PT Symmetry, Non-Gaussian Path Integrals, and the Quantum Black–Scholes Equation

Abstract

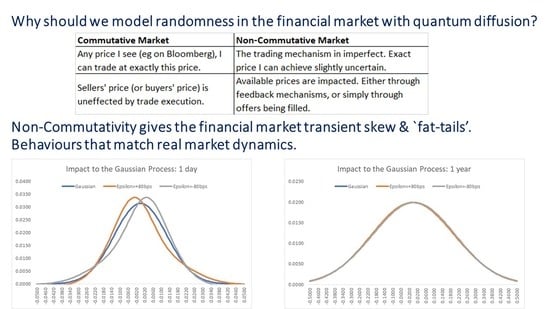

:1. Introduction

2. Quantum Stochastic Processes and the Accardi–Boukas Quantum Black–Scholes

2.1. Market State Space

2.1.1. Initial Space

2.1.2. Boson Fock Space

2.1.3. Quantum Drift

2.1.4. Quantum Diffusion

2.2. Quantum Ito Formula, and Quantum Black–Scholes

2.2.1. Quantum Ito Formula

2.2.2. Non-Commutative Quantum Black–Scholes

2.2.3. Translations, and Classical Black–Scholes

2.2.4. Rotation, and Bid-Offer Interference

3. Nonlocal Diffusion and Quantum Stochastic Processes

3.1. Kolmogorov’s Forward Equation

3.2. Nonlocal Diffusion on a Riemannian Manifold

4. Path Integral Approach

4.1. First Attempt

4.2. Symmetric Quantum Mechanics

- (i)

- Real and Symmetric Hamiltonian ().

- (ii)

- An inner product that defines a positive norm: .

- (iii)

- A unitary time development operator.

4.3. Second Attempt

4.4. Fourier Transform Method

4.5. Legendre Transform Method

5. Numerical Results and Future Work

5.1. Numerical Results

5.2. Future Developments

5.2.1. Nonlocal Diffusions

5.2.2. Multi-Dimensional Quantum Stochastic Processes

5.2.3. Iterated Quantum Stochastic Processes

- Choose a quantum stochastic process.

- Identify the relevant Hamiltonian function, by which the path integral method can be applied.

- Feed back the Hamiltonian into a new quantum stochastic process as the quantum drift.

- Go back to step 1.

6. Conclusions

Funding

Conflicts of Interest

References

- Nielsen, L.T. Pricing and Hedging of Derivative Securities; Oxford University Press: Oxford, UK, 1999. [Google Scholar]

- Haven, E. A Discussion on Embedding the Black–Scholes Option Pricing Model in a Quantum Physics Setting. Phys. A 2002, 304, 507–524. [Google Scholar] [CrossRef]

- Haven, E. A Black–Scholes Schrödinger Option Price: Bit versus qubit. Phys. A 2003, 324, 201–206. [Google Scholar] [CrossRef]

- Baaquie, B.E.; Coriano, C.; Srikant, M. Quantum mechanics, path integrals and option pricing: Reducing the complexity of finance. Nonlinear Phys. 2003, 333–339. [Google Scholar] [CrossRef]

- Linetsky, V. The Path Integral Approach to Financial Modelling and Options Pricing. Comput. Econ. 1998, 11, 129–163. [Google Scholar] [CrossRef]

- Baaquie, B.E. Statistical microeconomics and commodity prices: Theory and empirical results. Phil. Trans. R. Soc. A 2016, 374, 20150104. [Google Scholar] [CrossRef] [PubMed]

- Baaquie, B.E. Action with Acceleration I: Euclidean Hamiltonian and Path Integral. arXiv, 2012; arXiv:1211.7168v1. [Google Scholar]

- Baaquie, B.E. Action with Acceleration II: Euclidean Hamiltonian and Jordan Blocks. arXiv, 2012; arXiv:1211.7166v1. [Google Scholar]

- Segal, W.; Segal, I.E. The Black–Scholes pricing formula in the quantum context. Proc. Natl. Acad. Sci. USA 1998, 95, 4072–4075. [Google Scholar] [CrossRef] [PubMed]

- Accardi, L.; Boukas, A. The Quantum Black–Scholes Equation. Glob. J. Pure Appl. Math. 2006, 2, 155–170. [Google Scholar]

- Hudson, R.L.; Parthasarathy, K.R. Quantum Ito’s Formula and Stochastic Evolutions. Commun Math. Phys. 1984, 93, 301–323. [Google Scholar] [CrossRef]

- Hicks, W. Nonlocal Diffusions and the Quantum Black–Scholes Equation: Modelling the Market Fear Factor. Commun. Stoch. Anal. 2018, 12, 109–127. [Google Scholar] [CrossRef]

- McKean, H.P. A class of Markov processes associated with nonlinear parabolic equations. Proc. Natl. Acad. Sci. USA 1966, 56, 1907–1911. [Google Scholar] [CrossRef] [PubMed]

- Guyon, J.; Henry-Labordère, P. Nonlinear Option Pricing; CRC Financial Mathematics Series; Chapman and Hall: London, UK, 2014. [Google Scholar]

- Henry-Labordère, P. Analysis, Geometry and Modelling in Finance: Advanced Methods in Option Pricing; CRC Financial Mathematics Series; Chapman and Hall: London, UK, 2008. [Google Scholar]

- Dupire, B. Pricing with a smile. Risk Mag. 1994, 7, 18–20. [Google Scholar]

- Bender, C.M. Introduction to -Symmetric Quantum Theory. arXiv, 2005; arXiv:quant-ph/0501052v1. [Google Scholar]

- Hall, B.C. Quantum Theory for Mathematicians; Springer Graduate Texts in Mathematics 267; Springer: New York, NY, USA, 2013. [Google Scholar]

- Folland, G.B. Quantum Field Theory, A Tourist Guide for Mathematicians; Mathematical Surveys and Monographs; American Mathematical Society: Providence, RI, USA, 2008; Volume 149. [Google Scholar]

- Leyland, H.E. Option Pricing and Replication with Transaction Costs. J. Financ. 1985, 40, 1283–1301. [Google Scholar] [CrossRef]

- Glimm, J.; Jaffe, A. Quantum Physics: A Functional Integral Point of View; Springer: Berlin, Germany, 1981. [Google Scholar]

- Bender, C.M.; Orszag, S.A. Advanced Mathematical Methods for Scientists and Engineers I: Asymptotic Methods, and Perturbation Theory; Springer: New York, NY, USA, 1999. [Google Scholar]

- Heston, S.L. Options with Stochastic Volatility with Applications to Bond and Currency Options. Rev. Financ. Stud. 1993, 6, 327–343. [Google Scholar] [CrossRef]

- Tehranchi, M.; Rogers, C. Can the implied volatility surface move by parallel shifts. Financ. Stoch. 2010, 14, 235–248. [Google Scholar]

© 2019 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hicks, W. PT Symmetry, Non-Gaussian Path Integrals, and the Quantum Black–Scholes Equation. Entropy 2019, 21, 105. https://doi.org/10.3390/e21020105

Hicks W. PT Symmetry, Non-Gaussian Path Integrals, and the Quantum Black–Scholes Equation. Entropy. 2019; 21(2):105. https://doi.org/10.3390/e21020105

Chicago/Turabian StyleHicks, Will. 2019. "PT Symmetry, Non-Gaussian Path Integrals, and the Quantum Black–Scholes Equation" Entropy 21, no. 2: 105. https://doi.org/10.3390/e21020105

APA StyleHicks, W. (2019). PT Symmetry, Non-Gaussian Path Integrals, and the Quantum Black–Scholes Equation. Entropy, 21(2), 105. https://doi.org/10.3390/e21020105