1. Introduction

Online shopping has become a dominant mode of consumer purchasing worldwide, reshaping traditional retail landscapes and consumption patterns [

1]. In the rapidly developing Chinese e-commerce market, Taobao.com (hereafter, Taobao, which means “hunting for treasures” in Chinese) is an online retail platform where small businesses or individual entrepreneurs trade with prospective buyers. Founded by Alibaba Group, Inc. in 2003, Taobao has become China’s largest e-commerce platform. By the end of 2024, Taobao had close to 9.4 billion registered users and more than 1 billion product listings on a given day. It processed roughly 3.56 trillion transactions in 2024, more than Amazon and eBay combined. However, this rapid expansion has not only created extensive opportunities for market participation but has also introduced multifaceted challenges related to platform governance.

As the platform continues to soar, for consumers, the exponential increase in product variety and seller numbers intensify the difficulty of identifying high-quality products, thereby exacerbating the issues of counterfeit and low-quality products on online platforms owing to information asymmetry. For example, Taobao has been identified as a notorious market by the administrative office of the United States Trade Representative since 2016 in response to significant rights holders’ concerns regarding large numbers of low-quality and counterfeit goods being openly sold on the platform. Therefore, ensuring product quality is a critical governance challenge for e-commerce platforms, particularly in developing countries where market regulations are still underdeveloped [

2].

Recent studies have provided considerable evidence that online rating systems, third party certification mechanisms, and quality warranty can help consumers identify high-quality products and have a positive impact on the sales and price of high-quality products [

3,

4,

5]. While prior research has addressed the “lemon market” problem in online markets based on signaling theory, little work has examined the impact of industry dynamics on overall quality in the online market [

6].

Due to the reduction in entry and exit costs for firms, entry and exit dynamics are more prevalent in online markets compared to offline markets [

7].However, existing studies have predominantly focused on firm entry and exit in offline markets [

8,

9]. Moreover, these studies commonly argue that new entrants suffer from a reputation disadvantage, limiting their ability to convey product quality information to consumers, thereby resulting in a weaker impact on the overall product quality in industry [

10]. However, in the online market, new entrants may have operated offline for several years and thus do not necessarily suffer from a reputational disadvantage upon entry, and the entry of new firms into online markets is likely to produce different effects.

In order to develop the existing literature, and to advance the governance mechanisms of “lemon market” problems in the online market, we leverage the entry of flagship stores on Taobao as the research context, and investigate the impact of flagship entry on overall industry quality. In 2012, Alibaba Group strategically separated Tmall from Taobao, positioning Tmall as a dedicated platform for branded products by selectively inviting brand owners or authorized dealers of specific brands to operate flagship stores, thereby insuring the provision of high-quality products with guaranteed authenticity under those brands. Consequently, considering sellers offering the same brand within the e-commerce platform as a discrete industry, prior to flagship store entry, consumers could only purchase from third-party sellers whose product quality is uncertain, resulting in a pooling equilibrium. With the introduction of flagship stores, consumers are presented with a choice between third-party sellers supplying products of uncertain quality and flagship stores providing high-quality products, which reflects a semi-separating equilibrium in the market [

11,

12].

Moreover, unlike traditional offline markets, online markets offer consumers greater temporal and spatial flexibility. Beyond an expanded product selection, the buying and selling process in online markets is continuous, bidirectional, and occurs in real-time [

13,

14]. Therefore, consumers purchasing from an online marketplace can compare product descriptions between flagship stores and third-party sellers, as well as consult reviews from previous buyers, thereby forming a consumer-learning effect, which may help them to purchase high-quality goods and promote the exit of low-quality sellers and thereby improve the industry’s average product quality.

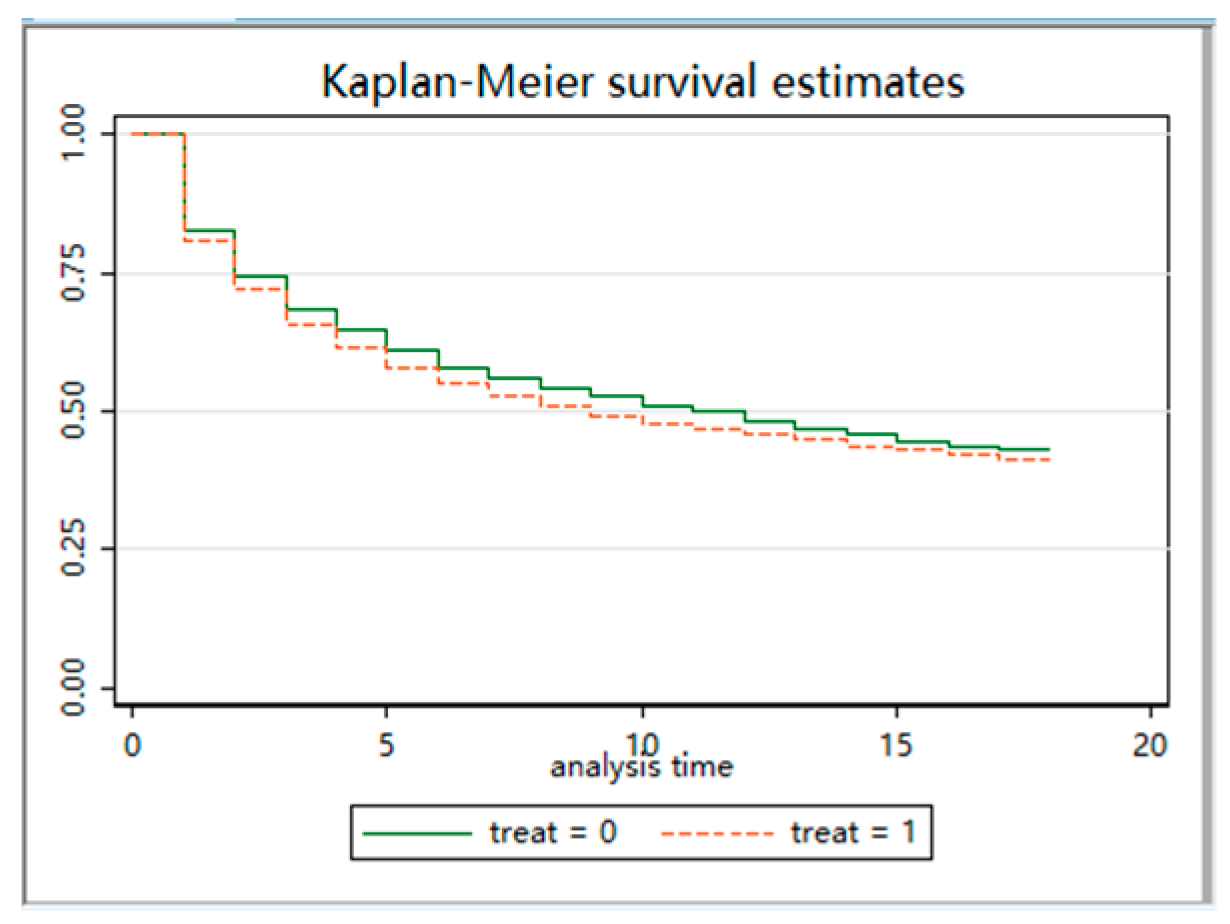

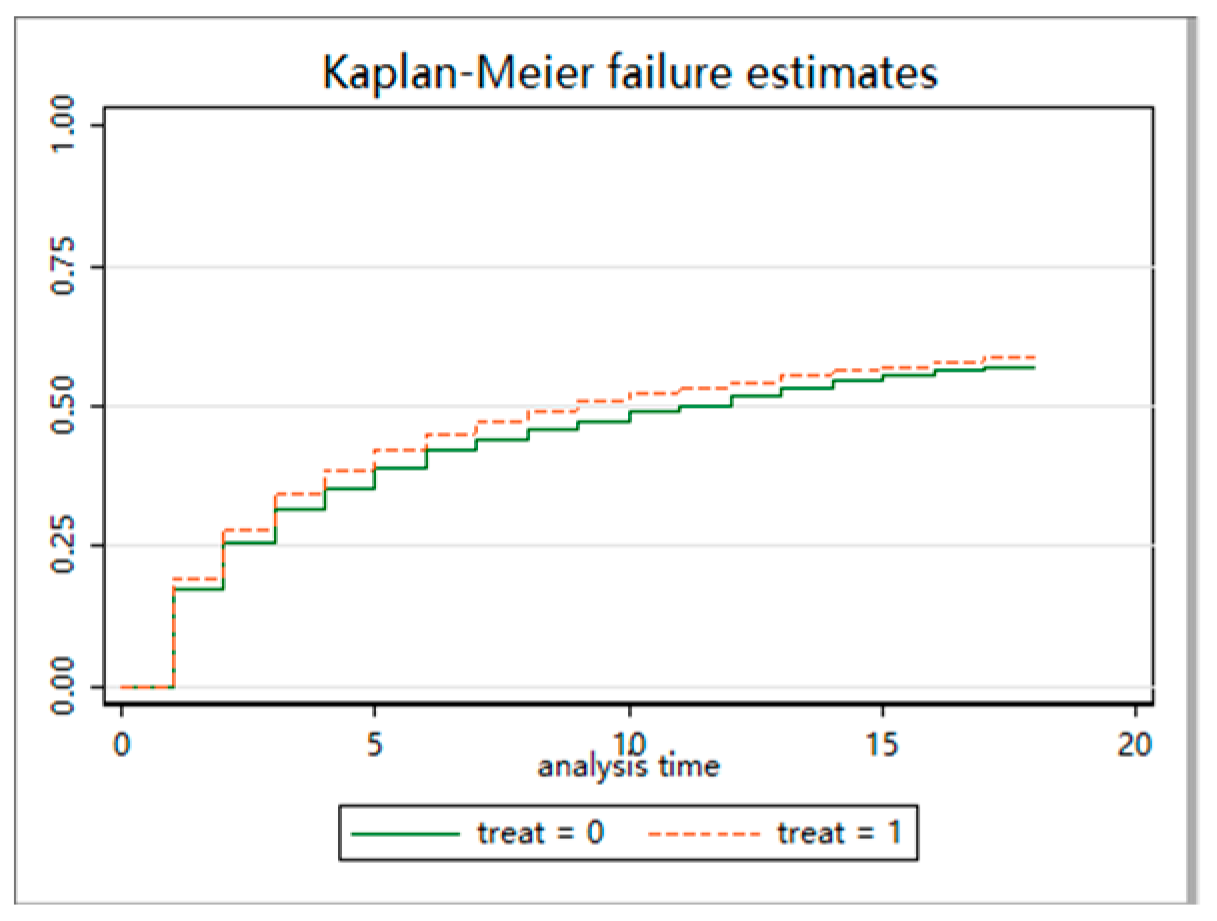

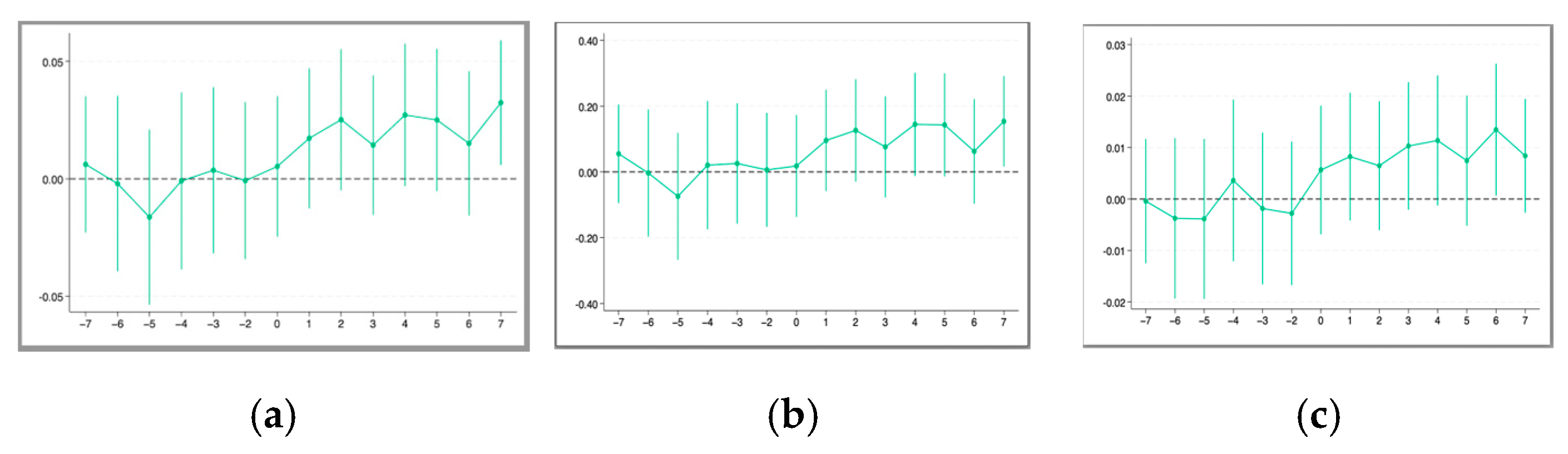

Based on this logic, by treating different sellers offering the same brand’s products as an industry, we first develop a theoretical framework to examine the mechanism through which the entry of flagship stores influences the industry’s average quality. Then, using full-category and large-span data from Taobao, we construct a multiple period difference-in-difference empirical model to test the hypotheses we proposed. Specifically, at the macro level, we analyze how flagship store entry affects industry entry and exit rates; and at the micro level, we investigate its impact on the survival risks of sellers with different quality types. Finally, we examine the impact of flagship store entry on the overall quality of the industry. Drawing on our empirical findings, we offer relevant policy and practical implications guidance.

This study makes several marginal contributions to the literature. First, it offers a novel perspective and empirical evidence on the governance of the “lemon market” on e-commerce platforms. Specifically, while the existing literature primarily focuses on evaluating the effectiveness of various signaling methods, insufficient attention has been paid to the impact of new entrants on industry dynamics and product quality in the online market. In this study, we examine how the entry of high reputation sellers affects the average product quality on online platforms. This analysis not only enriches the understanding of market structure design in the e-commerce context but also holds significant implications for enhancing product quality in online markets.

Second, this study integrates firm reputation into the research framework on new entrants and industry dynamics. The existing literature predominantly assumes that new entrants face reputational disadvantages, which constrain their competitive effects and their ability to influence industry product quality [

10,

15]. Drawing on the unique context flagship stores entering online markets, this study examines the impact of high-reputation entrants on industry dynamics, thereby addressing the gap in prior research concerning the consideration of entrant reputation [

16,

17].

Third, with the development of the internet, consumers’ information acquisition capabilities have significantly improved. This study innovatively incorporates consumer learning into the analysis of market competition. By examining the quality types of sellers entering and exiting the market, it indirectly explores the impact of consumer learning on industry dynamics. This approach addresses the gap in the existing literature, which primarily focuses on firms’ price and quantity competition while largely neglecting the role of consumer-learning behavior in market competition [

18,

19].

Finally, whereas prior empirical studies on product quality in e-commerce tended to rely on data from single product categories [

3,

20], our study uses a large sample of data with a large time span and multiple categories. This comprehensive approach enables a robust empirical examination of our hypotheses at both the industry and firm levels, thereby mitigating the potential biases associated with single-category analyses.

The remainder of this paper is organized as follows.

Section 2 reviews the recent literature on the governance of product quality in the online market and flagship store entry. In

Section 3, we develop hypotheses on how the entry of flagship stores affects sellers’ exit and entry decisions, as well as industry product quality.

Section 4 and

Section 5 present our methodology and regression results, respectively. Finally,

Section 6 summarizes the main conclusions, policy implications, and limitations of this study.

3. Theory and Hypotheses

It is well documented that new market entrants encounter difficulties acquiring reputation benefits. Reputation has been shown to have a beneficial effect on long-run players, enabling them to earn higher equilibrium payoffs than would be impossible in the absence of a reputation [

56,

57,

58]. Regardless, consumers can generally distinguish flagship stores from other sellers because of their extensive online shopping experience [

54]. Consequently, even in the absence of a strong reputation accumulated through numerous prior transactions, consumers hold elevated expectations regarding the quality of products sold by flagship stores and are willing to pay a premium for them [

55,

59]. Essentially, flagship stores embody a dual perception of high quality and strong brand reputation among consumers. Therefore, the entry of flagship stores constitutes direct competition with other sellers offering the same brand of products [

55]. This dynamic is likely to increase the survival risk of incumbent sellers by shifting demand away, thereby facilitating their exit from the market. Using transaction data from 2010 to 2020, Jin et al. (2021) [

55] provide empirical evidence that sales from sellers of the same brand significantly decline following the entry of flagship stores.

However, flagship entry in the online marketplace not only intensifies competitive pressure on third-party sellers but also changes the consumer perception of other sellers on the platform [

55], which may offer a protective advantage to sellers providing high-quality products. The entry of a flagship store is likely to provide consumers with additional opportunities for learning. Because flagship stores are directly owned by the manufacturers of branded products, they possess more specialized information regarding production processes and product quality than other sellers offering the same brand [

54]. On Taobao websites, flagship stores typically present comprehensive product quality information through images and videos, whereas other sellers generally disclose less detailed information [

60]. In some cases, sellers replicate or provide appropriate product descriptions created by the flagship stores. Therefore, the entry of flagship stores not only involves direct participation in market competition but also indirectly establishes product quality standards for consumers. This dynamic encourages consumers to seek detailed quality information provided by flagship stores actively when making purchasing decisions regarding third-party sellers. Furthermore, consumers can purchase products directly from flagship stores to obtain first-hand experience, thereby accumulating valuable knowledge for future purchase decisions.

Customer reviews on online platforms facilitate extensive communication between previous and prospective customers regarding product quality [

61], thereby reinforcing the consumer-learning effect associated with the entry of flagship stores. Tóth et al. (2022) [

62] demonstrate that buyers’ signals serve not only as feedback to sellers but also as influential information for other potential buyers in their purchasing decisions. Furthermore, flagship stores typically achieve higher sales than third-party sellers of branded products, which is attributable to their high quality and strong reputation. Consequently, both the volume and content of consumer reviews for flagship stores significantly surpass those of other sellers. For example, the flagship store of the “Apple Store” on Taobao, which sells Apple mobile phones, has accumulated approximately 100,000 consumer reviews, whereas “Cool Union Digital,” another seller of Apple mobile phones, has garnered only a few hundred reviews.

Therefore, following the entry of a flagship store, existing customers can obtain product quality information from previous buyers on the flagship store, thereby significantly reducing the cost of searching for such information from other sellers. Consequently, high-quality sellers may gain a competitive advantage through the consumer-learning effect, whereas the market demand for sellers offering low-quality products is likely to decline. Therefore, the entry of flagship stores may exert a more pronounced influence on low-quality sellers’ exit from the market. Based on these considerations, we propose the following hypothesis.

Hypothesis 1a. The entry of flagship stores causes more sellers selling low-quality products to exit the online market.

Incumbent firms with excellent reputations enjoy considerable advantages that undermine the competitiveness of new entrants [

63]. Consumers’ skepticism regarding the reputation of new entrants raises entry barriers because consumers are unable to verify product quality prior to purchase, leading them to reject goods from new entrants [

64,

65]. Consequently, reputation is a pivotal factor in the formation of entry barriers [

66]. In this context, the strong reputation of a flagship store may serve as an implicit entry barrier, thereby limiting the number of new market entrants [

67,

68].

Flagship stores also possess the financial resources necessary to support special events and promotional activities at the point of sale, thereby enhancing consumers’ brand experiences on e-commerce platforms [

60]. This capability may indirectly reduce advertising and reputation building costs for new sellers and potentially attract new entrants. Regardless, the impact of reputation spillovers may vary according to the quality of potential entrants. High-quality sellers typically exhibit a greater propensity to invest in reputation building, whereas low-quality sellers often adopt low pricing strategies to capture market demand rapidly and achieve profitability [

69]. Consequently, reputation spillovers from incumbent flagship stores are likely to be more attractive to high-quality sellers entering the market. Based on this logic, we propose the following hypothesis.

Hypothesis 1b. The entry of flagship stores causes more sellers selling high-quality products to enter the online market.

The distribution structure of sellers of different quality types directly influences an industry’s average product quality [

70]. In accordance with the postulations outlined in Hypotheses 1a and 1b, it can be deduced that following the entry of flagship stores, the industry’s average quality level is expected to rise because of the increased proportion of sellers offering high-quality products online. Based on this reasoning, we propose the following hypothesis.

Hypothesis 2a. The entry of flagship stores improves the average product quality in the online market.

Furthermore, the impact of flagship store entry on overall industry quality improvement may depend on the product characteristics of the entering brand. Numerous studies on consumer search behavior have demonstrated that consumers’ willingness to seek information and learn about a product prior to purchase is directly related to its price [

71,

72]. This relationship arises because the primary goal of consumer search before making a purchase decision is twofold: to select a high-quality product in a market characterized by quality uncertainty and to compare prices among products of similar quality [

73]. Consequently, consumer decisions to engage in further searches hinge on the marginal costs and benefits of that search [

74].

When purchasing low-priced products, potential savings from searching are limited. Therefore, consumers’ willingness to acquire information about product quality and their incentives to learn are reduced [

75]. This finding implies that flagship store entries involving lower-value products tend to generate weaker consumer-learning effects. Supporting this concept, Liu et al. (2016) [

76] analyzed online consumer purchase decision data and found that consumers spend less time reading and analyzing review content when buying cheaper products.

Conversely, for high-priced products, consumers tend to be more cautious and less sensitive to price differences [

77,

78]. In such cases, consumers are more inclined to purchase from flagship stores that ensure high-quality products, thereby intensifying the competitive effects of flagship store entry and further reinforcing the resulting improvement in average industry quality. Additionally, even consumers with high price elasticity who are unwilling to pay a premium for flagship store products exhibit stronger incentives to search for quality information when buying from third-party sellers, enhancing their ability to identify low-quality products and, consequently, amplifying the quality-enhancing effect of flagship store entry. Based on this logic, we propose Hypothesis 2b.

Hypothesis 2b. The higher the average price of branded products entering the online market, the greater the quality improvement effect on the industry due to the entry of flagship stores.

Furthermore, the durability of the products offered by a brand plays a pivotal role in enhancing product quality following the entry of flagship stores. Durable products characterized by a longer lifecycle typically require consumers to invest considerable time and effort in understanding product attributes and performance before purchase [

79,

80]. Consequently, low-quality sellers are more likely to exit the market after entering flagship stores. Conversely, for non-durable products, consumer sensitivity to quality is relatively low and the pre-purchase learning process is comparatively brief. Therefore, the quality-enhancing effect triggered by the entry of flagship stores tends to be weaker for nondurable products. Based on this rationale, we propose the following hypothesis.

Hypothesis 2c. The higher the durability of branded products entering the online market, the greater the quality improvement effect on the industry due to the entry of flagship stores.

6. Conclusions, Limitations, and Future Research

6.1. Conclusions and Implications

This study examined the influence of flagship store entry on the overall quality of a brand and conducted detailed empirical tests using full-category and large-span data from Taobao. By treating different sellers offering the same brand’s products on the e-commerce platform as an industry, our findings demonstrate that flagship store entry not only prompts the exit of incumbent sellers and deters potential new entrants, which aligns with previous research on competitive effects in online markets (Jin et al., 2021) [

55], but also facilitates the exit of low-quality sellers while attracting high-quality sellers as a result of consumer-learning effects. Consequently, the overall quality of the industry is enhanced. Specifically, at the macro level, after the entry of flagship stores, the proportion of existing sellers offering low-quality products, and the proportion of new entrants providing high-quality products increases. At the micro level, the entry of flagship stores increases incumbent sellers’ survival risk, and this effect is less pronounced for sellers offering superior-quality products. Furthermore, heterogeneity analysis revealed that the quality improvement effect is positively correlated with brand pricing and durability.

Based on these findings, this study offers several policy implications. First, e-commerce platforms should actively encourage brand owners to establish flagship stores online, as their “high quality and strong reputation” can improve overall industry quality through consumer-learning effects. Additionally, both online and offline markets should facilitate the entry of new sellers and support those offering high-quality products to build their reputations rapidly. Current regulatory approaches tend to rely on costly ex post punitive measures that target poor-quality goods. In contrast, promoting the market entry of high-quality producers and effectively signaling product quality to consumers can increase industry standards more efficiently. Policymakers may consider subsidies and tax incentives to motivate the participation of high-quality firms.

Second, platforms and government agencies should assist firms in expeditiously establishing credible reputations through mechanisms such as government procurement programs and market-based ratings, particularly for durable and high-priced products. This study underscores the fact that consumers’ limited knowledge of product quality is a key driver of low-quality purchases. Enhancing information disclosure channels can reduce consumer search costs and influence firms’ quality decisions, thereby improving the overall industry output quality. Furthermore, leveraging mobile internet technologies to facilitate frequent information exchange among firms and consumers could mitigate information asymmetry by strengthening the learning effects.

6.2. Limitations and Future Research

Although we employed various methods and robustness checks using comprehensive category coverage and extensive time-span data in our analysis of Taobao, several limitations remain that warrant further investigation.

First, the lack of product price data and consumer data constrains our ability to explore the potential mechanisms through which the entry of flagship stores affects third-party sellers’ pricing strategies, as well as to conduct an in-depth analysis of consumer-learning behavior. This represents a significant limitation of the present study. Future research should endeavor to collect more price data and consumer data, enabling a more thorough examination of how flagship store entry influences firms’ pricing decisions, thereby systematically clarifying its broader impacts.

Second, while our study incorporated the time effect into the empirical model to control for other time-varying factors, the platform itself continuously implements various measures such as counterfeiting detection and clearance to improve the quality of online sellers’ products. This changing environment makes it challenging to identify a platform’s behavior accurately, which can result in an overestimation of the quality improvement effect of the entry of flagship stores. Future studies should compile detailed information from Taobao’s official announcements to construct a precise timeline of platform governance strategies, thereby disentangling the influence of platform policies on seller entry, exit, and quality decisions.

Finally, the three product quality indicators utilized in this study serve as indirect proxies and may not fully capture true product quality information. Future research should incorporate richer and more comprehensive data to measure product quality levels directly and accurately in online markets.