Abstract

Background: The food sector plays a critical role in promoting population well-being and contributes significantly to economic, social, and environmental development. However, inefficiencies in distribution logistics often result in elevated operational costs, potentially compromising the viability of enterprises in this sector. This study focuses on evaluating the economic feasibility of a fresh beef and pork distribution center in the southern region of Minas Gerais, Brazil. Methods: A case study methodology with a quantitative approach was adopted. Methodological triangulation was applied by combining a traditional Economic Feasibility Analysis (EFA) with a Monte Carlo Simulation to incorporate uncertainty in key input variables. This approach enabled a comprehensive assessment of project viability under both deterministic and probabilistic conditions. Results: The results indicated that distribution price per kilogram, market share, population growth, and per capita meat consumption had a positive correlation with profitability. The economic analysis confirmed the viability of the proposed distribution center, with high expected profitability and a short payback period. The Monte Carlo Simulation revealed that market share, unit price, and consumption levels are the most influential drivers of financial performance, while logistics costs represent the main limiting factor. Conclusions: This study provides a robust, data-driven framework for investment decision-making in food logistics infrastructure. It demonstrates the value of integrating deterministic and probabilistic analyses to improve risk management and strategic planning in the food distribution sector.

1. Introduction

The food sector constitutes one of the foundational pillars of the global economy [1]. It enables critical advancements in technology, sustainability, food security, and public health in response to the increasing demands of a growing population [2]. This sector exhibits a high degree of dynamism and maintains strong interdependencies with other strategic sectors, particularly logistics [1]. However, factors such as the availability of transportation modes, infrastructure accessibility, and labor supply can significantly impact logistics performance, contributing to increased operational costs and, consequently, elevated final product prices for consumers [1,2].

Within this framework, logistics activities related to meat production play a pivotal role in the food supply chain both in Brazil and globally [3]. Brazil stands as one of the world’s leading producers and exporters of beef and pork, serving substantial domestic and international markets [4]. According to data from [3], national meat production was projected at 29.6 million metric tons in 2023, with 20.44 million tons intended for domestic consumption.

Despite this prominence, the sector faces several operational challenges. Ensuring food safety and quality, maintaining the cold chain for meat preservation, and managing distribution across a country with continental dimensions are critical concerns. These are compounded by intense market competition, high logistics costs, suboptimal road infrastructure, and a shortage of skilled labor [5,6]. Transportation expenses—particularly for long-haul refrigerated cargo—are among the main drivers of cost in meat distribution, directly impacting competitiveness [7]. The limited availability of trained personnel for logistics, storage, and quality control further exacerbates inefficiencies in the supply chain [8].

In light of these challenges, the present study aims to contribute to the field of logistics operations management by integrating Monte Carlo Simulation with Economic Feasibility Analysis (EFA) within the context of the meat production chain. By addressing the logistics cost structure and its influence on project viability, this research seeks to provide empirical support for more efficient investment strategies in the sector. Furthermore, this study aspires to serve as a reference for future investigations that adopt similar methodological approaches or focus on related segments of the agri-food supply chain.

Accordingly, the general objective of this study is to evaluate the economic feasibility of implementing a fresh beef and pork distribution center in the southern region of Minas Gerais, Brazil. The specific objectives include the following: (i) characterizing the operational model of cross-docking; (ii) projecting regional meat consumption and demand; (iii) constructing a project-based cash flow; (iv) performing a deterministic economic viability analysis; (v) conducting risk management through Monte Carlo Simulation; and (vi) critically discussing the findings.

Cross-docking is a logistics strategy designed to accelerate product flow by minimizing the need for intermediate storage [9]. This technique enhances supply chain efficiency and reduces operating costs by ensuring that inbound products are rapidly sorted and redirected to outbound shipments. In this system, goods received from suppliers are unloaded and directly transferred to dispatch areas without being stored, remaining in the facility only long enough for essential tasks such as verification, sorting, and order consolidation [10]. Figure 1 illustrates the structural configuration of a typical cross-docking operation.

Figure 1.

Operating structure of an advanced distribution center or cross-docking.

The successful implementation of a cross-docking system requires the execution of several strategic steps.

- (i)

- Planning: A detailed planning phase is essential to identify which products are appropriate for cross-docking operations, considering factors such as demand variability, physical characteristics, packaging requirements, and shelf life [11].

- (ii)

- Infrastructure adaptation: The physical infrastructure of the distribution center must be adequately modified to support cross-docking activities. This includes the establishment of designated zones for receiving, inspection, sorting, and rapid dispatch of goods, as well as the deployment of systems and equipment that enhance the speed and efficiency of material handling.

- (iii)

- Integration with supply chain partners: Effective implementation relies on robust communication and coordination among suppliers, the distribution center, and final customers. This level of integration ensures synchronized operations and minimizes bottlenecks throughout the supply chain [9].

- (iv)

- Monitoring and control: Continuous monitoring is vital to ensure real-time visibility and traceability of goods. Quality assurance, inventory management, and error prevention must be supported by the use of technological tools such as barcodes, Radio Frequency Identification (RFID), and integrated inventory management systems [9].

2. Literature Review

The analysis of economic feasibility is a crucial tool for decision-making in agri-food businesses. According to Brealey et al. [12], feasibility studies support investors by estimating returns, risks, and payback periods. Copeland et al. [13] highlight that evaluating Net Present Value (NPV) and Internal Rate of Return (IRR) helps to measure project attractiveness. Monteiro et al. [14] applied similar metrics to hydroelectric projects, showing their relevance in infrastructure investments. In food production, such tools allow the anticipation of operational and financial challenges [15]. The integration of deterministic analysis and risk-adjusted methods strengthens the decision-making process [12].

The use of probabilistic simulations, such as Monte Carlo, expands the quality of feasibility assessments. Yang et al. [16] affirm that this method models uncertainty through random variables, allowing a better understanding of outcome variability. In the dairy sector, Ferrari et al. [17] used this approach to optimize milk drying processes, improving efficiency under operational constraints. Griep-Moyer et al. [18] simulated shelf-life variations in pasteurized milk, indicating the model’s applicability to quality control. These studies show that Monte Carlo Simulation complements deterministic tools by incorporating risk and variability [19].

Monte Carlo Simulation is often used to support investment decisions in sectors with demand fluctuations and cost volatility. Elsharkawy [19] demonstrated its use in determining fat content in dairy products. Jang et al. [20] adopted it for evaluating hydrogen production systems under technological uncertainty. Similarly, Wealer et al. [21] applied the technique to forecast risks in nuclear power plant investments. These works reinforce the versatility of Monte Carlo Simulation for modeling complex systems [16]. Its use in agro-industrial ventures ensures robust and risk-aware analyses [22].

Studies in production efficiency further expand the literature in dairy sector evaluations. Kovács and Szűcs [23] identified inefficiencies of 22.4% in Hungarian milk production, suggesting potential gains through better resource allocation. Pedolin et al. [24] combined life cycle assessment and data envelopment analysis to assess environmental efficiency in Swiss agriculture. These approaches reinforce the relevance of evaluating not only profitability but also operational performance. Barros et al. [25] analyzed cow milk production systems in Brazil, associating productivity with sustainability. These findings point to the value of integrating economic and technical criteria.

Recent contributions by [26,27] expand the discussion by analyzing performance in cooperative and logistic systems. In fuel flow logistics, the authors used principal component analysis and DEA to identify operational bottlenecks [27]. In community-supported agriculture, the emphasis was on governance and food distribution efficiency [26]. These studies underline the need for multidimensional performance evaluation. In this sense, economic feasibility can benefit from incorporating social and structural aspects [26].

The study by [28], which focused on extended MRP in smart production systems, brings relevant methodological insights. While the authors prioritize production scheduling integrated with hybrid energy, the use of uncertainty modeling converges with the present study. Both works apply probabilistic simulations to support investment and operational planning. However, the current paper emphasizes financial viability in dairy production using Monte Carlo Simulation and cash flow modeling. Despite the different scopes, the shared concern with uncertainty handling reinforces the methodological robustness of both approaches [28].

Despite the growing application of Monte Carlo Simulation and Economic Feasibility Analysis in agro-industrial contexts, there remains a gap in the integration of these methodologies, specifically within the logistics of meat distribution chains in emerging economies. Most existing studies focus either on production efficiency or on general investment risk analysis, without addressing the operational constraints and cost structures of distribution networks that handle perishable goods [29,30,31,32,33,34]. Furthermore, limited research investigates the viability of lean logistics models—such as cross-docking—combined with probabilistic risk modeling in real-world distribution scenarios. This study addresses these gaps by developing a hybrid framework that incorporates deterministic and stochastic elements to assess the financial sustainability of a meat distribution center in Brazil. In doing so, it contributes to filling a methodological and empirical void in the literature on food logistics under uncertainty.

3. Materials and Methods

This study adopted a descriptive research design with a quantitative approach, employing the case study methodology due to its capacity to analyze real-world data within a specific operational context. The focus was the economic evaluation of a cross-docking system for the distribution of beef and pork in southern Minas Gerais. According to [28], the case study is a widely applicable methodological framework that enables in-depth investigation of a particular phenomenon within its real-life setting. The approach involves sequential phases of problem definition, data collection, data analysis, and structured presentation of results [28].

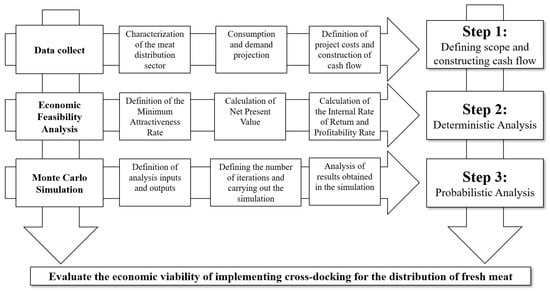

This research was initiated by characterizing the sector under analysis, including the identification of key market stakeholders and drivers, which served as the basis for estimating market share—outlined in Figure 2. Projections of meat production and consumption were then developed for a predefined set of 139 municipalities over the analysis period spanning from 2023 to 2030. To support the financial modeling, brainstorming sessions were conducted with the investor to define cost categories relevant to the project: initial investments, operating costs, and logistics expenses.

Figure 2.

Conceptual model of the study stages. Step 1: defining scope and constructing cash flow; Step 2: deterministic analysis; and Step 3: probabilistic analysis. The steps converge to achieve the general objective of this study. Source: adapted from [26,27,34,35,36,37,38].

The brainstorming sessions involved active participation from both the project team and key stakeholders, including the investor and representatives of the contracting company. The approach adopted followed the traditional brainstorming method, guided by a predefined scope to maintain focus and relevance. This scope encompassed the definition of essential project parameters, such as interest rates, risk premiums, cost structures, market share estimation, and the selection of input variables for the probabilistic model.

A total of three sessions were conducted, each lasting approximately 90 min. The sessions involved a multidisciplinary group of ten participants, including logistics managers, data analysts, supply chain specialists, and academic researchers with expertise in operations and decision-making. The primary objective of the sessions was to identify and validate key variables influencing distribution logistics performance. Discussions were guided by a semi-structured script, with central topics, including cost drivers, demand variability, infrastructure constraints, and technological enablers. The outcome of the sessions contributed to refining the list of input variables used in the modeling phase and to ensuring alignment between practical knowledge and the proposed analytical approach.

The inclusion of this participatory stage was critical to the project’s success, as it enabled the identification and validation of realistic assumptions, ensured alignment between financial expectations and logistical capabilities, and promoted the integration of tacit knowledge often inaccessible through secondary data alone. Furthermore, it strengthened the reliability of both the deterministic and probabilistic analyses by grounding the simulation inputs in consensus-based scenarios informed by those directly involved in or affected by the investment decision.

Thus, the brainstorming process functioned not merely as a planning tool but as a strategic mechanism for stakeholder engagement, risk anticipation, and enhanced model accuracy—factors that are essential to the feasibility and robustness of investment projects in complex, cost-sensitive sectors such as meat logistics. Based on the defined input and output parameters, a projected cash flow model was constructed for the entire analysis horizon, thereby completing Step 1 of this study.

Step 2 of this study involved the execution of the Economic Feasibility Analysis (EFA). In this phase, the Minimum Attractive Rate (MAR) was defined a priori, incorporating key financial parameters such as the Selic rate, business risk premium, and opportunity cost. Based on this rate, the following standard investment appraisal indicators were calculated: Net Present Value (NPV), Internal Rate of Return (IRR), Profitability Index, and the discounted payback period. These calculations constituted the deterministic analysis of the project and were performed using Microsoft Excel 365.

The Selic rate, which represents Brazil’s benchmark interest rate, was adopted at its prevailing level of 13.75% during the period of analysis. This rate functions as a key macroeconomic indicator for determining the cost of capital and is routinely employed in the formulation of discount rates for national investment evaluations.

Step 3 comprised the probabilistic analysis, which aimed to assess the impact of uncertainty and variability in project parameters. For this purpose, a Monte Carlo Simulation was employed. The input variables included: market share, deflated MAR, per capita meat consumption, operational and logistics costs, percentage of the meat-consuming population, population growth rate, administrative expenses, the IPCA (Broad Consumer Price Index), and the price received per kilogram of meat distributed. The output variables, used as decision-making indicators, were NPV, IRR, and Profitability Index. The simulation was executed with 100,000 iterations, enabling a robust analysis of risk and variability across multiple scenarios. While the deterministic analysis was conducted using Microsoft Excel 365, the probabilistic simulation was carried out using RStudio (version 2023.12.1+402).

4. Results

4.1. Consumption and Demand Projection

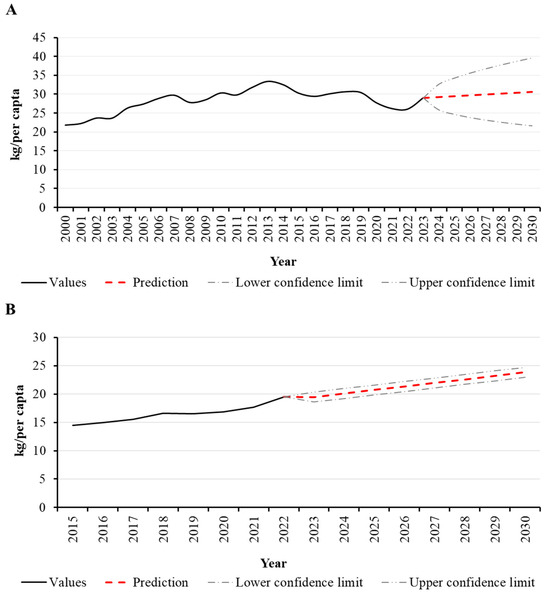

Initially, data on the history of per capita production of beef and pork in Brazil were obtained from [3]. Therefore, a production projection was made until the end of the project analysis period. The projection considered that there may be fluctuations in the behavior of per capita production over the years, which justifies the presence of lower and upper limits. The projected per capita production in 2023 was 18.500 kg of pork and 26.3 kg of beef. These values underwent increasing positive variations throughout the period, reaching 22,562 kg and 32,342 kg per capita in 2030, respectively. The use of per capita production, rather than total production, was intended to ensure comparability with per capita consumption data.

Regarding consumption, data were obtained from the Brazilian Association of Swine Breeders in 2023, corresponding to the history of per capita consumption of the Brazilian population in the period 2015–2022. A per capita beef consumption, data were obtained from [3], where variations of 29 kg were observed in 2023 up to 30.609 kg in 2030, as shown in Figure 3A. For per capita pork consumption in Brazil was then projected for the period 2023–2030, as shown in Figure 3B. An increase in Brazilian per capita consumption was observed, ranging from 19.500 kg in 2023 to 23.834 kg in 2030. It is worth highlighting that the incompatibility between production and consumption is due to the existence of informal meat production that was not considered in this project.

Figure 3.

Consumption of meat over time and its prediction until 2030. (A)—Per capita beef consumption (kg/per capta.year). (B)—Per capita pork consumption (kg/per capta.year).

The projected increase of approximately 12% in per capita pork consumption over the 2023–2030 period is based on historical data from the Brazilian Association of Swine Breeders, which shows a consistent upward trend from 2015 to 2022. This trajectory is supported by several structural drivers that help explain past and projected growth. Notably, pork has gained market share due to its relative price stability compared to beef, improvements in production efficiency, increased investments in sanitary controls, and diversification of pork-based products better aligned with evolving consumer preferences. Additionally, public campaigns promoting pork consumption and the growing presence of pork in institutional and food service markets have contributed to demand expansion.

While we acknowledge the possibility of a future consumption ceiling—as observed in the beef market—we emphasize that such saturation effects typically occur in later stages of market maturity. In the case of pork, particularly in regions of Brazil with historically lower consumption levels, there remains untapped growth potential. Therefore, we consider the projected rate plausible within the model’s time horizon. Furthermore, to account for uncertainty and avoid overestimation, the consumption variable was treated probabilistically in the Monte Carlo Simulation, with defined upper and lower bounds reflecting variability and potential market constraints. Maintaining this range ensures that the analysis remains conservative in structure while responsive to the dynamics observed in recent years.

According to data from [39], the population for the base year of 2021 was estimated, and projections for subsequent years were calculated using an annual growth rate of 0.74%. This rate, as reported by [39], represents the average demographic growth observed across the historical series considered up to 2021. It is important to note that this population estimate refers specifically to a group of 139 municipalities in Brazil, as detailed in Supplementary Material (Section S4.1 of the Supplemental Methods). The geographic distribution of these municipalities is illustrated in Figure 4. To estimate total meat consumption, the projected population values were combined with official per capita consumption rates for beef and pork, obtained from sectoral data. However, rather than applying these values uniformly across the entire population, we adjusted them by incorporating the percentage of the population that consumes meat, based on dietary and socioeconomic data. This adjustment aimed to avoid overestimation of effective demand, recognizing that a portion of the population abstains from meat consumption due to personal, cultural, or economic reasons.

Figure 4.

Region considered in the project. The reference point corresponds to the municipality of Lavras-MG.

Thus, total consumption growth over time in our model does not assume a significant increase in per capita meat intake. Instead, it is primarily driven by the projected increase in the number of meat-consuming individuals resulting from population growth. This methodological choice ensures a conservative and realistic estimate of market demand, mitigating the risk of inflating profitability results due to overly optimistic consumption assumptions.

Therefore, based on the projected values for per capita consumption in 2023–2030, calculations were made for the total consumption of pork and beef in this period for this volume of municipalities, as shown in Table 1.

Table 1.

Total pork and beef consumption for 2023–2030.

To calculate the annual meat-consuming population in these regions, an average percentage of 86% was considered, which, according to [40], represents the portion of the meat-consuming population in Brazil. Thus, by multiplying this estimated consumer population by the projected per capita meat consumption, the values for the projected total meat consumption are obtained.

Subsequently, to calculate the project demand, a fulfillment percentage of only 4% of the total estimated market demand was considered, based on outcomes from the brainstorming sessions held with the investor. The adoption of this conservative market share is justified by multiple strategic and operational factors and is consistent with best practices for early-stage project modeling [41].

Firstly, entering a competitive and consolidated market—such as the meat distribution sector—typically requires a gradual acquisition of clients and distribution routes, especially when the business model involves infrastructure-dependent operations like cross-docking. Secondly, the logistical complexity of covering 139 municipalities across Minas Gerais and São Paulo demands a phased operational rollout, where coverage, brand recognition, and contractual agreements evolve progressively. Therefore, an initial 4% share allows the project to account for realistic constraints related to transport capacity, regulatory licensing, cold chain reliability, and staffing. Third, using a conservative market share in early-stage projections is a well-established approach in risk-averse financial modeling, as it minimizes the likelihood of overestimating revenues and ensures the robustness of the viability analysis. The annual values for the project demand can be seen in Table 2.

Table 2.

Total pork and beef demand for 2023–2030.

According to Table 2, if a monthly analysis is carried out, there is an average value of approximately 400 tonnes of meat to be distributed per month through cross-docking.

4.2. Costs

Only the legal expenses for formalizing the enterprise and the working capital necessary to finance the activities in the first month of operation were considered as initial costs for this implementation project. Therefore, a value of BRL 5500 was defined for the payment of legal expenses and BRL 57,033 for working capital. The value assigned to working capital corresponded to tax expenses for the first year. This is a project with a low initial cost since the investor initially does not intend to build the distribution center but to use an existing unit from partner companies. There will also be no a priori need to purchase equipment, as the structure to be used already has all the necessary materials.

In the case of operating costs, that is, costs related to hired labor, according to brainstorming with the investor, only the cost of hiring a logistics analyst to assist with calculations, project updates, and decision-making was accounted for; a cleaning assistant and a loading inspector were hired to check boarding activities. The annual operating cost corresponded to BRL 238,046.

The logistics operating costs were calculated for the implementation of the project in the municipality of Lavras-MG, considering the delivery route already used by the meat supplier, which corresponds to a total of 139 municipalities and approximately 23,300 km in length. According to [42], for the transport of refrigerated cargo, a travel cost of BRL 3.47/Km will be charged, plus a loading and unloading fee of BRL 291 for two-axle trucks, such as those that will be used in the project (trucks ¾). To calculate the transportation logistics cost for this project, we used the values mentioned, which correspond to the minimum freight rate coefficients for road cargo transport published by the National Land Transport Agency (ANTT). This calculation was initially carried out over 1 month, resulting in a value of BRL 235,221. Subsequently, this amount was calculated for 1 year, multiplying the monthly amount by 12 months, resulting in a total of BRL 2,822,658.

Moreover, for the final composition of project costs, an additional amount of BRL 16,380.74 per year was considered to cover expenses related to the use of a third-party structure. This value is calculated based on demand, with a fee of BRL 10 per pallet packed at the partner company per day. Each pallet accommodates 1000 kg of meat. It was also established through brainstorming that only 1/3 of the demand may require the partner company’s storage structure, with the remainder being dispatched on the same day to end customers. Thus, Table 3 represents all costs for 2024 and, finally, the total unit cost (BRL/kg). Calculations were then replicated for the next years until completing the 2023–2030 analysis period.

Table 3.

Cost allocation based on demand in 2024.

According to Table 3, the type of share-out used for all costs considered was demand. In this context, adding up all the costs mentioned in this table and dividing this amount by the demand, we have the total cost per kg of meat distributed. Specifically for 2024, the total unit cost was BRL 0.63/kg. For subsequent years, the values obtained are BRL 0.62/kg in 2025, BRL 0.61/kg in 2026, BRL 0.60/kg in 2027, BRL 0.59/kg in 2028, BRL 0.59/kg in 2029, and BRL 0.58/kg in 2030.

Operating costs in this project include a lean labor structure appropriate for a cross-docking operation supported by shared infrastructure. The team comprises one logistics analyst, responsible for coordinating inbound and outbound flows, route planning, and performance monitoring; three cleaning assistants, tasked with maintaining hygiene standards required for handling perishable goods; and two loading inspectors, who oversee cargo verification, cold chain compliance, and documentation control. The limited staffing is justified by the low cargo dwell time and the operational support provided by the partner company, which absorbs auxiliary logistics functions. Sensitivity analyses were conducted to ensure cost robustness under potential labor adjustments.

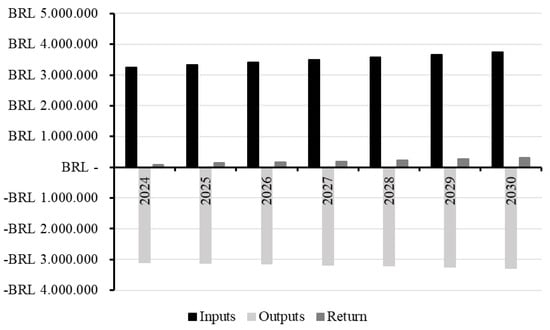

4.3. Projected Cash Flow

Using the annual demand values already calculated and multiplying them by the total annual unit costs, the projected cash flow outputs are obtained. On the other hand, to calculate annual inputs or revenues, a unit value of BRL 0.66/kg was considered, which is an amount already paid by the market for the distribution of meat in the region where the project is implemented. This value was defined based on logistics contracts established between the investor and the contracting company. Therefore, analogously, when multiplying this value by the annual demands, we have the annual inflows or revenues from the projected cash flow. The projected cash flow can be viewed in Figure 5.

Figure 5.

Inputs, outputs, and cash return for the period 2024–2030.

As shown in Figure 5, the first year of project implementation is marked by a lower return, primarily due to higher initial costs. These costs are associated with the initial investment, which includes legal and regulatory expenses required to formalize the business operation—such as the registration of the legal entity (CNPJ), acquisition of the operating license, and constitution of the required share capital. It is important to emphasize that the initial investment does not include expenditures related to the construction of physical infrastructure, as the project is designed to leverage existing logistics yards and facilities operated by partner companies. This strategic approach allows for a leaner capital structure and faster deployment of the operation.

Additionally, the reduced return in the first year reflects the lower demand volume during the project’s initial phase, before the projected growth observed in subsequent years. From the second year onward, a consistent upward trend in returns is noted, accompanied by decreasing annual variations, suggesting progressive operational stabilization and the potential for demand expansion studies or project updates. The financial flow also considers mandatory tax obligations, including IRPJ (Corporate Income Tax) and CSLL (Social Contribution on Net Profit). For IRPJ, a 15% rate on gross profit was applied when monthly profits did not exceed BRL 60,000, while CSLL was calculated using a 9% rate on gross revenue.

In the context of this cross-docking project for meat distribution, the operation requires a set of essential material handling equipment to ensure logistical efficiency, compliance with sanitary standards, and agility in transshipment processes. These include manual and electric pallet jacks, forklifts, weighing scales, plastic containers, transport carts, metal cages, labeling and tracking systems, cold chambers, and temperature sensors, among others.

However, it is important to highlight that, aligned with the project’s strategy of cost optimization and asset efficiency, most of these equipment items will be provided through operational agreements with the partner company. The project is designed to operate within the existing infrastructure of the partner’s logistics yards, thus eliminating the need for investment in new physical installations or equipment acquisition. Specifically, the use of forklifts, storage racks, reusable plastic boxes, weighing systems, mobile carts, transport cages, labeling and traceability systems, cold storage chambers, and thermal monitoring devices will be made possible through shared access to the partner’s operational facilities. This collaborative structure reinforces the lean operational model adopted for the venture, reducing capital expenditure and enabling faster implementation, while maintaining high performance and compliance with the specific requirements of refrigerated goods distribution.

In the context of this project, the unit return (BRL/kg) refers to the net financial gain generated per kilogram of meat distributed. This value is determined by the difference between two contractual arrangements: (i) the price paid by the contracting company for the distribution service (which includes both the meat supply and logistics) and (ii) the cost incurred by the investor, primarily related to logistics agreements with hired drivers. More specifically, the investor enters into purchasing contracts with meat suppliers and simultaneously negotiates transportation contracts with individual drivers or logistics partners. Meanwhile, the contracting company commits to a fixed payment per kilogram of meat delivered.

4.4. Deterministic Analysis: Traditional EFA

Traditional Economic Feasibility Analysis (EFA) is grounded in the application of financial mathematics and economic engineering principles. A critical component of this methodology is the definition of the discount rate, also known as the Minimum Attractive Rate of Return (MARR or MAR), which reflects the threshold below which an investment would be deemed financially unviable.

In this study, the Minimum Attractive Rate (MAR) was defined based on a nominal composite rate incorporating three fundamental components: the opportunity cost of capital, the business-specific risk premium, and the baseline interest rate (Selic). The rationale for including these components aligns with best practices in investment evaluation, as they account for the time value of money, the inherent uncertainty of the business environment, and the expected return from alternative investments [43,44].

- (i)

- The opportunity cost was set at 10%, representing the return foregone by allocating capital to this specific project rather than to a risk-free or low-risk alternative (e.g., government bonds and high-yield savings instruments).

- (ii)

- The business risk premium was also defined as 10%, capturing uncertainties specific to the sector, such as volatility in logistics costs, perishability of goods, regulatory constraints, and fluctuations in demand. This value is consistent with the literature that recommends a risk premium between 5% and 15% for projects in volatile or infrastructure-dependent industries [43,44].

- (iii)

- The Selic rate, Brazil’s official basic interest rate, was considered at its prevailing value of 13.75% at the time of analysis. This rate serves as a macroeconomic benchmark for the cost of capital in the country and is commonly used in discount rate composition for domestic investment projects.

The sum of these three components yielded a nominal Minimum Attractive Rate of 33.75% per year, which was then used to discount projected cash flows over a 12-month period. This approach is consistent with frameworks proposed by economic feasibility studies in similar sectors and reinforces the analytical rigor of the financial modeling process by incorporating both systemic and project-specific risk factors.

Therefore, the nominal rate () considered was 33.75% per year, with some periods () of 12 months per year, calculated according to Equation (1):

A real rate (i) of 39.49% per year was obtained. Considering an inflation rate () of 3.16%, which corresponds to the 12-month IPCA registered until June/2023 by [39], the interest rate without inflation () was calculated, according to Equation (2), where is the real or effective rate, and is the inflation rate:

Thus, the MAR used in this study corresponded to the value of the interest rate without inflation (), in this case, = 35.08% per year.

As presented in the theoretical reference section, the calculation of indicators NPV, IRR, profitability rate, and Payback Time was applied in this project. Table 4 represents the calculation of the project NPV, considering date 0 (period 0) as the current time in which the initial investments will be made and, subsequently, the seven periods that correspond to the time interval between 2024 and 2030.

Table 4.

NPV calculation.

Based on Table 4, it can be inferred that the project is viable since the accumulated NPV at the end of the period was positive (BRL 338,800). Furthermore, other indicators such as IRR, profitability rate, and Payback Time were calculated to confirm this viability, as represented in Table 5.

Table 5.

Calculation of IRR, profitability rate, and payback.

According to Table 5, the project remained viable based on the calculations of these indicators. The IRR, which represents the percentage of return on investment per unit of time, reached a value of 181.42% per year, which is higher than the MAR practiced (33.75% per year). The profitability rate indicated a return of BRL 6.42 for each real investment in the project. The Payback Time was approximately 0.94 years, that is, the project will take this time to recover the invested capital.

4.5. Probabilistic Analysis: Monte Carlo Simulation

As stipulated in the methodological procedures, Step 3 of this study corresponded to the aggregation of the Monte Carlo Simulation with the results of the Economic Feasibility Analysis (EFA). The specific project inputs and outputs were defined for this stage. The inputs represent variables that have a degree of uncertainty when considering traditional EFA. Thus, the inputs chosen were the following variables: market share (%); operating costs (BRL); logistics costs (BRL); administrative expenses (BRL); price paid per kg of meat distributed (BRL/kg); MAR (%); population growth rate (%); IPCA (%); consumption of beef and pork per capita (kg/inhabitant/year), and percentage of the meat-consuming population (%). The outputs represent the variables resulting from the analyses of the simulation carried out; the outputs were NPV, IRR, and profitability rate.

The market share (%) was included as a primary variable due to its significant impact on projected revenue. Since market share determines the proportion of total demand that the project is expected to capture, any deviation from initial assumptions can lead to substantial changes in cash inflows. Given the competitive nature of the food distribution industry, especially in perishables like meat, this variable is inherently uncertain and sensitive to market dynamics, such as competitor behavior, customer preferences, and regional penetration capabilities.

Operating costs (BRL) were selected due to their representation of the core expenses required to maintain daily operations, including labor, maintenance, energy, and packaging. These costs are susceptible to inflationary pressures, changes in input prices, and operational efficiency. Treating them as stochastic variables allows for a more nuanced understanding of their impact on cash outflows over time.

Logistics costs (BRL) are particularly critical in a cross-docking model, where the speed and efficiency of transportation are central to operational success. These costs include fuel, freight, routing, and delivery timing, all of which are highly volatile due to fluctuations in fuel prices, regulatory changes, and supply chain disruptions. As such, they represent a significant source of variability in the project’s cost structure.

Administrative expenses (BRL), although generally more stable, can vary due to salary adjustments, rental agreements, and IT infrastructure requirements as the business scales. These fixed costs impact the breakeven point and profitability margins, and their inclusion in the simulation ensures that the analysis captures a complete picture of the operational overhead.

The price paid per kilogram of meat (BRL/kg) is a critical revenue-side variable that directly affects income per unit distributed. This price is subject to supplier negotiations, seasonal availability, sanitary regulations, and market competition. Even small variations in price per kilogram can result in significant shifts in overall profitability, justifying its inclusion as a stochastic input.

The minimum attractive rate of return (MAR %) represents the investor’s required rate of return, which serves as a discount rate in net present value (NPV) calculations. This rate is influenced by risk perception, alternative investment opportunities, and macroeconomic conditions. Incorporating MAR as a variable acknowledges that the financial context is not static and helps assess the project’s resilience to varying financial expectations.

The population growth rate (%) was considered because it influences long-term demand projections. A growing population typically increases food consumption and, by extension, the demand for distributed meat products. However, population growth is subject to demographic shifts, migration trends, and economic development, making it a vital yet uncertain driver of future revenue.

IPCA (%), Brazil’s official inflation index, affects both cost escalation and pricing strategies. It has a pervasive influence on salaries, utilities, fuel, and service contracts, and directly impacts the real value of cash flows over time. Modeling it as a variable allows for more realistic sensitivity testing under inflationary scenarios.

Per capita consumption of beef and pork is a behavioral and cultural variable that determines the total volume of meat consumed in the target market. It can vary with income levels, dietary trends, health campaigns, and substitution effects (e.g., poultry or plant-based diets). Capturing this variability is essential for realistic demand forecasting.

Finally, the percentage of the population that consumes meat reflects the actual market reach within the broader demographic. This factor is increasingly relevant given rising vegetarianism, religious dietary restrictions, and ethical consumption movements. Variability in this parameter can considerably alter market size assumptions.

It is necessary to predefine the parameters and distributions for each input considered for data simulation, as shown in Table 6.

Table 6.

Inputs and simulation parameters.

The decision to maintain a broader parameter range for variables, such as the percentage of the meat-eating population and population growth, is justified by two key considerations. First, Brazil exhibits significant regional heterogeneity in dietary habits and demographic dynamics, influenced by socioeconomic, cultural, and geographic factors, which justifies the inclusion of a wider variability in the modeling. Second, from a methodological standpoint, the use of Monte Carlo Simulation requires a sufficiently broad input range to capture uncertainty realistically and to ensure the robustness of the sensitivity analysis. A narrower range could underestimate the potential impacts of future demographic or behavioral changes, thereby limiting the model’s capacity to support strategic, long-term investment decisions under uncertain conditions.

The selection of statistical distributions for the input variables was based on the nature of the available information and the degree of uncertainty associated with each parameter. In this study, Pert and triangular distributions were applied, as they are particularly suitable for simulation models that incorporate expert judgment, estimated ranges, and limited historical data. These choices help ensure a more realistic representation of the variability inherent in economic and operational parameters [45].

The Pert distribution (Program Evaluation and Review Technique) is commonly used in Monte Carlo Simulations when three estimates are known: the minimum, most likely, and maximum values. Compared to the triangular distribution, the Pert distribution provides a smoother probability curve, placing greater emphasis on the most probable value. It is particularly appropriate in contexts involving expert judgment or moderate uncertainty, as in the current project.

- (i)

- Market Share (%): Since this parameter reflects projected market penetration based on benchmarking or strategic expectations, the Pert distribution captures the associated uncertainty while emphasizing the central estimate.

- (ii)

- Operating Costs (BRL): These costs typically vary within a predictable range and are informed by operational plans and historical benchmarks. The Pert distribution is well suited to reflect this variability, especially when the most probable value is better understood than the extremes.

- (iii)

- Logistics Costs (BRL): Given their sensitivity to external factors such as fuel prices and transportation dynamics, logistics costs are inherently volatile. The Pert distribution accommodates this uncertainty, providing a more realistic representation of cost fluctuations.

- (iv)

- Minimum Attractive Rate of Return (MAR %): This rate reflects investor expectations and perceived risk. Its inherently subjective nature justifies modeling it with a Pert distribution to capture a central expectation while accounting for more conservative or optimistic scenarios.

- (v)

- Population Growth Rate (%): Although based on demographic projections, future population trends are subject to socioeconomic shifts. The Pert distribution effectively models this uncertainty within plausible bounds.

- (vi)

- IPCA (Inflation Index %): As a macroeconomic indicator, the IPCA is influenced by multiple factors and exhibits periodic fluctuations. Modeling it with the Pert distribution reflects market expectations and known variability patterns.

- (vii)

- Beef and Pork Consumption per Capita (kg/year): Consumption patterns are influenced by cultural, economic, and dietary factors. The Pert distribution captures the expected consumption while incorporating potential deviations due to behavioral or market changes.

- (viii)

- Percentage of the Meat-Consuming Population (%): This variable reflects societal and cultural trends, including dietary preferences. Given its relatively stable but not entirely deterministic behavior, the Pert distribution was chosen to account for expected shifts in consumer behavior.

The triangular distribution is typically used when detailed statistical data is limited, but a reasonable range can be estimated. It relies on the definition of minimum, most likely, and maximum values and is particularly useful for modeling cost-related variables with known bounds.

- (i)

- Administrative Costs (BRL): These costs are generally more stable and often defined by contracts or internal budgets. The triangular distribution effectively models this variable with minimal complexity, reflecting the limited but structured uncertainty.

- (ii)

- Price Paid per Kilogram of Meat Distributed (BRL/kg): While subject to market conditions, this price can often be estimated with reasonable accuracy based on supplier agreements and recent price trends. The triangular distribution is thus appropriate for modeling its variation in a transparent and interpretable manner.

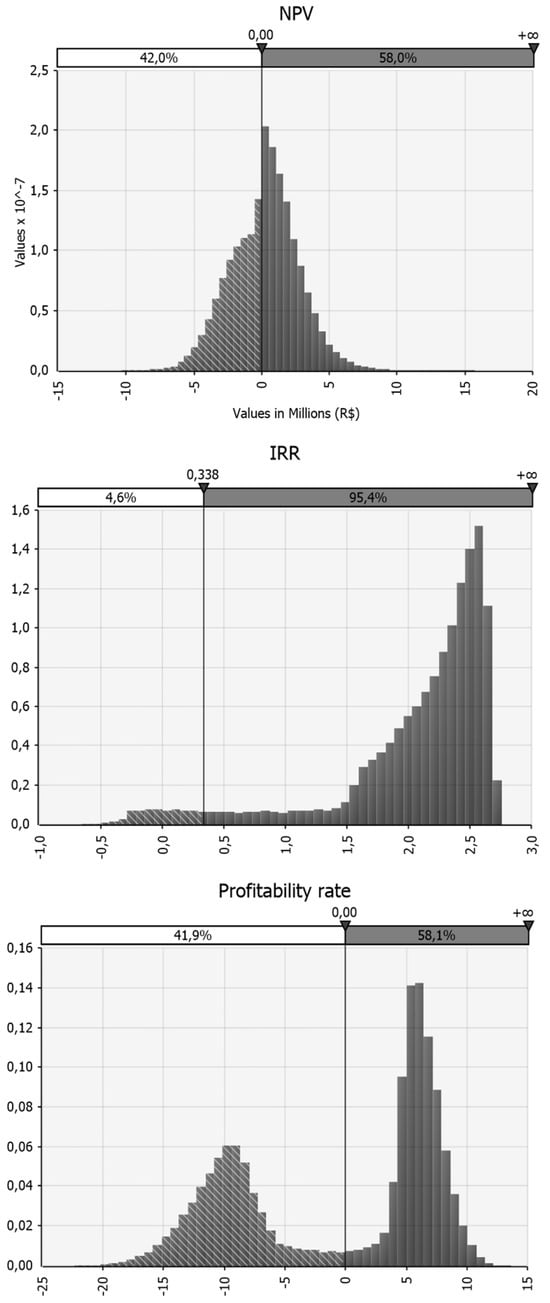

The simulation was then carried out in a total of 100,000 iterations, and the results are presented in Figure 6.

Figure 6.

Probabilistic histograms resulting from the Monte Carlo Simulation: NPV, IRR, and profitability rate, respectively.

According to Figure 6, the simulation signaled the viability of the project at 58.8% of the NPV values generated. Furthermore, when it comes to the IRR, a value for this quantity was found to be higher than the MAR (33.75%) in approximately 96.0% of the iterations, which also indicates the viability of the project in these cases. Finally, the profitability rate output revealed the existence of a 57.8% probability that each real invested in the project will return at least one real in profit. These analyses are important indicators of project viability for most cases observed in the simulation.

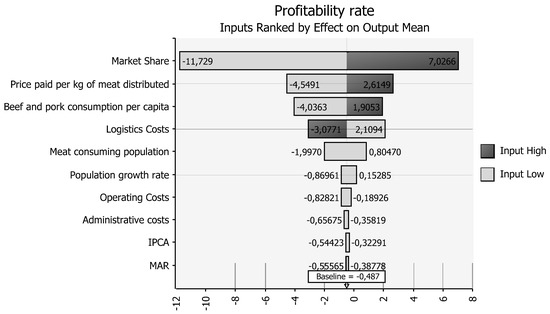

Another possible analysis corresponds to the assessment of the impact of inputs on the final value of the outputs, as shown in Figure 7. This analysis is relevant given that adjustments can be made to the inputs to maximize the outputs considered.

Figure 7.

Tornado diagram.

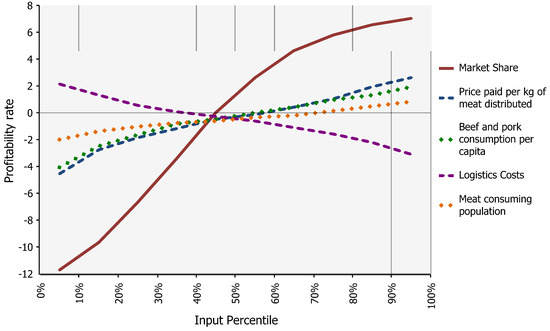

According to the analysis in Figure 7, the greatest impacts on profitability are observed with the inputs: market share, price, per capita consumption, logistics costs, and percentage of the meat-consuming population. The tornado diagram presented illustrates the sensitivity of the profitability rate to variations in key input variables used in the Monte Carlo Simulation. The variables are ranked according to their impact on the mean profitability rate, measured as the difference between high and low input values. The most influential factor is Market Share, which exhibits the greatest range of effect (from −11.729 to +7.0266), indicating that small variations in projected market penetration significantly alter profitability outcomes. This is followed by the price paid per kilogram of meat distributed and beef and pork consumption per capita, both of which show strong positive correlations with profitability when values are high. In contrast, logistics costs and operating costs negatively impact profitability, although to a lesser extent than demand-side variables. Inputs such as Population Growth Rate, administrative costs, and MAR (Minimum Attractive Rate of Return) show moderate to low sensitivity, suggesting limited influence within the simulated range. The chart underscores that demand-side variables (market share, consumption, and price) are the primary drivers of profitability, while cost-side variables, particularly logistics, remain key constraints. This sensitivity analysis supports strategic prioritization by identifying which variables should be targeted in risk mitigation and project planning efforts. Another important analysis corresponds to the correlation between these project inputs and profitability. Figure 8 presents a sensitivity curve illustrating the relationship between selected input percentiles and the resulting profitability rate. A strong positive correlation is observed between market share and profitability, characterized by a steep, upward-sloping curve. This suggests a near-linear relationship within the simulated range, indicating that incremental gains in market share generate proportional increases in profitability.

Figure 8.

Random variables that most impact the profitability rate by percentile.

Other inputs, including price paid per kilogram of meat distributed, beef and pork consumption per capita, and percentage of the meat-consuming population, also show positive but more moderate correlations with profitability. Their respective curves exhibit gradual upward trends, suggesting that their influence, while less intense than market share, remains significant. These effects could also be modeled using multivariate regression, with interaction terms considered to account for joint effects on profitability.

In contrast, logistics costs display a negative correlation with profitability, as demonstrated by the consistently downward-sloping curve. This inverse relationship highlights that increases in logistics expenses systematically reduce profitability, reinforcing the role of logistics efficiency as a major constraint in the economic performance of meat distribution systems.

Overall, the shape and direction of the curves support the conclusion that market-driven variables have a stronger and more direct impact on profitability than cost-side variables, except for logistics, which exerts a critical negative influence. When carrying out a target analysis, it is possible to observe such inputs and their impact on profitability. Table 7 represents the new values for these inputs to achieve a scenario with an 80% probability of positive profitability.

Table 7.

Target analysis.

Building upon the results of the advanced sensitivity analysis, several strategic scenarios were evaluated to infer the potential impact of targeted input adjustments on the project’s profitability rate. For instance, an increase of approximately 4.40 percentage points in market share would result in an estimated profitability rate of 5.89. Similarly, if the logistics team achieves a 10% reduction in baseline logistics costs (currently BRL 2,540,393), the profitability rate is projected to reach 5.87. In a scenario where the investor secures improved procurement conditions, reducing the price per kilogram of meat distributed by BRL 0.70, the profitability rate would also rise to approximately 5.89. Furthermore, if per capita consumption of beef and pork increases from 49.32 to 54.25 kg/per capta/year and/or the proportion of the meat-consuming population grows from 86% to 94%, the projected profitability rate would remain consistent, converging around 5.89. These findings underscore the critical influence of market penetration, cost optimization, and consumption dynamics on the economic performance of the proposed distribution center.

The upper limit of 105% for the meat-consuming population, as presented in Table 7, is intended solely for analytical purposes within the Monte Carlo Simulation framework. This figure does not represent a literal estimate of the population but rather a probabilistic parameter designed to explore high-demand scenarios. It accounts for potential variations not fully captured by official data, such as informal market formalization, internal migration, and statistical underreporting. By allowing for slightly higher-than-expected values, the model enhances the robustness of the economic analysis and tests the project’s resilience under extreme but plausible conditions.

5. Discussion

The logistics sector plays an essential role in supporting the food industry, facilitating the efficient distribution of inputs, goods, and finished food products. Despite its importance, logistics operations frequently incur substantial costs, which can significantly erode the profit margins of investors in the sector. Within the context of meat distribution—particularly when cross-docking models are employed—strategic advantages emerge from the ability to reorganize orders and consolidate shipments, thereby enabling reductions in delivery distances and associated expenses.

In this regard, ref. [29] highlights the benefits of optimizing delivery routes to reduce costs in the meat supply chain. Their proposed model integrates variables such as remaining shelf life (as a proxy for delivery urgency) and environmental controls (e.g., temperature, humidity, and gas concentration) to ensure product quality. An additional benefit noted in their study is the reduction in greenhouse gas emissions, achieved through shortened transportation routes. The present study confirms these findings by showing that logistics cost reductions are strongly influenced by route distance minimization, especially when serving a fixed set of municipalities, as modeled here using ANTT freight pricing guidelines.

In the present study, logistics costs were estimated for a set of municipalities located in the states of Minas Gerais and São Paulo. The estimation process adhered to the freight pricing guidelines established by the National Land Transport Agency (ANTT), which consider factors such as load volume, total distance traveled, and driver compensation. Notably, minimizing route distances was identified as the most effective means to reduce logistics costs, emphasizing the relevance of route optimization models in similar distribution networks. This approach complements and validates prior studies by replicating similar cost behavior under realistic spatial and regulatory constraints.

Furthermore, the meat distribution process involves strict requirements for storage and food preservation. The type of vehicle employed constitutes a critical variable, as it directly impacts the ability to maintain the cold chain and, consequently, product integrity. Several studies have underscored the relevance of best practices in meat preservation to ensure product safety and quality throughout transportation [30,31,46,47]. Our study incorporates these concerns by highlighting the role of temperature-sensitive vehicles and by modeling the cold chain as a constraint in both logistics cost and operational feasibility.

One viable strategy to enhance preservation and food safety standards is the implementation of traceability systems, which enable end-to-end monitoring of products from origin to the final consumer. In this context, ref. [48] examined traceability in the Greek meat supply chain, identifying key challenges related to internal process transparency, animal lifecycle documentation, and consumer trust. A traceability system facilitates the restoration of consumer confidence by ensuring access to verifiable information throughout the entire supply chain. Although the present study did not develop a traceability model per se, our findings reinforce the importance of such systems, particularly as a complementary solution to the logistical, sanitary, and reputational challenges identified in the literature.

From a methodological perspective, the present study contributes to the field by employing a Monte Carlo Simulation as part of a probabilistic economic feasibility assessment. Similar approaches have been adopted by researchers in the food sector to evaluate risk-adjusted investment performance and optimize decision-making processes [7,26,32,33,35,49]. The incorporation of probabilistic modeling provides analytical robustness by accounting for uncertainty and variability in market and operational conditions. This modeling choice was directly inspired by and aligned with recent applications of Monte Carlo methods in agro-industrial and food logistics studies, including those by [26,35], validating our framework’s structure and assumptions.

To reflect real-world complexity, the probabilistic stage of this research reused several variables from the deterministic analysis, now treated as stochastic inputs. This included all cost components, along with demand-related parameters and external macroeconomic factors such as interest rates. The goal was to assess the resilience of the investment project under a wide range of market scenarios. This structure mirrors the use of correlated and data-informed random variables found in ref. [26]’s analysis of soybean trade flows, demonstrating both methodological coherence and relevance to sector-specific uncertainties.

The sensitivity analysis revealed that certain expenses—particularly administrative and operating costs—exert minimal influence on overall profitability. This finding is aligned with the early-stage nature of the distribution project, which operates with a limited labor force and modest administrative infrastructure. The projected growth of the initiative is expected to occur gradually, in tandem with rising demand up to the year 2030. This finding is consistent with [32], who emphasized the strategic management of early-stage infrastructure and inventory to control cost volatility and improve scalability in the meat supply chain.

Among all stochastic variables analyzed, market share exhibited the greatest influence on project profitability. Consequently, substantial increases in demand could translate into higher margins. However, this expansion would likely be accompanied by increased logistics costs due to the broader geographic reach and longer distribution routes. This underscores the strategic importance of demand forecasting mechanisms, which can support proactive adjustments to mitigate seasonal variability and supply chain disruptions. This insight echoes the conclusions of [35], who proposed demand-oriented budgeting models to ensure sustainable growth under uncertainty.

Moreover, the variables related to per capita meat consumption and the percentage of meat consumers pointed to a favorable long-term outlook and potential for expanded production and distribution capacity. Population growth further reinforced this trend. Additionally, the price received per kilogram of meat distributed emerged as a key profitability driver, suggesting that strategies to secure higher sales prices may be as critical as cost reduction efforts in achieving desirable investment outcomes. These outcomes reinforce earlier findings in the literature, validating the balance between price leverage and cost control in food distribution investments.

For comparative purposes, reference [26] conducted a Monte Carlo-based analysis of soybean trade flows between the United States, Brazil, and China. Their findings highlighted seasonal market dominance and close alignment with empirical trade data from 2013 to 2019. The methodological parallels with the present study include the use of correlated random variables and up-to-date market information to ensure realistic simulation outcomes. Likewise, reference [35] proposed a budgeting model for meat processing startups, also based on a Monte Carlo Simulation. Their work aligns with this study in terms of delivering standardized, data-driven investment frameworks that improve managerial decision-making and enhance potential returns. The use of probabilistic modeling is particularly advantageous in this context, as it facilitates optimization, which is often unattainable through deterministic financial analysis alone.

Finally, reference [32] explored inventory management within the meat supply chain and developed a mathematical model to assess optimal storage capacity. While inventory holding is often discouraged in advanced distribution models due to cost implications—especially when compared to just-in-time approaches—it remains essential for perishable products such as meat. In this study, short-term storage was considered as a contingency measure to address unforeseen logistical challenges, thereby allowing for more flexible planning across different seasons and market conditions.

6. Conclusions

Economic Feasibility Analysis (EFA) serves as a critical instrument in expanding decision-making capabilities and guiding investors in the selection of financially viable projects. This study aimed to assess the economic viability of implementing a cross-docking meat distribution center in a municipality located in southern Minas Gerais, Brazil. The results obtained from both deterministic and probabilistic analyses confirmed the feasibility of the proposed project. Among the variables analyzed, distribution price per kilogram, market share, population size, and per capita consumption demonstrated a positive correlation with profitability, whereas logistics costs were identified as a limiting factor, showing a negative correlation with financial performance.

From a practical standpoint, the findings offer valuable insights to investors, providing a comprehensive understanding of the project’s critical variables and enabling anticipation of potential risk scenarios. This study also presents relevant implications for risk mitigation in investment decisions by highlighting the role of uncertainty in economic projections. Academically, this research contributes to the literature by integrating deterministic and probabilistic feasibility methods, thus enhancing analytical rigor and reducing uncertainty associated with project evaluation.

In this context, logistics emerges as a central pillar for the successful implementation of the proposed distribution center. Efficient logistical planning is not only essential for operational performance, but it also directly influences the project’s economic outcomes. Strategic decisions regarding transportation modes, route optimization, and cold chain integrity are critical to maintaining product quality and ensuring cost-effectiveness across a geographically dispersed distribution network.

Furthermore, the identification of logistics costs as a key constraint underscores the need for public and private efforts aimed at improving transportation infrastructure and operational efficiency. Strategically, this includes the development of multimodal transport solutions and the optimization of existing distribution routes. By reducing these costs, it becomes possible to lower the final price of meat for consumers and improve competitiveness across the supply chain. In this study, logistics costs were estimated to range between BRL 0.58/kg and BRL 0.63/kg, representing a significant portion of the total distribution cost and reaffirming the importance of efficient logistics as a determining factor for the project’s viability and long-term sustainability.

From a scientific perspective, this study advances the literature by integrating deterministic and probabilistic methods in the Economic Feasibility Analysis of logistics systems for perishable goods, a context still underexplored in operations and supply chain research. The development of a hybrid framework that combines traditional investment indicators (NPV, IRR, payback) with Monte Carlo Simulation under real market and logistical constraints represents a methodological innovation for assessing risk in food distribution networks. Furthermore, the incorporation of sensitivity analysis and target simulations strengthens decision-making under uncertainty and demonstrates how operational and market variables dynamically affect investment outcomes. These contributions offer a replicable analytical approach for future studies in agri-food logistics, especially in developing regions with infrastructure and market volatility.

Despite the robustness of the proposed methodological framework, this study presents some limitations that should be acknowledged. First, the analysis is based on a single case study, which, although detailed and grounded in real operational data, may limit the generalizability of the results to other regions or categories of perishable goods. Second, the assumptions used in the Monte Carlo Simulation—particularly the selection of probability distributions and parameter ranges—were based on expert judgment and secondary data, which may not fully capture extreme events or future market disruptions. Third, this study did not include a comprehensive environmental impact assessment or carbon footprint estimation, which could complement the economic analysis in future investigations. Lastly, while the cross-docking model was validated for the specific context of southern Minas Gerais, its operational performance was projected rather than monitored in real-time, restricting conclusions to a simulated horizon.

To address these limitations, future studies are encouraged to apply the proposed framework to multiple case studies across different regions and supply chains, allowing for comparative analyses and greater external validity. Additionally, incorporating longitudinal data on operational performance and expanding the model to include environmental and social indicators—such as CO2 emissions, food waste, or job creation—may provide a more holistic view of logistics feasibility in the agri-food sector. Further refinement of the probabilistic model using real-time data feeds or adaptive simulations could also enhance predictive accuracy and strategic decision-making under uncertainty.

Supplementary Materials

The following supporting information can be downloaded at: https://www.mdpi.com/article/10.3390/logistics9040166/s1, S4.1 Consumption and demand projection.

Author Contributions

Conceptualization, G.A.d.M. and L.G.d.C.J.; Methodology, G.A.d.M.; Software, G.A.d.M.; Validation, G.A.d.M., M.G.M.P. and S.B.B.; Formal analysis, G.A.d.M.; Investigation, G.A.d.M.; Resources, G.A.d.M.; Data curation, G.A.d.M.; Writing—original draft preparation, G.A.d.M.; Writing—review and editing, G.A.d.M., M.G.M.P. and A.L.M.S.; Visualization, G.A.d.M.; Supervision, G.A.d.M.; Project administration, G.A.d.M.; Funding acquisition, A.P.D.D., M.V., C.C.F.C. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by Research Support Foundation of the State of Minas Gerais (FAPEMIG) and the APC was funded by University of Brasilia.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The original contributions presented in this study are included in the article/supplementary material. Further inquiries can be directed to the corresponding author(s).

Acknowledgments

The authors would like to thank the Federal University of Lavras (UFLA) and the University of Brasilia (Unb) for the support in the development of this research. We are also thankful to the Research Support Foundation of the State of Minas Gerais (FAPEMIG) and the Federal District Research Support Foundation (FAPDF) for research funding.

Conflicts of Interest

The authors declare no conflict of interest.

References

- FAO. Publicações. Available online: https://www.fao.org/brasil/pt/ (accessed on 2 May 2023).

- MAPA. Setor Alimentício. Available online: https://www.gov.br/agricultura/pt-br (accessed on 2 May 2023).

- CONAB. Oferta e Demanda de Carnes. 2023. Available online: https://www.conab.gov.br/info-agro/analises-do-mercado-agropecuario-e-extrativista/analises-do-mercado/oferta-e-demanda-de-carnes (accessed on 2 May 2023).

- Malafaia, G.C.; Biscola, P.H.N.; Dias, F.R.T. Neutralização de Carbono na Produção de Carne Bovina no Brasil e no Mundo. Embrapa Gado de Corte-Fôlder/Folheto/Cartilha (INFOTECA-E), 2020. Available online: https://sistemas.bambui.ifmg.edu.br/open_conference/index.php/jornadacientifica/jc2021/paper/view/377 (accessed on 2 May 2023).

- Ferreira, A.F.V.; Fontgalland, I.L. O mercado de carnes no contexto dos processos de inovação: O caso da empresa Tyson Foods. E-Acadêmica 2021, 2, e082231. [Google Scholar] [CrossRef]

- Miranda, M.V.P.; Ciribeli, J.P.; de Moraes Sarmento, C. Análise das perdas em produtos do supermercado nova era: Um estudo no setor alimentício de carnes, padaria e hortifrúti. Cad. Científico UNIFAGOC Grad. E. Pós-Grad. 2022, 7, 1. [Google Scholar]

- Buss, R.N.; Mendanha, J.F.; da Silva, D.M.; Siqueira, G.M. Infraestrutura logística de transporte e armazenagem da soja no estado do Maranhão–Brasil. Braz. J. Dev. 2019, 5, 31564–31580. [Google Scholar] [CrossRef]

- Vilamaior, A.G.; Parreira, G.C.; Moreira, G.S.; Palotti, I.A.P.; Ferreira, J.C.B. Análise dos custos de mão de obra direta no setor de abate e processamento de carnes do ifmg campus bambuí. In Proceedings of the XIII Jornada Científica, Online, 20 October 2021. [Google Scholar]

- Bartholdi, J.J.; Gue, K.R. Reducing Labor Costs in an LTL Crossdocking Terminal. Oper. Res. 2000, 48, 823–832. [Google Scholar] [CrossRef]

- Armlogistica. Crossdocking, o Que é e Como Ele Pode me Ajudar a Economizar em Frete. Available online: https://www.armlogistica.com.br/cross-docking-o-que-e-e-como-ele-pode-me-ajudar-a-economizar-em-frete (accessed on 2 May 2023).

- Fonseca, G.B.; Ravetti, M.G.; Nogueira, T.H. O Problema de Sequenciamento de Caminhões em um Centro de Crossdocking com Duas Máquinas; Universidade Federal de Minas Gerais: Belo Horizonte, Brazil, 2015. [Google Scholar]

- Brealey, R.A.; Myers, S.C.; Allen, F. Principles of Corporate Finance, 13th ed.; McGraw-Hill Education: New York, NY, USA, 2020. [Google Scholar]

- Copeland, T.E.; Koller, T.; Murrin, J. Valuation: Measuring and Managing the Value of Companies, 3rd ed.; John Wiley & Sons: Hoboken, NJ, USA, 2005. [Google Scholar]

- Monteiro, W.M.M.; Vasconcelos, M.W.M.; da Silva, T. Análise de viabilidade econômica de projetos hidrelétricos com uso da TIR e VPL. Rev. Bras. De Energ. 2021, 27, 55–67. [Google Scholar]

- Yao, Y.; Wang, Y.; Zhang, L. Application of financial assessment models in food production planning. J. Food Eng. 2021, 302, 110567. [Google Scholar] [CrossRef]

- Li, N.; Dong, L.W.; Zhao, L.M.; Gong, G.H.; Zhang, X. A credibility evaluation method for complex simulation systems based on interactive network analysis. Simul. Model. Pract. Theory 2021, 109, 102289. [Google Scholar] [CrossRef]

- Ferrari, C.S.; Bressan, G.N.; Silva, L.T. Otimização do processo de secagem de leite por simulação de Monte Carlo. Rev. Bras. Eng. Produção 2023, 23, 45–58. [Google Scholar]

- Griep-Moyer, E.R.; Trmčić, A.; Qian, C.; Moraru, C.I. Monte Carlo simulation model predicts bactofugation can extend shelf-life of pasteurized fluid milk, even when raw milk with low spore counts is used as the incoming ingredient. J. Dairy Sci. 2022, 105, 9439–9449. [Google Scholar] [CrossRef]

- Elsharkawy, A.M. Monte Carlo-based quality prediction for dairy products. J. Dairy Sci. 2021, 104, 7385–7394. [Google Scholar]

- Jang, H.; Park, Y.; Lee, J.H. Monte Carlo evaluation of hydrogen production investment under uncertainty. Energy Policy 2022, 160, 112702. [Google Scholar] [CrossRef]

- Wealer, B.; Bauer, C.; Landry, J.S. Risk analysis in nuclear energy investments using Monte Carlo simulation. Energy Econ. 2021, 98, 105278. [Google Scholar] [CrossRef]

- Shahid, M.; Alam, T.; Baig, M.A. Robust planning in agro-industries with Monte Carlo methods. Agric. Syst. 2022, 196, 103302. [Google Scholar] [CrossRef]

- Kovács, K.; Szűcs, I. Exploring efficiency reserves in Hungarian milk production. Stud. Agric. Econ. 2020, 122, 37–43. [Google Scholar] [CrossRef]

- Pedolin, D.A.; Schmid, A.; Vázquez-Rowe, I. Environmental efficiency of Swiss agriculture: A combined DEA-LCA approach. J. Clean. Prod. 2021, 317, 128345. [Google Scholar] [CrossRef]

- Barros, G.S.; Santana, R.H.; Marques, V.S. Sustainability and productivity in Brazilian dairy farms. Sustainability 2022, 14, 11745. [Google Scholar] [CrossRef]

- De Melo, G.A.; Peixoto, M.G.M.; Barbosa, S.B.; Alves, A.J.S.; Souza, A.C.L.; Mendonça, M.C.A.; de Castro Júnior, L.G.; Santos, P.G.D.; Serrano, A.L.M.; Neumann, C. Generating insights to improve the performance of communities supported agriculture: An analysis focused on female participation, governance structure and volume of food distributed. Environ. Dev. Sustain. 2024, 1–19. [Google Scholar] [CrossRef]

- De Melo, G.A.; Peixoto, M.G.M.; Barbosa, S.B.; Alves, A.J.S.; Souza, A.C.L.; Mendonça, M.C.A.; de Castro Júnior, L.G.; Santos, P.G.D.; Serrano, A.L.M.; Neumann, C. Fuel flow logistics: An empirical analysis of performance in a network of gas stations using principal component analysis and data envelopment analysis. J. Adv. Manag. Res. 2024, 21, 605–626. [Google Scholar] [CrossRef]

- Zhang, C.; Gong, Y.; Brown, S. Research methodology. In Blockchain Applications in Food Supply Chain Management: Case Studies and Implications; Springer: Cham, Switzerland, 2023; pp. 77–98. [Google Scholar]

- Bogataj, D.; Hudoklin, D.; Bogataj, M.; Dimovski, V.; Colnar, S. Risk Mitigation in a Meat Supply Chain with Options of Redirection. Sustainability 2020, 12, 8690. [Google Scholar] [CrossRef]

- Blagojevic, B.; Nesbakken, T.; Alvseike, O.; Vågsholm, I.; Antic, D.; Johler, S.; Houf, K.; Meemken, D.; Nastasijevic, I.; Pinto, M.V.; et al. Drivers, opportunities, and challenges of the European risk-based meat safety assurance system. Food Control 2021, 124, 107870. [Google Scholar] [CrossRef]

- Modzelewska-Kapituła, M.; Jun, S. The application of computer vision systems in meat science and industry—A review. Meat Sci. 2022, 192, 108904. [Google Scholar] [CrossRef]

- Gholami-Zanjani, S.M.; Jabalameli, M.S.; Pishvaee, M.S. A resilient-green model for multi-echelon meat supply chain planning. Comput. Ind. Eng. 2021, 152, 107018. [Google Scholar] [CrossRef]

- Baležentis, T.; Morkūnas, M.; Žičkienė, A.; Volkov, A.; Ribašauskienė, E.; Štreimikienė, D. Policies for rapid mitigation of the crisis’ effects on agricultural supply chains: A multi-criteria decision support system with Monte Carlo simulation. Sustainability 2021, 13, 11899. [Google Scholar] [CrossRef]

- De Melo, G.A.; Paes, T.F.A.; da Costa, J.S.; Silva, C.S.J.E.; de Castro Júnior, L.G.; Gomide, L.R.; Peixoto, M.G.M.; Guarnieri, P.; Barbosa, S.B.; Serrano, A.L.M. Optimizing forest sector performance based on life cycle cost analysis and real options. Sci. Total Environ. 2025, 988, 179675. [Google Scholar] [CrossRef] [PubMed]

- Peixoto, M.G.M.; Musetti, M.A.; de Mendonça, M.C.A. Performance management in hospital organizations from the perspective of Principal Component Analysis and Data Envelopment Analysis: The case of Federal University Hospitals in Brazil. Comput. Ind. Eng. 2020, 150, 106873. [Google Scholar] [CrossRef]

- Peixoto, M.G.M.; Mendonça, M.C.A.; Castro, C.C.; de Castro, L.G.J.; de Melo, G.A.; Batalha, M.O. Evaluation of the operational efficiency of southeast intermodal terminals in the grain logistics chain using data envelopment analysis. Manag. Decis. Econ 2022, 43, 3044–3058. [Google Scholar] [CrossRef]

- Alves de Melo, G.; Peixoto, M.G.M.; Barbosa, S.B.; de Mendonça, M.C. The analysis of macro processes of the cashier service in a supermarket organization: A case study of quality management and simulation. Dyna 2022, 89, 19–26. [Google Scholar] [CrossRef]

- De Melo, G.A.; Peixoto, M.G.M.; Mendonça, M.C.A.; Musetti, M.A.; Serrano, A.L.M.; Ferreiraet, L.O.G. Performance measurement of Brazilian federal university hospitals: An overview of the public health care services through principal component analysis. J. Health Organ. Manag. 2024, 38, 351–371. [Google Scholar] [CrossRef]

- IBGE. Cidades. Available online: https://cidades.ibge.gov.br (accessed on 2 May 2023).

- Agência Brasil. No Brasil, 14% da População se Considera Vegetariana. Available online: https://agenciabrasil.ebc.com.br/saude/noticia/2021-10/no-brasil-14-da-populacao-se-considera-vegetariana (accessed on 2 May 2023).

- Apte, U.M.; Viswanathan, S. Effective Cross Docking for Improving Distribution Efficiencies. Int. J. Logist. Res. Appl. 2000, 3, 291–302. [Google Scholar] [CrossRef]

- ANTT. Agência Nacional de Transportes Terrestres (ANTT) Divulga Novos Valores da Tabela de Pisos Mínimos de Frete. Available online: https://www.gov.br/antt/pt-br/assuntos/ultimas-noticias/antt-divulga-novos-valores-da-tabela-de-pisos-minimos-de-frete (accessed on 2 May 2023).

- Benetti, C.; Terra, P.R.S.; Decourt, R.F. Financial Management in Practice: Analysis of Brazilian Survey Data. Rev. Adm. Contemp. 2022, 26, e200419. [Google Scholar] [CrossRef]