This section discusses the results of the statistical and spatial analyses conducted. The discussion is organized around the three research objectives presented in the Introduction. The objectives addressed factors that influenced the positioning of logistics firms in the City of Cape Town municipality, the linkages of logistics firms with Cape Town International Airport, and the association between airfreight-related logistics firms and the general attributes of logistics firms in the municipality.

4.1. General Characteristics and Factors That Influence the Location of Logistics Firms

As reflected by the responses in

Table 2, logistics firms were involved in multiple economic activities. For the first category of responses, distribution or transportation topped the list with 20 responses, followed by warehousing and manufacturing with 15 and 10, respectively. The supplier of goods recorded nine responses, while the courier recorded the least with one response. For the second category, distribution or transportation dominated with eight, followed by manufacturing and suppliers of goods, each accounting for five. The findings in the first two categories reflect the close connection between logistics facilities and manufacturing acknowledged in the literature [

50,

51]. Showing the magnitude of this connection, it should be noted that the close-ended question on the questionnaire (see

Section 3.4) did not include the option ‘manufacturing’. However, manufacturing had to be separated from the ‘other’ category because many respondents mentioned that their firms were involved in manufacturing activities. Packaging dominated the third category with six responses, followed by courier with two responses. For the fourth category, couriers dominated with five, while suppliers of goods recorded one. Concerning the last category, suppliers of goods recorded five, while other activities did not have a record.

The size of logistics firms was analyzed using the number of employees as a proxy for size [

42,

62].

Table 3 shows that the majority (38.9%) of the firms had between 10 and 49 employees, which are regarded as small firms according to the guidelines set by the Republic of South Africa [

63]. Very small firms, those with between 5 and 9 employees, followed with 18.5%. The firms with between 50 and 99 employees (medium firms) and those with 100 or more employees (large firms) had 14.8% each. Micro firms, those with between 1 and 4 employees, represented the least proportion with 13.0%. The findings show that, despite the diverse activities of the establishments, most logistics firms were small.

Against the backdrop of the multiple activities of the logistics firms and the dominance of small firms, it was essential to ascertain the age of the firms concerning the year of establishment at the premises occupied during the study.

Table 4 indicates that most (25) of the respondent logistics firms were established at their premises between 2010 and 2019. This group was followed by those established between 2000 and 2009, with 15. Six logistics firms were established between 1990 and 1999, while four were established between 1980 and 1989. The findings reflect that most logistics firms were young, as they had recently located at the premises occupied during the study.

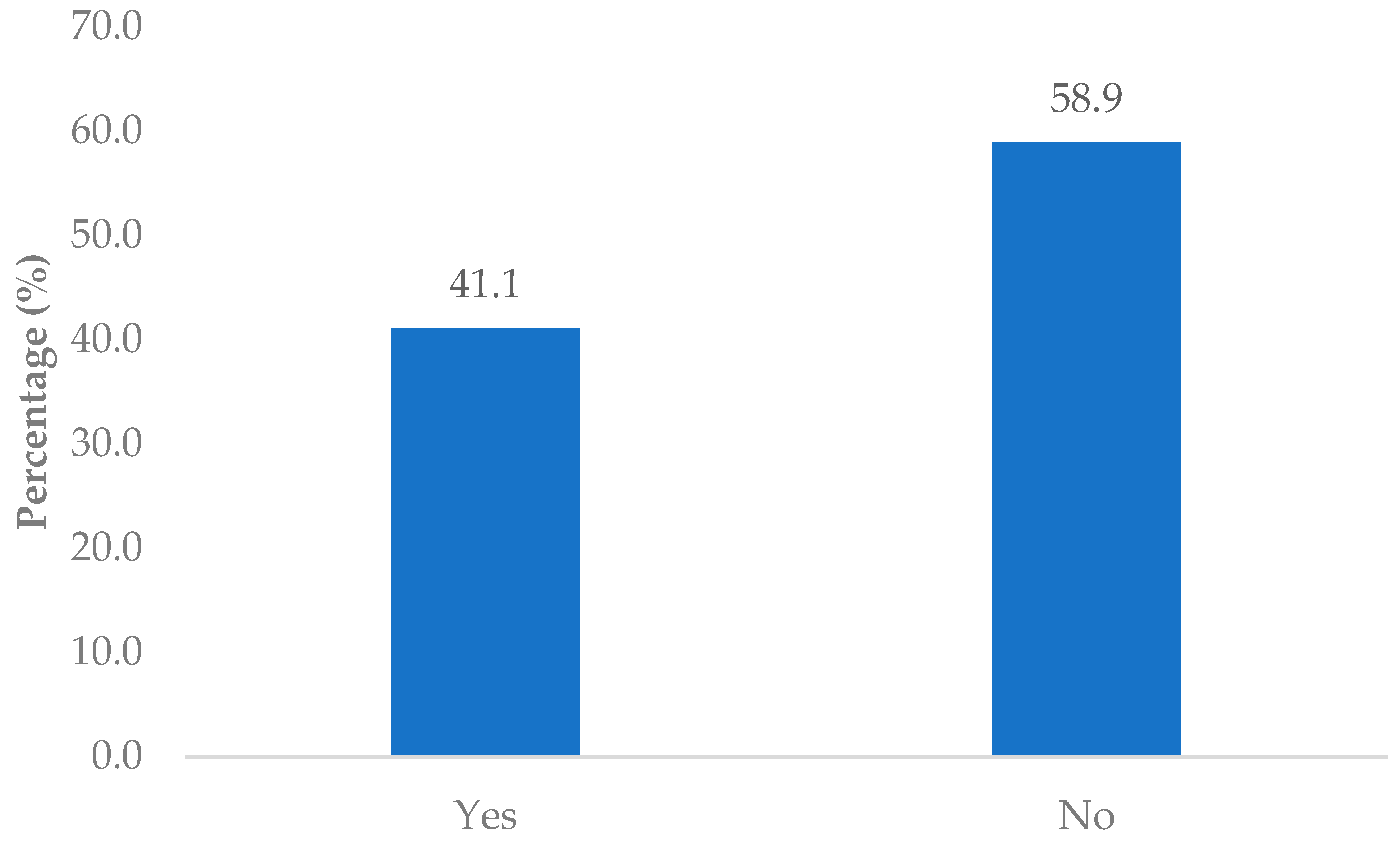

In light of the findings above that most logistics firms had located at their current premises relatively recently, it was essential to analyze the locational behavior of the firms. Regarding whether the logistics firms had always been located at the premises occupied during the study, 41.1% indicated so. In comparison, 58.9% reported that they had not always been located at their current premises (

Figure 5). This shows that although most logistics firms had recently located at the premises occupied during the study, they were not necessarily young overall, as some had relocated from elsewhere.

To ascertain the reasons behind the choice of location by the logistics firms, the respondents were asked two open-ended questions: (1) the reasons the company moved from the previous location for those who had not always been at their current premises; and (2) the reasons the company located at their current premises.

Figure 6 shows that the majority (10) of the logistics firms moved due to the previous premises being small and no longer meeting the requirements of the firms, followed by those who bought property or constructed their premises, with four. The rental of the previous premises being expensive and relocation due to COVID-19 accounted for one each.

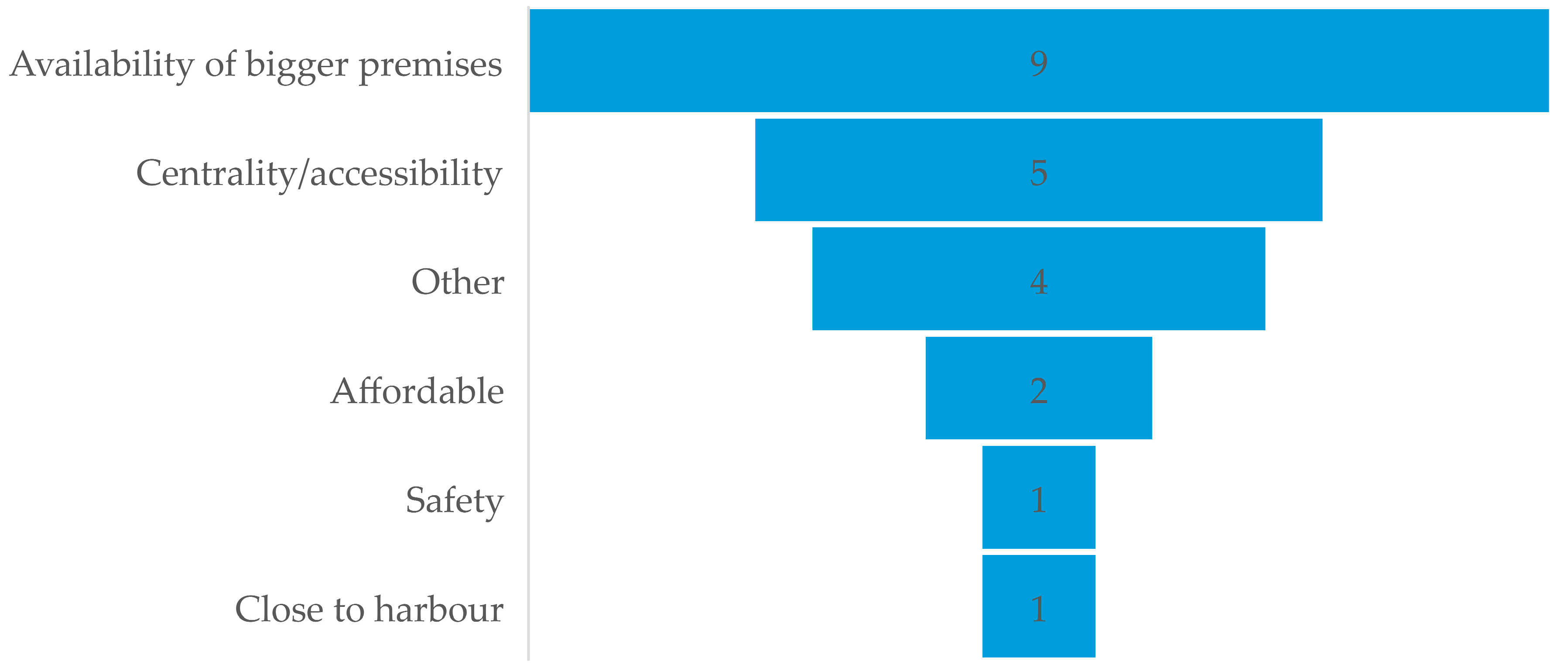

In addition to the ‘push’ factors presented above, it was equally essential to analyze the ‘pull’ factors that attracted the logistics firms. Reflecting the diversity of factors that influenced location-choice decisions of logistics firms [

37] and aligned with the reason for moving due to the insufficient size of the premises,

Figure 7 shows that the majority (9) of the logistics firms located in their current premises because of the availability of bigger premises. Showing the role of accessibility in the location choice of logistics firms [

37], the centrality or accessibility of the logistics firms’ premises was second with five responses. Relatedly, one logistics firm was located at its current location because of its proximity to the harbor. Notably, in response to an open-ended question, none of the firms explicitly mentioned CTIA as a factor that influenced location-choice decisions.

Given the importance of property-related considerations in the locational behavior of logistics firms, it was essential to analyze the ownership of the premises occupied during the study. This analysis could provide insight into the footlooseness of the logistics firms and, in part, ascertain the ability of the current premises to retain the firms. The literature notes that outsourcing logistics functions, among other reasons, has changed the property ownership structure from owning to leasing warehousing facilities, implying that logistics firms could respond quickly to internal and external demands to relocate or build new facilities [

49].

Figure 8 reflects that 39.7% of the logistics firms owned the premises they occupied, while the majority (60.3%) indicated that they did not own the premises. The findings show that the locational patterns of logistics firms mapped in the study could easily change because of possible relocations due to changing internal and external demands.

4.2. Linkages of Logistics Firms with Cape Town International Airport

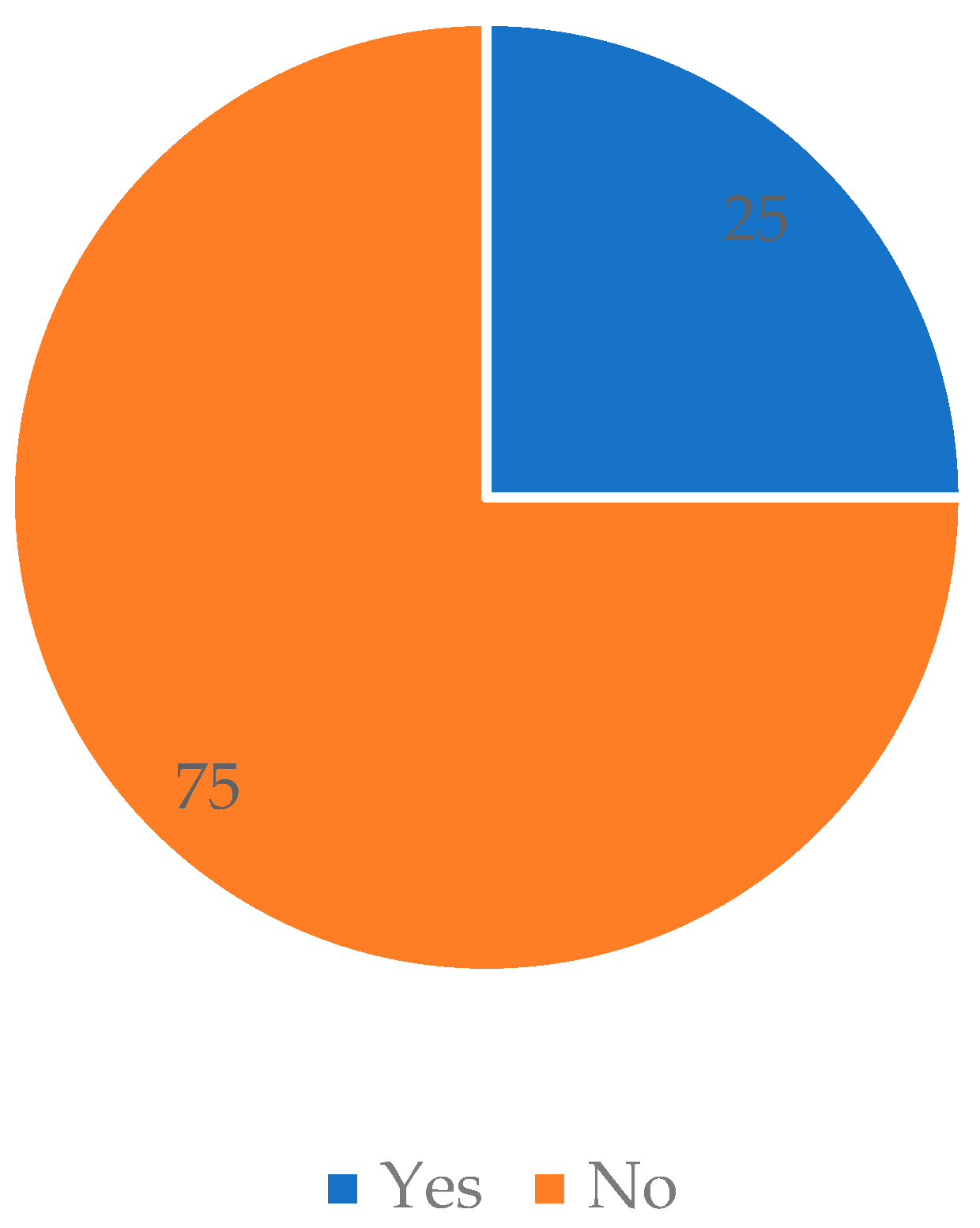

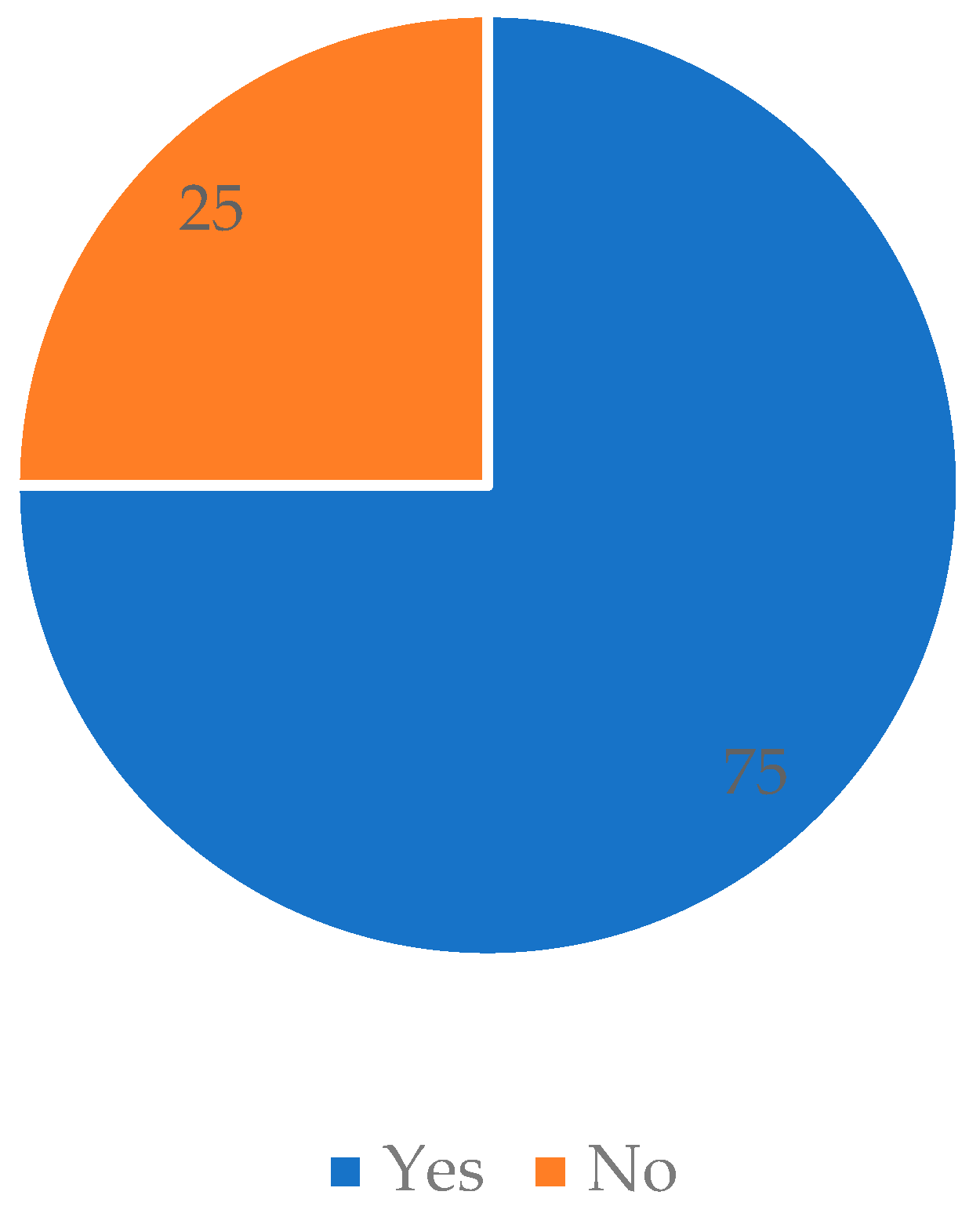

Despite the airport not being explicitly mentioned as a location-choice factor, it was essential to establish the linkages of the logistics firms with CTIA to address the second research objective and ascertain the airport’s catchment at a municipal scale. Sixteen logistics firms reported shipping or receiving cargo through CTIA, which translates to a quarter (25.0%) of the firms. The majority (75.0%) of the logistics firms in the City of Cape Town reported not shipping or receiving cargo through CTIA (

Figure 9). The findings show that logistics firms in the municipality predominantly used other modes of transport. The presence of the country’s second-busiest port, the Port of Cape Town, is noted in this regard (see

Section 3.1).

Figure 10 shows that the potential airfreight catchment of CTIA (at a municipal scale) extends to about a 20 km radius of the airport. Compared to the literature’s findings, the geographical extent of the potential metropolitan catchment of CTIA is small. Most firms that reported directly using the airfreight services were situated beyond a 10 km radius of the airport, with only two airfreight-related firms out of the 16 positioned within a 5 km radius. The results do not support the literature’s assertion that aviation-related businesses increasingly concentrate near airports. However, it is acknowledged that they may be positioned along transport routes that provide access to the airport [

28]. The findings also do not depict the logic of a radial network of logistics facilities around the airport [

14,

22]. Although there was no clear spatial pattern of the location of logistics firms concerning size, the two large logistics firms were located within a 10 km radius of CTIA (

Figure 10).

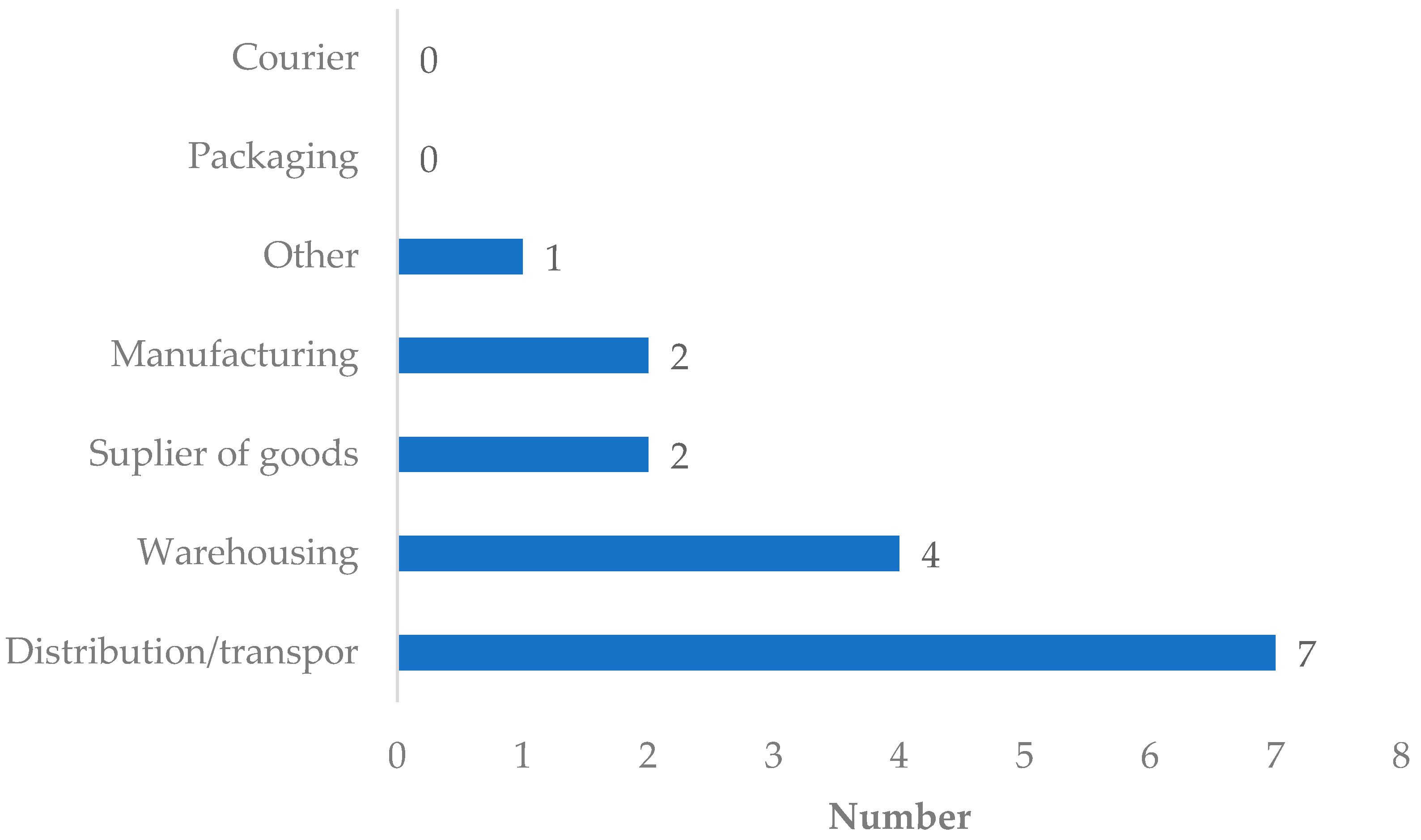

Of the 16 logistics firms that reported using CTIA, the majority (7) were involved in distribution or transportation activities, followed by those involved in warehousing, with four (

Figure 11). Manufacturing and suppliers of goods accounted for two logistics firms each. It is noted that the firms involved in courier activities did not report that they utilized the airport for airfreight purposes. This shows that such firms focused on parcel transfers within the municipality and region and were not responsible for the logistics of shipping parcels through the airport.

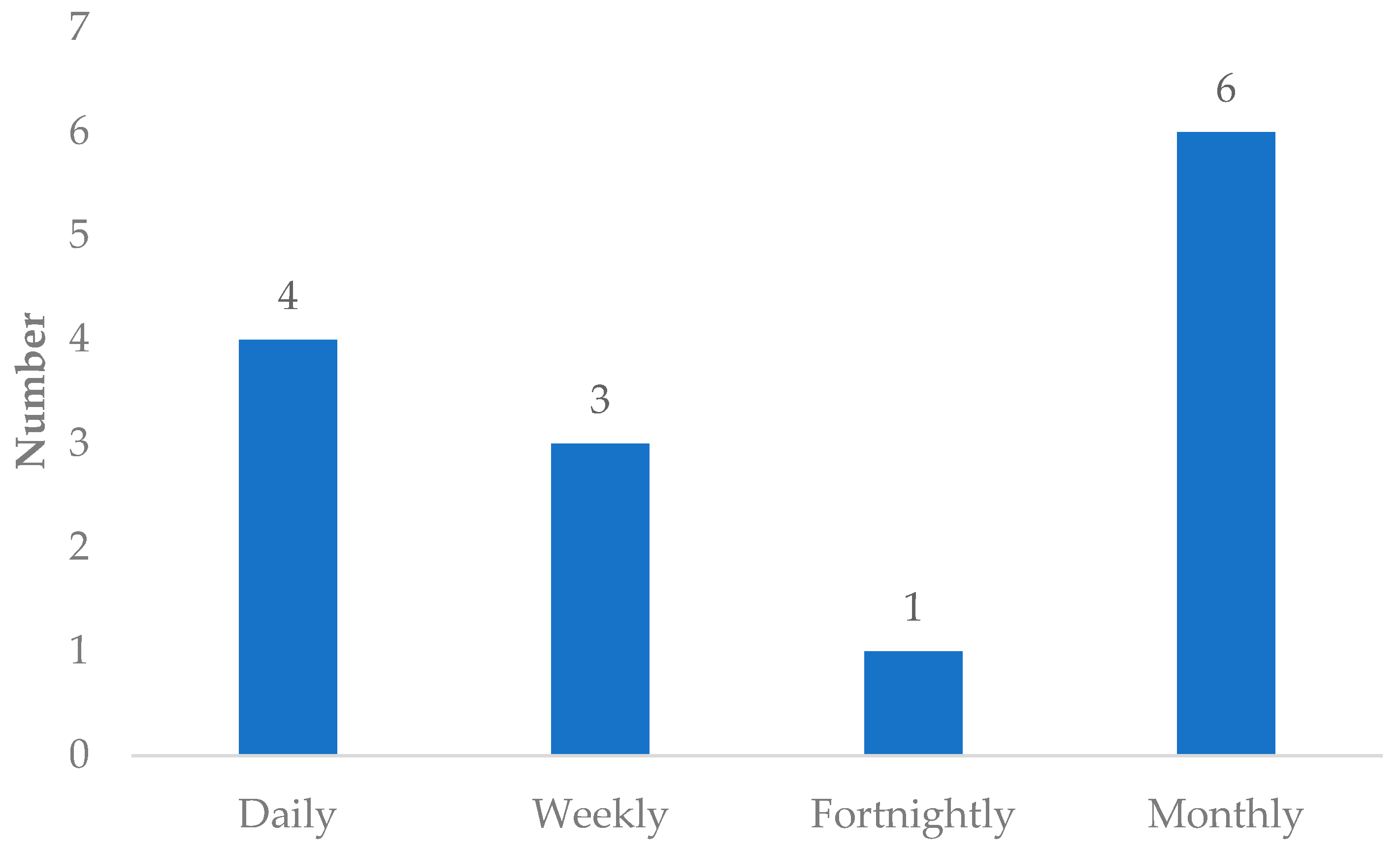

It was essential to go beyond merely identifying firms that used the airport and analyze the extent of its utilization. Six airfreight-related logistics firms reported shipping or receiving cargo through CTIA monthly (

Figure 12). These were followed by four firms that indicated they used the airport daily, and those that indicated weekly or fortnightly use of the airport recorded three and one, respectively. Reflecting the airport’s significance for the operations of logistics firms, the results show that airfreight-related logistics firms used airport cargo services frequently. Although, for a comprehensive dissection of the airport-relatedness of logistics firms, the survey questionnaire had a question on the quantity of cargo shipped through the airport, the respondent firms could not accurately provide that information; hence it was not included in the analysis.

4.3. COVID-19 Effects on Logistics Firms’ Operations

As the survey was conducted during COVID-19 lockdown restrictions, the respondents were asked whether their firms’ operations were affected by COVID-19.

Figure 13 indicates that the operations of three-quarters (75.0%) of the logistics firms were affected by COVID-19, and a quarter (25.0%) reported that their operations were unaffected by the pandemic. Although this study did not obtain further details of the impact of COVID-19, it has been reported elsewhere that factors that affected logistics firms during COVID-19 included labor shortage, a shortage of transportation capacity, a lack of safety, a disruption of the logistics network, a sharp drop in logistics demand, a change of service mode, disgruntled customers, and an increase in operating costs [

64,

65]. The findings that a quarter of the firms were unaffected by COVID-19 can, to some extent, be supported by Atayah et al. [

66], who found that some logistics firms performed well during the COVID-19 pandemic period compared to the prior 10 years.

4.4. Association between Airfreight-Related Logistics Firms and the General Attributes of Logistics Firms in the City of Cape Town

Table 5 shows that the Fisher’s Exact Test

p-value was 1.000, which was insignificant,

p > 0.05. Therefore, there was no significant association between whether a logistics firm owned the premises it occupied and whether it shipped or received cargo through CTIA.

Table 6 shows that the Fisher’s exact test

p-value was 1.000, which was insignificant,

p > 0.05. Therefore, no significant association existed between when a logistics firm was established and whether it shipped or received cargo through CTIA.

Table 7 shows that the Fisher’s exact test

p-value was 0.231, which was insignificant,

p > 0.05. Therefore, there was no significant association between whether a logistics firm had always been located at the current premises and whether it shipped or received cargo through CTIA.

Table 8 shows that the Fisher’s exact test

p-value was 0.748, which was insignificant,

p > 0.05. Therefore, there was no significant association between the company’s size and whether it shipped or received cargo through CTIA.

Table 9 shows that the Fisher’s exact test

p-value was 1.000, which was insignificant,

p > 0.05. Therefore, there was no significant association between whether a logistics firm was affected by COVID-19 and whether it shipped or received cargo through CTIA.