Labor Costs, Market Environment and Green Technological Innovation: Evidence from High-Pollution Firms

Abstract

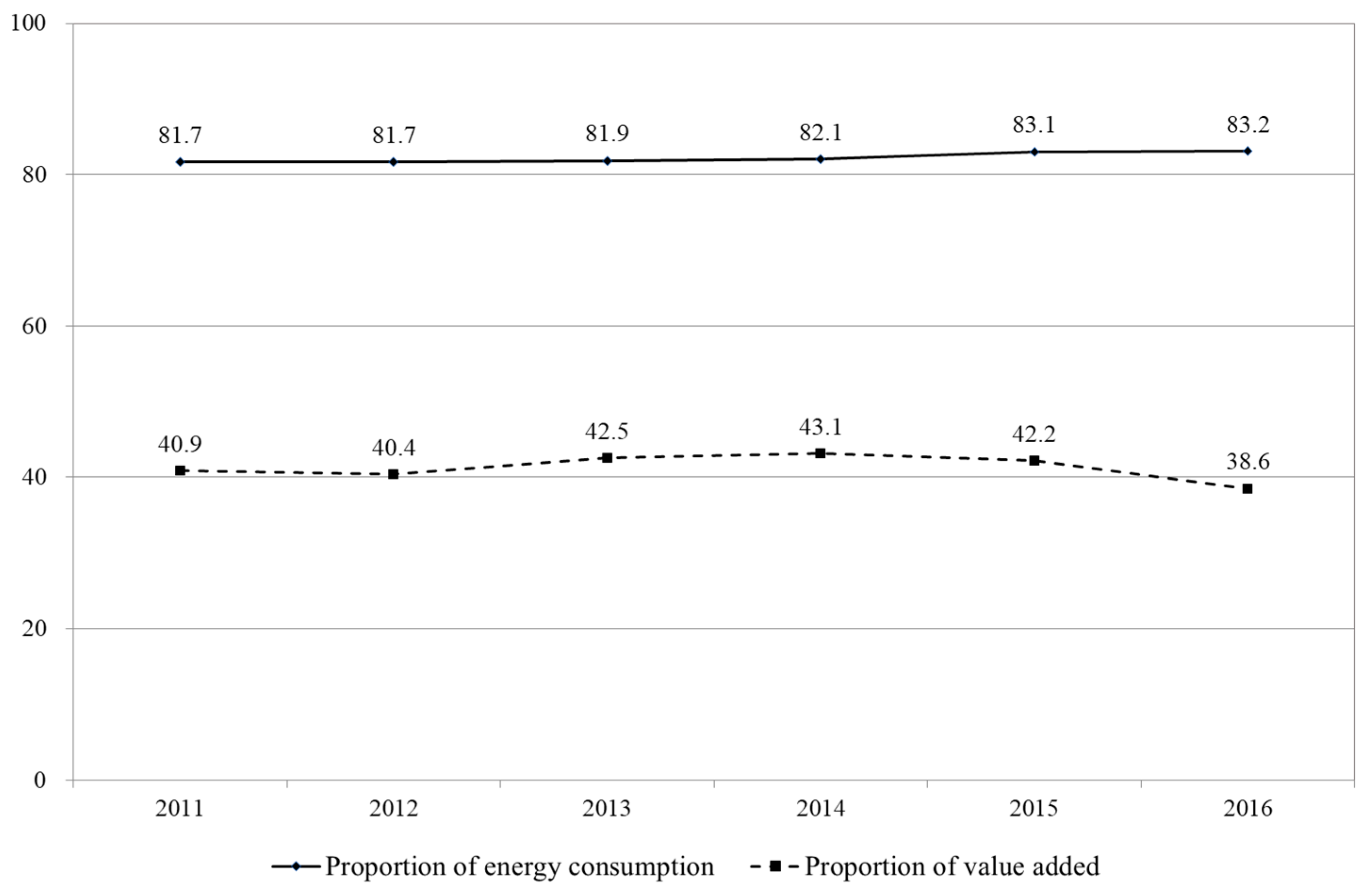

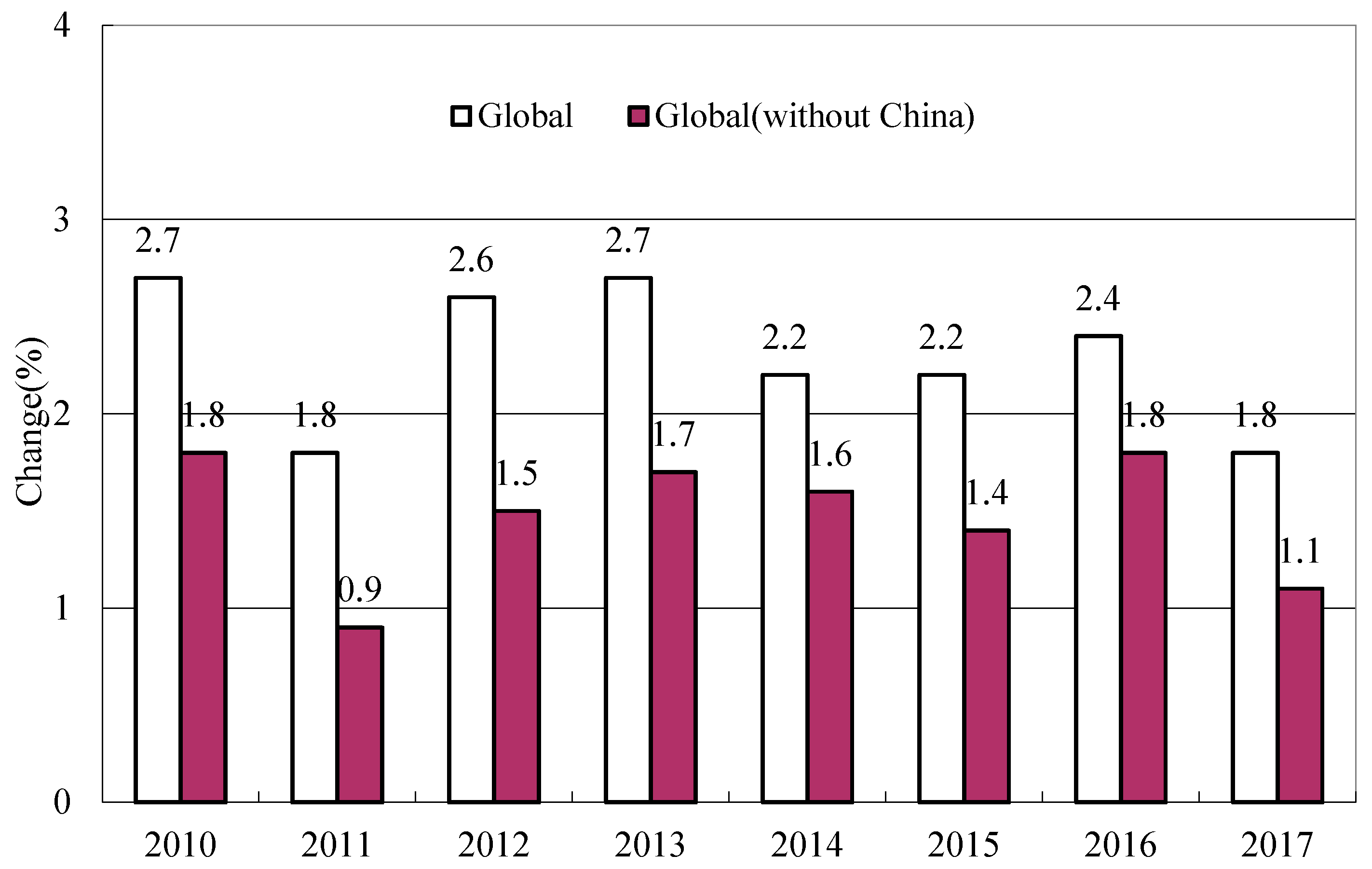

:1. Introduction

2. Research Hypotheses

2.1. Capability for Green Technological Innovation

2.2. Impetus for Green Technological Innovation

2.3. The Combined Effects

3. Data and Variable Declaration

3.1. Research Data

3.2. Variable Declaration

4. Estimation of Parameters

4.1. Estimation of Threshold Effect of Labor Cost on Firms Performance

4.2. Effects of Labor Costs on Green Technological Innovation under Different Market Structures

5. Discussion

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- World Energy Outlook 2018—IEA. Available online: https://www.iea.org/reports/world-energy-outlook-2018 (accessed on 6 January 2020).

- Du, L.; Xu, L.; Li, Y.; Liu, C.; Li, Z.; Wong, J.S.; Lei, B. China’s agricultural irrigation and water conservancy projects: A policy synthesis and discussion of emerging issues. Sustainability 2019, 11, 7027. [Google Scholar] [CrossRef] [Green Version]

- BP plc. BP Statistical Review of World Energy. Available online: https://www.bp.com/content/dam/bp/business-sites/en/global/corporate/pdfs/energy-economics/statistical-review/bp-stats-review-2018-full-report.pdf (accessed on 6 January 2020).

- The Listed Company Environmental Protection Check List of Industry Classification Management. 2008. Available online: http://www.gov.cn/gzdt/2008-07/07/content_1038083.htm (accessed on 6 January 2020).

- China Industry Economy Statistical Yearbook. Available online: http://data.stats.gov.cn/english/publish.htm?sort=1 (accessed on 6 January 2020).

- Data Collection on Wages and Income. Available online: https://www.ilo.org/travail/areasofwork/wages-and-income/WCMS_142568/lang--en/index.htm (accessed on 6 January 2020).

- Riveros, L.A. Labor costs and manufactured exports in developing countries: An econometric analysis. World Dev. 1992, 20, 991–1008. [Google Scholar] [CrossRef]

- Ozturk, M.; Durdyev, S.; Aras, O.N.; Banaitis, A. A productivity as a determinant of labour wage in New Zealand’s construction sector. Technol. Econ. Dev. Econ. 2019, 25, 1–15. [Google Scholar] [CrossRef] [Green Version]

- Ceglowski, J.; Golub, S. Just how low are China’s labour costs? World Econ. 2007, 30, 597–617. [Google Scholar] [CrossRef]

- Chen, V.W.; Wu, H.X.; Van Ark, B. More costly or more productive? measuring changes in competitiveness in manufacturing across regions in China. Rev. Income Wealth 2009, 55, 514–537. [Google Scholar] [CrossRef]

- Kleinknecht, A.; Naastepad, C.W.M. The Netherlands: Failure of a neo-classical policy agenda. Eur. Plan. Stud. 2005, 13, 1193–1203. [Google Scholar] [CrossRef]

- Altman, M. Economic Growth and the High Wage Economy: Choices, Constraints and Opportunities in the Market Economy, 1st ed.; Routledge: London, UK, 2012; ISBN 9780203114971. [Google Scholar]

- Thurow, L. Toward a HighWage, High-Productivity Service Sector Service Sector Wages, Productivity and Job Creation In the US and Other Countries Lmise waldstein; Economic Policy Institute: Washington, DC, USA, 1989; ISBN 0-944826-06-7. [Google Scholar]

- Resnick, D.P. Technical choice, innovation, and economic growth: Essays on American and British experience in the nineteenth century. Hist. Rev. New Books 1975, 3, 232. [Google Scholar] [CrossRef]

- Solow, R.M. Technical change and the aggregate production function. Rev. Econ. Stat. 1957, 39, 312–320. [Google Scholar] [CrossRef] [Green Version]

- Kennedy, C. Induced bias in Innovation and the theory of distribution. Econ. J. 1964, 74, 541–547. [Google Scholar] [CrossRef]

- Antonelli, C.; Quatraro, F. The effects of biased technological changes on total factor productivity: A rejoinder and new empirical evidence. J. Technol. Transf. 2014, 39, 281–299. [Google Scholar] [CrossRef] [Green Version]

- Lavoie, M.; Stockhammer, E. Wage-Led Growth: An Equitable Strategy for Economic Recovery; Palgrave Macmillan UK: London, UK, 2013; ISBN 978-1-349-47092-1. [Google Scholar]

- Burnette, J. Learning by doing: The real connection between innovation, wages, and wealth. Econ. Hist. Rev. 2016, 69, 742–743. [Google Scholar] [CrossRef]

- Carlsson, M.; Messina, J.; Skans, O.N. Wage adjustment and productivity shocks. Econ. J. 2016, 126, 1739–1773. [Google Scholar] [CrossRef] [Green Version]

- Braun, E.; Wield, D. Regulation as a means for the social control of technology. Technol. Anal. Strateg. Manag. 1994, 6, 259–272. [Google Scholar] [CrossRef]

- Beise, M.; Rennings, K. Lead markets and regulation: A framework for analyzing the international diffusion of environmental innovations. Ecol. Econ. 2005, 52, 5–17. [Google Scholar] [CrossRef]

- Chen, Y.S.; Lai, S.B.; Wen, C.T. The influence of green innovation performance on corporate advantage in Taiwan. J. Bus. Ethics 2006, 67, 331–339. [Google Scholar] [CrossRef]

- Horbach, J. Determinants of environmental innovation-New evidence from German panel data sources. Res. Policy 2008, 37, 163–173. [Google Scholar] [CrossRef] [Green Version]

- Rennings, K. Redefining innovation—Eco-innovation research and the contribution from ecological economics. Ecol. Econ. 2000, 32, 319–332. [Google Scholar] [CrossRef]

- Yang, D.; Chai, H. A review of driving factors of green technology innovation and its effect on firm’s performance. China Popul. Environ. 2015, S2, 132–136. [Google Scholar]

- Esty, D.C.; Winston, A.S. Green to Gold: How Smart Companies Use Environmental Strategy to Innovate, Create Value, and Build Competitive Advantage; Yale University Press: New Haven, CT, USA, 2006; ISBN 0-300-11997-8. [Google Scholar]

- Li, D.; Zheng, M.; Cao, C.; Chen, X.; Ren, S.; Huang, M. The impact of legitimacy pressure and corporate profitability on green innovation: Evidence from China top 100. J. Clean. Prod. 2017, 141, 41–49. [Google Scholar] [CrossRef] [Green Version]

- Wang, W.; Zhao, X.; Chen, F.; Wu, C.; Tsai, S.; Wang, J. 2019. The effect of corporate social responsibility and public attention on innovation performance: Evidence from high-polluting industries. Int. J. Environ. Res. Public Health. 2019, 16, 3939. [Google Scholar] [CrossRef] [Green Version]

- Woo, C.; Chung, Y.; Chun, D.; Han, S.; Lee, D. Impact of Green Innovation on Labor Productivity and its Determinants: An Analysis of the Korean Manufacturing Industry. Bus. Strateg. Environ. 2014, 23, 567–576. [Google Scholar] [CrossRef]

- Porter, M.E.; Van der Linde, C. Toward a new conception of the environment-competitiveness relationship. J. Econ. Perspect. 1995, 9, 97–118. [Google Scholar] [CrossRef]

- Chang, C.H. The influence of corporate environmental ethics on competitive advantage: The mediation role of green innovation. J. Bus. Ethics 2011, 104, 361–370. [Google Scholar] [CrossRef]

- Xue, M.; Boadu, F.; Xie, Y. The penetration of green innovation on firm performance: Effects of absorptive capacity and managerial environmental concern. Sustainability 2019, 11, 2455. [Google Scholar] [CrossRef] [Green Version]

- Albort-Morant, G.; Leal-Millán, A.; Cepeda-Carrión, G. The antecedents of green innovation performance: A model of learning and capabilities. J. Bus. Res. 2016, 69, 4912–4917. [Google Scholar] [CrossRef]

- Bansal, P. Evolving sustainably: A longitudinal study of corporate sustainable development. Strateg. Manag. J. 2005, 26, 197–218. [Google Scholar] [CrossRef]

- Nolting, L.; Priesmann, J.; Kockel, C.; Rödler, G.; Brauweiler, T.; Hauer, I.; Robinius, M.; Praktiknjo, A. Generating transparency in the worldwide use of the terminology industry 4.0. Appl. Sci. 2019, 9, 4659. [Google Scholar] [CrossRef] [Green Version]

- Berrone, P.; Fosfuri, A.; Gelabert, L.; Gomez-Mejia, L.R. Necessity as the mother of ‘green’ inventions: Institutional pressures and environmental innovations. Strateg. Manag. J. 2013, 34, 891–909. [Google Scholar] [CrossRef]

- Lanoie, P.; Laurent-Lucchetti, J.; Johnstone, N.; Ambec, S. Environmental policy, innovation and performance: New insights on the Porter hypothesis. J. Econ. Manag. Strateg. 2011, 20, 803–842. [Google Scholar] [CrossRef] [Green Version]

- Zhang, Y.; Wang, J.; Xue, Y.; Yang, J. Impact of environmental regulations on green technological innovative behavior: An empirical study in China. J. Clean. Prod. 2018, 188, 763–773. [Google Scholar] [CrossRef]

- Song, M.; Tao, J.; Wang, S. FDI, technology spillovers and green innovation in China: Analysis based on Data Envelopment Analysis. Ann. Oper. Res. 2015, 228, 47–64. [Google Scholar] [CrossRef]

- Chang, T.-W.; Chen, F.-F.; Luan, H.-D.; Chen, Y.-S. Effect of green organizational identity, green shared vision, and organizational citizenship behavior for the environment on green product development performance. Sustainability 2019, 11, 617. [Google Scholar] [CrossRef] [Green Version]

- Dinda, S. Environmental Kuznets Curve hypothesis: A survey. Ecol. Econ. 2004, 49, 431–455. [Google Scholar] [CrossRef] [Green Version]

- Hu, S.; Liu, S.; Li, D.; Lin, Y. How does regional innovation capacity affect the green growth performance? Empirical evidence from China. Sustainability 2019, 11, 5084. [Google Scholar] [CrossRef] [Green Version]

- Schumpeter, J.A. Capitalism, Socialism, and Democracy; Harper Perennial: New York, NY, USA, 1942. [Google Scholar]

- Baylis, R.; Connell, L.; Flynn, A. Company size, environmental regulation and ecological modernization: Further analysis at the level of the firm. Bus. Strateg. Environ. 1998, 7, 285–296. [Google Scholar] [CrossRef]

- Hewitt, F.; Clayton, M. Quality and complexity-lessons from English higher education. Int. J. Qual. Reliab. Manag. 1999, 16, 838–858. [Google Scholar] [CrossRef]

- Vrchota, J.; Pech, M. Readiness of enterprises in Czech Republic to implement industry 4.0: Index of industry 4.0. Appl. Sci. 2019, 9, 5405. [Google Scholar] [CrossRef] [Green Version]

- Erkut, B. The Emergence of the ERP software market between product innovation and market shaping. J. Open Innov. Technol. Mark. Complex. 2018, 4, 23. [Google Scholar] [CrossRef] [Green Version]

- Bain, J.S. Industrial Organization, 2nd ed.; John Wiley & Sons: New York, NY, USA, 1959; ISBN 0892327022 9780892327027. [Google Scholar]

- Brown, J.R.; Fazzari, S.M.; Peteresn, B.C. Financing Innovation and Growth: Cash Flow, External Equity, and the 1990s R&D Boom. J. Financ. 2009, 64, 151–185. [Google Scholar]

- Gorodnichenko, Y.; Schnitzer, M. Financial constraints and innovation: Why poor countries don’t catch up. J. Eur. Econ. Assoc. 2013, 11, 1115–1152. [Google Scholar] [CrossRef] [Green Version]

- Ye, Q.; Cheng, C. Green Technological Innovation Efficiency and Financial Ecological Environment. Open J. Soc. Sci. 2019, 7, 132–151. [Google Scholar] [CrossRef] [Green Version]

- Hicks, J.R. The Theory of Wages; Palgrave Macmillan UK: London, UK, 1963; ISBN 978-1-349-00191-0. [Google Scholar]

- Klemperer, P. Markets with consumer switching costs. Q. J. Econ. 1987, 102, 375. [Google Scholar] [CrossRef] [Green Version]

- Shy, O. A quick-and-easy method for estimating switching costs. Int. J. Ind. Organ. 2002, 20, 71–87. [Google Scholar] [CrossRef]

- Baumol, W.J.; Panzar, J.C.; Willig, R.D.; Baumol, W.; Panzar, J.C.; Willig, R.D. Contestable markets: An uprising in the theory of industry structure: Reply. Am. Econ. Rev. 1983, 73, 491–496. [Google Scholar]

- Otto, S.; Neaman, A.; Richards, B.; Marió, A. Explaining the ambiguous relations between income, environmental knowledge, and environmentally significant behavior. Soc. Nat. Resour. 2016, 29, 628–632. [Google Scholar] [CrossRef]

- Erkut, B. Structural similarities of economies for innovation and competitiveness—A decision tree based approach. Stud. Oeconomica Posnaniensia 2016, 4, 85–104. [Google Scholar] [CrossRef] [Green Version]

- Arrow, K.J. The economic implications of learning by doing. Rev. Econ. Stud. 1962, 29, 155. [Google Scholar] [CrossRef]

- Wilson, R.W. The effect of technological environment and product rivalry on R&D effort and licensing of inventions. Rev. Econ. Stat. 1977, 59, 171–178. [Google Scholar]

- Jaffe, A.B. Demand and supply influences in R&D intensity and productivity growth. Rev. Econ. Stat. 1988, 70, 431. [Google Scholar]

- Levin, R.; Cohen, W.; Mowery, D. R&D appropriability, opportunity, and market structure: New evidence on some Schumpeterian hypotheses. Am. Econ. Rev. 1985, 75, 20–24. [Google Scholar]

- Song, M.; Wang, S. Market competition, green technology progress and comparative advantages in China. Manag. Decis. 2018, 56, 188–203. [Google Scholar] [CrossRef]

- International Labour Office. Key Indicators of the Labour Market (KILM), 9th ed.; International Labour Office: Geneva, Switzerland, 2016; ISBN 978-92-2-130121-9. Available online: https://www.ilo.org/global/publications/books/WCMS_409035/lang--en/ind (accessed on 6 January 2020).

- Dang, C.; Frank Li, Z.; Yang, C. Measuring firm size in empirical corporate finance. J. Bank. Financ. 2018, 86, 159–176. [Google Scholar] [CrossRef]

- Guan, J.C.; Pang, L. Industry specific effects on innovation performance in China. China Econ. Rev. 2017, 44, 125–137. [Google Scholar] [CrossRef]

- Ghosh, A. Capital Structure and Firm Performance; Routledge: New York, NY, USA, 2017. [Google Scholar]

- Xie, X.; Huo, J.; Zou, H. Green process innovation, green product innovation, and corporate financial performance: A content analysis method. J. Bus. Res. 2019, 101, 697–706. [Google Scholar] [CrossRef]

- Charitou, M.S.; Elfani, M.; Lois, P. The effect of working capital management on firms profitability: Empirical evidence from an emerging market. J. Bus. Econ. Res. 2010, 8. [Google Scholar] [CrossRef] [Green Version]

- Wang, K.; Shailer, G. Ownership concentration and firm performance in emerging markets: A meta-analysis. J. Econ. Surv. 2015, 29, 199–229. [Google Scholar] [CrossRef]

- Nguyen, T.; Locke, S.; Reddy, K. Ownership concentration and corporate performance from a dynamic perspective: Does national governance quality matter? Int. Rev. Financ. Anal. 2015, 41, 148–161. [Google Scholar] [CrossRef]

- Minetti, R.; Murro, P.; Paiella, M. Ownership structure, governance, and innovation. Eur. Econ. Rev. 2015, 80, 165–193. [Google Scholar] [CrossRef]

- Lim, C.Y.; Wang, J.; Zeng, C. (Colin) China’s “mercantilist” government subsidies, the cost of debt and firm performance. J. Bank. Financ. 2018, 86, 37–52. [Google Scholar] [CrossRef] [Green Version]

- Zemzem, A.; Ftouhi, K.; Ayed, A. Tax planning and firm value: Evidence from European companies. Conf. Int. Conf. Bus. Econ. Mark. Res. 2015, 4, 73–78. [Google Scholar]

- Hansen, B.E. Threshold effects in non-dynamic panels: Estimation, testing, and inference. J. Econom. 1999, 93, 345–368. [Google Scholar] [CrossRef] [Green Version]

- Shapiro, C.; Stiglitz, J.E. Equilibrium unemployment as a worker discipline device. Am. Econ. Rev. 1984, 74, 433–444. [Google Scholar]

- Konings, J.; Walsh, P.P. Evidence of efficiency wage payments in UK firm level panel data. Econ. J. 1994, 104, 542–555. [Google Scholar] [CrossRef]

| Sample Processing Method | Number of Firms | Sample Size |

|---|---|---|

| A-share listed firms in high pollution industries | 1023 | 8123 |

| Exclude firms with incomplete or missing R&D investment data | 721 | 4967 |

| Exclude firms with incomplete or missing comprehensive energy consumption data | 45 | 450 |

| Valid samples of remaining firms | 45 | 450 |

| Variables | Unit | Mean | Standard Deviation | Minimum | Maximum |

|---|---|---|---|---|---|

| GTI | 10,000 CNY/kwh | 0.0584 | 0.1768 | 0.0015 | 8.9525 |

| ROA | % | 2.9334 | 5.6761 | −32.632 | 28.169 |

| Labor cost | 1000 CNY | 98.868 | 44.293 | 25.270 | 342.151 |

| HHI | -- | 0.1002 | 0.1039 | 0.0190 | 0.5302 |

| Asset scale | CNY | 1.08 × 1010 | 2.25 × 1010 | 6.73 × 108 | 1.90 × 1011 |

| Asset-liability ratio | % | 48.189 | 17.104 | 7.1145 | 111.23 |

| Liquidity of assets | % | 44.797 | 14.906 | 13.350 | 92.068 |

| Top 10 shareholders | % | 54.896 | 15.025 | 19.932 | 91.697 |

| Capital cost | % | 8.9140 | 7.0208 | 1.0763 | 29.778 |

| Tax burden | % | 2.5184 | 2.8915 | −10.789 | 22.509 |

| Independent Variables | Dependent Variable: ROA | |

|---|---|---|

| Model 1: OLS | Model 2: FE | |

| Labor cost | −0.0012 * (−1.76) | −0.0023 ** (−2.09) |

| Asset scale | 1.8097 *** (25.13) | 1.264863 *** (4.77) |

| Liquidity of assets | 0.0415 *** (8.77) | 0.1015474 *** (9.00) |

| Asset–liability ratio | −0.2235 *** (−239.29) | −0.2279553 *** (−246.26) |

| Top 10 shareholders | 0.1442 ** (2.48) | 0.0258974 (2.81) |

| Capital cost | −0.1865 *** (−13.04) | −0.104984 *** (−4.51) |

| Tax burden | 0.0001 (0.38) | −0.0003984 (−1.45) |

| HHI | −3.9542 *** (−3.71) | 15.49862 ** (2.44) |

| Constant | −31.5747 *** (−19.27) | −18.99597 *** (−3.09) |

| R-squared | 0.9231 | 0.9070 |

| F-statistics | 7493.28 | 8183.14 |

| Hausman test | 48.04 | |

| Number of observations | 450 | 450 |

| Threshold Number | Threshold Value | F-Statistic | p-Value |

|---|---|---|---|

| Single | (0.1526) | 121.720 *** | 0.0000 |

| Double | (0.1526, 0.2791) | 20.708 | 0.1293 |

| Independent Variables | Dependent Variable: ROA | |

|---|---|---|

| Model 1: OLS | Model 2: FE | |

| (HHI < ) | −0.0421 *** (−9.51) | 0.0434 *** (2.80) |

| (HHI ≥ ) | 0.0001 (0.04) | −0.0004 (−0.58) |

| Asset scale | 1.000 *** (3.85) | 11.430 *** (10.05) |

| Liquidity of assets | 0.0871 *** (7.88) | −0.229747 *** (−255.64) |

| Asset–liability ratio | −0.2281 *** (−253.63) | |

| Top 10 shareholders | 0.0227 *** (2.54) | |

| Capital cost | −0.0868 *** (−3.83) | −0.0857455 *** (−3.75) |

| Tax burden | −0.0004 (−1.52) | −0.0004374 (−1.59) |

| HHI | 15.5673 ** (2.52) | |

| Constant | −15.5279 ** (−2.44) | 13.92737 *** (60.84) |

| 0.1526 | 0.1526 | |

| R-squared | 0.9099 | 0.8222 |

| F-statistics | 6930.55 | 3165.93 |

| Number of observations | 450 | 450 |

| Variables | Dependent Variable: GTI | |

|---|---|---|

| Model 1: OLS | Model 2: FE | |

| Labor cost | 0.000182 *** (76.35) | 0.000155 *** (58.14) |

| ln(asset scale) | 0.018094 *** (13.26) | 0.007116 ** (1.92) |

| Liquidity of assets | −0.002146 *** (−23.80) | −0 0.001266 *** (−6.56) |

| Asset–liability ratio | 1.90 × 10−6 (0.11) | 6.48 × 10−6 (0.41) |

| Top 10 shareholders | 0.000096 (0.88) | 0.000119 (0.76) |

| Capital cost | 0.000287 (1.05) | −0.000149 (−0.37) |

| Constant | −0.259107 *** (−8.30) | −0.0565547 (0.56) |

| R-squared | 0.5753 | 0.5045 |

| F-statistics | 127.74 | 492.47 |

| Hausman test | 110.92 | |

| Number of observations | 450 | 450 |

| Threshold Number | Threshold Value | F-Statistic | p-Value |

|---|---|---|---|

| Single | (0.1529) | 1071.75 *** | 0.000 |

| Double | (0.1173, 0.2145) | 4715.02 *** | 0.000 |

| Triple | (0.0793, 0.1173, 0.2145) | 16.16 | 0.6167 |

| Variables | Dependent Variable: GTI | |

|---|---|---|

| Model 1: OLS | Model 2: FE | |

| (HHI < ) | 9.12 × 10−7 (0.46) | 2.80 × 10−7 (0.14) |

| (≤ HHI < ) | 0.000284 *** (191.00) | 0.000284 *** (184.99) |

| (HHI ≥ ) | 0.000152 *** (98.47) | 0.000152 *** (95.39) |

| ln(asset scale) | 0.016276 *** (8.82) | |

| Liquidity of assets | −0.000838 *** (−10.57) | |

| Asset–liability ratio | −2.12 × 10−6 (−0.33) | −9.91 × 10−6 (−0.02) |

| Top 10 shareholders | −0.000028 (−0.43) | |

| Capital cost | −0.000056 (−0.34) | −0.000420 ** (−2.53) |

| Constant | −0.262619 *** (−6.79) | 0.055301 *** (33.19) |

| 0.1173 | 0.1173 | |

| 0.2145 | 0.2145 | |

| R-squared | 0.7001 | 0.6420 |

| F-statistics | 185.43 | 168.47 |

| Number of observations | 450 | 450 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gong, R.; Wu, Y.-Q.; Chen, F.-W.; Yan, T.-H. Labor Costs, Market Environment and Green Technological Innovation: Evidence from High-Pollution Firms. Int. J. Environ. Res. Public Health 2020, 17, 522. https://doi.org/10.3390/ijerph17020522

Gong R, Wu Y-Q, Chen F-W, Yan T-H. Labor Costs, Market Environment and Green Technological Innovation: Evidence from High-Pollution Firms. International Journal of Environmental Research and Public Health. 2020; 17(2):522. https://doi.org/10.3390/ijerph17020522

Chicago/Turabian StyleGong, Rui, Yong-Qiu Wu, Feng-Wen Chen, and Tai-Hua Yan. 2020. "Labor Costs, Market Environment and Green Technological Innovation: Evidence from High-Pollution Firms" International Journal of Environmental Research and Public Health 17, no. 2: 522. https://doi.org/10.3390/ijerph17020522

APA StyleGong, R., Wu, Y.-Q., Chen, F.-W., & Yan, T.-H. (2020). Labor Costs, Market Environment and Green Technological Innovation: Evidence from High-Pollution Firms. International Journal of Environmental Research and Public Health, 17(2), 522. https://doi.org/10.3390/ijerph17020522