A Review of Micro-Based Systemic Risk Research from Multiple Perspectives

Abstract

1. Introduction

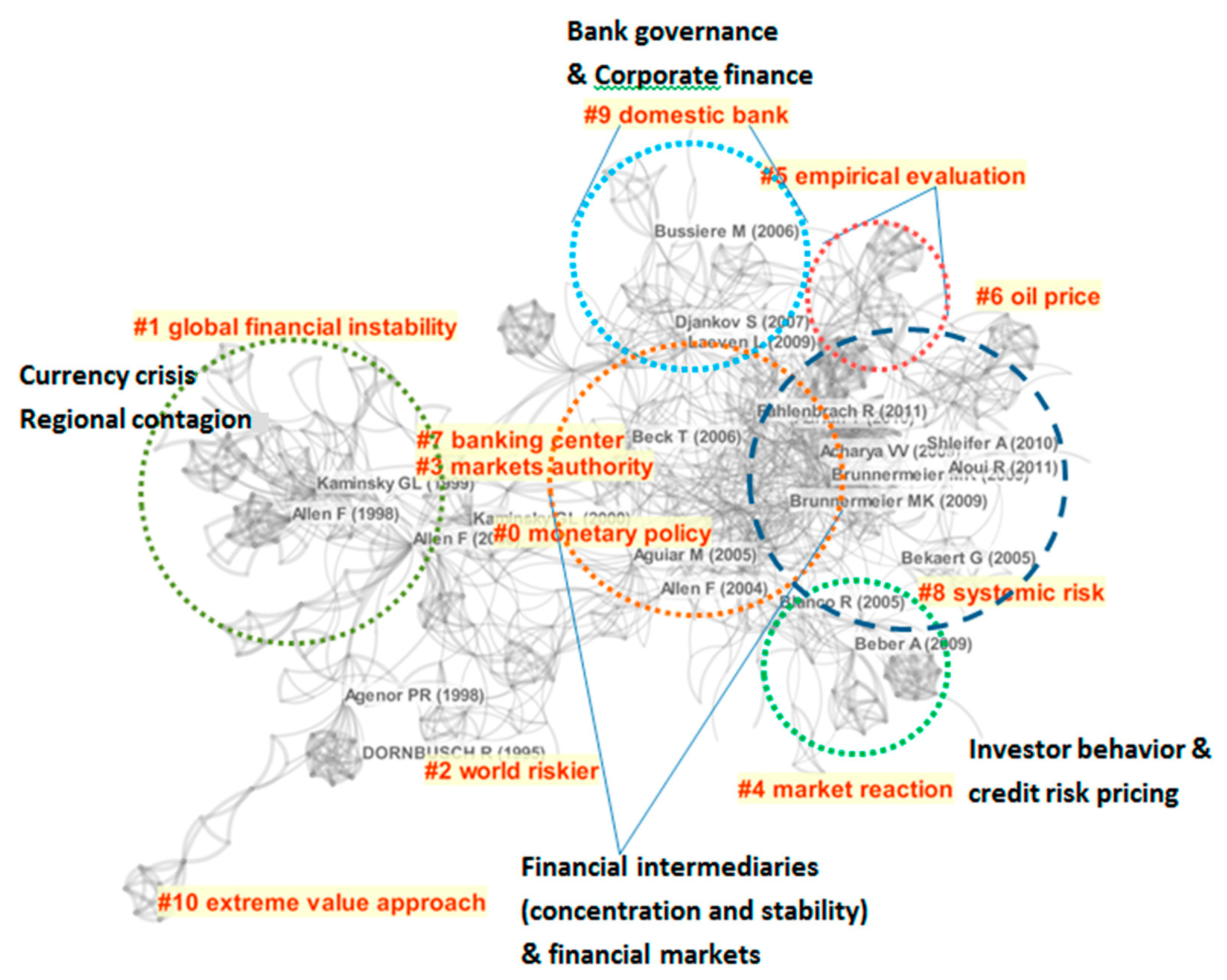

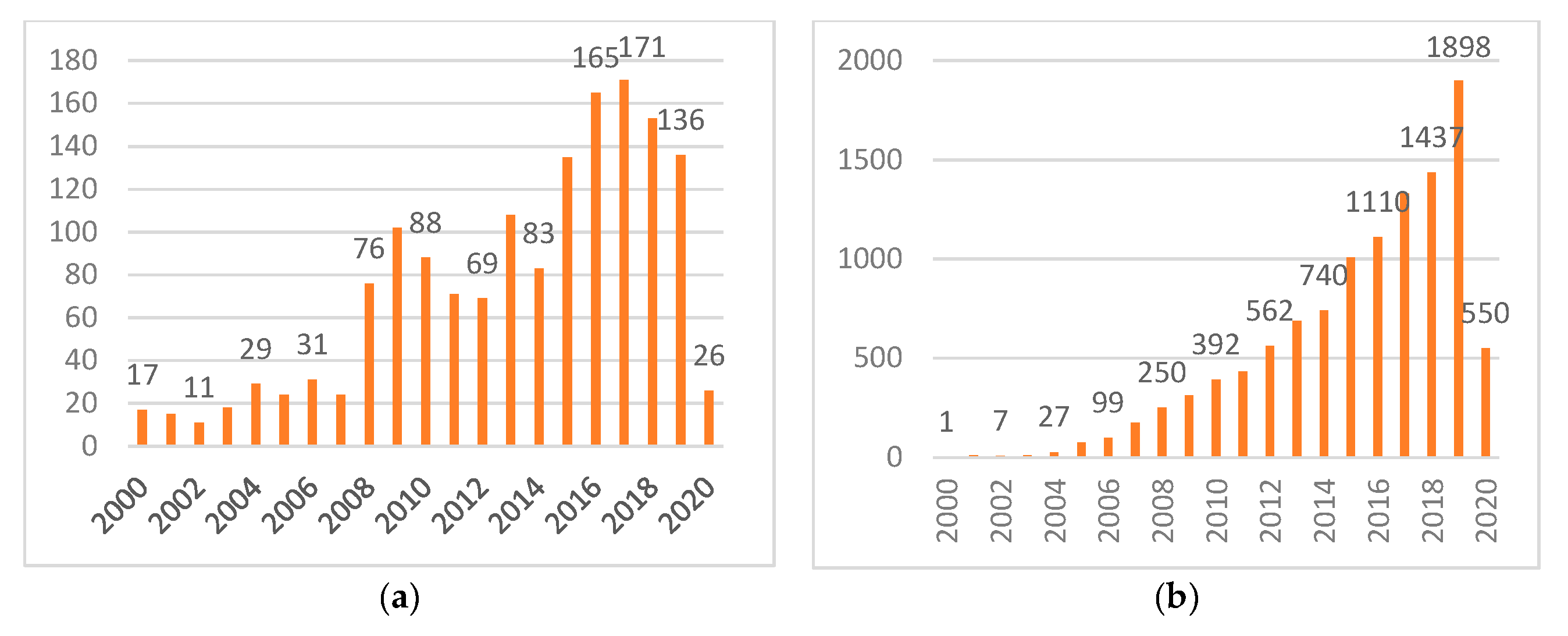

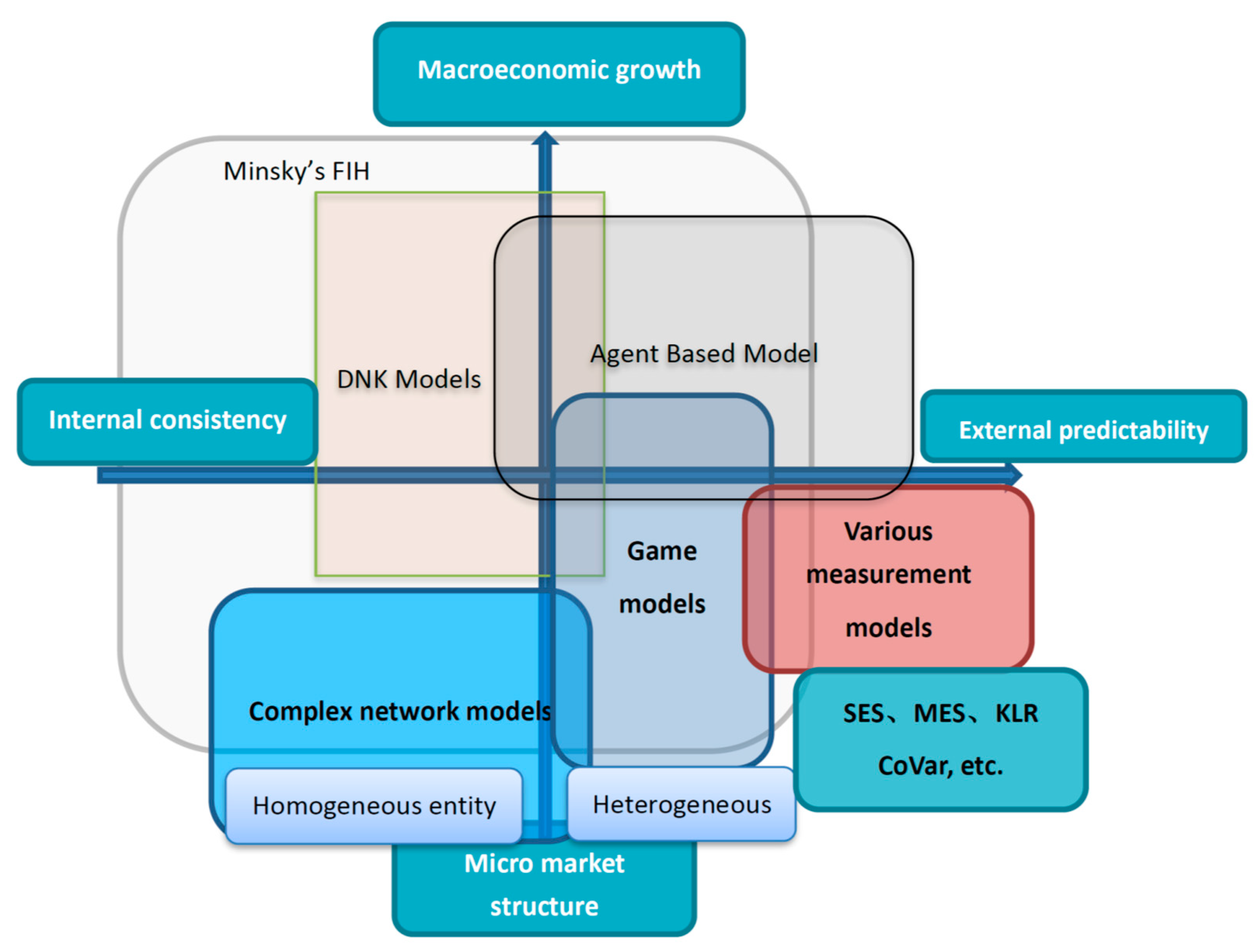

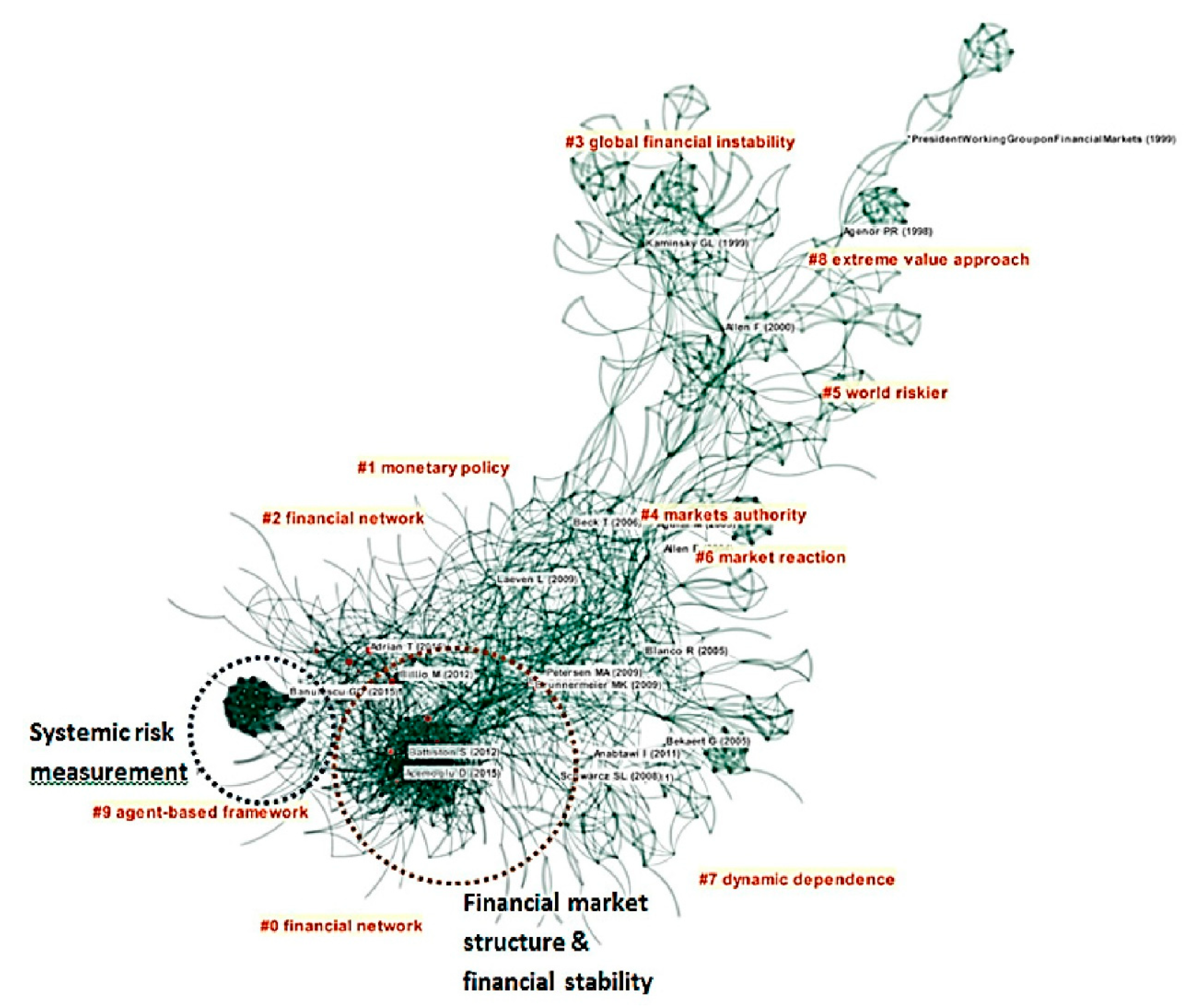

2. Progress in Systemic Risk Research

2.1. The Connotation of Systemic Risk

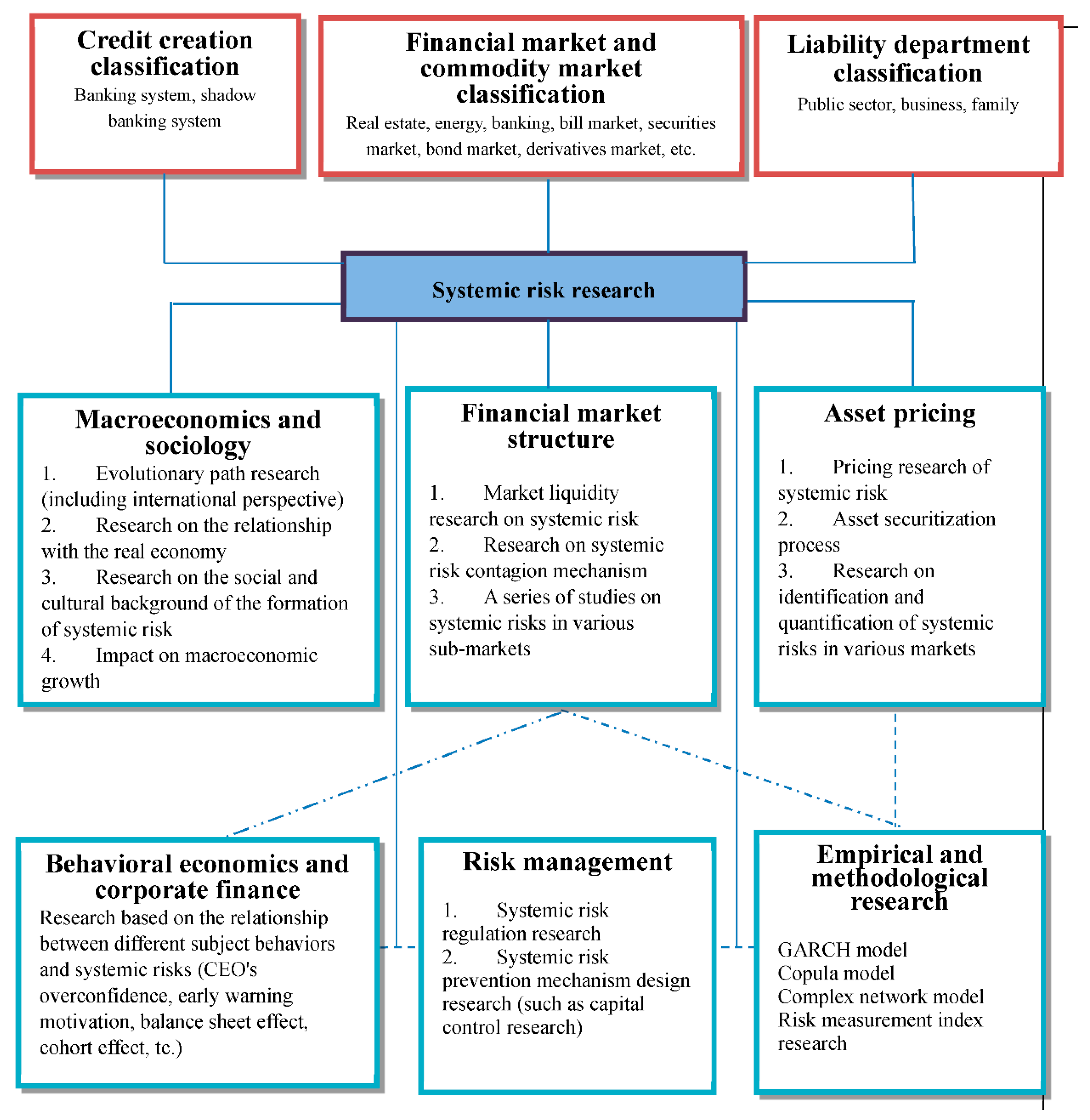

2.2. Content and Category of Systemic Risk Research

2.3. Research on the Evolution Mechanism of Systemic Risk

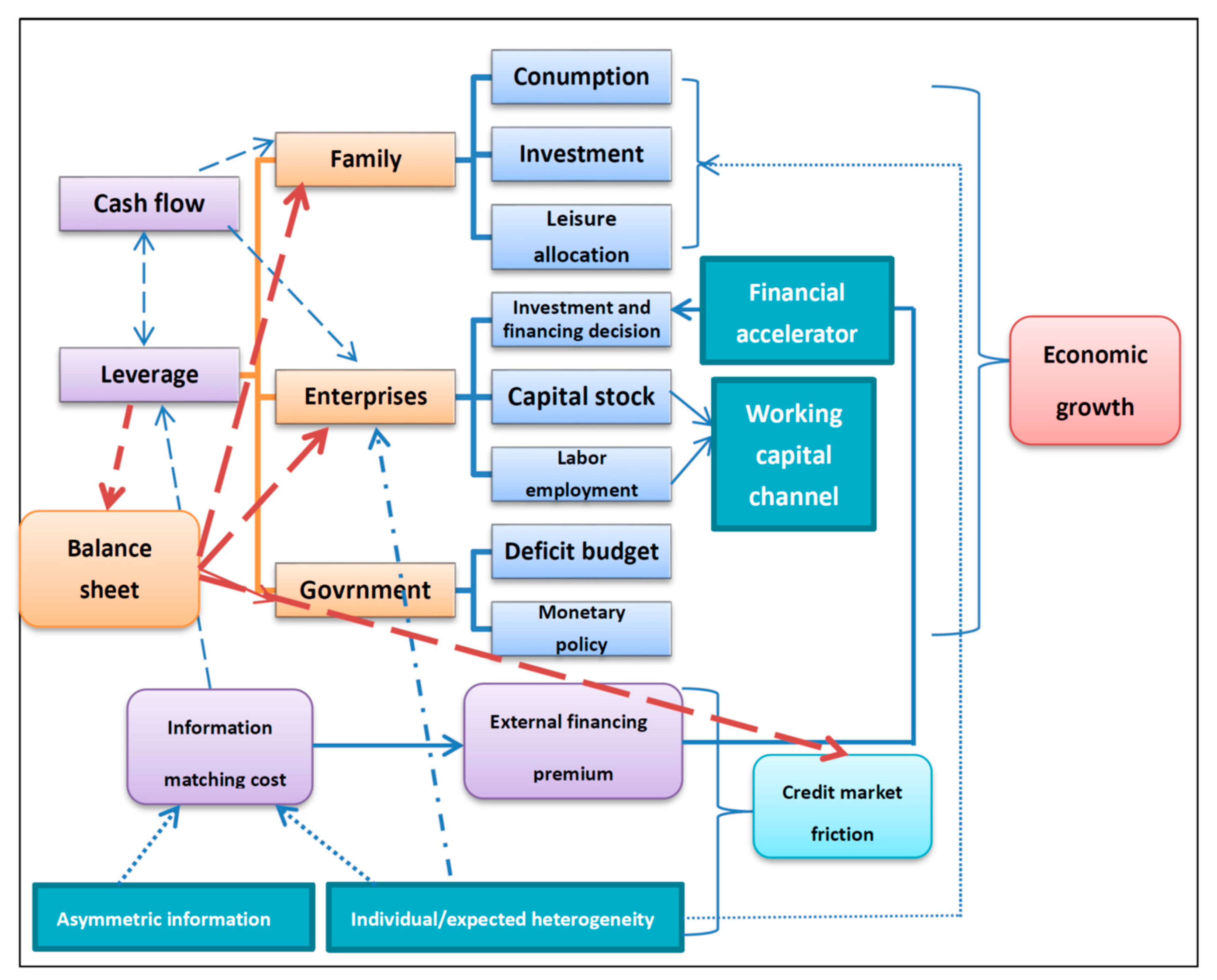

2.3.1. Research on the Formation Mechanism of Systemic Risk

2.3.2. Research on the Impact of Systemic Risk on Economic Growth

2.4. Micro Market Structure Research on Systemic Risk

2.4.1. Research on Financial Network Complexity and Financial Stability

2.4.2. Research on Systemic Risk Related to the Behavior of Financial Market Participants

2.4.3. Systemic Risk and Market Liquidity Research

- (1)

- Information asymmetry

- (2)

- Liquidity mismatch

- (3)

- Actual demand shock

2.4.4. Financial Contagions

- (1)

- Default contagion

- (2)

- Price-mediated contagion

- (1)

- Explaining the contagion path via networks of all types;

- (2)

- Empirically revealing the impact of contagion on the whole financial system;

- (3)

- Providing supportive evidence for capital requirements, mark-to-market accounting and limitation of the scale of interbank business.

2.5. Systemic Risk Identification and Measurement

3. Review of the Main Research Methods of Systemic Risk

3.1. Theorectical Foundations

3.2. Mathematical Models

3.3. Econometric Methods

3.4. Agent-Based Models

3.5. Conclusions

4. Future Expansion

- (1)

- More work on models with multiple shocks and spillover effects be done. No matter endogenous or exogenous shocks, the contagion rotation shall not be limited to a specific market or intermediaries. More than one spillover risk is discussed within a model. Moreover, at present, there are many types of research on systemic risks in the banking system, the real estate market and the foreign exchange market. There are few studies on the systemic risks of the shadow banking [179,180] and internet financial markets, which may be related to the lack of available data and difficulties in providing supporting empirical studies.

- (2)

- Dynamic multi-layer networks expect further exploration, especially when the prices of assets have a connection with the financial contagions.

- (3)

- More empirical studies of the impact of systemic risk on the real economy are necessary. It is expected that recent advances in large-scale data and computing tools benefit systemic risk studies, acquiring more real-world and large-scale data for empirical analysis [181].

- (4)

- Event studies shall be focused on the modification of market structure, which is being affected by new technology or policies that help promote information disclosure, for example, the alternative index (like SOFR) in place of LIBOR. Moreover, digital currency issued by central banks substituting banknotes means that the monetary multiplier is no longer applicable, which will profoundly alter the whole financial system. Therefore, these innovative measures should also be paid attention to.

- (5)

- Systemic risk analysis of China’s financial market. The regulation of China’s financial market is just like modular management, which can cut off the transmission of systemic risks in a special period. Coupled with the intervention of government funds, there has been no substantial systemic collapse in China’s financial markets. Therefore, it is necessary to study the systemic risk of China’s financial market, and study what effective measures mitigate systemic risks and whether the trade-offs between the costs and benefits of these measures are optimal.

Author Contributions

Funding

Conflicts of Interest

References

- Schweitzer, F.; Fagiolo, G.; Sornette, D.; Vega-Redondo, F.; Vespignani, A.; White, D.R. Economic Networks: The New Challenges. Science 2009, 325, 422–425. [Google Scholar] [CrossRef] [PubMed]

- Lorenz, J.; Battiston, S.; Schweitzer, F. Systemic risk in a unifying framework for cascading processes on networks. Eur. Phys. J. B 2009, 71, 441–460. [Google Scholar] [CrossRef]

- Haldane, A.G.; May, R. Systemic Risk in Banking Ecosystems. Nature 2011, 469, 351–355. [Google Scholar] [CrossRef] [PubMed]

- Helbing, D. Systemic Risks in Society and Economics, Social Self-Organization; Springer: Berlin/Heidelberg, Germany, 2012; pp. 261–284. [Google Scholar]

- Battiston, S.; Puliga, M.; Kaushik, R.; Tasca, P.; Caldarelli, G. DebtRank: Too Central to Fail? Financial Networks, the FED and Systemic Risk. Sci. Rep. 2012, 2, 1–6. [Google Scholar] [CrossRef]

- Amini, H.; Rama, C.; Andreea, M. Resilience to contagion in financial networks. Math. Financ. 2016, 26, 329–365. [Google Scholar] [CrossRef]

- Acharya, V.V.; Pedersen, L.H.; Philippon, T.; Richardson, M.P. Measuring Systemic Risk. SSRN Electron. J. 2010, 30, 2–47. [Google Scholar]

- Brownlees, C.; Engle, R.F. Volatility, Correlation and Tails for Systemic Risk Measurement. SSRN Electron. J. 2011. [Google Scholar] [CrossRef]

- Adrian, T.; Brunnermeier, M.K. CoVaR. Am. Econ. Rev. 2016, 106, 1705–1741. [Google Scholar] [CrossRef]

- Acharya, V.; Engle, R.; Richardson, M. Capital Shortfall: A New Approach to Ranking and Regulating Systemic Risks. Am. Econ. Rev. 2012, 102, 59–64. [Google Scholar] [CrossRef]

- Balla, E.; Ergen, I.; Migueis, M. Tail dependence and indicators of systemic risk for large US depositories. J. Financ. Stab. 2014, 15, 195–209. [Google Scholar] [CrossRef]

- Reboredo, J.C.; Ugolini, A. Systemic risk in European sovereign debt markets: A CoVaR-copula approach. J. Int. Money Financ. 2015, 51, 214–244. [Google Scholar] [CrossRef]

- Kaufman, G.; Kenneth, E.S. What is Systemic Risk, and Do Bank Regulators Retard or Contribute to It? Indep. Rev. 2003, 7, 71–91. [Google Scholar]

- Brimmer, F.A. Distinguished lecture on Economics in Government: Central banking and systemic risks in capital markets. J. Econ. Perspect. 1989, 3, 3–16. [Google Scholar] [CrossRef]

- Hendricks, D. Defining Systemic Risk. Pew Financ. Reform Proj. No. 1. 2009. Available online: https://www.pewtrusts.org/en/research-and-analysis/reports/2009/07/08/defining-systemic-risk (accessed on 24 June 2020).

- Kaufman, G.G.; Malliaris, A.G. The Financial Crisis of 2007–2009: Missing Financial Regulation Or Absentee. In Lessons from the Financial Crisis: Causes, Consequences, and Our Economic Future; Wiley Online Library: Hoboken, NJ, USA, 2010. [Google Scholar]

- Mishkin, F.S. Symposium on the Monetary Transmission Mechanism. J. Econ. Perspect. 1997, 9, 3–10. [Google Scholar] [CrossRef]

- Chan, N.T.; Getmansky, M.; Haas, S. Systemic Risk and Hedge Funds. In The Risks of Financial Institutions; Carey, M., Stulz, R.M., Eds.; University of Chicago Press: Chicago, IL, USA, 2006; pp. 235–338. ISBN 0-226-09285-2. [Google Scholar]

- Hartmann, P.; Straetmans, S.; De Vries, C. Banking System Stability: A Cross-Atlantic Perspective. In The Risks of Financial Institutions; Carey, M., Stulz, R.M., Eds.; University of Chicago Press: New York, NY, USA, 2007; pp. 133–192. ISBN 9780226092850. [Google Scholar]

- Yongqiao, W.; Xuewei, J. Financial Systemic Risk Measurement Based on Time-Varying Copula; China Economic Publishing House: Beijing, China, 2016; pp. 25–26. ISBN 9787513639880. [Google Scholar]

- Kodres, L.E.; Pritsker, M. A Rational Expectations Model of Financial Contagion. J. Financ. 2002, 57, 769–799. [Google Scholar] [CrossRef]

- Allen, F.; Gale, D. Financial Contagion. J. Politi- Econ. 2000, 108, 1–33. [Google Scholar] [CrossRef]

- Kaminsky, G.; Reinhart, C. The Twin Crises: The Causes of Banking and Balanceof-Payments Problems. Am. Econ. Rev. 1999, 89, 473–500. [Google Scholar] [CrossRef]

- Kaminsky, G.; Lizondo, S.; Reinhart, C.M. Leading Indicators of Currency, Crises. IMF Staff Papers 1996, 45, 1–48. [Google Scholar]

- Allen, F.; Gale, D. Financial Intermediaries and Markets. Econometrica. 2004, 72, 1023–1061. [Google Scholar] [CrossRef]

- Allen, F.; Gale, D. Competition and Financial Stability. J. Money Credit. Bank. 2004, 36, 453–480. [Google Scholar] [CrossRef]

- Blanco, R.; Brennan, S.; Marsh, W.I. An Empirical Analysis of the Dynamic Relation between Investment-Grade Bonds and Credit Default Swaps. J. Financ. 2005, 60, 2255–2281. [Google Scholar] [CrossRef]

- Beber, A.; Driessen, J.; Neuberger, A.; Tuijp, P. Pricing Liquidity Risk with Heterogeneous Investment Horizons. J. Financ. Quant. Anal. 2020. [Google Scholar] [CrossRef]

- Laeven, L.; Levine, R. Bank Governance, Regulation and Risk Taking. J. Financ. Econ. 2009, 93, 259–275. [Google Scholar] [CrossRef]

- Brunnermeier, M.; Pedersen, L. Market Liquidity and Funding Liquidity. Rev. Financ. Stud. 2009, 22, 2201–2238. [Google Scholar] [CrossRef]

- Acharya, V.V.; Hanh, T.L.; Hyun, S.S. Bank Capital and Dividend Externalities. Rev. Financial. Stud. 2017, 30, 988–1018. [Google Scholar] [CrossRef]

- Shleifer, A.; Vishny, R.W. Unstable Banking. J. Financ. Econ. 2010, 97, 306–318. [Google Scholar] [CrossRef]

- Smith, R.L. Systemic, not just systematic. Syst. Res. 1989, 6, 27–37. [Google Scholar] [CrossRef]

- Allen, B.A.; Carletti, E. Financial Crises: Theory and Evidence. Annu. Rev. Financ. Econ. 2009, 1, 97–116. [Google Scholar] [CrossRef]

- Bryant, J. A model of reserves, bank runs, and deposit insurance. J. Bank. Financ. 1980, 4, 335–344. [Google Scholar] [CrossRef]

- Diamond, D.W.; Dybvig, P.H. Bank Runs, Deposit Insurance, and Liquidity. J. Politi- Econ. 1983, 91, 401–419. [Google Scholar] [CrossRef]

- Goldstein, I.; Pauzner, A. Demand-Deposit Contracts and the Probability of Bank Runs. J. Financ. 2005, 60, 1293–1327. [Google Scholar] [CrossRef]

- Chen, Q.; Goldstein, I.; Jiang, W. Payoff complementarities and financial fragility: Evidence from mutual fund outflows. J. Financ. Econ. 2010, 97, 239–262. [Google Scholar] [CrossRef]

- Jacklin, C.J.; Bhattacharya, S. Distinguishing Panics and Information-Based Bank Runs: Welfare and Policy Implications. J. Political Econ. 1988, 96, 568–592. [Google Scholar] [CrossRef]

- Gorton, G. Banking Panics and Business Cycles. Oxf. Econ. Pap. 1988, 40, 751–781. [Google Scholar] [CrossRef]

- Friedman, M.; Schwartz, L.A. A Monetary History of the United States, 1867-1960; Princeton University Press: New York, NY, USA, 1963; pp. 676–695. ISBN 0-691-00354-8. [Google Scholar]

- Calomiris, C.W.; Mason, R.J. Consequences of Bank Distress During the Great Depression. Am. Econ. Rev. 2003, 93, 937–947. [Google Scholar] [CrossRef]

- Calomiris, C.W.; Gorton, G. The Origins of Banking Panics: Models, Facts, and Bank Regulation Financial Markets and Financial Crises; Hubbard, R.G., Ed.; University of Chicago Press: Chicago, USA, 1991; pp. 109–174. ISBN 0-226-35588-8. [Google Scholar]

- Bordo, M.D.; Eichengreen, B.; Klingebiel, D.; Martinez-Peria, S.M. Is the Crisis Problem Growing More Severe? Econ. Policy 2001, 16, 51–82. [Google Scholar] [CrossRef]

- Heinsohn, G.; Decker, F.; Heinsohn, U. A Property Economics Explanation of the 2008 Global Financial Crisis. SSRN Electron. J. 2008. [Google Scholar] [CrossRef]

- Adrian, T.; Shin, H.S. Liquidity and Leverage. SSRN Electron. J. 2009, 19, 418–437. [Google Scholar] [CrossRef]

- Greenlaw, D.; Hatzius, J.; Kashyap, A.; Shin, H. Leveraged Losses: Lessons from the Mortgage Market Meltdown. Available online: http://vladyslavsushko.com/docs/presentation3.pdf (accessed on 24 June 2020).

- Taylor, B.J. Economic Policy and the Financial Crisis: an Empirical Analysis of What Went Wrong. Crit. Rev. A J. Politics Soc. 2009, 21, 341–364. [Google Scholar] [CrossRef]

- Reinhart, M.C.; Rogoff, S.K. The Aftermath of Financial Crises. Am. Econ. Rev. 2009, 99, 466–472. [Google Scholar] [CrossRef]

- Reinhart, M.C.; Rogoff, S.K. This Time is Different: A Panoramic View of Eight Centuries of Financial Crises. Ann. Econ. Financ. Soc. AEF. 2014, 15, 1065–1188. [Google Scholar]

- Reinhart, M.C.; Rogoff, S.K. Recovery from Financial Crises: Evidence from 100 Episodes. Am. Econ. Rev. 2014, 104, 50–55. [Google Scholar] [CrossRef]

- Herring, R.; Wachter, S. Bubbles in Real Estate Markets. In Asset Price Bubbles: The Implications for Monetary, Regulatory, and International Policies; Hunter, W., Kaufman, G., Pomerleano, M., Eds.; MIT Press: Cambridge, MA, USA, 2003; pp. 112–156. ISBN 978-0262582537. [Google Scholar]

- Gordon, J.R. Is U.S. Economic Growth Over? Faltering Innovation Confronts the Six Headwinds. Available online: https://www.nber.org/papers/w18315 (accessed on 24 June 2020).

- Bardhan, A. Of Subprimes and Subsidies: The Political Economy of the Financial Crisis. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1270196 (accessed on 24 June 2020).

- Friedman, H.H.; Friedman, L.W. The Global Financial Crisis of 2008: What Went Wrong? Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1356193 (accessed on 24 June 2020).

- Baker, A.P.; Widmaier, W. The Institutionalist Roots of Macroprudential Ideas: Veblen and Galbraith on Regulation, Policy Success and Overconfidence. New Political Econ. 2016, 19, 487–506. [Google Scholar] [CrossRef]

- Titman, S. Financial markets and investment externalities. J. Financ. 2013, 68, 1307–1329. [Google Scholar] [CrossRef]

- Kydland, E.F.; Prescott, C.E. Time to Build and Aggregate Fluctuations. Econometrica 1982, 50, 1345–1370. [Google Scholar] [CrossRef]

- Long, J.; Plosser, C. Real Business Cycles. J. Political Econ. 1983, 91, 36–69. [Google Scholar] [CrossRef]

- King, R.; Plosser, C. Money, Credit and Prices in a Real Business Cycle. Am. Econ. Rev. 1984, 74, 363–380. [Google Scholar]

- Christiano, J.L.; Eichenbaum, M.; Evans, L.C. Nominal Rigidities and the Dynamic Effects of a Shock to Monetary Policy. J. Political Econ. 2005, 113, 1–45. [Google Scholar] [CrossRef]

- Altig, D.; Christiano, J.L.; Eichenbaum, M.; Linde, J. Firm-specific Capital, Nominal Rigidities and the Busyness Cycle. Rev. Econ. Dyn. 2011, 14, 225–247. [Google Scholar] [CrossRef]

- Bernanke, B.; Gertler, M.; Gilchrist, S. The Financial Accelerator and the Flight to Quality. Rev. Econ. Stat. 1996, 78, 1. [Google Scholar] [CrossRef]

- Tirole, J. Illiquidity and All Its Friends. J. Econ. Lit. 2011, 49, 287–325. [Google Scholar] [CrossRef]

- Alejandro, A.; Giorgio, E.P.; Andrea, T. Quantitative Modeling of the Financial Crisis: A Simple Model of Subprime Borrowers and Credit Growth. Am. Econ. Rev. 2016, 106, 543–547. [Google Scholar]

- Christiano, J.L.; Trabandt, M.; Walentin, K. Introducing Financial Frictions and Unemployment into a Small Open Economy Model. J. Econ. Dyn. Control 2011, 35, 1999–2041. [Google Scholar] [CrossRef]

- Gertler, M.; Kiyotaki, N. Banking, Liquidity, and Bank Runs in an Infinite Horizon Economy. Am. Econ. Rev. 2015, 105, 2011–2043. [Google Scholar] [CrossRef]

- Brunnermeier, M.K.; Sannikov, Y. A Macroeconomic Model with a Financial Sector. Am. Econ. Rev. 2014, 104, 379–421. [Google Scholar] [CrossRef]

- Stefano, G.; Bryan, K.; Seth, P. Systemic Risk and the Macroeconomy: An Empirical Evaluation. J. Financ. Econ. 2016, 119, 457–471. [Google Scholar]

- Minsky, H.P. The Financial Instability Hypothesis: A Restatement; Hyman, P., Ed.; Minsky Archive: New York, NY, USA, 1978. [Google Scholar]

- Taylor, L.; O‘Connell, A.S. A Minsky Crisis. Q. J. Econ. 1985, 100, 871–885. [Google Scholar] [CrossRef]

- Lavoie, M.; Seccareccia, M. Minsky’s Financial Fragility Hypothesis: A Missing Macroeconomic Link? In Financial Fragility and Investment in the Capitalist Econom; Bellofiore, R., Ferri, P., Eds.; Edward Elgar Publishing: Oregan, Portland, 2001; pp. 156–168. ISBN 978-1840643596. [Google Scholar]

- Charles, S. Is Minsky’sFfinancial Instability Hypothesis Valid? Camb. J. Econ. 2015, 40, 427–436. [Google Scholar] [CrossRef]

- Rowthorn, R. Demand, Real Wages and Economic Growth. Thames Pap. Political Econ. 1981, 1–39. [Google Scholar]

- Dutt, A.; Sen, A. Union Bargaining Power, Employment and Output in a Model of Monopolistic Competition with Wage Bargaining. J. Econ. 1997, 65, 1–17. [Google Scholar] [CrossRef]

- Dutt, A. Kaleckian Growth Theory: an Introduction. Metroeconomica 2012, 63, 1–6. [Google Scholar] [CrossRef]

- Bhaduri, A.; Marglin, S. Unemployment and the Real Wage: the Economic Basis for Contesting Political Ideologies. Camb. J. Econ. 1990, 14, 375–393. [Google Scholar] [CrossRef]

- Blecker, R.A. International Competition, Income Distribution and Economic Growth. Camb. J. Econ. 1989, 13, 395–412. [Google Scholar]

- Lavoie, M. Interest Rates In Post-Keynesian Models Of Growth And Distribution. Metroeconomica 1995, 46, 146–177. [Google Scholar] [CrossRef]

- Ryoo, S. The Paradox of Debt and Minsky’s Financial Instability Hypothesis. Metroeconomica 2012. [Google Scholar] [CrossRef]

- Coelho, G.D.; Caldentey, P.E. Neo-Kaleckian Models with Financial Cycles: A Center-periphery Framework. PSL Quarterly Rev. Economia Civile. 2018, 71, 309–326. [Google Scholar]

- Ninomiya, K.; Tokuda, M. Financial Instability in Japan: Debt, Confidence, and Financial Structure. In Return of Marxian Macro-Dynamics in East Asia; Masao, I., Jeong, S., Li, M., Eds.; Emerald Publishing Ltd.: Bingley, UK, 2017; pp. 39–61. ISBN 978-1787144781. [Google Scholar]

- Ninomiya, K.; Tokuda, M. Structural change and financial instability in the US economy. Evol. Inst. Econ. Rev. 2020, 1–22. [Google Scholar] [CrossRef]

- Torres Filho, E.T.; Martins, N.M.; Miaguti, C.Y. Minsky’s Financial Fragility: an Empirical Analysis of Electricity Distribution Firms in Brazil (2007–2015). J. Post Keynesian Econ. 2019, 42. [Google Scholar] [CrossRef]

- Allen, F.; Gale, D. Comparing Financial Systems; MIT Press: Cambridge, MA, USA, 2000. [Google Scholar]

- Freixas, X.; Parigi, B.M.; Rochet, J.-C. Systemic Risk, Interbank Relations, and Liquidity Provision by the Central Bank. J. Money Credit. Bank. 2000, 32, 611. [Google Scholar] [CrossRef]

- Vivier-Lirimonty, S. Contagion in Inter-bank Debt Networks. G Ital Cardiol. 2012, 36–40. [Google Scholar]

- Blume, L.; Easley, D.; Kleinberg, J.; Kleinberg, R. Éva Which Networks are Least Susceptible to Cascading Failures? In Proceedings of the 2011 IEEE 52nd Annual Symposium on Foundations of Computer Science, Palm Springs, CA, USA, 23–25 October 2011; pp. 393–402. [Google Scholar]

- Blume, L.; Brock, A.W.; Durlauf, N.S.; Jayaraman, R. Linear Social Interactions Models. J. Political Econ. 2015, 123, 444–496. [Google Scholar] [CrossRef]

- Kiyotaki, N.; Moore, J. Credit Cycles. J. Political Econ. 1997, 105, 211–248. [Google Scholar] [CrossRef]

- Elliott, M.; Golub, B.; Jackson, M.O. Financial Networks and Contagion. Am. Econ. Rev. 2014, 104, 3115–3153. [Google Scholar] [CrossRef]

- Allen, F.; Babus, A.; Carletti, E. Asset commonality, debt maturity and systemic risk. J. Financ. Econ. 2012, 104, 519–534. [Google Scholar] [CrossRef]

- Trapp, M.; Wewel, C. Transatlantic systemic risk. J. Bank. Finane. 2013, 37, 4241–4255. [Google Scholar] [CrossRef]

- Shin, H.S. Risk and liquidity in a system context. J. Financ. Intermed. 2008, 17, 315–329. [Google Scholar] [CrossRef]

- Shin, H.S. Securitisation and Financial Stability. Econ. J. 2009, 119, 309–332. [Google Scholar] [CrossRef]

- Castiglionesi, F.; Feriozzi, F.; Lorenzoni, G. Financial Integration and Liquidity Crises. Manag. Sci. 2019, 65, 955–975. [Google Scholar] [CrossRef]

- Acemoglu, D.; Ozdaglar, A.; Tahbaz-Salehi, A. Systemic Risk and Stability in Financial Networks. Am. Econ. Rev. 2013, 105, 564–608. [Google Scholar] [CrossRef]

- Jackson, O.M.; Dutta, B. On the Formation of Networks and Groups. In Networks and Groups: Models of Strategic Formation; Dutta, B., Jackson, M.O., Eds.; Springer: Berlin/Heidelberg, Germany, 2003; pp. 1–15. [Google Scholar]

- Boss, M.; Elsinger, H.; Summer, M.; Thurner, S. Network topology of the interbank market. Quant. Financ. 2004, 4, 677–684. [Google Scholar] [CrossRef]

- Eisenberg, L.; Noe, T.H. Systemic Risk in Financial Systems. Manag. Sci. 2001, 47, 236–249. [Google Scholar] [CrossRef]

- Elsinger, H.; Lehar, A.; Summer, M. Risk Assessment for Banking Systems. Manag. Sci. 2006, 52, 1301–1314. [Google Scholar] [CrossRef]

- Fricke, D.; Lux, T. Core–Periphery Structure in the Overnight Money Market: Evidence from the e-MID Trading Platform. Comput. Econ. 2014, 45, 359–395. [Google Scholar] [CrossRef]

- Morgan, D.L.; Neal, M.B.; Carder, P. The stability of core and peripheral networks over time. Soc. Netw. 1997, 19, 9–25. [Google Scholar] [CrossRef]

- Holme, P. Core-periphery organization of complex networks. Phys. Rev. E 2005, 72, 046111. [Google Scholar] [CrossRef]

- Borgatti, S.; Everett, M.G. Models of core/periphery structures. Soc. Netw. 2000, 21, 375–395. [Google Scholar] [CrossRef]

- Rombach, M.P.; Porter, M.A.; Fowler, J.H.; Mucha, P.J. Core-Periphery Structure in Networks. SIAM J. Appl. Math. 2014, 74, 167–190. [Google Scholar] [CrossRef]

- Rombach, P.; Porter, M.A.; Fowler, J.H.; Mucha, P.J. Core-Periphery Structure in Networks (Revisited). SIAM Rev. 2017, 59, 619–646. [Google Scholar] [CrossRef]

- Markose, S.; Giansante, S.; Gatkowski, M.; Shaghaghi, A. Too Interconnected to Fail: Financial Contagion and Systemic Risk in Network Model of CDS and Other Credit Enhancement Obligations of US Banks, Economics Discussion Papers 683; University of Essex, Department of Economics: Colchester, UK, 2010. [Google Scholar]

- Veld, D.I.T.; Van Lelyveld, I. Finding the core: Network structure in interbank markets. J. Bank. Financ. 2014, 49, 27–40. [Google Scholar] [CrossRef]

- Craig, B.R.; von Peter, G. Interbank Tiering and Money Center Banks. J. Financ. Intermediation 2014, 23, 322–347. [Google Scholar] [CrossRef]

- Halaj, G.; Kok, C. Assessing Interbank Contagion Using Simulated Networks. Comput. Manag. Sci. 2013, 10, 157–186. [Google Scholar] [CrossRef]

- Gandy, A.; Veraart, L.A.M. A Bayesian Methodology for Systemic Risk Assessment in Financial Networks. Manag. Sci. 2017, 63, 4428–4446. [Google Scholar] [CrossRef]

- Bargigli, L.; di Iasio, G.; Infante, L.; Pierobon, F.; Lillo, F. Interbank Markets and Multiplex Networks: Centrality Measures and Statistical Null Models. In Interconnected Networks. Understanding Complex Systems; Garas, A., Ed.; Springer, Cham: Zürich, Switzerland, 2016; pp. 179–194. ISBN 978-3-319-23947-7. [Google Scholar]

- Martinez-Jaramillo, S.; Alexandrova-Kabadjova, B.; Bravo-Benitez, B.; Solorzano-Margain, P.J. An Empirical Study of the Mexican Banking System’s Network and Its Implications for Systemic Risk. J. Econ. Dyn. Control 2014, 40, 242–265. [Google Scholar] [CrossRef]

- Dick, A.A.; Lehnert, A. Personal Bankruptcy and Credit Market Competition. J. Financ. 2010, 65, 655–668. [Google Scholar] [CrossRef]

- Bertrand, M.; Schoar, A.; Thesmar, D. Banking Deregulation and Industry Structure: Evidence from the French Banking Reforms of 1985. J. Financ. 2007, 62, 597–628. [Google Scholar] [CrossRef]

- Beck, T.; De Jonghe, O.; Schepens, G. Bank Competition and Stability: Cross-country Heterogeneity. J. Financ. Intermed. 2013, 22, 218–244. [Google Scholar] [CrossRef]

- Boyd, J.H.; De Nicolo, G. The Theory of Bank Risk Taking and Competition Revisited. J. Financ. 2005, 60, 1329–1343. [Google Scholar] [CrossRef]

- Demirguc-Kunt, A.; Detragiache, E. Does Deposit Iinsurance Iincrease Banking System Stability? An Empirical Investigation. J. Monet. Econ. 2002, 49, 1373–1406. [Google Scholar] [CrossRef]

- Boot, A.W.A.; Thakor, A.V. Self-interested bank regulation. Am. Econ. Rev. 1993, 83, 206–212. [Google Scholar]

- Bertay, A.C.; Demirgüç-Kunt, A.; Huizinga, H. Do we need big banks? Evidence on performance, strategy and market discipline. J. Financ. Intermed. 2013, 22, 532–558. [Google Scholar] [CrossRef]

- Bhattacharya, S.; Gale, D. Preference Shocks, Liquidity and Central Bank Policy. In New Approaches to Monetary Economics; Barnett, W., Singleton, K., Eds.; Cambridge University Press: Cambridge, UK, 1987; pp. 69–88. [Google Scholar]

- Hakenes, H.; Schnabel, I. Capital regulation, bank competition, and financial stability. Econ. Lett. 2011, 113, 256–258. [Google Scholar] [CrossRef]

- Martinez-Miera, D.; Repullo, R. Does Competition Reduce the Risk of Bank Failure? Rev. Financ. Stud. 2010, 23, 3638–3664. [Google Scholar] [CrossRef]

- Acharya, V.V.; Yorulmazer, T. Too many to fail–an analysis of time-inconsistency in bank closure policies. J. Financ. Intermed. 2007, 16, 1–31. [Google Scholar] [CrossRef]

- Carlsson, H.; van Damme, E. Global Games and Equilibrium Selection. Econom. Soc. 1993, 61, 989–1018. [Google Scholar] [CrossRef]

- Stephen, M.; Hyun, S.S. Unique Equilibrium in a Model of Self-Fulfilling Currency Attacks. Am. Econ. Rev. 1998, 88, 587–597. [Google Scholar]

- Heider, F.; Hoerova, M.; Holthausen, C. Liquidity hoarding and interbank market spreads: the role of counterparty risk. J. Financ. Econ. 2005, 118, 336–354. [Google Scholar] [CrossRef]

- Farhi, E.; Tirole, J. Collective Moral Hazard, Maturity Mismatch, and Systemic Bailouts. Am. Econ. Rev. 2012, 102, 60–93. [Google Scholar] [CrossRef]

- Freeman, S. ClearinghouseB anks and BanknoteO ver-Issue. J. Monet. Econ. 1996, 38, 101–115. [Google Scholar] [CrossRef]

- Feinstein, Z. Financial contagion and asset liquidation strategies. Oper. Res. Lett. 2017, 45, 109–114. [Google Scholar] [CrossRef]

- Hurd, T.R. Contagion! Systemic Risk in Financial Networks; Springer: Berlin/Heidelberg, Germany, 2016; pp. 1–17. ISBN 978-3-319-33930-6. [Google Scholar]

- Gai, P.; Kapadia, S. Contagion in Financial Networks. Proc. R. A. Soc. 2010, 466, 2401–2423. [Google Scholar]

- Rogers, L.C.G.; Veraart, L.A.M. Failure and Rescue in an Interbank Network. Manag. Sci. 2013, 59, 882–898. [Google Scholar] [CrossRef]

- Glasserman, P.; Peyton, H.Y. How likely is contagion in financial networks? J. Bank. Financ. 2015, 50, 383–399. [Google Scholar] [CrossRef]

- Helmut, E. Financial Networks, cross Holdings, and Limited Liability, Österreich; National Bank: Coffeyville, KS, USA, 2009; Working Papers, No. 156; Available online: https://www.researchgate.net/publication/46467874_Financial_Networks_Cross_Holdings_and_Limited_Liability (accessed on 24 June 2020).

- Capponi, A.; Chen, P.-C.; Yao, D.D. Liability Concentration and Systemic Losses in Financial Networks. Oper. Res. 2016, 64, 1121–1134. [Google Scholar] [CrossRef]

- Greenwood, R.; Landier, A.; Thesmar, D. Vulnerable banks. J. Financ. Econ. 2015, 115, 471–485. [Google Scholar] [CrossRef]

- Cifuentes, R.; Gianluigi, F.; Hyun, S.S. Liquidity Risk and Contagion. J. Eur. Econ. Assoc. 2005, 3, 556–566. [Google Scholar] [CrossRef]

- Amini, H.; Damir, F.; Andreea, M. Systemic Risk with Central Clearing Counterparty Design, Swiss Finance Institute Research Paper No. 13–34; Swiss Finance Institute: Geneva, Zurich, 2015. [Google Scholar]

- Chen, N.; Liu, X.; Yao, D.D. An Optimization View of Financial Systemic Risk Modeling: Network Effect and Market Liquidity Effect. Oper. Res. 2016, 64, 1089–1108. [Google Scholar] [CrossRef]

- Amini, H.; Damir, F.; Andreea, M. Uniqueness of equilibrium in a payment system with liquidation costs. Oper. Res. Lett. 2016, 44, 1–5. [Google Scholar] [CrossRef]

- Braouezec, Y.; Lakshithe, W. Strategic fire-sales and price-mediated con- tagion in the banking system. Eur. J. Oper. Res. 2019, 274, 1180–1197. [Google Scholar] [CrossRef]

- Rama, C.; Lakshithe, W. Running for the exit: Distressed selling and endogenous correlation in financial markets. Math. Financ. 2013, 23, 718–741. [Google Scholar]

- Rama, C.; Lakshithe, W. Fire sale forensics: Measuring endogenous risk. Math. Financ. 2016, 26, 835–866. [Google Scholar]

- Kerstin, A.; Stefan, W. The Joint Impact of Bankruptcy Costs, Crossholdings and Fire Sales on Systemic Risk in Financial Networks. Probab Uncertain Quant Risk. 2017, 2. [Google Scholar] [CrossRef]

- Hasman, A. A critical review of contagion risk in banking. J. Econ. Surv. 2012, 27, 978–995. [Google Scholar] [CrossRef]

- Upper, C. Simulation methods to assess the danger of contagion in interbank markets. J. Financ. Stab. 2011, 7, 111–125. [Google Scholar] [CrossRef]

- Cont, R.; Schaanning, E. Monitoring indirect contagion. J. Bank. Financ. 2019, 104, 85–102. [Google Scholar] [CrossRef]

- Huang, X.; Zhou, H.; Zhu, H. A framework for assessing the systemic risk of major financial institutions. J. Bank. Financ. 2009, 33, 2036–2049. [Google Scholar] [CrossRef]

- Segoviano Basurto, M.; Goodhart, C. Banking Stability Measures. IMF Working Papers, No. 9/4. 2009, pp. 1–54. Available online: https://ssrn.com/abstract=1356460 (accessed on 24 June 2020).

- Bisias, D.; Flood, M.D.; Lo, A.W.; Valavanis, S. A Survey of Systemic Risk Analytics. U.S. Department of Treasury, Office of Financial Research No. 0001. Available online: https://ssrn.com/abstract=1983602.2012 (accessed on 24 June 2020).

- Lee, S.C.; Lin, C.T.; Tsai, M.S. The Pricing of Deposit Insurance in the Presence of Systemic Risk. J. Bank. Financ. 2015, 51, 1–11. [Google Scholar] [CrossRef]

- Jobst, A.A. Multivariate Dependence of Implied Volatilities from Equity Options as Measure of Systemic Risk. Int. Rev. Financ. Anal. 2013, 28, 112–129. [Google Scholar] [CrossRef]

- Billio, M.; Getmansky, M.; Lo, A.W.; Pelizzon, L. Econometric measures of connectedness and systemic risk in the finance and insurance sectors. J. Financ. Econ. 2012, 104, 535–559. [Google Scholar] [CrossRef]

- Avramidis, P.; Pasiouras, F. Calculating systemic risk capital: A factor model approach. J. Financial Stab. 2015, 16, 138–150. [Google Scholar] [CrossRef]

- Giesecke, K.; Spiliopoulos, K.; Sowers, R.B. Default clustering in large portfolios: Typical events. Ann. Appl. Probab. 2013, 23, 348–385. [Google Scholar] [CrossRef]

- Jin, X.; Simone, F.D.A.N.D. Banking systemic vulnerabilities: A tail-risk dynamic CIMDO approach. J. Financ. Stab. 2014, 14, 81–101. [Google Scholar] [CrossRef]

- Feinstein, Z.; Rudloff, B.; Weber, S. Measures of Systemic Risk. SIAM J. Financ. Math. 2017, 8, 672–708. [Google Scholar] [CrossRef]

- Biagini, F.; Fouque, J.-P.; Frittelli, M.; Meyer-Brandis, T. A unified approach to systemic risk measures via acceptance sets. Math. Financ. 2018, 29, 329–367. [Google Scholar] [CrossRef]

- Brusco, S.; Castiglionesi, F. Liquidity Coinsurance, Moral Hazard, and Financial Contagion. J. Financ. 2007, 62, 2275–2302. [Google Scholar] [CrossRef]

- Leitner, Y. Financial Networks: Contagion, Commitment, and Private Sector Bailouts. J. Finance 2005, 60, 2925–2953. [Google Scholar] [CrossRef]

- Castiglionesi, F.; Navarro, N. Optimal Fragile Financial Networks. EFA 2008 Athens Meetings Paper. Athens, Greece; 2008. Available online: https://ssrn.com/abstract=1089357 (accessed on 24 June 2020).

- Sun, G. Liquidity Crisis, Credit Crisis and Regulatory Reform; Fudan University: Shanghai, China, 2011. [Google Scholar]

- Ren, P.; Chen, D. A Study on the Contagion Mechanism of Liquidity Crisis from Non-formal to Formal Financial Institutions: Based on the Depositors’ Global Game. J. Cent. Univ. Financ. Econ. 2015, 12, 6. [Google Scholar]

- Neveu, R.A. A Survey of Network-based Analysis and Systemic Risk Measurement. J. Econ. Interact. Coord. 2018, 13, 241–281. [Google Scholar] [CrossRef]

- Amini, H.; Rama, C.; Andreea, M. Stress testing the resilience of financial networks. Int. J. Theor. Appl. Financ. 2012, 15, 1250006. [Google Scholar] [CrossRef]

- Amini, H.; Andreea, M. Inhomogeneous financial networks and contagious links. Oper. Res. 2016, 64, 1109–1120. [Google Scholar] [CrossRef]

- Detering, N.; Meyer-Brandis, T.; Panagiotou, K.; Ritter, D. Managing Default Contagion in Inhomogeneous Financial Networks. SIAM J. Financ. Math. 2019, 10, 578–614. [Google Scholar] [CrossRef]

- Garnier, J.; Papanicolaou, G.; Yang, T.-W. Large deviations for a mean field model of systemic risk. SIAM J. Financ. Math. 2013, 4, 151–184. [Google Scholar] [CrossRef]

- Carmona, R.; Fouque, J.-P.; Sun, L.-H. Mean Field Games and systemic risk. Commun. Math. Sci. 2015, 13, 911–933. [Google Scholar] [CrossRef]

- Fouque, J.-P.; Ichiba, T. Stability in a Model of Interbank Lending. SIAM J. Financ. Math. 2013, 4, 784–803. [Google Scholar] [CrossRef]

- Giesecke, K.; Spiliopoulos, K.; Sowers, R.; Sirignano, J. Large portfolio asymptotics for loss from default. Math. Financ. 2015, 25, 77–114. [Google Scholar] [CrossRef]

- Sowers, R.; Spiliopoulos, K. Default clustering in large pools: Large deviations. SIAM J. Financ. Math. 2015, 6, 86–116. [Google Scholar]

- Haldane, A.; Turrell, A.E. An Interdisciplinary Model for Macroeconomics. Oxford Review of Economic Policy. 2018, 34, 219–251. [Google Scholar] [CrossRef]

- Lenzu, S.; Tedeschi, G. Systemic risk on different interbank network topologies. Phys. A Stat. Mech. Appl. 2012, 391, 4331–4341. [Google Scholar] [CrossRef]

- Tedeschi, G.; Mazloumian, A.; Gallegati, M.; Helbing, D. Bankruptcy Cascades in Interbank Markets. PLoS ONE 2012, 7, e52749. [Google Scholar] [CrossRef]

- Cabrales, G.; Vega, R. Risk-Sharing and Contagion in Networks; CESifo Working Paper Series: Munich, Germany, 2014; No. 4715. [Google Scholar]

- Zabala, C.A.; Josse, J.M. Shadow credit in the middle market: The decade after the financial collapse. J. Risk Financ. 2018, 19, 414–436. [Google Scholar] [CrossRef]

- Zhu, F.; Chen, J.; Chen, Z.; Li, H. Shadow banking shadowed in banks’ balance sheets: Evidence from China’s commercial banks. Account. Financ. 2019, 59, 2879–2903. [Google Scholar] [CrossRef]

- Gao, J.; Zhang, Y.-C.; Zhou, T. Computational socioeconomics. Phys. Rep. 2019, 817, 1–104. [Google Scholar] [CrossRef]

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bai, X.; Sun, H.; Lu, S.; Taghizadeh-Hesary, F. A Review of Micro-Based Systemic Risk Research from Multiple Perspectives. Entropy 2020, 22, 711. https://doi.org/10.3390/e22070711

Bai X, Sun H, Lu S, Taghizadeh-Hesary F. A Review of Micro-Based Systemic Risk Research from Multiple Perspectives. Entropy. 2020; 22(7):711. https://doi.org/10.3390/e22070711

Chicago/Turabian StyleBai, Xiao, Huaping Sun, Shibao Lu, and Farhad Taghizadeh-Hesary. 2020. "A Review of Micro-Based Systemic Risk Research from Multiple Perspectives" Entropy 22, no. 7: 711. https://doi.org/10.3390/e22070711

APA StyleBai, X., Sun, H., Lu, S., & Taghizadeh-Hesary, F. (2020). A Review of Micro-Based Systemic Risk Research from Multiple Perspectives. Entropy, 22(7), 711. https://doi.org/10.3390/e22070711