Services on Platform Ecosystems in the Smart Home 2.0 Era: Elements Influencing Consumers’ Value Perception for Smart Home Products

Abstract

:1. Introduction

1.1. Research Background

1.2. Research Question and Purpose

1.3. Novelty and Contribution of This Study

2. Literature Review

2.1. Smart Home

2.1.1. Smart Home Products

2.1.2. Smart Home Platform

2.2. Platform Ecosystem

2.2.1. Platform Service

2.2.2. Modularity of Products

2.2.3. Inter-Consumer Connectivity

3. Methodology

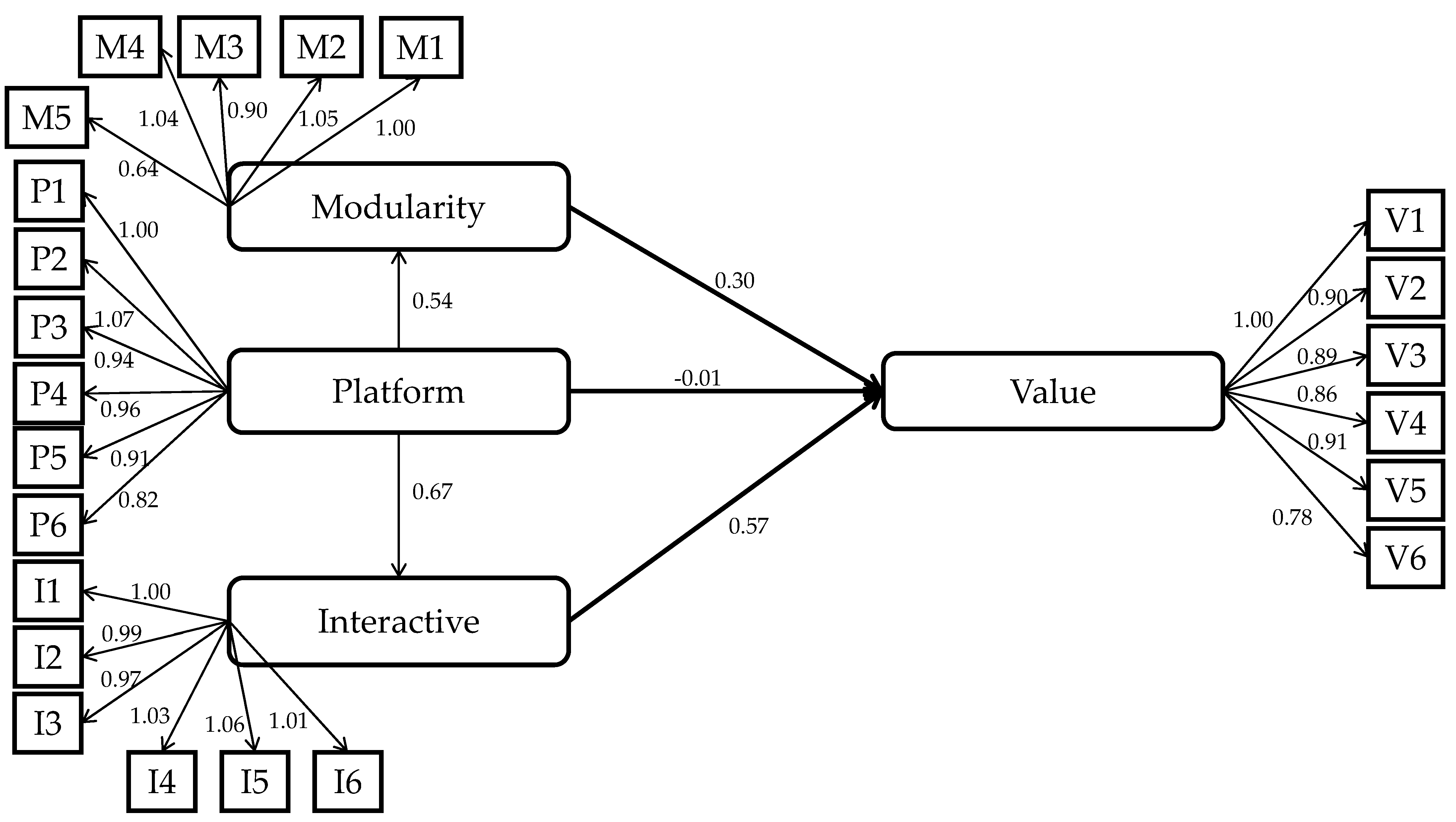

3.1. Analytical Model

- Value perception: Customers’ value perception is generated from their experience of a complete product or service [57]. In other words, consumers perceive the value of their products and services through the abilities of the same products and services to meet their needs. Therefore, value perception is defined as whether products meet the needs of consumers and whether consumers perceive the value of these products.

- Platform services: Platform services are now at the center of meeting consumers’ needs [44]. Platform services support other elements of the platform and help provide better products and services for consumers. Consumers can satisfy their needs and perceive the value of products by using platform services [46,47]. Platform service is a service that can provide platform capabilities for products—all while guaranteeing interconnection and operation among smart home products. Platform services may also provide support and consultation for other companies’ products to promote the simultaneous use of their products and smart home products.

- Modularity of products: The products made by complements and consumers are related by indirect network effects, making consumers feel valued [7]. Complements can also improve the performance and service of products developed through modularization, thus becoming of great value to consumers interested in modularization [49]. Therefore, this study examined the modularization of products. Here, modularization is defined as a combination of smart home products with individual, separated product features. The unification of smart home products refers to a form in which a unified smart home service can be received by a single product.

- Inter-consumer connectivity: Consumer’s interaction can be achieved using a platform [7]. Consumers can meet their own needs by communicating with each other, thereby improving their satisfaction [58]. This way, the smart home platform will play the role of an ecological product combination and meet the needs of consumers. In parallel, consumers can choose products that they think are valuable in order to meet their needs, thus making the interaction between consumers with the same demands and needs more valuable. Hence, this study includes inter-consumer connectivity as a variable. Here, inter-consumer connectivity refers to the ways in which consumers can exchange opinions and communicate with each other through a smart home platform.

3.2. Survey Overview

3.3. Questionnaire Design

3.4. Dependent Variable

3.5. Explanatory Variables

- Platform service: This variable represents the acceptance of platform services by consumers, that is, the element of the “platform company”. This variable is referred to as factor “Platform”;

- Modularization of smart home products: This variable refers to the degree of consumers’ preference for the modularization of smart homes. This variable is referred to as factor “Modularization”;

- Inter-consumer connectivity: Interactions between users among themselves concerning products are realized and enable consumers to perceive the value of these products. This variable represents consumers’ interactions. This variable is referred to as factor “Interactive”.

4. Results

4.1. Results of the Factor Analysis

4.2. Results of SEM

5. Discussion

5.1. Theoretical Implications

5.1.1. Contribution to Platform Ecosystem Research

5.1.2. Contribution to Smart Home Research

5.2. Managerial Contributions

5.2.1. Implications on Platform Service

5.2.2. Implications on Modularity

5.2.3. Implications on Inter-Consumer Connectivity

5.3. Limitations and Future Research

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| Code Name | Option A | Option B |

|---|---|---|

| V1 | Set the temperature with smart refrigerators, and check the shelf life of food with smart phones. | Satisfied with the use of ordinary refrigerator. |

| V2 | By using the intelligent washing machine, the dosage of powder detergent and liquid detergent can be automatically controlled. | The function of the washing machine has been sufficient so far. |

| V3 | Smart scales can manage the health data of separated families and can take care of their family health without meeting each other. | It is sufficient to use an ordinary weight scale for weight measurement. |

| V4 | Intelligent electric toothbrushes can be used to display the status of brushing the teeth and diagnose whether it is good or bad. | Satisfied with the toothbrush used after brushing. |

| V5 | With a smart rice cooker, it is possible to set the timing of rice cooking through smartphone on the go. | So far, the function of rice cooker is very good. |

| V6 | Intelligent ceiling lamps can automatically control dimming by connecting to other devices in order to create an appropriate atmosphere in the room. | Controlling the lamp with one’s own hands is suffice. |

| P1 | Centralized management of smart home products on the platform enables usage of a variety of products and their usage simultaneously when needed. | Smart home products are purchased with a purpose, so there is no feeling regarding the need for mutual cooperation. |

| P2 | Platform allows all smart home products to be connected through the platform, which saves the trouble of establishing connections. | Integration of smart home products should be handled separately as required. |

| P3 | Smart home products connected to a platform can be controlled using the unified application program (interface) of the platform | Operating each smart home product with a separate application is not particularly troublesome. |

| P4 | Uploading personal information required by the platform eliminates the need for individual uploads to connect to smart home products. | If necessary, personal information should be uploaded independently. |

| P5 | Consult the service desk of the platform company for help regarding smart home products that can be connected to. | For product support, one should consult the support department in the product’s company. |

| P6 | Products that can be connected to the platform can be purchased through the website. | When purchasing a smart home product, product collection and buying information should be on the websites of each brand. |

| M1 | Expanding the ability of intelligent service should be through expansion. | The service function of the product may remain as it was at the time of purchase. |

| M2 | The ability of expansion and cooperation with other products. | A function that is complete within a single product should be provided. |

| M3 | Each product has few functions and can be used alone, but with the option to buy a large number of products to meet the needs and work together. | One general-purpose product that can meet general needs is suffice. |

| M4 | Expand user’s capabilities by connecting to other devices. | Features are well contained in a single product, but cannot be connected to the outside world. |

| M5 | Each product has specific functions, and there is no overlap between the functions of the products. | Versatility cannot help but overlap features between products. |

| I1 | If an acquaintance is using intelligent health services, the results of their use can be seen and will motivate the users to improve their health. | It is enough to use the health service function to check my own health. |

| I2 | An option for a video conference or bulletin board function on the smart TV, can improve communication with any acquaintance of the user. | Smart TV should be able to surf the Internet, such as YouTube. |

| I3 | The option to easily talk with online with acquaintances using the intelligent artificial intelligence systems is very convenient. | The intelligent artificial intelligence systems are sufficient to have artificial intelligence assistance capabilities. |

| I4 | A mechanism to cook and exchange information with an expert in a smart kitchen would be nice. | Just using the ready-made menu is enough for cooking. |

| I5 | The usage of intelligent security with family members and acquaintances enable to understand the situation at home. | Intelligent security is enough to prevent crime. |

| I6 | The possibility to listen to the same music with family members and friends using smart speakers, brings more enjoyment. | It is sufficed if smart speakers could be used to enjoy music alone. |

References

- You, I.; Pau, G.; Salerno, V.M.; Sharma, V. Special Issue “Internet of Things for Smart Homes”. Sensors 2019, 19, 4173. [Google Scholar] [CrossRef] [Green Version]

- Nield, D. The Best Smart Home Systems 2021: Top Ecosystems Explained. The Ambient. Available online: https://www.the-ambient.com/guides/smart-home-ecosystems-152 (accessed on 5 July 2021).

- Wang, B. Here’s Everything on Huawei’s Harmony OS 2 Event, and We Gave Them a Try. Available online: https://en.pingwest.com/a/8716 (accessed on 5 July 2021).

- Chen, M.; Yang, J.; Zhu, X.; Wang, X.; Liu, M.; Song, J. Smart Home 2.0: Innovative smart home system powered by botanical IoT and emotion detection. Mob. Netw. Appl. 2017, 22, 1159–1169. [Google Scholar] [CrossRef]

- CSHIA Research. White Paper on China’s Smart Home Ecological Development-From Whole House Intelligence to Space Intelligence. Available online: http://www.d-long.com/eWebEditor/uploadfile/2020080317033248467705.pdf (accessed on 21 December 2020). (In Chinese).

- IQUII. Smart Home 2.0: IoT Alone Is Not Enough, We Need to Focus on Integration and Experience. Available online: https://medium.com/iquii/smart-home-2-0-iot-alone-is-not-enough-we-need-to-focus-on-integration-and-experience-4cf2ddfd94de (accessed on 8 July 2021).

- Gawer, A. Bridging differing perspectives on technological platforms: Toward an integrative framework. Res. Policy 2014, 43, 1239–1249. [Google Scholar] [CrossRef] [Green Version]

- Pedeliento, G.; Andreini, D.; Bergamaschi, M.; Salo, J. Brand and product attachment in an industrial context: The effects on brand loyalty. Ind. Mark. Manag. 2016, 53, 194–206. [Google Scholar] [CrossRef]

- Sujin, B.; Timothy, H.J.; Natasha, M.; Minjeong, S.; Ohbyung, K. The influence of mixed reality on satisfaction and brand loyalty in cultural heritage attractions: A brand equity perspective. Sustainability 2020, 12, 2956. [Google Scholar]

- Gunawan, T.S.; Yaldi, I.R.H.; Kartiwi, M.; Mansor, H. Performance Evaluation of Smart Home System using Internet of Things. Int. J. Electr. Comput. Eng. 2018, 8, 400–411. [Google Scholar] [CrossRef]

- Kuwari, A.; Ramadan, A.; Ismael, Y.; Sughair, A.; Gastli, A.; Benammar, M. Smart-home automation using IoT-based sensing and monitoring platform. In Proceedings of the 2018 IEEE 12th International Conference on Compatibility, Power Electronics and Power Engineering 2018, Doha, Qatar, 10–12 April 2018; pp. 1–6. [Google Scholar]

- Inoue, Y. Winner-takes-all or co-evolution among platform ecosystems: A look at the competitive and symbiotic actions of complementors. Sustainability 2019, 11, 726. [Google Scholar] [CrossRef] [Green Version]

- Furr, N.; Shipilov, A. Building the Right Ecosystem for Innovation. MIT Sloan Management Review. Available online: https://sloanreview.mit.edu/article/building-the-right-ecosystem-for-innovation/ (accessed on 9 July 2021).

- Balta-Ozkan, N.; Amerighi, O.; Boteler, B. A comparison of consumer perceptions towards smart homes in the UK, Germany and Italy: Reflections for policy and future research. Anal. Strateg. Manag. 2014, 26, 1176–1195. [Google Scholar] [CrossRef]

- Liu, Y.; Gan, Y.; Song, Y.; Liu, J. What Influences the Perceived Trust of a Voice-Enabled Smart Home System: An Empirical Study. Sensors 2021, 21, 2037. [Google Scholar] [CrossRef] [PubMed]

- Yang, H.; Lee, W.; Lee, H. IoT smart home adoption: The importance of proper level automation. J. Sens. 2018, 2018, 1–11. [Google Scholar] [CrossRef] [Green Version]

- Tang, R.; Inoue, Y. Factors That Influence the Continuity of IoT Smart Home Products. In Proceedings of the ISPIM Connects Global 2020: Celebrating the World of Innovation, Virtual, Manchester, UK, 6–8 December 2020; pp. 1–11. [Google Scholar]

- Risteska Stojkoska, B.L.; Trivodaliev, K.V. A review of Internet of Things for smart home: Challenges and solutions. J. Clean. Prod. 2017, 140, 1454–1464. [Google Scholar] [CrossRef]

- Shin, J.; Park, Y.; Lee, D. Who will be smart home users? An analysis of adoption and diffusion of smart homes. Technol. Forecast. Soc. Chang. 2018, 134, 246–253. [Google Scholar] [CrossRef]

- Gubbi, J.; Buyya, R.; Marusic, S.; Palaniswami, M. Internet of Things (IoT): A vision, architectural elements, and future directions. Future Gener. Comput. Syst. 2013, 29, 1645–1660. [Google Scholar] [CrossRef] [Green Version]

- Accenture. How to Successfully Scale Digital Innovation to Drive Growth. Available online: https://www.accenture.com/_acnmedia/Thought-Leadership-Assets/PDF/Accenture-IXO-HannoverMesse-report.pdf (accessed on 8 July 2021).

- Haaker, T.; Ly, P.T.M.; Nguyen-Thanh, N.; Nguyen, N.T.H. Business model innovation through the application of the Internet-of-Things: A comparative analysis. J. Bus. Res. 2021, 126, 126–136. [Google Scholar] [CrossRef]

- Phan, L.A.; Kim, T. Breaking down the compatibility problem in smart homes: A dynamically updatable gateway platform. Sensors 2020, 20, 2783. [Google Scholar] [CrossRef] [PubMed]

- Marikyan, D.; Papagiannidis, S.; Alamanos, E. A systematic review of the smart home literature: A user perspective. Technol. Forecast. Soc. Chang. 2019, 138, 139–154. [Google Scholar] [CrossRef]

- Wang, Z.; Liu, Z.; Shi, L. The Smart Home Controller Based on zigbee. In Proceedings of the 2010 2nd International Conference on Mechanical and Electronics Engineering, Kyoto, Japan, 1–3 August 2010; Volume 2, pp. 300–302. [Google Scholar]

- Jie, Y.; Pei, J.Y.; Jun, L.; Yun, G.; Wei, I.X. Smart home system based on IOT technologies. In Proceedings of the 2013 International Conference on Computational and Information Sciences, Shiyang, China, 21–23 June 2013; pp. 1789–1791. [Google Scholar]

- Kadam, R.; Mahamuni, P.; Parikh, Y. Smart home system. Int. J. Innov. Res. Adv. Eng. 2015, 2, 81–86. [Google Scholar]

- Wright, A.; Ubrani, J.; Shirer, M. Worldwide Smart Home Device Forecast Remains Resilient Despite Pandemic, Says. IDC. Available online: https://www.idc.com/getdoc.jsp?containerId=prUS46891 (accessed on 3 February 2021).

- Grand View Research. Smart Home Appliances Market Size, Share & Trends Analysis Report by Product (Washing Machines, Refrigerators, TVs, Air Purifiers), 2020–2027. Available online: https://www.grandviewresearch.com/industry-analysis/smart-home-appliances-market/methodology (accessed on 21 December 2020).

- Smedlund, A.; Faghankhani, H. Platform Orchestration for Efficiency, Development, and Innovation. In Proceedings of the 2015 48th Hawaii International Conference on System Sciences, Kauai, HI, USA, 5–8 January 2015; pp. 1380–1388. [Google Scholar]

- Cronin, J.J.; Brady, M.K.; Hult, G.T.M. Assessing the effects of quality, value, and customer satisfaction on consumer behavioral intentions in service environments. J. Retail. 2000, 76, 193–218. [Google Scholar] [CrossRef]

- Gaiardelli, P.; Pezzotta, G.; Rondini, A.; Romero, D.; Jarrahi, F.; Bertoni, M.; Wiesner, S.; Wuest, T.; Larsson, T.; Zaki, M.; et al. Product-service systems evolution in the era of Industry 4.0. Serv. Bus. 2021, 15, 177–207. [Google Scholar] [CrossRef]

- Coumau, J.B.; Furuhashi, H.; Sarrazin, H. A Smart Home Is Where the Bot Is. McKinsey Quarterly. Available online: https://www.mckinsey.com/business-functions/mckinsey-digital/our-insights/a-smart-home-is-where-the-bot-is (accessed on 8 July 2021).

- Hein, A.; Böhm, M.; Krcmar, H. Platform Configurations within Information Systems Research: A Literature Review on the Example of IoT Platforms; Multi konferenz Wirtschaftsinformatik: Lüneburg, Germany, 2018; pp. 465–476. [Google Scholar]

- Wareham, J.; Fox, P.B.; Cano Giner, J.L. Technology ecosystem governance. Organ. Sci. 2014, 25, 1195–1215. [Google Scholar] [CrossRef] [Green Version]

- Moore, J.F. Predators and prey: A new ecology of competition. Harv. Bus. Rev. 1993, 71, 75–86. [Google Scholar]

- Cusumano, M.A.; Gawer, A. The elements of platform leadership. MIT Sloan Manag. Rev. 2002, 43, 51–58. [Google Scholar] [CrossRef] [Green Version]

- Inoue, Y. Indirect innovation management by platform ecosystem governance and positioning: Toward collective ambidexterity in the ecosystems. Technol. Forecast. Soc. Chang. 2021, 166, 120652. [Google Scholar] [CrossRef]

- Kapoor, K.; Bigdeli, A.Z.; Dwivedi, Y.K.; Schroeder, A.; Beltagui, A.; Baines, T. A socio-technical view of platform ecosystems: Systematic review and research agenda. J. Bus. Res. 2021, 128, 94–108. [Google Scholar] [CrossRef]

- Jacobides, M.G.; Cennamo, C.; Gawer, A. Towards a theory of ecosystems. Strateg. Manag. J. 2018, 39, 2255–2276. [Google Scholar] [CrossRef] [Green Version]

- McIntyre, D.P.; Srinivasan, A. Networks, platforms, and strategy: Emerging views and next steps. Strateg. Manag. J. 2017, 38, 141–160. [Google Scholar] [CrossRef]

- Hagiu, A.; Wright, J. Multi-sided platforms. Int. J. Ind. Organ. 2015, 43, 162–174. [Google Scholar] [CrossRef]

- Ceccagnoli, M.; Forman, C.; Huang, P.; Wu, D.J. Cocreation of Value in a Platform Ecosystem! The Case of Enterprise Software. MIS Q. 2012, 36, 263–290. [Google Scholar] [CrossRef]

- Fu, W.; Wang, Q.; Zhao, X. The influence of platform service innovation on value co-creation activities and the network effect. J. Serv. Manag. 2017, 28, 348–388. [Google Scholar] [CrossRef]

- Pellizzoni, E.; Trabucchi, D.; Buganza, T. Platform strategies: How the position in the network drives success. Technol. Anal. Strateg. Manag. 2019, 31, 579–592. [Google Scholar] [CrossRef]

- Patrício, L.; Cunha, J.F.; Fisk, R.P.; Nunes, N.J. Customer Experience Requirements for Multi-Platform Service Interaction: Bringing Services Marketing to the Elicitation of User Requirements. In Proceedings of the 12th IEEE International Requirements Engineering Conference, Kyoto, Japan, 10 September 2004; pp. 26–35. [Google Scholar]

- Nikayin, F.; De Reuver, M.; Itälä, T. Collective action for a common service platform for independent living services. Int. J. Med. Inform. 2013, 82, 922–939. [Google Scholar] [CrossRef]

- Boudreau, K.J.; Jeppesen, L.B. Unpaid crowd complementors: The platform network effect mirage. Strateg. Manag. J. 2015, 36, 1761–1777. [Google Scholar] [CrossRef] [Green Version]

- Tiwana, A. Evolutionary competition in platform ecosystems. Inf. Syst. Res. 2015, 26, 266–281. [Google Scholar] [CrossRef] [Green Version]

- Pynnönen, M.; Ritala, P.; Hallikas, J. The new meaning of customer value: A systemic perspective. J. Bus. Strategy 2011, 32, 51–57. [Google Scholar] [CrossRef]

- Riegel, I.; Rozendaal, R.; TSchleyer, T.; Schantz, S. Making Smart Platforms Stick. McKinsey Insights. Available online: https://www.mckinsey.com/business-functions/operations/our-insights/making-smart-platforms-stick (accessed on 6 July 2021).

- Wan, X.; Cenamor, J.; Parker, G.; Van Alstyne, M.W. Unraveling platform strategies: A review from an organizational ambidexterity perspective. Sustainability 2017, 9, 734. [Google Scholar] [CrossRef] [Green Version]

- Lee, R.M.; Robbins, S.B. The relationship between social connectedness and anxiety, self-esteem, and social identity. J. Couns. Psychol. 1998, 45, 338–345. [Google Scholar] [CrossRef]

- Lee, D. Effects of key value co-creation elements in the healthcare system: Focusing on technology applications. Serv. Bus. 2019, 13, 389–417. [Google Scholar] [CrossRef]

- Podoynitsyna, K.; Song, M.; Van der, B.H.; Weggeman, M. Improving new technology venture performance under direct and indirect network externality conditions. J. Bus. Ventur. 2013, 28, 195–210. [Google Scholar] [CrossRef]

- Van Alstyne, M.; Parker, G. Platform Business: From Resources to Relationships. NIM Mark. Intell. Rev. 2017, 9, 24–29. [Google Scholar] [CrossRef] [Green Version]

- Rintamäki, T.; Kuusela, H.; Mitronen, L. Identifying competitive customer value propositions in retailing. Manag. Serv. Qual. Int. J. 2007, 17, 621–634. [Google Scholar] [CrossRef] [Green Version]

- Sawhney, M.; Verona, G.; Prandelli, E. Collaborating to create: The Internet as a platform for customer engagement in product innovation. J. Interact. Mark. 2005, 19, 4–17. [Google Scholar] [CrossRef]

- Chung, V.; Dietz, M.; Rab, I.; Townsend, Z. Ecosystem 2.0: Climbing to the Next Level. McKinsey Quarterly. Available online: https://www.mckinsey.com/business-functions/mckinsey-digital/our-insights/ecosystem-2-point-0-climbing-to-the-next-level (accessed on 9 July 2021).

- Cochran, W.G. Sampling Techniques, 3rd ed.; John Wiley & Sons: Hoboken, NJ, USA, 2007. [Google Scholar]

- Singh, S.K.; Del Giudice, M.; Chierici, R.; Graziano, D. Green innovation and environmental performance: The role of green transformational leadership and green human resource management. Technol. Forecast. Soc. Chang. 2020, 150, 119762. [Google Scholar] [CrossRef]

- Statistics Bureau of Japan. Result of the Population Estimates. Available online: https://www.stat.go.jp/english/data/jinsui/tsuki/index.html (accessed on 9 October 2021).

- Iqbal, A.; Ullah, F.; Anwar, H.; Kwak, K.S.; Imran, M.; Jamal, W.; Rahman, A. Interoperable Internet-of-Things platform for smart home system using Web-of-Objects and cloud. Sustain. Cities Soc. 2018, 38, 636–646. [Google Scholar] [CrossRef]

- Domb, M. Smart home systems based on internet of things. In Internet of Things (IoT) for Automated and Smart Applications; Ismail, Y., Ed.; IntechOpen: London, UK, 2019. [Google Scholar]

- Demirtas, B.; Merritt, J. Feeling Safe in the Home of the Future: A Product Life-Cycle Approach to Improve the Trustworthiness of Smart Home Products and Services. Available online: https://www.weforum.org/reports/feeling-safe-in-the-home-of-the-future-a-product-life-cycle-approach-to-improve-the-trustworthiness-of-smart-home-products-and-services (accessed on 23 October 2021).

- Ursuţiu, D.; Neagu, A.; Samoilă, C.; Jinga, V. MODULARITY Applied to SMART HOME. In Online Engineering & Internet of Things; Auer, M.E., Zutin, D.G., Eds.; Springer: Cham, Switzerland, 2018; Volume 22, pp. 56–67. [Google Scholar]

- Jha, A.; Kropczynski, J.; Lipford, H.R.; Wisniewski, P.J. An Exploration on Sharing Smart Home Devices Beyond the Home. In Proceedings of the IUI Workshops, Los Angeles, CA, USA, 20 March 2019. [Google Scholar]

- Hair, J.F.; Black, B.; Babin, B.; Anderson, R.E.; Tatham, R.L. Multivariate Data Analysis: Pearson Prentice Hall; Pearson: Upper Saddle River, NJ, USA, 2006; pp. 1–816. [Google Scholar]

- Fornell, C.; Larcker, D.F. Evaluating Structural Equation Models with Unobservable Variables and Measurement Error. J. Mark. Res. 1981, 18, 39–50. [Google Scholar] [CrossRef]

- Nunnally, J.C. Psychometric Theory; McGraw-Hill: New York, NY, USA, 1978. [Google Scholar]

- Bagozzi, R.P.; Yi, Y. On the evaluation of structural equation models. J. Acad. Mark. Sci. 1988, 16, 74–94. [Google Scholar] [CrossRef]

- Bentler, P.M.; Bonett, D.G. Significance tests and goodness of fit in the analysis of covariance structures. Psychol. Bull. 1980, 88, 588–606. [Google Scholar] [CrossRef]

- Bajaj, B.; Robins, R.W.; Pande, N. Mediating role of self-esteem on the relationship between mindfulness, anxiety, and depression. Personal. Individ. Differ. 2016, 96, 127–131. [Google Scholar] [CrossRef]

- Sethi, P.; Sarangi, S.R. Internet of things: Architectures, protocols, and applications. J. Electr. Comput. Eng. 2017, 2017, 1–25. [Google Scholar] [CrossRef] [Green Version]

- Ledden, L.; Kalafatis, S.P.; Samouel, P. The relationship between personal values and perceived value of education. J. Bus. Res. 2007, 60, 965–974. [Google Scholar] [CrossRef]

- Gawer, A.; Cusumano, M.A. How Companies Become Platform Leaders. Harvard Business Review. Available online: https://store.hbr.org/product/how-companies-become-platform-leaders/smr268?sku=SMR268-PDF-ENG (accessed on 9 July 2021).

- Lee, S.M.; Kim, T.; Noh, Y.; Lee, B. Success factors of platform leadership in web 2.0 service business. Serv. Bus. 2010, 4, 89–103. [Google Scholar] [CrossRef]

| Question Item | Value | Platform | Modularity | Interactive |

|---|---|---|---|---|

| For the dependent variable | ||||

| V1 | 0.72 | |||

| V2 | 0.68 | |||

| V3 | 0.62 | |||

| V4 | 0.65 | |||

| V5 | 0.68 | |||

| V6 | 0.60 | |||

| For the explanatory variables | ||||

| P1 | 0.76 | |||

| P2 | 0.80 | |||

| P3 | 0.71 | |||

| P4 | 0.63 | |||

| P5 | 0.73 | |||

| P6 | 0.63 | |||

| M1 | 0.75 | |||

| M2 | 0.74 | |||

| M3 | 0.66 | |||

| M4 | 0.77 | |||

| M5 | 0.47 | |||

| I1 | 0.69 | |||

| I2 | 0.71 | |||

| I3 | 0.68 | |||

| I4 | 0.73 | |||

| I5 | 0.71 | |||

| I6 | 0.71 | |||

| Average variance extracted | 0.43 | 0.51 | 0.47 | 0.49 |

| Composite reliability | 0.82 | 0.86 | 0.81 | 0.85 |

| Cronbach’s α | 0.82 | 0.86 | 0.81 | 0.85 |

| Estimate | Std. Error | p Value | |

|---|---|---|---|

| Platform~Value | 0.020 | 0.076 | 0.793 |

| Modularity~Value | 0.277 | 0.083 | 0.001 |

| Interactive~Value | 0.564 | 0.070 | 0.000 |

| RMESA | IFI | CFI | |

|---|---|---|---|

| Level | 0.04 | 0.96 | 0.96 |

| Acceptance level | <0.06 | >0.90 | >0.90 |

| Chisq. | Df | Chisq./df | RMESA | SRMR | CFI | Aic | Ecvi | |

|---|---|---|---|---|---|---|---|---|

| Model 1 | 465.467 | 225.000 | 2.069 | 0.044 | 0.052 | 0.950 | 33194.650 | 1.049 |

| Model 2 | 793.020 | 227.000 | 3.493 | 0.068 | 0.182 | 0.883 | 33518.214 | 1.647 |

| Model 3 | 680.589 | 226.000 | 3.001 | 0.061 | 0.148 | 0.906 | 33407.782 | 1.443 |

| Model 4 | 589.015 | 226.000 | 2.606 | 0.054 | 0.140 | 0.925 | 33316.209 | 1.274 |

| Estimate | Std. Error | p Value | |

|---|---|---|---|

| Platform~Value | −0.006 | 0.084 | 0.943 |

| Modularity~Value | 0.304 | 0.083 | 0.000 |

| Interactive~Value | 0.574 | 0.070 | 0.000 |

| Platform~Modularity | 0.639 | 0.054 | 0.000 |

| Platform~Interactive | 0.545 | 0.057 | 0.000 |

| Results | Contributions for the Product Development in Smart Home 2.0 |

|---|---|

| Consumers who perceive the value of “platform service” can perceive more value of smart home products through modularity and inter-consumer connectivity. | Consumers who perceive the “platform service” have higher expectations for smart home products. However, this relationship is indirectly realized through expectations for “modularity” and “inter-consumer connectivity”. |

| Consumers who perceive the value of “modularity” can perceive more value of smart home products. | Consumers who perceive the “modularity” of products have higher expectations for smart home products. This could suggest legitimacy to develop more modularized smart home product in the Smart Home 2.0 era. |

| Consumers who perceive the value of “inter-consumer connectivity” can perceive more value of smart home products. | As the consumers who perceive “inter-consumer connectivity” have higher expectations for smart home products, enhancing the inter-consumer connectivity could be a viable option for platform companies and product developers of the future smart home market. |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tang, R.; Inoue, Y. Services on Platform Ecosystems in the Smart Home 2.0 Era: Elements Influencing Consumers’ Value Perception for Smart Home Products. Sensors 2021, 21, 7391. https://doi.org/10.3390/s21217391

Tang R, Inoue Y. Services on Platform Ecosystems in the Smart Home 2.0 Era: Elements Influencing Consumers’ Value Perception for Smart Home Products. Sensors. 2021; 21(21):7391. https://doi.org/10.3390/s21217391

Chicago/Turabian StyleTang, Ruiyang, and Yuki Inoue. 2021. "Services on Platform Ecosystems in the Smart Home 2.0 Era: Elements Influencing Consumers’ Value Perception for Smart Home Products" Sensors 21, no. 21: 7391. https://doi.org/10.3390/s21217391

APA StyleTang, R., & Inoue, Y. (2021). Services on Platform Ecosystems in the Smart Home 2.0 Era: Elements Influencing Consumers’ Value Perception for Smart Home Products. Sensors, 21(21), 7391. https://doi.org/10.3390/s21217391