Does Emission Trading Boost Carbon Productivity? Evidence from China’s Pilot Emission Trading Scheme

Abstract

1. Introduction

2. Literature Review

3. Methods and Data

3.1. Methods

3.1.1. Difference-in-Difference-in-Difference (DDD) Model

3.1.2. Regional DDD Model

3.1.3. Industrial DDD Model

3.1.4. Stepwise Method

3.2. Data

3.2.1. Dependent Variable

3.2.2. Control Variables

3.2.3. Mediators

4. Results and Discussions

4.1. The Overall Impact of ETS

4.2. Heterogeneity Analysis Results

4.2.1. Regional Heterogeneity

4.2.2. Industrial Heterogeneity

4.3. Mediating Effects Results

4.3.1. Technological Progress

4.3.2. Capital Investment

4.4. Robustness Test Results

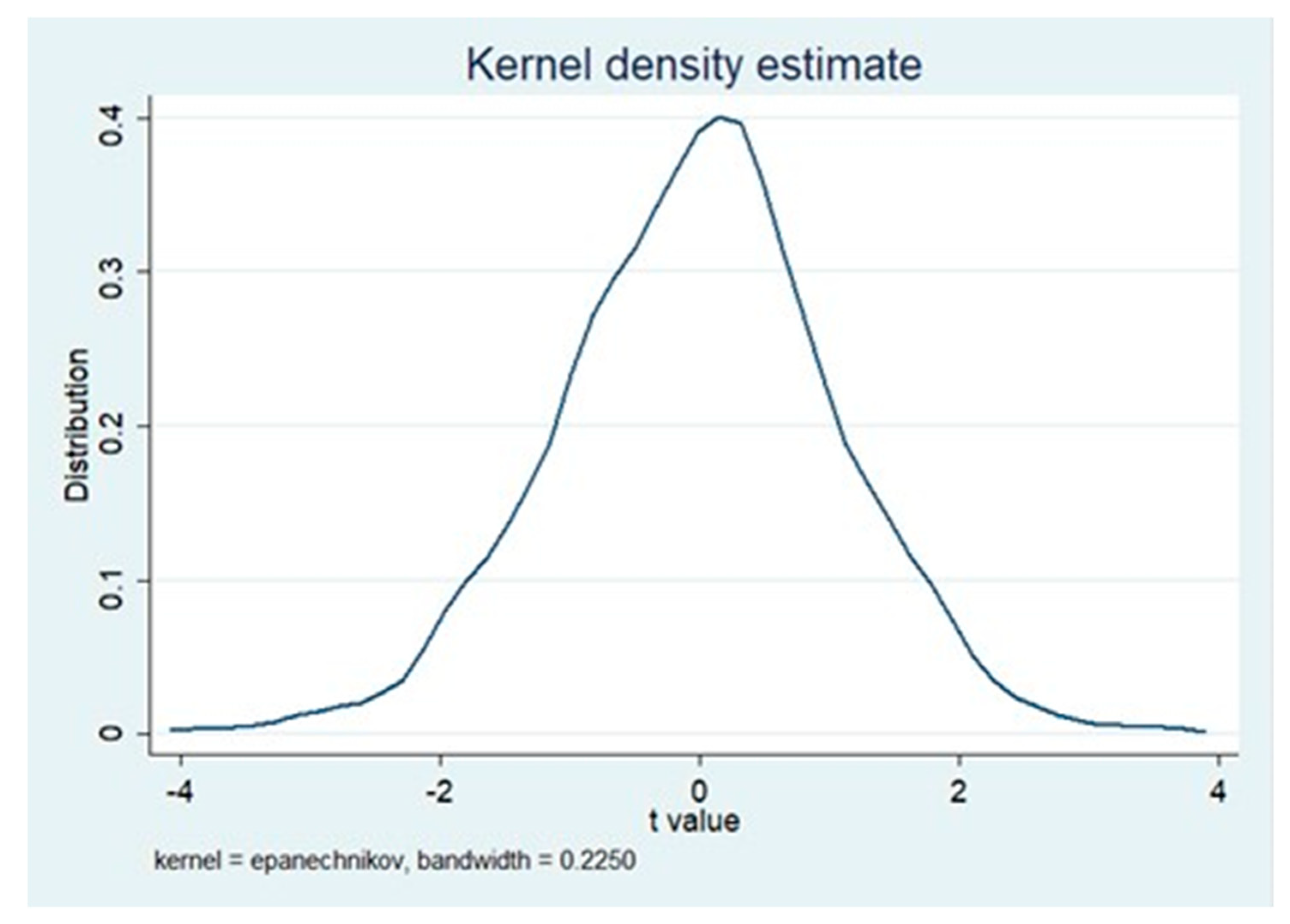

4.4.1. Placebo Test

4.4.2. Concurrent Event Test

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

Abbreviations

| ETS | emissions trading scheme |

| CTM | carbon trading market |

| DDD | difference-in-difference-in-difference |

| DID | difference-in-difference |

| PSM-DID | propensity score matching difference-in-difference |

Appendix A

| Industry Classification Name | Code | Industry Classification Name | Code |

|---|---|---|---|

| Mining and Washing of Coal | B06 | Processing of Petroleum, Coking, Processing of Nuclear Fuel | C25 |

| Extraction of Petroleum and Natural Gas | B07 | Manufacture of Raw Chemical Materials and Chemical Products. | C26 |

| Mining and Processing of Ferrous Metal Ores | B08 | Manufacture of Medicines | C27 |

| Mining and Processing of Non-Ferrous Metal Ores | B09 | Manufacture of Chemical Fibers | C28 |

| Mining and Processing of Nonmetal Ores | B10 | Manufacture of Rubber and Plastics | C29 |

| Processing of Food from Agriculture Products | C13 | Manufacture of Non-Metallic Mineral Products | C30 |

| Manufacture of Foods | C14 | Smelting and Pressing of Ferrous Metals | C31 |

| Manufacture of Beverages | C15 | Smelting and Pressing of Non-Ferrous Metals | C32 |

| Manufacture of Tobacco | C16 | Manufacture of Metal Products | C33 |

| Manufacture of Textile | C17 | Manufacture of General Purpose Machinery | C34 |

| Manufacture of Textile Wearing Apparel, Footware and Caps | C18 | Manufacture of Special Purpose Machinery | C35 |

| Manufacture of Leather, Furs, Feather and Related Products | C19 | Manufacture of Transport Equipment | C36, C37 |

| Processing of Timber, Manufacture of Wood, Bamboo, Rattan, Palmand Straw Products | C20 | Manufacture of Electrical Machinery and Equipment | C38 |

| Manufacture of Furniture | C21 | Manufacture of Communication Equipment, Computers and Other Electronic Equipment | C39 |

| Manufacture of Paper and Paper Products | C22 | Manufacture of Measuring Instruments and Machinery for Culture Activity and Office Work | C40 |

| Printing, Reproduction of Recording Media | C23 | Production and Distribution of Electric Power, Heat Power and Gas | D44, D45 |

| Manufacture of Articles for Culture, Education and Sports Activity | C24 | Production and Distribution of Water | D46 |

| Pilot Industries | Industry Classification Name | Data Description |

|---|---|---|

| Papermaking | Papermaking and Paper Products | |

| Petrochemical | Petroleum Processing and Coking | |

| Chemical | Raw Chemical Materials and Chemical Products | |

| Building materials | Non-metal Mineral Products | |

| Steel | Smelting and Pressing of Ferrous Metals | |

| Non-ferrous metal | Smelting and Pressing of Nonferrous Metals | |

| Transportation | Transportation Equipment Manufacturing | Merge “Automotive Manufacturing” with “Railroad, Ships, Aerospace and Other Transportation Equipment Manufacturing” |

| Electric power | Production and Supply of Electric Power, Heat Power and Gas | Merge “Production and Supply of Electric Power and Heating Power” with “Production and Supply of Gas” |

References

- Wang, Y.; Ge, X.L.; Liu, J.L.; Ding, Z. Study and analysis of energy consumption and energy-related carbon emission of industrial in Tianjin, China. Energy Strategy Rev. 2016, 10, 18–28. [Google Scholar] [CrossRef]

- van Vliet, M.T.; Franssen, W.H.; Yearsley, J.R.; Ludwig, F.; Haddeland, I.; Lettenmaier, D.P.; Kabat, P. Global river discharge and water temperature under climate change. Glob. Environ. Chang. 2013, 23, 450–464. [Google Scholar] [CrossRef]

- Hasegawa, T.; Fujimori, S.; Takahashi, K.; Yokohata, T.; Masui, T. Economic implications of climate change impacts on human health through undernourishment. Clim. Chang. 2016, 136, 189–202. [Google Scholar] [CrossRef]

- Tang, K.; Hailu, A.; Kragt, M.E.; Ma, C. The response of broadacre mixed crop-livestock farmers to agricultural greenhouse gas abatement incentives. Agric. Syst. 2018, 160, 11–20. [Google Scholar] [CrossRef]

- Wang, S.; Liu, X. China’s city-level energy-related CO2 emissions: Spatiotemporal patterns and driving forces. Appl. Energy 2017, 200, 204–214. [Google Scholar] [CrossRef]

- Li, S.; Zhou, C.; Wang, S.; Hu, J. Dose urban landscape pattern affect CO2 emission efficiency? Empirical evidence from megacities in China. J. Clean. Prod. 2018, 203, 164–178. [Google Scholar] [CrossRef]

- Wu, J.; Ma, C.; Tang, K. The static and dynamic heterogeneity and determinants of marginal abatement cost of CO2 emissions in Chinese cities. Energy 2019, 178, 685–694. [Google Scholar] [CrossRef]

- National Plan on Climate Change (2014–2020). Available online: http://www.scio.gov.cn/xwfbh/xwbfbh/wqfbh/2015/20151119/xgzc33810/document/1455885/1455885.htm (accessed on 2 June 2020).

- Yang, L.; Yang, Y.; Zhang, X.; Tang, K. Whether china’s industrial sectors make efforts to reduce CO2 emissions from production? A decomposed decoupling analysis. Energy 2018, 160, 796–809. [Google Scholar] [CrossRef]

- Wu, J.; Guo, Q.; Yuan, J.; Lin, J.; Xiao, L.; Yang, D. An integrated approach for allocating carbon emission quotas in China’s emissions trading system. Resour. Conserv. Recycl. 2019, 143, 291–298. [Google Scholar] [CrossRef]

- Tang, K.; Hailu, A. Smallholder farms’ adaptation to the impacts of climate change: Evidence from China’s Loess Plateau. Land Use Policy 2020, 91, 104353. [Google Scholar] [CrossRef]

- Zhang, L.; Xiong, L.; Cheng, B.; Yu, C. How does foreign trade influence China’s carbon productivity? Based on panel spatial lag model analysis. Struct. Chang. Econ. Dyn. 2018, 47, 171–179. [Google Scholar] [CrossRef]

- Li, S.; Wang, S. Examining the effects of socioeconomic development on China’s carbon productivity: A panel data analysis. Sci. Total Environ. 2019, 659, 681–690. [Google Scholar] [CrossRef] [PubMed]

- OECD. Green Growth Indicators for Agriculture: A Preliminary Assessment; OECD Green Growth Studies; OECD Publishing: Paris, France, 2014. [Google Scholar]

- Ekins, P.; Pollitt, H.; Summerton, P.; Chewpreecha, U. Increasing carbon and material productivity through environmental tax reform. Energy Policy 2012, 42, 365–376. [Google Scholar] [CrossRef]

- Shao, S.; Yang, Z.; Yang, L.; Ma, S. Can China’s energy intensity constraint policy promote total factor energy efficiency? Evidence from the industrial sector. Energy J. 2019, 40. [Google Scholar] [CrossRef]

- Dong, F.; Dai, Y.; Zhang, S.; Zhang, X.; Long, R. Can a carbon emission trading scheme generate the Porter effect? Evidence from pilot areas in China. Sci. Total Environ. 2019, 653, 565–577. [Google Scholar] [CrossRef]

- Zhang, Y.; Zhang, J. Estimating the impacts of emissions trading scheme on low-carbon development. J. Clean. Prod. 2019, 238, 117913. [Google Scholar] [CrossRef]

- Zhou, B.; Zhang, C.; Song, H.; Wang, Q. How does emission trading reduce China’s carbon intensity? An exploration using a decomposition and difference-in-differences approach. Sci. Environ. 2019, 676, 514–523. [Google Scholar] [CrossRef]

- Wang, S.J.; Huang, Y.Y. Spatial spillover effects and driving factors of carbon emission intensity in Chinese cities. Acta Geogr. Sin. 2019, 74, 1131–1148. [Google Scholar]

- Tang, B.J.; Ji, C.J.; Hu, Y.J.; Tan, J.X.; Wang, X.Y. Optimal carbon allowance price in China’s carbon emission trading system: Perspective from the multi-sectoral marginal abatement cost. J. Clean. Prod. 2020, 253, 119945. [Google Scholar] [CrossRef]

- Crossland, J.; Li, B.; Roca, E. Is the European Union Emissions Trading Scheme (EU ETS) informationally efficient? Evidence from momentum-based trading strategies. Appl. Energy 2013, 109, 10–23. [Google Scholar]

- Tang, K.; He, C.; Ma, C.; Wang, D. Does carbon farming provide a cost-effective option to mitigate GHG emissions? Evidence from China. Aust. J. Agric. Resour. Econ. 2019, 63, 575–592. [Google Scholar] [CrossRef]

- Lu, H.; Ma, X.; Huang, K.; Azimi, M. Carbon trading volume and price forecasting in China using multiple machine learning models. J. Clean. Prod. 2020, 249, 119386. [Google Scholar] [CrossRef]

- Tang, L.; Wu, J.; Yu, L.; Bao, Q. Carbon allowance auction design of China’s emissions trading scheme: A multi-agent-based approach. Energy Policy 2017, 102, 30–40. [Google Scholar] [CrossRef]

- Liu, Y.; Tan, X.J.; Yu, Y.; Qi, S.Z. Assessment of impacts of Hubei Pilot emission trading schemes in China: A CGE-analysis using TermCO2 model. Appl. Energy 2017, 189, 762–769. [Google Scholar] [CrossRef]

- Lin, B.; Jia, Z. What will China’s carbon emission trading market affect with only electricity sector involvement? A CGE based study. Energy Econ. 2019, 78, 301–311. [Google Scholar] [CrossRef]

- Chen, Z.; Yuan, X.C.; Zhang, X.; Cao, Y. How will the Chinese national carbon emissions trading scheme work? The assessment of regional potential gains. Energy Policy 2020, 137, 111095. [Google Scholar] [CrossRef]

- Yi, L.; Bai, N.; Yang, L.; Li, Z.; Wang, F. Evaluation on the effectiveness of China’s pilot carbon market policy. J. Clean. Prod. 2020, 246, 119039. [Google Scholar] [CrossRef]

- Clò, S.; Ferraris, M.; Florio, M. Ownership and environmental regulation: Evidence from the European electricity industry. Energy Econ. 2017, 61, 298–312. [Google Scholar] [CrossRef]

- Zhang, H.; Duan, M.; Deng, Z. Have China’s pilot emissions trading schemes promoted carbon emission reductions? The evidence from industrial sub-sectors at the provincial level. J. Clean. Prod. 2019, 234, 912–924. [Google Scholar] [CrossRef]

- Hu, Y.; Ren, S.; Wang, Y.; Chen, X. Can carbon emission trading scheme achieve energy conservation and emission reduction? Evidence from the industrial sector in China. Energy Econ. 2020, 85, 104590. [Google Scholar] [CrossRef]

- Zhang, Y.J.; Liang, T.; Jin, Y.L.; Shen, B. The impact of carbon trading on economic output and carbon emissions reduction in China’s industrial sectors. Appl. Energy 2020, 260, 114290. [Google Scholar] [CrossRef]

- Zhang, K.; Xu, D.; Li, S.; Zhou, N.; Xiong, J. Has China’s pilot emissions trading scheme influenced the carbon intensity of output? Int. J. Environ. Res. Public Health 2019, 16, 1854. [Google Scholar] [CrossRef] [PubMed]

- Fang, G.; Lu, L.; Tian, L.; Yin, H. Research on the influence mechanism of carbon trading on new energy: A case study of ESER system for China. Phys. Stat. Mech. Appl. 2020, 545, 123572. [Google Scholar] [CrossRef]

- Rogge, K.S.; Schneider, M.; Hoffmann, V.H. The innovation impact of the EU Emission Trading System: Findings of company case studies in the German power sector. Ecol. Econ. 2011, 70, 513–523. [Google Scholar] [CrossRef]

- Fang, G.; Tian, L.; Liu, M.; Fu, M.; Sun, M. How to optimize the development of carbon trading in China: Enlightenment from evolution rules of the EU carbon price. Appl. Energy 2018, 211, 1039–1049. [Google Scholar] [CrossRef]

- Zhu, B.; Zhang, M.; Huang, L.; Wang, P.; Su, B.; Wei, Y. Exploring the effect of carbon trading mechanism on China’s green development efficiency: A novel integrated approach. Energy Econ. 2020, 85, 104601. [Google Scholar] [CrossRef]

- Hoque, H.; Mu, S. Partial private sector oversight in China’s A-share IPO market: An empirical study of the sponsorship system. J. Corp. Financ. 2019, 56, 15–37. [Google Scholar] [CrossRef]

- Lichtman-Sadot, S. Can public transportation reduce accidents? Evidence from the introduction of late-night buses in Israeli cities. Reg. Sci. Urban Econ. 2019, 74, 99–117. [Google Scholar] [CrossRef]

- Kaya, Y.; Yokobori, K. (Eds.) Environment, Energy, and Economy: Strategies for Sustainability; United Nations University Press: Tokyo, Japan, 1997. [Google Scholar]

- Rodriguez, M.; Pansera, M.; Lorenzo, P.C. Do indicators have politics? A review of the use of energy and carbon intensity indicators in public debates. J. Clean. Prod. 2020, 243, 118602. [Google Scholar] [CrossRef]

- Wang, H.; Chen, Z.; Wu, X.; Nie, X. Can a carbon trading system promote the transformation of a low-carbon economy under the framework of the porter hypothesis? Empirical analysis based on the PSM-DID method. Energy Policy 2019, 129, 930–938. [Google Scholar] [CrossRef]

- Wang, Y.; Sun, X.; Wang, B.; Liu, X. Energy saving, GHG abatement and industrial growth in OECD countries: A green productivity approach. Energy 2020, 194, 116833. [Google Scholar] [CrossRef]

- Iftikhar, Y.; He, W.; Wang, Z. Energy and CO2 emissions efficiency of major economies: A non-parametric analysis. J. Clean. Prod. 2016, 139, 779–787. [Google Scholar] [CrossRef]

- Chen, G.; Hou, F.; Chang, K.; Zhai, Y.; Du, Y. Driving factors of electric carbon productivity change based on regional and sectoral dimensions in China. J. Clean. Prod. 2018, 205, 477–487. [Google Scholar] [CrossRef]

- Li, W.; Wang, W.; Wang, Y.; Ali, M. Historical growth in total factor carbon productivity of the Chinese industry: A comprehensive analysis. J. Clean. Prod. 2018, 170, 471–485. [Google Scholar] [CrossRef]

- Du, K.; Li, J. Towards a green world: How do green technology innovations affect total-factor carbon productivity. Energy Policy 2019, 131, 240–250. [Google Scholar] [CrossRef]

- Meng, M.; Niu, D. Three-dimensional decomposition models for carbon productivity. Energy 2012, 46, 179–187. [Google Scholar] [CrossRef]

- Shi, X.; Xu, Z. Environmental regulation and firm exports: Evidence from the eleventh Five-Year Plan in China. J. Environ. Econ. Manag. 2018, 89, 187–200. [Google Scholar]

- Cai, H.; Chen, Y.; Gong, Q. Polluting thy neighbor: Unintended consequences of China’s pollution reduction mandates. J. Environ. Econ. Manag. 2016, 76, 86–104. [Google Scholar]

- Saeidi, S.P.; Sofian, S.; Saeidi, P.; Saeidi, S.P.; Saaeidi, S.A. How does corporate social responsibility contribute to firm financial performance? the mediating role of competitive advantage, reputation, and customer satisfaction. J. Bus. Res. 2015, 68, 341–350. [Google Scholar] [CrossRef]

- Tang, K.; Qiu, Y.; Zhou, D. Does command-and-control regulation promote green innovation performance? Evidence from China’s industrial enterprises. Sci. Total Environ. 2020, 712, 136362. [Google Scholar] [CrossRef]

- Department of Industry Statistics, National Bureau of Statistics. China Industry Statistical Yearbook (2008–2018); China Statistics Press: Beijing, China, 2018.

- Urban Society and Economic Statistics Department, National Bureau of Statistics. China Price Statistical Yearbook (2008–2018); China Statistics Press: Beijing, China, 2018.

- Eggleston, S.; Buendia, L.; Miwa, K.; Ngara, T.; Tanabe, K. IPCC Guidelines for National Greenhouse Gas Inventories; IPCC National Greenhouse Gas Inventories Programme; Institute for Global Environmental Strategies: Hayama, Kanagawa, Japan, 2006; Volume 5. [Google Scholar]

- Department of Energy Statistics, National Bureau of Statistics. China Energy Statistical Yearbook (2008–2018); China Statistics Press: Beijing, China, 2018.

- Shan, Y.; Guan, D.; Zheng, H.; Ou, J.; Li, Y.; Meng, J.; Mi, Z.; Liu, Z.; Zhang, Q. China CO2 emission accounts 1997–2015. Sci. Data 2018, 5, 170201. [Google Scholar] [CrossRef] [PubMed]

- Baumers, M.; Dickens, P.; Tuck, C.; Hague, R. The cost of additive manufacturing: Machine productivity, economies of scale and technology-push. Technol. Forecast. Soc. Chang. 2016, 102, 193–201. [Google Scholar] [CrossRef]

- He, J.J.; Tian, X. The dark side of analyst coverage: The case of innovation. J. Financ. Econ. 2013, 109, 856–878. [Google Scholar] [CrossRef]

- Xie, R.H.; Yuan, Y.J.; Huang, J.J. Different types of environmental regulations and heterogeneous influence on “green” productivity: Evidence from China. Ecol. Econ. 2017, 132, 104–112. [Google Scholar] [CrossRef]

- Deng, F.; Jin, Y.; Ye, M.; Zheng, S. New fixed assets investment project environmental performance and influencing factors: An empirical analysis in China’s Optics Valley. Int. J. Environ. Res. Public Health 2019, 16, 4891. [Google Scholar] [CrossRef] [PubMed]

- Yin, H.T.; Ma, C.B. International integration: A hope for a greener China? Int. Mark. Rev. 2009, 26, 348–367. [Google Scholar] [CrossRef]

- Brown, J.R.; Martinsson, G.; Petersen, B.C. Do financing constraints matter for R&D? Eur. Econ. Rev. 2012, 56, 1512–1529. [Google Scholar]

- Jaraite-Kažukauske, J.; Di Maria, C. Did the EU ETS make a difference? An empirical assessment using Lithuanian firm-level data. Energy J. 2016, 37, 1–23. [Google Scholar] [CrossRef]

- Liu, W.; Wang, Z. The effects of climate policy on corporate technological upgrading in energy intensive industries: Evidence from China. J. Clean. Prod. 2017, 142, 3748–3758. [Google Scholar] [CrossRef]

- Zhao, X.G.; Zhang, Y. Technological progress and industrial performance: A case study of solar photovoltaic industry. Renew. Sustain. Energy Rev. 2018, 81, 929–936. [Google Scholar]

- Liu, H.; Wu, J.; Chu, J. Environmental efficiency and technological progress of transportation industry-based on large scale data. Technol. Forecast. Soc. Chang. 2019, 144, 475–482. [Google Scholar] [CrossRef]

- Levinsohn, J.; Petrin, A. Estimating production functions using inputs to control for unobservables. Rev. Econ. Stud. 2003, 70, 317–341. [Google Scholar] [CrossRef]

- Bel, G.; Joseph, S. Policy stringency under the European Union Emission trading system and its impact on technological change in the energy sector. Energy Policy 2018, 117, 434–444. [Google Scholar] [CrossRef]

- Gulbrandsen, L.H.; Stenqvist, C. The limited effect of EU emissions trading on corporate climate strategies: Comparison of a Swedish and a Norwegian pulp and paper company. Energy Policy 2013, 56, 516–525. [Google Scholar] [CrossRef]

- Segura, S.; Ferruz, L.; Gargallo, P.; Salvador, M. Environmental versus economic performance in the EU ETS from the point of view of policy makers: A statistical analysis based on copulas. J. Clean. Prod. 2018, 176, 1111–1132. [Google Scholar] [CrossRef]

- Richter, J.L.; Mundaca, L. Market behavior under the New Zealand ETS. Carbon Manag. 2013, 4, 423–438. [Google Scholar] [CrossRef][Green Version]

- Meng, S.; Siriwardana, M.; McNeill, J.; Nelson, T. The impact of an ETS on the Australian energy sector: An integrated CGE and electricity modelling approach. Energy Econ. 2018, 69, 213–224. [Google Scholar] [CrossRef]

- Nong, D.; Meng, S.; Siriwardana, M. An assessment of a proposed ETS in Australia by using the MONASH-Green model. Energy Policy 2017, 108, 281–291. [Google Scholar] [CrossRef]

- Choi, Y.; Qi, C. Is South Korea’s Emission Trading Scheme Effective? An Analysis Based on the Marginal Abatement Cost of Coal-Fueled Power Plants. Sustainability 2019, 11, 2504. [Google Scholar] [CrossRef]

- ICAP. Global Carbon Market Progress: 2020; Annual Report; International Carbon Action Partnership (ICAP): Berlin, Germany, 2020. [Google Scholar]

- Ji, C.J.; Hu, Y.J.; Tang, B.J. Research on carbon market price mechanism and influencing factors: A literature review. Nat. Hazards 2018, 92, 761–782. [Google Scholar] [CrossRef]

- Takeda, S.; Arimura, T.H.; Tamechika, H.; Fischer, C.; Fox, A.K. Output-based allocation of emissions permits for mitigating the leakage and competitiveness issues for the Japanese economy. Environ. Econ. Policy Stud. 2014, 16, 89–110. [Google Scholar] [CrossRef]

- Caparrós, A.; Pereau, J.C.; Tazdaït, T. Emission trading and international competition: The impact of labor market rigidity on technology adoption and output. Energy Policy 2013, 55, 36–43. [Google Scholar] [CrossRef]

- Ezzi, F.; Jarboui, A. Does innovation strategy affect financial, social and environmental performance? J. Econ. Financ. Adm. Sci. 2016, 21, 14–24. [Google Scholar] [CrossRef]

- Albrizio, S.; Kozluk, T.; Zipperer, V. Environmental policies and productivity growth: Evidence across industries and firms. J. Environ. Econ. Manag. 2017, 81, 209–226. [Google Scholar]

- Smale, R.; Hartley, M.; Hepburn, C.; Ward, J.; Grubb, M. The impact of CO2 emissions trading on firm profits and market prices. Clim. Policy 2006, 6, 31–48. [Google Scholar] [CrossRef]

- Liu, H.; Zhang, X.C. Carbon emission trading system and enterprise R&D innovation: An empirical study based on triple difference model. Econ. Sci. 2017, 3, 102–114. [Google Scholar]

- La Ferrara, E.; Chong, A.; Duryea, S. Soap operas and fertility: Evidence from Brazil. Am. Econ. J. Appl. Econ. 2012, 4, 1–31. [Google Scholar] [CrossRef]

- Deng, X.; Song, X.; Xu, Z. Transaction costs, modes, and scales from agricultural to industrial water rights trading in an inland river basin, northwest China. Water 2018, 10, 1598. [Google Scholar] [CrossRef]

| Bourse | Brand | Time | Turnover (106 ¥) | Trading Volume (105 ton) | Average Unit Transaction Price (¥/ton) |

|---|---|---|---|---|---|

| Beijing | BEA | 28 November 2013–31 December 2017 | 358.86 | 71.20 | 50.40 |

| Guangdong | GDEA | 19 December 2013–31 December 2017 | 558.02 | 384.85 | 14.50 |

| Tianjin | TJEA | 26 December 2013–31 December 2017 | 41.16 | 30.05 | 13.70 |

| Hubei | HBEA | 2 April 2014–31 December 2017 | 911.10 | 489.16 | 18.63 |

| Chongqing | CQEA | 19 June 2014–31 December 2017 | 30.05 | 75.13 | 4.00 |

| Variable Type | Variable | Symbol | Variable Meaning | Mean | Standard Deviation |

|---|---|---|---|---|---|

| Dependent variable | Carbon productivity | Lncp | Industrial carbon emissions/industrial total output value (in log) (106t/108 RMB) | 1.6376 | 2.2057 |

| Control variable | Industrial scale | Lnasset | Industrial total assets in log (108 RMB) | 4.9014 | 2.0799 |

| Lnlabor | Industrial average number of employees in log (104 people) | 1.4347 | 1.0586 | ||

| Asset-liability ratio | AL | Industrial total liabilities/industrial total assets × 100% | 83.3002 | 344.2183 | |

| Asset profit ratio | AP | Industrial total profit/industrial total assets × 100% | 10.4222 | 43.9045 | |

| Current assets ratio | CA | Industrial total current assets/industrial total assets × 100% | 45.1310 | 19.0907 | |

| Mediator | Technological progress | Lntfp | Total factor productivity | 1.9317 | 2.3115 |

| Capital investment | CI | Industrial fixed assets investment/industrial total output value | 19.8296 | 984.4881 |

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| ttg | 1.2682 *** (0.2526) | 0.5631 ** (0.2824) | 1.1626 *** (0.2665) | 0.5825 ** (0.2803) |

| _cons | 1.6070 *** (0.6739) | 1.6240 *** (0.0068) | 0.1491 (0.2487) | 0.8154 *** (0.2749) |

| Controls | N | N | Y | Y |

| Iyfe | Y | Y | Y | Y |

| Pyfe | N | Y | N | Y |

| R-squared | 0.4570 | 0.6149 | 0.4950 | 0.6301 |

| Variables | Regional Heterogeneity | Industrial Heterogeneity | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Beijing | Guangdong | Tianjin | Hubei | Chongqing | Papermaking | Petrochemical | Chemical | Building Materials | Steel | Non-Ferrous Metal | Transportation | Electric Power | |

| ttg | 1.0721 *** (0.3691) | 0.7366 (0.4581) | 0.0196 (0.6093) | −0.4756 (0.5124) | −1.2894 ** (0.5349) | −0.1101 (0.2862) | 1.3908 *** (0.1883) | 0.0443 (0.2605) | −0.5102 * (0.2524) | −0.3486 (0.3015) | −0.3420 (0.2590) | −0.9184 ** (0.2756) | 0.7409 ** (0.3037) |

| _cons | 1.0624 (0.9379) | 1.1469 (0.9205) | 1.2036 (0.9590) | 1.2030 (0.9502) | 1.1436 (0.8987) | 0.4128 (0.4678) | 0.3108 (0.5124) | 0.4132 (0.4611) | 0.4166 (0.4657) | 0.4181 (0.4634) | 0.4482 (0.4640) | 0.3404 (0.4860) | 0.4334 (0.4490) |

| Controls | Y | Y | Y | Y | Y | Y | Y | Y | Y | Y | Y | Y | Y |

| Iyfe | Y | Y | Y | Y | Y | Y | Y | Y | Y | Y | Y | Y | Y |

| Pyfe | Y | Y | Y | Y | Y | Y | Y | Y | Y | Y | Y | Y | Y |

| R-squared | 0.6673 | 0.6650 | 0.6628 | 0.6638 | 0.6697 | 0.6996 | 0.7041 | 0.6996 | 0.7002 | 0.6999 | 0.6999 | 0.7014 | 0.7009 |

| Variables | Technological Progress | Capital Investment | ||||||

|---|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

| ttg | 0.5825 ** (0.2803) | 0.4845 * (0.2801) | 0.5825 ** (0.2803) | 0.5809 ** (0.2805) | ||||

| Lntfp | 0.6303 *** (0.1303) | 0.2125 * (0.1168) | 0.2228 *** (0.0453) | |||||

| CI | 0.0549 * (0.0285) | 0.0682 * (0.1168) | 0.0098 *** (0.0453) | |||||

| _cons | 0.8154 *** (0.2749) | −1.2764 *** (0.2730) | −1.0281 *** (0.2482) | 1.3141 *** (0.2773) | 0.8154 *** (0.2749) | 1.0645 *** (0.3611) | −1.6171 (1.8374) | 1.3141 *** (0.0026) |

| Controls | Y | Y | Y | Y | Y | Y | Y | Y |

| Iyfe | Y | Y | Y | Y | Y | Y | Y | Y |

| Pyfe | Y | N | Y | Y | Y | N | N | Y |

| Pfe | N | N | N | N | N | N | Y | N |

| R-squared | 0.6301 | 0.2218 | 0.8348 | 0.6400 | 0.6301 | 0.0877 | 0.0883 | 0.6304 |

| Variables | Pilot Water Rights Trading | |

|---|---|---|

| (1) | (2) | |

| time × treat × group | 1.1323 *** | 0.5355 ** |

| (0.1763) | (0.2353) | |

| _cons | −0.0560 * | 0.5528 ** |

| (0.2999) | (0.3102) | |

| Controls | Y | Y |

| Pyfe | N | Y |

| Iyfet | Y | Y |

| R-squared | 0.4668 | 0.6125 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhou, D.; Liang, X.; Zhou, Y.; Tang, K. Does Emission Trading Boost Carbon Productivity? Evidence from China’s Pilot Emission Trading Scheme. Int. J. Environ. Res. Public Health 2020, 17, 5522. https://doi.org/10.3390/ijerph17155522

Zhou D, Liang X, Zhou Y, Tang K. Does Emission Trading Boost Carbon Productivity? Evidence from China’s Pilot Emission Trading Scheme. International Journal of Environmental Research and Public Health. 2020; 17(15):5522. https://doi.org/10.3390/ijerph17155522

Chicago/Turabian StyleZhou, Di, Xiaoyu Liang, Ye Zhou, and Kai Tang. 2020. "Does Emission Trading Boost Carbon Productivity? Evidence from China’s Pilot Emission Trading Scheme" International Journal of Environmental Research and Public Health 17, no. 15: 5522. https://doi.org/10.3390/ijerph17155522

APA StyleZhou, D., Liang, X., Zhou, Y., & Tang, K. (2020). Does Emission Trading Boost Carbon Productivity? Evidence from China’s Pilot Emission Trading Scheme. International Journal of Environmental Research and Public Health, 17(15), 5522. https://doi.org/10.3390/ijerph17155522