1. Introduction

Credit risk refers to the possibility of credit-related events, which include defaults and migrations of credit ratings. After the financial crisis in 2008 and European debit crisis in 2010, credit migration risk has attracted more attention. Credit migration is a change in an issuer’s creditworthiness from one credit rating category to another. For example, at the onset of the European debit crisis, Greece’s sovereign credit rating was downgraded from an initial rating of “A” to “BBB” and subsequently, to “BB” or even lower. Investors holding Greek bonds experienced a decline in the value of their investments due to the increased credit risk and the credit ratings of other European countries were also affected due to broader concerns about the stability of the eurozone. Indeed, the credit migration risk has a great impact on the financial market, not only affecting confidence in the market but also affecting the value of financial products.

There have been some studies on the transformation of credit ratings, which can be traced back to the reduced form method. In detail, Jarrow, Lando and Turnbull [

1] were the first to apply a Markov chain, and they adopted a transfer intensity matrix to capture the credit migration process. This reduced-form approach is developed naturally (see Arvanitis et al. [

2], Hurd and Kuznetsov [

3], Lando [

4], Thomas et al. [

5], Nguyen [

6], Chen et al. [

7] and so forth). The transfer intensity matrix is usually derived from general statistical data and mainly reflects the impact of macroeconomic factors on credit rating. However, the firm’s features, such as its financial status, play a key role in credit rating migration.

Liang et al. [

8,

9] took a firm’s asset value or capital structure as the major determinant of credit migration using the structural method. In detail, Liang and Zeng [

8] built the first structural model to price bonds with credit migration, in which a given credit migration boundary divides the asset value into high- and low-rating regions. Further, Hu, Liang and Wu [

9] governed the credit migration boundary via the liability–asset ratio rather than giving it directly, and they deduced a credit migration problem with a free boundary. However, setting a strict threshold in the structural model may lead to an infinite number of credit rating migrations under the assumption that the asset values follow a geometric Brownian motion. This is because Brownian motion crosses any level an infinite number of times in any time interval. Chen and Liang [

10] and Liang and Lin [

11] introduced a buffer zone to overcome this shortcoming in the free-boundary model [

9] and the fixed-boundary model [

8], respectively. That is, they set a pair of asymmetric thresholds for credit rating migration: one threshold for upgrades and the other slightly different threshold for downgrades. Compared to models with a strict threshold, those with asymmetric thresholds represent a significant improvement as they limit the frequency of credit rating transitions. All the models in [

8,

9,

10,

11] bifurcate credit ratings into two categories: high rating and low rating.

In reality, there are more than two ratings for firms’ credit. Rating agencies use a wide range of scales; for instance, Standard and Poor’s divides credit ratings into several letter grades ranging from “AAA” (the highest credit rating) to “C” (the lowest credit rating). For applications, it is necessary to consider structural models for credit migration in cases with multiple credit ratings. For the strict threshold model in [

9], Wu and Liang [

12] extended this to the case with three rating regions and suggested a general form for multi-credit-rating models. However, there has not yet been a multirating form proposed for the asymmetric threshold model. In fact, this form may have a more complex multirating structure as the downgrade threshold and upgrade threshold are different. To fill this research gap, we aim to define a well-posed multi-credit-rating model with asymmetric thresholds. We confirm the mathematical theory for the corresponding PDE problem to ensure the rationality of this kind of model and solve the problem in numerical schemes to show the different structures of models for different parameters of asymmetric boundaries. As a first attempt, we focus on the fixed-boundary problem in this paper.

Specifically, this article improved the model in [

11] to the level of that with multiple credit ratings. First, we divide the firm’s value into low-, medium- and high-rating regions using two pairs of asymmetric boundaries within a proper order. Thus, a buffer zone is introduced between each pair of asymmetric boundaries, in which the credit rating maintains its status. Then, we derive a system of partial differential equations with several overlaps. For the existence of the solution, we construct convergence sequences by using a method of monotonic iteration. As a significant difference with [

11], it is necessary to construct two sequences converging towards the solution on the intermediate-rating region (i.e., the medium rating in the three-rating model), for a complete iterative loop. And we prove the uniqueness of the solution by contradiction with more branches than [

11]. Finally, the general multirating problem with asymmetric migration boundaries is obtained. This kind of model has more types of structures than the original multirating model in [

12], which is mainly reflected in the aspect of buffers, due to the flexible asymmetric boundary settings. As far as we know, this is the first time that the asymmetric model with multiple ratings has been studied, which guarantees the model’s rationality and indicates its potential advantage in real-world settings.

The structure of this paper is as follows. In

Section 2, the relevant literature is reviewed. In

Section 3, we establish an asymmetric threshold model with three ratings, and derive a PDE system. In

Section 4, by constructing monotonic sequences, we prove the existence of the solution to this problem. In

Section 5, the uniqueness of the solution is confirmed via contradiction.

Section 6 presents the numerical results for different parameters of asymmetric boundaries and conducts a real parameter calibration.

Section 7 shows the form of general multirating models.

Section 8 constitutes the conclusion and discussion.

2. Literature Review

The first structural model on credit risk could be traced back to Merton [

13], which focuses on the default. In Merton’s model, the firm’s asset value was assumed to follow a geometric Brownian motion and a default would be triggered if the asset value fell below the debt at maturity. Thus, the corporate debt was a contingent claim of the asset value. Black and Cox [

14] extended this model to allow the default to occur before maturity as long as the asset value dropped below a given threshold. For further research on structural models of defaults, see also Leland [

15], Longstarff and Schwartz [

16], Leland and Toft [

17], Briys and deVarenne [

18] and so forth. In addition to the default, the phenomenon of credit rating migration has also been analyzed, such as the stability and dependencies of rating transitions (Carty [

19]; Nickell et al. [

20]), non-Markov effects in rating drifts (Altman and Kao [

21] and Lando and Skødeberg [

22]), implied migration rates (Albanese and Chen [

23]), etc. As for the valuation of credit migration risk, Liang et al. [

8,

9] pioneered the adoption of structured models, subsequently followed by a series of further studies, while the reduced-form model is another important method [

2,

3,

4].

Under the framework of the structural model with a strict credit migration threshold, some studies have concentrated on model extension, theoretical exploration, empirical analysis and so forth. For instance, Wu et al. [

24] extended the free-boundary model in [

9] by permitting defaults to occur at any time up to maturity, while Li et al. [

25] proved the convergence and error estimates of a finite difference scheme for this model. Lin and Liang [

26] identified the credit migration boundaries empirically by pricing long-term corporate bonds in the U.S. financial market. And another crucial extension for applying the strict threshold model is to transition it from the simplicity of two-tiered ratings to a more general multirating scenario. Wu and Liang [

12] extended the model in [

9] to the multirating case, and Wang et al. [

27] studied the asymptotic traveling-wave solution for the new model using an inductive method to overcome the multiplicity of free boundaries. Yin et al. [

28] considered a multirating model with a stochastic interest rate based on the model in [

29].

In the form of a structural model with a pair of different upgrade and downgrade thresholds, Chen and Liang [

10] investigated the free-boundary problem, while Liang and Lin [

11] explored the fixed-boundary one. Liang and Lin [

30] presented more theoretical results primarily on the traveling-wave solution with a buffer zone. However, there is a research gap concerning the multirating scenarios for the asymmetric threshold model. It is imperative to proffer a general form of multirating asymmetric model and establish its well-posedness, which serves as the basis for further theoretical research and the practical applications of the model. In this paper, we begin to explore the asymmetric threshold model with multiple ratings, focusing on the fixed-boundary problem as the first step.

4. Existence

In this section, we prove the existence of solutions to the PDE problem (

7). It is not a general semi-unbounded problem or a Dirichlet problem, since the value of the solution on the boundaries is not given. We use a monotonic iterative method, which is a generalization from [

10,

11]. In detail, starting from

and

, we successively construct the sequences

which are decreasing with

k. Sending

, we obtain the limit as a solution.

4.1. Monotonic Sequences

We first define the sequences via induction and then show that the sequences are monotonic. Define the operator , and the domains , and . Suppose is an integer.

- Step 1.

Define

as the solution of

This is a general semi-unbounded problem for a diffusion equation in , and the solution satisfies the compatibility conditions. It has a closed-form solution and .

- Step 2.

Define

as the solution of

Since is solved, the value of on the boundary is already known. Thus, such a Dirichlet problem in generates a solution .

- Step 3.

Assuming are known, could be defined via induction.

is defined as the solution of

is defined as the solution of

is defined as the solution of

is defined as the solution of

This completes the construction of the sequences

that satisfy

Remark 5. It is necessary to build two sequences and towards to form an iterative loop. The establishment of the existence of solutions to the general multirating problem follows the same rule; two iterative sequences need to be constructed for the solution function on the intermediate-rating region.

Lemma 1. The sequences are monotonically decreasing with a lower bound; in fact, for each , Consequently, for each or , there are the limits Proof. The main idea of the proof is to take the maximum principle and comparison principle (e.g., see [

34]) repeatedly.

First, we show

in

and

in

. For a semi-unbounded problem (

8), using the maximum principle gives

. Thus,

for

. For the Dirichlet problem (

9), using the maximum principle, we obtain

Therefore,

for

. It follows that

in

according to the maximum principle. Given that

, we have

for

. Noting that

and

, using the comparison principle, we find

Further,

in

. Hence,

. Combining with

yields

Then, we make an inductive assumption that in , in .

On account of the iterative relationships

and

, we obtain

for

. And considering that

, using the comparison principle, we obtain

Combined with in , we have in .

Also, the iterative conditions

and

imply

. Appling the comparison principle shows that

From this, we deduce that

Combined with

, it follows that

Noting (

13), we conclude that

in

.

According to the comparison principle,

From Equations (

13)–(

16), we can see that the induction argument for the monotonicity of the sequences is completed.

Similarly, via induction, we can derive that for each , . □

Lemma 2. and defined by (

10)

form a solution for the PDE problem (

7).

Proof. I. in , in , and in .

Based on interior estimates of parabolic differential equations, it is easy to obtain that any finite derivative of is uniformly bounded for in any interior neighborhood of for . Thus, we can deduce that is infinitely differentiable within its region and satisfies the corresponding equation.

II. and satisfy the initial and boundary conditions.

For any

,

, hence it is obvious that

Since

for all

, as

, we obtain

□

4.2. Existence

Lemma 2 gives the following existence result:

Theorem 1 (Existence).

Problem (

7)

admits a solution that satisfies 5. Uniqueness

We use the maximum principle to prove the uniqueness of the solution of problem (

7). Since the asymmetric boundary of each region is inside another region, the solution of each region cannot obtain the maximum or minimum value on the boundary.

Theorem 2 (Uniqueness).

The solution of problem (

7)

is unique. Proof. It suffices to show that the following equation has solutions only for zero functions.

We first show that in . If not, there is a point which is denoted by in such that . According to the maximum principle, the maximum value of in , represented by , must be taken at the boundary. Since at , there must be a point on , denoted by , such that .

Clearly, . From the maximum principle, the maximum value of in , represented by , must be taken at the boundary. Since at , there must be a point on , denoted by , such that , or a point on , denoted by , such that .

If the former holds, then

Since

, we also see that

contrary to (

18).

If the latter is true, then

. Using the maximum principle, the maximum value of

in

, represented as

, must be taken at the boundary. Since

at

, there exists a point on

, denoted by

, such that

. It follows that

As

, we have

which is a contradiction.

Next, we can prove that in in the same manner. It follows immediately that in .

Similarly, we have in and in . □

6. Numerical Results

We used an explicit difference scheme to calculate and present the results in figures. The parameters we chose as examples are listed in the figure captions.

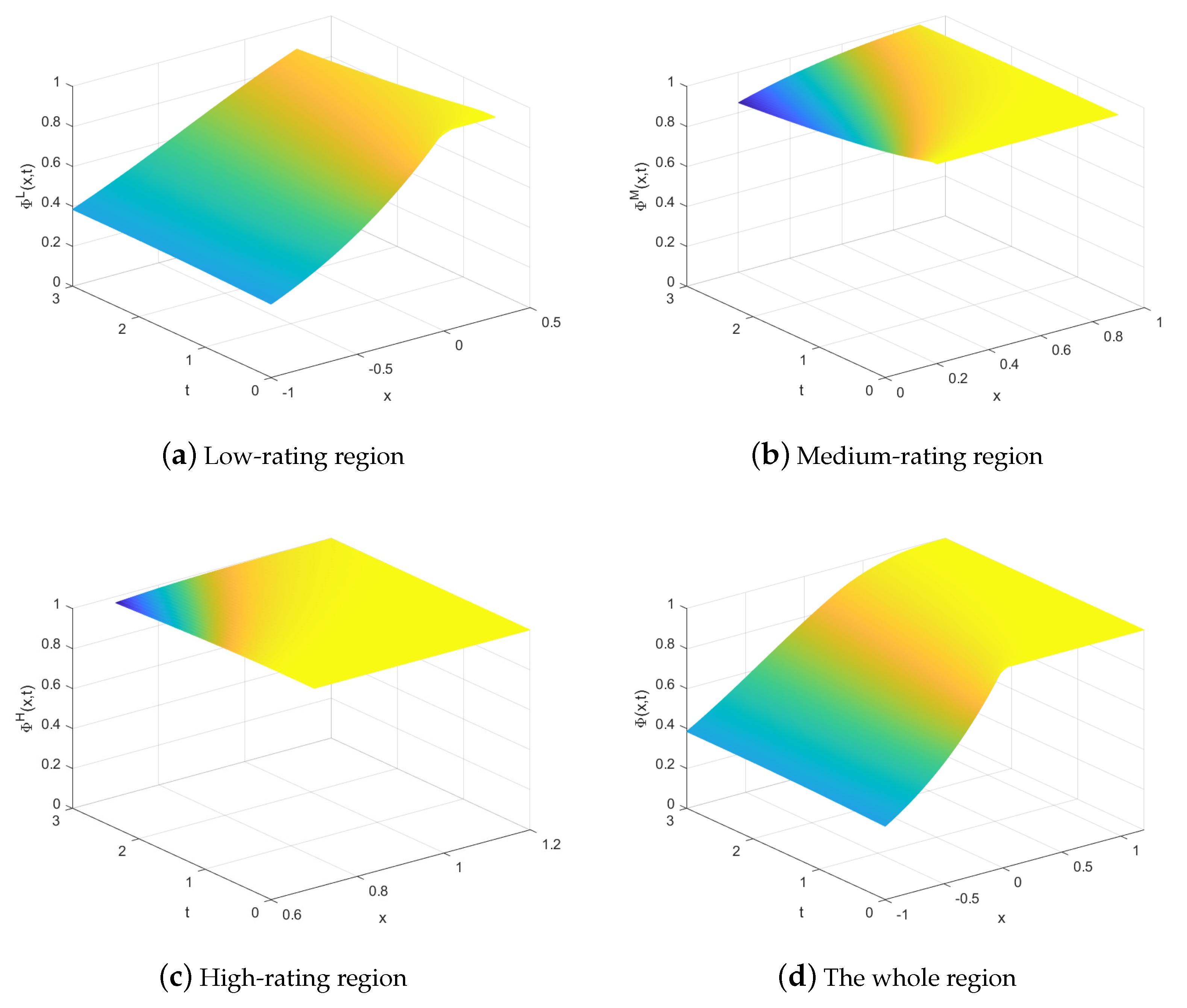

Figure 1 shows the bond value functions on different rating regions.

Figure 1a–c depict the function images on the low-, medium- and high-rating regions that correspond to the domains

,

and

, respectively. The function image on the lower-rating region exhibits greater variation with respect to

x, which implies that lower-grade bonds are more affected by the asset value. Note that

Figure 1d displays the overall shape of the function graph across the entire region. In fact, there is an overlapping area between every two adjacent rating regions, forming a buffer zone for credit rating migrations where the credit rating maintains its original status. The overlap of the low-rating and medium-rating regions is confined in the range of

, while that of the medium-rating and high-rating regions is restricted within the interval

. In these overlaps, the graphs of the functions effectively consist of two layers, and the differences between these layers are depicted in

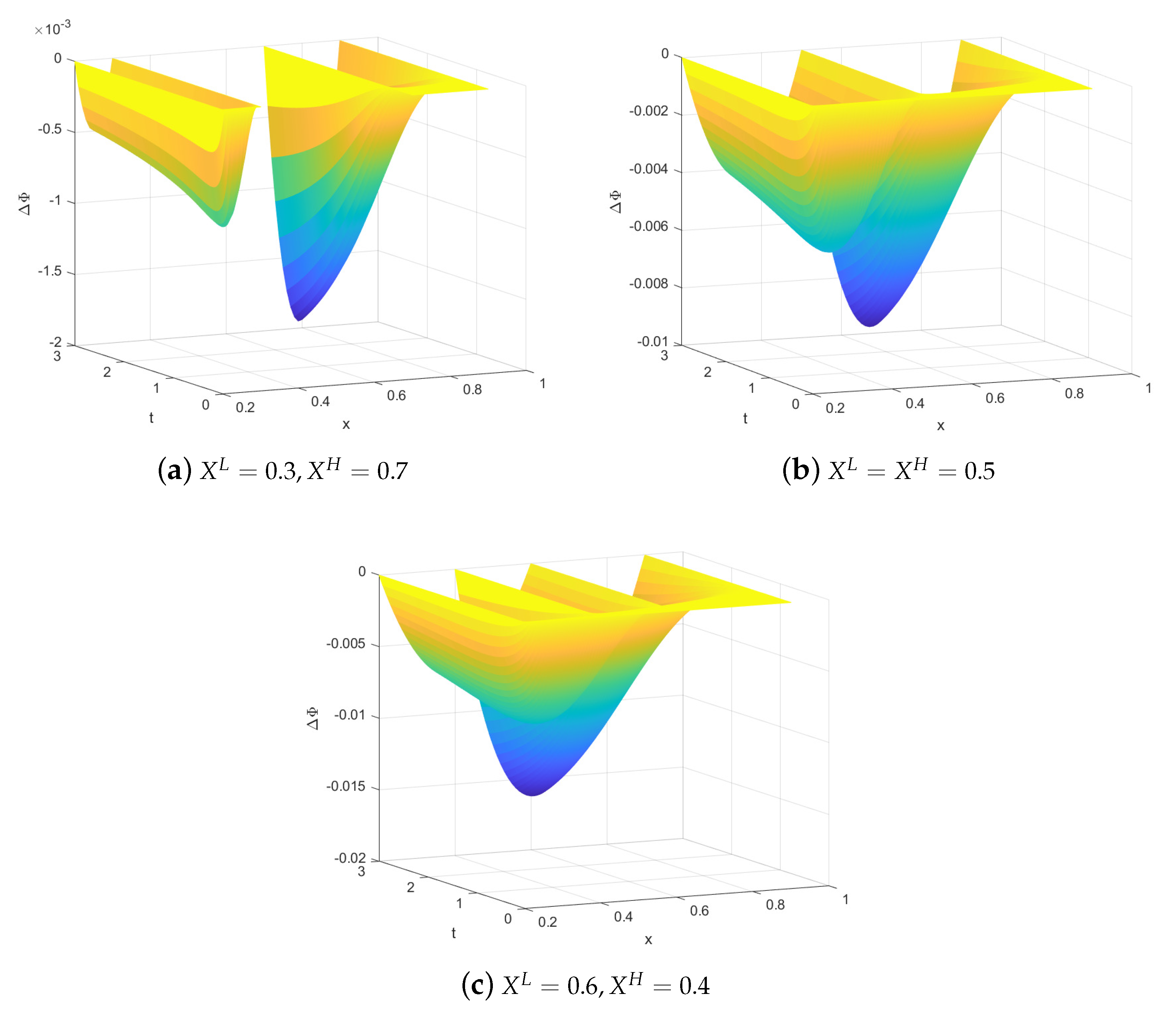

Figure 2.

We can see the differences are negative, except at zero on the boundaries in

Figure 2, which means that the price of higher-grade bonds exceeds that of lower-grade bonds in the buffer zone, although the gap is not huge.

Figure 2a–c were prepared based on three groups of different asymmetric boundary parameters, respectively. From

Figure 2a with

, the low–medium overlap and the medium–high overlap are separate. In

Figure 2b with

, the two overlaps are connected on

. In

Figure 2c with

, the function images on the two overlaps are crossed together. Indeed, the two overlaps have a common part, the low–medium–high overlap

, where the credit rating of bonds may fall into any of the three categories: low, medium or high. Conclusively, each set of parameters represents a kind of theoretically meaningful configuration of asymmetric boundaries:

,

or

. The flexibility in boundary settings leads to various structures in the buffer zones for the multirating model with asymmetric boundaries, which contributes to identifying different types of credit migration phenomena.

The above numerical results are calculated by employing example parameters. We now explain how to carry out a real parameter calibration in the model by taking the Walt Disney Company (DIS) as an example. The calibration method we use is similar to that of Liang and Lin [

11], albeit more intricate, as we need to calibrate more migration boundary parameters and volatility parameters than the two-rating case.

We analyze the DIS from 15 October 2001 to 12 March 2019. During this interval, the DIS underwent four credit rating migrations on the dates highlighted in

Table 2, considering “A−” and “BBB+” as the low rating, “A” as the medium rating and “A+” as the high rating. The thresholds for downgrades and upgrades,

,

,

and

, are the asset values at the time when the credit rating changes, which can be approximated by the sum of the market capitalization and the book value of the total liabilities. The face value of debt

F is represented by the average of total liabilities reported in the balanced sheet during this interval. Thus, we can obtain the transformed thresholds,

,

,

and

, by

. The asset return volatility in different ratings,

, can be obtained from historical equity volatility

over the correspond interval using the relationship formula

, where

denotes the market value of equity at time

t. For the details of this formula, we refer to [

11]. Moreover, we substitute the risk-free interest

r by the ten-year Treasury yield.

Table 3 presents the final parameter calibration results, which belong to the asymmetric boundary type of

. This calibration can provide a benchmark parameter estimation for the multirating model as a first step, and we leave the complete empirical analysis to future research.

7. General Form for Multi-Credit-Rating Model

The establishment and analysis of the three-rating model show that it shares characteristics and properties with the general multirating model. Based on this, it is not difficult to extend the three-rating model to a general multirating form. The problem with

N credit ratings becomes

with the operator

and

as the bond value in the

ith rating for

,

N. Note that the difference between the operator

defined in

Section 4 and the one defined here is that

i in the former is equal to

, and

i in the latter is in the range from 1 to

N.

Correspondingly, there are

N volatility values

and

pairs of asymmetric migration boundaries: one group for downgrades

and the other group for upgrades

And asymmetric boundaries between adjacent ratings satisfy

We summarize the meaning of all symbols in the PDE problem of (

22) in

Table 4.

We can see that the multirating model has various structures on the buffers, resulting from various order relations of the migration boundaries that only need to satisfy inequalities (

23)–(

25).

Although problem (

22) has more boundaries and overlapping regions than problem (

7), the existence and uniqueness of the solution can still be obtained using the previous methods in addition to requiring more argument steps. For the uniqueness, we now need to construct the sequence

via monotonic iteration. And the argument about the uniqueness by contradiction needs to be divided into more branches as the number of credit ratings increases.

8. Conclusions and Discussion

In this paper, we studied a multi-credit-rating migration model with asymmetric migration boundaries. This research extends the work of Liang and Lin [

11], who only considered two credit ratings; this study thus aligns with the finer delineation of credit ratings seen in the real world. By arranging the order of asymmetric boundaries suitably, a model with three ratings was established in a meaningful manner. A problem in the PDE system was derived, and the existence, uniqueness and regularity of the solution for the problem were obtained, which verified the rationality of the model further. The model featured two buffer zones, one for the migration between low rating and medium rating, and the other for the migration between medium rating and high rating. Due to various asymmetric boundary settings, these two buffers exhibited three possible positional relationships: separated, connected and intersected, as evident in the numerical results. The establishment and analysis of the three-rating model showed that it shared common characteristics with the general multirating model. Consequently, we readily presented the general form of a multirating model and asserted that the relevant theoretical results were valid in that model as well.

Our work may lay a valuable foundation for the asymmetric fixed-boundary problem with multiple ratings in theory. And the model has the potential for applications in practice. For instance, firstly, the multirating model adapts to the reality that the company’s credit is labeled with several ratings, such as from “AAA” to “C” according to Standard & Poor’s classifications. Secondly, the asymmetric boundaries can be flexibly configured to accommodate various types of issuers with different risk features, primarily manifested in different structures of the buffer zones. The Walt Disney Company, for which we calibrated parameters, corresponds to one of these types. In a word, the model enhances the previous existing models in which the credit changes between two ratings with asymmetric thresholds [

11] or multiple ratings with strict thresholds [

12]. Furthermore, the asymmetry threshold model can describe the deadband and backlashlike hysteresis in engineering, and the model we proposed is suitable for their multistate scenarios.

As an initial attempt, in this paper, we concentrated on the multirating form of an asymmetric threshold model with fixed boundaries, where the asset value served as the determinant of the credit migration. In fact, it is more reasonable to drive the migration in credit ratings according to the liability-to-asset ratio, which produces a free boundary. A potential avenue for future research involves extending the free-boundary model with asymmetric thresholds in [

10] to a multirating form. On the other hand, a constant interest rate was assumed in our model, while the interest rate is a stochastic process [

35,

36,

37]. Therefore, considering a multirating model with both asymmetric migration thresholds and stochastic interest rates is worthwhile in future research.