Economic Freedom: The Top, the Bottom, and the Reality. I. 1997–2007

Abstract

:1. Introduction

1.1. Rule of Law

1.2. The Right to Own

1.3. Freedom to Contract

1.4. Other Definitions of Economic Freedom

1.5. Paper Content

2. Economic Freedom Indices

2.1. Economic Measures

2.1.1. Economic Freedom of the World (EFW) Index

- The size of the government, i.e., public expenditure, taxes, influence on the economy

- The legal structure which guarantees the right to own

- The access to a healthy currency

- Freedom in international trade

- Regulation of costs, work and economy

2.1.2. Index of Economic Freedom (IEF)

- Tax freedom: measures the importance of fiscal fees imposed by the government on the income of individuals and businesses.

- Government spending: measures the total government spending.

- Free trade: it measures the absence of commercial barriers, affecting the import and export of goods or services.

- Investment freedom: measures the freedom of capital flows.

- Financial freedom: measurement of the independence from the government of credit and banking systems.

- Property rights: they are measures of the ease with which individuals acquire a property of their own.

- Corruption: measures the importance of corruption in the economic world.

- Business undertaking freedom: measures the ease with which it is possible to create, develop and close a business.

- Monetary freedom: measures price stability in relation to a price control.

- Labor Code (This item has been added in 2007. Moreover, in 2017, the Heritage Foundation made some methodological changes; the IEF has 12 components nowadays. The new components are “Judicial Effectiveness” belonging to the Rule of Law pillar and “Fiscal Health” as the new factor of the Government size pillar.): it measures the ease with which workers and companies interact without restriction from the state government.

2.2. Economic Growth

2.3. Criticism/Limitations

3. Data

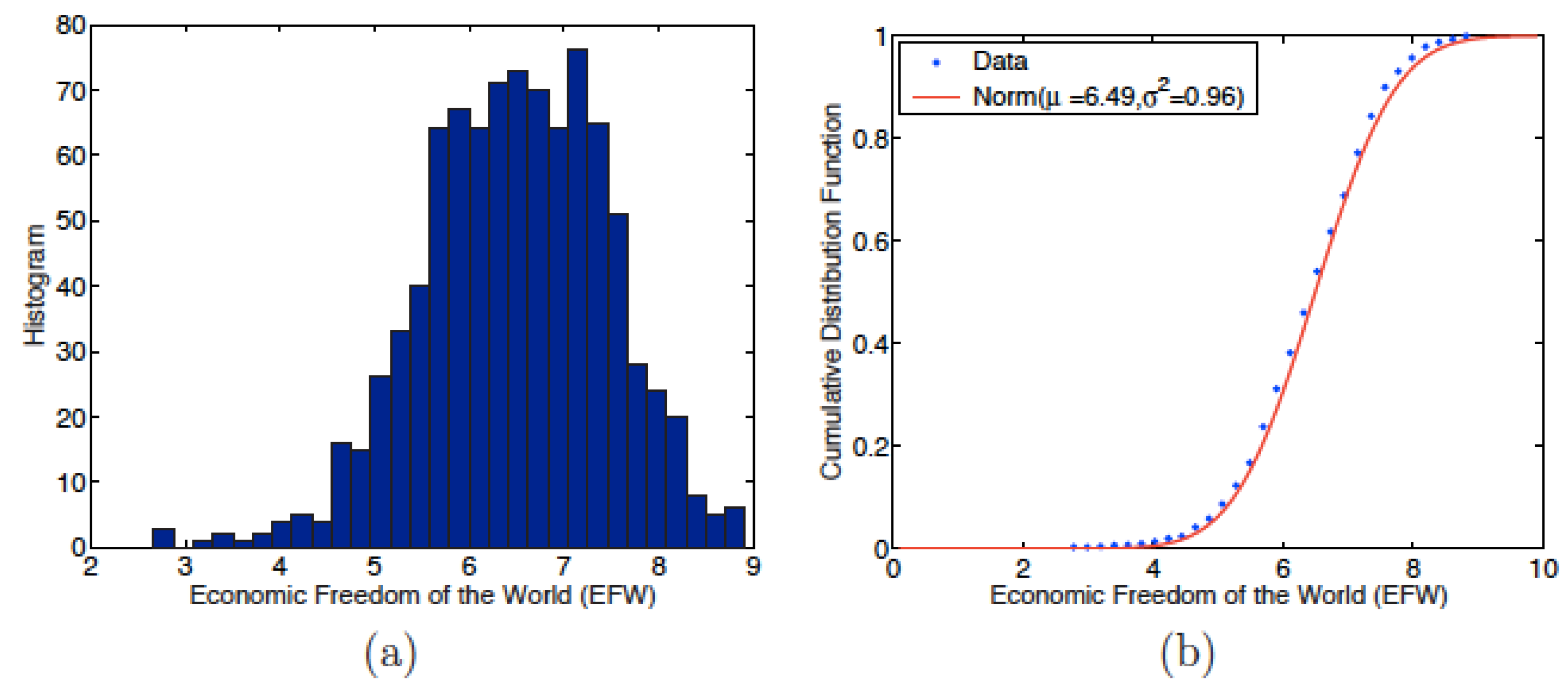

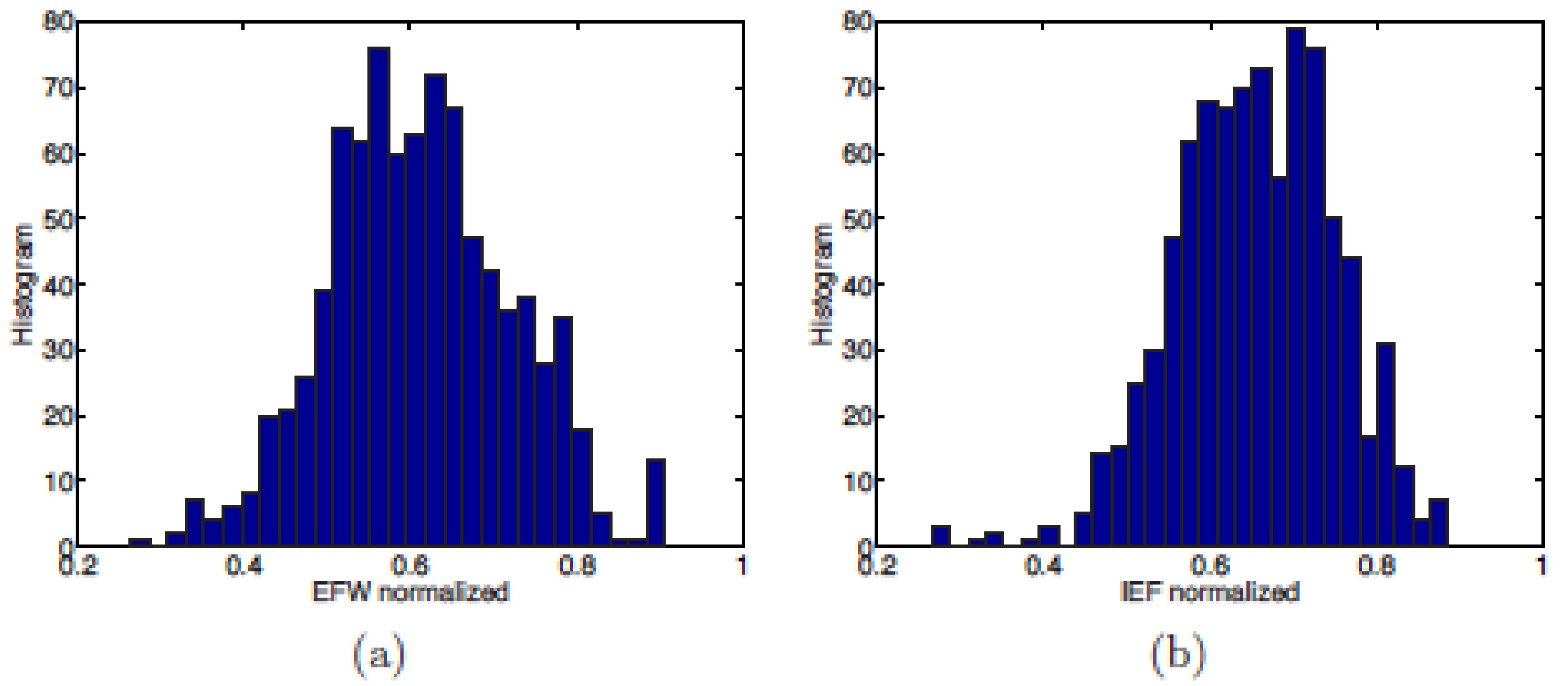

3.1. Statistical Characteristics of Indices Distribution

3.2. EFW Index in Year 2006

3.3. IEF in Year 2006

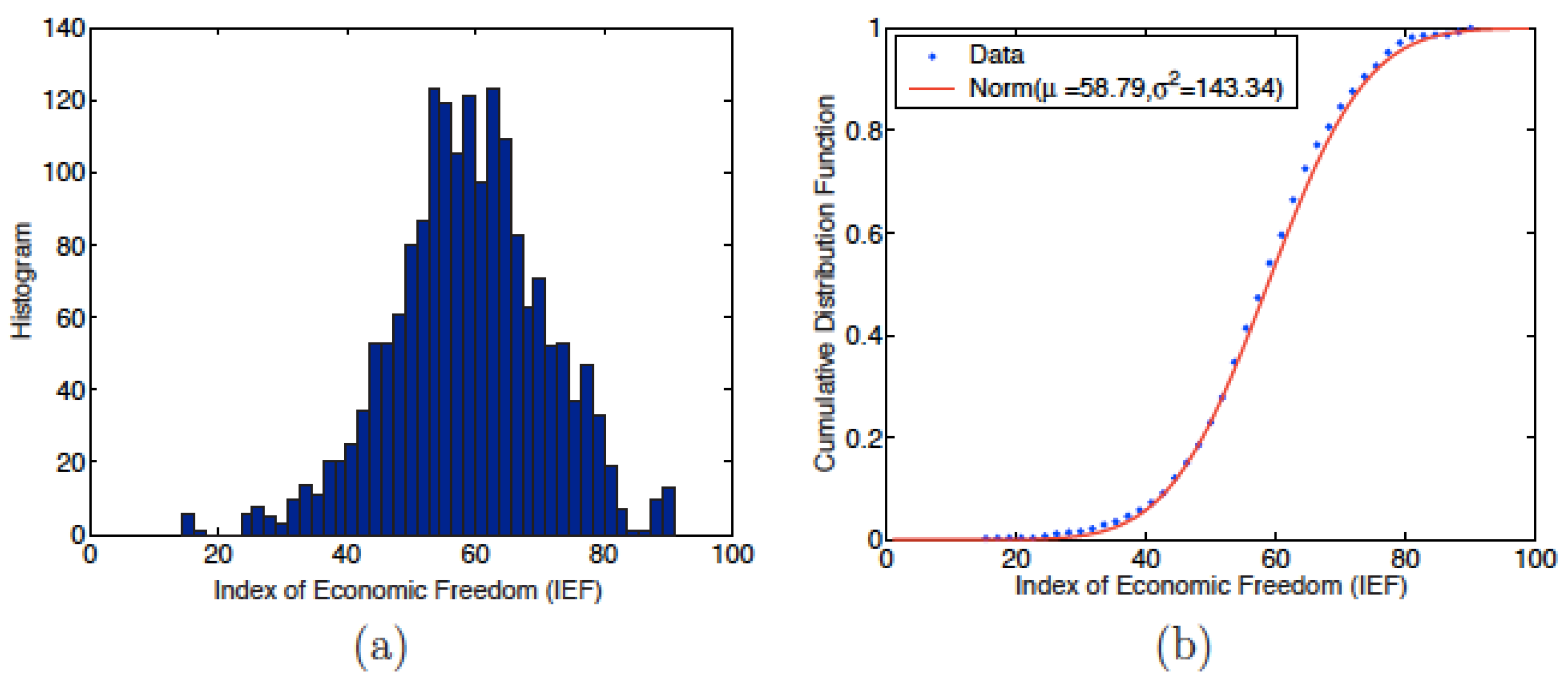

3.4. Regional Evolution of Economic Freedom

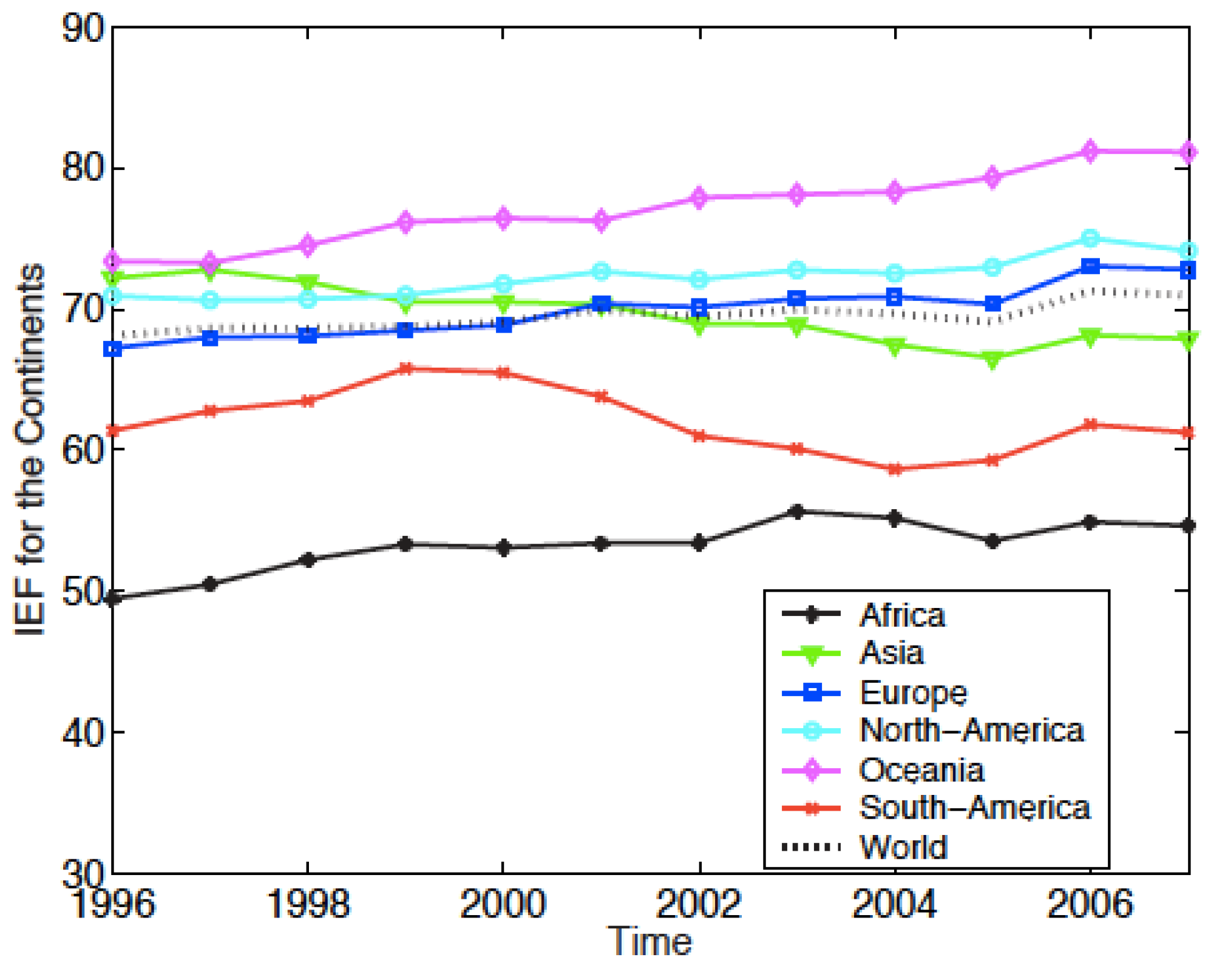

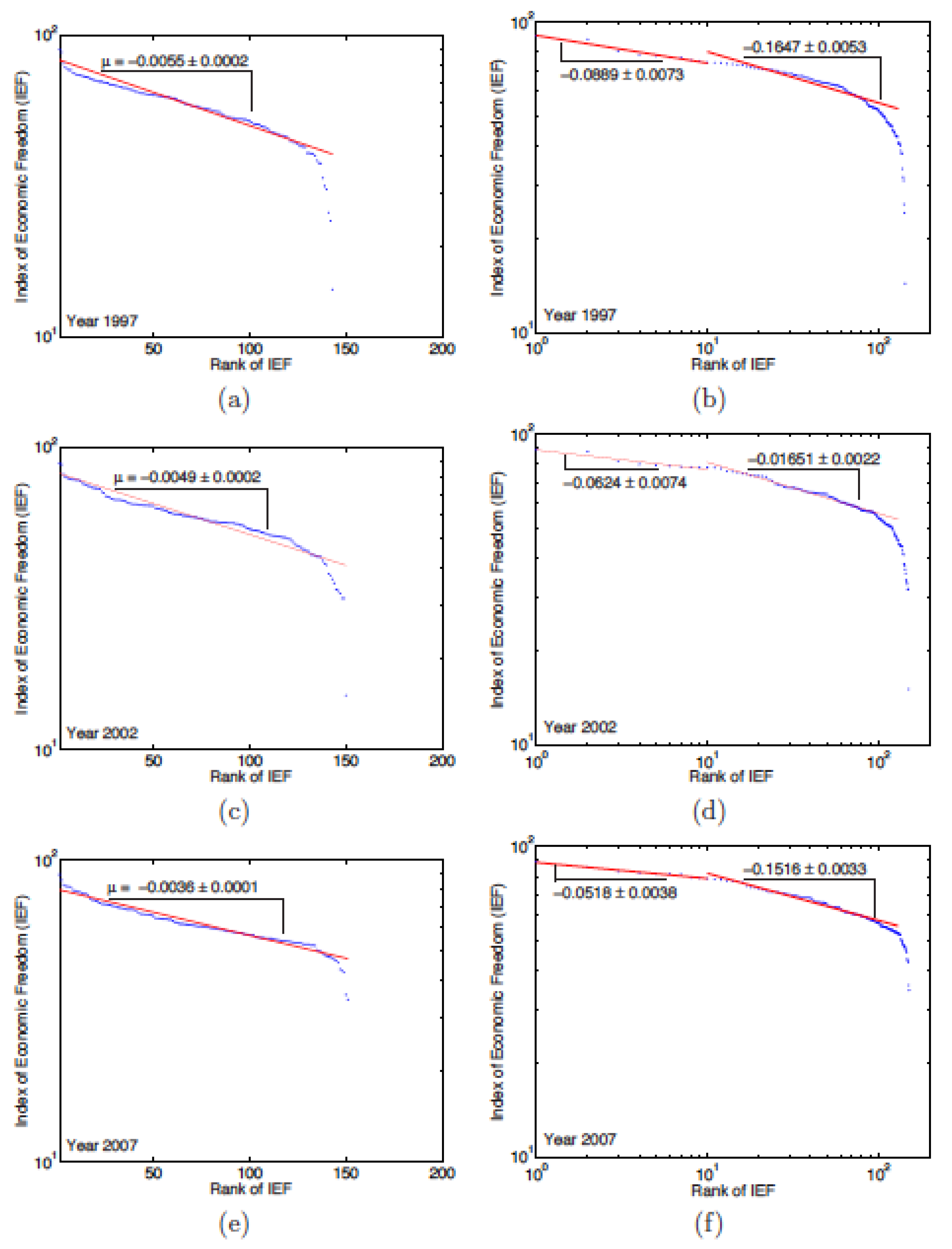

3.5. Exponential Versus Power Law Behaviour

3.6. Comparison of both Indices

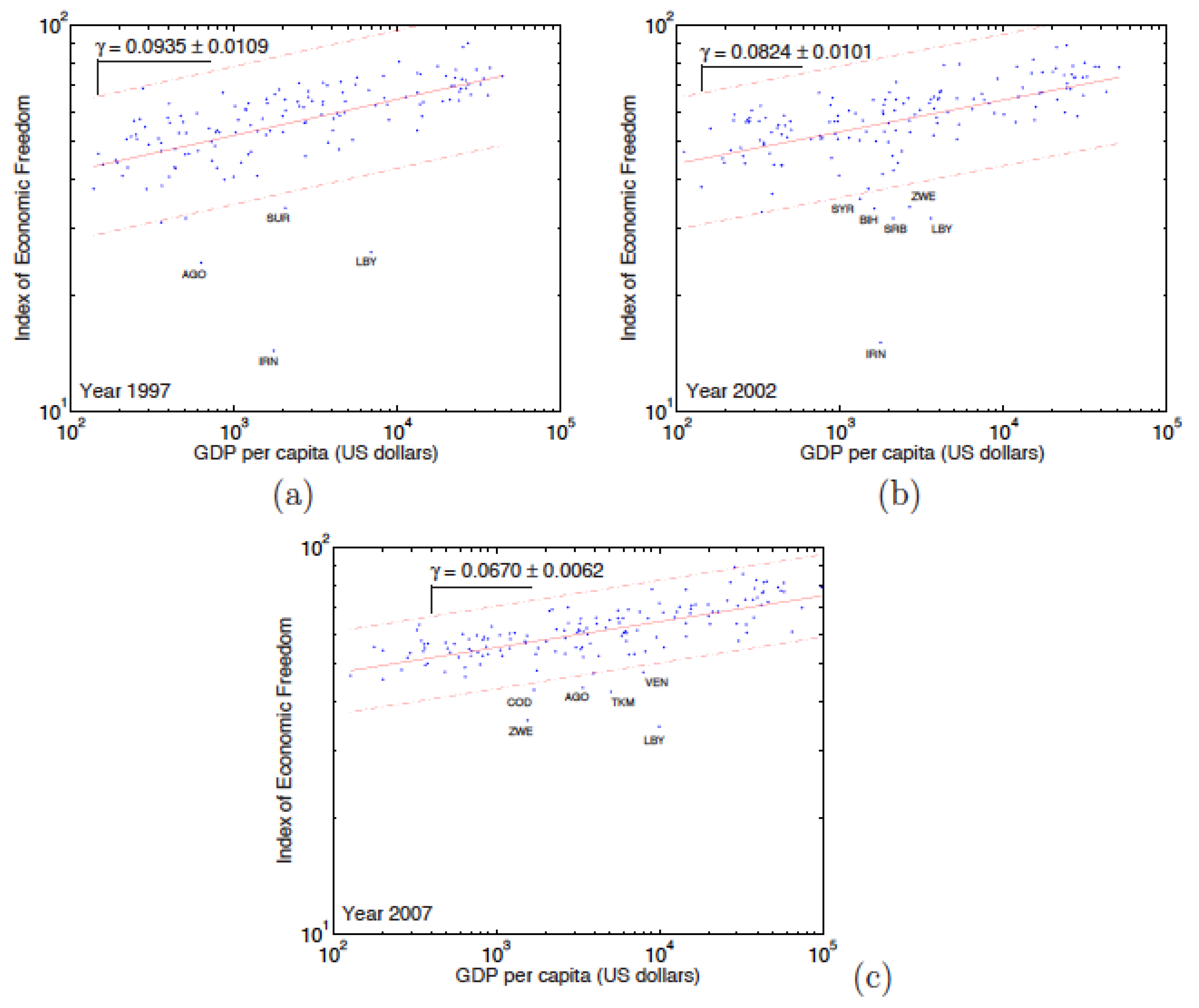

4. Relationship between Economic Freedom and Wealth of Countries

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Jolly, A. OECD Economies and the World Today: Trends, Prospects and OECD Statistics; Kogan Page Business Books: London, UK, 2003. [Google Scholar]

- Smith, A. The Wealth of Nations: An Inquiry into the Nature and Causes of the Wealth of Nations; Harriman House Limited: Petersfield, UK, 2010. [Google Scholar]

- Bastiat, F. Economic Harmonies. Irvington-On-Hudson; Foundation for Economic Education: New York, NY, USA, 1964. [Google Scholar]

- Bastiat, F. Harmonies of Political Economy; Jazzybee Verlag Jürgen Beck: Altenmünster, Deutschland, 1944. [Google Scholar]

- Gwartney, J.; Lawson, R.; Norton, S. Economic Freedom of the World: 2008 Annual Report; The Fraser Institute: Vancouver, BC, Canada, 2008. [Google Scholar]

- Gollwitzer, S.; Quintyn, M. The Effectiveness of Macroeconomic Commitment in Weak (er) Institutional Environments; International Monetary Fund: Washington, DC, USA, 2010. [Google Scholar]

- Friedman, M.; Friedman, R.D. Two Lucky People: Memoirs; University of Chicago Press: Chicago, IL, USA, 1998. [Google Scholar]

- Krugman, P. Who Was Milton Friedman? N. Y. Rev. Books 2007, 54, 27. [Google Scholar]

- Rothbard, M.N. For a New Liberty: The Libertarian Manifesto; Ludwig von Mises Institute: Auburn, AL, USA, 1978. [Google Scholar]

- Rothbard, M.N. Ethics of Liberty; New York University Press: New York, NY, USA, 2015. [Google Scholar]

- Weimer, D.L. The Political Economy of Property Rights: Institutional Change and Credibility in the Reform of Centrally Planned Economies; Cambridge University Press: Cambridge, UK, 1997; pp. 1–19. [Google Scholar]

- De Soto, H. The Mystery of Capital. Financ. Dev. 2001, 38, 66–67. [Google Scholar]

- Sen, A. Markets and Freedoms: Achievements and Limitations of the Market Mechanism in Promoting Individual Freedoms. Oxf. Econ. Pap. 1993, 45, 519–541. [Google Scholar] [CrossRef]

- Goodin, R.E.; Rice, J.M.; Parpo, A.; Eriksson, L. Discretionary Time: A New Measure of Freedom; Cambridge University Press: Cambridge, UK, 2008. [Google Scholar]

- Available online: http://www.fraserinstitute.rog/ (accessed on 30 October 2006).

- Available online: http://www.freetheworld.com/index.html/ (accessed on 30 October 2006).

- Lawson, R.A.; Murphy, R.; Powell, B. The determinants of economic freedom: A survey. Contemp. Econ. Policy 2020, 38, 622–642. [Google Scholar] [CrossRef]

- Available online: http://www.heritage.org/ (accessed on 30 October 2006).

- Available online: http://online.wsj.com/public/us (accessed on 30 October 2006).

- Executive Summary, Index of Economic Freedom. 2008. Available online: http://www.heritage.org/index/PDF/2008/Index2008ExecSum.pdf (accessed on 30 October 2009).

- Beach, W.W.; Kane, T. Methodology: Measuring the 10 Economic Freedoms, Index of Economic Freedom. 2008. Available online: http://thf_media.s3.amazonaws.com/index/pdf/2008/Index2008_Chapter4.pdf (accessed on 30 October 2009).

- Dialga, I.; Vallée, T. The index of economic freedom: Methodological matters. Stud. Econ. Financ. 2021, 38, 529–561. [Google Scholar] [CrossRef] [Green Version]

- Pei, M. Political Institutions, Democracy, and Development, Democracy, Market Economics, and Development; World Bank Publications: Herndon, VA, USA, 2001. [Google Scholar]

- Easton, S.T.; Walker, M.A. Income, growth, and economic freedom. Am. Econ. Rev. 1997, 87, 328–332. [Google Scholar]

- Ayal, E.B.; Karras, G. Components of economic freedom and growth: An empirical study. J. Dev. Areas 1998, 32, 327–338. [Google Scholar]

- Scully, G. Economic Freedom, Government Policy, and the Trade-Off Between Equity and Economic Growth. Public Choice 2002, 113, 77–96. [Google Scholar] [CrossRef]

- Berggren, N. Economic Freedom and Equality: Friends or Foes? Public Choice 1999, 100, 203–223. [Google Scholar] [CrossRef]

- Holcombe, R.G. Entrepreneurship and Economic Growth. Q. J. Austrian Econ. 1998, 1, 45–62. [Google Scholar] [CrossRef] [Green Version]

- De Haan, J.; Sturm, J.E. On the relationship between economic freedom and economic growth. Eur. J. Political Econ. 2000, 16, 215–241. [Google Scholar] [CrossRef] [Green Version]

- Doucouliagos, C.; Ulubasoglu, M.A. Economic freedom and economic growth: Does specification make a difference? Eur. J. Political Econ. 2006, 22, 60–68. [Google Scholar] [CrossRef]

- Hristova, K.D. Does Economic Freedom Determine Economic Growth? A Discussion of the Heritage Foundation’s Index of Economic Freedom. Ph.D. Thesis, Mount Holyoke College, South Hadley, MA, USA, 2012. [Google Scholar]

- Islam, S. Economic freedom, per capita income and economic growth. Appl. Econ. Lett. 1996, 3, 595–597. [Google Scholar] [CrossRef]

- Rode, M.; Coll, S. Economic freedom and growth. Which policies matter the most? Const. Political. Econ. 2012, 23, 95–133. [Google Scholar] [CrossRef]

- Cole, J.H. Contribution of Economic Freedom to World Economic Growth, 1980–1999. Cato J. 2003, 23, 189–198. [Google Scholar]

- Dawson, J.W. Causality in the freedom-growth relationship. Eur. J. Political. Econ. 2003, 19, 479–495. [Google Scholar] [CrossRef]

- Available online: http://www.dollarsandsense.org/archives/2005/0305miller.html (accessed on 30 October 2006).

- Heckelman, J.C.; Stroup, M.D. Which Economic Freedoms contribute to growth? Kyklos 2000, 53, 527–544. [Google Scholar] [CrossRef]

- Available online: http://www.freetheworld.com/datasets_-efw.html (accessed on 30 October 2006).

- Available online: http://www.heritage.org/index/download.aspx (accessed on 30 October 2006).

- Available online: http://www.imf.org/external/pubs/ft/weo/2007/01/data/index.aspx (accessed on 30 October 2009).

- Available online: https://millenniumindicators.un.org/unsd/mdg/Data.aspx (accessed on 30 October 2009).

- Zipf, G.K. Human Behavior and the Principle of Least Effort: An Introduction to Human Ecology; Addison Wesley: Cambridge, MA, USA, 1949. [Google Scholar]

- Wigmore, B.A. The Financial Crisis of 2008: A History of US Financial Markets 2000–2012; Cambridge University Press: Cambridge, UK, 2021. [Google Scholar]

(yrs) | N | Mean () | St.Dev. () | Var. () | CoV. () | Skewn. | Kurt. | |

|---|---|---|---|---|---|---|---|---|

| EFW | 7 | 908 | 6.49 | 0.98 | 0.96 | 0.151 | −0.3567 | 3.3670 |

| IEF | 12 | 1784 | 58.79 | 11.97 | 143.34 | 0.2036 | −0.2373 | 3.5416 |

| Kolmogorov–Smirnov (KS) Test | EFW | IEF |

|---|---|---|

| p-value | 0.1088 | 0.0633 |

| Gaussian Distribution Critical Value | 0.0449 | 0.0321 |

| Significance Level | 0.05 | 0.05 |

| Number of data points | 908 | 1784 |

| DKS | 0.0399 | 0.0310 |

| 2006 EFW Ranking | |||||

|---|---|---|---|---|---|

| Rank | Country | 2006 | Rank | Country | 2006 |

| 1 | Hong-Kong | 8.94 | 11 | Estonia | 7.89 |

| 2 | Singapore | 8.57 | 12 | Iceland | 7.8 |

| 3 | New Zealand | 8.28 | 13 | Denmark | 7.78 |

| 4 | Switzerland | 8.20 | 14 | Finland | 7.69 |

| 5 | United Kingdom | 8.07 | 15 | Austria | 7.66 |

| 6 | Chile | 8.06 | 16 | Netherlands | 7.65 |

| 7 | Canada | 8.05 | 17 | Germany | 7.64 |

| 8 | Australia | 8.04 | 18 | Taiwan | 7.63 |

| 8 | United States | 8.04 | 19 | Kuwait | 7.62 |

| 10 | Ireland | 7.92 | 20 | Slovak Rep. | 7.61 |

| 2006 EFW Ranking | |||||

|---|---|---|---|---|---|

| Rank | Country | 2006 | Rank | Country | 2006 |

| 121 | Ethiopia | 5.64 | 131 | Burundi | 5.23 |

| 121 | Ukraine | 5.64 | 131 | Rwanda | 5.23 |

| 123 | Burkina Faso | 5.63 | 133 | Chad | 5.12 |

| 124 | Algeria | 5.57 | 134 | Central Africa Rep. | 5.01 |

| 125 | Syria | 5.54 | 134 | Guinea-Bissau | 5.01 |

| 126 | Malawi | 5.42 | 136 | Venezuela | 4.76 |

| 127 | Gabon | 5.37 | 137 | Niger | 4.67 |

| 128 | Nepal | 5.35 | 138 | Congo, Rep. of | 4.64 |

| 129 | Togo | 5.33 | 139 | Myanmar | 4.19 |

| 130 | Congo, Dem. Rep. | 5.25 | 140 | Angola | 4.10 |

| 141 | Zimbabwe | 2.67 | |||

| 2006 IEF Ranking | |||||

|---|---|---|---|---|---|

| Rank | Country | 2006 | Rank | Country | 2006 |

| 1 | Hong-Kong | 88.6 | 11 | Iceland | 75.8 |

| 2 | Singapore | 88.0 | 12 | Denmark | 75.4 |

| 3 | Ireland | 82.2 | 12 | Netherlands, The | 75.4 |

| 4 | New Zealand | 82.0 | 14 | Luxembourg | 75.3 |

| 5 | United States | 81.2 | 15 | Estonia | 74.9 |

| 6 | United Kingdom | 80.4 | 16 | Japan | 73.3 |

| 7 | Australia | 79.9 | 17 | Finland | 72.9 |

| 8 | Switzerland | 78.9 | 18 | Bahamas, The | 72.3 |

| 9 | Chile | 78.0 | 19 | Barbados | 71.9 |

| 10 | Canada | 77.4 | 20 | Cyprus | 71.8 |

| 2006 IEF Ranking | |||||

|---|---|---|---|---|---|

| Rank | Country | 2006 | Rank | Country | 2006 |

| 138 | Chad | 50.0 | 148 | Iran | 45.0 |

| 139 | Haiti | 49.2 | 149 | Venezuela | 44.6 |

| 140 | Nigeria | 48.7 | 150 | Turkmenistan | 43.8 |

| 140 | Burundi | 48.7 | 150 | Congo. Rep. of | 43.8 |

| 140 | Uzbekistan | 48.7 | 152 | Angola | 43.5 |

| 143 | Laos | 47.5 | 153 | Burma | 40.0 |

| 143 | Belarus | 47.5 | 154 | Zimbabwe | 33.5 |

| 145 | Togo | 47.3 | 155 | Libya | 33.2 |

| 146 | Guinea-Bissau | 46.5 | 156 | Cuba | 29.3 |

| 147 | Sierra Leone | 45.2 | 157 | Korea. North | 4.0 |

| EFW | ||||

|---|---|---|---|---|

| Year | ||||

| 2000 | −0.0043 | 0.0001 | 0.0272 | 0.9316 |

| 2001 | −0.0039 | 0.0001 | 0.0257 | 0.9388 |

| 2002 | −0.0037 | 0.0001 | 0.0208 | 0.9591 |

| 2003 | −0.0035 | 0.0001 | 0.0129 | 0.9839 |

| 2004 | −0.0035 | 0.0001 | 0.0068 | 0.9954 |

| 2005 | −0.0029 | 0.0001 | 0.0107 | 0.9889 |

| 2006 | −0.0029 | 0.0001 | 0.0113 | 0.9876 |

| EFW | ||||

|---|---|---|---|---|

| Year | ||||

| 2000 | −0.0992 | 0.0034 | 0.0343 | 0.9161 |

| 2001 | −0.0907 | 0.0029 | 0.0314 | 0.9285 |

| 2002 | −0.0890 | 0.0029 | 0.0328 | 0.9226 |

| 2003 | −0.0872 | 0.0032 | 0.0369 | 0.9038 |

| 2004 | −0.0857 | 0.0034 | 0.0393 | 0.8924 |

| 2005 | −0.0743 | 0.0023 | 0.0306 | 0.9319 |

| 2006 | −0.0700 | 0.0024 | 0.0344 | 0.9154 |

| IEF | ||||

|---|---|---|---|---|

| Year | ||||

| 1996 | −0.0060 | 0.0003 | 0.0422 | 0.8087 |

| 1997 | −0.0055 | 0.0002 | 0.0405 | 0.8124 |

| 1998 | −0.0057 | 0.0002 | 0.0385 | 0.8211 |

| 1999 | −0.0054 | 0.0002 | 0.0416 | 0.7919 |

| 2000 | −0.0051 | 0.0002 | 0.0382 | 0.8185 |

| 2001 | −0.0050 | 0.0002 | 0.0345 | 0.8508 |

| 2002 | −0.0049 | 0.0002 | 0.0381 | 0.8235 |

| 2003 | −0.0044 | 0.0001 | 0.0212 | 0.9374 |

| 2004 | −0.0043 | 0.0001 | 0.0241 | 0.9215 |

| 2005 | −0.0041 | 0.0001 | 0.0246 | 0.9180 |

| 2006 | −0.0037 | 0.0001 | 0.0238 | 0.9223 |

| 2007 | −0.0036 | 0.0001 | 0.0227 | 0.9285 |

| IEF | ||||||||

|---|---|---|---|---|---|---|---|---|

| Year | (%) | (%) | (%) | (%) | ||||

| 1996 | −0.0931 | 0.0071 | 7.60 | 95.58 | −0.1820 | 0.0056 | 3.09 | 92.16 |

| 1997 | −0.0889 | 0.0073 | 8.26 | 94.82 | −0.1647 | 0.0053 | 3.25 | 91.43 |

| 1998 | −0.0808 | 0.0099 | 12.28 | 89.24 | −0.1505 | 0.0044 | 2.92 | 92.96 |

| 1999 | −0.0797 | 0.0079 | 9.90 | 92.73 | −0.1477 | 0.0029 | 1.95 | 96.73 |

| 2000 | −0.0807 | 0.0089 | 10.97 | 91.21 | −0.1504 | 0.0030 | 1.98 | 96.63 |

| 2001 | −0.0723 | 0.0058 | 8.02 | 95.11 | −0.1634 | 0.0042 | 2.54 | 94.57 |

| 2002 | −0.0624 | 0.0074 | 11.80 | 89.97 | −0.1651 | 0.0022 | 1.36 | 98.38 |

| 2003 | −0.0686 | 0.0070 | 10.17 | 92.35 | −0.1704 | 0.0031 | 1.81 | 97.18 |

| 2004 | −0.0690 | 0.0092 | 13.35 | 87.52 | −0.1690 | 0.0024 | 1.45 | 98.16 |

| 2005 | −0.0717 | 0.0095 | 13.26 | 87.67 | −0.1678 | 0.0024 | 1.40 | 98.28 |

| 2006 | −0.0564 | 0.0047 | 8.29 | 94.78 | −0.1522 | 0.0022 | 1.45 | 98.17 |

| 2007 | −0.0518 | 0.0038 | 7.33 | 95.88 | −0.1516 | 0.0022 | 1.47 | 98.11 |

| Variable | (Years) | N | Mean () | StDev () | CoV () | |

|---|---|---|---|---|---|---|

| EFW | 138 | 7 | 862 | 0.6542 | 0.0948 | 0.1449 |

| IEF | 138 | 7 | 862 | 0.6118 | 0.1094 | 0.1788 |

| EFW | |

|---|---|

| Year | Countries |

| 2000 | DZA-COD-MMR-ZWE |

| 2001 | DZA-ZWE |

| 2002 | DZA-COD-MMR-VEN-ZWE |

| 2003 | DZA-MMR-VEN-ZWE |

| 2004 | DZA-COD-VEN-ZWE |

| 2005 | DZA-COD-VEN-ZWE |

| 2006 | AGO-COD-MMR-VEN-ZWE |

| IEF | |

|---|---|

| Year | Countries |

| 1996 | AGO-AZE-IRN-LBY |

| 1997 | AGO-IRN-LBY-SUR |

| 1998 | AGO-BIH-IRN-LOA-LBY-UZB |

| 1999 | AGO-BIH-COG-IRN-LAO-LBY-UZB |

| 2000 | AGO-COG-IRN-LOA-LBY |

| 2001 | BLR-BIH-LOA-LBY |

| 2002 | BIH-IRN-LBY-SRB-SYR-ZWE |

| 2003 | BLR-BIH-LBY–SYR-ZWE |

| 2004 | BLR-LBY-SYR-VEN-ZWE |

| 2005 | LBY-VEN-ZWE |

| 2006 | AGO-COD-LBY-TKM-VEN-ZWE |

| 2007 | AGO-COD-LBY-TKM-VEN-ZWE |

| EFW ∼ | ||||

|---|---|---|---|---|

| Year | ||||

| 2000 | 0.0744 | 0.0061 | 0.0824 | 0.5490 |

| 2001 | 0.0669 | 0.0061 | 0.0917 | 0.4959 |

| 2002 | 0.0636 | 0.0062 | 0.0978 | 0.4636 |

| 2003 | 0.0641 | 0.0059 | 0.0922 | 0.4847 |

| 2004 | 0.0705 | 0.0057 | 0.0814 | 0.5410 |

| 2005 | 0.0667 | 0.0062 | 0.0934 | 0.4540 |

| 2006 | 0.0653 | 0.0062 | 0.0952 | 0.4443 |

| IEF ∼ | ||||

|---|---|---|---|---|

| Year | ||||

| 1996 | 0.0940 | 0.0117 | 0.1248 | 0.3255 |

| 1997 | 0.0935 | 0.0109 | 0.1163 | 0.3439 |

| 1998 | 0.0994 | 0.0113 | 0.1140 | 0.3435 |

| 1999 | 0.0956 | 0.0112 | 0.1166 | 0.3261 |

| 2000 | 0.0915 | 0.0099 | 0.1086 | 0.3583 |

| 2001 | 0.0870 | 0.0098 | 0.1131 | 0.3472 |

| 2002 | 0.0824 | 0.0101 | 0.1224 | 0.3107 |

| 2003 | 0.0802 | 0.0075 | 0.0940 | 0.4332 |

| 2004 | 0.0773 | 0.0073 | 0.0947 | 0.4313 |

| 2005 | 0.0728 | 0.0070 | 0.0956 | 0.4267 |

| 2006 | 0.0662 | 0.0064 | 0.0961 | 0.4208 |

| 2007 | 0.0670 | 0.0062 | 0.0922 | 0.4414 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ausloos, M.; Bronlet, P. Economic Freedom: The Top, the Bottom, and the Reality. I. 1997–2007. Entropy 2022, 24, 38. https://doi.org/10.3390/e24010038

Ausloos M, Bronlet P. Economic Freedom: The Top, the Bottom, and the Reality. I. 1997–2007. Entropy. 2022; 24(1):38. https://doi.org/10.3390/e24010038

Chicago/Turabian StyleAusloos, Marcel, and Philippe Bronlet. 2022. "Economic Freedom: The Top, the Bottom, and the Reality. I. 1997–2007" Entropy 24, no. 1: 38. https://doi.org/10.3390/e24010038

APA StyleAusloos, M., & Bronlet, P. (2022). Economic Freedom: The Top, the Bottom, and the Reality. I. 1997–2007. Entropy, 24(1), 38. https://doi.org/10.3390/e24010038