The Protective Effect of Digital Financial Inclusion on Agricultural Supply Chain during the COVID-19 Pandemic: Evidence from China

Abstract

:1. Introduction

2. Literature Review

2.1. ASC and the COVID-19

2.2. Digital Finance Inclusion in ASC

3. Method and Data

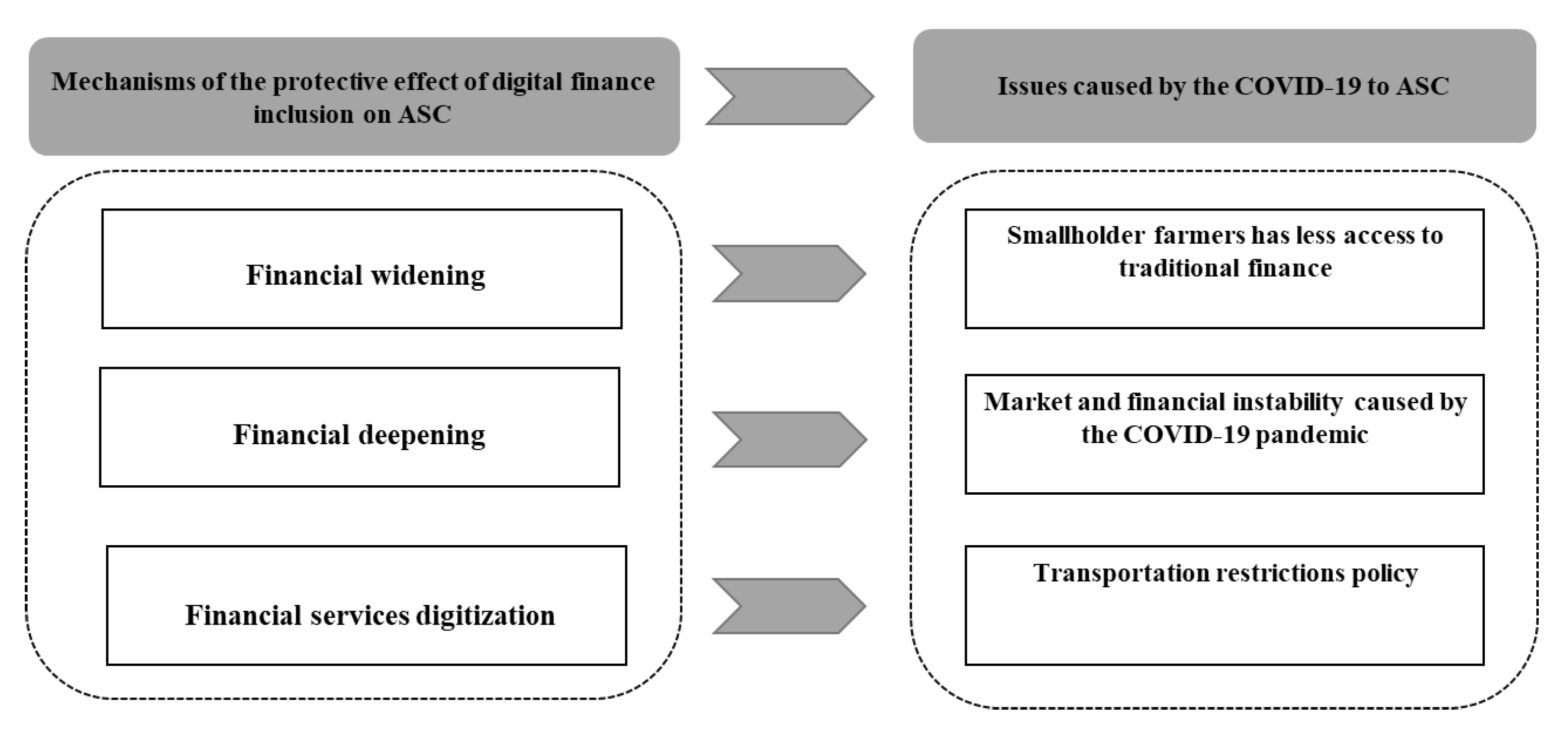

3.1. Theoretical Framework

3.2. Methods

3.2.1. Log-Log Regression Model with Fixed Effects (LL-FE)

3.2.2. Poisson Pseudo-Maximum Likelihood with Fixed Effects (PPML-FE)

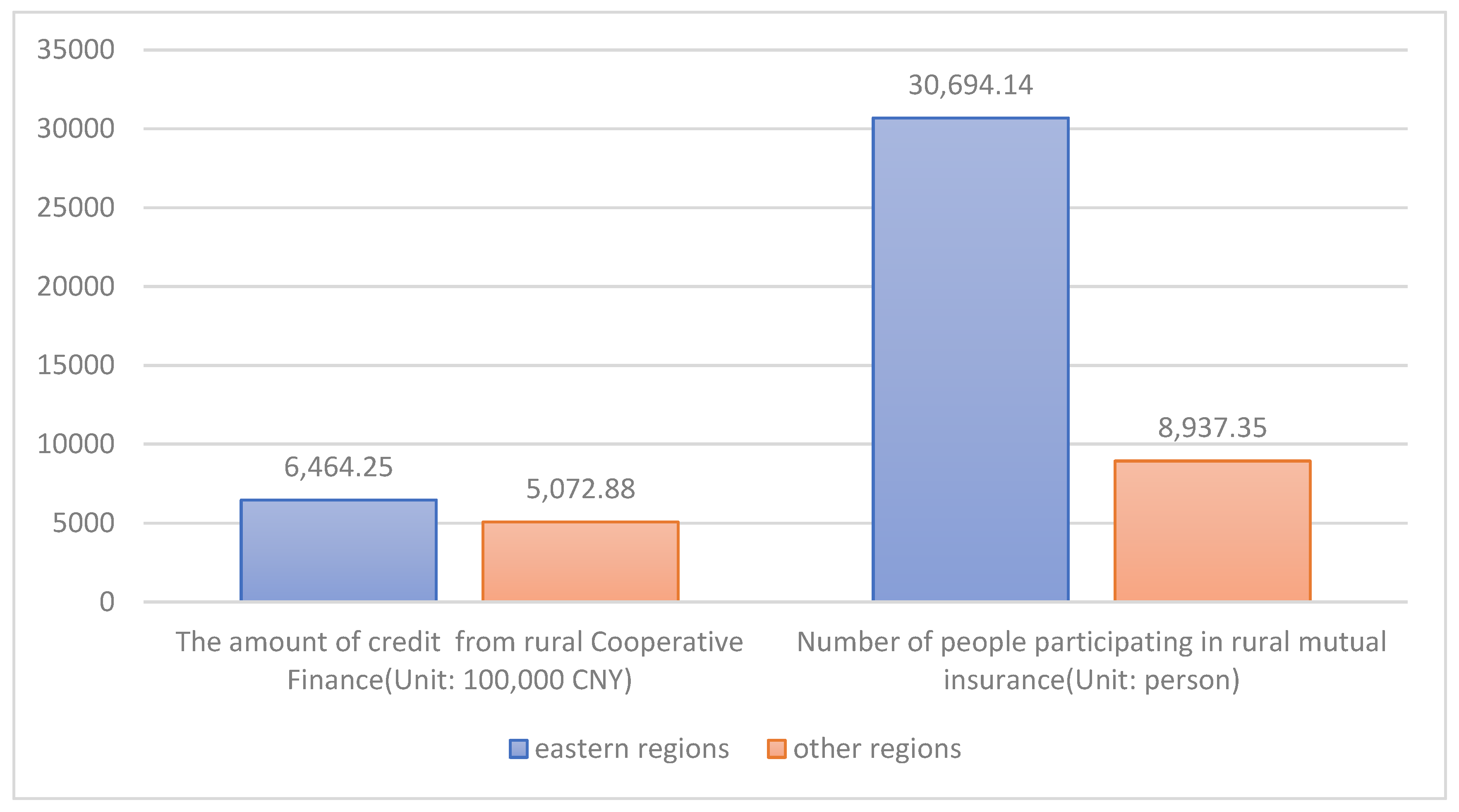

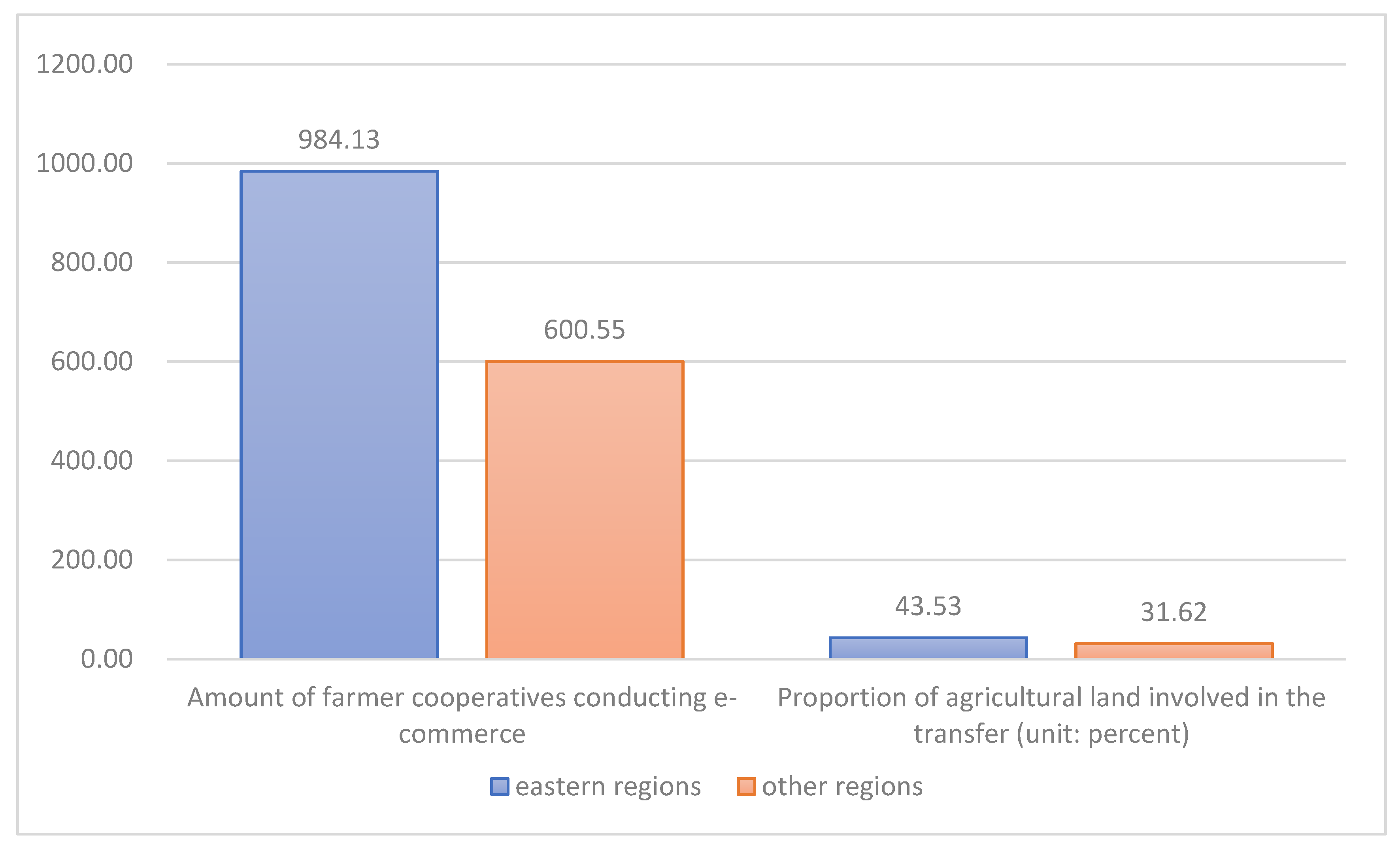

3.3. Data

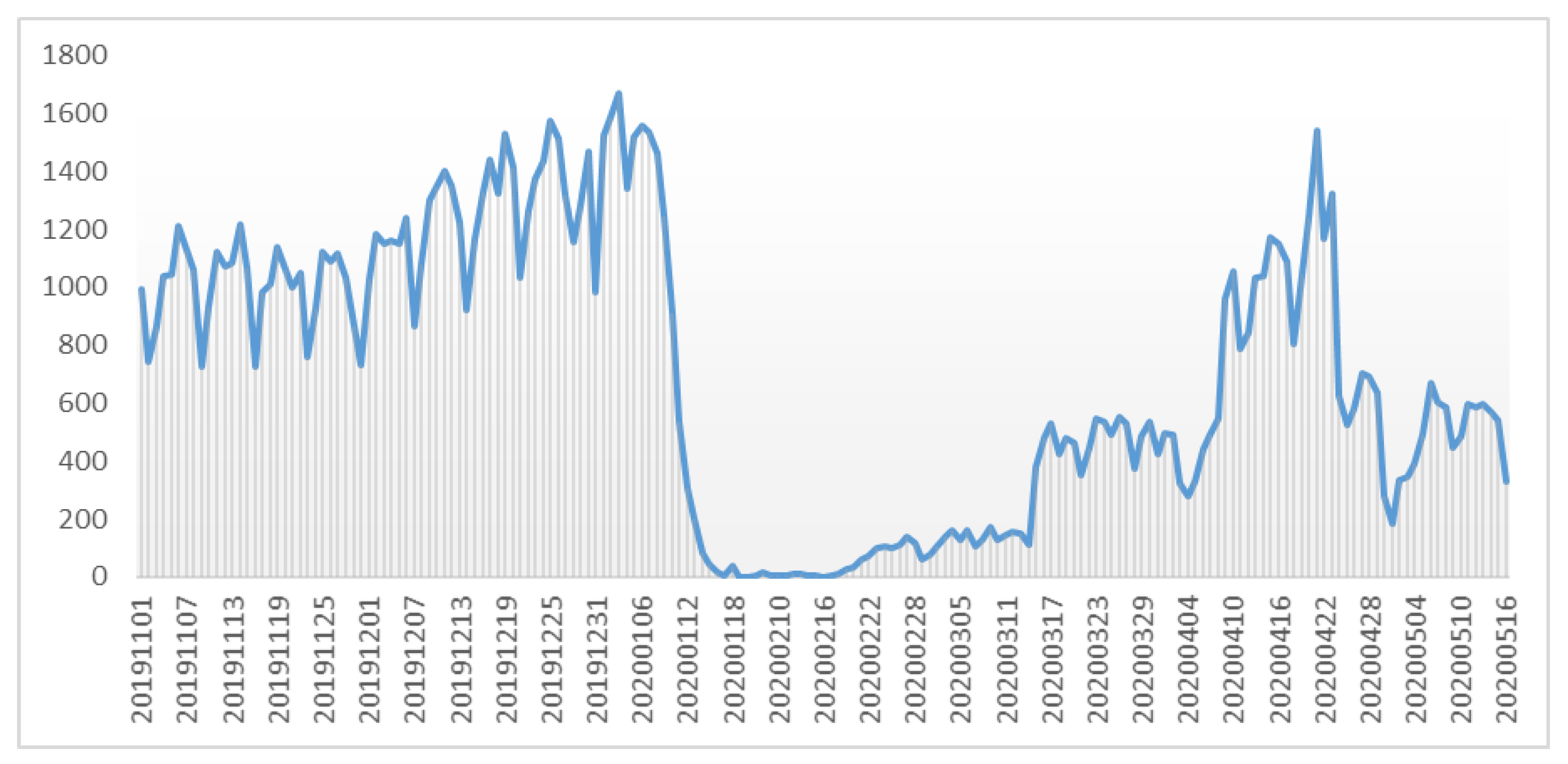

3.3.1. Dependent Variable on Trade

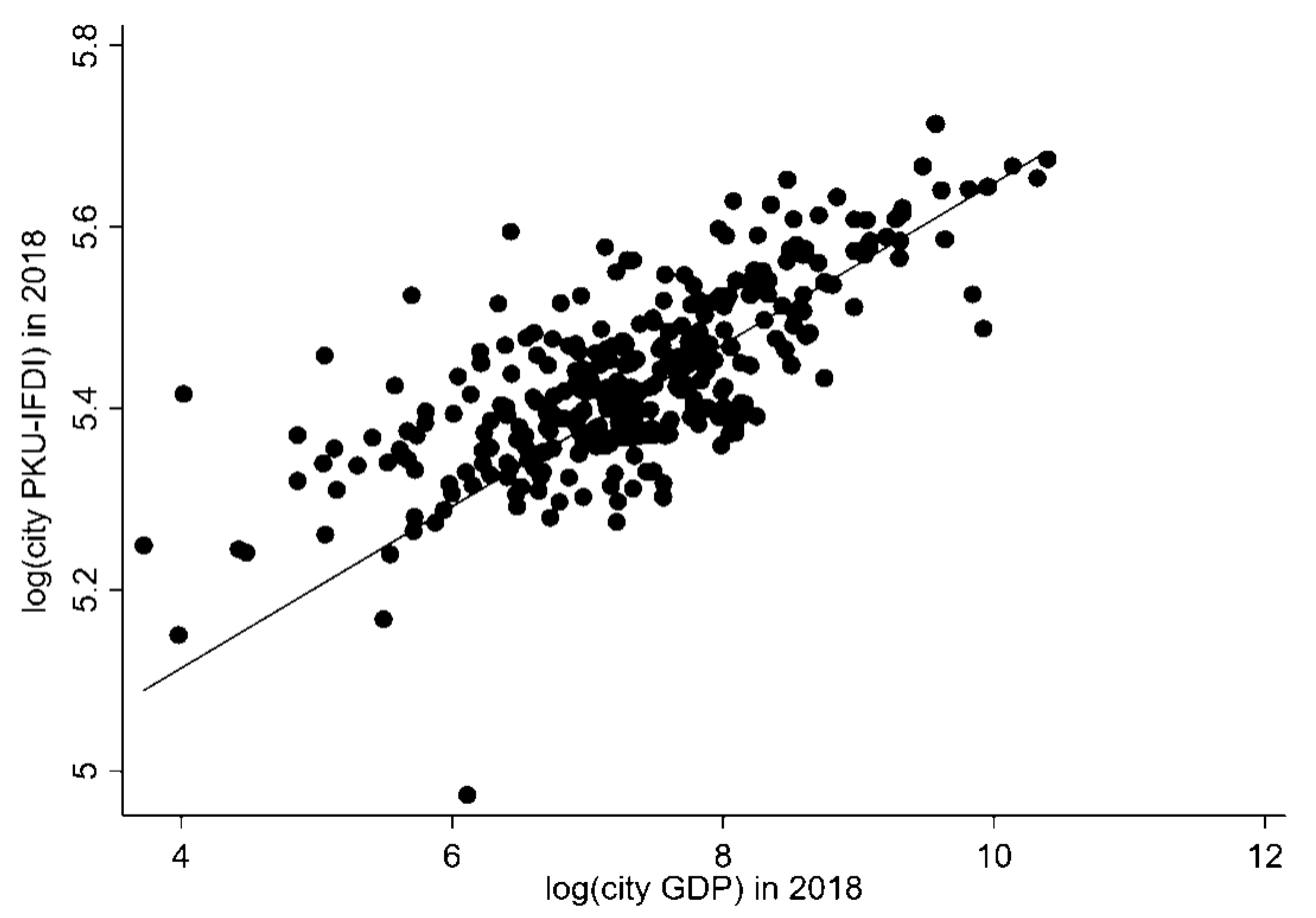

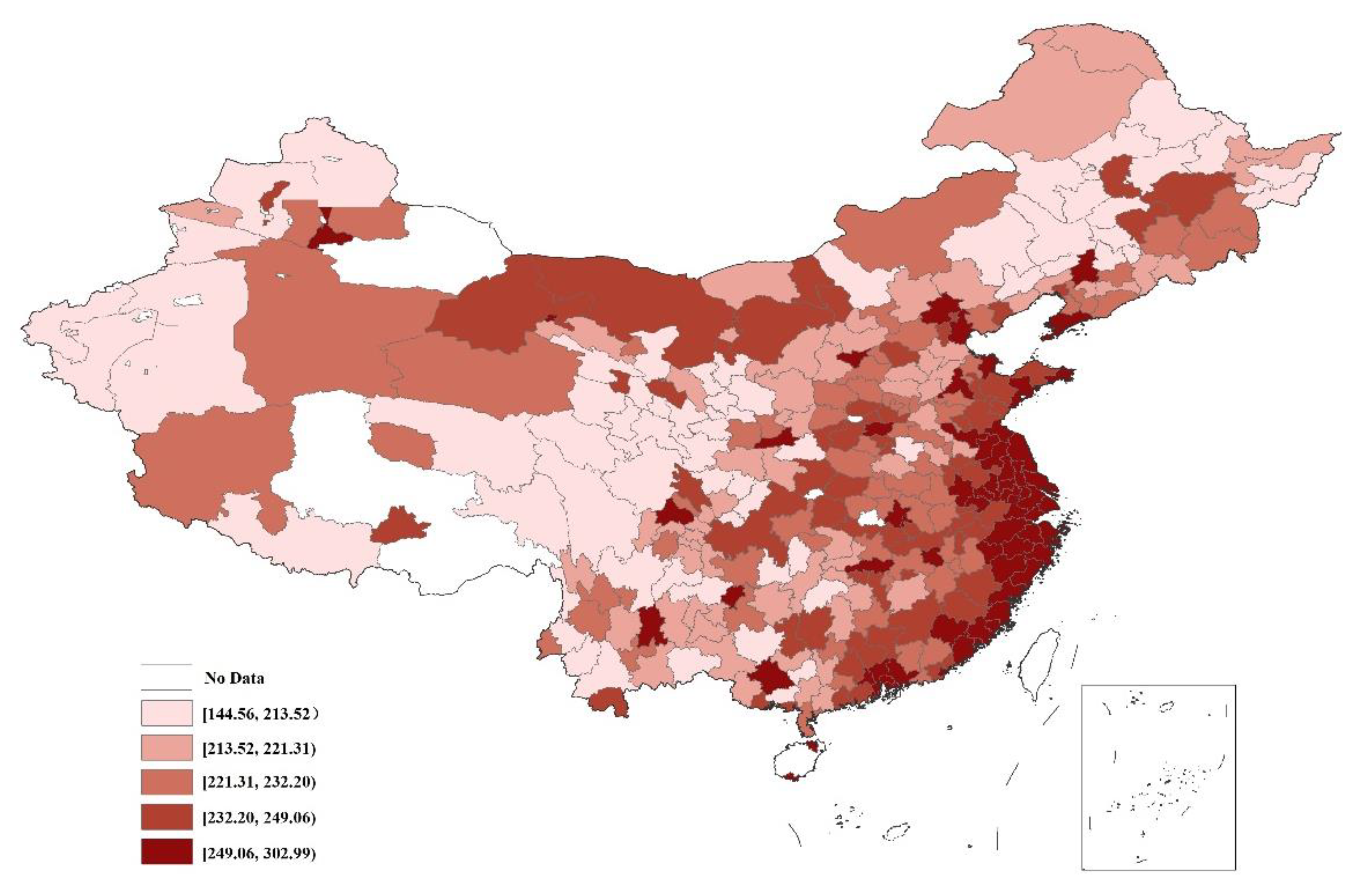

3.3.2. Independent Variable on Digital Financial Inclusion

3.3.3. Other Variable

4. Results

4.1. Baseline Model

4.2. Further Discussion

5. Conclusions

6. Limitations and Implications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Food and Agriculture Organization. Novel Coronavirus (COVID-19). 2020. Available online: http://www.fao.org/2019-ncov/q-and-a/impact-on-food-and-agriculture/en (accessed on 30 July 2021).

- Nayal, K.; Raut, R.D.; Queiroz, M.M.; Yadav, V.S.; Narkhede, B.E. Are artificial intelligence and machine learning suitable to tackle the COVID-19 impacts? An agriculture supply chain perspective. Int. J. Logist. Manag. 2021, in press. [Google Scholar] [CrossRef]

- Sharma, R.; Shishodia, A.; Kamble, S.; Gunasekaran, A.; Belhadi, A. Agriculture supply chain risks and COVID-19: Mitigation strategies and implications for the practitioners. Int. J. Logist. Res. Appl. 2020, in press. [Google Scholar] [CrossRef]

- Altieri, M.A.; Clara, I.N. Agroecology and the reconstruction of a post-COVID-19 agriculture. J. Peasant Stud. 2020, 47, 881–898. [Google Scholar] [CrossRef]

- William, A.K. The COVID-19 pandemic and agriculture: Short- and long-run implications for international trade relations. Can. J. Agric. Econ.-Rev. Can. Agroecon. 2020, 68, 225–229. [Google Scholar] [CrossRef]

- Viliamu, I.; Morgan, W.; Gordon, M.H.; David, U.; Diana, H.S. Impacts of COVID-19 on agriculture and food systems in Pacific Island countries (PICs): Evidence from communities in Fiji and Solomon. Agric. Syst. 2021, 190, 103099. [Google Scholar] [CrossRef]

- Davila, F.; Crimp, S.; Wilkey, B. A systemic assessment of COVID-19 impacts on pacific islands’ food systems. Hum. Ecol. Rev. 2020, 26, 5–17. [Google Scholar] [CrossRef]

- Ruth, R. Bending the arc of COVID-19 through a principled food systems approach. Agric. Human Values 2020, 37, 653–654. [Google Scholar] [CrossRef]

- McEwan, K.; Marchand, L.; Shang, M.; Bucknell, D. Potential implications of COVID-19 on the Canadian pork industry. Can. J. Agric. Econ. 2020, 68, 201–206. [Google Scholar] [CrossRef] [Green Version]

- Kumar, A.; Mangla, S.K.; Kumar, P.; Song, M. Mitigate risks in perishable food supply chains: Learning from COVID-19. Technol. Forecast. Soc. Chang. 2021, 166, 120643. [Google Scholar] [CrossRef]

- Huang, J.K. Impacts of COVID-19 on agriculture and rural poverty in China. J. Integr. Agric. 2020, 19, 2849–2853. [Google Scholar] [CrossRef]

- Xie, Y.; Sarkar, A.; Hossain, M.S.; Hasan, A.K.; Xia, X. Determinants of Farmers’ Confidence in Agricultural Production Recovery during the Early Phases of the COVID-19 Pandemic in China. Agriculture 2021, 11, 1075. [Google Scholar] [CrossRef]

- Komarek, A.M.; Pinto, A.D.; Smith, V.H. A Review of Types of Risks in Agriculture: What we Know and What we Need to Know. Agric. Syst. 2020, 178, 102738. [Google Scholar] [CrossRef]

- Zhang, Y.; Khan, S.A.R. Evolutionary game analysis of green agricultural product supply chain financing system: COVID-19 pandemic. Int. J. Logist. Res. Appl. 2021, in press. [Google Scholar] [CrossRef]

- Dercon, S. Growth and shocks: Evidence from rural Ethiopia. J. Dev. Econ. 2004, 74, 309–329. [Google Scholar] [CrossRef]

- Boucher, S.; Carter, M.; Guirkinger, C. Risk rationing and wealth effects in credit markets: Theory and implications for agricultural development. Am. J. Agric. Econ. 2008, 90, 409–423. [Google Scholar] [CrossRef]

- Miranda, M.; Gonzalez-Vega, C. Systemic risk, index insurance, and optimal management of agricultural loan portfolios in developing countries. Am. J. Agric. Econ. 2011, 93, 399–406. [Google Scholar] [CrossRef]

- Collier, B.L. “Financial Inclusion and Natural Disasters.” PhD Dissertation, University of Kentucky. Outstanding Doctoral Dissertation. Am. J. Agric. Econ. 2015, 97, 656–657. [Google Scholar] [CrossRef]

- Bauchet, J.; Mahul, O. Weather index insurance for agriculture and rural areas in lower income countries. Am. J. Agric. Econ. 2007, 89, 1241–1247. [Google Scholar] [CrossRef]

- Kifayat, U.; Abdul, Q.M.; Abdul, S.; Saranjam, B. Financial Inclusion, Socioeconomic Disaster Risks and Sustainable Mountain Development: Empirical Evidence from the Karakoram Valleys of Pakistan. Sustainability 2020, 12, 9737. [Google Scholar] [CrossRef]

- Babenko, V.; Zomchak, L.; Nehrey, M.; Salem, A.B.M.; Nakisko, O. Agritech Startup Ecosystem in Ukraine: Ideas and Realization. In Digital Transformation Technology. Lecture Notes in Networks and Systems; Magdi, D.A., Helmy, Y.K., Mamdouh, M., Joshi, A., Eds.; Springer: Singapore, 2022; p. 224. [Google Scholar] [CrossRef]

- Babenko, V.O. Modeling of factors influencing innovation activities of agricultural enterprises of Ukraine. Sci. Bull. Polissia 2017, 1, 115–121. [Google Scholar] [CrossRef]

- Lezoche, M.; Hernandez, J.E.; Alemany, D.; Maria, E.; Panetto, H.; Kacprzyk, J. Agri-food 4.0: A survey of the supply chains and technologies for the future agriculture. Comput. Ind. 2020, 117, 103187. [Google Scholar] [CrossRef]

- World Bank Report. ICT for Greater Development Impact: World Bank Group Strategy for Information and Communication Technology; World Bank: Washington, DC, USA, 2012; Available online: https://openknowledge.worldbank.org/bitstream/handle/10986/27411/%20715400WP0WBG0I0sclosed0July02502012.pdf?sequence=1&isAllowed%20=%20y (accessed on 25 July 2012).

- Bruhn, M.; Love, I. The Real Impact of Improved Access to Finance: Evidence from Mexico. J. Financ. 2014, 69, 1347–1376. [Google Scholar] [CrossRef]

- Agwu, M.E. Can technology bridge the gap between rural development and financial inclusions? Technol. Anal. Strateg. Manag. 2021, 33, 123–133. [Google Scholar] [CrossRef]

- Turvey, C.G.; Xiong, X.P. Financial inclusion, financial education and e-commerce in rural China. Agribusiness 2017, 33, 279–285. [Google Scholar] [CrossRef]

- Liu, M.; Zhang, Q.; Gao, S.; Huang, J.K. The spatial aggregation of rural e-commerce in China: An empirical investigation into Taobao Villages. J. Rural Stud. 2020, 80, 403–417. [Google Scholar] [CrossRef]

- Tsolakis, N.K.; Keramydas, C.A.; Toka, A.K.; Aidonis, D.A.; Iakovou, E.T. Agrifood Supply Chain Management: A Comprehensive Hierarchical Decision making Framework and a Critical Taxonomy. Biosyst. Eng. 2014, 120, 47–64. [Google Scholar] [CrossRef]

- Khandelwal, C.; Singhal, M.; Gaurav, G.; Dangayach, G.S.; Meena, M.L. Agriculture Supply Chain Management: A Review (2010–2020). Mater. Today Proc. 2021, 47, 3144–3153. [Google Scholar] [CrossRef]

- Yazdani, M.; Gonzalez, E.D.; Chatterjee, P. A multi-criteria decision-making framework for agriculture supply chain risk management under a circular economy context. Manag. Decis. 2019, 59, 1801–1826. [Google Scholar] [CrossRef]

- Glowacz, M.; Rees, D. Using jasmonates and salicylates to reduce losses within the fruit supply chain. Eur. Food Res. Technol. 2016, 242, 143–156. [Google Scholar] [CrossRef]

- Zirham, M.; Palomba, R. Female Agriculture in the Short Food Supply Chain: A New Path towards the Sustainability Empowerment. Agric. Agric. Sci. Procedia 2016, 8, 372–377. [Google Scholar] [CrossRef] [Green Version]

- Haley, E.; Caxaj, S.; George, G.; Hennebry, J.; Martell, E.; McLaughlin, J. Migrant Farmworkers Face Heightened Vulnerabilities During COVID-19. J. Agric. Food Syst. Community Dev. 2020, 9, 35–39. [Google Scholar] [CrossRef]

- Hobbs, J.E. Food Supply Chains During the COVID-19 Pandemic. Can. J. Agric. Econ. 2020, 68, 171–176. [Google Scholar] [CrossRef] [Green Version]

- de Paulo, F.D.; dos Santos, G.; Mayara, G. COVID-19 Outbreak: What Should be Done to Avoid Food Shortages? Trends Food Sci. Technol. 2020, 102, 291–292. [Google Scholar] [CrossRef] [PubMed]

- International Monetary Fund (IMF). Policy Responses to COVID-19. 2020. Available online: https://www.imf.org/en/Topics/imf-and-covid19/Policy-Responses-to-COVID-19#I (accessed on 30 July 2021).

- Stephens, E.C.; Martin, G.; van Wijk, M.; Timsina, J.; Snow, V. Impacts of COVID-19 on Agricultural and Food Systems Worldwide and on Progress to the Sustainable Development Goals. Agric. Syst. 2020, 183, 102873. [Google Scholar] [CrossRef] [PubMed]

- Hailu, G. Economic Thoughts on COVID-19 for Canadian Food Processors. Can. J. Agric. Econ. 2020, 68, 163–169. [Google Scholar] [CrossRef]

- Xu, D.; Long, Y. The Role of Supply Chain Integration in the Transformation of Food Manufacturers: A Case Study from China. Int. J. Logist. Res. Appl. 2021, 24, 198–212. [Google Scholar] [CrossRef]

- Isakson, S.R. Food and finance: The financial transformation of agro-food supply chains. J. Peasant Stud. 2014, 41, 749–775. [Google Scholar] [CrossRef]

- Magnan, A. New avenues of farm corporatization in the prairie grains sector: Farm family entrepreneurs and the case of One Earth Farms. Agric. Hum. Values 2011, 29, 161–175. [Google Scholar] [CrossRef]

- Burch, D.; Lawrence, G. Financialization in agri-food supply chains: Private equity and the transformation of the retail sector. Agric. Hum. Values 2013, 30, 247–258. [Google Scholar] [CrossRef]

- Ghosh, J. The unnatural coupling: Food and global finance. J. Agrar. Chang. 2010, 10, 72–86. [Google Scholar] [CrossRef]

- Burch, D.; Lawrence, G. Towards a third food regime: Behind the transformation. Agric. Hum. Value 2009, 26, 267–279. [Google Scholar] [CrossRef]

- Fairbairn, M. “Like gold with yield”: Evolving intersections between farmland and finance. J. Peasant Stud. 2014, 41, 777–795. [Google Scholar] [CrossRef] [Green Version]

- Qi, J.; Zheng, X.; Guo, H. The formation of Taobao villages in China. China Econ. Rev. 2019, 53, 106–127. [Google Scholar] [CrossRef]

- Tang, W.C.; Zhu, J. Informality and rural industry: Rethinking the impacts of E-commerce on rural development in China. J. Rural Stud. 2020, 75, 20–29. [Google Scholar] [CrossRef]

- Ma, W.L.; Zhou, X.S.; Liu, M. What drives farmer’s willingness to adopt e-commerce in rural China? The role of Internet use. Agribusiness 2020, 36, 159–163. [Google Scholar] [CrossRef]

- Chai, S.J.; Chen, Y.; Huang, B.H.; Ye, D.Z. Social networks and informal finance inclusion in China. Asia Pac. J. Manag. 2019, 36, 529–563. [Google Scholar] [CrossRef]

- Liu, T.; He, G.W.; Turvey, G.C. Inclusive Finance, Farm Households Entrepreneurship, and Inclusive Rural Transformation in Rural Poverty-stricken Areas in China. Emerg. Mark. Financ. Trade 2021, 57, 1929–1958. [Google Scholar] [CrossRef]

- Goedecke, J.; Guérin, I.; D’Espallier, B.; Venkatasubramanian, G. Why do financial inclusion policies fail in mobilizing savings from the poor? Lessons from rural south India. Dev. Policy Rev. 2016, 36, 201–219. [Google Scholar] [CrossRef] [Green Version]

- Cnaan, R.A.; Moodithaya, M.S.; Handy, F. Financial Inclusion: Lessons from Rural South India. J. Soc. Policy 2012, 41, 183–205. [Google Scholar] [CrossRef] [Green Version]

- Wang, X.; He, G.W. Digital Financial Inclusion and Farmers’ Vulnerability to Poverty: Evidence from Rural China. Sustainability 2020, 12, 1668. [Google Scholar] [CrossRef] [Green Version]

- Di Vaio, A.; Boccia, F.; Landriani, L.; Palladino, R. Artificial Intelligence in the Agri-Food System: Rethinking Sustainable Business Models in the COVID-19 Scenario. Sustainability 2020, 12, 4851. [Google Scholar] [CrossRef]

- Apostolopoulos, N.; Ratten, V.; Petropoulos, D.; Liargovas, P.; Anastasopoulou, E. Agri-food sector and entrepreneurship during the COVID-19 crisis: A systematic literature review and research agenda. Strateg. Chang. 2021, 30, 159–167. [Google Scholar] [CrossRef]

- Alibaba Group. Alibaba Corporate Social Responsibility Report 2020–2021. Available online: http://www.alijijinhui.org/Uploads/file/20210804/6109ad3032390.pdf (accessed on 4 August 2021).

- People’s Bank of China (PBOC). China Inclusive Finance Indicators Analysis Report. 2020. Available online: http://www.pbc.gov.cn/goutongjiaoliu/113456/113469/4335821/2021090816343161697.pdf (accessed on 8 September 2021).

- Baldwin, R.E.; Taglioni, D. Gravity Chains: Estimating bilateral trade flows when parts and components trade is important. J. Bank. Financ. Econ. 2014, 2, 61. [Google Scholar] [CrossRef] [Green Version]

- Kohl, T. The Belt and Road Initiative’s effect on supply-chain trade: Evidence from structural gravity equations. Camb. J. Reg. Econ. Soc. 2019, 12, 77–104. [Google Scholar] [CrossRef] [Green Version]

- Anderson, J.E.; Wincoop, E.V. Gravity with Gravitas: A Solution to the Border Puzzle. Am. Econ. Rev. 2003, 93, 170–192. [Google Scholar] [CrossRef] [Green Version]

- Bergstrand, J.H.; Egger, P.; Larch, M. Gravity Redux: Estimation of Gravity-equation Coefficients, Elasticties of Substitution and General Equilibrium Comparative statics under asymmertric bilateral trade costs. J. Int. Econ. 2013, 89, 110–121. [Google Scholar] [CrossRef]

- Novy, D. Internation trade without CES: Estimating translog gravity. J. Int. Econ. 2013, 89, 271–282. [Google Scholar] [CrossRef] [Green Version]

- Chaney, T. Distorted gravity: The intensive and extensive margins of international trade. Am. Econ. Rev. 2008, 98, 1707–1721. [Google Scholar] [CrossRef] [Green Version]

- Silva, J.M.C.S.; Tenreyro, S. Further simulation evidence on the performance of the Poisson pseudo-maximum likelihood estimator. Econ. Lett. 2011, 112, 220–222. [Google Scholar] [CrossRef] [Green Version]

- Chaney, T. The network structure of international trade. Am. Econ. Rev. 2014, 104, 3600–3634. [Google Scholar] [CrossRef] [Green Version]

- Chaney, T. The Gravity Equation in international trade: An explanation. J. Political Econ. 2018, 126, 150–177. [Google Scholar] [CrossRef] [Green Version]

- Helpman, E.; Melitz, M.; Rubinstein, Y. Estimating Trade Flows: Trading Partners and Trading Volumes. Q. J. Econ. 2013, 123, 441–487. [Google Scholar] [CrossRef] [Green Version]

- Martínez-Zarzoso, I. The Log of Gravity Revisited. Appl. Econ. 2013, 45, 311–327. [Google Scholar] [CrossRef] [Green Version]

- Sergio, C.; Guimarães, P.; Tom, Z. Fast Poisson estimation with high-dimensional fixed effects. Stata J. 2020, 20, 95–115. [Google Scholar] [CrossRef]

- Chen, J.; Chen, W.; Liu, E.; Luo, J.; Song, Z.M. The Economic Impact of COVID-19 in China: Evidence from City-to-City Truck Flows. 2020, Working Paper. Available online: https://scholar.princeton.edu/sites/default/files/ernestliu/files/covid_truckflow_0.pdf (accessed on 14 December 2020).

- Guo, F.; Kong, S.T.; Wang, J.Y. General patterns and regional disparity of internet finance development in China: Evidence from the Peking University Internet Finance Development Index. China Econ. J. 2016, 9, 253–271. [Google Scholar] [CrossRef]

- Guo, F.; Wang, J.Y.; Wang, F.; Kong, S.T.; Zhang, X.; Cheng, Z.Y. Measuring China’s Digital Financial Inclusion: Index Compilation and Spatial Characteristics. China Econ. Q. 2020, 19, 1401–1418. (In Chinese) [Google Scholar] [CrossRef]

- Liu, Y.; Liu, C.; Zhou, M. Does digital inclusive finance promote agricultural production for rural households in China? Research based on the Chinese family database (CFD). China Agric. Econ. Rev. 2021, 13, 475–494. [Google Scholar] [CrossRef]

| Variable | Definition | Obs | Mean | Std. Dev. |

|---|---|---|---|---|

| Tradei,j | Agricultural products logistics data between region i and region j definited by Section 3.3.1 | 10,300 | 137.94 | 129.98 |

| Aggregatei,j | Aggregate index from PKU-IFDI and calculated according to Equation (4) | 10,554 | 256.83 | 17.09 |

| Widthi,j | Digital financial inclusion widening sub-index from PKU-IFDI and calculated according to Equation (4) | 10,554 | 248.03 | 20.05 |

| Depthi,j | Digital financial inclusion deepening sub-index from PKU-IFDI and calculated according to Equation (4) | 10,554 | 254.92 | 18.06 |

| Digitalizationi,j | Financial services digitization sub-index from PKU-IFDI and calculated according to Equation (4) | 10,554 | 289.40 | 10.87 |

| Distancei,j | Geographical distance between region i and region j (Unit: km) | 10,300 | 1170.35 | 605.44 |

| Easti,j | 1 = Origin or destination in the Eastern Province, 0 = others | 10,682 | 0.60 | 0.49 |

| Variable | Trade | Aggregate | Width | Depth | Digitalization | Distance | East |

|---|---|---|---|---|---|---|---|

| Trade | 1.0000 | ||||||

| Aggregate | 0.4297 | 1.0000 | |||||

| Width | 0.4903 | 0.9730 | 1.0000 | ||||

| Depth | 0.6470 | 0.9302 | 0.8243 | 1.0000 | |||

| Digitalization | −0.0550 | 0.8777 | 0.7737 | 0.9013 | 1.0000 | ||

| Distance | −0.1916 | 0.0080 | 0.0367 | −0.0392 | −0.0282 | 1.0000 | |

| East | 0.0231 | 0.0379 | −0.0290 | 0.1271 | 0.1553 | −0.0420 | 1.0000 |

| Dependent Variable: lnTradei,j | Model-1 | Model-2 | Model-3 | Model-4 | Model-5 |

|---|---|---|---|---|---|

| lnAggregatei,j | 0.8404 ** | ||||

| (2.23) | |||||

| lnWidthi,j | 0.6967 ** | 0.5398 *** | |||

| (2.25) | (3.66) | ||||

| lnDepthi,j | 0.7321 ** | 2.513 *** | |||

| (2.20) | (3.27) | ||||

| lnDigitalizationi,j | 0.1490 | −4.8552 | |||

| (0.24) | (−1.13) | ||||

| lnDistancei,j | −0.5702 *** | −0.5698 *** | −0.5704 *** | −0.5683 *** | 0.5698 *** |

| (−38.28) | (−38.28) | (−38.28) | (−38.14) | (−38.26) | |

| Constant | 3.9632 * | 4.7821 *** | 4.5706 ** | 7.7687 ** | 19.0293 *** |

| (1.90) | (2.80) | (2.49) | (2.18) | (4.24) | |

| Regioni Fixed effect | yes | yes | yes | yes | yes |

| Regionj Fixed effect | yes | yes | yes | yes | yes |

| Adj R-squared | 0.4988 | 0.4988 | 0.4988 | 0.4986 | 0.4994 |

| F-value | 732.74 *** | 732.79 *** | 732.68 *** | 729.93 *** | 370.29 *** |

| obs | 10,295 | 10,295 | 10,295 | 10,295 | 10,295 |

| Dependent Variable: Tradei,j | Model-6 | Elasticity Calculated by Model-6 1 | Model-7 | Model-8 | Model-9 | Model-10 |

|---|---|---|---|---|---|---|

| Aggregatei,j | 0.0063 * | 1.6311 | ||||

| (1.95) | ||||||

| Widthi,j | 0.0049 * | 0.0002 ** | ||||

| (1.72) | (2.11) | |||||

| Depthi,j | 0.0065 *** | 0.0170 *** | ||||

| (2.68) | (2.88) | |||||

| Digitalizationi,j | 0.0045 | −0.0183 | ||||

| (1.17) | (0.05) | |||||

| Distancei,j | −0.0005 *** | −0.6159 | −0.0005 *** | −0.0005 *** | −0.0006 *** | −0.0005 *** |

| (−21.61) | (−21.53) | (−21.70) | (−21.23) | (−21.91) | ||

| Constant | 3.9773 *** | 4.3923 *** | 3.9442 *** | 4.3087 *** | 6.5240 *** | |

| (4.77) | (5.86) | (6.36) | (3.89) | (4.61) | ||

| Regioni Fixed effect | yes | yes | yes | yes | yes | |

| Regionj Fixed effect | yes | yes | yes | yes | yes | |

| Pseudo R-squared | 0.4287 | 0.4286 | 0.4289 | 0.4283 | 0.4295 | |

| Wald test | 471.82 *** | 468.81 *** | 480.69 *** | 450.79 *** | 513.82 *** | |

| obs | 10,611 | 10,611 | 10,611 | 10,611 | 10,611 |

| Dependent Variable: lnTradei,j | Model-11 | Model-12 | Model-13 | Model-14 | Model-15 East = 1 | Model-16 East = 0 |

|---|---|---|---|---|---|---|

| lnAggregatei,j | 2.1601 *** | |||||

| (4.78) | ||||||

| lnWidthi,j | 1.1404 *** | |||||

| (2.98) | ||||||

| lnDepthi,j | 1.9708 ** | |||||

| (5.51) | ||||||

| lnDigitalizationi,j | 3.2856 *** | 2.3340 *** | −0.6922 | |||

| (4.34) | (3.09) | (−0.49) | ||||

| east | 10.7849 *** | 3.0403 * | 16.2590 *** | 29.1555 *** | ||

| (5.14) | (1.82) | (9.32) | (7.33) | |||

| east*lnindexi,j | −1.9345 *** | −0.3026 * | −2.9329 *** | −1.1433 *** | ||

| (−5.13) | (−1.80) | (−9.31) | (−7.33) | |||

| lnDistancei,j | −0.5755 *** | −0.5752 *** | −0.5623 *** | −0.5752 *** | −0.6140 *** | −0.5871 *** |

| (−37.90) | (−37.83) | (−36.99) | (−37.92) | (−24.92) | (−20.72) | |

| Constant | −3.3530 | 2.3443 | −2.3407 | −9.9495 ** | 22.2242 *** | 12.5714 |

| (−1.34) | (1.11) | (1.18) | (−2.32) | (5.19) | (1.57) | |

| Regioni Fixed effect | yes | yes | yes | yes | yes | yes |

| Regionj Fixed effect | yes | yes | yes | yes | yes | yes |

| Adj R-squared | 0.5001 | 0.4990 | 0.5031 | 0.5012 | 0.5137 | 0.5700 |

| F-value | 374.34 *** | 367.71 *** | 391.63 *** | 380.58 *** | 320.90 *** | 249.90 *** |

| obs | 10,295 | 10,295 | 10,295 | 10,295 | 6404 | 3891 |

| Dependent Variable: Tradei,j | Model-16 | Model-17 | Model-18 | Model-19 | Model-20 East = 1 | Model-21 East = 0 |

|---|---|---|---|---|---|---|

| Aggregatei,j | 0.0072 * | |||||

| (1.72) | ||||||

| Widthi,j | 0.0040 | |||||

| (0.98) | ||||||

| Depthi,j | 0.0083 *** | |||||

| (3.04) | ||||||

| Digitalizationi,j | 0.0074 * | 0.0078 ** | −0.2993 | |||

| (1.75) | (2.04) | (−0.81) | ||||

| east | 0.5585 | −0.2107 | 1.3161 ** | 2.1438 * | ||

| (0.82) | (−0.36) | (2.43) | (1.90) | |||

| east*indexi,j | −0.0025 | 0.0003 | −0.0056 *** | −0.0039 ** | ||

| (−0.99) | (0.16) | (−2.66) | (−2.00) | |||

| Distancei,j | −0.0005 *** | −0.0005 *** | −0.0005 *** | −0.0005 *** | −0.0008 *** | −0.0006 *** |

| (−21.35) | (−21.22) | (−21.14) | (−20.93) | (−24.92) | (−8.88) | |

| Constant | −3.828 *** | 4.6743 *** | −3.5828 *** | 3.5297 *** | 8.1093 *** | 4.1406 ** |

| (−3.57) | (4.59) | (5.18) | (2.87) | (7.28) | (1.98) | |

| Regioni Fixed effect | yes | yes | yes | yes | yes | yes |

| Regionj Fixed effect | yes | yes | yes | yes | yes | yes |

| Pseudo R-squared | 0.4296 | 0.4294 | 0.4304 | 0.4296 | 0.4789 | 0.4857 |

| Wald test | 477.29 *** | 468.08 *** | 510.20 *** | 457.60 *** | 372.39 *** | 80.45 *** |

| obs | 10,611 | 10,611 | 10,611 | 10,611 | 6626 | 4349 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Fang, D.; Zhang, X. The Protective Effect of Digital Financial Inclusion on Agricultural Supply Chain during the COVID-19 Pandemic: Evidence from China. J. Theor. Appl. Electron. Commer. Res. 2021, 16, 3202-3217. https://doi.org/10.3390/jtaer16070174

Fang D, Zhang X. The Protective Effect of Digital Financial Inclusion on Agricultural Supply Chain during the COVID-19 Pandemic: Evidence from China. Journal of Theoretical and Applied Electronic Commerce Research. 2021; 16(7):3202-3217. https://doi.org/10.3390/jtaer16070174

Chicago/Turabian StyleFang, Da, and Xiaoke Zhang. 2021. "The Protective Effect of Digital Financial Inclusion on Agricultural Supply Chain during the COVID-19 Pandemic: Evidence from China" Journal of Theoretical and Applied Electronic Commerce Research 16, no. 7: 3202-3217. https://doi.org/10.3390/jtaer16070174

APA StyleFang, D., & Zhang, X. (2021). The Protective Effect of Digital Financial Inclusion on Agricultural Supply Chain during the COVID-19 Pandemic: Evidence from China. Journal of Theoretical and Applied Electronic Commerce Research, 16(7), 3202-3217. https://doi.org/10.3390/jtaer16070174