Economics of HIV Prevention: Understanding the Empirical Intersection between Commodity Price Shocks, Health Spending and HIV Infections in Developing Countries

Abstract

1. Introduction

2. Material and Methods

2.1. Data

- The country must be considered a commodity-dependent country—exporting commodities in one of the three commodity-export sectors (agricultural products, precious metals, and energy commodities) as defined by the United Nations Conference on Trade and Development (UNCTAD) (See Table 1).

- According to the International Monetary Fund (IMF), UNCTAD, or Morgan Stanley Capital International (MSCI) classification, the country must be considered a developing country.

- Without gaps, the country must have at least 30 years of consecutive annual data for macro-economic variables presented in World Bank or IMF databases.

2.2. Panel Unit Root Tests

2.3. Cointegration Tests

2.4. Econometric Estimation

2.4.1. Structural Vector Autoregression

2.4.2. Vector Error Correction Model

3. Results

3.1. Long-Run and Short-Run Dynamic Relationships

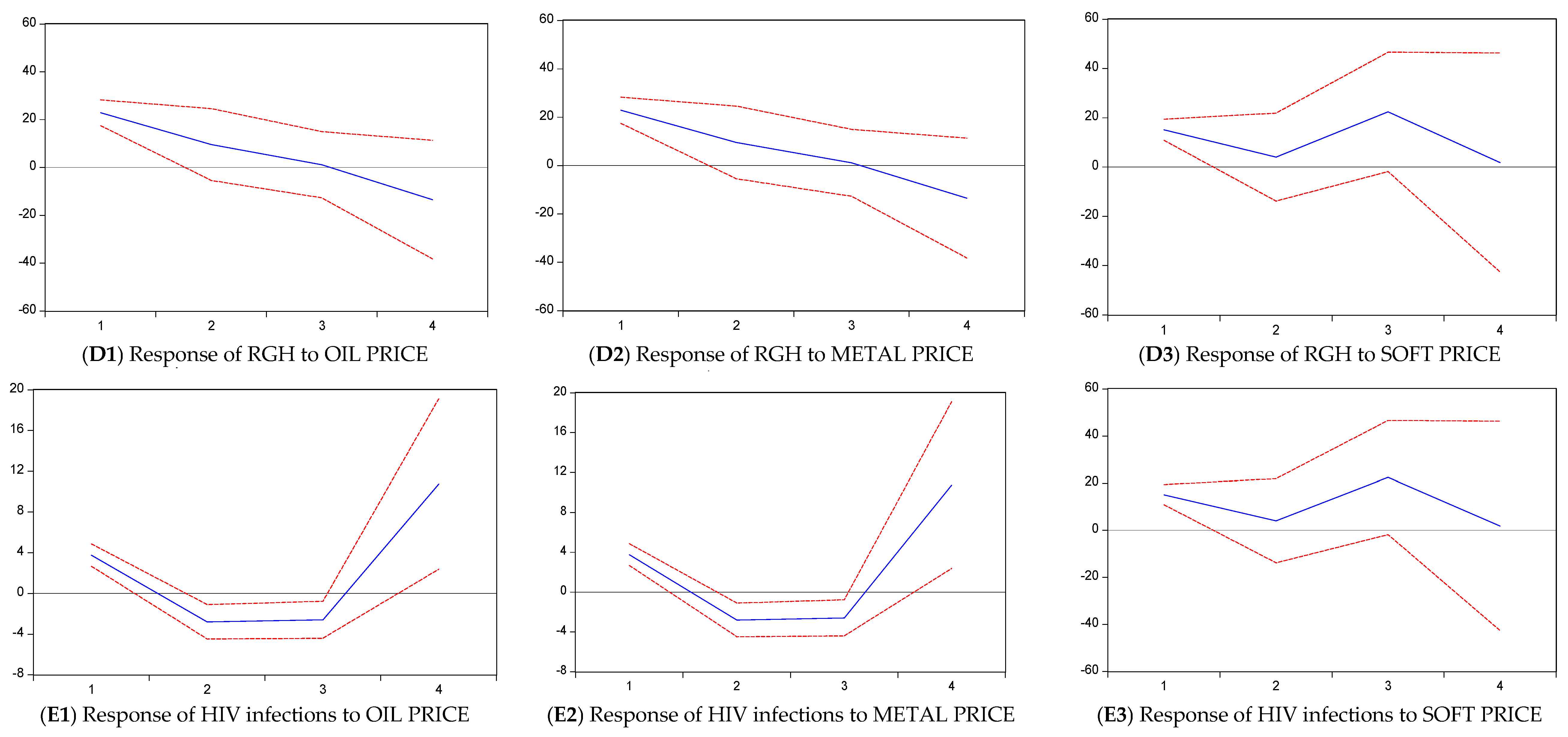

3.2. Shock Estimation

4. Discussion

- The long-run relationships between commodity prices and the analyzed four macroeconomic variables reveal a powerful, long-run relationship among the analyzed data. Commodity price shocks cause instant adjustment in the macro-economy environment of developing countries, worsening HIV infections.

- GDP per capita are more exposed to price fluctuations in the agricultural block. Hence, price shocks cause a rapid upswing in HIV infections. This reflects the fragility of the agricultural economies [32].

- HIV infections tend to respond the same way in metal and energy blocks due to modest adjustments in health spending arising from price shocks.

- Agricultural economies are more volatile [35]. Health spending in this block is also more volatile, driving a quick upswing in HIV infections.

Limitations

5. Conclusions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Global Burden of Disease Health Financing Collaborator Network. Health sector spending and spending on HIV/AIDS, tuberculosis, and malaria, and development assistance for health: Progress towards Sustainable Development Goal 3. Lancet 2020, 396, 693–724. [Google Scholar] [CrossRef] [PubMed]

- Allel, K.; Abou Jaoude, G.J.; Birungi, C.; Palmer, T.; Skordis, J.; Haghparast-Bidgoli, H. Technical efficiency of national HIV/AIDS spending in 78 countries between 2010 and 2018: A data envelopment analysis. PLOS Glob. Public Health 2022, 2, e0000463. [Google Scholar] [CrossRef] [PubMed]

- Mostert, C.M. Macroeconomics and health: Understanding the impact of a declining economy on health outcomes of children and young adults in South Africa. SSM Popul. Health 2023, 22, 101404. [Google Scholar] [CrossRef]

- Da, D.; Diarra, M. Effect of international commodity price shocks on public finances in Africa. Public Financ. Rev. 2023, 51, 236–261. [Google Scholar] [CrossRef]

- Bova, E.; Medas, P.; Poghosyan, T. Macroeconomic Stability in Resource-Rich Countries: The Role of Fiscal Policy. J. Financ. Econ. Bank. 2018, 1, 103–122. [Google Scholar] [CrossRef]

- Raouf, E. Oil Prices Shocks and Government Expenditure. Int. J. Energy Econ. Policy 2021, 11, 78–84. [Google Scholar] [CrossRef]

- Boakye, E.; Heimonen, K.; Junttila, J. Assessing the commodity market price and terms of trade exposures of macroeconomy in emerging and developing countries. Emerg. Mark. Financ. Trade 2022, 58, 2243–2257. [Google Scholar] [CrossRef]

- Canbay, Ş.; Kırca, M. Health expenditures (total, public and private) and per capita income in the BRICS+T: Panel bootstrap causality analysis. J. Econ. Financ. Adm. Sci. 2022, 27, 52–67. [Google Scholar] [CrossRef]

- Packel, L.; Fahey, C.; Kalinjila, A.; Mnyippembe, A.; Njau, P.; McCoy, S.I. Preparing a financial incentive program to improve retention in HIV care and viral suppression for scale: Using an implementation science framework to evaluate an mHealth system in Tanzania. Implement. Sci. Commun. 2021, 2, 109. [Google Scholar] [CrossRef]

- Mostert, C.M. The Impact and Spillover Effects of HIV Self-Test Technology on HIV Outcomes of the South African Working Class. Venereology 2022, 1, 187–198. [Google Scholar] [CrossRef]

- Zhou, C. Global recession linked to rising HIV deaths. J. Glob. Health 2021. Available online: https://jogh.org/global-recession-linked-to-rising-hiv-deaths-study-finds/#:~:text=Rising%20unemployment%20is%20linked%20to%20higher%20death%20rates,spending%20helps%20to%20reduce%20deaths%20from%20the%20disease (accessed on 28 July 2023).

- Kempton, J.; Hill, A.; Levi, J.A.; Heath, K.; Pozniak, A. Most new HIV infections, vertical transmissions and AIDS-related deaths occur in lower-prevalence countries. J. Virus Erad. 2019, 5, 92–101. [Google Scholar] [CrossRef]

- Ben, M.; Slimane, B.; Houfi, M. Commodity prices and economic growth in commodity-dependent countries: New evidence from nonlinear and asymmetric analysis. Resour. Policy 2021, 72, 102043. [Google Scholar] [CrossRef]

- Naz, A. Linkages between different types of globalization and socio-economic variables: Panel data analysis for 129 countries. Econ. Struct. 2023, 12, 7. [Google Scholar] [CrossRef]

- Mekasha, T.; Molla, K.; Tarp, F.; Aikaeli, J. Commodity price fluctuations and child malnutrition. World Dev. 2022, 158, 105927. [Google Scholar] [CrossRef]

- Sauermilch, D. HIV and the economic recession in the 2020s. J. Assoc. Nurses AIDS Care 2020, 31, 376–378. [Google Scholar] [CrossRef] [PubMed]

- Paraskevis, D.; Nikolopoulos, G.; Fotiou, A.; Tsiara, C.; Paraskeva, D.; Sypsa, V.; Lazanas, M.; Gargalianos, P.; Psichogiou, M.; Skoutelis, A.; et al. Economic recession and emergence of an HIV-1 outbreak among drug injectors in Athens metropolitan area: A longitudinal study. PLoS ONE 2013, 8, e78941. [Google Scholar] [CrossRef]

- Zavras, D. Studying Healthcare Affordability during an Economic Recession: The Case of Greece. Int. J. Environ. Res. Public Health 2020, 17, 7790. [Google Scholar] [CrossRef] [PubMed]

- UNCTAD. The state of commodity dependence. In International Trade and Commodities; UNCTAD: Geneva, Switzerland, 2023; Available online: https://unctad.org/publication/state-commodity-dependence-2023 (accessed on 28 July 2023).

- Hamilton, J. Why you should never use the Hodrick-Prescott filter. Rev. Econ. Stat. 2018, 100, 831–843. [Google Scholar] [CrossRef]

- World Health Organization. Monitoring the Building Blocks of Health Systems: A Handbook of Indicators and Their Measurement Strategies. 1.Delivery of Health Care. 2.Monitoring. 3.Health Care quality, Access, and Evaluation. 4.Health Care Evaluation Mechanisms. 5.National Health Programs—Organization and Administration. Available online: https://apps.who.int/iris/bitstream/handle/10665/258734/9789241564052-eng.pdf (accessed on 28 July 2023).

- Kirwin, E.; Meacock, R.; Round, J.; Sutton, M. The diagonal approach: A theoretic framework for the economic evaluation of vertical and horizontal interventions in healthcare. Soc. Sci. Med. 2022, 301, 114900. [Google Scholar] [CrossRef]

- Chudik, A.; Georgiadis, G. Estimation of Impulse Response Functions When Shocks Are Observed at a Higher Frequency Than Outcome Variables. J. Bus. Econ. Stat. 2022, 40, 965–979. [Google Scholar] [CrossRef]

- Drechsel, T.; Tenreyro, S. Commodity booms and busts in emerging economies. J. Int. Econ. 2018, 112, 200–218. [Google Scholar] [CrossRef]

- Fernández, A.; Schmitt-Grohé, S.; Uribe, M. World shocks, world prices, and business cycles: An empirical investigation. J. Int. Econ. 2017, 108, 2–14. [Google Scholar] [CrossRef]

- Blackburne, E.; Frank, F. Estimation of nonstationary heterogenous panels. Stata J. 2007, 7, 197–208. [Google Scholar] [CrossRef]

- Pesaran, M.; Shin, Y.; Smith, P. Pooled mean group estimation of dynamic heterogeneous panels. J. Am. Stat. Assoc. 1999, 94, 621–634. [Google Scholar] [CrossRef]

- Ben-Zeev, N.; Pappa, E.; Vicondoa, A. Emerging economies business cycles: The role of commodity terms of trade news. J. Int. Econ. 2017, 108, 368–376. [Google Scholar] [CrossRef]

- Fernández, A.; Gonzalez, A.; Rodriguez, D. Sharing a ride on the commodities roller coaster: Common factors in business cycles of emerging economies. J. Int. Econ. 2018, 111, 99–121. [Google Scholar] [CrossRef]

- Schmitt-Grohé, S.; Uribe, M. How important are terms-of-trade shocks? Int. Econ. Rev. 2018, 59, 85–111. [Google Scholar] [CrossRef]

- Baptista, D.; Spray, J.; Filiz, U. Coping with Climate Shocks: Food Security in a Spatial Framework; IMF Working: Washington, DC, USA, 2023; Paper 23/166. [Google Scholar]

- Nwafor, A. Are Agriculture Systems Well Prepared to Withstand High Impact Shocks such as the COVID-19 Pandemic, and, Faced with Such Shocks, Are They Resilient? Policy Brief. 2020. Available online: https://agra.org/wp-content/uploads/2020/07/Policy-Brief-Vulnerability-of-the-agriculture-sector-to-shocks-7-10-20.pdf (accessed on 28 July 2023).

- Baffes, J.; Streifel, S.; Temaj, K. How do Current Oil Market Conditions Differ from Those during the Price Shocks of the 1970s? World Bank Online Publication. 2023. Available online: https://blogs.worldbank.org/developmenttalk/how-do-current-oil-market-conditions-differ-those-during-price-shocks-1970s (accessed on 28 July 2023).

- Arezki, R.; Matsumoto, A. Chapter 5. Metal Prices Signal Global Economic Shifts. In Shifting Commodity Markets in a Globalized World; International Monetary Fund: Washington, DC, USA, 2017. [Google Scholar] [CrossRef]

- Kalkuhl, M.; von Braun, J.; Torero, M. Volatile and Extreme Food Prices, Food Security, and Policy: An Overview. In Food Price Volatility and Its Implications for Food Security and Policy; Kalkuhl, M., von Braun, J., Torero, M., Eds.; Springer: Cham, Switzerland, 2016. [Google Scholar] [CrossRef]

- Dzau, V.; Fuster, V.; Frazer, J.; Snair, M. Investing in Global Health for Our Future. N. Engl. J. Med. 2017, 377, 1292–1296. [Google Scholar] [CrossRef]

| Metal Block | Energy Block | Agricultural Block |

|---|---|---|

| Brazil (Tin and iron ore) | Gabon (Crude oil) | Honduras (Coffee) |

| Jamaica (Alumina) | Egypt (Crude oil) | Kenya (Tea) |

| Peru (Copper) | Indonesia (Crude oil) | Mali (Cotton) |

| Ukraine (Coal) | Malaysia (Natural gas) | Paraguay (Sugar) |

| Zambia (Copper) | Nigeria (Crude oil) | Sri Lanka (Cocoa) |

| Zimbabwe (Platinum) | Russia (Natural gas) | Uruguay (Soyabeans) |

| Variable | Data Source |

|---|---|

| Commodity prices | World Bank & Bloomberg |

| GDP per capita | World Bank & Bloomberg |

| Real government health spending (RGH) | World Health Organization & Business Monitor International |

| Real private health spending (RPH) | World Health Organization & Business Monitor International |

| HIV infections | Institute of Health Metrics and Evaluation |

| Variable | Fisher-ADF | Fisher-PP | |

|---|---|---|---|

| LN commodity price | Level | 80.966 *** | 47.987 |

| 1st difference | −2.457 *** | 66.345 ** | |

| GDP per capita | Level | 28.612 *** | 29.412 |

| 1st difference | −6.171 | 123.912 *** | |

| Real government health spending | Level | 97.123 *** | 86.125 *** |

| 1st difference | 99.124 *** | 123.543 *** | |

| Real private health spending | Level | 30.134 | 52.345 |

| 1st difference | 173.223 *** | 110.469 *** | |

| HIV infection rate | Level | 150.804 *** | 184.231 *** |

| 1st difference | −10.234 *** | 255.814 *** |

| Long-Run and Short-Run Relationships between Commodity Prices and Variables of Interest | |||||

|---|---|---|---|---|---|

| Panel 1 | Soft price | ||||

| Agricultural block (six countries) | GDP per capita | RGH | RPH | HIV | |

| LR | −0.491 (0.003) *** | −0.432 (0.007) *** | −0.102(0.005) *** | 0.049 (0.098) | |

| SR | −0.452 (0.226) ** | −0.010(0.001) *** | −0.007 (0.004) * | 0.153 (0.002) *** | |

| ECT | −0.611 (0.001) *** | −0.591 (0.002) *** | −0.599 (0.003) *** | −0.622 (0.001) *** | |

| Panel 2 | Oil price | ||||

| Energy block (six countries) | |||||

| LR | −0.231 (0.003) *** | −0.292 (0.007) *** | −0.022(0.005) *** | 0.025 (0.001) *** | |

| SR | −0.282 (0.016) *** | −0.003(0.001) *** | −0.002 (0.002) | −0.001 (0.003) | |

| ECT | −0.431 (0.005) *** | −0.421 (0.009) *** | −0.411 (0.008) *** | −0.442 (0.009) *** | |

| Panel 3 | Metal price | ||||

| Metal block (six countries) | |||||

| LR | −0.331 (0.003) *** | −0.302 (0.004) *** | −0.020(0.005) *** | 0.023 (0.001) *** | |

| SR | −0.312 (0.111) ** | −0.005(0.002) *** | −0.003 (0.009) | −0.001 (0.008) | |

| ECT | −0.531 (0.001) *** | −0.521 (0.003) *** | −0.561 (0.001) *** | −0.552 (0.007) *** | |

| Commodity | Brazil Tin %∆ | Jamaica Alumina %∆ |

|---|---|---|

| Price | −26.67 | −8.58 |

| RGH (g %) | −10.76 | −8.19 |

| RPH (g %) | −7.80 | −19.50 |

| HIV new infections (%) | 5.10 | 8.00 |

| Commodity | Egypt Oil %∆ | Malaysia Gas %∆ |

|---|---|---|

| Price | −17.17 | −18.10 |

| RGH (g %) | −2.70 | −57.84 |

| RPH (g %) | −7.98 | −24.03 |

| HIV new infections (%) | 10.44 | 10.00 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mostert, C. Economics of HIV Prevention: Understanding the Empirical Intersection between Commodity Price Shocks, Health Spending and HIV Infections in Developing Countries. Venereology 2024, 3, 51-62. https://doi.org/10.3390/venereology3010005

Mostert C. Economics of HIV Prevention: Understanding the Empirical Intersection between Commodity Price Shocks, Health Spending and HIV Infections in Developing Countries. Venereology. 2024; 3(1):51-62. https://doi.org/10.3390/venereology3010005

Chicago/Turabian StyleMostert, Cyprian. 2024. "Economics of HIV Prevention: Understanding the Empirical Intersection between Commodity Price Shocks, Health Spending and HIV Infections in Developing Countries" Venereology 3, no. 1: 51-62. https://doi.org/10.3390/venereology3010005

APA StyleMostert, C. (2024). Economics of HIV Prevention: Understanding the Empirical Intersection between Commodity Price Shocks, Health Spending and HIV Infections in Developing Countries. Venereology, 3(1), 51-62. https://doi.org/10.3390/venereology3010005