Yes, The Government Should Tax Soft Drinks: Findings from a Citizens’ Jury in Australia

Abstract

:1. Introduction

2. Methods

2.1.Study Design

2.1.1. Development of Questions

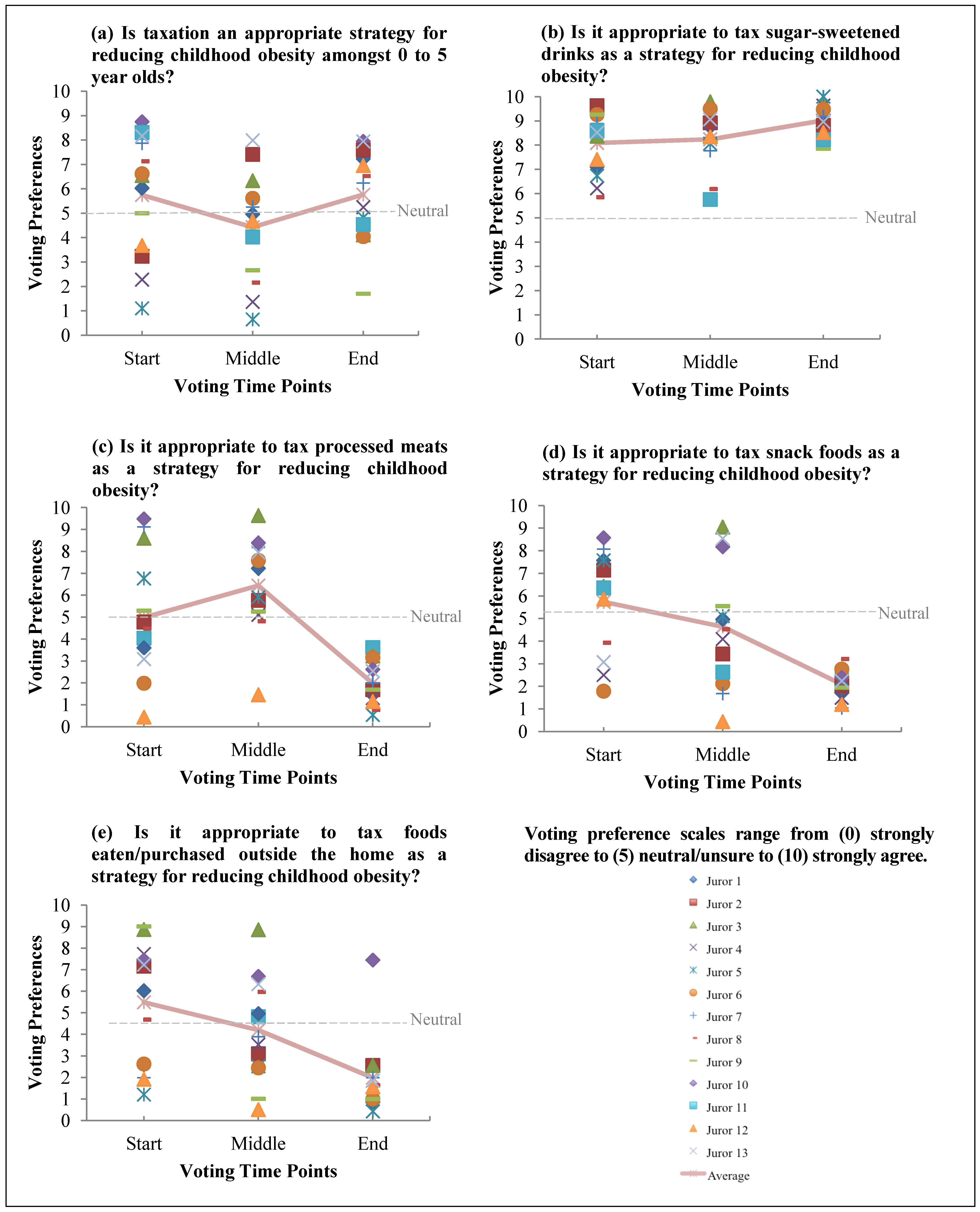

- (a)

- Is taxation an appropriate strategy for reducing childhood obesity amongst 0–5 year olds?;

- (b)

- Is it appropriate to tax sugar-sweetened drinks as a strategy for reducing childhood obesity? (sugar-sweetened drinks refers to all drinks with added sugar including soft drinks (carbonated drinks), cordials, flavoured milks, fruit juices, fruit drinks and vitamin waters);

- (c)

- Is it appropriate to tax processed meats as a strategy for reducing childhood obesity? (processed meats refers to meat and meat alternatives that have been processed including chicken nuggets, sausages and meats with high fat and sodium content);

- (d)

- Is it appropriate to tax snack foods as a strategy for reducing childhood obesity? (snack foods refers to sweet or savoury snack packs and individually wrapped snacks including packets of biscuits, potato chips, sweets, muesli bars, small cakes, muffins and crackers with cheese), and

- (e)

- Is it appropriate to tax food eaten away from home as a strategy for reducing childhood obesity? (foods eaten outside the home refers to takeaway foods that are purchased and/or eaten outside the home including well-known fast food brands and specific items with high energy fat, sugar and sodium content).

2.1.2. Selection of Jurors

2.1.3. Selection of Expert Witnesses

2.2. Procedure

| Day 1 |

|

|

|

|

|

|

|

|

| Day 2 |

|

|

|

2.3. Outcome Measures

2.3.1. Voting Preferences of Jurors

2.3.2. Verdicts and Recommendations

3. Results and Discussion

3.1. Profile of the Jury

| Demographic Characteristic of Jurors | N (%) |

|---|---|

| Gender | |

| Male | 5 (38) |

| Female | 8 (62) |

| Age | |

| 18–34 years | 1 (8) |

| 35–44 years | 2 (15) |

| 45–54 years | 3 (23) |

| 55–64 years | 4 (31) |

| <65 years | 3 (23) |

| Children under 18 years living at home | |

| 0 children | 9 (69) |

| 1 child | 1 (8) |

| 2 or more children | 3 (23) |

| Born overseas | 5 (38) |

| Speaks a language other than English at home | 0 (0) |

| Indigenous | 0 (0) |

| Education | |

| Did not complete high school | 2 (15) |

| Up to year 12 | 3 (23) |

| Diploma or trade certificate | 7 (54) |

| Bachelor’s degree or higher | 1 (8) |

| Employment | |

| Full-time | 5 (38) |

| Part-time | 4 (31) |

| Unemployed | 0 (0) |

| Not in labour force/Retired | 4 (31) |

| Annual household income | |

| <$42,000 | 4 (31) |

| $42,000–$130,000 | 7 (54) |

| >$130,000 | 1 (8) |

| Not stated | 1 (8) |

3.2. Jury Verdicts

3.2.1. Question One: “Is Taxation an Appropriate Strategy for Reducing Childhood Obesity amongst 0 to 5 Year Olds?”

3.2.2. Question Two: “Is It Appropriate to Tax Sugar-sweetened Drinks as a Strategy for Reducing Childhood Obesity?”

3.2.3. Question Three: “Is It Appropriate to Tax Processed Meats as a Strategy for Reducing Childhood Obesity?”

3.2.4. Question Four: “Is It Appropriate to Tax Snack Foods as a Strategy for Reducing Childhood Obesity?”

3.2.5. Question Five: “Is It Appropriate to Tax Food Eaten outside the Home (Purchased outside the Home) as a Strategy for Reducing Childhood Obesity?”

3.3. Recommendations from the Jurors about Strategies Other Than Taxation

3.4. Discussion

4. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Reilly, J.J.; Kelly, J. Long-term impact of overweight and obesity in childhood and adolescence on morbidity and premature mortality in adulthood: systematic review. Int. J. Obesity 2011, 35, 891–898. [Google Scholar] [CrossRef]

- Abdullah, A.; Wolfe, R.; Stoelwinder, J.U.; de Courten, M.; Stevenson, C.; Walls, H.L.; Peeters, A. The number of years lived with obesity and the risk of all-cause and cause-specific mortality. Int. J. Epidemiol. 2011, 40, 985–996. [Google Scholar] [CrossRef]

- Colquitt, J.L.; Picot, J.; Loveman, E.; Clegg, A.J. Surgery for obesity. Cochrane Database Syst. Rev. 2009, 15. [Google Scholar] [CrossRef]

- Smithers, L.G.; Lynch, J.W.; Merlin, T. Television Marketing of Unhealthy Food and Beverages to Children: A Review of the Published Evidence from 2009; Australian National Preventive Health Agency: Canberra, Australia, 2012. [Google Scholar]

- Annual Report 2010–2011; Australian Food and Grocery Council: Barton, Australia, 2011.

- Front-of-pack Labelling Update 14 June 2013; Australian Government Department of Health and Ageing: Canberra, Australia, 2013.

- De Vogli, R.; Kouvonenb, A.; Gimeno, D. The influence of market deregulation on fast food consumption and body mass index: A cross-national time series analysis. Bull. WHO 2014, 92, 99–107. [Google Scholar]

- Bond, M.E.; Williams, M.J.; Crammond, B.; Loff, B. Taxing junk food: applying the logic of the Henry tax review to food. Med. J. Australia 2010, 193, 472–473. [Google Scholar]

- Brownell, K.D.; Frieden, T.R. Ounces of prevention—The public policy case for taxes on sugared beverages. New Engl. J. Med. 2009, 360, 1805–1808. [Google Scholar] [CrossRef]

- DAFF. National Food Plan: Our Food Future; Department of Agriculture, Fisheries and Forestry: Canberra, Australia, 2013. [Google Scholar]

- Submission from Cancer Council Australia—National Food Plan, Green Paper; Cancer Council: Sydney, Australia, 2012.

- Blewett, N.; Goddard, N.; Pettigrew, S.; Reynolds, C.; Yeatman, H. Labelling Logic Review of Food Labelling Law and Policy; Department of Health and Ageing: Canberra, Asutralia, 2011. [Google Scholar]

- Chapman, K.; Watson, W. Out with Traffic Lights, in with Stars—Next Steps for Food Labelling. Available online: http://theconversation.com/out-with-traffic-lights-in-with-stars-next-steps-for-food-labelling-11069 (accessed on 13 February 2014).

- Baggott, R. A funny thing happened on the way to the forum? Reforming patient and public involvement in the NHS in England. Public Admin. 2005, 83, 533–551. [Google Scholar] [CrossRef]

- Bruni, R.A.; Laupacis, A.; Martin, D.K. University of Toronto Priority Setting in Health Care Research Group. Public engagement in setting priorities in health care. CMAJ 2008, 179, 15–18. [Google Scholar] [CrossRef]

- Arnstein, S. A ladder of citizen participation. JAIP 1969, 35, 216–224. [Google Scholar]

- Tritter, J.Q.; McCallum, A. The snakes and ladders of user involvement: Moving beyond Arnstein. Health Policy 2006, 76, 156–168. [Google Scholar] [CrossRef]

- Rowe, G.; Frewer, L.J. A typology of public engagement mechanisms. Sci. Technol. Hum. Val. 2005, 30, 251–290. [Google Scholar] [CrossRef]

- The Jefferson Center. Citizens Jury Handbook. Available online: http://jefferson-center.org/ (accessed on 14 May 2013).

- Mooney, G. A Handbook on Citizens’ Juries with particular reference to health care, 2010. Available online: http://www.newdemocracy.com.au/library/research-papers/item/151-a-handbook-on-citizens-juries-with-particular-reference-to-health-care (accessed on 21 February 2014).

- Mooney, G.H.; Blackwell, S.H. Whose health service is it anyway? Community values in healthcare. Med. J. Aust. 2004, 180, 76–78. [Google Scholar]

- Iredale, R.; Longley, M.; Thomas, C.; Shaw, A. What choices should we be able to make about designer babies? A Citizens’ Jury of young people in South Wales. Health Expect. 2006, 9, 207–217. [Google Scholar] [CrossRef]

- Menon, D.; Stafinski, T. Engaging the public in priority-setting for health technology assessment: Findings from a citizens’ jury. Health Expect. 2008, 11, 282–293. [Google Scholar] [CrossRef]

- Scuffham, P.A.; Kendall, E.; Rixon, K.; Whitty, J.; Ratcliffe, J.; Wilson, A.; Krinks, R. Engaging the Public in Healthcare Decision Making. Citizens’ Jury on Emergency Care Services. Report 1: Methods, Processes, and Verdicts; Griffith Health Institute, Griffith University: Brisbane, Australia, 2012. [Google Scholar]

- Wells, J. Should Fast Food Be Taxed? Available online: http://media.mytalk.com.au/4bc/audio/Mornings_Fat.mp3 (accessed on 20 May 2013).

- Lewis, S. Fat Tax to batter obesity—Study flags fast food hike in health strategy. Courier Mail 2013, 7. [Google Scholar]

- Thow, A.M.; Quested, C.; Juventin, L.; Kun, R.; Khan, A.N.; Swinburn, B. Taxing soft drinks in the Pacific: Implementation lessons for improving health. Health Promot. International 2011, 26, 55–64. [Google Scholar] [CrossRef]

- Sturm, R.; Powell, L.M.; Chriqui, J.F.; Chaloupka, F.J. Soda taxes, soft drink consumption, and children’s body mass index. Health Affair. 2010, 29, 1052–1058. [Google Scholar] [CrossRef]

- Mytton, O.T.; Clarke, D.; Rayner, M. Taxing unhealthy food and drinks to improve health. BMJ 2012, 344. [Google Scholar] [CrossRef]

- Powell, L.M.; Chaloupka, F.J. Food prices and obesity: Evidence and policy implications for taxes and subsidies. Milbank Quart. 2009, 87, 229–257. [Google Scholar] [CrossRef]

- Briggs, A.D.; Mytton, O.T.; Madden, D.; O’Shea, D.; Rayner, M.; Scarborough, P. The potential impact on obesity of a 10% tax on sugar-sweetened beverages in Ireland, an effect assessment modelling study. BMC Public Health 2013, 13. [Google Scholar] [CrossRef]

- Jacobson, M.F.; Brownell, K.D. Small taxes on soft drinks and snack foods to promote health. Amer. J. Public Health 2000, 90, 854–857. [Google Scholar] [CrossRef]

- Stafford, N. Denmark cancels “fat tax” and shelves “sugar tax” because of threat of job losses. BMJ 2012, 345. [Google Scholar] [CrossRef]

- Tutty, J. Healthy food labels blamed for rise in obesity as Queenslanders fall into high sugar and fat trap. Courier Mail 2013. [Google Scholar]

- Moodie, R.; Swinburn, B.; Richardson, J.; Somaini, B. Childhood obesity—A sign of commercial success, but a market failure. Int. J. Pediatr. Obes. 2006, 1, 133–138. [Google Scholar] [CrossRef]

© 2014 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/3.0/).

Share and Cite

Moretto, N.; Kendall, E.; Whitty, J.; Byrnes, J.; Hills, A.P.; Gordon, L.; Turkstra, E.; Scuffham, P.; Comans, T. Yes, The Government Should Tax Soft Drinks: Findings from a Citizens’ Jury in Australia. Int. J. Environ. Res. Public Health 2014, 11, 2456-2471. https://doi.org/10.3390/ijerph110302456

Moretto N, Kendall E, Whitty J, Byrnes J, Hills AP, Gordon L, Turkstra E, Scuffham P, Comans T. Yes, The Government Should Tax Soft Drinks: Findings from a Citizens’ Jury in Australia. International Journal of Environmental Research and Public Health. 2014; 11(3):2456-2471. https://doi.org/10.3390/ijerph110302456

Chicago/Turabian StyleMoretto, Nicole, Elizabeth Kendall, Jennifer Whitty, Joshua Byrnes, Andrew P. Hills, Louisa Gordon, Erika Turkstra, Paul Scuffham, and Tracy Comans. 2014. "Yes, The Government Should Tax Soft Drinks: Findings from a Citizens’ Jury in Australia" International Journal of Environmental Research and Public Health 11, no. 3: 2456-2471. https://doi.org/10.3390/ijerph110302456

APA StyleMoretto, N., Kendall, E., Whitty, J., Byrnes, J., Hills, A. P., Gordon, L., Turkstra, E., Scuffham, P., & Comans, T. (2014). Yes, The Government Should Tax Soft Drinks: Findings from a Citizens’ Jury in Australia. International Journal of Environmental Research and Public Health, 11(3), 2456-2471. https://doi.org/10.3390/ijerph110302456