Financial Fraud, Mental Health, and Quality of Life: A Study on the Population of the City of Madrid, Spain

Abstract

1. Introduction

2. Materials and Methods

2.1. 2017 Madrid Health Survey

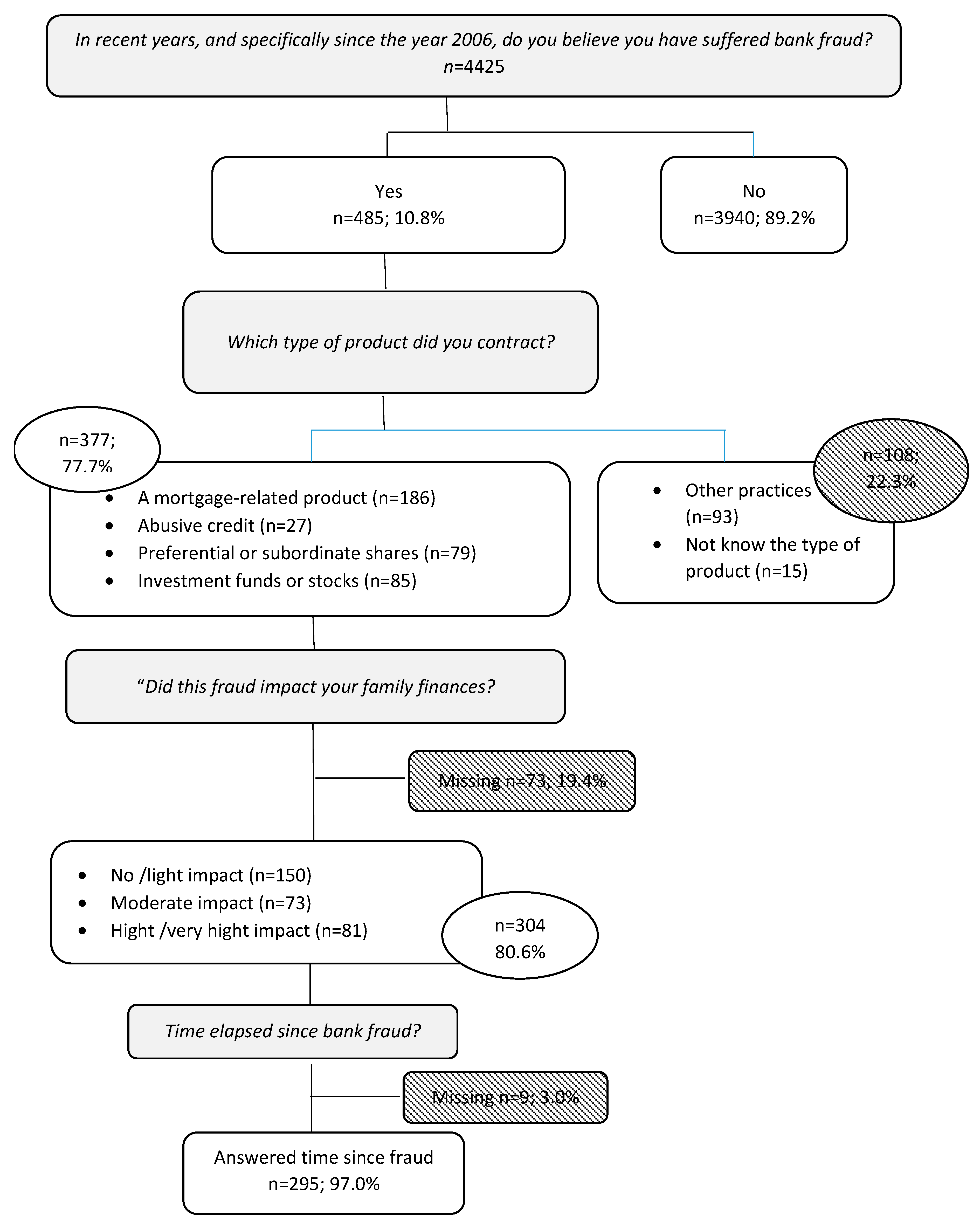

2.2. Recruitment and Study Procedures

2.3. Human Subjects

2.4. Outcomes

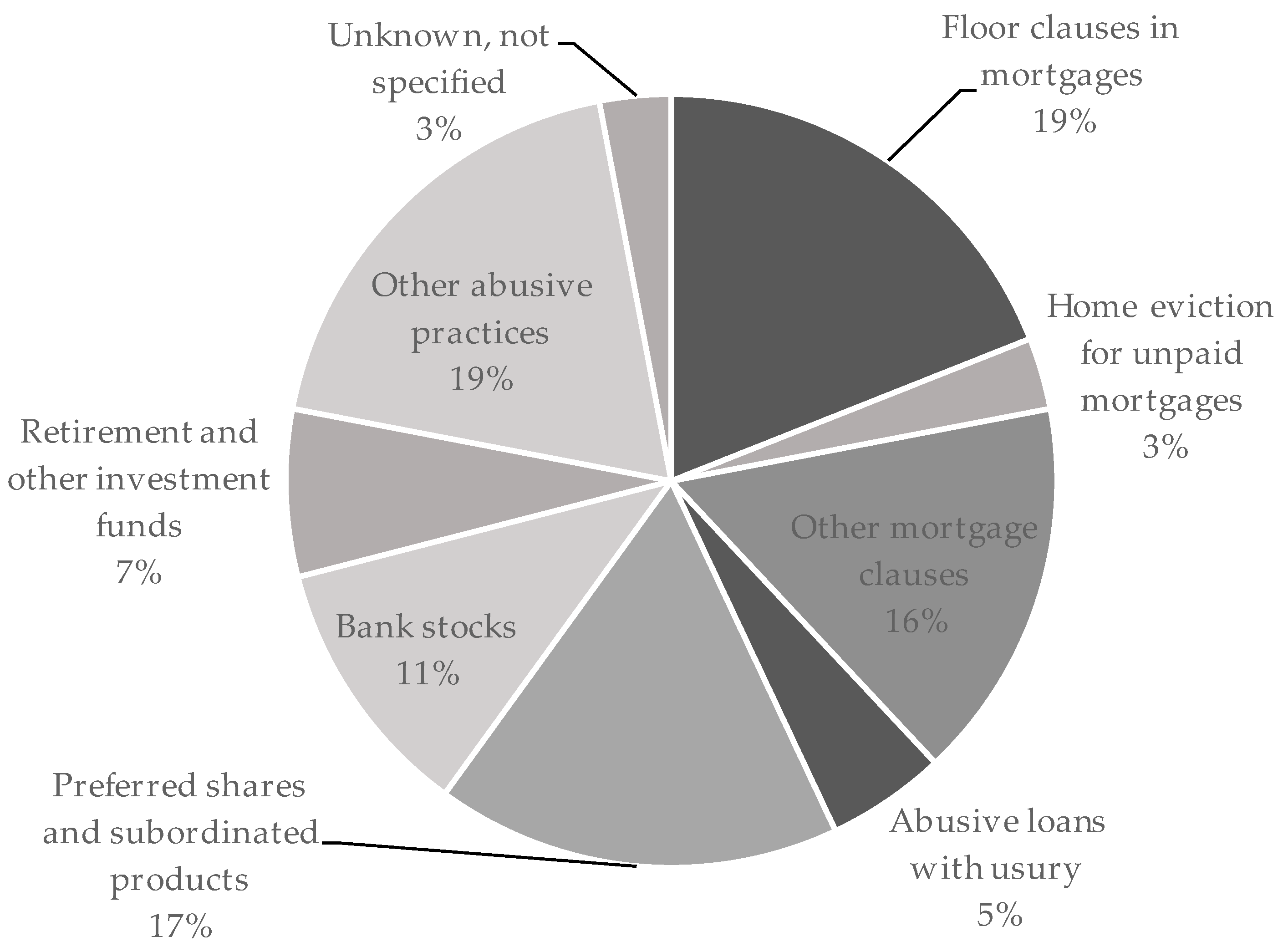

2.5. Exposure Variables

2.6. Covariates

2.7. Statistical Analysis

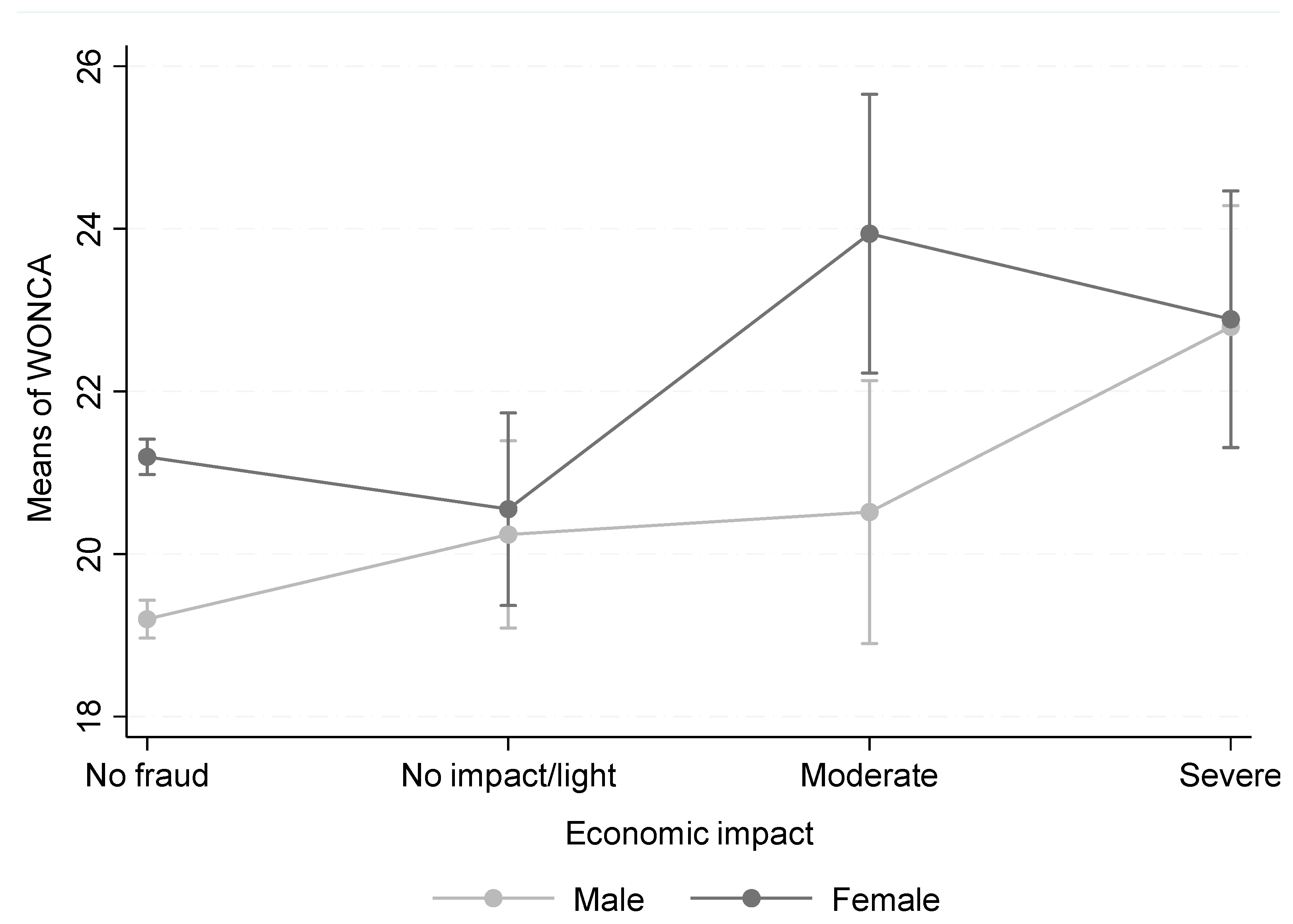

3. Results

4. Discussion

Strengths and Limitations

5. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Financial Crisis Inquiry Commission. Financial Crisis Inquiry Report; US Government: Washington, DC, USA, 2011.

- Conac, P.H. Mis-selling of financial products: Subordinated debt and self-placement. In Policy Department for Economic Scientific and Quality of Life Policies; European Parliament: Bruxelles, Belgium, 2018. [Google Scholar]

- Zunzunegui, F. Mis-selling of financial products: Mortgages credits. In Policy Department for Economic Scientific and Quality of Life Policies; European Parliament: Brussels, Belgium, 2018. [Google Scholar]

- Comision de seguimiento. Comisión de Seguimiento Sobre Comercialización de Los Instrumentos Híbridos de Capital y Deuda Subordinada; Ministerio de la Presidencia: Madrid, Spain, 2013.

- Misse, A. La Gran Estafa de Las Preferentes; Alternativas economicas: Madrid, Spain, 2016. [Google Scholar]

- Real Academia Española. Diccionario de la lengua española; Real Academia Española: Madrid, Spain, 2019. [Google Scholar]

- Ganzini, L.; McFarland, B.H.; Cutler, D. Prevalence of mental disorders after catastrophic financial loss. J. Nerv. Ment. Dis. 1990, 178, 680–685. [Google Scholar] [CrossRef]

- Spalek, B. Exploring the impact of financial crime: A study looking into the effects of the Maxwell scandal upon the Maxwell pensioners. Int. Rev. Vict. 1999, 6, 213–230. [Google Scholar] [CrossRef]

- Freshman, A. Financial disaster as a risk factor for posttraumatic stress disorder: Internet survey of trauma in victims of the Madoff Ponzi scheme. Health Soc. Work 2012, 37, 39–48. [Google Scholar] [CrossRef]

- Glodstein, D.; Glodstein, S.L.; Fornaro, J. Fraud trauma syndrome: The victims of the Bernard Madoff scandal. J. Forensic Stud. Account. Bus. 2010, 2, 1–9. [Google Scholar]

- Zunzunegui, M.V.; Belanger, E.; Benmarhnia, T.; Gobbo, M.; Otero, A.; Beland, F.; Zunzunegui, F.; Ribera-Casado, J.M. Financial fraud and health: The case of Spain. Gac. Sanit. 2017, 31, 313–319. [Google Scholar] [CrossRef]

- Goldberg, D.P.; Oldehinkel, T.; Ormel, J. Why GHQ threshold varies from one place to another. Psychol. Med. 1998, 28, 915–921. [Google Scholar] [CrossRef]

- Goodchild, M.E.; Duncan-Jones, P. Chronicity and the general health questionnaire. Br. J. Psychiatry 1985, 146, 55–61. [Google Scholar] [CrossRef]

- Artazcoz, L.; Benach, J.; Borrell, C.; Cortes, I. Unemployment and mental health: Understanding the interactions among gender, family roles, and social class. Am. J. Public Health 2004, 94, 82–88. [Google Scholar] [CrossRef]

- Llacer, A.; Amo, J.D.; Garcia-Fulgueiras, A.; Ibanez-Rojo, V.; Garcia-Pino, R.; Jarrin, I.; Diaz, D.; Fernandez-Liria, A.; Garcia-Ortuzar, V.; Mazarrasa, L.; et al. Discrimination and mental health in Ecuadorian immigrants in Spain. J. Epidemiol. Community Health 2009, 63, 766–772. [Google Scholar] [CrossRef][Green Version]

- Bones Rocha, K.; Perez, K.; Rodriguez-Sanz, M.; Borrell, C.; Obiols, J.E. Prevalence of mental health problems and their association with socioeconomic, work and health variables: Findings from the Spain National Health Survey. Psicothema 2010, 22, 389–395. [Google Scholar]

- Roca, K.B.; Pérez, K.; Rodriguez-Sanz, M.; Borrell, C.; Obiols, J.E. Propiedades psicométricas y valores normativos del General Health Questionnaire (GHQ-12) en población general española. Int. J. Clin. Health Psychol. 2011, 11, 125–139. [Google Scholar]

- Nelson, E.; Wasson, J.; Kirk, J.; Keller, A.; Clark, D.; Dietrich, A.; Stewart, A.; Zubkoff, M. Assessment of function in routine clinical practice: Description of the COOP Chart method and preliminary findings. J. Chronic Dis. 1987, 40 (Suppl. 1), 55s–63s. [Google Scholar] [CrossRef]

- Serrano-Gallardo, P.; Lizan-Tudela, L.; Diaz-Olalla, J.M.; Otero, A. Reference population values of the Spanish version of the COOP/WONCA charts of quality of life in an urban adult population. Med. Clin. 2009, 132, 336–343. [Google Scholar] [CrossRef]

- Pedrero-Perez, E.J.; Diaz-Olalla, J.M. COOP/WONCA: Reliability and validity of the test administered by telephone. Aten. Primaria 2016, 48, 25–32. [Google Scholar] [CrossRef]

- Domingo-Salvany, A.; Bacigalupe, A.; Carrasco, J.M.; Espelt, A.; Ferrando, J.; Borrell, C. Proposals for social class classification based on the Spanish National Classification of Occupations 2011 using neo-Weberian and neo-Marxist approaches. Gac. Sanit. 2013, 27, 263–272. [Google Scholar] [CrossRef]

- Vasquez-Vera, H.; Palencia, L.; Magna, I.; Mena, C.; Neira, J.; Borrell, C. The threat of home eviction and its effects on health through the equity lens: A systematic review. Soc. Sci. Med. 2017, 175, 199–208. [Google Scholar] [CrossRef]

- Ganzini, L.; McFarland, B.; Bloom, J. Victims of fraud: Comparing victims of white collar and violent crime. J. Am. Acad. Psychiatry Law Online 1990, 18, 55–63. [Google Scholar]

- Cross, C.; Richards, K.; Smith, R.G. The reporting experiences and support needs of victims of online fraud. Trends Issues Crime Crim. Justice 2016, 518, 1–14. [Google Scholar]

- Turunen, E.; Hiilamo, H. Health effects of indebtedness: A systematic review. BMC Public Health 2014, 14, 489. [Google Scholar] [CrossRef]

- Downing, J. The health effects of the foreclosure crisis and unaffordable housing: A systematic review and explanation of evidence. Soc. Sci. Med. 2016, 162, 88–96. [Google Scholar] [CrossRef]

- Tsai, A.C. Home foreclosure, health, and mental health: A systematic review of individual, aggregate, and contextual associations. PLoS ONE 2015, 10, e0123182. [Google Scholar] [CrossRef]

- Modic, D.; Anderson, R. It’s all over but the crying: The emotional and financial impact of internet fraud. IEEE Secur. Priv. 2015, 13, 99–103. [Google Scholar] [CrossRef]

- Ross, S.; Smith, R.G. Risk factors for advance fee fraud victimisation. Trends Issues Crime Crim. Justice 2011, 420, 1. [Google Scholar]

- Whitty, M.T.; Buchanan, T. The online dating romance scam: The psychological impact on victims—Both financial and non-financial. Criminol. Crim. Justice 2016, 16, 176–194. [Google Scholar] [CrossRef]

- Button, M.; Lewis, C.; Tapley, J. Not a victimless crime: The impact of fraud on individual victims and their families. Secur. J. 2014, 27, 36–54. [Google Scholar] [CrossRef]

- Drentea, P.; Reynolds, J.R. Where does debt fit in the stress process model? Soc. Ment. Health 2015, 5, 16–32. [Google Scholar] [CrossRef]

- Dackehag, M.; Ellegård, L.-M.; Gerdtham, U.-G.; Nilsson, T. Debt and mental health: New insights about the relationship and the importance of the measure of mental health. Eur. J. Public Health 2018, 29, 488–493. [Google Scholar] [CrossRef]

- Brown, S.; Taylor, K.; Price, S.W. Debt and distress: Evaluating the psychological cost of credit. J. Econ. Psychol. 2005, 26, 642–663. [Google Scholar] [CrossRef]

- Sweet, E.; Nandi, A.; Adam, E.K.; McDade, T.W. The high price of debt: Household financial debt and its impact on mental and physical health. Soc. Sci. Med. 2013, 91, 94–100. [Google Scholar] [CrossRef]

- Białowolski, P.; Węziak-Białowolska, D.; VanderWeele, T.J. The impact of savings and credit on health and health behaviours: An outcome-wide longitudinal approach. Int. J. Public Health 2019, 64, 573–584. [Google Scholar] [CrossRef]

- Bolivar Munoz, J.; Bernal Solano, M.; Mateo Rodriguez, I.; Daponte Codina, A.; Escudero Espinosa, C.; Sanchez Cantalejo, C.; Gonzalez Usera, I.; Robles Ortega, H.; Mata Martin, J.L.; Fernandez Santaella, M.C.; et al. The health of adults undergoing an eviction process. Gac. Sanit. 2016, 30, 4–10. [Google Scholar] [CrossRef]

- Berg, L.; Brännström, L. Evicted children and subsequent placement in out-of-home care: A cohort study. PLoS ONE 2018, 13, e0195295. [Google Scholar] [CrossRef]

- McLaughlin, K.A.; Nandi, A.; Keyes, K.M.; Uddin, M.; Aiello, A.E.; Galea, S.; Koenen, K.C. Home foreclosure and risk of psychiatric morbidity during the recent financial crisis. Psychol. Med. 2012, 42, 1441–1448. [Google Scholar] [CrossRef]

- Vasquez-Vera, H.; Rodriguez-Sanz, M.; Palencia, L.; Borrell, C. Foreclosure and health in southern Europe: Results from the platform for people affected by mortgages. J. Urban Health 2016, 93, 312–330. [Google Scholar] [CrossRef]

- Bernal-Solano, M.; Bolivar-Munoz, J.; Mateo-Rodriguez, I.; Robles-Ortega, H.; Fernandez-Santaella, M.D.C.; Mata-Martin, J.L.; Vila-Castellar, J.; Daponte-Codina, A. Associations between home foreclosure and health outcomes in a Spanish city. Int. J. Environ. Res. Public Health 2019, 16. [Google Scholar] [CrossRef]

- Khan, S.; Khan, R.A. Chronic stress leads to anxiety and depression. Ann Psychiatry Ment Health 2017, 5, 1091. [Google Scholar]

- Schneiderman, N.; Ironson, G.; Siegel, S.D. Stress and health: Psychological, behavioral, and biological determinants. Annu. Rev. Clin. Psychol. 2005, 1, 607–628. [Google Scholar] [CrossRef]

- Kircanski, K.; Notthoff, N.; DeLiema, M.; Samanez-Larkin, G.R.; Shadel, D.; Mottola, G.; Carstensen, L.L.; Gotlib, I.H. Emotional arousal may increase susceptibility to fraud in older and younger adults. Psychol. Aging 2018, 33, 325–337. [Google Scholar] [CrossRef]

| Variable | Unweighted n | Mental Health Problems (GHQ-12) | Quality of Life (COOP/WONCA) | ||

|---|---|---|---|---|---|

| Weighted % | p-Value | Mean (SD) | p-Value | ||

| Age (years) | |||||

| 15–29 | 750 | 22.8 | 0.054 a | 18.4 (4.9) | 0.000 a |

| 30–44 | 1198 | 21.1 | 19.7 (5.2) | ||

| 45–64 | 1436 | 23.0 | 21.0 (5.6) | ||

| >65 | 1041 | 18.0 | 21.9 (5.2) | ||

| Gender | |||||

| Men | 2035 | 16.8 | 0.000 b | 19.2 (4.8) | 0.000 b |

| Women | 2390 | 25.1 | 21.4 (5.7) | ||

| Social class | |||||

| High | 1743 | 17.8 | 0.000 a | 19.1 (4.8) | 0.000 a |

| Middle | 1009 | 22.1 | 20.7 (5.4) | ||

| Low | 1584 | 23.9 | 21.5 (5.6) | ||

| Immigration status (Place of birth) | |||||

| Outside of Spain | 764 | 23.2 | 0.166 b | 20.4 (5.1) | 0.942 b |

| Spain | 3661 | 20.8 | 20.4 (5.5) | ||

| Economic Impact of Fraud | Unweighted n (weighted %) a | Time since Awareness of Fraud (Months) |

|---|---|---|

| (Mean, SD) | ||

| No fraud (4425 − 485 = 3940) | 3940 (92.9) | |

| No or light impact | 150 (3.5) | 49.4 (35.1) |

| Moderate | 73 (1.7) | 66.6 (39.8) |

| Severe or very severe | 81 (2.0) | 68.8 (39.5) |

| Variable | Unweighted n | Mental Health Problems (GHQ-12) | Quality of Life (WONCA) | ||

|---|---|---|---|---|---|

| Weighted % | p-Value | Mean (SD) | p-Value | ||

| Economic impact | 0.016 a | <0.001 a | |||

| No fraud | 3940 | 20.4 | 20.3 (5.4) | ||

| No/light impact | 150 | 20.6 | 20.4 (5.4) | ||

| Moderate | 73 | 28.8 | 22.4 (5.4) | ||

| Severe/very severe | 81 | 31.2 | 23.2 (5.4) | ||

| Claims | 0.884 b | 0.877 b | |||

| None | 87 | 22.1 | 21.6 (5.5) | ||

| Judiciary | 106 | 26.6 | 21.8 (5.5) | ||

| Extrajudiciary | 109 | 27.6 | 21.7 (5.5) | ||

| Economic compensation | 0.896 b | 0.414 b | |||

| None | 102 | 26.9 | 21.3 (6.1) | ||

| Partial | 42 | 28.5 | 22.6 (6.1) | ||

| Total | 63 | 28.4 | 22.0 (6.1) | ||

| In process | 6 | 18.3 | 22.4 (6.1) | ||

| Items’ Contents | Unweighted n | Economic Impact on Family Finances (Weighted %) | p-Value a | |||

|---|---|---|---|---|---|---|

| No Fraud | No or Light Impact | Moderate | Severe or Very Severe | |||

| Physical fitness activity | 0.077 | |||||

| Very intense | 973 | 23.5 | 24.6 | 15.7 | 10.3 | |

| Intense | 580 | 13.7 | 13.5 | 12.8 | 7.5 | |

| Moderate | 1872 | 43.6 | 46.1 | 46.3 | 49.7 | |

| Light | 629 | 14.9 | 12 | 18 | 26.4 | |

| Very light | 190 | 4.3 | 3.8 | 7.1 | 6.1 | |

| Disturbed by negative feelings | 0.044 | |||||

| None | 2329 | 55.4 | 53.1 | 50.9 | 49 | |

| Some | 964 | 22.4 | 29.9 | 23.9 | 16.6 | |

| Moderately | 519 | 12.3 | 7.5 | 10.2 | 17.4 | |

| A lot | 301 | 6.7 | 9.2 | 8.4 | 11.2 | |

| Very much | 131 | 3.3 | 0.2 | 6.5 | 5.8 | |

| Daily activities difficulties | <0.001 | |||||

| None | 2875 | 68.6 | 57.5 | 59 | 53.5 | |

| A little bit | 668 | 15.5 | 22.3 | 13.3 | 14.2 | |

| Moderately difficult | 492 | 11.3 | 14.3 | 14.3 | 21.3 | |

| Highly difficulty | 160 | 3.5 | 5.3 | 12.1 | 9.2 | |

| Completely unable | 49 | 1.2 | 0.7 | 1.3 | 1.9 | |

| Social activities limited by health | 0.001 | |||||

| None | 3345 | 79.4 | 73 | 66.6 | 67.5 | |

| A little bit | 435 | 10 | 17.3 | 7.3 | 16.5 | |

| Moderately | 260 | 6 | 7.4 | 12.3 | 10.2 | |

| A lot | 137 | 3.1 | 1.6 | 7.4 | 3.9 | |

| Completely | 67 | 1.6 | 0.7 | 6.3 | 1.9 | |

| Health status change (last two weeks) | 0.367 | |||||

| Much better | 336 | 8.1 | 7 | 3.8 | 11.7 | |

| Somewhat better | 464 | 11.4 | 10.5 | 7.4 | 8.1 | |

| Same | 3155 | 73.8 | 73.5 | 77.2 | 69.9 | |

| Somewhat worse | 242 | 5.5 | 8.7 | 8.4 | 8.4 | |

| Much worse | 47 | 1.1 | 0.3 | 3.2 | 1.9 | |

| Self-rated health (today) | 0.07 | |||||

| Excellent | 465 | 11.2 | 9.1 | 9.3 | 3.9 | |

| Very good | 842 | 20.1 | 18 | 14.6 | 15.7 | |

| Good | 1994 | 46.7 | 50.6 | 44 | 42.2 | |

| Fair | 784 | 18.4 | 19.2 | 23.9 | 33 | |

| Poor | 159 | 3.7 | 3.1 | 8.1 | 5.2 | |

| Pain | 0.001 | |||||

| None | 1699 | 40.2 | 43.7 | 35.2 | 19.4 | |

| Very light pain | 937 | 22.3 | 16.2 | 13.3 | 27.9 | |

| Light pain | 548 | 12.5 | 16.8 | 8.4 | 14.5 | |

| Moderate pain | 735 | 17.1 | 17.3 | 31.1 | 31 | |

| Severe pain | 325 | 7.9 | 6 | 12 | 7.1 | |

| Availability of help | 0.013 | |||||

| Yes, everyone | 707 | 16.3 | 21.2 | 17.8 | 1.9 | |

| Yes, a lot of people | 1300 | 30.5 | 21.2 | 26.5 | 29.9 | |

| Yes, some people | 1044 | 24.9 | 28.5 | 29.7 | 24.4 | |

| Yes, a few people | 1007 | 23.7 | 25.6 | 20.5 | 39.2 | |

| Nobody | 186 | 4.6 | 3.6 | 5.5 | 4.6 | |

| General quality of life | <0.001 | |||||

| Very good, could not be better | 499 | 11.9 | 11.2 | 13.2 | 6.4 | |

| Good | 2146 | 51 | 46.0 | 35,7 | 34,9 | |

| Fair | 1430 | 33.2 | 39.8 | 38.5 | 51.4 | |

| Bad | 130 | 2.9 | 2.6 | 12.6 | 5.5 | |

| Very bad, could not be worse | 39 | 1 | 0 | 0 | 1.9 | |

| Economic Impact (Ref: No Fraud) | Unadjusted Prevalence Rates (CI 95%) | Adjusted Prevalence Rates 1 (CI 95%) | ||||

|---|---|---|---|---|---|---|

| Both genders | Male | Female | Both genders | Male | Female | |

| No/light impact | 1.01 (0.72–1.41) | 1.09 (0.64–1.86) | 0.99 (0.64–1.53) | 1.06 (0.75–1.49) | 1.15 (0.67–1.95) | 1.01 (0.64–1.59) |

| Moderate | 1.41 (0.96–2.06) | 1.26 (0.66–2.38) | 1.61 (1.02–2.52) | 1.41 (0.97–2.07) | 1.22 (0.61–2.43) | 1.64 (1.06–2.53) * |

| Severe/very severe | 1.52 (1.09–2.12) * | 1.55 (0.91–2.64) * | 1.58 (1.04–2.38) * | 1.62 (1.17–2.25) * | 1.64 (0.96–2.79) * | 1.64 (1.09–2.47) * |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sarriá, E.; Recio, P.; Rico, A.; Díaz-Olalla, M.; Sanz-Barbero, B.; Ayala, A.; Zunzunegui, M.V. Financial Fraud, Mental Health, and Quality of Life: A Study on the Population of the City of Madrid, Spain. Int. J. Environ. Res. Public Health 2019, 16, 3276. https://doi.org/10.3390/ijerph16183276

Sarriá E, Recio P, Rico A, Díaz-Olalla M, Sanz-Barbero B, Ayala A, Zunzunegui MV. Financial Fraud, Mental Health, and Quality of Life: A Study on the Population of the City of Madrid, Spain. International Journal of Environmental Research and Public Health. 2019; 16(18):3276. https://doi.org/10.3390/ijerph16183276

Chicago/Turabian StyleSarriá, Encarnación, Patricia Recio, Ana Rico, Manuel Díaz-Olalla, Belén Sanz-Barbero, Alba Ayala, and María Victoria Zunzunegui. 2019. "Financial Fraud, Mental Health, and Quality of Life: A Study on the Population of the City of Madrid, Spain" International Journal of Environmental Research and Public Health 16, no. 18: 3276. https://doi.org/10.3390/ijerph16183276

APA StyleSarriá, E., Recio, P., Rico, A., Díaz-Olalla, M., Sanz-Barbero, B., Ayala, A., & Zunzunegui, M. V. (2019). Financial Fraud, Mental Health, and Quality of Life: A Study on the Population of the City of Madrid, Spain. International Journal of Environmental Research and Public Health, 16(18), 3276. https://doi.org/10.3390/ijerph16183276