Abstract

High upfront costs that district energy retrofitting entails, implies long-term financing schemes. Moreover, multi-private ownership in Spanish residential sector hinders the decision-making process. In the case of CITyFiED project, an innovative business model has been developed between an Energy Services Company and a Building company for Torrelago district renovation. This paper addresses this demo case from a global perspective, identifying the elements of the business case using the Canvas methodology approach and analysing the financing scheme. After a total investment of 16.5 M€, the energy savings achieved enable the payback without increasing the Community fees to the dwellings’ owners.

1. Background

Partly granted by the European Commission, one of the main aims of CITyFiED project is the development of better business models to support urban transformation into low-energy and nearly-zero emission cities. Three demonstration cases are developed in the project: Torrelago (Spain), Soma (Turkey) and Linero (Sweden). Torrelago district involves 31 private multi-property residential buildings (1488 dwellings) that were constructed in the 1970s–1980s, more than 140,000 m2 and 4000 residents involved. Former conditions of the district were very low in terms of efficiency, comfort and costs, which fostered the intervention. Main energy measures implemented are buildings external insulation, district heating interconnection, new biomass thermal plant, variable flow pumping, full renovation of the buildings substations, integration of CHP, optimized control strategies and the individual metering raising users’ awareness. Figure 1 shows a district panoramic view with some retrofitted buildings (a) and the new biomass thermal plant (b).

Figure 1.

(a) Current status of the district, (b) Biomass thermal plant.

2. Description of the Business Case for Torrelago District

Torrelago business model will be addressed using Canvas approach [1], but gathering the main blocks in four different parts: offer and service, infrastructure, customer and finances. Table 1 shows theses different Canvas blocks [2], as well as the ones identified for Torrelago. Within CITyFiED consortium, two partners have a key role in Torrelago in the relationship with the customer: Veolia as energy services company (ESCO) and 3IA as building company.

Table 1.

Business case blocks.

2.1. Offer/Service

Regarding the services provided to the customer within the project, Veolia is in charge of the energy facilities, while 3IA renovates the buildings’ façades. Table 2 shows the different services provided during the different phases the project: design, implementation and operation.

Table 2.

Services provided in Torrelago district.

2.2. Infrastructure

Veolia group comprises two divisions that are essential to the project: Veolia Contracting and Enerbosque. Veolia Contracting carries out the construction works related to the energy interventions, while Enerbosque is a biomass supplier that provides the wood chips to the consumption points, ensuring the fuel supply chain during the project lifetime. In addition, Veolia covers the initial investment needed for the renovation of Torrelago district heating with equity, offering then a sustainable long-term financing scheme to the owners. Regarding 3IA, its design and building experience is one of their most important assets, since it was an enabling factor to carry out this large-scale urban retrofitting. To accomplish the refurbishment, the construction works were subcontracted. A key partner for 3IA was Triodos Bank, which is an entity that supports sustainable and environmental projects. Classical banks perceive this kind of projects as too risky since they do not see energy savings as a real guarantee.

2.3. Customers

Veolia and 3IA have two costumers, which are the two Communities of Owners that constitute the Torrelago district: Phase I and Phase II. As they are two different customers, each Community has its own contracts (buildings and district heating) with the private companies (3IA and Veolia). Table 3 shows the number of buildings and dwellings included in each Community.

Table 3.

Customers.

However, decision making remains in all the dwellings’ owners as long as the Spanish legislation obliges that is has to be approved by a minimum of 60% of the owners. This fact is completely different from the common European residential sector, in which the building owner is usually the municipality or a housing association. Due to this, an intensive communication was necessary to reach the social acceptance. During the long-term contract, a buildings renovation bill and an energy bill are charged to the two Communities and they in turn charge the corresponding individual costs to the home owners through monthly Community fees. The current price is fixed for each dwelling and stable during the year no matter the energy consumption. During the contract period, the two Communities will have the possibility to individualize the energy bill per building or even per dwelling. Moreover, it has to be highlighted that the economic savings that will be achieved during the project will allow the Communities to reduce the fees to the owners.

2.4. Finances

In Veolia’s case, energy management incomes are the main term in the financing scheme and are variable with energy consumption, production mix (biomass and gas) and price indexes. Secondly, operation, maintenance and total guarantee revenues have a base-fixed indexed price which is updated each contract year according to consumer price index. Finally, financing revenues are similar to a bank loan, being distributed in monthly bills with a fixed interest rate.

In the case of 3IA, they have a single income which comes from the amortization of the construction works developed on the façades. These revenues are quite similar to the financing incomes in Veolia’s contract since they are also similar to a loan from 3IA to the Communities.

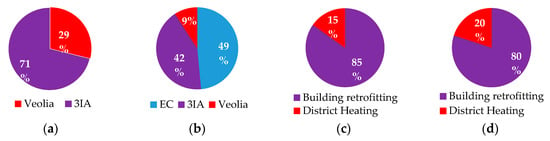

Figure 2 shows comparative graphs of the financing scheme and the main figures of the business case are presented in Table 4.

Figure 2.

(a) Financing revenues, (b) Total investments, (c) Private investments, (d) Energy savings.

Table 4.

Financing figures.

3. Discussion

After the previous comprehensive description of Torrelago business case for district retrofitting, the most relevant figures are summarised in Table 5.

Table 5.

Key figures for Torrelago business case.

Private buildings ownership can be considered as a barrier because it affects decision making processes and makes more difficult to reach an agreement. In addition, general lack of knowledge about energy retrofitting makes people reluctant to these projects. Finally, high upfront costs imply long-term contracts to pay the investment and Communities of Owners see it as an additional risk.

Classical financial entities do not see the energy savings as a guarantee to endorse retrofitting projects, being necessary to look for other financial schemes like green banks. The financing scheme that made this business case feasible involved public institutions, private companies and private building owners. European Commission grant allowed maintaining, or even reducing, the fees to the owners, while increasing the energy efficiency and thermal comfort. Despite this important support, communication with the owners fosters their confidence and increases the social acceptance. End users are key actors in accomplishing energy savings as they have the power to decide heating schedules and setpoints in their houses.

4. Conclusions

Large-scale district energy renovation projects are only possible under long-term financing schemes with a close partnership between different entities. The main innovation of Torrelago business model is the combination of financing schemes for passive and active solutions in such a way that the energy savings obtained allow the Community of Owners to payback the investment without increasing the fees that their dwellings’ owners had to pay before the project. This makes the model more attractive for the residents, favouring the social acceptance and citizen engagement.

Acknowledgments

Part of the work presented in this paper is based on the research carried out within CITyFiED project, which has been granted by the European Commission within the 7th Framework Programme for Research and Technological Development (FP7) under the Grant Agreement No. 609129.

Author Contributions

The CITyFiED business model methodology applied in Torrelago demo case aimed to improve the overall energy efficiency and increase the share of renewables in the district has been developed through a collaborative work between 3IA and Veolia Servicios LECAM. As written contributions for this paper, Javier Martín analysed the background for the business case; Isabel Martín defined the part of the business case related to 3IA building company; José Ramón Martín-Sanz described the offer/service and infrastructures parts in the case of Veolia and Enrique Martín included the customers and finances chapters for Veolia’s case. Finally, Alfonso Gordaliza drafted the Discussion and Conclusions chapters.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Osterwalder, A.; Pigneur, Y. Business Model Generation, 1st ed.; John Wiley and Sons Ltd.: Chichester, UK; Amsterdam, The Netherlands, 2009. [Google Scholar]

- Building a Business Case for Your Project, by Darter K.—Project Smart. Available online: https://www.projectsmart.co.uk/building-a-business-case-for-your-project.php (accessed on 14 June 2017).

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).