4.1. Pricing Decision

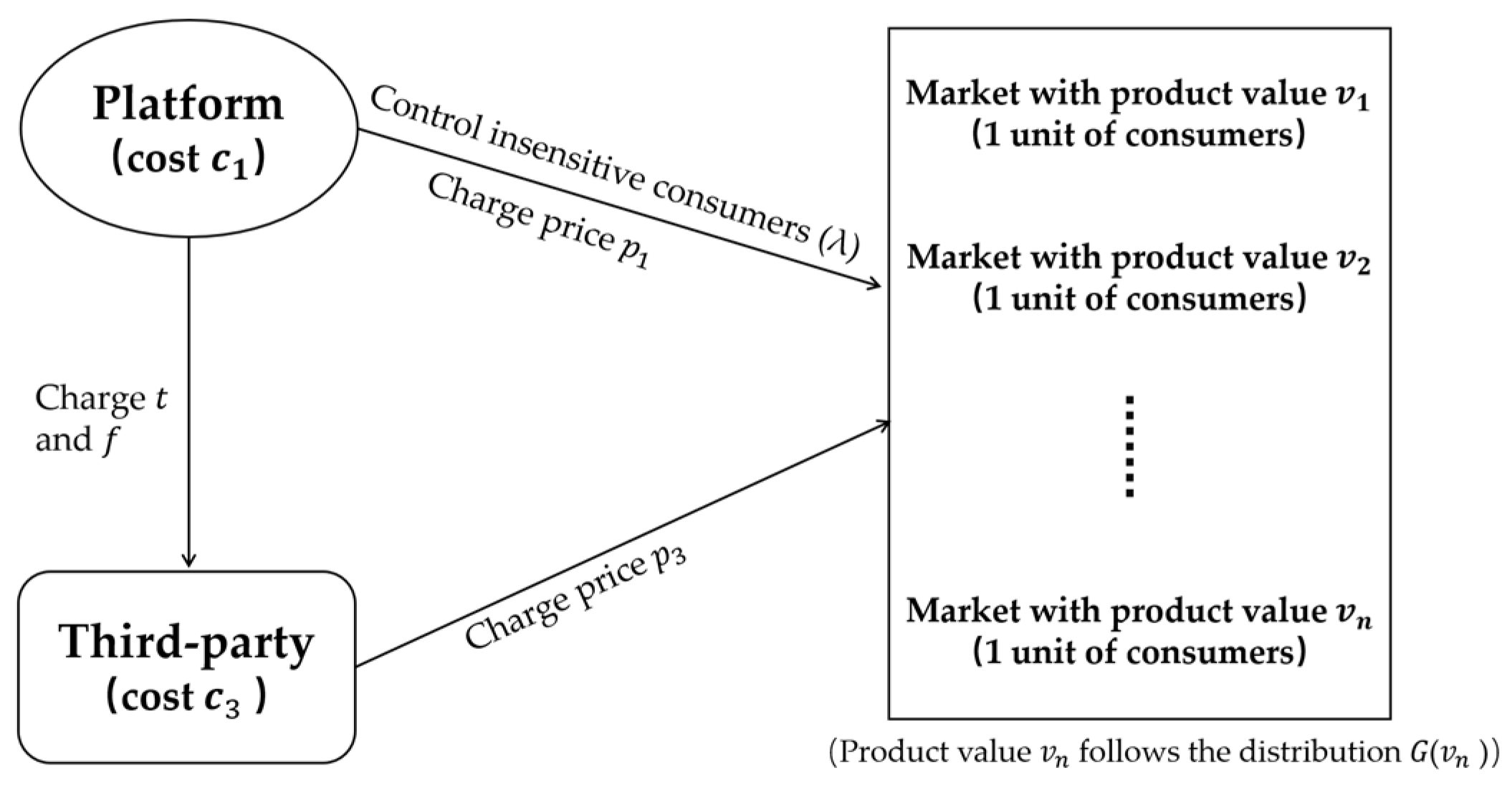

Initially, we explore the pricing strategies for first-party and third-party products in scenarios where the platform faces no entry capability constraints. The product market operated exclusively by the platform’s own merchandise is denoted by (retailer), where the platform monopolizes the market. To maximize profits, the platform sets the price of its first-party product at , resulting in a revenue of for the platform in this product market.

The product market characterized by sales exclusively through third-party sellers is represented by

(market), where only third-party sellers’ products are available. To maximize their profits, third-party sellers set the product price at

. In this context, the profit for a third-party seller is

, while the platform’s revenue is

. For the third-party seller’s profit to be positive (

), the value of the product must satisfy

. These scenarios are summarized in Proposition 1, with all proofs provided in the

Appendix A.

Proposition 1. In a purely first-party scenario, the optimal pricing for first-party products is set at , yielding the platform a profit of . In a scenario exclusive to third-party sellers, the optimal pricing for their products is also , resulting in a profit of for the third-party sellers, and the platform’s profit is .

Comparing the pure first-party model with the pure third-party-seller model across various cost scenarios reveals distinct operational modes for different product value ranges. Detailed market operation modes for these different product values are presented in

Table 1. The analysis yields the following insights: If third-party sellers’ products do not offer a clear cost advantage over the platform’s own products, third-party sellers might encounter significant market competition on the platform. Conversely, if the platform’s own products do not have a cost advantage, the market opportunity for third-party sellers will be determined by the cost advantage of their products, with a greater cost advantage leading to a larger market space. Additionally, the platform might select its operational model based on the profit margin of the product market, opting to operate first-party in markets with higher profit margins and allowing third-party sellers to independently operate in markets with lower profit margins. Taking JD.com and PDD as examples, although JD.com’s first-party products have higher costs, it focuses on selling higher-value items such as home appliances and digital products. In contrast, PDD, an exclusive third-party-seller platform, primarily features lower-value products.

In markets for high-value products, third-party sellers are motivated to enter markets traditionally dominated by pure first-party sales. We use

(hybrid) to describe a market model where third-party sellers and first-party products coexist and compete within the same product market. In this model, the strategic use of platform dominance and pricing strategies becomes a key competitive tactic. The positioning of first-party products relative to third-party sellers necessitates a differentiated discussion, primarily due to the significant variance in strategies and their impacts across different pricing environments. For instance, the price discrepancies between first-party and third-party products on major e-commerce platforms such as Amazon reflect complex strategic considerations. In certain categories such as electronics and high-end cosmetics, first-party product prices may exceed those of third-party sellers, potentially indicating the platform’s higher control standards for product quality or its desire to enhance its brand image through high-priced offerings [

36]. Conversely, in categories such as daily consumer goods, where first-party product prices are lower than those of third-party sellers, the strategy might be aimed at attracting more consumers to increase market share [

5]. Additionally, government regulations on e-commerce platforms profoundly affect their pricing strategies. In some cases, to maintain fair market competition, the government may require that prices of first-party products not exceed those of third-party sellers. The Chinese government has implemented measures to ensure a fair competition environment on e-commerce platforms, influencing the pricing of first-party products [

39]. Therefore, in a hybrid model, analyzing the pricing strategies for first-party products requires considering scenarios where prices either exceed or do not exceed those of third-party sellers. Next, we will discuss the pricing strategies and underlying mechanisms for both first-party and third-party sellers under these two scenarios.

We first consider the scenario where the price of first-party products does not exceed that of third-party products. When the prices of first-party and third-party products are equal, consumers generally prefer purchasing first-party products. If the price of first-party products is lower than that of third-party products (), price-sensitive consumers are inclined to buy first-party products to maximize their utility, presenting the platform with the decision of guiding price-insensitive customers to purchase from either its own offerings or third-party sellers. If the platform directs price-insensitive consumers to its own products, the product market evolves into a purely first-party market, where the platform’s profit is . Since the platform’s profit is directly related to pricing at this juncture, the price of first-party products will align with that of third-party sellers (), maximizing the platform’s profit to . However, if the platform channels price-insensitive users to third-party sellers, a hybrid market model emerges, where a proportion of consumers purchase from third-party sellers, and purchase first-party offerings. The platform’s revenue is then derived from a combination of commission and entry fees from third-party-seller sales, plus the revenue from first-party products, calculated as . This leads to Proposition 2.

Proposition 2. If the price of a platform’s own products is at or below that of third-party products, a threshold exists. Below this threshold, the platform directs price-insensitive consumers to third-party products, creating a hybrid market, and prefers earning through commission and entry fees. Above , it guides these consumers to its own products, potentially excluding third-party sellers and establishing a purely first-party market.

From Proposition 2, it is evident that if the price of first-party products does not exceed that of third-party products, the platform’s ability to direct price-sensitive consumers towards specific sellers imposes a constraint on the pricing of third-party-seller products. This phenomenon is based on the fact that the price equilibrium between first-party and third-party products influences consumer purchasing decisions, and the platform can restrict the pricing of third-party products by managing price-insensitive consumers, thereby optimizing its revenue structure. Such pricing control by the platform over third-party sellers benefits consumers in high-value-product markets. Another interesting observation is that under these conditions, the optimal pricing for third-party sellers on the platform depends solely on the cost of first-party products, the commission rate, and the entry fee, and is independent of the cost of third-party products. This indicates that while enforcing a policy where the price of first-party products cannot exceed that of third-party products may lead the platform to direct some traffic to third-party sellers, creating a hybrid market, the platform retains control over the pricing of third-party products, maintaining a position of advantage over third-party sellers on the platform.

Table 2 examines market models and optimal pricing under various cost structures when first-party-product pricing cannot exceed that of third-party products. Analysis of

Table 2 indicates that such pricing restrictions on first-party products alter the guidance strategy for price-insensitive consumers in high-value markets, thereby reducing platform revenue in these areas. If first-party pricing must remain below third-party prices, the platform tends towards exclusively selling its own products in high-value markets. However, third-party sellers, motivated by a cost advantage, may enter these markets, leading to a hybrid market model. Specifically, third-party sellers can survive in low-value markets only if the platform cannot achieve cost optimization. If third-party products fail to offer a cost advantage over first-party products, the platform might use its competitive strength to exclude third-party sellers by optimizing its resource allocation, highlighting the importance for third-party sellers to continually enhance their cost structure and efficiency for survival on the platform.

The pricing strategies of third-party sellers in high-value markets are limited by the platform, indicating that focusing on lower-value markets is a prudent choice for their market positioning. This phenomenon also indirectly exposes the imbalances in market competition, presenting challenges to market fairness. For instance, third-party sellers on platforms such as JD.com, who can secure cost advantages through economies of scale and process optimization, can capture larger market shares in competitive niches. E-commerce platforms such as Amazon or JD.com, with logistical and storage advantages, prefer entering markets dominated by third-party products to amplify their market presence. Yet, even without cost advantages, these platforms can maintain stable revenue streams by imposing commission and fees on third-party sellers, such as Amazon’s FBA service, ensuring continuous operation and business stability.

If the pricing of first-party products exceeds that of third-party products (), price-sensitive consumers will opt for third-party products. In scenarios where the platform allocates price-insensitive customers to its own products, a hybrid market model emerges. The platform’s revenue then comprises sales income from its own products and commission and entry fees from third-party sellers, expressed as . Since is directly proportional to , the platform’s maximum revenue is . When the platform directs a proportion of users to third-party sellers, first-party products do not sell, leading to a market exclusively for third-party sellers, with the platform’s revenue being .

Proposition 3. Assuming

, if first-party product pricing is higher than third-party product pricing and , the optimal pricing for third-party sellers is , with a profit of . The platform guides price-insensitive consumers to purchase first-party products, creating a hybrid market model. The optimal pricing for first-party products is , yielding a profit of ; when , the optimal pricing for third-party products is , with a profit of . The platform directs price-insensitive consumers to third-party products, establishing an exclusively third-party market model, with the platform’s profit being .

Proposition 3 identifies a threshold where the platform’s revenue in a hybrid market model equals that in an exclusively third-party-seller market. When third-party product pricing exceeds this threshold, the platform prefers maintaining an exclusively third-party-seller operational model. Conversely, if third-party product pricing falls below this threshold, the platform adopts a high-price strategy for its first-party products targeted at price-insensitive consumers, while price-sensitive consumers gravitate towards third-party sellers, allowing the platform to earn commission and entry fees from this market segment. Thus, with higher-priced first-party products, adjusting the strategy to direct price-insensitive consumers can effectively mitigate competitive pressure from third-party sellers. For third-party sellers, in markets with smaller profit margins, they capture the entire consumer surplus, whereas in markets with larger profit margins, third-party sellers may reduce product prices to gain more market share, resulting in a positive consumer surplus. In a hybrid model, third-party-seller pricing positively correlates with product value, contrasting with Proposition 2, which emphasizes the fixed nature of third-party-seller pricing in a hybrid market.

Table 3 presents the optimal pricing and market operation modes for both the platform and third-party sellers when

. The analysis of market models and optimal pricing under various cost conditions indicates that third-party sellers can coexist with first-party products in high-value markets, even in the absence of a cost advantage. This coexistence is facilitated by price-sensitive consumers opting for the more affordably priced third-party products. It is observed that the platform adjusts its strategy for directing price-insensitive consumers based on the price differential between its own and third-party products. If first-party product pricing is at or below third-party product pricing, the platform directs price-insensitive consumers to its own products when third-party pricing is higher; conversely, it guides them towards third-party products when their pricing is lower. However, when first-party product pricing is above that of third-party products, and if third-party pricing is relatively higher, the platform will direct price-insensitive consumers to third-party products; otherwise, it will lead them to its own products. Moreover, when first-party product pricing is above that of third-party products and third-party sellers have a cost advantage, the market space for an exclusively third-party-seller model is broader compared to when first-party product pricing is not above third-party product pricing.

Analyzing the pricing of first-party products and third-party-seller products reveals that the price of first-party products () either matches that of third-party products () or reaches the maximum value (). When the platform has a cost advantage and , it allocates price-insensitive consumers to its own products, resulting in a purely first-party market model with the platform’s profit being . If the price of first-party products can exceed that of third-party products, the platform also directs price-insensitive consumers to its own products, leading to a hybrid market model. The platform’s profit in this scenario is . Comparing the platform’s revenue across these scenarios leads to Proposition 4.

Proposition 4. When the platform has a cost advantage, it directs price-insensitive consumers to purchase first-party products. If third-party-seller pricing () exceeds a specific threshold (), the platform opts to sell its own products in that market, setting the optimal price for first-party products at with profits of . If , the platform chooses to create a hybrid market model, where the optimal price for first-party products is , resulting in platform profits of . The optimal pricing for third-party sellers is , yielding profits of , where .

Proposition 4 explores the strategies employed by a platform with a cost advantage to direct price-insensitive consumers, as well as the pricing strategies for first-party and third-party products across different market models. According to Proposition 4, the platform always prefers guiding price-insensitive consumers to its first-party products when it has a cost advantage, regardless of third-party product pricing. When third-party products are priced higher, the platform’s pricing strategy for its own products aligns with that of third-party products. Under such pricing parity, consumers typically favor first-party products, leading to a hybrid market model, even if third-party products might not achieve sales. As third-party product pricing decreases to the threshold , first-party product pricing shifts to , attracting price-sensitive consumers towards third-party products, from which the platform earns commission and entry fees. This pricing strategy shift highlights the platform’s ability to flexibly adjust its pricing strategies based on market conditions to balance its interests with consumer demands and mitigate competition between first-party and third-party sellers.

In scenarios where the platform lacks a cost advantage, the market for high-quality products becomes a hybrid model. The platform must decide whether its first-party product pricing matches or exceeds third-party product pricing. Without a cost advantage, if , the platform directs price-insensitive consumers to third-party products, with its profit being . If , the platform assigns price-insensitive consumers to its own products, with its profit being . Comparing the platform’s revenue across these scenarios leads to Proposition 5.

Proposition 5. If first-party products lack a cost advantage yet still enter the market, their price is invariably set at . When , the platform steers price-insensitive consumers towards these third-party offerings. The optimal pricing for third-party products is set at , leading to a profit of , while the profit for first-party products is calculated as . When , the platform influences price-insensitive consumers to purchase its own products. Under these conditions, the optimal pricing for third-party products is , with their resulting profit being , and the platform’s profit is . Here, .

Proposition 5 examines the strategies a platform without a cost advantage uses to direct price-insensitive consumers upon entering the market, alongside the pricing strategies for both first-party and third-party products in a hybrid model. Analyzing the profits of third-party sellers under the two scenarios described in Proposition 5 reveals that the proportion of price-insensitive consumers on the platform plays a crucial role in shaping third-party sellers’ pricing decisions, leading to Corollary 1.

Corollary 1. If first-party products enter the market without a cost advantage, the optimal pricing strategy for third-party products is set at when ; for cases where , the optimal pricing for third-party sellers shifts to .

Corollary 1 suggests that an increase in the proportion of price-insensitive consumers leads to higher prices for third-party products. Specifically, as the platform’s influence on consumers increases, it benefits third-party product pricing and can alleviate competition between first-party and third-party products in a hybrid model. This is because an increase in the proportion of price-insensitive consumers on the platform often results in strategies that guide these consumers towards purchasing from third-party sellers. In setting their prices, third-party sellers are more inclined to opt for higher pricing, positively impacting both their own and the platform’s profits.

Table 4 presents the optimal pricing and market operation modes for the platform and third-party sellers, revealing that an increased cost advantage of first-party products leads to a greater market share in exclusive markets. However, the platform opts to leave a portion of the lower-value-product markets to third-party sellers, forming an exclusive third-party-seller model, only when third-party sellers have a significant cost advantage, specifically when

. Conversely, in most scenarios, regardless of whether first-party products have a cost advantage, the platform chooses to enter, resulting in either an exclusive first-party model or a hybrid market model. When first-party products have a cost advantage, the presence of third-party products limits the pricing of first-party products within the low-value product range

. When the platform lacks a cost advantage, its first-party product pricing remains unaffected by the entry of third-party sellers. This is due to the platform’s ability to guide price-insensitive consumers and its power to charge commission and entry fees from third-party sellers, allowing it to optimize its revenue structure under various scenarios. Taking JD.com as an example, its premium logistics services lead to higher costs for its first-party products, typically resulting in pricing above that of third-party products. Currently, JD.com opts to enter only high-value markets, leaving lower-value markets to third-party sellers. However, JD.com’s recent announcement of expanding into all product categories indicates the platform’s desire to enter more product spaces.

4.2. Market Entry Strategy

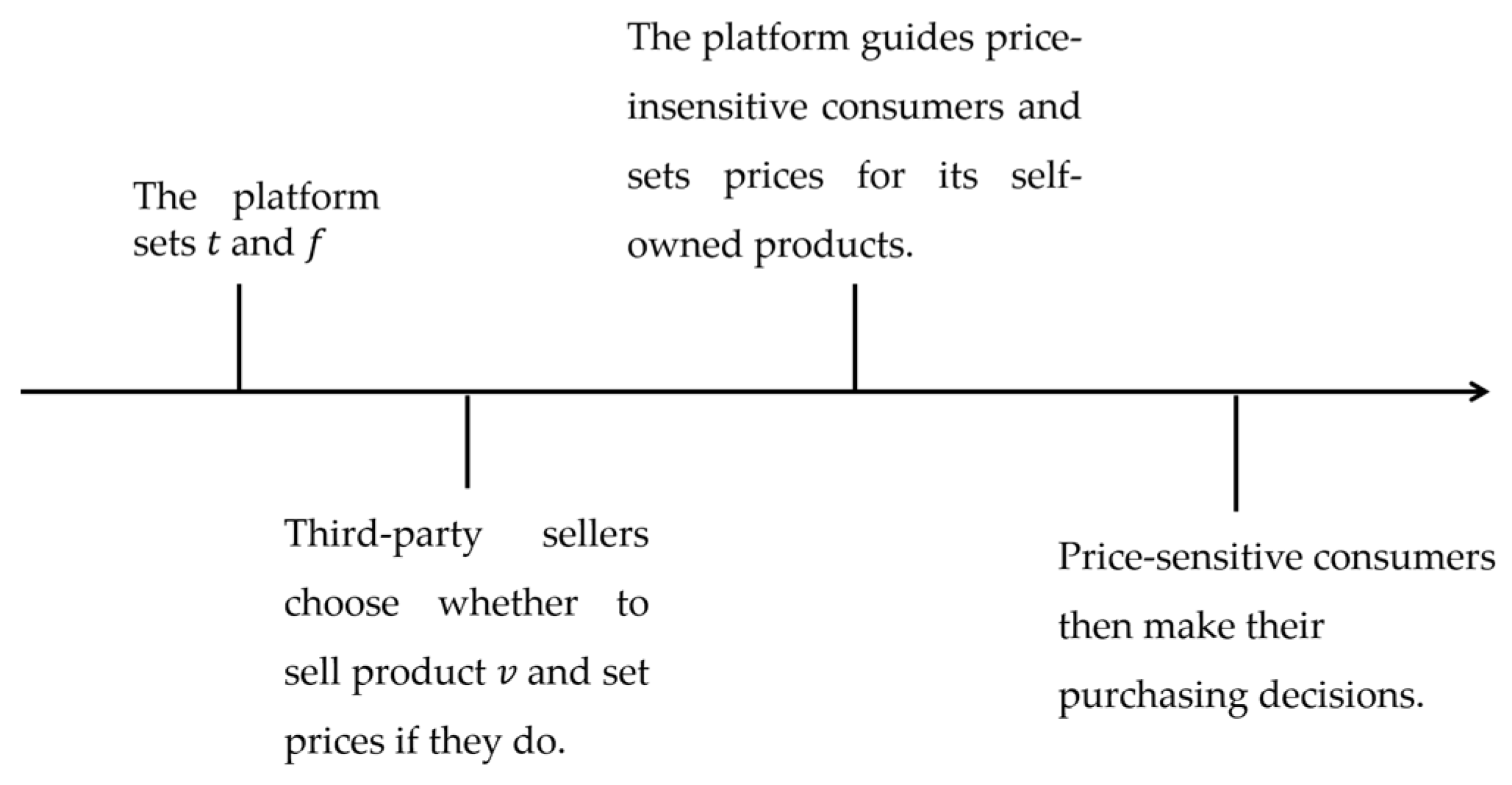

Our previous analysis discussed the operational modes of first-party products in various cost scenarios without entry capability restrictions. However, in reality, first-party products cannot cover all types of products in the market. This section delves into the entry strategies of the platform and third-party sellers under limited first-party entry capabilities and their implications.

Assuming all product markets initially operate under an exclusive third-party model, where only third-party sellers participate in sales, in this model, third-party sellers enter a product market only if it is profitable (), i.e., they enter an exclusive third-party market only when the product value meets or exceeds a threshold value . Once first-party products enter a market, it transitions to a hybrid model. Similarly, third-party sellers will continue selling in a hybrid market only if their profits satisfy .

Corollary 2. Third-party sellers choose to enter the market when the product value satisfies .

Corollary 2 indicates that the platform’s product scale is influenced by the commission rate and entry fee. Specifically, the platform’s product space is maximized when no commission or entry fee is charged (). Conversely, higher commission rates or entry fees may constrict market space, potentially leaving no products for sale on the platform. High commission or entry fees raise the entry barrier for third-party sellers, dampening their enthusiasm to participate. Notably, the threshold product value for third-party market entry is unaffected by platform entry. As decreases, the variety of products offered by third-party sellers in the market increases, leading to an expansion in product market scale.

The platform can earn revenue by charging active third-party sellers commission and entry fees, but the entry of first-party products encroaches upon the market demand for original third-party products. Before entering the market, the platform must compare two types of income: direct sales revenue from first-party products and the reduced commission and entry fee income from third-party sellers due to the entry of first-party products. The boundary condition for first-party-product market entry can be derived as .

Corollary 3. Given the capability to enter, the platform will only venture into third-party sellers’ product markets when .

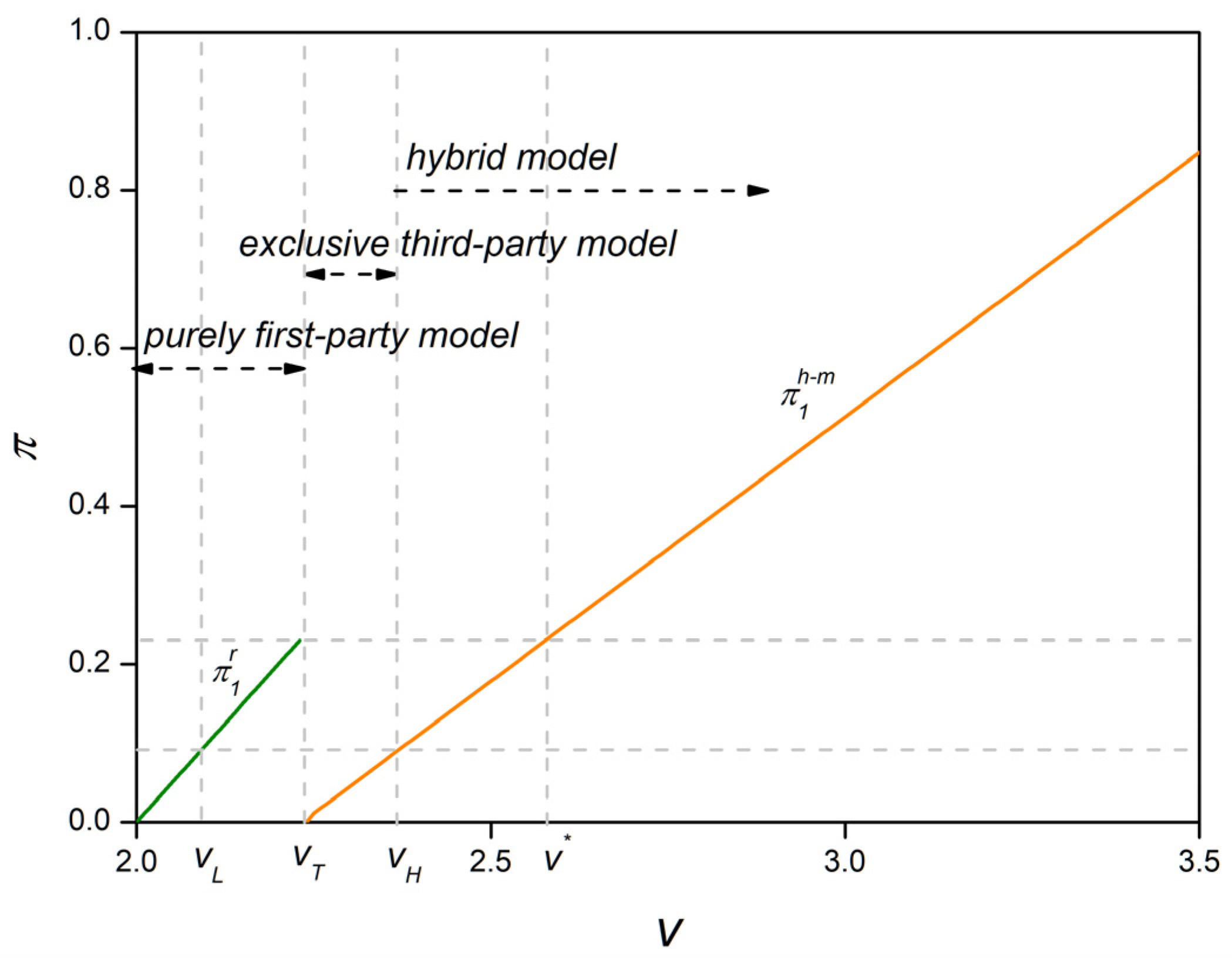

Assuming no cost difference between first-party and third-party products and more than half of the consumers are price-insensitive , with unrestricted entry capability for first-party products, the market operates under a pure first-party model in the range and shifts to a hybrid model for . In the hybrid model, the marginal profit for first-party products entering the market is , where . It is observed that always holds, indicating that the higher the product value (and thus the larger the profit margin), the more incentivized the platform is to enter the product market. The motivation for platform entry diminishes as and increase, suggesting that when the platform can obtain higher commission and entry fees from third-party sellers, it lacks the incentive to enter the product market. Since and , indicating higher product values yield greater platform profits, the platform prioritizes its limited entry capability towards markets with higher product values. There exists a critical point such that .

Corollary 4. With limited entry capability, the platform prioritizes high-value-product markets (). Only when surplus entry capability exists does it consider entering markets with .

Defining the critical entry capability as

, when the platform’s entry capability

, it aims for maximum profit by allocating all available entry capability to high-value markets (

). The lowest-value market the platform enters is determined by

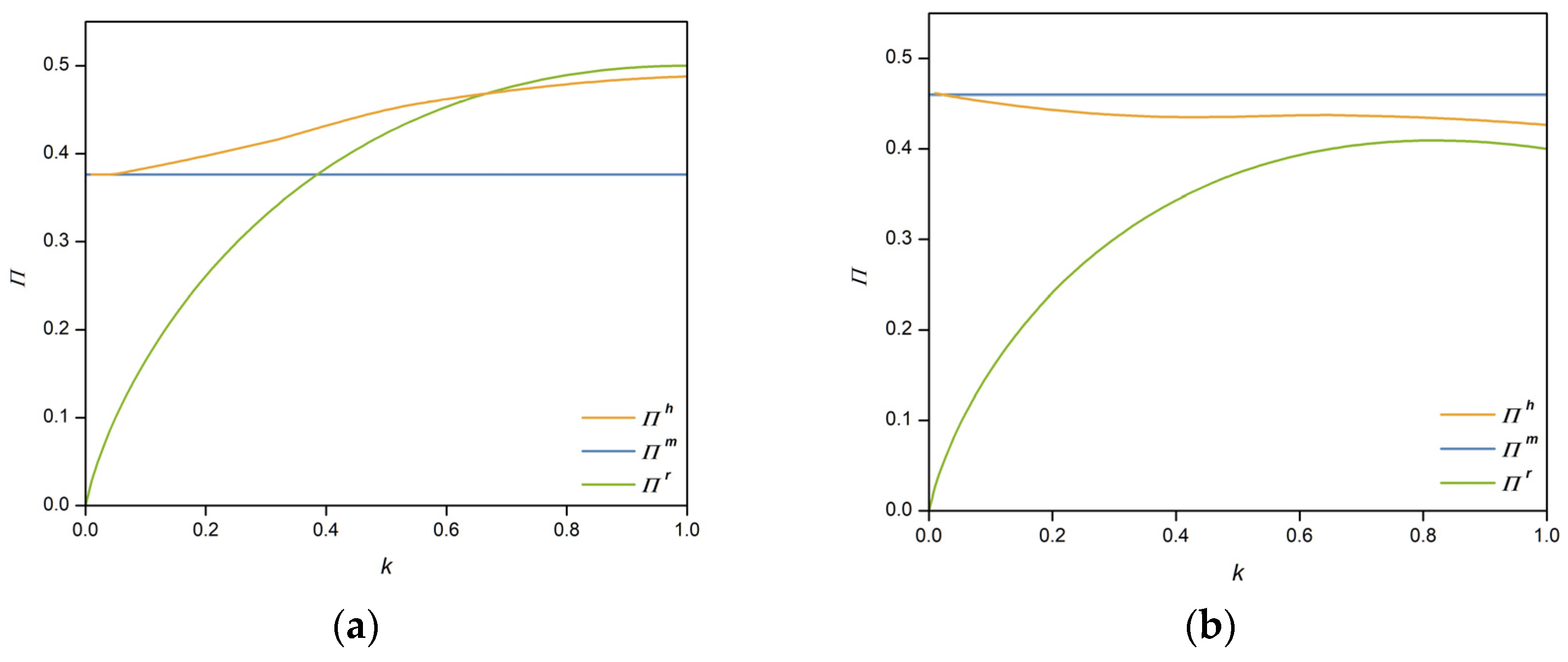

. As shown in

Figure 3, when platform entry capability

, not only can the platform enter high-value markets, but it also has the excess capability to enter lower-value markets. The platform then faces the decision of entering hybrid model markets within

or exclusively first-party markets with

. Defining

and

such that

equates the marginal profits from entering a purely first-party market at

and the marginal profits from entering a hybrid market at

, assuming a product value distribution

, where

is the cost (ignoring cost differences between first-party and third-party products) and

. The rationale for utilizing this exponential distribution is that it not only captures the entire spectrum of heterogeneous product spaces but also ensures that a small fraction of high-value products generate the majority of sales revenue. This aligns with real-world observations and adheres to the 80/20 rule (the Pareto principle). Combining

with

yields:

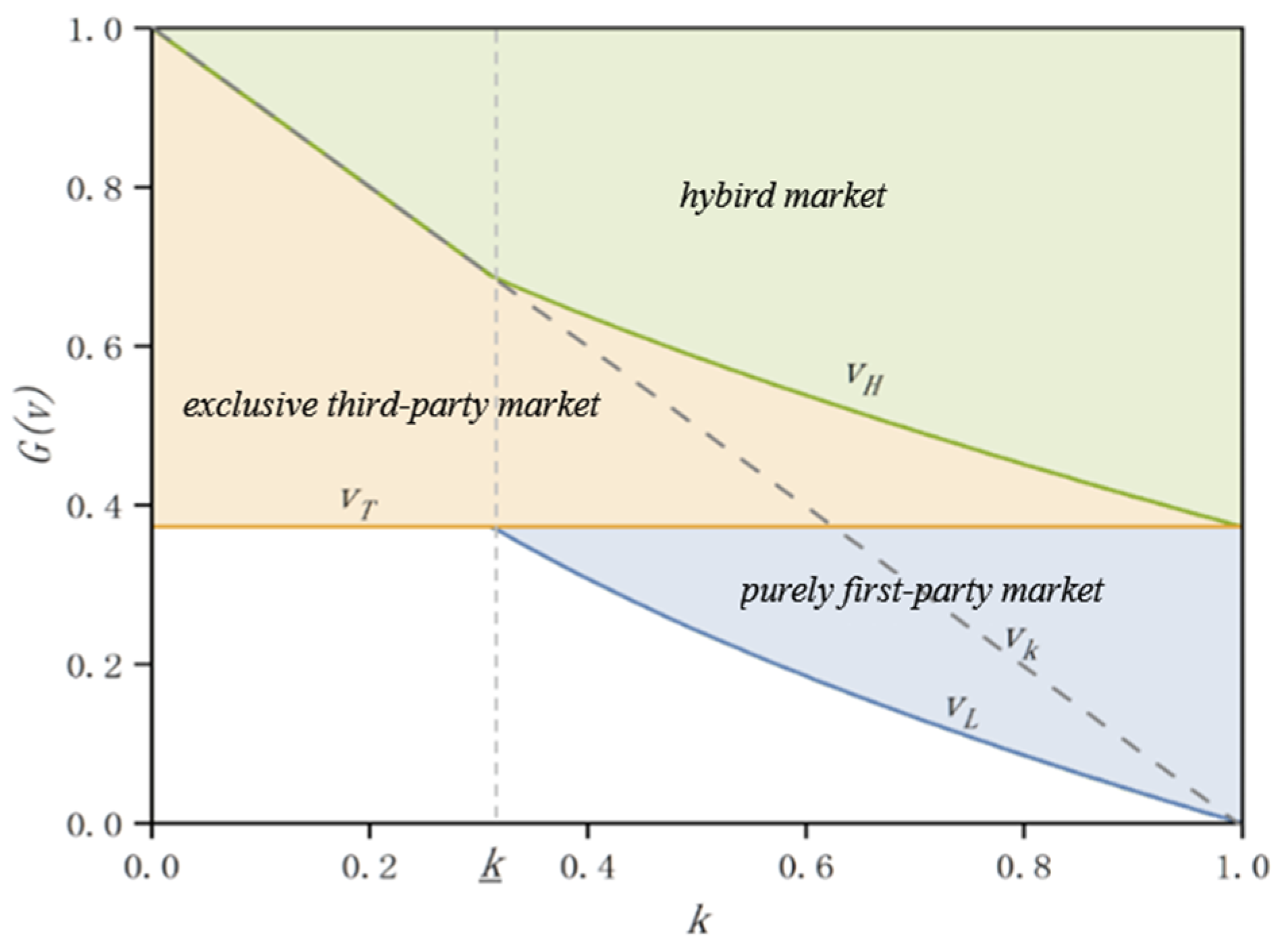

Proposition 6. Under varying levels of entry capability, the platform’s market dynamics are as follows:

Scenario I: When the platform has limited entry capability (), markets within the range

operate under an exclusive third-party-seller model, and markets in the range adopt a hybrid model.

Scenario II: With moderate entry capability

, markets in the range

are purely first-party, those within

are exclusively third-party, and markets extending from

function as hybrid models.

Scenario III: When the platform’s entry capability is unrestricted (), markets ranging from

are purely first-party, while those in the range

transition to a hybrid model.

Figure 4 illustrates the operational modes of product markets under different levels of entry capability. In an extremely limited entry capability scenario (

), the market exhibits characteristics of Scenario I, where the platform prioritizes entry into higher-value markets, leaving the long-tail markets to third-party sellers. As the platform’s entry capability increases, the proportion of markets operating exclusively under third-party sellers decreases, while the share of hybrid model markets gradually increases. In Scenario II, with moderate entry capability (

), the platform competes in high-value-product markets with third-party sellers and ventures into markets not yet reached by third-party sellers for direct sales. The composition of the platform’s revenue shifts towards a higher proportion from direct sales of first-party products, with a relative decrease in commission and fees from third-party sellers. Scenario III reflects the market mode when the platform has unrestricted entry capability, entering all markets occupied by third-party sellers and those not reached by them, transforming all exclusive third-party-seller markets into hybrid model markets.

From this analysis, it is clear that the platform’s operational strategy is closely linked to its entry capability. When choosing which product categories and models to enter, the platform must weigh its entry capability. Research by Zhu and Liu [

5] shows that Amazon continuously enters product spaces dominated by third-party sellers, with the products entered by Amazon having excellent customer reviews and high sales volumes. This aligns with our study’s findings on the platform’s entry strategy for high-value-product markets. Moreover, the platform’s entry reduces the proportion of markets operating under an exclusive third-party-seller model, intensifying competition between the platform and third-party sellers. A greater entry capability allows the platform to venture into markets not covered by third-party sellers, expanding its product assortment. The choice of operational mode under limited entry capability, as discussed in this study, adds to the understanding of long-tail theory by examining the drivers behind retailers introducing lower-value products, complementing research by Bar-Isaac et al. [

40], Yang [

41], and Hervas-Drane [

42].

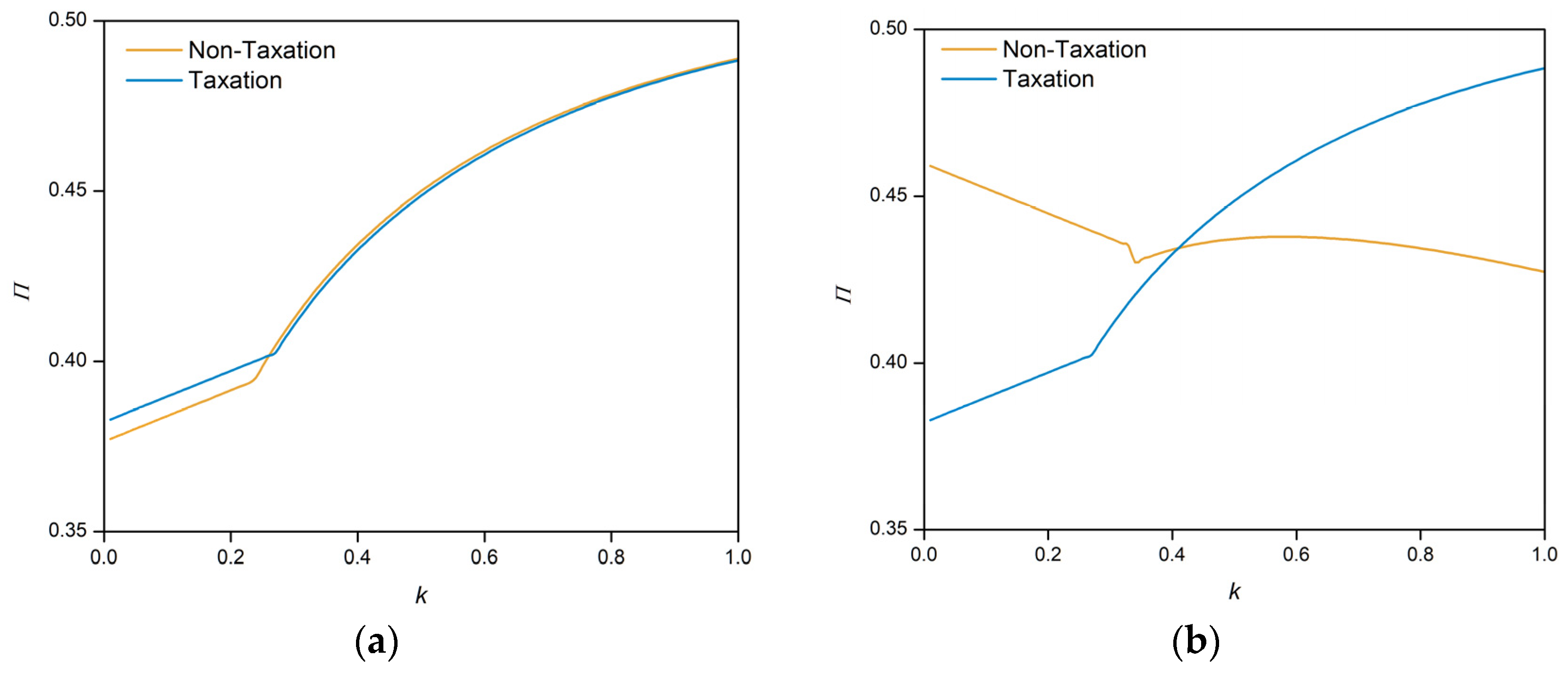

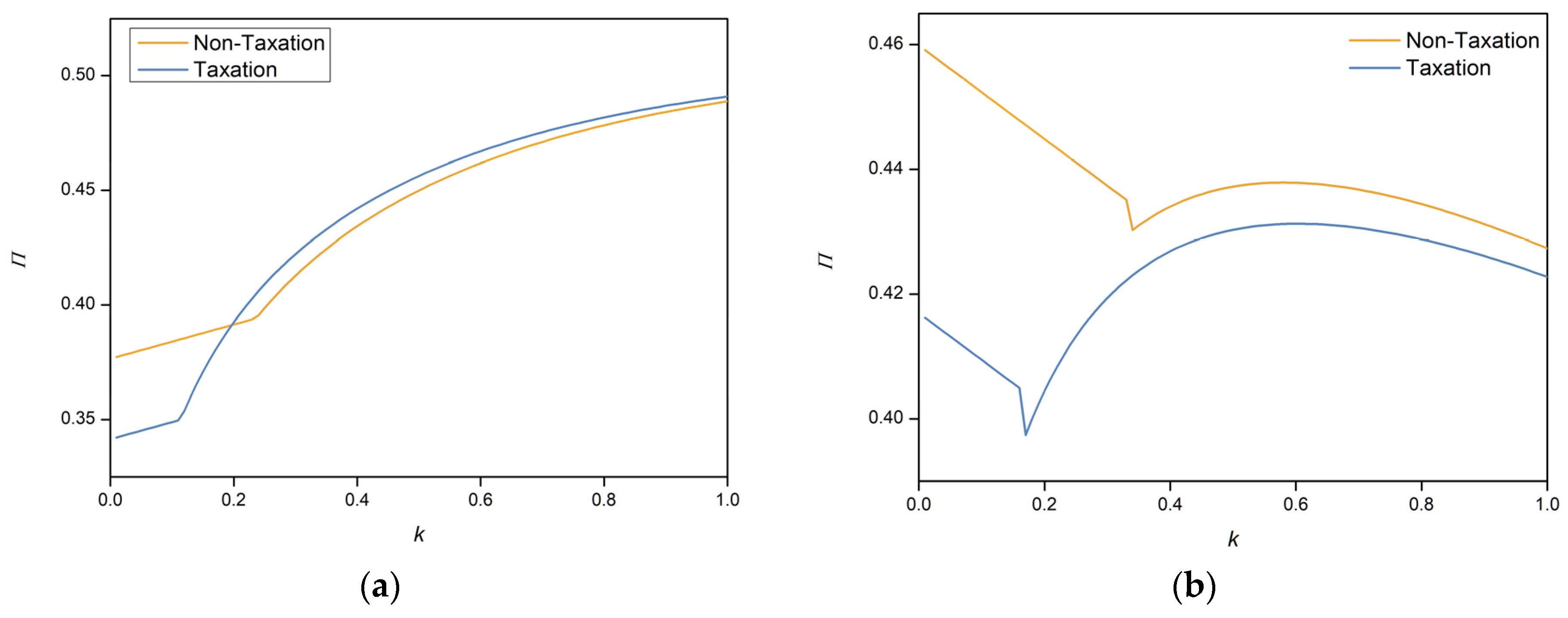

4.3. Fee Structure Adjustment Strategy

The preceding analysis underscores the significant impact of the commission and entry fees the platform charges third-party sellers. This section focuses on the platform’s strategy for adjusting the commission rate () and entry fee () under various cost scenarios. Assuming the platform’s optimal commission rate and entry fee are , a decrease in the entry fee by results in a new entry fee . There exists a pair such that the threshold value , keeping the third-party seller’s entry strategy unchanged. It follows that , implying . The platform’s shift from ( to indicates a reduction in the entry fee charged to third-party sellers and an increase in the commission rate on their sales revenue. This change in the platform’s fee structure affects its revenue in exclusively third-party and hybrid model markets ( and ) but not in purely first-party markets ().

In exclusively third-party markets, the platform’s revenue change from to is . Given , it follows that always holds, meaning reducing the entry fee () and increasing the commission rate () on third-party sales enhances the platform’s revenue in exclusively third-party markets.

After the platform changes its fee structure from to , the revenue change in the hybrid market model is given by . Setting allows for the derivation of . When the platform has a cost advantage , reducing the entry fee () and increasing the commission rate () on third-party sales results in a decrease in platform revenue within the range ; however, the platform’s revenue increases in the range . If the platform does not have a cost advantage , then the platform’s revenue increases across the range .

Proposition 7. In exclusively third-party-seller markets, the platform charges a commission rate but no entry fee. In hybrid markets, if first-party products lack a cost advantage, the platform does not charge third-party sellers an entry fee; if first-party products have a cost advantage, the platform charges an entry fee in low-value hybrid markets but only charges a commission in other product ranges.

Proposition 7 indicates that, in most cases, a commission system based on third-party sales revenue is more efficient than charging entry fees, leading platforms to reduce or even eliminate entry fees for third-party sellers. This is because platforms can achieve significant revenue from high-value goods markets by extracting a commission on sales revenue. However, in markets with relatively low product values, especially where the platform has a significant cost advantage, platforms prefer charging entry fees to third-party sellers to enhance revenue due to the lower profit margins of such products. According to Alibaba’s 2021 platform operation environment report [

43], Alibaba is working to simplify the merchant entry process and reduce entry costs to improve business efficiency, aligning significantly with our research findings.