The Nexus between Economic Complexity and Energy Consumption under the Context of Sustainable Environment: Evidence from the LMC Countries

Abstract

1. Introduction

2. Literature Review

2.1. Literature on Economic Development and Energy Consumption

2.2. Literature on Panel Vector Autoregressive Model

3. Methodology

4. Data

5. Empirical Analysis

5.1. Model Specification

5.2. Unit Root Test

5.3. Lag Optimum Test

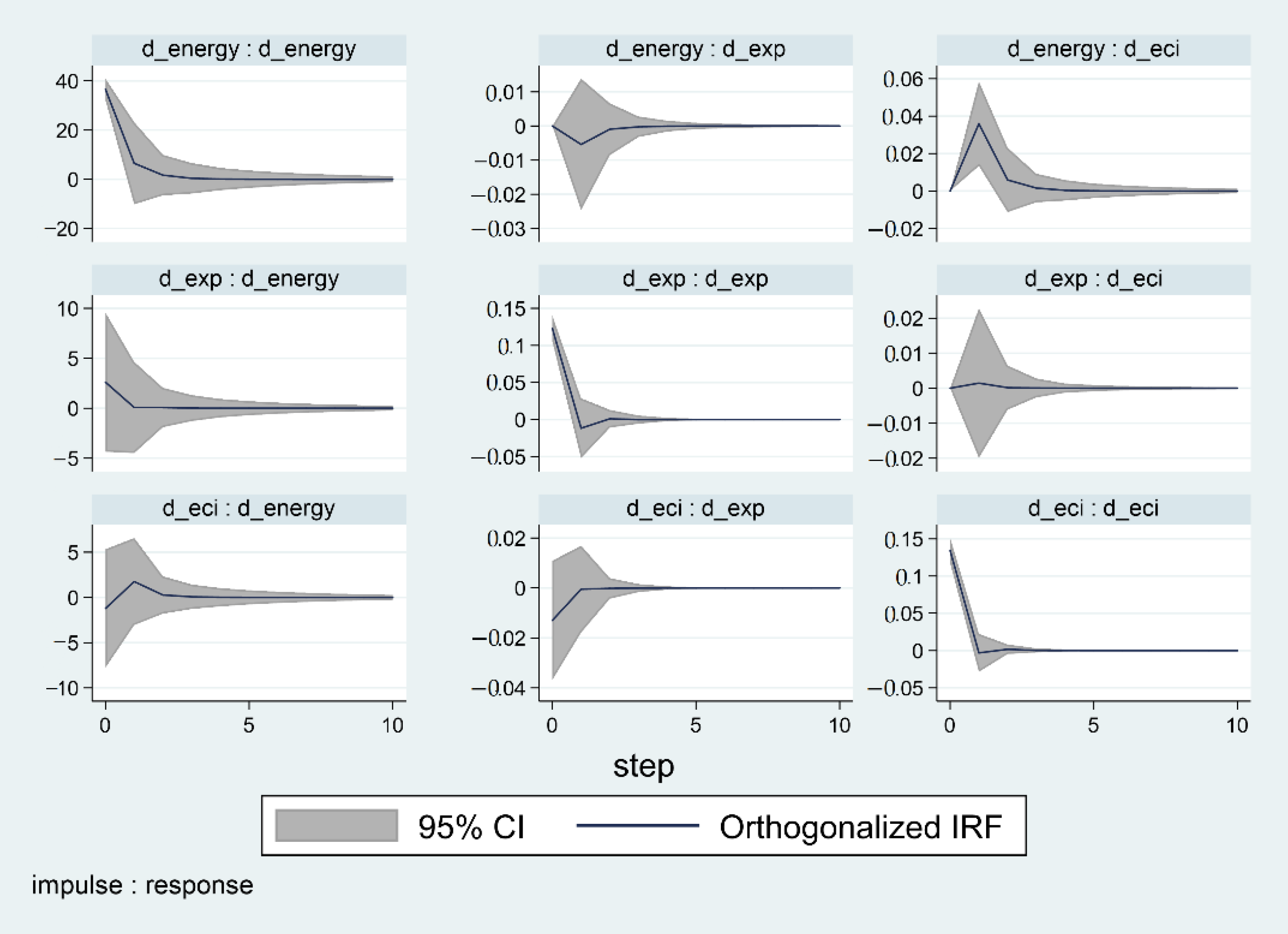

5.4. Results

6. Discussions

7. Conclusions and Policy Implications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Acheampong, A.O. Economic growth, CO2 emissions and energy consumption: What causes what and where? Energy Econ. 2018, 74, 677–692. [Google Scholar] [CrossRef]

- Ahmed, A.; Uddin, G.S.; Sohag, K. Biomass energy, technological progress and the environmental Kuznets curve: Evidence from selected European countries. Biomass Bioenerg. 2016, 90, 202–208. [Google Scholar] [CrossRef]

- Mealy, P.; Teytelboym, A. Economic complexity and the green economy. Res. Policy 2020, in press. [Google Scholar] [CrossRef]

- Suganthi, L.; Samuel, A.A. Energy models for demand forecasting—A review. Renew. Sustain. Energy Rev. 2012, 16, 1223–1240. [Google Scholar] [CrossRef]

- Al-mulali, U.; Fereidouni, H.G.; Lee, J.Y.M. Electricity consumption from renewable and non-renewable sources and economic growth: Evidence from Latin American countries. Renew. Sustain. Energy Rev. 2014, 30, 290–298. [Google Scholar] [CrossRef]

- Brizga, J.; Feng, K.; Hubacek, K. Household carbon footprints in the Baltic States: A global multi-regional input–output analysis from 1995 to 2011. Appl. Energy 2017, 189, 780–788. [Google Scholar] [CrossRef]

- Chang, T.; Gupta, R.; Inglesi-Lotz, R.; Simo-Kengne, B.; Smithers, D.; Trembling, A. Renewable energy and growth: Evidence from heterogeneous panel of G7 countries using Granger causality. Renew. Sustain. Energy Rev. 2015, 52, 1405–1412. [Google Scholar] [CrossRef]

- Adewuyi, A.O.; Awodumi, O.B. Renewable and non-renewable energy-growth-emissions linkages: Review of emerging trends with policy implications. Renew. Sustain. Energy Rev. 2017, 69, 275–291. [Google Scholar] [CrossRef]

- Destek, M.A.; Aslan, A. Renewable and non-renewable energy consumption and economic growth in emerging economies: Evidence from bootstrap panel causality. Renew. Energy 2017, 111, 757–763. [Google Scholar] [CrossRef]

- Liu, H.; Liang, S. The Nexus between Energy Consumption, Biodiversity, and Economic Growth in Lancang-Mekong Cooperation (LMC): Evidence from Cointegration and Granger Causality Tests. IJERPH 2019, 16, 3269. [Google Scholar] [CrossRef]

- Gu, Z.; Fan, H.; Wang, Y. Dynamic characteristics of sandbar evolution in the lower Lancang-Mekong River between 1993 and 2012 in the context of hydropower development. Estuar. Coast. Mar. Sci. 2020, 237, 106678. [Google Scholar] [CrossRef]

- Hausmann, R.; Hidalgo, C. The Atlas of Economic Complexity: Mapping Paths to Prosperity; MIT Press Books: Cambridge, MA, USA, 2014; p. 1. Available online: https://growthlab.cid.harvard.edu/files/growthlab/files/atlas_2013_part1.pdf (accessed on 16 December 2020).

- Hidalgo, C.A.; Hausmann, R. The building blocks of economic complexity. Proc. Natl. Acad. Sci. USA 2009, 106, 10570–10575. [Google Scholar] [CrossRef] [PubMed]

- A New Interpretation of the Economic Complexity Index. Available online: https://www.inet.ox.ac.uk/files/main_feb4.pdf (accessed on 16 December 2020).

- Kemp-Benedict, E. An Interpretation and Critique of the Method of Reflections. MPRA Paper. Available online: https://mpra.ub.uni-muenchen.de/60705/1/MPRA_paper_60705.pdf (accessed on 16 December 2020).

- Apergis, N.; Payne, J.E. The renewable energy consumption–growth nexus in Central America. Appl. Energy 2011, 88, 343–347. [Google Scholar] [CrossRef]

- Khan, M.K.; Teng, J.-Z.; Khan, M.I. Effect of energy consumption and economic growth on carbon dioxide emissions in Pakistan with dynamic ARDL simulations approach. ESPR 2019, 26, 23480–23490. [Google Scholar] [CrossRef]

- Wolde-Rufael, Y. Electricity consumption and economic growth: A time series experience for 17 African countries. Energy Policy 2006, 34, 1106–1114. [Google Scholar] [CrossRef]

- Shahbaz, M.; Hye, Q.M.A.; Tiwari, A.K.; Leitão, N.C. Economic growth, energy consumption, financial development, international trade and CO2 emissions in Indonesia. Renew. Sustain. Energy Rev. 2013, 25, 109–121. [Google Scholar] [CrossRef]

- Dogan, E. The relationship between economic growth and electricity consumption from renewable and non-renewable sources: A study of Turkey. Renew. Sustain. Energy Rev. 2015, 52, 534–546. [Google Scholar] [CrossRef]

- Apergis, N.; Payne, J.E. Energy consumption and economic growth in Central America: Evidence from a panel cointegration and error correction model. Energy Econ. 2009, 31, 211–216. [Google Scholar] [CrossRef]

- Apergis, N.; Payne, J.E. Renewable energy consumption and economic growth: Evidence from a panel of OECD countries. Energy Policy 2010, 38, 656–660. [Google Scholar] [CrossRef]

- Shahbaz, M.; Lean, H.H. The dynamics of electricity consumption and economic growth: A revisit study of their causality in Pakistan. Energy 2012, 39, 146–153. [Google Scholar] [CrossRef]

- Shahbaz, M.; Lean, H.H.; Shabbir, M.S. Environmental Kuznets Curve hypothesis in Pakistan: Cointegration and Granger causality. Renew. Sustain. Energy Rev. 2012, 16, 2947–2953. [Google Scholar] [CrossRef]

- Ang, J.B. CO2 emissions, energy consumption, and output in France. Energy Policy 2007, 35, 4772–4778. [Google Scholar] [CrossRef]

- Maji, I.K.; Sulaiman, C.; Abdul-Rahim, A.S. Renewable energy consumption and economic growth nexus: A fresh evidence from West Africa. Energy Reports 2019, 5, 384–392. [Google Scholar] [CrossRef]

- Doytch, N.; Narayan, S. Does FDI influence renewable energy consumption? An analysis of sectoral FDI impact on renewable and non-renewable industrial energy consumption. Energy Econ. 2016, 54, 291–301. [Google Scholar] [CrossRef]

- Kahia, M.; Aïssa, M.S.B.; Lanouar, C. Renewable and non-renewable energy use - economic growth nexus: The case of MENA Net Oil Importing Countries. Renew. Sustain. Energy Rev. 2017, 71, 127–140. [Google Scholar] [CrossRef]

- Pao, H.-T.; Li, Y.-Y.; Hsin-Chia, F. Clean energy, non-clean energy, and economic growth in the MIST countries. Energy Policy 2014, 67, 932–942. [Google Scholar] [CrossRef]

- Ohler, A.; Fetters, I. The causal relationship between renewable electricity generation and GDP growth: A study of energy sources. Energy Econ. 2014, 43, 125–139. [Google Scholar] [CrossRef]

- Fang, Y. Economic welfare impacts from renewable energy consumption: The China experience. Renew. Sustain. Energy Rev. 2011, 15, 5120–5128. [Google Scholar] [CrossRef]

- Al-mulali, U.; Fereidouni, H.G.; Lee, J.Y.; Sab, C.N.B.C. Examining the bi-directional long run relationship between renewable energy consumption and GDP growth. Renew. Sustain. Energy Rev. 2013, 22, 209–222. [Google Scholar] [CrossRef]

- Koçak, E.; Şarkgüneşi, A. The renewable energy and economic growth nexus in Black Sea and Balkan countries. Energy Policy 2017, 100, 51–57. [Google Scholar] [CrossRef]

- Destek, M.A. Renewable energy consumption and economic growth in newly industrialized countries: Evidence from asymmetric causality test. Renew. Energy 2016, 95, 478–484. [Google Scholar] [CrossRef]

- Hausmann, R.; Hwang, J.; Rodrik, D. What you export matters. J. Econ. Growth 2007, 12, 1–25. [Google Scholar] [CrossRef]

- Ozcan, B. The nexus between carbon emissions, energy consumption and economic growth in Middle East countries: A panel data analysis. Energy Policy 2013, 62, 1138–1147. [Google Scholar] [CrossRef]

- Shahzad, U.; Fareed, Z.; Shahzad, F.; Shahzad, K. Investigating the nexus between economic complexity, energy consumption and ecological footprint for the United States: New insights from quantile methods. J. Clean. Prod. 2021, 279, 123806. [Google Scholar] [CrossRef]

- Can, M.; Gozgor, G. Dynamic relationships among CO2 emissions, energy consumption, economic growth, and economic complexity in France. SSRN 2016. [Google Scholar] [CrossRef]

- Economic Complexity and Environmental Performance: Evidence from a World Sample. Available online: https://mpra.ub.uni-muenchen.de/92833/1/MPRA_paper_92833.pdf (accessed on 16 December 2020).

- Tacchella, A.; Cristelli, M.; Caldarelli, G.; Gabrielli, A.; Pietronero, L. A new metrics for countries’ fitness and products’ complexity. Sci. Rep. 2012, 2, 723. [Google Scholar] [CrossRef]

- Alam, M.S.; Paramati, S.R. Do oil consumption and economic growth intensify environmental degradation? Evidence from developing economies. Appl. Econ. 2015, 47, 5186–5203. [Google Scholar] [CrossRef]

- Ertugrul, H.M.; Cetin, M.; Seker, F.; Dogan, E. The impact of trade openness on global carbon dioxide emissions: Evidence from the top ten emitters among developing countries. Ecol. Indic. 2016, 67, 543–555. [Google Scholar] [CrossRef]

- Jaforullah, M.; King, A. Does the use of renewable energy sources mitigate CO2 emissions? A reassessment of the US evidence. Energy Econ. 2015. [Google Scholar] [CrossRef]

- Zhang, C.; Lam, P.-L. On electricity consumption and economic growth in China. Renew. Sustain. Energy Rev. 2017, 76, 353–368. [Google Scholar] [CrossRef]

- Mutascu, M. A time-frequency analysis of trade openness and CO2 emissions in France. Energy Policy 2018, 115, 443–455. [Google Scholar] [CrossRef]

- Raza, S.A.; Shah, N. Testing environmental Kuznets curve hypothesis in G7 countries: The role of renewable energy consumption and trade. Environ. Sci. Pollut. Res. 2018, 25, 26965–26977. [Google Scholar] [CrossRef] [PubMed]

- Ben Jebli, M.; Ben, S.Y.; Ozturk, I. Testing environmental Kuznets curve hypothesis: The role of renewable and non-renewable energy consumption and trade in OECD countries. Ecol. Indic. 2016, 60, 824–831. [Google Scholar] [CrossRef]

- Pao, H.-T.; Tsai, C.-M. CO2 emissions, energy consumption and economic growth in BRIC countries. Energy Policy 2010, 38, 7850–7860. [Google Scholar] [CrossRef]

- Liu, H.; Kim, H. Ecological Footprint, Foreign Direct Investment, and Gross Domestic Production: Evidence of Belt & Road Initiative Countries. Sustainability 2018, 10, 3527. [Google Scholar]

- Tiwari, A.K. Comparative performance of renewable and nonrenewable energy source on economic growth and CO2 emissions of Europe and Eurasian countries: A PVAR approach. Econ. Bull. 2011, 31, 2356–2372. [Google Scholar]

- Shahiduzzaman, M.; Alam, K. Information Technology and Its Changing Roles to Economic Growth and Productivity in Australia. Telecomm. Policy 2014, 38, 125–135. [Google Scholar] [CrossRef]

- Khayyat, N.T.; Lee, J.D. A measure of technological capabilities for developing countries. Technol. Forecast. Soc. Change 2014, 92, 210–223. [Google Scholar] [CrossRef]

- Koop, G.; Korobilis, D. Model uncertainty in Panel Vector Autoregressive models. Eur. Econ. Rev. 2016, 81, 115–131. [Google Scholar] [CrossRef]

- Koop, G.; Korobilis, D. Forecasting with High-Dimensional Panel VARs; Working Paper; 2018; Available online: https://econpapers.repec.org/paper/glaglaewp/2015_5f25.htm (accessed on 16 December 2020).

- Estimation of Panel Vector Autoregression in StatA: A Package of Programs. Available online: https://www.economics.hawaii.edu/research/workingpapers/WP_16-02.pdf (accessed on 16 December 2020).

- Love, I.; Zicchino, L. Financial development and dynamic investment behavior: Evidence from panel VAR. QREF 2006, 46, 190–210. [Google Scholar] [CrossRef]

- Bölük, G.; Mert, M. The renewable energy, growth and environmental Kuznets curve in Turkey: An ARDL approach. Renew. Sustain. Energy Rev. 2015, 52, 587–595. [Google Scholar] [CrossRef]

- Chu, Z. Logistics and economic growth: A panel data approach. Ann. Reg. Sci. 2012, 49, 87–102. [Google Scholar] [CrossRef]

- Vásconez Rodríguez, A. Economic Growth and Gender Inequality: An Analysis of Panel Data for Five Latin American Countries; CEPAL Review; 2017; Available online: https://repositorio.cepal.org/handle/11362/42660 (accessed on 16 December 2020).

- Liu, H.; Kim, H.; Choe, J. Export diversification, CO2 emissions and EKC: Panel data analysis of 125 countries. APJRS 2019, 3, 361–393. [Google Scholar] [CrossRef]

- Choi, I. Unit root tests for panel data. J. Int. Money Financ. 2001, 20, 249–272. [Google Scholar] [CrossRef]

- Dinda, S.; Coondoo, D. Income and emission: A panel data-based cointegration analysis. Ecol. Econ. 2006, 57, 167–181. [Google Scholar] [CrossRef]

- Elliot, B.; Rothenberg, T.; Stock, J. Efficient tests of the unit root hypothesis. Econometrica 1996, 64, 13–36. [Google Scholar]

- Engle, R.F.; Granger, C.W.J. Co-Integration and Error Correction: Representation, Estimation, and Testing. Econometrica 1987, 55, 251–276. [Google Scholar] [CrossRef]

- Andreoni, J.; Levinson, A. The simple analytics of the environmental Kuznets curve. J Public Econ. 2001, 80, 269–286. [Google Scholar] [CrossRef]

- Levin, A.; Lin, C.-F.; James, C. –S. Unit root tests in panel data: Asymptotic and finite-sample properties. J. Econom. 2002, 108, 1–24. [Google Scholar] [CrossRef]

- Hovhannisyan, N.; Sedgley, N. Using panel VAR to analyze international knowledge spillovers. Int. Econ. Rev. 2019, 27, 1633–1660. [Google Scholar] [CrossRef]

- Topcu, E.; Altinoz, B.; Aslan, A. Global evidence from the link between economic growth, natural resources, energy consumption, and gross capital formation. Resources Policy 2020, 66, 101622. [Google Scholar] [CrossRef]

- Sassi, S.; Gasmi, A. The Dynamic Relationship Between Corruption–Inflation: Evidence from Panel Vector Autoregression. Jpn. Econ. Rev. 2017, 68, 458–469. [Google Scholar] [CrossRef]

- Johansen, S. The Interpretation of Cointegrating Coefficients in the Cointegrated Vector Autoregressive Model. Oxf. Bull. Econ. Stat. 2005, 67, 93–104. [Google Scholar] [CrossRef]

- Ozturk, I.; Al-Mulali, U. Investigating the validity of the environmental Kuznets curve hypothesis in Cambodia. Ecol. Indic. 2015, 57, 324–330. [Google Scholar] [CrossRef]

- Belaid, F.; Youssef, M. Environmental degradation, renewable and non-renewable electricity consumption, and economic growth: Assessing the evidence from Algeria. Energy Policy 2017, 102, 277–287. [Google Scholar] [CrossRef]

| Authors | Time Period | Country | Methodology | Variables | Empirical Findings | Reference |

|---|---|---|---|---|---|---|

| Dogan Eyup | 1990–2012 | Turkey | Granger causality test, VECM | Economic growth, renewable energy consumption, nonrenewable energy consumption | Feedback consumption between NRELC and GR | [20] |

| Syed Ali Raza, Nida Shah | 1991–2016 | G7 countries | FMOLS, DOLS | CO2 emission, GDP, export, import, trade, renewable energy consumption | Support EKC hypothesis | [46] |

| Nicholas Apergis, James Payne | 1980–2004 | Central America | Panel cointegration | GDP, energy usage, labor force, capital formation | Support growth hypothesis | [21] |

| Chi Zhang, Kaile Zhou | 1978–2016 | China | ARDL, VAR, ECM, OLS | GDP, electricity consumption | Interaction between electricity consumption and economic growth | [44] |

| Mohammad Jaforullah | 1965–2012 | United States | Granger causality test | CO2 emission, nuclear energy consumption, renewable energy consumption, real GDP, real price of energy | Renewable energy decreases CO2 emission | [43] |

| Medhdi Ben Jebli, Slim Ben Youssef | 1980–2010 | OECD countries | FMOLS, DOLS | CO2 emission, trade, renewable energy consumption | Renewable energy consumption imports | [47] |

| Mihai Mutascu | 1960–2013 | France | Wavelet tool | CO2 emission, trade openness | Confirm neutral hypothesis | [45] |

| Pao, Hsiao-Tien | 1971–2005 | BRIC countries | Panel causality test | CO2 emission, GDP, energy consumption | Bidirection causality between energy and emission | [48] |

| Variable | Observations | Mean | Standard Deviation | Minimum | Maximum |

|---|---|---|---|---|---|

| Renewable energy consumption | 160 | 54.29 | 26.54 | 11.70 | 91.12 |

| Fossil energy consumption | 135 | 53.72 | 26.17 | 13.81 | 88.90 |

| Economic complexity | 160 | −0.47 | 0.75 | −1.48 | 1.16 |

| Export diversification | 159 | 3.20 | 1.01 | 1.86 | 4.85 |

| Extensive margin | 159 | 0.19 | 0.27 | 0.002 | 1.36 |

| Intensive margin | 159 | 3.03 | 0.97 | 1.73 | 4.80 |

| Maddala and Wu-Test | ||||

|---|---|---|---|---|

| Variables | Non-TREND | TREND | ||

| Zt-Bar | p-Value | Zt-Bar | p-Value | |

| L.EC | 1.050 | 0.902 | 3.564 | 0.468 |

| L.ECI | 1.230 | 0.873 | 4.466 | 0.347 |

| L.EXP | 10.288 | 0.036 | 3.481 | 0.481 |

| L.TRADE | 17.171 | 0.002 ** | 12.945 | 0.012 |

| 28.540 | 0.001 ** | 19.432 | 0.035 | |

| 99.965 | 0.000 *** | 78.068 | 0.000 *** | |

| 32.169 | 0.000 *** | 33.718 | 0.000 *** | |

| 82.270 | 0.000 *** | 65.915 | 0.000 *** | |

| Lag | CD | J | J p-Value | MBIC | MAIC | MQIC |

|---|---|---|---|---|---|---|

| 1 | 0.9991 | 25.56778 | 0.0604 | −45.515 | −6.432 | −22.152 |

| 2 | 0.9985 | 8.077455 | 0.7842 | 45.300 | −15.989 | −27.779 |

| 3 | 0.9988 | 2.027557 | 0.9802 | −33.514 | −13.972 | −21.832 |

| 4 | 0.9931 | 7,897,810 | 0 | 7,897,774 | 7,897,794 | 7,897,786 |

| Response of | Response to | |||

|---|---|---|---|---|

| Ln_ECI | Ln_EXP | Ln_Renew | Ln_Fossil | |

| Ln_ECI | 0.683 ** (4.72) | −1.786 (−0.97) | −0.296 (−0.57) | 1.426 (0.37) |

| Ln_EXP | −0.00664 (−0.41) | 0.704 ** (3.22) | 0.0836 (1.50) | 0.350 (0.84) |

| Ln_Renew | 0.0599 (1.66) | −0.827 (−1.80) | 0.916 *** (8.71) | −1.110 (−1.30) |

| Ln_Fossil | −0.00772 (1.35) | 0.159 * (2.04) | 0.00391 (0.26) | 1.000 *** (7.48) |

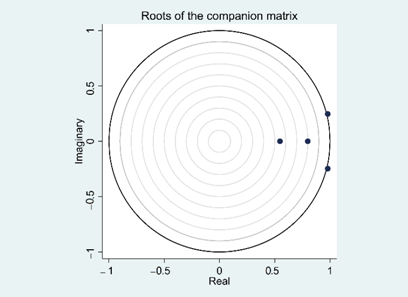

| Eigenvalue | Graph | ||

|---|---|---|---|

| Real | Imaginary | Modulus |  |

| 0.979 | 0.247 | 1.009994 | |

| 0.979 | −0.247 | 1.009994 | |

| 0.798 | 0 | 0.798 | |

| 0.547 | 0 | 0.547 | |

| Equation/Excluded | Chi2 | DF | Prob > Chi2 | |

|---|---|---|---|---|

| Ln_ECI | Ln_EXP | 0.932 | 1 | 0.334 |

| Ln_Renew | 0.327 | 1 | 0.567 | |

| Ln_Fossil | 0.139 | 1 | 0.709 | |

| ALL | 5.687 | 3 | 0.128 | |

| Ln_EXP | Ln_ECI | 0.166 | 1 | 0.683 |

| Ln_Renew | 2.246 | 1 | 0.134 | |

| Ln_Fossil | 0.702 | 1 | 0.402 | |

| ALL | 4.898 | 3 | 0.179 | |

| Ln_Renew | Ln_ECI | 2.763 | 1 | 0.096 |

| Ln_EXP | 3.250 | 1 | 0.071 | |

| Ln_Fossil | 1.677 | 1 | 0.195 | |

| ALL | 8.486 | 3 | 0.037 | |

| Ln_Fossil | Ln_ECI | 1.818 | 1 | 0.178 |

| Ln_EXP | 4.173 | 1 | 0.041 | |

| Ln_Renew | 0.067 | 1 | 0.795 | |

| ALL | 11.131 | 3 | 0.011 | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, H.; Liang, S.; Cui, Q. The Nexus between Economic Complexity and Energy Consumption under the Context of Sustainable Environment: Evidence from the LMC Countries. Int. J. Environ. Res. Public Health 2021, 18, 124. https://doi.org/10.3390/ijerph18010124

Liu H, Liang S, Cui Q. The Nexus between Economic Complexity and Energy Consumption under the Context of Sustainable Environment: Evidence from the LMC Countries. International Journal of Environmental Research and Public Health. 2021; 18(1):124. https://doi.org/10.3390/ijerph18010124

Chicago/Turabian StyleLiu, Hongbo, Shuanglu Liang, and Qingbo Cui. 2021. "The Nexus between Economic Complexity and Energy Consumption under the Context of Sustainable Environment: Evidence from the LMC Countries" International Journal of Environmental Research and Public Health 18, no. 1: 124. https://doi.org/10.3390/ijerph18010124

APA StyleLiu, H., Liang, S., & Cui, Q. (2021). The Nexus between Economic Complexity and Energy Consumption under the Context of Sustainable Environment: Evidence from the LMC Countries. International Journal of Environmental Research and Public Health, 18(1), 124. https://doi.org/10.3390/ijerph18010124