Last-Mile Capacity Constraints in Online Grocery Fulfilment in Great Britain

Abstract

:1. Introduction

2. Literature Review

- The number of delivery vans and drivers available on a given day/shift;

- The number of staff available for in-store order picking and packing;

- Productivity of delivery vans—the number of orders that can be delivered during a single shift, which is influenced by the distance travelled between delivery addresses and the size of each customer order (larger orders take up more space and can restrict the number of orders carried by a single vehicle).

3. Materials and Methods

3.1. Data

3.2. Methodology

4. Results

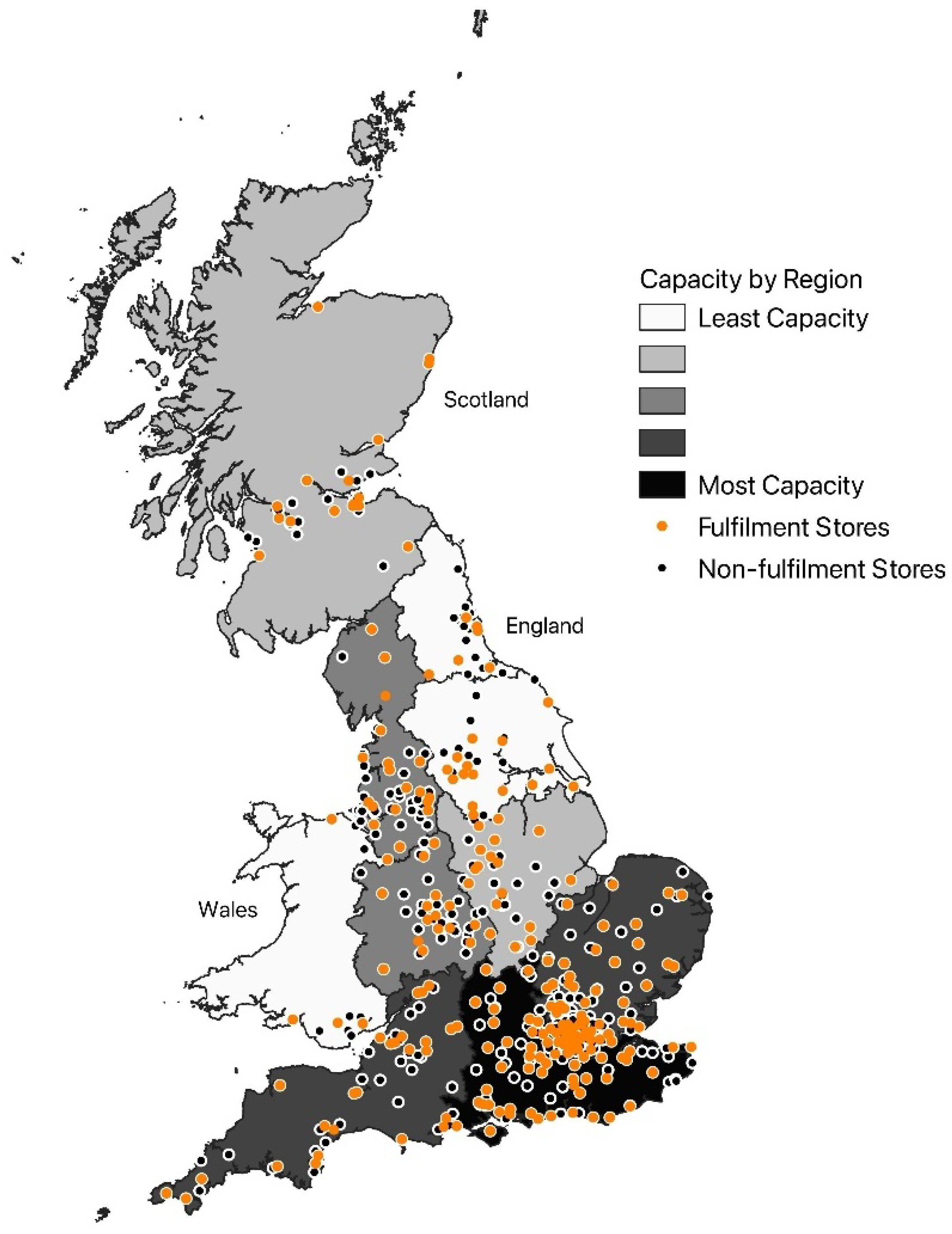

4.1. Geographical Distribution of Delivery Capacity

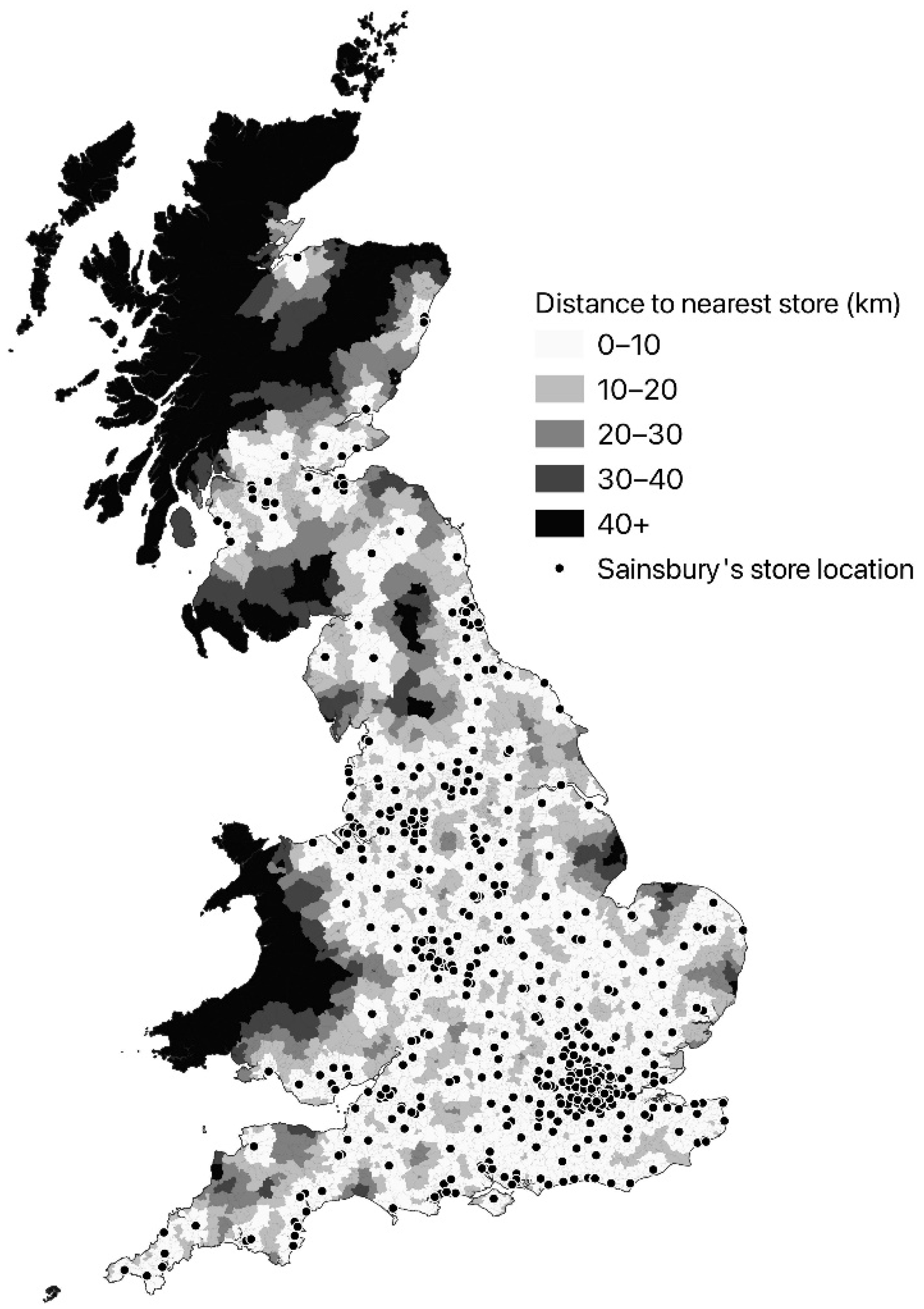

4.2. The Last Mile—Delivery to the Consumer

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- IGD. Uk Food and Grocery Market to Grow 10% by 2022. Available online: https://www.igd.com/articles/article-viewer/t/uk-food-and-grocery-market-to-grow-10-by-2022/i/26531 (accessed on 19 January 2022).

- Hood, N.; Urquhart, R.; Newing, A.; Heppenstall, A. Sociodemographic and spatial disaggregation of e-commerce channel use in the grocery market in great britain. J. Retail. Consum. Serv. 2020, 55, 102076. [Google Scholar] [CrossRef]

- IGD. Uk Retail Food and Grocery Market Growth to Slow Sharply in the Short Term, According to Latest Igd Market Forecasts. Available online: https://www.igd.com/articles/article-viewer/t/uk-retail-food-and-grocery-market-growth-to-slow-sharply-in-the-short-term-according-to-latest-igd-market-forecasts/i/28369 (accessed on 19 January 2022).

- Verhoef, P.C.; Kannan, P.K.; Inman, J.J. From multi-channel retailing to omni-channel retailing. J. Retail. 2015, 91, 174–181. [Google Scholar] [CrossRef]

- Hübner, A.; Kuhn, H.; Wollenburg, J. Last mile fulfilment and distribution in omni-channel grocery retailing. Int. J. Retail. Distrib. Manag. 2016, 44, 228–247. [Google Scholar] [CrossRef]

- Wollenburg, J.; Hübner, A.; Kuhn, H.; Trautrims, A. From bricks-and-mortar to bricks-and-clicks: Logistics networks in omni-channel grocery retailing. Int. J. Phys. Distrib. Logist. Manag. 2018, 48, 415–438. [Google Scholar] [CrossRef]

- Newing, A.; Hood, N.; Videira, F.; Lewis, J. Sorry we do not deliver to your area’: Geographical inequalities in online groceries provision. Int. Rev. Retail. Distrib. Consum. Res. 2021, 32, 80–99. [Google Scholar] [CrossRef]

- Masters, B. Stores still matter when it comes to online groceries. Financial Times, 10 March 2021. Available online: https://www.ft.com/content/ce6aa47e-9096-4952-933b-08385609a581(accessed on 10 March 2021).

- Sleeman, J. Impact of the Pandemic on the Demand for Logistics and Distribution Capacity. Presentation Delivered at the Society for Location Analysis Event ‘Logistics and the Future of Retail Real Estate’, 10 February 2022; Jones Lang LaSalle: London, UK, 2022. [Google Scholar]

- Eley, J.; McMorrow, R. Why supermarkets are struggling to profit from the online grocery boom. Financial Times, 23 July 2020. Available online: https://www.ft.com/content/b985249c-1ca1-41a8-96b5-0adcc889d57d(accessed on 23 July 2020).

- Sainsbury’s. Sainsbury’s Dials up Digital, Doubling Capacity and Extending Delivery Times. Available online: https://www.about.sainsburys.co.uk/news/latest-news/2020/28-09-20-sainsburys-dials-up-digital (accessed on 19 January 2022).

- Butler, S. Uk Online Grocery Sales Likely to Surge by a Quarter Amid Lockdown. Available online: https://www.theguardian.com/business/2020/may/05/uk-online-grocery-sales-lockdown-internet-coronavirus (accessed on 19 January 2022).

- Smithers, R. Pandemic Prompts Doubling of Online Grocery Shoppers in UK. Available online: https://www.theguardian.com/business/2020/aug/20/pandemic-prompts-doubling-of-online-grocery-shoppers-in-uk (accessed on 19 January 2022).

- Pilbeam, D. Understanding Post-Pandemic Food Retail Location Dynamics. Presentation Given at Spatial Data Secience in Cpg & Retail Summit, 21 May 2021. Available online: https://www.youtube.com/watch?v=ivaJY_819lg&ab_channel=CARTO (accessed on 19 January 2022).

- Birkin, M.; Clarke, G.P.; Clarke, M. Retail Location Planning in an era of Multi-Channel Growth; Routledge: London, UK, 2017. [Google Scholar]

- Newing, A.; Clarke, G.P.; Clarke, M. Visitor expenditure estimation for grocery store location planning: A case study of cornwall. Int. Rev. Retail. Distrib. Consum. Res. 2013, 23, 221–244. [Google Scholar] [CrossRef]

- Berry, T.; Newing, A.; Davies, D.; Branch, K. Using workplace population statistics to understand retail store performance. Int. Rev. Retail. Distrib. Consum. Res. 2016, 26, 375–395. [Google Scholar] [CrossRef] [Green Version]

- Waddington, T.; Clarke, G.P.; Clarke, M.C.; Newing, A. Exploring spatiotemporal fluctuations in uk grocery store sales. Int. Rev. Retail. Distrib. Consum. Res. 2017, 28, 1–26. [Google Scholar]

- Sturley, C.; Newing, A.; Heppenstall, A. Evaluating the potential of agent based modelling to capture consumer store choice behaviours. Int. Rev. Retail. Distrib. Consum. Res. 2017, 28, 27–46. [Google Scholar] [CrossRef]

- Beckers, J.; Birkin, M.; Clarke, G.; Hood, N.; Newing, A.; Urquhart, R. Incorporating e-commerce into retail location models. Geogr. Anal. 2021, 54, 274–293. [Google Scholar] [CrossRef]

- Teller, C.; Kotzab, H.; Grant, D.B. The consumer direct services revolution in grocery retailing: An exploratory investigation. Manag. Serv. Qual. Int. J. 2006, 16, 78–96. [Google Scholar] [CrossRef] [Green Version]

- Grant, D.B.; Fernie, J.; Schulz, B. Enablers and barriers in german online food retailing. Supply Chain. Forum Int. J. 2014, 15, 4–11. [Google Scholar] [CrossRef]

- Clarke, G.; Thompson, C.; Birkin, M. The emerging geography of e-commerce in british retailing. Reg. Stud. Reg. Sci. 2015, 2, 371–391. [Google Scholar] [CrossRef]

- Singleton, A.; Alexiou, A.; Savani, R. Mapping the geodemographics of digital inequality in great britain: An integration of machine learning into small area estimation. Comput. Environ. Urban Syst. 2020, 82, 101486. [Google Scholar] [CrossRef]

- Anderson, W.P.; Chatterjee, L.; Lakshmanan, T. E-commerce, transportation, and economic geography. Growth Chang. 2003, 34, 415–432. [Google Scholar] [CrossRef]

- Kirby-Hawkins, E.; Birkin, M.; Clarke, G. An investigation into the geography of corporate e-commerce sales in the uk grocery market. Environ. Plan. B Urban Anal. City Sci. 2018, 46, 1148–1164. [Google Scholar] [CrossRef] [Green Version]

- Azadiamin, S.; Masel, D. Last mile delivery route planning for grocery stores. In Proceedings of the 2021 IISE Annual Conference, Washington, DC, USA, 25 May 2021; Ghate, A., Krishnaiyer, K., Paynabar, K., Eds.; 2021; pp. 1106–1111. [Google Scholar]

- Siddhartha, P.; Goda, D. Simulation and optimization framework for on-demand grocery delivery. In 2021 Winter Simulation Conference (WSC); 2021; pp. 1–12. [Google Scholar]

- Liu, D.; Deng, Z.; Zhang, W.; Wang, Y.; Kaisar, E.I. Design of sustainable urban electronic grocery distribution network. Alex. Eng. J. 2021, 60, 145–157. [Google Scholar] [CrossRef]

- Leyerer, M.; Sonneberg, M.-O.; Heumann, M.; Breitner, M.H. Shortening the last mile in urban areas: Optimizing a smart logistics concept for e-grocery operations. Smart Cities 2020, 3, 585–603. [Google Scholar] [CrossRef]

- Maltese, I.; Le Pira, M.; Marcucci, E.; Gatta, V.; Evangelinos, C. Grocery or @grocery: A stated preference investigation in rome and milan. Res. Transp. Econ. 2021, 87, 101096. [Google Scholar] [CrossRef]

- Cardenas, I.; Borbon-Galvez, Y.; Verlinden, T.; Van de Voorde, E.; Vanelslander, T.; Dewulf, W. City logistics, urban goods distribution and last mile delivery and collection. Compet. Regul. Netw. Ind. 2017, 18, 22–43. [Google Scholar] [CrossRef]

- Aspray, W.; Royer, G.; Ocepek, M.G. Anatomy of a dot-com failure: The case of online grocer webvan. In Food in the Internet Age; Aspray, W., Royer, G., Ocepek, M.G., Eds.; Springer: Boston, MA, USA, 2013; pp. 25–35. [Google Scholar]

- Clark, T.; Ping Chang, S. A History of Tesco: The Rise of Britain’s Biggest Supermarket. Available online: https://www.telegraph.co.uk/finance/markets/2788089/A-history-of-Tesco-The-rise-of-Britains-biggest-supermarket.html (accessed on 19 January 2022).

- Cope, N. Asda Joins the Battle for Home Shoppers. Available online: https://www.independent.co.uk/news/business/asda-joins-the-battle-for-home-shoppers-1167607.html (accessed on 19 January 2022).

- Belavina, E.; Girotra, K.; Kabra, A. Online grocery retail: Revenue models and environmental impact. Manag. Sci. 2017, 63, 1781–1799. [Google Scholar] [CrossRef] [Green Version]

- Siragusa, C.; Tumino, A. E-grocery: Comparing the environmental impacts of the online and offline purchasing processes. Int. J. Logist. Res. Appl. 2021, 1–27. [Google Scholar] [CrossRef]

- Brown, J.R.; Guiffrida, A.L. Carbon emissions comparison of last mile delivery versus customer pickup. Int. J. Logist. Res. Appl. 2014, 17, 503–521. [Google Scholar] [CrossRef]

- Buldeo Rai, H.; Verlinde, S.; Macharis, C. The “next day, free delivery” myth unravelled: Possibilities for sustainable last mile transport in an omnichannel environment. Int. J. Retail. Distrib. Manag. 2019, 47, 39–54. [Google Scholar] [CrossRef]

- Beck, N.; Rygl, D. Categorization of multiple channel retailing in multi-, cross-, and omni-channel retailing for retailers and retailing. J. Retail. Consum. Serv. 2015, 27, 170–178. [Google Scholar] [CrossRef]

- Davies, A.; Dolega, L.; Arribas-Bel, D. Buy online collect in-store: Exploring grocery click & collect using a national case study. Int. J. Retail. Distrib. Manag. 2019, 47, 278–291. [Google Scholar]

- DPD. 6000 New UK Jobs as Dpd Scales-Up to Meet ‘New Normal’ Demand from Online Retailers. Available online: https://www.dpd.co.uk/content/about_dpd/6000-new-uk-jobs-as-dpd-scales-up-to-meet-new-normal-demand-from-online-retailers.jsp (accessed on 19 January 2022).

- Espiner, T. Royal Mail to Pilot Sunday Parcel Delivery, BBC News. Available online: https://www.bbc.co.uk/news/business-56362491 (accessed on 19 January 2022).

- Cao, Y.; Strauss, A.; Pratt, M. Estimate Impact of Slot Availability on Customer Demand by using Choice-Based Demand Models. Masters Research Dissertation Programme Case Studies 2017; Consumer Data Research Centre: London, UK, 2017. [Google Scholar]

- ONS. 2011 Local Authority Rural Urban Classification. Available online: https://www.ons.gov.uk/methodology/geography/geographicalproducts/ruralurbanclassifications (accessed on 19 July 2021).

- Scottish Government. Scottish Government Urban Rural Classification 2016. Available online: https://www.gov.scot/publications/scottish-government-urban-rural-classification-2016/pages/2/#:~:text=2.-,Overview,and%20rural%20areas%20across%20Scotland.&text=This%20is%20done%20by%20calculating,Large%20and%20Other%20Urban%20Areas) (accessed on 16 July 2019).

- MRS. Postcode Format; Market Research Society London Undated. Available online: https://www.mrs.org.uk/pdf/postcodeformat.pdf (accessed on 10 March 2021).

- Poole, R.; Clarke, G.; Clarke, D. The battle for safeway. Int. J. Retail. Distrib. Manag. 2003, 31, 280–289. [Google Scholar] [CrossRef]

| Store Name | Geographic Coordinates | Store-Based Capacity | Delivery Capacity | Capacity Constraints |

|---|---|---|---|---|

| Example store 1 | Latitude and longitude (e.g., 53.80433, 1.550997796) | 2100 | 1820 | Delivery |

| Example store 2 | 902 | 1047 | Chilled | |

| Example store 3 | 1126 | 4456 | Ambient | |

| Example store 4 | 989 | 989 | MLFs |

| Region/Nation | Fulfilment Stores (Count) | Total Delivery Capacity (Relative Value) | Non-Fulfilment Stores 1 |

|---|---|---|---|

| South East | 52 | 100,788 | 39 |

| Greater London | 33 | 76,676 | 46 |

| East of England | 30 | 52,627 | 27 |

| South West | 27 | 49,311 | 25 |

| West Midlands | 17 | 31,489 | 28 |

| North West | 18 | 23,547 | 29 |

| Scotland | 16 | 23,056 | 14 |

| East Midlands | 16 | 22,907 | 17 |

| Yorkshire and the Humber | 15 | 22,543 | 12 |

| North East | 6 | 9039 | 12 |

| Wales | 4 | 6685 | 7 |

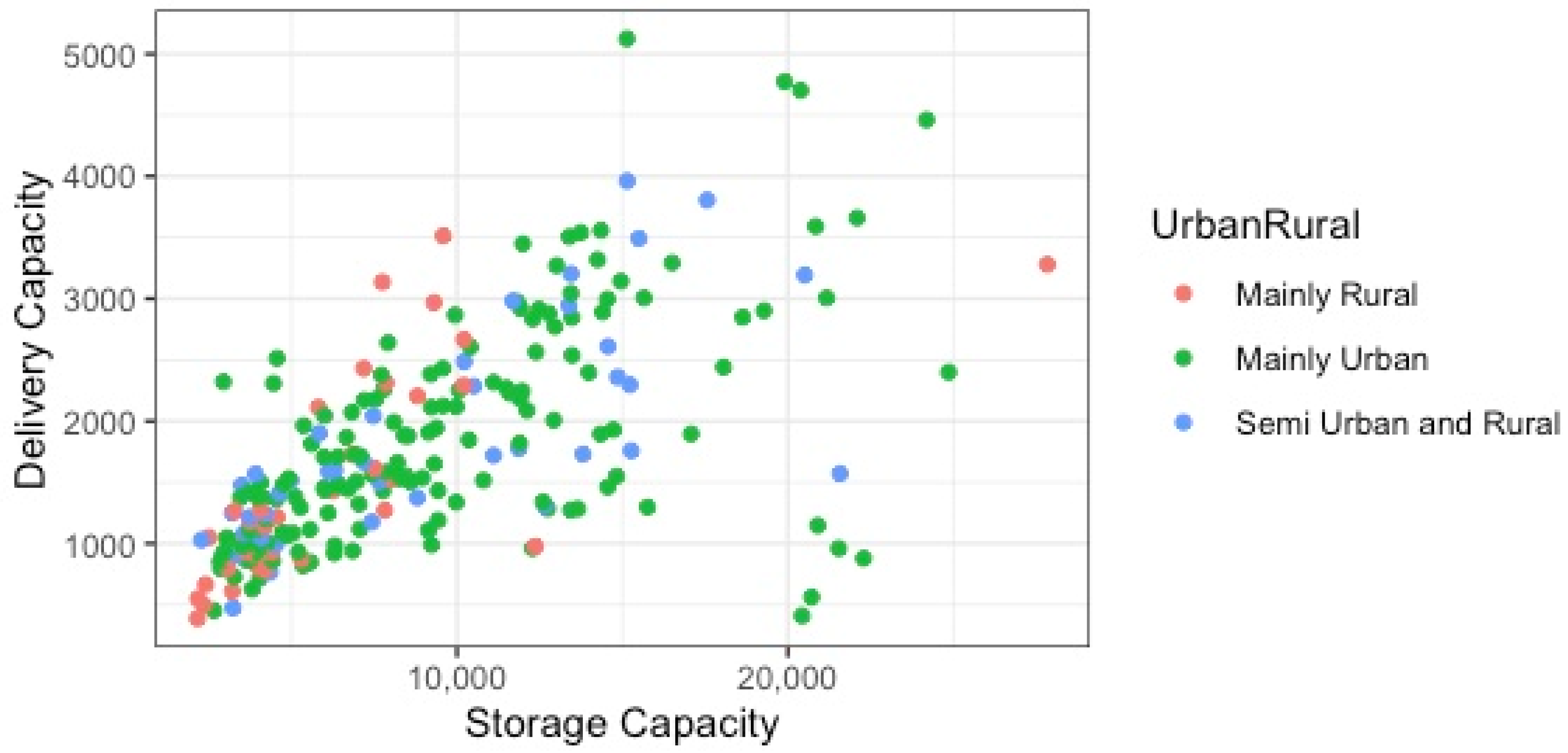

| Area Classification 1 | Store Count | Mean Delivery Capacity by Store | Sum of Delivery Capacity |

|---|---|---|---|

| Predominantly rural | 37 | 1465 | 54,145 |

| Urban with significant rural | 40 | 1858 | 74,324 |

| Predominantly urban | 157 | 1848 | 290,199 |

| Store Characteristic | Correlation | Significance | n | |

|---|---|---|---|---|

| Location | Mainly urban | 0.585 | 0.000 | 157 |

| Semi urban and rural | 0.730 | 0.000 | 40 | |

| Mainly rural | 0.702 | 0.000 | 37 | |

| Size | Size A | 0.650 | 0.000 | 218 |

| Size B | 0.295 | 0.267 | 16 | |

| All stores | 0.635 | 0.000 | 234 | |

| England | Scotland | Wales | ||||

|---|---|---|---|---|---|---|

| % of Postal Sectors within Distance (km) | Current Fulfilment Stores | Potential Fulfilment Stores | Current Fulfilment Stores | Potential Fulfilment Stores | Current Fulfilment Stores | Potential Fulfilment Stores |

| 0–10 | 72.2 | 87.0 | 37.4 | 49.1 | 24.7 | 46.1 |

| 10–20 | 19.6 | 9.6 | 21.3 | 16.0 | 22.3 | 16.7 |

| 20–30 | 5.2 | 2.3 | 10.3 | 6.9 | 18.4 | 6.4 |

| 30–40 | 1.8 | 0.7 | 7.1 | 6.6 | 7.1 | 4.5 |

| 40+ | 1.2 | 0.4 | 23.9 | 21.4 | 27.5 | 26.3 |

| Median service area extent | 5.3 | 2.7 | 15.6 | 10.3 | 21.3 | 12.3 |

| Maximum service area extent | 94.3 | 94.3 | 339.4 | 339.4 | 128.2 | 128.2 |

| Service Area Extent | Count of Stores | Mean Delivery Capacity | % of Stores with Delivery Capacity as a Limiting Factor |

|---|---|---|---|

| Less than 10 km | 45 | 1914 | 71% |

| 10–20 km | 79 | 1862 | 81% |

| 20–30 km | 51 | 1607 | 69% |

| 30–40 km | 22 | 1950 | 73% |

| Over 40 km | 37 | 1634 | 70% |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Urquhart, R.; Newing, A.; Hood, N.; Heppenstall, A. Last-Mile Capacity Constraints in Online Grocery Fulfilment in Great Britain. J. Theor. Appl. Electron. Commer. Res. 2022, 17, 636-651. https://doi.org/10.3390/jtaer17020033

Urquhart R, Newing A, Hood N, Heppenstall A. Last-Mile Capacity Constraints in Online Grocery Fulfilment in Great Britain. Journal of Theoretical and Applied Electronic Commerce Research. 2022; 17(2):636-651. https://doi.org/10.3390/jtaer17020033

Chicago/Turabian StyleUrquhart, Ryan, Andy Newing, Nicholas Hood, and Alison Heppenstall. 2022. "Last-Mile Capacity Constraints in Online Grocery Fulfilment in Great Britain" Journal of Theoretical and Applied Electronic Commerce Research 17, no. 2: 636-651. https://doi.org/10.3390/jtaer17020033

APA StyleUrquhart, R., Newing, A., Hood, N., & Heppenstall, A. (2022). Last-Mile Capacity Constraints in Online Grocery Fulfilment in Great Britain. Journal of Theoretical and Applied Electronic Commerce Research, 17(2), 636-651. https://doi.org/10.3390/jtaer17020033