1. Introduction

Digital finance is described as the “impact of new technologies on the financial services industry… [resulting in] a variety of products, applications, processes and business models that have transformed the traditional way of providing banking and financial services” [

1]. Prior research has shown that this transformation has a significant impact on supporting multiple UN Sustainable Development (SDG) goals, including gender equality (SDG 5), decent work and economic growth (SDG 8), and reducing inequalities (SDG 10) (UNDP, 2020). These effects are especially profound in geographic areas where traditional banking infrastructure has historically remained under-developed, including Sub-Saharan Africa. Innovations in digital financial technologies create opportunities to connect people, communities, and organizations without traditional banking infrastructure, bypassing physical geographic restrictions by using internet access and mobile networks. Financial services critical for the support of SDGs can thus be offered at a distance with tools as simple as a Nokia mobile phone. The recent COVID-19 pandemic has further accelerated awareness of the need for regional ecosystems to develop capacity in sustainably creating and implementing such digital innovations at a local level to address evolving local needs.

In this study, we sought to identify existing gaps in support necessary for stakeholders within an African context to engage with developing digital financial tools in an inclusive, resilient, and sustainable manner. The results of these analyses are presented in this paper. We believe that the recommendations identified may help local industry leaders, policymakers, and entrepreneurs to leverage the strengths of digital finance as a catalyst for increasing inclusive and sustainable local innovation across the African continent while still remaining aware of its limitations as a tool.

2. Materials and Methods

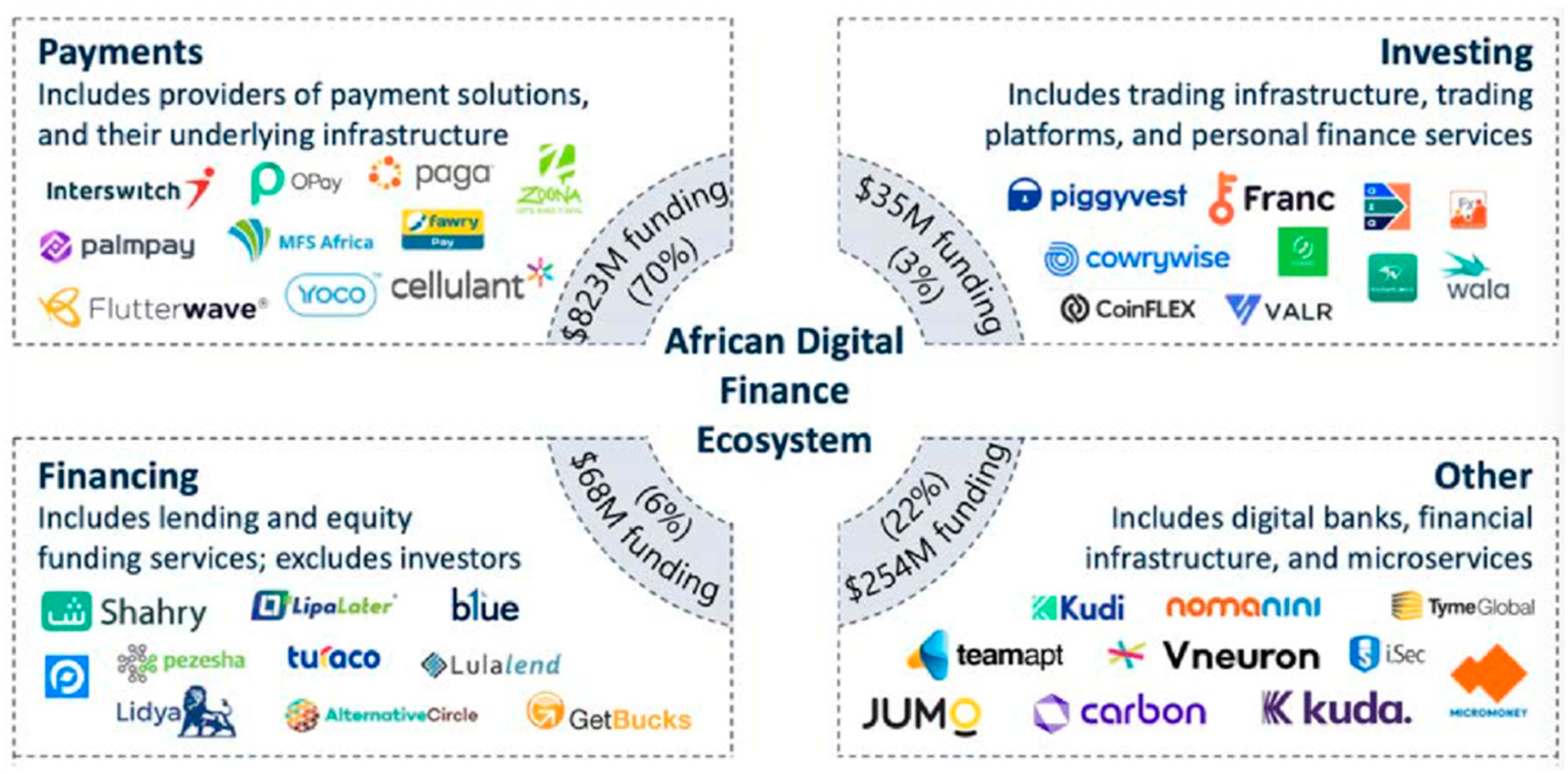

The authors analyzed the current state of local and regional digital innovation in the financial landscape across Africa through a mixed-methods approach. First, we reviewed equity funding data within the African digital financial services sector to identify trends in the current digital innovation ecosystem, extending beyond the common focus of mobile money payment systems (70% of current funding) to include financing services (6% of total funding), investing services (3% of total funding), and supporting digital financial services (22% of total funding). This data was supplemented by 27 informational interviews with regional and sector experts, including managing and regional directors of incumbent companies in the financial and telco sectors, local Fintech entrepreneurs, regulators and government officials, and investors. Based on these interviews, we conducted a third analysis mapping the current regulatory landscape at a national level to determine current barriers and enablers to further local-level growth and innovation within the digital finance sector.

Additionally, the core research for this study was conducted over the summer of 2020 during the initial outbreak of the COVID-19 pandemic. The authors were constrained by the geographical limitations posed by rolling national and international lockdowns and thus conducted all interviews, literature reviews, and database analyses virtually.

2.1. Databases

2.1.1. Crunchbase

Business information platform Crunchbase was used to source equity funding information on startups as well as privately and publicly held companies operating within the African Fintech space. While considered a standard resource for investment and academic research on startups, we are aware that there are missing data and limitations on the accuracy of crowdsourced data [

2].

2.1.2. GSMA Mobile Money Deployment Tracker

The authors used the GSMA Mobile Money Deployment Tracker to build a picture of the geographical distribution of mobile money and digital finance across African countries, as well as to obtain a list of international technological actors and partnerships. The Deployment Tracker monitors global mobile money services through a combination of primary and secondary sources collected monthly. This database allowed us to follow live services in each African country, including their launch year, the range of mobile money products provided (e.g., peer-to-peer transfers, bill payments, airtime top-up, etc.), and to map out relevant partnerships with banks and technological actors. These data were invaluable in building a solid overview of the number and origin of mobile money actors across regions and countries of Africa, as well as in understanding the penetration of global technological actors within each market (e.g., Huawei’s technological partnerships with TNM and M-Pesa, respectively, in Malawi, DRC, and Mozambique, among others).

2.1.3. GSMA Mobile Money Regulatory Index

The GSMA Mobile Money Regulatory Index was used to identify regulatory systems across Sub-Saharan Africa. The GSMA MMRI is a single composite indicator used to measure how enabling a county’s regulatory approach is. It follows 26 indicators across 6 main categories that rank systems from 0 to 100: authorization, consumer protection, KYC, agent network, transaction limits, and infrastructure and investment environment. The authors used this index to distinguish among regional regulatory patterns and to build our own classification of regulatory frameworks between over- and under-regulation, constructing key case studies, and ultimately, identifying best practice examples for digital finance regulation (e.g., as found in Ghana).

2.1.4. Regulatory Datasets

Given the non-centralized nature of African government websites, regulatory information was identified by visiting each individual country’s central bank website(s). Oftentimes, there would not be sufficient information to paint a full picture, which prompted the use of more specific regulating entities’ websites. When a specific government was too fragmented into multiple regulatory agencies to efficiently locate needed data, the researchers found it was more task-specific and efficient to use third party websites applicable to mobile and data laws, such as Thomson Reuters guides. This was essential in building a fuller picture of regulatory practices across different countries and identifying how they impacted the development of local mobile money and digital payment services. On some government websites, however, it was extremely difficult to extract any applicable information on the topic (mainly principle-based regulatory systems); examples of this include regulatory information on Liberia, Sierra Leone, and Chad.

2.2. Informational Interviews

The authors additionally conducted a series of informational interviews with geographic and sector experts within the African digital finance space to gather qualitative insights following a review of equity funding data within the African digital financial services sector. These experts included managing and regional directors of incumbent companies in the sector, reporters, entrepreneurs within the fintech space, regulators and government officials, investors, and academics specializing in fintech. Most interviewees were geographically based in the major fintech hubs of Africa (Nigeria, Ghana, Kenya, South Africa, etc.), with a few located in North America and/or Europe. These interviews were not recorded and were solely used to inform research directions for further database selection and subsequent analyses.

3. Results

The analysis conducted in this study first focused on an evaluation of the present state of digital finance in Africa, incorporating an ecosystem map to identify the geographical and industry distribution of current and emerging fintech players across the continent. We next analyzed the fundamental and ongoing trends determining the environment in which digital finance in Africa is present and will be taking place, identifying both critical near-term and longer-term factors that will shape this landscape in the years to come. These analyses were then used to identify existing gaps in support necessary for stakeholders within an African context to engage with developing digital financial tools in an inclusive, resilient, and sustainable local manner. The results are clustered in four main groups of findings presented below.

3.1. Funding Distribution

Distribution of the total USD 1.1B in VC funding across Africa is highly stratified, with 70% concentrated on payment solutions alone. While serving an immediate need across the continent, this concentration of financing neglects to build up the financing (USD 68M in funding, or approx. 6% of the overall landscape) and investment services (USD 35M in funding, or 3% of the overall landscape) necessary to strengthen the African digital financial ecosystem in the years to come (

Figure 1).

The authors identified a total of 514 fintech companies offering digital financial services (DFS) operating across the African continent. Most of these companies have received comparatively little funding; 98 have received over USD 100K, and only 50 companies have received funding over USD 1M. This has resulted in a total of USD 1.2B in equity funding within the African digital financial services (DFS) sector since 2000. By comparison, fintech investments in the US reached USD 75B in 2020 alone [

3]. This funding is expected to increase as rising interest in online services, including e-commerce, continues to expand, especially following the COVID-19 pandemic.

Of the total investments made across the continent, 70% (USD 823M) is concentrated in payments. These include providers of payment solutions and underlying infrastructure. Notable businesses within this space include Interswitch, which reached ‘unicorn’ status after a recent funding round led by Visa in November 2019 [

4]. Other sub-sectors within the fintech space have received only limited funding. Financial solutions account for 6% of total funding, while fintech enabled investment services account for only 3%. Other financial services, including digital banks and (non-payment) infrastructure providers, account for the remaining 22% (USD 254M).

Funding remains heavily geographically concentrated in a small number of countries across the continent. Of existing fintech funding in Africa, 91% has gone to the “Big Four”: Nigeria, South Africa, Kenya, and Egypt. By comparison, fintech companies headquartered in all other 50 African countries have received only USD 109M in total funding since 2000. With this concentration of funding has also come a concentration of talent development. Those interested in the fintech space have relocated to these specific hubs, with the resulting tech workforce developing strong experience from working in an increasing number of tech companies.

Finally, telecommunications companies (Telecoms) function as key gatekeepers given the varied geographic landscape and concentration of robust infrastructure primarily in select urban areas, resulting in large swathes of rural-based populations reliant on mobile phone services. Other traditional gatekeepers include financial services and technology incumbents, governments, regulators, and venture capital investors.

Opportunities within the fintech space have expanded as hard and soft infrastructure across the continent has continued to gradually improve due to a mixture of domestic and foreign investment [

5,

6,

7]. Recent reports have noted that while the energy, water, and sanitation infrastructure sectors are still in greatest need of financing, telecommunications infrastructure is performing significantly better than any other sector [

8]. Smartphones (via telecoms) remain the primary method of financial services access for many. Early mobile money services (such as M-Pesa) historically dominated their national fintech landscape, though, in recent years, new channels have continued to open for e-commerce, ride-hailing, and digital entertainment (e.g., offering opportunities around payment services, user lending, merchant lending, etc.)

3.2. Unaddressed Pain Points: Merchant Payment Suppliers

The authors identified that merchant payment suppliers experience the greatest pain points around the informal businesses that constitute the core of the African economy. That market is split between small urban businesses and townships’ informal retailers, street vendors, and (for example) hair salons. Despite the high concentration of funding in the payment solutions space, our analysis further identified multiple existing, unsatisfactorily addressed pain points within customer journeys across the continent. Such gaps suggest an untapped potential for the emergence of new ventures meeting these needs in the coming years—dependent, of course, on other foundational conditions being met across the overall landscape.

Businesses providing merchant payment solutions occupy an essential stage in the financial inclusion process. The prevailing cultural attachment to cash is often reinforced by technological limitations but is not necessarily supported by all users (e.g., due to security reasons). In that sense, a further limitation that must be addressed is a lack of payment processing methods among merchants outside of highly developed urban areas. Unsurprisingly, cash prevalence increases as density and city size decline. The difficulty of reaching small businesses at scale in those areas has made it prohibitively costly and unprofitable for banks to expand their card servicing network outside of most big cities in Africa. As a result, customers with bank accounts from specific regions are unable to pay with their cards.

In short, merchant payments are a key link in developing the digital finance ecosystem across Africa and an opportunity for supporting local and inclusive innovation. When ineffectively run or poorly disseminated, merchant payment systems break the diffusion of digital payments and instead force users to return to ATMs, wait in long queues, and expose individuals to related security issues. Though its effects still remain to be seen, there is a distinct possibility of the recent COVID-19 pandemic catalyzing the dissemination of contactless merchant payment systems, as has been similarly observed across many other parts of the world.

Countries within Africa where ‘first-stage’ digital payments and banking solutions are not yet widely disseminated are not seen as suitable candidates for merchant payment suppliers, as initial digital finance infrastructure is necessary for demand to exist. There is an existing unfulfilled need among merchants for non-cash payment, but the informational interviews, literature review, and database analyses conducted for this study suggest that it has not yet shifted to active demand in places where digital and card payments remain insignificant. We find that similar reasons to restricted credit solutions dissemination are also behind this: cash prevalence due to cultural attachment being further reinforced by poor energy and internet connections, with reticent regulators slowing down the adoption of digital payments, all culminate in limited merchant demand for business solutions bridging the payment-acceptance link. Here, we can picture a critical user threshold above which sufficient customers adopt digital payments technologies for it to motivate the merchant-side shift to payment acceptance solutions. Until this occurs, merchant payment solutions will remain limited. In countries where digital payments have already developed, however, payment acceptance has become more naturally integrated.

3.3. Uncoordinated Regulatory Landscape: Under- and Over-Regulation

A significant historical barrier limiting support for local development of products and services in Africa’s digital finance space has been the tendency of individual countries to either over- or under-regulate digital finance products and/or services. Given both (a) the novelty of many of these emerging products and services, as well as (b) the difficulties governments in both the developed and developing world face in classifying them within existing financial services or technology sectors, we find that there needs to be a greater ongoing dialogue between stakeholders. Specifically, innovators and regulators must reach a balance allowing innovation within the digital finance sector alongside the protection of these same users, as well as greater coordination across countries and regions within the African continent.

The authors have identified three broad types of regulatory environments. Briefly summarized, the ‘South African’ model is one where the regulatory environment seeks to encourage merchant payment challengers through sandboxes but is generally highly bureaucratic and slow to react. A ‘Tanzanian’ or ‘Nigerian’ model, on the other hand, historically results in unpredictable and stifling policies by authorities who seek to exercise an extremely high degree of control against challenger fintechs and in favor of incumbent merchant payment suppliers. Finally, the ‘Kenyan’ model is one where authorities have so far let dominant telecom providers act freely to exploit their existing large user data resources, creating information asymmetries versus new challengers entering the market. Further country-level case studies offer greater analytical depth regarding the challenges faced (e.g., of under-regulation in Kenya, overregulation in Nigeria, and a current best practices regulatory model in Ghana), though they will not be presented in this proceeding due to space constraints.

3.4. Critical Further Roadblocks to Growth

Access to talent, funding, and hard infrastructure were identified as the three primary roadblocks limiting growth in the African digital finance landscape based on the literature and databases reviewed. The authors further found that talent has become highly concentrated, primarily in South Africa (greatest pool), with smaller, yet viable, emerging talent pools in Kenya, Nigeria, and Egypt. Funding access, too, currently remains concentrated in viable ecosystems though it remains below the global average, as previously mentioned. New ventures in other African markets also continue to face difficulties in accessing equity financing due to a higher risk profile. Finally, access to reliable hard infrastructure remains a significant hurdle. Stable internet connections, electricity, and (for more remote or disadvantaged users) access to basic mobile phones remain barriers that must be overcome for the digital finance sector to flourish across Africa. Yet, these same hurdles presently remain restrictive due to the financial cost and regulatory complexity of internet infrastructure coupled with cross-border interoperability.

4. Discussion

Based on these findings, we argue that providing strong, foundational support for local digital financial innovations will increase inclusivity and micro-, small- and medium-sized business resilience across Africa. Yet, the potential to do so is currently hindered by five specific support gaps that can be addressed through concrete stakeholder actions. Those identified include: (1) redistributing the concentration of funding beyond payment systems to also include digital financing and investment services; (2) addressing significant customer pain points in existing digital finance products and services, particularly for merchant payment suppliers; (3) greater regulatory coordination appropriately balancing regulatory sandboxes with consumer protections, especially for mobile money lending services; (4) addressing unequal concentrations of talent; and (5) strengthening access to reliable hard infrastructure, especially within landlocked countries. Addressing these gaps is likely to enable further local-level growth and innovation within the digital finance sector, resulting in greater financial inclusivity (especially for the unbanked) and increasing local-level sustainable development resilience.

The findings presented in this study paint an image of a promising yet presently still insufficiently stewarded future for digital finance in Africa. To appropriately leverage the strengths of digital finance as a catalyst for a better social and economic environment across the African continent—while remaining aware of its limitations as a tool—requires focused and coordinated efforts by all stakeholders involved in the specific challenges identified in this study. Yet, if executed with responsible stewardship, the strengths and opportunities of digital financial tools have the possibility of creating a more fair, just, and bountiful future for all.