Impact of Geographic Location on Risks of Fintech as a Representative of Financial Institutions

Abstract

1. Introduction

2. Materials and Methods

2.1. Determination of Financial and Environmental Risks

- Governance risks refer to the possibility that the organisation’s policies, procedures, and other systems, which are crucial for supervision and decision-making, will not work as intended. This risk is associated with the directors’ decisions made about the composition, leadership, and organisation of the board, as well as the decisions related to applicable legal framework [3].

- ICT risks are associated with malicious attacks, spam, viruses, hardware and software malfunctions, and other ICT issues [32].

- Strategic risks are associated with the potential for loss resulting from poorly aligned business decisions with strategic goals, the inability to respond to industry and macroeconomic dynamics, and the unsuccessful implementation of policies and processes intended to achieve those goals [59].

2.2. Risk Estimation

2.3. Fintech as a Representative of Financial Institutions

- Financing;

- Payments;

- Asset management;

- Insurance.

2.4. Experts’ Board

- The company should be registered in the EU;

- The company should be subjected to the regulation of legal supervisor;

- The company is involved in payment operations;

- The company should have an official responsible risk officer/risk specialist.

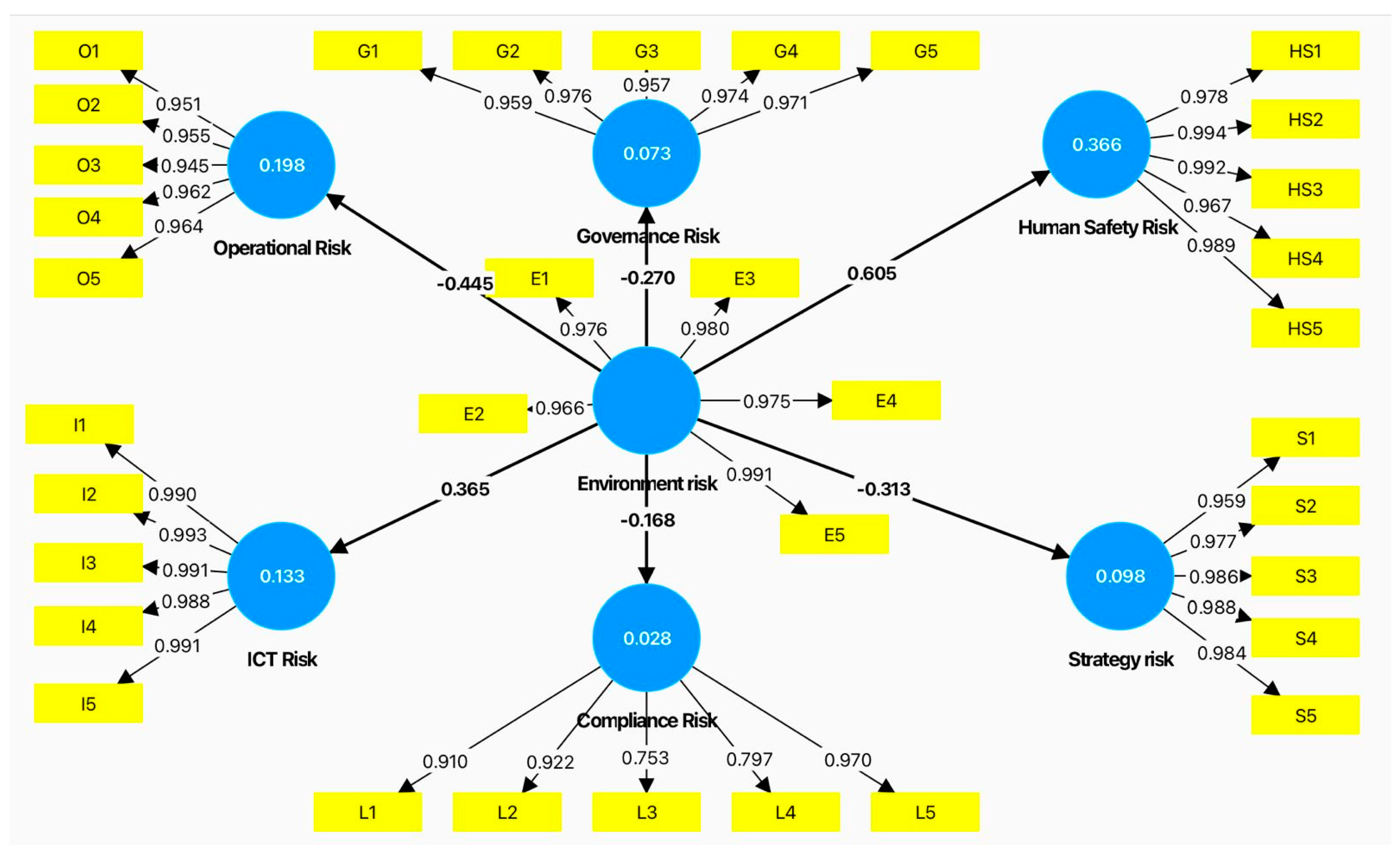

2.5. PLS-SEM Model

- Governance risks;

- Operational risks;

- Human resources and safety risks;

- ICT risks;

- Environmental/external risks;

- Compliance risks;

- Strategic risks.

3. Results

3.1. Result Assessment

3.1.1. Model Reliability

3.1.2. Discriminant Validity

3.1.3. Model Fit: SRMR and d_ULS

- -

- In this model, the SRMR value is 0.08, exactly at the threshold for acceptable model fit. This indicates that the difference between the predicted and observed correlations is small, and the model fits the data well, though it is close to the upper limit of acceptability.

- -

- The d_ULS value in this model is 4.025. This value can be interpreted by comparing it to other models or assessing it in context with other fit measures, such as the SRMR. Given the acceptable SRMR value of 0.08, we can infer that while d_ULS might seem relatively high, the overall model fit remains within an acceptable range.

3.1.4. Testing Results of the Total Effects

4. Discussion

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Deng, S.; Elyasiani, E. Geographic Diversification, Bank Holding Company Value, and Risk. J. Money Credit. Bank. 2008, 40, 1217–1238. [Google Scholar] [CrossRef]

- Al Kez, D.; Foley, A.M.; Laverty, D.; Del Rio, D.F.; Sovacool, B. Exploring the Sustainability Challenges Facing Digitalization and Internet Data Centers. J. Clean. Prod. 2022, 371, 133633. [Google Scholar] [CrossRef]

- Schmid, M.M.; Sabato, G.; Aebi, V. Risk Management, Corporate Governance, and Bank Performance in the Financial Crisis. SSRN Electron. J. 2011. [Google Scholar] [CrossRef]

- Ciobanu, A.; Androniceanu, A.; Lazaroiu, G. An Integrated Psycho-Sociological Perspective on Public Employees’ Motivation and Performance. Front. Psychol. 2019, 10, 36. [Google Scholar] [CrossRef]

- Laeven, L.; Levine, R. Bank Governance, Regulation and Risk Taking. J. Financ. Econ. 2009, 93, 259–275. [Google Scholar] [CrossRef]

- CRISTEA, M.-A. Operational Risk Management In Banking Activity. J. East. Eur. Res. Bus. Econ. 2021, 2021, 969612. [Google Scholar] [CrossRef]

- Boon, C.; Den Hartog, D.N.; Lepak, D.P. A Systematic Review of Human Resource Management Systems and Their Measurement. J. Manag. 2019, 45, 2498–2537. [Google Scholar] [CrossRef]

- Popova, Y.; Zagulova, D. UTAUT Model for Smart City Concept Implementation: Use of Web Applications by Residents for Everyday Operations. Informatics 2022, 9, 27. [Google Scholar] [CrossRef]

- Lavrinenko, O.; Čižo, E.; Ignatjeva, S.; Danileviča, A.; Krukowski, K. Financial Technology (FinTech) as a Financial Development Factor in the EU Countries. Economies 2023, 11, 45. [Google Scholar] [CrossRef]

- Katalkina, O.; Saksonova, S. Crowdfunding Cross-Border Business Financing Practice: The Evidence from the Baltic States; Springer International Publishing: Cham, Switzerland, 2022; pp. 472–481. [Google Scholar]

- Saksonova, S.; Kuzmina-Merlino, I. The Principles of Creating a Balanced Investment Portfolio for Cryptocurrencies; Springer International Publishing: Cham, Switzerland, 2019; pp. 714–724. [Google Scholar]

- Cernisevs, O. Regional Dimension in European Union: Shaping Key Performance Indicators for Financial Institutions. Doctoral Thesis, Rīga Stradiņš University, Rīga, Latvia, 2024. [Google Scholar]

- Cernisevs, O.; Popova, Y. ICO as Crypto-Assets Manufacturing within a Smart City. Smart Cities 2023, 6, 40–56. [Google Scholar] [CrossRef]

- Armstrong, P. Financial Technology: The Regulatory Tipping Points. In Proceedings of the FMA’s FinTech Conference, Liechtenstein, Germany, 27 September 2016; ESMA: Liechtenstein, Germany. [Google Scholar]

- Ahern, D. Regulatory Lag, Regulatory Friction and Regulatory Transition as FinTech Disenablers: Calibrating an EU Response to the Regulatory Sandbox Phenomenon. Eur. Bus. Organ. Law Rev. 2021, 22, 395–432. [Google Scholar] [CrossRef]

- Rupeika-Apoga, R.; Wendt, S. FinTech Development and Regulatory Scrutiny: A Contradiction? The Case of Latvia. Risks 2022, 10, 167. [Google Scholar] [CrossRef]

- Richter, J. EU Regulatory Developments. Law Financ. Mark. Rev. 2020, 14, 261–273. [Google Scholar] [CrossRef]

- Cheng, M.; Qu, Y.; Jiang, C.; Zhao, C. Is Cloud Computing the Digital Solution to the Future of Banking? J. Financ. Stab. 2022, 63, 101073. [Google Scholar] [CrossRef]

- Bhat, J.R.; AlQahtani, S.A.; Nekovee, M. FinTech Enablers, Use Cases, and Role of Future Internet of Things. J. King Saud Univ.-Comput. Inf. Sci. 2023, 35, 87–101. [Google Scholar] [CrossRef]

- Cernisevs, O. Analysis of The Factors Influencing the Formation of the Transaction Price in the Blockchain. Financ. Credit. Syst. Prospect. Dev. 2021, 3, 36–47. [Google Scholar] [CrossRef]

- Basel Committee on Banking Supervision. Principles for the Effective Management and Supervision of Climate-Related Financial Risks; BCBS: Basel, Switzerland, 2022. [Google Scholar]

- ESMA. Monitoring Environmental Risks in EU Financial Markets; ESMA: Paris, France, 2022. [Google Scholar]

- EBA. The EBA Consults on Guidelines on the Management of ESG Risks; EBA: Courbevoie, France, 2024. [Google Scholar]

- European Central Bank. Guide on Climate-Related and Environmental Risks; European Central Bank: Frankfurt am Main, Germany, 2020. [Google Scholar]

- Naveen, G.; Basaiah, P. A Study on Risk and Return Analysis on Selected Equities with Reference to Shriram Insigh. Int. J. Trend Sci. Res. Dev. (IJTSRD) 2022, 6, 358–371. [Google Scholar]

- Civelek, M.; Krajčík, V.; Ključnikov, A. The Impacts of Dynamic Capabilities on SMEs’ Digital Transformation Process: The Resource-Based View Perspective. Oeconomia Copernic. 2023, 14, 1367–1392. [Google Scholar] [CrossRef]

- Ključnikov, A.; Civelek, M.; Krajčík, V.; Novák, P.; Červinka, M. Financial Performance and Bankruptcy Concerns of SMEs in Their Export Decision. Oeconomia Copernic. 2022, 13, 867–890. [Google Scholar] [CrossRef]

- Ključnikov, A.; Civelek, M.; Klimeš, C.; Farana, R. Export Risk Perceptions of SMEs in Selected Visegrad Countries. Equilib. Q. J. Econ. Econ. Policy 2022, 17, 173–190. [Google Scholar] [CrossRef]

- Cernisevs, O.; Popova, Y.; Cernisevs, D. Business KPIs Based on Compliance Risk Estimation. J. Tour. Serv. 2023, 14, 222–248. [Google Scholar] [CrossRef]

- Cernisevs, O.; Popova, Y.; Cernisevs, D. Risk-Based Approach for Selecting Company Key Performance Indicator in an Example of Financial Services. Informatics 2023, 10, 54. [Google Scholar] [CrossRef]

- Cernisevs, O. KPI Selection for Fintech Companies: A Systematic Review of Literature. Am. Res. J. Humanit. Soc. Sci. (ARJHSS) 2024, 7, 50–63. [Google Scholar]

- Cox, L. Some Limitations of “Risk = Threat × Vulnerability × Consequence” for Risk Analysis of Terrorist Attacks. Risk Anal. 2008, 28, 1749–1761. [Google Scholar] [CrossRef]

- Dvorský, J.; Petráková, Z.; Ajaz Khan, K.; Formánek, I.; Mikoláš, Z. Selected Aspects of Strategic Management in the Service Sector. J. Tour. Serv. 2020, 11, 109–123. [Google Scholar] [CrossRef]

- Smart, A.; Creelman, J. RBPM: Integrating Risk Frameworks and Standards with the Balanced Scorecard. In Risk-Based Performance Management; Palgrave Macmillan UK: London, UK, 2013; pp. 53–84. [Google Scholar]

- Torabi, S.A.; Giahi, R.; Sahebjamnia, N. An Enhanced Risk Assessment Framework for Business Continuity Management Systems. Saf. Sci. 2016, 89, 201–218. [Google Scholar] [CrossRef]

- Varga, S.; Brynielsson, J.; Franke, U. Cyber-Threat Perception and Risk Management in the Swedish Financial Sector. Comput. Secur. 2021, 105, 102239. [Google Scholar] [CrossRef]

- Wang, Y.; Li, G.; Li, J.; Zhu, X. Comprehensive Identification of Operational Risk Factors Based on Textual Risk Disclosures. Procedia Comput. Sci. 2018, 139, 136–143. [Google Scholar] [CrossRef]

- Wei, L.; Dou, Z.; Li, J.; Zhu, B. Impact of Institutional Investors on Enterprise Risk-Taking. Transform. Bus. Econ. 2021, 20, 886. [Google Scholar]

- Gornicza, D. Assessment of Risk Factors and Project Success in Construction Industry. Transform. Bus. Econ. 2022, 21, 56B. [Google Scholar]

- Aven, T. Risk Assessment and Risk Management: Review of Recent Advances on Their Foundation. Eur. J. Oper. Res. 2016, 253, 1–13. [Google Scholar] [CrossRef]

- Sun, C.; Luo, Y.; Li, J. Urban Traffic Infrastructure Investment and Air Pollution: Evidence from the 83 Cities in China. J. Clean. Prod. 2018, 172, 488–496. [Google Scholar] [CrossRef]

- Russo, A.; Chan, W.T.; Cirella, G.T. Estimating Air Pollution Removal and Monetary Value for Urban Green Infrastructure Strategies Using Web-Based Applications. Land 2021, 10, 788. [Google Scholar] [CrossRef]

- Dawson, R.J.; Thompson, D.; Johns, D.; Wood, R.; Darch, G.; Chapman, L.; Hughes, P.N.; Watson, G.V.R.; Paulson, K.; Bell, S. A Systems Framework for National Assessment of Climate Risks to Infrastructure. Philos. Trans. R. Soc. A Math. Phys. Eng. Sci. 2018, 376, 20170298. [Google Scholar] [CrossRef] [PubMed]

- Kadri, F.; Birregah, B.; Châtelet, E. The Impact of Natural Disasters on Critical Infrastructures: A Domino Effect-Based Study. J. Homel. Secur. Emerg. Manag. 2014, 11, 217–241. [Google Scholar] [CrossRef]

- Hall, E. CCRA2: Updated Projections for Water Availability for the UK; London, UK. 2015. Available online: https://www.theccc.org.uk/wp-content/uploads/2015/09/CCRA-2-Updated-projections-of-water-availability-for-the-UK.pdf (accessed on 26 September 2024).

- Glendinning, S.; Hughes, P.; Helm, P.; Chambers, J.; Mendes, J.; Gunn, D.; Wilkinson, P.; Uhlemann, S. Construction, Management and Maintenance of Embankments Used for Road and Rail Infrastructure: Implications of Weather Induced Pore Water Pressures. Acta Geotech. 2014, 9, 799–816. [Google Scholar] [CrossRef]

- Muchan, K.; Lewis, M.; Hannaford, J.; Parry, S. The Winter Storms of 2013/2014 in the UK: Hydrological Responses and Impacts. Weather 2015, 70, 55–61. [Google Scholar] [CrossRef]

- Rowsell, P.; Sayers, P. Third UK Climate Change Risk Assessment (CCRA3) Future Flood Risk Projections; Committee on Climate Change: London, UK, 2021. [Google Scholar]

- van Leeuwen, Z.; Lamb, R. Flood and Scour Related Failure Incidents at Railway Assets Between 1846 and 2013; JBA Trust Ltd.: London, UK, 2014. [Google Scholar]

- Hall, E.; Panzeri, M. Indicators to Assess the Exposure of Critical Infrastructure in England to Current and Projected Climate Hazards; HR Wallingford: London, UK, 2014. [Google Scholar]

- Williams, P.A.; Sutherland, J. Coastal Defence Vulnerability 2075; HR Wallingford: London, UK, 2002. [Google Scholar]

- McColl, L.; Palin, E.J.; Thornton, H.E.; Sexton, D.M.H.; Betts, R.; Mylne, K. Assessing the Potential Impact of Climate Change on the UK’s Electricity Network. Clim. Chang. 2012, 115, 821–835. [Google Scholar] [CrossRef]

- Jenkins, K.; Glenis, V.; Ford, A.C.; Hall, J.W. A Probabilistic Risk-Based Approach to Addressing Impacts of Climate Change on Cities: The Tyndall Centre’s Urban Integrated Assessment Framework. UGEC Viewp. 2012, 8, 8–11. [Google Scholar]

- SP Energy Networks Climate Change Adaptation Report; SP Energy Networks (SPEN): Glasgow, UK, 2021.

- Ibrahim, I.; Melhem, B. Impact of the Human Resources on the Risk Management and the Company Performance. Int. J. Econ. Manag. Sci. 2016, 5, 320. [Google Scholar] [CrossRef]

- Silva, J.L.; Navarro, V.L. Work Organization and the Health of Bank Employees. Rev. Lat. Am. Enferm. 2012, 20, 226–234. [Google Scholar] [CrossRef] [PubMed]

- Hummel, K.; Laun, U.; Krauss, A. Management of Environmental and Social Risks and Topics in the Banking Sector—An Empirical Investigation. Br. Account. Rev. 2021, 53, 100921. [Google Scholar] [CrossRef]

- Kunz, J.; Heitz, M. Banks’ Risk Culture and Management Control Systems: A Systematic Literature Review. J. Manag. Control 2021, 32, 439–493. [Google Scholar] [CrossRef]

- Kaddumi, T.; Al-Kilani, Q.A. Operational Risks and Financial Performance—The Context of the Jordanian Banking Environment. J. Southwest Jiaotong Univ. 2022, 57, 338–349. [Google Scholar] [CrossRef]

- Abid, A.; Gull, A.A.; Hussain, N.; Nguyen, D.K. Risk Governance and Bank Risk-Taking Behavior: Evidence from Asian Banks. J. Int. Financ. Mark. Inst. Money 2021, 75, 101466. [Google Scholar] [CrossRef]

- Popova, Y.; Cernisevs, O. Smart City: Sharing of Financial Services. Soc. Sci. 2023, 12, 8. [Google Scholar] [CrossRef]

- Popova, Y.; Zagulova, D. Aspects of E-Scooter Sharing in the Smart City. Informatics 2022, 9, 36. [Google Scholar] [CrossRef]

- Hair, J.; Hult, G.T.M.; Ringle, C.; Sarstedt, M. A Primer on Partial Least Squares Structural Equation Modeling; Springer International Publishing: Cham, Switzerland, 2014; ISBN 1452217440. [Google Scholar]

- Hair, J.F.; Risher, J.J.; Sarstedt, M.; Ringle, C.M. When to Use and How to Report the Results of PLS-SEM. Eur. Bus. Rev. 2019, 31, 2–24. [Google Scholar] [CrossRef]

- Kock, N. WarpPLS 5.0 User Manual; ScriptWarp Systems: Laredo, TX, USA, 2015. [Google Scholar]

- Nunnally, J.D. Psychometric Theory, 2nd ed.; McGraw-Hill: New York, NY, USA, 1978; ISBN 0070474656. [Google Scholar]

- Wong, K.K. Mastering Partial Least Squares Structural Equation Modeling (Pls-Sem) with Smartpls in 38 Hours; iUniverse: Lincoln, NE, USA, 2019; ISBN 9781532066498. [Google Scholar]

- Peter, J.P. Reliability: A Review of Psychometric Basics and Recent Marketing Practices. J. Mark. Res. 1979, 16, 6–17. [Google Scholar] [CrossRef]

- Bagozzi, R.P.; Yi, Y. On the Evaluation of Structural Equation Models. J. Acad. Mark. Sci. 1988, 16, 74–94. [Google Scholar] [CrossRef]

- Fornell, C.; Larcker, D.F. Evaluating Structural Equation Models with Unobservable Variables and Measurement Error. J. Mark. Res. 1981, 18, 39–50. [Google Scholar] [CrossRef]

- Hair, J.; Hollingsworth, C.L.; Randolph, A.B.; Chong, A.Y.L. An Updated and Expanded Assessment of PLS-SEM in Information Systems Research. Ind. Manag. Data Syst. 2017, 117, 442–458. [Google Scholar] [CrossRef]

- Henseler, J.; Ringle, C.M.; Sarstedt, M. A New Criterion for Assessing Discriminant Validity in Variance-Based Structural Equation Modeling. J. Acad. Mark. Sci. 2015, 43, 115–135. [Google Scholar] [CrossRef]

- Hair, J.F., Jr.; Sarstedt, M.; Hopkins, L.; Kuppelwieser, V.G. Partial Least Squares Structural Equation Modeling (PLS-SEM): An Emerging Tool in Business Research. Eur. Bus. Rev. 2014, 26, 106–121. [Google Scholar] [CrossRef]

- Chin, W.W. The Partial Least Squares Approach to Structural Equation Modeling. In Modern Methods for Business Research/Lawrence Erlbaum Associates; Lawrence Erlbaum: Mahwah, NJ, USA, 1998; pp. 295–336. [Google Scholar]

- Cohen, J. Statistical Power Analysis for the Behavioral Sciences; Routledge: London, UK, 2013; ISBN 9781134742707. [Google Scholar]

- Hair, J.F., Jr.; Anderson, R.E.; Babin, B.J.; Black, W.C. Multivariate Data Analysis: A Global Perspective, 7th ed.; Pearson Education: Upper Saddle River, NJ, USA, 2010; ISBN 9780135153093. [Google Scholar]

- Hair, J.F.; Ringle, C.M.; Sarstedt, M. PLS-SEM: Indeed a Silver Bullet. J. Mark. Theory Pract. 2011, 19, 139–152. [Google Scholar] [CrossRef]

- Petter, S.; Straub, D.; Rai, A. Specifying Formative Constructs in Information Systems Research. MIS Q. 2007, 31, 623. [Google Scholar] [CrossRef]

- Bentler, P.M.; Bonett, D.G. Significance Tests and Goodness of Fit in the Analysis of Covariance Structures. Psychol. Bull. 1980, 88, 588–606. [Google Scholar] [CrossRef]

- Lohmöller, J.-B. Predictive vs. Structural Modeling: PLS vs. ML. In Latent Variable Path Modeling with Partial Least Squares; Physica-Verlag HD: Heidelberg, Germany, 1989; pp. 199–226. [Google Scholar]

- Homer-Dixon, T.F. Environment, Scarcity, and Violence; Princeton University Press: Princeton, NJ, USA, 2010; ISBN 1400822998. [Google Scholar]

- Adger, W.N. Social and Ecological Resilience: Are They Related? Prog. Hum. Geogr. 2000, 24, 347–364. [Google Scholar] [CrossRef]

- Popova, Y.; Sproge, I. Decision-Making within Smart City: Waste Sorting. Sustainability 2021, 13, 10586. [Google Scholar] [CrossRef]

- Cernisevs, O.; Surmach, A.; Buka, S. Smart Agriculture for Urban Regions: Digital Transformation Strategies in the Agro-Industrial Sector for Enhanced Compliance and Economic Growth. Sci. Horiz. 2024, 27, 166–175. [Google Scholar] [CrossRef]

- Popova, Y.; Popovs, S. Impact of Smart Economy on Smart Areas and Mediation Effect of National Economy. Sustainability 2022, 14, 2789. [Google Scholar] [CrossRef]

- Popova, Y. Economic or Financial Substantiation for Smart City Solutions: A Literature Study. Econ. Ann.-XXI 2020, 183, 125–133. [Google Scholar] [CrossRef]

- Zagulova, D.; Prokofyeva, N.; Yulia, K.; Ziborova, V.; Katalnikova, S.; Popova, Y. Personalization of Distance Learning: Using PLS-SEM for Analyzing the Possibility of Differentiating Students with the Felder-Silverman Learning Style Model. Procedia Comput. Sci. 2023, 225, 3077–3085. [Google Scholar] [CrossRef]

- Popova, Y.; Fesyuk, A. Factors Affecting the Growth of Demand on Carsharing Services Within Smart City. Transp. Telecommun. J. 2022, 23, 252–261. [Google Scholar] [CrossRef]

- Popova, Y.; Petrov, I. Impact of the Human Capital Factors on the Country Competitiveness. In Proceedings of the Reliability and Statistics in Transportation and Communication: Selected Papers from the 19th International Conference on Reliability and Statistics in Transportation and Communication, RelStat’19, Riga, Latvia, 16–19 October 2019; Springer: Cham, Switzerland, 2020; pp. 662–671. [Google Scholar]

- Abels, J.; Bieling, H.-J. Infrastructures of Globalisation. Shifts in Global Order and Europe’s Strategic Choices. Compet. Chang. 2023, 27, 516–533. [Google Scholar] [CrossRef]

- Smith, R.A. Railways: How They May Contribute to a Sustainable Future. Proc. Inst. Mech. Eng. F J. Rail Rapid Transit 2003, 217, 243–248. [Google Scholar] [CrossRef]

- Izdebski, M.J.; Kalahasthi, L.K.; Regal-Ludowieg, A.; Holguín-Veras, J. Short Sea Shipping as a Sustainable Modal Alternative: Qualitative and Quantitative Perspectives. Sustainability 2024, 16, 4515. [Google Scholar] [CrossRef]

- van Wee, B. The Unsustainability of Car Use. In Handbook of Sustainable Travel; Springer Netherlands: Dordrecht, The Netherlands, 2014; pp. 69–83. [Google Scholar]

- Corbett, J.J.; Winebrake, J.J. Sustainable Goods Movement: Environmental Implications of Trucks, Trains, Ships, and Planes. EM Magazine, 2007. [Google Scholar]

- Tseng, H.-K.; Wu, J.S.; Liu, X. Affordability of Electric Vehicles for a Sustainable Transport System: An Economic and Environmental Analysis. Energy Policy 2013, 61, 441–447. [Google Scholar] [CrossRef]

- Hossain, M.S.; Kumar, L.; Islam, M.M.; Selvaraj, J. A Comprehensive Review on the Integration of Electric Vehicles for Sustainable Development. J. Adv. Transp. 2022, 2022, 3868388. [Google Scholar] [CrossRef]

- Guo, Y.; Zhang, Y. Understanding Factors Influencing Shared E-Scooter Usage and Its Impact on Auto Mode Substitution. Transp. Res. D Transp. Environ. 2021, 99, 102991. [Google Scholar] [CrossRef]

- Melnyk, O.; Onishchenko, O.; Onyshchenko, S. Renewable Energy Concept Development and Application in Shipping Industry. Lex Portus 2023, 9, 15. [Google Scholar] [CrossRef]

- Melnyk, O.; Onyshchenko, S. Ensuring Safety of Navigation in the Aspect of Reducing Environmental Impact. In International Symposium on Engineering and Manufacturing; Springer: Cham, Switzerland, 2022; pp. 95–103. [Google Scholar]

- Cohen, B.S.; Bronzaft, A.L.; Heikkinen, M.; Goodman, J.; Nádas, A. Airport-Related Air Pollution and Noise. J. Occup. Environ. Hyg. 2007, 5, 119–129. [Google Scholar] [CrossRef] [PubMed]

- Givoni, M.; Brand, C.; Watkiss, P. Are Railways Climate Friendly? Built Environ. 2009, 35, 70–86. [Google Scholar] [CrossRef]

| Indicator | Criterion | Value | Source |

|---|---|---|---|

| Number of iterations | The sum of the changes in the outer weights between two iterations | 5–10 | [62,63] |

| Max 300 | |||

| Indicators loadings | The degree to which the indicator represents the latent variable; the links between the indicator and the latent variable | >0.70 (highly satisfactory) | [64,65,66,67] |

| >0.50 <0.70 (acceptable) | |||

| >0.40 <0.50 (week) | |||

| Convergent validity (the research variables accurately capture the intended latent constructs, showcasing their validity in convergence) | The degree to which one test is associated with other tests that assess the same or comparable constructs is known as convergent validity [62] | >0.80 (satisfactory) | [68] |

| >0.70 <0.80 (acceptable) | |||

| 0.60 <0.70 (Exploratory study acceptable range is 0.60 to 0.70) | [68] | ||

| The average variance extracted (AVE) | >0.5 | [69] | |

| AVE >0.5 and CR <0.6 | [70] | ||

Discriminant validity:

| Shows whether seemingly unrelated concepts or measurements are in fact unrelated | HTMT: <0.85 for theoretically distinct constructs | [71,72] |

| <0.90 for analogous constructs |

| Indicator | Criterion | Value | Source |

|---|---|---|---|

| Coefficient of determination | Evaluation of the strength of the linear relationship between two variables (higher value is preferred) | 0.67 (substantial) | [73,74] |

| 0.33 (average) | |||

| 0.19 (weak) | |||

| Standardised path coefficients | Demonstrates the relative magnitude of the effects of various explanatory variables; estimation of the importance and the confidence intervals | From −1 to +1. | |

| Effect size (f2) | Evaluates the degree to which two variables in a population are associated | 0.35 (strong effects) | [73,75] |

| 0.15 (moderate) | |||

| 0.02 (weak) | |||

| Variance inflation factor | Estimated the degree of multicollinearity of the data (VIF) | <3.3 | [76,77,78] |

| p-value | The probability of the statistical test’s null hypothesis is true | Based on the degrees of freedom p < 0.05 | [64] |

| Predictive relevance Q2 | Demonstrates how well the model predicts the future results | >0.5 | [74] |

| Indicator | Criterion | Value | Source |

|---|---|---|---|

| Standardised root mean square residual (SRMR) | Shows the discrepancy between the correlation matrix’s actual and model-predicted correlations. | <0.08 | [72] |

| Bentler and Bonett Index: normed fit index (NFI) | It compares the Chi2 value of the proposed model against a meaningful benchmark | >0.09, the closer NFI to 1, the better the match | [79,80] |

| Latent Variable | Convergent Validity | Internal Consistency Reliability | Discriminant Validity | ||||

|---|---|---|---|---|---|---|---|

| Loadings | Indicator Reliability | AVE | Cronbach’s Alpha | Composite Reliability (ρc) | HTMT | ||

| >0.7 | >0.5 | >0.5 | >0.7 | >0.6 | Significantly Lower Than 0.85 | ||

| Environmental Risk | Compliance (1) | 0.910 | 0.857 | 0.764 | 0.964 | 0.941 | 0.097 |

| Compliance (2) | 0.922 | 0.864 | |||||

| Compliance (3) | 0.753 | 0.863 | |||||

| Compliance (4) | 0.797 | 0.856 | |||||

| Compliance (5) | 0.970 | 0.853 | |||||

| Human Safety (1) | 0.978 | 0.957 | 0.968 | 0.992 | 0.993 | 0.607 | |

| Human Safety (2) | 0.944 | 0.983 | |||||

| Human Safety (3) | 0.992 | n/a | |||||

| Human Safety (4) | 0.967 | n/a | |||||

| Human Safety (5) | 0.989 | n/a | |||||

| ICT (1) | 0.990 | 0.980 | 0.981 | 0.995 | 0.996 | 0.348 | |

| ICT (2) | 0.993 | 0.982 | |||||

| ICT (3) | 0.991 | 0.980 | |||||

| ICT (4) | 0.988 | 0.976 | |||||

| ICT (5) | 0.991 | 0.981 | |||||

| Operational (1) | 0.951 | 0.944 | 0.913 | 0.976 | 0.981 | 0.445 | |

| Operational (2) | 0.955 | 0.950 | |||||

| Operational (3) | 0.945 | 0.933 | |||||

| Operational (4) | 0.962 | 0.949 | |||||

| Operational (5) | 0.964 | 0.955 | |||||

| Strategy (1) | 0.959 | 0.950 | 0.956 | 0.989 | 0.991 | 0.310 | |

| Strategy (2) | 0.977 | 0.967 | |||||

| Strategy (3) | 0.986 | 0.975 | |||||

| Strategy (4) | 0.988 | 0.977 | |||||

| Strategy (5) | 0.984 | 0.971 | |||||

| Governance (1) | 0.959 | 0.946 | 0.956 | 0.983 | 0.991 | 0.269 | |

| Governance (2) | 0.976 | 0.961 | |||||

| Governance (3) | 0.956 | 0.942 | |||||

| Governance (4) | 0.974 | 0.956 | |||||

| Governance (5) | 0.971 | 0.958 | |||||

| Total Effect | t Values | p Values | 95% Confidence Intervals | Total Effect | |

|---|---|---|---|---|---|

| Environment risk -> compliance risk | −0.168 | 0.509 | 0.611 | [−0.589; 0.489] | No |

| Environment risk -> human safety risk | 0.605 | 2.220 | 0.026 | [−0.070; 0.948] | Yes |

| Environment risk -> ICT risk | 0.365 | 1.943 | 0.052 | [−0.258; 0.661] | No |

| Environment risk -> operational risk | −0.445 | 1.971 | 0.049 | [−0.725; 0.298] | Yes |

| Environment risk -> strategy risk | −0.313 | 1.558 | 0.119 | [−0.592; 0.269] | No |

| Environment risk -> governance risk | −0.270 | 1.609 | 0.108 | [−0.516; 0.228] | No |

| No. | Hypotheses | Results |

|---|---|---|

| H1 | Environmental risks have a direct significant impact on governance risks; | Rejected |

| H2 | Environmental risks have a direct significant impact on human and safety risks; | Confirmed |

| H3 | Environmental risks have a direct significant impact on strategic risks; | Rejected |

| H4 | Environmental risks have a direct significant impact on compliance risks; | Rejected |

| H5 | Environmental risks have a direct significant impact on operational risks; | Confirmed |

| H6 | Environmental risks have a direct significant impact on ICT risks. | Rejected |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Popova, Y.; Cernisevs, O.; Popovs, S. Impact of Geographic Location on Risks of Fintech as a Representative of Financial Institutions. Geographies 2024, 4, 753-768. https://doi.org/10.3390/geographies4040041

Popova Y, Cernisevs O, Popovs S. Impact of Geographic Location on Risks of Fintech as a Representative of Financial Institutions. Geographies. 2024; 4(4):753-768. https://doi.org/10.3390/geographies4040041

Chicago/Turabian StylePopova, Yelena, Olegs Cernisevs, and Sergejs Popovs. 2024. "Impact of Geographic Location on Risks of Fintech as a Representative of Financial Institutions" Geographies 4, no. 4: 753-768. https://doi.org/10.3390/geographies4040041

APA StylePopova, Y., Cernisevs, O., & Popovs, S. (2024). Impact of Geographic Location on Risks of Fintech as a Representative of Financial Institutions. Geographies, 4(4), 753-768. https://doi.org/10.3390/geographies4040041