1. Introduction

The landscape of the online video streaming industry has undergone a substantial transformation in the last two decades. The emergence of global players like Netflix, Disney, Amazon, HBO, and Apple has resulted in a diverse and competitive market, blurring the boundaries of different markets. Modern media giants face crucial decisions regarding creating viral content to boost viewership (France et al., 2021 [

1]). Subscription-based video services like Netflix and Hulu have become the primary revenue drivers in the home entertainment industry, offering on-demand video content on computers and mobile devices (Yu et al., 2022 [

2]). A J.D. Power survey from October 2022 reveals a rise in subscriptions, with 60% of subscribers having at least four services. Despite this, the average monthly household expenditure has remained stable at USD 54 in July 2022 compared to USD 55 in June 2021. However, overall satisfaction with streaming services is declining, particularly concerning content quality and subscription costs, with Netflix maintaining its dominance as the largest and most popular brand ([

3,

4,

5,

6,

7]).

The online video streaming industry is part of the Information and Communication Technologies (ICT) infrastructure, whose goal is to advance the development of technologies that enable sharing information content. The ongoing advancement of ICT is reshaping the online video streaming industry. The widespread availability of high-speed network connectivity and the pervasive use of smartphones and mobile devices have driven a transition from ownership to access-based models, which include streaming (Im et al., 2020 [

8]).

Video streaming will grow to USD 149.34 billion in 2026 (Rake & Baul, 2021 [

9]). Live streaming constituted 61% of the market share in 2020, with the subscription-based model holding the largest share at 43% (Grand View Research, 2021 [

10]). According to Nielsen, traditional television viewership declined nearly 4% in the second quarter of 2020, contrasting with a 70% surge in online video streaming. Services like Netflix, Disney+, Hulu, Twitch, HBO Max, and Peacock are gaining popularity, marking a shift from traditional media sources. The Internet has become the primary content delivery medium, and streaming video is receiving significant attention due to the growing demand for multimedia information. Despite bandwidth, delay, and loss challenges, streaming services like Netflix have invested in content delivery networks to ensure uninterrupted availability.

Adopting online streaming services varies for different reasons; people often view online platforms as convenient and cost-effective alternatives to cable TV (Cha & Chan-Olmsted, 2012 [

11]); instead of exploring all available media, users tend to select and repeatedly consume content from a limited set of options (Taneja et al., 2012 [

12]). Early platforms like Netflix attracted users with lower prices and additional benefits, such as anytime, anywhere, on-demand access and binge-watching. As cable TV prices rose, improved network and internet performance led to improvements, and many users “cut the cord, with consumers subscribing to streaming for most of their entertainment. By 2021, online spending on streaming services exceeded that for traditional pay-TV for the first time in history (Bergström, 2021) [

13].

The online video streaming space has witnessed a proliferation of providers offering general and specialized content, either licensed or original and exclusive. Netflix, with around 1500 TV series and 4000 films; Amazon Prime Video, boasting almost 20,000 titles; and Disney+, adding about 7000 TV episodes and 500 films, exemplify this diversity (Bergström, 2021) [

13]. Major platforms like Netflix, Amazon Prime Video, and Disney+ showcase this diversity. At the same time, specialized services such as Twitch and Curiosity Stream further enrich the landscape. Streaming services aim to distinguish themselves by providing original and exclusive content to stay competitive. Providers invest in artificial intelligence-based exclusive content and AI-driven recommendation engines, reducing search time and costs for viewers deciding what to watch next. Systems that enhance user experience. Leading over-the-top (OTT) services including Netflix, Hulu, Amazon Prime, and Disney+, bypass traditional satellite systems, and privacy and design factors significantly affect brand loyalty and satisfaction (Pekpazar et al., 2023) [

14].

A specific online video streaming platform. This study explores why consumers choose a particular streaming phenomenon by applying Transaction Cost Economics (TCE). TCE suggests that users seek to minimize the costs of transactions by considering uncertainty, frequency, and asset specificity (Coase, 1960 [

15]; Fink, 2013 [

16]; Rindfleisch, 2019 [

17]; Williamson, 1981 [

18], 1979 [

19]). The manuscript analyzes how these factors affect subscription decisions and the reluctance to switch services, evaluating TCE’s usefulness in explaining consumer behavior in the streaming industry.

Research is sparse in the application of TCE concepts to the consumer realm of B2C markets. This study differentiates itself from prior research by examining the purchase continuation and not the initial decision across five leading streaming service providers. It only examines consumers who have already adopted and are using streaming services. While consumer satisfaction and technology acceptance models provide insights into initial subscription adoption or satisfaction levels, they inadequately explain consumers’ ongoing decisions to renew subscriptions. TCE uniquely addresses continuous relational dynamics through asset specificity based on streaming and uncertainty, making it particularly appropriate for understanding retention.

This paper is organized as follows. Following this introduction,

Section 2 presents a literature review exploring the relevant constructs.

Section 3 outlines the propositions and the model under consideration. The methodology employed is provided in

Section 4, while

Section 5 presents the results.

Section 6 addresses the limitations of the study, and

Section 7 presents the conclusion of the paper.

2. Literature Review

Since the inception of transaction cost economics, extensive academic research has emerged on the subject. The TCE approach to elucidate governance structures was conceptualized by Coase (1937) [

20]. In his work “The Nature of the Firm,” Coase posited that firms exist to mitigate transaction costs arising during production and exchange, capturing efficiencies beyond the reach of individuals. In “The Problem of Social Cost” (Coase, 1960 [

15]), Coase outlined the essential steps for a market transaction, including identifying bargaining parties, conducting negotiations, drafting a contract, ensuring contract conditions are met, and reviewing critical elements. Each transaction in the marketplace incurs a cost associated with adhering to contract terms. Williamson (1979) [

19] identified three dimensions characterizing transactions: uncertainty, frequency, and the necessity of durable, transaction-specific investments.

Shih (2004) [

21] proposed a model using the theory of reasoned action (TRA) and the technology acceptance model (TAM) to predict user acceptance of online shopping. Brynjolfsson et al. (2003) [

22] quantified the economic impact of increased product variety through electronic markets, revealing it as a significant source of consumer surplus gains. Studies, including Teo et al. (2004) [

23], emphasized that perceived transaction costs, uncertainty, dependability, and purchase frequency influence consumers’ willingness to buy online. Dahlquist and Garver (2022) [

24] purport that the newest consumer segment, Gen Z consumers, are considered to be more distrusting of consumer product companies. Thus, these consumers may be more easily influenced by uncertainty and dependability.

Few studies have explored the factors influencing users’ intention to pay for online services to predict consumers’ willingness to pay (Fernandes et al., 2024 [

25]). Liang and Huang (1998) [

26] related the decision to purchase online services to the uncertainty and asset specificity of the product and transaction costs. Kim et al. (2009) [

27] explored the relationship between TCE antecedents and customer satisfaction, finding positive links with uncertainty and negative links with frequency and personal security. Che (2015) [

28] demonstrated that higher unpredictability diminishes consumer satisfaction and the likelihood of revisiting a site. While rooted in institutional economics, applying TCE to describe the online subscription-based video streaming phenomenon is justified. TCE, exploring business-to-consumer relationships, organizes agreement paradigms around transactions between two parties rather than physical exchanges of commodities. Therefore, TCE proves a fitting paradigm for investigating online subscription-based video streaming services.

In recent years, the evolution of online video streaming services, as part of the ongoing digital transformation, has impacted managerial decisions related to corporate digital responsibility. This shift has prompted corporations to adapt to consumers’ decision-making processes and preferences when subscribing to online services (Paul et al., 2024) [

29]. Despite significant research on live streaming platforms and streamers, scholars lack a comprehensive framework to develop a more holistic understanding and strategic evolution of online video services (Xu et al., 2023 [

30]). Online streaming services highlight transactional relationships because providers retain ownership of the content, offering users temporary access without transferring actual ownership. Grounded in economic theory, TCE provides a theoretical framework for understanding why consumers prefer specific transaction forms. This elucidates the rationale behind choosing subscription services like Netflix or Amazon over alternatives like buying, renting, or accessing free media content. Opting for online stores with lower transaction costs aligns with consumer preferences, making TCE a viable theory for explaining online buying behavior.

2.1. Uncertainty

The concept of uncertainty is multidimensional. Although uncertainty plays a key role in transaction cost economics, Williamson does not provide a detailed definition. Williamson primarily characterizes uncertainty as external disruptions to transactions, varying in frequency and impact on the exchange (Williamson, 1991 [

31]).

Uncertainty predominantly emerges from information asymmetry, bounded rationality, and opportunism. As proposed, “environmental uncertainties become so numerous that they cannot all be considered, [they] presumably exceed the data processing capabilities of the parties. The complete decision tree cannot be generated…” (Williamson, 1985 [

32]). In contrast to informational uncertainty, interpretative uncertainty emerges when TCE integrates perceptual limitations within its bounded rationality assumption. This uncertainty does not solely stem from limitations in information processing; rather, it also arises when parties hold divergent interpretations of the exchange (Mayer et al., 2007 [

33]). Consequently, we perceive uncertainty as an external disturbance in video streaming, encompassing uncertainties about service availability, media quality, or the availability of desired content. Therefore, we hypothesize the following:

H1: Uncertainty is negatively related to the intention to use online subscription-based video streaming.

2.2. Frequency

Another dimension in describing a transaction is the frequency with which transactions recur (Williamson, 1979 [

19]). Frequency can be classified as one-time, occasional, or recurrent, with the distinction between occasional and one-time frequency not distinctly apparent (Williamson, 1979 [

19]). Williamson suggests that higher levels of transaction frequency incentivize firms to adopt hierarchical governance because “the cost of specialized governance structures will be easier to recover for large transactions of a recurring kind.” A highly specialized governance structure is only justifiable for recurrent transactions, while occasional transactions of a non-standardized kind do not support a transaction-specific structure. Millennials are exposed to frequent exposure to digital media and welcome new technologies, which makes them consider monetary and non-monetary benefits (Tian et al., 2020 [

34]).

However, governance structure demands specific attention. In the streaming consumer B2C space, this construct is operationalized as the number of times a consumer watches content and the duration spent. The ease of transactions increases the number of transactions a customer will engage in with a streaming service. As the frequency of watching subscription-based video content increases, the transaction evolves into a recurrent nature, enabling the recovery of costs for a specialized governance structure (Williamson, 1979 [

19]). Therefore, we hypothesize the following:

H2: Transaction frequency is positively related to intention to use online subscription-based video streaming.

2.3. Asset Specificity

Asset specificity, as defined by Williamson (1991) [

31], is “the degree to which an asset can be redeployed to alternative uses and by alternative users with the sacrifice of product value.” It signifies the buyer’s level of bilateral dependence on tangible and intangible aspects and the capacity to redeploy assets within these levels without compromising value (Oliver E Williamson, 1991 [

31]). Asset specificity denotes a situation where the identity of the parties holds significance for the ongoing relationship and can manifest in various forms, such as physical, human, site-specific, dedicated, brand-name capital, and episodic (also known as temporal specificity). The optimal response to asset specificity involves a greater reliance on “administration.”

Asset specificity presents challenges in streaming video and e-commerce, as it may not initially appear to influence the consumer’s decision. There is no physical proximity concern, and the signal remains consistent regardless of the receiving equipment. However, when considering the availability of desired video content, a situation arises that simulates physical proximity and asset specificity. From the perspective of the streaming video provider, acquiring digital content becomes a matter of asset specificity, as hosting any digital content demands both storage space and bandwidth. For this reason, the following hypothesis is proposed:

H3: Set specificity is positively related to the intention to use online subscription-based video streaming.

2.4. Transaction Cost

Transaction costs, as defined by Coase (1937) [

20], encompass the expenses associated with initiating, carrying out, and potentially terminating an agreement. These costs involve both ex-ante elements, such as pricing, bargaining, and decision-making, and ex-post components like enforcement costs. Ex-ante pricing costs encompass drafting, negotiating, safeguarding (Williamson, 1979 [

19]), and identifying pricing, parties, and products. For online users, ex-ante costs translate into the time and expenses needed to identify websites, track involved parties, understand their information handling practices, and evaluate the benefits (if any) of sharing information. Users seem willing to provide this information in exchange for service access, especially when the platform establishes a proper privacy policy and instills trust (Flavian, 2006 [

35]).

The concept that the transaction, rather than the commodity, is the basic unit of analysis was proposed by John Commons (1932) [

36]. In this study, transactions were defined as the smallest unit of economic activity involving the alienation and acquisition of rights to property and liberty between individuals, distinct from tangible commodity exchange (Commons, 1932 [

36]). Commons argued that transactions, rather than the “exchange of commodities,” should be the measured unit, emphasizing that societal rules control legal access to commodities. In “The Problem of Social Cost,” transaction cost is described as the necessary steps to carry out a market transaction, including discovering potential parties, conducting negotiations, drafting contracts, ensuring contract adherence through inspection, and more (Commons, 1932 [

36]). Williamson (1981) [

18] extended this by stating that a transaction occurs when a good or service is transferred across a technologically separable interface.

The transaction cost approach considers the transaction the fundamental unit of analysis, emphasizing that understanding how organizations economize on these costs is crucial. This study conceptualizes transaction cost as the time, money, and effort required to discover and subscribe to an online subscription-based streaming provider for accessing desired video content (Williamson, 1981 [

18]). Lower transaction cost motivates a customer to keep their subscription.

2.5. Intention to Subscribe to an Online Video Streaming Service

In our study, we conceptualized this construct as the anticipation that an individual will make monetary payments to obtain access to online video streaming within a specific timeframe. The payment structure itself is beyond the scope of this study. Here, “video” encompasses movies, TV series, TV shows, documentaries, cartoons, and similar content, while an “Online streaming provider” refers to a service delivering access to video content via the internet. As defined in our study, subscription-based online video streaming services include any internet-based services that permit customers to stream video content online in exchange for a subscription fee. Such services include Netflix, Hulu, and Amazon Prime, among others. Notably, our definition excludes paid cable and satellite TV subscription services.

The Transaction Cost Economics (TCE) theory posits that consumers opt for transaction methods that enable savings on transaction costs (Williamson, 1985 [

32]). This consideration influences their decision-making process when selecting whether to subscribe to a particular video streaming service in preference to others.

3. Research Model

Our study is rooted in the fundamental principles of transaction cost economics theory. According to this theory, uncertainty positively correlates with transaction cost, while frequency is inversely related to cost. Additionally, transaction cost exhibits a positive relationship with the intention to subscribe to online video streaming services. Transaction costs decrease as transactions become more recurrent, straightforward, clear, transparent, and entail a lower degree of uncertainty. As discussed earlier, consumers optimize their transaction methods by choosing those that minimize transaction costs, finding reliable, quality, and desirable content easily and affordably, influencing their intention to subscribe to online video streaming services.

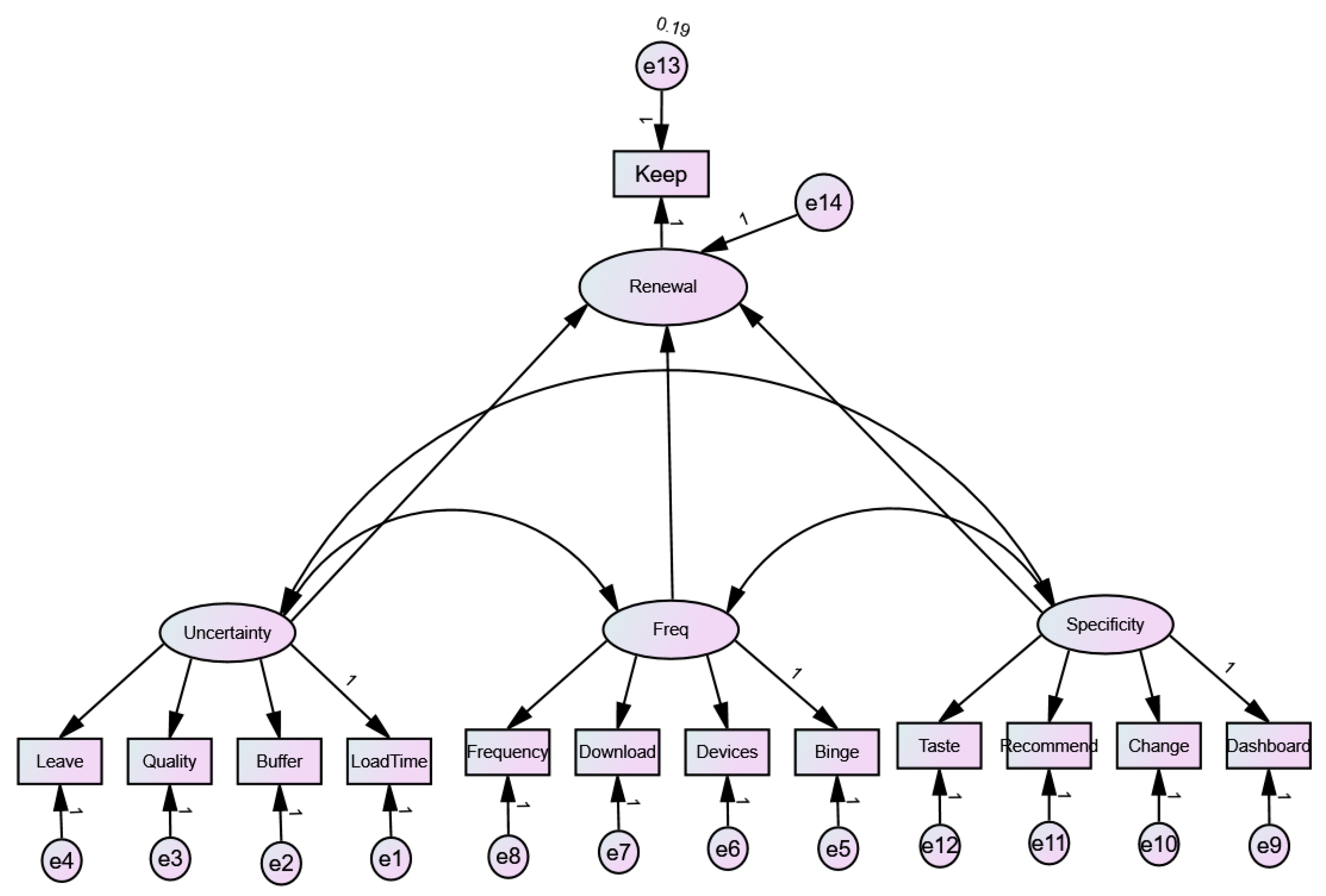

Figure 1 illustrates our research framework, encompassing the constructs of uncertainty, frequency (freq), and specificity, measured using multiple indicators. These indicators were determined through initial research, primarily from practitioner literature, and further refined through panel evaluations.

Transaction cost, measured by a single indicator, “willingness to continue subscription of the streaming service,” aligns with the approach of some researchers, including pioneers in structural equation modeling like Hayduk and Littvay (2012) [

37]. Their paper [

37] explains and justifies situations under which a single-item construct is warranted, and hence, our study believes that this approach for the dependent variable is appropriate. Hayduk and others have argued that using a few key indicators for each latent variable promotes the development of theoretically sophisticated models. In constructing the survey instrument tailored for the average consumer, we opted for a single indicator directly measuring the intention to maintain the subscription service.

5. Analysis

Data collection for the study was conducted through a Qualtrics panel, involving a payment of USD 5.00 per participant to Qualtrics. Participants, in turn, received an unspecified subset of that amount as an incentive for their involvement. The targeted sample size was 300, with a desired response rate of 30% or higher. Qualtrics presented the informed consent and survey link to all eligible panelists aged 18 and older, ensuring that the survey stopped for participants below this age threshold—those who opted to participate provided informed consent before commencing the study. The researchers obtained Institutional Review Board (IRB) approval to administer the questionnaire.

A total of 312 respondents participated in the survey, resulting in 305 completed responses, indicating a high response rate and suggesting participant interest in the survey. No missing values were observed, as the survey design required respondents to answer all questions, and checks were implemented to prevent unanswered questions. This approach was considered reasonable, given the relevance and ease of the questions and the fact that respondents were remunerated for their participation. Participants were instructed to respond to their top three streaming services, resulting in 797 responses, accounting for multiple selections by each respondent. The questionnaire was structured so the respondents could choose their top three services from a list of Netflix, Disney, Hulu, Amazon Prime Video, HBO Max, and Apple TV+.

Data cleaning was a crucial step in the research process, aimed at identifying and correcting errors, inconsistencies, and inaccuracies in the collected data and coding it. The goal is to ensure the reliability and validity of the data for meaningful analysis and interpretation. Data was inspected to ensure respondents provided reliable and thoughtful responses and understood the requested information.

5.1. Respondent Profile

The demographic profile of the respondents is outlined in

Table 2,

Table 3 and

Table 4. Regarding gender identification, 174 respondents identified as female, 129 as male, and two as non-binary/third gender. The age distribution is detailed in

Table 2:

Table 3 presents the identified race of the respondents, showcasing a noteworthy aspect of diversity within the sample. The data reveals that respondents were allowed to select multiple races, allowing for the identification of mixed-race individuals within the sample. This inclusive approach in data collection acknowledges and reflects the varied racial identities of the participants.

The table displays the primary streaming services respondents utilize, as outlined in

Table 4. Notably, Netflix emerges as the most favored service, with 252 out of the 305 respondents subscribing to it. Additionally, the data indicates that most respondents are subscribers to more than one service. The correlations between the different items are shown in

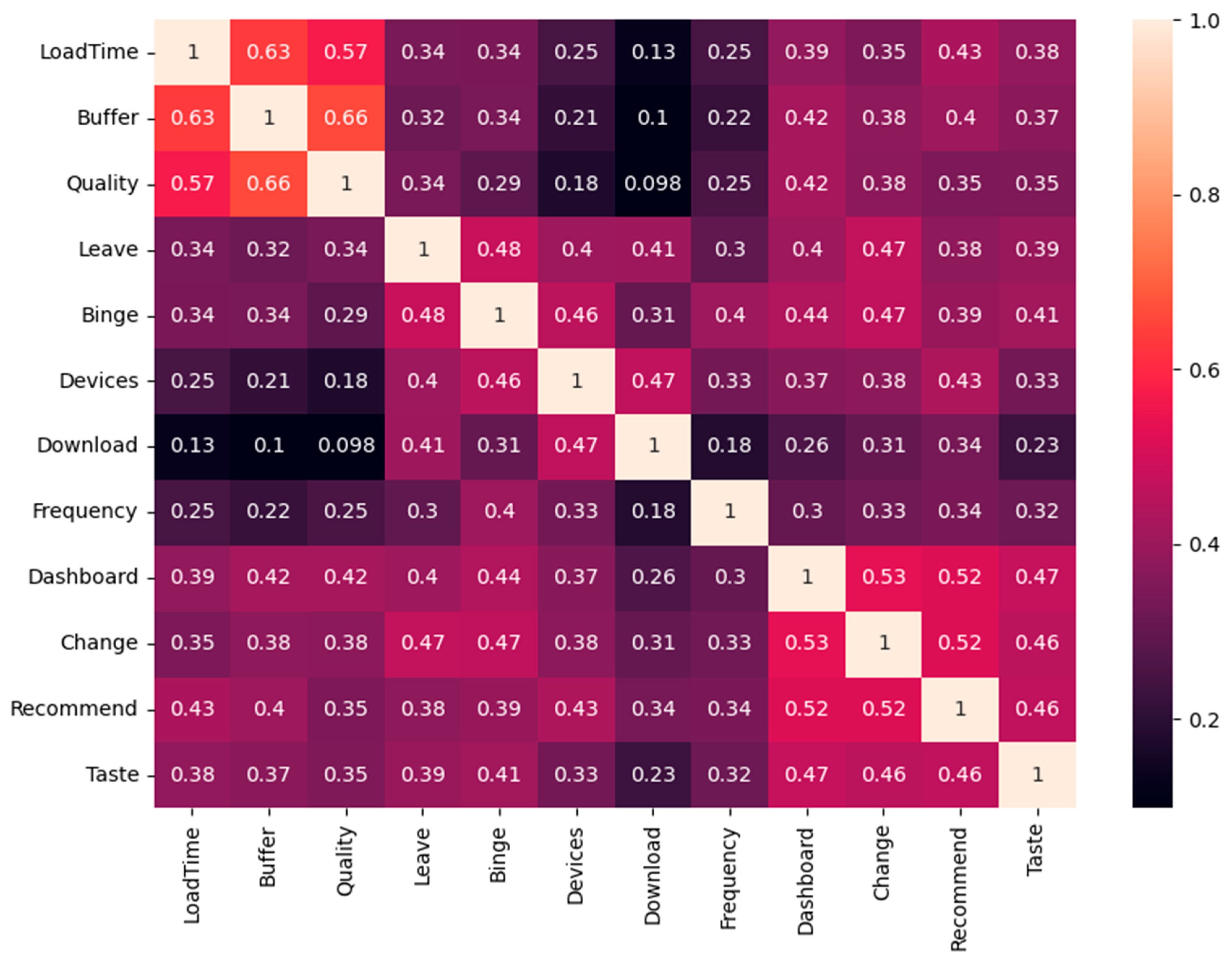

Figure 2 below. The pattern of correlations shows reasonable inter-item correlations between indicators of the same construct. The pattern of correlations also points to a correlated factor structure as hypothesized in the structural equation model.

5.2. Single Item “Intention to Renew” Treatment

This study evaluated the intention to renew the subscription using a single item. To ensure the reliability of this indicator, a thorough review of prior research measuring a similar construct was conducted. The only identified study that utilized a scale with more than one item for gauging the intention to renew a subscription was carried out by Walther et al. (2013) [

38]. Their research focused on measuring the intention to renew the Operational Cloud Enterprise Systems (CES) subscription through a two-item scale, demonstrating a reliability coefficient of 0.83. The items in their scale were as follows: (a) “We intend to continue the subscription of our CES rather than discontinue its subscription.” (b) “We intend to continue the subscription of our CES rather than to subscribe to any alternative means.”

These items were originally adapted from a study by Bhattacherjee (2001) [

39], which measured Information Systems continuance using a three-item scale, also exhibiting a reliability of 0.83. Considering that the decision to renew a subscription for a streaming service was perceived as less intricate than in these prior studies, the reliability of the single-item indicator was conservatively set at 0.9 for analysis in the current study. This decision considers the acknowledgment that the simplified nature of the subscription renewal decision may lead to higher reliability for the single-item measure.

5.3. Hypotheses Testing

The research hypotheses were tested using structural equation modeling (SEM). As per the recommendation for such analysis (Kline, 2023) [

40], the confirmatory measurement model was analyzed first to examine and confirm the factor structure. This analysis was performed using SPSS AMOS 30. Modification indices were chosen to investigate any suggested improvements in the model that could be backed by theoretical support. Model estimation was performed using the maximum likelihood method due to its desirable statistical properties.

The chi-square for the measurement model was 376.377 (51 degrees of freedom) and significant at the 0.05 level (

p < 0.0001). The chi-squared is expected to be significant with relatively large sample sizes in most cases. This was the case here with a sample size of 797. The CFI for the model was 0.908, the TLI was 0.881, and the GFI was 0.927. The RMSEA was 0.090. These fit measures indicated that the model is adequate, but needs improvement. Hence, the modification indices were examined to discern if any improvements could be made based on theoretical justifications. The modification indices indicated the possibility of “Leave” being a more appropriate indicator of “Freq” latent. Correlations between items of the constructs are presented in

Figure 2. This figure illustrates that the correlations do not show any issues with multicollinearity and that cross-loadings among items in different constructs should not be an issue.

Informal conversations were conducted with students at a major university to explore the relationship between the information that a show or movie is leaving the service and the frequency of watching a service and downloading it. As would be obvious, the explanation was that if a show or movie of choice was leaving a streaming service, the frequency of watching increased to watch the show or service before the deadline. In addition, the show or movie was often downloaded so that the patron could watch the show after the show had left the service. Shows were mostly downloaded when the patron was going on a plane without an internet connection so that the patron could watch the downloaded show or movie. Given the explanation provided and the value of the modification indices, “Leave” was moved as an indicator of “Uncertainty” to the “Freq” latent construct. The measurement model was refitted. As expected, the model fit improved substantially. The chi-sq for the new measurement model was 189.017, which was reduced significantly. It was still significant at the 0.05 level. The model had a GFI of 0.961, TLI of 0.949, and CFI of 0.961. The RMSEA was 0.058. All the indices indicate a strong model fit. All the factor loadings and correlations between the latent variables were significant. The errors are also substantial. An examination of the modification indices did not indicate any large values for changes in the model. The reliability of the constructs Uncertainty, Freq, and Specificity is substantiated by Cronbach’s alphas of 0.831, 0.743, and 0.796, respectively, indicating high reliability.

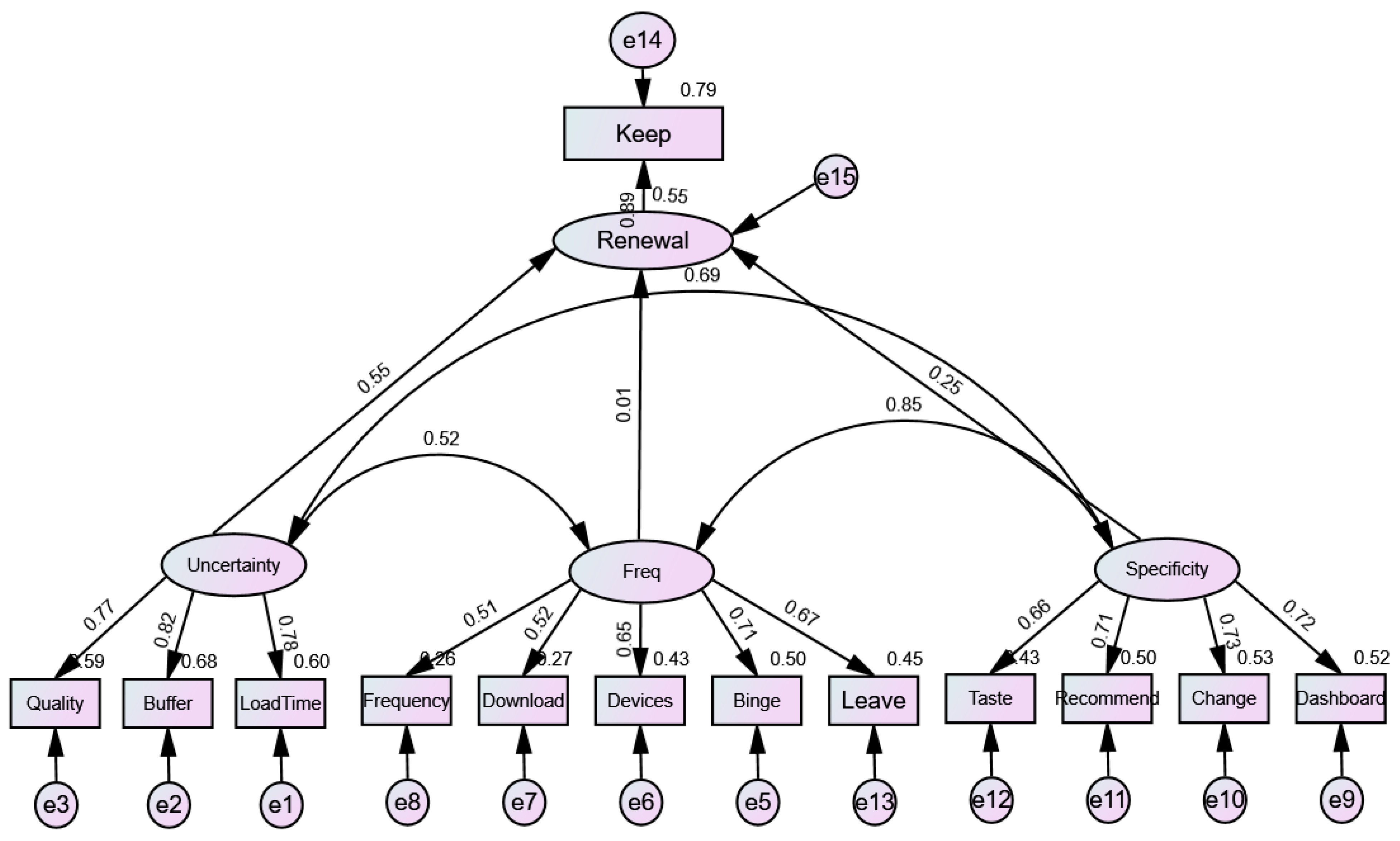

Next, the structural model was run along with the single-item latent variable of “Renewal” as the endogenous variable. The error variance of the single-item indicator of keep was fixed to (1-reliability)

2 or 0.19 as per the recommendation of Hayduk and Littvay (2012) [

37] and discussed earlier. The model and its standardized parameters are shown in

Figure 3.

The chi-square for the model was 234.946 and was significant at the 0.05 level. As discussed earlier, this may be expected with a sample size of 797 since the chi-square test is susceptible to the sample size. The model had a GFI of 0.956, TLI of 0.942, and CFI of 0.956. The RMSEA was 0.061. All indices indicated a reasonable fit of the data to the hypothesized model. The path from “Uncertainty” to “Renewal” was significant at the 0.05 level. The

p-value for the path from “Uncertainty” to “Renewal” was 0.910, indicating that the path was insignificant. The

p-value for the path from “Specificity” to “Renewal” was 0.053, which can be taken as significant for all practical purposes. The hypotheses and their support are shown in

Table 5.

6. Discussion

Hypotheses 1 and 3 were supported, and the standardized regression weights were 0.55 and 0.25 and were significant at the 0.05 level. Not only was the effect size from “Freq” to “Renewal” very low (0.01), but it was also highly insignificant at the

p-value of 0.91. To explore the reasons for the ratings, one may look at the ratings distribution for intent to keep a subscription as provided in

Table 6.

The vast majority of survey participants are inclined to keep their existing subscriptions. The latent indicators, identified as “Freq,” which include binge-watching, usage on multiple devices, downloading shows, awareness of show departure, and watching frequency, may not significantly impact the decision to renew. These factors could be considered baseline expectations for subscribers, serving as essential elements. The absence of these factors might discourage individuals from initially subscribing to the service. Regarding watching frequency, since streaming services often replace traditional TV, regular viewing habits may persist irrespective of the specific intent to renew the subscription. The sample likely consists of a few consumers who have subscribed but do not watch regularly and are contemplating cancelation, possibly due to factors like exclusive content availability when they do decide to watch. Most respondents indicate daily streaming service usage (see

Table 7).

Various streaming services have consistently set themselves apart by offering exclusive content. For instance, HBO Max’s critically acclaimed series “The Last of Us,” based on the popular video game, and Disney’s “Star Wars” franchise are examples of content not available elsewhere. As patrons engage with streaming services, they become aware that specific platforms offer content unique to their catalog. This awareness is measured by the indicator “Taste” (refer to

Table 8) and aligns with asset specificity. Customers are more inclined to retain subscriptions when the content offered by a streaming service is exclusive and aligns with their personal preferences and tastes. This observation supports the notion that the uniqueness and alignment with individual preferences contribute to the asset specificity of streaming services, influencing customer retention.

The traditional appeal of cable TV, particularly live sports (Rubenking & Bracken, 2024 [

41]), is now increasingly available on streaming services. The uncertainty associated with watching a live stream and the concern about missing crucial gameplay are pivotal considerations for most consumers. In this context, the quality of streaming, especially issues like buffering, becomes highly relevant. Many streaming services consistently invest in content caching and establish agreements with Internet Service Providers (Jayakar & Park, 2023 [

42]) for last-mile delivery. As previously mentioned, platforms like Netflix have committed substantial resources, spanning over a decade and roughly a billion dollars (Keck, 2021 [

43]), to build their content delivery network, Open Connect. This investment aims to ensure the uninterrupted availability of video streams to viewers. Given that the indicators under “Uncertainty” impact the quality of the viewing experience, this construct becomes crucial in maintaining a subscription to a streaming service.

Table 9 highlights the significance of minimal buffering in streaming, emphasizing its importance to subscribers.

8. Conclusions

8.1. Theoretical Contribution

To explain the specific gap in our study’s literature, we first state that the dependent variable “Intention to Purchase” is a standard variable of interest in research models. For example, Yang et al. (2022) [

44] investigate consumers’ purchase intentions in social commerce, highlighting the significance of value, effort, and social distance constructs. They propose that future research explore purchase intentions across various media presentations, including live streaming. In line with this, our study concentrates on predictors for the “Intention to subscribe to an online video streaming service,” aligning with the Transaction Cost Economics (TCE) theory, incorporating Uncertainty, Frequency, and Asset Specificity. An alternative theory that could be used to support the model in our study is the extended technology acceptance model (TAM) (Venkatesh and Davis, 2000) [

45]. The TAM is used to motivate usage intentions. However, it does not directly address renewal or continued usage. Thus, a research gap exists concerning modeling the dependent variable “Intention to Renew” in examining subscriptions to video streaming platforms.

Our study addresses this research gap by examining a model in which the sample of observations only consists of users (not non-users), and the dependent variable is continuation of usage, which is synonymous with “Intention to Renew.” This is a subtle difference in research involving intention to purchase and intention to continue purchasing. Another gap that our paper fills is the application of theory to online video streaming services. A common theory to use in examining intention to purchase is consumer behavior theory. Wu et al. (2024) [

46] examine existing models and frameworks in the literature that apply to studying video streaming platforms and use this theory. Consumer emotions and choices can be complex and involve a variety of behavioral theories. Our study’s contribution is applying TCE theory in studying the continuation of subscribing to an online video streaming service. Our study empirically supports this theory in the context of our research. Although prior studies have employed TCE constructs (uncertainty, asset specificity, frequency) broadly in contexts like organizational transactions or initial consumer adoption, they rarely address the ongoing continual retention decision of subscribers, which differs fundamentally from purchase decisions, whether they be initial or repeat (Bhattacherjee, 2001; Lemon & Verhoef, 2016) [

39,

47].

This study’s research employs a robust Structural Equation Modeling approach, resulting in a well-fitted model for a valid and reliable confirmatory factor analysis. This framework provides insights into the economic underpinnings of market-based economic activity, specifically online video streaming. TCE is recognized as a valuable lens for scholars and practitioners, facilitating a deeper understanding of the economic dynamics in the examined domain of online video streaming. An analysis of the model using a regression approach for each streaming service reveals that Uncertainty and Specificity are the two significant components of TCE that contribute to the prediction of renewal across all streaming services.

Prior research does not suggest that the “Frequency” of usage may have little predictive power in a model with intent to renew or repurchase. The insignificance of the “Freq” construct in our model implies that regular viewing habits will endure, irrespective of the specific intention to renew a subscription. A conceivable rationale for its lack of significance is that the study’s sample includes consumers experiencing video-watching fatigue. These consumers could be altering their choice of streaming service to align with specific criteria such as quality, costs, content variety, and the availability of exclusive content. Each streaming service employs an ‘optimized’ yet imperfect machine-learning-driven “personalization” to suggest content for consumers. However, these ‘suggested viewing’ recommendations may be causing disappointment among consumers in the long run.

Lu and Chen (2021) [

7] study live streaming and its effect on e-commerce. They consider product uncertainty and quality in terms of purchase intentions and use a structural equations modeling approach to support the importance of these constructs. Our study’s findings consistently underscore the considerable influence of uncertainty, a factor negatively associated with streaming quality, on the landscape of online subscription-based video streaming. Furthermore, the research reveals a positive correlation between asset specificity, representing the uniqueness and exclusivity of content, and the sustained utilization of online subscription-based video streaming services. What sets this research apart is its focus on individuals already subscribed to an online video streaming service. This unique perspective extends the current body of literature. It furnishes valuable insights for marketing professionals striving to gain a profound understanding of consumer behavior within the dynamic realm of online streaming. The streaming industry is highly competitive, and retaining current customers is crucial for marketing initiatives.

8.2. Managerial Implications

The findings of this study provide valuable insights for industry decision-makers into how Transaction Cost Economics (TCE) components influence customers’ renewal intentions. Specifically, management should recognize that uncertainty, which could be manifested as poor streaming quality or inconsistent user experience, erodes trust and discourages continued subscriptions. To mitigate this, management should invest in technical reliability, responsive customer service, and transparent communication regarding content availability and platform updates. Additionally, asset specificity, particularly the availability of exclusive or original content, is a strong driver of retention. Management should strategically develop or acquire unique content for streaming platforms that aligns with viewer preferences and cannot be easily substituted by competitors.

Although the frequency of use did not show predictive power in our model, it should not be dismissed. Understanding patterns of viewing fatigue and evolving preferences can help platforms improve personalization algorithms and create more engaging user experiences. Enhancing the attributes associated with frequent use, such as offering offline viewing, customizable settings, and user-curated content, can still positively affect customer satisfaction. In short, managers should use the components of TCE, namely, uncertainty, asset specificity, and frequency, as a strategic framework for identifying opportunities to strengthen customer engagement, boost retention, and build loyalty in a competitive and rapidly evolving marketplace.

8.3. Limitations and Suggestions for Future Research

Future studies can build upon the models used in this paper by incorporating additional predictive variables, such as consumer traits, akin to Yang et al.’s (2022) [

44] exploration of consumer purchase intentions. There are several limitations to this study that future research can investigate. Future studies should recognize the evolving landscape of streaming services. Video streaming services have matured and are expanding into new content areas, including live sports and live TV streaming. Over-the-top (OTT) platforms such as Netflix, Hulu, and Amazon Video have begun offering live sports and TV content, making them resemble traditional broadcast networks more closely (Hutchins et al., 2019) [

48]. This strategic shift represents a recent development and contributes to increased asset specificity for these platforms. Additionally, streaming services such as FuboTV and Sling provide competitive video subscription services that offer flexibility for viewers who may not want complete streaming services. This study did not explicitly consider some ongoing transformations within the streaming industry.

Future research should investigate the applicability of TCE to microtransactions. The primary business model among streaming services has traditionally involved subscriptions. However, an emerging alternative, microtransactions (Chaudhary & DaSouza, 2024) [

49], can shift the relationship structure from a long-term commitment to a transaction-based one. In such a context, the applicability of TCE may be less pronounced, and the results may not hold with the same salience. However, the concepts of TCE may still offer valuable insights into identifying revenue potential within microtransaction-driven models for digital content.

An underlying assumption in this study is that the Qualtrics panel of respondents represents the actual population that uses streaming services. A limitation of our study is that the true population characteristics of the predominant viewership of streaming services are not well documented. Future research should identify the baseline characteristics of the population subscribing to streaming services. These characteristics may vary by streaming service.

Future studies should consider aspects of consumer behavior that were not examined in this study. Since this study restricted itself to only those customers who are current subscribers, future research should consider the issue of consumer inertia, which may lead to the continuation of a subscription when the subscription renews automatically (Einav et al., 2025) [

50]. Einav et al. (2025) [

50] found that consumer inertia may be driven by inattention or switching costs. In such cases, cancelation frictions roughly double seller revenues on average, thus keeping most initial subscribers. It is quite possible that switching costs may be contributing to subscription renewal when hype about a particular show or its second or third season may keep the consumer subscribed to the streaming service. This effect was not parsed out or explored in the study.