1. Introduction

Against the backdrop of pursuing common prosperity in developing countries, overcoming the income growth bottleneck among rural households has become a shared concern for both scholars and policymakers. In many developing economies, the sluggish growth of rural incomes remains a major driver of widening income disparities and persistent poverty [

1]. Excessive income inequality and high poverty rates constrain economic development and undermine social stability. Poverty eradication is thus not merely a national priority but a global challenge that demands collective efforts [

2]. Accordingly, identifying effective pathways to raise farmer income is a pressing policy issue.

Existing studies have highlighted the role of rural e-commerce in stimulating economic development and creating new channels for income generation in rural areas [

3]. By leveraging big data and internet-based platforms, e-commerce enables farmers to access real-time market information and adjust their production strategies accordingly [

4]. It also facilitates market integration and expands the geographic scope of agricultural sales [

1]. Moreover, e-commerce offers digital management tools [

5] that enhance the efficiency of resource allocation in agricultural production, thereby improving farm income. On the non-farm side, e-commerce development generates employment opportunities [

6], encourages entrepreneurial activities, and creates new sources of business and property income for rural households [

7].

However, some studies have raised concerns about the adverse effects of e-commerce. These include rising labor costs, planning deficiencies, and price distortions in rural e-commerce systems, all of which may reduce the competitiveness of agricultural products and ultimately suppress farmer income [

8,

9,

10]. The mixed findings in the literature may reflect differences in research methods, regional contexts, or sample characteristics. More importantly, they may stem from the oversimplified measurement of e-commerce participation. Most existing studies adopt a binary classification—whether farmers participate in e-commerce [

11,

12,

13]—and fail to examine how varying degrees of engagement within e-commerce-driven industrial chains affect income outcomes. This limited perspective restricts a deeper understanding of the actual mechanisms through which e-commerce contributes to rural income growth.

In practice, the evolution of rural e-commerce has transformed it from a simple sales platform into an embedded digital value chain. Through e-commerce operations, farmers increasingly engage in diverse activities such as product marketing, financial services, information acquisition, and production coordination. The degree to which farmers are embedded in this e-commerce-led digital value chain directly influences their ability to benefit from the digital economy. Nonetheless, the existing literature largely neglects this dynamic dimension of “chain-based participation” and fails to investigate how different levels of embeddedness generate heterogeneous income effects.

This paper centers on the concept of the e-commerce-led digital chain and proposes a novel analytical framework that shifts the focus from mere participation to deeper levels of embeddedness. We investigate how farmers’ embeddedness in the digital chain influences both their income structure and income expectations. Drawing on nationally representative data from the China Rural Revitalization Survey (CRRS), we focus on crop-producing households. A composite index of digital chain embeddedness is constructed using factor analysis. To address sample selection bias and potential endogeneity, we employ a treatment effects model and instrumental variable estimation to identify the causal effects of embeddedness depth on income outcomes.

In summary, this study examines how varying degrees of farmers’ embeddedness in the e-commerce–led digital chain influence their income outcomes, thereby filling an important gap in the literature by uncovering the micro-level mechanisms through which e-commerce empowers agricultural households. It offers empirical evidence to support rural income enhancement strategies under digital transformation, with broader implications for farmer welfare and the sustainable development of the rural economy.

2. Background

In recent years, supported by the rapid advancement of internet technologies, e-commerce has emerged as a dominant force in the digital economy worldwide [

14]. Traditionally, smallholder farmers have relied on intermediaries such as traders and wholesalers to sell their agricultural products. However, such conventional marketing channels often result in significant price gaps between purchase and retail stages, thereby eroding producers’ profit margins [

15]. The rise of e-commerce and the emergence of virtualized marketing channels have significantly improved farmers’ access to information [

16], breaking the constraints of time, space, and geography imposed by traditional transactions [

17]. These innovations have enhanced overall market efficiency and facilitated the integration of smallholders into modern agricultural systems [

18].

China has become the world’s largest online retail market, driven by the expansion of rural internet infrastructure and a series of pro-agriculture digital policies [

19]. According to data from China’s Ministry of Commerce, the total national e-commerce transaction volume reached CNY 43.83 trillion in 2022, up by 3.5% from the previous year. Notably, rural online retail sales totaled CNY 2.17 trillion, up 3.6% year-on-year, while online agricultural product sales reached CNY 531.3 billion, growing by 9.2%. These figures indicate the growing relevance of digital platforms in rural development and raise important questions: Can farmers—especially crop producers—truly benefit from e-commerce-driven transformation? If so, through what mechanisms do these income gains occur?

As digital technologies penetrate deeper into agricultural production, farmers’ modes of participation in e-commerce have become increasingly layered. From basic infrastructure access to the intelligent transformation of farm operations, and from online market expansion to the digitalization of financial services, the depth of participation across these domains significantly shapes the extent to which farmers can capture value from the digital economy. The foundational threshold for digital engagement is established by farmers’ access to internet-enabled devices and their attainment of digital literacy [

20]. Building upon this foundation, the adoption of smart agricultural technologies, such as the Internet of Things and big data analytics, enhances productivity and refines decision-making processes [

21,

22]. Furthermore, the utilization of e-commerce platforms to expand marketing channels transforms traditional supply chains and significantly strengthens farmers’ market access [

23,

24]. In parallel, the diffusion of mobile payments and digital credit reshapes rural capital flows and household risk attitudes [

25,

26]. These dimensions not only exert individual effects, but also interact to influence both the structure of farmer income and expectations regarding future earnings.

Recent research emphasizes the rapid evolution of digital agriculture and the growing role of e-commerce in rural development worldwide. Studies have documented that digital platform facilitate broader market access, improve supply chain efficiency, and support rural households in integrating into modern agricultural systems [

20,

27]. Moreover, scholars have highlighted the transformative potential of e-commerce for rural livelihoods, noting its influence on income generation, employment opportunities, and economic resilience during periods of market disruption [

28,

29]. Policy-driven initiatives and infrastructure improvements have also played a critical role in enabling these developments. Collectively, these insights demonstrate the increasing importance of digital technologies in shaping rural economies and provide a compelling context for examining how farmers engage with e-commerce-driven digital chains.

Given that crop-producing households represent the mainstay of China’s agricultural sector, their income levels and livelihood status directly reflect the performance of rural development policies. This study focuses on the distinct role of crop farmers in China’s agricultural transformation, using them as the primary unit of analysis. By examining how their depth of participation in e-commerce-driven digital chains affects both their income structure and income expectations, the study contributes to a clearer understanding of the micro-level mechanisms through which the digital economy fosters sustainable rural income growth.

3. Analytical Framework

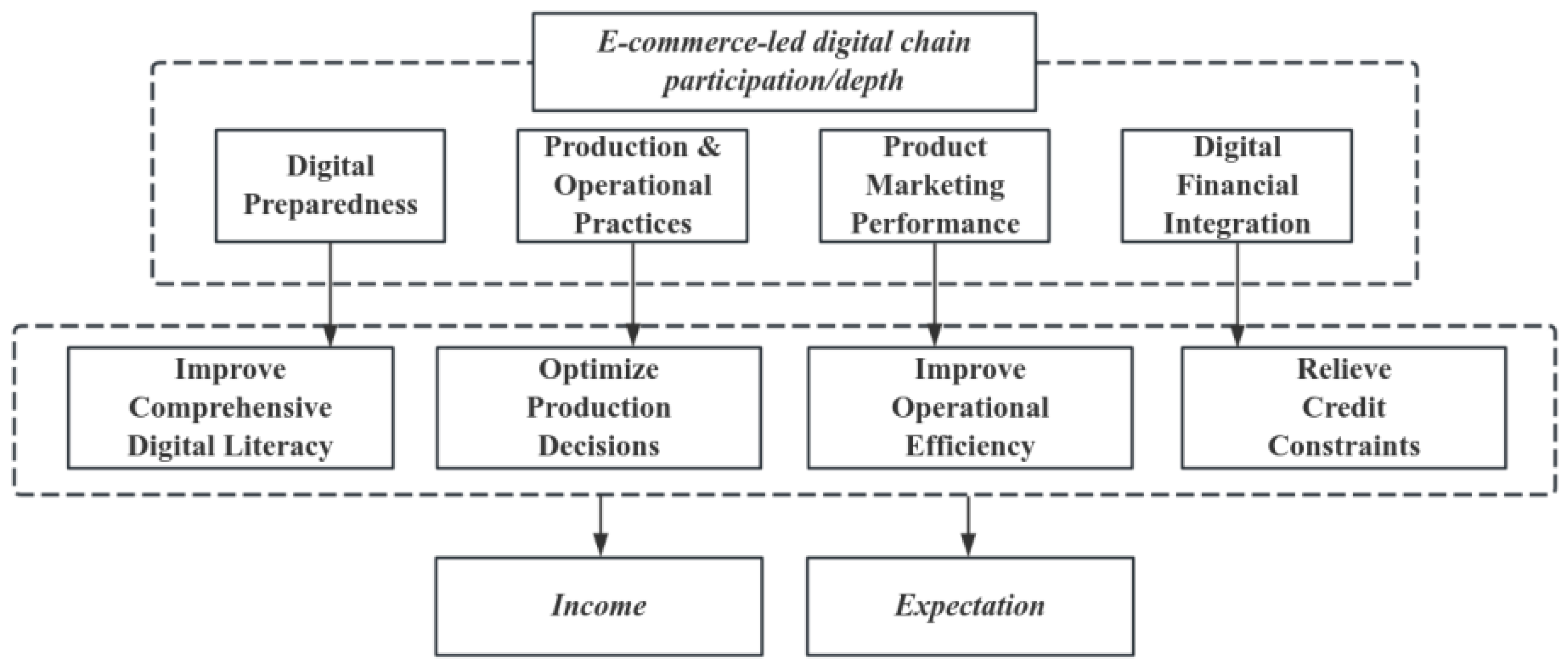

E-commerce participation, along with integration into the e-commerce-led digital chain, has the potential to systematically enhance farmers’ capacity to integrate resources and improve operational capabilities, thereby indirectly facilitating income growth. This mechanism functions through four interrelated dimensions: digital preparedness, production and operational practices, product marketing performance, and the integration of digital financial services (see

Figure 1). Together, these dimensions promote continuous improvements in production efficiency, market responsiveness, and resource allocation. By strengthening both individual digital engagement and value-chain integration, these mechanisms generate endogenous momentum for sustained income growth among rural households.

First, digital preparedness refers to the acquisition of digital skills, knowledge, and information-processing capabilities that serve as the foundational competencies for more advanced digital collaboration across the agricultural value chain. In the digital economy, digital literacy has emerged as a key component of human capital. Through continuous engagement with e-commerce operations, farmers acquire experience in operating digital devices and processing online information, thereby enhancing their overall digital literacy. This improvement in digital capabilities enables farmers to access timely production information and market signals more effectively, reducing information asymmetry and supporting more rational production decisions. Prior studies have shown that individuals with higher levels of digital literacy are more capable of integrating digital resources, increasing labor productivity, and innovating products and services, all of which contribute to income growth [

30].

Second, production and operational practices have been upgraded through e-commerce participation, facilitating a shift in farm production from experience-based practices toward a more demand-driven model. By narrowing the information gap between producers and consumers [

31], e-commerce platforms allow farmers to leverage consumer data analytics to identify market preferences with greater precision. This enables more scientific adjustments in crop structure, production scale, and market timing. Additionally, e-commerce platforms provide centralized procurement services for agricultural inputs [

32], thereby reducing input costs and improving the match between supply and demand. As a result, farmers’ resource allocation becomes more efficient, capital turnover accelerates, and production operations become more stable and profitable [

33].

Third, product marketing performance is significantly improved through the reconstruction of traditional agricultural marketing systems enabled by e-commerce. By aggregating and analyzing consumer preferences [

34], platforms help farmers overcome geographic limitations and connect with diversified demand sources [

25]. The digitalization of logistics and transaction processes enhances both operational and transactional efficiency, reduces intermediary costs and post-harvest losses, and shortens response times, allowing farmers to adapt more flexibly to market fluctuations. As digitalization deepens across the supply chain, farmers gain greater autonomy in decision-making and achieve more precise resource allocation, thereby promoting the transition toward digitized and intensive farming and injecting new momentum into income growth.

Finally, digital financial integration plays a critical role in easing farmers’ credit constraints. In many developing economies, smallholders often face financial exclusion due to the lack of formal collateral [

35,

36], exacerbating the Matthew effect in rural financial markets [

37,

38]. Leveraging internet technologies, big data analytics, and mobile interfaces, e-commerce platforms have accelerated the development of digital inclusive finance by streamlining loan procedures and improving lending efficiency [

39]. Moreover, the integration of platform-based credit scoring mechanisms facilitates more accurate risk assessments and better resource allocation [

40]. By mitigating credit constraints, farmers are enabled to increase investment in production, improve resource utilization, and ultimately enhance agricultural productivity and household income [

41].

In summary, farmers’ multi-dimensional engagement in e-commerce—through digital preparedness, production and operational practices, product marketing performance, and digital financial integration—has played a pivotal role in improving productivity, broadening income sources, lowering operational costs, and alleviating financing barriers. Each of these dimensions constitutes a distinct channel of value creation. The overall income effect of e-commerce-led digital-chain embedding is an aggregate of these dimensional effects, which may operate independently or with varying intensity across different farmer groups. This composite process of digital empowerment has systematically enhanced farmers’ resource allocation capabilities and market competitiveness under the digital economy. It not only strengthens farmer operational performance but also provides a robust foundation for sustainable income growth and long-term development.

4. Econometric Models

4.1. Treatment Effect Model

First, this study investigates the impact of participation in e-commerce-led digital chain on farmer income. Whether a household participates in an e-commerce-led digital chain is proxied by whether it sells agricultural products online, with a value of 1 indicating participation and 0 otherwise. Previous studies have shown that farmers’ participation in e-commerce is an endogenous decision [

37]. The factors influencing this decision may also directly affect household income, thereby introducing endogeneity. To obtain unbiased and consistent estimates of the impact of e-commerce participation on farmers’ income, it is essential to address this endogeneity issue. In the existing literature, scholars have applied methods such as Propensity Score Matching (PSM) [

37], Endogenous Switching Regression Models [

19], and Two-Way Fixed Effects Models [

9,

42] to address endogeneity concerns. However, PSM is a non-parametric approach that cannot fully account for unobservable factors leading to selection bias and thus cannot identify the determinants of income. Meanwhile, fixed effects models are limited to causal inference only on observed explanatory variables included in the model. Although the endogenous switching regression model can correct for endogeneity arising from both observed and unobserved factors [

43], it mainly relies on the estimation of average treatment effects and does not allow direct estimation of the treatment’s effect on income.

To overcome these limitations, this study adopts a Treatment Effect (TE) model to estimate the impact of e-commerce participation on farmers’ income. Compared with the methods mentioned above, the TE model offers two advantages. First, it simultaneously considers observable and unobservable factors, making it possible to correct estimation bias due to omitted variables and self-selection. Second, it allows for direct estimation of the impact of e-commerce participation on income [

43].

The TE model is a two-stage estimation method that jointly estimates the following two equations. First stage: The treatment equation (i.e., the regression model for farmers’ e-commerce participation) is specified as:

where

is a binary variable indicating whether the farmer participates in e-commerce-led digital chain.

is the instrumental variable (IV) in the treatment equation. Chen [

44] noted that many scholars use aggregation data at the state, county, or metropolitan level as instruments, as geographic distance may influence economic behavior but remains exogenous to individual development. Following Zhang et al. [

45], this study uses the spherical distance from the farmer’s location to Hangzhou as the instrumental variable. Hangzhou is the headquarters of leading digital platforms such as Taobao, Tmall, and Alipay, and represents China’s most advanced digital economy ecosystem. It is reasonable to assume that farmers living closer to Hangzhou are more likely to engage in online sales due to stronger local digital economy development and awareness. This variable is expected to be strongly correlated with e-commerce participation, while satisfying the exclusion restriction by not directly affecting farmers’ income.

includes control variables such as human capital, physical and social capital, and external environmental characteristics. Since this study uses cross-sectional data, regional fixed effects are included to control for unobserved heterogeneity across locations.

Second stage: The outcome equation estimates the corrected impact of e-commerce-led digital chain participation on household income.

where

denotes the total annual income of the household,

represents e-commerce-led digital chain participation, and

is the inverse Mills ratio (IMR) derived from the first-stage Probit model to correct for sample selection bias. As in the treatment equation,

includes the same set of control variables. The coefficient

captures the treatment effect, representing the causal impact of e-commerce-led digital chain participation on farmers’ income.

4.2. Instrumental Variable Model

Subsequently, this study examines how the depth of participation in e-commerce-led digital chain influences farmer income. A key challenge in this analysis is also the potential endogeneity of the participation depth variable. While the Treatment Effect (TE) model helps address selection bias between treatment and control groups by incorporating an inverse Mills ratio—thus improving the identification of causal effects [

46]—it is not well-suited for handling endogeneity involving continuous endogenous regressors. To address this limitation, the present study employs an instrumental variable (IV) approach. Specifically, consistent with the logic applied in the TE model, the spherical distance between the farmer’s residence and Hangzhou—a major hub of China’s digital economy—is used as an instrument. The estimation model is specified as follows:

where

is the endogenous continuous variable representing the depth of e-commerce-led digital chain participation,

is the instrumental variable, and

represents a set of exogenous control variables. The predicted value

, obtained from the first-stage regression, is used in the second-stage model to eliminate the endogeneity between

and the error term

. The coefficient

captures the causal effect estimated using the IV approach.

4.3. Factor Analysis Method

To systematically examine how the depth of e-commerce-led digital chain participation affects farmers’ income, this study constructs a composite index of e-commerce-led digital chain participation depth using factor analysis. This method extracts common factors with eigenvalues greater than 1 through principal component analysis (PCA) or maximum likelihood estimation, followed by orthogonal rotation (e.g., varimax rotation) to achieve a simple structure in the factor loading matrix, thereby enhancing the interpretability of the factors. Factor scores for each observation are then calculated using the regression method. These scores, representing a reduced-dimensional continuous variable, are incorporated into subsequent regression analyses. This approach not only alleviates multicollinearity among original variables but also reveals the structural effects of e-commerce-led digital chain participation depth. The model is expressed as:

where

is the matrix of observed variables related to farmers’ e-commerce-led digital chain participation behavior,

is the factor loading matrix indicating the strength of association between observed variables and latent factors,

is the matrix of unobservable common factors, and

is the vector of random errors.

4.4. Unconditional Quantile Regression Model

Previous studies suggest that conditional quantile regression (CQR) results are highly sensitive to the choice of covariates, and altering covariates without redefining the quantile may lead to inconsistent results [

47,

48]. Considering potential endogeneity, this study adopts an Unconditional Quantile Regression (UQR) model that accounts for endogeneity in estimating the heterogeneous effects of e-commerce-led digital chain participation on household income across different income levels.

To mitigate the endogeneity of key explanatory variables, the village-level average participation in the same chain type (excluding the household in question) is used as an instrumental variable. Following Firpo [

48], the UQR-IV model is estimated via a Recentered Influence Function (RIF)-OLS approach. The model specification is as follows:

where

is the outcome variable (in this study, TotalIncome),

denotes the τ-th quantile of the cumulative distribution of

,

represents the key explanatory variable of interest indicating participation in e-commerce-led digital chain (e.g., Ecommerce, Depth),

is the instrumental variable,

represents the set of control variables, and

is the error term.

The RIF is defined as:

where

is the probability density function of

, and

is an indicator function equal to 1 if

is less than or equal to the quantile

, and 0 otherwise.

5. Data Source and Variables

5.1. Data Source

This study uses data from the 2020 China Rural Revitalization Survey (CRRS) to analyze the impact of e-commerce-led digital chain participation on farmers’ income. The selection of this specific period is highly relevant to our research topic as it coincides with a crucial juncture for China’s national digital rural development strategy. The CRRS dataset provides a rigorously collected, large-scale, and nationally representative snapshot, making it an ideal source for establishing a robust baseline understanding of farmers’ e-commerce participation during this pivotal time. The survey covers a wide range of topics, including rural and individual farmer characteristics, production and living environments, informatization level, financial inclusion, agricultural production and operations, public services, village governance, and local customs. The sample spans ten provinces—Guangdong, Zhejiang, Shandong, Anhui, Henan, Guizhou, Sichuan, Shaanxi, Ningxia Hui Autonomous Region, and Heilongjiang—making it nationally representative.

The sampling process of CRRS is as follows: First, ten provinces were randomly selected from eastern, central, western, and northeastern China based on regional economic development, geographic location, and agricultural development status. These provinces include Guangdong, Zhejiang, Shandong, Anhui, Henan, Heilongjiang, Guizhou, Sichuan, Shaanxi, and Ningxia Hui Autonomous Region. Second, using per capita GDP at the county level, a systematic random sampling method was applied to select five counties (or county-level cities/districts) from each province, ensuring spatial coverage across the entire province. Third, using the same sampling method, three townships with varying levels of economic development were randomly selected from each sampled county, and two villages—one with high and one with low economic development—were selected from each township. The CRRS household surveys were conducted in 300 administrative villages. Finally, based on the village rosters provided by local committees, approximately 14 households were randomly selected in each village for questionnaire-based interviews, yielding a total of 3821 samples.

For this study, relevant data on individual farmer characteristics, informatization levels, financial inclusion, and agricultural production and operations were extracted. After removing irrelevant or abnormal values, 1815 (The baseline analysis utilizes a total of 1815 valid crop-farming samples. The slight variations in the number of observations across subsequent regression models are due to missing values in certain key explanatory and control variables. For example, some households did not provide complete information for core variables like e-commerce participation, leading to their exclusion from specific models. These minor differences in sample size are common in empirical analysis and do not affect the robustness of our conclusions.) valid crop-farming household samples were retained for analysis.

5.2. Construction of the E-Commerce-Led Digital Chain Participation Depth Index System

Based on the index system for measuring the depth of participation in e-commerce-led digital chain (see

Table 1), this study constructs a composite variable using factor analysis. The specific indicators are categorized into four dimensions: The first category focuses on digital preparedness, including participation in internet training, payment for digital services, and timely access to information, which reflect the household’s readiness for engaging in e-commerce operations. The second category relates to production and operational practices, assessing the extent to which online information supports daily production and living needs, thereby indicating the impact of digital engagement on production efficiency. The third category evaluates product marketing performance, including the number of years since the farmer first sold products online, the number of online stores operated by the household, and online sales revenue in 2019, aiming to capture the household’s market share in the digital economy. Finally, the fourth category measures digital financial integration, encompassing variables such as e-cash balances, internet credit overdraft limits, and payment preferences when purchasing vehicles, which reflect the potential influence of e-commerce engagement on farmers’ financial behavior.

Through this multidimensional design, the system helps clarify the role of e-commerce-led digital chain in promoting income growth among farmers and highlights their significance in the broader context of agricultural digital transformation.

5.3. Variable Definitions and Descriptive Statistics

Table 2 presents the definitions and descriptive statistics of the variables used in this study.

Table 3 presents the differences between crop farmers who participate in e-commerce operations and those who do not. Compared to non-participants, e-commerce participants tend to have significantly higher income levels, with the difference being significant at the 1% level. This finding is consistent with previous studies such as Li and Qin [

49]. Participants also tend to be younger and have a higher level of education, which aligns with the conclusions of earlier research [

50]. One possible explanation is that higher education levels improve farmers’ awareness of the benefits of e-commerce participation and enhance their technical capabilities, making them more likely to engage in digital business activities. In addition, farmers with larger landholdings are more willing to participate in e-commerce, possibly because they have a greater need to expand their sales channels. Furthermore, farmers in relatively more developed regions are more likely to be involved in e-commerce operations. Overall,

Table 3 reveals systematic differences between participants and non-participants, thereby justifying the use of regression models that control for endogeneity.

6. Empirical Results and Analysis

6.1. The Impact of E-Commerce-Led Digital Chain Participation on Farmer Income

Table 4 presents the estimation results regarding the effect of e-commerce-led digital chain participation on the income of crop farmers. Column (1) reports the first-stage regression results of the treatment effect (TE) model, where the coefficient of the instrumental variable is estimated at –0.447 and is statistically significant at the 1% level. This indicates a significant negative correlation between the instrumental variable and the endogenous regressor. Moreover, the correlation coefficient rho is significant at the 10% level, suggesting the presence of selection bias due to unobservable factors [

43]. The Wald test yields a value of 321.33, allowing for the rejection of the null hypothesis of no correlation between treatment and outcome error terms, thereby justifying the use of the TE model to account for endogeneity.

In Column (2), the coefficient for e-commerce-led digital chain participation is 8.943 and is statistically significant at the 1% level, indicating that participation in e-commerce-led digital chain is associated with an increase in annual household income of approximately 89,430 yuan. This coefficient is economically meaningful, as an average income gain of nearly 89,430 yuan represents a substantial improvement for rural households. This income gain may be attributed to the fact that, in developing countries, individual farmers typically lack direct access to distant consumer markets and instead rely on local intermediaries or wholesalers, thereby reducing their bargaining power [

42]. The rise of e-commerce platforms has enabled farmers to bypass these intermediaries by reaching consumers directly, which has improved their market access and negotiation leverage [

42]. Through digital participation, farmers have been empowered to engage more actively in market-oriented activities and to capture greater benefits from the digital economy, ultimately resulting in income growth. These findings are consistent with evidence from similar studies in developing countries, which highlight the role of e-commerce in reducing farmers’ reliance on intermediaries and improving market efficiency. However, the magnitude observed here suggests that when farmers are more deeply embedded in the digital chain, the income-enhancing effect is even more pronounced, underscoring the importance of both access and depth of participation. The significance of rho and the rejection of the null hypothesis in the Wald test further confirm the presence of selection bias and justify the use of the TE model.

Column (3) of

Table 4 presents the results of the ordinary least squares (OLS) regression. Although the coefficient for e-commerce-led digital chain participation remains statistically significant at the 1% level, its magnitude differs substantially from that obtained using the TE model, further validating the use of the TE model to address potential endogeneity.

6.2. Effects of E-Commerce-Led Digital Chain Participation Depth on Farmer Income

To comprehensively assess how engagement in e-commerce-led digital chain contributes to income growth among farmers, a factor analysis method was employed to construct a multidimensional index representing the depth of participation. An instrumental variable (IV) regression model was subsequently applied to address potential endogeneity, thereby yielding more reliable estimates of the income effects associated with varying levels of engagement.

The empirical findings reveal that the coefficient for participation depth in e-commerce-led digital chain is 5.163 and statistically significant at the 1% level. This result suggests that, holding other factors constant, each one-unit increase in participation depth is associated with an average rise of 51,630 yuan in household income. The estimated coefficient reflects the marginal income gain attributable to deeper integration into digital activities, including e-commerce-based production management, product marketing, and digital financial services, thereby underscoring the substantial economic benefits of digital engagement for rural households.

To further identify the heterogeneous effects of various modes of e-commerce participation on farmer income, the depth of farmers’ involvement in e-commerce-led digital chain was categorized into four dimensions: digital readiness, production and operation, product sales, and digital financial participation. Grouped instrumental variable regressions were conducted accordingly, with the results presented in

Table 5. The estimated coefficients for digital readiness, product sales, and digital financial participation were 5.957, 8.789, and 9.832, respectively—all statistically significant at the 5% level. These findings underscore the robust explanatory power of these dimensions in promoting income growth among rural households. The relatively large coefficients suggest that deeper participation generates substantial income gains, with the strongest effects observed in product sales and digital finance. In contrast, digital production remains constrained by higher costs and structural barriers. These findings imply that policies should prioritize enhancing farmers’ digital skills and financial access in the short term, while gradually addressing the obstacles to digital production.

In the dimension of digital readiness, farmers with enhanced digital literacy were found to be more capable of utilizing digital management systems [

5], improving their ability to search for and process information [

51], and making more informed production and business decisions. These improvements enable more effective responses to real-time market fluctuations, reduce decision-making blind spots caused by information lags, and enhance resource allocation efficiency, ultimately contributing to income growth. In terms of product sales, e-commerce platforms and digital marketing tools help remove geographic constraints, enabling farmers to access broader consumer markets, including national and international buyers. This access is particularly beneficial for specialty agricultural products, which often command price premiums. Moreover, by reducing dependence on traditional intermediaries, e-commerce increases farmers’ net profit margins and enhances overall household income. Within the digital financial participation dimension, digital finance mitigates long-standing challenges in rural financial services related to access and efficiency [

39], Its inclusive design allows farmers to obtain financial resources previously inaccessible or difficult to secure, thereby lowering financing costs. Digital payment tools further reduce transaction friction and improve payment efficiency [

52]. Real-time settlement features also shorten traditional payment cycles, reduce capital holding costs, and support income enhancement.

In contrast, although the estimated coefficient for the production and operation dimension is relatively large, it is not statistically significant. One plausible explanation is that digital agricultural services often require substantial upfront investment [

53] and encounter significant technological adoption barriers. Constraints such as limited financial resources, insufficient technical expertise, and inadequate infrastructure have hindered the full utilization of digital tools among many farmers, resulting in low adoption rates or superficial applications with limited productivity gains [

54]. Furthermore, the digital transformation of agricultural production tends to benefit from economies of scale, which are difficult to realize within China’s smallholder farming context, where land fragmentation and dispersed production remain prevalent. These structural barriers may counteract the marginal returns of digital investment in this domain.

6.3. Heterogeneity Analysis of Household Income Structure

Farmers typically adopt either a single livelihood strategy—relying solely on agricultural production—or a diversified livelihood strategy that includes off-farm employment and wage labor. As the process of urban–rural integration continues, income sources among rural households have become increasingly diversified and may broadly be classified into agricultural and non-agricultural income. Given the distinct origins and mechanisms through which these income types are generated, this section investigates the effects of both participation and participation depth in the e-commerce-led digital chain on agricultural and non-agricultural income.

As presented in

Table 6, the estimated coefficient for e-commerce-led digital chain participation on agricultural income is 5.807 and is statistically significant at the 1% level, indicating a substantial positive impact. However, no statistically significant effect is found on non-agricultural income. These results suggest that e-commerce platforms serve as vital bridges connecting farmers to external markets, allowing them to access market information through digital tools and directly sell their agricultural products, thereby boosting sales revenue. On the one hand, the relative decline in the share of agricultural income—driven by ongoing urbanization and industrialization—has made the income-enhancing effects of e-commerce in the agricultural sector more salient. On the other hand, the development of e-commerce benefits not only individual farmers but also contributes to broader regional economic growth. By promoting the circulation of agricultural and local specialty products, e-commerce facilitates the optimization of resource allocation and the restructuring of rural economies, which in turn enhances economies of scale and leads to further increases in agricultural income.

It is also noteworthy that the depth of participation in the e-commerce-led digital chain exerts a significantly positive effect on agricultural income, while its impact on non-agricultural income remains limited. This may be attributed to the direct role of digital tools in improving agricultural production processes, reducing input waste, increasing yields, and shortening supply chains—benefits that can be quickly translated into income gains. In contrast, non-agricultural income generally requires higher skill levels and greater reliance on external labor markets, thereby rendering the income effects of digital participation less immediate or direct for most farmers.

Agricultural income constitutes a fundamental component of farmers’ livelihoods [

55]. Although previous studies have emphasized the income-enhancing potential of technologies such as the Internet of Things and big data [

20,

56], the mechanisms by which digital technologies are integrated across various stages of agricultural production, distribution, and financing remain insufficiently investigated. To address this gap, the present study explores four dimensions—farmers’ digital readiness, production and operational characteristics, agricultural product marketing, and digital financial participation—to identify the differentiated pathways through which e-commerce empowers farmers across the agricultural value chain.

The results reported in

Table 7 reveal that the depth of participation in the e-commerce-led digital chain exerts significantly heterogeneous effects on agricultural income. These heterogeneous effects are broadly consistent with the full-sample estimates. The findings imply that income gains from digital chain participation are not uniform across all farmers but are instead shaped by the degree of engagement with various segments of the digital chain. Deeper involvement in digital readiness, agricultural product marketing, and digital financial services is associated with more substantial improvements in agricultural income.

6.4. Heterogeneity Analysis Based on Cooperative Membership

An important factor influencing household income is the organizational form under which farmers operate. As of 2021, approximately 2.419 million farmers’ cooperatives had been registered in China, involving nearly 100 million participants—accounting for around 50% of the total farming population. However, whether participation in e-commerce yields additional income effects through cooperative engagement remains an open question. To address this, a heterogeneity analysis was conducted by classifying farmers based on cooperative membership status, aiming to provide a more precise assessment of the impact of e-commerce-led digital chain participation.

The results presented in

Table 8 indicate that for farmers who are not members of cooperatives, the coefficient for e-commerce-led digital chain participation is 12.205; for cooperative members, the coefficient is 14.563. Both estimates are statistically significant at the 1% level, suggesting that participation in e-commerce-led digital chain operations significantly increases household income regardless of cooperative affiliation. These findings may be attributed to the general benefits of e-commerce in reducing transaction costs, expanding market access, and enhancing product value. By leveraging e-commerce platforms, farmers can bypass traditional intermediaries and reach broader markets directly, thereby improving bargaining power and increasing profit margins [

42]. Furthermore, the transparency and speed of information dissemination through digital technologies enable farmers to better understand market trends and optimize production decisions [

57].

However, regarding the depth of participation in the e-commerce-led digital chain, a significant positive income effect is observed only for non-cooperative farmers. Among cooperative members, deeper participation does not generate a statistically significant marginal income effect. One possible explanation is that cooperatives already provide structural advantages in terms of market access and risk mitigation, thereby reducing the incremental benefits of deeper engagement in the digital chain. Functions such as product standardization, market matching, and information coordination may have already been internalized by the cooperative structure [

58]. Through collective action, cooperatives offer economies of scale and risk-sharing mechanisms, enabling members to benefit from organizational synergies.

Consequently, for farmers embedded within cooperative systems, further digital engagement may not translate into additional income gains. Moreover, internal governance mechanisms—such as centralized information sharing and unified marketing strategies—may constrain individual members’ flexibility in managing e-commerce operations and limit their ability to innovate, resulting in a degree of path dependence. In contrast, non-cooperative farmers, who lack such institutional support, tend to rely more heavily on digital platforms for access to market information and resources, making their income more responsive to deeper participation in the digital chain.

6.5. Heterogeneous Effects Across Income Quantiles

Farmers at different income levels often encounter unequal access to digital resources, market information, and platform-based advantages, which may result in heterogeneous marginal returns from e-commerce participation. Traditional mean-based estimation methods, such as ordinary least squares (OLS), assume a uniform treatment effect across the income distribution, potentially obscuring important variations among income groups. To address this issue, quantile regression was employed to examine whether the income-enhancing effects of e-commerce-led digital chain participation are uniformly distributed or concentrated among specific income strata.

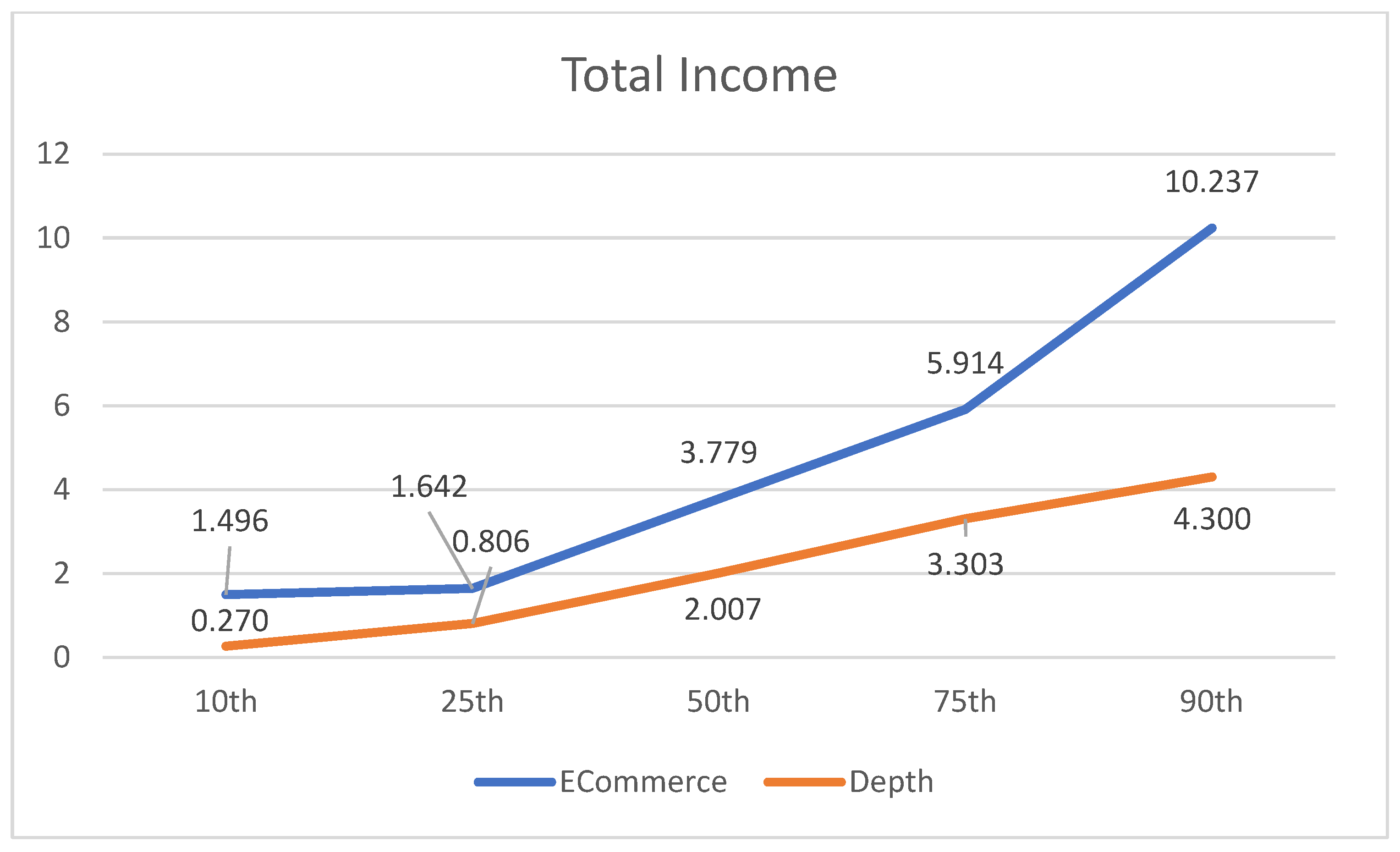

The results presented in

Table 9 indicate that e-commerce-led digital chain participation exerts a significantly positive effect on household income across all quantiles, suggesting that income gains from e-commerce are broadly experienced by farmers regardless of income level. However, a progressive increase in the estimated coefficients is observed from lower to higher quantiles, indicating that the magnitude of income benefits is more pronounced among higher-income households. Specifically, at the 10th percentile, the coefficient for e-commerce participation is 1.496, corresponding to an average increase of 14,960 yuan in household income. At the 90th percentile, the coefficient rises to 10.237, translating into an income gain of 102,370 yuan, which highlights a substantial disparity. A similar upward trend is observed for the depth of participation in the e-commerce-led digital chain. This trend is illustrated in

Figure 2.

One plausible explanation for this pattern lies in the inherent requirements of successful engagement in digital agricultural platforms. Although these platforms are designed to provide open access, they demand substantial capabilities in areas such as technology adoption, brand development, supply chain integration, and customer relationship management. These demands place greater pressure on farmers’ resource endowments and operational capacities. High-income farmers—who typically possess stronger financial capital, technological literacy, social networks, and market awareness—are better positioned to meet these requirements and, therefore, more likely to realize sustained benefits from digital chain engagement. This dynamic is consistent with the “Matthew Effect,” wherein the advantages of the well-endowed are further amplified over time.

Consequently, while e-commerce-led digital development offers the potential for inclusive growth, the observed pattern suggests a tendency toward benefit concentration among relatively advantaged households. Low-income farmers, despite participating in e-commerce activities, appear to derive only modest returns. This outcome challenges the inclusive promise of digital agriculture and raises concerns about the potential exacerbation of rural income inequality, as pre-existing structural disparities are reinforced by digital transformation processes.

6.6. Subjective Perception: Effects on Income Satisfaction

Previous studies have predominantly focused on the direct effects of digital tech-nologies on objective economic indicators such as income and productivity [

59,

60,

61], with relatively little attention paid to farmers’ subjective perceptions and psychological expectations during the technology adoption process. In practice, income satisfaction reflects not only realized economic gains but also farmers’ assessments of risk and their confidence in future development [

62]. These psychological expectations, in turn, may influence production, consumption, and investment decisions.

To address this gap, the present study examines the differentiated effects of e-commerce-led digital chain participation and the depth of participation in the digital chain on farmers’ income satisfaction. The results demonstrate that both variables exert significantly positive effects on income satisfaction, with the depth of participation showing a stronger explanatory power. This suggests that digital empowerment—by improving farmers’ control over production and enhancing their capacity to anticipate market risks—serves to reduce uncertainty-related anxiety and fosters more resilient psychological expectations.

As presented in

Table 10, the coefficient for the depth of participation in the digital chain is 0.872, compared to 0.701 for e-commerce-led digital chain participation, with both effects statistically significant. These findings imply that while basic engagement with e-commerce platforms facilitates access to broader sales channels, a deeper and more integrated participation—encompassing multiple stages of the agricultural value chain—contributes more substantially to strengthening farmers’ operational confidence.

Specifically, e-commerce-led digital chain participation indicates a connection with online platforms but does not necessarily entail comprehensive digital empowerment in areas such as production, marketing, or finance. Therefore, its effect on income satisfaction remains comparatively limited. In contrast, deeper participation reflects a broader application of digital technologies across various operational domains, thereby capturing more substantial and multidimensional benefits that farmers derive from digitalization. This deeper involvement offers a more reliable sense of security and return, which translates into higher levels of subjective income satisfaction.

Moreover, greater depth of engagement is often associated with improvements in capabilities related to standardized production, brand cultivation, financial access, and customer relationship management. The accumulation of such capabilities not only enhances current income but also reduces exposure to production risks and increases autonomy in decision-making. Consequently, farmers are more likely to develop stable production expectations and a strong belief in the sustainability of their livelihoods, thereby reinforcing a more optimistic psychological outlook regarding their economic future.

7. Conclusions and Policy Implications

This study empirically investigates the income effects of farmers’ participation in e-commerce-led digital chain using micro-level data from the China Rural Revitalization Survey (CRRS). By constructing a multidimensional framework encompassing farmers’ digital readiness, production and operation characteristics, product sales channels, and digital financial engagement, we reveal the heterogeneous mechanisms through which digital participation impacts farmers’ income and income expectations. The major findings and implications are as follows:

First, participation in e-commerce-led digital chain significantly improves farmers’ total income. This effect is further amplified when farmers are deeply engaged in the e-commerce-led digital chain, which integrates digital tools across production, circulation, and financing. However, the income-boosting effects are not uniformly distributed. Farmers with higher levels of digital engagement benefit more, indicating that the returns to e-commerce participation are contingent on the depth and quality of engagement rather than mere access.

Second, in terms of income structure, e-commerce-led digital chain participation has a more significant effect on increasing agricultural income, while its impact on non-agricultural income is not statistically significant. Moreover, while both cooperative and non-cooperative members gain from participating in e-commerce-led digital chain, the marginal returns from deeper digital chain involvement are more pronounced among non-members.

Third, quantile regression analysis reveals a strong distributional heterogeneity in e-commerce effects. Higher-income farmers benefit disproportionately more from digital participation, pointing to a potential Matthew effect or elite capture in the development of digital agriculture. Although digital platforms nominally lower entry barriers, effective participation requires substantial capital, technical literacy, and market acumen—resources more readily available to wealthier farmers. This could lead to increasing rural income inequality if left unaddressed.

Finally, beyond objective income improvements, deep integration into the digital chain significantly enhances farmers’ subjective income expectations. While basic e-commerce participation yields modest gains in income satisfaction, deeper engagement provides farmers with greater control over production processes, stronger market foresight, and reduced anxiety in the face of uncertainty. This contributes to more resilient and optimistic income expectations, which are critical in shaping long-term investment and development behavior.

In addition to these findings, this study contributes to the literature in three key aspects. First, in terms of analytical perspective, we go beyond the conventional binary categorization of e-commerce participation and introduce the concept of an e-commerce-led digital chain. We emphasize farmers’ embeddedness across multiple digital nodes and propose a “participation–embeddedness–income enhancement” behavioral mechanism. Second, in terms of analytical dimensions, we extend the analysis from overall income effects to a dual focus on income structure and income expectations, thereby capturing both short-term and medium-to-long-term income dynamics. Third, in terms of methodological innovation, we utilize nationally representative microdata from the CRRS and apply factor analysis, treatment effects models, and unconditional quantile regression with instrumental variables (UQR-IV) to assess both the magnitude and distributional equity of income gains across different embeddedness levels.

Building on these contributions, the empirical findings offer several important policy implications. Promoting the application of digital technologies in agriculture should not only focus on their overall income-enhancing effects, but also pay close attention to their distributional consequences, to prevent the digital dividends from being monopolized by a small group of digital elites. At the policy level, first, efforts should be made to fully leverage the income-enhancing potential of e-commerce by improving the rural e-commerce ecosystem. Specifically, widespread digital literacy training should be provided to enhance farmers’ ability to utilize digital platforms, enabling them to fully capitalize on the business opportunities and resources brought by e-commerce. Meanwhile, the government should offer policy guidance and financial support to ease farmers’ credit constraints, thereby fostering the development of inclusive finance and ensuring that farmers can access a broader range of financial resources and services. In addition, the operational models of rural e-commerce should be continuously optimized. By reducing costs and improving efficiency, the economic returns of e-commerce can be enhanced. Furthermore, effective policy calls for a strategic shift: beyond promoting initial participation via cooperatives, it must actively foster the deep adoption of digital technologies in production and management among non-cooperative households to unlock greater income potential. In addition, demonstration programs and targeted capacity-building initiatives should be implemented to enhance farmers’ digital literacy and managerial skills, thereby facilitating their deeper engagement in the e-commerce-led digital chain, and enabling them to capture greater benefits across production, marketing, and financing stages. Second, infrastructure development related to rural e-commerce should be accelerated. Given the significant role of e-commerce in boosting farmers’ incomes and the essential role of the internet in its development, governments should increase investment in digital infrastructure in rural areas. Expanding broadband and mobile communication networks will significantly improve farmers’ access to the internet and digital technologies. At the same time, the construction of integrated e-commerce platforms for agricultural products should be promoted to ensure functionality, user-friendliness, and responsiveness to the diverse needs of rural households. Moreover, further improvements to the rural logistics network are needed to build a highly efficient and low-cost agricultural logistics system. Such efforts will enhance the overall performance of the rural economy and support farmers in achieving sustainable income growth.

Author Contributions

Conceptualization, Y.P.; Methodology, Y.P.; Formal analysis, Y.P. and X.W.; Writing—original draft, Y.P. and X.W.; Writing—Review And Editing, Y.P. and Y.Z.; Supervision, Y.Z. All authors have read and agreed to the published version of the manuscript.

Funding

This work was supported by National Natural Science Foundation of China (NSFC) (grant numbers: 72303112 and 72173064); Humanities and Social Science Fund of Ministry of Education of China (grant number: 22YJC790093).

Institutional Review Board Statement

The study was conducted in accordance with the Declaration of Helsinki, and approved by the Ethics Committee of Nanjing Agricultural University Science and Technology (protocol code 2024-002, 19 September 2024).

Informed Consent Statement

Informed consent was obtained from all subjects involved in the study.

Data Availability Statement

The datasets analyzed during the current study are not publicly available due to institutional restrictions but are available from the corresponding author on reasonable request.

Acknowledgments

The authors would like to thank reviews and the editor-in-charge for helpful comments and suggestions.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Li, W.; He, W. Revenue-Increasing Effect of Rural E-Commerce: A Perspective of Farmers’ Market Integration and Employment Growth. Econ. Anal. Policy 2024, 81, 482–493. [Google Scholar] [CrossRef]

- Tollefson, J. Can Randomized Trials Eliminate Global Poverty? Nature 2015, 524, 150–153. [Google Scholar] [CrossRef] [PubMed]

- Li, X.; Guo, H.; Jin, S.; Ma, W.; Zeng, Y. Do Farmers Gain Internet Dividends from E-Commerce Adoption? Evidence from China. Food Policy 2021, 101, 102024. [Google Scholar] [CrossRef]

- Lin, H.; Li, R.; Hou, S.; Li, W. Influencing Factors and Empowering Mechanism of Participation in E-Commerce: An Empirical Analysis on Poor Households from Inner Mongolia, China. Alex. Eng. J. 2021, 60, 95–105. [Google Scholar] [CrossRef]

- Schaafsma, M.; Eigenbrod, F.; Gasparatos, A.; Gross-Camp, N.; Hutton, C.; Nunan, F.; Schreckenberg, K.; Turner, K. Trade-Off Decisions in Ecosystem Management for Poverty Alleviation. Ecol. Econ. 2021, 187, 107103. [Google Scholar] [CrossRef]

- Lin, Y.; Li, C. Does Rural E-Commerce Agglomeration Help Expand Family Farms’ Size? Evidence from Taobao Villages in China’s Yangtze River Delta. Electron. Commer. Res. 2023, 23, 1731–1752. [Google Scholar] [CrossRef]

- George, N.M.; Parida, V.; Lahti, T.; Wincent, J. A Systematic Literature Review of Entrepreneurial Opportunity Recognition: Insights on Influencing Factors. Int. Entrep. Manag. J. 2016, 12, 309–350. [Google Scholar] [CrossRef]

- Couture, V.; Faber, B.; Gu, Y.; Liu, L. Connecting the Countryside via E-Commerce: Evidence from China. Am. Econ. Rev. Insights 2021, 3, 35–50. [Google Scholar] [CrossRef]

- Li, L.; Zeng, Y.; Ye, Z.; Guo, H. E-Commerce Development and Urban-Rural Income Gap: Evidence from Zhejiang Province, China. Pap. Reg. Sci. 2021, 100, 475–495. [Google Scholar] [CrossRef]

- Fafchamps, M.; Minten, B. Impact of SMS-Based Agricultural Information on Indian Farmers. World Bank Econ. Rev. 2012, 26, 383–414. [Google Scholar] [CrossRef]

- Qin, T.; Wang, L.; Zhou, Y.; Guo, L.; Jiang, G.; Zhang, L. Digital Technology-and-Services-Driven Sustainable Transformation of Agriculture: Cases of China and the EU. Agriculture 2022, 12, 297. [Google Scholar] [CrossRef]

- Wang, C.; Tong, Q.; Xia, C.; Shi, M.; Cai, Y. Does Participation in E-Commerce Affect Fruit Farmers’ Awareness of Green Production: Evidence from China. J. Environ. Plan. Manag. 2024, 67, 809–829. [Google Scholar] [CrossRef]

- Yi, F.; Yao, L.; Sun, Y.; Cai, Y. E-Commerce Participation, Digital Finance and Farmers’ Income. China Agric. Econ. Rev. 2023, 15, 833–852. [Google Scholar] [CrossRef]

- Bukht, R.; Heeks, R. Defining, Conceptualising and Measuring the Digital Economy. In Development Informatics; Working Paper No. 68; Global Development Institute: Manchester, UK, 2017. [Google Scholar]

- Giaglis, G.M.; Klein, S.; O’Keefe, R.M. The Role of Intermediaries in Electronic Marketplaces: Developing a Contingency Model. Inf. Syst. J. 2002, 12, 231–246. [Google Scholar] [CrossRef]

- Goldfarb, A.; Tucker, C. Digital Economics. J. Econ. Lit. 2019, 57, 3–43. [Google Scholar] [CrossRef]

- Ma, W.; Wang, X. Internet Use, Sustainable Agricultural Practices and Rural Incomes: Evidence from China. Aust. J. Agric. Resour. Econ. 2020, 64, 1087–1112. [Google Scholar] [CrossRef]

- Cristobal-Fransi, E.; Montegut-Salla, Y.; Ferrer-Rosell, B.; Daries, N. Rural Cooperatives in the Digital Age: An Analysis of the Internet Presence and Degree of Maturity of Agri-Food Cooperatives’ E-Commerce. J. Rural Stud. 2020, 74, 55–66. [Google Scholar] [CrossRef]

- Dai, X.; Zeng, Y. Research on the Income Growth Effect of Farmers’ Participation in E-Commerce in Poor Areas. Inf. Syst. Econ. 2023, 4, 41–52. [Google Scholar] [CrossRef]

- Zhang, X.; Fan, D. Can Agricultural Digital Transformation Help Farmers Increase Income? An Empirical Study Based on Thousands of Farmers in Hubei Province. Environ. Dev. Sustain. 2024, 26, 14405–14431. [Google Scholar] [CrossRef]

- Duguma, A.L.; Bai, X. How the Internet of Things Technology Improves Agricultural Efficiency. Artif. Intell. Rev. 2024, 58, 63. [Google Scholar] [CrossRef]

- Alahmad, T.; Neményi, M.; Nyéki, A. Applying IoT Sensors and Big Data to Improve Precision Crop Production: A Review. Agronomy 2023, 13, 2603. [Google Scholar] [CrossRef]

- Zhang, Y. Research on China’s Agricultural Product Sales Transformation: Online Marketing Mix Strategy and Performance in the Post-Pandemic Area. Front. Sustain. Food Syst. 2024, 7, 1297732. [Google Scholar] [CrossRef]

- Yu, A.; Cao, J.; She, H.; Li, J. Unveiling the Impact of E-Commerce on Smallholder Livestock Marketing: Insights on Egg Price Premiums and Mechanisms. Econ. Anal. Policy 2023, 80, 1582–1596. [Google Scholar] [CrossRef]

- Yang, N.; Ao, X.; Tu, Y. The Impact of Digital Financial Development on Rural Household Income Mobility. Finance Res. Lett. 2024, 63, 105368. [Google Scholar] [CrossRef]

- Yu, C.; Hui, E.C.M.; Dong, Z. Digital Inclusive Finance and Entrepreneurship in Rural Areas: Evidence from China. China Agric. Econ. Rev. 2024, 16, 712–730. [Google Scholar] [CrossRef]

- Abate, G.T.; Abay, K.A.; Chamberlin, J.; Kassim, Y.; Spielman, D.J.; Tabe-Ojong, M.P.J. Digital Tools and Agricultural Market Transformation in Africa: Why Are They Not at Scale Yet, and What Will It Take to Get There? Food Policy 2023, 116, 102439. [Google Scholar] [CrossRef]

- Zhang, A.; Chandio, A.A.; Yang, T.; Ding, Z.; Liu, Y. Examining How Internet Use and Non-Farm Employment Affect Rural Households’ Income Gap? Evidence from China. Front. Sustain. Food Syst. 2023, 7, 1173158. [Google Scholar] [CrossRef]

- Guo, J.; Jin, S.; Zhao, J.; Li, Y. E-Commerce and Supply Chain Resilience During COVID-19: Evidence from Agricultural Input E-Stores in China. J. Agric. Econ. 2023, 74, 369–393. [Google Scholar] [CrossRef]

- Yin, Z.C.; Song, Q.Y.; Wu, Y.; Peng, C. Financial Knowledge, Entrepreneurial Decision and Entrepreneurial Motivation. Manag. World 2015, 1, 87–98. [Google Scholar]

- Angmo, D.; Aithal, R.K.; Jaiswal, A.K. Reducing Market Separation through E-Commerce: Cases of Bottom of the Pyramid (BoP) Firms in India. Inf. Technol. Dev. 2024, 30, 93–113. [Google Scholar] [CrossRef]

- Wang, W. Centralized Agricultural Networks and Changing Agrarian Power Dynamics in the Platform Economy. Int. J. Commun. 2019, 13, 21. [Google Scholar]

- Qiu, H.; Tang, W.; Huang, Y.; Deng, H.; Liao, W.; Ye, F. E-Commerce Operations and Technology Perceptions in Promoting Farmers’ Adoption of Green Production Technologies: Evidence from Rural China. J. Environ. Manag. 2024, 370, 122628. [Google Scholar] [CrossRef]

- Cano, J.A.; Londoño-Pineda, A.A.; Campo, E.A.; Fernández, S.A. Sustainable Business Models of E-Marketplaces: An Analysis from the Consumer Perspective. J. Open Innov. Technol. Mark. Complex. 2023, 9, 100121. [Google Scholar] [CrossRef]

- Stiglitz, J.E.; Weiss, A. Credit Rationing in Markets with Imperfect Information. Am. Econ. Rev. 1981, 71, 393–410. [Google Scholar]

- Knight, J.; Yueh, L. The Role of Social Capital in the Labour Market in China. Econ. Transit. 2008, 16, 389–414. [Google Scholar] [CrossRef]

- Su, L.; Peng, Y.; Kong, R.; Chen, Q. Impact of E-Commerce Adoption on Farmers’ Participation in the Digital Financial Market: Evidence from Rural China. J. Theor. Appl. Electron. Commer. Res. 2021, 16, 1434–1457. [Google Scholar] [CrossRef]

- Li, J.; Wu, Y.; Xiao, J.J. The Impact of Digital Finance on Household Consumption: Evidence from China. Econ. Model. 2020, 86, 317–326. [Google Scholar] [CrossRef]

- Altarturi, H.H.M.; Nor, A.R.M.; Jaafar, N.I.; Anuar, N.B. A Bibliometric and Content Analysis of Technological Advancement Applications in Agricultural E-Commerce. Electron. Commer. Res. 2023, 25, 805–848. [Google Scholar] [CrossRef]

- Xie, X.L.; Shen, Y.; Zhang, H.X.; Gou, F. Can Digital Finance Promote Entrepreneurship? Evidence from China. China Econ Q. 2018, 17, 1557–1580. [Google Scholar]

- Chen, S.; Luo, E.G.; Alita, L.; Han, X.; Nie, F.-Y. Impacts of Formal Credit on Rural Household Income: Evidence from Deprived Areas in Western China. J. Integr. Agric. 2021, 20, 927–942. [Google Scholar] [CrossRef]

- Liu, M.; Shi, P.; Wang, J.; Wang, H.; Huang, J. Do Farmers Get a Greater Return from Selling Their Agricultural Products through E-Commerce? Rev. Dev. Econ. 2023, 27, 1481–1508. [Google Scholar]

- Ma, W.; Abdulai, A. The Economic Impacts of Agricultural Cooperatives on Smallholder Farmers in Rural China. Agribusiness 2017, 33, 537–551. [Google Scholar] [CrossRef]

- Chen, Y.S. Logic, Imagination and Interpretation: The Application of Instrumental Variables in Causal Inference in Social Sciences. Sociol. Stud. 2012, 27, 192–216. [Google Scholar]

- Zhang, X.; Wan, G.H.; Zhang, J.J. Digital Economy, Inclusive Finance and Inclusive Growth. Econ. Res. J. 2019, 54, 71–86. [Google Scholar]

- Belloni, A.; Chernozhukov, V.; Hansen, C. Inference on Treatment Effects after Selection Among High-Dimensional Controls. Rev. Econ. Stud. 2014, 81, 608–650. [Google Scholar] [CrossRef]

- Borah, B.J.; Basu, A. Highlighting Differences Between Conditional and Unconditional Quantile Regression Approaches through an Application to Assess Medication Adherence. Health Econ. 2013, 22, 1052–1070. [Google Scholar] [CrossRef]

- Firpo, S.; Fortin, N.M.; Lemieux, T. Unconditional Quantile Regressions. Econometrica 2009, 77, 953–973. [Google Scholar] [CrossRef]

- Li, G.; Qin, J. Income Effect of Rural E-Commerce: Empirical Evidence from Taobao Villages in China. J. Rural Stud. 2022, 96, 129–140. [Google Scholar] [CrossRef]

- Ma, W.; Zhou, X.; Liu, M. What Drives Farmers’ Willingness to Adopt E-Commerce in Rural China? The Role of Internet Use. Agribusiness 2020, 36, 159–163. [Google Scholar] [CrossRef]

- Tadesse, G.; Bahiigwa, G. Mobile Phones and Farmers’ Marketing Decisions in Ethiopia. World Dev. 2015, 68, 296–307. [Google Scholar] [CrossRef]

- Xia, H.; Gao, Y.; Zhang, J.Z. Understanding the Adoption Context of China’s Digital Currency Electronic Payment. Financ. Innov. 2023, 9, 63. [Google Scholar] [CrossRef] [PubMed]

- Gangwar, D.S.; Tyagi, S.; Soni, S.K. A Techno-Economic Analysis of Digital Agriculture Services: An Ecological Approach toward Green Growth. Int. J. Environ. Sci. Technol. 2022, 19, 3859–3870. [Google Scholar] [CrossRef]

- Abdulai, A.R.; Tetteh-Quarshie, P.; Duncan, E.; Fraser, E. Is Agricultural Digitization a Reality Among Smallholder Farmers in Africa? Unpacking Farmers’ Lived Realities of Engagement with Digital Tools and Services in Rural Northern Ghana. Agric. Food Secur. 2023, 12, 11. [Google Scholar] [CrossRef]

- Ahmad, M.I.; Oxley, L.; Ma, H.; Liu, R. Does Rural Livelihood Change? Household Capital, Climate Shocks and Farm Entry-Exit Decisions in Rural Pakistan. Front. Environ. Sci. 2023, 10, 857082. [Google Scholar] [CrossRef]

- Rehman, A.; Saba, T.; Kashif, M.; Fati, S.M.; Bahaj, S.A.; Chaudhry, H. A Revisit of Internet of Things Technologies for Monitoring and Control Strategies in Smart Agriculture. Agronomy 2022, 12, 127. [Google Scholar] [CrossRef]

- Zheng, Y.; Fan, Q.; Jia, W. How Much Did Internet Use Promote Grain Production? Evidence from a Survey of 1242 Farmers in 13 Provinces in China. Foods 2022, 11, 1389. [Google Scholar] [CrossRef]

- Abraham, M.; Chiu, L.V.; Joshi, E.; Ilahi, M.A.; Pingali, P. Aggregation Models and Small Farm Commercialization—A Scoping Review of the Global Literature. Food Policy 2022, 110, 102299. [Google Scholar] [CrossRef]

- Qi, Y.; Han, J.; Shadbolt, N.M.; Zhang, Q. Can the Use of Digital Technology Improve the Cow Milk Productivity in Large Dairy Herds? Evidence from China’s Shandong Province. Front. Sustain. Food Syst. 2022, 6, 1083906. [Google Scholar] [CrossRef]

- Guan, X.; He, L.; Hu, Z. Impact of Rural E-Commerce on Farmers’ Income and Income Gap. Agriculture 2024, 14, 1689. [Google Scholar] [CrossRef]

- Fabregas, R.; Kremer, M.; Schilbach, F. Realizing the Potential of Digital Development: The Case of Agricultural Advice. Science 2019, 366, eaay3038. [Google Scholar] [CrossRef]

- Howley, P.; Dillon, E.; Heanue, K.; Meredith, D. Worth the Risk? The Behavioural Path to Well-Being. J. Agric. Econ. 2017, 68, 534–552. [Google Scholar] [CrossRef]

| Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).