The Impact of Digital Finance on the Development of Cross-Border E-Commerce

Abstract

1. Introduction

2. Literature Review

2.1. Research on Digital Finance

2.2. Research on Cross-Border E-Commerce

2.3. Research on the Relationship Between Digital Finance and Cross-Border E-Commerce

3. Theoretical Analysis and Research Hypotheses

3.1. The Direct Mechanism of Digital Finance in Promoting Cross-Border E-Commerce Development

3.2. The Indirect Mechanism of Digital Finance in Promoting Cross-Border E-Commerce Development

4. Research Design

4.1. Variable Definitions

4.1.1. Explained Variable

4.1.2. Core Explanatory Variable

4.1.3. Mediator Variable

4.1.4. Regulatory Variables

4.1.5. Control Variables

4.2. Model Settings

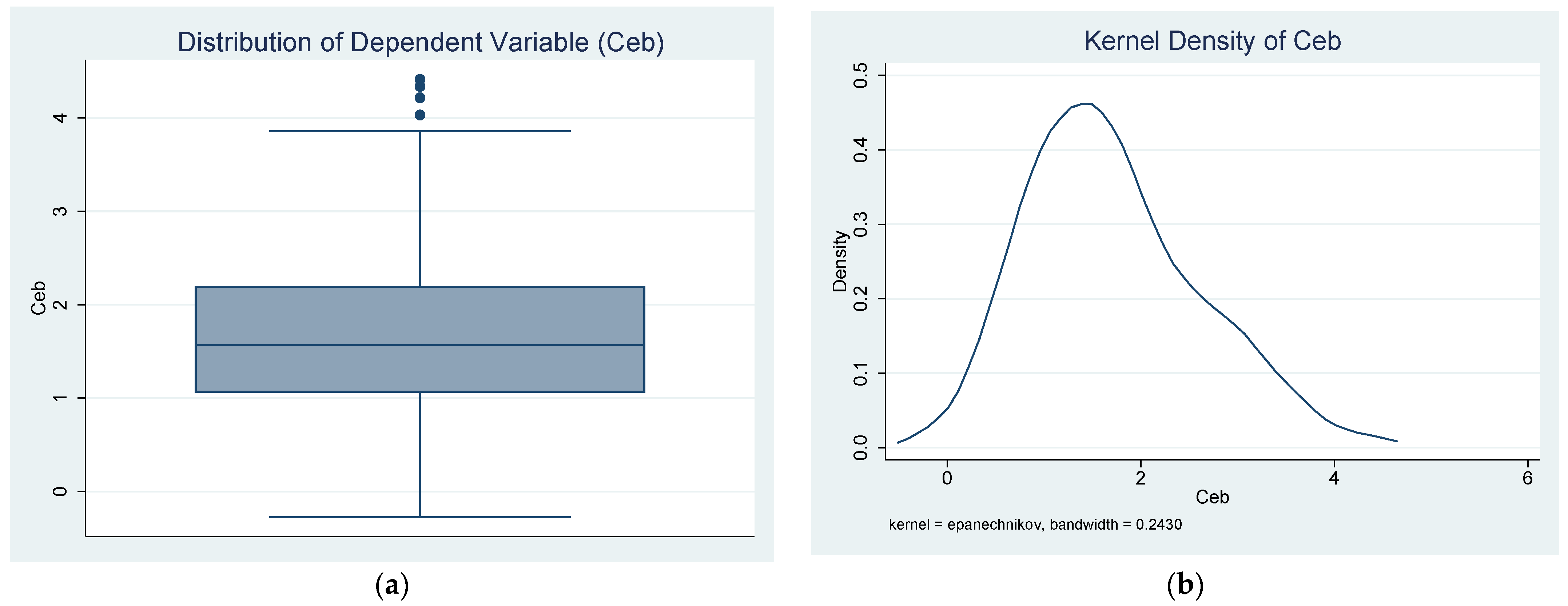

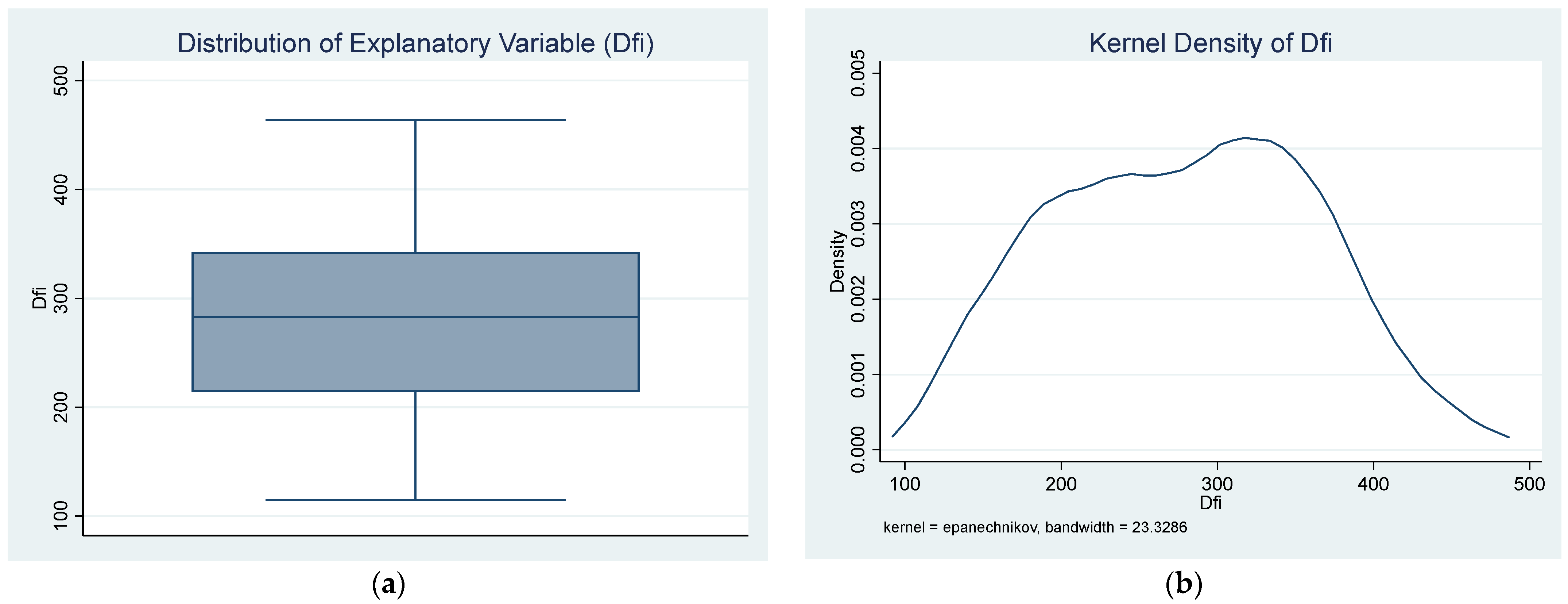

4.3. Descriptive Statistics of Variables

5. Empirical Results and Analysis

5.1. Benchmark Regression Analysis

5.2. Stability Testing Analysis

5.2.1. Replacing Explanatory Variables

5.2.2. Excluding the Year

5.2.3. Replacing the Regression Model FE (Fixed Effects Model)

5.2.4. Excluding Municipalities

5.2.5. Tail Trimming

5.3. Endogeneity Test Analysis

5.3.1. Instrumental Variable Method

5.3.2. System GMM

5.4. Mechanism Effect Test Analysis

5.5. Moderation Effect Analysis

5.5.1. Internet Penetration Rate

5.5.2. Innovative Capital Investment

5.5.3. Technology Market

5.6. Heterogeneity Analysis

5.6.1. Degree of Marketization

5.6.2. Number of Enterprises

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Demertzis, M.; Merler, S.; Wolff, G.B. Capital markets union and the fintech opportunity. J. Financ. Regul. 2018, 4, 157–165. [Google Scholar] [CrossRef]

- Lendle, A.; Olarreaga, M.; Schropp, S. There goes gravity: eBay and the death of distance. Econ. J. 2016, 126, 406–441. [Google Scholar] [CrossRef]

- Gomez-Herrera, E.; Martens, B.; Turlea, G. The drivers and impediments for cross-border e-commerce in the EU. Inf. Econ. Policy 2014, 28, 83–96. [Google Scholar] [CrossRef]

- Che, L.B. Digital finance enables the cross-border e-commerce: Theoretical logic, realistic dilemma and development path. Southwest Financ. 2024, 8, 81–92. [Google Scholar]

- Ghosh, C.; Hom Chaudhury, R. Determinants of digital finance in India. Innov. Dev. 2022, 12, 343–362. [Google Scholar] [CrossRef]

- Anane, I.; Nie, F. Determinants factors of digital financial services adoption and usage level: Empirical evidence from Ghana. Int. J. Manag. Technol. 2022, 9, 26–47. [Google Scholar] [CrossRef]

- Aloulou, M.; Grati, R.; Al-Qudah, A.A. Does FinTech adoption increase the diffusion rate of digital financial inclusion? A study of the banking industry sector. J. Financ. Rep. Acc. 2024, 22, 289–307. [Google Scholar] [CrossRef]

- King, R.G.; Levine, R. Finance, entrepreneurship and growth. J. Monet. Econ. 1993, 32, 513–542. [Google Scholar] [CrossRef]

- Rajan, R.; Zingales, L. Financial Dependence and Growth; NBER: Cambridge, MA, USA, 1996. [Google Scholar] [CrossRef]

- Levine, R. Finance and growth: Theory and evidence. Handb. Econ. Growth 2005, 1, 865–934. [Google Scholar] [CrossRef]

- Ozili, P.K. Impact of digital finance on financial inclusion and stability. Borsa Istanb. Rev. 2018, 18, 329–340. [Google Scholar] [CrossRef]

- Durai, T.; Stella, G. Digital finance and its impact on financial inclusion. J. Emerg. Technol. Innov. Res. 2019, 6, 122–127. [Google Scholar]

- Ozili, P.K. Financial inclusion research around the world: A review. Forum Soc. Econ. 2021, 50, 457–479. [Google Scholar] [CrossRef]

- Li, J.; Wu, Y.; Xiao, J.J. The impact of digital finance on household consumption: Evidence from China. Econ. Model. 2020, 86, 317–326. [Google Scholar] [CrossRef]

- Sadigov, S.; Vasilyeva, T.; Rubanov, P. FinTech in Economic Growth: Cross-country Analysis. In Book of Proceedings, Proceedings of the 55th International Scientific Conference on Economic and Social Development, Baku, Azerbaijan, 18–19 June 2020; UNEC: Baku, Azerbaijan, 2020; Volume 1/4, pp. 729–739. [Google Scholar]

- Guo, C.; Wang, X.; Yuan, G. Digital Finance and the Efficiency of Household Investment Portfolios. Emerg. Mark. Financ. Trade 2021, 58, 2895–2909. [Google Scholar] [CrossRef]

- Creehan, S. How digital innovation can increase small business access to finance in Asia. Asia Focus 2018, 3. [Google Scholar]

- Bollaert, H.; Lopez-de-Silanes, F.; Schwienbacher, A. Fintech and access to finance. J. Corp. Financ. 2021, 68, 101941. [Google Scholar] [CrossRef]

- Wang, Q.; Yang, J.; Chiu, Y.H.; Lin, T.Y. The impact of digital finance on financial efficiency. Manag. Decis. Econ. 2020, 41, 1225–1236. [Google Scholar] [CrossRef]

- Wales, K. Internet finance: Digital currencies and alternative finance liberating the capital markets. J. Govern. Regul. 2015, 4, 190–201. [Google Scholar] [CrossRef]

- Lin, B.; Ma, R. How does digital finance influence green technology innovation in China? Evidence from the financing constraints perspective. J. Environ. Manag. 2022, 320, 115833. [Google Scholar] [CrossRef]

- Ozili, P.K. Digital finance research and developments around the world: A literature review. Int. J. Bus. Forecast. Mark. Intell. 2023, 8, 35–51. [Google Scholar] [CrossRef]

- Yang, J.; Yang, N.; Yang, L. The Factors Affecting Cross-border E-commerce Development of SMEs—An Empirical Study. In Proceedings of the 13th Wuhan International Conference on E-Business (WHICEB 2014), Wuhan, China, 31 May–1 June 2014. [Google Scholar]

- Cardona, M.; Duch-Brown, N.; Francois, J. The Macro-Economic Impact of e-Commerce in the EU Digital Single Market; Institute for Prospective Technological Studies: Seville, Spain, 2015. [Google Scholar]

- Kim, T.Y.; Dekker, R.; Heij, C. Cross-border electronic commerce: Distance effects and express delivery in European Union markets. Int. J. Electron. Commer. 2017, 21, 184–218. [Google Scholar] [CrossRef]

- Ma, S.; Chai, Y.; Zhang, H. Rise of Cross-border E-commerce Exports in China. China World Econ. 2018, 26, 63–87. [Google Scholar] [CrossRef]

- Zhu, W.; Mou, J.; Benyoucef, M. Exploring purchase intention in cross-border E-commerce: A three stage model. J. Retail. Consum. Serv. 2019, 51, 320–330. [Google Scholar] [CrossRef]

- Cassia, F.; Magno, F. Cross-border e-commerce as a foreign market entry mode among SMEs: The relationship between export capabilities and performance. Rev. Int. Bus. Strateg. 2022, 32, 267–283. [Google Scholar] [CrossRef]

- Chen, W.H.; Lin, Y.C.; Bag, A. Influence factors of small and medium-sized enterprises and micro-enterprises in the cross-border e-commerce platforms. J. Theor. Appl. Electron. Commer. Res. 2023, 18, 416–440. [Google Scholar] [CrossRef]

- Wen, H.; Liu, Y.; Zhou, F. Promoting the international competitiveness of small and medium-sized enterprises through cross-border e-commerce development. SAGE Open 2023, 13, 21582440231210119. [Google Scholar] [CrossRef]

- Dallocchio, M.; Lambri, M.; Sironi, E. The role of digitalization in cross-border e-commerce performance of Italian SMEs. Sustainability 2024, 16, 508. [Google Scholar] [CrossRef]

- Chen, Y.; Wang, Q.; Zhang, J. The role of cross-border E-commerce platforms in the digital economy: Empower firms to gain global market insights to increase global competitiveness. J. Digit. Manag. 2025, 1, 4. [Google Scholar] [CrossRef]

- Xie, Y.; Ye, H.-Q.; Zhu, W. Prediction and Optimization for Multi-Product Marketing Resource Allocation in Cross-Border E-Commerce. J. Theor. Appl. Electron. Commer. Res. 2025, 20, 124. [Google Scholar] [CrossRef]

- Zhang, S.; Zhang, X.; Wang, B.; Dan, B. Quality Information Disclosure and Blockchain Technology Adoption of Competitive Suppliers on the Third-Party E-Commerce Platform. J. Theor. Appl. Electron. Commer. Res. 2025, 20, 127. [Google Scholar] [CrossRef]

- Liu, C.; Chen, T.; Pu, Q.; Jin, Y. Text Mining for Consumers’ Sentiment Tendency and Strategies for Promoting Cross-Border E-Commerce Marketing Using Consumers’ Online Review Data. J. Theor. Appl. Electron. Commer. Res. 2025, 20, 125. [Google Scholar] [CrossRef]

- Zhong, M.; Wang, Z.; Ge, X. Does cross-border e-commerce promote economic growth? empirical research on China’s Pilot Zones. Sustainability 2022, 14, 11032. [Google Scholar] [CrossRef]

- Ma, Y. Exploring innovative business models in cross-border e-commerce under digital economy. Front. Bus. Econ. Manag. 2024, 13, 205–209. [Google Scholar] [CrossRef]

- Zheng, M. Digital Finance, E-commerce Development, and Regional Trade Development. Financ. Res. Lett. 2025, 81, 107532. [Google Scholar] [CrossRef]

- Xu, X. From Yiwu to the Global Market: Leading the Future of Trade with Cross-border Electronic Commerce and Financial Science and Technology Innovation. Macro Manag. Public Policies 2025, 6, 6–14. Available online: https://ojs.s-p.sg/index.php/mmpp/article/view/18379 (accessed on 10 July 2025).

- Abendin, S.; Duan, P. International trade and economic growth in Africa: The role of the digital economy. Cogent Econ. Financ. 2021, 9, 1911767. [Google Scholar] [CrossRef]

- Derindağ, Ö.F. Rise of Cross-Border E-Commerce: A Systematic Literature Review. J. Appl. Theor. Soc. Sci. 2022, 4, 352–372. [Google Scholar] [CrossRef]

- Tan, H. Study on Chinese cross-border e-commerce payments from a “double cycle” standpoint. J. Comput. Electron. Inf. Manag. 2025, 16, 46–50. [Google Scholar] [CrossRef]

- Cui, Y. Research on the influence of digital inclusive finance on high-quality development of manufacturing industry-analysis based on the moderating effect of internet. Southwest Financ. 2025, 4, 100–116. [Google Scholar]

- Chen, Y.T.; Liu, J.T.; Huang, Z.Y. How can technological mergers and acquisitions empower the development of enterprises’ new quality productive forces. Financ. Econ. 2025, 1, 27–39. [Google Scholar] [CrossRef]

- Chen, S.L.; Li, X.R.; Luo, M.H. The impact mechanism of digital finance on new quality productivity—An analysis based on mediating effect and threshold. J. Syst. Sci. Math. Sci. 2025, 45, 1813–1831. [Google Scholar]

- Jiang, Y.Q.; Fan, C.J. Construction of cross-border e-commerce development indices and empirical analysis. Math. Theory Appl. 2019, 39, 113–120. [Google Scholar]

- Yi, F.; Liu, X.F.; Liu, H.Z. The mechanism and countermeasures for the coordinated development of cross-border e-commerce in Beijing-Tianjin-Hebei region. J. Commer. Econ. 2021, 15, 157–161. [Google Scholar]

- Ren, Y.X.; Wu, Y.; Wu, Z. Financial agglomeration and new quality productivity, industry-university research cooperation. Theory Pract. Financ. Econ. 2024, 45, 27–34. [Google Scholar] [CrossRef]

- Chen, J.; Guo, H.W. How can digital transformation promote the creation of shared value in enterprises. World Surv. Res. 2023, 10, 12–23. [Google Scholar] [CrossRef]

- Zhao, Y.H.; Zhang, Z.; Feng, T.W. Big Data Development, Institutional Environment, and Government Governance Efficiency. J. Manag. World 2019, 35, 119–132. [Google Scholar] [CrossRef]

| Variable Type | Variable Name | Variable Symbol | Variable Meaning |

|---|---|---|---|

| Explained variable | Cross-border E-commerce development | Cbe | Entropy weighting method calculation |

| Core explanatory variable | Digital finance | Dfi | Entropy value calculation method |

| Mediating variable | New quality productive forces | NQPF | Entropy value calculation method |

| Regulatory variable | Internet penetration rate | Ipr | Number of Internet broadband access users/Total permanent population |

| Innovative capital investment | Ici | Internal expenditure on R&D/GDP | |

| Technology market | Tech | Technology market transaction volume/regional gross domestic product | |

| Control variables | Urbanization | Urb | Urbanization rate |

| Economic development | Gdp | Regional gross domestic product | |

| Degree of openness | Open | (Total import and export of goods × US dollar to RMB exchange rate)/Regional Gdp | |

| Industrial structure | Ind | Value added of tertiary industry/value added of secondary industry | |

| Human capital | Labor | Number of students enrolled in higher education institutions/total population | |

| Industrial agglomeration | Ial | Number of employed persons/administrative area | |

| Government intervention | Gov | Fiscal expenditure/regional GDP |

| Variable Type | Variables | Observation | Mean | Median | Standard Deviation | Minimum Value | Maximum Value |

|---|---|---|---|---|---|---|---|

| Explained variable | Cbe | 301 | 279 | 283 | 81.20 | 115 | 464 |

| Core explanatory variable | Dfi | 301 | 8.660 | 4.800 | 10.80 | 0.761 | 82.40 |

| Mediating variable | NQPF | 301 | 0.283 | 0.253 | 0.134 | 0.0718 | 0.747 |

| Regulatory variable | Ipr | 301 | 0.265 | 0.259 | 0.108 | 0.0603 | 0.523 |

| Ici | 301 | 1.830 | 1.560 | 1.230 | 0.189 | 6.840 | |

| Tech | 301 | 0.0199 | 0.00822 | 0.0324 | 2.58 × 10−5 | 0.195 | |

| Control variables | Urb | 301 | 0.605 | 0.594 | 0.126 | 0.239 | 0.896 |

| Gdp | 301 | 12,980 | 9945 | 8607 | 5692 | 49,352 | |

| Open | 301 | 0.258 | 0.143 | 0.260 | 0.00763 | 1.260 | |

| Ind | 301 | 1.440 | 1.270 | 0.792 | 0.665 | 5.690 | |

| Labor | 301 | 21.20 | 20.80 | 5.980 | 8.880 | 43.60 | |

| Ial | 301 | 25.90 | 15.30 | 39.20 | 0.146 | 217 | |

| Gov | 301 | 0.279 | 0.226 | 0.195 | 0.107 | 1.330 |

| Variable | (1) | (2) |

|---|---|---|

| Cbe | Cbe | |

| Dfi | 0.234 *** (7.43) | 0.243 *** (7.41) |

| Urb | −23.103 (−1.13) | |

| Gdp | −0.001 *** (−2.65) | |

| Open | −8.440 * (−1.83) | |

| Ind | 0.975 (0.59) | |

| Labor | −0.263 (−1.41) | |

| Ial | 1.213 *** (6.28) | |

| Gov | 6.965 (0.89) | |

| Constant | −56.604 *** (−6.45) | −64.621 *** (−4.01) |

| Year fixed effect | Yes | Yes |

| Province fixed effect | Yes | Yes |

| N | 300 | 300 |

| R2 | 0.906 | 0.927 |

| Variable | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) |

|---|---|---|---|---|---|---|---|---|

| Replaced Explanatory Variable Depth | Replaced Explanatory Variable Digit | Exclude Year | Excluding Municipalities | Replaced Regression Model FE | Tailing Method | Instrumental Variable Method | System GMM | |

| Cbe | Cbe | Cbe | Cbe | Cbe | Cbe | Cbe | Cbe | |

| L. Ceb | 1.119 *** (45.62) | |||||||

| Dfi | 0.244 *** (6.89) | 0.307 *** (8.71) | 0.243 *** (7.41) | 0.203 *** (8.59) | 0.497 *** (7.97) | 0.003 * (1.87) | ||

| Depth | 0.121 *** (6.36) | |||||||

| Digit | 0.067 *** (5.40) | |||||||

| Control variables | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Constant | −42.232 *** (−2.75) | −29.724 * (−1.97) | −62.037 *** (−3.73) | −32.652 * (−1.90) | −40.549 *** (−3.12) | −62.762 *** (−5.31) | −36.313 *** (−2.60) | 0.137 (0.09) |

| Year fixed effect | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Province fixed effect | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| N | 300 | 300 | 270 | 260 | 301 | 300 | 290 | 271 |

| R2 | 0.923 | 0.920 | 0.923 | 0.941 | 0.645 | 0.954 | 0.915 |

| Variable | (1) | (2) |

|---|---|---|

| NQPF | Cbe | |

| Dfi | 0.001 *** (3.00) | 0.231 *** (6.98) |

| NQPF | 14.642 * (1.83) | |

| Control variables | Yes | Yes |

| NQPF | 14.642 * (1.83) | |

| Constant | −0.145 (−1.15) | −62.494 *** (−3.88) |

| Year fixed effect | Yes | Yes |

| Province fixed effect | Yes | Yes |

| N | 300 | 300 |

| R2 | 0.970 | 0.928 |

| Variable | (1) Ipr | (2) Ici | (3) Tech |

|---|---|---|---|

| Cbe | Cbe | Cbe | |

| Dfi | 0.112 ** (2.59) | 0.162 *** (4.69) | 0.204 *** (6.09) |

| D_I | 0.195 *** (4.02) | ||

| Ipr | −106.817 *** (−5.92) | ||

| D_C | 0.009 *** (2.71) | ||

| Ici | 4.238 ** (2.53) | ||

| D_T | −0.429 *** (−3.72) | ||

| Tech | 256.187 *** (4.52) | ||

| Control variables | Yes | Yes | Yes |

| Constant | −50.643 *** (−3.30) | −43.447 *** (−2.62) | −51.434 *** (−3.17) |

| Year fixed effect | Yes | Yes | Yes |

| Province fixed effect | Yes | Yes | Yes |

| N | 300 | 300 | 300 |

| R2 | 0.937 | 0.938 | 0.932 |

| Variable | (1) | (2) |

|---|---|---|

| Cbe | Cbe | |

| High Emi | Low Emi | |

| Dfi | 0.206 *** (3.16) | 0.002 (0.21) |

| Control variables | Yes | Yes |

| Constant | −83.234 ** (−2.54) | −1.779 (−0.48) |

| Year fixed effect | Yes | Yes |

| Province fixed effect | Yes | Yes |

| N | 166 | 132 |

| R2 | 0.935 | 0.958 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Meng, F.; Xiao, Y. The Impact of Digital Finance on the Development of Cross-Border E-Commerce. J. Theor. Appl. Electron. Commer. Res. 2025, 20, 180. https://doi.org/10.3390/jtaer20030180

Meng F, Xiao Y. The Impact of Digital Finance on the Development of Cross-Border E-Commerce. Journal of Theoretical and Applied Electronic Commerce Research. 2025; 20(3):180. https://doi.org/10.3390/jtaer20030180

Chicago/Turabian StyleMeng, Fanyong, and Yuqing Xiao. 2025. "The Impact of Digital Finance on the Development of Cross-Border E-Commerce" Journal of Theoretical and Applied Electronic Commerce Research 20, no. 3: 180. https://doi.org/10.3390/jtaer20030180

APA StyleMeng, F., & Xiao, Y. (2025). The Impact of Digital Finance on the Development of Cross-Border E-Commerce. Journal of Theoretical and Applied Electronic Commerce Research, 20(3), 180. https://doi.org/10.3390/jtaer20030180