This section analyzes the model results through numerical experiments. The supplier is a company with a dominant market position in the apparel category, and the retailer adopts a reservation sales system in facing the consumers, thus acquiring the product market demand by determining the pre-sale quantity. Because the clothing product is updated frequently and has a short sales season, and frequently requires only one purchase during a single sales season, the retailer’s choice is a one-time, single-cycle choice. With an effectively forecasted sales volume, neither side must bear the risk of inventory and out-of-stock risk.

5.1. Parameter Settings and Numerical Results

By referring to the assignment of the relevant literature [

12,

59], the following relevant parameters are set: the unit production cost of the supplier

(

$) and the sensitivity coefficient of product demand to the retail price

. Since the demand is assumed to be in the form of a normal distribution,

is set. The range of the random variable market demand is

and the mean value of demand is

. Assume that the supplier has complete knowledge of the retailer’s personality traits. Based on the parameter settings of the above model, the satisfaction function (2) of the retailer is obtained as

The relative likelihood function of the potential market demand is given by

According to

Section 3, the reaction function

and the positive focus of potential demand

of the retailer under the positive evaluation system are first determined. At different levels of optimism and self-confidence, Theorem 3 shows that the optimal reaction function, as well as the positive demand focus, will be different. The solution yields the following classification of the optimal retail price in the face of different ranges of wholesale prices as follows:

(2) When

and

,

(3) When

,

The two thresholds for are and . According to the range of , we can obtain and . Additionally, the three thresholds for is , and . Furthermore, .

The retailer’s positive demand focus and optimal retail price are subject to changes in their own optimism and confidence level. It is necessary to reasonably set the values of and , and then calculate the optimal wholesale price , the optimal retail price , the supplier’s payoff , the retailer’s satisfaction level , and the relative likelihood . The equilibrium solutions with different and values are presented in tables to visualize the effect of retailer’s optimism and confidence level on the equilibrium results.

5.2. Results Analysis

The data in

Table 2,

Table 3,

Table 4,

Table 5,

Table 6 and

Table 7 present the effects of different levels of optimism

and confidence level

of retailers on the final decision. The analysis of the results can be obtained for two specific aspects:

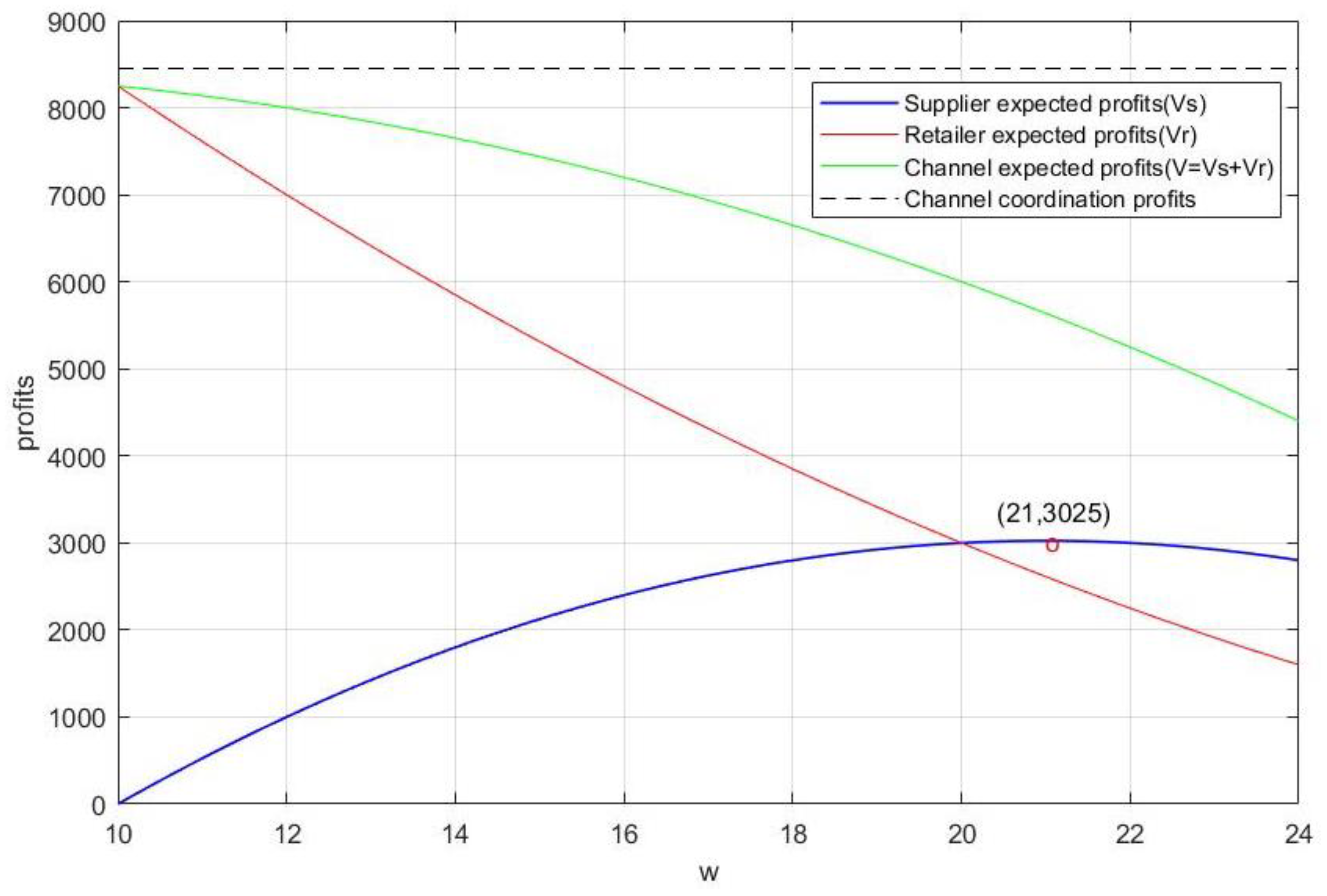

(1) Under the positive evaluation system, for a supplier, the retailer’s optimism level and confidence level have a more intuitive effect on the supplier’s wholesale price decision and payoff. The supplier’s decision is based on the premise that the information about the retailer’s personality characteristics is better known. When the retailer has a high level of optimism and confidence, i.e., a low value () and a low value (), the supplier will choose the optimal wholesale price of 21, while the retailer will choose the optimal retail price of 30.5. This result will be maintained in the range of . As the retailer’s confidence level decreases, i.e., when increases to a larger range (), the wholesale price chosen by the supplier will plummet, followed by an increasing and then decreasing trend. After the retailer’s optimism level decreases, i.e., after the value becomes larger (), the optimal wholesale price chosen by the supplier slowly increases and the expected payoff slowly increases as the retailer’s confidence level gradually decreases () for and the value is determined. Overall, the larger the , the higher the supplier’s payoff will be for a fixed value of .

(2) There is also a significant trend in the effect of the retailer’s optimism level and confidence level on his or her satisfaction level and positive demand focus. When the retailer has high levels of optimism and confidence (), the retailer’s satisfaction level is close to 1 and focuses on the market potential demand with low probability. When there is a significant decrease in the level of confidence (), the retailer’s satisfaction level decreases rapidly, and the focus on the market demand is infinitely close to 1. The retailer will pay more attention to the occurrence of potential demand in the market with a higher probability. After the level of the retailer’s optimism decreases to a certain level, as the increases (), the level of the retailer’s satisfaction decreases as the retailer’s confidence level decreases gradually () and the concerned demand increases close to 1. Overall, the lower the value, the higher the satisfaction level of the retailer, and the lower the probability of occurrence of the concerned potential demand in the market. The lower has the same trend of change.

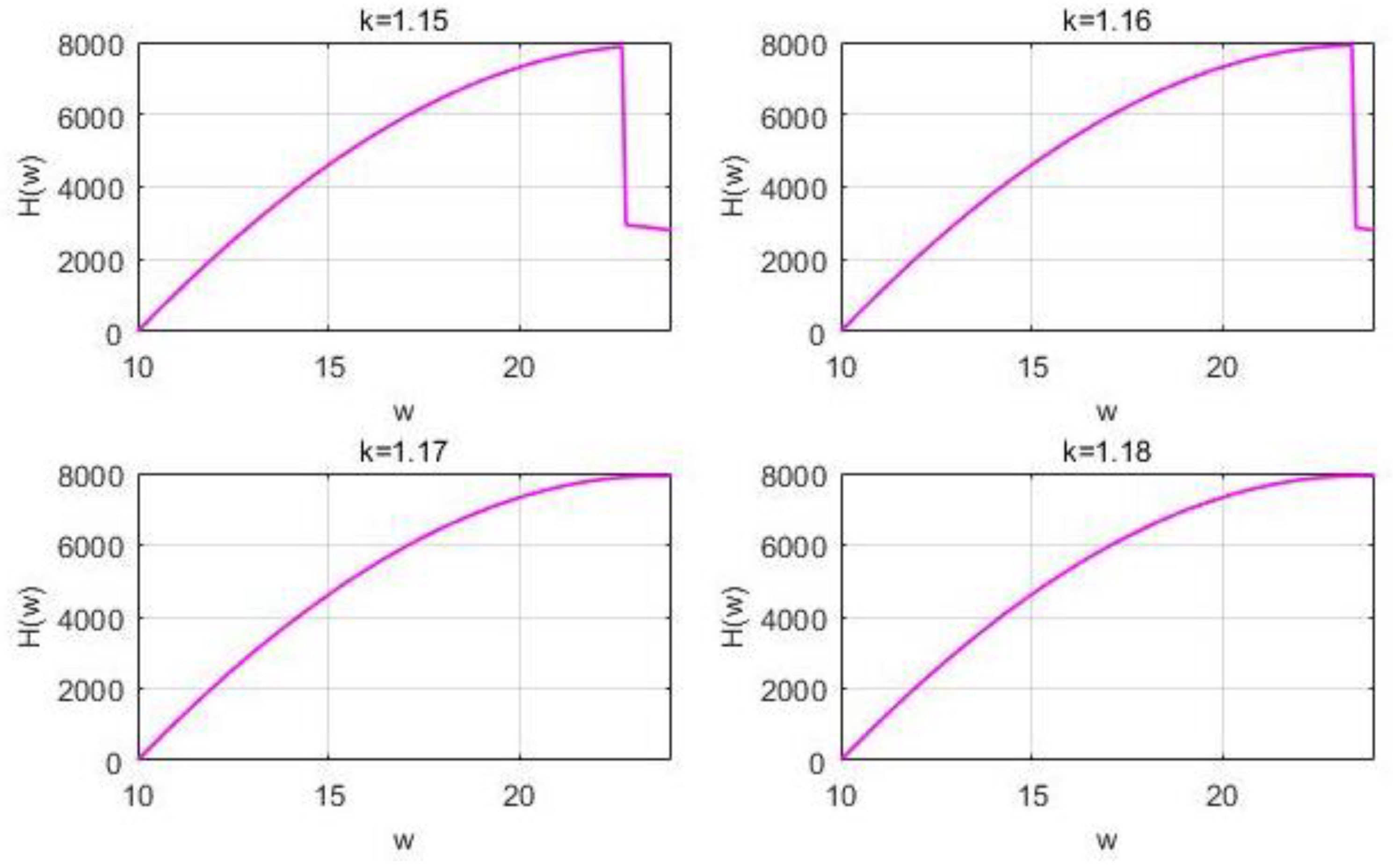

The table data can observe changes under different personality traits to a certain extent. However, there are still some shortcomings in the amount of data, resulting in a less intuitive presentation of specific trend variations. The cases of are divided into three ranges. The table data determine that belongs to Theorem 3(i), and belongs to Theorem 3(iii). The conclusions are more complex since in the range spans the presence of Theorem 3(i) and 3(ii). The following images of the supplier’s payoff function show more clearly the trend variation under the different and .

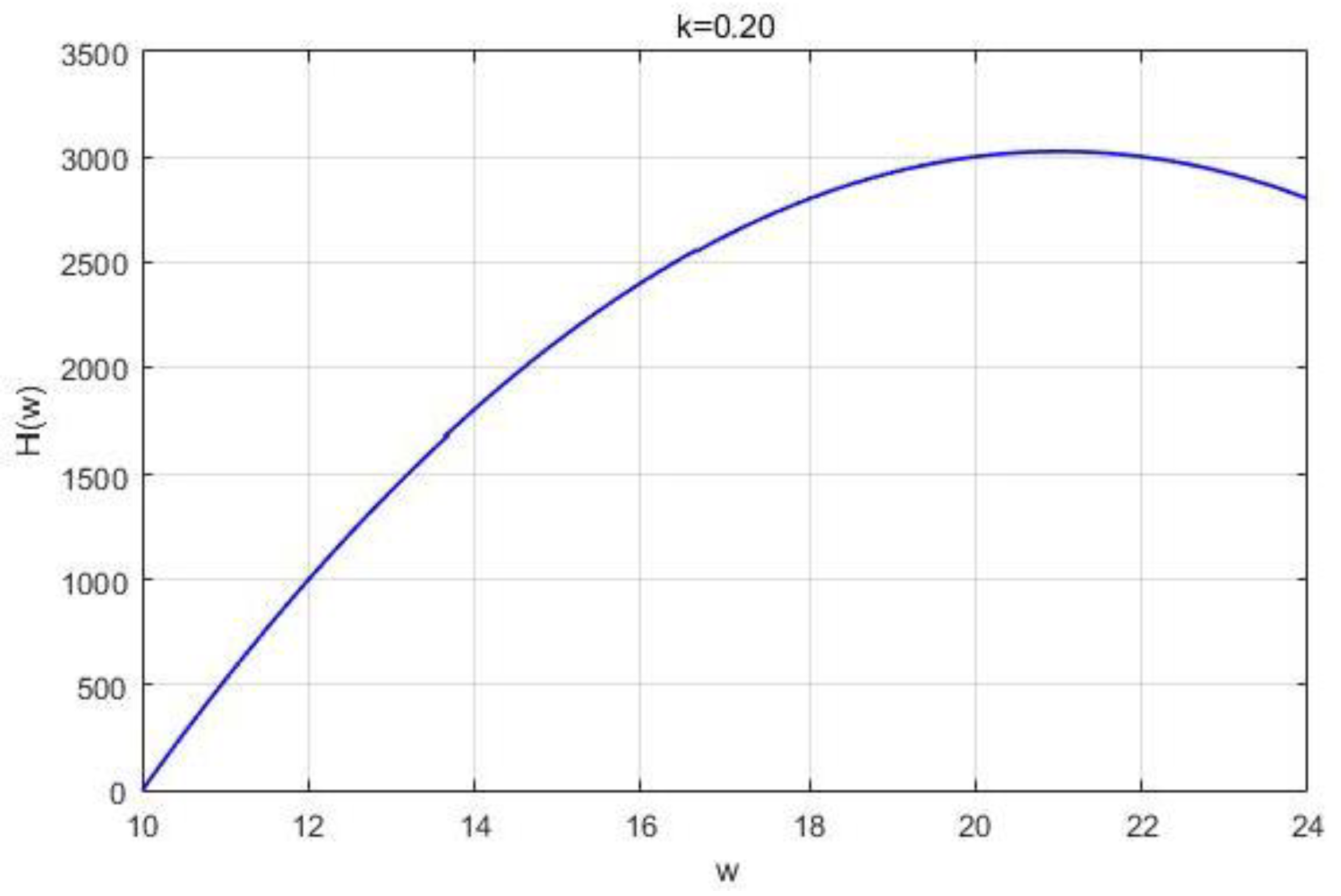

Firstly, in the range of

, taking

as an exemplar can indicate a certain regular variation. As shown in

Figure 2, the supplier believes that the retailer will choose the retail price

, when the wholesale price and the optimal retail price will remain constant within a smaller range of

. In

Figure 3, there is a bound of

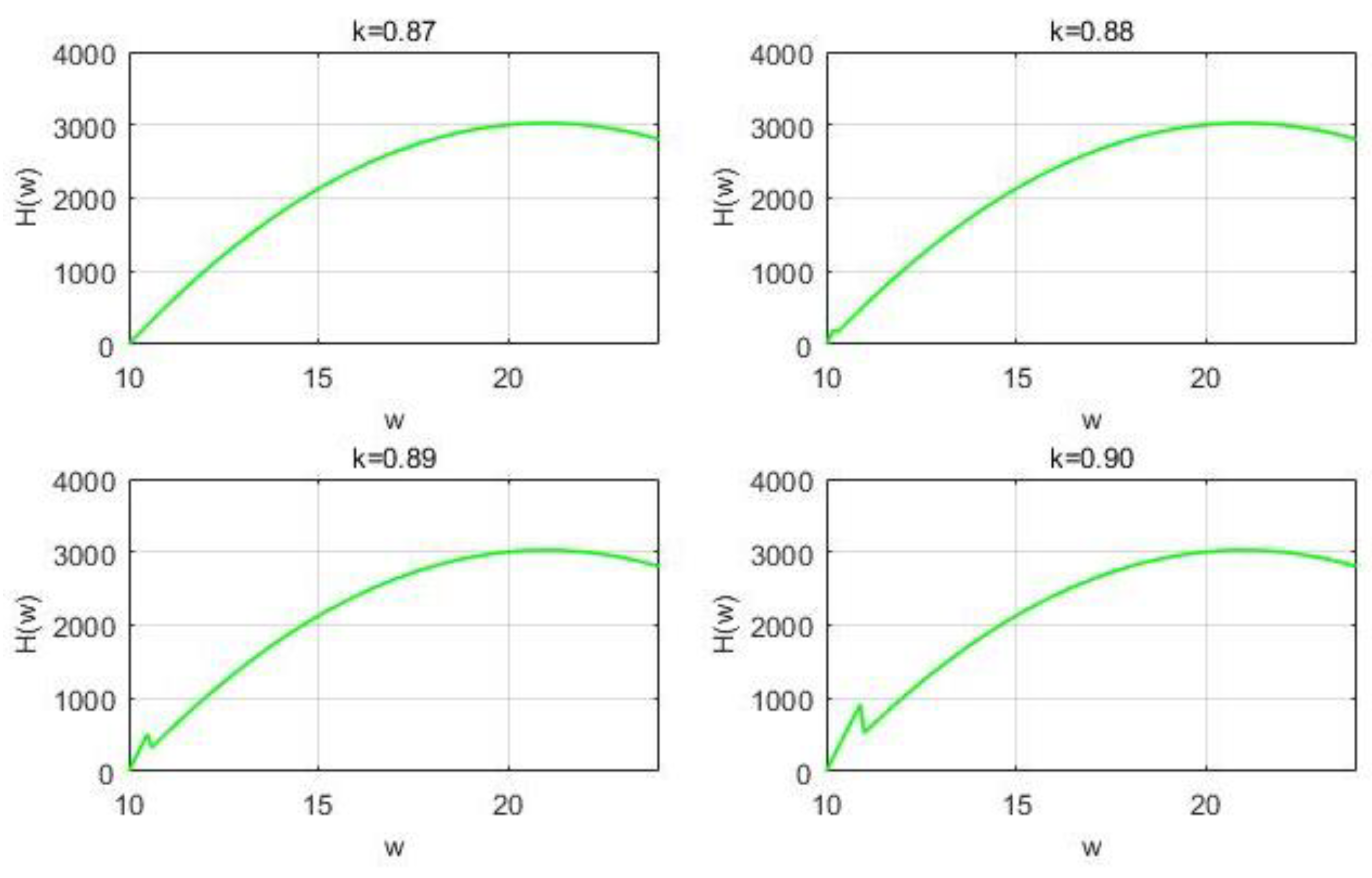

between 0.87 and 0.88, which causes the supplier’s payoff function to change from a single peak to a double peak as the retailer’s confidence level declines.

Where the left peak in

Figure 3 indicates that the supplier believes that this range of the retailer will lead them to choose the retail price

, the right peak remains constant. As

rises, the left peak climbs, and the supplier’s optimal wholesale price stays the same up until it equals the right peak, taking the right peak point—a range where the retailer’s level of confidence has no bearing on the supplier’s decision. In

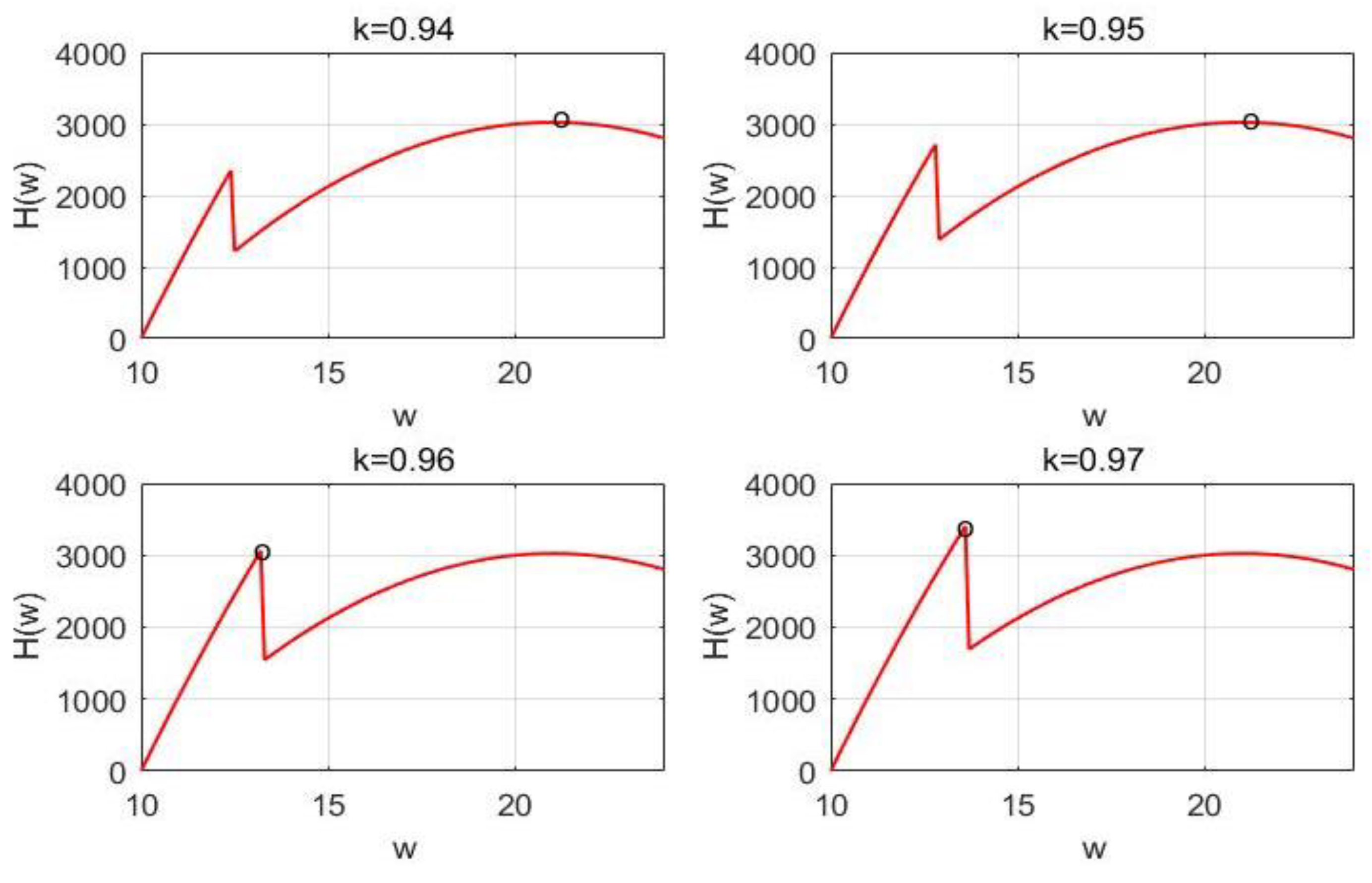

Figure 4, as the retailer’s confidence level decreases, the black circle indicates the maximum value of the function. Additionally,

exists between 0.95 and 0.96 with bimodal equality, indicating that the supplier’s wholesale price decision will produce a sudden drop when the retailer’s confidence level decreases. As

continues to increase, as shown in

Figure 5, the range of retailer’s choice of

gradually decreases and is occupied by

. When

exceeds the threshold value of 1.1679, the supplier only considers the situation in which retailers accept

. At this point, both the wholesale price and the optimum retail price show a trend of first increasing and then decreasing, though the variations in both the wholesale and retail prices are very subtle. After the retailer’s confidence level falls to a certain bound, the supplier’s pricing decision roughly exhibits a monotonically increasing situation, converging to the highest wholesale price 24.

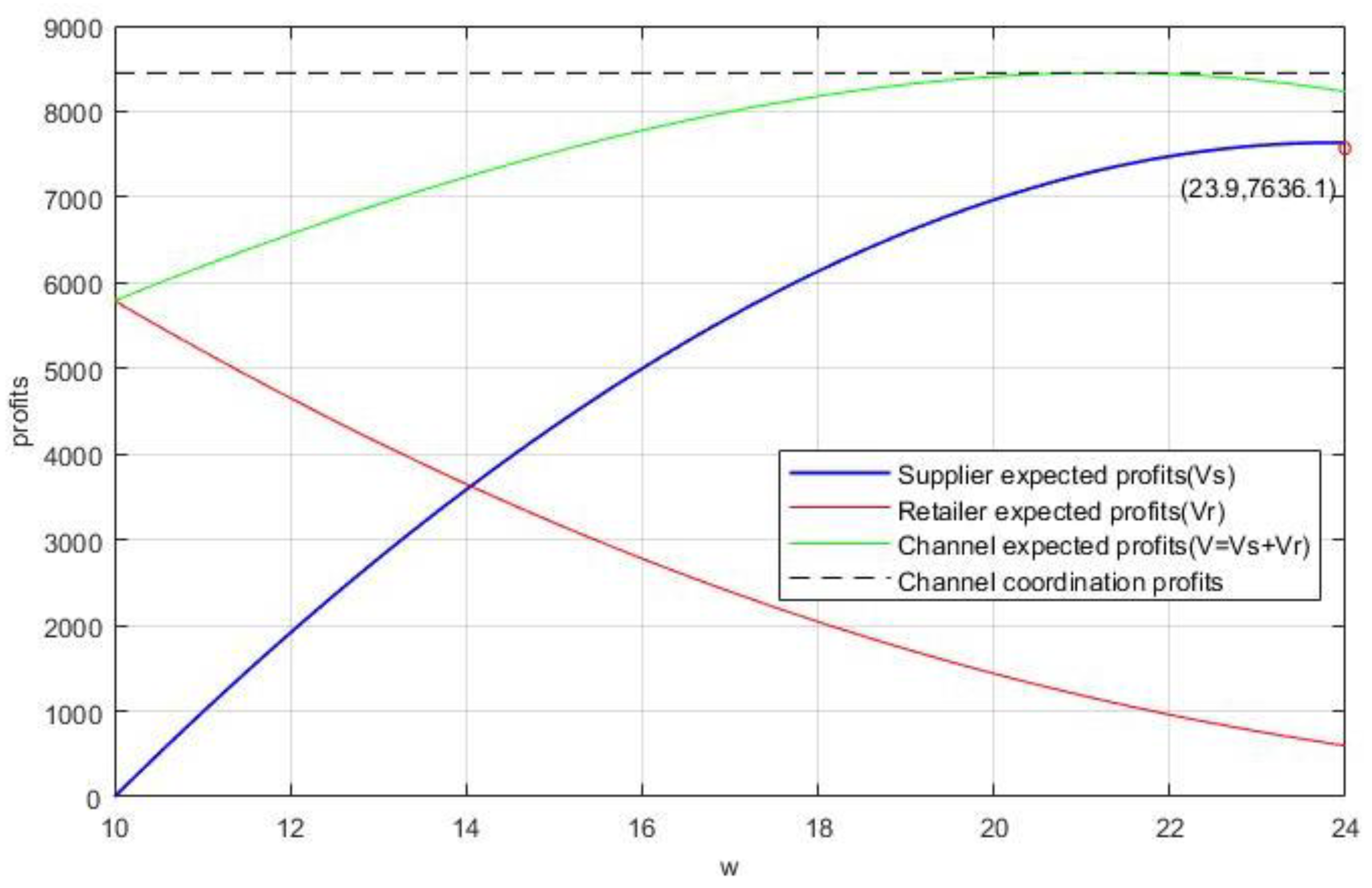

After that, we discuss the situation in the . The overall change is more similar to the trend at , and the trend also changes from single-peak to double-peak and then to single-peak again. When the bimodal peaks already appear at smaller values of . The maximum payoff of the supplier increases as increases, with the change in between 0.2 and 0.3 appearing as the left peak enclosing the right peak. This trend indicates that for the supplier, the lack of confidence is the more favorable situation in the case of the degree of optimism of the retailer and the existence of opportunities to enable the supplier to reach a higher payoff.

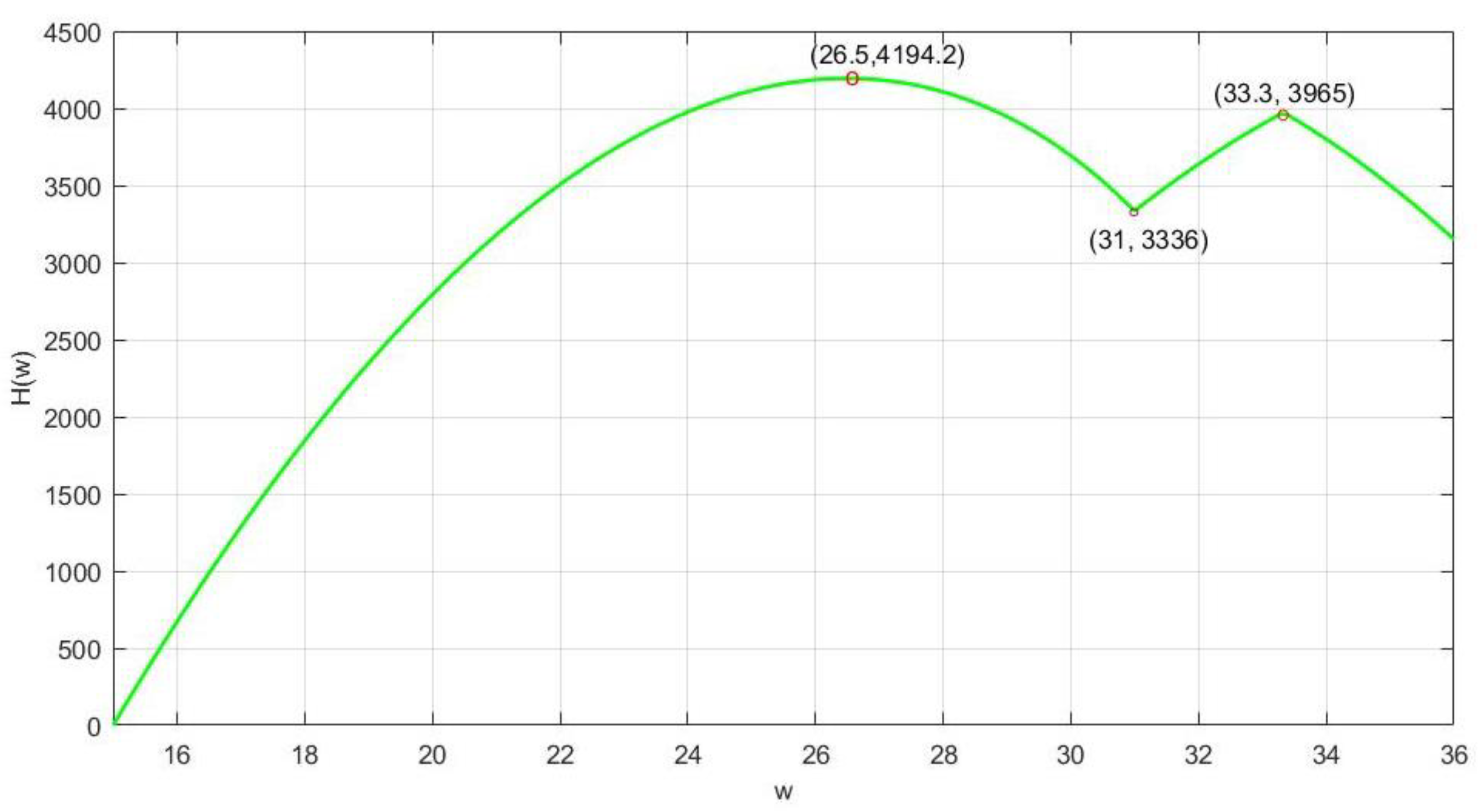

Finally, we discuss the case when , when we can guarantee and satisfy the Theorem 3(iii). When and is small, the right peak in the double peak has been almost covered by the left, and the process of changing from a single peak to a double peak disappears. As the value increases currently, the image changes to a single-peak at a faster rate. When the value increases, it is almost a complete S-peak state.

When the value reaches a higher range, after the retailer optimism decreases significantly, the supplier believes that the retailer’s decision to choose the retail price is only . When , the supplier’s payoff image that the image of the function (12), the change of the image is very insignificant; only when there is a large change in will it cause a subtle increase in the optimal wholesale price; as increases to higher range, the optimal wholesale price will be infinitely close to the upper limit of 24. The trend illustrates that when the value of is small, the change floats more and produces larger fluctuations according to the change in . As the value of increases, the payoff function of the supplier is gradually decreased by and the trend becomes smaller and smaller. It indicates that when the retailer’s optimism is low, the supplier’s payoff is almost negligible by the retailer’s confidence level, and the supplier’s payoff fluctuates more only when the retailer is more optimistic.

The influence of the retailer’s optimism and self-confidence level on the decision can be obtained as follows:

(1) When the level of optimism and confidence of the retailer are both high, the pricing decision of the supplier and retailer do not produce fluctuations and are relatively stable. The best wholesale price will produce a trend from high to low as the retailer’s degree of confidence gradually declines while it is high.

(2) When the retailer’s optimism is determined, the lower the confidence level, the higher the supplier’s payoff.

The image comparison shows that it is more beneficial for the supplier to partner with a retailer who has a higher level of optimism and a lower level of confidence to expect payoff growth.