Structural Change and Dynamics of Pakistan Stock Market during Crisis: A Complex Network Perspective

Abstract

:1. Introduction

2. Literature Review

3. Data and Methodology

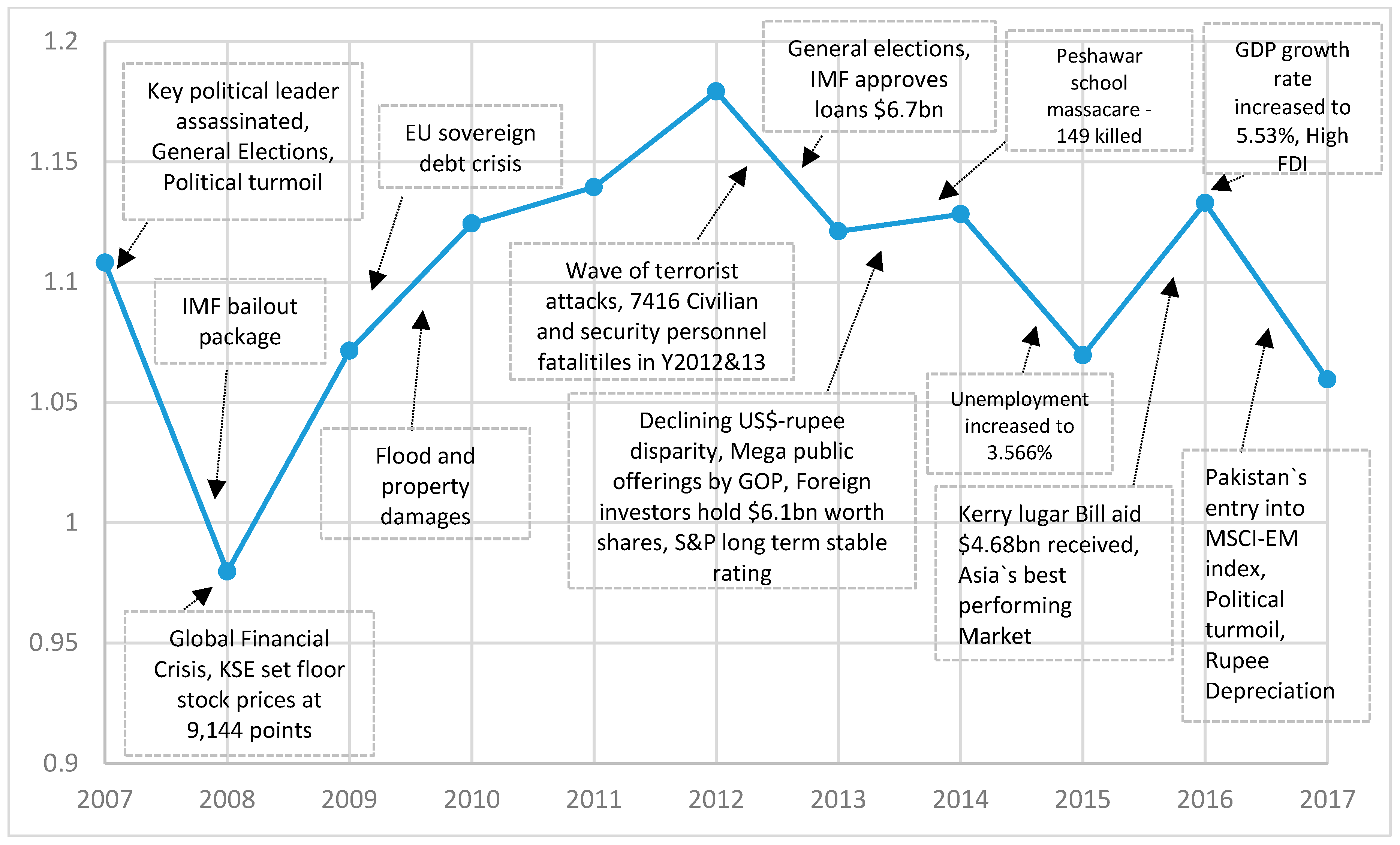

4. Results and Discussion

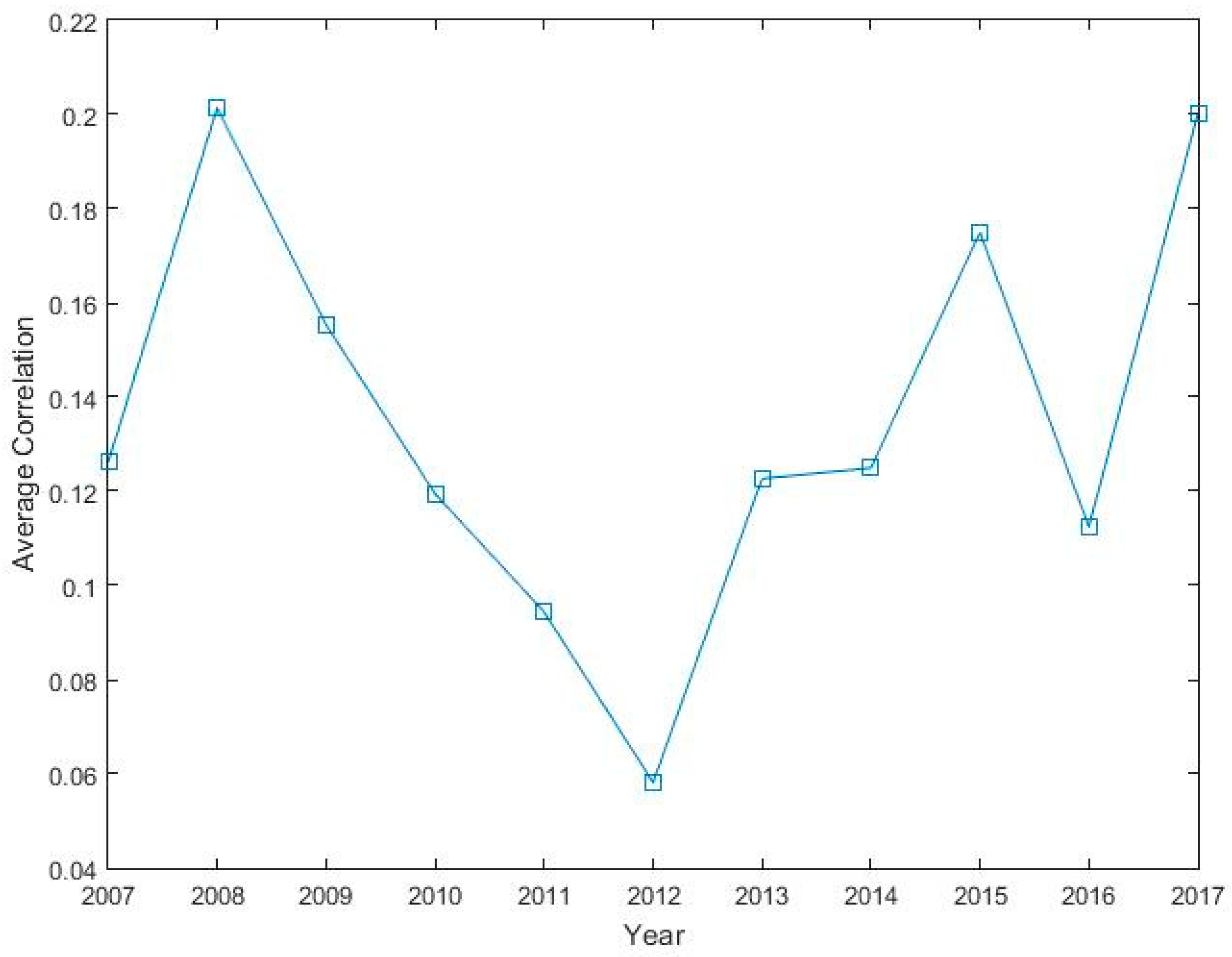

4.1. Correlation Coefficients and Distance Matrices

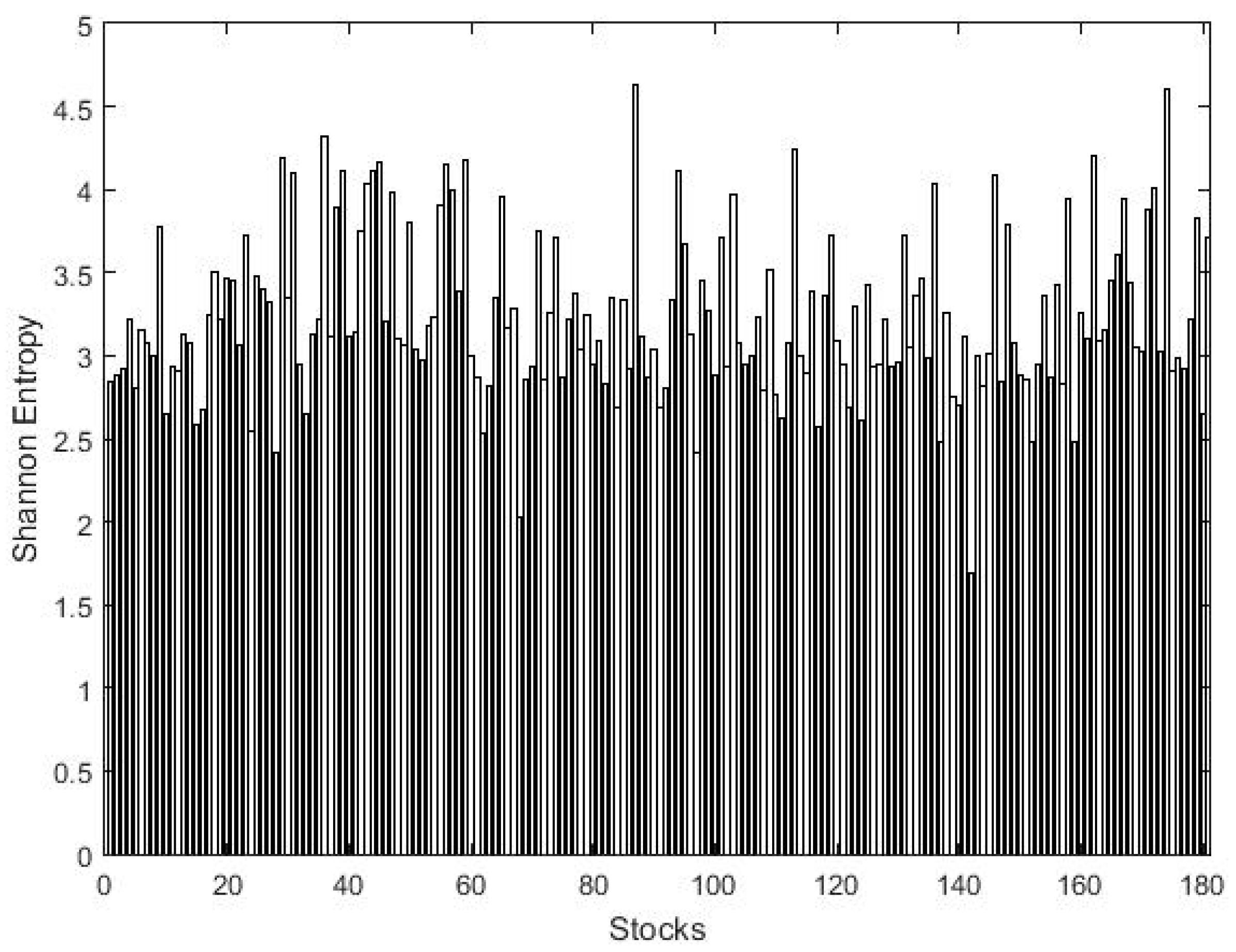

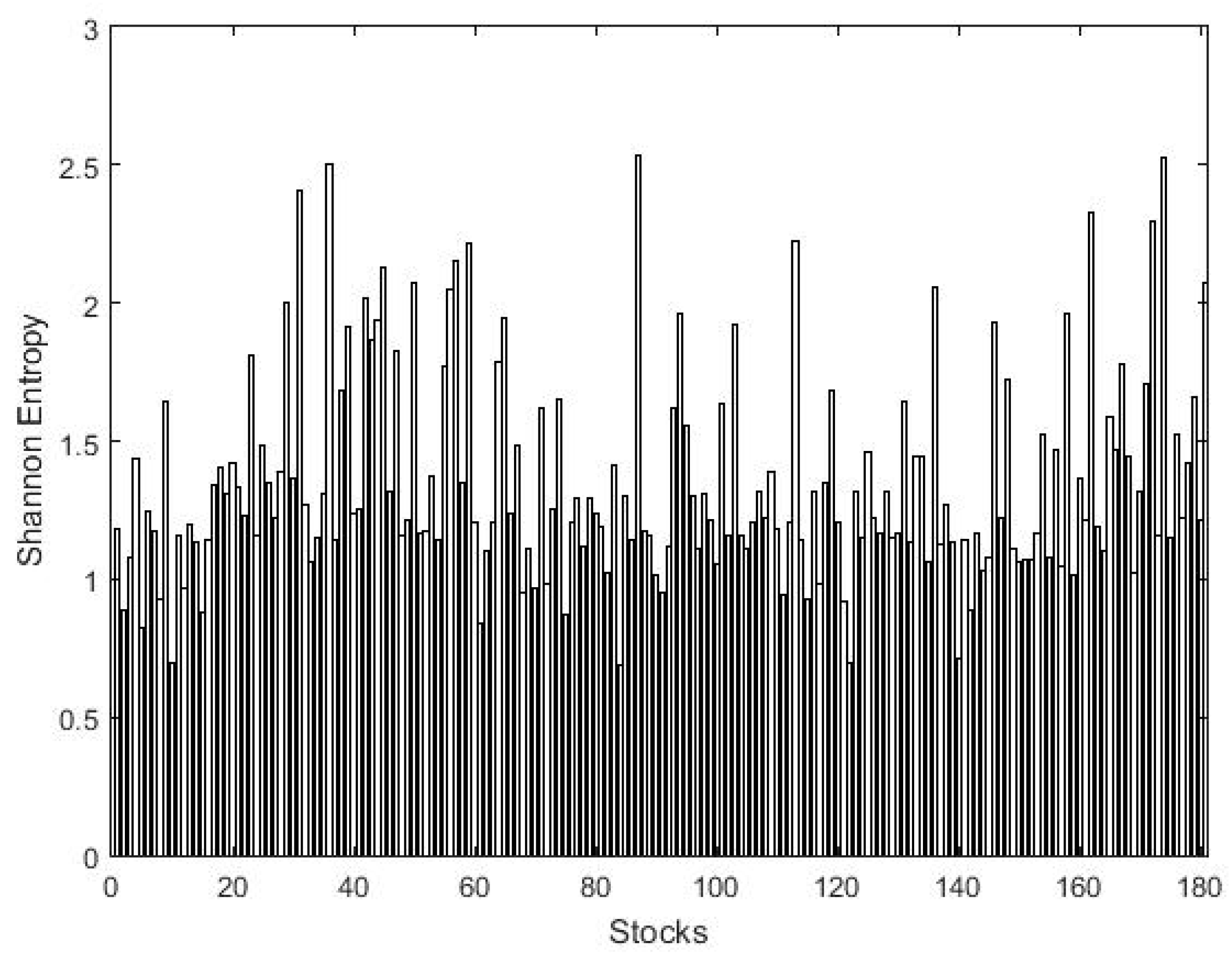

4.2. Shannon Entropy

4.3. Threshold Network

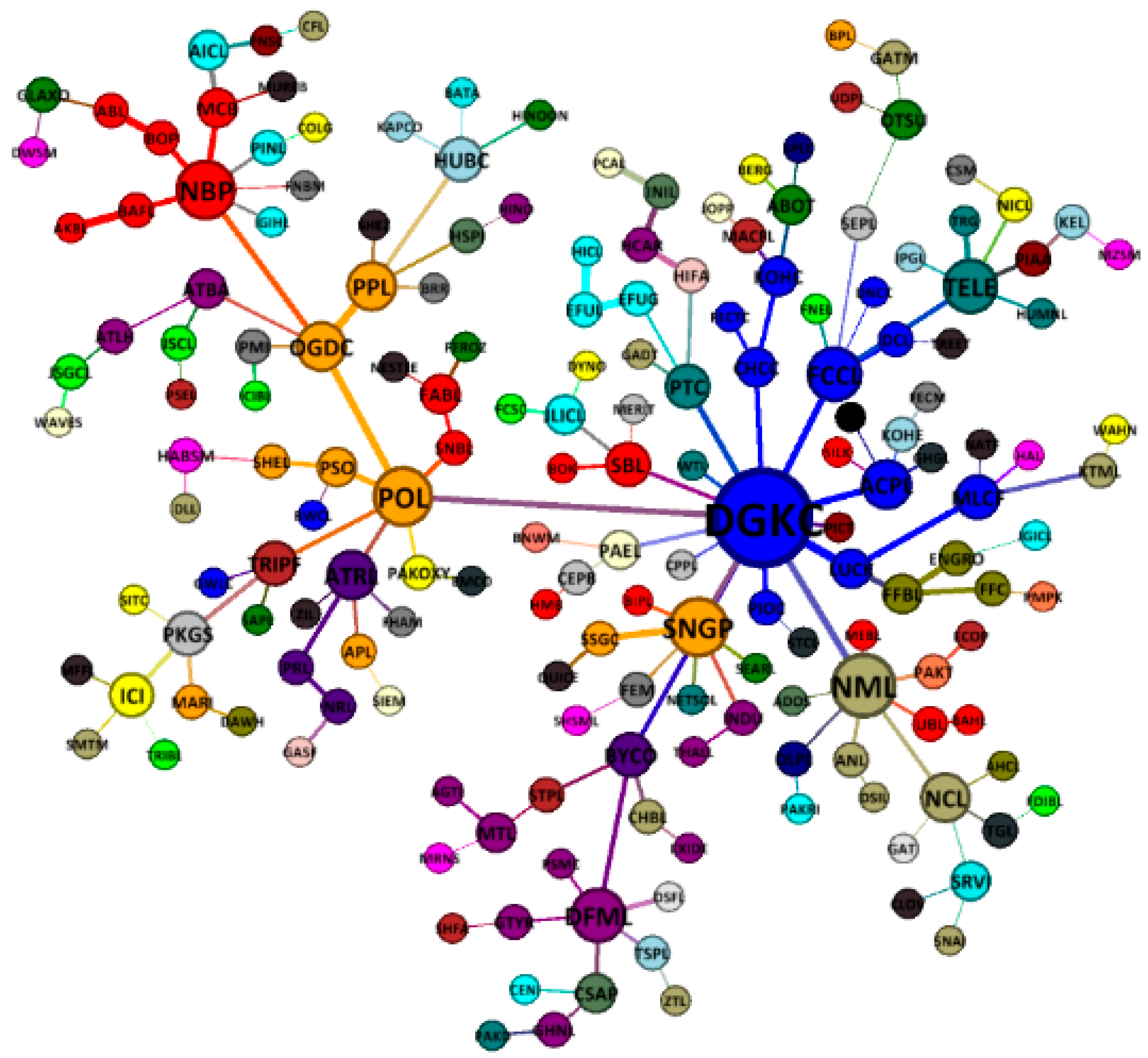

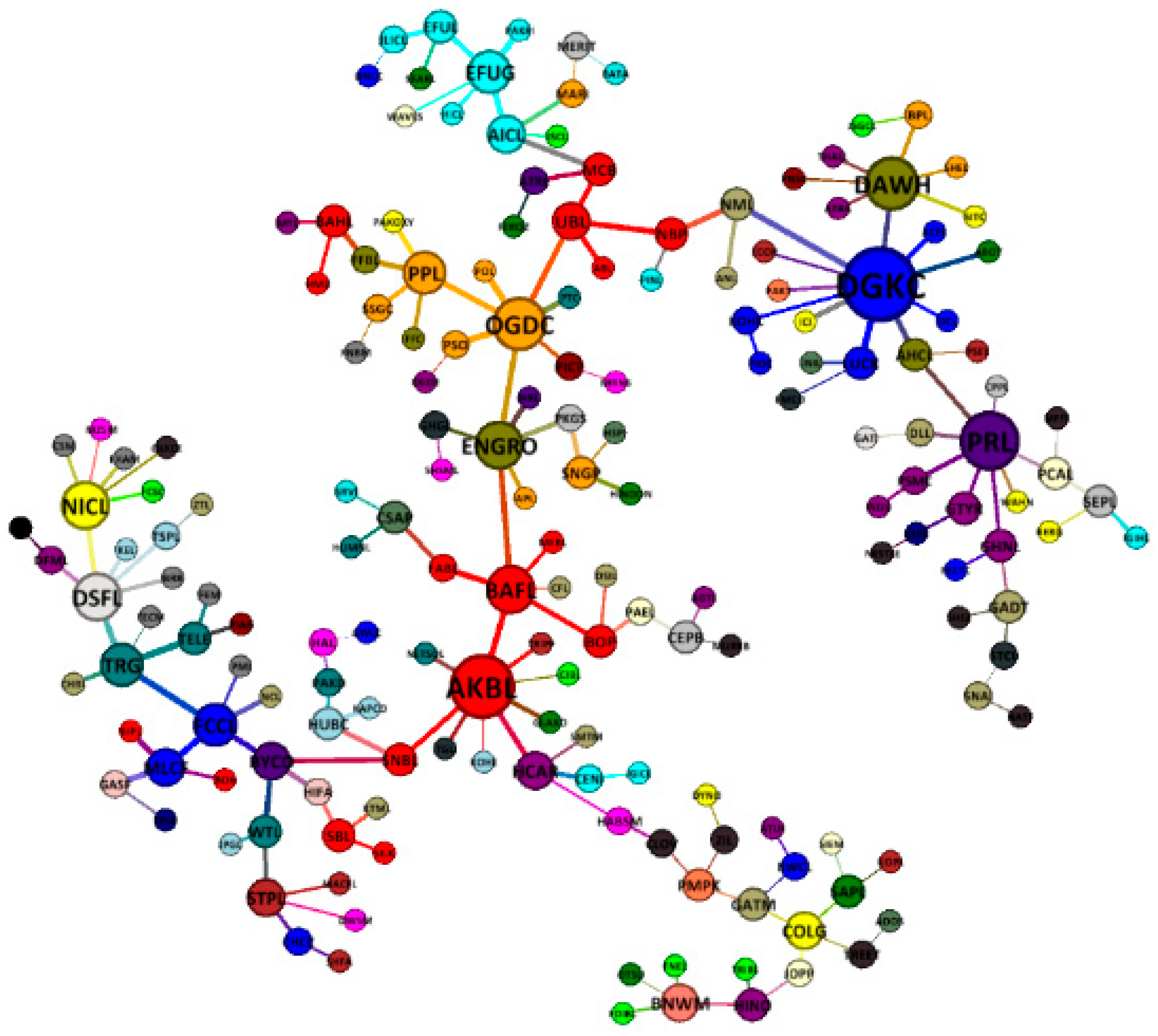

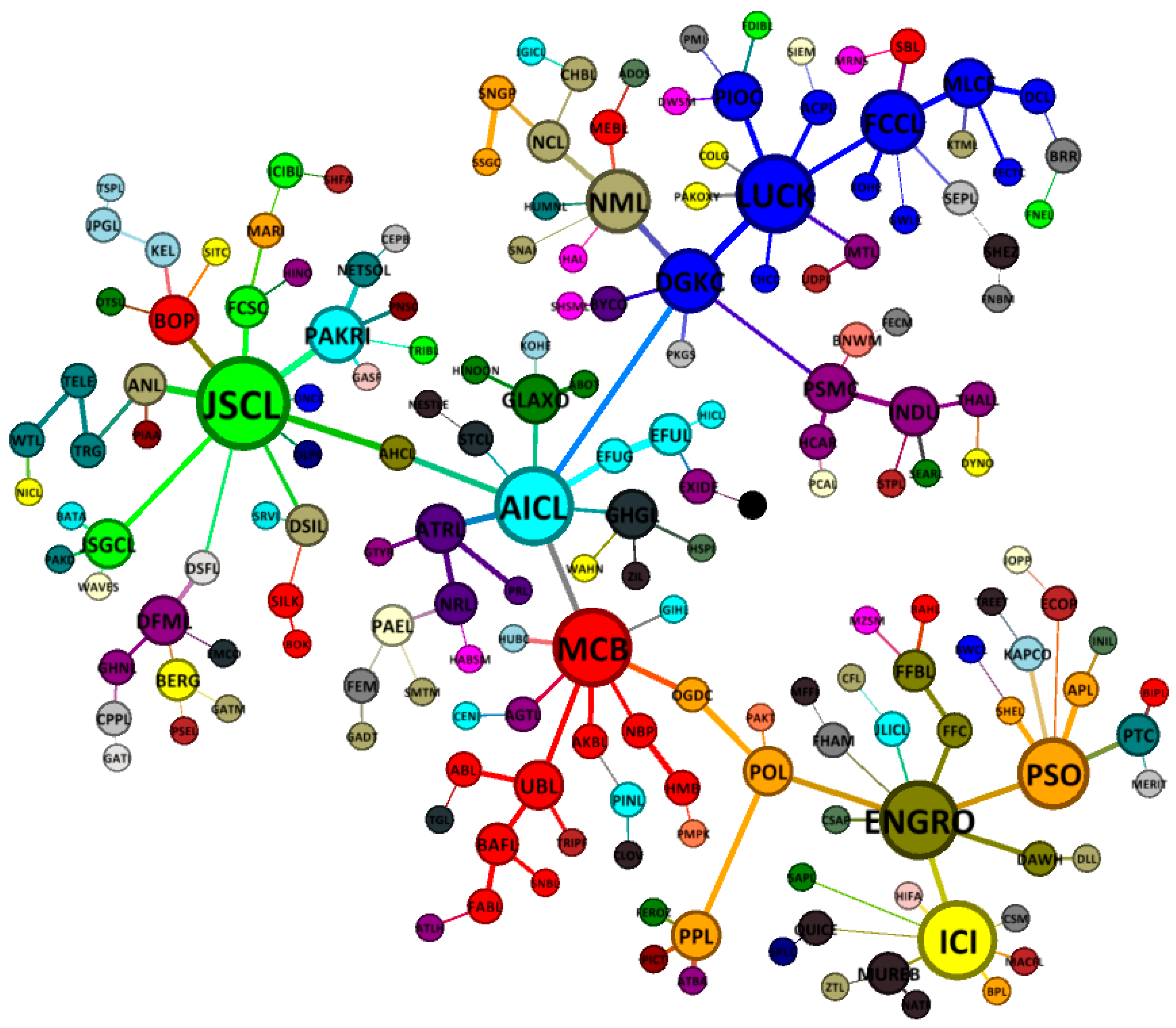

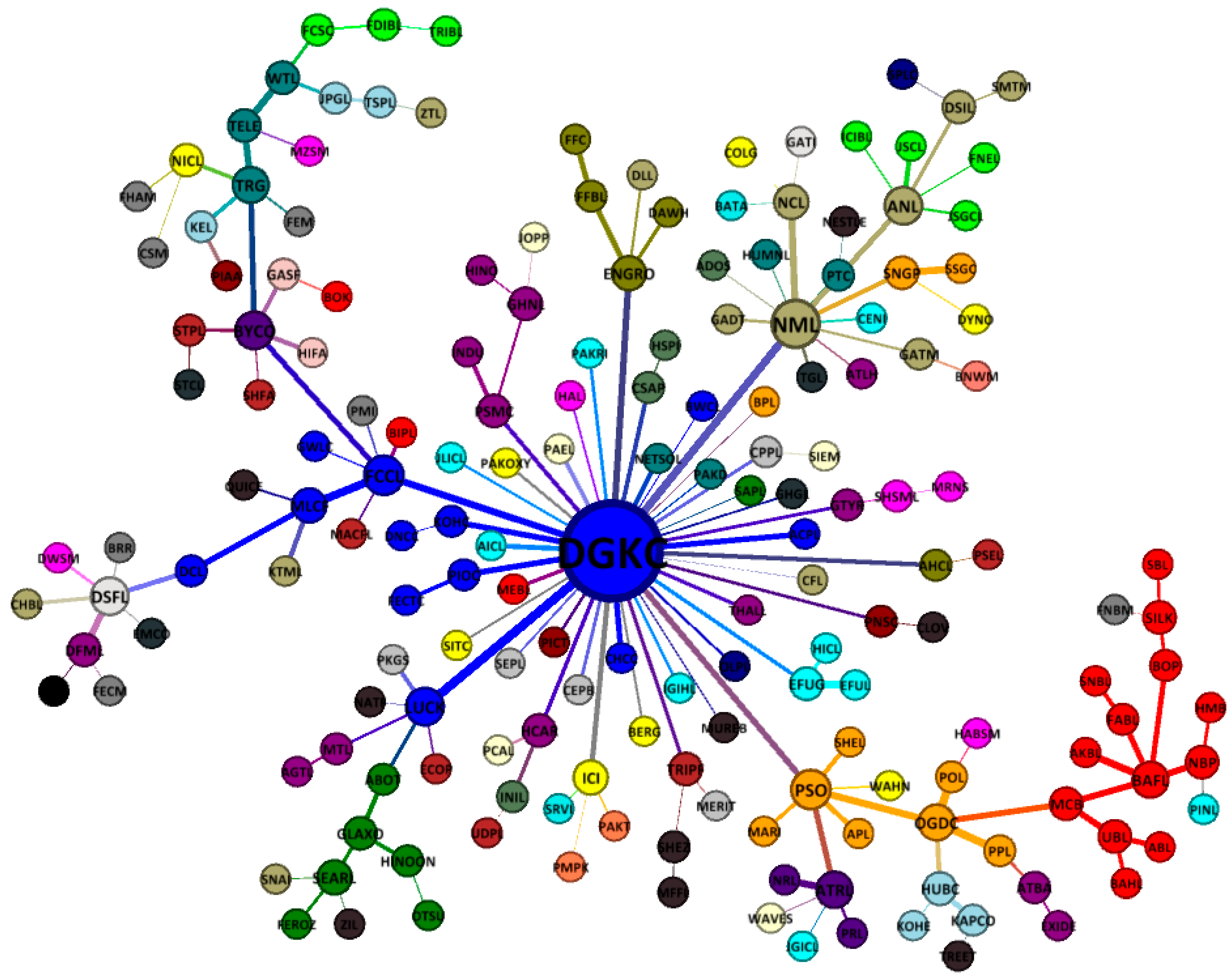

4.4. Minimum Spanning Tree

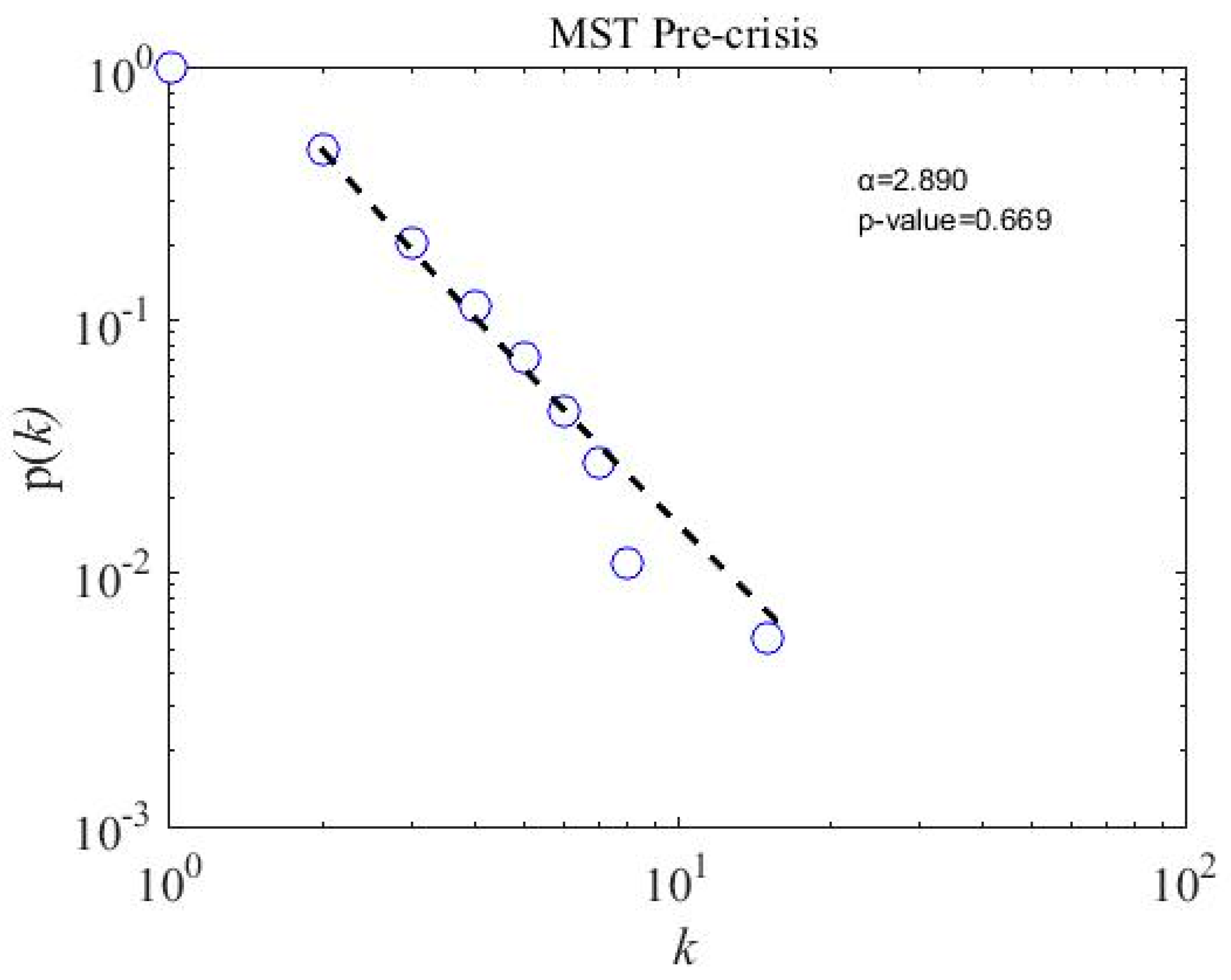

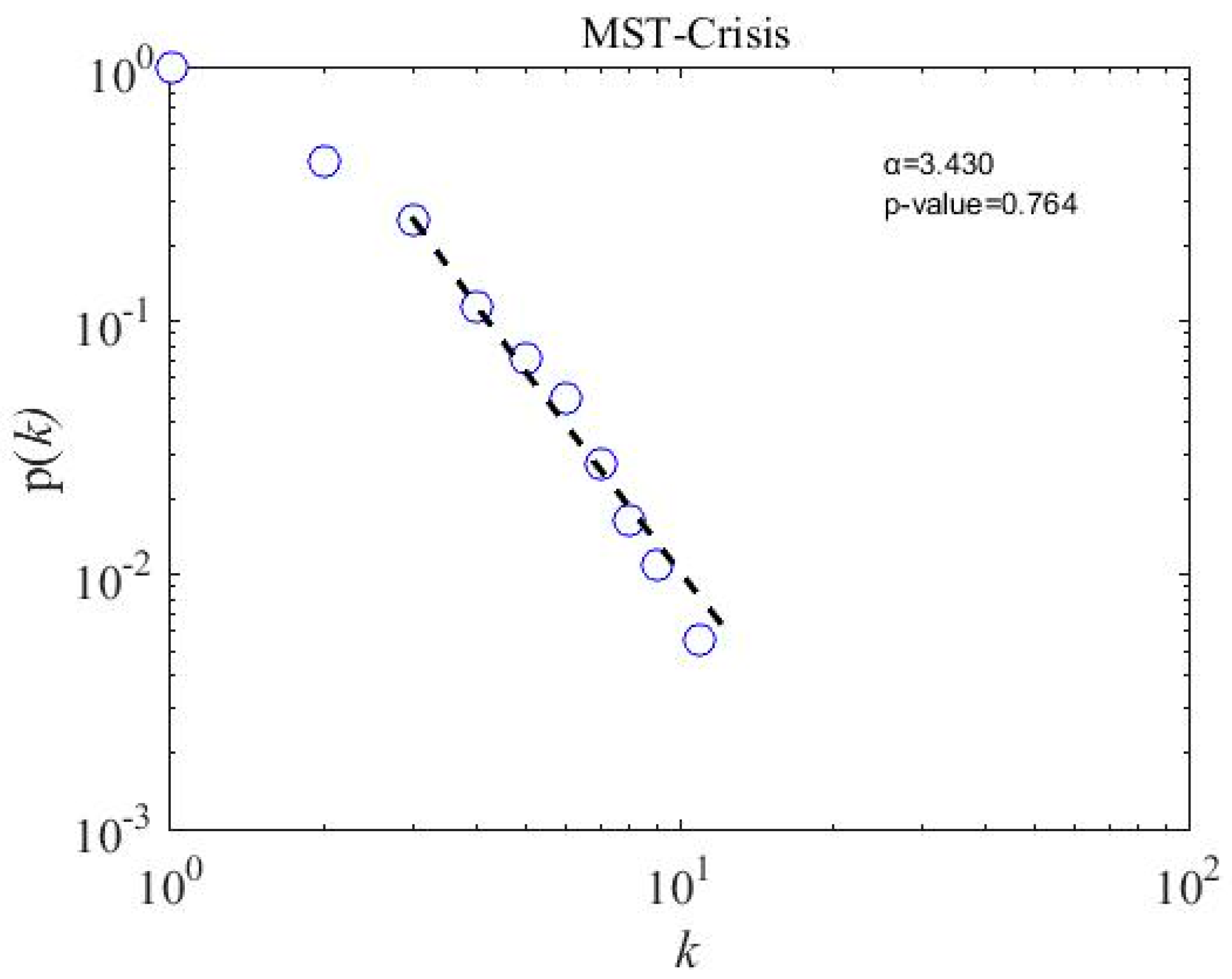

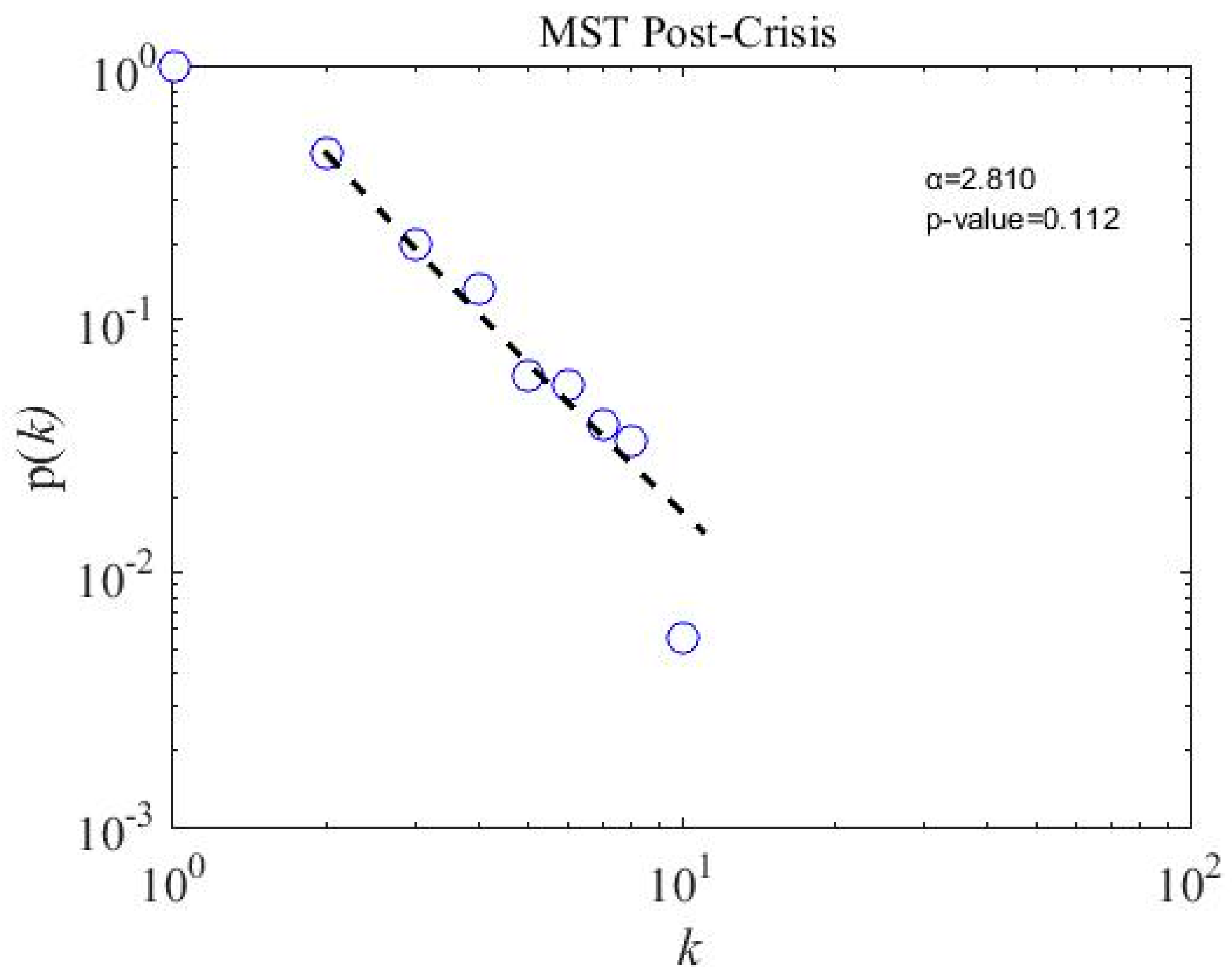

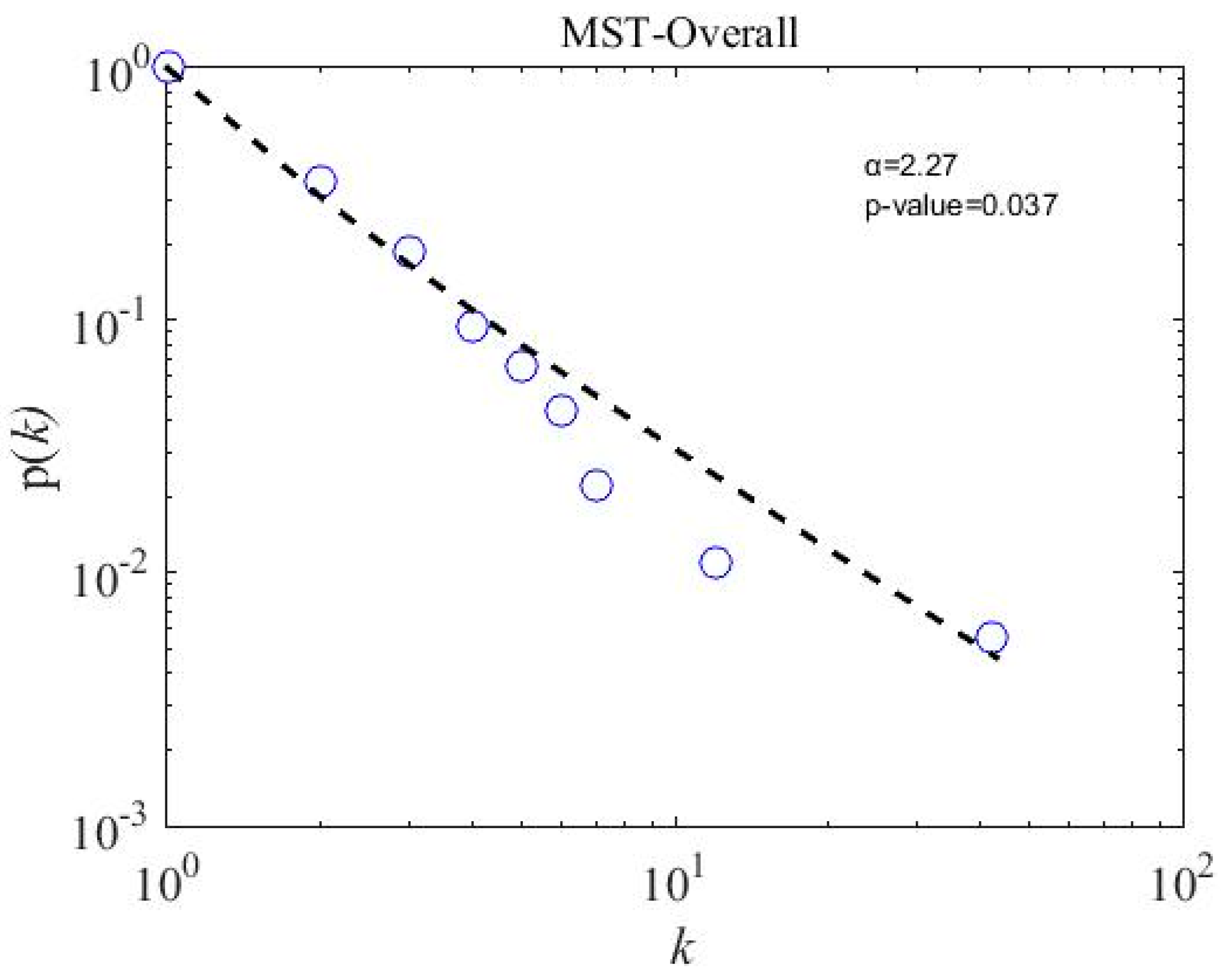

4.5. Scale-Free Strcuture of MSTs

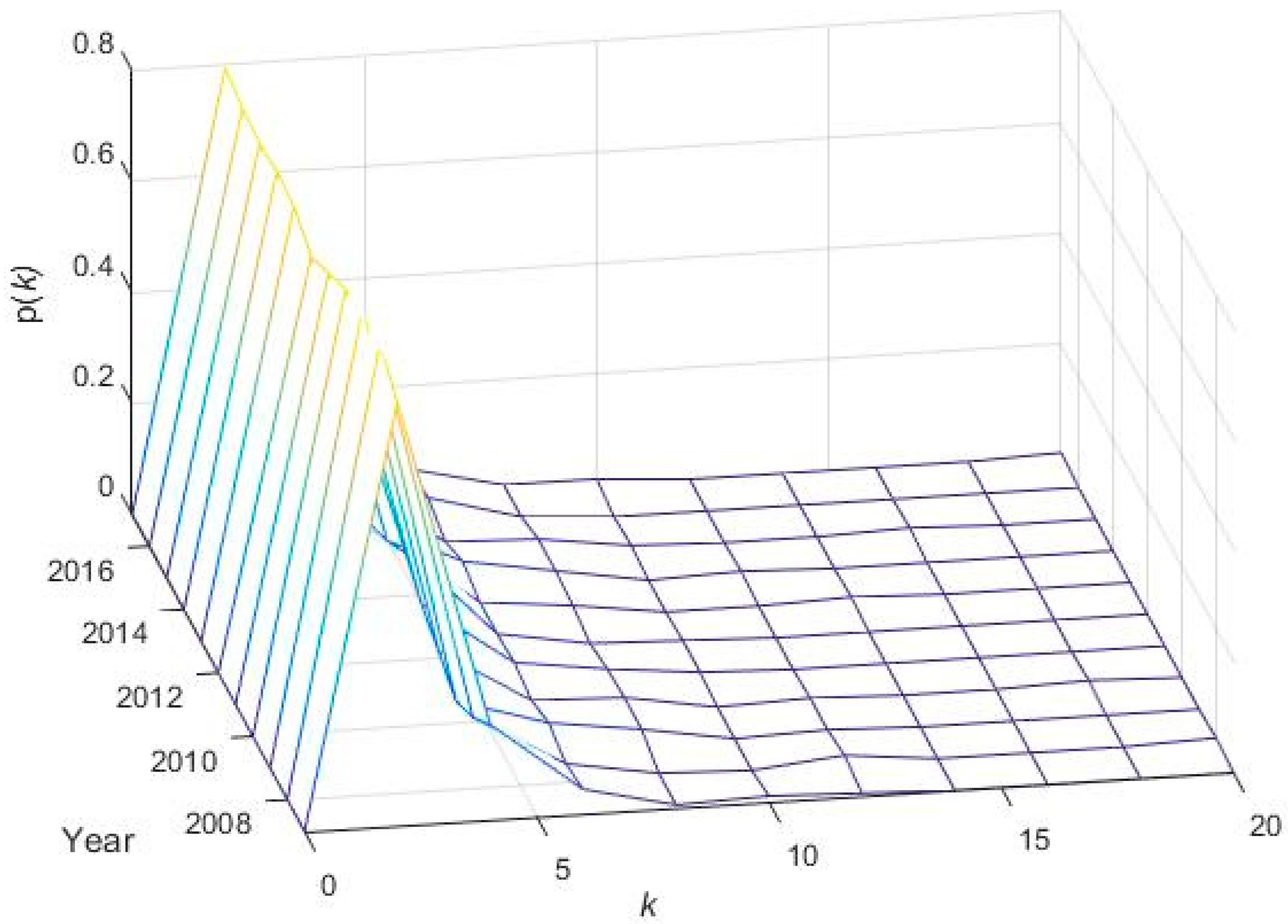

4.6. Dynamic Structures of MSTs

4.6.1. Degree Distribution

4.6.2. Normalized Tree Length

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

Appendix A

| Node | Ticker | Company Name | Sector | Color |

|---|---|---|---|---|

| 1 | ABL | Allied Bank Limited | Commercial Banks | RED |

| 2 | ABOT | Abbot Laboatories (Pakistan) Limited | Pharmaceuticals | GREEN |

| 3 | ACPL | Attock Cement (Pakistan) Limited | Cement | BLUE |

| 4 | ADOS | Ados Pakistan Limited | Engineering | HAZEL GREEN |

| 5 | AGTL | Al-Ghazi Tractors Limited | Automobile Assembler | PURPLE |

| 6 | AHCL | Arif Habib Corporation Limited | Fertilizer | OLIVE |

| 7 | AICL | Adamjee Insurance Company Limited | Insurance | CYAN |

| 8 | AKBL | Askari Bank Limited | Commercial Banks | RED |

| 9 | ANL | Azgard Nine Limited | Textile Composite | KHAKI |

| 10 | APL | Attock Petroleum Limited | Oil and Gas Marketing Companies | ORANGE |

| 11 | ATBA | Atlas Battery Limited | Automobile Parts & Accessories | PURPLE |

| 12 | ATLH | Atlas Honda Limited | Automobile Assembler | PURPLE |

| 13 | ATRL | Attock Refinery Limited | Refinery | INDIGO |

| 14 | BAFL | Bank Al-Falah Limited | Commercial Banks | RED |

| 15 | BAHL | Bank Al-Habib Limited | Commercial Banks | RED |

| 16 | BATA | Bata Pakistan Limited | Leather and Tanneries | CELESTE |

| 17 | BERG | Berger Paints Pakistan Limited | Chemical | YELLOW |

| 18 | BIPL | Bankislami Pakistan Limited | Commercial Banks | RED |

| 19 | BNWM | Bannu Woollen Mills Limited | Woollen | SALMON |

| 20 | BOK | Bank of Khyber Limited | Commercial Banks | RED |

| 21 | BOP | Bank of Punjab Limited | Commercial Banks | RED |

| 22 | BPL | Burshane LPG (Pakistan) Limited | Oil and Gas Marketing Companies | ORANGE |

| 23 | BRR | B.R.R. Guardian Modaraba | Modarabas | GREY |

| 24 | BWCL | Bestway Cement Limited | Cement | BLUE |

| 25 | BYCO | Byco Petroleum Pakistan Limited | Refinery | INDIGO |

| 26 | CENI | Century Insurance Company Limited | Insurance | CYAN |

| 27 | CEPB | Century Paper and Board Mills Limited | Paper and Board | SILVER |

| 28 | CFL | Crescent Fibres Limited | Textile Spinning | KHAKI |

| 29 | CHBL | Chenab Limited | Textile Composite | KHAKI |

| 30 | CHCC | Cherat Cement Company Limited | Cement | BLUE |

| 31 | CJPL | Crescent Jute Proudcts Limited | Jute | BLACK |

| 32 | CLOV | Clover Pakistan Limited | Food and Personal Care Products | CHARCOAL |

| 33 | COLG | Colgate Palmolive (Pakistan) Limited | Chemical | YELLOW |

| 34 | CPPL | Cherat Packaging Limited. | Paper and Board | SILVER |

| 35 | CSAP | Crescent Steel & Allied Products Limited | Engineering | HAZEL GREEN |

| 36 | CSM | Crescent Standard Modaraba | Modarabas | GREY |

| 37 | DAWH | Dawood Hercules Corporation Limited | Fertilizer | OLIVE |

| 38 | DCL | Dewan Cement Limited | Cement | BLUE |

| 39 | DFML | Dewan Farooque Motors Limited | Automobile Assembler | PURPLE |

| 40 | DGKC | D.G. Khan Cement Company Limited | Cement | BLUE |

| 41 | DLL | Dawood Lawrancepur Limited | Textile Composite | KHAKI |

| 42 | DNCC | Dandot Cement Company Limited | Cement | BLUE |

| 43 | DSFL | Dewan Salman Fibre Limited | Synthetic and Rayon | PLATINUM |

| 44 | DSIL | D.S. Industires Limited | Textile Spinning | KHAKI |

| 45 | DWSM | Dewan Sugar Mills Limited | Sugar and Allied Industries | MAGENTA |

| 46 | DYNO | Dynea Pakistan Limited | Chemical | YELLOW |

| 47 | ECOP | Ecopack Limited | Miscellaneous | BROWN |

| 48 | EFUG | EFU General Insurance Limited | Insurance | CYAN |

| 49 | EFUL | EFU Life Assurance Limited | Insurance | CYAN |

| 50 | EMCO | Emco Industries Limited | Glass and Ceramics | GUNMETAL |

| 51 | ENGRO | Engro Corporation Limited | Fertilizer | OLIVE |

| 52 | EXIDE | Exide Pakistan Limited | Automobile Parts and Accessories | PURPLE |

| 53 | FABL | Faysal Bank Limited | Commercial Banks | RED |

| 54 | FCCL | Fauji Cement Company Limited | Cement | BLUE |

| 55 | FCSC | First Capital Securites Corporation Limited | Inv. Banks/Inv. Cos./Securities Cos. | LIME |

| 56 | FDIBL | First Dawood Investment Bank Limited | Inv. Banks/Inv. Cos./Securities Cos. | LIME |

| 57 | FECM | First Elite Capital Modaraba | Modarabas | GREY |

| 58 | FECTC | Fecto Cement Limited | Cement | BLUE |

| 59 | FEM | First Equity Modarba | Modarabas | GREY |

| 60 | FEROZ | Ferozsons Laboratories Limited | Pharmaceuticals | GREEN |

| 61 | FFBL | Fauji Fertilizer Bin Qasim Limited | Fertilizer | OLIVE |

| 62 | FFC | Fauji Fertilizer Company Limited | Fertilizer | OLIVE |

| 63 | FHAM | First Habib Modarba Limited | Modarabas | GREY |

| 64 | FNBM | First National Bank Modarba | Modarabas | GREY |

| 65 | FNEL | First National Equities Limited | Inv. Banks/Inv. Cos./Securities Cos. | LIME |

| 66 | GADT | Gadoon Textile Mills Limited | Textile Spinning | KHAKI |

| 67 | GASF | Golden Arrow Selected Funds Limited | Close-End Mutual Fund | ROSEGOLD |

| 68 | GATI | Gatron Industries Limited | Synthetic and Rayon | PLATINUM |

| 69 | GATM | Gul Ahmed Textile Mills Limited | Textile Composite | KHAKI |

| 70 | GHGL | Ghani Glass Limited | Glass and Ceramics | GUNMETAL |

| 71 | GHNL | Ghandara Nissan Limited | Automobile Assembler | PURPLE |

| 72 | GLAXO | GlaxoSmithKline (Pakistan) Limited | Pharmaceuticals | GREEN |

| 73 | GTYR | General Tyre and Rubber Co. of Pakistan Limited | Automobile Parts and Accessories | PURPLE |

| 74 | GWLC | Gharibwal Cement Limited | Cement | BLUE |

| 75 | HABSM | Habib Sugar Mills Limited | Sugar and Allied Industries | MAGENTA |

| 76 | HAL | Habib-ADM Limited | Sugar and Allied Industries | MAGENTA |

| 77 | HCAR | Honda Atlas Cars (Pakistan) Limited | Automobile Assembler | PURPLE |

| 78 | HICL | Habib Insurance Company Limited | Insurance | CYAN |

| 79 | HIFA | HBL Investment Fund | Close-End Mutual Fund | ROSEGOLD |

| 80 | HINO | HinoPak Motors Limited | Automobile Assembler | PURPLE |

| 81 | HINOON | Highnoon Laboratories Limited | Pharmaceuticals | GREEN |

| 82 | HMB | Habib Metropolitan Bank Limited | Commercial Banks | RED |

| 83 | HSPI | Huffaz Seamless Pipe Industries Limited | Engineering | HAZEL GREEN |

| 84 | HUBC | Hub Power Company Limited | Power Generation and Distribution | LIGHTBLUE |

| 85 | HUMNL | Hum Network Limited | Technology and Communication | TEAL |

| 86 | ICI | I.C.I. Pakistan Limited | Chemical | YELLOW |

| 87 | ICIBL | Invest Capital Investment Bank Limited | Inv. Banks/Inv. Cos./Securities Cos. | LIME |

| 88 | IGIHL | IGI Holdings Limited | Insurance | CYAN |

| 89 | INDU | Indus Motor Company Limited | Automobile Assembler | PURPLE |

| 90 | INIL | International Industries Limited | Engineering | HAZEL GREEN |

| 91 | JGICL | Jubilee General Insurance Company Limited | Insurance | CYAN |

| 92 | JLICL | Jubilee Life Insurance Company Limited | Insurance | CYAN |

| 93 | JOPP | Johnson and Phillips (Pakistan) Limited | Cable and Electric Goods | CREAM |

| 94 | JPGL | Japan Power Generation Limited | Power Generation and Distribution | LIGHTBLUE |

| 95 | JSCL | Jahangir Siddiqui Company Limited | Inv. Banks/Inv. Cos./Securities Cos. | LIME |

| 96 | JSGCL | JS Global Capital Limited | Inv. Banks/Inv. Cos./Securities Cos. | LIME |

| 97 | KAPCO | Kot Addu Power Company Limited | Power Generation and Distribution | LIGHTBLUE |

| 98 | KEL | K-Electric Limited | Power Generation and Distribution | LIGHTBLUE |

| 99 | KOHC | Kohat Cement Limited | Cement | BLUE |

| 100 | KOHE | Kohinoor Energy Limited | Power Generation and Distribution | LIGHTBLUE |

| 101 | KTML | Kohinoor Textile Mills Limited | Textile Composite | KHAKI |

| 102 | LUCK | Lucky Cement Limited | Cement | BLUE |

| 103 | MACFL | Macpac Films Limited | Miscellaneous | BROWN |

| 104 | MARI | Mari Petroleum Company Limited | Oil and Gas Exploration Companies | ORANGE |

| 105 | MCB | MCB Bank Limited | Commercial Banks | RED |

| 106 | MEBL | Meezan Bank Limited | Commercial Banks | RED |

| 107 | MERIT | Merit Packaging Limited | Paper and Board | SILVER |

| 108 | MFFL | Mitchells Fruit Farms Limited | Food and Personal Care Products | CHARCOAL |

| 109 | MLCF | Maple Leaf Cement Factory Limited | Cement | BLUE |

| 110 | MRNS | Mehran Sugar Mills Limited | Sugar and Allied Industries | MAGENTA |

| 111 | MTL | Millat Tractors Limited | Automobile Assembler | PURPLE |

| 112 | MUREB | Murree Brewery Company Limited | Food and Personal Care Products | CHARCOAL |

| 113 | MZSM | Mirza Sugar Mills Limited | Sugar and Allied Industries | MAGENTA |

| 114 | NATF | National Foods Limited | Food and Personal Care Products | CHARCOAL |

| 115 | NBP | National Bank of Pakistan | Commercial Banks | RED |

| 116 | NCL | Nishat Chunian Limited | Textile Composite | KHAKI |

| 117 | NESTLE | Nestle Pakistan Limited | Food and Personal Care Products | CHARCOAL |

| 118 | NETSOL | NetSol Technologies Limited | Technology and Communication | TEAL |

| 119 | NICL | Nimir Industrial Chemicals Limited | Chemical | YELLOW |

| 120 | NML | Nishat Mills Limited | Textile Composite | KHAKI |

| 121 | NRL | National Refinery Limited | Refinery | INDIGO |

| 122 | OGDC | Oil and Gas Development Company Limited | Oil and Gas Exploration Companies | ORANGE |

| 123 | OLPL | Orix Leasing Pakistan Limited | Leasing | NAVY |

| 124 | OTSU | Otsuka Pakistan Limited | Pharmaceuticals | GREEN |

| 125 | PAEL | Pak Elektron Limited | Cable and Electric Goods | CREAM |

| 126 | PAKD | Pak Datacom Limited | Technology and Communication | TEAL |

| 127 | PAKOXY | Pakistan Oxygen Limited | Chemical | YELLOW |

| 128 | PAKRI | Pakistan Reinsurance Company Limited | Insurance | CYAN |

| 129 | PAKT | Pakistan Tobacco Company Limited | Tobacco | CORAL |

| 130 | PCAL | Pakistan Cables Limited | Cable and Electric Goods | CREAM |

| 131 | PIAA | Pakistan International Airlines Corporation | Transport | MAROON |

| 132 | PICT | Pakistan International Container Terminal Limited | Transport | MAROON |

| 133 | PINL | Premier Insurance Limited | Insurance | CYAN |

| 134 | PIOC | Pioneer Cement Limited | Cement | BLUE |

| 135 | PKGS | Packages Limited | Paper and Board | SILVER |

| 136 | PMI | First Prudential Modarba | Modarabas | GREY |

| 137 | PMPK | Philip Morris (Pakistan) Limited | Tobacco | CORAL |

| 138 | PNSC | Pakistan National Shipping Corporation Limited | Transport | MAROON |

| 139 | POL | Pakistan Oilfields Limited | Oil and Gas Exploration Companies | ORANGE |

| 140 | PPL | Pakistan Petroleum Limited | Oil and Gas Exploration Companies | ORANGE |

| 141 | PRL | Pakistan Refinery Limited | Refinery | INDIGO |

| 142 | PSEL | Pakistan Services Limited | Miscellaneous | BROWN |

| 143 | PSMC | Pak Suzuki Motor Company Limited | Automobile Assembler | PURPLE |

| 144 | PSO | Pakistan State Oil Company Limited | Oil and Gas Marketing Companies | ORANGE |

| 145 | PTC | Pakistan Telecommunication Company Limited | Technology and Communication | TEAL |

| 146 | QUICE | Quice Food Limited | Food and Personal Care Products | CHARCOAL |

| 147 | SAPL | Sanofi-Aventis Pakistan Limited | Pharmaceuticals | GREEN |

| 148 | SBL | Samba Bank Limited | Commercial Banks | RED |

| 149 | SEARL | The Searle Company Limited | Pharmaceuticals | GREEN |

| 150 | SEPL | Security Paper Limited | Paper and Board | SILVER |

| 151 | SHEL | Shell Pakistan Limited | Oil and Gas Marketing Companies | ORANGE |

| 152 | SHEZ | Shezan International Limited | Food and Personal Care Products | CHARCOAL |

| 153 | SHFA | Shifa International Hospitals Limited | Miscellaneous | BROWN |

| 154 | SHSML | Shahmurad Sugar Mills Limited | Sugar and Allied Industries | MAGENTA |

| 155 | SIEM | Siemens Pakistan Engineering Co. Limited | Cable and Electric Goods | CREAM |

| 156 | SILK | Silkbank Limited | Commercial Banks | RED |

| 157 | SITC | Sitara Chemical Industries Limited | Chemical | YELLOW |

| 158 | SMTM | Samin Textiles Limited | Textile Weaving | KHAKI |

| 159 | SNAI | Sana Industries Limited | Textile Spinning | KHAKI |

| 160 | SNBL | Soneri Bank Limited | Commercial Banks | RED |

| 161 | SNGP | Sui Northern Gas Pipelines Limited | Oil and Gas Marketing Companies | ORANGE |

| 162 | SPLC | Saudi Pak Leasing Company Limited | Leasing | NAVY |

| 163 | SRVI | Service Industries Limited | Leather and Tanneries | CELESTE |

| 164 | SSGC | Sui Southern Gas Company Limited | Oil and Gas Marketing Companies | ORANGE |

| 165 | STCL | Shabbir Tiles and Ceramics Limited | Glass and Ceramics | GUNMETAL |

| 166 | STPL | Siddiqsons Tin Plate Limited | Miscellaneous | BROWN |

| 167 | TELE | Telecard Limited | Technology and Communication | TEAL |

| 168 | TGL | Tariq Glass Industries Limited | Glass and Ceramics | GUNMETAL |

| 169 | THALL | Thal Limited | Automobile Parts and Accessories | PURPLE |

| 170 | TREET | Treet Corporation Limited | Food and Personal Care Products | CHARCOAL |

| 171 | TRG | TRG Pakistan Limited | Technology and Communication | TEAL |

| 172 | TRIBL | Trust Investment Bank Limited | Inv. Banks/Inv. Cos./Securities Cos. | LIME |

| 173 | TRIPF | Tri-Pack Films Limited | Miscellaneous | BROWN |

| 174 | TSPL | Tri-Star Power Limited | Power Generation and Distribution | LIGHTBLUE |

| 175 | UBL | United Bank Limited | Commercial Banks | RED |

| 176 | UDPL | United Distributors Pakistan Limited | Miscellaneous | BROWN |

| 177 | WAHN | Wah Noble Chemicals Limited | Chemical | YELLOW |

| 178 | WAVES | Waves Singer Pakistan Limited | Cable and Electric Goods | CREAM |

| 179 | WTL | WorldCall Telecom Limited | Technology and Communication | TEAL |

| 180 | ZIL | ZIL Limited | Food and Personal Care Products | CHARCOAL |

| 181 | ZTL | Zephyr Textile Limited | Textile Weaving | KHAKI |

References

- Chen, Y.; Mantegna, R.N.; Pantelous, A.A.; Zuev, K.M. A dynamic analysis of S&P 500, FTSE 100 and EURO STOXX 50 indices under different exchange rates. PLoS ONE 2018, 13, e0194067. [Google Scholar] [PubMed]

- Mantegna, R.N. Hierarchical structure in financial markets. Eur. Phys. J. B 1999, 11, 193–197. [Google Scholar] [CrossRef]

- Dias, J. Spanning trees and the Eurozone crisis. Phys. A Stat. Mech. Its Appl. 2013, 392, 5974–5984. [Google Scholar] [CrossRef]

- Matesanz, D.; Ortega, G.J. Sovereign public debt crisis in Europe. A network analysis. Phys. A Stat. Mech. Its Appl. 2015, 436, 756–766. [Google Scholar] [CrossRef]

- Majapa, M.; Gossel, S.J. Topology of the South African stock market network across the 2008 financial crisis. Phys. A Stat. Mech. Its Appl. 2016, 445, 35–47. [Google Scholar] [CrossRef]

- Zhao, L.; Li, W.; Cai, X. Structure and dynamics of stock market in times of crisis. Phys. Lett. A 2016, 380, 654–666. [Google Scholar] [CrossRef]

- Onnela, J.P.; Chakraborti, A.; Kaski, K.; Kertész, J. Dynamic asset trees and Black Monday. Phys. A Stat. Mech. Its Appl. 2003, 324, 247–252. [Google Scholar] [CrossRef]

- Li, B.; Pi, D. Analysis of global stock index data during crisis period via complex network approach. PLoS ONE 2018, 13, e0200600. [Google Scholar] [CrossRef]

- Xia, L.; You, D.; Jiang, X.; Guo, Q. Comparison between global financial crisis and local stock disaster on top of Chinese stock network. Phys. A Stat. Mech. Its Appl. 2018, 490, 222–230. [Google Scholar] [CrossRef]

- Jang, W.; Lee, J.; Chang, W. Currency crises and the evolution of foreign exchange market: Evidence from minimum spanning tree. Phys. A Stat. Mech. Its Appl. 2011, 390, 707–718. [Google Scholar] [CrossRef]

- Nobi, A.; Maeng, S.E.; Ha, G.G.; Lee, J.W. Structural changes in the minimal spanning tree and the hierarchical network in the Korean stock market around the global financial crisis. J. Korean Phys. Soc. 2015, 66, 1153–1159. [Google Scholar] [CrossRef]

- Tumminello, M.; Aste, T.; Di Matteo, T.; Mantegna, R.N. A tool for filtering information in complex systems. Proc. Natl. Acad. Sci. USA 2005, 102, 10421–10426. [Google Scholar] [CrossRef] [PubMed]

- Boginski, V.; Butenko, S.; Pardalos, P.M. Statistical analysis of financial networks. Comput. Stat. Data Anal. 2005, 48, 431–443. [Google Scholar] [CrossRef]

- Risso, W.A. The informational efficiency and the financial crashes. Res. Int. Bus. Financ. 2008, 22, 396–408. [Google Scholar] [CrossRef]

- Sonia, R.B.; Rui, M. Entropy: A new measure of stock market volatility? J. Phys. Conf. Ser. 2012, 394, 012033. [Google Scholar]

- Sheraz, M.; Dedu, S.; Preda, V. Entropy Measures for Assessing Volatile Markets. Procedia Econ. Financ. 2015, 22, 655–662. [Google Scholar] [CrossRef]

- Sónia, R.B. An entropy-based approach to stock market volatility: Evidence from the G7’s market indices. Int. J. Ind. Syst. Eng. 2016, 24, 158–177. [Google Scholar]

- Oh, G.; Kim, H.-Y.; Ahn, S.-W.; Kwak, W. Analyzing the financial crisis using the entropy density function. Phys. A Stat. Mech. Its Appl. 2015, 419, 464–469. [Google Scholar] [CrossRef]

- Huang, J.; Shang, P.; Zhao, X. Multifractal diffusion entropy analysis on stock volatility in financial markets. Phys. A Stat. Mech. Its Appl. 2012, 391, 5739–5745. [Google Scholar] [CrossRef]

- Onnela, J.P.; Chakraborti, A.; Kaski, K.; Kertész, J.; Kanto, A. Dynamics of market correlations: Taxonomy and portfolio analysis. Phys. Rev. E 2003, 68, 056110. [Google Scholar] [CrossRef]

- Vandewalle, N.; Brisbois, F.; Tordoir, X. Non-random topology of stock markets. Quant. Financ. 2001, 1, 372–374. [Google Scholar] [CrossRef]

- Nobi, A.; Maeng, S.E.; Ha, G.G.; Lee, J.W. Effects of global financial crisis on network structure in a local stock market. Phys. A Stat. Mech. Its Appl. 2014, 407, 135–143. [Google Scholar] [CrossRef]

- Li, W.; Hommel, U.; Paterlini, S. Network topology and systemic risk: Evidence from the Euro Stoxx market. Financ. Res. Lett. 2018, 27, 105–112. [Google Scholar] [CrossRef]

- Dimitrios, K.; Vasileios, O. A Network Analysis of the Greek Stock Market. Procedia Econ. Financ. 2015, 33, 340–349. [Google Scholar] [CrossRef]

- Kantar, E.; Keskin, M.; Deviren, B. Analysis of the effects of the global financial crisis on the Turkish economy, using hierarchical methods. Phys. A Stat. Mech. Its Appl. 2012, 391, 2342–2352. [Google Scholar] [CrossRef]

- Bhattacharjee, B.; Shafi, M.; Acharjee, A. Network mining based elucidation of the dynamics of cross-market clustering and connectedness in Asian region: An MST and hierarchical clustering approach. J. King Saud Univ. Comput. Inf. Sci. 2017. [Google Scholar] [CrossRef]

- Sensoy, A.; Tabak, B.M. Dynamic spanning trees in stock market networks: The case of Asia-Pacific. Phys. A Stat. Mech. Its Appl. 2014, 414, 387–402. [Google Scholar] [CrossRef]

- Yang, R.; Li, X.; Zhang, T. Analysis of linkage effects among industry sectors in China’s stock market before and after the financial crisis. Phys. A Stat. Mech. Its Appl. 2014, 411, 12–20. [Google Scholar] [CrossRef]

- Nie, C.X.; Song, F.T. Relationship between Entropy and Dimension of Financial Correlation-Based Network. Entropy 2018, 20, 177. [Google Scholar] [CrossRef]

- Namaki, A.; Shirazi, A.H.; Raei, R.; Jafari, G.R. Network analysis of a financial market based on genuine correlation and threshold method. Phys. A Stat. Mech. Its Appl. 2011, 390, 3835–3841. [Google Scholar] [CrossRef]

- Onnela, J.-P.; Saramäki, J.; Kertész, J.; Kaski, K. Intensity and coherence of motifs in weighted complex networks. Phys. Rev. E 2005, 71, 065103. [Google Scholar] [CrossRef] [PubMed]

- Lyócsa, Š.; Výrost, T.; Baumöhl, E. Stock market networks: The dynamic conditional correlation approach. Phys. A Stat. Mech. Its Appl. 2012, 391, 4147–4158. [Google Scholar] [CrossRef]

- Brida, J.G.; Matesanz, D.; Seijas, M.N. Network analysis of returns and volume trading in stock markets: The Euro Stoxx case. Phys. A Stat. Mech. Its Appl. 2016, 444, 751–764. [Google Scholar] [CrossRef]

- Bonanno, G.; Lillo, F.; Mantegna, R.N. High-frequency cross-correlation in a set of stocks. Quant. Financ. 2001, 1, 96–104. [Google Scholar] [CrossRef]

- Ulusoy, T.; Keskin, M.; Shirvani, A.; Deviren, B.; Kantar, E.; Çaǧrı Dönmez, C. Complexity of major UK companies between 2006 and 2010: Hierarchical structure method approach. Phys. A Stat. Mech. Its Appl. 2012, 391, 5121–5131. [Google Scholar] [CrossRef]

- Brida, J.G.; Risso, W.A. Hierarchical structure of the German stock market. Expert Syst. Appl. 2010, 37, 3846–3852. [Google Scholar] [CrossRef]

- Lee, J.; Youn, J.; Chang, W. Intraday volatility and network topological properties in the Korean stock market. Phys. A Stat. Mech. Its Appl. 2012, 391, 1354–1360. [Google Scholar] [CrossRef]

- Zhang, J.; Zhou, H.; Jiang, L.; Wang, Y. Network topologies of Shanghai stock index. Phys. Procedia 2010, 3, 1733–1740. [Google Scholar] [CrossRef]

- Huang, W.-Q.; Zhuang, X.-T.; Yao, S. A network analysis of the Chinese stock market. Phys. A Stat. Mech. Its Appl. 2009, 388, 2956–2964. [Google Scholar] [CrossRef]

- Nguyen, Q.; Nguyen, N.K.K.; Nguyen, L.H.N. Dynamic topology and allometric scaling behavior on the Vietnamese stock market. Phys. A Stat. Mech. Its Appl. 2019, 514, 235–243. [Google Scholar] [CrossRef]

- Bahaludin, H.; Abdullah, M.H.; Salleh, S.M. Minimal spanning tree for 100 companies in Bursa Malaysia. AIP Conf. Proc. 2015, 1643, 609–615. [Google Scholar]

- Tabak, B.M.; Serra, T.R.; Cajueiro, D.O. Topological properties of stock market networks: The case of Brazil. Phys. A Stat. Mech. Its Appl. 2010, 389, 3240–3249. [Google Scholar] [CrossRef]

- Forbes, K.J.; Rigobon, R. No Contagion, Only Interdependence: Measuring Stock Market Comovements. J. Financ. 2002, 57, 2223–2261. [Google Scholar] [CrossRef]

- Ferreira, P.; Dionísio, A.; Zebende, G.F. Why does the Euro fail? The DCCA approach. Phys. A Stat. Mech. Its Appl. 2016, 443, 543–554. [Google Scholar] [CrossRef]

- Peron, T.K.D.M.; Costa, L.D.F.; Rodrigues, F.A. The structure and resilience of financial market networks. Chaos Interdiscip. J. Nonlinear Sci. 2012, 22, 013117. [Google Scholar] [CrossRef] [PubMed]

- Jin, X. The impact of 2008 financial crisis on the efficiency and contagion of Asian stock markets: A Hurst exponent approach. Financ. Res. Lett. 2016, 17, 167–175. [Google Scholar] [CrossRef]

- Okubo, T.; Kimura, F.; Teshima, N. Asian fragmentation in the Global Financial Crisis. Int. Rev. Econ. Financ. 2014, 31, 114–127. [Google Scholar] [CrossRef]

- Zhang, J.; Teng, F. Are China Stock Markets Efficient after the Global Financial Crisis? In Proceedings of the 2010 International Conference on Computational Intelligence and Software Engineering, Wuhan, China, 10–12 December 2010; pp. 1–4. [Google Scholar]

- Mustafa, N.N.S.; Samsudin, S.; Shahadan, F.; Yi, A.K.J. Flight-to-Quality between Stock and Bond Markets: Pre and Post Global Financial Crisis. Procedia Econ. Financ. 2015, 31, 846–855. [Google Scholar] [CrossRef]

- Shannon, C.E. A Mathematical Theory of Communication. Bell Syst. Tech. J. 1948, 27, 379–423. [Google Scholar] [CrossRef]

- Sandoval, L. Structure of a Global Network of Financial Companies Based on Transfer Entropy. Entropy 2014, 16, 4443–4482. [Google Scholar] [CrossRef]

- Lee, J.W.; Nobi, A. State and Network Structures of Stock Markets around the Global Financial Crisis. Comput. Econ. 2018, 51, 195–210. [Google Scholar] [CrossRef]

- Mantegna, R.N.; Stanley, H.E. An Introduction to Econophysics: Correlations and Complexity in Finance; Cambridge University Press: Cambridge, UK, 2000. [Google Scholar]

- Kruskal, J.B. On the Shortest Spanning Subtree of a Graph and the Traveling Salesman Problem. Proc. Am. Math. Soc. 1956, 7, 48–50. [Google Scholar] [CrossRef]

- Jiang, Y.; Yu, M.; Hashmi, S.M. The Financial Crisis and Co-Movement of Global Stock Markets—A Case of Six Major Economies. Sustainability 2017, 9, 260. [Google Scholar] [CrossRef]

- Pele, D.T.; Lazar, E.; Dufour, A. Information Entropy and Measures of Market Risk. Entropy 2017, 19, 226. [Google Scholar] [CrossRef]

- Xu, R.; Wong, W.-K.; Chen, G.; Huang, S. Topological Characteristics of the Hong Kong Stock Market: A Test-based P-threshold Approach to Understanding Network Complexity. Sci. Rep. 2017, 7, 41379. [Google Scholar] [CrossRef] [PubMed]

- Sandoval, L.; Franca, I.D.P. Correlation of financial markets in times of crisis. Phys. A Stat. Mech. Its Appl. 2012, 391, 187–208. [Google Scholar] [CrossRef]

- Heiberger, R.H. Stock network stability in times of crisis. Phys. A Stat. Mech. Its Appl. 2014, 393, 376–381. [Google Scholar] [CrossRef]

- Sharif, S.; Ismail, S.; Zurni, O.; Theng, L.H. Validation of Global Financial Crisis on Bursa Malaysia Stocks Market Companies via Covariance Structure. Am. J. Appl. Sci. 2016, 13, 1091–1095. [Google Scholar] [CrossRef]

- Wiliński, M.; Sienkiewicz, A.; Gubiec, T.; Kutner, R.; Struzik, Z.R. Structural and topological phase transitions on the German Stock Exchange. Phys. A Stat. Mech. Its Appl. 2013, 392, 5963–5973. [Google Scholar] [CrossRef]

- Barabási, A.-L.; Albert, R. Emergence of Scaling in Random Networks. Science 1999, 286, 509–512. [Google Scholar]

- Wang, G.-J.; Xie, C.; Chen, Y.-J.; Chen, S. Statistical Properties of the Foreign Exchange Network at Different Time Scales: Evidence from Detrended Cross-Correlation Coefficient and Minimum Spanning Tree. Entropy 2013, 15, 1643–1662. [Google Scholar] [CrossRef]

- Górski, A.Z.; Drożdż, S.; Kwapień, J. Scale free effects in world currency exchange network. Eur. Phys. J. B 2008, 66, 91–96. [Google Scholar] [CrossRef]

- Clauset, A.; Shalizi, C.R.; Newman, M.E.J. Power-Law Distributions in Empirical Data. SIAM Rev. 2009, 51, 661–703. [Google Scholar] [CrossRef]

- Wang, G.-J.; Xie, C. Correlation structure and dynamics of international real estate securities markets: A network perspective. Phys. A Stat. Mech. Its Appl. 2015, 424, 176–193. [Google Scholar] [CrossRef]

- Onnela, J.P.; Chakraborti, A.; Kaski, K.; Kertsz, J.; Kanto, A. Asset Trees and Asset Graphs in Financial Markets. Phys. Scr. 2003, T106, 48. [Google Scholar] [CrossRef]

- Gaurav, K.; Sinha, R.; Panda, P.K. The Indus flood of 2010 in Pakistan: A perspective analysis using remote sensing data. Nat. Hazards 2011, 59, 1815–1826. [Google Scholar] [CrossRef]

| S. No | Sector | Color | Number of Companies |

|---|---|---|---|

| 1 | Automobile Assembler | Purple | 9 |

| 2 | Automobile Parts and Accessories | Purple | 4 |

| 3 | Cable and Electric Goods | Cream | 5 |

| 4 | Cement | Blue | 13 |

| 5 | Chemical | Yellow | 8 |

| 6 | Close-End Mutual Fund | Rose gold | 2 |

| 7 | Commercial Banks | Red | 16 |

| 8 | Engineering | Hazel Green | 4 |

| 9 | Fertilizer | Olive | 5 |

| 10 | Food and Personal Care Products | Charcoal | 9 |

| 11 | Glass and Ceramics | Gunmetal | 4 |

| 12 | Insurance | Cyan | 10 |

| 13 | Inv. Banks/Inv. Cos./Securities Cos. | Lime | 7 |

| 14 | Jute | Black | 1 |

| 15 | Leasing | Navy | 2 |

| 16 | Leather and Tanneries | Celeste | 2 |

| 17 | Miscellaneous | Brown | 7 |

| 18 | Modarabas | Grey | 7 |

| 19 | Oil and Gas Exploration Companies | Orange | 4 |

| 20 | Oil and Gas Marketing Companies | Orange | 6 |

| 21 | Paper and Board | Silver | 5 |

| 22 | Pharmaceuticals | Green | 7 |

| 23 | Power Generation and Distribution | Light blue | 6 |

| 24 | Refinery | Indigo | 4 |

| 25 | Sugar and Allied Industries | Magenta | 6 |

| 26 | Synthetic and Rayon | Platinum | 2 |

| 27 | Technology and Communication | Teal | 7 |

| 28 | Textile Composite | Khaki | 7 |

| 29 | Textile Spinning | Khaki | 4 |

| 30 | Textile Weaving | Khaki | 2 |

| 31 | Tobacco | Coral | 2 |

| 32 | Transport | Maroon | 3 |

| 33 | Woollen | Salmon | 1 |

| Distance | Pearson Correlation Coefficient | |||||

|---|---|---|---|---|---|---|

| Mean | Maximum | Minimum | Mean | Maximum | Minimum | |

| Precrisis | 1.311 | 1.744 | 0.635 | 0.137 | 0.799 | −0.521 |

| Crisis | 1.265 | 1.585 | 0.641 | 0.191 | 0.795 | −0.255 |

| Postcrisis | 1.313 | 1.554 | 0.693 | 0.134 | 0.760 | −0.208 |

| Overall | 1.319 | 1.450 | 0.786 | 0.128 | 0.691 | −0.051 |

| Rank | Node | Sector | Entropy with bins 0.01 | Entropy with bins 0.05 |

|---|---|---|---|---|

| List of top five stocks with the highest Shannon entropy scores | ||||

| 1 | ICIBL | Inv. Banks/Inv. Cos./Securities Cos. | 4.634 | 2.533 |

| 2 | TSPL | Power Generation and Distribution | 4.607 | 2.525 |

| 3 | CSM | Modarabas | 4.318 | 2.503 |

| 4 | MZSM | Sugar and Allied Industries | 4.245 | 2.226 |

| 5 | SPLC | Leasing | 4.209 | 2.324 |

| List of top five stocks with the lowest Shannon entropy scores | ||||

| 1 | PSEL | Miscellaneous | 1.694 | 0.887 |

| 2 | GATI | Synthetic and Rayon | 2.025 | 0.948 |

| 3 | KAPCO | Power Generation and Distribution | 2.415 | 1.111 |

| 4 | CFL | Textile Spinning | 2.421 | 1.389 |

| 5 | SHEZ | Food and Personal Care Products | 2.484 | 1.073 |

| Precrisis | Crisis | Postcrisis | |||||||

|---|---|---|---|---|---|---|---|---|---|

| p >0.1 | p > 0.3 | p > 0.5 | p > 0.1 | p > 0.3 | p > 0.5 | p > 0.1 | p > 0.3 | p > 0.5 | |

| Nodes | 181 | 123 | 37 | 181 | 161 | 86 | 181 | 107 | 49 |

| Retaining Edges | 9684 | 1250 | 74 | 10975 | 3891 | 669 | 9370 | 1421 | 94 |

| % of Retaining Edges | 59 | 8 | 0.45 | 67.37 | 23.89 | 4.11 | 57.52 | 8.72 | 0.58 |

| Average Degree | 107.006 | 20.325 | 4 | 121.271 | 48.335 | 15.558 | 103.536 | 26.561 | 3.837 |

| Network Diameter | 3 | 5 | 7 | 3 | 9 | 6 | 3 | 5 | 7 |

| Average Path Length | 1.411 | 2.163 | 2.545 | 1.329 | 2.245 | 2.399 | 1.431 | 1.964 | 2.777 |

| Graph Density | 0.594 | 0.167 | 0.111 | 0.674 | 0.302 | 0.183 | 0.575 | 0.251 | 0.08 |

| Communities | 5 | 8 | 8 | 4 | 5 | 5 | 5 | 5 | 9 |

| Modularity | 0.044 | 0.134 | 0.459 | 0.09 | 0.167 | 0.273 | 0.041 | 0.109 | 0.417 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Memon, B.A.; Yao, H. Structural Change and Dynamics of Pakistan Stock Market during Crisis: A Complex Network Perspective. Entropy 2019, 21, 248. https://doi.org/10.3390/e21030248

Memon BA, Yao H. Structural Change and Dynamics of Pakistan Stock Market during Crisis: A Complex Network Perspective. Entropy. 2019; 21(3):248. https://doi.org/10.3390/e21030248

Chicago/Turabian StyleMemon, Bilal Ahmed, and Hongxing Yao. 2019. "Structural Change and Dynamics of Pakistan Stock Market during Crisis: A Complex Network Perspective" Entropy 21, no. 3: 248. https://doi.org/10.3390/e21030248

APA StyleMemon, B. A., & Yao, H. (2019). Structural Change and Dynamics of Pakistan Stock Market during Crisis: A Complex Network Perspective. Entropy, 21(3), 248. https://doi.org/10.3390/e21030248