4.1. Derivations

A game of chance is defined by a random variable, X, and a payoff function, F. The value states the amount of reward associated with a particular outcome, x, of the variable. This technical definition covers many practical situations. For instance, might denote the payout for medical insurance in the event of a diagnosis x.

Consider an investor who is interested in finding the optimal shape of

F so as to maximize their benefit. Following von Neumann and Morgenstern [

14] we understand the benefit as the expected utility of the payoff

where

U is the utility function and

b is the investor-believed probability distribution for the variable

X. It is important to remember that both the probability distribution

b and the utility function

U reflect the investor’s personal understanding of the game.

When maximizing

, the investor is subject to a budget constraint. To state this constraint mathematically, we need the ability to price the game. Assuming a very general setting which is used in the financial industry we write the fair price of

F as the average (

2), where the positive-valued function

m summarizes the relative prices of ensuring against every outcome

x of the random variable

X. In game-theoretic illustrations this is often stated in terms of “odds”; economists would recognize this as Arrow–Debreu prices. For our purposes, the important point to remember is that

m is a given property of the market and the investor has no choice but to take it into account when understanding their budget. For simplicity we assume that

m is a probability distribution (“fair odds”) and that

.

The payoff

F which achieves the maximum of

under the constraint

satisfies the payoff elasticity equation [

15]

where

and

is the Arrow–Pratt relative risk aversion. This equation is used in finance to produce

information derivatives—financial instruments which are derived from all relevant information (including market-implied

m together with investor-believed

b and

R).

Kelly’s intuition concerns the important special case of

. This is the famous case of the growth-optimizing investor which was first introduced by Bernoulli in 1738 [

16]. Indeed, when

the utility function

, so the investor is optimizing the expected logarithmic rate of return:

Kelly studied the growth-optimizing investor in detail and showed that under some natural assumptions the investor’s expectation for the logarithmic rate of return is exactly the relative entropy [

3]. The reader can verify this result independently by substituting

into Equation (

5) and computing

This is the mathematical essence of Kelly’s game-theoretic (financial) interpretation for the information rate.

Kelly’s interpretation depends on the investor being growth-optimizing. According to Samuelson, this is a major weakness which limits (if not prevents) any use of Kelly’s interpretation in practice [

5,

6].

In an entirely separate argument, Rényi considered the core mathematical properties of information, formulated them as axioms, and recognized relative entropy (the last expression in Equation (

7)) as a special case of a much larger class of information measures [

2]. This class is spanned by linear combinations of the quantities defined in (

1) with different values of

. An individual

is called Rényi’s divergence of order

of a probability distribution

b from another distribution

m. The relative entropy is included in this definition as the limiting case [

2]

In what follows, we show that Samuelson’s demands for considering more general investors and Rényi’s generalization of the relative entropy are in fact a statement and a solution of the same economic problem which translates information content (captured as disagreement between distributions) into financial returns.

Let us consider an investor with an arbitrary constant relative risk aversion,

. Unless

, i.e., unless the investor is growth-optimizing, the growth rate expected by the investor will be smaller than the Kelly benchmark (

7). The natural question to ask is how much smaller. Using Equation (

5) we derive the optimal payoff

By direct substitution into Equation (

6) we compute

Together with Equations (

7) and (

8) this gives us the transformation (

3). As a side observation, the reader might be interested to note that the structure of this expression is rather general. In particular, by replacing the investor-believed distribution

b with any other distribution

p one can prove a much more general law with the exact same structure. Expanding

one can write this as

In other words, one can talk about the investor-expected returns (

) or look at the actual realized returns (in which case

p coincides with the actual distribution for

X) or we can take the perspective of a totally independent observer who computes expectations using a very different distribution

p and, in all of these cases, the effect of risk aversion on the financial performance of the growth-optimizing investor would follow the same universal law (

11).

Coming back to the investor-expected returns, let us investigate the drop in the expected return of

F relative to the growth-optimizing

f. Using the Kelly result,

, we compute from Equation (

3)

Using the fact that

is a nondecreasing function in

we can rewrite this as

Equations (

3), (

11) and (

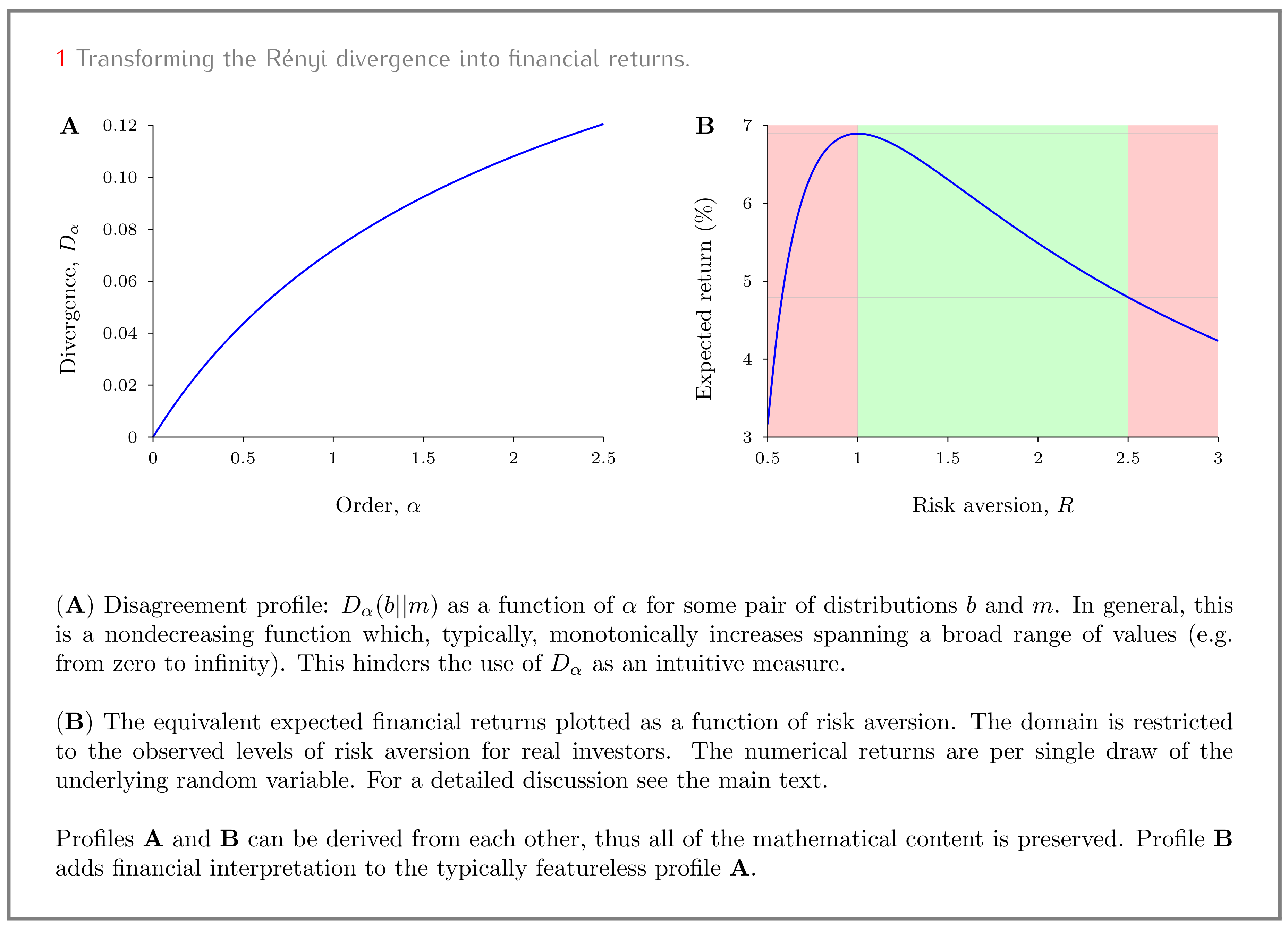

13) convert the abstract axiomatically-motivated measure of Rényi divergence into a much more intuitive measure of financial returns. This is the point where pure and simple mathematics turns into science about the real world, so we need to be extra careful: we need to understand the limitations of the resulting economic intuition before it can be used in practice.

4.2. Reality Check—Risk Aversion of Equity Investors

Using the rational part of Samuelson’s critique as inspiration, we demand, as a matter of principle, that economic intuition can only be based on realistic investors. Failing that, we might not be able to relate correctly to the calculated experience, so the resulting financial intuition might be flawed.

Putting aside the information-theoretic definitions, we see that all our expressions for financial returns follow directly from the payoff elasticity Equation (

5). We therefore require Equation (

5) to be tested for its ability to explain the observed financial returns.

In this section, we review the observed data on equity returns, formulate the relevant tests and summarize their results. In terms of practical outcomes, we estimate the range of risk aversion for which the financial intuition is safe to use (the domain of

Figure 1B). The amount of technical detail embedded in this section might seem out of proportion to the relatively simple topic of this paper. For this reason we defer as many technical arguments as we can to the

supplementary materials paper.

The type and the amount of available data depend greatly on a financial asset. Often we have some records of past performance (i.e., realized returns). For a popular established asset we might also have records of investors’ past expectations (expected returns). Both types of returns are interesting for us (as they would be for any investor making a decision).

Some assets might also support a derivatives market. Price records from such markets effectively provide us with a history of market-implied distributions. Imagine, for instance, that in Equation (

2) we knew

for any

F. That would give us the distribution

, which is a very important element in our theory (

m enters Equation (

5) via

f).

In what follows, we focus on the famous S&P 500 index and the relevant derivatives markets. The value of the index is proportional to the aggregated capitalization of 500 large companies listed on US stock exchanges. The total returns on the index (i.e., returns including dividends) reflect a fairly broad equity investment. The records of the index go back to its inception in 1926. The records of derivative prices and the investor-believed returns are much more recent by comparison (see below). Nevertheless, the S&P 500 is an excellent benchmark of equity performance which is widely used in both industry and academia.

The above mentioned data contain a lot of nontrivial information which continues to challenge major economic theories. For instance, the entire class of consumption-based models have been struggling to explain the data for over 30 years. This fact is widely known in economics as the equity premium puzzle (see [

17] and references therein).

In order to see how we can test Equation (

5) we need to understand its place in the bigger picture. The equation describes a rational strategy. In other words, it provides a solution to a standard optimization with the standard form of expected utility (

4). However, unlike the consumption-based models in economics, the payoff elasticity Equation (

5) does not claim to describe the entirety of human economic behavior.

It is a key scientific fact that the human brain is (simultaneously) engaged in many strategies [

18]. Each of these strategies has a goal. In this sense all individual strategies are rational by definition (with respect to their individual narrow goals). Equation (

5) can be very useful in describing such individual strategies.

The individual strategies are in constant competition with each other for limited resources. Even within a single person this competition produces a highly complex behavior which, as far as we know, does not fit any simple model. Equation (

5), or indeed any single-goal rational framework, fails to describe a human person (let alone an economy).

In order to test Equation (

5) we need to isolate a single strategy. Competition between strategies helps us to do that. Indeed, competition promotes strategies which make sense, strategies which justify themselves. In particular, a simple strategy which demonstrates realistic expectations that are regularly confirmed by actual performance has a good chance of becoming popular. The popularity of such strategies makes their effects measurable on a large scale.

Equity investment is a very simple and popular strategy. Specialized infrastructure in the form of stock exchanges and numerous trading firms support huge transaction volumes (currently approaching transactions per day globally). Equity investments are easy to liquidate. To sustain high levels of popularity for many decades (if not a century) the strategy of equity investment must make a lot of sense.

This gives us an opportunity to test Equation (

5). Indeed, if the equation claims to describe a real investment product, it must apply to a simple equity investment. In the context of financial returns we identify three key types of tests: (i) understanding investor-expected returns, (ii) understanding realized returns and (iii) demonstrating consistency between the investor-expected and the realized returns.

Let us now progress to a more technical level and see how such tests can be performed. First let us examine the structure of Equation (

5). We notice that Equation (

5) involves four quantities: the payoff

F, the investor’s view

b, the market-implied

m and the investor’s risk aversion

R. In the case of a simple equity investment the payoff structure,

F, is known exactly. The data from derivatives also gives us

m (as explained above). Eliminating these quantities from Equation (

5) leaves us with the connection between

b and

R. Equivalently, we can speak of a family of investor-believed distributions parameterized by their risk aversion:

. This observation is very useful for understanding the logic of the tests.

Since we know

F, the reader should not be surprised that thinking in terms of

might allow us to compute the expected rate of return as a function of

R (see Equation (

6)). So, if we know what the investors are expecting, as we do in test (i), we can deduce the investor’s risk aversion

R.

In the

supplementary materials paper we complete the above logic with all the details. The independent quotes on the implied equity premium [

19] provide us with data on the investor-expected returns. The research reported in

supplementary materials paper was based on the most current data available at the time. This covered the period of time from September 2008 to April 2015 (monthly quotes at the beginning of each month, see

Figure S1 of supplementary materials paper. In terms of derivatives data (which we need for

m) this timeline is well within the recent history retained by most investment banks. For the readers who have no license to standard commercial data on derivatives

supplementary materials paper provides a simplified version of the calculations (which can also serve as a ball-park stability check for the main calculations).

We found that the values of

R corresponding to the investor-expected returns were mostly in the range between 1 and 2.5 (see

Figure S2 of supplementary materials paper). By the standards adopted in the literature on the equity premium puzzle [

17] these values are well within the expected norm. Certainly, looking at the original paper by Mehra and Prescott [

20], we see that no puzzle would ever have been reported if these values of risk aversion had been implied by a consumption-based model. This completes the test of Equation (

5) for its consistency with the observed investor-expected returns (test-(i) in the above enumeration).

In the second type of tests (on realized returns) we do not have

b. Instead we have an historical distribution of returns. We know, however, that the investor who happened to have the correct view will find the long-term realized returns approaching their expectations. Mathematically, this can be seen by substituting

into Equation (

11) and comparing the result to Equation (

3). This is in fact how the investors’ expectations materialize in practice (see Section 2.2 of

supplementary materials paper for detailed explanations).

Thus, by matching to the historical distribution, we can once again estimate the values of R. This time, however, the numerical values of risk aversion are implied by the historical (i.e., realized) distribution.

Accurate representation of a distribution by a sample requires a lot of data. The data must include the derivatives market (because we need

m). We managed to find daily records on both the equity returns and, crucially, the derivatives market dating back to 17 May 2000. The last day in the sample is 27 April 2015. We found the range of

R explaining the realized returns was between 0.5 and 3 (see

Figure S4 of the supplementary materials paper). Just like we saw in the case of investor-expected returns (test-(i)), these values of risk aversion are well within the expectations.

For test-(iii) we need to compare our findings regarding the investor-expected and the realized returns. We see that the corresponding ranges of R overlap showing good agreement. More accurately, we notice the range of explaining the realized returns is slightly wider than the corresponding range explaining the investor-expected returns, . This is indeed what we should expect.

We expect our test of the realized returns to overestimate the range for

R because real investors do make mistakes in their forecasts. For example, we can find historical periods with very low (or even negative) realized returns. Rational investors would accept such returns only if they had very low levels of risk aversion. In reality, however, the investors enter such periods unawares so their actual

R might not be as low as suggested by the data. By trying to explain all of the data (as was done in

supplementary materials paper) we assume that the investor foresaw the realized distribution of returns and invested in full knowledge of that distribution. This overestimates the range of

R that is necessary to explain the observations.

Consequently, we use the values of R between 1 and 2.5 as confirmed and think of the wider range (between 0.5 and 3) as a possible overestimation.

Future investigations using Equation (

5) for different types of investors (not necessarily equity) and considering broader time periods will deepen our understanding of the possible ranges for

R. As we can see from the above formulae, this in turn will provide better intuition over the Rényi parameter

.

4.3. Further Reality Check—The Neuroscience of Decision-Making

For better or worse, the concept of financial returns has been very influential in human decision making. Indeed, even in the narrow field of finance, investment returns are by no means the only characteristic that one could compute about a business and yet it is certainly a very popular (if not the most popular) quantity that is always discussed during any investment decision process. Even the critics of the financial industry acknowledge the use of financial returns as a prime decision quantity (albeit as a manifestation of greed rather than a rational procedure).

Could it be that our brains naturally operate with quantities akin to financial returns when implementing at least some types of decision making? Below we give a cautiously positive answer to this question.

We turn our attention to the neurophysiological experiments reported in [

10,

11]. In these experiments, rhesus monkeys were presented with a binary decision task under uncertainty. Hoping for a reward, the monkeys communicated their decision by making an eye movement to either a green or a red target.

The monkeys had to base their decisions on a sequence of (visually presented) abstract shapes which influenced the reward probabilities in a certain well-controlled manner. Some shapes supported the green choice while others suggested the red target. The statistical meaning of each individual shape was fixed and the monkeys were given enough training to learn the general direction (red or green) as well as the shapes’ relative importance.

During the decision process the electrical activity of individual neurons in the lateral intraparietal area was measured. This area is rich in neurons, which are believed to be involved in planning eye movements [

21,

22,

23,

24]. The electrical activity of such neurons reliably predicts whether the target of the planned movement lies within or outside a fixed small region of the visual field (the response field of a neuron). It was found experimentally that the firing rate of such neurons is proportional to the log–likelihood ratio [

10]:

where

is the sequence of shapes shown to the monkey,

is the conditional probability of the sequence given the rewarded target appears is in the neuron’s response field and

is the conditional probability of the sequence given the rewarded target lies outside the neuron’s response field.

The gradual neurophysiological accumulation of probabilistic evidence suggested by the above expression has been explicitly tested [

11]. The same experiments revealed that, given the choice, the monkeys would voluntarily terminate the process of evidence accumulation and express their decision once the firing rate (

14) reaches a certain critical value.

Let us now examine what the above experiments say in the context of the payoff elasticity Equation (

5). Using the notation of Equation (

14), the binary outcome for the location of the reward in or out of the response field of the measured neuron corresponds to a binary random variable

. In this notation

Writing the analogous equation for

and using Equation (

5) we compute

Now let us recall the interpretation of

f as the likelihood function [

25]. This comes from understanding the equation

as Bayes’ theorem

The market-implied distribution,

, is perceived by the investor as prices. In the above experiments, for example, there was no a priori price difference between the red and the green targets. In other words, the market was flat:

. With no other data, i.e., before any further learning took place,

defines the prior distribution

. The investor-believed distribution reflects the investor’s final state of knowledge, i.e., it is the posterior

. It follows that

f is the likelihood

Using this fact, we can rewrite Equation (

16) as

By comparing this equation with the experimentally observed relationship (

14), we derive

where the proportionality coefficient may depend on risk aversion

R.

On the right-hand side of proportionality relation (

21) we have a quantity which is directly involved in decision making— the firing rate of the relevant neurons. The quantity on the left-hand side is about the optimal investment payoff

F; it is the difference of log-returns between the two possible outcomes inside the optimal investment.

Although we should be careful not to overstate the importance of (

21), it does provide us with some evidence that the concept of financial returns on optimized investments is not at all alien to our brains. Sometimes it can even be measured directly from individual neurons.