Africa GreenCo and the Independent Off-Taker Model: Beyond ‘Single-Buyer’ Power Markets and Uncreditworthy Utilities †

Abstract

:1. Introduction

2. Insufficient Investment

2.1. The Challenge

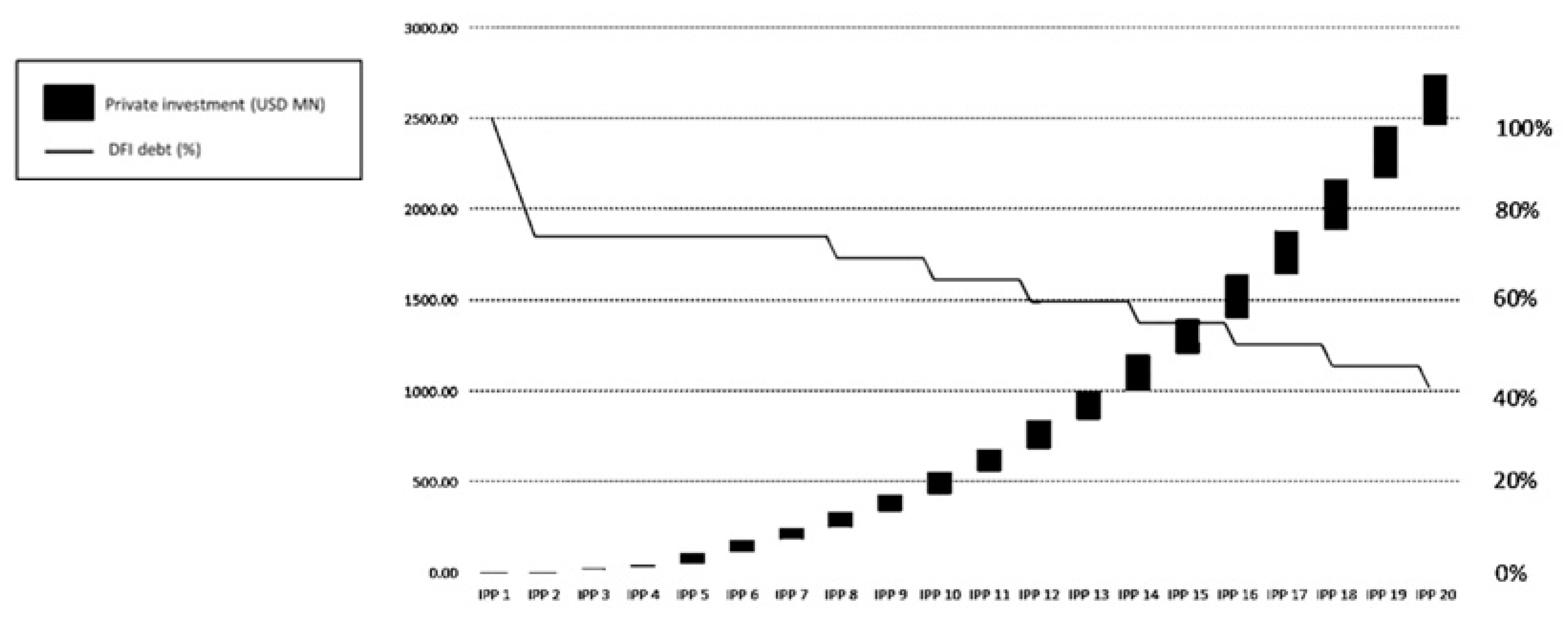

2.2. GreenCo Impact

3. Climate Resilience

3.1. The Challenge

3.2. GreenCo Impact

4. Conclusions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Trimble, C.; Kojima, M.; Perez Arroyo, I.; Mohammadzadeh, F. Financial Viability of Electricity Sectors in Sub-Saharan Africa: Quasi-Fiscal Deficits and Hidden Costs; World Bank: Washington, DC, USA, 2016. [Google Scholar]

- IRENA. Renewable Energy Finance: Sovereign Guarantees; International Renewable Energy Agency: Abu Dhabi, United Arab Emirates, 2020; Available online: https://www.irena.org/-/media/Files/IRENA/Agency/Publication/2020/Jan/IRENA_RE_Sovereign_guarantees_2020.pdf (accessed on 12 April 2021).

- Steffen, B. Estimating the cost of capital for renewable energy projects. Energy Econ. 2020, 88, 104783. [Google Scholar] [CrossRef]

- GreenCo. Africa GreenCo—An Overview; AGC-AGG: Lusaka, Zambia, 2020. [Google Scholar]

- Bayliss, K.; Bonizzi, B.; Dimakou, O.; Laskaridis, C.; Sial, F.; Van Waeyenberge, E. The Use of Development Funds for De-Risking Private Investment: How Effective Is It in Delivering Development Results? European Parliament’s Committee on Development: Brussels, Belgium, 2020; Available online: https://www.europarl.europa.eu/RegData/etudes/STUD/2020/603486/EXPO_STU(2020)603486_EN.pdf (accessed on 22 June 2021).

- Gabor, D. The Wall Street Consensus. Dev. Chang. 2021, 52, 429–459. [Google Scholar] [CrossRef]

- AUDA-NEPAD. Africa Has the Potential to Make Renewable Energy the Engine of Its Growth; NEPAD: Johannesburg, South Africa, 2020; Available online: https://www.nepad.org/news/africa-has-potential-make-renewable-energy-engine-of-its-growth (accessed on 2 March 2021).

- ESMAP. Chapter 6 Outlook for SDG7. In Tracking SDG7 Report 2021; ESMAP: Washington, DC, USA, 2021; Available online: https://trackingsdg7.esmap.org/data/files/download-documents/2021_tracking_sdg7_chapter_6_outlook_for_sdg7.pdf (accessed on 22 June 2021).

- Begashaw, B. Africa and the Sustainable Development Goals: A Long Way to Go; Brookings: Washington, DC, USA, 2019; Available online: https://www.brookings.edu/blog/africa-in-focus/2019/07/29/africa-and-the-sustainable-development-goals-a-long-way-to-go/ (accessed on 1 May 2021).

- Semieniuk, G.; Mazzucato, M. Working Paper 210: Financing Green Growth; SOAS Department of Economics: London, UK, 2018; Available online: https://www.soas.ac.uk/economics/research/workingpapers/file132132.pdf (accessed on 14 December 2020).

- IRENA. Renewable Power Generation Costs in 2019; International Renewable Energy Agency: Abu Dhabi, United Arab Emirates, 2019; Available online: https://www.irena.org/publications/2020/Jun/Renewable-Power-Costs-in-2019 (accessed on 15 April 2021).

- Bloomberg NEF. Sub-Saharan Africa Market Outlook 2020; Bloomberg NEF, Climatescope: London, UK, 2020; Available online: https://global-climatescope.org/assets/data/docs/updates/2020-02-06-sub-saharan-africa-market-outlook-2020.pdf (accessed on 1 September 2020).

- Baumli, K.; Jamasb, T. Assessing Private Investment in African Renewable Energy Infrastructure: A Multi-Criteria Decision Analysis Approach. Sustainability 2020, 12, 9425. [Google Scholar] [CrossRef]

- AfDB. Debt Dynamics & Consequences. In African Economic Outlook 2021; African Development Bank: Abidjan, Côte d’Ivoire, 2021; Available online: https://www.afdb.org/sites/default/files/2021/03/09/aeo_2021_-_chap2_-_en.pdf (accessed on 10 August 2021).

- Kojima, M.; Trimble, C. Making Power Affordable for Africa and Viable for Its Utilities; World Bank: Washington, DC, USA, 2016; Available online: http://hdl.handle.net/10986/25091 (accessed on 11 April 2021).

- Sam, J. Power, Default, and Water Distress: Lessons from Zambia. Available online: https://joel-sam.medium.com/power-default-and-water-distress-lessons-from-zambia-ef89117be9e (accessed on 11 July 2021).

- MoF. The Republic of Zambia Ministry of Finance (MoF)—Q&As following Zambia’s Presentation to Investors; London Stock Exchange: London, UK, 2020; Available online: https://www.londonstockexchange.com/news-article/16EJ/q-a-follow-up-to-presentation-to-creditors/14712037 (accessed on 1 July 2021).

- Saavalainen, T.; ten Berge, J. Quasi-Fiscal Deficits and Energy Conditionality in Selected CIS Countries; IMF: Washington, DC, USA, 2006; Available online: https://www.imf.org/external/pubs/ft/wp/2006/wp0643.pdf (accessed on 2 July 2021).

- SAPP. SAPP Pool Plan; Southern African Power Pool: Harare, Zimbabwe, 2017; Available online: http://www.sapp.co.zw/sapp-pool-plan-0 (accessed on 1 July 2021).

- SAPP. Annual Rreport of the Southern African Power Pool—2019; Southern African Power Pool: Harare, Zimbabwe, 2019; Available online: http://www.sapp.co.zw/sites/default/files/SAPP%20ANNUAL%20REPORT%202019.pdf (accessed on 22 June 2021).

- Aliyu, K.; Modu, B.; Tan, C. A review of renewable energy development in Africa: A focus in South Africa, Egypt and Nigeria. Ren. Sus. Energy Rev. 2018, 81, 2502–2518. [Google Scholar] [CrossRef]

- Ahmed, I.U. The Political Economy of the Energy Mix of Hydropower Dependent Developing Nations—A Case Study of Zambia. Ph.D. Thesis, University College London, London, UK, February 2021. [Google Scholar]

- IPCC. AR5 Climate Change 2014: Impacts, Adaptation, and Vulnerability; IPCC: Geneva, Switzerland, 2014; Available online: https://www.ipcc.ch/report/ar5/wg2/ (accessed on 10 September 2020).

- Spalding-Fecher, R.; Joyce, B.; Winkler, H. Climate change and hydropower in the Southern African Power Pool and Zambezi River Basin: System-wide impacts and policy implications. Energy Policy 2017, 103, 84–97. [Google Scholar] [CrossRef]

- Trace, S. The Impact of Climate Change on Hydropower in Africa; Oxford Policy Management: Oxford, UK, 2019; Available online: https://www.opml.co.uk/blog/the-impact-of-climate-change-on-hydropower-in-africa (accessed on 27 February 2021).

- Conway, D.; Patrick, C.; Gannon, K. Climate Risks to Hydropower Supply in Eastern and Southern Africa; Grantham Research Institute on Climate Change and the Environment: London, UK, 2018. [Google Scholar]

- Geels, F.W.; Sovacool, B.K.; Schwanen, T.; Sorrell, S. Sociotechnical transitions for deep decarbonization. Science 2017, 357, 1242–1244. [Google Scholar] [CrossRef] [PubMed]

- Baker, L. The evolving role of finance in South Africa’s renewable energy sector. Geoforum 2015, 64, 146–156. Available online: https://www.sciencedirect.com/science/article/pii/S0016718515001669 (accessed on 8 December 2020). [CrossRef]

- Fine, B.; Rustomjee, Z. The Political Economy of South Africa: From Minerals-Energy-Complex to Industrialisation; C. Hurst & Co., Ltd.: London, UK, 1996. [Google Scholar]

- Rubio-Varas, M.; Muñoz-Delgado, B. The Energy Mix Concentration Index (EMCI): Methodological considerations for implementation. MethodsX 2019, 6, 1228–1237. [Google Scholar] [CrossRef] [PubMed]

| Power Pool 1 | % GDP |

|---|---|

| Central Africa | 0.62 |

| East Africa | 0.87 |

| West Africa | 1.46 |

| Southern Africa | 2.07 |

| Private Investment Requirement ′22-′40 (USD bn) | |

|---|---|

| Low | High |

| 19.6 | 23.8 |

| Energy Source | SAPP Additions ′21-′31 (MW) | SAPP + GreenCo Additions ′21-′31 (MW) |

|---|---|---|

| Natural gas | 4766 | 3933 |

| Coal | 1502 | 669 |

| Hydro small | 890 | 1723 |

| Hydro large | 14,025 | 13,192 |

| Solar thermal CSP | 100 | 100 |

| Solar PV | 120 | 953 |

| Wind | 155 | 988 |

| Total | 21,558 | 21,558 |

| HHI | 4788 | 4192 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sam, J. Africa GreenCo and the Independent Off-Taker Model: Beyond ‘Single-Buyer’ Power Markets and Uncreditworthy Utilities. Environ. Sci. Proc. 2022, 15, 54. https://doi.org/10.3390/environsciproc2022015054

Sam J. Africa GreenCo and the Independent Off-Taker Model: Beyond ‘Single-Buyer’ Power Markets and Uncreditworthy Utilities. Environmental Sciences Proceedings. 2022; 15(1):54. https://doi.org/10.3390/environsciproc2022015054

Chicago/Turabian StyleSam, Joel. 2022. "Africa GreenCo and the Independent Off-Taker Model: Beyond ‘Single-Buyer’ Power Markets and Uncreditworthy Utilities" Environmental Sciences Proceedings 15, no. 1: 54. https://doi.org/10.3390/environsciproc2022015054

APA StyleSam, J. (2022). Africa GreenCo and the Independent Off-Taker Model: Beyond ‘Single-Buyer’ Power Markets and Uncreditworthy Utilities. Environmental Sciences Proceedings, 15(1), 54. https://doi.org/10.3390/environsciproc2022015054