Effect of Subsidies and Tax Deductions on Promoting the Construction of Long-Life Quality Houses in Japan

Abstract

1. Introduction

- Measures against degradation: Level 3 (the highest criteria level in the Housing Performance Indication System) measures against degradation (Level 1: measures required by the Building Standards Act; Level 2: measures to extend the life of housing to 50–60 years [two generations]; and Level 3: measures to extend the life of housing to 75–90 years [three generations]).

- Seismic capacity: Level 1 or 2 seismic capacity or a seismically isolated structure (Level 1: seismic capacity required by the Building Standards Act; Level 2: seismic capacity 1.25 times higher than that required by the Building Standards Act; and Level 3: seismic capacity 1.5 times higher than that required by the Building Standards Act).

- Ease of management and renewal: level 3 (the highest criteria level in the Housing Performance Indication System) operation and maintenance measures (Level 1: other than levels 2 and 3; Level 2: basic measures for easy management and renewal [e.g., not embedding pipes into concrete]; and Level 3: specific measures for easy management and renewal [e.g., installing cleaning holes and inspection chambers]).

- Energy saving: Level 4 (the highest criteria level in the Housing Performance Indication System) heat insulation capacity (Level 1: other than levels 2–4; Level 2: measures to save a small amount of energy [energy saving standard established in 1980]; Level 3: measures to save a moderate amount of energy [energy saving standard established in 1992]; and Level 4: measures to save a large amount of energy, as required by the Act on the Rational Use of Energy [energy saving standard established in 2016]).

- Living space: 75 m2 or larger.

- Living environment: Harmonization with district planning, landscape planning, building agreement, etc.

- Plan for maintenance: Development of a plan for future periodic inspections and maintenance of housing.

2. Materials and Methods

2.1. Policy Measures for Long-Life Quality Housing

2.1.1. Policy Measures at the National Level

2.1.2. Policy Measures at the Prefectural Level

2.2. Panel Data Analysis

2.3. Data

3. Results and Discussion

4. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Kobayashi, M. The Housing Market and Housing Policies in Japan; ADBI Working Paper 558; Asian Development Bank Institute: Tokyo, Japan, 2016; pp. 1–36. [Google Scholar]

- Minami, K. Japanese innovation in adaptable homes. Archit. Des. 2017, 87, 38–45. [Google Scholar] [CrossRef]

- Minami, K. The efforts to develop longer life housing with adaptability in Japan. Energy Procedia 2016, 96, 662–673. [Google Scholar] [CrossRef]

- Cabinet Office. Annual Economic and Financial Report (2010 Edition); Cabinet Office: Tokyo, Japan, 2010.

- Ministry of Land, Infrastructure, Transport and Tourism (MILT). White Paper on Land, Infrastructure, Transport and Tourism in Japan (2014 Edition); MILT: Tokyo, Japan, 2014. [Google Scholar]

- Ministry of Land, Infrastructure, Transport and Tourism (MILT). White Paper on Land, Infrastructure, Transport and Tourism in Japan (2016 Edition); MILT: Tokyo, Japan, 2016. [Google Scholar]

- Ministry of Land, Infrastructure, Transport and Tourism (MILT). Laws Related to Real Estate Transactions in Japan; MILT: Tokyo, Japan, 2016. [Google Scholar]

- Kim, R.-H.; Tae, S.-H.; Yang, K.-H.; Kim, T.-H.; Roh, S.-J. Analysis of lifecycle CO2 reduction performance for long-life apartment house. Environ. Prog. Sustain. Energy 2015, 34, 555–566. [Google Scholar] [CrossRef]

- Ministry of Land, Infrastructure, Transport and Tourism (MILT). Summary for Certification Criteria of Long-Life Quality Housing; MILT: Tokyo, Japan, 2017. (In Japanese)

- Institute for Housing Performance Evaluation and Representations (IHPEF). Technical Description: Accreditation Criteria for Long-Life Quality Housing; IHPER: Tokyo, Japan, 2016. (In Japanese) [Google Scholar]

- Kawamoto, S.; Ando, M. A study on the life of the Japanese housing stock estimated from the house and land statistics survey. J. Archit. Plan. 2009, 74, 209–216. (In Japanese) [Google Scholar] [CrossRef]

- Yoshioka, K.; Hayami, H.; Ikeda, A.; Kan, M. Simulation analysis of environmental burdens of energy-saving houses. Keio Econ. Obs. Occ. Pap. 1993, 32, 1–20. (In Japanese) [Google Scholar]

- Tango, M.; Yokomatsu, M.; Ishikura, T. Moving behavior, used house market and policy effect of extending the life time expectancy of residential housing. J. Jpn. Soc. Civ. Eng. D3 2011, 67, 495–509. (In Japanese) [Google Scholar] [CrossRef]

- Sunaga, N.; Onodera, H.; Kumakura, E.; Nakano, I.; Roh, H. Solar town Fuchu—Plan and performance. Procedia Eng. 2017, 180, 1433–1442. [Google Scholar] [CrossRef]

- Hamada, Y.; Nakamura, M.; Ochifuji, K.; Nagano, K.; Yokoyama, S. Field performance of a Japanese low energy home relying on renewable energy. Energy Build. 2001, 33, 805–814. [Google Scholar] [CrossRef]

- Fujimoto, T.; Yamaguchi, Y.; Shimoda, Y. Energy management for voltage control in a net-zero energy house community considering appliance operation constraints and variety of households. Energy Build. 2017, 147, 188–199. [Google Scholar] [CrossRef]

- Suzuki, T.; Sakaguchi, D.; Adachi, K. Study on the housing of long life and good quality in the stocked society. Proc. Archit. Inst. Jpn. Kinki Branch 2010, 50, 177–180. (In Japanese) [Google Scholar]

- Hasegawa, H.; Nagaoka, A.; Takaya, H.; Chikazumi, S. A study on site condition and building cooperative rule to secure good residential environment of the long-term durable good quality houses: Part 1, actual situation of site suitable for the long-term durable good quality houses. Proc. Archit. Inst. Jpn. Hokuriku Branch 2010, 2010, 1387–1388. (In Japanese) [Google Scholar]

- Wong, S.C.; Abe, N. Stakeholders’ perspectives of a building environmental assessment method: The case of CASBEE. Build. Environ. 2014, 82, 502–516. [Google Scholar] [CrossRef]

- Park, M.; Tae, S. Suggestions of policy direction to improve the housing quality in South Korea. Sustainability 2016, 8, 438. [Google Scholar] [CrossRef]

- Kim, E.; Hwang, E. Analysis of the current scoring distribution by evaluation criteria in Korean long-life housing certification system cases. Sustainability 2017, 9, 1794. [Google Scholar] [CrossRef]

- Juan, Y.; Cheng, Y. Improving Building Longevity, Adaptability, and sustainability: Examination of multi-unit residential building regulations in Taiwan. Civ. Eng. J. 2018, 4, 394–401. [Google Scholar] [CrossRef]

- Prochorskaite, A.; Couch, C.; Malys, N.; Maliene, V. Housing stakeholder preferences for the “Soft” features of sustainable and healthy housing design in the UK. Int. J. Environ. Res. Public Health 2016, 13, 111. [Google Scholar] [CrossRef] [PubMed]

- Roufechaei, K.M.; Abu Bakar, A.H.; Tabassi, A.A. Energy-efficient design for sustainable housing development. J. Clean. Prod. 2014, 65, 380–388. [Google Scholar] [CrossRef]

- Knudstrup, M.A.; Ring Hansen, H.T.; Brunsgaard, C. Approaches to the design of sustainable housing with low CO2 emission in Denmark. Renew. Energy 2009, 34, 2007–2015. [Google Scholar] [CrossRef]

- Mulliner, E.; Smallbone, K.; Maliene, V. An assessment of sustainable housing affordability using a multiple criteria decision making method. Omega 2013, 41, 270–279. [Google Scholar] [CrossRef]

- Mulliner, E.; Malys, N.; Maliene, V. Comparative analysis of MCDM methods for the assessment of sustainable housing affordability. Omega 2016, 59, 146–156. [Google Scholar] [CrossRef]

- Maliene, V.; Malys, N. High-quality housing—A key issue in delivering sustainable communities. Build. Environ. 2009, 44, 426–430. [Google Scholar] [CrossRef]

- Seyfang, G. Community action for sustainable housing: Building a low-carbon future. Energy Policy 2010, 38, 7624–7633. [Google Scholar] [CrossRef]

- Zhu, Y.; Lin, B. Sustainable housing and urban construction in China. Energy Build. 2004, 36, 1287–1297. [Google Scholar] [CrossRef]

- Winston, N.; Pareja Eastaway, M. Sustainable housing in the urban context: International sustainable development indicator sets and housing. Soc. Indic. Res. 2008, 87, 211–221. [Google Scholar] [CrossRef]

- Lovell, H. Framing sustainable housing as a solution to climate change. J. Environ. Policy Plan. 2004, 6, 35–55. [Google Scholar] [CrossRef]

- Dubois, M.; Allacker, K. Energy savings from housing: Ineffective renovation subsidies vs efficient demolition and reconstruction incentives. Energy Policy 2015, 86, 697–704. [Google Scholar] [CrossRef]

- Rothrock, H. Sustainable housing: Emergy evaluation of an off-grid residence. Energy Build. 2014, 85, 287–292. [Google Scholar] [CrossRef]

- Howden-Chapman, P.; Chapman, R. Health co-benefits from housing-related policies. Curr. Opin. Environ. Sustain. 2012, 4, 414–419. [Google Scholar] [CrossRef]

- Sullivan, E.; Ward, P.M. Sustainable housing applications and policies for low-income self-build and housing rehab. Habitat Int. 2012, 36, 312–323. [Google Scholar] [CrossRef]

- Börsch-Supan, A. Panel data analysis of housing choices. Reg. Sci. Urban Econ. 1990, 20, 65–82. [Google Scholar] [CrossRef]

- Börsch-Supan, A.; Pollakowski, H.O. Estimating housing consumption adjustments from panel data. J. Urban Econ. 1990, 27, 131–150. [Google Scholar] [CrossRef]

- Haurin, D.R.; Hendershott, P.H.; Wachter, S.M. Borrowing constraints and the tenure choice of young households. J. Hous. Res. 1997, 8, 137–154. [Google Scholar] [CrossRef]

- Boehm, T.P.; Schlottmann, A.M. The dynamics of housing tenure choice: Lessons from Germany and the United States. J. Hous. Econ. 2014, 25, 1–19. [Google Scholar] [CrossRef]

- Beenstock, M.; Felsenstein, D. Estimating spatial spillover in housing construction with nonstationary panel data. J. Hous. Econ. 2015, 28, 42–58. [Google Scholar] [CrossRef]

- Poterba, J.M. Taxation and housing markets: Preliminary evidence on the effects of recent reforms. In Do Taxes Matter? Slemrod, J., Ed.; MIT Press: Cambridge, MA, USA, 1990; ISBN 9780262193023. [Google Scholar]

- Poterba, J.M. House price dynamics: The role of tax policy and demography. Brook. Pap. Econ. Act. 1991, 22, 143–183. [Google Scholar] [CrossRef]

- Poterba, J.M. Taxation and housing: Old questions, new answers. Am. Econ. Rev. 1992, 82, 237–242. [Google Scholar]

- Yokozeki, Y. Establishment and issues of the act on the promotion of dissemination of long-life quality housing. Lawmak. Surv. 2009, 289, 154–168. (In Japanese) [Google Scholar]

- Program for Promotion of Long-Life Quality Housing. Available online: http://www.mlit.go.jp/report/press/house04_hh_000076.html (accessed on 20 September 2018). (In Japanese)

- Program for Promotion of Wooden Housing. Available online: http://www.mlit.go.jp/report/press/house04_hh_000242.html (accessed on 20 September 2018). (In Japanese)

- Regional Housing Branding Program. Available online: http://www.mlit.go.jp/jutakukentiku/house/jutakukentiku_house_tk4_000095.html (accessed on 20 September 2018). (In Japanese)

- Ministry of Land, Infrastructure, Transport and Tourism (MILT). Press Release: Regional Housing Greening Program; MILT: Tokyo, Japan, 2018. (In Japanese)

- Subsidies for Housing Stock Circulation Support. Available online: https://stock-jutaku.jp/about/ (accessed on 6 May 2018). (In Japanese).

- Housing Cash Benefit. Available online: http://www.sumai-kyufu.jp/ (accessed on 6 May 2018). (In Japanese).

- Summary of Housing Eco-Points. Available online: http://www.mlit.go.jp/jutakukentiku/house/jutakukentiku_house_tk4_000017.html (accessed on 6 May 2018). (In Japanese)

- Project to Promote Long-Life Quality Houses in Fukuoka. Available online: http://www.pref.fukuoka.lg.jp/contents/smile-scrumh24.html (accessed on 6 May 2018). (In Japanese).

- Preferential Treatment System for Housing Loan in Shizuoka. Available online: http://www.pref.shizuoka.jp/kenmin/km-310a/garden/yuuguuseido.html (accessed on 6 May 2018). (In Japanese).

- Subsidies for Housing Construction and Renovation. Available online: http://www.pref.iwate.jp/kenchiku/kojin/hojo/011139.html (accessed on 6 May 2018). (In Japanese).

- Subsidies for Promoting Eco-Friendly Housing. Available online: http://www.pref.ishikawa.lg.jp/ontai/pp/ecojyuutaku_seibi.html (accessed on 6 May 2018). (In Japanese).

- Subsidies for Eco-Friendly Housing. Available online: http://www.pref.nagano.lg.jp/kenchiku/kurashi/sumai/shien/ninte/sedo-02/index.html (accessed on 6 May 2018). (In Japanese).

- Subsidies for Building Energy-Saving Housing in Gifu. Available online: http://www.pref.gifu.lg.jp/kurashi/jutaku/sumai/11659/syouenehojyokin.html (accessed on 10 September 2018). (In Japanese).

- Subsidies for Promoting Healthy and Energy-Saving Housing in Kochi. Available online: http://www.pref.kochi.lg.jp/soshiki/171901/2017050800014.html (accessed on 10 September 2018). (In Japanese).

- Subsidies for Promoting Comfortable Housing in Fukuoka. Available online: http://www.pref.fukuoka.lg.jp/contents/kaitekinasumaidukuri.html (accessed on 6 May 2018). (In Japanese).

- National Accounting in 2016. Available online: http://www.esri.cao.go.jp/jp/sna/data/data_list/kakuhou/files/h28/h28_kaku_top.html (accessed on 6 May 2018). (In Japanese)

- Certified Long-Life Quality Housing Based on the Act on the Promotion of Dissemination of Long-Life Quality Housing. Available online: http://www.mlit.go.jp/report/press/house04_hh_000731.html (accessed on 6 May 2018). (In Japanese)

- Building Construction Starts Survey. Available online: http://www.e-stat.go.jp/SG1/estat/GL08020103.do?_toGL08020103_&listID=000001179884&requestSender=search (accessed on 6 May 2018). (In Japanese)

- Website on Long-Life Quality Housing. Available online: http://www.mlit.go.jp/jutakukentiku/house/jutakukentiku_house_tk4_000006.html (accessed on 6 May 2018). (In Japanese)

- Population and Household Survey. Available online: http://www.e-stat.go.jp/SG1/estat/GL08020102.do?_toGL08020102_&tclassID=000001028704&cycleCode=7&requestSender=estat (accessed on 6 May 2018).

- Household Expenditure Survey. Available online: https://www.e-stat.go.jp/stat-search/files?page=1&layout=datalist&toukei=00200561&tstat=000000330001&cycle=7&tclass1=000000330007&tclass2=000000330008&tclass3=000000330009 (accessed on 6 May 2018).

- Prefectural Land Price Survey. Available online: http://tochi.mlit.go.jp/kakaku/chika-chousa (accessed on 6 May 2018). (In Japanese)

- Flat 35. Available online: http://www.flat35.com/kinri/kinri_suii.htm (accessed on 6 May 2018). (In Japanese).

- National Institute of Population and Social Security Research. Survey of Migration, 8th ed.; National Institute of Population and Social Security Research: Tokyo, Japan, 2016. [Google Scholar]

| Type of Tax | Regular Housing | LLQH | |

|---|---|---|---|

| Registration and license tax | Ownership preservation registration | 0.15% | 0.1% |

| Ownership transfer registration | 0.3% | 0.2% | |

| Real estate acquisition tax | 12 million JPY deduction | 13 million JPY deduction | |

| Fixed assets tax | Half of full tax rate (3 years) | Half of full tax rate (5 years) | |

| 2009 | 2010 | 2011 | 2012 | 2013 | 2014– | ||

|---|---|---|---|---|---|---|---|

| Regular housing | Deduction rate | 1.0% | |||||

| Maximum annual deduction (thousand JPY) | 500 | 500 | 400 | 300 | 200 | 400 | |

| LLQH | Deduction rate | 1.2% (2009–2011) | 1.0% (2012–2014) | ||||

| Maximum annual deduction (thousand JPY) | 600 | 600 | 600 | 400 | 300 | 500 | |

| Variables | Explanation |

|---|---|

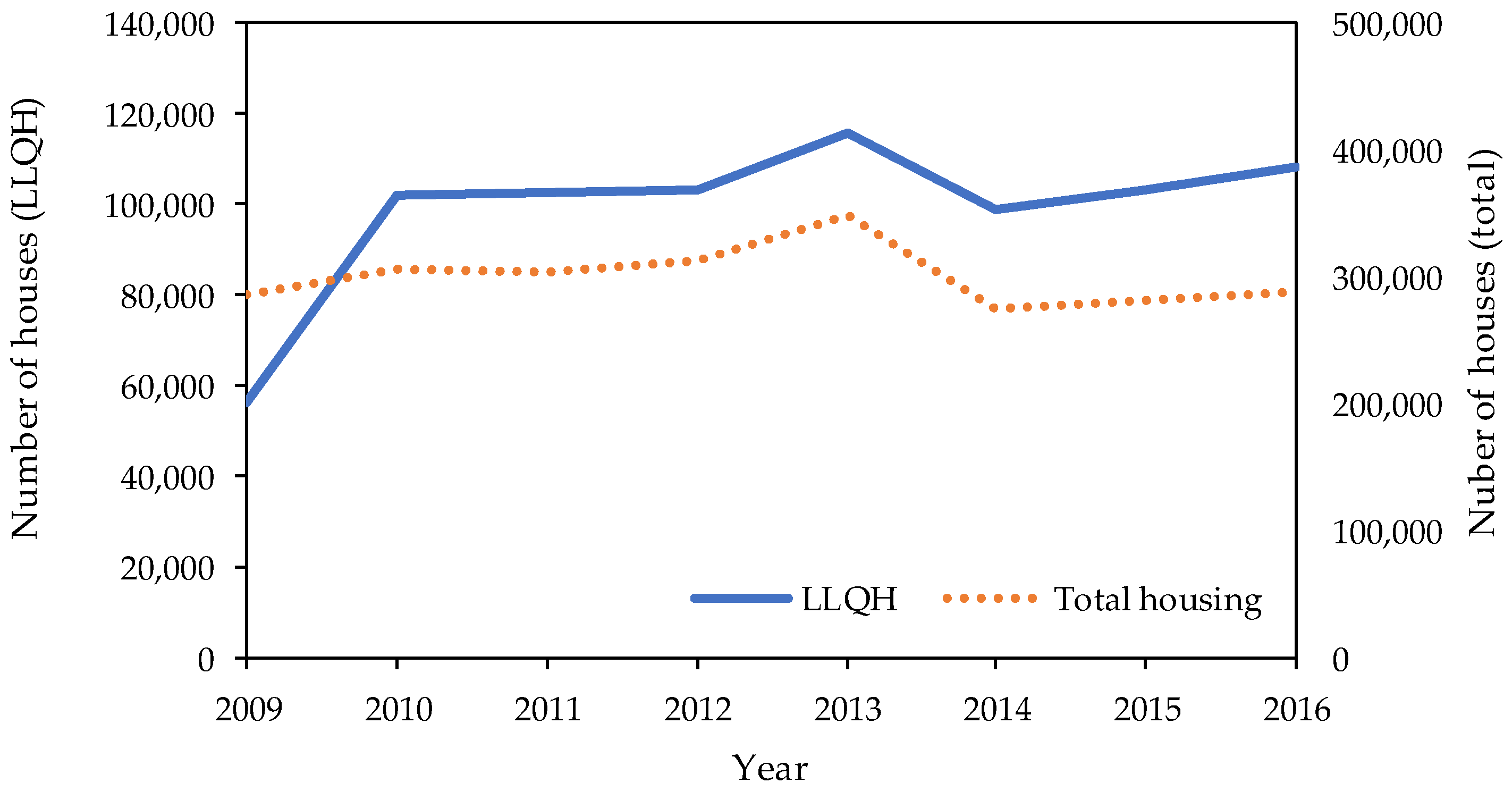

| lqh | The rate of newly built LLQH per total newly built houses |

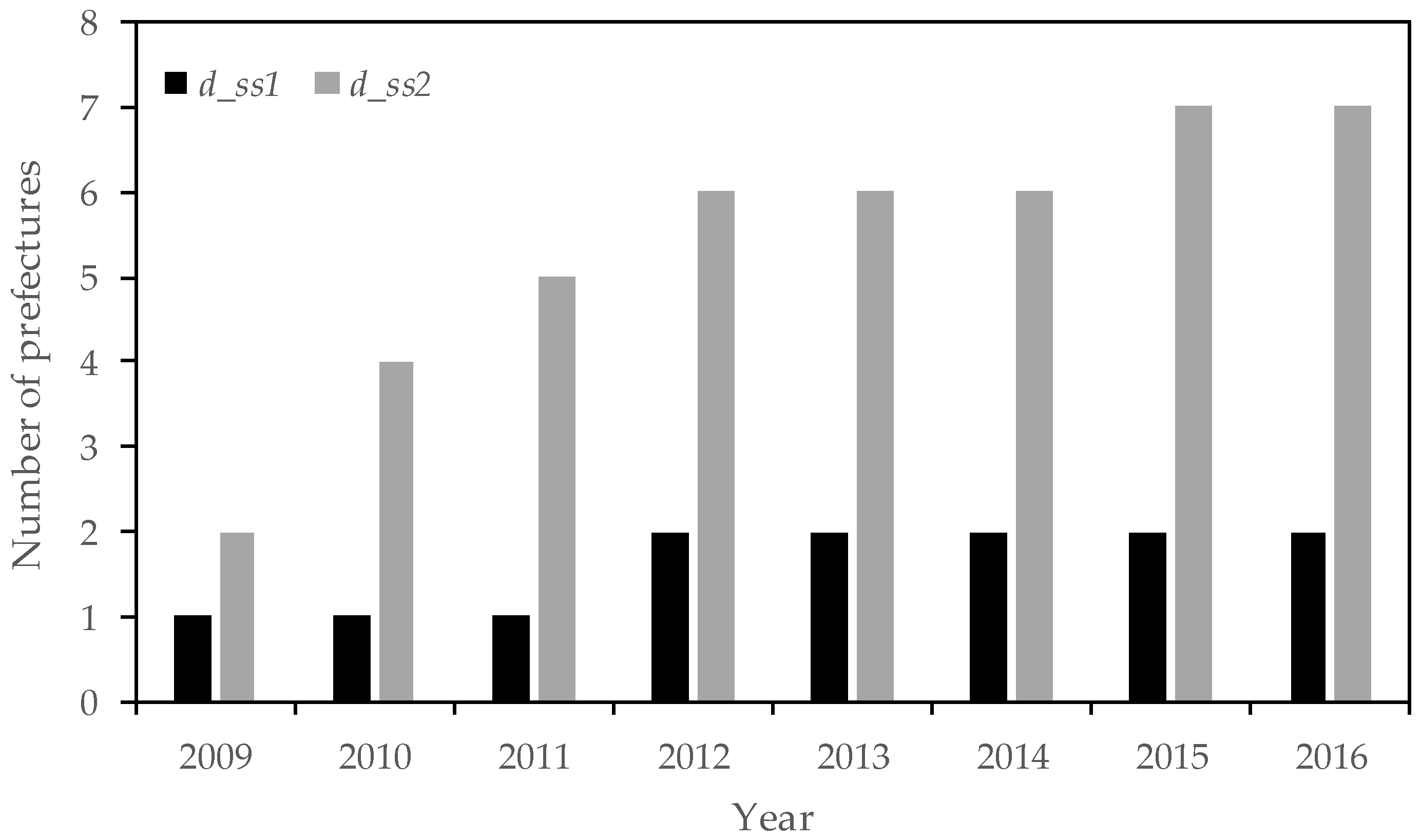

| d_ss1 | A dummy variable for policy measures that only cover LLQH at the prefectural level |

| d_ss2 | A dummy variable for policy measures that cover LLQH and other types of housing at the prefectural level |

| l_lqh | Subsidies for LLQH (ten thousand JPY) |

| l_itd | Income tax deduction for a housing loan (ten thousand JPY) |

| l_all | Aggregation of l_lqh and l_itd (ten thousand JPY) |

| s_shs | Subsidies for Housing Stock Circulation Support (ten thousand JPY) |

| s_hcb | Housing Cash Benefit (ten thousand JPY) |

| s_all | Aggregation of s_shs and s_hcb (ten thousand JPY) |

| d_s_hep | A dummy variable for Housing Eco-Points |

| t_all | Aggregation of l_lqh, l_itd, s_shs, and s_hcb (ten thousand JPY) |

| hld | Number of households (thousand household) |

| hic | Household income in year t (ten thousand JPY) |

| sav | Accumulated amount of household savings (ten thousand JPY) |

| ldp | Land price (thousand JPY/m2) |

| hlr | Housing loan rate (%) |

| Variables | Mean | Std. Dev. | Min | Max | Data Sources |

|---|---|---|---|---|---|

| lqh | 0.306 | 0.114 | 0.0340 | 0.693 | [62,63] |

| Policy Measures (policy) | |||||

| d_ss1 | 0.036 | 0.188 | 0 | 1 | a |

| d_ss2 | 0.125 | 0.331 | 0 | 1 | a |

| l_lqh | 114.307 | 17.739 | 101.967 | 150.873 | a |

| l_itd | 498.486 | 99.268 | 314.560 | 622.200 | [64] |

| l_all | 612.793 | 100.676 | 419.414 | 725.900 | b |

| s_shs | 7.184 | 17.625 | 0 | 50.291 | [50] |

| s_hcb | 13.052 | 15.095 | 0 | 30.924 | [51] |

| s_all | 20.236 | 28.023 | 0 | 80.466 | b |

| d_s_hep | 0.714 | 0.452 | 0 | 1 | [52] |

| t_all | 633.029 | 110.062 | 419.414 | 734.248 | b |

| Control Variables (X) | |||||

| hld | 1173.892 | 1257.816 | 226.434 | 6889.913 | [65] |

| hic | 625.358 | 57.062 | 463.867 | 774.946 | [66] |

| sav | 1669.096 | 401.594 | 599.386 | 3015.447 | [66] |

| ldp | 52.205 | 53.082 | 13.724 | 334.737 | [67] |

| hlr | 2.290 | 0.540 | 1.371 | 2.938 | [68] |

| Items | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| Policy Measures (policy) | ||||||

| d_ss1 | 0.0156 | 0.0198 *** | 0.00335 | 0.00323 | 0.00329 | 0.00323 |

| (0.0191) | (0.00388) | (0.00510) | (0.00521) | (0.00515) | (0.00521) | |

| l_lqh | 8.19 × 10−5 | 0.000499 *** | 0.000120 | 1.59 × 10−5 | - | - |

| (0.000147) | (0.000119) | (9.59 × 10−5) | (0.000129) | |||

| l_itd | 9.63 × 10−5 *** | 6.47 × 10−5 *** | 0.000102 *** | 0.000113 *** | - | - |

| (1.49 × 10−5) | (1.40 × 10−5) | (8.54 × 10−6) | (1.93 × 10−5) | |||

| l_all | - | - | - | - | 0.000102 *** | 0.000108 *** |

| (9.33 × 10−6) | (1.43 × 10−5) | |||||

| Control Variables (X) | ||||||

| hld | 1.07 × 10−7 *** | - | 3.06 × 10−7 *** | 3.06 × 10−7 *** | 3.06 × 10−7 *** | 3.06 × 10−7 *** |

| (1.81 × 10−8) | (6.14 × 10−8) | (6.62 × 10−8) | (6.12 × 10−8) | (6.62 × 10−8) | ||

| hic | 4.33 × 10−5 | - | 5.14 × 10−5 | 5.59 × 10−5 | 5.15 × 10−5 | 5.59 × 10−5 |

| (4.63 × 10−5) | (3.64 × 10−5) | (3.75 × 10−5) | (3.64 × 10−5) | (3.75 × 10−5) | ||

| sav | −8.94 × 10−6 | - | −1.97 × 10−5 *** | −1.99 × 10−5 *** | −1.97 × 10−5 *** | −1.99 × 10−5 *** |

| (7.54 × 10−6) | (6.31 × 10−6) | (6.47 × 10−6) | (6.31 × 10−6) | (6.47 × 10−6) | ||

| ldp | −1.34 × 10−6 *** | - | −1.62 × 10−6 * | −1.57 × 10−6 | −1.61 × 10−6 * | −1.57 × 10−6 |

| (4.26 × 10−7) | (8.59 × 10−7) | (1.04 × 10−6) | (8.44 × 10−7) | (1.04 × 10−6) | ||

| hlr | −0.00873 | - | 0.00184 | [omitted] | 0.00128 | 0.00320 |

| (0.00556) | (0.00573) | (0.00453) | (0.00477) | |||

| Constant | 0.200 *** | 0.216 *** | −0.0369 | −0.0295 | −0.0344 | −0.0455 |

| (0.0409) | (0.0101) | (0.0824) | (0.0754) | (0.0798) | (0.0815) | |

| Estimation | Pooled OLS | FE | FE | FE | FE | FE |

| Single FE | X | X | X | |||

| Double FE | X | X | ||||

| Observations | 329 | 329 | 329 | 329 | 329 | 329 |

| Adjusted R2 | 0.363 | 0.191 | 0.451 | 0.455 | 0.450 | 0.455 |

| Items | (7) | (8) | (9) | (10) |

|---|---|---|---|---|

| Policy Measures (policy) | ||||

| d_ss2 | −0.00700 | −0.00700 | −0.00792 | −0.00700 |

| (0.0148) | (0.0148) | (0.0145) | (0.0148) | |

| l_lqh | −0.00315 | 0.000179 | - | - |

| (0.00247) | (0.000118) | |||

| l_itd | 8.86 × 10−5 | 0.000113 *** | - | - |

| (0.000129) | (2.03 × 10−5) | |||

| l_all | - | - | 0.000103 *** | 0.000112 *** |

| (1.38 × 10−5) | (2.08 × 10−5) | |||

| s_shs | 0.00118 | −8.29 × 10−5 | - | - |

| (0.000763) | (8.13 × 10−5) | |||

| s_hcb | −0.000199 | −0.000106 | - | - |

| (0.00190) | (0.000170) | |||

| s_all | - | - | −4.51 × 10−5 | −5.19 × 10−5 |

| (0.000146) | (8.85 × 10−5) | |||

| d_s_hep | −0.0922 | [omitted] | −0.00222 | [omitted] |

| (0.0626) | (0.00330) | |||

| Control Variables (X) | ||||

| hld | 3.05 × 10−7 *** | 3.05 × 10−7 *** | 3.04 × 10−7 *** | 3.05 × 10−7 *** |

| (6.58 × 10−8) | (6.58 × 10−8) | (6.27 × 10−8) | (6.58 × 10−8) | |

| hic | 5.56 × 10−5 | 5.56 × 10−5 | 5.25 × 10−5 | 5.56 × 10−5 |

| (3.74 × 10−5) | (3.74 × 10−5) | (3.66 × 10−5) | (3.74 × 10−5) | |

| sav | −1.98 × 10−5 *** | −1.98 × 10−5 *** | −1.95 × 10−5 *** | −1.98 × 10−5 *** |

| (6.43 × 10−6) | (6.43 × 10−6) | (6.28 × 10−6) | (6.43 × 10−6) | |

| ldp | −1.57 × 10−6 | −1.57 × 10−6 | −1.55 × 10−6 | −1.57 × 10−6 |

| (1.04 × 10−6) | (1.04 × 10−6) | (9.27 × 10−7) | (1.04 × 10−6) | |

| hlr | −0.00452 | [omitted] | 1.45 × 10−5 | [omitted] |

| (0.0740) | (0.0116) | |||

| Constant | 0.415 | −0.0444 | −0.0290 | −0.0372 |

| (0.421) | (0.0783) | (0.0819) | (0.0781) | |

| Estimation | FE | FE | FE | FE |

| Single FE | X | X | ||

| Double FE | X | X | ||

| Observations | 329 | 329 | 329 | 329 |

| Adjusted R2 | 0.456 | 0.456 | 0.452 | 0.456 |

| Items | (11) | (12) |

|---|---|---|

| Policy measures (policy) | ||

| d_ss2 | −0.00770 | −0.00700 |

| (0.0146) | (0.0148) | |

| d_s_hep | −0.00325 | [omitted] |

| (0.00316) | ||

| t_all | 8.93 × 10−5 *** | 9.76 × 10−5 *** |

| (8.56 × 10−6) | (1.31 × 10−5) | |

| Control variables (X) | ||

| hld | 3.06 × 10−7 *** | 3.05 × 10−7 *** |

| (6.09 × 10−8) | (6.58 × 10−8) | |

| hic | 4.98 × 10−5 | 5.56 × 10−5 |

| (3.66 × 10−5) | (3.74 × 10−5) | |

| sav | −1.97 × 10−5 *** | −1.98 × 10−5 *** |

| (6.30 × 10−6) | (6.43 × 10−6) | |

| ldp | −1.68 × 10−6 * | −1.57 × 10−6 |

| (8.57 × 10−7) | (1.04 × 10−6) | |

| hlr | 0.00790 * | 0.00824 |

| (0.00455) | (0.00534) | |

| Constant | −0.0355 | −0.0509 |

| (0.0793) | (0.0817) | |

| Estimation | FE | FE |

| Single FE | X | |

| Double FE | X | |

| Observations | 329 | 329 |

| Adjusted R2 | 0.451 | 0.373 |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Matsumoto, K.; Yamamoto, Y.; Ohya, N. Effect of Subsidies and Tax Deductions on Promoting the Construction of Long-Life Quality Houses in Japan. Int. J. Environ. Res. Public Health 2018, 15, 2376. https://doi.org/10.3390/ijerph15112376

Matsumoto K, Yamamoto Y, Ohya N. Effect of Subsidies and Tax Deductions on Promoting the Construction of Long-Life Quality Houses in Japan. International Journal of Environmental Research and Public Health. 2018; 15(11):2376. https://doi.org/10.3390/ijerph15112376

Chicago/Turabian StyleMatsumoto, Ken’ichi, Yuki Yamamoto, and Nao Ohya. 2018. "Effect of Subsidies and Tax Deductions on Promoting the Construction of Long-Life Quality Houses in Japan" International Journal of Environmental Research and Public Health 15, no. 11: 2376. https://doi.org/10.3390/ijerph15112376

APA StyleMatsumoto, K., Yamamoto, Y., & Ohya, N. (2018). Effect of Subsidies and Tax Deductions on Promoting the Construction of Long-Life Quality Houses in Japan. International Journal of Environmental Research and Public Health, 15(11), 2376. https://doi.org/10.3390/ijerph15112376