Taxonomy and Stakeholder Risk Management in Integrated Projects of the European Green Deal

Abstract

:1. Introduction

2. Analysis of Literature Data and Problem Statement

- -

- offering a taxonomy of projects involving agricultural waste and features of their implementation;

- -

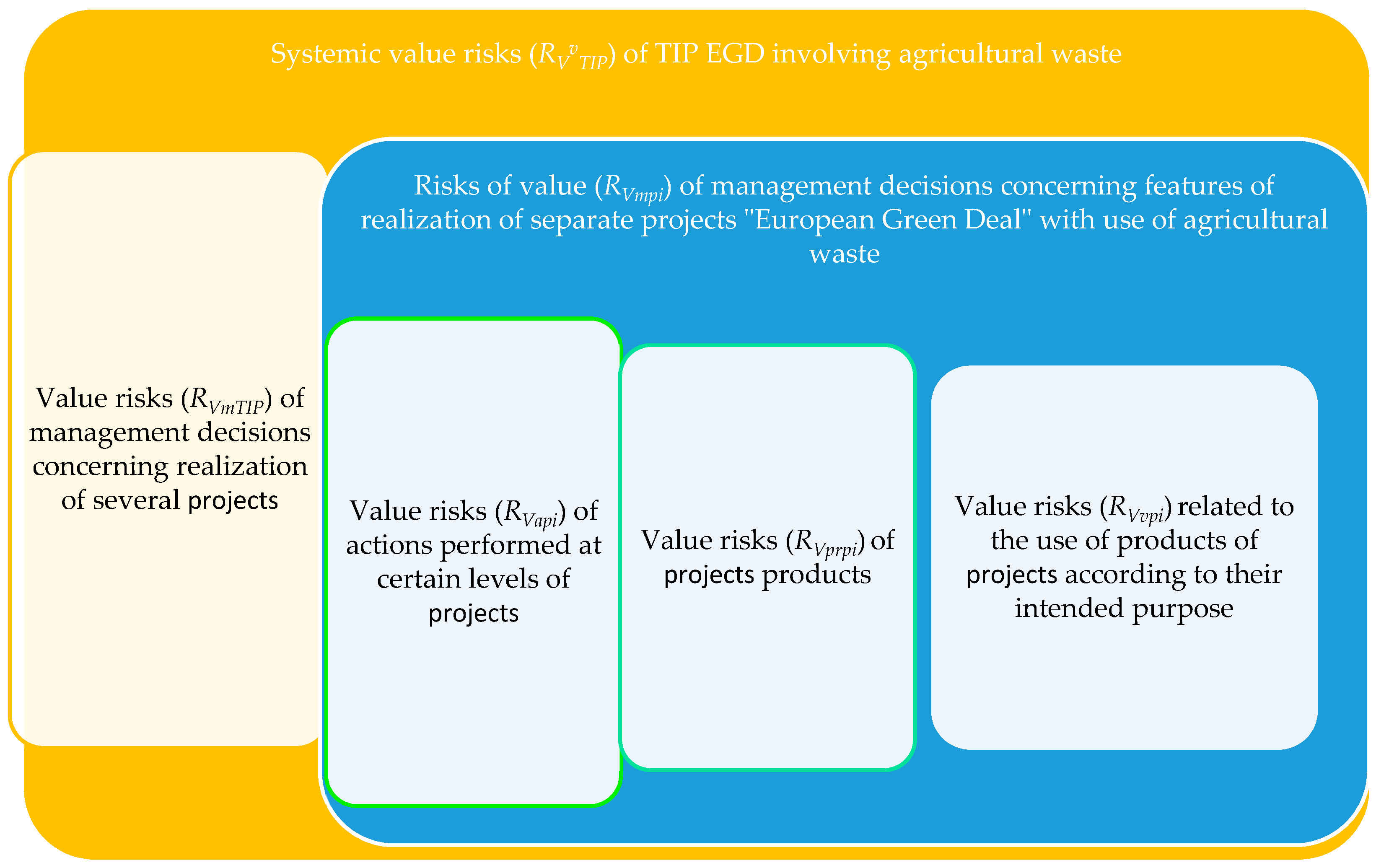

- substantiating the components and model of stakeholder risk value formation in projects;

- -

- establishing the affiliation of the stakeholder value of grain waste procurement projects and performing a quantitative assessment of their risks.

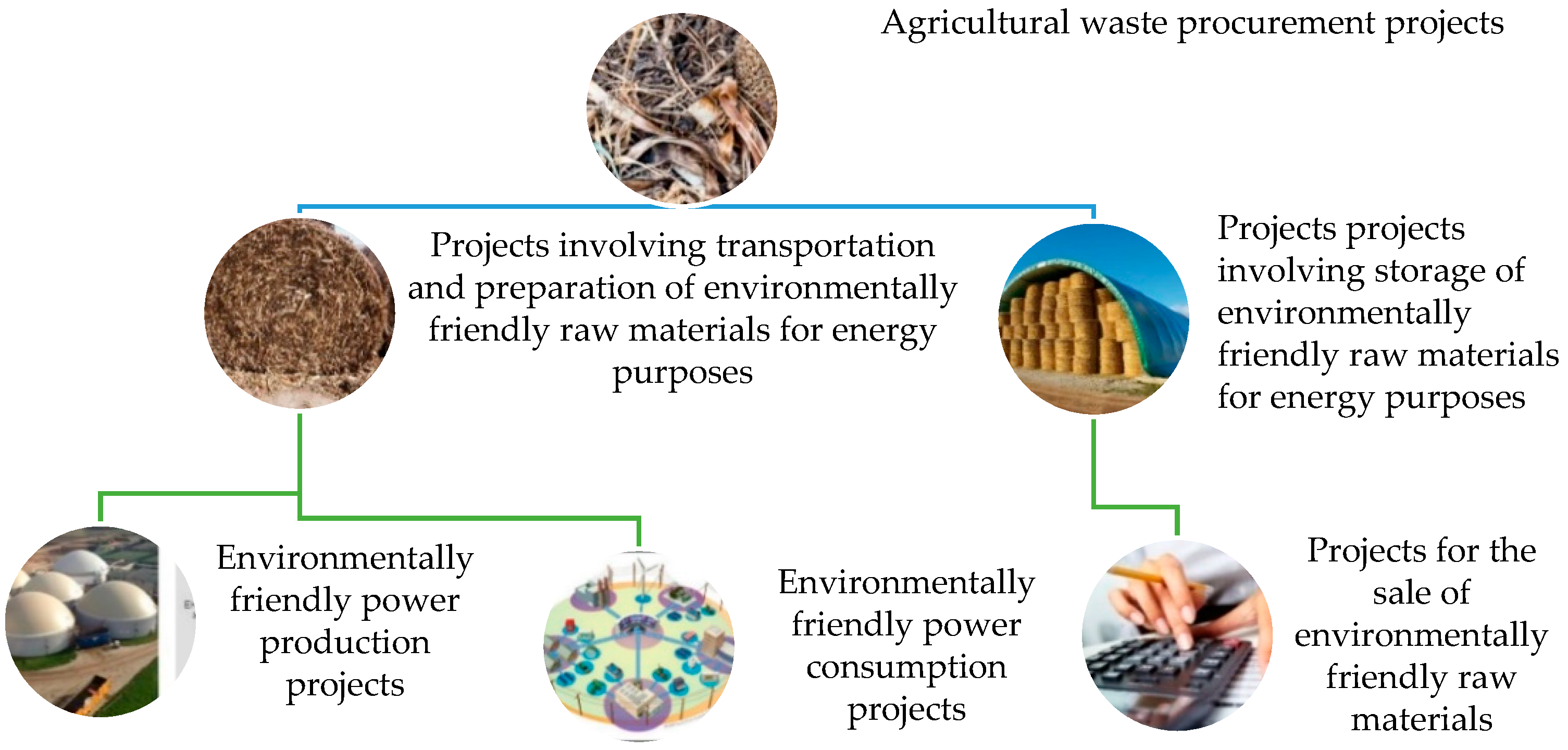

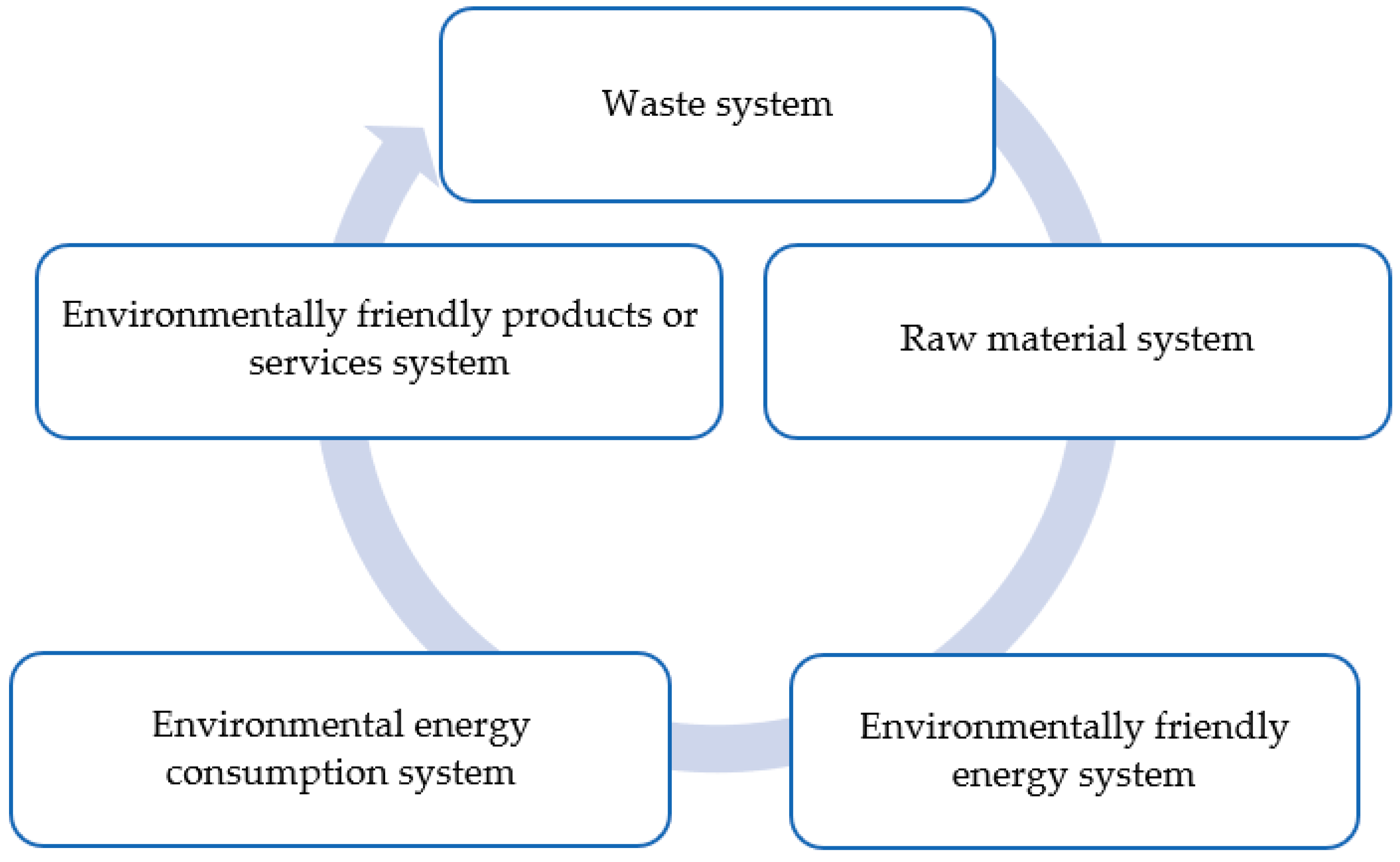

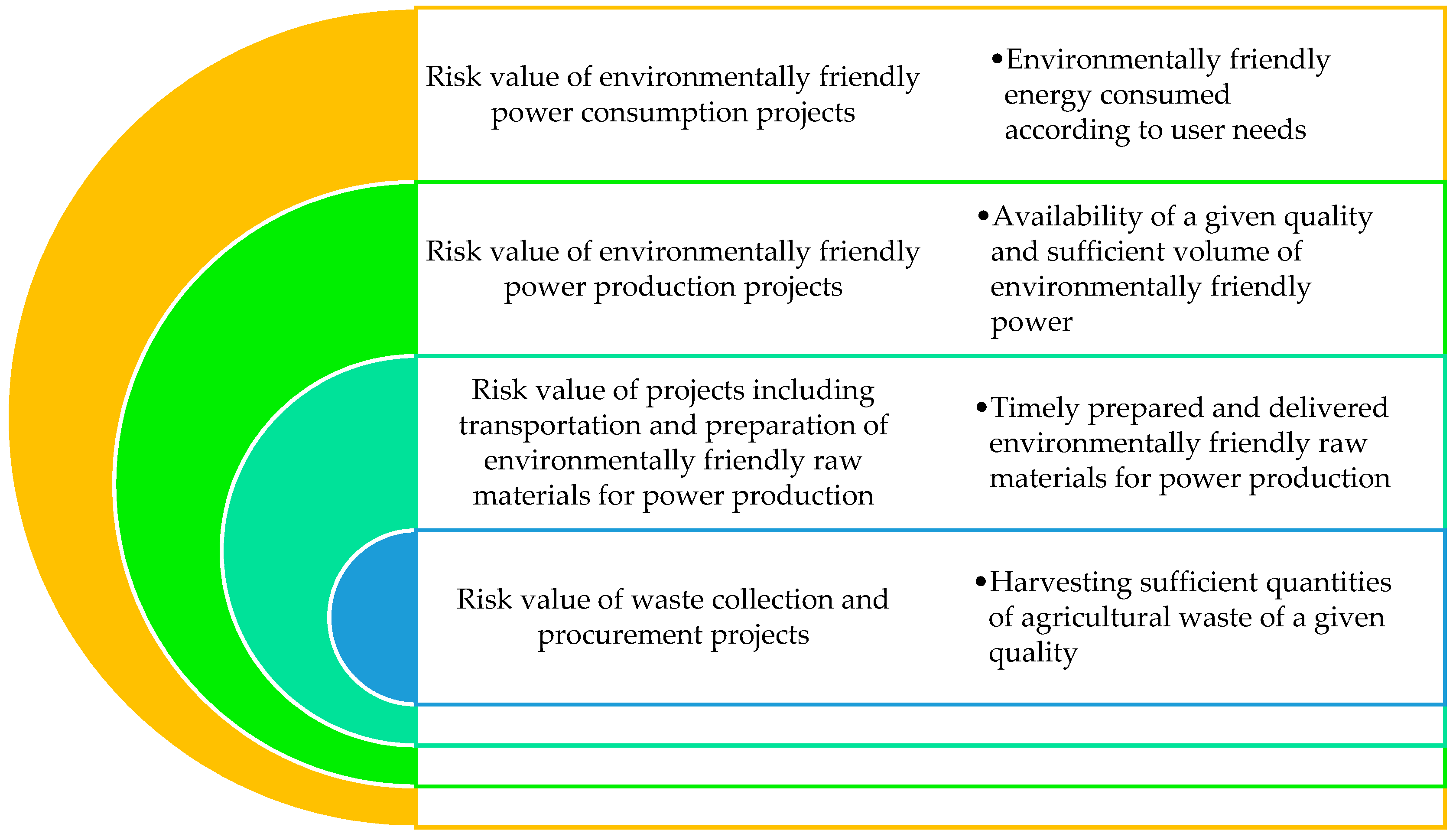

3. Taxonomy of TIP “EGD” Involving Agricultural Waste and the Model of Stakeholder Risk Formation

- -

- obtained waste—for agricultural waste procurement projects;

- -

- obtained raw materials—for projects involving transportation and preparation of environmentally friendly raw materials for energy;

- -

- stored raw materials—for projects involving the storage of environmentally friendly raw materials for energy purposes;

- -

- marketable raw materials—for projects involving the sale of environmentally friendly raw materials for energy purposes;

- -

- obtained “clean” energy—for projects involving ecological power production;

- -

- production and supply of “clean” energy—for projects involving the consumption of ecological power.

- -

- features of the project (scale, resources, duration, complexity, adaptability, experience, and knowledge);

- -

- product of the project (type of service, volume of provided service);

- -

- requirements of project stakeholders (requirements for resources for the production of clean energy, duration, and responsibility for the quality of work performed).

- (1)

- receipt of information (information);

- (2)

- supply of resources (resource);

- (3)

- the impact of the project environment (information);

- (4)

- management decisions (information).

4. Results of the Affiliation of the Stakeholder Values and of Quantitative Risk Assessment in Grain Waste Procurement Projects

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- A European Green Deal. Available online: https://ec.europa.eu/info/strategy/priorities/2019-2024/european-green-deal (accessed on 10 September 2021).

- Von der Leyen, U. My Agenda for Europe. Political Guidelines for the Next European Commission 2019–2024. 2019. Available online: https://ec.europa.eu/commission/sites/beta-political/files/political-guidelines-next-commission_en.pdf (accessed on 12 October 2021).

- European Commission. The European Green Deal. COM (2019) 640 Final. Brussels. 11 December 2019. Available online: https://ec.europa.eu/info/sites/info/files/european-green-deal-communication_en.pdf (accessed on 18 October 2021).

- Alberti, V.; Caperna, G.; Colagrossi, M.; Geraci, A.; Mazzarella, G.; Panella, F.; Saisana, M. Tracking EU Citizens’ Interest in EC Priorities Using Online Search Data. The European Green Deal, EUR 30580 EN; Publications Office of the European Union: Luxembourg, 2021. [Google Scholar] [CrossRef]

- Sikora, J.; Niemiec, M.; Szeląg-Sikora, A.; Gródek-Szostak, Z.; Kuboń, M.; Komorowska, M. The Impact of a Controlled-Release Fertilizer on Greenhouse Gas Emissions and the Efficiency of the Production of Chinese Cabbage. Energies 2020, 13, 2063. [Google Scholar] [CrossRef] [Green Version]

- Sikora, J.; Niemiec, M.; Tabak, M.; Gródek-Szostak, Z.; Szeląg-Sikora, A.; Kuboń, M.; Komorowska, M. Assessment of the Efficiency of Nitrogen Slow-Release Fertilizers in Integrated Production of Carrot Depending on Fertilization Strategy. Sustainability 2020, 12, 1982. [Google Scholar] [CrossRef] [Green Version]

- Kovalenko, N.; Kovalenko, V.; Hutsol, T.; Ievstafiieva, Y.; Polishchuk, A. Economic Efficiency and Internal Competitive Advantages of Grain Production in the Central Region of Ukraine. Agric. Eng. 2021, 25, 51–62. [Google Scholar] [CrossRef]

- Hutsol, T.; Kovalenko, V.; Glowacki, S.; Kokovikhin, S.; Dubik, V.; Mudragel, O.; Kuboń, M.; Tomaszewska-Górecka, W. Hydrogen Production Analysis: Prospects for Ukraine. Agric. Eng. 2021, 25, 99–114. [Google Scholar] [CrossRef]

- Kovalenko, N.; Hutsol, T.; Labenko, O.; Glowacki, S.; Sorokin, D. Ecological and Economical Substatiation of Production of Hydrogen. Environment. Technologies. Resources. Proc. Int. Sci. Pract. Conf. 2021, 1, 127–131. [Google Scholar] [CrossRef]

- Bashynsky, O. Conceptual model of management of technologically integrated industry development projects. In Proceedings of the 15th International Scientific and Technical Conference on Computer Sciences and Information Technologies (CSIT), Zbarazh, Ukraine, 23–26 September 2020; pp. 155–158. [Google Scholar]

- Diachuk, O.; Chepeliev, M.; Podolets, R.; Trypolska, G.; Venger, V.; Saprykina, T.; Yukhymets, R. Transition of Ukraine to the Renewable Energy by 2050, Heinrich Boell Foundation Regional Office in Ukraine; Publishing House “Art Book” Ltd.: London, UK, 2017; 88p. [Google Scholar]

- European Biogas Association. Available online: https://www.europeanbiogas.eu/2020-gas-decarbonisation-pathways-study (accessed on 18 October 2021).

- Gas Decarbonisation Pathways 2020–2050-Gas for Climate. Available online: https://www.gasforclimate2050.eu (accessed on 19 October 2021).

- Ratushny, R.; Bashynsky, O.; Shcherbachenko, O. Identification of firefighting system configuration of rural settlements. In Fire and Enviromnental Safety Engineering, MATEC Web Conference (FESE 2018); EDP Sciences: Les Ulis, France, 2018; Volume 247. [Google Scholar]

- Hutsol, T.; Glowacki, S.; Tryhuba, A.; Kovalenko, N.; Pustova, Z.; Rozkosz, A.; Sukmaniuk, O. Current Trends of Biohydrogen Production from Biomass—Green Hydrogen; Libra-Print: Warsaw, Poland, 2021; 102p. [Google Scholar] [CrossRef]

- Tryhuba, A.; Tryhuba, I.; Ftoma, O.; Boyarchuk, O. Method of quantitative evaluation of the risk of benefits for investors of fodder-producing cooperatives. In Proceedings of the 14th International Scientific and Technical Conference on Computer Sciences and Information Technologies (CSIT), Lviv, Ukraine, 17–20 September 2019; pp. 55–58. [Google Scholar]

- Tryhuba, A.; Boyarchuk, V.; Tryhuba, I.; Boyarchuk, O.; Ftoma, O. Evaluation of Risk Value of Investors of Projects for the Creation of Crop Protection of Family Daily Farms. Acta Univ. Agric. Silvic. Mendel. Brun. 2019, 67, 1357–1367. [Google Scholar] [CrossRef] [Green Version]

- Ni, M.; Leung, D.Y.C.; Leung, M.K.H.; Sumathy, K. An overview of hydrogen production from biomass. Fuel Process. Technol. 2006, 87, 461–472. [Google Scholar] [CrossRef]

- Rudynets, M.; Pavlikha, N.; Kytsyuk, I.; Komeliuk, O.; Fedorchuk-Moroz, V.; Androshchuk, I.; Skorokhod, I.; Seleznov, D. Establishing patterns of change in the indicators of using milk processing shops at a community territory. East. Eur. J. Enterp. Technol. Control. Process. 2019, 6, 57–65. [Google Scholar]

- Tryhuba, A.; Boyarchuk, V.; Boiarchuk, O.; Pavlikha, N.; Kovalchuk, N. Study of the impact of the volume of investments in agrarian projects on the risk of their value (ITPM-2021). In Proceedings of the CEUR Workshop Proceedings, Lviv, Ukraine, 16–18 February 2021; Volume 2851. [Google Scholar]

- Kowalczyk, Z.; Kwasniewski, D. Environmental impact of the cultivation of energy willow in Poland. Sci. Rep. 2021, 11, 4571. [Google Scholar] [CrossRef] [PubMed]

- Wójcik, A.; Krupa, K.; Łapczyńska-Kondon, B.; Francik, S.; Kwaśniewski, D. The Dynamic Model of Willow Biomass Production. In Renewable Energy Sources: Engineering, Technology, Innovation. Springer Proceedings in Energy; Mudryk, K., Werle, S., Eds.; Springer: Berlin/Heidelberg, Germany, 2018. [Google Scholar] [CrossRef]

- Project Management Institute. A Guide to the Project Management Body of Knowledge (PMBOK Guide), 4th ed.; Project Management Institute: Newtown Square, PA, USA, 2008. [Google Scholar]

- Project Management Association of Japan. P2M (Project & Program Management for Enterprise Innovation) Guidebook; Project Management Association of Japan: Tokyo, Japan, 2008. [Google Scholar]

- Shigenobu Ohara. Booklet on P2M/Project & Program Management for Enterprise Innovation; Project Management Association of Japan: Tokyo, Japan, 2003. [Google Scholar]

- ISO 21500; Guidance on Project Management. ISO: Geneva, Switzerland, 2012. Available online: http://www.projectprofy.ru (accessed on 19 October 2021).

- Tryhuba, A.; Ratushny, R.; Tryhuba, I.; Koval, N.; Androshchuk, I. The Model of Projects Creation of the Fire Extinguishing Systems in Community Territories. Acta Univ. Agric. Silvic. Mendel. Brun. 2020, 68, 419–431. [Google Scholar] [CrossRef]

- Boyarchuk, V.; Ftoma, O.; Francik, S.; Rudynets, M. Method and Software of Planning of the Substantial Risks in the Projects of Production of raw Material for Biofuel. In Proceedings of the CEUR Workshop Proceedings, Kherson, Ukraine, 15–16 October 2020. [Google Scholar]

- Tryhuba, A.; Boyarchuk, V.; Tryhuba, I.; Ftoma, O. Forecasting of a Lifecycle of the Projects of Production of Biofuel Raw Materials with Consideration of Risks. In Proceedings of the International Conference on Advanced Trends in Information Theory (ATIT), Kyiv, Ukraine, 18–20 December 2019; pp. 420–425. [Google Scholar]

- Gródek-Szostak, Z.; Malik, G.; Kajrunajtys, D.; Szeląg-Sikora, A.; Sikora, J.; Kuboń, M.; Niemiec, M.; Kapusta-Duch, J. Modeling the Dependency between Extreme Prices of Selected Agricultural Products on the Derivatives Market Using the Linkage Function. Sustainability 2019, 11, 4144. [Google Scholar] [CrossRef] [Green Version]

- Komleva, N.; Liubchenko, V.; Zinovatna, S.; Kobets, V. Risk management with lean methodology. In Proceedings of the CEUR Workshop Proceedings, Kherson, Ukraine, 15–16 October 2020; Volume 2805, pp. 266–281. [Google Scholar]

- Verezubova, T.; Paientko, T. Modeling input financial flows of insurance companies as a component of financial strategy. In Proceedings of the CEUR Workshop Proceedings, Kolkata, India, 7–10 December 2016; Volume 1614, pp. 566–574. [Google Scholar]

- Smith, N.; Male, S. Risk, value, uncertainty and requirements management in projects. In Proceedings of the CME 2007 Conference—Construction Management and Economics: Past, Present and Future, Reading, UK, 16–18 July 2007; pp. 385–394. [Google Scholar]

- Koch, S. Value-at-risk for e-business project and portfolio appraisal and risk management. In Proceedings of the International Conference on Electronic Business (ICEB), Taipei, Taiwan, 2–6 December 2007; pp. 765–768. [Google Scholar]

- Ibrahim, M.N.; Thorpe, D.; Mahmood, M.N. Risk factors affecting the ability for earned value management to accurately assess the performance of infrastructure projects in Australia. Constr. Innov. 2019, 19, 550–569. [Google Scholar] [CrossRef]

- Ratushny, R.; Horodetskyy, I.; Molchak, Y.; Grabovets, V. The configurations coordination of the projects products of development of the community fire extinguishing systems with the project environment (ITPM-2021). In Proceedings of the CEUR Workshop Proceedings, Lviv, Ukraine, 16–18 February 2021; Volume 2851. [Google Scholar]

- Batyuk, B.; Dyndyn, M. Coordination of Configurations of Complex Organizational and Technical Systems for Development of Agricultural Sector Branches. J. Autom. Inf. Sci. 2020, 52, 63–76. [Google Scholar]

- Hutsol, T.; Glowacki, S.; Tryhuba, I.; Tabor, S.; Kwasniewski, D.; Sorokin, D.; Yermakov, S. Forecasting Quantitative Risk Indicators of Investors in Projects of Biohydrogen Production from Agricultural Raw Materials. Processes 2021, 9, 258. [Google Scholar] [CrossRef]

- Tryhuba, A.; Boyarchuk, V.; Tryhuba, I.; Ftoma, O.; Tymochko, V.; Bondarchuk, S. Model of assessment of the risk of investing in the projects of production of biofuel raw materials. In Proceedings of the 15th International Scientific and Technical Conference on Computer Sciences and Information Technologies (CSIT), Zbarazh, Ukraine, 23–26 September 2020; Volume 2, pp. 151–154. [Google Scholar]

- Willumsen, P.; Oehmen, J.; Stingl, V.; Geraldi, J. Value creation through project risk management. Int. J. Proj. Manag. 2019, 37, 731–749. [Google Scholar] [CrossRef] [Green Version]

- Lou, A.K.B.; Parvishi, A.; Taghifam, R.; Lotfi, M.; Taleei, A. Integrating earned value management with risk management to control the time-cost of the project. IIOAB J. 2016, 7, 114–119. [Google Scholar]

- Boyarchuk, V.; Ftoma, O.; Padyuka, R.; Rudynets, M. Forecasting the risk of the resource demand for dairy farms basing on machine learning (MoMLeT&DS-2020). In Proceedings of the CEUR Workshop Proceedings, Kherson, Ukraine, 15–16 October 2020; Volume 2631. [Google Scholar]

- Ratushnyi, R.; Bashynsky, O.; Ptashnyk, V. Development and Usage of a Computer Model of Evaluating the Scenarios of Projects for the Creation of Fire Fighting Systems of Rural Communities. In Proceedings of the Xl-th International Scientific and Practical Conference on Electronics and Information Technologies (ELIT), Lviv, Ukraine, 16–18 September 2019; pp. 34–39. [Google Scholar]

- McConnell, E. Project Management Methodology: Definition, Types, Examples. Available online: http://www.mymanagementguide.com/basics/project-methodology-definition/ (accessed on 19 October 2021).

- Ratushny, R.; Bashynsky, O.; Ptashnyk, V. Planning of Territorial Location of Fire-Rescue Formations in Administrative Territory Development Projects. In Proceedings of the CEUR Workshop Proceedings, Kherson, Ukraine, 15–16 October 2020. [Google Scholar]

- Tryhuba, A.; Bashynsky, O.; Hutsol, T.; Rozkosz, A.; Prokopova, O. Justification of Parameters of the Energy Supply System of Agricultural Enterprises with Using Wind Power Installations. E3S Web Conf. 2020, 154, 04005. [Google Scholar] [CrossRef] [Green Version]

- Perederiy, N.; Kuzmenko, S.; Labenko, O. Energy-saving technologies in agriculture of Ukraine. Quant. Methods Econ. 2016, XVII, 89–100. [Google Scholar] [CrossRef]

- Sablina, N.V.; Telychko, V.A. Applying of the taxonomy method for the analysis of the internal resources of the enterprise. Biznes-Inform 2009, 3, 78–82. [Google Scholar]

- Pliuta, V. Sravnitielnyy Mnohomernyy Analiz v Mnohomernyh Issliedivaniyah: Metody Taksonomii i Faktornoho Analiza [Comparative Multidimensional Analysis in the Economic Researches: Methods of the Taxonomy and the Factor Analysis]; Statistika: Moscow, Russia, 1980. [Google Scholar]

- Kozhushko, O. Taxonomy Method during the Intellectual Capital Protection Evaluation in the Industrial Enterprises. Retrieved 15 October 2014. Available online: http://www.library.tane.edu.ua/images/nauk_vydannya/5SIjDC.pdf (accessed on 15 October 2014).

- Tryhuba, A.; Hutsol, T.; Tryhuba, I.; Pokotylska, N.; Kovalenko, N.; Tabor, S.; Kwasniewski, D. Risk Assessment of Investments in Projects of Production of Raw Materials for Bioethanol. Processes 2021, 9, 12. [Google Scholar] [CrossRef]

| Indicator | Characteristic | ||

|---|---|---|---|

| Type of Project | European Green Deal Projects | ||

| Taxonomic ranks | Features of the project | Product project | Stakeholder requirements for the project |

| Taxonomy | Scale, amount of resources, duration, complexity, adaptability, experience, and knowledge | Type/volume of products (services) | Requirements for resources, duration, quality, and liability |

| Stakeholders | Stakeholder Value Risk Components | |||

|---|---|---|---|---|

| Management Decisions | Actions Related to Implementation | Product Projects | Use of Products for Their Intended Purpose | |

| The state and its regions or districts | Regulatory framework | Regulation of relations by stakeholders | Market value of created products | Creating conditions for the use of products for their intended purpose |

| Project executors | Project configuration | Resource provision | Compliance of project products with customer requirements | Volume, quality, and cost of project products |

| Project clients | Budget and scale of projects | Stages and volumes of resource use | Compliance of the obtained product with the requirements of stakeholders | Satisfaction of consumers with the product |

| Resource providers | Adequacy of resources to the performed works | Timeliness, quality, and cost of resources | The cost of the received products of projects | — |

| Project managers | Effectiveness of management decisions | Consistency of actions in projects with the configuration of the project environment | Effectiveness of projects | — |

| Indicator | Volume of Grain Waste, tons/ha | ||||

|---|---|---|---|---|---|

| 1.5 | 2.0 | 2.5 | 3.0 | 3.5 | |

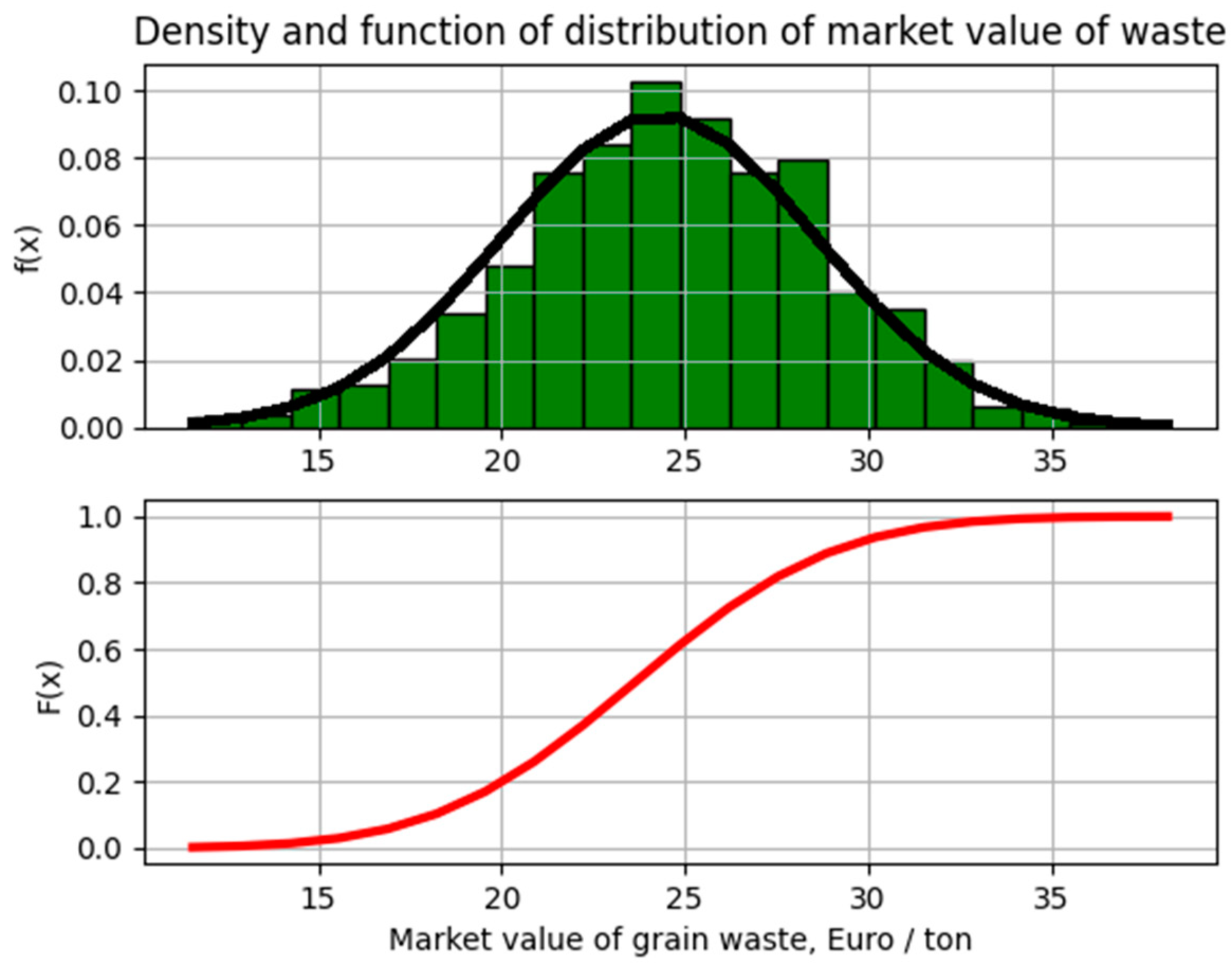

| Mathematical expectation of the market value of grain waste | 24.3 | ||||

| Standard deviation of the market value of grain waste | 4.3 | ||||

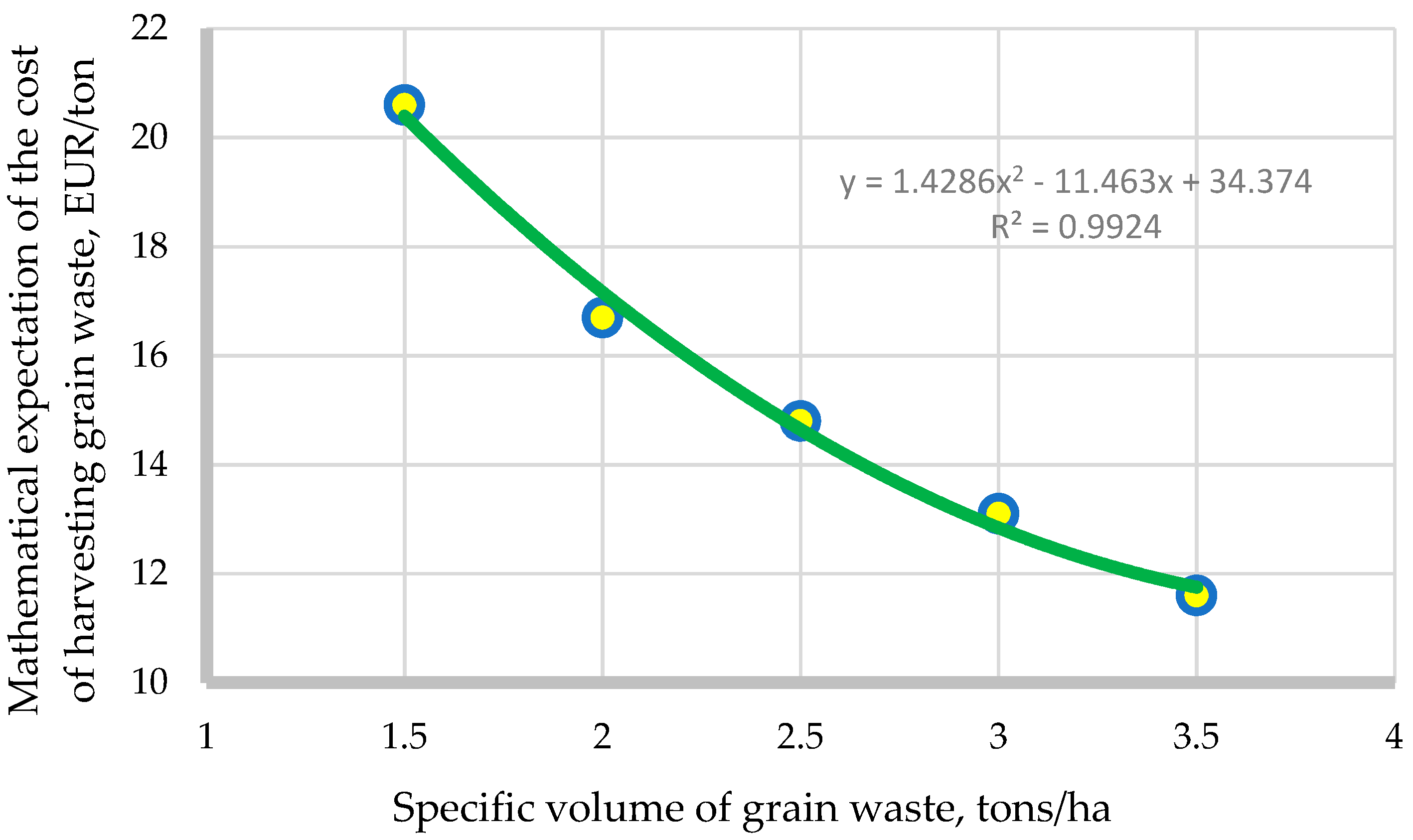

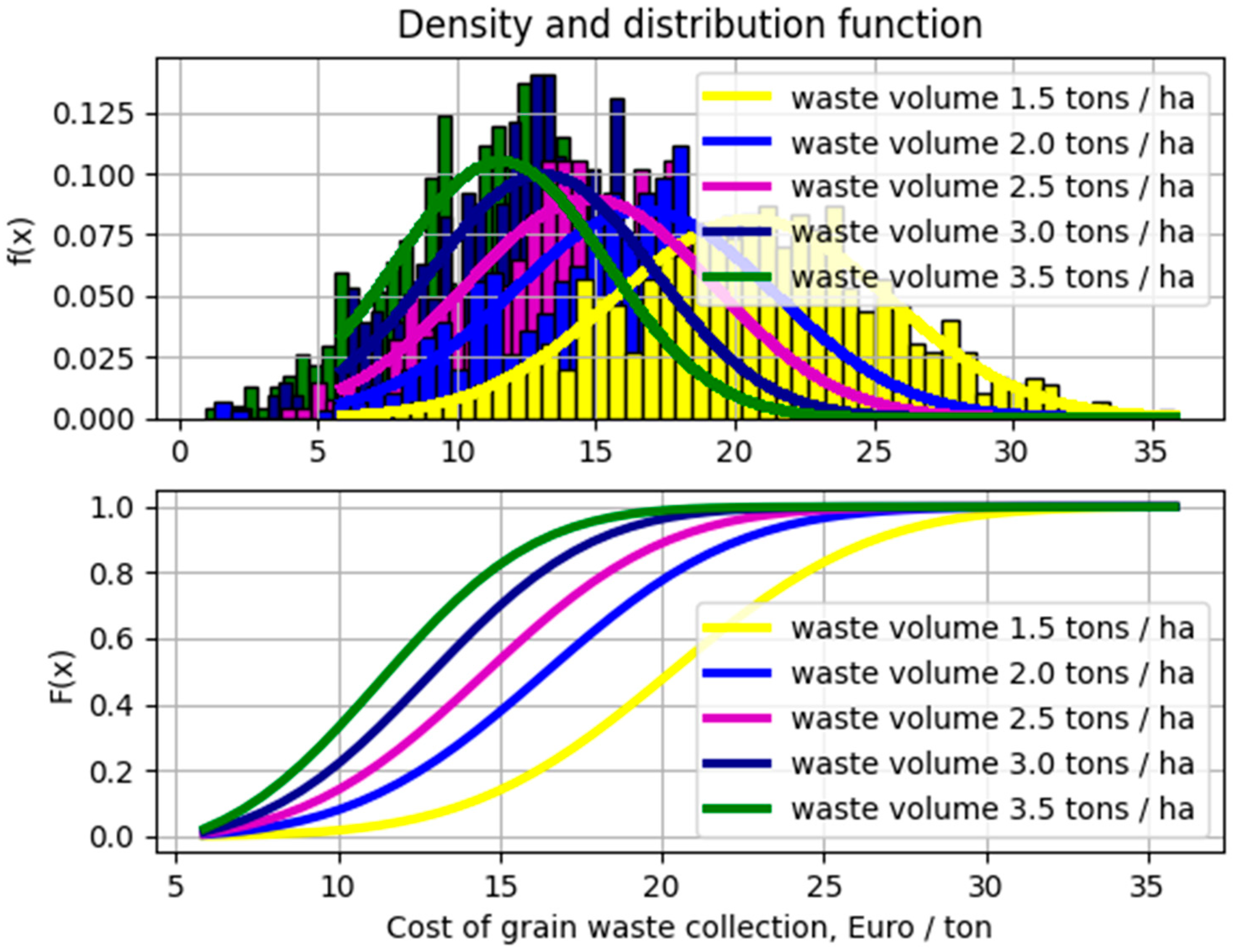

| Mathematical expectation of the cost of grain waste collection in individual agricultural enterprises | 20.6 | 16.7 | 14.8 | 13.1 | 11.6 |

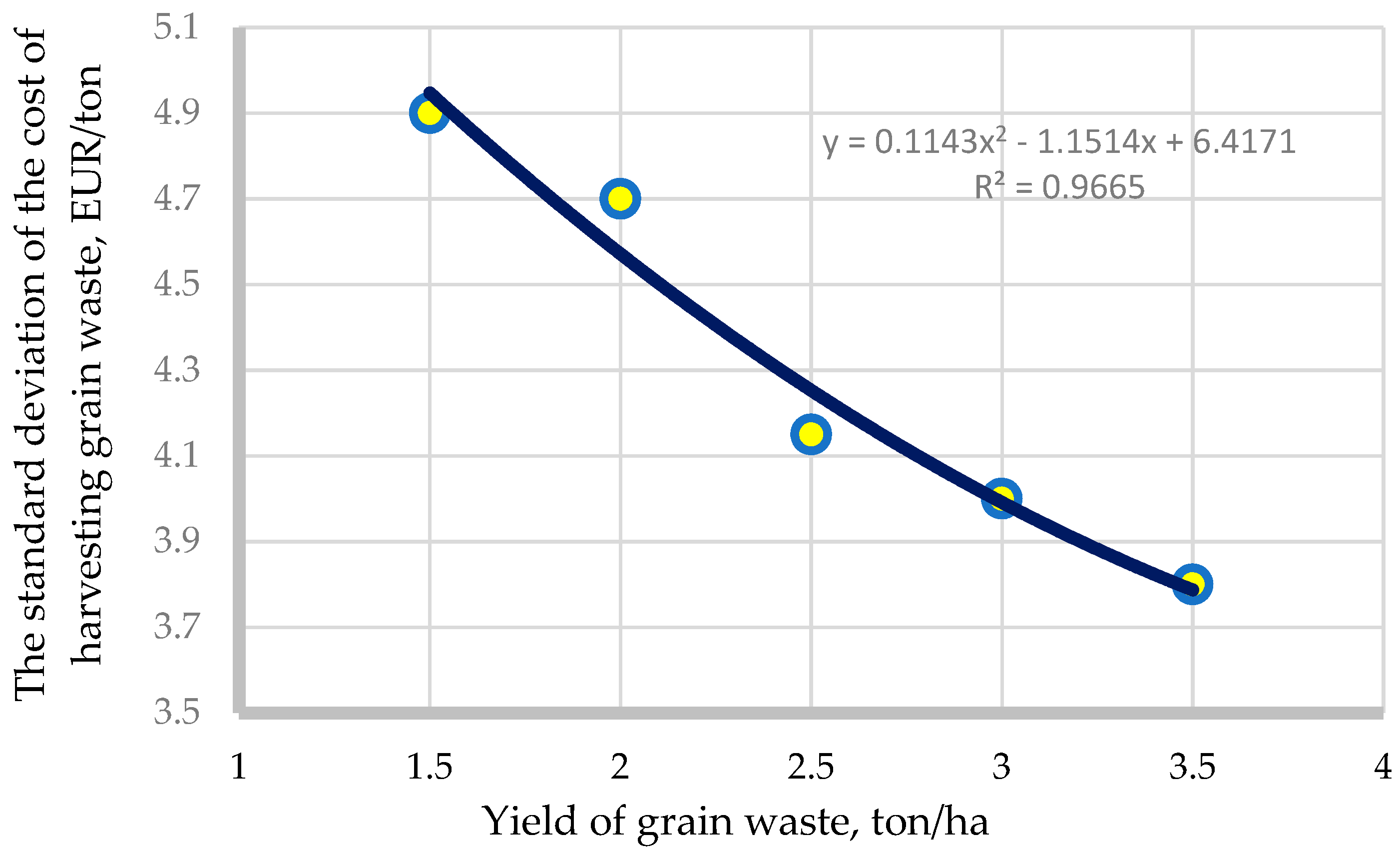

| Standard deviation of the cost of collecting grain waste in individual agricultural enterprises | 4.9 | 4.7 | 4.15 | 4.0 | 3.8 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tryhuba, A.; Hutsol, T.; Kuboń, M.; Tryhuba, I.; Komarnitskyi, S.; Tabor, S.; Kwaśniewski, D.; Mudryk, K.; Faichuk, O.; Hohol, T.; et al. Taxonomy and Stakeholder Risk Management in Integrated Projects of the European Green Deal. Energies 2022, 15, 2015. https://doi.org/10.3390/en15062015

Tryhuba A, Hutsol T, Kuboń M, Tryhuba I, Komarnitskyi S, Tabor S, Kwaśniewski D, Mudryk K, Faichuk O, Hohol T, et al. Taxonomy and Stakeholder Risk Management in Integrated Projects of the European Green Deal. Energies. 2022; 15(6):2015. https://doi.org/10.3390/en15062015

Chicago/Turabian StyleTryhuba, Anatoliy, Taras Hutsol, Maciej Kuboń, Inna Tryhuba, Serhii Komarnitskyi, Sylwester Tabor, Dariusz Kwaśniewski, Krzysztof Mudryk, Oleksandr Faichuk, Tetyana Hohol, and et al. 2022. "Taxonomy and Stakeholder Risk Management in Integrated Projects of the European Green Deal" Energies 15, no. 6: 2015. https://doi.org/10.3390/en15062015

APA StyleTryhuba, A., Hutsol, T., Kuboń, M., Tryhuba, I., Komarnitskyi, S., Tabor, S., Kwaśniewski, D., Mudryk, K., Faichuk, O., Hohol, T., & Tomaszewska-Górecka, W. (2022). Taxonomy and Stakeholder Risk Management in Integrated Projects of the European Green Deal. Energies, 15(6), 2015. https://doi.org/10.3390/en15062015