The Effects of the Global Economic Recession and a Reduced Alcohol Tax on Hospitalizations Due to Alcohol-Attributed Diseases in Taiwan

Abstract

:1. Introduction

2. Materials and Methods

2.1. Data Measurement

2.2. Statistics Analysis

3. Results

3.1. Model Identification

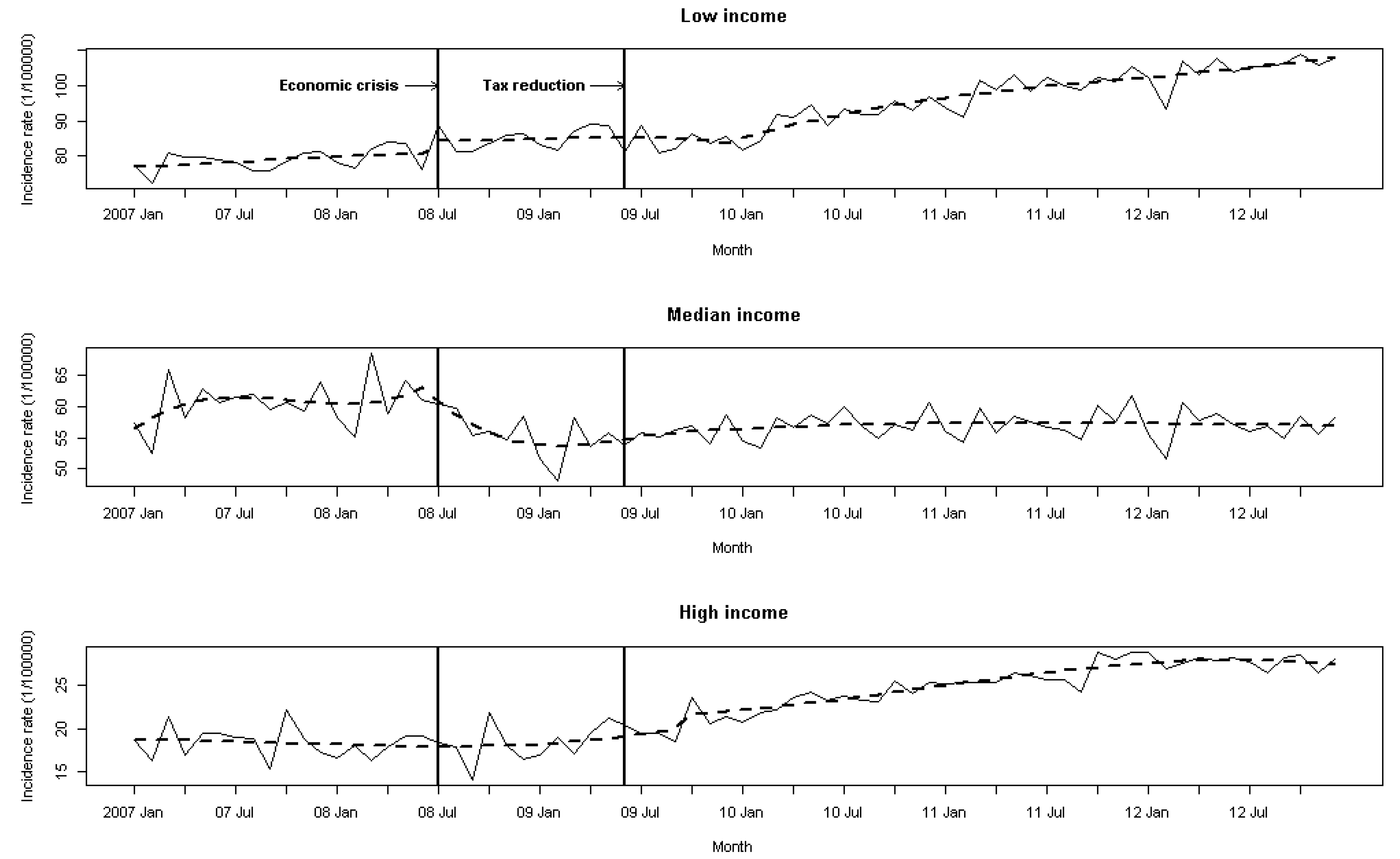

3.1.1. Low Income

3.1.2. Middle Income

3.1.3. High Income

3.2. ARIMA Analyses

4. Discussion

5. Strengths and Limitations

6. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- International Monetary Fund. World Economic Outlook April 2009. In IMF: World Economic and Financial Surveys III; International Monetary Fund: Washington, DC, USA, 2006. [Google Scholar]

- A Developmental Emergency. Global Monitoring Report 2009; World Bank: Washington, DC, USA, 2010. [Google Scholar]

- Wahlbeck, K.; Awolin, M. The impact of economic crises on the risk of depression and suicide: A literature review. In Proceedings of the EU Thematic Conference on Preventing Depression and Suicide, Budapest, Hungary, 10–11 December 2009; pp. 1–10. [Google Scholar]

- Lee, S; Guo, W.J.; Tsang, A.; Mak, A.D.; Wu, J.; Ng, K.L.; Kwok, K. Evidence for the 2008 economic crisis exacerbating depression in Hong Kong. J. Aff. Disord. 2010, 126, 125–133. [Google Scholar] [CrossRef] [PubMed]

- Cooper, B. Economic recession and mental health: An overview. Neuropsychiatrie 2011, 25, 113–117. [Google Scholar] [PubMed]

- Karanikolos, M.; Mladovsky, P.; Cylus, J.; Thomson, S.; Basu, S.; Stuckler, D.; Mackenbach, J.P.; Mckee, M. Financial crisis, austerity, and health in Europe. Lancet 2013, 381, 1323–1331. [Google Scholar] [CrossRef]

- World Health Organization. Impact of Economic Crises on Mental Health. Available online: http://www.euro.who.int/__data/assets/pdf_file/0008/134999/e94837.pdf (accessed on 5 November 2013).

- Hessel, P.; Vandoros, S.; Avendano, M. The differential impact of the financial crisis on health in Ireland and Greece: A quasi-experimental approach. Public Health 2014, 128, 911–919. [Google Scholar] [CrossRef] [PubMed]

- Ettner, S.L. Measuring the human cost of a weak economy: Does unemployment lead to alcohol abuse? Soc. Sci. Med. 1997, 44, 251–260. [Google Scholar] [CrossRef]

- Freeman, D.G. Alternative panel estimates of alcohol demand, taxation, and the business cycle. South. Econ. J. 2000, 67, 325–344. [Google Scholar] [CrossRef]

- Ruhm, C.J.; Black, W.E. Does drinking really decrease in bad times? J. Health Econ. 2002, 21, 659–678. [Google Scholar] [CrossRef]

- Bor, J.; Basu, S.; Coutts, A.; McKee, M.; Stuckler, D. Alcohol use during the Great Recession of 2008–2009. Alcohol Alcohol. 2013, 48, 343–348. [Google Scholar] [CrossRef] [PubMed]

- Dee, T. Alcohol abuse and economic conditions: Evidence from repeated cross sections of individual-level data. Health Econ. 2001, 10, 257–270. [Google Scholar] [CrossRef] [PubMed]

- Anderson, B.; Moro, M. Depression Economics and Alcohol Consumption; Working Paper; University College: Dublin, CA, USA, 2008. [Google Scholar]

- Stuckler, D.; Basu, S.; Suhrcke, M.; Coutts, A.; McKee, M. The public health effect of economic crises and alternative policy responses in Europe: An empirical analysis. Lancet 2009, 374, 315–323. [Google Scholar] [CrossRef]

- National Statistics. GDP and Economic Growth National Statistics. Available online: https://www.stat.gov.tw/ct.asp?xItem=33338&ctNode=2085&mp=4 (accessed on 20 Febuary 2016).

- Lin, C.Y.Y.; Edvinsson, L.; Chen, J.; Beding, T. Impact of the 2008 global financial crisis. National intellectual capital and the financial crisis in China, Hong Kong, Singapore, and Taiwan. SpringerBriefs Econ. 2013, 8, 7–16. [Google Scholar]

- Chaloupka, F.J.; Grossman, M.; Saffer, H. The effects of price on alcohol consumption and alcohol related problems. Alcohol Res. Health 2002, 26, 22–34. [Google Scholar] [PubMed]

- Babor, T.; Caetano, R.; Casswell, S.; Edwards, G.; Giesbrecht, N.; Graham, K. Alcohol: No Ordinary Commodity; Oxford University Press: New York, NY, USA, 2003. [Google Scholar]

- Maldonado-Molina, M.M.; Wagenaar, A.C. Effects of alcohol taxes on alcohol-related mortality in Florida: Time-series analyses from 1969 to 2004. Alcohol. Clin. Exp. Res. 2010, 34, 1915–1921. [Google Scholar] [CrossRef] [PubMed]

- Herttua, K.; Mäkelä, P.M.; Martikainen, P. An evaluation of the impact of a large reduction in alcohol prices on alcohol-related and all-cause mortality: Time series analysis of a population-based natural experiment. Int. J. Epidemiol. 2009, 40, 441–454. [Google Scholar] [CrossRef] [PubMed]

- Herttua, K.; Mäkelä, P.; Martikainen, P. The effects of a large reduction in alcohol prices on hospitalisations related to alcohol: A population-based natural experiment. Addiction 2011, 106, 759–767. [Google Scholar] [CrossRef] [PubMed]

- Elder, R.W.; Lawrence, B.; Ferguson, A.; Naimi, T.S.; Brewer, R.D.; Chattopadhyay, S.K.; Toomey, T.L.; Fielding, J.E. The effectiveness of tax policy interventions for reducing excessive alcohol consumption and related harms. Am. J. Prev. Med. 2010, 38, 217–229. [Google Scholar] [CrossRef] [PubMed]

- Wagenaar, A.C.; Tobler, A.L.; Komro, K.A. Effects of alcohol tax and price policies on morbidity and mortality: A systematic review. Am. J. Public Health 2010, 100, 2270–2278. [Google Scholar] [CrossRef] [PubMed]

- Health Promotion Administration. National Survey of Health Visit Investigation in Taiwan. Research Report No. 1. Available online: http://www.hpa.gov.tw/Bhpnet/Web/HealthTopic/TopicArticle.aspx?No=200712270007&parentid=200712270001 (accessed on 22 October 2016).

- Mäkelä, P.; Herttua, K.; Martikainen, P. The socioeconomic differences in alcohol-related harm and the effects of alcohol prices on them: A summary of evidence from Finland. Alcohol Alcohol. 2015, 50, 661–669. [Google Scholar] [CrossRef] [PubMed]

- Leinsalu, M.; Vågerö, D.; Kunst, A.E. Estonia 1989–2000: Enormous increase in mortality differences by education. Int. J. Epidemiol. 2003, 32, 1081–1087. [Google Scholar] [CrossRef] [PubMed]

- Herttua, K.; Mäkelä, P.; Martikainen, P. Differential trends in alcohol-related mortality: A register-based follow-up study in Finland in 1987–2003. Alcohol Alcohol. 2007, 42, 456–464. [Google Scholar] [CrossRef] [PubMed]

- Probst, C.; Roerecke, M.; Behrendt, S.; Rehm, J. Socioeconomic differences in alcohol-attributable mortality compared with all-cause mortality: A systematic review and meta-analysis. Int. J. Epidemiol. 2014, 43, 1314–1327. [Google Scholar] [CrossRef] [PubMed]

- Mattei, G.; Ferrari, S.; Pingani, L.; Rigatelli, M. Short-term effects of the 2008 Great Recession on the health of the Italian population: An ecological study. Soc. Psychiatry Psychiatr. Epidemiol. 2014, 49, 851–858. [Google Scholar] [CrossRef] [PubMed]

- World Health Organization. Commission on Social Determinants of Health: Closing the Gap in a Generation: Health Equity Through Action on the Social Determinants of Health; World Health Organization: Geneva, Switzerland, 2008. [Google Scholar]

- De Vogli, R. Financial crisis, austerity, and health in Europe. Lancet 2013, 382, 391. [Google Scholar] [CrossRef]

- De Goeij, M.C.M.; Suhrcke, M.; Toffolutti, V.; van de Mheen, D.; Schoenmakers, T.M.; Kunst, A.E. How economic crises affect alcohol consumption and alcohol-related health problems: A realist systematic review. Soc. Sci. Med. 2015, 131, 131–146. [Google Scholar] [CrossRef] [PubMed]

- Margerison-Zilko, C.; Goldman-Mellor, S.; Falconi, A.; Downing, J. Health Impacts of the Great Recession: A Critical Review. Curr. Epidemiol. Rep. 2016, 3, 81–91. [Google Scholar] [CrossRef] [PubMed]

- Shultz, J.M.; Rice, D.P.; Parker, D.L.; Goodman, R.A.; Stroh, G.; Chalmers, N. Quantifying the disease impact of alcohol with ARDI software. Public Health Rep. 1991, 106, 443–450. [Google Scholar] [PubMed]

- Rehm, J.; Patra, J.; Popova, S. Alcohol-attributable mortality and potential years of life lost in Canada 2001: Implications for prevention and policy. Addiction 2006, 101, 373–384. [Google Scholar] [CrossRef] [PubMed]

- Lin, C.M.; Liao, C.M. Alcohol tax policy in relation to hospitalization from alcohol attributed diseases in Taiwan: A nation-wide population analysis of data from 1996–2010. Alcohol. Clin. Exp. Res. 2013, 37, 1544–1551. [Google Scholar] [CrossRef] [PubMed]

- Lin, C.M.; Liao, C.M. Inpatient expenditures on alcohol-attributed diseases and alcohol tax policy: A nationwide analysis in Taiwan from 1996 to 2010. Public Health 2014, 128, 977–984. [Google Scholar] [CrossRef] [PubMed]

- Box, G.E.P.; Jenkins, G.M.; Reinsel, G.C. Time Series Analysis: Forecasting and Control, 3rd ed.; Prentice Hall: Upper Saddle River, NJ, USA, 1994. [Google Scholar]

- Wei, W.W.S. Time Series Analysis; Addison-Wesley Publishing Company: Boston, MA, USA, 1990. [Google Scholar]

- Gili, M.; Roca, M.; Basu, S.; McKee, M.; Stuckler, D. The mental health risks of economic crisis in Spain: Evidence from primary care centres, 2006 and 2010. Eur. J. Public Health 2012, 23, 103–108. [Google Scholar] [CrossRef] [PubMed]

- Harhay, M.O.; Bor, J.; Basu, S.; McKee, M.; Mindell, J.S.; Shelton, N.J.; Stuckler, D. Differential impact of the economic recession on alcohol use among white British adults, 2004–2010. Eur. J. Public Health 2013, 24, 410–415. [Google Scholar] [CrossRef] [PubMed]

- Mulia, N.; Zemore, S.; Murphy, R.; Liu, H.; Catalano, R. Economic loss and alcohol consumption and problems during the 2008 to 2009 U.S. recession. Alcohol. Clin. Exp. Res. 2014, 38, 1026–1034. [Google Scholar] [CrossRef] [PubMed]

- Wilkinson, R.; Marmot, M. Social Determinants of Health: The Solid Facts; World Health Organization: Copenhagen, Denmark, 2003. [Google Scholar]

- Marmot, M.G. How will the financial crisis affect health? Br. Med. J. 2009, 338, b1314. [Google Scholar] [CrossRef] [PubMed]

- Bosque-Prous, M.; Espelt, A.; Sordo, L.; Guitart, A.M.; Brugal, M.T.; Bravo, M.J. Job loss, unemployment and the incidence of hazardous drinking during the late 2000s Recession in Europe among adults aged 50–64 years. PLoS ONE 2015, 10, e0140017. [Google Scholar] [CrossRef] [PubMed]

- Eliason, M.; Storrie, D. Job loss is bad for your health—Swedish evidence on cause-specific hospitalization following involuntary job loss. Soc. Sci. Med. 2009, 68, 1396–1406. [Google Scholar] [CrossRef] [PubMed]

- Backhans, M.C.; Balliu, N.; Lundin, A.; Hemmingsson, T. Unemployment is a risk factor for hospitalization due to alcohol problems: A longitudinal study based on the Stockholm Public Health Cohort (SPHC). J. Stud. Alcohol Drugs 2016, 77, 936–942. [Google Scholar] [CrossRef] [PubMed]

- Lo, C.C.; Cheng, T.C. Heavy drinking during periods of high unemployment: 15-Year trend study of the role of race/ethnicity. Drug Alcohol Depend. 2013, 133, 383–390. [Google Scholar] [CrossRef] [PubMed]

- Zemore, S.Z.; Mulia, N.; Jones-Webb, R.J.; Liu, H.; Schmidt, L. The 2008–2009 Recession and alcohol outcomes: Differential exposure and vulnerability for Black and Latino populations. J. Stud. Alcohol Drugs 2013, 74, 9–20. [Google Scholar] [CrossRef] [PubMed]

- Kalousova, L.; Burgard, S. Unemployment, measured and perceived decline of economic resources: Contrasting three measures of recessionary hardships and their implications for adopting negative health behaviors. Soc. Sci. Med. 2014, 106, 28–34. [Google Scholar] [CrossRef] [PubMed]

- Tarkiainen, L.; Martikainen, P.; Laaksonen, M. The contribution of education, social class and economic activity to the income–mortality association in alcohol-related and other mortality in Finland in 1988–2012. Addition 2016, 11, 456–464. [Google Scholar] [CrossRef] [PubMed]

- Shim, E.; Cho, Y. Widening social disparities in alcohol-attributable deaths among Korean men aged 40–59 years during the transitional period of the economic crisis (1995–2005). Int. J. Public Health 2013, 58, 521–527. [Google Scholar] [CrossRef] [PubMed]

- DGBAS. Human Resource Statistics Inquiry. Directorate-General of Budget, Accounting and Statistics, Executive Yuan, ROC (Taiwan), 2016. Available online: http://www.dgbas.gov.tw/ct.asp?xItem=18844&ctNode=4943 (accessed on 22 October 2016).

- DGBAS. Directorate-General of Budget, Accounting and Statistics, Executive Yuan, ROC (Taiwan), 2016. Available online: http://statdb.dgbas.gov.tw/pxweb/Dialog/varval.asp?ma=NA8203A2Q&ti=%A5%C1%B6%A1%AE%F8%B6O-%A9u&path=../PXfile/NationalIncome/&lang=9&strList=L (accessed on 22 October 2016).

- Glonti, K.; Gordeev, V.S.; Goryakin, Y.; Reeves, A.; Stuckler, D.; McKee, M.; Roberts, B. A systematic review on health resilience to economic crises. PLoS ONE 2015, 10, e0123117. [Google Scholar] [CrossRef] [PubMed]

| Year | Low Income | Middle Income | High Income | |||

|---|---|---|---|---|---|---|

| Rate | Change (%) | Rate | Change (%) | Rate | Change (%) | |

| 2007 | 78.3 | - | 60.4 | - | 18.6 | - |

| 2008 | 82.0 | 4.5% | 57.8 | −4.5% | 18.1 | −3.2% |

| 2009 | 84.6 | 3.1% | 54.3 | −6.5% | 19.9 | 9.1% |

| 2010 | 92.6 | 8.6% | 56.7 | 4.3% | 23.4 | 15.3% |

| 2011 | 98.1 | 5.7% | 56.9 | 0.3% | 26.8 | 12.4% |

| 2012 | 105.1 | 6.7% | 55.7 | −2.1% | 26.6 | −0.7% |

| Income Groups | Economic Intervention in 2008 | Tax Intervention in 2009 | Box-Ljung | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| a (SE) | T | p-Value | Mean Before First Intervention (1/105) | Change b (%) | a (SE) | T | p-Value | Mean Before Second Intervention (1/105) | Change b (%) | Q-Statistics (df c) | |

| (SE) | (SE) | p-Value | |||||||||

| Low | 5.702 (1.349) | 3.760 | 0.00017 | 80.189 | 7.11 | 0.997 (0.229) | 4.354 | <0.0001 | 83.628 | 39.74 | 22.82 (17) |

| - | - | - | - | - | 970 (0.017) | 57.06 | <0.0001 | - | - | 0.155 | |

| Middle | 1.042 (0.329) | 3.167 | 0.0015 | 59.870 | −22.90 | - | - | - | 54.745 | - | 15.54 (16) |

| 0.924 (0.015) | 18.12 | <0.0001 | - | - | - | - | - | - | 0.485 | ||

| High | - | - | 17.882 | - | 0.561 (0.267) | 2.101 | 0.0356 | 19.283 | 47.69 | 12.01 (16) | |

| - | - | - | - | - | 0.939 (0.047) | 19.98 | <0.0001 | - | - | 0.743 | |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liao, C.-M.; Lin, C.-M. The Effects of the Global Economic Recession and a Reduced Alcohol Tax on Hospitalizations Due to Alcohol-Attributed Diseases in Taiwan. Int. J. Environ. Res. Public Health 2017, 14, 580. https://doi.org/10.3390/ijerph14060580

Liao C-M, Lin C-M. The Effects of the Global Economic Recession and a Reduced Alcohol Tax on Hospitalizations Due to Alcohol-Attributed Diseases in Taiwan. International Journal of Environmental Research and Public Health. 2017; 14(6):580. https://doi.org/10.3390/ijerph14060580

Chicago/Turabian StyleLiao, Chen-Mao, and Chih-Ming Lin. 2017. "The Effects of the Global Economic Recession and a Reduced Alcohol Tax on Hospitalizations Due to Alcohol-Attributed Diseases in Taiwan" International Journal of Environmental Research and Public Health 14, no. 6: 580. https://doi.org/10.3390/ijerph14060580

APA StyleLiao, C.-M., & Lin, C.-M. (2017). The Effects of the Global Economic Recession and a Reduced Alcohol Tax on Hospitalizations Due to Alcohol-Attributed Diseases in Taiwan. International Journal of Environmental Research and Public Health, 14(6), 580. https://doi.org/10.3390/ijerph14060580