Is Zero Subsidy in Fixed-Bottom Offshore Wind Farms Feasible? The Case of Incheon, South Korea

Abstract

:1. Introduction

2. Strategy and Project Aim

2.1. Fixed-Bottom Wind Farm Site—Incheon

2.2. South Korea’s Renewable Energy Policies (Offshore Wind Energy)

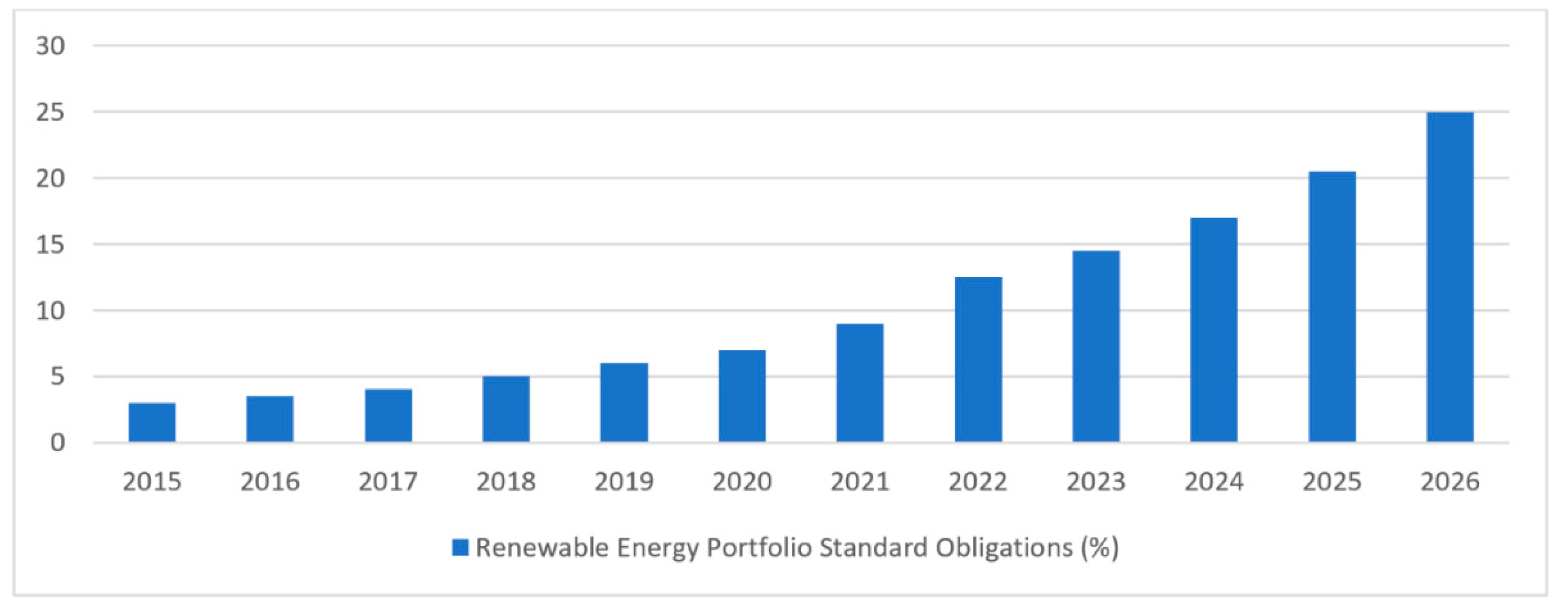

2.2.1. Renewable Energy Portfolio Standard (RPS)

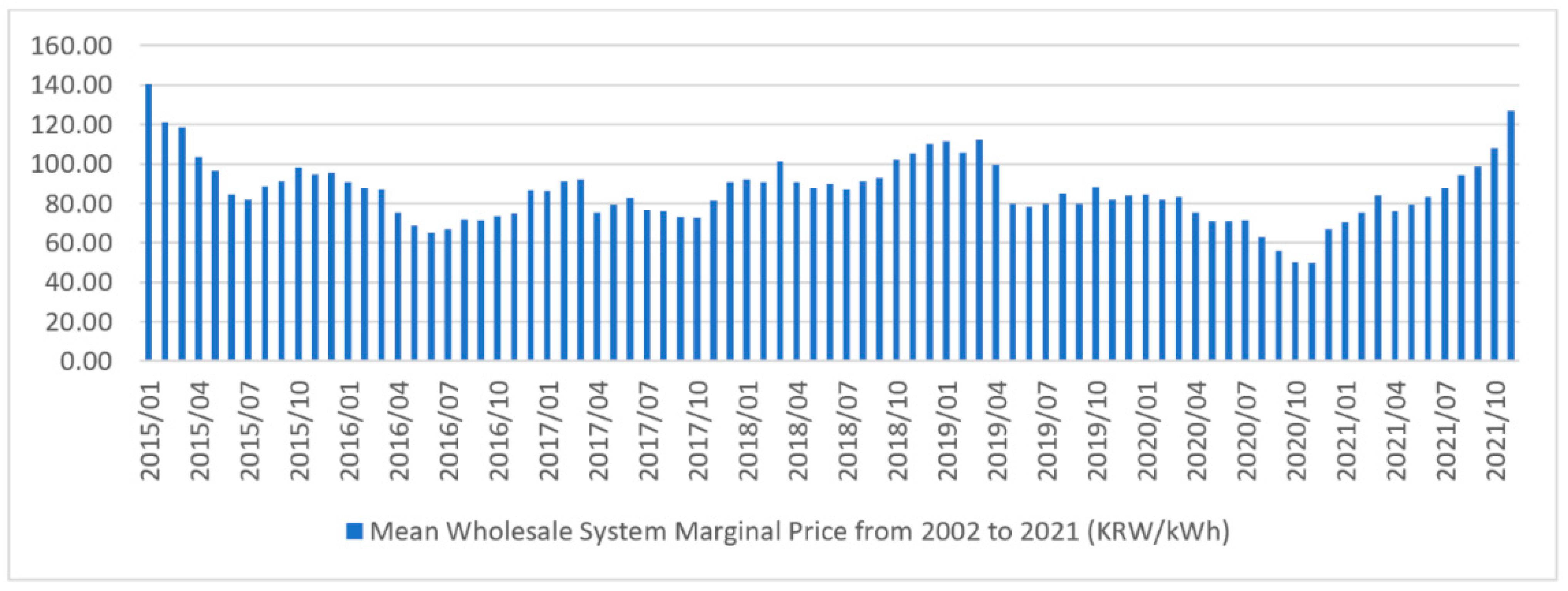

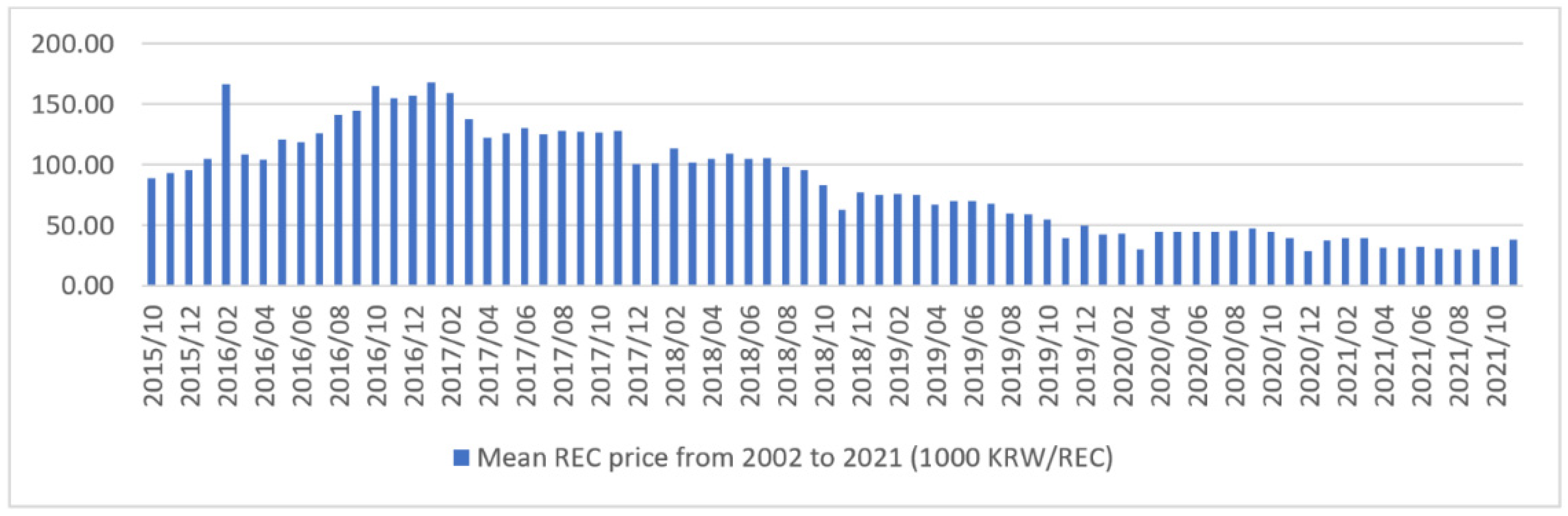

2.2.2. Renewable Energy Certificates (REC)

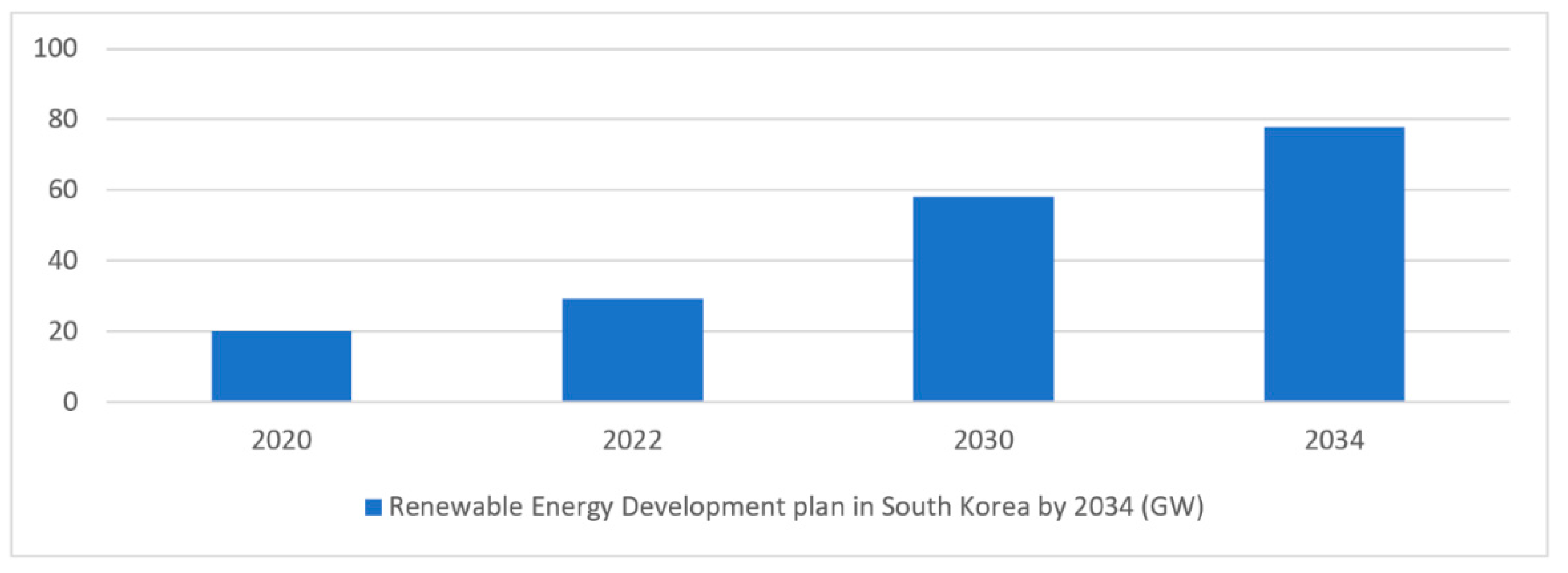

2.2.3. Renewable Energy 3020 Implementation Plan (RE3020)

2.2.4. The Third Energy Master Plan and the Ninth Basic Plan for Power Supply and Demand

2.2.5. The Korean New Deal

2.2.6. Fishing Industry Collaboration

3. Methods

4. Analysis and Results

4.1. LCoE for the Incheon Wind Project

4.2. Scenarios

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- GWEC Global Wind Report 2021. 2021. Available online: https://gwec.net/global-wind-report-2021/ (accessed on 21 December 2021).

- IRENA. Future of Wind: Deployment, Investment, Technology, Grid Integration and Socio-Economic Aspects; International Renewable Energy Agency: Abu Dhabi, United Arab Emirates, 2019. [Google Scholar]

- Hutfilter, U.F.; Wilson, R.; Gidden, M.; Ganti, G.; Ramalope, D.; Hare, B. Transitioning towards a Zero-Carbon Society: Science-Based Emissions Reduction Pathways for South Korea under the Paris Agreement. 2020. Available online: https://climateanalytics.org/media/climateanalytics_skorea_zerocarbontransistion_2020.pdf (accessed on 5 February 2022).

- Reve. South Korea to Increase Wind Energy Generation to 12 Gigawatts by 2030. 2020. Available online: https://www.evwind.es/2020/07/19/south-korea-to-increase-wind-energy-generation-to-12-gigawatts-by-2030/75844 (accessed on 27 December 2021).

- Kim, J.H.; Yoo, S.H. Comparison of the economic effects of nuclear power and renewable energy deployment in South Korea. Renew. Sustain. Energy Rev. 2021, 135, 110236. [Google Scholar] [CrossRef]

- Third Energy Master Plan. 2019, A New Energy Paradigm for the Future, Ministry of Trade, Industry, and Energy, South Korea. Available online: https://www.etrans.or.kr/ebook/05/files/assets/common/downloads/Third%20Energy%20Master%20Plan.pdf (accessed on 9 January 2022).

- MOTIE (Ministry of Trade, Industry and Energy). The 9th Basic Plan for Power Supply and Demand. 2020. Available online: https://www.motie.go.kr/motie/ne/presse/press2/bbs/bbsView.do?bbs_seq_n=163670&bbs_cd_n=81 (accessed on 12 December 2021).

- Tosatto, A.; Beseler, X.M.; Østergaard, J.; Pinson, P.; Chatzivasileiadis, S. North Sea Energy Islands: Impact on National Markets and Grids. arXiv 2021, arXiv:2103.17056. [Google Scholar]

- Chu, K.H.; Lim, J.; Mang, J.S.; Hwang, M.H. Evaluation of strategic directions for supply and demand of green hydrogen in South Korea. Int. J. Hydrog. Energy 2022, 47, 1409–1424. [Google Scholar] [CrossRef]

- Kim, J.H.; Nam, J.; Yoo, S.H. Public acceptance of a large-scale offshore wind power project in South Korea. Mar. Policy 2020, 120, 104141. [Google Scholar] [CrossRef]

- Korea’s Offshore Wind Collaboration Plan. 2020. Available online: https://energycentral.com/news/koreas-offshore-wind-collaboration-plan (accessed on 2 December 2021).

- Wind Europe. Floating Offshore Wind Vision Statement. 2017. Available online: https://windeurope.org/wp-content/uploads/files/about-wind/reports/Floating-offshore-statement.pdf (accessed on 2 November 2021).

- Park, J.; Kim, B. An analysis of South Korea’s energy transition policy with regards to offshore wind power development. Renew. Sustain. Energy Rev. 2019, 109, 71–84. [Google Scholar] [CrossRef]

- Global Wind Atlas. 2021. Available online: https://globalwindatlas.info/area/South%20Korea/Incheon (accessed on 5 October 2021).

- Oh, H.; Hong, I.; Oh, I. South Korea’s 2050 Carbon Neutrality Policy. East Asian Policy 2021, 13, 33–46. [Google Scholar] [CrossRef]

- Kwon, T.H. Is the renewable portfolio standard an effective energy policy? Early evidence from South Korea. Util. Policy 2015, 36, 46–51. [Google Scholar] [CrossRef]

- Ministry of Trade, Industry and Energy. Renewable Energy Portfolio Standards Weight. 2021. Available online: http://www.motie.go.kr/motie/ne/presse/press2/bbs/bbsView.do?bbs_seq_n=164409&bbs_cd_n=81¤tPage=1&search_key_n=title_v&cate_n=1&dept_v=&search_val_v= (accessed on 2 October 2021).

- Ministry of Trade, Industry and Energy. Renewable Energy Portfolio Standards Obligations. 2021. Available online: http://www.motie.go.kr/common/download.do?fid=bbs&bbs_cd_n=81&bbs_seq_n=164641&file_seq_n=3 (accessed on 20 November 2021).

- Kwon, T.H. Policy synergy or conflict for renewable energy support: Case of RPS and auction in South Korea. Energy Policy 2018, 123, 443–449. [Google Scholar] [CrossRef]

- Yoon, J.H.; Sim, K.H. Why is South Korea’s renewable energy policy failing? A qualitative evaluation. Energy Policy 2015, 86, 369–379. [Google Scholar] [CrossRef]

- Electric Power Statistics Information System (EPSIS) 2021, Mean Wholesale System Marginal Price from 2002 to 2021. Available online: http://epsis.kpx.or.kr/epsisnew/selectEkmaSmpSmpChart.do?menuId=040201 (accessed on 17 November 2021).

- Korea Power Exchange. 2021, REC Price. Available online: https://onerec.kmos.kr/portal/selectBbsNttList.do?key=1970&bbsNo=477&searchCtgry=&pageUnit=10&searchCnd=all&searchKrwd=&integrDeptCode=&pageIndex=1 (accessed on 10 November 2021).

- Park, S.; Yun, S.J. Multiscalar energy transitions: Exploring the strategies of renewable energy cooperatives in South Korea. Energy Res. Soc. Sci. 2021, 81, 102280. [Google Scholar] [CrossRef]

- Ministry of Trade, Industry and Energy. Renewable Energy 3020 Plan. 2017. Available online: http://www.motie.go.kr/common/download.do?fid=bbs&bbs_cd_n=81&bbs_seq_n=159996&file_seq_n=2 (accessed on 1 November 2021).

- Stangarone, T. South Korean efforts to transition to a hydrogen economy. Clean Technol. Environ. Policy 2021, 23, 509–516. [Google Scholar] [CrossRef] [PubMed]

- Rodriguez, B.; Xydis, G. A five-target innovation discussion on low-speed wind turbine system optimization. Energy Sources Part A Recovery Util. Environ. Eff. 2021, 1–15. [Google Scholar] [CrossRef]

- Cruz, K.V. Moon Jae-In’s Strategy Amid COVID-19 Pandemic: Reviving the Green in the Korean New Deal. In Collection of Essays on Korea’s Public Diplomacy: Possibilities and Future Outlook; Ministry of Foreign Affairs, Republic of Korea: Seoul, Korea, 2020; p. 315. [Google Scholar]

- Ministry of Economy and Finance. Korean New Deal: National Strategy for a Great Transformation. 2020. Available online: https://english.moef.go.kr/pc/selectTbPressCenterDtl.do?boardCd=N0001&seq=4948#fn_download (accessed on 10 November 2021).

- Lai, C.S.; Locatelli, G.; Pimm, A.; Tao, Y.; Li, X.; Lai, L.L. A financial model for lithium-ion storage in a photovoltaic and biogas energy system. Appl. Energy 2019, 251, 113179. [Google Scholar] [CrossRef]

- Kocsis, G.; Xydis, G. Repair process analysis for wind turbines equipped with hydraulic pitch mechanism on the US market in focus of cost optimization. Appl. Sci. 2019, 9, 3230. [Google Scholar] [CrossRef] [Green Version]

- Enevoldsen, P.; Permien, F.H.; Bakhtaoui, I.; von Krauland, A.K.; Jacobson, M.Z.; Xydis, G.; Sovacool, B.K.; Valentine, S.V.; Luecht, D.; Oxley, G. How much wind power potential does Europe have? Examining european wind power potential with an enhanced socio-technical atlas. Energy Policy 2019, 132, 1092–1100. [Google Scholar] [CrossRef]

- AEGIR, PONDERA and COWI. Accelerating South Korean Offshore Wind Through Partnerships: A Scenario-Based Study of Supply Chain, Levelized Cost of Energy and Employment Effects. 2021. Available online: https://www.cowi.com/-/media/Cowi/Documents/Accelerating-Offshore-Wind (accessed on 29 December 2021).

- Kim, Y.K.; Chang, B.M. Real Option Valuation of a Wind Power Project Based on the Volatilities of Electricity Generation Tariff & Long Term Interest Rate. 2014. Available online: https://www.koreascience.or.kr/article/JAKO201412835857778.pdf (accessed on 6 December 2021).

- Presidential Committee on Jobs. 2021. Available online: https://dashboard.jobs.go.kr/index/summary?pg_id=PSCT040200&data2=SCT040200&ct_type=run (accessed on 29 December 2021).

- Kim, K.N. The Effects of Depreciation Methods on Investment Motivation for Solar Photovoltaic Systems. 2020. Available online: http://www.koreascience.or.kr/article/JAKO202009835825476.pdf (accessed on 27 December 2021).

- Supreme Court of Korea. 2021. Available online: https://glaw.scourt.go.kr/wsjo/lawod/sjo192.do?lawodNm=%EB%B2%95%EC%9D%B8%EC%84%B8%EB%B2%95%20%EC%8B%9C%ED%96%89%EB%A0%B9&jomunNo=26&jomunGajiNo= (accessed on 7 January 2022).

- Xydis, G. A techno-economic and spatial analysis for the optimal planning of wind energy in Kythira Island, Greece. Int. J. Prod. Econ. 2013, 146, 440–452. [Google Scholar] [CrossRef] [Green Version]

- Ucal, M.; Xydis, G. Multidirectional relationship between energy resources, climate changes and sustainable development: Technoeconomic analysis. Sustain. Cities Soc. 2020, 60, 102210. [Google Scholar] [CrossRef]

- Barutha, P.; Nahvi, A.; Cai, B.; Jeong, H.D.; Sritharan, S. Evaluating commercial feasibility of a new tall wind tower design concept using a stochastic levelized cost of energy model. J. Clean. Prod. 2019, 240, 118001. [Google Scholar] [CrossRef]

- Broughel, A.; Wüstenhagen, R. The influence of policy risk on Swiss wind power investment. In Swiss Energy Governance; Springer: Cham, Switzerland, 2022; pp. 345–368. [Google Scholar]

- Enevoldsen, P.; Xydis, G. Examining the trends of 35 years growth of key wind turbine components. Energy Sustain. Dev. 2019, 50, 18–26. [Google Scholar] [CrossRef]

- Leite, G.D.N.P.; Weschenfelder, F.; de Farias, J.G.; Ahmad, M.K. Economic and sensitivity analysis on wind farm end-of-life strategies. Renew. Sustain. Energy Rev. 2022, 160, 112273. [Google Scholar] [CrossRef]

- Gu, Y.; Wang, D.; Chen, Q.; Tang, Z. Techno-economic analysis of green methanol plant with optimal design of renewable hydrogen production: A case study in China. Int. J. Hydrog. Energy 2022, 47, 5085–5100. [Google Scholar] [CrossRef]

- Jaunatre, M. Renewable Hydrogen: Renewable Energy and Renewable Hydrogen APAC Markets Policies Analysis; Springer Nature: Berlin/Heidelberg, Germany, 2021. [Google Scholar]

- Xydis, G.; Vlachakis, N. Feed-in-Premium Renewable Energy Support Scheme: A Scenario Approach. Resources 2019, 8, 106. [Google Scholar] [CrossRef] [Green Version]

- Wiser, R.; Rand, J.; Seel, J.; Beiter, P.; Baker, E.; Lantz, E.; Gilman, P. Expert elicitation survey predicts 37% to 49% declines in wind energy costs by 2050. Nat. Energy 2021, 6, 555–565. [Google Scholar] [CrossRef]

- Rubio-Domingo, G.; Linares, P. The future investment costs of offshore wind: An estimation based on auction results. Renew. Sustain. Energy Rev. 2021, 148, 111324. [Google Scholar] [CrossRef]

- Herenčić, L.; Melnjak, M.; Capuder, T.; Andročec, I.; Rajšl, I. Techno-economic and environmental assessment of energy vectors in decarbonization of energy islands. Energy Convers. Manag. 2021, 236, 114064. [Google Scholar] [CrossRef]

| At Heigh 100 m | Incheon | South Jeolla | North Jeolla | Ulsan | Jeju |

|---|---|---|---|---|---|

| Mean Wind Speed (m/s) | 6.98 | 7.77 | 6.79 | 7.81 | 7.51 |

| Mean Power Density (W/m2) | 439 | 538 | 469 | 722 | 525 |

| Water depth at site (m) | 25 | 55 | - | 140 | 105 |

| Type of Offshore Wind Farm | Fixed-bottom | Floating | |||

| Category | Value | |

|---|---|---|

| Period | 2024–2053 | Year |

| Capacity | 500 | MW |

| Capital Expenditure (CAPEX) [32] | 3,837,000 | USD/MW |

| Operating Expenses (OPEX) [32] | 51.92 | USD/MWh |

| Net Capacity Factor [32] | 38.80 | % |

| Tax Rate [33] | 22.00 | % |

| Inflation [34] | 2.00 | % |

| Discount Rate [35] | 6.00 | % |

| Debt term [33] | 15 | Years |

| Debt Fraction [33] | 70 | % |

| Depreciation in Korea: Straight-line method [36] | 5 | %/year |

| Category | Criteria | REC Weighting |

|---|---|---|

| Onshore | - | 1.2 |

| Offshore | - | 2.5 |

| Offshore | grid connection ≥ 5 km and water depth ≥ 5 m | +0.4 per 5 km and 5 m (Max. 3.5) |

| Category | Value | |

|---|---|---|

| SMP | 80 | KRW/kWh |

| REC | 30.2 | KRW/kWh |

| REC Weight | 2.5 | |

| SMP + 1 REC | 155.5 | KRW/kWh |

| PPA = SMP + 1 REC in USD | 130.45 | USD/MWh |

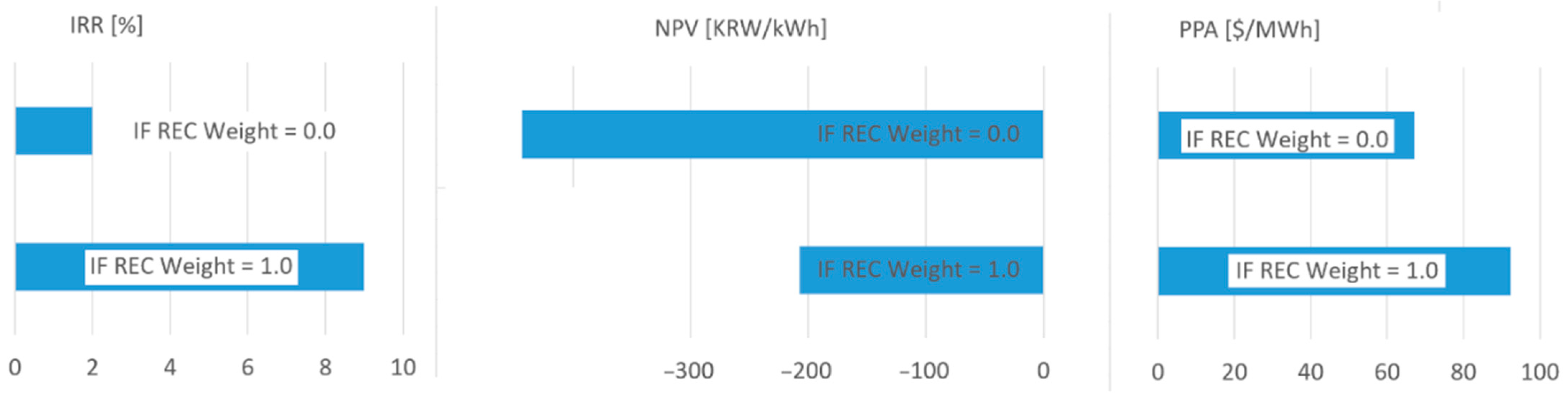

| PPA [USD/MWh] | NPV [KRW/kWh] | IRR [%] | |

|---|---|---|---|

| IF REC Weight = 1.0 | 92.45 | −207.22 | 9 |

| IF REC Weight = 0.0 | 67.11 | −443.47 | 2 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lee, J.; Xydis, G. Is Zero Subsidy in Fixed-Bottom Offshore Wind Farms Feasible? The Case of Incheon, South Korea. Wind 2022, 2, 210-220. https://doi.org/10.3390/wind2020012

Lee J, Xydis G. Is Zero Subsidy in Fixed-Bottom Offshore Wind Farms Feasible? The Case of Incheon, South Korea. Wind. 2022; 2(2):210-220. https://doi.org/10.3390/wind2020012

Chicago/Turabian StyleLee, Jongmin, and George Xydis. 2022. "Is Zero Subsidy in Fixed-Bottom Offshore Wind Farms Feasible? The Case of Incheon, South Korea" Wind 2, no. 2: 210-220. https://doi.org/10.3390/wind2020012

APA StyleLee, J., & Xydis, G. (2022). Is Zero Subsidy in Fixed-Bottom Offshore Wind Farms Feasible? The Case of Incheon, South Korea. Wind, 2(2), 210-220. https://doi.org/10.3390/wind2020012