2.1. The Effect of CER Based on Innovation Offsets

The relationship between CER and TFP remains a central controversy in environmental economics. International studies grounded in the “innovation offsets” by Porter and Linde [

1] contended that well-designed environmental regulations spur technological innovation, thereby enhancing resource allocation efficiency. Dechezleprêtre and Sato [

19] demonstrated this mechanism in their analysis of the U.S. Clean Air Act, where regulated firms achieved TFP growth through energy efficiency improvements while simultaneously stimulating R&D innovation within affected industries. Furthermore, Wu et al. [

20] suggested that technological innovation indirectly enhances environmental performance by improving operational efficiency. Distinct organizational resources and capabilities can lead to superior corporate ecological performance [

21]. Meanwhile, the adoption of enterprise risk management (ERM) not only contributes to enhancing organizational legitimacy and fostering positive stakeholder relationships but also promotes green growth within organizations [

22]. However, scholars such as Gray and Shadbegian [

9] presented counterevidence: their study of the U.S. paper industry reveals that environmental compliance costs directly crowd out productive investment, leading to measurable TFP declines. This critique is further reinforced by Acemoglu et al. [

23], whose endogenous growth model indicates that when clean technologies yield lower returns than conventional alternatives, emission reduction triggers “transitional productivity losses”. Additionally, Cainelli et al. [

24] observed that environmental motivation exerts an insignificant or even negative impact on labor productivity growth in specific service sectors in the short term, which appears inconsistent with the Porter effect. Consequently, the drivers of capital efficiency and eco-efficiency may not always be entirely aligned [

25].

China, as the world’s largest carbon emitter, exhibits unique complexities in the CER-TFP relationship. On one hand, heterogeneous policy-industry interactions yield divergent outcomes. Cheng and Meng [

26] demonstrated that China’s carbon emissions trading policy suppresses listed firms’ TFP primarily due to heightened compliance costs. In contrast, Wu and Wang [

27] identified a persistent positive causal relationship between carbon emission prices and TFP, mediated by increased investments in R&D patents and financing. Sectoral analyses further reveal differential impacts. Ge et al. [

28] confirmed that environmental regulations enhance manufacturing (secondary sector) productivity while inhibiting TFP in agriculture (primary sector) and services (tertiary sector). Yet counterevidence emerges from Pan et al. [

29] and Yang and Zhang [

30], who documented significant TFP gains in carbon trading pilot firms through market-based incentives. This dichotomy is ultimately reconciled by Cheng and Kong [

31], whose integrated environmental policy portfolio framework demonstrates that technical innovation enables environmental regulations to stimulate green TFP growth. The observed divergence is attributable to policy instrument designs: administrative mandates tend to trigger compliance costs, whereas market-based instruments more effectively induce innovation and resource reallocation [

28]. On the other hand, firm-specific technological capacity constitutes a critical threshold. Li and Cheng [

32] revealed that technology-intensive manufacturers in China achieve higher total-factor carbon efficiency, while Cheng and Kong [

31] and Wang et al. [

33] jointly established that technological progress and industrial structure upgrading accelerate TFP growth. These patterns align with European evidence where emissions trading systems stimulate low-carbon innovation and productivity in frontier firms [

34,

35], though China’s transformation likely incurs heightened transition costs.

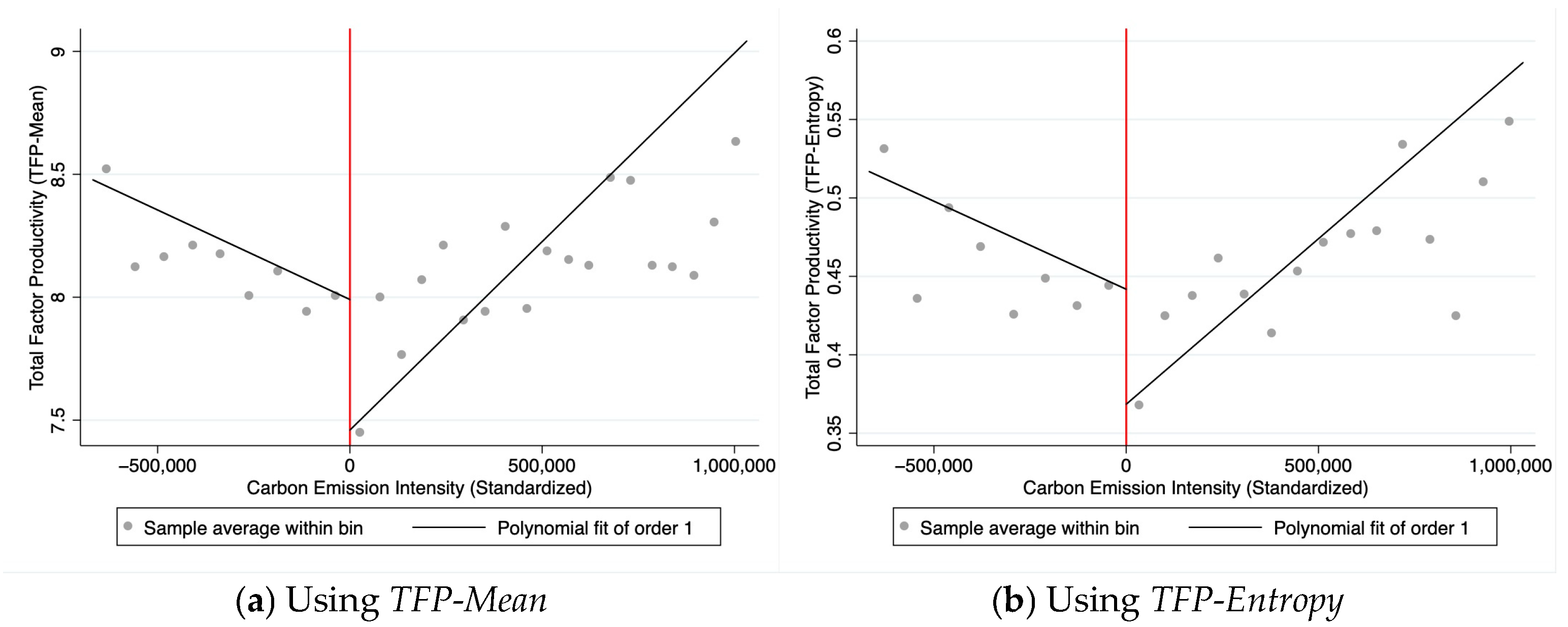

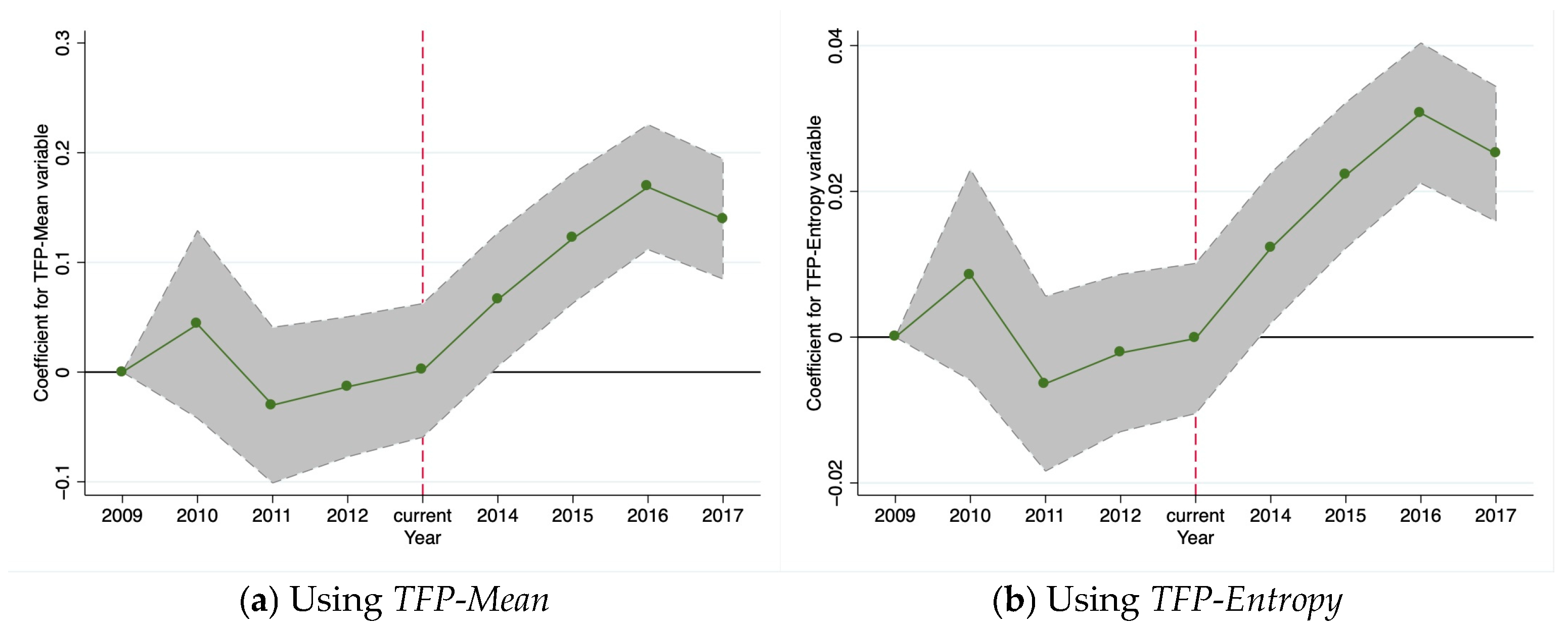

Current research exhibits three critical gaps. First, endogeneity concerns in the CER-TFP relationship remain inadequately addressed. Hasanov et al. [

36] posited that high-TFP firms may proactively reduce emissions, suggesting potential reverse causality rather than CER driving productivity gains. Mukhtarov [

37] further identified concurrent negative impacts on carbon emissions from TFP, renewable energy adoption, and export activities. Zhong and Wang [

38] demonstrated an inverted U-shaped curve linking forestry TFP to carbon emissions, while Yang et al. [

39] confirmed that industrial structure upgrading and green TFP development jointly suppress carbon emissions. Second, insufficient attention is paid to heterogeneity across firm sizes and industries, with extant studies lacking rigorous causal identification strategies. For instance, Liu et al. [

40] merely discussed sectoral and ownership-type variations. Third, conventional TFP measurement approaches fail to capture the technological essence of CER impacts. Li and Li [

41] attributed this to inherent methodological flaws in traditional techniques, which generate inconsistent estimates and underscore the imperative of selecting appropriate productivity metrics. This study’s Hypothesis 1 aims to transcend these limitations by leveraging Chinese firm-level microdata to verify the causal effect of CER on TFP, thereby revealing boundary conditions for Porter Hypothesis applicability across heterogeneous enterprises under alternative measurement frameworks. Based on the theory of innovation offsets within the Porter Hypothesis, we propose the following first hypothesis:

Hypothesis 1. CER is positively related to TFP in Chinese firms.

2.2. Moderating Effect of Ownership Structures Based on Agency Cost Theory and Upper Echelons Theory

The moderating role of ownership structures in the CER-TFP relationship is emerging as a frontier in interdisciplinary research bridging corporate governance and environmental economics. International scholarship primarily advances along two theoretical paths: agency cost theory and upper echelons theory. First, building on the agency cost theory by Jensen and Meckling [

7] and Ang et al. [

42] ownership concentration is shown to shape long-term strategic orientation. Azimi et al. [

43] confirmed that the ownership structure exerts nonlinear effects on aggregate enterprise productivity growth. Complementary evidence from Ben-Amar and André [

44] indicated that dispersed ownership structures entail lower agency costs without detrimental performance impacts. Hill and Snell [

45] further established that ownership configurations directly and indirectly influence productivity through diversification strategies, R&D expenditures, and capital intensity. Second, leveraging Hambrick and Mason [

12]’s upper echelons theory, Shahab et al. [

46] demonstrated that executive characteristics filter environmental decisions through cognitive lenses. However, the development of agency theory has not been limited to this perspective; incentive compatibility mechanisms also create possibilities for achieving organizational objectives [

47]. Modern corporate governance mechanisms are designed to reduce agency costs and align managers’ interests with the long-term value of shareholders. Consequently, a revised agency perspective centered on incentive compatibility has emerged [

48]. Hindley [

49] observed divergent managerial behaviors following ownership-management transitions, while Cheon et al. [

50] revealed that ownership restructuring enhances TFP. Mnasri and Ellouze [

51] confirmed the pivotal role of family-controlled firms in boosting productivity, thereby strengthening the CER-TFP relationship. Contrastingly, Wang et al. [

52] cautioned that excessive fiscal decentralization among shareholders heightens resistance to environmental regulation implementation. Furthermore, Shahrour et al. [

53] suggested that higher CEO ownership is associated with lower commitment to carbon reduction goals, yet adversely influences carbon disclosure decisions [

54]. Claessens et al. [

55] specifically documented that the separation of ownership and control proves most pronounced in family-controlled enterprises and smaller firms within Asian economies.

The moderating mechanism of ownership structures in Chinese enterprises exhibits a unique three-dimensional characterization: chairman shareholding ratio, manager shareholding ratio, and the separation ratio between ownership and control rights. While international research has addressed the generic role of ownership concentration [

56,

57], analyses remain insufficient regarding the distinctive corporate governance context in China. Focusing on the Chairman’s shareholding dimension, Lu et al. [

58] revealed that power centralization may elevate decision-making risks but simultaneously enhances procedural efficiency. Complementary evidence from Chiang and Lin [

59] indicated that smaller boards experience fewer bureaucratic impediments, thereby improving functional productivity. Managers shareholding restructures managerial behavior through incentive alignment and executive characteristics. Bulan et al. [

60] confirmed that CEO’s emolument sensitivity to stock options relates with productivity positively. However, Shahrour, Arouri, Tran and Rao [

53] demonstrated that CEOs with substantial ownership stakes (5–10%) exhibit the strongest propensity to deprioritize CER. Contrastingly, Sun et al. [

61] established that equity incentives positively moderate the relationship between CEO stability, TFP, and green innovation. Shen [

62] further identified that CEOs’ overseas experience enhances the TFP-boosting effect of ESG performance. Nevertheless, these effects are significantly constrained by ownership–control separation in Chinese firms. Current empirical research on control rights’ efficiency implications faces methodological challenges due to complex ownership patterns [

63]. Boubaker et al. [

64] substantiated that excessive control rights suppress production efficiency, while Kim and Na [

65] observed improved social-environmental ratings when ownership–control divergence widens post-merger. Sun et al. [

66] documented positive associations between family ownership/control and ESG scores, though market competition negatively moderates this relationship.

Existing research exhibits three critical limitations. First, ownership structure is conducted in relatively isolated dimensions. Most literature exclusively examines isolated ownership indicators—primarily focusing on family holdings, largest holdings, and concentrated ownership [

67,

68,

69]—while neglecting interactive effects between Chairman and manager shareholdings. When Chairman ownership is high, but manager ownership remains low, strategic decision–execution misalignment may undermine emission reduction efficiency. Second, moderating pathways remain ambiguous. How ownership structure transmits corporate governance effects to emission technology choices (e.g., end-of-pipe treatment vs. source innovation) has yet to be clarified. While Alfi et al. [

70] identified a positive relation between board size and carbon disclosure. Elsayih et al. [

71] observed higher carbon performance in firms with greater board independence. Third, China’s corporate governance transition remains inadequately integrated with carbon reduction dynamics, despite evidence linking managerial ownership to carbon disclosure transparency [

72]. Although ownership–control separation typically intensifies post-IPO in private enterprises (e.g., through founder divestment diluting control rights), no study has dynamically analyzed its evolving moderating mechanisms in emission reduction [

73,

74]. This revised agency perspective, termed “incentive compatibility”, posits that external pressures can reshape the incentive structure under significant separation of ownership and control, thereby aligning the controlling shareholder’s self-interest with the firm’s long-term green transition goals [

75]. Under strong external institutional pressures—such as stringent environmental regulations, intense green market competition, and strong public environmental demands—controlling shareholders in firms with high ownership–control separation may recognize that strong environmental performance is crucial for maintaining corporate legitimacy, obtaining policy benefits, avoiding penalties, and preserving reputational capital related to control [

76]. In such contexts, to protect and maximize their private benefits of control, they may have strong incentives to urge management to effectively implement carbon emission reduction projects and ensure these are genuinely transformed into productivity gains and competitive advantages [

77]. Under these conditions, a high degree of ownership–control separation may enhance the positive effect of CER on TFP. The innovative value of Hypothesis H2 lies in constructing an integrated model addressing China’s tripartite ownership structures characteristics: Chairman shareholding ratio reflects strategic decision-making resolve (overcoming short-termism), manager shareholding ratio represents executive incentive intensity (technology implementation efficiency), and ownership–control separation signifies agency conflict magnitude (resource misallocation risks). This framework transcends conventional unidimensional moderation models by revealing synergistic governance logic within China’s transitional economy, thereby providing theoretical foundations for aligning environmental policies with corporate governance structures. Consequently, drawing on agency cost theory and upper echelons theory, we develop a set of moderated relationships. Informed by Baron and Kenny [

78]’s multidimensional approach to identifying moderator attributes, we propose one comprehensive moderator followed by three specific moderated hypotheses. Building on this foundation, we further advance a second comprehensive hypothesis that integrates both theoretical perspectives.

Hypothesis 2. Ownership structures play a moderating role in the relationship between CER and TFP.

For the first specific moderator, grounded in agency cost theory, we examine the governance and environmental implications when ownership is highly concentrated in the chairman.

Hypothesis 2a. In ownership structures, chairman shareholding negatively moderates the relationship between CER and TFP.

For the second moderator, based on the upper echelons theory, we contend that executive characteristics shape strategic decisions and performance outcomes.

Hypothesis 2b. In ownership structures, manager shareholding positively moderates the relationship between CER and TFP.

From the perspectives of agency cost theory and the lens of incentive compatibility, we propose a third specific moderator, suggesting that effective supervisory and incentive mechanisms can mitigate the adverse effects associated with the separation of ownership and control.

Hypothesis 2c. In ownership structures, ownership–control separation positively moderates the relationship between CER and TFP.