Modelling the Behaviour of Currency Exchange Rates with Singular Spectrum Analysis and Artificial Neural Networks

Abstract

1. Introduction

2. Materials and Methods

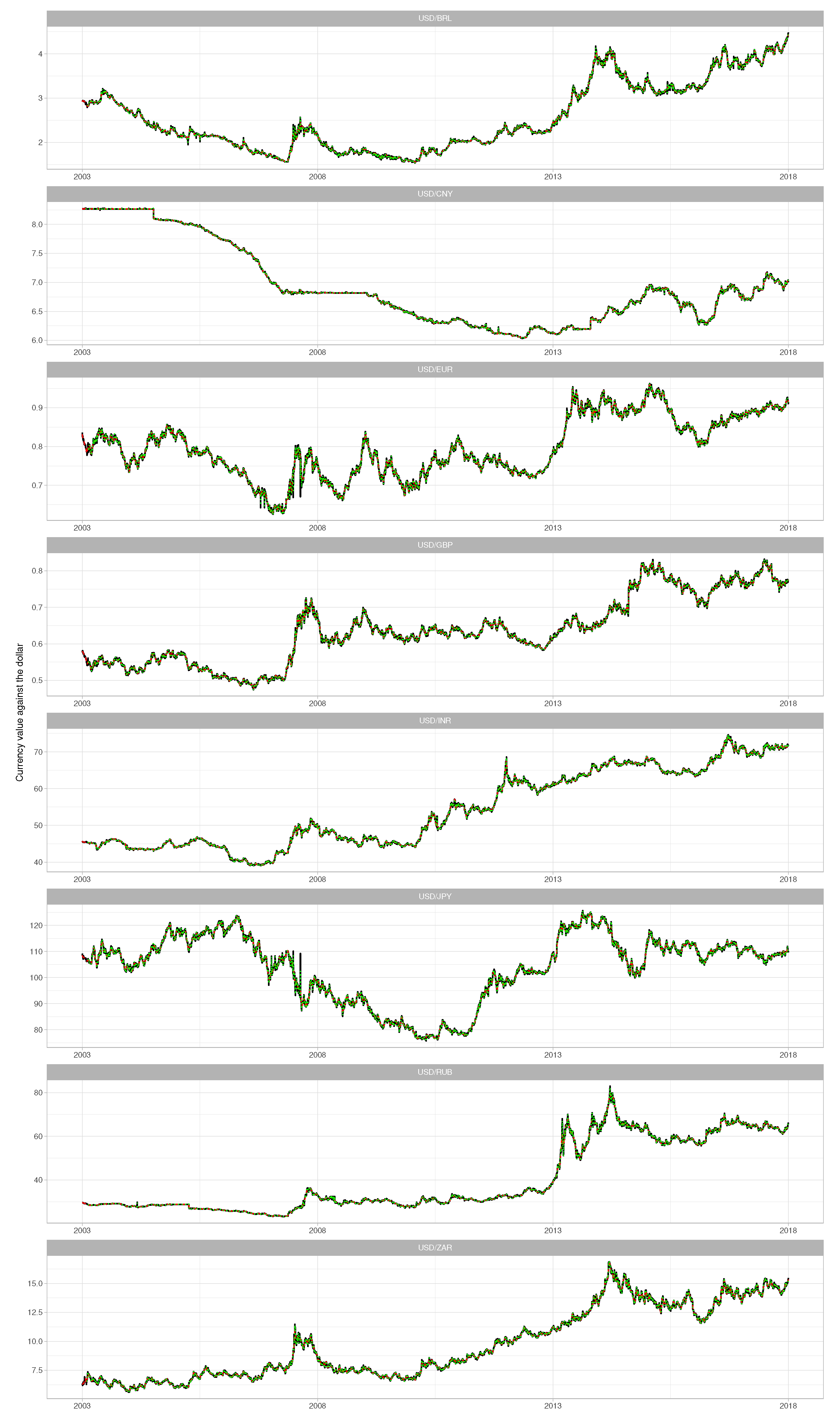

2.1. The Data

2.2. Autoregressive Integrated Moving Average (ARIMA) Model

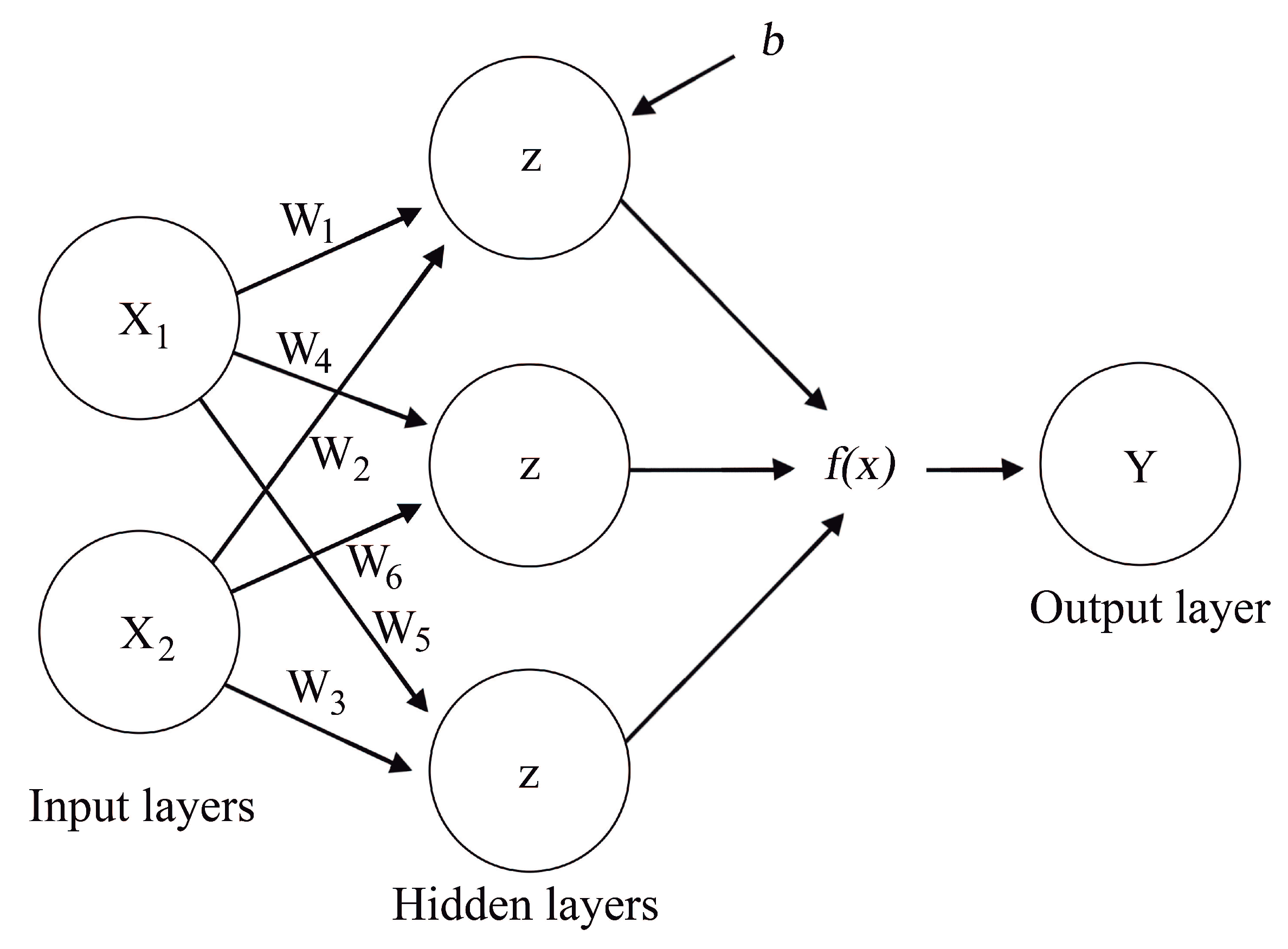

2.3. Artificial Neural Network (ANN)

2.4. Singular Spectrum Analysis (SSA)

2.4.1. First Stage: Decomposition

2.4.2. Second Stage: Reconstruction

2.4.3. Third Stage: Forecasting

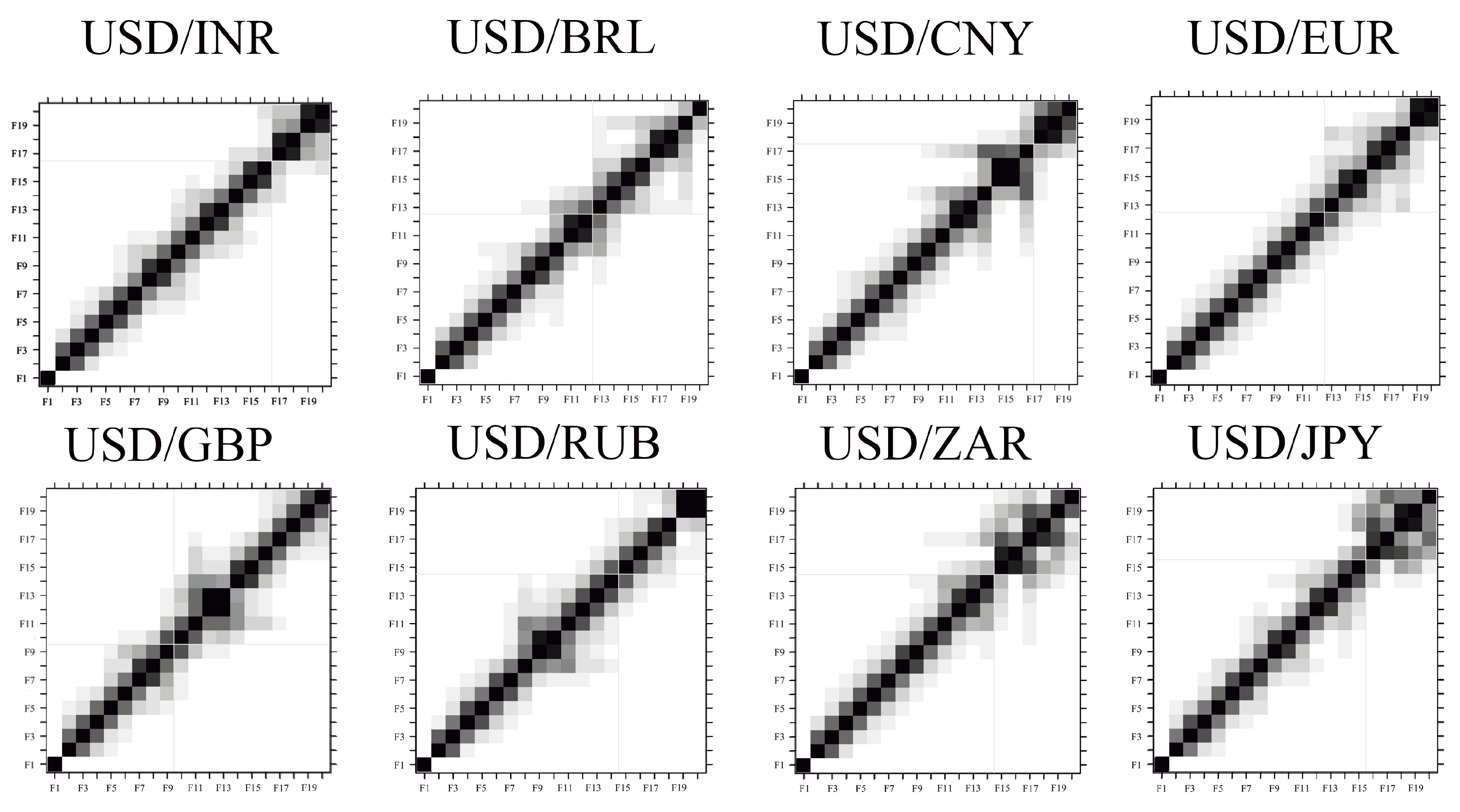

2.4.4. SSA Parameter Selection

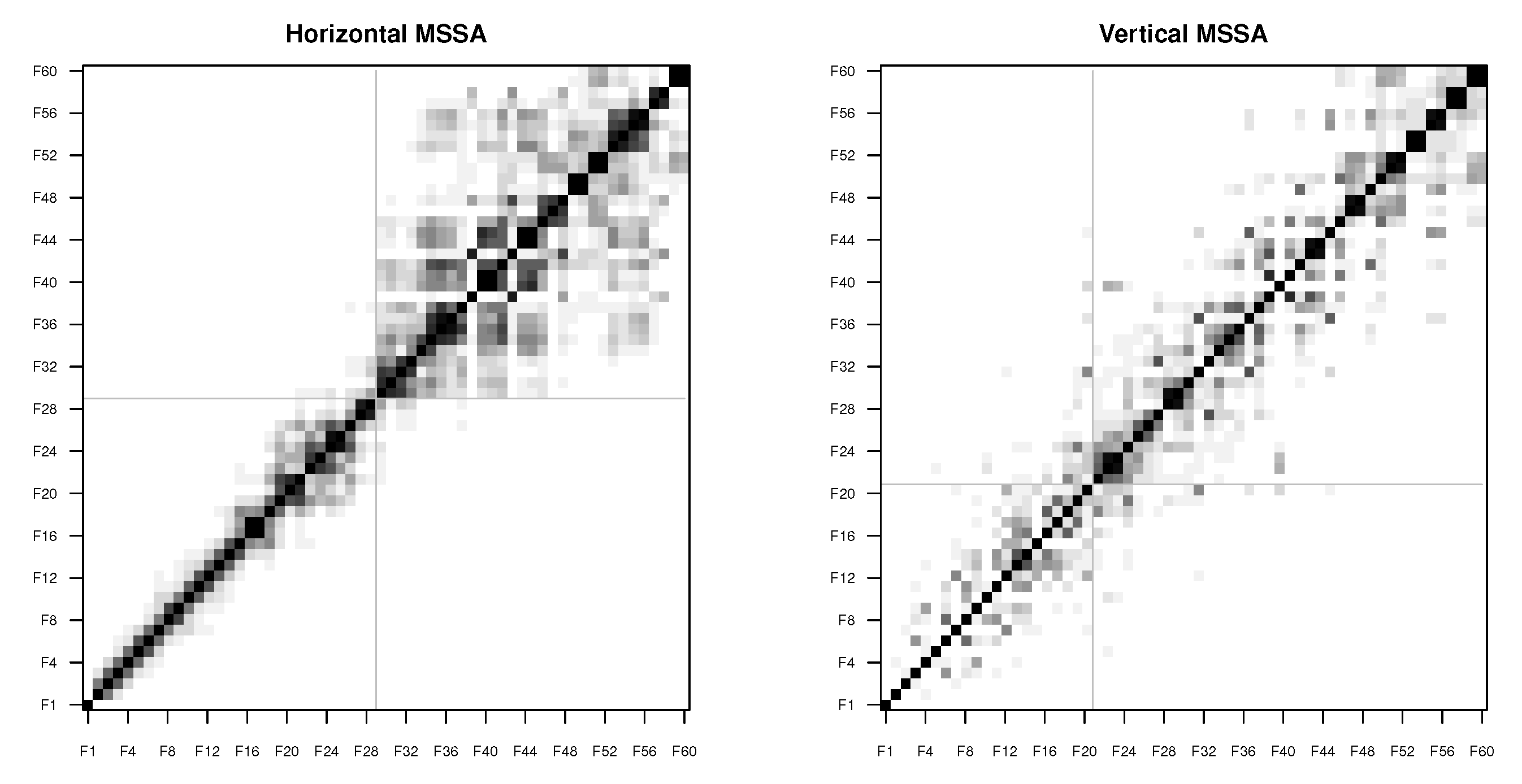

2.5. Multivariate Singular Spectrum Analysis (MSSA)

2.5.1. First Stage: Decomposition

- Horizontal form:

- Vertical form:

2.5.2. Second Stage: Reconstruction

2.5.3. Third Stage: Forecasting

2.6. Hybrid Approach

2.7. Accuracy Measure

3. Results and Discussion

3.1. Model Fit

3.2. Model Forecasting

4. Discussion and Conclusions

Author Contributions

Funding

Conflicts of Interest

Abbreviations

| ANN | artificial neural network |

| ARMA | autoregressive moving average |

| ARIMA | autoregressive integrated moving average |

| BRICS | Brazil, Russia, India, China, South Africa |

| BRL | Brazilian real |

| CNY | Chinese renminby |

| EUR | Euro |

| GBP | British pound |

| H-MSSA | horizontal form of the MSSA algorithm |

| INR | Indian rupee |

| JPY | Japanese yen |

| MAPE | mean absolute percentage error |

| MSSA | multivariate singular spectrum analysis |

| RUB | Russian rouble |

| SSA | singular spectrum analysis |

| SVD | Singular value decomposition |

| RMSE | Root mean square error |

| USD | United States dollar |

| V-MSSA | vertical form of the MSSA algorithm |

| ZAR | South African rand |

Appendix A

References

- Paul, A.; Ibrahim, M. On the causes and effects of exchange rate volatility on economic growth: Evidence from Ghana. J. Afr. Bus. 2017, 18, 169–193. [Google Scholar]

- Nag, A.K.; Mitra, A. Forecasting daily foreign exchange rates using genetically optimized neural networks. J. Forecast. 2002, 21, 501–511. [Google Scholar] [CrossRef]

- Edwards, S.; Savastano, M.A. Exchange rates in emerging economies: What do we know? What do we need to know? In NBER Working Paper 7228; National Bureau of Economic Research: Cambridge, MA, USA, 1999. [Google Scholar]

- Gali, J.; Monacelli, T. Monetary policy and exchange rate volatility in a small open economy. Rev. Econ. Stud. 2005, 72, 707–734. [Google Scholar] [CrossRef]

- von Hagen, J.; Zhou, J. The choice of exchange regimes in developing countries: A multinomial panel analysis. J. Int. Money Financ. 2007, 26, 1071–1094. [Google Scholar] [CrossRef]

- Ca’Zorzi, M.; Kolasa, M.; Rubaszek, M. Exchange rate forecasting with DSGE models. J. Int. Econ. 2017, 107, 127–146. [Google Scholar]

- Awe, O.O.; Gil-Alana, L.A. Time series analysis of economic growth rate series in Nigeria: Structural breaks, non-linearities and reasons behind the recent recession. Appl. Econ. 2019, 51, 5482–5489. [Google Scholar] [CrossRef]

- Jiang, M.N. A comparative analysis of the exchange rate system of the BRICS. Mod. Econ. 2019, 10, 1168–1177. [Google Scholar] [CrossRef][Green Version]

- Sulandari, W.; Subanar; Lee, M.H.; Rodrigues, P.C. Indonesian electricity load forecasting using singular spectrum analysis. Energy 2020, 190, 116408. [Google Scholar] [CrossRef]

- Box, G.E.; Jenkins, G.M.; Reinsel, G.C.; Ljung, G.M. Time Series Analysis: Forecasting and Control; John Wiley and Sons: Hoboken, NJ, USA, 2015. [Google Scholar]

- Hyndman, R.; Athanasopoulos, G. Forecasting: Principles and Practice; Otexts: Melbourne, Australia, 2013. [Google Scholar]

- Ripley, B.D. Time series in R 1.5.0. R News. 2/2, pp. 2–7. Available online: https://www.r-project.org/doc/Rnews/Rnews_2002-2.pdf (accessed on 28 March 2020).

- Hsu, M.W.; Lessmann, S.; Sung, M.C.; Ma, T.; Johnson, J.E. Bridging the divide in financial market forecasting: Machine learners vs. financial economists. Expert Syst. Appl. 2016, 37, 215–234. [Google Scholar] [CrossRef]

- Babu, A.S.; Reddy, S.K. Exchange rate forecasting using ARIMA, neural network and fuzzy neuron. J. Stock Forex Trading 2015, 3, 1–5. [Google Scholar]

- Ciaburro, G.; Venkateswaran, B. Neural Networks with R: Smart Models Using CNN, RNN, Deep Learning, and Artificial Intelligence Principles; Packt Publishing: Birmingham, UK, 2017. [Google Scholar]

- Samarasinghe, S. Neural Networks for Applied Sciences and Engineering: From Fundamentals to Complex Pattern Recognition; CRC Press: Boca Raton, FL, USA, 2016. [Google Scholar]

- Zhang, G.P. Time series forecasting using a hybrid ARIMA and neural network model. Neurocomputing 2003, 50, 159–175. [Google Scholar] [CrossRef]

- Khandelwal, I.; Adhikari, R.; Verma, G. Time series forecasting using hybrid ARIMA and ANN models based on DWT decomposition. Procedia Comput. Sci. 2015, 48, 173–179. [Google Scholar] [CrossRef]

- Abou-Zaid, A.; Stokes, A. Forecasting foreign exchange rates using artificial neural networks: A trader’s approach. Int. J. Monet. Econ. Financ. 2012, 5, 370–394. [Google Scholar]

- Rosenblatt, F. The Perceptron, a Perceiving and Recognizing Automaton Project Para; Cornell Aeronautical Laboratory: New York, NY, USA, 1957. [Google Scholar]

- Widrow, B. An Adaptive “Adaline” Neuron Using Chemical “Memistors”; Stanford University, Stanford Electronics Laboratories, Solid State Electronics Laboratory: Stanford, CA, USA, 1960. [Google Scholar]

- Broomhead, D.S.; King, G.P. Extracting qualitative dynamics from experimental data. Phys. D Nonlinear Phenom. 1986, 20, 217–236. [Google Scholar] [CrossRef]

- Golyandina, N.; Nekrutkin, V.; Zhigljavsky, A. Analysis of Time Series Structure: SSA and Related Techniques; Chapman & Hall/CRC: New York, NY, USA, 2001. [Google Scholar]

- Golyandina, N.; Zhigljavsky, A. Singular Spectrum Analysis for Time Series; Springer Science and Business Media: Berlin/Heidelberger, Germany, 2013. [Google Scholar]

- Hassani, H.; Mahmoudvand, R. Singular Spectrum Analysis Using R; Palgrave Advanced Texts in Econometrics; Springer: London, UK, 2018. [Google Scholar]

- Hassani, H. Singular spectrum analysis: Methodology and comparison. J. Data Sci. 2007, 5, 239–257. [Google Scholar]

- Hassani, H.; Zhigljavsky, A. Singular spectrum analysis: Methodology and application to economics data. J. Syst. Sci. Complex. 2009, 22, 372–394. [Google Scholar] [CrossRef]

- de Carvalho, M.; Rodrigues, P.C.; Rua, A. Tracking the US business cycle with a singular spectrum analysis. Econ. Lett. 2012, 114, 32–35. [Google Scholar] [CrossRef]

- Rodrigues, P.C.; de Carvalho, M. Spectral modeling of time series with missing data. Appl. Math. Model. 2013, 37, 4676–4684. [Google Scholar] [CrossRef]

- Mahmoudvand, R.; Alehosseini, F.; Rodrigues, P.C. Forecasting mortality rate by singular spectrum analysis. RevStat-Stat. J. 2015, 13, 193–206. [Google Scholar]

- Mahmoudvand, R.; Rodrigues, P.C. Missing value imputation in time series using singular spectrum analysis. Int. J. Energy Stat. 2016, 4, 1650005. [Google Scholar] [CrossRef]

- Groth, A.; Ghil, M. Synchronization of world economic activity. Chaos Interdiscip. J. Nonlinear Sci. 2017, 27, 127002. [Google Scholar] [CrossRef] [PubMed]

- Mahmoudvand, R.; Konstantinides, D.; Rodrigues, P.C. Forecasting mortality rate by multivariate singular spectrum analysis. Appl. Stoch. Models Bus. Ind. 2017, 33, 717–732. [Google Scholar] [CrossRef]

- Zabalza, J.; Qing, C.; Yuen, P.; Sun, G.; Zhao, H.; Ren, J. Fast implementation of two-dimensional singular spectrum analysis for effective data classification in hyperspectral imaging. J. Frankl. Inst. 2018, 355, 1733–1751. [Google Scholar] [CrossRef]

- Mahmoudvand, R.; Rodrigues, P.C.; Yarmohammadi, M. Forecasting daily exchange rates: A comparison between SSA and MSSA. RevStat-Stat. J. 2019, 17, 599–616. [Google Scholar]

- Mahmoudvand, R.; Rodrigues, P.C. Predicting the Brexit outcome using singular spectrum analysis. J. Comput. Stat. Model. 2019, 1, 9–15. [Google Scholar]

- Ge, M.; Lv, Y.; Zhang, Y.; Yi, C.; Ma, Y. An effective bearing fault diagnosis technique via local robust principal component analysis and multi-scale permutation entropy. Entropy 2019, 21, 959. [Google Scholar] [CrossRef]

- Rodrigues, P.C.; Pimentel, J.; Messala, P.; Kazemi, M. Decomposition and forecasting of mutual investment funds using singular spectral analysis. Entropy 2020, 22, 83. [Google Scholar] [CrossRef]

- Rodrigues, P.C.; Mahmoudvand, R. The benefits of multivariate singular spectrum analysis over the univariate version. J. Frankl. Inst. 2018, 355, 544–564. [Google Scholar] [CrossRef]

- Danilov, D. Principal components in time series forecast. J. Comput. Graph. Stat. 1997, 6, 112–121. [Google Scholar]

- Mahmoudvand, R.; Rodrigues, P.C. A new parsimonious recurrent forecasting model in singular spectrum analysis. J. Forecast. 2018, 37, 191–200. [Google Scholar] [CrossRef]

- Mahmoudvand, R.; Rodrigues, P.C. Prediction intervals for the vector SSA forecasting algorithm in a median based singular spectrum analysis. Comput. Math. Methods 2020, e1080. [Google Scholar] [CrossRef]

- Rodrigues, P.C.; Mahmoudvand, R. A new approach for the vector forecast algorithm in singular spectrum analysis. Commun. Stat. Simul. Comput. 2020, 49, 591–605. [Google Scholar] [CrossRef]

- Hassani, H.; Mahmoudvand, R. Multivariate singular spectrum analysis: A general view and new vector forecasting algorithm. Int. J. Energy Stat. 2013, 1, 55–83. [Google Scholar] [CrossRef]

- Sulandari, W.; Subanar; Suhartono, S.; Utami, H.; Lee, M.H.; Rodrigues, P.C. SSA based hybrid forecasting models and applications. Bull. Electr. Eng. Inform. 2020, in press. [Google Scholar]

- Kim, T.Y.; Oh, K.J.; Kim, C.; Do, J.D. Artificial neural networks for non-stationary time series. Neurocomputing 2004, 61, 439–447. [Google Scholar] [CrossRef]

- Hyndman, R.J.; Khandakar, Y. Automatic time series forecasting: The forecast package for R. J. Stat. Softw. 2008, 26. [Google Scholar] [CrossRef]

- de Carvalho, M.; Rua, A. Real-Time Nowcasting the US Output Gap: Singular Spectrum Analysis at Work. Int. J. Forecast. 2017, 33, 185–198. [Google Scholar] [CrossRef]

- Golyandina, N.; Korobeynikov, A.; Shlemov, A.; Usevich, K. Multivariate and 2D Extensions of Singular Spectrum Analysis with the Rssa Package. J. Stat. Softw. 2015, 67. [Google Scholar] [CrossRef]

- Hassani, H.; Heravi, S.; Zhigljavsky, A. Forecasting European industrial production with singular spectrum analysis. Int. J. Forecast. 2009, 25, 103–118. [Google Scholar] [CrossRef]

- Rodrigues, P.C.; Lourenço, V.M.; Mahmoudvand, R. A robust approach to singular spectrum analysis. Qual. Reliab. Eng. Int. 2018, 34, 1437–1447. [Google Scholar] [CrossRef]

- Makridakis, S.; Spiliotis, E.; Assimakopoulos, V. The M4 Competition: Results, findings, conclusion and way forward. Int. J. Forecast. 2018, 34, 802–808. [Google Scholar] [CrossRef]

- Makridakis, S.; Spiliotis, E.; Assimakopoulos, V. The M4 Competition: 100,000 time series and 61 forecasting methods. Int. J. Forecast. 2020, 36, 54–74. [Google Scholar] [CrossRef]

- Rodrigues, P.C.; Mahmoudvand, R. Correlation analysis in contaminated data by singular spectrum analysis. Qual. Reliab. Eng. Int. 2016, 32, 2127–2137. [Google Scholar] [CrossRef]

- Rodrigues, P.C.; Tuy, P.G.S.E.; Mahmoudvand, R. Randomized singular spectrum analysis for long time series. J. Stat. Comput. Simul. 2018, 88, 1921–1935. [Google Scholar] [CrossRef]

- Montero, P.; Vilar, J.A. TSclust: An R Package for Time Series Clustering. J. Stat. Softw. 2014, 62, 1–43. [Google Scholar]

| Currency | Minimum | Mean | Maximum | Standard Deviation | Coefficient of Variation |

|---|---|---|---|---|---|

| Brazilian real (USD/BRL) | 1.53 | 2.57 | 4.48 | 0.769 | 0.2992 |

| Chinese renminby (USD/CNY) | 6.03 | 6.93 | 8.28 | 0.691 | 0.0997 |

| Euro (USD/EUR) | 0.63 | 0.80 | 0.96 | 0.076 | 0.0951 |

| British pound (USD/GBP) | 0.47 | 0.64 | 0.83 | 0.090 | 0.1411 |

| Indian rupee (USD/INR) | 39.04 | 54.35 | 74.60 | 10.411 | 0.1916 |

| Japanese yen (USD/JPY) | 75.74 | 103.93 | 125.63 | 12.780 | 0.1230 |

| Russian rouble (USD/RUB) | 23.17 | 40.27 | 82.90 | 15.984 | 0.3969 |

| South African rand (USD/ZAR) | 5.60 | 9.71 | 16.87 | 3.050 | 0.3141 |

| Dickey-Fuller Test | |||||

|---|---|---|---|---|---|

| Currency | AR(p) | I(d) | MA(q) | Test Statistic | p-Value |

| Brazilian real (USD/BRL) | 5 | 2 | 0 | −13.586 | 0.01 |

| Chinese renminby (USD/CNY) | 5 | 2 | 0 | −13.189 | 0.01 |

| Euro (USD/EUR) | 1 | 1 | 1 | −15.531 | 0.01 |

| British pound (USD/GBP) | 0 | 1 | 0 | −15.420 | 0.01 |

| Indian rupee (USD/INR) | 1 | 1 | 0 | −15.313 | 0.01 |

| Japanese yen (USD/JPY) | 0 | 1 | 1 | −16.261 | 0.01 |

| Russian rouble (USD/RUB) | 2 | 1 | 2 | −14.292 | 0.01 |

| South African rand (USD/ZAR) | 0 | 1 | 0 | −16.945 | 0.01 |

| Currency Exchange Rate | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Brazilian real (USD/BRL) | 212 | 11 | 2120 | 7 | 60 | 20 | 60 | 30 | 60 | 21 |

| Chinese renminby (USD/CNY) | 212 | 11 | 2120 | 7 | 60 | 18 | 60 | 30 | 60 | 21 |

| Euro (USD/EUR) | 212 | 12 | 2120 | 14 | 60 | 13 | 60 | 30 | 60 | 21 |

| British pound (USD/GBP) | 212 | 10 | 2120 | 19 | 60 | 10 | 60 | 30 | 60 | 21 |

| Indian rupee (USD/INR) | 212 | 10 | 2120 | 7 | 60 | 17 | 60 | 30 | 60 | 21 |

| Japanese yen (USD/JPY) | 212 | 7 | 2120 | 10 | 60 | 16 | 60 | 30 | 60 | 21 |

| Russian rouble (USD/RUB) | 212 | 9 | 2120 | 7 | 60 | 15 | 60 | 30 | 60 | 21 |

| South African rand (USD/ZAR) | 212 | 8 | 2120 | 11 | 60 | 15 | 60 | 30 | 60 | 21 |

| Currency Exchange Rate | ||||||||

|---|---|---|---|---|---|---|---|---|

| Brazilian real (USD/BRL) | 0.0317 | 0.0293 | 0.1235 | 0.0215 | 0.0124 | 0.0545 | 0.0291 | 0.0074 |

| Chinese renminby (USD/CNY) | 0.0129 | 0.0144 | 0.0773 | 0.0072 | 0.0050 | 0.0259 | 0.0119 | 0.0020 |

| Euro (USD/EUR) | 0.0057 | 0.0062 | 0.0151 | 0.0039 | 0.0025 | 0.0332 | 0.0053 | 0.0016 |

| British pound (USD/GBP) | 0.0038 | 0.0055 | 0.0169 | 0.0028 | 0.0015 | 0.0301 | 0.0039 | 0.0013 |

| Indian rupee (USD/INR) | 0.2767 | 0.3013 | 1.2830 | 0.1738 | 0.1163 | 0.2988 | 0.2727 | 0.0498 |

| Japanese yen (USD/JPY) | 0.7668 | 1.1127 | 2.5112 | 0.5831 | 0.3389 | 0.6140 | 0.6146 | 0.1812 |

| Russian rouble (USD/RUB) | 0.4739 | 0.6480 | 2.2367 | 0.4268 | 0.1775 | 0.4763 | 0.3839 | 0.0849 |

| South African rand (USD/ZAR) | 0.1109 | 0.1466 | 0.3833 | 0.0769 | 0.0434 | 0.2023 | 0.1114 | 0.0255 |

| Currency Exchange Rate | ||||||||

|---|---|---|---|---|---|---|---|---|

| Brazilian real (USD/BRL) | 0.82% | 0.78% | 3.71% | 0.57% | 0.32% | 1.50% | 0.75% | 0.21% |

| Chinese renminby (USD/CNY) | 0.11% | 0.14% | 0.80% | 0.06% | 0.05% | 0.27% | 0.10% | 0.02% |

| Euro (USD/EUR) | 0.47% | 0.58% | 1.45% | 0.33% | 0.20% | 3.34% | 0.45% | 0.13% |

| British pound (USD/GBP) | 0.43% | 0.64% | 2.05% | 0.32% | 0.17% | 3.67% | 0.44% | 0.15% |

| Indian rupee (USD/INR) | 0.33% | 0.38% | 1.81% | 0.22% | 0.14% | 0.38% | 0.33% | 0.06% |

| Japanese yen (USD/JPY) | 0.47% | 0.79% | 1.89% | 0.38% | 0.20% | 0.40% | 0.43% | 0.10% |

| Russian rouble (USD/RUB) | 0.52% | 0.77% | 3.49% | 0.48% | 0.21% | 0.57% | 0.50% | 0.12% |

| South African rand (USD/ZAR) | 0.80% | 1.09% | 2.98% | 0.56% | 0.31% | 1.55% | 0.80% | 0.19% |

| Currency Exchange Rate | H- | V- | ||||||

|---|---|---|---|---|---|---|---|---|

| Brazilian real (USD/BRL) | 0.3847 | 0.0360 | 0.8881 | 0.0132 | 0.0133 | 0.0923 | 0.1048 | 2.4027 |

| Chinese renminby (USD/CNY) | 0.2677 | 0.0290 | 0.8860 | 0.0172 | 0.0133 | 0.0923 | 0.1038 | 1.8119 |

| Euro (USD/EUR) | 0.2218 | 0.0281 | 0.9392 | 0.0145 | 0.0133 | 0.0923 | 0.2378 | 2.7058 |

| British pound (USD/GBP) | 0.0712 | 0.0259 | 0.9157 | 0.0139 | 0.0133 | 0.0923 | 0.0806 | 2.6205 |

| Indian rupee (USD/INR) | 0.1378 | 0.0412 | 0.8880 | 0.0186 | 0.0133 | 0.0923 | 0.1804 | 2.2644 |

| Japanese yen (USD/JPY) | 0.1970 | 0.0223 | 10.111 | 0.0112 | 0.0133 | 0.0923 | 1.6194 | 2.6516 |

| Russian rouble (USD/RUB) | 0.1064 | 0.0305 | 0.8561 | 0.0105 | 0.0133 | 0.0923 | 0.8474 | 2.6506 |

| South African rand (USD/ZAR) | 0.0859 | 0.0300 | 1.0156 | 0.0146 | 0.0133 | 0.0923 | 0.0746 | 1.6494 |

| Currency Exchange Rate | H- | V- | ||||||

|---|---|---|---|---|---|---|---|---|

| one-step-ahead | ||||||||

| Brazilian real (USD/BRL) | 0.1323 | 0.0370 | 0.2580 | 0.0372 | 0.0410 | 0.0348 | 0.0494 | 0.0247 |

| Chinese renminby (USD/CNY) | 0.0239 | 0.0183 | 0.1644 | 0.0148 | 0.0248 | 0.0135 | 0.0407 | 0.0091 |

| Euro (USD/EUR) | 0.0110 | 0.0095 | 0.0076 | 0.0038 | 0.0029 | 0.0037 | 0.0056 | 0.0017 |

| British pound (USD/GBP) | 0.0056 | 0.0030 | 0.0461 | 0.0037 | 0.0042 | 0.0035 | 0.0048 | 0.0026 |

| Indian rupee (USD/INR) | 0.3448 | 0.2141 | 2.5460 | 0.2521 | 0.2231 | 0.2069 | 0.2802 | 0.1498 |

| Japanese yen (USD/JPY) | 0.9702 | 0.8953 | 11.461 | 0.7099 | 0.6853 | 0.6515 | 0.7578 | 0.4927 |

| Russian rouble (USD/RUB) | 2.1820 | 0.9059 | 1.5589 | 0.4637 | 0.6613 | 0.5168 | 1.4898 | 0.2807 |

| South African rand (USD/ZAR) | 0.4340 | 0.2963 | 0.2387 | 0.1040 | 0.1273 | 0.1023 | 0.2165 | 0.0723 |

| five-steps-ahead | ||||||||

| Brazilian real (USD/BRL) | 0.2280 | 0.0544 | 0.2727 | 0.0648 | 0.0788 | 0.0645 | 0.0804 | 0.0209 |

| Chinese renminby (USD/CNY | 0.0273 | 0.0179 | 0.1738 | 0.0282 | 0.0489 | 0.0303 | 0.0418 | 0.0078 |

| Euro (USD/EUR) | 0.0107 | 0.0124 | 0.0070 | 0.0087 | 0.0088 | 0.0094 | 0.0071 | 0.0025 |

| British pound (USD/GBP) | 0.0056 | 0.0124 | 0.0469 | 0.0044 | 0.0063 | 0.0056 | 0.0047 | 0.0025 |

| Indian rupee (USD/INR) | 0.3632 | 0.2212 | 2.5601 | 0.5689 | 0.4848 | 0.3977 | 0.2850 | 0.1209 |

| Japanese yen (USD/JPY) | 0.9709 | 0.9186 | 11.842 | 1.2772 | 1.5018 | 1.0590 | 0.7407 | 0.5181 |

| Russian rouble (USD/RUB) | 2.1820 | 1.1078 | 1.6070 | 0.9951 | 1.3190 | 1.1384 | 1.4981 | 0.2759 |

| South African rand (USD/ZAR) | 0.4340 | 0.3613 | 0.2444 | 0.2105 | 0.2776 | 0.2053 | 0.1728 | 0.0470 |

| ten-steps-ahead | ||||||||

| Brazilian real (USD/BRL) | 0.3498 | 0.0891 | 0.2909 | 0.0941 | 0.0890 | 0.0974 | 0.1499 | 0.0232 |

| Chinese renminby (USD/CNY) | 0.0457 | 0.0481 | 0.1862 | 0.0516 | 0.0653 | 0.0415 | 0.0434 | 0.0080 |

| Euro (USD/EUR) | 0.0107 | 0.0157 | 0.0059 | 0.0134 | 0.0137 | 0.0138 | 0.0090 | 0.0023 |

| British pound (USD/GBP) | 0.0056 | 0.0066 | 0.0478 | 0.0070 | 0.0060 | 0.0044 | 0.0047 | 0.0024 |

| Indian rupee (USD/INR) | 0.3836 | 0.3020 | 2.5821 | 0.5738 | 0.5168 | 0.4507 | 0.3151 | 0.1011 |

| Japanese yen (USD/JPY) | 0.9709 | 0.9404 | 12.293 | 1.0223 | 1.2728 | 1.1189 | 0.8205 | 0.3122 |

| Russian rouble (USD/RUB) | 2.1820 | 1.5443 | 1.6784 | 0.8272 | 1.6145 | 1.2535 | 1.8017 | 0.2482 |

| South African rand (USD/ZAR) | 0.4340 | 0.3854 | 0.2467 | 0.2894 | 0.3442 | 0.2878 | 0.2019 | 0.0470 |

| Currency Exchange Rate | H- | V- | ||||||

|---|---|---|---|---|---|---|---|---|

| one-step-ahead | ||||||||

| Brazilian real (USD/BRL) | 2.82% | 0.64% | 5.84% | 0.71% | 0.76% | 0.62% | 1.02% | 0.51% |

| Chinese renminby (USD/CNY) | 0.31% | 0.20% | 2.32% | 0.15% | 0.29% | 0.14% | 0.48% | 0.09% |

| Euro (USD/EUR) | 1.12% | 0.91% | 0.77% | 0.32% | 0.26% | 0.31% | 0.53% | 0.13% |

| British pound (USD/GBP) | 0.58% | 0.33% | 5.95% | 0.39% | 0.47% | 0.40% | 0.49% | 0.31% |

| Indian rupee (USD/INR) | 0.37% | 0.25% | 3.54% | 0.31% | 0.28% | 0.24% | 0.35% | 0.17% |

| Japanese yen (USD/JPY) | 0.58% | 0.52% | 10.35% | 0.45% | 0.49% | 0.40% | 0.56% | 0.39% |

| Russian rouble (USD/RUB) | 3.07% | 1.02% | 2.18% | 0.52% | 0.83% | 0.63% | 1.99% | 0.38% |

| South African rand (USD/ZAR) | 2.66% | 1.62% | 1.19% | 0.54% | 0.71% | 0.55% | 1.27% | 0.37% |

| five-steps-ahead | ||||||||

| Brazilian real (USD/BRL) | 5.10% | 1.08% | 6.17% | 1.17% | 1.44% | 1.22% | 1.52% | 0.39% |

| Chinese renminby (USD/CNY) | 0.32% | 0.20% | 2.46% | 0.37% | 0.58% | 0.35% | 0.50% | 0.08% |

| Euro (USD/EUR) | 1.10% | 1.21% | 0.70% | 0.83% | 0.82% | 0.90% | 0.71% | 0.23% |

| British pound (USD/GBP) | 0.58% | 0.41% | 6.05% | 0.43% | 0.66% | 0.63% | 0.49% | 0.31% |

| Indian rupee (USD/INR) | 0.39% | 0.24% | 3.56% | 0.66% | 0.60% | 0.42% | 0.36% | 0.12% |

| Japanese yen (USD/JPY) | 0.58% | 0.55% | 10.69% | 0.86% | 1.02% | 0.71% | 0.56% | 0.40% |

| Russian rouble (USD/RUB) | 3.07% | 1.42% | 2.25% | 1.33% | 1.75% | 1.36% | 2.01% | 0.36% |

| South African rand (USD/ZAR) | 2.66% | 1.94% | 1.22% | 1.22% | 1.51% | 1.20% | 0.92% | 0.26% |

| ten-steps-ahead | ||||||||

| Brazilian real (USD/BRL) | 7.93% | 1.96% | 6.59% | 1.93% | 1.80% | 2.07% | 3.27% | 0.46% |

| Chinese renminby (USD/CNY) | 0.56% | 0.55% | 2.64% | 0.69% | 0.79% | 0.53% | 0.52% | 0.09% |

| Euro (USD/EUR) | 1.10% | 1.61% | 0.56% | 1.28% | 1.32% | 1.32% | 0.91% | 0.21% |

| British pound (USD/GBP) | 0.58% | 0.77% | 6.17% | 0.73% | 0.61% | 0.49% | 0.50% | 0.34% |

| Indian rupee (USD/INR) | 0.42% | 0.35% | 3.59% | 0.64% | 0.58% | 0.52% | 0.41% | 0.11% |

| Japanese yen (USD/JPY) | 0.58% | 0.57% | 11.10% | 0.86% | 0.94% | 0.92% | 0.57% | 0.21% |

| Russian rouble (USD/RUB) | 3.07% | 2.26% | 2.36% | 0.95% | 2.06% | 1.54% | 5.20% | 0.30% |

| South African rand (USD/ZAR) | 2.66% | 2.08% | 1.23% | 1.54% | 2.00% | 1.49% | 0.99% | 0.25% |

| Currency Exchange Rate | H- | V- | ||||||

|---|---|---|---|---|---|---|---|---|

| one-step-ahead | ||||||||

| Brazilian real (USD/BRL) | 4.3655 | 0.5333 | 17.699 | 0.1891 | 0.2323 | 0.2755 | 0.8877 | 28.337 |

| Chinese renminby (USD/CNY) | 3.7305 | 0.4544 | 18.158 | 0.2448 | 0.2323 | 0.2755 | 0.8795 | 15.076 |

| Euro (USD/EUR) | 2.9998 | 0.4562 | 17.755 | 0.1813 | 0.2323 | 0.2755 | 0.9253 | 29.917 |

| British pound (USD/GBP) | 0.9440 | 0.5494 | 17.549 | 0.1530 | 0.2323 | 0.2755 | 0.8994 | 29.427 |

| Indian rupee (USD/INR) | 1.8074 | 0.4961 | 17.675 | 0.2385 | 0.2323 | 0.2755 | 2.2634 | 27.408 |

| Japanese yen (USD/JPY) | 2.9255 | 0.4253 | 17.502 | 0.2316 | 0.2323 | 0.2755 | 20.062 | 30.499 |

| Russian rouble (USD/RUB) | 1.3511 | 0.6087 | 17.294 | 0.3392 | 0.2323 | 0.2755 | 4.2888 | 29.711 |

| South African rand (USD/ZAR) | 1.1148 | 0.6444 | 17.377 | 0.2995 | 0.2323 | 0.2755 | 0.8910 | 19.033 |

| five-steps-ahead | ||||||||

| Brazilian real (USD/BRL) | 4.5827 | 0.5158 | 17.352 | 0.1827 | 0.2112 | 0.2532 | 0.8935 | 28.563 |

| Chinese renminby (USD/CNY) | 4.0223 | 0.4433 | 17.328 | 0.2371 | 0.2112 | 0.2532 | 0.8928 | 15.157 |

| Euro (USD/EUR) | 3.3133 | 0.4625 | 17.574 | 0.1825 | 0.2112 | 0.2532 | 0.9231 | 30.004 |

| British pound (USD/GBP) | 1.0444 | 0.4335 | 17.296 | 0.1478 | 0.2112 | 0.2532 | 0.8987 | 29.270 |

| Indian rupee (USD/INR) | 1.9946 | 0.5102 | 17.376 | 0.2310 | 0.2112 | 0.2532 | 2.1407 | 26.658 |

| Japanese yen (USD/JPY) | 2.8206 | 0.3862 | 17.437 | 0.2172 | 0.2112 | 0.2532 | 19.977 | 30.510 |

| Russian rouble (USD/RUB) | 1.7594 | 0.4156 | 17.064 | 0.2088 | 0.2112 | 0.2532 | 4.1824 | 29.583 |

| South African rand (USD/ZAR) | 1.5077 | 0.4542 | 17.382 | 0.2100 | 0.2112 | 0.2532 | 0.8782 | 19.019 |

| ten-steps-ahead | ||||||||

| Brazilian real (USD/BRL) | 4.6075 | 0.5136 | 17.217 | 0.1833 | 0.2335 | 0.2865 | 0.8950 | 28.491 |

| Chinese renminby (USD/CNY) | 4.0933 | 0.4469 | 17.272 | 0.2396 | 0.2335 | 0.2865 | 0.8961 | 15.133 |

| Euro (USD/EUR) | 3.3071 | 0.4646 | 17.442 | 0.1862 | 0.2335 | 0.2865 | 0.9321 | 29.974 |

| British pound (USD/GBP) | 1.0325 | 0.4219 | 17.230 | 0.1477 | 0.2335 | 0.2865 | 0.9158 | 29.441 |

| Indian rupee (USD/INR) | 1.9575 | 0.4892 | 17.271 | 0.2319 | 0.2335 | 0.2865 | 2.1563 | 26.646 |

| Japanese yen (USD/JPY) | 2.8240 | 0.3899 | 17.338 | 0.2184 | 0.2335 | 0.2865 | 20.062 | 30.689 |

| Russian rouble (USD/RUB) | 1.5355 | 0.4161 | 16.986 | 0.2080 | 0.2335 | 0.2865 | 4.2013 | 29.597 |

| South African rand (USD/ZAR) | 1.2403 | 0.4578 | 17.209 | 0.2099 | 0.2335 | 0.2865 | 0.8795 | 19.178 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Rodrigues, P.C.; Awe, O.O.; Pimentel, J.S.; Mahmoudvand, R. Modelling the Behaviour of Currency Exchange Rates with Singular Spectrum Analysis and Artificial Neural Networks. Stats 2020, 3, 137-157. https://doi.org/10.3390/stats3020012

Rodrigues PC, Awe OO, Pimentel JS, Mahmoudvand R. Modelling the Behaviour of Currency Exchange Rates with Singular Spectrum Analysis and Artificial Neural Networks. Stats. 2020; 3(2):137-157. https://doi.org/10.3390/stats3020012

Chicago/Turabian StyleRodrigues, Paulo Canas, Olushina Olawale Awe, Jonatha Sousa Pimentel, and Rahim Mahmoudvand. 2020. "Modelling the Behaviour of Currency Exchange Rates with Singular Spectrum Analysis and Artificial Neural Networks" Stats 3, no. 2: 137-157. https://doi.org/10.3390/stats3020012

APA StyleRodrigues, P. C., Awe, O. O., Pimentel, J. S., & Mahmoudvand, R. (2020). Modelling the Behaviour of Currency Exchange Rates with Singular Spectrum Analysis and Artificial Neural Networks. Stats, 3(2), 137-157. https://doi.org/10.3390/stats3020012