2. Literature Review

Bitcoin is a digital currency and payment system created by Satoshi Nakamoto [

1]. As the first decentralized digital cryptocurrency, bitcoin’s price and popularity have risen rapidly since its introduction in 2009. With the growing popularity of bitcoin worldwide, the economic and financial properties of bitcoin have begun to attract the attention of researchers [

2,

3,

4]. The relevant literature focuses on whether bitcoin is a currency or an asset, what kind of asset bitcoin is, and what kind of risk–return properties bitcoin has.

The earlier literature focused on whether bitcoin was a currency or an asset. Undeniably, there are some commonalities between bitcoin and currency, but from the perspective of monetary function, bitcoin can only be used as a medium of exchange and not as a unit of account or a storage of value [

5]; therefore, bitcoin does not have a complete form of currency. Glaser et al. [

6] focused on the liquidity of bitcoin when it functions as a medium of exchange, and argued that the convertibility between bitcoin and traditional currencies gives bitcoin liquidity, but the limited supply of bitcoin limits its liquidity. Böhme et al. [

7] argued that the liquidity of bitcoin can be significantly weakened due to the frequent delays in bitcoin transactions. However, because of the anonymity of user identities, the bitcoin protocol does not restrict international transfer operations to countries that are on watch lists or embargoed, which provides bitcoin with higher flexibility and liquidity than deposit currencies in supporting international transfers [

7]. In terms of the attitudes of bitcoin holders, since most bitcoin users view bitcoin as an investment tool rather than a transactional payment tool [

6], the market value of bitcoin is much higher than the size of the economic transactions it facilitates [

5], making bitcoin more of a speculative investment tool than a currency. Luther and Salter [

8] examined bitcoin’s ability to replace traditional currencies based on the increase in bitcoin app downloads after the Cyprus bailout announcement and found that the rise in bitcoin app downloads was insignificant, suggesting that bitcoin is not replacing the currencies of those countries whose domestic banks are in trouble.

After determining that bitcoin is more of an asset, scholars began comparing bitcoin to traditional assets in an attempt to generalize which asset, or class of assets, bitcoin is more comparable. Bitcoin is often analogized to gold in the literature, and is even referred to as digital gold or the new gold [

9]. The similarities between bitcoin and gold are that both have a much higher market value than their intrinsic value, and both derive their market value from scarcity of supply and high mining costs; both have no national attributes, and their supply is not controlled by the government; gold was used as a medium of exchange during the gold standard period but was abandoned later due to lack of liquidity, and bitcoin is likely to face similar problems in the future as the scale of bitcoin users expands. However, there are also differences between bitcoin and gold; for example, people use gold mainly because of its function as a store of value, while the instability of bitcoin prices makes it difficult for it to perform value storage effectively [

10]. Klein et al. [

11] compared the return volatility of bitcoin and gold and their respective correlations with other asset prices and found that while both prices respond asymmetrically to market shocks, their respective correlations with other asset prices differ significantly, especially during market downturns. Shahzad et al. [

12] compared the safe-haven, hedging and diversification properties of bitcoin and gold for the G7 stock markets and found that gold outperforms bitcoin in terms of safe-haven and hedging effectiveness and can provide higher conditional diversification benefits for stock investments than bitcoin, while Thampanya et al. [

13] found that neither bitcoin nor gold is a good hedge for the Thailand stock market. Furthermore, Whelan [

14] drew an analogy between bitcoin and the U.S. dollar, arguing that both are used as a medium of exchange, but the difference is that the dollar is backed by the government, whereas bitcoin is a private currency issued by the private sector, and, thus, the supply and governance mechanisms for both assets are different. Dyhrberg [

10] examined whether bitcoin is more comparative to gold or the U.S. dollar, and found that the behavioral characteristics of bitcoin prices have both dollar- and gold-like components because bitcoin’s property falls between a pure medium of exchange and a pure store of value. As such, bitcoin can be classified as an asset that is between the U.S. dollar and gold, and can be used as an effective tool for portfolio management.

More recent studies have begun to focus on the risk–return properties of bitcoin and its risk diversification, hedging and safe haven properties for traditional assets. Although bitcoin has a higher volatility than traditional assets [

15], the inclusion of bitcoin in a portfolio may still improve the portfolio’s risk–return performance [

16,

17,

18,

19]. Eisl et al. [

20] used a CVaR approach to find that although the inclusion of bitcoin raises the conditional VaR of the portfolio, this additional risk is fully compensated by high returns, which ultimately improves the risk–return ratio. Dyhrberg [

21] used daily frequency data to test the hedging effect of bitcoin on U.K. equities and the USD exchange rate and found that bitcoin can be used as a hedge for the FTSE index as well as the USD/EUR and USD/GBP exchange rates over the 2010–2015 period. Yang et al. [

22] used a time-frequency domain approach to find that bitcoin has the capability to hedge against the currency market in the long term. Using a daily frequency sample over 2011–2015, Bouri et al. [

23] found that bitcoin prices are negatively correlated with the Nikkei 225, MSCI Pacific and commodity indices and, therefore, have the ability to hedge against price fluctuations in these assets. Chan et al. [

24] found that bitcoin can be used as an effective hedge for the U.S., European, Canadian, Japanese and Chinese stock markets in the monthly frequency dimension over the period 2010–2017. Wang et al. [

25] found that cryptocurrencies are a safe haven rather than a hedge for most international stock indices, and the safe-haven properties are more pronounced in developed markets or markets with larger market capitalizations and higher liquidity. Shahzad et al. [

26] showed that the safe-haven role of bitcoin for Chinese, U.S. and other developed and developing stock markets is time-varying and varies across different stock markets. Urquhart and Zhang [

27] used high-frequency data to examine bitcoin’s hedging and safe-haven capabilities for foreign exchange and found that bitcoin can be a hedge for the CHF, EUR and GBP, a diversifier for the AUD, CAD and JPY, and a safe haven for the CAD, CHF and GBP in times of extreme market turmoil. Wang et al. [

28] examined the mean and volatility spillovers between bitcoin and six major financial assets in China and found that bitcoin can hedge China’s stock, bond, and monetary markets and can serve as a safe haven for China’s monetary market. Smales [

29] argued that bitcoin’s high volatility, low liquidity and high transaction costs (in terms of time and fees) compared to other assets preclude it from being considered a safe haven until its market matures. Kwapień et al. [

3] analyzed detrended cross-correlations between cryptocurrency markets and some traditional markets (including stock, commodity and forex markets) and found that the levels of cross-correlations become higher in turbulent periods.

After the outbreak of the COVID-19 pandemic, the price dynamics and portfolio performance of cryptocurrencies during the pandemic attracted widespread attention [

30]. Wątorek et al. [

4] pointed out that the COVID-19 pandemic has had a significant impact on the cryptocurrency market, transforming cryptocurrencies from a hedging instrument for investors fleeing traditional markets into a part of the global market which is closely linked to traditional financial instruments including currency, stock and commodity. Using a network connectedness model, Balcilar et al. [

31] found increasing risk spillovers between cryptocurrencies and global emerging stock markets following the COVID-19 pandemic outbreak, and that cryptocurrencies cannot serve as a diversifier for emerging stock markets in both the short and long term. Caferra and Vidal-Tomas [

32] used the wavelet coherence approach and Markov switching autoregressive model to find that cryptocurrencies have some hedging properties against stock markets in response to shocks from the COVID-19 pandemic. Using the COVID-19 outbreak as a quasi-experiment, Grobys [

33] used a difference-in-differences approach to test bitcoin’s performance in hedging U.S. stock market risk and found that bitcoin performs poorly in hedging the tail risk of the U.S. market. Conlon and McGee [

2] evaluated the safe-haven capability of bitcoin against traditional assets during the sharp decline in global financial markets following the outbreak of COVID-19, and found that bitcoin is not a safe haven for the S&P 500 and that including bitcoin in an equity portfolio at this time would substantially increase the portfolio’s downward risk exposure. Conlon et al. [

34] further found that bitcoin is not a safe haven for most international stock markets except for China’s CSI 300 index. Wen et al. [

35] used time-varying parameter vector autoregression to find that bitcoin is not a safe haven for crude oil and stocks during the COVID-19 pandemic. Dutta et al. [

36] also found that bitcoin is only a diversifier rather than a safe haven for crude oil during the COVID-19 pandemic.

Although there has been a rich literature on the economic and financial properties of bitcoin, several gaps still remain. First, the sample of relevant studies does not cover a wide enough range of asset classes, and, therefore, they fail to provide a comprehensive dissection of the linkage between bitcoin and various major global assets and the diversification, hedging and safe-haven properties of bitcoin for these assets. Most of the existing studies focus on analyzing the linkage between bitcoin and a specific class of financial assets and bitcoin’s diversification, hedging and safe-haven properties for that class of assets, including stocks [

24,

25,

26,

31,

32,

33,

34], commodities [

36], currencies [

22,

27], etc. Although the sample selected by Wang et al. [

28] covers multiple asset classes, these assets are all Chinese assets and are not globally representative. Second, most of the existing studies have examined the risk–return characteristics of bitcoin and its correlation with other assets in a frequency-specific sample, while few have conducted comparative analyses at different time frequencies. The high short-term volatility and speculative nature of the bitcoin market is likely to impair the short-term correlation between bitcoin and other assets, resulting in the linkage between bitcoin and other assets exhibiting very different characteristics in different time frequency dimensions, and may even lead to changes in bitcoin’s risk diversification, hedging and safe-haven properties in different time frequency dimensions.

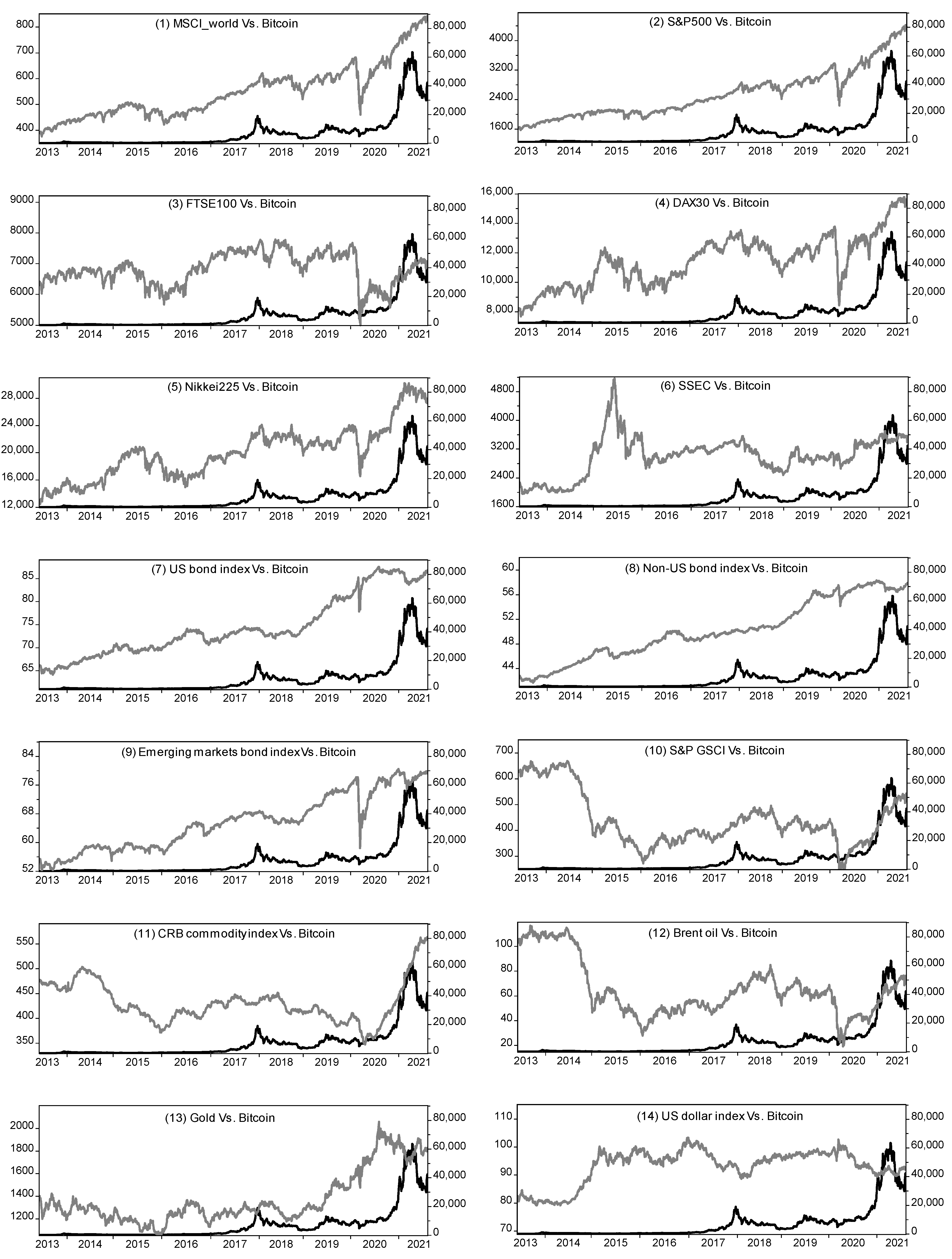

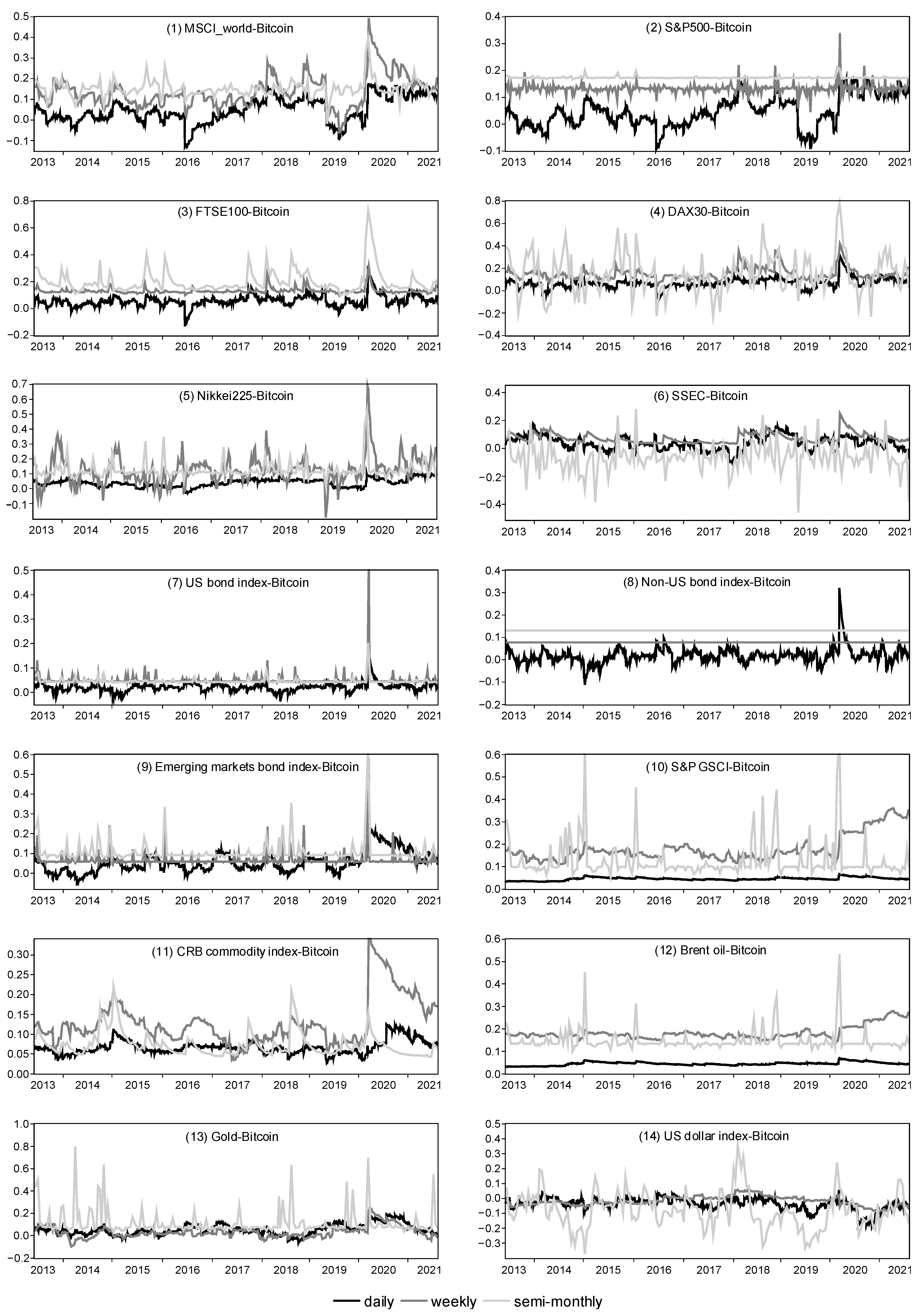

We selected the prices of bitcoin and 14 major financial assets covering stock, bond, commodity and currency over the period 2013–2021 as a sample to test the dynamic linkage of bitcoin with each asset and the linkage’s variation in different time frequency dimensions, and to further identify the risk diversification, hedging and safe-haven properties of bitcoin for various assets. We first used the ADCC-GARCH approach to quantitatively measure the dynamic correlation between bitcoin and other traditional assets. Based on the estimated dynamic conditional correlation (DCC) series, we further adopted Ratner and Chiu’s [

37] approach to identify the risk diversification, hedging and safe-haven properties of bitcoin for various types of assets to assess the extent to which bitcoin can be used as a diversifier, hedge or safe haven for those assets. As a result, we show that: (i) bitcoin is positively linked to risk assets, including stocks, bonds and commodities, and negatively linked to the U.S. dollar, which is a typical safe-haven asset, so bitcoin is closer in nature to a risk asset than a safe-haven asset; (ii) the high short-term volatility and speculative nature of the bitcoin market makes its long-term correlation with other asset prices stronger than the short-term correlation; (iii) the positive linkage between the prices of bitcoin and risk assets increases sharply under extreme shocks (e.g., the outbreak of COVID-19 in early 2020); (iv) bitcoin can hedge against the U.S. dollar, and in the long term, bitcoin can hedge against the Chinese stock market and act as a safe haven for the U.S. stock market and crude oil. However, for most other traditional assets, bitcoin is only an effective diversifier.

The contribution of this study is twofold. First, our selected sample covers four major asset classes—stock, bond, commodity and currency—which specifically include 14 major representative global financial assets. Based on this sample, we provide a comprehensive analysis of the linkage between bitcoin and major global assets as well as bitcoin’s diversification, hedging and safe haven properties for these assets. Second, we also perform a comparative analysis in different time-frequency dimensions, comparing the dynamic correlation between bitcoin and each asset in daily, weekly and semi-monthly frequency dimensions as well as the differences in bitcoin’s risk diversification, hedging and safe-haven capabilities for other assets in different time-frequency dimensions.