1. Introduction

Many parts of the world have long suffered from serious water shortage, intensified water conflicts, and deteriorating aquatic ecosystems amid dramatic human socioeconomic activities and significant climate changes [

1,

2]. As the chief source of renewable freshwater supply, flowing rivers have irreplaceable functions in natural ecology and social services because of their ability to adjust hydrological regimes, transport materials and energy, shape geology and geomorphology, and regulate surrounding climate changes. The water resources system in the transboundary river basin is usually associated with multiple local decision makers, who are generally self-optimizers, giving priority to their own objectives rather than broader state or national objectives [

3]. The statistics from the Transboundary Freshwater Dispute Database show that approximately 276 transboundary rivers are shared by 148 riparian countries throughout the world [

4], possess about 60% of the global river flows [

5], and host more than 2.7 billion people [

4,

5]. Although many international water laws and conventions, including the Helsinki Rules [

6], the UN Watercourses Convention [

7], and the Berlin Rules [

8], have been promulgated and implemented in an attempt to manage these rivers in an equitable and reasonable manner, they still failed to introduce internationally accepted and standardized allocation schemes for sharing these resources and their corresponding benefits [

9,

10,

11], largely due to the absence of effective methods for synthetically considering the multidimensional attributes of river-sharing problems.

As a special natural resource, water resources have the attribute of quasi-public good in that in principle all stakeholders enjoy equal rights to access and use. Unilateral actions taken by self-optimizing decision makers may pose negative externalities for others as well as environmental systems, especially when water availability is not sufficient to cover claims. A situation which is often referred to as “the tragedy of the commons” will inevitably appear if the water resources system collapses due to water overuse. Nevertheless, it is probably excessively pessimistic to use this term to predict an inevitable tragedy for water resources [

12], in the sense that resource users do not necessarily always follow the Nash strategies of the prisoner’s dilemma game with actions merely based on individual rationality [

13]. Agents may self-organize in efforts to achieve a sustainable complex social-ecological system [

14] through their learning process of improving adaptation and responsiveness to changing environmental and social conditions [

15].

Conflict and cooperation coexist in the transboundary water governance [

16,

17,

18], and the simultaneous consideration of these two processes helps to improve the quality of negotiation over water distributions [

19,

20]. Generally, three categories of institutions involving non-cooperation, cooperation, and exogenous regulation have been identified for managing common pool resources like water resources [

21]. Non-cooperative institutions have been proven to not necessarily result in tragic outcomes [

21], while a combination of laissez-faire and open access is very likely to trigger serious conflicts and even social instability. Effective exogenous regulation, for example in groundwater exploitation regulation, usually necessitates an authorized intervener (e.g., a social planner, government, or regulator), whose decisions are enforceable and acceptable by all agents, so this may be less practical in resolving realistic resource-sharing problems, particularly transboundary ones involving multiple local decision makers representing different or even conflicting interests. Cooperative institutions are obviously more conducive to the sustainable management of water resources and the long-term interests of agents involved [

12].

Numerous theories and methods from various disciplines could be used to develop cooperative solutions for allocating internationally contested water resources among riparian agents. The social welfare maximization approach is often used to maximize the global gains with the assumption of a fully cooperative attitude among the agents involved, but it fails to distribute the total benefits among them, and often ignores their heterogeneity in terms of political, social, and economic status [

22]; hence, the allocation solutions derived from this approach are not always practical [

23]. Operations research-based allocation methods, such as compromise programming [

24,

25] and goal programming [

26,

27], usually focus on finding the social-optimal solutions by minimizing the sum of agent’s dissatisfaction with various solutions or the distance between the solutions and the ideal ones. Indeed, these distance-based methods [

28] allow an increase in the system-level gains [

29] compared with totally uncooperative mechanisms. Nevertheless, similar to the social welfare maximization approach, these methods distribute resources only from the social planner’s view with the assumption that perfect cooperation, transferable utility, and economic compensation exist among local agents [

30], neglecting the interactions between them. Therefore, the practical feasibility of allocation solutions based on these methods is also likely questionable [

28,

31,

32].

Analytical methods originated from the bankruptcy literature [

33,

34,

35,

36] have proved to be promising methods for addressing river bankruptcy problems [

31]. As these distribution rules are normally based on common sense [

10,

31], concentrating on sharing resources among stakeholders directly according to their claims without the need to clarify their utility information and incremental benefits of cooperation, they have relatively good practical significance and flexibility in solving complex river-sharing problems, and the decision results are easily understood and accepted by local decision makers and policy makers [

10,

31,

37]. However, these methods usually model the river bankruptcy problem as a cooperative transferable utility game [

9] under the assumption that all agents involved have equivalent power in politics, society, and the economy, and in practice, these asymmetric factors inevitably influence each agent’s actions and decisions [

28].

Water governance in the transboundary river context is complicated by overlapping interactions among the involved agents [

38]. Correct understanding and dealing with these strategic interactions is critical to avoiding water conflicts [

16] and achieving self-enforcing distribution agreements. Unpacking the discourse of water scarcity facilitates an understanding of agents’ causes, consequences, and interactions [

39,

40], greatly increasing the possibility of reaching a cooperation agreement. Solution concepts derived from cooperative game (CG) theory, such as the Nash bargaining solution, and the nuclear, the core and the Shapley value, have a strong potential to facilitate win–win solutions for sharing water resources and their benefits since they can well capture coalitional dynamics and multidimensional elements [

23,

41] affecting cooperation among the agents involved. Among these solution concepts, the Nash bargaining solution [

42] has the ability to incorporate multiple desirable properties such as feasibility, invariance under changing utilities, Pareto optimality, and unanimity [

43] into transboundary water sharing problems [

9]. It has proved to be able to significantly balance the utilities among parties involved [

44], and can serve as a base for sustainable river water-sharing agreements [

45]. Hence, it is frequently used in the water resources literature [

3,

9,

12,

23,

29,

32,

44,

46,

47,

48,

49,

50,

51,

52,

53,

54] to address river-sharing issues involving multiple local decision makers that require consideration of the reliability criterion.

The transnational water management system could be described as a cooperative game with externalities [

54]; effective negotiations among agents over water allocations, to a certain extent, can prevent hydro-hegemony [

55]. However, the negotiation process is not necessarily based on the background of power symmetry [

56], in the sense that agents likely have heterogeneous social, economic, political, and military positions that will inevitably influence the final negotiation outcome [

57]. Asymmetry in power is a fundamental aspect of hydro-politics, which is one key element for conflict resolution in transboundary water governance [

58,

59]. Although asymmetrical powers between agents do not necessarily determine the results of negotiations, the overall benefits lie in the hands of the most powerful agent [

60]. Therefore, the agents’ bargaining powers should be taken into account in river-sharing problems when available [

28,

55,

56,

58,

59,

60,

61,

62,

63,

64], as they help create a more realistic negotiation analysis [

28]. The asymmetric Nash bargaining solution (ANBS) [

65], generalized by the Nash bargaining solution [

43], proved to be suitable for describing the agents’ asymmetrical negotiation powers through bargaining weights, and ensuring mutually beneficial resolutions for water-sharing problems. Nevertheless, it is both crucial and challenging to define agents’ bargaining weights (BWs) and disagreement utility points (DUPs).

Briefly, transboundary river management should be formulated as the multi-criteria decision-making (MCDM) problem bargained by multiple groups with disparate social, economic, political, and military status and needs [

28,

56,

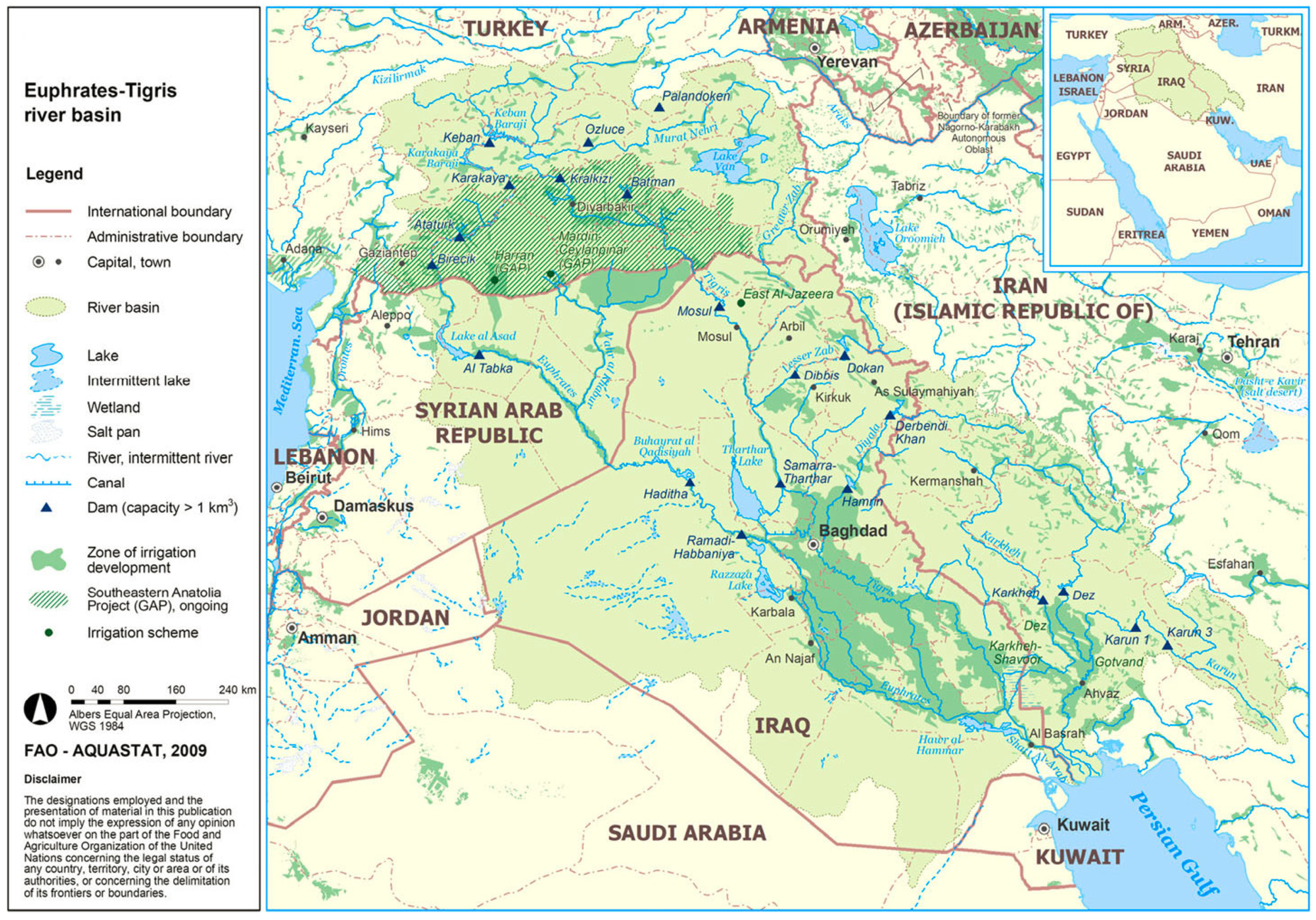

66]. The present study aims to develop an asymmetric bargaining model to find realistic and feasible solutions for river-sharing problems. The detailed operation steps are as follows: (1) data envelopment analysis (DEA) is selected as the MCDM approach to define agents’ negotiation powers (NPs) by synthetically considering their asymmetry in social, economic, political, and military aspects; (2) three methods based on the bankruptcy theory are developed to generate the minimum water rights (MWRs) for all participating agents with respect to their desired water needs and total available water resources, and then their DUPs are reckoned and considered as the starting points of bargaining in water allocation; (3) the ANBS is employed to establish an optimal allocation model for transboundary water resources by integrating the outcomes from the first two steps and some corresponding constraints; and (4) the proposed allocation framework is applied to the Euphrates River Basin (ERB), the center of one of the world’s insurmountable disputes involving the three sovereign littoral states of Turkey, Syria, and Iraq, for developing multiple allocation alternatives under different division scenarios, and four classical bankruptcy theoretical solutions are also derived for comparison.

The remainder of this paper is structured as follows. The next section will briefly describe the case study of the ERB, and then systematically present the proposed allocation framework and examine relevant methods.

Section 3 will report possible allocation results and corresponding discussion. Finally, the conclusions will be summarized in

Section 4.

4. Conclusions

Transboundary water governance is challenged by multiple local groups with varying asymmetric social, economic, and political status and needs. Effective negotiations among riparian areas over water allocations can prevent hydro-hegemony, but the negotiation process is not necessarily symmetrical, and asymmetry in power will inevitably influence the final negotiation outcome. Therefore, the agents’ bargaining powers should be taken into account in river-sharing problems when available. The ANBS, generalized by the Nash bargaining solution, could offer a good mathematical framework to simulate competition and cooperation among involved agents, and ensure mutually beneficial resolutions for water sharing problems.

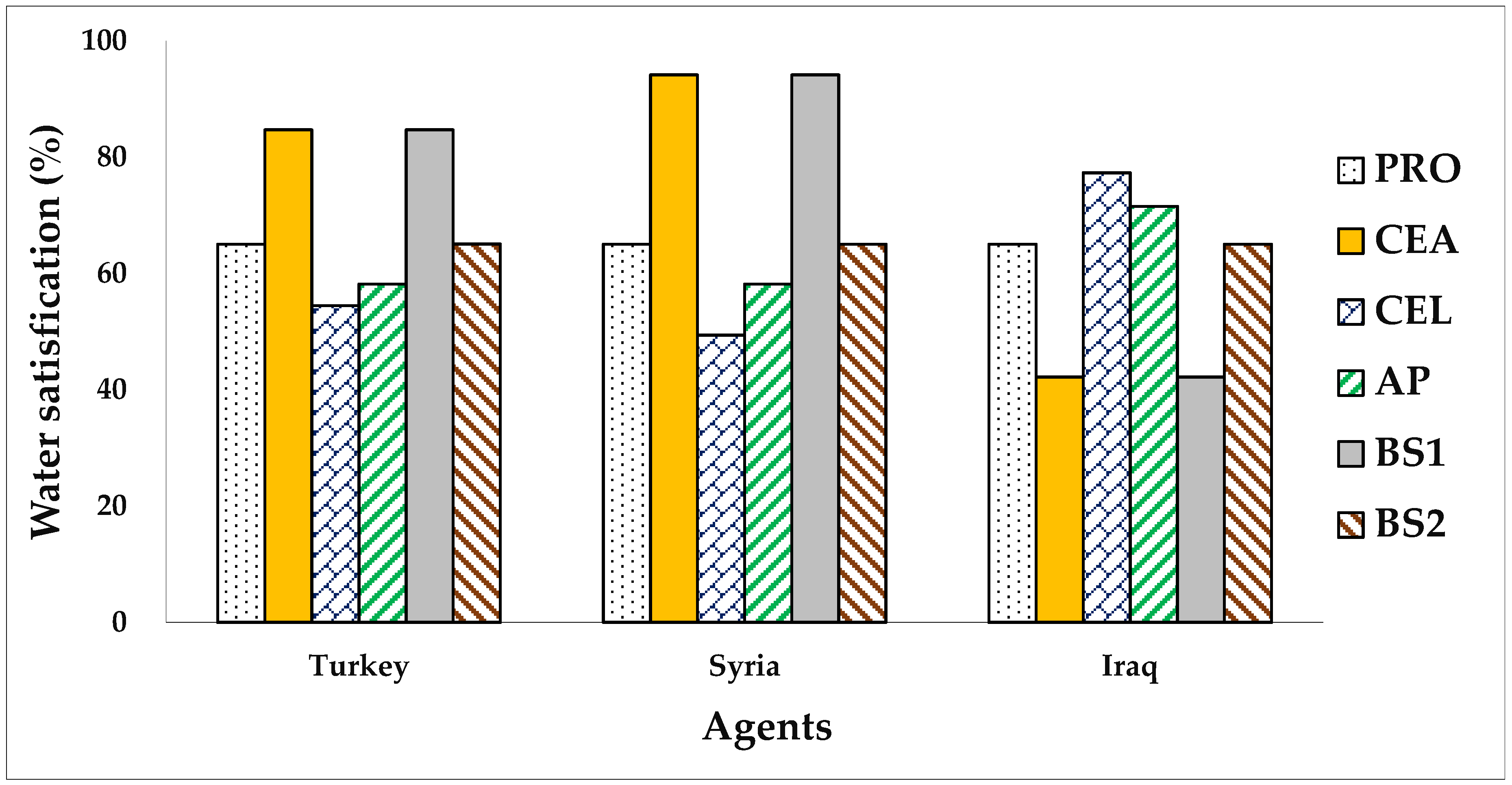

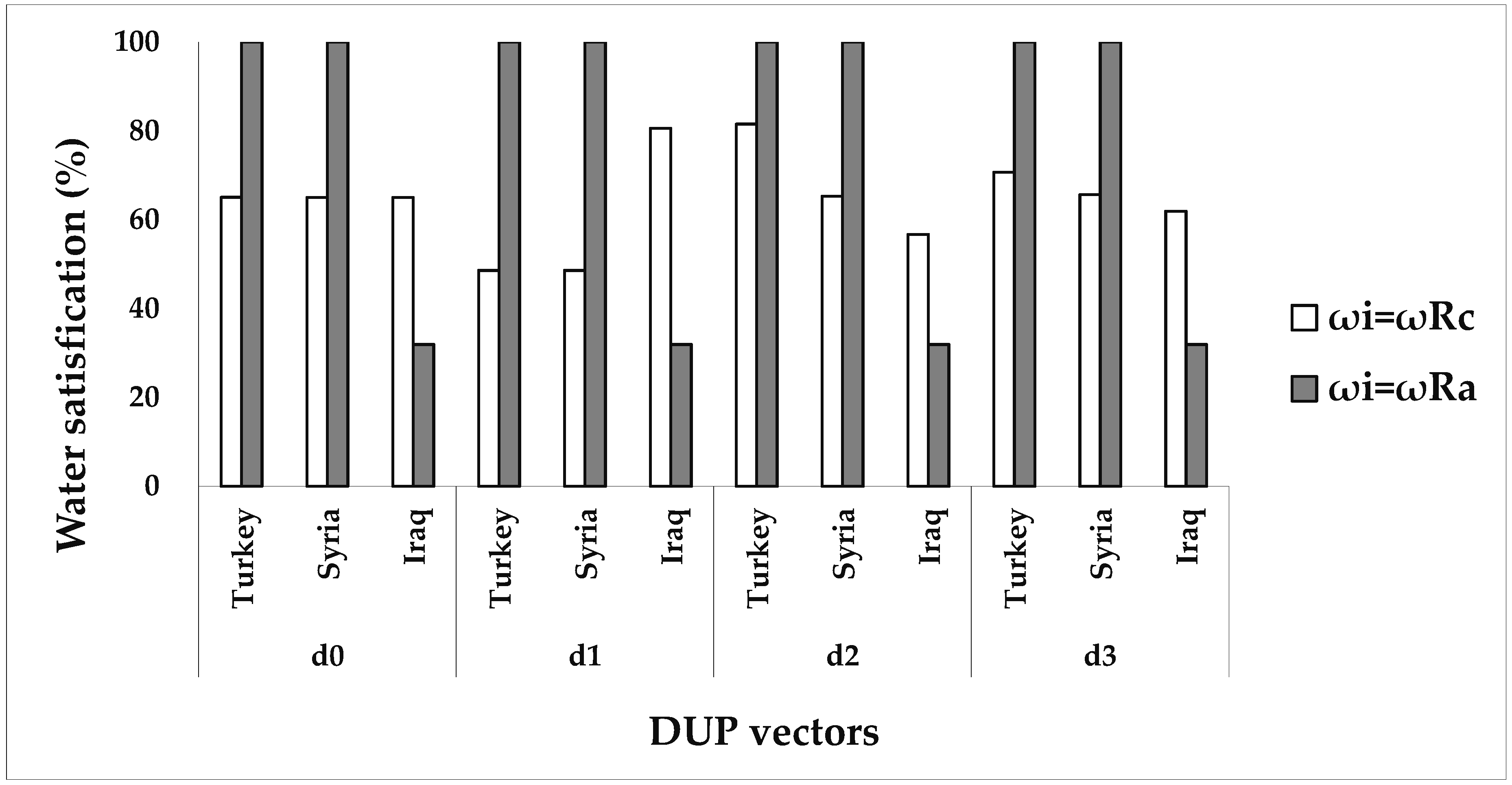

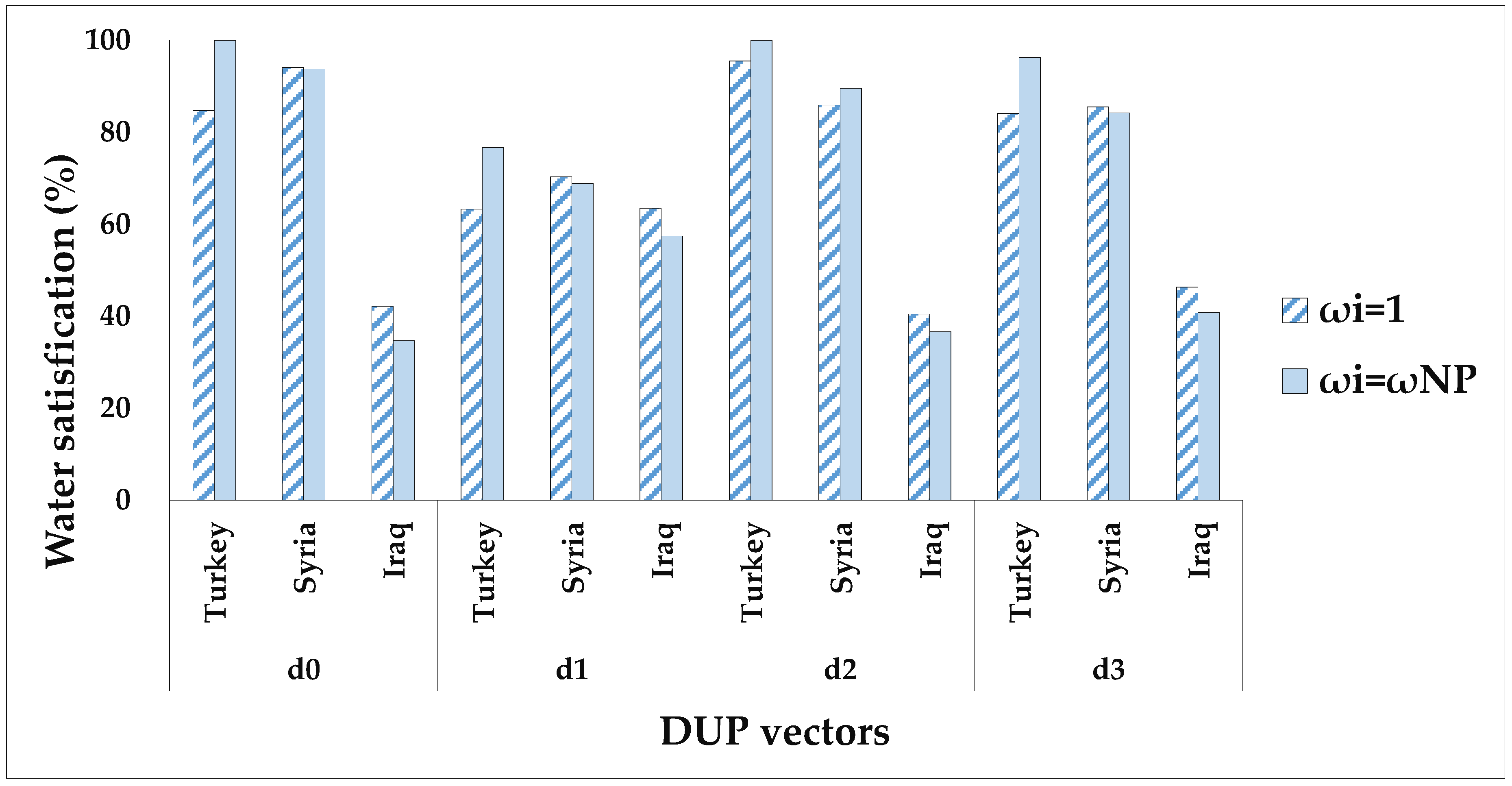

This paper developed an asymmetric bargaining model for water allocations in the transboundary river basin, consisting of the following three parts: (1) the DEA is chosen as the MCDM approach to define negotiator power by synthesizing their asymmetric information in social, economic, and political aspects; (2) it develops three methods based on traditional bankruptcy approach and the PRO to generate agent’ DUPs as the starting points of bargaining for water allocations; and (3) it uses the ANBS to establish a water allocation model for the transboundary river by integrating the outcomes from the first two steps and corresponding constraints involving Pareto efficiency, claim boundedness, and non-negativity. The ERB with three littoral states is used to demonstrate how the proposed river allocation model can be helpful in practice.

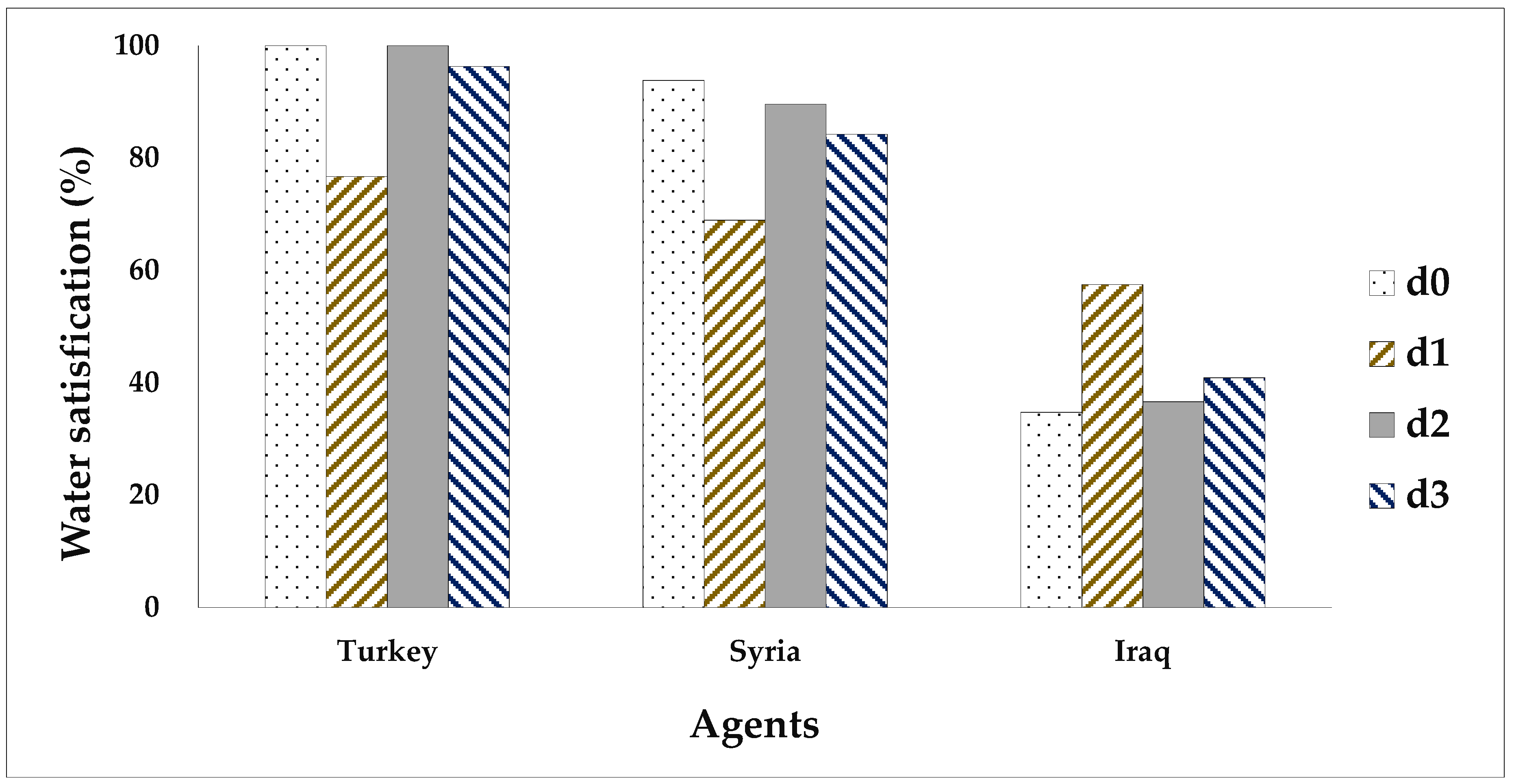

The numerical results show Turkey receives the highest NP value of 0.4036 since it dominates in terms of economic strength, regional and global political influence, and military capacity, indicating the highest influential capacity in the ERB negotiation. Syria´s NP value is 0.3266. The NP value of Iraq is the lowest at 0.2698, mainly due to its internal political fragmentation and weak military status. The asymmetric Nash solution under the MENP-based DUPs and ωNP is identified as the most favorable alternative for ERB management since it considers more attributes relevant to realistic water allocation in this river basin. The water satisfaction percentages of Turkey, Syria, and Iraq within the ERB under the best alternative identified are 96.30%, 84.23% and 40.88%, respectively. The findings highlight that the acceptability of allocation solutions is sensitive to multidimensional factors and circumstances, and these factors need to be considered simultaneously for creating more realistic negotiations for water allocation. The proposed framework is recommended as an effective tool to facilitate negotiation over practical water allocation within transboundary river basins.