Precision Measurement of the Return Distribution Property of the Chinese Stock Market Index

Abstract

1. Introduction

2. Datasets

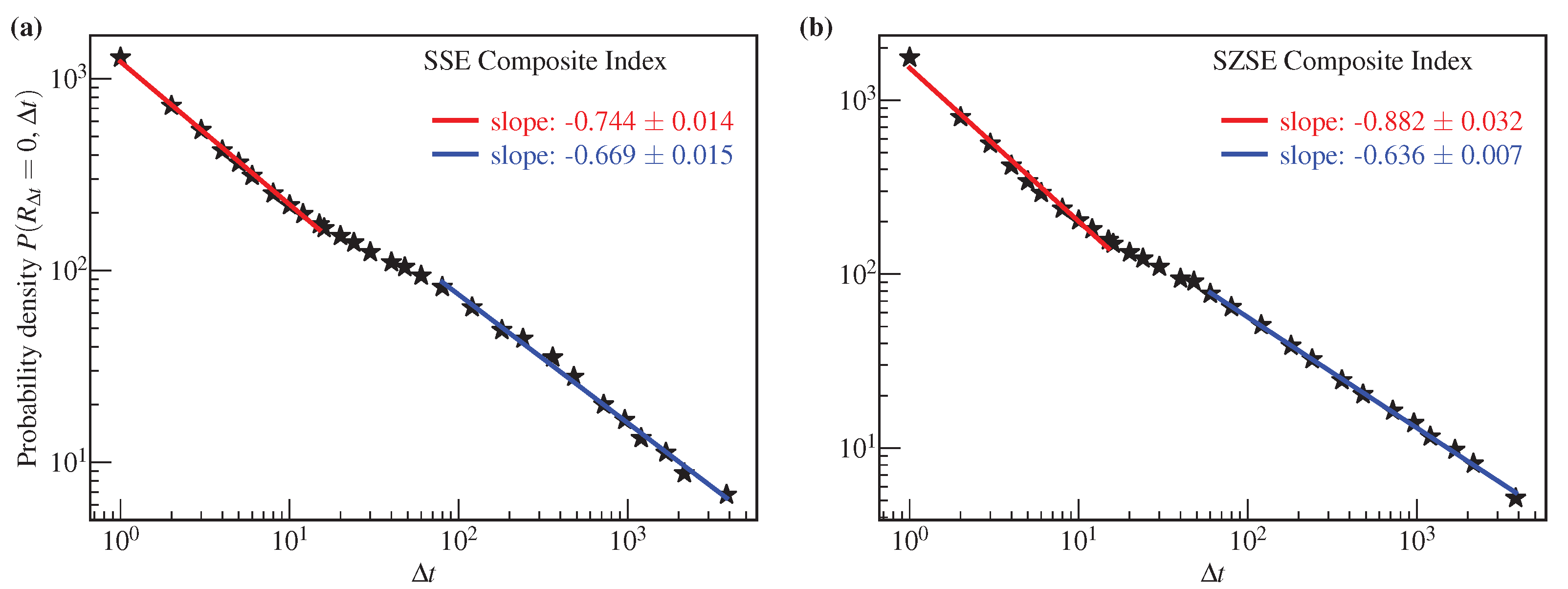

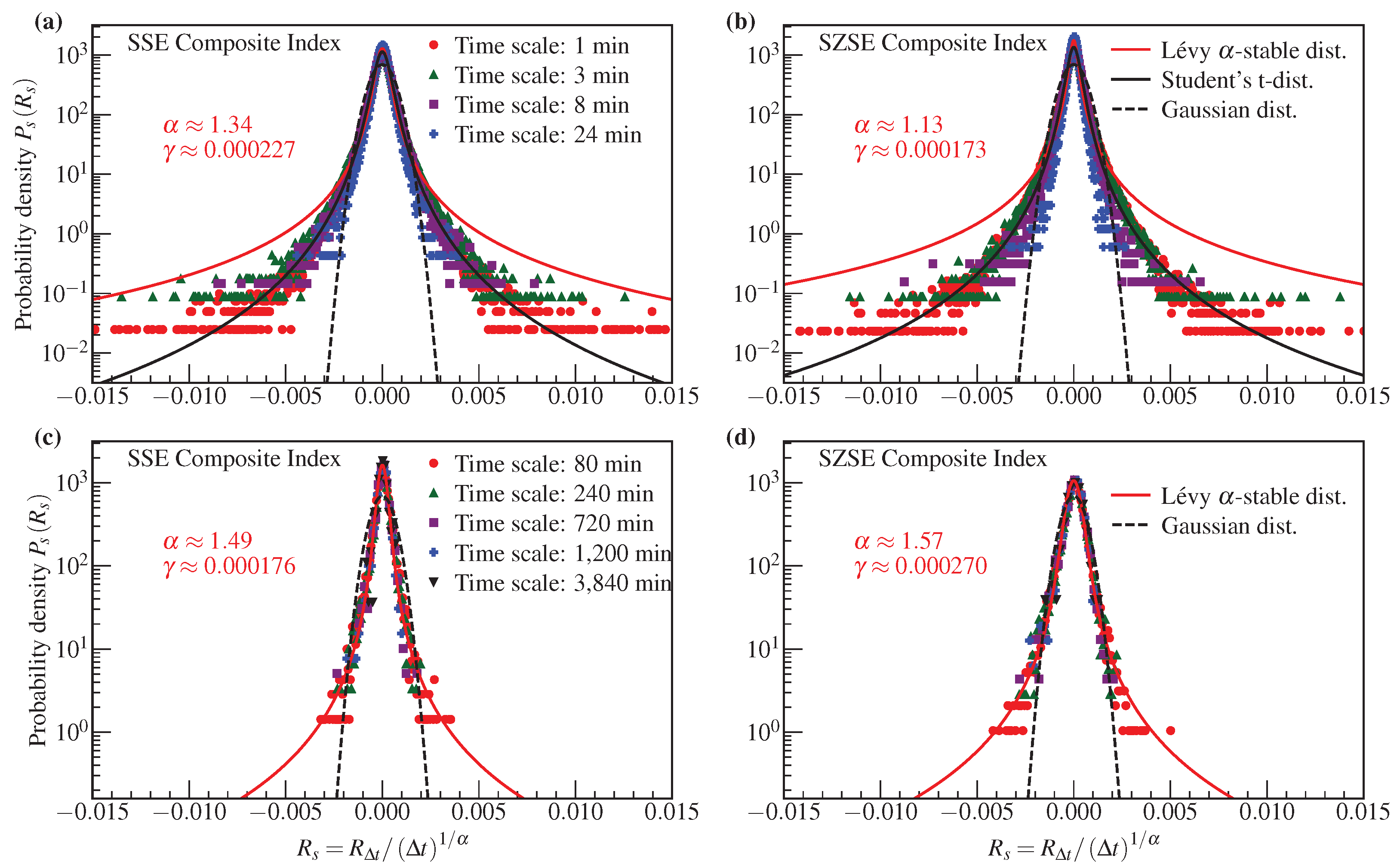

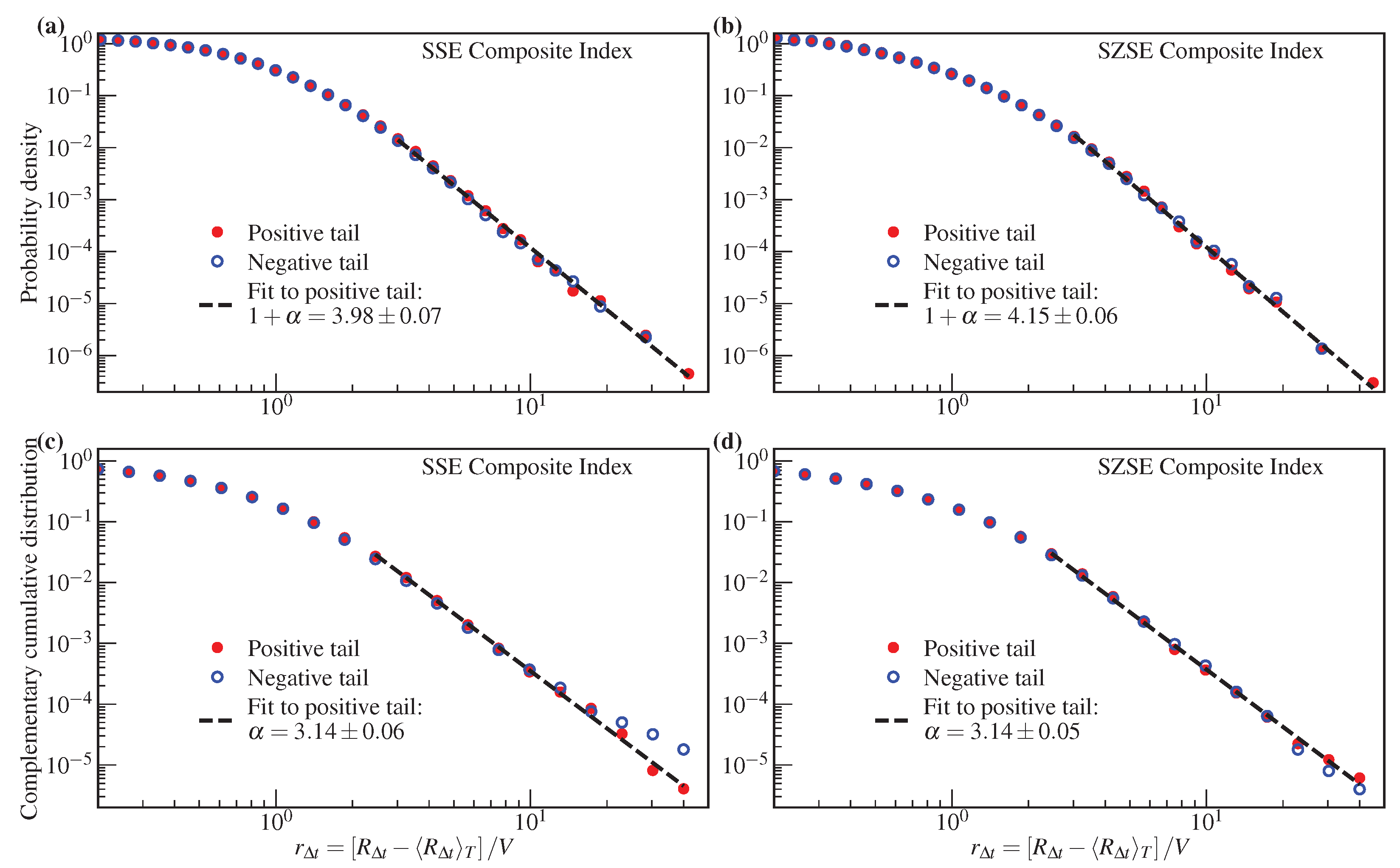

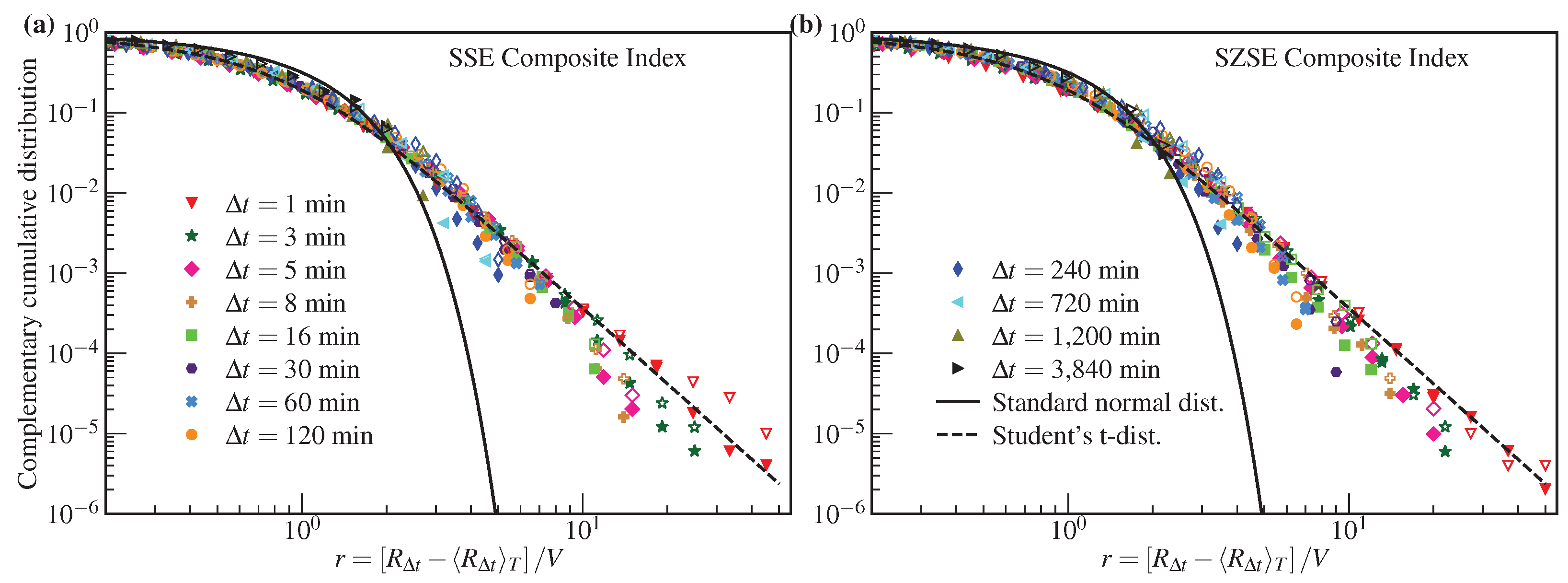

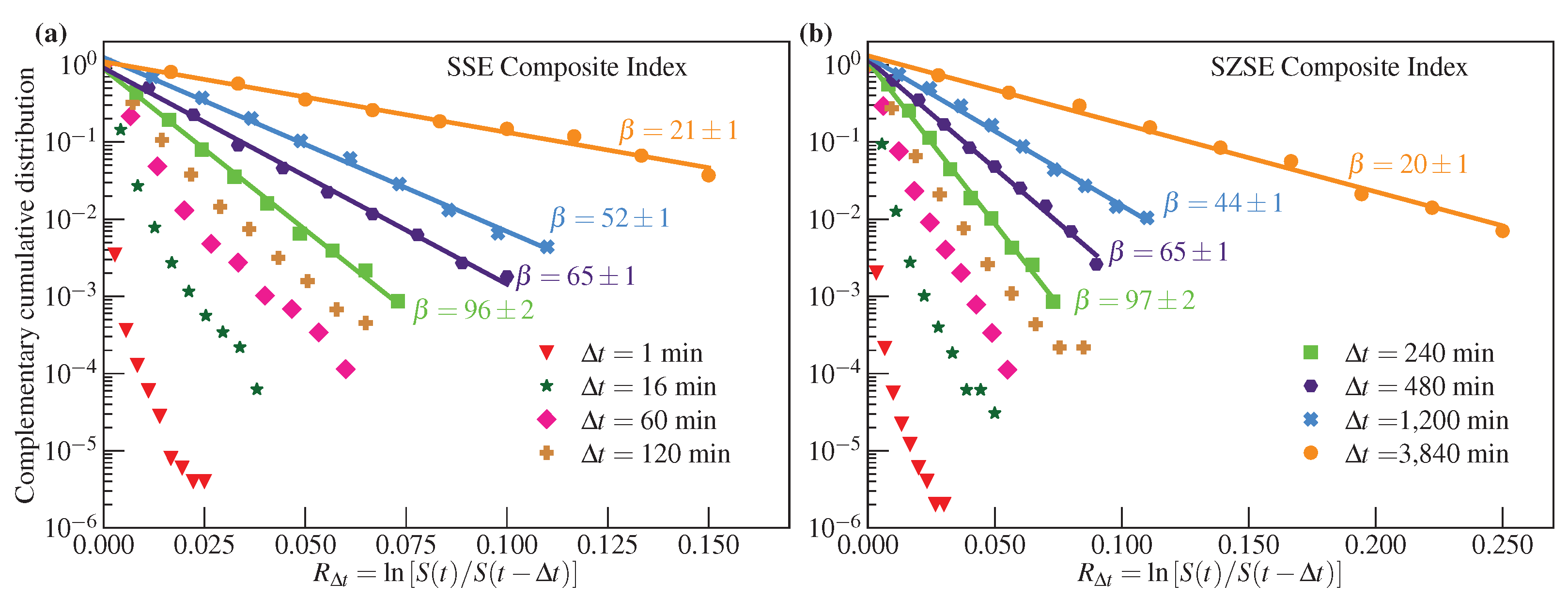

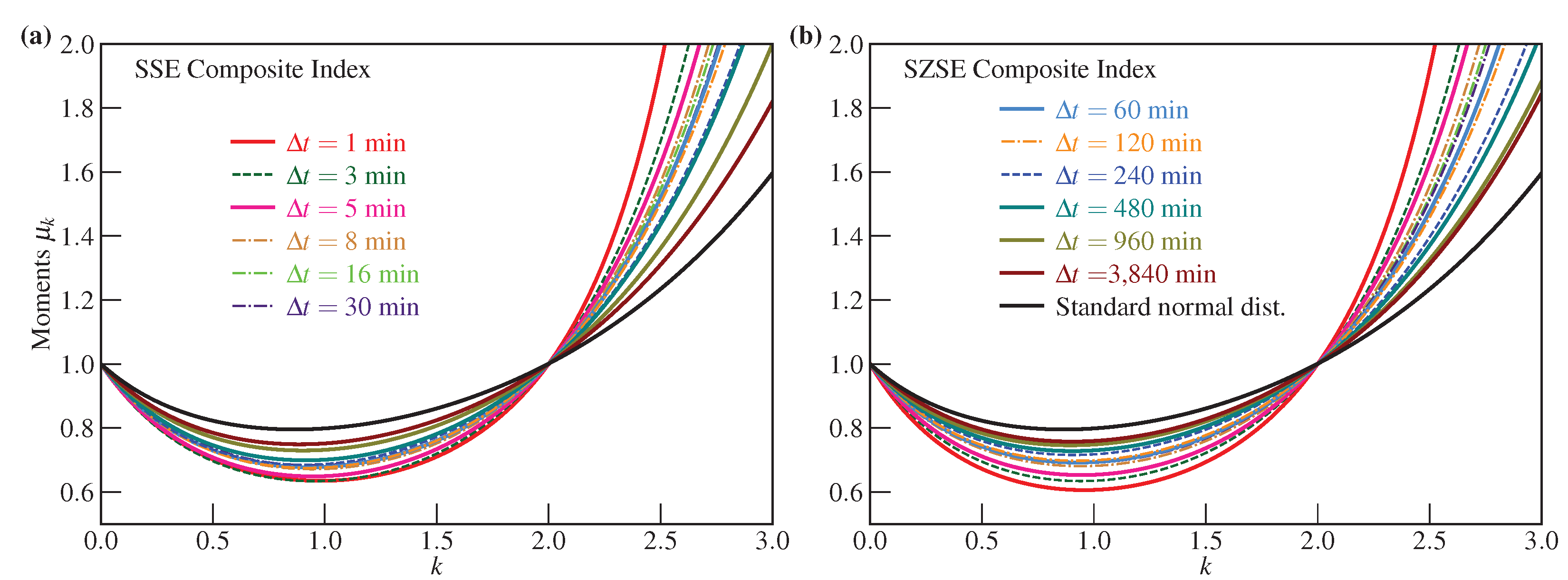

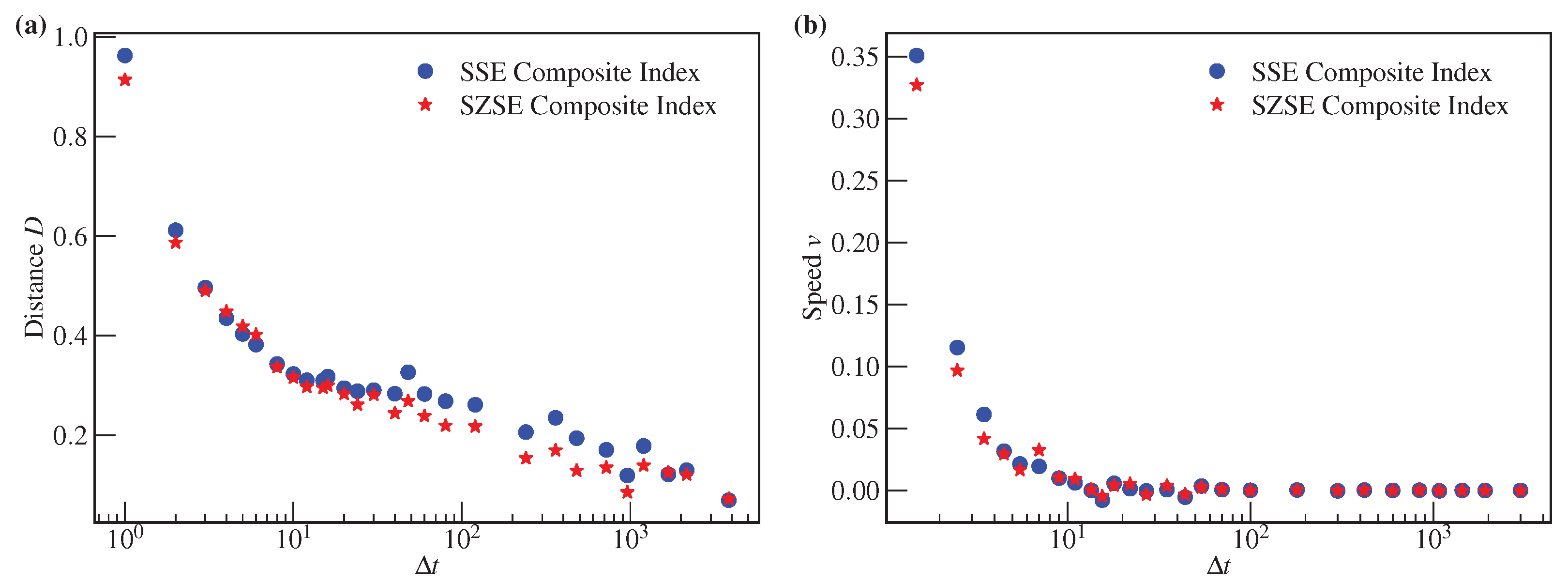

3. Results and Discussion

4. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- The Nobel Foundation. Jan Tinbergen Facts. 2022. Available online: https://www.nobelprize.org/prizes/economic-sciences/1969/tinbergen/facts/ (accessed on 18 December 2022).

- Kutner, R.; Ausloos, M.; Grech, D.; Matteo, T.D.; Schinckus, C.; Stanley, H.E. Econophysics and sociophysics: Their milestones & challenges. Physica A 2019, 516, 240–253. [Google Scholar]

- Ribeiro, M.B. Income Distribution Dynamics of Economic Systems: An Econophysical Approach; Cambridge University Press: Cambridge, UK, 2020. [Google Scholar]

- Andersen, J.V.; Nowak, A. Symmetry and financial markets. EPL 2022, 139, 22001. [Google Scholar] [CrossRef]

- Smolyak, A.; Havlin, S. Three decades in econophysics—From microscopic modeling to macroscopic complexity and back. Entropy 2022, 24, 271. [Google Scholar] [CrossRef] [PubMed]

- Mantegna, R.N.; Stanley, H.E. An Introduction to Econophysics: Correlations and Complexity in Finance; Cambridge University Press: Cambridge, UK, 2000. [Google Scholar]

- Bouchaud, J.-P.; Potters, M. Theory of Financial Risks: From Statistical Physics to Risk Management; Cambridge University Press: Cambridge, UK, 2000. [Google Scholar]

- Malevergne, Y.; Sornette, D. Extreme Financial Risks: From Dependence to Risk Management; Springer: Berlin/Heidelberg, Germany, 2006. [Google Scholar]

- Bachelier, L. Théorie de la Spéculation. Ph.D. Thesis, University of Paris, Paris, France, 1900. [Google Scholar]

- Fama, E.F. Efficient capital markets: A review of theory and empirical work. J. Finance 1970, 25, 383–417. [Google Scholar] [CrossRef]

- Mandelbrot, B. The Pareto-Lévy law and the distribution of income. Int. Econ. Rev. 1960, 1, 79–106. [Google Scholar] [CrossRef]

- Mandelbrot, B. New methods in statistical economics. J. Polit. Econ. 1963, 71, 421–440. [Google Scholar] [CrossRef]

- Mandelbrot, B. The variation of certain speculative prices. J. Bus. 1963, 36, 394–419. [Google Scholar] [CrossRef]

- Mandelbrot, B. The variation of some other speculative prices. J. Bus. 1967, 40, 393–413. [Google Scholar] [CrossRef]

- Akgiray, V.; Booth, G.G. The stable-law model of stock returns. J. Bus. Econ. Stat. 1988, 6, 51–57. [Google Scholar] [CrossRef]

- Jiang, Z.-Q.; Xie, W.-J.; Zhou, W.-X.; Sornette, D. Multifractal analysis of financial markets: A review. Rep. Prog. Phys. 2019, 82, 125901. [Google Scholar] [CrossRef]

- Merton, R.C. Option pricing when underlying stock returns are discontinuous. J. Finance Econ. 1976, 3, 125–144. [Google Scholar] [CrossRef]

- Madan, D.B.; Carr, P.P.; Chang, E.C. The variance gamma process and option pricing. Rev. Finance 1998, 2, 79–105. [Google Scholar] [CrossRef]

- Kou, S.G. A jump-diffusion model for option pricing. Manag. Sci. 2002, 48, 955–1101. [Google Scholar] [CrossRef]

- Bouskraoui, M.; Arbai, A. Pricing option CGMY model. IOSR-JM 2017, 13, 5–11. [Google Scholar] [CrossRef]

- Schoutens, W. Meixner Processes in Finance; Eurandom: Eindhoven, The Netherlands, 2001. [Google Scholar]

- Heston, S.L. A closed-form solution for options with stochastic volatility wth applications to bond and currency options. Rev. Finance Stud. 2015, 6, 327–343. [Google Scholar] [CrossRef]

- Dupire, B. Pricing with a smile. Risk 1994, 7, 18–20. [Google Scholar]

- Chourdakis, K. Lévy processes driven by stochastic volatility. Asia-Pac. Financ. Mark. 2005, 12, 333–352. [Google Scholar] [CrossRef]

- Bayer, C.; Friz, P.; Gatheral, J. Pricing under rough volatility. Quant. Finance 2016, 16, 887–904. [Google Scholar] [CrossRef]

- Mantegna, R.N.; Stanley, H.E. Scaling behaviour in the dynamics of an economic index. Nature 1995, 376, 46–49. [Google Scholar] [CrossRef]

- Mantegna, R.N.; Stanley, H.E. Stochastic process with ultraslow convergence to a gaussian: The truncated Lévy flight. Phys. Rev. Lett. 1994, 73, 2946–2949. [Google Scholar] [CrossRef]

- Gopikrishnan, P.; Plerou, V.; Amaral, L.A.N.; Meyer, M.; Stanley, H.E. Scaling of the distribution of fluctuations of financial market indices. Phys. Rev. E 1999, 60, 5305–5316. [Google Scholar] [CrossRef] [PubMed]

- Gopikrishnan, P.; Meyer, M.; Amaral, L.A.N.; Stanley, H.E. Inverse cubic law for the distribution of stock price variations. Eur. Phys. J. B 1998, 3, 139–140. [Google Scholar] [CrossRef]

- Plerou, V.; Gopikrishnan, P.; Amaral, L.A.N.; Meyer, M.; Stanley, H.E. Scaling of the distribution of price fluctuations of individual companies. Phys. Rev. E 1999, 60, 6519–6529. [Google Scholar] [CrossRef] [PubMed]

- Laherrère, J.; Sornette, D. Stretched exponential distributions in nature and economy: “Fat tails” with characteristic scales. Eur. Phys. J. B 1998, 2, 525–539. [Google Scholar] [CrossRef]

- Gabaix, X.; Gopikrishnan, P.; Plerou, V.; Stanley, H.E. A theory of power-law distributions in financial market fluctuations. Nature 2003, 423, 267–270. [Google Scholar] [CrossRef]

- Plerou, V.; Stanley, H.E. Stock return distributions: Tests of scaling and universality from three distinct stock markets. Phys. Rev. E 2008, 77, 037101. [Google Scholar] [CrossRef]

- Stanley, H.E.; Plerou, V.; Gabaix, X. A statistical physics view of financial fluctuations: Evidence for scaling and universality. Physica A 2008, 387, 3967–3981. [Google Scholar] [CrossRef]

- Lux, T. The stable paretian hypothesis and the frequency of large returns: An examination of major German stocks. Appl. Finance Econ. 1996, 6, 463–475. [Google Scholar] [CrossRef]

- Coronel-Brizio, H.F.; Hernández-Montoya, A.R. On fitting the Pareto-Levy distribution to stock market index data: Selecting a suitable cutoff value. Physica A 2005, 354, 437–449. [Google Scholar] [CrossRef]

- Alfonso, L.; Mansilla, R.; Terrero-Escalante, C.A. On the scaling of the distribution of daily price fluctuations in the Mexican financial market index. Physica A 2012, 391, 2990–2996. [Google Scholar] [CrossRef]

- Storer, R.; Gunner, S.M. Statistical properties of the Australian “all ordinaries” index. Int. J. Mod. Phys. C 2002, 13, 893–897. [Google Scholar] [CrossRef]

- Bertram, W.K. An empirical investigation of Australian Stock Exchange data. Physica A 2004, 341, 533–546. [Google Scholar] [CrossRef]

- Makowiec, D.; Gnaciński, P. Fluctuations of WIG—The index of Warsaw stock exchange preliminary studies. Acta Phys. Pol. B 2001, 32, 1487–1500. [Google Scholar]

- Matia, K.; Pal, M.; Salunkay, H.; Stanley, H.E. Scale-dependent price fluctuations for the Indian stock market. EPL 2004, 66, 909–914. [Google Scholar] [CrossRef]

- Pan, R.K.; Sinha, S. Inverse-cubic law of index fluctuation distribution in Indian markets. Physica A 2008, 387, 2055–2065. [Google Scholar] [CrossRef]

- Pan, R.K.; Sinha, S. Self-organization of price fluctuation distribution in evolving markets. EPL 2007, 77, 58004. [Google Scholar] [CrossRef]

- Huang, Z.-F. The first 20 min in the Hong Kong stock market. Physica A 2000, 287, 405–411. [Google Scholar] [CrossRef][Green Version]

- Wang, B.H.; Hui, P.M. The distribution and scaling of fluctuations for Hang Seng index in Hong Kong stock market. Eur. Phys. J. B 2001, 20, 573–579. [Google Scholar] [CrossRef]

- Matteo, T.D.; Aste, T.; Dacorogna, M.M. Scaling behaviors in differently developed markets. Physica A 2003, 324, 183–188. [Google Scholar] [CrossRef]

- Wan, Y.-L.; Xie, W.-J.; Gu, G.-F.; Jiang, Z.-Q.; Chen, W.; Xiong, X.; Zhang, W.; Zhou, W.-X. Statistical properties and pre-hit dynamics of price limit hits in the Chinese stock markets. PLoS ONE 2015, 10, e0120312. [Google Scholar] [CrossRef]

- Yan, C.; Zhang, J.W.; Zhang, Y.; Tang, Y.N. Power-law properties of Chinese stock market. Physica A 2005, 353, 425–432. [Google Scholar] [CrossRef]

- Dou, G.X.; Ning, X.X. Statistical properties of probability distributions of returns in Chinese stock markets. Chin. J. Manag. Sci. 2007, 15, 16–22. [Google Scholar]

- Chen, S.; Yang, H.L.; Li, S.F. Multiscale power-law properties and criticality of Chinese stock market. Chin. J. Manag. Sci. 2008, 16, 8–15. [Google Scholar]

- Gu, G.-F.; Chen, W.; Zhou, W.-X. Empirical distributions of Chinese stock returns at different microscopic timescales. Physica A 2008, 387, 495–502. [Google Scholar] [CrossRef][Green Version]

- Mu, G.-H.; Zhou, W.-X. Tests of nonuniversality of the stock return distributions in an emerging market. Phys. Rev. E 2010, 82, 066103. [Google Scholar] [CrossRef]

- Bai, M.-Y.; Zhu, H.-B. Power law and multiscaling properties of the Chinese stock market. Physica A 2010, 389, 1883–1890. [Google Scholar] [CrossRef]

- D’Agostino, R.B.; Belanger, A.; D’Agostino, R.B., Jr. A suggestion for using powerful and informative tests of normality. Am. Stat. 1990, 44, 316–321. [Google Scholar]

- Anscombe, F.J.; Glynn, W.J. Distribution of the kurtosis statistic b2 for normal samples. Biometrika 1983, 70, 227–234. [Google Scholar] [CrossRef]

- Liu, P.; Zheng, Y. Temporal and spatial evolution of the distribution related to the number of COVID-19 pandemic. Physica A 2022, 603, 127837. [Google Scholar] [CrossRef]

- Liu, P.; Zheng, Y. Distribution law of the COVID-19 number through different temporal stages and geographic scales. arXiv 2022, arXiv:2208.06435. [Google Scholar]

- Queirós, S.M.D. on non-Gaussianity and dependence in financial time series: A nonextensive approach. Quant. Finance 2005, 5, 475–487. [Google Scholar] [CrossRef]

- Queirós, S.M.D.; Moyano, L.G.; Souza, J.D.; Tsallis, C. A nonextensive approach to the dynamics of financial observables. Eur. Phys. J. B 2007, 55, 161–167. [Google Scholar] [CrossRef]

- Granha, M.F.B.; Vilela, A.L.M.; Wang, C.; Nelson, K.P.; Stanley, H.E. Opinion dynamics in financial markets via random networks. Proc. Natl. Acad. Sci. USA 2022, 119, e2201573119. [Google Scholar] [CrossRef] [PubMed]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, P.; Zheng, Y. Precision Measurement of the Return Distribution Property of the Chinese Stock Market Index. Entropy 2023, 25, 36. https://doi.org/10.3390/e25010036

Liu P, Zheng Y. Precision Measurement of the Return Distribution Property of the Chinese Stock Market Index. Entropy. 2023; 25(1):36. https://doi.org/10.3390/e25010036

Chicago/Turabian StyleLiu, Peng, and Yanyan Zheng. 2023. "Precision Measurement of the Return Distribution Property of the Chinese Stock Market Index" Entropy 25, no. 1: 36. https://doi.org/10.3390/e25010036

APA StyleLiu, P., & Zheng, Y. (2023). Precision Measurement of the Return Distribution Property of the Chinese Stock Market Index. Entropy, 25(1), 36. https://doi.org/10.3390/e25010036