) | 1150 (20.0) | |

| Smoking status | 0.118 | |||

| Current smoker | 1692 (19.4) | 574 (19.1) | 1118 (19.5) | |

| Past smoker | 839 (9.6) | 263 (8.8) | 576 (10.0) | |

| Non-smoker | 6212 (71.1) | 2167 (72.1) | 4045 (70.5) | |

| Drinking status | 0.003 | |||

| Yes | 3354 (38.4) | 1407 (46.8) | 1947 (33.9) | |

| No | 5389 (61.6) | 1597 (53.2) | 3792 (66.1) | |

| Regular exercise status | <0.001 | |||

| Yes | 2353 (26.9) | 866 (28.8) | 1487 (25.9) | |

| No | 6390 (73.1) | 2138 (71.2) | 4252 (74.1) | |

| Hypertension | <0.001 | |||

| Yes | 2284 (26.1) | 541 (18.0) | 1743 (30.4) | |

| No | 6459 (73.9) | 2463 (82.0) | 3996 (69.6) | |

| Diabetes mellitus | <0.001 | |||

| Yes | 978 (11.2) | 235 (7.8) | 743 (12.9) | |

| No | 7765 (88.8) | 2769 (92.2) | 4996 (87.1) | |

| Cancer | <0.001 | |||

| Yes | 199 (2.3) | 41 (1.4) | 158 (2.8) | |

| No | 8544 (97.7) | 2963 (98.6) | 5581 (97.2) | |

| Cardiovascular disease | <0.001 | |||

| Yes | 386 (4.4) | 65 (2.2) | 321 (5.6) | |

| No | 8357 (95.6) | 2939 (97.8) | 5418 (94.4) | |

| Cerebrovascular disease | <0.001 | |||

| Yes | 279 (3.2) | 40 (1.3) | 239 (4.2) | |

| No | 8464 (96.8) | 2964 (98.7) | 5500 (95.8) | |

| Education level | <0.001 | |||

| ≥High school | 3413 (39.0) | 1679 (55.9) | 1734 (30.2) | |

| <High school | 5330 (61.0) | 1325 (44.1) | 4005 (69.8) | |

| Annular household income (USD) | <0.001 | |||

| ≥30,000 | 2332 (26.7) | 1175 (39.1) | 1157 (20.2) | |

| 20,000–29,999 | 1335 (15.3) | 537 (17.9) | 798 (13.9) | |

| 10,000–19,999 | 1687 (19.3) | 538 (17.9) | 1149 (20.0) | |

| <10,000 | 3389 (38.8) | 754 (25.1) | 2635 (45.9) | |

| Marital status | <0.001 | |||

| Single | 1648 (18.8) | 286 (9.5) | 1362 (23.7) | |

| Couple | 7095 (81.2) | 2718 (90.5) | 4377 (76.3) | |

| Overall death | <0.001 | |||

| Living | 8075 (92.4) | 2924 (97.3) | 5151 (89.8) | |

| Deceased | 668 (7.6) | 80 (2.7) | 588 (10.2) |

| NHI Only | NHI + PHI | |

|---|---|---|

| HR | 1 | 0.53 * |

| 95% CI | Reference | (0.41–0.69) |

| <55 Years | ≥55 Years | |||

|---|---|---|---|---|

| HR | 95% | HR | 95% CI | |

| NHI only | 1 | Reference | 1 | Reference |

| NHI + PHI | 0.89 * | (0.25–1.13) | 0.33 * | (0.24–0.45) |

| <USD 20,000 | ≥USD 20,000 | |||

|---|---|---|---|---|

| HR | 95% | HR | 95% CI | |

| NHI only | 1 | Reference | 1 | Reference |

| NHI + PHI | 0.52 * | (0.41–0.67) | 0.81 * | (0.56–1.20) |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Baek, E.-M.; Oh, J.-I.; Kwon, E.-J. The Effect of Additional Private Health Insurance on Mortality in the Context of Universal Public Health Insurance. Int. J. Environ. Res. Public Health 2021, 18, 8363. https://doi.org/10.3390/ijerph18168363

Baek E-M, Oh J-I, Kwon E-J. The Effect of Additional Private Health Insurance on Mortality in the Context of Universal Public Health Insurance. International Journal of Environmental Research and Public Health. 2021; 18(16):8363. https://doi.org/10.3390/ijerph18168363

Chicago/Turabian StyleBaek, Eun-Mi, Jae-Il Oh, and Eun-Jung Kwon. 2021. "The Effect of Additional Private Health Insurance on Mortality in the Context of Universal Public Health Insurance" International Journal of Environmental Research and Public Health 18, no. 16: 8363. https://doi.org/10.3390/ijerph18168363

APA StyleBaek, E.-M., Oh, J.-I., & Kwon, E.-J. (2021). The Effect of Additional Private Health Insurance on Mortality in the Context of Universal Public Health Insurance. International Journal of Environmental Research and Public Health, 18(16), 8363. https://doi.org/10.3390/ijerph18168363