Has the Pilot Project of Innovative Cities Increased Economic Growth? An Empirical Study Based on Chinese Cities

Abstract

1. Introduction

2. Theory and Hypothesis

3. Model and Data

3.1. Methodology

3.1.1. Benchmark Regression Model

3.1.2. Mediating Effect Model

3.2. Variable Selection and Data

3.2.1. Data Source

3.2.2. Variables

- Explained variable: Urban economic growth. This is characterized by the growth rate of the city’s GDP (Rgdp) in the benchmark regression; in the robustness test, the real GDP of the entire city (Realgdp) and the GDP growth rate of the municipal district (Rgdp1) are used.

- Independent variable: The paper uses the dummy variable (Innovcity) to capture the impact of the policy. If a city is designated as an innovation-pilot city (By 2017, the 61 pilot cities were established in four batches, comprising 55 prefecture-level cities, four municipalities directly under the central government, and two county-level cities. In this study, Shenzhen, the first innovative city pilot approved in 2008, was excluded from the treated group due to its unique policies and lack of representativeness. Additionally, the four municipalities were excluded because only certain districts within these municipalities implemented innovative pilot policies, and district-level data was relatively scarce. The two county-level cities, Changji and Shihezi, were also excluded. Therefore, in our research, the number of innovation-pilot cities is 54) in a given year, the dummy variable will be assigned a value of 1 for that year and all subsequent years; otherwise, it will be 0 (This dummy variable is an interaction term for city and policy year, indicating whether an innovative city policy is implemented in a city during a given year. Thus, the value of 0 applies to two cases: cities that have never been designated as pilot innovative cities and the years before a city is designated as such).

- Control variables: Comprehensively considering other factors affecting economic growth, this study selects the following series of variables as control variables. (1) City size (Size): Existing studies [24] have shown that urban scale will affect urban efficiency through two contrary effects: economies of scale and the crowding effect. Therefore, the city size is taken as the control variable and described by the total population in the study. (2) Industrial structure (Sec): Empirical research showed that the change in China’s industrial structure had a significant impact on economic growth and fluctuations [25]. Thus, the proportion of the secondary industry was used in this study to reflect the industrial structure. (3) Trade openness (Open): Foreign investors can provide financial support to China’s enterprises or directly construct new factories in China; thus, these activities bring technology spillover and promote economic development [26]. In this study, the logarithm of the amount of foreign direct investment is used to describe this concept. (4) Internet (Internet): In recent years, internet technology has effectively decreased resource mismatch, improved the efficiency of resource allocation, and promoted economic development [27]. This study uses internet indicators to measure the construction of urban information infrastructure using logarithms. (5) Infrastructure (Infras): The improvement of transportation infrastructure can reduce transaction costs, promote market competition and professional division of labor [28], and thus affect economic development. Therefore, this study uses per capita road area to describe infrastructure.

- Intermediary variable.

4. Empirical Results

4.1. Benchmark Regression Results

4.2. Robust Tests

4.2.1. Parallel Trend Tests

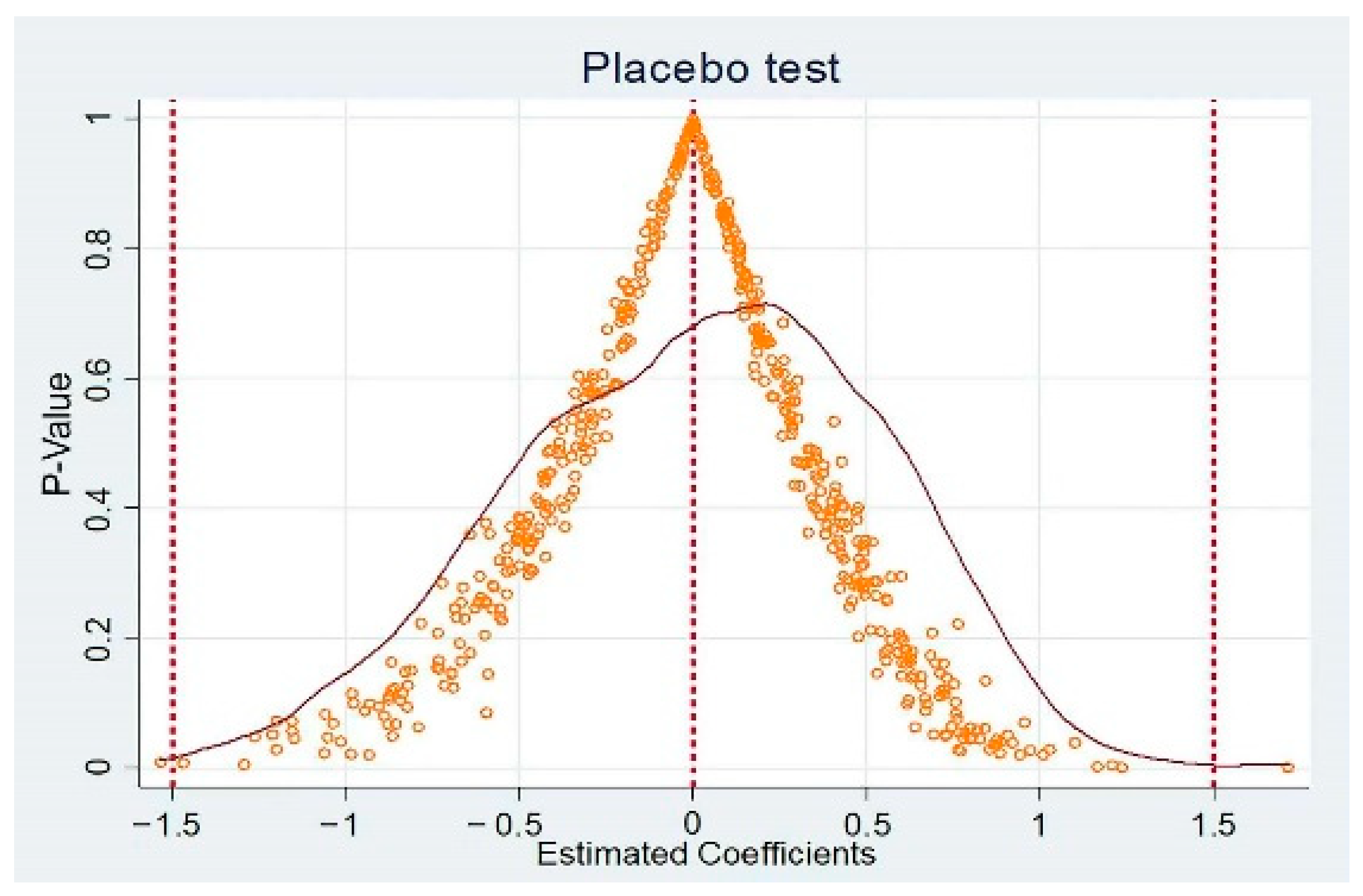

4.2.2. Placebo Test

4.2.3. Changing Explained Variable

4.2.4. Changing the Region of Data

4.2.5. Eliminating the Interference of High-Speed Rails

4.3. Test of Mediating Effects

4.3.1. The Mediating Effect of Technological Progress

4.3.2. The Mediating Effect of Human Capital

4.4. Heterogeneity Test

4.4.1. Regional Heterogeneity

4.4.2. Heterogeneity of City Size

4.4.3. Heterogeneity of a City’s Administrative Grade

4.4.4. Heterogeneity of Marketization Degree

4.4.5. The Heterogeneity of Government Efficiency

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Fan, F.; Yang, B.; Wang, S. The Convergence Mechanism and Spatial Spillover Effects of Urban Industry-University-Research Collaborative Innovation Performance in China. Technol. Anal. Strateg. Manag. 2023, 1–17. [Google Scholar] [CrossRef]

- Zhao, W.; Toh, M.Y. Impact of Innovative City Pilot Policy on Industrial Structure Upgrading in China. Sustainability 2023, 15, 7377. [Google Scholar] [CrossRef]

- Yang, J.; Xiong, G.; Shi, D. Innovation and Sustainable: Can Innovative City Improve Energy Efficiency? Sust. Cities Soc. 2022, 80, 103761. [Google Scholar] [CrossRef]

- Nie, F.; Liu, H. The Influence of on China’s FDI Quality. Econ. Rev. 2019, 6, 67–79. [Google Scholar] [CrossRef]

- He, J. An Empirical Test of the Impact of the Establishment of Innovative Cities on the Efficiency of Logistics Industry. Stat. Decis. 2020, 36, 80–83. [Google Scholar] [CrossRef]

- Chen, C.; Guang, S.Z. National Innovative City Policy, High -End Productive Service Industry Agglomeration and High-Quality Regional Economic Development. Financ. Trade Res. 2020, 31, 36–51. [Google Scholar] [CrossRef]

- Wang, S.; Wang, J.X.; Wei, C.Q.; Wang, X.L.; Fan, F. Collaborative Innovation Efficiency: From within Cities to between Cities-Empirical Analysis Based on Innovative Cities in China. Growth Chang. 2021, 52, 1330–1360. [Google Scholar] [CrossRef]

- Zhou, Y.; Li, S. Can the Innovative-City-Pilot Policy Promote Urban Innovation? An Empirical Analysis from China. J. Urban Aff. 2021, 45, 1679–1697. [Google Scholar] [CrossRef]

- Li, L.; Li, M.; Ma, S.; Zheng, Y.; Pan, C. Does the Construction of Innovative Cities Promote Urban Green Innovation? J. Environ. Manag. 2022, 318, 115605. [Google Scholar] [CrossRef]

- Guo, F.; Yang, S.; Chai, Z. Does the construction of innovative cities improve the quantity and quality of enterprise innovation? Micro-evidence from Chinese industrial enterprises. Ind. Econ. Res. 2021, 3, 128–142. [Google Scholar]

- Nie, C.; Lu, J.; Feng, Y.; Hu, Z. Impact of Innovative City Construction on Green Total Factor Productivity. China Popul. Resour. Environ. 2021, 31, 117–127. [Google Scholar] [CrossRef]

- Zhang, H.; Kang, C.; Feng, C. From Innovation to Green: Does China’s Innovative City Construction Contribute to Green Development? Emerg. Mark. Financ. Trade 2024, 60, 2497–2532. [Google Scholar] [CrossRef]

- Zandiatashbar, A.; Hamidi, S.; Foster, N. High-Tech Business Location, Transportation Accessibility, and Implications for Sustainability: Evaluating the Differences between High-Tech Specializations Using Empirical Evidence from US Booming Regions. Sustain. Cities Soc. 2019, 50, 101648. [Google Scholar] [CrossRef]

- Fan, F.; Lian, H.; Wang, S. Can Regional Collaborative Innovation Improve Innovation Efficiency? An Empirical Study of Chinese Cities. Growth Chang. 2020, 51, 440–463. [Google Scholar] [CrossRef]

- Wu, Y.; Gu, X.; Tu, Z.; Zhang, Z. System Dynamic Analysis on Industry-University-Research Institute Synergetic Innovation Process Based on Knowledge Flow. Scientometrics 2022, 127, 1317–1338. [Google Scholar] [CrossRef]

- Nee, V. Organizational Dynamics of Market Transition—Hybrid Forms, Property-Rights, and Mixed Economy in China. Adm. Sci. Q. 1992, 37, 1–27. [Google Scholar] [CrossRef]

- Gao, Y.; Hu, Y.; Liu, X.; Zhang, H. Can Public R&D Subsidy Facilitate Firms? Exploratory Innovation? The Heterogeneous Effects between Central and Local Subsidy Programs. Res. Policy 2021, 50, 104221. [Google Scholar] [CrossRef]

- Lee, C.; Lee, K.; Pennings, J.M. Internal Capabilities, External Networks, and Performance: A Study on Technology-Based Ventures. Strateg. Manag. J. 2001, 22, 615–640. [Google Scholar] [CrossRef]

- Coe, D.T.; Helpman, E. International R-and-D Spillovers. Eur. Econ. Rev. 1995, 39, 859–887. [Google Scholar] [CrossRef]

- Lucas, R.E. On the Mechanics of Economic Development. J. Monet. Econ. 1988, 22, 3–42. [Google Scholar] [CrossRef]

- Ganau, R.; Grandinetti, R. Disentangling Regional Innovation Capability: What Really Matters? Ind. Innov. 2021, 28, 749–772. [Google Scholar] [CrossRef]

- Beck, T.; Levine, R.; Levkov, A. Big Bad Banks? The Winners and Losers from Bank Deregulation in the United States. J. Financ. 2010, 65, 1637–1667. [Google Scholar] [CrossRef]

- Baron, R.M.; Kenny, D.A. The Moderator-Mediator Variable Distinction in Social Psychological Research: Conceptual, Strategic, and Statistical Considerations. J. Personal. Soc. Psychol. 1986, 51, 1173–1182. [Google Scholar] [CrossRef] [PubMed]

- Acemoglu, D.; Garcia-Jimeno, C.; Robinson, J.A. State Capacity and Economic Development: A Network Approach. Am. Econ. Rev. 2015, 105, 2364–2409. [Google Scholar] [CrossRef]

- Zhang, L.; Lin, G.; Lyu, X.; Su, W. Suppression or Promotion: Research on the Impact of Industrial Structure Upgrading on Urban Economic Resilience. Humanit. Soc. Sci. Commun. 2024, 11, 843. [Google Scholar] [CrossRef]

- Wang, S.; Zhang, J.; Fan, F.; Lu, F.; Yang, L. The Symbiosis of Scientific and Technological Innovation Efficiency and Economic Efficiency in China—An Analysis Based on Data Envelopment Analysis and Logistic Model. Technol. Anal. Strateg. Manag. 2019, 31, 67–80. [Google Scholar] [CrossRef]

- Lin, J.; Yu, Z.; Wei, Y.D.; Wang, M. Internet Access, Spillover and Regional Development in China. Sustainability 2017, 9, 946. [Google Scholar] [CrossRef]

- Redding, S.J.; Turner, M.A. Transportation Costs and the Spatial Organization of Economic Activity. In Handbook of Regional and Urban Economics; Duranton, G., Henderson, J.V., Strange, W.C., Eds.; Elsevier: Amsterdam, The Netherlands, 2015; Volume 5, Chapter 20; pp. 1339–1398. ISBN 1574-0080. [Google Scholar]

- Archibugi, D.; Pianta, M. Measuring Technological Change through Patents and Innovation Surveys. Technovation 1996, 16, 451–468. [Google Scholar] [CrossRef]

- Cantoni, D.; Chen, Y.Y.; Yang, D.Y.; Yuchtman, N.; Zhang, Y.J. Curriculum and Ideology. J. Political Econ. 2017, 125, 338–392. [Google Scholar] [CrossRef]

- Tang, H.Y.; Zhang, J.Q.; Fan, F.; Wang, Z.W. High-Speed Rail, Urban Form, and Regional Innovation: A Time-Varying Difference-in-Differences Approach. Technol. Anal. Strateg. Manag. 2022, 36, 195–209. [Google Scholar] [CrossRef]

- Li, H.; Strauss, J.; Shunxiang, H.; Lui, L. Do High-Speed Railways Lead to Urban Economic Growth in China? A Panel Data Study of China’s Cities. Q. Rev. Econ. Financ. 2018, 69, 70–89. [Google Scholar] [CrossRef]

- Arnott, R. Optimal City Size in a Spatial Economy. J. Urban Econ. 1979, 6, 65–89. [Google Scholar] [CrossRef]

- Fan, F.; Dai, S.; Zhang, K.; Ke, H. Innovation Agglomeration and Urban Hierarchy: Evidence from Chinese Cities. Appl. Econ. 2021, 53, 6300–6318. [Google Scholar] [CrossRef]

- Fan, G.; Ma, G.; Wang, X. Institutional Reform and Economic Growth of China: 40-Year Progress toward Marketization. Acta Oeconomica 2019, 69, 7–20. [Google Scholar] [CrossRef]

- Aghion, P.; Cai, J.; Dewatripont, M.; Du, L.S.; Harrison, A.; Legros, P. Industrial Policy and Competition. Am. Econ. J. Macroecon. 2015, 7, 1–32. [Google Scholar] [CrossRef]

- Tang, R.; Tang, T.; Lee, Z. The Efficiency of Provincial Governments in China from 2001 to 2010: Measurement and Analysis. J. Public Aff. 2014, 14, 142–153. [Google Scholar] [CrossRef]

| Variables | Definition of Variables | |

|---|---|---|

| Economic growth | Rgdp | The growth rate of GDP in the city |

| Realgdp | The logarithm of real GDP in the city | |

| Rgdp1 | The rate of GDP in the municipal district of the city | |

| Control variable | Size | The logarithm of total population in the city |

| Sec | The proportion of the second industry in the regional GDP | |

| Open | The amount of foreign direct investment, taking a logarithm | |

| Internet | The amount of internet, taking a logarithm | |

| Infrast | Per capita urban road area | |

| Intermediary variable | Patent1 | Innovation index, from the “Report on China’s Urban and Industrial Innovation” |

| Patent2 | Number of patent applications/total population | |

| Hum | The proportion of higher education students in the total population of the region | |

| Variables | Count | Mean | Std. | Min | Max | Years |

|---|---|---|---|---|---|---|

| Rgdp | 3360 | 11.2831 | 4.5968 | −19.0100 | 32.9000 | 12 |

| Realgdp | 3360 | 6.7028 | 0.9669 | 3.9155 | 9.7393 | 12 |

| Rgdp1 | 3360 | 11.2509 | 4.9709 | −19.6700 | 30.0000 | 12 |

| Size | 3360 | 5.8455 | 0.6733 | 2.8685 | 7.2689 | 12 |

| Sec | 3360 | 48.9986 | 10.6965 | 14.9500 | 90.9700 | 12 |

| Open | 3360 | 11.0974 | 3.0862 | 0.0000 | 15.9676 | 12 |

| Internet | 3360 | 3.5062 | 1.0652 | 0.0296 | 6.6412 | 12 |

| Infrast | 3360 | 0.1956 | 0.3892 | 0.0009 | 5.7902 | 12 |

| Hum | 3360 | 164.9450 | 227.5575 | 0.0405 | 1311.2407 | 12 |

| Patent1 | 3360 | 5.1591 | 15.9764 | 0.0000 | 219.3894 | 12 |

| Patent2 | 3360 | 5.8524 | 13.6865 | 0.0109 | 213.2227 | 12 |

| (1) | (2) | |

|---|---|---|

| Rgdp | Rgdp | |

| Innovcity | 0.7493 ** | 1.1359 *** |

| (0.3620) | (0.3880) | |

| Size | 7.0757 *** | |

| (2.1887) | ||

| Sec | 0.1974 *** | |

| (0.0241) | ||

| Open | 0.1738 ** | |

| (0.0720) | ||

| Internet | 0.6281 ** | |

| (0.2453) | ||

| Infrast | 2.6230 *** | |

| (0.8111) | ||

| Constant | 14.2275 *** | −40.0054 *** |

| (0.1609) | (12.9358) | |

| City fixed effects | Yes | Yes |

| Time fixed effects | Yes | Yes |

| Observations | 3360 | 3360 |

| N | 280 | 280 |

| Adjusted R2 | 0.4529 | 0.4991 |

| (1) | (2) | (3) | |

|---|---|---|---|

| Realgdp | Rgdp1 | Rgdp | |

| Innovcity | 0.0402 *** | 1.2366 *** | 1.1360 *** |

| (0.0103) | (0.3704) | (0.3884) | |

| Hsr | −0.2398 | ||

| (0.3130) | |||

| Control variable | Yes | Yes | Yes |

| City fixed effects | Yes | Yes | Yes |

| Time fixed effects | Yes | Yes | Yes |

| Observations | 3360 | 3360 | 3360 |

| N | 280 | 280 | 280 |

| Adjusted R2 | 0.9807 | 0.4813 | 0.4991 |

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| Patent 1 | Rgdp | Patent 2 | Rgdp | Hum | Rgdp | |

| Innovcity | 16.8242 *** | 0.8741 ** | 5.8592 *** | 0.9766 ** | 53.3311 *** | 0.9627 ** |

| (3.0569) | (0.3987) | (1.7837) | (0.3965) | (13.0604) | (0.3883) | |

| Patent1 | 0.0174 *** | |||||

| (0.0057) | ||||||

| Patent2 | 0.0272 ** | |||||

| (0.0110) | ||||||

| Hum | 0.0032 * | |||||

| (0.0017) | ||||||

| Control variable | Yes | Yes | Yes | Yes | Yes | Yes |

| City fixed effects | Yes | Yes | Yes | Yes | Yes | Yes |

| Time fixed effects | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 3360 | 3360 | 3360 | 3360 | 3360 | 3360 |

| N | 280 | 280 | 280 | 280 | 280 | 280 |

| Adjusted R2 | 0.3641 | 0.4792 | 0.4303 | 0.5001 | 0.3305 | 0.4998 |

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| Regional Distribution | City Size | |||||

| East | Central | West | Large | Medium | Small | |

| Innovcity | 1.7897 *** | −0.2881 | 1.8418 ** | −0.1920 | 1.8314 ** | 1.5653 * |

| (0.5143) | (0.5848) | (0.9080) | (0.4030) | (0.7997) | (0.8465) | |

| Control variable | Yes | Yes | Yes | Yes | Yes | Yes |

| City fixed effects | Yes | Yes | Yes | Yes | Yes | Yes |

| Time fixed effects | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 1164 | 1200 | 996 | 1092 | 972 | 1296 |

| N | 97 | 100 | 83 | 91 | 81 | 108 |

| Adjusted R2 | 0.6272 | 0.4758 | 0.4652 | 0.5756 | 0.5035 | 0.4839 |

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| Administrative Grade | Marketization | Government Efficiency | ||||

| High | Low | High | Low | High | Low | |

| Innovcity | 1.6387 * | 1.7212 *** | 0.7882 * | 1.7964 ** | 2.1657 *** | 0.1967 |

| (0.8237) | (0.4899) | (0.4653) | (0.7583) | (0.5181) | (0.5199) | |

| Control variable | Yes | Yes | Yes | Yes | Yes | Yes |

| city fixed effects | Yes | Yes | Yes | Yes | Yes | Yes |

| time fixed effects | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 540 | 2820 | 2052 | 1308 | 1536 | 1824 |

| N | 45 | 235 | 171 | 109 | 128 | 152 |

| Adjusted R2 | 0.6041 | 0.4862 | 0.5840 | 0.4602 | 0.5581 | 0.4462 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Xu, E.; Xiao, Z.; Wang, Z. Has the Pilot Project of Innovative Cities Increased Economic Growth? An Empirical Study Based on Chinese Cities. Reg. Sci. Environ. Econ. 2024, 1, 31-45. https://doi.org/10.3390/rsee1010003

Xu E, Xiao Z, Wang Z. Has the Pilot Project of Innovative Cities Increased Economic Growth? An Empirical Study Based on Chinese Cities. Regional Science and Environmental Economics. 2024; 1(1):31-45. https://doi.org/10.3390/rsee1010003

Chicago/Turabian StyleXu, Enni, Zihan Xiao, and Zhengwen Wang. 2024. "Has the Pilot Project of Innovative Cities Increased Economic Growth? An Empirical Study Based on Chinese Cities" Regional Science and Environmental Economics 1, no. 1: 31-45. https://doi.org/10.3390/rsee1010003

APA StyleXu, E., Xiao, Z., & Wang, Z. (2024). Has the Pilot Project of Innovative Cities Increased Economic Growth? An Empirical Study Based on Chinese Cities. Regional Science and Environmental Economics, 1(1), 31-45. https://doi.org/10.3390/rsee1010003