Abstract

The way of payment has changed in recent years: people have turned away from physical payment methods to virtual payment methods. The traditional banking industry is facing challenges brought by new technologies. The main purpose of this study is to investigate customer trust and loyalty transferring from physical banks to mobile payments because mobile payment platforms are a self-service technology. The goal is to create an eco-platform to facilitate transition from a cash-based economy to a cashless economy. This study is the first attempt to integrate platform management, electronic marketing (online trust and online loyalty), and relationship marketing (offline trust and offline loyalty) into one model. We theoretically and empirically take certain factors into consideration to further explore the transfer impact of physical to mobile payments, which is not discussed in literature. The SEM (structural equation modelling) analysis from the 353 respondents in this study found that trust from both the physical and mobile contexts has positively influenced loyalty. Additionally, customers’ trust and loyalty transfer from the physical to the mobile environment has had a significantly positive effect between the physical and mobile environment. Corporate reputation and structure assurance have also significantly positively affected physical trust and mobile trust, respectively. The findings also reveal that the structure assurance plays an essential role in mobile payment. Users may have certain concerns about the procedure of transactions and their personal information. Theoretical and practical implications are provided.

1. Introduction

1.1. Research Background

Mobile payment is a trending topic which has been discussed and used in recent years, despite the fact that mobile payment has been around since the millennium [1,2,3]. The growth of mobile payment services has increased [4,5], and with the development and innovation mobile services, has become an indispensable part of daily life. Mobile payment is defined as a combination of mobile device and payment platform that enables users to make payments through mobile devices [6,7] and is utilized to initiate, authorize, and confirm a commercial transaction [8,9]. Some scholars also define m-payments as use of an application-enabled mobile phone as a payment form, substituting for a check, cash, or a card, to eventually create a mobile wallet [10,11]. Users can pay for a wide range of services and digital or hard goods by mobile devices. Despite the concept of non-monetary platforms having a long history, it is only the advancement of technology and support for such platforms that make mobile payments prevalent.

Mobile payment is still behind traditional payment methods in terms of usage frequency on the basis of PricewaterhouseCoopers market survey. From the global perspective, the mobile payment market had grown from $450 billion in 2015 to $1800 billion in 2019, driven by government policy support from all countries, advances in communication transmission and identity verification technology, input from new entrepreneurs, and changes in millennial usage behavior. Based on the report by Mordor Intelligence, the use of mobile payments will rise steeply between 2020 and 2025, and it has predicted that mobile payments will become the second most common payment method after debit cards by 2022.

From the domestic perspective, the use of mobile payments has reached 96.6% in Taiwan. According to the research of MIC (Market Intelligence & Consulting Institute) in 2019, as many as 77.6% of the 46–55-year-old generation have used the mobile payment, and it has the highest growth rate (31.2%) in 2018 for all ages. It was also observed that 82.7% of young people between the ages of 18 and25 have used mobile payment within the past 3 months, and 70.9% of the 26–35 year olds have shown high enthusiasm. Additionally, the study showed that young people still lead the current mobile payment market. Further investigation found that the top 6 mobile payments used by users in 2019 were “Line Pay (59.6%)”, “JKO Pay (40.7%)”, “PX Pay (32.6%)”, “Taiwan Pay (27.3%)”, “Apple Pay (25.3%)” and “FamiPay (25.3%)”. The government has declared that the penetration rate of mobile payment will reach up to 60% by 2020 and 90% by 2025. To strengthen industrial cooperation and integration, different industries, including field operators, payment operators, telecom operators, financial operators, and so on have chosen to participate in the development of such technologies.

The popularity of mobile devices has spawned the development of the fintech industry, and digital technology application and industry cross-border integration have allowed customers to turn to virtual payments. Due to the high degree of development and intensiveness of the financial industry in Taiwan, financial institutions have been used as the main body to promote the “Financial Internet” in recent years. At the same time, the popularity of mobile devices has gradually become a developing trend. Brett King, the author of 《Bank 3.0: Why Banking Is No Longer Somewhere You Go But Something You Do》said that the banks have changed from “a place” to “a behavior”, which reflects the ubiquitous services of banking. By making financial behavior as convenient as possible, consumers are only aware of payment behavior. In order to keep up with the trend, many traditional bankers are also proactively giving consumers more convenient and faster services, and they have allied with mobile payment platforms in order to attract more users and provide users with better services to enhance customer stickiness so as to gain more customer size in order to react to a volatile market.

However, the traditional banking industry is facing challenges brought on by new technologies. Digital banking has increased in the last five years; it is a branch concept of mobile banking, which means that there are no branches and no business locations, and banking services are only provided through computers, mobile devices, ATMs, telephones, and so on. Although this seems to be more fierce competition for bank digital services and it will have a greater impact on the existing banking industry, the influence on traditional banks as a whole is still small at present. Because of the scale of customers and the long-established reputation of traditional banks, digital bank usage is lower than that of traditional banks.

1.2. Research Motivation

The integration of physical and mobile is also a major area of mobile payment. It emphasizes entity and virtual integration of customers’ payment habits. People are used to paying for goods with cards or cash; payment platforms transfer physical cards into virtual ones and provides customer more convenient ways of payment. Customers can gain more efficient services and improved purchase experience through this environment. Mobile devices and networks provide a ubiquitous environment, freeing users from temporal and spatial constraints. The combination of different channels may cause cross-channel interactive effects [12], which jointly influence the consumers’ behaviors. Research has also noted that cross-channel synergies are particularly important when customers choose from different channel types belonging to the same firm [13,14]. Furthermore, channel integration also simplifies customer movement in cross-channel platforms and provides further incentives for such moves [15,16]. It can be assumed that integration is associated with greater usage and enhanced customer loyalty, which may lead to increased usage in a multichannel platform [17,18]. Due to the rapid growth of mobile payment, different industries from the banking, electronic payment, and various channels are rushing in actively in order to win a place in the mobile payment market.

Most of the existing studies in literature are focused on consumers’ adoption and attitudes toward mobile payments. In terms of cooperative partners such as the financial institution, they are organizations that provide physical cards and mobile payments. In this study, we focus on consumers’ psychological impact on mobile payment platforms and physical banks because their relationship is rarely explored in literature. We also want to explore the relationship between issuing banks and mobile payment platforms to see whether there are any correlated scenarios. To the best of our knowledge, this study is the first attempt to integrate platform management, electronic marketing (online trust and online loyalty), and relationship marketing (offline trust and offline loyalty) in one model.

Customer orientation is able to enduring banking relationships, and it is sensitive to bankers’ reputation relationships with their existing customers [19,20]. Moreover, a bank with a reputation of being trustworthy would have a greater incentive to institute measures to avoid losing that trust and will attempt to strengthen its position in the financial domain. A firm’s mechanism of promoting trustworthy behavior is often considered as reputation [21,22]. Corporate reputation is highly significant in order to build a profitable enterprise. If the bank holds a beneficial reputation with its customers, it will reflect high customer trust. Therefore, we take corporate reputation as the pre-factor in the enhancement of customer trust.

When consumers are accustomed to a current consumption pattern, it is difficult to change or accept a new consumption pattern due to the increased perception of risk brought on by customers’ psychological reflection. Furthermore, risk perception has been divided into two dimensions, which are perceived risk with services or products and perceived risk of mobile transactions themselves [23]. On the physical side, perceived risk will interfere with the trust of physical banks because customers may reduce their attention to the platform [24] and decrease the use of bank services. On the mobile side, the sense of risk dealing with mobile payments may be overwhelming when compared to the traditional mode of payments, based on the TAM model (Technology Acceptance Model). In the context of m-payments, perceived environmental risk affect users’ trust due to the uncertainty in a particular situation [7]. Consumers might feel anxious without cash, checks, or physical cards, or because of some complicated processes, platform security problems, or unfamiliarity with the operating platform. Thus, this study wants to investigate whether perceived risk on the physical issuing bank service and the mobile payment platform will negatively affect customer trust.

Additionally, whether through direct or indirect experiences, perceived quality plays an essential role in trust. In this study, we also divided perceived quality into bank services (physical) and payment platforms (mobile). Based on the literature, from the physical environment, personal service is one of the determinants of customers’ trust in a bank [25]. It has been argued that the importance of a face-to-face meeting will make the bank more likely to build customers’ trust [26]. Sometimes customers will form an impression of the bank’s services based on the information or the attitude they receive from the employee with whom they interact. Regarding the mobile environment, the platform quality, in particular, factors such as speed of connection or the customer interface, are of great concern to consumers. Platform quality may influence trust because it is easy for users to observe qualities such as visual appeal and navigation when accessing mobile technologies [27]. Consequently, this study wants to examine whether perceived qualities of the issuing bank and the payment platform will strengthen customer trust.

Mobile payment platforms provide convenient and time-saving methods for transactions; however, as the mobile payment is a relatively new service, consumers are not familiar with the procedure and the environment of this payment method [28]. McKnight et al. had claimed that structure assurance is critical to build trust in technology and protect consumers from uncertainty and perceived risk [29]. Due to the lack of direct experience, users need to rely on third-party mechanisms such as technological and legal structures to ensure payment security and mitigate perception of risk [30]. When consumers are using mobile payment, they may be unsure whether the mobile environment is safe for them to carry out transactions. In this study, we will focus more on the payment platform itself, to examine if platform providers set up a reassuring platform that will ultimately enhance and acquire consumer trust.

Studies have shown the importance of trust in consumer behavior on mobile payments, and it has been argued that trust is of paramount importance for the consumer of financial services [31], either in a physical or mobile environment. Thus, we also divided trust into bank services (physical) and payment platforms (mobile). The significance of trust can be explained by core products of the financial industry, which can be regarded as the transmission and processing of highly confidential information. Therefore, the trust on the physical banking service may affect the trust on the mobile payment platform by means of entity and virtual card payments.

Loyalty reflects the level of trust and dependence that users have with a brand. As far as this study is concerned, we regard each issuing bank and mobile payment platform as different brands. Physical loyalty represents customer loyalty to the issuing bank; if customers enhance their trust in the bank, their loyalty will also increase. In contrast, mobile loyalty represents users’ loyalty to the mobile payment platform; if users enhance their trust in the mobile payment platform, their loyalty will also increase. As explained earlier, cross-channel integration will greatly affect customer psychological factors. Consequently, the loyalty on the physical banking service may directly affect the loyalty on the mobile payment platform due to the level of trust.

Overall, in order to discuss the impact between four pre-factors and two-sided trusts, two-sided trusts and loyalties, and the transfer between two-sided trusts and loyalties, we examined several relationships: (1) the influence of corporate reputation, structure assurance, perceived risk, and perceived quality on physical trust and mobile trust; (2) the influence of physical and mobile trust on physical and mobile loyalty; (3) the transfer from physical trust to mobile trust and from physical loyalty to mobile loyalty. According to the background and motivation above, we want to further investigate the following questions from the collected data by mobile payments users:

- What factors will affect and strengthen the degree of customer trust on physical banking and mobile payment platforms when customers are conducting financial transactions and services?

- Will customer trust and loyalty toward physical banking transfer toward mobile payment platforms?

2. Literature Review and Hypotheses

2.1. Trust

Trust is defined as the willingness of a party to be susceptible to the actions of another party based on the expectation that the other will perform a particular action important to the trustor [32]. In these circumstances, the trustor may expose itself to existing risk. Thus, trust is also the willingness of one party to be subject to the risks brought by another party’s actions [33]. From a psychological perspective, some scholars believe that trust is a state comprising the intention to accept vulnerability based upon positive expectations of the intentions or behavior of another [34]. In addition, trust can be built-up by one party’s positive response, thus generating the other’s expectation. From a broader perspective, trust is the basis between two parties and existing specific beliefs, including integrity, benevolence, ability, and predictability [35].

This study distinguishes between physical trust and mobile trust. Physical trust represents the customer’s trust toward the issuing bank services of the physical credit card, whereas mobile trust represents the user’s trust toward the payment platform of the virtual credit card. Trust in issuing banks and other financial institutions is crucial for the functioning of the banking platform and for society as a whole. Physical trust can be built by customers’ perception that the physical card provides reliable services to meet their needs based on the financial procedures, the issuing bank’s reputation, and so on.

In contrast, in a mobile commerce environment, trust can be described as consumers’ perceptions of particular attributes of mobile providers, including their ability, integrity, and benevolence when dealing with consumers’ transactions [36]. Prior studies have also identified trust as of most important antecedent that facilitates customers’ acceptance and succeeding usage of m-payment in various situations [37]. Trust toward the virtual credit card embedded on the payment platform reduces the need for situational awareness, control, and investigation, thereby making it easier for users to work during mobile transactions [38]. Mobile trust involves user’s perception that the platform that could provide a stable and secure transaction for users.

Trust does not directly lead to any particular behavioral consequence, but it does affect how people interpret or evaluate information about their attitudes and behaviors [39]. When applied to this study, the above might imply that physical trust and mobile trust are directly related to physical loyalty and mobile loyalty, which influence their attitude towards the issuing bank and the mobile payment platform by relying on the physical and virtual credit card, as well as their intentions for reuse in the future.

2.2. Trust towards the Bank and Trust towards the Payment Platform

The contemporary Internet-oriented world has made trust transfer more significant for marketers to study the interaction between physical and mobile channels when analyzing customer behavior [40]. Trust transfer is a cognitive process in which the trust in one domain has an influence on attitudes and perceptions in another domain. The trust transfer process is related to how one’s trust in a familiar target can be transferred to another target because of existing associations [41]. Trust transfer including intra-channel and inter-channel trust transfer. The former examines trust transfer within a physical or mobile channel. The intra-channel of trust transfer is when evaluated entities have the same status. The latter examines trust migrating from one context to another, i.e., from the physical to mobile or from mobile to mobile channels [42,43]. We will explore the inter-channel of trust transfer due to the different context of the physical card of the issuing bank and the virtual credit card on the platform. Physical trust can be used as an enabling factor by which a mobile company that started from a physical domain can attract customers and make them more loyal to its mobile domain [24]. The trustworthiness of an intermediary with institutional mechanisms helps build the two sides of the entities, which act to facilitate mobile transactions by reducing perceived risk [44]. Multiple studies propose that consumer trust in a physical firm will have positive effect on a mobile business [45]. However, there is little research on trust transfer from the physical to the mobile domain, as the latter is relatively new. So far, this study has focused on the trust transfer between the physical domain and the mobile domain in which the physical issuing bank provides a physical cards to the users, and people will embed physical cards to the mobile payment platform as virtual cards for engaging in the mobile payment. Thus, we consider that certain cards are an intermediary between the physical and the mobile. In addition, it is also suggested that physical channels will significantly influence customer trust in the mobile counterpart [46]. The idea is that the trust in the entity services of the card will affect (or transfer to) positive perception of the virtual services of the card. Therefore, we have:

Hypothesis H1.

Trust towards the issuing bank will positively affect trust towards the payment platform.

2.3. Loyalty

It is defined that customer loyalty is a good attitude towards the company, a promise to repurchase the company’s products or services, and a recommendation to others [47]. Keller believed that loyalty is defined as the repeated purchase behavior over a period of time due to a favorable attitude toward the subject from both attitude and behavioral aspects [48]. In this study, we will focus on attitudinal loyalty rather than on behavioral loyalty for the following reasons. Behavioral loyalty is represented as repeated transactions and can be measured quite simply with observational techniques [49]. However, sometimes it may be a fake phenomenon, as behaviorally loyal customers may stay with the organization or service provider until they find better alternative. In contrast, attitudinal loyalty is often considered as both sides of the continuous relationship have a positive affect and desire to maintain in the relationship, which is easily vacillated by appealing alternatives [50].

In this study, we distinguished between physical loyalty toward the physical credit card and mobile loyalty toward the virtual credit card. The physical loyalty is the service or the product loyalty [51], thus, physical loyalty indicates the customer will tend to use the service of the physical credit card of the issuing bank. Service loyalty is the degree to which customers show repeated purchasing or use and express a positive attitude toward the provider, tending to use only this provider when certain services or products are needed [52]. Customers may rely on the physical card services of the issuing bank and tend to use them in the long-term. It is proposed that brand trust is related to attitudinal loyalty; it is also the key determinant of brand loyalty and commitment. In the physical environment, a high level of trust allows parties to focus on the long-term benefits of the relationship [53]. Strong bonds and enhanced loyalty could be crucial to suppliers [54]. Therefore, we have:

Hypothesis H2a.

Trust towards the bank will positively affect loyalty towards the bank.

Mobile loyalty, from another point of view, is regarded as the users preferring to use the virtual credit card on the payment, which further provides multi-services for the users. Loyalty towards the mobile platform is defined as a user’s intention to do more transactions and recommend the platform to other people [55]. Thus, their intention may drive them to use the virtual credit card on the platform in the long-term. Numerous studies found that trust has a positive effect on customer loyalty and also emphasized it is fundamental determinant of customer loyalty in a mobile environment [44,54]. On the mobile platform, customers may have a high level of perceived risk in terms of payment or information disclosure; thus, customers may prefer to transact on the mobile environment to which they are accustomed and is trustworthy for them. Therefore, we have:

Hypothesis H2b.

Trust towards the payment platform will positively affect loyalty towards the payment platform.

2.4. Loyalty towards the Bank and Loyalty towards the Payment Platform

Many transactions that start in the mobile environment are performed in the physical environment [56], and the results obtained in the physical environment have an impact on the mobile environment [57]. According to the halo effect, the entire assessment affects one’s response to other attributes, or the impression of one attribute affects the impression of other independent attributes [58]. Research on the interaction effects between channels claims the existence of a halo effect, whereby physical behaviors build mobile behaviors [59]. Researchers have assessed the effect of physical-mobile channel integration on customer evaluations, and their unexpected results showed that integration did not affect the physical channel negatively [60]. In other words, customers can extend their positive evaluations of the mobile channel to the physical channel by the halo effect, which indicates that there are cross-channel synergies [61] and that the physical channel benefits from the mobile-physical channel integration. Offering multiple channels of services to meet customer needs will lead to increased customer loyalty [50]. However, compared to the physical context, earning and maintaining customer loyalty may be even more challenging in the Internet environment because of the exceedingly low switching cost and constant competition among other competitors [61]. Based on the synergistic combination of two-sided functions, the issuing bank and the payment platform may collaborate on launching programs to enhance customer stickiness on both sides of the platform. It can be speculated that loyal users using virtual cards embedded on the mobile payment platform may be affected by their loyalty to physical cards of the physical bank due to the halo effect. As a result, customers transfer existing attitudes and beliefs built from the physical side to the mobile side. In other words, customers who are loyal toward the physical card are more likely loyal toward the virtual card because loyalty toward the issuing bank service develops from stability. Therefore, we have:

Hypothesis H3.

Loyalty towards the bank will positively affect loyalty towards the payment platform.

2.5. Corporate Reputation

Corporate reputation can be defined with different aspects; based on the resource-based approach, it refers to a beneficial strategic resource that continue the company’s competitive edge [62]. Reputation is considered to be one of the main standards to assess the trustworthiness of a potential trustee. For this reason, an agent can trust another agent by means of mobile interactions [63]. Reputation has also been found to decrease customer anxiety about virtual interactions [64]. Hence, the second-hand information or word of mouth can influence a person’s perception of service when they do not have first-hand knowledge of the company. As confidence is a crucial factor in the creation of relational trust [65] when the company possesses a favorable reputation, it can strengthen customers’ confidence and lower risk perceptions when customers make judgments on organizational performance and quality of products or services [66]. Company reputation can also establish entrance obstacles for competitors outside the market and reinforce customer retention and loyalty and may even result in a munificent revenue and greater value in the marke.

Good corporate reputation can bring advantages for the issuing bank. In order to establish good reputation, the firm needs to acquire loyalty from employees and customers, even favorable comments from the cooperative partners. In the moral responsibility of a bank, reputation is both personal and collective, and it leads to positive externalities [67]. As an intangible asset, reputation directly affects the value of a financial services firm, for the reason that a formidable reputation is essential to the sustainable development of the industry [68]. Therefore, we consider that customers will contact banks that are well-known or have a high reputation in the market, and at the psychological level customer trust will increase when the bank has a high reputable impression toward customers. Therefore, we have:

Hypothesis H4.

Corporate reputation will positively affect trust on the bank.

2.6. Perceived Risk

The concept of perceived risk is defined as an attribute of a decision alternative that reflects the variance of its possible outcomes [69]. It is considered to be a consequence when customers have unanticipated and uncertain influences on purchasing experience [70]. Perceived risk refers to detrimental results for customers on account of the inability or uncertainty of predicted results when purchasing a product or service [71]. An attribute of the conceptualization of perceived risk within consumer psychology is mainly from the potentially negative outcomes [72].

The level of perceived risk is significant mainly at the purchase point [73] when the transaction process is related to finance problems; therefore, good care of the physical credit card service improves the usage situation of customers with the issuing bank. The main factor is kindness; a positive atmosphere reduces the defense mentality and enhances the interactions with each other. Brand trust can reduce risk perception in a physical context, and the cognitive dimension plays a vital role in this environment [74]. As discussed above, in this study, perceived risk is concerned with adverse consequences from unfavorable results from physical card services. It might affect the customer’s impression of the issuing bank. They might feel anxious if they have a less than ideal experience and therefore diminish their trust of the issuing bank. Yet, if consumers believe in the technical capability, integrity, and benevolence of the issuing bank, they are more likely to overcome their risk perceptions toward new credit card services. Higher levels of societal trust associated with better financial services could result in lower risk-taking. Therefore, we have:

Hypothesis H5a.

Perceived risk will negatively affect trust of the bank.

Another aspect is the risk of customer behavior with the mobile technology. Risk about the technology being used becomes integral to customer decisions when engaged in mobile payments. People tend to use mobile payments in their daily life, and privacy and security are exposed and discussed on the internet frequently. Concerns over privacy risks have negative influences on perceptions of security [75]. Customers may pay more attention to their rights and interests; therefore, they form a higher risk perception of internet commerce [76], including mobile payments. If they are not familiar with the mobile payment and it is a new technology for them, customers might have a resistive mentality if the virtual credit card embedded on the platform does not have stable and secure protection. Furthermore, they might lower their trust of the payment platform. In addition, financial loss is also one of the major concerns that impedes the adoption of mobile payment [37] due to the uninformed concerns and natural risk aversion [77]. Overall, hesitation on using virtual credit cards on the payment platform might have a negative impact on customers’ degree of trust. Therefore, we have:

Hypothesis H5b.

Perceived risk will negatively affect trust on the payment platform.

2.7. Perceived Quality

Perceived quality is determined as the customer’s perception of the overall quality or superiority of a product or service relative to alternatives regarding its intended purpose [78]. Perceived quality is also defined as the consumers’ judgments about physical services including integrated excellence or superiority [79]. Different from the objective quality, which is used to describe technical advantages of a product, perceived quality may not exist and is invaluable because all qualities are comprehended in distinct ways by different people [78].

In this research, we distinguish between the service quality of the physical credit card of the issuing bank and the platform quality of the virtual credit card on the payment platform. Service quality reflects reliability, responsiveness, assurance, and personalization [80]. Service quality is derived from the comparison between what is provided and what the customer feels should be offered [81]. The perception of service quality is derived by comparing expectations with perceptions of performance [82]. Sharma and Patterson defined technical service quality as the quality of the service output [83]. In the research, we will apply this idea to the performance of the physical card services of the issuing bank. If services are comprehensive, customers may feel the bank is reliable; therefore, it may affect their trust of and satisfaction with the issuing bank. Hartline and Ferrell defined functional service quality as the extent to which an advisor provides courteous and attentive service and empathizes with customers’ circumstances [84]. Those intangible soft powers may affect customers’ trust levels and enhance their willingness to use the services on the credit card. Further, customers are then willing to trust the issuing bank for their services. Therefore, we have:

Hypothesis H6a.

Perceived quality will positively affect trust of the bank services.

In terms of the platform quality, Zeithaml et al. defined it as the extent to which a website facilitates efficient transactions [85]. The platform quality also reflects efficiency, privacy, fulfillment, and platform availability [86]. Increasing the perceived quality level of a website requires convincing users that the website is prompt and precise and will provide helpful information [87]. Returning to the study, when people use the virtual credit card on the payment platform, they are not merely attracted by the convenience but likewise the platform’s features will also affect their attitude to the usage of the mobile payment. Quality of platform design, which encompasses platform features, has been identified as critical for the success of a platform design. The features of the interface of the platform may be attractive choices that facilitates interactions among different parties such as firms and its customers or among customers [88]. The performance of the platform quality includes the access of the virtual card on the platform, which should be available and reliable for customers so they can obtain the information and the function of the virtual credit card through the platform. The convenience of using the platform interface is also an important factor that affects customers’ perception of the platform quality; therefore, powerful navigation, clear layout, and prompt response may be critical for using payment platforms. Platform qualities, including navigational structure and visual appeal of the platform, will affect users’ trust in mobile commerce technologies [27]. Superior platform quality will increase users’ expectation on receiving positive outcomes in the future, and thus will increase their trust of the mobile platform. Thus, with a stable and reliable platform of the virtual credit card and the friendly layout of the payment platform comes the reduction of users’ potential risk and strengthening of their sense of trust. Therefore, we have:

Hypothesis H6b.

Perceived quality will positively affect trust on the payment platform.

2.8. Structure Assurance

Structure assurance represents an institution-based trust construct [29]. Researchers from the social sciences have found that trust is supported by institutional structures such as guarantees, regulations, promises, legal recourse, or other procedures that will create a secure environment for the participants to be successful [89]. Therefore, at the Internet level, structural assurance means the belief in the web having a protective legal or technical structure [90] to ensure that web business can be carried out safely and reliably. Applied to this research, one who believes that high security and privacy structure assurance with legal and technological internet protections on the virtual card embedded on payment platforms will reduce their concern for losing identity, money, and so on. Kim and Prabhakar suggested that structural assurances are particularly important when the parties in question are involved in financial transactions through electronic channels [91]. In this case, structure assurance is the level of user confidence in the existence of protection that guarantees transactions in a secure manner [92]. Thus, its’ existence could increase trust and the sense of security among relevant parties. This study will focus on two major concerns from the payment platform: users’ perception of security and the privacy of virtual cards. In terms of security and privacy, the mobile environment holds high risk and additional uncertainties compared to the physical environment; therefore, consumers would respond well to such structural assurances [93]. Due to the lack of direct experience and knowledge about mobile payment platforms, users may highly depend on the structural assurance to build their trust of mobile payments. Structure assurance of the mobile environment positively affects users’ trust. Because the Internet has a high standard of structural assurance, it will produce a sense of structurally guaranteed security, so people are more likely to rely upon specific Internet providers [94]. It could be demonstrated that structural assurance of the virtual card on the payment platform should affect willingness to depend on the platform provider because high structural assurance indicates consumers are capable of prevailing over fears of the mobile side so that they are comfortable dealing with it. Therefore, we have:

Hypothesis H7.

Structure assurance will positively affect trust on the payment platform.

3. Research Methodology

3.1. Conceptual Framework

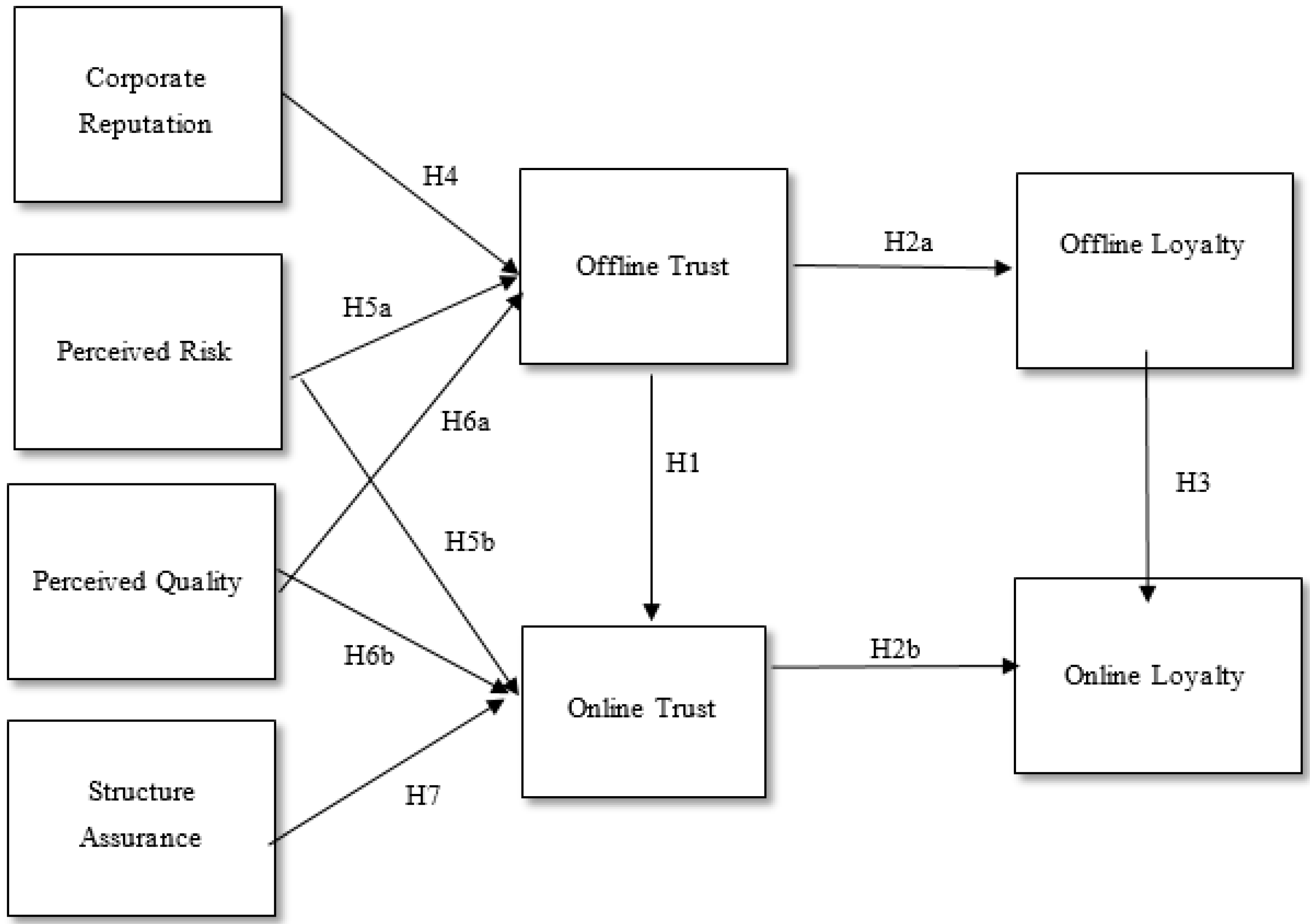

In order to further understand the relationship between potential impact factors and trust, and transfer of trust and loyalty between physical (the issuing bank) and mobile (the mobile payment platform), we purpose a list of hypotheses that will investigate users’ intention and will be tested using questionnaires. The hypotheses state that the corporate reputation, perceived quality, and structure assurance will have a positive influence on physical trust of the bank and mobile trust of the payment platform, and the perceived risk will have a negative influence on physical trust on the bank and mobile trust on the payment platform. Furthermore, both trust of physical and mobile will have positive influence on physical loyalty and mobile loyalty. The transfer of trust and loyalty will be regarded as the opposite way of the physical to mobile strategy, which means that physical trust will have an impact on mobile trust, and physical loyalty will have an impact on mobile loyalty. These relationships are summarized in Figure 1:

Figure 1.

Exploring antecedents and consequences of trust and loyalty in physical banks affecting mobile payments: original research framework.

Based on the above research framework, hypotheses of this study are in Table 1:

Table 1.

Hypotheses.

3.2. Definitions and Items

The definitions of variables are interpreted and measured for the purpose of identifying the concept of variables in the investigation. The definitions of the variables and the items in the questionnaire of this study are as follows.

3.2.1. Antecedents of Physical Trust and Mobile Trust

In this study, the antecedents of physical trust (OFFT) and mobile trust (ONT) are explained as the variables that affect and strengthen the level of physical trust and mobile trust when customers are using the issuing bank services and the payment platform. The antecedents of physical customer trust and mobile customer trust that are investigated in this study include corporate reputation (CR), perceived risk (PR), perceived quality (PQ), and structure assurance (SA).

Corporate reputation in this study is explained as the customers’ belief about the issuing banks’ status and their impression of the prestige. The items regarding corporate reputation are adapted from the studies of Doney and Cannon [54], Harrison McKnight et al. [29], and Keh and Xie [66].

Perceived risks are described as unfavorable experiences with bank services and uncertain mentality with using payment platform by the customers, who may have negative emotions from the preceding experience. This perceived risk may affect customers’ future willingness to use. The items regarding perceived risk are adapted from the studies of Dholakia [72] and Harrison McKnight et al. [89].

Perceived qualities are defined as reliable and dependable services from the issuing banks as well as the mobile payment platform that may further increase customers’ ease of use. The items regarding perceived qualities are adapted from the studies of Corbitt et al. [76] and Harrison McKnight et al. [89].

Structure assurance is determined as consumers’ feeling relief from using the payment platform due to its high security and their willingness to process financial transactions without hesitation. The items regarding structure assurance were adapted from the studies of Wu et al. [93], Chandra et al. [7], and Harrison McKnight et al. [89]. Table 2 lists the variables and the relevant questionnaire items.

Table 2.

Items of the antecedents of customer participation.

3.2.2. Physical Customer Trust and Mobile Customer Trust

Customer trust is explained as the confident belief that customers have obtained from two different channels (physical and mobile) when receiving financial services or transactions. Customer trust in the financial procedures means that the expectation they are concerned about is met. If the physical bank and the mobile payment platform are trusted to function well according to the expectation, the customer may be willing to take advantage of the platforms. Especially on the mobile payment platform, it may reinforce the customer belief. The items in this study (see Table 3) that focused on the physical and the mobile mechanism are adapted from Harrison McKnight et al. [89] and Wu et al. [93].

Table 3.

Items of customer trust.

3.2.3. Physical Customer Loyalty and Customer Mobile Loyalty

Customer loyalty is described as the engagement of the customer who participates in the financial procedures with the particular platform. More positive attitudes toward the physical bank and the mobile payment platform increase the behavioral intention to use it. No matter the attitudinal or the behavioral adoption intention of both channels (the physical and the mobile payment platform), the stickiness of the customer will maintain faith to the physical and the mobile payment platforms. The related items (see Table 4) regarding customer loyalty are adapted from the studies of Chandra et al. [7] and Hong and Cho [29].

Table 4.

Items of customer loyalty.

3.3. Sample and Data Collection

This research collects data through paper-based and web-based questionnaires. The questionnaires are surveys for those people who have experience in using the banking services and in using mobile payment platforms when processing payment for goods or services. The survey was primarily handed out to students studying at universities and graduate schools in Taiwan, ROC. Data were collected from 4 February 2020 to 10 April 2020. In total, 445 web-based questionnaires and 74 paper-based questionnaires were distributed, and all entries were returned (a return rate of 100%). Out of 519 questionnaires 353 were valid (68% valid rate).

3.4. Questionnaire Design

The study adopted the 5-point Likert scale for measuring and analyzing the degrees of the variables (1 = Strongly Disagree, 2 = Disagree, 3 = Neutral, 4 = Agree, 5 = Strongly Agree). As noted earlier, all questionnaire items were designed and constructed. All items were originally written in English; however, they were translated one by one into Chinese to avoid any language interference when participants read the details and determined their responses to the surveyed items.

The questionnaire is composed of two sections. The beginning section documents the participants’ basic information and their experience of using banking services and payment platforms, and the second section contains the main study questions containing the aforementioned items.

3.5. Analysis Method

This study applied statistical analysis software LISREL to analyze the data collected from both the physical paper and mobile questionnaires. On the whole, this study analyzed the data in descriptive statistics, tested reliability and validity, correlation, and also used SEM (structural equation modeling). Quantitatively, this study investigated the hypotheses proposed in the preceding section.

3.5.1. Reliability and Validity

Reliability refers to the repeatability of the survey data collected. If the questionnaire was issued once again, the results of the responses should be approximately the same. This research utilized the Cronbach’s Alpha and composite reliability (CR) to verify the reliability of the survey results. In general, the higher the value of Cronbach’s Alpha, the greater the correlation between the factors. Specifically, Nunnally [95] pointed out the value of Cronbach’s Alpha should surpass 0.7 to ensure that the survey results are reliable. For CR, Fornell and Larcker [96] indicated that the value should exceed 0.6 to reflect that the items are acceptable.

Validity describes the believability and correctness of the survey findings. Whether the data are authentic and credible is important, as they are used for further structural analyses. This research applied the factor loading and average variance extracted (AVE) to test the convergence validity of the questionnaire results. In detail, Fornell and Larcker [96] suggested that factor loading and AVE are both expected to reach over 0.5 to show the validity of survey results. Furthermore, the correlation coefficient between two constructs is less than the square root of the AVE, indicating that there is discriminant validity between two concepts. We will further analyze the eight facets (physical trust, mobile trust, physical loyalty, mobile loyalty, corporate reputation, perceived risk, perceived quality, and structure assurance) proposed in this study.

3.5.2. Structural Equation Modeling (SEM)

Structural equation modeling (SEM) is a multivariate statistical analysis. This technique is used to analyze, estimate, and verify the relationships between different variables (e.g., measured variables and latent constructs). SEM is also referred to as causal modeling, regression modeling, analysis of covariance structures, path analysis, or confirmatory factor analysis [97,98].

This study applies the SEM analysis method via the path analysis to find out whether there is a correlation between variables. Using the statistical software LISREL, the model was examined to discover evidence to show whether the hypotheses set for the research are supported.

To test whether the antecedents positively influence the enhancement of customer trust towards customer loyalty, the impact between trust and loyalty, and the transfer results of physical and mobile side of trust and loyalty, the analysis method of Bagozzi and Phillips [99] is applied in this research. Examining the high and low effects of the antecedents, they found the difference between the two models by investigating whether there is a significant inequality of the chi-square between them (a difference of 3.84 is needed for a degree of freedom of 1 between them to make the antecedents significant). This method is applied to four antecedents (corporate reputation, perceived risk, perceived quality, and structure assurance) investigated in this study.

4. Data Analysis and Empirical Results

4.1. Reliability and Validity Analysis

This study analyzes the reliability of the survey results by using the Cronbach’s Alpha and composite reliability (CR) and the validity via factor loading and average variance extracted (AVE). When the items of the questionnaire are reliable, it means that they have internal consistency. When the materials are convincing and the investigation outcomes are credible and trustworthy, the content can be considered highly valid. Furthermore, some wording has been replaced to improve responses to fit in with the research.

4.1.1. Cronbach’s Alpha

Cronbach’s alpha is a method of analyzing internal consistency and correctness of the construct when the items are put together in the questionnaire. Nunnally [95] determined that a standard for the Cronbach’s Alpha value should be over 0.7 in order to be acceptable. Hair et al. [100] pointed out the coefficient between 0.7 and 0.8 indicates the items are highly reliable; however, if the coefficient falls below 0.35, the items should be rejected. Overall, as the table has shown, the Cronbach’s Alphas are all acceptable, meaning that the reliability in this study has internal consistency and correctness.

4.1.2. Composite Reliability (CR)

The composite reliability (CR) is an alternative to Cronbach’s Alpha. It is an indicator of the shared variance among the observed variables used as an indicator of a latent construct [96]. The test results can be regarded as the difference of the measurement error, meaning that if the reliability is high the difference between measurement error does not exist and it will show that CR value has high correlation with the measurement items. According to Fornell and Larcker [96], the CR value should be above 0.6 to ensure the acceptability of the collected data. In this study, analysis of each factor has a value higher than the suggested level of 0.6, therefore, hold composite reliability. The formula of calculating the CR is listed in Equation (1).

CR = (∑loading)^2 ÷ [(∑loading)^2 + ∑error]

4.1.3. Average Variance Extracted (AVE)

The average variance extracted (AVE) is a measurement of validity proposed by Fornell and Larcker (1981). The value is measured by the amount of variance that is captured by the structure relative to the amount of variance due to measurement errors. AVE can examine whether there is convergent validity and discriminant validity. If the AVE value is high, then the latent variables have high validity and convergent validity. In addition, it is suggested the AVE should be above 0.5; the results of each construct described in Table 5 reveals that the values are higher than suggested level of 0.5, except the AVE of perceived risk is lower than the suggested level of 0.5. The formula of measuring the AVE is shown in Equation (2).

AVE = ∑〖loading〗^2 ÷ [∑〖〖loading〗^2 + ∑error〗]

Table 5.

Results of factor loading analysis and reliability and validity analysis.

4.1.4. Factor Loading

Factor loading is used to examine variability, which is defined as the relationship between each different variable and the underlying factor. The size of factor loading represents the measured items of each construct are only influenced by one factor. Fornell and Larcker [96] pointed out that the acceptable value should be over 0.5. The extraction of each construct is shown in Table 5; all the values are higher than the acceptable value.

4.2. Research Hypothesis Testing

This study adopted LISREL to test 353 valid data in order to examine whether each hypothesis is supported. The results are shown in Table 6.

Table 6.

Path analysis.

According to the results, H1 is supported as physical trust will have a positive effect on mobile trust (β = 0.355, CR = 4.838). Furthermore, in terms of variables of trust toward loyalty, H2a and H2b are represented in the same direction, which affirmed that physical trust is positively related to physical loyalty and mobile trust is positively related to mobile loyalty (β = 0.885, CR = 15.003) (β = 0.763, CR = 10.731), thus H2a and H2b are supported. Additionally, H3 is supported because physical loyalty will have a positive effect on mobile loyalty (β = 0.290, CR = 4.102). The positive relationship between corporate reputation and physical trust in H4 is also supported (γ = 0.289, CR = 6.818). H5a and H5b are indicated in the same direction, which means that perceived risk will have a negative effect on physical trust and mobile trust. However, the result has shown that H5a is not supported (γ = 0.019, CR = 0.550); in contrast, H5b is supported as the path is significant (γ = 0.289, CR = 6.818). Subsequently, H6a and H6b state that affirmed perceived quality will have a positive effect on both physical trust and mobile trust, yet the evidence shows the opposite result, as H6a is supported (γ = 0.662, CR = 10.929) but H6b is not supported (γ = 0.166, CR = 1.526). Structure assurance have a positive influence on mobile trust (γ = 0.459, CR = 6.637); therefore, H7 is supported.

4.3. SEM Analysis

This study will execute the confirmatory factor analysis (CFA) by estimating the model fitness throughout LISREL (LInear Structural RELations) for verifying the structure of the items. The CFA was done for the all the variables and the whole study structure framework and also antecedents for the enhancement of customer trust towards customer loyalty, including the transfer of physical trust toward mobile trust and physical loyalty toward mobile loyalty. The results of the model fitness for this study are shown in Table 7.

Table 7.

Model fitness.

4.4. Summary of the Research Hypothesis Testing Results

The results of research hypothesis testing are shown in Table 8. Eight of ten research hypotheses are supported.

Table 8.

Summary of the hypotheses.

5. Conclusions and Discussions

There are various implications of the study identified from the researcher, managerial, and service provider perspectives. The need is to integrate the mobile payment eco-platform to facilitate consolidation among multiple service providers, including physical banks. There could be emerging issues more related to trust, loyalty, and perceived risk as the rate of usage and volume of transactions expands over time.

The ten proposed hypotheses in this study are examined for the four antecedents that have either positive or negative influences on physical and mobile trust. Significant relationships exist between the variables of trust and loyalty. The internal transition of physical trust and mobile trust and physical loyalty and mobile loyalty also show significant relationships between the same variables. As much of the existing literature has focused more on the mobile context of the mobile payment, few of the studies have put attention on the physical context as it also relates to the mobile payment [1,3,7,8]. Obviously, it extends prior research on trust and loyalty that has examined a single dimension of trust and loyalty, which is rather limiting [101]. By considering multiple dimensions of trust and loyalty, this study reveals multiple routes through which banks can build trust and loyalty. In general, customers’ responses significantly vary due to the co-existence of offline and online platforms operated by banks. This study has shown that it operates in two different ways. Therefore, the aspects of our study extend prior research to discuss two constructs of trust and loyalty in accordance with different customers’ behaviors, which do not exist in the literature and enrich the existing literature [101]. This study is focused on both physical and mobile environments and further research in this field obtain benefits from this study and may further adopt the value of cross-context fields.

Analysis of this study has found that most of the null hypotheses can be rejected, apart from the perceived risk towards the physical trust and the perceived quality towards the mobile, which cannot not reject the null hypotheses. Both trust from the physical and mobile contexts positively influence loyalty in the same context as trust does. Customer trust and loyalty from physical to mobile have a positive effect between the physical and mobile environment. Additionally, corporate reputation and structure assurance have positively affected physical trust and mobile trust, respectively. Furthermore, even though perceived risk has negative influences on both physical and mobile trust in the hypotheses, nevertheless, the empirical evidence has shown that perceived risk has no significant effect on the physical trust. Perceived quality has a positively effect on physical trust; however, it did not have a significant influence on mobile trust.

The main purpose of this study was investigating customer trust, loyalty, and perceived risk from physical and mobile platforms of issuing banks and mobile payments because mobile payments platforms are a relatively self-service technology. The goal is to create an eco-platform to facilitate transition from a cash-based economy to a cashless economy. An entirely new business model disrupts the traditional cash-based payment model and take advantage of the trends emerging in massive penetration of smart phones and ubiquitous access to mobile Internet. Trust is an indispensable and intangible factor among relationships between human beings and organizations. While the combination of entity and virtual has been utilized in various categories of technology, customs have not been committed to the virtual mode due to the uncertainty of technology. Therefore, trust is the driving force that plays a major part in the cross-context of economic platforms. Furthermore, in technology adoption literature, trust issues and risk perception are probable hindrances in consumer adoption of mobile payments. Trust in mobile payment operators is extremely important. Their reputation and brand name assure customers and minimize the risks involved in mobile payment.

Trust can serve as an informal control mechanism to reduce friction and opportunistic behaviors, encouraging future transactions, and help build long-term relationships. For diffusing mobile payment services, it is crucial to investigate how consumers develop mobile payment trust. Researchers and industry should use multiple perspectives to fully understand the formation of consumer trust transferring from physical banks to mobile payment. For example, structural assurance, as a type of institution-based trust, refers to safeguards such as regulations, laws, and guarantees that make the customer feel safe to make mobile payments. It helps to reduce uncertainties associated with technology disruption during the transaction process.

5.1. Physical Trust, Mobile Trust, Physical Loyalty, and Mobile Loyalty

According to the statistical analysis results, physical trust has a significant effect on mobile trust in terms of the different environments of the physical card issued by the bank and the virtual card embedded in the payment platform. The trust is mostly based on the same brand in a physical firm to a mobile business. In this study, we believe trustworthy services provided by the bank will induce customers get a physical credit card from the issuing bank; further, when using mobile payments, they will tend to embed that specific virtual credit card on the platform that customers are willing to trust. In addition, because users have faith that the issuing bank they have used will do the right things, the physical credit card that the bank issued will be able to transfer to the virtual one and be embedded in the mobile payment platform. Customer reliance will also transfer to the mobile environment and they will trust the trading contract and the trading process on the payment platform. Further, as we noted above, customer trust from the physical context will have an effect and transfer to the mobile context from the findings of the research.

In addition, physical trust has positively and significantly influenced loyalty in the physical context, and mobile trust has positively affected mobile loyalty in the same way. As numerous preceding studies have shown the effects of trust toward loyalty in certain services or the products, customers who tend to have a positive attitude and willingness to use the service or the product, further, recommend their own positive views on services or products to others. Having outlined the relationship between trust and loyalty, we then address the application of the physical credit card and the mobile credit card. From the physical bank, customers with trust and confidence toward the physical credit card may further trust other services, including services of employees or accounting services the issuing bank provides. With regard to the customer, service from the bank staff is the profound expression of the bank, thus, attentive and considerate attitude toward consumers is one of the key factors that draw them to use the services. From another point of view, customers will also pay close attention to the accounting services the issuing bank provides, such as credit card services, discounts, or e-banking transactions. Therefore, perfect and sound accounting services will also attract users, who will further recommend the issuing bank to people around them through word of mouth.

The complete and immediate service of the virtual credit card will enhance reliance on the payment platform. The mobile trust for the platform is determined by its stability and immediacy regarding the transaction process. With respect to the user, who believes the virtual card will provide immediate transaction on the payment platform, they will tend to use the payment platform repeatedly and will not readily switch to another payment platform. Therefore, when users are accustomed to using the mobile payment platform, the mobile trust will positively influence the mobile loyalty of the payment platform. Furthermore, it also increases users’ stickiness on the platform itself.

Based on the statistical analysis outcomes, physical loyalty to the physical credit card can positively affect mobile loyalty to the virtual credit card. Physical trust has a significant influence on mobile trust. It was noted that the halo effect will play a part in two different attributes, and providing a multi-channel of services will enhance customers’ or users’ loyalty. In this study, when customers have loyalty for the physical issuing bank, they will be prone to use the physical credit card that the bank provides. Simultaneously, owing to the virtual credit cards embedded in the payment platform, the effect will transfer to the mobile payment platform. As -noted above, the physical credit card is able to transfer into the virtual one and embed in the mobile payment platform and link two different environments together; the customers or the users are able to carry out a transaction on the mobile payment platform through their cards. In the meantime, due to the habit and orientation the customers or the users have for certain mobile payment platforms, the mobile loyalty toward the platform will be influenced by the loyalty toward virtual credit cards. Furthermore, the physical trust will have a significant and positive influence toward the physical loyalty, and it also has a positive result transfer toward the mobile trust. There is evidence to prove that there is a transformation from physical loyalty to mobile loyalty.

5.2. Corporate Reputation, Perceived Risk, Perceived Quality, Structure Assurance, and Physical Trust and Mobile Trust

For the other four antecedents of physical trust and mobile trust, as this study noted earlier, corporate reputation is a criterion that evaluates the level of trustworthiness of a potential trustee, as customers will tend to use the issuing bank of the physical credit card, which has high recognition due to the status in the market, and the corporate reputation will be deeply rooted in their heart. Believing the bank that they have used will be responsible in the financial services and establish the moral standard, customers will trust the value of the bank. As the high attention or influence of the bank among the financial market will affect the economic pulse of the entire financial industry, further customers will be prone to entrust their confidence on the physical bank as a result of status and further use the services of the physical credit card.

The evidence shows that perceived risk does not have significant influence on physical trust. Because physical credit cards of issuing banks have been in the market for a long history, brand trust can lower risk perception in a physical environment, customers have ingrained knowledge of physical credit cards, and they do not have concerns about its services or even mode of operation. Customers feel more relieved by means of using the actual cards because its services are more familiar with to them. Therefore, they are willing to use the service of the physical credit card when they are conducting transactions. In contrast, the consequence of the analysis of perceived risk to mobile trust is similar to literatures as referred to in the earlier paragraph, which had noted that customers have concerns about the reliability or the resistance mentality toward unfamiliar objects. As perceived risk affects the level of mobile trust in terms of the usage of the users, they are not willing to use the virtual credit card on the mobile payment due to certain apprehensions. Consequently, anxiety caused by perceived risk will lead to diminished customer reliance of the mobile payment platform.

It is demonstrated by survey results that the advantage of perceived quality providing positive outcomes toward the physical trust is in accordance with the study, which had elaborated that service quality is derived from customer expectation of certain performance [84]. Perceived service quality stands by impacts on the physical trust as the bank provides fine quality with its physical credit card services. Customers will look forward to the quality while they are using the card services, especially the service platform construction. On account of the point of attentiveness to physical services, consumers will take notice of its completeness and immediacy. Further, their perception on the service quality will have an impact on the reliance of the physical credit card and further toward the issuing bank. Moreover, the result of the analysis of perceived quality has no positive effect on the mobile trust. For users, platform quality of virtual credit cards on the payment platform do not influence their attitude and trust. The consequences are inconsistent with literature due to two reasons: possible one is that the lack of samples may cause an insignificant outcome, and twos that currently advances in technology make users consider that maintaining the quality of the platform and the function of the card is a basic ability, thus, it did not enhance users’ confidence of the virtual card on the platform. Therefore, perceived quality did not positively affect mobile trust on payment platforms.

Finally, the outcome demonstrates that the factor of structure assurance has a direct effect on mobile trust in line with the literature that had discovered the structural assurances have a significant influence on parties involved in financial transactions via mobile channels [91]. Employing the theories to examine the influence of the structural assurance on mobile trust, it shows that mobile payment platform users will perceive security and privacy when the virtual card provides sound protection mechanism to users. Thus, it will further cause them to build their confidence in the payment platform. When they are accustomed to deal with the financial transaction with the virtual card on the payment platform, it will enhance their mobile trust toward platform of the virtual card and the platform.

5.3. Managerial Implications

The way of payment has been changed in the recent years; people have turned the physical payment method into the virtual payment method. The main reason is that customer trust from the side of virtual payment has been strengthened by the advancement of technology, including the perfect service level or the sound platform of the credit card embedded on the payment platform. In this study, we also take certain factors into consideration in order to further explore the transfer impact of physical to mobile payments, which is not discussed in past research.

In the line with the research results, we have several practical suggestions to both physical and mobile payment providers. To start with, physical issuing banks should put more effort into enhancing customer trust of its credit card services, involving benefits from purchasing, experience using counter services by the staff, or even the problem of credit card fraud. Once customers have the confidence of bank services, it is important for retaining the customer by means of aiming their target customers and providing suitable services for the purpose of strengthening their loyalty. Likewise, from the mobile perspective, payment platforms should pay more attention to customer trust of its overall virtual credit card payment platform service, including secured transactions, virtualization of various services on the platform, and feedback on consumer spending. For the purpose of attracting more users, the payment platform provider should collaborate with more issuing banks and service providers in order to create a more integrated eco-platform.

The significance of this study is threefold. First, although physical and mobile payment integration has been recognized as a beneficial strategy [102,103], empirical studies on the determinants of loyalty on banks are lacking. As customers’ payment choices exist in the physical and mobile model, examining online and offline integration in the payment context contributes to the deep understanding on this field and their consequences. This study is the first attempt to integrate platform management, electronic marketing (online trust and online loyalty), and relationship marketing (offline trust and offline loyalty) in one model. This model concentrates on antecedents that customers perceive that facilitate the realization of trust and loyalty. Second, the strengthening between online and offline platforms happens once banks integrate both online and offline platforms. Customer evaluations of their credit card experience provide the momentum to move them to the mobile platform and influence their evaluations incrementally. Therefore, if banks want to build physical loyalty towards the bank and mobile loyalty towards the payment platform, then they should enhance customers’ physical trust towards the bank and mobile trust towards the payment platform. Efforts to build higher trust will convert into higher loyalty. Meanwhile, we suggest that while customers keep consistency in their beliefs and attitudes, they will transfer their attitudes of the bank to the mobile payment. Thus, banks can leverage their banking presence by exploiting reinforcement effects between the bank and mobile payment, such as the positive effect of physical trust towards the bank on mobile trust towards the payment platform and physical loyalty towards the bank on mobile loyalty towards the payment platform. In other words, they can increase mobile loyalty towards the payment platform by enhancing trust towards the payment platform and stimulating physical loyalty towards the bank. Accordingly, we strive for understanding the reinforcement between trust and loyalty of different platforms. The payment experiences that customers obtain from one channel will spread to other ones [59]. Third, exploring determinants of loyalty across different platforms should provide banks with insights into this important subject. This knowledge enables managers to thoroughly coordinate efforts across online and offline platforms to maximize the effectiveness of payment arrangements. Understanding how to manage payment model will result in nurturing deeper customer relationships with banks [104].

In addition, as the analysis of this study shows, corporate reputation and perceived quality would enhance the level of customer trust toward the physical issuing bank. A favorable reputation of the issuing bank will induce customers to use other services, not just the credit card services, and increase the customer trust of the issuing bank. For instance, the issuing bank should protect the rights and interests of financial consumers; it is the indispensable duty of the bank and an objective requirement for improving its own business development level. In terms of the perceived quality, the bank could strengthen service awareness by cultivating good service attitude and consciously improve customers experience by providing multiple service contents. In this case, due to good reputation and perfect perceived quality, the issuing bank will gain more users and increase reliance from them rapidly.

Mobile payment providers should pay attention to customer perception of platform risk and the structure assurance of the transaction platform. For further explanation, when the virtual credit card embeds on the platform, users will be affected by the risk of the platform directly. When consumers think they lack product knowledge, they will refuse to accept the new payment method, instead maintaining tradition ways. Thus, the mobile payment provider could put more effort toward simplifying payment operation mode to further reduce users’ doubts and make ease of use about the payment platform. Our findings revealed that the structure assurance plays an essential role on the mobile payment platform. Users may have certain concerns including the transaction procedure and the safety of their personal information. Platform providers should establish a secure and private environment for users. For instance, they could provide a transparent method to let users come to understand the encryption mechanism of the payment platform or the authentication of the security platform. Wherefore, as a result of the protecting users’ transaction on their virtual credit card through the mobile payment platform, they can lower their anxiety concerning the mobile environment.

For the purpose of achieving the goal of a cashless society, the issue of people’s trust has received considerable critical attention to be discussed. With the above information of this study, entity and virtual payment providers could figure out what factors are relatively considerable in their service procedures and come up with suitable solutions for their target customers and users and further increase their trust and loyalty. Moreover, payment providers could collaborate with multiple merchants to launch more convenient and preferential services to draw consumers and assimilate mobile payment into their daily lives for increasing trust and decreasing risk from using the payment service. By identifying what aspects will promote the reliance from consumers and then taking further steps to improve it, our society will reach the objective of cashless society rapidly.

5.4. Limitations and Suggestions for Future Research

The empirical results reported herein should be considered in the light of several limitations. The first is the collected questionnaires are non-random, as the respondents are mostly students and young people; therefore, there may be differences with regard to the pre-factors they valued. The second limitation is that the questionnaire was delivered to participants mainly through the Internet. It may neglect the results of those respondents who might not be accustomed to using mobile payment and resulting in the response of customer trust and customer loyalty, and it may let slip the potential customers who are not willing to fill in the mobile survey. Third, regional restrictions should also be considered because merchants who collaborate with mobile payment are mostly in urban areas, thus, data collection may lead to incomplete consequences. The fourth limitation is that most of the research about trust transfer and loyalty transfer was from the intra-context of merchant in the past; nevertheless, this study is involved with disparate merchants and concern the credit card as the medium for physical issuing bank and mobile payment platform. For the reason that there may not be adequate literature on the research structure. As far as influence factors are concerned, promotion may be essential to customers attitude and behavior on mobile payment. When there are new preferential schemes, some customers may shift to other payment platforms; there may be no loyalty to them at all as a consequence.

For future research, owing to the advance in the technology, Internet-only banking has expanded in recent years. Although it still provides physical credit cards and other services for users, however, the business model is very different from that of physical banks. Therefore, researchers may figure out some different influences on the issues under investigation and discussion. Furthermore, different cultures of people may have different levels of trust toward the payment platform based on of usage habits. For instance, the penetration rate of mobile payment of Britain and China is much greater than that of Taiwan; hence, people may have less risk or other attitudes on payment platforms. Last but not the least, this study has four pre-factors for the trust (corporate reputation, perceived risk, perceived quality, structure assurance). Subsequent research may add different variables to keep up with the times that have effect on the relationship for the level of customers trust for more outcome of the research.

Author Contributions

Conceptualization, B.-C.S., L.-W.W. and Y.-C.Y.; methodology, B.-C.S., L.-W.W. and Y.-C.Y.; software, Y.-C.Y.; validation, B.-C.S., L.-W.W. and Y.-C.Y.; formal analysis, B.-C.S., L.-W.W. and Y.-C.Y.; investigation, B.-C.S., L.-W.W. and Y.-C.Y.; resources, B.-C.S., L.-W.W. and Y.-C.Y.; data curation, B.-C.S., L.-W.W. and Y.-C.Y.; writing—original draft preparation, B.-C.S., L.-W.W. and Y.-C.Y.; writing—review and editing, B.-C.S. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Informed consent was obtained from all subjects involved in the study.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Dennehy, D.; Sammon, D. Trends in mobile payments research: A literature review. J. Innov. Manag. 2015, 3, 49–61. [Google Scholar] [CrossRef]

- Leong, C.M.; Tan, K.L.; Puah, C.H.; Chong, S.M. Predicting mobile network operators users m-payment intention. Eur. Bus. Rev. 2020, 33, 1–23. [Google Scholar] [CrossRef]

- Liébana-Cabanillas, F.; Singh, N.; Zoran, K.; Carvajal-Trujillo, E. Examining the determinants of continuance intention to use and the moderating effect of the gender and age of users of NFC mobile payments: A multi-analytical approach. Inf. Technol. Manag. 2021, 22, 133–161. [Google Scholar] [CrossRef]

- Loh, X.M.; Lee, V.H.; Tan, G.W.H.; Ooi, K.B.; Dwivedi, Y.K. Switching from cash to mobile payment: What’s the hold-up? Internet Res. 2021, 31, 376–399. [Google Scholar] [CrossRef]