1. Introduction

The von Neumann and Morgenstern expected utility model [

1] has been generally accepted as a normative decision-making model of rational choice under risk, and widely applied as a descriptive model of economic behavior [

2]. It is assumed that all reasonable people would wish to take risky action to maximize expected utility, and that most people actually do. However, its normative and descriptive power has been challenged and discussed by some famous paradoxes and researchers, such as the Allais paradox [

3], Machina [

4], Levy [

5], and so on. Meanwhile, many decision-making models have been developed to provide alternatives as the decision-making model under risk. These models include those developed by Kahneman and Tversky [

2], Sarin and Weber [

6], Bell [

7], Levy [

8], Marley et al. [

9], Luce et al. [

10,

11], Yang and Qiu [

12], etc.

Yang and Qiu [

8] established a normative decision-making model under risk, the expected utility-entropy (EU-E) decision-making model, combining the decision-maker’s subjective preference and the objective uncertainty regarding the states of nature, in which the decision-maker’s subjective preference is reflected by the expected utility; the objective uncertainty is measured using Shannon entropy [

13]. In this model, the measure of risky action is the weighted linear average of expected utility and entropy using a risk tradeoff factor. Using the EU-E decision model, some typical decision problems including the famous Allais paradox can be solved reasonably.

The work conducted by Yang and Qiu [

8] is not axiomatic, and mathematically is not very general. To further these results under behavioral axioms about preference orderings among gambles and their joint receipt, Luce et al. [

6] derived the numerical representations. These representations are for uncertain alternatives and consist of a subjective utility term plus a term depending upon the events and the subjective weights. For the risky case, Luce et al. [

7] obtained a linear weighted utility term plus a term corresponding to information-theoretical entropies as the numerical representations under segregation and under duplex decomposition. To some extent, their results can be regarded as an axiomatic basis of the EU-E model. This further demonstrates the reasonability of the EU-E decision model in Yang and Qiu [

8]. Recently, Yang and Qiu [

14] improved the model and measure of risk into a normalized expected utility-entropy measure of risk, allowing for comparing acts or choices where the number of states are quite apart. Using this decision model, the certainty effect in prospect theory [

2] can be interpreted in a reasonable way. Dong et al. [

15] presented a further discussion on the expected utility and entropy decision-making model. They emphasize the important role of Shannon entropy in the field of decision-making under risk.

Furthermore, Shannon entropy has been widely used in the field of finance [

16]. One of the most prominent applications in finance is in portfolio selection [

17]. Portfolio selection originated from modern portfolio theory by Markowitz [

18]. Since then, there has been a growing literature concerning portfolio models, in which the original portfolio model was the mean-variance model and prominent risk measures were developed as variance or standard deviation of the portfolios [

14]. In addition, as entropy is a measure of uncertainty in information theory, using entropy as an alternative risk measure of portfolio selection was developed as well. Philippatos and Wilson [

19] applied entropy to portfolio selection, proposing a mean-entropy approach to construct portfolios of 50 randomly selected New York Stock Exchange (NYSE) securities over a 14-year period. They found that the mean-entropy portfolios are consistent with the Markowitz full-covariance and Sharpe single-index models, indicating that mean-entropy portfolios are also mean-variance efficient. Similarly, Philippatos and Gressis [

13] applied the concept of entropy into portfolio selection theory and examined the selection criteria of mean-variance and mean-entropy portfolios. They found that the mean-entropy portfolios are consistent with the Markowitz full-covariance and the Sharpe single-index models under uniform, normal, and lognormal return distributions. Most importantly, the use of mean-entropy criteria is preferred to mean-variance as it is not constrained to any particular distribution. Moreover, Usta and Kantar [

20] proposed an approach in which an entropy measure is added to the mean-variance-skewness model (MVSM) to generate a well-diversified portfolio and present a multi-objective approach based on a mean-variance-skewness-entropy portfolio selection model (MVSEM). They evaluated the performance of the MVSEM in terms of several portfolio performance measures. They demonstrated that the MVSEM performs well out-of sample relative to traditional portfolio selection models.

Recently, Ormos and Zibriczky [

21] investigated entropy as a measures of financial risk by evaluating the performance of the Shannon and the Rényi entropy measures with respect to traditional measures such as beta and standard deviation. The results show that entropy yields a similar amount of diversification effects as standard deviations, confirming its ability as an appropriate risk measure. In their regression analyses, they found that entropy has a higher explanatory power for the expected return than the capital asset pricing model.

Caraiani [

22] examined the predictability of the Dow Jones Industrial Index by computing the entropy based singular value decomposition of correlation matrices between the components of the market index using both daily and monthly data. The conclusion shows that the entropy has a predictive ability with respect to stock market dynamics, as indicated by the Granger causality tests.

Most of the previous studies deal with a situation in which investors have already selected a certain set of stocks, and then constructed the efficient portfolios using various criteria. Yet, in practice, the first step for investors to do is to select a certain set of stocks from hundreds or thousands of stocks in the stock market. The commonly used way is to select a certain set of stocks with the highest expected utility of stock returns among all the stocks in the market. However, this kind of selection method does not take the uncertainty of stock returns into account. In fact, it is necessary to consider the variation of stock returns. From previous studies, the mean-entropy portfolios are consistent with the Markowitz full-covariance model under three different return distributions [

13]. Furthermore, entropy has a higher explanatory power for the expected return than the capital asset pricing model [

17]. Entropy, as a measure of uncertainty of returns, can be an important factor to select an appropriate set of stocks in which to invest. This consideration suggests the use of the EU-E decision-making model to select stocks at first, after which various kinds of portfolios can be constructed to invest using these stocks. Therefore, this idea stimulated us to perform the following research.

Differing from previous studies, in this paper, we apply the EU-E decision model to stock selection, i.e., selecting the set of stocks with the lowest EU-E measure of risk for tradeoff coefficients within certain intervals, and then derive the efficient portfolios using these sets of stocks in the mean-variance framework proposed by Markowitz. In the paper, we select 7 and 10 stocks from 30 sample stocks of Dow Jones Industrial Average index as an illustrative sample, and then derive efficient portfolios in the traditional mean-variance framework. Having compared the efficient frontier for the various intervals of

λ, the conclusion shows that for intermediate values of the tradeoff coefficient

λ, the efficient portfolios composed of the set of stocks selected using the EU-E model are more efficient than that of the set of stocks selected using the expected utility criterion. Moreover, the efficient frontiers of portfolios for intermediate values of

λ are almost the same as that of portfolios composed from the sample of all stocks. Previously, Yang et al. [

23] preliminarily apply the EU-E decision model to stock section for constructing portfolios of 4 stocks from a sample of 40 stocks from the Shenzhen Component Index. The results concluded in Yang et al. [

23] highlight the importance of using entropy when considering the uncertainty of states in making decisions under risk. In addition to results in Yang et al. [

23], the conclusions in this paper further demonstrate the necessity of incorporating both the expected utility and Shannon entropy together for risky choices, and shows the usefulness of Shannon entropy as the measure of uncertainty in a decision-making model. The results show that the EU-E decision model can be a useful method for stock selection.

2. EU-E Measure of Risk and Decision Model

2.1. EU-E Measure of Risk

Yang and Qiu [

8] proposed an expected utility-entropy (EU-E) measure of risk and then improved the model to a normalized EU-E measure of risk and decision model [

10]. We simply refer to the original and improved models as the EU-E measure of risk and the decision-making model. We give the definition of the EU-E measure of risk and the decision-making model in Definition 1 and Definition 2 as follows.

Definition 1. Given a general decision analysis model , action , state of nature . Suppose there exist at least two actions in the action space and at least two states in the state space, respectively; the decision-maker’s utility function u(x) is mono-increasing. If is nonzero, the EU-E measure of risk when taking action a is defined as follows:where λ is the tradeoff coefficient ranging from 0 to1, denotes the Shannon entropy of the distribution of its corresponding states; denotes the outcome corresponding to state θ when taking action a. In Definition 1, the λ reflects a tradeoff between the decision-maker’s subjective expected utility of an action and objective uncertainty of the corresponding states of the action.

The above definition provides a quantified measure of an individual’s intuitive perception of an action’s risk. It is the weighted linear average of normalized expected utility and normalized Shannon entropy. The idea of the normalized entropy is based on Golan et al. [

24].

Definition 2. For a given general decision analysis model , action , , denote the EU-E measure of risk of and , respectively. If , then action is preferred to action in the sense of the EU-E measure of risk, denoted by ; if , then action is not superior to , denoted by .

The decision model based on Definition 2 is referred to as the EU-E decision model. The EU-E model is a representation of the decision-maker’s preferences. From the model, the decision-maker prefers a lower EU-E measure of risk. Also, we can rank all of the actions in action space by EU-E measure of risk in ascending order, where a smaller risk is better.

2.2. EU-E Investment Decision Model for Stock Selection

We consider an investor seeking to select k stocks to compose portfolios from m stocks and denote the action of selecting stock as (i = 1, 2, …, m). For each stock, we collect the return for l previous days and denote the return series of stock as , , …, , and , , to form an interval [a, b]. Next, we construct the distribution of stock returns by dividing interval [a, b] into n equal sub-intervals , , …, , where , denoting these intervals as (j = 1,2,…,n), respectively. We then calculate the frequency of the return of stock , which falls within interval , denoted by , and let the expected return of within interval be . According to the law of large numbers by Bernoulli, approaches the probability of the return of stock , , as l increases. Therefore, if l is large enough, can be regarded as an approximation of . Consequently, we can assume that in the future, the return of stock Si will take an expected value of within interval drawn from the probability distribution, .

The investment decision model for stock selection can be summarized as , where is the set of investing stocks, is the state space, and u(x) is the investor’s utility function.

According to Definition 1, the EU-E measure of risk for stock selection is shown in Equation (2) as follows:

where

is the risk measure of investing stock

(

i = 1, 2, …,

m;

j = 1, 2, …,

n).

By Equation (2), investors can calculate the EU-E risk measure of investing each stock, then select k stocks with the lowest risk measure. After that, we can derive and compare the set of efficient frontiers in the traditional mean-variance framework.

3. Stock Selection Using the EU-E Investment Decision Model

3.1. Sample Stocks and Probability Distribution of Stock Returns

We apply the EU-E investment decision model to stock selection for portfolios. Taking 30 component stocks of Dow Jones Industrial Average (DJIA) in December 2016 as an example, we select a set of stocks from 30 component stocks, and then derive efficient portfolios using this set of stocks. Since the DJIA is an index that shows how 30 large, publicly owned companies based in the United States have traded during a standard trading session in the stock market, it is typical enough to choose a number of stocks from DJIA component stocks to derive efficient portfolios as the application. These 30 component stocks are denoted by

(

i = 1, 2, …, 30), respectively. Beginning on 18 March 2015, after the close, the DJIA consists of the following 30 major American companies shown in

Table 1.

We collect the daily closing prices of components of the DJIA over the period of January 2014 to December 2016. There are 756 transaction days in the American stock market over the period for these three years. Therefore, we obtain 756 daily closing prices for each component stock.

We determine the daily log returns of each component stock according to Equation (3), where

(

i = 1, 2, …, 30;

t = 1, 2, …, 755) is the return of stock

at the

tth transaction day, and

and

denote the closing price and dividend of stock

at the

tth transaction day, respectively [

25].

Then, we calculate the probability distribution of return for each stock. The daily return of each stock is between a and b, where a and b are the minimum and maximum of all stock returns, respectively. The variations of the daily return of each stock are usually within interval [−0.11, 0.11]. We make a minor adjustment of intervals in the EU-E investment decision model and let and . Then, we divide variations of the daily return of each stock into 11 sub-intervals [, −0.09), [−0.09, −0.07), [−0.07, −0.05), [−0.05, −0.03), [−0.03, −0.01), [−0.01, 0.01), [0.01, 0.03), [0.03, 0.05), [0.05, 0.07), [0.07, 0.09), [0.09, ], and we denote these sub-intervals as , , …, , respectively. Next, we calculated the frequency of the return of stock , which falls within interval . Let the expected return of the stock within interval be denoted by , and the probability of the return of stock within interval be denoted by . In this paper, we obtained 755 returns for each stock, therefore Bernoulli’s theorem holds. Then, we can use as an estimation of . Thus, we can obtain the probability distribution of each sample stock.

3.2. Stock Selection by the EU-E Investment Decision Model

Before using the EU-E model for stock selection, we need to determine investors’ utility function

u(

x). Kahneman and Tversky prospect theory demonstrates that most human utility is defined on deviations from the reference point; the utility function is normally concave for gains and commonly convex for losses, and is generally steeper for losses than for gains. These features of human behavior in decision-making can often be characterized by the following S-shaped utility function [

26] in Equation (4):

where

G(⋅) is increasing and strictly concave on (0, +∞) with

G(0) = 0, and

reflects that the change in utility value is steeper for losses than for gains.

We take the return of zero as the reference point, hence the returns quantifies the deviation from the reference point. This means that the utility function u(x) is equal to 0 when the stock return is zero. These factors imply that most investors are risk averse for gains and risk seeking for losses.

In particular, exponential utility is commonly used in economics and decision analysis, e.g., in the work of Bouakiz and Sobel [

27], and Chen et al. [

28]. Therefore, based on the properties above, we adopt the following exponential-type S-shaped utility function as shown in Equation (5):

where

reflects that the change in utility value is a little steeper for losses than for gains for the stock returns being very small. By expanding

u(

x) in Taylor series approximations around zero in Equation (5), then the utility function tends to be approximately linear when the return is small, which means that investors tend to be risk neutral in the case of small returns. Moreover, Rabin [

29] also shows that people are approximately risk neutral when stakes are small.

Using Equation (2), we calculate the EU-E measure of risk of selecting each stock when the value of λ varies from 0 to 1. We determine different risk measures of selecting each stock for different values of coefficient λ. Then, we rank these stocks using the EU-E risk measure of each stock in ascending order.

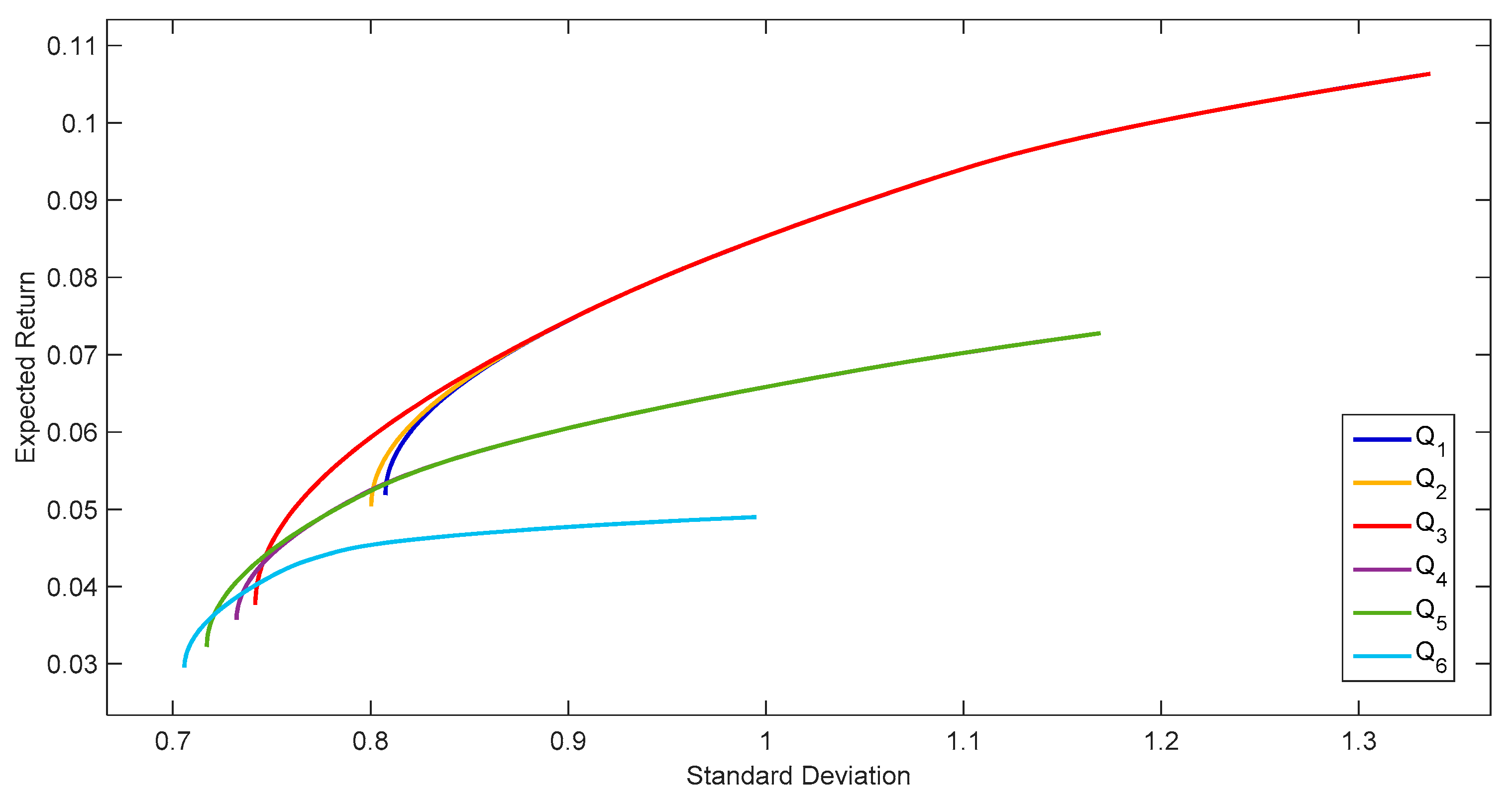

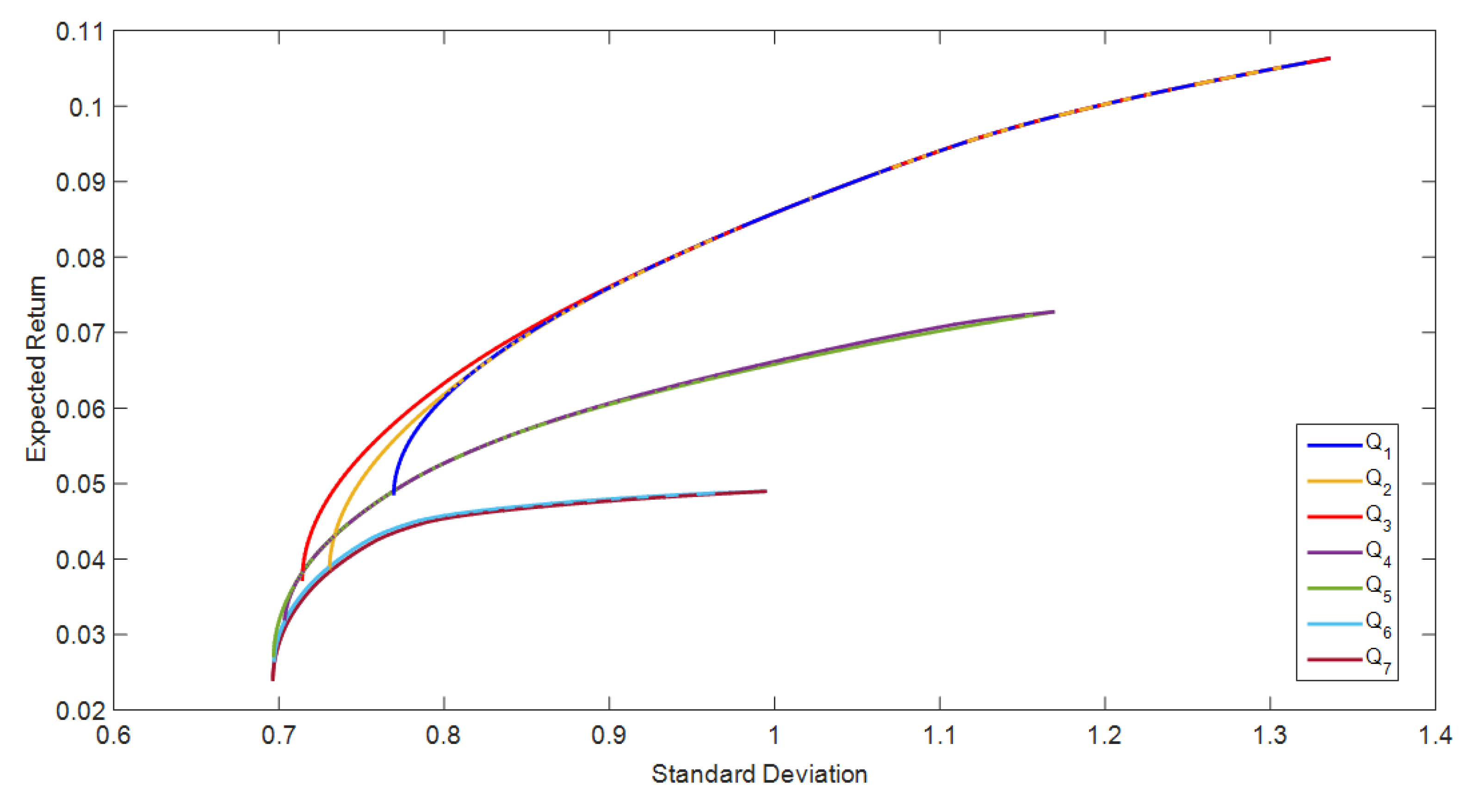

Alexeev and Dungey [

30] used high frequency and daily data on S&P500 constituents for the period from 2003 to 2011, and found that an average investor is able to diversify away 85% (90%) of the unsystematic risk using equally weighted portfolios of 7(10) stocks, irrespective of the data frequency used or the time period considered. Therefore, we select 7 and 10 stocks, denoted by sets

Q with subscripts in each portfolio with the lowest EU-E measure of risks corresponding to different values of

λ. Using Equation (2), we find that 7 and 10 stocks with the lowest EU-E risk measures are the same when

λ takes values within a certain interval. We obtain six different sets of stocks corresponding to six different intervals of

λ, as shown in

Table 2. Similarly, we obtain seven different sets of stocks corresponding to seven different intervals of

λ in

Table 3.

In

Table 2, the first column stands for the set

of seven stocks (

i = 1, 2, …, 6), the second column represents the corresponding intervals of the tradeoff coefficient

λ to set

. The third column shows the corresponding subscripts of 7 stocks included in the set

, e.g., when the tradeoff coefficient

λ varies from 0 to 0.337, the set

consists of stocks

,

,

,

,

,

,

, as shown in the

Table 1.

Similarly, in

Table 3, the first column stands for the set

of ten stocks (

i = 1, 2, …, 7), the second column represents the corresponding intervals of the tradeoff coefficient

λ to set

. The third column lists the corresponding subscripts of 10 stocks included in the set

.

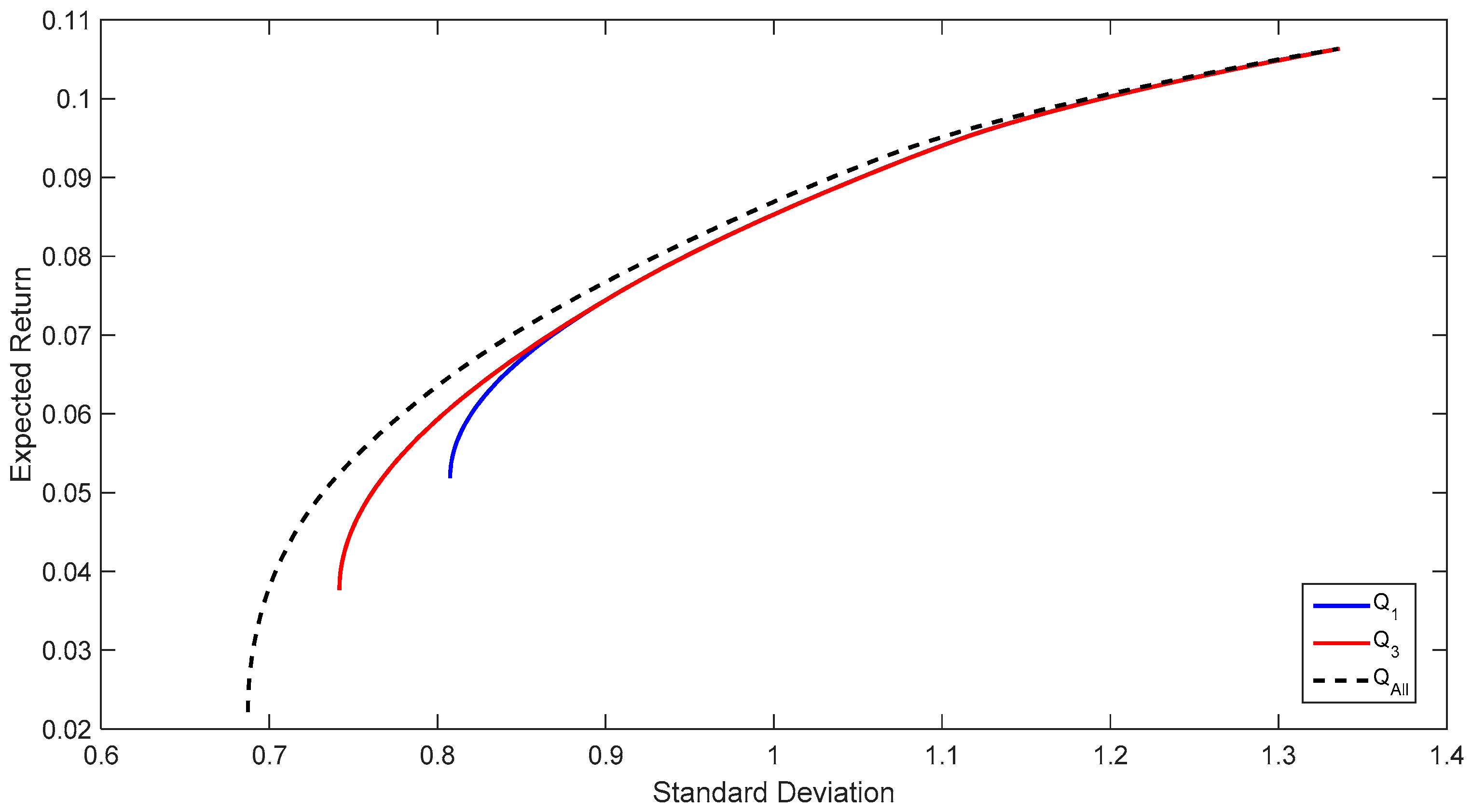

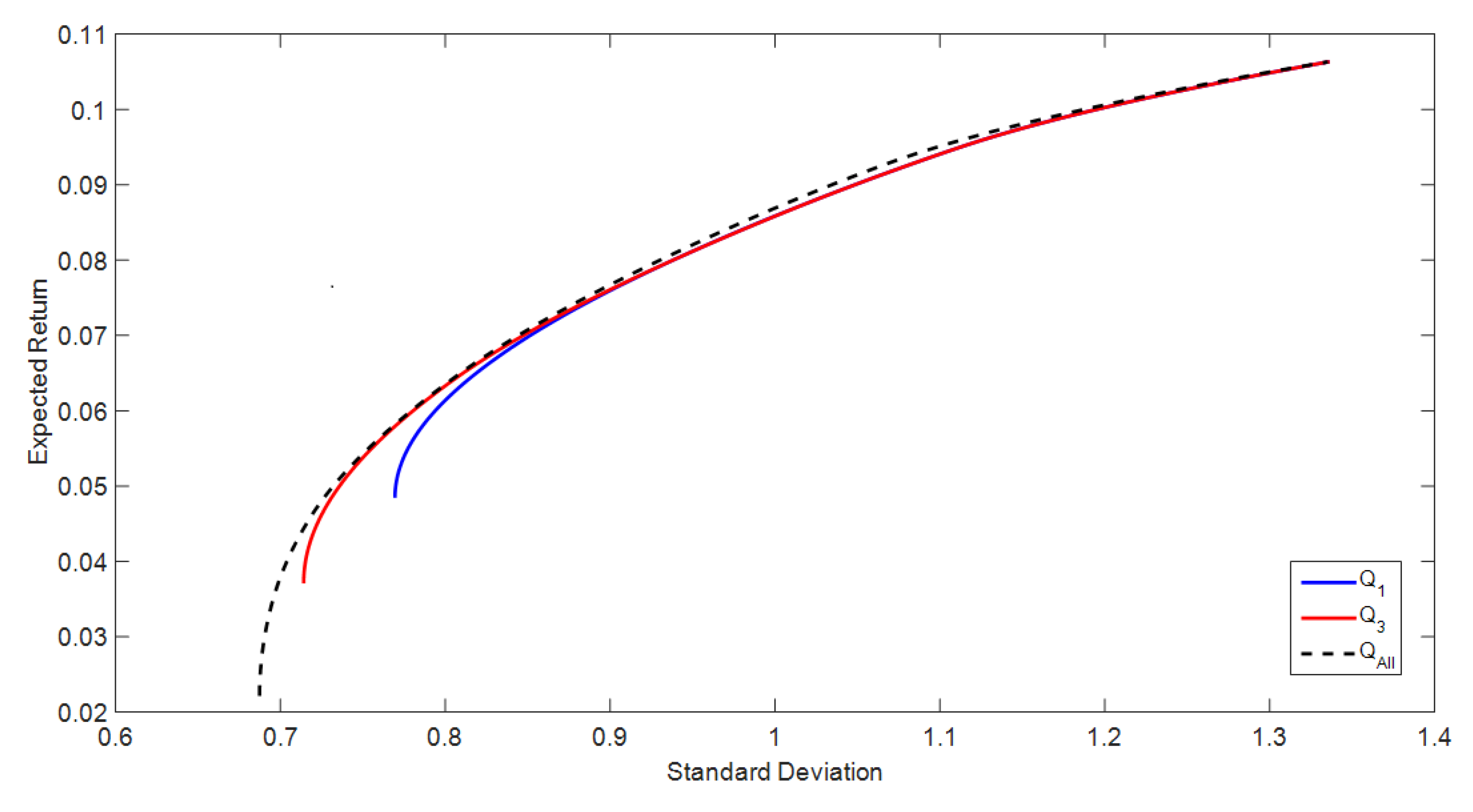

5. Conclusions

In this paper, we applied the EU-E decision model to stock selection for portfolios of 7(10) stocks from the 30 DJIA components stocks, and then derived efficient portfolios using sets of stocks selected by the EU-E model for different values of λ. We compared the efficiency of several portfolios for different tradeoff coefficients (λ) and found that portfolios constructed by the set of stocks selected using an intermediate value of λ are more efficient than those selected using a smaller λ, especially when λ equals zero, i.e., using the expected utility model. Furthermore, portfolios constructed by the set of stocks selected using values of λ with a specific interval are found to yield similar results to a portfolio selected under the expected utility theory. To be exact, when λ takes values within [0.000, 0.337] or [0.000, 0.175], the stock selection sets are equivalent to 7 or 10 stocks, respectively, selected using the expected utility model.

We also compared the efficient frontiers of portfolios of sets of stocks selected using the EU-E model and that of all the sample stocks. We found that the efficient frontier of portfolios of 7(10) stocks has almost the same performance with that of all the sample stocks.

The conclusions suggest that the EU-E decision model is a useful method in stock selection for investors. As the EU-E decision model takes into account both investors’ subjective expectation and objective uncertainty of outcomes by information entropy, it is a useful method for stock selection in the field of investment decision-making.

The results show the necessity of incorporating both the expected utility and Shannon entropy together in decision-making under risk, and further demonstrate the importance of entropy as the measure of uncertainty in the decision-making model. Thus, based on the results, we conclude that the incorporated form of expected utility and information entropy is a reasonable measure of risky action. If we only take the expected utility as a unique decision-making factor, the results may not be as good as that selected by the expected utility-entropy decision model.