Abstract

Background: International transportation has grown substantially, causing total logistics costs (TLCs) to rise. Companies are increasingly striving for their reduction. The most crucial factor affecting TLCs is the transportation mode, and its appropriate selection has become vital for firms. Maritime transport is the most preferred mode for international shipments, while air transport is also increasingly preferred due to the rise in underweight and high-frequency shipments, the expectation of reduced delivery times, and inventory costs. However, a thorough comparative analysis is necessary for the selection. Methods: This paper proposes an intelligent approach based on TLCs. Non-linear optimization is adopted for regular replenishment, while maching-learning classifiers are employed to establish a decision boundary for the chargeable weight of shipments. Conclusions: The study assists in decision making and also establishes a country-wide threshold, highlighting the importance of a country-based logistics strategy. The paper successfully establishes the trends and relations between logistics parameters, which assists the logistics decision making. Research identifies the gaps in the existing literature and bridges them by addressing the required concerns.

1. Introduction

The scale of international trade has been on the rise since the 1970s. Globalization has reduced the trade barriers between nations, and many free trade agreements promote international free trade. It has become possible to trade with parts of the world that were never accessible. The average distance of trade has been increasing over the years. The fragmentation of production has been on the rise. Outsourcing and offshoring have become crucial for companies to remain competitive [1,2]. Companies are increasingly willing to expand their markets around the world and seek new sourcing opportunities [3]. International trade allows companies to take advantage of global demand, liberal government policies, and resource availabilities in different parts of the world. Firms can now bridge the technological gap between the two countries faster. Firms can leverage economies of scale, meeting the truly global demand. Many companies have set up global distribution centers for their regional warehouses.

Logistics companies also have to follow the customers who have employed offshoring strategies. International transportation systems have been under increasing pressure to support additional demands in freight volume and the distance at which this freight is being carried. Companies have to adapt to such changing conditions constantly. Along with manufacturing costs, firms are increasingly focusing on reducing logistics costs [4]. Reduction in total logistics costs is vital to sustaining the company’s finances, as they directly affect the profit margins. Total logistics cost is one of the most crucial components of the total supply chain cost [5]. Total logistics cost consists of transportation cost, inventory holding cost, and ordering costs. These costs depend upon the freight mode selected for the shipment’s transport. Therefore, transport mode decision has become vital for firms [1,6].

Maritime transport is the backbone of international trade and the global economy [7]. The primary transport mode for global trade is maritime transport. Maritime transport accounts for roughly 80% of international trade, according to UNCTAD, in 2020, and this percentage is even higher for developing countries. In India, 95% of the country’s trade volume is moved by sea. Maritime transport handles huge loads, particularly in terms of tonnage. On the other hand, air cargo carries around 35% of world trade by value and transports over USD 6 trillion worth of goods, according to the International Air Transport Association (IATA). Road and rail modes of transport are predominantly utilized for national or regional transportation services in many countries rather than being extensively employed for international transport. They are more essential for their roles in global distribution’s first and last miles. Freight is generally brought to a seaport or airport using road, rail, or a combination. However, these intermediate transportation costs by rail/road are not considered in this model, as they are generally a significantly smaller proportion of total logistics costs. There are, however, few exceptions in the role of overland transportation. A substantial share of the NAFTA trade between Canada, the United States, and Mexico is supported by trucking; also, a large share of western European trade is supported by these modes [8], but infrastructure requirements for such cases are special.

Transportation costs are generally higher for air mode, while inventory holding costs are higher for sea mode due to more significant lead times [8,9]. Heavy and bulky shipments are generally preferred via sea mode; on the other hand, lighter and high-value shipments are preferred by air mode [8,10]. Underweight and high-frequency shipments are growing [11] due to demand diversification, shortened product life cycles, and increased agile response to customers. The definition and context of underweight shipments might vary as per the industry, but in this paper, we refer to any shipment with chargeable weight (air) less than 200 Kg as underweight. Faster delivery times are increasingly becoming the new norm in many industries. Customer satisfaction is vital for profitability [12]. Therefore, many companies prefer air cargo to meet customer demands as it is faster and more reliable. Many companies are now following the JIT strategy to keep inventory levels low [9], which also causes underweight and high-frequency shipments to increase. This, in turn, is causing a surge in the total logistics costs for those shippers [13] that need to export/import a few products overseas. A small shipment shipped via sea can cost significantly more than one shipped via air mode. To reduce the total logistics cost, companies are now switching to air mode but need clarification on which shipments should go by air mode. Several other parameters, such as shipment value, shipment volume, product type, and freight mode reliability, should be considered when selecting a freight mode [6,11]. That is why it is essential to thoroughly calculate [6] and compare costs before choosing the mode of shipment [3] between air and sea.

This paper proposes a study that helps select transportation modes based on the comparison of total logistics costs calculated for respective shipment modes. The freight mode with the least TLC will be the preferred mode of shipment. Total logistics cost includes the costs such as transportation cost, inventory holding cost, and ordering cost. The paper also proposes a case study as the application of the proposed model. Non-linear optimization has been carried out for regular replenishment to obtain the minimum possible TLC. These minimum possible values are then compared for air mode and sea mode to make a selection of freight mode. Underweight shipments are generally preferred via air, but understanding a shipment’s exact threshold weight still needs clarification. Companies generally come up with a threshold chargeable weight without thorough analysis. This paper, however, proposes a way to calculate the threshold chargeable weight using maching-learning classifiers to help save the TLC. Linear classifiers yielded a suitable accuracy of ~97% for the total price approach (Framework 2), while ~95% accuracy was obtained for framework 1, as discussed further in the paper. This paper has presented the results using logistics regression classifier. Machine-learning classification also helps identify the impact of various parameters on transportation mode selection. A comparative study of various parameters for air and sea mode has also been proposed.

2. Literature Review

The significance of making informed transport mode decisions cannot be overstated; nevertheless, the research in this area remains relatively limited. Recognizing the importance of logistics costs, particularly in the context of inventory models, emphasizes the need to comprehensively consider transportation factors. Regrettably, a notable observation is that numerous existing models either neglect or oversimplify transportation costs and capacities, often assuming the presence of only one transportation option. This restricted examination of transportation complexities in current research underscores the urgency for adopting more comprehensive and sophisticated methodologies to effectively tackle real-world logistics challenges. As discussed earlier it is vital to perform comparative analysis between sea freight and air freight in context of international transportation. One study proposes a comparative analysis between rail and sea freight [14]. Some other studies are performed, are not comparative, but are focused on one the transportation modes and often ignore the inventory holding costs [4,6]. The proposed study in this paper addresses the above-mentioned problem effectively. A study by Dajana Bartulović et al. [15] has also been performed on intermodal supply chain, reiterating the importance of air freight in the intermodal supply chains. This study however does not take into account the intermodal supply chains. A study [4] has been performed to reduce logistics costs for sea shipping by ocean carrier selection. Product value density as a concept is used to make a supply chain selection, where product value density can be used for mode selection [1]; however, it is generally preferable and wiser to establish a threshold on to the chargeable weight as proposed in the paper. Multi-criterion decision method is used to decide transport mode [16], which assigns weights to different criteria. Such weights are subjective and vary as per companies and products. Few other papers have used optimization in scheduling problems [17] and networking problems [5]. The study for minimization of supply chain cost has also been performed with non-linear optimization [18], but this study does not focus specifically on to the transportation domain. Various studies have utilized and explained machine learning in supply chain management and real-world problems [19]. A study by Beresford et al. has proposed a model, application of which enables organizations to evaluate door-to-door supply chain costs, revealing insights into multimodal transport [20]. Vasilev and Milkova presented optimization of inventory management by proposing an approach to determine optimal supply sizes for different types of stocks, specifically addressing multi-nomenclature scenarios. The authors have employed mathematical optimization using MS Excel to obtain the results, but the study is applicable for limited SKUs and also has few oversimplified assumptions [21]. The review article explores and locates the current state-of-the-art-related application areas from freight transportation, supply chain, and logistics. The papers mainly focus on arrival time, demand forecasting, industrial processes optimization, traffic flow and location prediction, the vehicle routing problem, and anomaly detection on transportation data [22]. Many papers have limited data, making the results inconclusive. Various trends and limitations of machine learning in logistics are also explained in the study [23], which highlights the need of sophisticated models. There are few studies that explore and explain the importance of logistics decisions in sustainability perspective [24]. This sustainability perspective is not considered in the given paper, though it can be incorporated as a future scope.

The proposed research centers on a comprehensive examination of total logistics cost (TLC), encompassing all integral elements that significantly impact the decision-making process for transportation mode selection. This study presents a systematic comparative framework, thereby facilitating an in-depth analysis of each mode’s applicability under varying scenarios. Furthermore, the investigation takes into account the crucial factor of inventory holding costs, revealing their substantial influence on the ultimate determination of the most suitable transportation modes. Throughout this paper, a rigorous and thorough approach has been adopted to ensure the accuracy, credibility, and originality of the research findings.

3. Methodology

3.1. Components of Total Logistics Cost

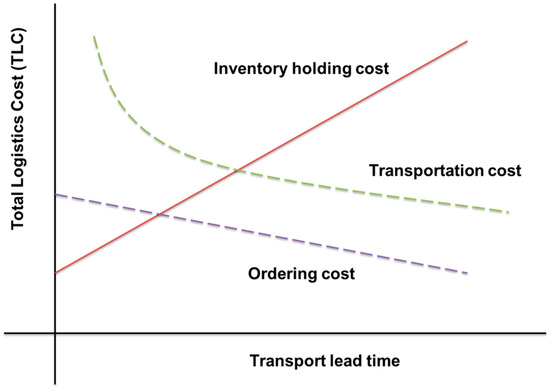

Selecting the mode of shipment for transporting goods is one of the most crucial business decisions affecting an organization’s finances. As the transport lead time increases, inventory holding costs rise to a significantly higher value, but as more goods are carried at a time, Overall transportation costs reduce. When lead times are higher, there is an increase in order quantities. Hence, fewer orders are placed, reducing overall ordering costs, as shown in Figure 1. It illustrates TLC against transport lead time adopted from literature explaining planning, organizing, and controlling of business logistics/supply chain management by Ballou and Srivastava [25]. This interdependence has to be carefully understood, and TLC should be minimized. The below graph can easily be obtained by the relation in Equation (9), discussed in a later portion of this paper.

Figure 1.

Graph of TLC against transport lead time.

This paper is based upon the approach to minimize the total logistics, i.e., the freight mode that offers the least total logistics cost will be selected for the shipment. The total logistics cost can be represented as [26,27]:

Total Logistics cost = Transportation cost + Inventory holding cost + Ordering cost

Incoterms are standardized set of terms used in international trade, published by the International Chamber of Commerce (ICC) that define the responsibilities of buyers and sellers in international trade. These terms ensure the clarity between the buyers and sellers about their respective set of obligations in the trade. The above formula for TLC might vary as per the Incoterm agreement between the buyer and the seller. The firm should consider only the costs that affect its finances if you are a buyer, and as per the Incoterm agreement [28,29], transportation costs are not part of your finances, then they should be ignored.

3.1.1. Transportation Cost

Transportation cost is generally the most crucial factor affecting the total logistics cost. Generally, faster speed and lower cargo volumes are charged higher. In the case of international shipments, the general dilemma is whether to ship by air or by sea. The decision significantly affects transportation costs.

Air freight is billed through chargeable weight, which is a metric calculated by combining the weight and size of the shipment. The cargo’s actual weight or volumetric weight equals the chargeable weight, depending on which number is higher. To find the air shipment’s volumetric weight, multiply the length, width, and height to determine its volume in cubic meters. Then, multiply the volume by 167 to find the dimensional weight in kg. The chargeable weight of the shipment is a higher number among the actual weight of the shipment and the volumetric weight as calculated above [9].

In ocean shipping, the cost is dependent upon whether the shipment is FCL (full container load) or LCL (lower than container load). LCL describes sea shipping where the shipment is not large enough to fill a full 20 ft. or 40 ft. container; therefore, they are clubbed with other cargo and are charged based upon the chargeable weight, while an FCL is charged per container irrespective of the weight of the shipment. FCL carries huge loads, while LCL can carry small shipments. In this study, for transportation cost calculation for sea freight, we will refer to LCL, as FCL carries huge loads that cannot be carried economically by air. A shipment that is able to fill up the FCL will always cost more to carry by air freight; hence, air freight has to be explored as an alternative to LCL of sea freight. To calculate volumetric weight in LCL, calculate the volume of the shipment in cubic meters by multiplying the length, width, and height. Then, multiply this volume by 1000 to obtain the volumetric weight in kg. The chargeable weight of LCL is the higher number among the actual weight and volumetric weight as calculated above [9].

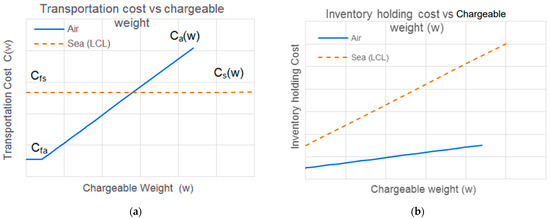

The above graph in Figure 2a has been obtained by comparison of transportation costs obtained from freight forwarding agencies and for varying countries. The Y intercept of the graph might vary, but general trend was found consistent. Figure 2b inventory holding costs are, however, obtained using formula-based computation explained further. Cfs = Cs(w) when w approaches zero, and Cfa = Ca(w) when w approaches zero. Cfa and Cfs, denoted in Figure 2a, are the fixed costs for transporting goods by air and sea, respectively. They can be thought to be as Y intercept of the graph between transportation cost and chargeable weight. Fixed costs are the costs charged by the shipper irrespective of the weight of the shipment. Fixed costs can also be seen as the costs the shipper charges to ship infinitesimally small chargeable weight. Generally, the fixed cost for sea (Cfs) is significantly higher than that of the air (Cfa). Transportation cost for sea increases gradually with increasing chargeable weight, while transportation cost for air increases drastically with an increase in the chargeable weight. As shipment size and weight increase, transportation costs for air freight rise dramatically faster than LCL costs.

Figure 2.

(a) Graph of transportation cost against chargeable weight. (b) Graph of inventory holding cost against chargeable weight.

w = chargeable weight of the shipment,

C(w) = transportation cost per shipment of chargeable weight (w),

n = number of shipments in the time (t),

t = time horizon considered for optimization.

3.1.2. Inventory Holding Cost

Inventory holding cost includes the cost of capital, obsolescence cost, handling cost, occupancy cost and miscellaneous costs [30,31]. The cost of capital can be evaluated as the weighted average cost of capital (WACC). It is opportunity cost, i.e., capital engaged in the inventory would have produced some equity returns. Also, this engaged capital constitutes debt that is charged interest. WACC considers the required return on the firm’s equity and the cost of its debt. Obsolescence cost estimates the rate at which the value of the stored product drops because its market value or quality falls. This cost can range dramatically, depending on the type of product. Handling cost includes only incremental receiving and storage costs that vary with the quantity of product received. Occupancy cost reflects the incremental change in space cost due to changing cycle inventory. A miscellaneous cost is a final component of holding costs and deals with some other relatively small costs. These costs include theft, security, damage, tax, and additional insurance charges.

Holding cost is generally estimated as a percentage of the value of the product, which takes into account the cumulative effect of all these costs mentioned above [25]. The inventory holding cost can be divided into two significant constituents, as shown below:

Inventory holding cost = Stationary inventory holding + Transit inventory holding

Here, stationary inventory holding cost that includes cycle stock holding cost and safety stock holding cost.

Stationary inventory holding cost = Cycle stock holding + Safety stock holding

When the shipment is made, the quantity on hand becomes zero, and as more goods are manufactured, they accumulate up to quantity (q) before the next shipment goes out. The average amount of stock on hand is q/2. The cost of holding q/2 units of inventory is:

Even if you are a buyer, the formula for the cycle stock will not change because when the stock is replenished, the cycle stock has quantity “q” and as the inventory is consumed stock finally becomes zero. The average amount of stock on hand is q/2.

The lead time of any shipping mode varies due to several unpredictable factors, hence to account for these variations in lead time, we maintain extra in-hand stock called safety stock [31], which is equal to the expected demand for a particular product during average lead time variation (ΔT) for a particular mode of shipment. Airlines are generally better at following the schedules, and also flights are rescheduled efficiently and effectively, while ocean carriers are less reliable. The variation in the lead time is higher for sea carriers. Hence, more safety stock is maintained. The cost of holding this safety stock can be seen as a percentage of the value of the total safety stock held over the optimization horizon. It can be written as:

Transit inventory holding costs can be seen as handling costs when the goods are in transit [31]. Cost of capital, obsolescence cost, handling cost, occupancy costs, and miscellaneous costs required for in-transit inventory constitutes transit inventory holding costs.

This cost could be calculated as follows:

V = unit price of the shipped product,

I = annual inventory holding rate (% per year),

T = lead time of particular freight mode (days),

ΔT = average variation in lead time for a particular freight mode,

q = shipment size,

t = time horizon considered for optimization,

n = number of shipments in time (t),

d = average demand for a particular product per day,

t′ = total in-transit inventory holding time.

From Equations (5)–(7),

Here, inventory holding rate is divided by 365 to convert annual inventory holding rate to daily inventory holding rate. Lead time for sea shipment is significantly higher than for air shipment. Sea shipments are also significantly heavier than air shipments. Therefore, sea shipments have higher cycle stock and transit inventory holding costs. Also, the variations in the lead time are more significant for the sea than for the air. Air freight offers greater schedule reliability than the sea freight; therefore, less safety stock is maintained in regular air freight shipments than in sea freight shipments. Therefore, the inventory holding cost for the sea is generally higher than for air. Figure 2b shows a graph of inventory holding cost against chargeable weight. As chargeable weight increases, inventory holding cost goes up. As the chargeable weight increases, value of the shipment also rises, which significantly increases the cost of capital. Inventory holding costs are generally higher for the sea than for the air. This is due to the higher lead time of the sea, causing holding costs to go up.

3.1.3. Ordering Cost

Ordering costs includes buyer time cost and receiving costs [25]. Buyer time is the total time of the buyer placing the extra order. This cost should be included only if the buyer is fully utilized. This cost may not be considered in some cases. The incremental cost of getting an idle buyer to place an order is zero and does not add to the ordering cost. Receiving costs are incurred regardless of the size of the order. These include administration work, such as purchase order matching and any effort to update inventory records. Other administrative costs such as personal expenses, technology and software costs, and information systems costs are not included in the TLC for this paper, as these costs do not affect the selection of the freight mode and are more or less constant irrespective of the freight mode. The ordering cost must include only the incremental change in actual cost for an additional order, denoted as “z” in this paper. Packaging costs also can constitute to be a small portion of TLC, though as these costs are generally incorporated into the value of the item, we will not consider them separately.

From Equation (1),

Total Logistics cost = Transportation cost + Inventory holding cost + Ordering cost

From Equations (2)–(7),

4. Case Studies, Results, and Discussion

4.1. Determining Freight Mode for Regularly Replenished Products

Logistics cost varies with shipment size (q) and the number of shipments (n); therefore, to minimize the total logistics cost, we have to optimize shipment size (q) and the number of shipments (n) to meet the demand in a particular time horizon. Equation (9) consists of all the constants except n and q, which has to be optimized to minimize the total logistics cost. A case study was conducted at “Anil electronics and atta-chakki Solutions Pvt. Ltd.” in Pune, India, the biggest flour mill manufacturer in western India. They import various parts and electrical appliances from various countries. Freight costs considered are actual costs from shipment providers while conducting this study.

4.1.1. Case I: Regular Replenishment of the Same Product

For case 1, for simplicity, we will assume that the considered product is the only product regularly replenished from a specific country. Consolidation will be discussed in later cases. Inventory holding rate (I) refers to the costs appearing if items kept as inventory are to be unsold. The top management team sets this number, and as the firm increases profitability and requires a higher return on equity, the cost of keeping items as inventory increases [25]. The time horizon of one month signifies the monthly demand would be replenished regularly.

- Origin country: Germany, Destination country: India

- Origin airport: Frankfurt, Destination airport: Mumbai

- Origin seaport: Bremerhaven, Destination seaport: Mumbai

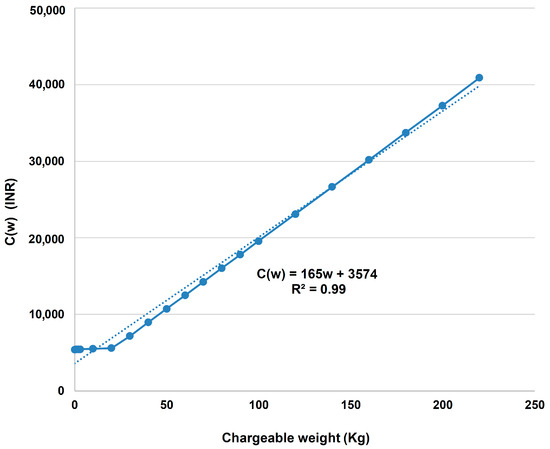

Transportation Cost Considering Air Mode

The transportation cost function C(w) is dependent on variable w (chargeable weight). A transportation cost for import shipments by air from Germany to India is discussed. Figure 3 shows the variation in transportation cost by air transport for different values of chargeable weight. The curve is represented as a linear function for transportation cost (C(w)) per shipment. This will help us generalize the function and define the overall optimization problem more clearly, as discussed further:

C(w)Air = 165w + 3574

Figure 3.

Transportation cost against chargeable weight for air transport mode.

From Equation (2),

Total transportation cost for air transport = n × C(w)Air

Here, “w” is the chargeable weight for the shipment, which can be denoted as the maximum number among the volumetric weight and actual weight of the shipment. “q” is shipment size, i.e., number of units of a particular product in the shipment. “n” signifies the number of shipments in a given time horizon.

Where for Air mode, w = Max (Actual weight, Volumetric weight) = Max (q × U, q × L × 167)

As U and L are constants, from Equations (10)–(12), it is clear that the formula for transportation cost for air has only two variables named shipment size (q) and number of shipments (n) in the considered time horizon for a particular product.

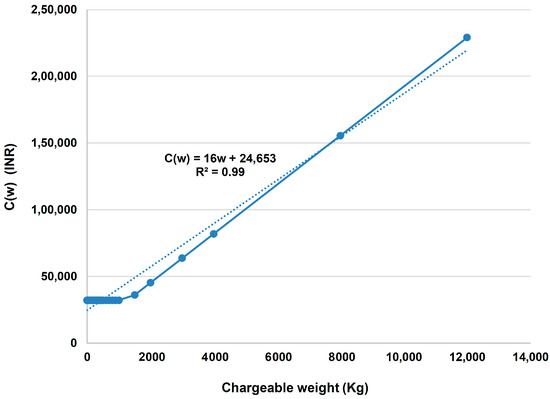

Transportation Cost (Sea Mode (LCL))

Figure 4 denotes the transportation cost by sea transport for different values of chargeable weight. The curve is represented as a linear function for transportation cost (C(w)) per shipment. The linear trendline was found to be best suitable for almost all the country combinations considered in the study.

C(w)Sea = 16w + 24,653

Figure 4.

Transportation cost against chargeable weight for sea transport mode.

The above function was found to be staying constant for trade between two specific countries unless there is a significant change in the country’s policies or significant supply chain disruptions, etc. In case of change, the new function could easily be obtained using the data points. This is the only equation that might change over time and needs to be updated. The unpredictability of the variables influencing the above equation makes it unsuitable for modeling them. Rather, it is significantly easy to update the function as per new data points obtained from freight forwarding agencies partnering with the firm.

From Equation (2),

Transportation cost for sea transport = n × C(w)Sea

Where for Sea mode, w = Max (Actual weight, Volumetric weight) = Max (q × U, q × L × 1000)

As U and L are constants, from Equations (13)–(15), it is clear that the transportation cost formula for the sea also has only two variables named shipment size (q) and number of shipments (n) in the considered time horizon for a particular product. All the variables considered in Equation (9) for TLC are constants for a particular product and company, except the shipment size (q) and number of shipments (n) in a particular time horizon; hence, to minimize the TLC, we have to optimize the decision variables, which are shipment size (q) and a number of shipments (n).

Optimization for Sea Shipping

The computations shown in this section were carried out at the backend by software, though the below calculations are not mandatory and are valid only for the given case. Though this approach was easily generalized using computation software, which will be explained further. After substituting the values from Table 1 in Equation (9) for the above case study for sea transport mode, we get

where “t” is the time for which the inventory will be traveling to reach the warehouse. As there can be multiple orders to meet the demand, the lead time is multiplied by the number of shipments to obtain the total in-transit time.

TLC = [n × C(w)Sea] + [71.91 × q] + [15,438.4] + [4.794 × t′ × q × n] + [n × 1000]

Hence, t′ = Total in-transit inventory holding time for water mode = n × Ts = n × 55 = 55n

Table 1.

Parameters considered for the case study.

Therefore, Equation (16) becomes

TLC = [n × C(w)Sea] + [71.91 × q] + [15,438.4] + [263.67 × q × n2] + [n × 1000]

For maritime transport mode,

w = Max (q × U, q × L × 1000) = q × L × 1000 = 18q

By substituting Equation (18) into Equation (13), we get

C(w)Sea = 288q + 24,653

Equation (17) becomes

TLC(n, q) = [n × (288q + 24,653)] + [71.91 × q] + [15,438.4] + [263.67 × q × n2] + [n × 1000]

From the above equation, it is clear that TLC is a function of two decision variables n and q.

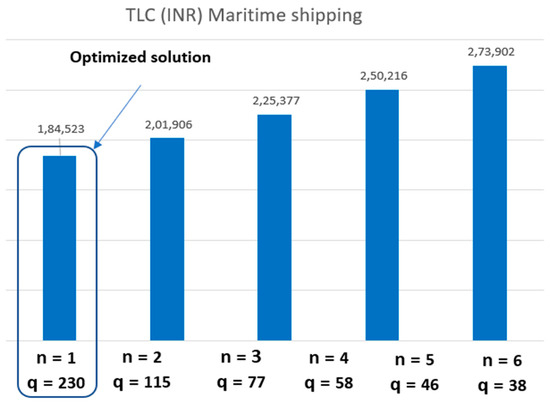

Figure 5.

Graph for TLC with varying “n” and “q” values for sea shipping.

The optimization problem can be defined as:

Minimize,

TLC(n, q)= [n × (288q + 24,653)] + [71.91 × q] + [15,438.4] + [263.67 × q × n2] + [n × 1000].

Subject to,

30d = n × q (Availability constraint).

(Above constraint ensures that monthly demand will be replenished).

n, q ≥ 1 (Nonnegative constraint).

Solution:

After employing “GRG non-linear” solver on MS EXCEL or “Fmincon” Solver on MATLAB, the optimization process yielded the following results:

n = 1, q = 230, and minimum TLC with sea as a mode of shipment: 184,523 INR.

The GRG (generalized reduced gradient) non-linear solver, like many other optimization algorithms, is designed to obtain the solution where the gradient of the objective function becomes zero. In optimization problems, such points are called “stationary points” or “critical points”. A critical point refers to a specific location where all the partial derivatives of the objective function with respect to the decision variables are equal to zero.

Optimization for Air Shipping

Similarly, for air mode,

Total in-transit inventory holding time for air mode = n × Ta = n × 6.

For air mode, w = Max (q × U, q × L × 167) = q × U = 3.5q.

We obtain an optimization problem as follows:

Minimize,

TLC(n, q).

Subject to,

30d = n × q (availability constraint).

The above constraint ensures that monthly demand will be replenished. We are assuming that every shipment is identical, with quantity “q” of a product contained in it.

n, q ≥ 1 (non-negative constraint)

Solution:

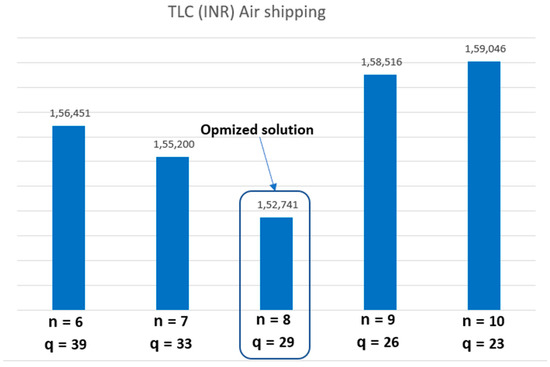

After solving using GRG non-linear solver yields the following result:

n = 8, q = 29, minimum TLC with air as a mode of shipment: 152,741 INR.

After optimization, it is clear that the optimized TLC value for air is less as compared to sea mode. Therefore, product 1 has to be imported by air to minimize the total logistics cost. Figure 6 denotes the total logistic cost by air shipping for different values of ‘n’ and ‘q’.

Figure 6.

Graph for TLC with varying “n” and “q” values for air shipping.

4.1.2. Case II: Regular Replenishment of Multiple Types of Products

Case I was applicable for any specific product coming via a shipment, but it is likely the case that there will be several products with varying dimensions and weights, etc., that will be coming from the same country regularly, which will be consolidated into a single shipment coming regularly as required. The same optimization method could be used for such cases as well. Let us consider “p” to be the number of products that are to be replenished every month. We have to meet the monthly demand for every product, at the same time minimizing the TLC, with optimal values of “n” and “q” for every product. Here, every product will have different monthly demands, different volumes, and weights. Let w1, w2, w3, …, wp be the chargeable weights of product 1, product 2, product 3 … product p, respectively, as the products coming from the same country will be clubbed together in a shipment.

The number of shipments = n1 = n2 = n3 … np = n

q1, q2, q3, …, qp be the quantities of product 1, product 2 … product p, coming in each shipment.

Inventory holding cost = Summation of inventory holding costs for all the products.

Inventory holding cost for any product is obtained from Equation (8), in terms of decision variables, “n” and q1, q2, …, qp

where

C () = Total transportation cost of shipment containing multiple products.

n = number of shipments.

z = ordering cost for a single shipment.

As we know,

TLC(n, q) = Transportation cost + Inventory holding cost + Ordering cost.

Hence, our optimization problem can be defined as,

Minimize,

TLC(n, q).

Subject to,

30di = ni × qi i = 1, 2, …, p.

(above constraint ensures that monthly demand will be replenished).

ni, qi ≥ 1 i = 1, 2, …, p (non-negative constraint).

The above optimization was applied to the products coming from Germany to India with the values shown in Table 2, and the results were obtained, suggesting to use of the air as a transport mode to minimize the TLC.

Table 2.

Various products and their features and corresponding TLC for different transportation modes with optimal “n” and “q”.

The aforementioned methodology was applied to all shipments originating from various countries over the course of a month, resulting in substantial cost savings in terms of total logistics costs (TLCs) compared to the firm’s previous practice of default maritime shipping. The firm maintained a centralized database of product information. This information was automatically captured and integrated into the model using software. The firm possessed average product demand figures and inventory holding rates. The transportation cost function utilized in the model was derived from data points provided by freight forwarders and remained consistent throughout the study period. To ensure convenience, the solver was automated using Excel macros within Microsoft Excel, employing the GRG non-linear solver. The above solver provides ease of access, which improves the applicability of the given model. While a similar approach could have been implemented using MATLAB R2021a software by MathWorks, the firm’s compatibility and preference led to the utilization of Microsoft Excel for further analysis.

4.2. Determining the Freight Mode of Any Shipment

The approach discussed in the previous section could be used for regularly replenished products that meet the demand for a particular time horizon by optimizing the number of orders and quantity for each product to minimize TLC. Sometimes, however, the freight mode selection has to be made for a one-time shipment, i.e., we cannot vary the lot size or number of orders. As shown in Equation (9), total logistics cost depends on different variables. Though inventory holding rate and ordering cost are constants for a specific firm/entity, the chargeable weight and price of the shipment are variables that vary as per the shipment. The chargeable weight for air can be the same or different than that for sea, as evident from Equations (12) and (15). In this model, we will use chargeable weight for air and establish a threshold for it, as explained below.

4.2.1. Machine Learning-Based Classification

Two frameworks are presented herein. The first one is based on chargeable weight and unit price, and the second one is based on chargeable weight and total price of the shipment. Though it was proved in this study that the second framework yielded more accurate results, while the first framework helps us to establish and understand the impact of unit price on the decision-making process and helps with the decision process when shipment size is not constant, which makes it harder to establish the total price of the shipment.

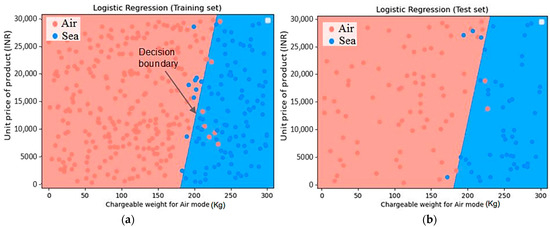

First framework: Classification based on the chargeable weight and unit price of the product in the shipment.

As explained earlier, we can directly compute the TLC for a particular shipment for various transport modes. We can decide on the transportation mode accordingly, but a generalization with reasonable accuracy is often necessary for convenience. Data were generated using the simulation model, which computes TLC and suggests the expected mode of transportation. Generated data consisted of 500 data points, consisting of many possible combinations of different variables to generate the database. In the paper, we have added the results for shipments between Germany and India with a 15% holding rate. At the same time, the same study was conducted for various other countries and with varying holding rates. The top five rows of the generated data are shown in Table 3. These generated data were divided into an output set consisting of the last column and an input set containing all the other columns. These sets were then divided into training and test sets to obtain four datasets. The training and test set data were then scaled based on standardization using StandardScaler class of Python. The standardized training sets were fed to various maching-learning classifiers to train a model. Test datasets were then fed to the classifier model to obtain the prediction for the freight mode. The accuracy score was computed by comparing the expected mode of shipment and the predicted mode of shipment.

Table 3.

Top five rows of the generated data for the 1st framework.

Accuracy scores and form of decision boundary for various machine-learning classifiers were compared to select an ideal classifier using Table 4. Linear models performed better than other non-linear models. The best result was obtained using a logistics regression classifier. The decision boundary for logistic regression is plotted in the scatter plot shown in Figure 7. The training and test set classification results for various classifiers, which might be important for answering the importance of linear solver selection, are stated in Appendix A. The confusion matrix for logistic regression is shown as a confusion matrix in Table 5. Figure 7a indicates the scatter plot for the training set, while Figure 7b is for the test set. It is evident from the graphs in Figure 7 that we can establish a chargeable threshold weight as per unit price of the product, below which all the shipments of that product could be brought by air freight and above which all the shipments will be brought by sea freight to obtain the minimum TLC., e.g., for a product pricing 10,000, coming from Germany, the threshold chargeable weight for air is ~200 Kg, as evident from Figure 7a, i.e., all the shipments with chargeable weight for air, above 200 Kg, should be preferred to come via sea to reduce the TLC. The slope of the decision boundary is positive, indicating that as the unit price of the product goes up, the threshold for the chargeable weight also goes up; this is because a higher price of the product and longer lead times for maritime transport increases the inventory holding costs to significantly higher levels as compared to air, where lead times are low. The high-value products carried for long as an inventory constitutes lost capital for more time, increasing the inventory holding costs. This suggests as the products get costlier, more and more of them are preferred to go by air, which allows inventory holding costs to reduce, which in turn reduces TLC. This framework allows the user to decide the freight mode irrespective of the shipment size, which could be very beneficial to broadly classify the products into categories irrespective of their varying demands.

Table 4.

Accuracy scores for different maching-learning classifiers for the 1st framework.

Figure 7.

(a) Scatter plot for training set: unit price of product in the shipment (INR) against chargeable weight for air mode (Kg); (b) scatter plot for test set: unit price of product in the shipment (INR) against chargeable weight for air mode (Kg).

Table 5.

Confusion matrix for logistic regression for the 1st framework.

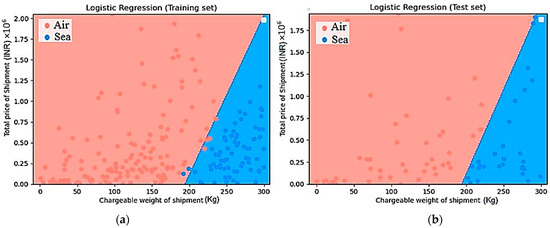

Second framework: Classification based on the chargeable weight and total price of the shipment.

A similar study considered the “Total price of the shipment” rather than the “Unit price of the product” shipped. This second framework considers the total price of shipment; therefore, it takes into account the unit price as well as shipment size, yielding more accurate results. Three hundred data points were generated, with 25% data used for testing. The top five rows for the data are shown in Table 6.

Table 6.

Top five rows of the generated data for the 2nd framework.

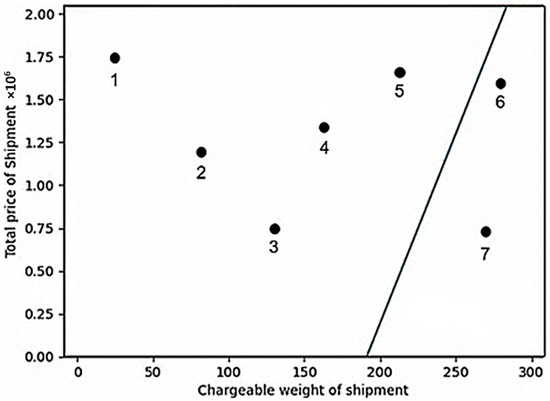

Similar steps mentioned in the first framework were followed for these data to yield the following results, as mentioned in Table 7. In this case, as well, logistic regression outperforms all other classifiers, with well-established and justifiable decision boundaries, as shown in Figure 8. The confusion matrix for logistic regression is shown as the confusion matrix in Table 8. The decision boundary in Figure 8 has a positive slope, indicating that as the total price of the shipment increases, the threshold for chargeable weight also rises. That is, costlier shipments are preferred to come by air; the reason for the trend is that bringing costlier shipments by air will lower the inventory holding costs because of shorter lead times, reducing the TLC. Though, if sea routes become faster in the future than air, the model can still be used to establish the decision boundary. The decision boundary, as shown in Figure 9, could be constructive to deciding the mode of freight based on the chargeable weight of shipment for air mode and the price of the shipment. Table 9 indicates predictions and also the probability of the prediction being true. As the shipments approach the decision boundary, the probabilities are ~50% for both modes. It suggests that both modes are equally likely on the decision boundary, as TLC carries an equal value, irrespective of the freight mode. Near the decision boundary, prediction accuracy might reduce because TLC values for both freight modes are nearby. Still, in this region, the decision itself is not pivotal, as the difference in TLC values for any mode is small.

Table 7.

Accuracy scores of different maching-learning classifiers for the 2nd framework.

Figure 8.

(a) Scatter plot for training set: total price of shipment (INR) against chargeable weight for air mode (Kg); (b) scatter plot for test set: total price of shipment (INR) against chargeable weight for air mode (Kg).

Table 8.

Confusion matrix for logistic regression for the 2nd framework.

Figure 9.

Scatter plot of total price of shipment (INR) plotted against chargeable weight of the shipment (Kg).

Table 9.

Predictions and their respective probabilities of being true for logistics regression.

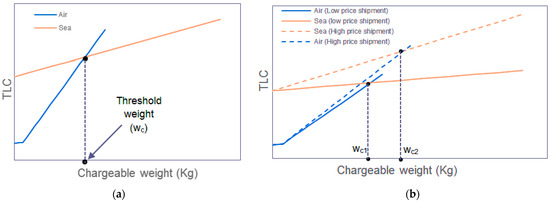

4.2.2. Establishing Threshold for Chargeable Weight

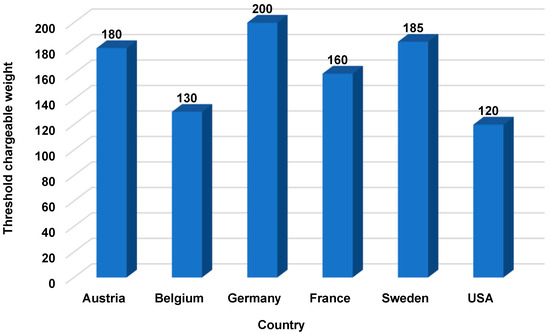

To understand the concept of threshold weight, we will consider a shipment where the chargeable weight for air mode, as well as sea mode, is the actual weight of the shipment in kg. The plots of the chargeable weight for such a case against TLC are shown in Figure 10. These plots are representative plots for simplicity of understanding to explain the concept of threshold weight. The graphs for TLC for air mode and sea mode intersect at only one point. Hence, once the threshold chargeable weight is crossed, sea becomes the preferred mode of transportation. In Figure 10b, the higher-priced shipment has a higher threshold chargeable weight (Wc2), while lower-priced shipments have a lower threshold chargeable weight (Wc1), i.e., Wc2 > Wc1. This is majorly due to the high-value shipments having higher inventory holding costs than low-value shipments for both sea and air modes of transportation, but the increase in inventory holding cost is higher for sea mode than for the air mode due to the longer lead times of the sea mode of transportation. A similar analysis was also carried out for trade between India and many other countries. Figure 11 shows a graph of threshold chargeable weight drawn for a shipment costing 250,000 INR. All the shipments with chargeable weight below this should be shipped by air. Firms that depend solely on freight forwarders and have limited control over the process can establish such thresholds. The X intercept of the decision boundary could be seen as the minimum threshold. This is a representative graph to indicate that threshold weights vary significantly as per the countries, majorly due to customs, tax policies, free-trade agreements, and infrastructure to support the shipment mode, which highlights the need for country-level logistics strategy. Countries may have different government policies that affect the TLC. Trade regulations, tariffs, and customs costs may be impacted depending upon the specific countries. Trade agreements between the nations may also provide the incentive for specific transportation modes. International transportation will be widely impacted depending on these policies, such as “South Korea’s new southern policy”, which assists in strengthening the transportation infrastructure within Asian countries, and the “China belt and road initiative”, which has the potential to improve logistics along the BRI routes. It is, therefore, vital to have a country-dependent logistics strategy.

Figure 10.

(a) Total logistics cost against chargeable weight showing threshold weight. (b) Total logistics cost against chargeable weight for high- and low-priced shipments showing varying threshold weights.

Figure 11.

Thresholds for chargeable weight as per countries in Kgs.

4.3. Impact of Inventory Holding Rates on Transportation Mode Selection

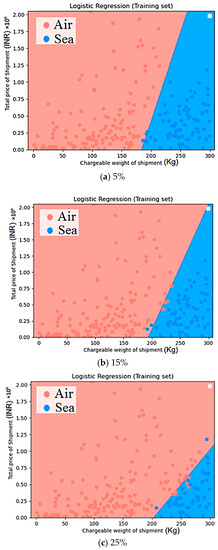

Figure 12 presents the decision boundaries for different values of inventory holding rates. As the inventory holding rate increases, the decision boundary shifts to the right, and the slope decreases, indicating a preference for more shipments via air mode. This is due to the higher inventory holding costs associated with increased holding rates. The impact on sea mode is more significant than on air mode because of the longer lead times for sea shipments. As a result, the total logistics cost (TLC) for sea mode increases significantly, making it a costlier option. Particularly, when a firm deals with perishable products with a low shelf life, inventory holding rates tend to be higher due to elevated obsolescence costs. These decision boundaries provide clear guidelines for transportation mode selection, even for individuals without extensive logistics expertise.

Figure 12.

Decision boundaries for varying inventory holding rates at (a) 5%, (b) 15%, and (c) 25%.

There are some limitations to the full applicability of the proposed model in the cases discussed below. Customer trust and brand loyalty are some factors that cannot easily be justified based on TLC. Some shipments might be subject to urgency; in such cases, the product’s availability at the destination is vital, and the mode with a shorter lead time is preferred in such cases. Some shipments might have products with a shelf life less than the lead time of one of the freight modes; in that case, another shipment mode with less lead time will be preferred irrespective of TLC; also, the supply chain has to be designed to preserve perishables and avoid the wastages, for which various strategies are used [32,33] that have to be accounted in the model to make an accurate prediction.

For landlocked countries, direct sea transport is not possible. For such countries, the shipment is generally carried to nearby countries and then shipped from there. Modifications in the above model will be necessary in such cases.

During the COVID-19 times, the overall business performance was heavily impacted [34,35]. There was a disruption in the overall logistics supply chain [36,37]. The pandemic significantly affected container shipping by ocean. Sea freight increased drastically during these times due to increased container costs, which caused many delays. Russia’s Ukraine war, on the other side, increased fuel costs significantly, making air freight expensive. Despite the increased cost, many firms preferred air to avoid delays and maintain customer loyalty. These are very dynamic conditions, and many companies follow their own strategies to tackle them. These are not merely financial issues but involve many other aspects, so it seems that continuous ongoing analysis will be required. During periods of uncertainty and unforeseen events such as the COVID-19 pandemic, our proposed model exhibits adaptability to cater to specific requirements and minimize costs. By fine-tuning the lead time (T) for each mode of transportation and increasing the lead time variation (ΔT) to accommodate uncertainties, safety stock levels can be improved. During situations akin to the COVID-19 pandemic, opting for shorter optimization horizons (t) over longer ones becomes more prudent, as it helps mitigate losses arising from swift and unpredictable changes. These model adjustments contribute to enhanced flexibility and resilience, empowering logistics practitioners to adeptly navigate dynamic and challenging circumstances.

5. Conclusions, Limitations, and Future Research Avenues

The importance of systematic decision making while selecting a transportation mode is demonstrated successfully in this paper, which reduces TLC, thereby improving the margins for the firm. This investigation considered the total logistics cost as a basis for decision making, using all three components: transportation costs, inventory holding costs, and ordering costs. First, the TLC for products regularly replenished is minimized with a unique number of shipments, shipment sizes, and corresponding modes. The freight mode offering the minimum value among these was selected. Further, the decision boundaries have been established using the maching-learning approach. These decision boundaries enable companies to establish clear guidelines for transportation mode selection, even for individuals without extensive logistics expertise. Within this decision boundary, all the shipments could be allowed to go by air freight, while beyond this boundary, shipments should be preferred to go by sea. This model suggests that transportation mode decision varies significantly with different countries, highlighting the need for the companies to have a country-based logistics strategy. This paper could also establish the relationship between various logistics parameters and their impact on transportation mode selection, such as unit price and holding rates. It is important to note that the paper acknowledges the need to consider sustainability aspects in future research, incorporating them into the decision-making process. Also, specific infrastructural advantages or limitations for specific countries are not accounted for in the study. Major disruptions like COVID-19 or the Russia–Ukraine war can significantly affect the supply chains for any mode. In such cases, it is imperative to adjust the model accordingly and conduct ongoing analysis to ensure optimal decision making in the face of changing circumstances.

Author Contributions

Conceptualization, R.A.P. and A.D.P.; Methodology, R.A.P.; Software, R.A.P. and A.D.P.; Formal analysis, A.D.P. and S.S.P.; Resources, S.S.P. and A.D.P.; Writing—original draft preparation, A.D.P.; Writing—review and editing, R.A.P. and A.D.P.; Project administration, A.D.P. and S.S.P. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data presented in this study are available on request from the corresponding author.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

The training and test set classification results for various classifiers, which might be important for answering the importance of linear solver selection, are stated as follows.

References

- Lovell, A.; Saw, R.; Stimson, J. Product value-density: Managing diversity through supply chain segmentation. Int. J. Logist. Manag. 2005, 16, 142–158. [Google Scholar] [CrossRef]

- Tate, W.L.; Bals, L. Outsourcing/offshoring insights: Going beyond reshoring to rightshoring. Int. J. Phys. Distrib. Logist. Manag. 2017, 47, 106–113. [Google Scholar] [CrossRef]

- Ceniga, P.; Sukalova, V. Future of Logistics Management in the Process of Globalization. Procedia Econ. Financ. 2015, 16, 160–166. [Google Scholar] [CrossRef]

- Saldanha, J.P.; Tyworth, J.E.; Swan, P.F.; Russell, D.M. Cutting logistics cost with ocean carrier selection. J. Bus. Logist. 2009, 30, 175–195. [Google Scholar] [CrossRef]

- Prajapati, D.; Kumar, M.M.; Pratap, S.; Chelladurai, H.; Zuhair, M. Sustainable Logistics Network Design for Delivery Operations with Time Horizons in B2B E-Commerce Platform. Logistics 2021, 5, 61. [Google Scholar] [CrossRef]

- Meixell, M.J.; Norbis, M. A Review of the Transportation Mode Choice And Carrier Selection Literature. Int. J. Logist. Manag. 2008, 19, 183–211. [Google Scholar] [CrossRef]

- Song, D. A Literature Review, Container Shipping Supply Chain: Planning Problems and Research Opportunities. Logistics 2021, 5, 41. [Google Scholar] [CrossRef]

- Rodrigue, J.P. Chapter 5: International trade and freight distribution. In The Geography of Transport Systems, 3rd ed.; Routledge Publisher: London, UK, 2013; pp. 158–183. [Google Scholar]

- Achahchah, M. Transportation, Lean Transportation Management: Using Logistics as a Strategic Differentiator, 1st ed.; Taylor and Francis Group; Productivity Press: New York, NY, USA, 2018; Chapter 2; pp. 44–111. [Google Scholar] [CrossRef]

- Feng, B.; Li, Y.; Shen, Z.-J.M. Air cargo operations: Literature review and comparison with practices. Transp. Res. Part C Emerg. Technol. 2015, 56, 263–280. [Google Scholar] [CrossRef]

- Jung, H.; Kim, J.; Shin, K. Importance Analysis of Decision Making Factors for Selecting International Freight Transportation Mode. Asian J. Shipp. Logist. 2019, 35, 55–62. [Google Scholar] [CrossRef]

- Fallah, S. 11—Customer Service. In Logistics Operations Management; Farahani, R.Z., Razapour, S., Kardar, L., Eds.; Elsevier: Amsterdam, The Netherlands, 2011; pp. 199–218. [Google Scholar] [CrossRef]

- Bang, K.T.; Jang, H.H. An empirical study on the transport mode selection factors of Korean exporters -based on the control factor of manufacturing and logistics industry. J. Shipp. Logist. 2011, 69, 245–263. [Google Scholar] [CrossRef]

- Neumann, T. Comparative Analysis of Long-Distance Transportation with the Example of Sea and Rail Transport. Energies 2021, 14, 1689. [Google Scholar] [CrossRef]

- Bartulović, D.; Abramović, B.; Brnjac, N.; Steiner, S. Role of air freight transport in intermodal supply chains. Transp. Res. Procedia 2022, 64, 119–127. [Google Scholar] [CrossRef]

- Černá, L.; Zitrický, V.; Daniš, J. The Methodology of Selecting the Transport Mode for Companies on the Slovak Transport Market. Open Eng. 2017, 7, 6–13. [Google Scholar] [CrossRef]

- Patil, R.; Rahegaonkar, A.; Patange, A.; Nalavade, S. Designing an optimized schedule of transit electric bus charging: A municipal level case study. Mater. Today Proc. 2022, 56, 2653–2658. [Google Scholar] [CrossRef]

- Galindo-Pacheco, G.M.; Paternina-Arboleda, C.D.; Barbosa-Correa, R.A.; Llinás-Solano, H. Non-linear programming model for cost minimisation in a supply chain, including non-quality and inspection costs. Int. J. Oper. Res. 2012, 14, 301–323. [Google Scholar] [CrossRef]

- Tirkolaee, E.B.; Sadeghi, S.; Mooseloo, F.M.; Vandchali, H.R.; Aeini, S. Application of Machine Learning in Supply Chain Management: A Comprehensive Overview of the Main Areas. Math. Probl. Eng. Hindawi 2021, 2021, 1476043. [Google Scholar] [CrossRef]

- Beresford, A.K.C.; Banomyong, R.; Pettit, S. A Critical Review of a Holistic Model Used for Assessing Multimodal Transport Systems. Logistics 2021, 5, 11. [Google Scholar] [CrossRef]

- Vasilev, J.; Milkova, T. Optimisation Models for Inventory Management with Limited Number of Stock Items. Logistics 2022, 6, 54. [Google Scholar] [CrossRef]

- Tsolaki, K.; Vafeiadis, T.; Nizamis, A.; Ioannidis, D.; Tzovaras, D. Utilizing machine learning on freight transportation and logistics applications: A review. ICT Express 2022, 9, 284–295. [Google Scholar] [CrossRef]

- Singh, A.; Wiktorsson, M.; Hauge, J.B. Trends in Machine Learning To Solve Problems In Logistics. Procedia CIRP 2021, 103, 67–72. [Google Scholar] [CrossRef]

- Chang, C.H.; Thai, V.V. Shippers’ choice behaviour in choosing transport mode: The case of South East Asia (SEA) region. Asian J. Shipp. Logist. 2017, 33, 199–210. [Google Scholar] [CrossRef]

- Ballou, R.H.; Srivastava, S.K. Business Logistics/Supply Chain Management: Planning, Organizing, and Controlling the Supply Chain; Pearson Education India: Chennai, India, 2007. [Google Scholar]

- Zeng, A. Developing a framework for evaluating the logistics costs in global sourcing processes: An implementation and insights. Int. J. Phys. Distrib. Logist. Manag. 2003, 33, 785–803. [Google Scholar] [CrossRef]

- Santoso, S.; Nurhidayat, R.; Mahmud, G.; Arijuddin, A.M. Measuring the Total Logistics Costs at the Macro Level: A Study of Indonesia. Logistics 2021, 5, 68. [Google Scholar] [CrossRef]

- Davis, P. Incoterms® 2020 and the missed opportunities for the next version. Int. J. Logist. Res. Appl. 2021, 30, 1263–1286. [Google Scholar] [CrossRef]

- Vogt, J.; Davis, J. The State of Incoterm® Research. Transp. J. 2020, 59, 304–324. [Google Scholar] [CrossRef]

- Azzi, A. Inventory holding costs measurement: A multi-case study. Int. J. Logist. Manag. 2014, 25, 109–132. [Google Scholar] [CrossRef]

- Tony Arnold, J.R. Chapter 9—Inventory Fundamentals, Introduction to Materials Management; Pearson Prentice-Hall: Hoboken, NJ, USA, 2004; pp. 254–280. [Google Scholar]

- Deniz, B.; Karaesmen, I.; Scheller-Wolf, A. A comparison of inventory policies for perishable goods. Oper. Res. Lett. 2020, 48, 805–810. [Google Scholar] [CrossRef]

- Önal, M. The two-level economic lot sizing problem with perishable items. Oper. Res. Lett. 2016, 44, 403–408. [Google Scholar] [CrossRef]

- Biswas, S.; Bandyopadhyay, G.; Mukhopadhyaya, J.N. A multi-criteria based analytic framework for exploring the impact of Covid-19 on firm performance in emerging market. Decis. Anal. J. 2022, 5, 100143. [Google Scholar] [CrossRef]

- Xidonas, P.; Steuer, R. A multicriteria evaluation methodology for assessing the impact of COVID-19 in EU countries. Decis. Anal. J. 2022, 4, 100123. [Google Scholar] [CrossRef]

- Pujawan, I.N.; Bah, A.U. Supply chains under COVID-19 disruptions: Literature review and research agenda. Supply Chain Forum 2021, 23, 81–95. [Google Scholar] [CrossRef]

- Hossain, M.R.; Akhter, F.; Sultana, M.M. SMEs in Covid-19 Crisis and Combating Strategies: A Systematic Literature Review (SLR) and A Case from Emerging Economy. Oper. Res. Perspect. 2022, 9, 2214–7160. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).