Environmental Regulation, Two-Way Foreign Direct Investment, and Green Innovation Efficiency in China’s Manufacturing Industry

Abstract

1. Introduction

2. Literature Review and Research Hypothesis

2.1. Literature Review

2.1.1. The Relationship between Environmental Regulation and Green Innovation

2.1.2. The Relationship between Two-Way FDI and Green Innovation

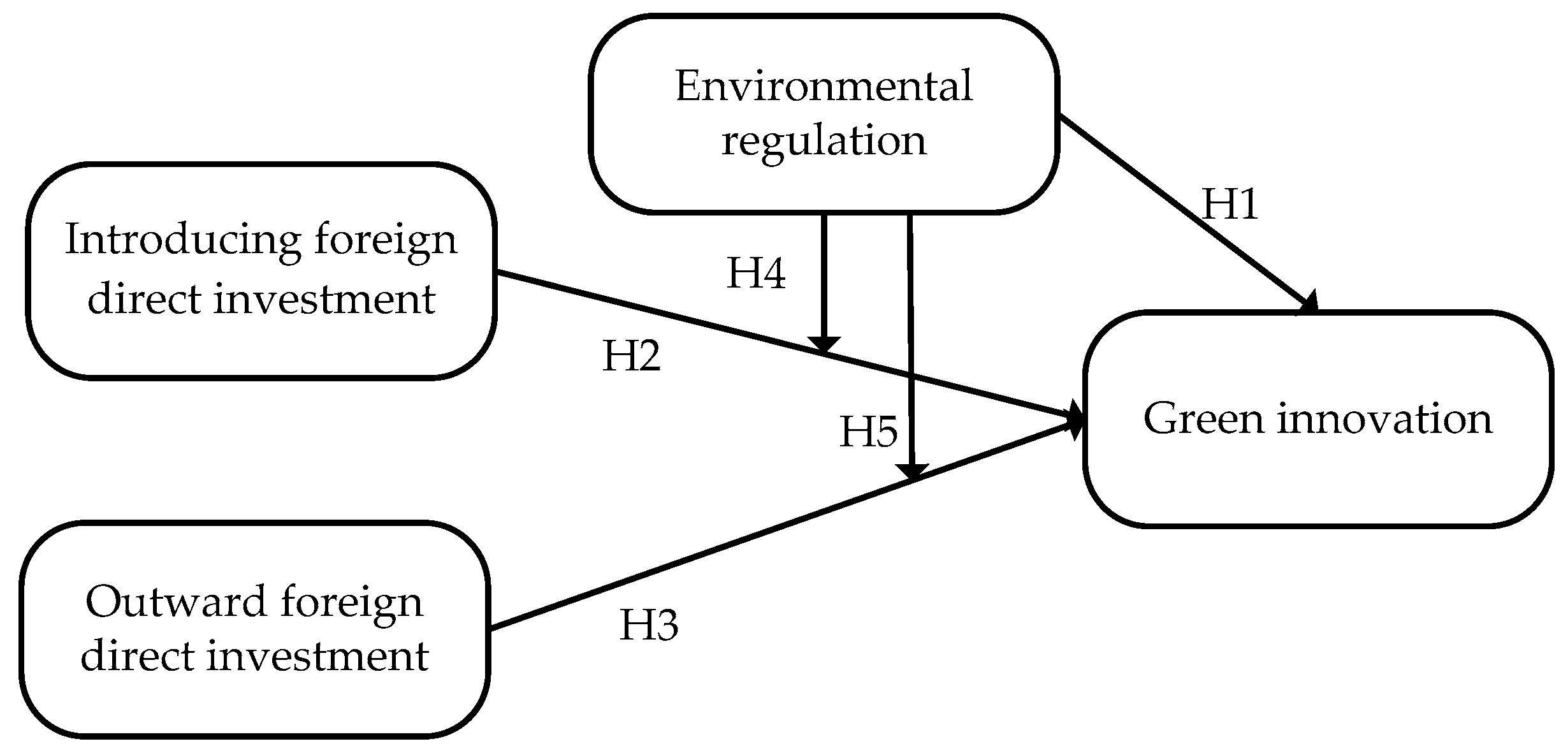

2.2. Research Hypothesis

2.2.1. Environmental Regulation and Green Innovation

2.2.2. Two-Way FDI and Green Innovation

2.2.3. The Regulatory Role of Environmental Regulation between Two-Way FDI and Green Innovation

3. Empirical Design

3.1. Model Design

3.2. Selection of Variables

3.2.1. Explained Variable: Green Innovation Efficiency

3.2.2. Core Explanatory Variables

3.2.3. Control Variables

3.3. Data Source and Description

3.3.1. Data Sources

3.3.2. Data Adjustment

4. Empirical Results and Analysis

4.1. The Result of Measuring the Green Innovation Efficiency of the Manufacturing Industry

4.2. Measurement Test Results and Analysis

4.2.1. The Influence of Environmental Regulation on the Green Innovation Efficiency of China’s Manufacturing Industry

4.2.2. The Influence of Two-Way FDI on the Green Innovation Efficiency of China’s Manufacturing Industry

4.2.3. Test of Control Variables

4.2.4. The Influence of the Interaction between Environmental Regulation and Two-Way FDI on the Green Innovation Efficiency of China’s Manufacturing Industry

5. Conclusions and Policy Implications

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Tian, Y.; Xiong, S.; Ma, X.; Ji, J. Structural path decomposition of carbon emission: A study of China’s manufacturing industry. J. Clean. Prod. 2018, 61, 113–121. [Google Scholar] [CrossRef]

- Hou, J.; Chen, H.; Xu, J.Z. External knowledge sourcing and green innovation growth with environmental and energy regulations: Evidence from manufacturing in China. Sustainability 2017, 9, 342. [Google Scholar] [CrossRef]

- Xu, R.; Lin, B. Why are there large regional differences in CO2 emissions? Evidence from China’s manufacturing industry. J. Clean. Prod. 2017, 140, 1330–1343. [Google Scholar] [CrossRef]

- Yuan, B.; Xiang, Q. Environmental regulation, industrial innovation and green development of Chinese manufacturing: Based on an extended CDM model. J. Clean. Prod. 2018, 176, 895–908. [Google Scholar] [CrossRef]

- National Bureau of Statistics of China. China Statistical Yearbook on Environment; National Bureau of Statistics of China: Beijing, China, 2017.

- Zeng, B.; Tan, Y.; Xu, H.; Quan, J.; Wang, L.; Zhou, X. Forecasting the electricity consumption of commercial sector in Hong Kong. J. Grey Syst. 2018, 30, 157–172. [Google Scholar]

- Zeng, B.; Duan, H.; Bai, Y.; Meng, W. Forecasting the output of shale gas in China using an unbiased grey model and weakening buffer operator. Energy 2018, 151, 238–249. [Google Scholar] [CrossRef]

- Bi, K.X.; Yang, C.J.; Huang, P. Research on the influence of FDI on China’s manufacturing green process innovation: An empirical analysis based on industry panel data. China Soft Sci. 2011, 9, 172–180. [Google Scholar]

- Gong, X.Y.; Li, M.J.; Zhang, H.Z. Does OFDI enhance China’s industrial green innovation efficiency: An empirical study based on agglomeration economic effects. Int. Trans. Issues 2017, 11, 127–137. [Google Scholar]

- Nigel, D.; James, H.L. Foreign direct investment, technology sourcing and reverse spillovers. Manch. Sch. 2003, 71, 659–672. [Google Scholar]

- Zhu, J.; Huang, W. Regional differences of OFDI reverse technology spillover effect: An empirical analysis based on China’s provincial panel data. Int. J. Sci. 2017, 4, 86–92. [Google Scholar]

- Gao, Y.; Tsai, S.B.; Xue, X.; Ren, T.; Du, X.; Chen, Q.; Wang, J. An empirical study on green innovation efficiency in the green institutional environment. Sustainability 2018, 10, 724. [Google Scholar] [CrossRef]

- Huang, Y.; Zhang, Y. How does outward foreign direct investment enhance firm productivity? A heterogeneous empirical analysis from Chinese manufacturing. China Econ. Rev. 2017, 44, 1–15. [Google Scholar] [CrossRef]

- Jia, J.; Wei, J.Y.; Wang, Y. Analysis of the impact of environmental regulation on china’s OFDI green technology innovation: Based on heterogeneous host country perspective. Res. Dev. Manag. 2017, 6, 81–90. [Google Scholar]

- Li, L.; Liu, X.; Yuan, D.; Yu, M. Does outward FDI generate higher productivity for emerging economy MNEs?—Micro-level evidence from Chinese manufacturing firms. Int. Bus. Rev. 2017, 26, 839–854. [Google Scholar] [CrossRef]

- Zhou, C.; Hong, J.; Wu, Y.; Marinova, D. Outward foreign direct investment and domestic innovation performance: evidence from China. Int. Bus. Rev. 2016, 25, 1010–1019. [Google Scholar] [CrossRef]

- Piperopoulos, P.; Wu, J.; Wang, C. Outward FDI, location choices and innovation performance of emerging market enterprises. Res. Policy 2017, 47, 232–240. [Google Scholar] [CrossRef]

- Grekova, K.; Bremmers, H.; Trienekens, J.; Kemp, R.G.M.; Omta, O. The mediating role of environmental innovation in the relationship between environmental management and firm performance in a multi-stakeholder environment. J. Chain Netw. Sci. 2013, 13, 119–137. [Google Scholar] [CrossRef]

- Feng, Z.; Chen, W. Environmental regulation, green innovation, and industrial green development: An empirical analysis based on the spatial Durbin model. Sustainability 2018, 10, 223. [Google Scholar] [CrossRef]

- Rennings, K. Towards a Theory and Policy of Eco-Innovation: Neoclassical and Co-Evolutionary Perspectives; ZEW Discussion Paper; ZEW: Mannheim, Germany, 1998; Volume 6, pp. 98–124. [Google Scholar]

- Lee, C.W. The effect of environmental regulation on green technology innovation through supply chain integration. Int. J. Sust. Econ. 2010, 2, 92–112. [Google Scholar] [CrossRef]

- Porter, M.E.; Van, D.L.C. Green and competitive: Ending the stalemate. Harv. Bus. Rev. 1995, 5, 120–134. [Google Scholar]

- Ambec, S.; Barla, P. Can environmental regulations be good for business? An assessment of the Porter Hypothesis. Energy Stud. Rev. 2006, 14, 601–610. [Google Scholar] [CrossRef]

- Arimura, T.H.; Sugino, M. Does stringent environmental regulation stimulate environment related technological innovation. Sophia Econ. Rev. 2007, 52, 1–14. [Google Scholar]

- Horbach, J. Determinants of environmental innovations-new evidence from German panel data sources. Res. Policy 2008, 37, 163–173. [Google Scholar] [CrossRef]

- Kammerer, D. The effects of customer benefit and regulation on environmental product innovation: Empirical evidence from appliance manufacturers in Germany. Ecol. Econ. 2009, 68, 2285–2295. [Google Scholar] [CrossRef]

- Kneller, R.; Manderson, E. Environmental regulations and innovation activity in UK manufacturing industries. Resour. Energy Econ. 2012, 2, 211–235. [Google Scholar] [CrossRef]

- Kesidou, E.; Demirel, P. On the drives of eco-innovations: Empirical evidence from the UK. Res. Policy 2012, 5, 862–870. [Google Scholar] [CrossRef]

- Acemoglu, D.; Aghion, P.; Burszyyn, L.; Hemous, D. The environment and directed technical change. Am. Econ. Rev. 2012, 1, 131–166. [Google Scholar] [CrossRef] [PubMed]

- Calel, R.; Dechezlepretre, A. Environmental policy and directed technological change: Evidence from the European carbon market. Rev. Econ. Stat. 2016, 1, 173–191. [Google Scholar] [CrossRef]

- Jia, J.; Zhang, W. Analysis of path dependence and environmental regulation impact in green technology innovation. Sci. Technol. Manag. 2014, 5, 44–52. [Google Scholar]

- Castellacci, F.; Lie, C.M. A taxonomy of green innovators: Empirical evidence from South Korea. J. Clean. Prod. 2017, 143, 1036–1047. [Google Scholar] [CrossRef]

- Barbara, A.J.; Mconnell, V.D. The Impact of environmental regulations on industry productivity: Direct and indirect effects. J. Environ. Econ. Manag. 1990, 18, 50–65. [Google Scholar] [CrossRef]

- Greenstone, M. The impacts of environmental regulations on industrial activity. J. Polit. Econ. 2002, 6, 1175–1219. [Google Scholar] [CrossRef]

- Montalvo, C.C. Sustainable production and consumption systems-cooperation for change: Assessing and simulating the willingness of the firm to adopt/develop cleaner technologies. J. Clean. Prod. 2003, 4, 411–426. [Google Scholar] [CrossRef]

- Wagner, M. On the relationship between environmental management, environmental innovation and patenting: Evidence from German manufacturing firms. Res. Policy 2007, 10, 1587–1602. [Google Scholar] [CrossRef]

- Chintrakarn, P. Environmental regulation and U.S. States’ technical inefficiency. Econ. Lett. 2008, 100, 363–365. [Google Scholar] [CrossRef]

- Peng, W.B.; Cheng, F.F.; Lu, J.L. Research on the threshold effect of environmental regulation on provincial green innovation efficiency. South China J. Econ. 2017, 9, 73–84. [Google Scholar]

- Guo, Y.Y.; Xia, X.N.; Zhang, S.; Zhang, D.P. Environmental regulation, government R&D funding and green technology innovation: evidence from China provincial data. Sustainability 2018, 10, 940. [Google Scholar] [CrossRef]

- Frondel, M.; Horbach, J.; Rennings, K. End-of-Pipe or cleaner production? An empirical comparison of environmental innovation decisions across OECD countries. Bus. Strategy Environ. 2007, 16, 571–584. [Google Scholar] [CrossRef]

- Wang, F.Z.; Jiang, T. The impact of environmental regulation on the green technology innovation of resource-based industries: based on the perspective of industry heterogeneity. Res. Financ. Econ. Issues 2015, 8, 17–23. [Google Scholar]

- Bi, K.X.; Wang, Y.H.; Yang, C.J. Study on the influence of FDI on China’s green innovation in manufacturing system. Appl. Mech. Mater. 2013, 448–453, 4571–4576. [Google Scholar] [CrossRef]

- Song, M.L.; Tao, J.; Wang, S.H. FDI, technology spillovers and green innovation in China: Analysis based on Data Envelopment Analysis. Ann. Oper. Res. 2015, 1, 47–64. [Google Scholar] [CrossRef]

- Kogut, B.; Chang, S. Technological capabilities and Japanese foreign direct investment in the United States. Rev. Econ. Stat. 1991, 3, 401–413. [Google Scholar] [CrossRef]

- Coe, D.T.; Helpman, E. International R&D spillovers. Eur. Econ. Rev. 1995, 5, 859–887. [Google Scholar]

- Branstetter, L. Is foreign direct investment a channel of knowledge spillovers? Evidence from Japan’s FDI in the United States. J. Int. Econ. 2006, 2, 325–344. [Google Scholar] [CrossRef]

- Fosfuri, A.; Motta, M. Multinationals without advantages. Scand. J. Econ. 1999, 4, 617–630. [Google Scholar] [CrossRef]

- Lichtenberg, F.; Pottelsberghe, B. Does foreign direct investment transfer technology across borders? Rev. Econ. Stat. 2001, 83, 490–497. [Google Scholar]

- Pradhan, J.P.; Singh, N. Outward FDI and knowledge flows: A Study of the Indian automotive sector. Int. J. Inst. Econ. 2008, 11, 156–187. [Google Scholar]

- Chen, V.Z.; Li, J.; Shapiro, D.M. International reverse spillover effects on parent firms: Evidences from emerging market MNEs in developed markets. Eur. Manag. J. 2012, 30, 204–218. [Google Scholar] [CrossRef]

- Bitzer, J.; Görg, H. Foreign direct investment, Competition and industry performance. World Econ. 2010, 32, 221–233. [Google Scholar] [CrossRef]

- Lee, G. The effectiveness of international knowledge spillover channels. Eur. Econ. Rev. 2006, 50, 2075–2088. [Google Scholar] [CrossRef]

- Bitzer, J.; Kerekes, M. Does foreign direct investment transfer technology across borders? Econ. Lett. 2008, 83, 355–358. [Google Scholar] [CrossRef]

- Li, M.; Liu, S.C. Regional differences and threshold effects of foreign direct investment reverse technology spillover: Threshold regression analysis based on Chinese provincial panel data. Manag. World 2012, 1, 21–32. [Google Scholar]

- Borensztein, E.; Gregorio, J.D.; Lee, J.W. How does foreign direct investment affect economic growth. J. Int. Econ. 1998, 45, 115–135. [Google Scholar] [CrossRef]

- Görg, H.; Greenaway, D. Much ado about nothing? Do domestic firms really benefit from foreign direct investment? World Bank Res. Obser. 2004, 19, 171–197. [Google Scholar] [CrossRef]

- Song, W.J.; Du, F. Independent research and development, technology spillovers and green technology innovation in China. Res. Financ. Econ. Issues 2017, 8, 98–105. [Google Scholar]

- Li, G.X.; Zhang, W. Research on international capital and trade channels of green technology innovation under environmental regulation conditions. Sci. Technol. Manag. Res. 2016, 24, 15–20. [Google Scholar]

- Rennings, K. Redefining innovation–eco-innovation research and the contribution from ecological economics. Ecol. Econ. 2000, 32, 319–332. [Google Scholar] [CrossRef]

- Hamamoto, M. Environmental regulation and the productivity of Japanese manufacturing industries. Resour. Energy Econ. 2006, 28, 299–312. [Google Scholar] [CrossRef]

- Li, G.X.; Zhang, W.; Wang, Y.J. Foreign direct investment, environmental regulation and domestic green technology innovation. Sci. Technol. Manag. Res. 2016, 13, 227–231. [Google Scholar]

- Eskeland, G.S.; Harrison, A.E. Moving to greener pastures? Multinationals and the pollution haven hypothesis. J. Dev. Econ. 2003, 70, 1–23. [Google Scholar] [CrossRef]

- Mericana, Y.; Yusopb, Z.; Noorc, Z.M.; Law, S.H. Foreign direct investment and the pollution in five ASEAN nations. Int. J. Econ. Manag. 2007, 1, 245–261. [Google Scholar]

- Li, P.; Su, W.Z. Foreign direct investment and China’s technology innovation: Based on the perspective of heterogeneous investment host country. Int. Bus. 2014, 2, 71–82. [Google Scholar]

- Zeng, B.; Liu, S. A self-adaptive intelligence gray prediction model with the optimal fractional order accumulating operator and its application. Math. Method Appl. Sci. 2017, 23, 1–15. [Google Scholar] [CrossRef]

- Zeng, B.; Li, C. Improved multi-variable grey forecasting model with a dynamic background-value coefficient and its application. Comput. Ind. Eng. 2018, 118, 278–290. [Google Scholar] [CrossRef]

- Tone, K. A slacks-based measure of efficiency in data envelopment analysis. Eur. J. Oper. Res. 2001, 130, 498–509. [Google Scholar] [CrossRef]

- Tone, K. Dealing with Strange Outputs in DEA: A Slacks-Based Measure (SBM) Approach; Grips Research Report Series; 1-2003-0005; The Operations Research Society of Japan: Tokyo, Japan, 2003. [Google Scholar]

- Gray, W.B.; Shadbegian, R.J. Environmental regulation, investment timing, and technology choice. J. Ind. Econ. 1998, 46, 235–256. [Google Scholar] [CrossRef]

- Seiford, L.M.; Zhu, J. Modeling undesirable factors in efficiency evaluation. Eur. J. Oper. Res. 2002, 142, 16–20. [Google Scholar] [CrossRef]

- Liu, H.Y.; Nie, F. Research on the hollowing effect of China’s manufacturing foreign direct investment. China Ind. Econ. 2015, 4, 83–96. [Google Scholar]

- Jefferson, G.H.; Bai, H.M.; Guan, X.J.; Yu, X.Y. R&D performance in Chinese industry. Econ. Innov. New Technol. 2006, 15, 2–13. [Google Scholar]

- Goto, A. R&D capital, rate of return on R&D investment and spillover of R&D in Japanese manufacturing industries. Rev. Econ. Stat. 2001, 4, 555–564. [Google Scholar]

- Harberger, A.C. Perspectives on Capital and Technology in less Developed Countries; Croom Helm: London, UK, 1978. [Google Scholar]

| Variable Type | Variable | Mean | S.D. | Min | Max | Explanation |

|---|---|---|---|---|---|---|

| Explained variable | GIE | 0.4697 | 0.3445 | 0.1153 | 1.2864 | Green innovation efficiency: calculated by Super-SBM |

| Core explanatory variables | ER | 0.1327 | 0.1698 | 0.0023 | 0.7999 | Industrial wastewater treatment facilities operating costs + industrial waste gas treatment facilities operating costs/total industrial output value (%) |

| IFDI | 0.0609 | 0.0697 | 0.0010 | 0.5404 | IFDI flow/total industrial output value (%) | |

| OFDI | 0.3997 | 0.4545 | 0.0085 | 2.7448 | OFDI flow/total industrial output value (%) | |

| Control variables | CI | 23.5105 | 18.1091 | 3.1964 | 102.4353 | Industrial fixed assets net/employee number (104 yuan/person) |

| SE | 4.7135 | 10.4729 | 0.4398 | 70.2315 | Total industrial output value/number of industrial enterprises (100 million/enterprise) | |

| GS | 3.1225 | 2.0677 | 0.1141 | 10.4539 | The proportion of government funds in the intramural expenditures on R&D (%) | |

| PRS | 16.8712 | 22.1472 | 0.3897 | 99.3666 | The proportion of state-owned and state-controlled enterprises in total industrial output value (%) |

| Code | Sector | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | Mean | Rank |

|---|---|---|---|---|---|---|---|---|---|---|

| C13 | Processing of food from agricultural products | 0.1559 | 0.1828 | 0.1922 | 0.2441 | 0.2438 | 0.2461 | 0.2559 | 0.2173 | 22 |

| C14 | Manufacture of foods | 0.2130 | 0.2370 | 0.1997 | 0.2157 | 0.2252 | 0.2667 | 0.2398 | 0.2282 | 20 |

| C15 | Manufacture of beverages | 0.1181 | 0.1267 | 0.1153 | 0.1290 | 0.1153 | 0.1167 | 0.1191 | 0.1200 | 27 |

| C16 | Manufacture of tobacco | 0.5666 | 0.6548 | 1.1232 | 1.0003 | 1.0194 | 1.0144 | 1.0848 | 0.9234 | 5 |

| C17 | Manufacture of textile | 0.1392 | 0.2099 | 0.2123 | 0.2196 | 0.2500 | 0.2600 | 0.2900 | 0.2259 | 21 |

| C18 | Manufacture of textile wearing apparel, foot ware and caps | 0.3157 | 0.4368 | 0.2629 | 1.0373 | 1.0141 | 0.7410 | 0.5795 | 0.6267 | 8 |

| C19 | Manufacture of leather, fur, feather and related products | 0.4115 | 0.4311 | 0.3199 | 0.3211 | 0.2998 | 0.2635 | 0.2537 | 0.3286 | 13 |

| C20 | Processing of timber, manufacture of wood, bamboo, rattan, palm, and straw products | 0.3976 | 0.3470 | 0.3143 | 0.2518 | 0.2241 | 0.1913 | 0.1754 | 0.2717 | 14 |

| C21 | Manufacture of furniture | 1.2305 | 1.1493 | 1.2125 | 1.0588 | 1.0979 | 0.8524 | 1.0582 | 1.0942 | 1 |

| C22 | Manufacture of paper and paper products | 0.1335 | 0.1404 | 0.1276 | 0.1301 | 0.1282 | 0.1514 | 0.1382 | 0.1356 | 26 |

| C23 | Printing, reproduction of recording media | 0.5495 | 0.5762 | 0.4576 | 0.5050 | 0.6358 | 0.4987 | 0.4215 | 0.5206 | 10 |

| C24 | Manufacture of articles for culture, education and sport activity | 1.2168 | 1.2864 | 0.7023 | 1.0503 | 1.0406 | 1.0981 | 0.8510 | 1.0351 | 2 |

| C25 | Processing of petroleum, coking, processing of nuclear fuel | 0.1285 | 0.1167 | 0.1154 | 0.1330 | 0.2571 | 0.2800 | 0.3008 | 0.1902 | 24 |

| C26 | Manufacture of raw chemical materials and chemical products | 0.2173 | 0.2067 | 0.2425 | 0.2751 | 0.2872 | 0.2884 | 0.2795 | 0.2567 | 17 |

| C27 | Manufacture of medicines | 0.3581 | 0.4043 | 0.3529 | 0.3989 | 0.4110 | 0.4190 | 0.3188 | 0.3804 | 12 |

| C28 | Manufacture of chemical fibers | 0.1500 | 0.1438 | 0.1573 | 0.1792 | 0.1738 | 0.1843 | 0.2250 | 0.1733 | 25 |

| C29 | Rubber and plastic products industry | 0.2251 | 0.2442 | 0.3671 | 0.2374 | 0.2761 | 0.2762 | 0.2673 | 0.2705 | 15 |

| C31 | Manufacture of non-metallic mineral products | 0.3227 | 0.1930 | 0.2210 | 0.2207 | 0.2337 | 0.2297 | 0.1963 | 0.2310 | 19 |

| C32 | Smelting and pressing of ferrous metals | 0.2180 | 0.2114 | 0.2612 | 0.2460 | 0.2432 | 0.2400 | 0.2482 | 0.2383 | 18 |

| C33 | Smelting and pressing of non-ferrous metals | 0.1376 | 0.1767 | 0.1635 | 0.1975 | 0.2478 | 0.2845 | 0.2802 | 0.2125 | 23 |

| C34 | Manufacture of metal products | 0.2301 | 0.3091 | 0.2210 | 0.2791 | 0.2506 | 0.2524 | 0.2681 | 0.2586 | 16 |

| C35 | Manufacture of general purpose machinery | 0.2524 | 0.2807 | 1.1100 | 0.4703 | 0.5032 | 0.4590 | 0.4599 | 0.5051 | 11 |

| C36 | Manufacture of special purpose machinery | 0.2875 | 0.3649 | 0.4027 | 0.5061 | 0.6536 | 0.6369 | 1.0034 | 0.5507 | 9 |

| C37 | Manufacture of transport equipment | 1.0233 | 1.0054 | 1.0810 | 0.6591 | 0.5881 | 0.6746 | 1.0055 | 0.8624 | 7 |

| C39 | Manufacture of electrical machinery and equipment | 0.6520 | 1.0363 | 0.8522 | 1.0054 | 1.0014 | 1.0816 | 1.0497 | 0.9541 | 4 |

| C40 | Manufacture of communication equipment, computers and other electronic equipment | 1.0173 | 0.7093 | 1.0437 | 1.0085 | 1.0681 | 1.0144 | 1.0375 | 0.9855 | 3 |

| C41 | Manufacture of measuring instruments and machinery for cultural activity and office work | 0.5668 | 0.5675 | 1.0900 | 0.7723 | 1.1193 | 1.0699 | 1.0184 | 0.8863 | 6 |

| Mean of patent-intensive manufacturing | 0.4743 | 0.5061 | 0.6559 | 0.5572 | 0.6130 | 0.6181 | 0.6721 | 0.5852 | ||

| Mean of non-patent-intensive manufacturing | 0.3819 | 0.3934 | 0.3742 | 0.4223 | 0.4399 | 0.4065 | 0.3944 | 0.4018 | ||

| Mean of manufacturing | 0.4161 | 0.4351 | 0.4786 | 0.4723 | 0.5040 | 0.4849 | 0.4972 | 0.4697 | ||

| Variable | Model (1) | Model (2) | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Manufacturing | Patent-Intensive Manufacturing | Non-Patent Intensive Manufacturing | Manufacturing | Patent-Intensive Manufacturing | Non-Patent Intensive Manufacturing | |||||||

| RE | FE | RE | FE | RE | FE | RE | FE | RE | FE | RE | FE | |

| C | −0.4588 (0.3771) | −1.6051 ** (0.7323) | −0.1365 (0.917) | −0.7432 (1.6995) | −0.6628 (0.4653) | −1.6903 * (0.9070) | −0.4644 (0.4031) | −1.7918 ** (0.7389) | −0.4510 (0.8861) | −2.1090 (1.8078) | −0.5656 (0.4802) | −2.0694 ** (0.8987) |

| ER | −0.1660 *** (0.0264) | −0.0866 ** (0.0360) | −0.1418 ** (0.0539) | −0.0141 (0.0716) | −0.1552 *** (0.0320) | −0.1297 *** (0.0411) | −0.1554 ** (0.0727) | −0.1289 (0.0836) | −0.3050 * (0.1617) | −0.3383 * (0.1797) | −0.0831 (0.0791) | −0.0591 (0.0939) |

| IFDI | 0.1999 *** (0.0474) | 0.0853 (0.0709) | 0.2214 ** (0.1040) | 0.0031 (0.1315) | 0.1146 * (0.0611) | 0.1161 (0.0844) | 0.2196 *** (0.0779) | 0.0663 (0.0938) | 0.0964 (0.1648) | −0.3440 (0.2149) | 0.2152 ** (0.0895) | 0.1677 * (0.0991) |

| OFDI | 0.1555 * (0.0855) | 0.2386 * (0.1399) | 0.0606 (0.1479) | 0.0859 (0.1967) | 0.1785 (0.1247) | 0.3865 * (0.2057) | 0.0981 (0.1185) | 0.1104 (0.1587) | 0.1322 (0.2119) | 0.0470 (0.2652) | 0.0105 (0.1560) | 0.2497 (0.2156) |

| CI | −0.1920 (0.1508) | 0.4341 (0.2668) | −0.1719 (0.3177) | 0.2198 (0.4374) | −0.1471 (0.1939) | 0.5319 (0.3624) | −0.1820 (0.1605) | 0.4246 (0.2714) | −0.2807 (0.2961) | 0.2465 (0.4305) | −0.1339 (0.2056) | 0.6551 * (0.3679) |

| SE | 0.2497 *** (0.0768) | 0.0431 (0.1168) | 0.2988 * (0.1615) | 0.2955 (0.2065) | 0.1751 * (0.1028) | −0.0479 (0.1453) | 0.2498 *** (0.0793) | 0.0721 (0.1177) | 0.3081 ** (0.1449) | 0.3292 (0.2035) | 0.1906 * (0.1043) | 0.0170 (0.1451) |

| GS | −0.0419 (0.0491) | −0.0431 (0.0604) | −0.0258 (0.1954) | −0.1178 (0.2360) | −0.0980 * (0.0579) | −0.0661 (0.0620) | −0.0373 (0.0497) | −0.0411 (0.0604) | −0.0658 (0.1856) | −0.2241 (0.2492) | −0.0972 * (0.0570) | −0.0676 (0.0606) |

| PRS | 0.1211 * (0.0626) | −0.1282 (0.0965) | −0.0002 (0.1956) | −0.2467 (0.3664) | −0.0536 (0.0813) | −0.1356 (0.1016) | 0.1072 * (0.0639) | −0.1372 (0.0969) | 0.1112 (0.1702) | −0.1203 (0.3820) | 0.0332 (0.0808) | −0.1298 (0.0997) |

| ER × IFDI | 0.0103 (0.0237) | 0.0007 (0.0253) | −0.0577 (0.0488) | −0.1074 * (0.0547) | 0.0490 * (0.0266) | 0.0457 (0.0288) | ||||||

| ER × OFDI | −0.0212 * (0.0259) | −0.0468 * (0.0280) | 0.0324 (0.0547) | −0.0128 (0.0585) | −0.0697 ** (0.0295) | −0.0756 ** (0.0315) | ||||||

| ADJ-R2 | 0.3503 | 0.9082 | 0.3803 | 0.8813 | 0.2803 | 0.9182 | 0.3349 | 0.9099 | 0.4688 | 0.8899 | 0.3013 | 0.9236 |

| F-statistic | 13.9406 | 46.4906 | 5.4345 | 24.6000 | 6.1745 | 46.3844 | 10.0143 | 44.1694 | 5.8840 | 22.8920 | 5.2231 | 44.9575 |

| Applicable model | FE | RE | RE | FE | FE | RE | ||||||

| Hausman test | 37.2936 *** | 11.1036 | \ | 37.9680 *** | 20.3976 ** | \ | ||||||

| Samples | 189 | 70 | 119 | 189 | 70 | 119 | ||||||

| Green Innovation | ||||

|---|---|---|---|---|

| Research Hypothesis | Empirical Result | |||

| Manufacturing | Patent-intensive Manufacturing | Non-Patent Intensive Manufacturing | ||

| Environmental regulation (ER) | promotion (H1) | inhibition, significant | inhibition, significant | inhibition, significant |

| Inward foreign direct investment (IFDI) | promotion (H2) | promotion, insignificant | promotion, significant | promotion, significant |

| Outward foreign direct investment (OFDI) | promotion (H3) | promotion, significant | promotion, insignificant | promotion, insignificant |

| ER × IFDI | promotion (H4) | promotion, insignificant | inhibition, significant | promotion, significant |

| ER × OFDI | promotion (H5) | inhibition, significant | inhibition, insignificant | inhibition, significant |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Feng, Z.; Zeng, B.; Ming, Q. Environmental Regulation, Two-Way Foreign Direct Investment, and Green Innovation Efficiency in China’s Manufacturing Industry. Int. J. Environ. Res. Public Health 2018, 15, 2292. https://doi.org/10.3390/ijerph15102292

Feng Z, Zeng B, Ming Q. Environmental Regulation, Two-Way Foreign Direct Investment, and Green Innovation Efficiency in China’s Manufacturing Industry. International Journal of Environmental Research and Public Health. 2018; 15(10):2292. https://doi.org/10.3390/ijerph15102292

Chicago/Turabian StyleFeng, Zhijun, Bo Zeng, and Qian Ming. 2018. "Environmental Regulation, Two-Way Foreign Direct Investment, and Green Innovation Efficiency in China’s Manufacturing Industry" International Journal of Environmental Research and Public Health 15, no. 10: 2292. https://doi.org/10.3390/ijerph15102292

APA StyleFeng, Z., Zeng, B., & Ming, Q. (2018). Environmental Regulation, Two-Way Foreign Direct Investment, and Green Innovation Efficiency in China’s Manufacturing Industry. International Journal of Environmental Research and Public Health, 15(10), 2292. https://doi.org/10.3390/ijerph15102292