1. Introduction

In 2021, the government issued Law No. 7/2021 concerning the harmonization of tax regulations. One of the articles regulates the integration of National Identity Number (NIK) as the Tax Identity (NPWP). The implementation of the article was regulated in Minister of Finance Regulation No 112/PMK/2022, which became effective on 14 July 2022. One of the objectives of the NIK policy to become a tax identity number is to increase state revenue through Personal imcome tax.

Personal income tax contributions (PPh article 21 and PPh pasal 25/29 OP) are only Rp 152.34 trillion, or about 14.2% of total state revenue. Compared to other OECD countries, the personal income tax contributes 26% of total state revenues [

1]. This is inversely related to the fact that from the year 2016 to 2020, the percentage of the number of regis- tered individual taxpayers is very significant. In 2020, the number of registered individual taxpayers was 91.2%, or 42,304,811 people, out of a total of 46,380,119 registered taxpayers. Employee individual compliance ratio increased to 85.14% in 2020, from 73.23% in 2019. The compliance rate of nonemployee individuals was 52.44% in 2020, a decrease from 75.93% in 2019 [

2]. Meanwhile, on 30 December 2021, the Ministry of Home Affairs Directorate General of Population and Civil Registration released that the population of Indonesian for the second semester of 2021, was 273,879,750 people. This

Table 1 shows a population increase of 2,529,861 people compared to the year 2020 [

3].

The integration of NIK into NPWP not only broadens the tax base but also increases tax revenue [

4,

5]. The use of a single identity number can help to streamline the population database system, ensure the integrity and accuracy of population data, and integrate all financial and non-financial data. The integration will not only increase revenue but also helps to prevent corruption [

6]. However, to ensure data security, data integration must be validated, which can only be done by government agencies under the Ministry of Home Affairs [

7]. The integration of financial and non-financial data through a single identity number can help prevent tax evasion because the taxpayer cannot conceal the compensation received. By cross-referencing data from different tax registers, big data analysis enables fiscus to identify tax avoidance risks [

8]. Previous research has found that the convenience of NPWP does not effect on tax awareness or compliance [

9], but with big data, taxpayers are forced to comply.

3. Results and Discussion

In response to the development of the digital world and globalization and to simplify the administration of tax, the government regulates the integration of the National Identity Number (NIK) as the Tax Identity (NPWP). The implementation faces challenges, not only by the government but also by the taxpayers. Some issues with the use of a single identity are:

3.1. Application of Digital Identity (e-KTP)

According to the result from the interview: “By the direction of the Director General, at this time the implementation of digital identity (e-KTP) will be carried out in stages and development will still be carried out, especially in terms of security”. The obstacle to implementing digital identity from the user side is that it is necessary to ensure that users have adequate facilities to support the use of digital identity, namely smartphones and internet networks, while from the management side, it is necessary to ensure that the platform used is really safe”.

While according to other key informants: “The application of e-KTP in the area is currently running very well, almost all residents who are at least 17 years old have e-KTP, the obstacles encountered now are almost zero, and have been greatly reduced. It was found that 2–3 years ago, managing e-KTP was difficult and time-consuming, with long lines at the Population and Civil Registration Agency every day. Residents can take care of their e-KTP now only need to come to the village office, make a letter of introduction in the continuation of data recording in the district, and it is finished… Just wait for the E-KTP to arrive. e-KTP, not too long, delivered by The Postal Officer.

The role of e-KTP is very important because the national population data in the e-KTP can be a source of valid resident data. The e-KTP, or Electronic KTP, is a population document that contains a security/control system both from the administrative and information technology based on the national population database. Residents are only allowed to have one KTP listed with a National Identity Number (NIK). NIK is the single identity of each resident and is valid for life. The government is working towards a single identity number by implementing e-KTP.

According to the Director General of Population and Civil Registration of the Ministry of Home Affairs, the challenges faced by the Indonesian government in implementing e-KTP are because digital identity implementation has previously been done in stages [

10]. Since 2021, e-KTP has been in the trial stage in 58 regencies/cities and is still being carried out in stages. The Indonesian government is currently confronted with the challenges of a large population, a large labor force, and security issues in the process of integrating NIK and NPWP. Another challenge is obtaining a digital ID card, which requires a smartphone, network, and knowledge technology. Residents who are unable to meet these requirements receive services in person at the Population and Civil Registration Agency, such as when obtaining a physical ID card. As a result, the Population and Civil Registration employs the principle of double-track system service (service delivery via two lines), namely, digital services and physically manual services. The benefits of digital e-KTP can secure the ownership of digital identity through an authentication system to prevent counterfeiting. e-KTP are in the form of quick responses (QR Codes), so they are not physical cards but are directly stored on smartphones via the Digital Identity application. It is hoped that the issue of this digital e-KTP will further facilitate and accelerate community service activities. To avoid impeding the process of integrating NIK into NPWP, the government must complete the e-KTP immediately and evenly throughout Indonesia.

3.2. Dualism of NIK to Different User

Referring to the key informants from the interview: “Related to this problem, hopefully, the active participation of the community to maintaining and ensuring that their NIK is not misused by other parties. The community can come to the local Disdukcapil to be checked. By being inputted into the SIAK system, it will immediately be able to find out which NIK is in accordance with the system”.

Other key informants stated: “Related to the dualism of the name on one NIK number, to our knowledge, this has never happened in our area; we do not know about other regions, because not all residents in our area have NPWP; only certain residents have NPWP, such as civil servant, entrepreneurs, state-owned enterprise employees, and so on. To avoid the foregoing, the government must validate existing population data through the Population and Civil Registration Agency (Disdukcapil) and create a truly valid Indonesian population data bank”.

There are cases of the dualism of NIK to different users, but it is not evenly distributed to all villages in Indonesia. To validate the data, the stages of improvement should be communicated to the community through local village officials. Disdukcapil verifies and validates data, then after all valid data has been input to the SIAK; there must be no more dualism in the NIK.

3.3. Security Issue

Based on the findings of the interview, all key informants believe that security is a critical issue and they expressed their views from various perspectives.

- -

“The government’s personal data protection law, which seeks to protect people’s personal data, is expected to become a strong legal umbrella for the governance and protection of citizens and government officials’ personal data”.

- -

“A single identity number is expected to increase the number of registered taxpayers; the challenge for tax authorities is to keep taxpayer data safe and not leaking”. To avoid the dualism of NIK to a different user, the Directorate General of Taxation of the Ministry of Finance and the Director General of the Population and Civil Registration of the Ministry of Home Affairs must synchronize and validate the NIK and Tax Identity number. The Tax Administration Core System Update (PSIAP) and collaboration with ILAP (Agency Institutions Association and other parties) can overcome security issues and prevent hacker attacks.

- -

“In terms of the security of confidential government data by hackers, it is possible that employees themselves leaked it. Based on the above experience, the government must have valid population data and ensure that data security is not hacked by hackers, as well as government-to-public data security socialization”.

- -

“The government’s challenge in terms of taxpayers is to maintain the confidentiality of taxpayers’ personal data in the form of the Personal Data Protection Law, which is still in draft form”. Further: “The most important thing, however, is that law enforcement exists for parties who fail to maintain personal information, so that taxpayers have legal certainty”.

Recently, the issue of personal data security in Indonesia is very critical, hackers own and trade important data in the free trade market. Kaspersky, a cybersecurity company, revealed that Indonesia faced more than 11 million cyberattacks in the first quarter of 2022. The rise of cyber threats is triggered by many people using cyberspace, such as for NFTs, metaverses, crypto asset transactions, and investment adoption among young people. In terms of the dangers posed by Internet use, Indonesia ranks first in the Southeast Asian region and 60th globally [

11]. Basically, all of the key informants support the integration of the NIK as the Tax Identification Number as long as their data is guaranteed, secure, and protected by law, therefore it cannot be abused by an irresponsible party.

3.4. Utilization of Big Data

Key informants suggested: “With the significant number of additional taxpayers, the government must also increase investment by providing adequate e-reporting infrastructure to ensure a smooth workflow”. Under the current circumstances, the Directorate General of Taxation server frequently experiences problems near the end of the tax reporting year and cannot be accessed.

Integrating the NIK into the Tax Identification Number made all information about taxpayers more open and detailed and can be accessed not only by the Directorate General of Taxation but also by other institutions. Actually, this has been going on since the enactment of the automatic exchange of information (AEOI) between the Directorate General of Taxation and other institution. The Automatic Exchange of Information (AEOI) between international tax authorities aims to reduce global tax evasion and increase tax transparency. This includes financial account information, tax rulings, cross-border arrangements, and so on. In maintaining big data, adequate infrastructure for digital technology is very important. It requires the use of technology to be able to process data correctly so that valid data output is produced. In addition, the competence of human resources as operators is also very important. They must be prepared for and adapt to work changes.

The cultural factor is the most difficult to overcome when implementing work changes. Work culture is included in the cultural factor because it is difficult for some people to adapt to changes, particularly public sector employees who are no longer young and require more time to operate digital systems. The next challenge in the integrated system of the public sector is the complexity related to the scope of the public sector, which is very broad and affects the lives of many people, so implementation takes a long time. An Indonesian resident can obtain 40 different identity numbers from disparate institutions that are not well integrated [

12]. Another issue is the requirement for regulatory integration. According to the Ministry of Communication and Informatics, central and regional government agencies are currently using technology but are unable to share data due to regulations. Information from each agency for the same object is duplicated and differs, resulting in inefficiency and inaccuracies in data, which results in legal uncertainty. Another challenge is providing infrastructure that can accommodate big data in order to create a digital ecosystem that facilitates/accelerates the workflow of public sector employees [

13]. Tax authorities can also use big data analysis to create taxpayer models based on risk, occupation, age, and other factors that can aid in risk analysis, compliance analysis, or income tax extensification and intensification.

3.5. Impact on Tax Compliance

According to the key informants: “The impact of using a single identity number is that information about taxpayers becomes more transparent”, and “we support the policy of using single identity numbers because using a NIK as a Taxpayer Identification Number (NPWP) can address the issue of compliance gaps in the Indonesian tax system, thereby increasing the tax ratio”.

Data from the Bureau of Statistics (BPS) states that the percentage of the productive age population between the ages of 15 and 64 in Indonesia was 70.72 percent in 2020, or approximately 191,898,641 people. This means that by using this number, there is the potential for an additional 191,898,641 registered taxpayers, or 453.6%, to increase the tax base. With the assumption that residents who are taxed have met the subjective and objective requirements, the integration of the NIK to the Tax Identity Number makes all transaction of all the registered taxpayer recorded. To the equity principle, the taxpayer with a high income must report all of their income and consequently pay higher taxes than lower-income [

14]. Can using big data to increase the number of taxpayers improve taxpayer compliance? Is the compliance voluntary or compelled [

15]? Kirchler (2008) explained that if the power associated with the tax authority demonstrates the strength of preventive measures, then the empirical literature on the effects of audits and penalties supports enforcement compliance.

With big data utilization, tax authorities can cross-check income reported by taxpayers with a self-assessment system, ensuring that taxpayers do not engage in tax evasion and are eventually forced to comply. Compliance, on the other hand, can be voluntary. However, education has a positive (slightly significant) impact on voluntary compliance [

14]. This positive correlation can be explained by Eriksen and Fallan’s (1996) study, which found that tax knowledge leads to better attitudes toward the tax system. As a result, it is reasonable to assume that with education and time, knowledge of taxes and understanding of their needs increase, resulting in voluntary tax compliance.

The impact of using a single identity number is that information about taxpayers becomes more transparent. This is the implication of the AEOI and ILAP (Agencies, Institutions, Associations, and Other Parties) to the Directorate General of Taxes based on the NIK. If there is income or assets that have not been reported, this will have an impact on tax inspections and research. As a result, increased tax compliance and awareness are required to prevent tax evasion. Tax awareness can be increased by collaborating with various parties, such as academics and professional associations, to provide taxpayer counseling.

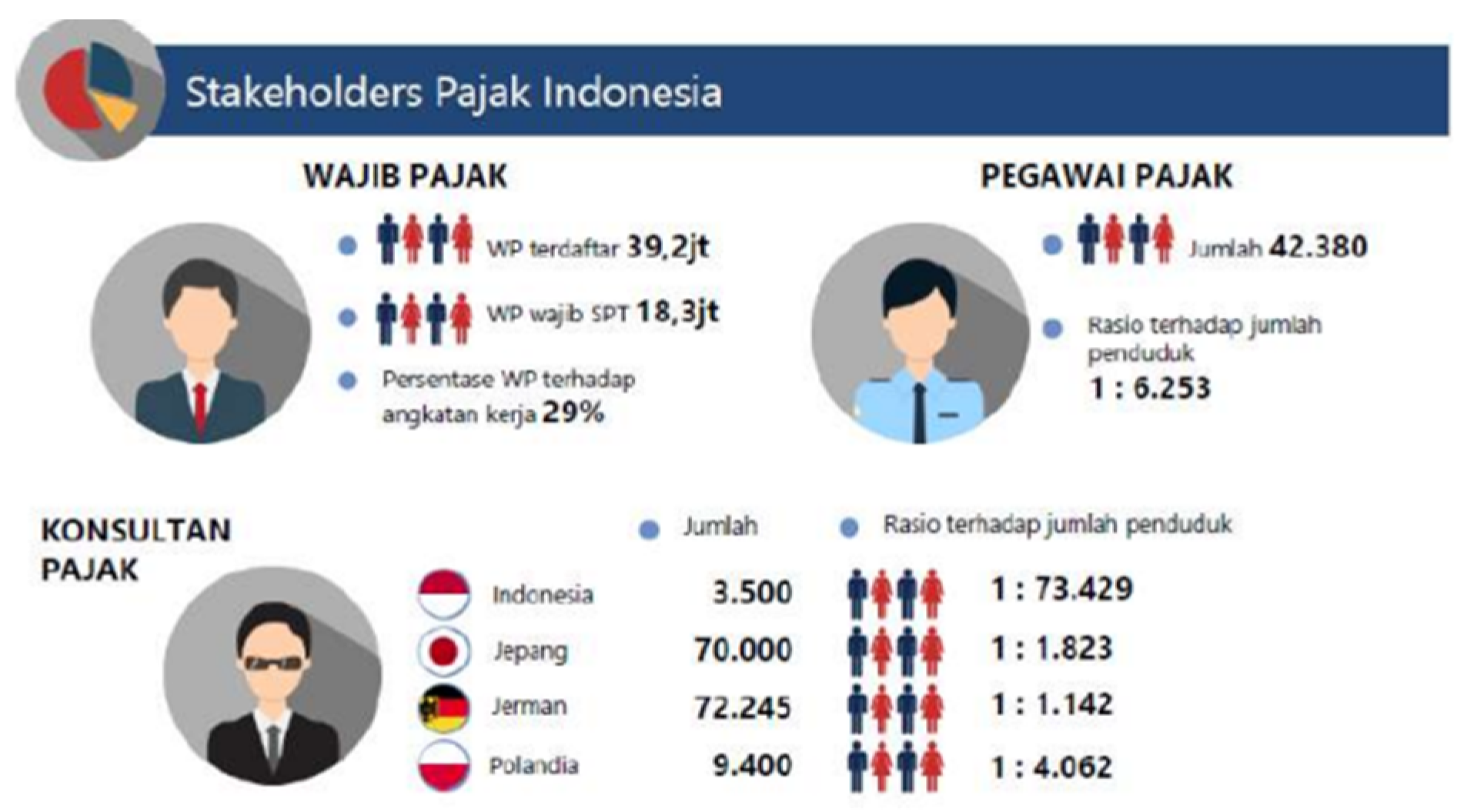

The composition of Tax Stakeholders in Indonesia is depicted in

Figure 1. In 2019, the ratio of tax officers to the total population of Indonesia was 1:6253, implying that each tax employee in Indonesia must deal with 6253 Indonesians’ residences. The population of tax consultants is 1:73,429 of the total population. When compared to other countries, such as Japan and Germany, the number of tax consultants in Indonesia remains very low.

From the perspective of the tax authorities, it can increase the tax base; however, in order to increase the tax ratio, it must be supported by providing tax knowledge so that tax compliance can be achieved. The Directorate General of Taxation can work together with the stakeholder to improve tax awareness and broaden tax knowledge of taxpayer, especially to the new taxpayer

4. Conclusions

The integration of NIK into a single identity number faces challenges, not only for the government, but also for taxpayers. The use of big data with digital technology necessitates changes not only in infrastructure but also in human resources. The government must ensure that all data are trustworthy, valid, and secure for both users and owners of the information. The government must regulate how information is used and protect its citizens through individual data protection legislation. The government should also consider areas that have not been touched by digitalization.

The policy also affects the number of taxpayers and the tax base. Although Indonesia has implemented a self-assessment system, the transparency of the data will make it difficult for taxpayers to avoid paying taxes and will eventually force them to comply. However, in order to increase the tax ratio, tax awareness and knowledge must be improved so that tax compliance can be achieved. In terms of taxpayers, compliance with tax obligations must be balanced with tax knowledge, and it is critical to protect tax payer data through regulation.