1. Introduction

For many corporations and financial institutions, basket options are an important tool in managing currency exposures. In this article, we derive new results relating the prices of currency basket options to the prices of standard currency option contracts. The need for basket options arises naturally in practice. For example, a company that purchases products from a variety of countries may be exposed to changes in the value of a basket of currencies against its home currency. In seeking to manage its foreign currency exposures, the company could use individual options on each foreign currency separately. But this way would be inefficient when the value changes in one currency are offset by the others to which the company is also exposed. Basket options whose payoffs are based on multiple currency pairs are traded as alternative instruments to manage currency exposures more effectively.

A number of pricing models have been proposed to price and hedge basket options after careful calibration to market prices of options on individual underlying assets. (Although the analytical formula for basket options is unattainable, there exist a number of numerical techniques for pricing and hedging them, for instance, Ashraff, Tarczon and Wu (1995) [

1] for a variance-minimizing hedge; Ju (2002) [

2] for the method of characterization functions; Brigo, Mercurio, Rapisarda and Scotti (2004) [

3] for the moment-matching approach; Pellizzari (2005) [

4] for Monte–Carlo simulation; Caldana et al. (2016) [

5] for the valuation bounds on basket options for a general class of continuous-time financial models; Bae (2019) [

6] for pricing compound basket options.) On the one hand, a wide spectrum of parametric models are available to practitioners. Bates (1996) [

7] presents a stochastic volatility jump-diffusion model to explain the skewness and excess kurtosis implicit in currency option prices. Bollen, Gray and Whaley (2000) [

8] suggest a regime-switching model and document that the market prices of currency options do incorporate some regime-switching information. Daal and Madan (2005) [

9] propose a pure jump model, termed the variance-gamma (VG) model, to capture large movements in exchange rates. Recently, Carr and Wu (2007) [

10] and Bakshi, Carr and Wu (2008) [

11] develop stochastic skew models to generate both stochastic volatility and stochastic skewness which are documented in currency options. On the other hand, some researchers are interested in copula theory. A copula function is used to construct multivariate density distributions in order to be consistent with the market prices of traded assets. Both Cherubini and Luciano (2002) [

12] and Rosenberg (2003) [

13] propose approaches to price basket options with two underlying assets through copula functions.

However, these models are easily mis-specified, because of little information about which is the correct model. A pricing model delivers the precise and fair price for a basket option, only if this model is the true representation of reality. As a result, the method of model building in turn introduces an uncertainty in the choice of model. In this article, we tackle the problem of pricing currency basket options from a different perspective. Rather than using a single parametric model, we consider a set of pricing models that are consistent with the observed prices of traded assets. The aim is to derive model-independent price bounds on currency basket options.

More specifically, a set of currency options is identified as hedging instruments. These assets provide a wide range of hedging strategies for investors. The underlying argument is that vanilla options determine the marginal risk-adjusted probability density of exchange rates, but they do not determine either the complete terminal density or the dynamics of exchange rates. Fitting a model to the prices of vanilla options and using the model for designing a dynamic hedge are subject to errors. Also, it is difficult to perfectly hedge a basket option using option portfolios. These concerns make super-replicating strategies useful. These trading strategies have the appealing features of model independence and simplicity, and they require only static positions in hedging instruments at inception. (The method of super-replication in incomplete financial markets can be linked back to the early studies of Kramkov (1994) [

14] and EI Karoui and Quenez (1995) [

15].)

Lamberton and Lapeyre (1992) [

16] first suggest that basket options could be hedged using portfolios of underlying assets. Bertsimas and Popescu (2002) [

17] investigate the super-replication of financial derivatives, including basket options and other exotics. Given the knowledge about the moments of return distributions or the prices of relevant hedging assets, they propose a convex optimization method to derive valuation bounds on complex financial derivatives. This method is closely related to the techniques developed by Gotoh and Konno (2002) [

18], who propose an efficient algorithm to deal with semidefinite programmes in order to attain valuation bounds on basket options.

D’Aspremont and EI-Ghaoui (2003) [

19] and Pena, Vera and Zuluaga (2006) [

20] apply the linear programming (LP) approach to price basket options and suggest that valuation bounds on these options can be derived from the prices of other relevant basket options. Laurence and Wang (2005) [

21] investigate the relation between pricing and hedging basket options. In these three papers, valuation bounds on basket options with two underlying assets may be expressed analytically. In particular, Laurence and Wang (2005) [

21] assume that there is only one strike for each individual option.

In Hobson, Laurence and Wang (2005a, 2005b) [

22,

23], the arbitrage bounds on basket options in a general setup are derived using portfolios of options on individual underlying assets with the number of

. These studies extend the results of Laurence and Wang (2005) [

21] when traded options are available at a continuum of strike prices. In the first paper, they use a Lagrange optimization approach to characterize the optimal strikes. A super-replicating strategy that enforces an upper bound is simply a linear combination of European call options. To support upper price bounds, underlying asset processes must be comonotonic. In the second paper, they construct the so-called “STP” portfolios to sub-replicate basket options. Countermonotonic underlying processes yield lower price bounds. Chen, Deelstra, Dhaene and Vanmaele (2008) [

24] construct static super-replicating strategies for a class of exotic options written on a weighted sum of asset prices, including Asian options and basket options, among others. Based on the theory of integral stochastic orders, they provide a characterization for the optimal strikes, which is different from the methodology proposed by Hobson, Laurence and Wang (2005a) [

22].

Slightly different from the setup in Hobson, Laurence and Wang (2005a, 2005b) [

22,

23], this study explores the arbitrage valuation bounds of currency basket options in the presence of both cross-currency options and individual options quoted in a dominant currency. In terms of pricing basket options on three currencies (i.e., the Euro, British pound and U.S. dollar), we make use of the facts that (i) there typically exist deep and liquid markets in these three currency pairs; (ii) the prices of cross-currency options are actually attainable (by contrast such options are usually unavailable in equity markets); and (iii) the prices of these options carry useful information about the joint distribution of underlying currencies. We find that the valuation bounds on currency basket options could be further tightened when the cross-currency options are incorporated. These valuation bounds are also enforced by static portfolios of both cross-currency options and options denominated in the numeraire currency.

This article is organized as follows.

Section 2 introduces the setup. The properties of both the marginal and joint densities of underlying currency pairs are discussed.

Section 3 presents main results.

Section 4 provides a numerical analysis regarding both dominating (dominated) strategies and joint distributions. The final section concludes.

2. Preliminaries

Consider a single-period setting in a frictionless currency market (i.e., no short sale restrictions, transaction costs and other frictions). Within this setup, all investments are made at time zero, and all payments are received at time

T. There are three main currencies, the Euro (EUR, €), British pound (GBP, £) and U.S. dollar (USD,

$). The interest rates in all currencies are zero. Let the dollar (

$) be the numeraire currency. The positive variables

X and

Y represent the (unknown) dollar-denominated prices of the Euro and British pound at maturity,

Their time-0 prices are

(

) and

(

). We hereafter also use them to indicate the corresponding foreign currencies unless otherwise specified. Let the variable

represent the Euro-denominated price of the Pound at maturity.

There are European-style call options written on these three currency pairs at all strikes. It is assumed that the prices of these options are twice differentiable, convex and decreasing with respect to strike. Specifically, there exist two complete sets of dollar-denominated options on the Euro (X) and Pound (Y). There also exists a complete set of cross-currency options, the X-denominated options on Y. All these options mature at time T. Put options with the same maturity on individual currency pairs are known through the call–put parity.

Within this setup, we make the following assumption:

Since a continuum of call option prices is available and these prices are twice differentiable, Breeden and Litzenberger (1978) [

25] establish that the pricing density of Arrow–Debreu claims can be inferred from option prices. Therefore, the available option prices imply that for each of three exchange rates there exists a state price density. Since option prices are twice differentiable, each price density is continuous with respect to strike.

Let () be the price density of an Arrow–Debreu claim that pays 1 unit domestic currency if an exchange rate reaches the level k and zero otherwise. Similarly, let the integrable function be the price density (or pricing function) of a claim that pays at maturity if and . Since the interest rates in all currencies are zero, the pricing function p has two properties: (1) and (2) . Let be the set of all pricing functions. Assumption [A1] implies that the set is not empty.

Lemma 1. Given the dollar-denominated options on X and Y and the X-denominated options on Y, the absence of arbitrage implies the following equalities The following lemma shows that the similar properties in Lemma 1 are maintained if the currency base is changed.

Lemma 2. Given a pricing function that satisfies the conditions in (2), then a new pricing function in the currency base X can be derived from the function p in the following way:such that Throughout this study, we are interested in the valuation bounds on a basket call option that delivers the dollar-denominated payoff (The function

takes the non-negative part of

x.)

Note that this representation also contains the payoffs of spread options. As far as the valuation bounds on this call is attained, the “put-call” parity relationship for European-style basket options, as pointed out by Hobson, Laurence and Wang (2005a, 2005b) [

22,

23] and Su (2005) [

26], immediately implies that the model-independent valuation bounds on a basket put can be obtained:

As for the payoff in (

4), state price densities implied from option prices impose restrictions on a set of pricing functions. The possible value range of this payoff is determined by all pricing functions in

that satisfy the conditions in (

2). We now establish valuation bounds on call options in (

4).

3. Valuation Bounds and Hedging Portfolios

We seek arbitrage valuation bounds. When dollar-denominated options are traded as hedging instruments, the results in Hobson, Laurence and Wang (2005a, 2005b) [

22,

23] show that valuation bounds on the payoff in (

4) (

) can be attained. Our main result is that valuation bounds are (much) tightened when cross-currency options are traded as hedging instruments. Valuation bounds are enforced by static portfolios of dollar-denominated options and cross-currency options. Also, the pricing function that maximizes a basket option’s price is characterized.

We at present look only at upper price bounds, and lower bounds will be discussed later. This section first formulates the valuation problem of a basket option in (

4) as an infinite-dimensional LP. This problem is to find the maximum price bound on this basket option within a set of pricing functions. These functions are subject to restrictions imposed by option prices. The dual problem is to search for dominating strategies which enforce upper price bounds. These strategies ensure that an agent who writes this option can put a floor on potential losses.

3.1. Problem Formulation

Consider the basket option that delivers the payoff in (

4) at maturity. Its dollar-denominated price is formally expressed as follows:

Hence, the price bound on this option is attained by seeking all pricing functions over the entire set

.

To seek the least upper price bound, we express the valuation problem as an LP:

s.t.

The initial market prices of options are incorporated into the three constraints. Furthermore, the first two constraints ensure the following

The feasible set of this program is not empty due to assumption [A1]. The value of this program is bounded below by zero and from above:

for any strikes

. So the program in (

7) must have a solution.

The dual of the problem in (

7) is to find the cheapest dominating strategy. Let

(

) be a trading strategy such that the functions

and

f represent the respective components of dollar-denominated and cross-currency options. As a result, the hedging problem may be described as follows:

s.t.

where is an indicator function. Both programs have the same Lagrangian form. Their equivalence is established through the following result:

Proposition 1 (Strong Duality).

Given assumption [A1], the values of the primal in (7) and the dual in (9) coincide. This strong duality follows from Isii (1963) [

27], Gotoh and Konno (2002) [

18] and Laurence and Wang (2005) [

21]. The necessary condition required in Isii’s theorem is satisfied in (

8):

Hence, there exists a strategy which involves trading dollar-denominated options and cross-currency options. All the strategies that solve the program in (

9) construct a non-empty set

.

Lemma 2 shows that if the currency base is changed, a new pricing function can be constructed from a pricing function that solves the program in (

7). This new pricing function also maximizes the basket option’s price in the new currency base, and the associated trading strategy is a dominating one.

Proposition 2. Given the dollar as the currency base, suppose that there exists a pair that supports the market prices of all traded options. If is optimal for the programs in (7) and (9) respectively, so is based on the currency X. This proposition establishes the correspondence between pricing and hedging basket options in different currency bases. Dominating strategies do not depend on the choice of base currency. In the next section, we first establish upper bounds on basket options in the case where only dollar-denominated options are tradable. Valuation bounds on currency basket options with two underlying assets may be sought by solving the primal problem where the third restriction in (

7) is dropped. Trading strategies that enforce these bounds can be sought by setting

in (

9). We then assume that cross-currency options are also traded in markets, and show how these options can tighten valuation bounds.

3.2. Upper Valuation Bounds

When only the dollar-denominated options on

X and

Y are available, the upper price bounds on a basket option with positive parameters (

) can be attained by applying the result in Hobson, Laurence and Wang (2005a) [

22]. These bounds are enforced by static portfolios of dollar-denominated options.

Proposition 3. Given a triplet , the upper price bounds on the option b in (4) are achieved by the dollar-denominated options on X and Y as follows:The associated pricing function is characterized as follows:where the strikes and solve the problem (10). From Hobson, Laurence and Wang (2005a) [

22], the cheapest dominating strategy is sought via a Lagrangian approach. As shown in (

10), dominating strategies are to buy call options on the Euro with strike

and call options on the Pound with strike

. For a basket option in (

4) (

), the strikes are chosen so that in the region where both calls are in the money, and two sets of options replicate it exactly. There is no possibility of one option being in the money and the other being out of the money. Since there is no assumption on the behavior of currency prices, these dominating strategies are robust to both model and correlation misspecification.

On the other hand, the dollar-denominated options indeed provide information about the joint distribution of the variables

X and

Y at maturity. Conditional on the marginal price densities, the joint density in (

11) that maximizes the value of the basket option

suggests that the variables

X and

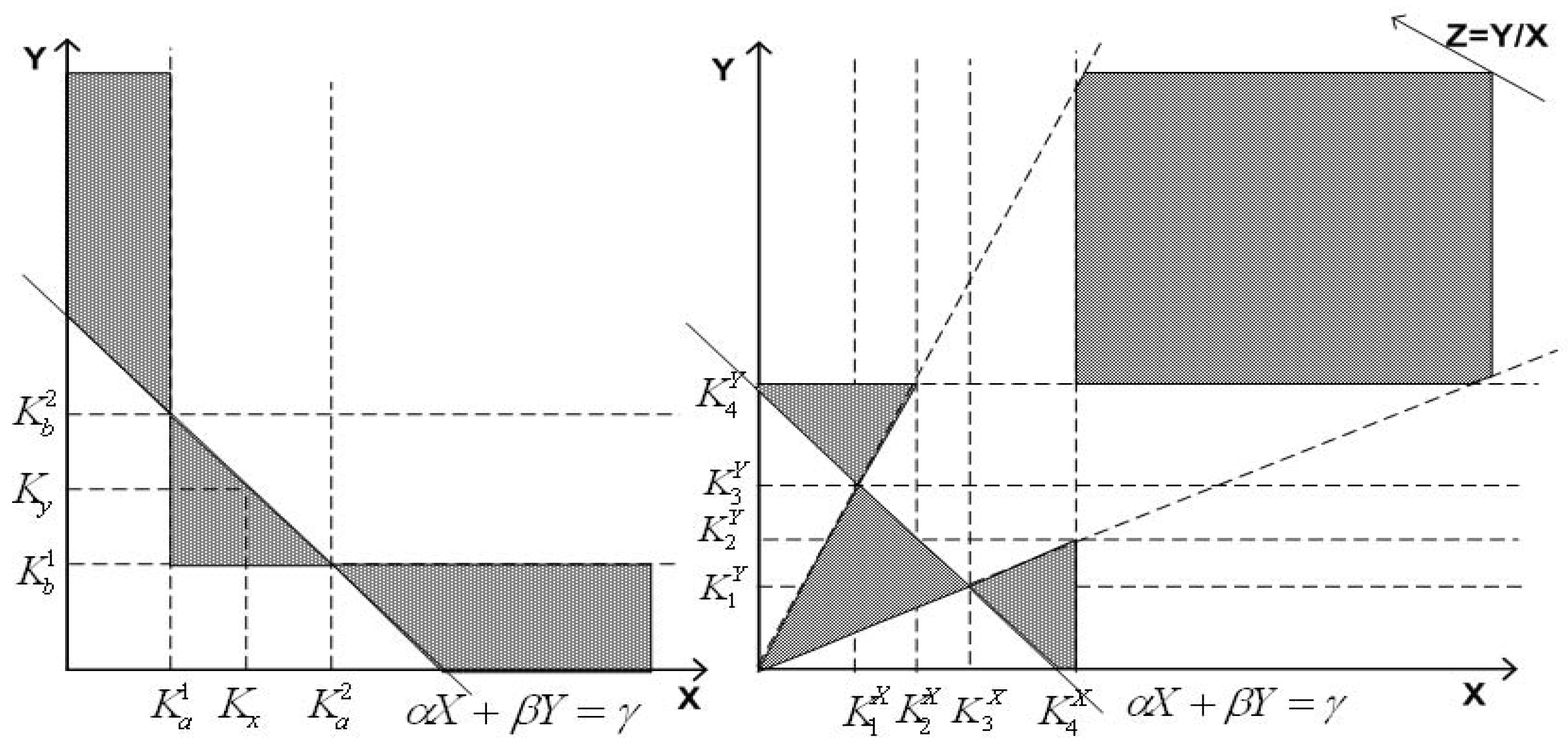

Y are strongly correlated. The left panel in

Figure 1 illustrates this pricing function. Since the basket option is an option on a basket of the Euro (X) and Pound (Y), maximizing the correlation between

X and

Y ensures the maximum volatility for the basket and hence the maximum value for an option on the basket.

If the X-denominated options on Y are traded, information embedded in these options tends to restrict the range of correlation between X and Y. The following statement establishes that valuation bounds on basket options are enforced by static portfolios that consist of both dollar-denominated and cross-currency options.

Proposition 4. Given a triplet , the upper price bounds on the option b in (4) are achieved by the dollar-denominated options on X and Y and the X-denominated options on Y as follows:whereThe associated probability density function is characterized as follows:where the strikes and real numbers solve the problem (12). To dominate the option

, hedging strategies involve eight variables. Four variables

(

are used to determine the specific price levels on the Euro (

X). These variables together with two variables

and

determine the corresponding price levels on the Pound (

Y). These price levels are strikes for buying or selling dollar-denominated options or cross-currency options. The quantity of each hedging instrument is specified by the variables

and

. There exists a feasible solution which is identified in (

12):

where

. Note that the equalities in the first constraint are valid only for

and

, and hence the feasible solution above is consistent with the constraints in (

12). This program therefore has a solution.

In the presence of only dollar-denominated options, a bivariate process

that maximizes a basket option’s price implies the strong dependence between two currency pairs. By incorporating information about cross-currency options, valuation bounds on basket options can be tightened. As a result, the pricing function in (

13) that also maximizes the basket option’ price indicates that the strong dependence two currency pairs might be unnecessary due to restrictions on correlation between them imposed by cross-currency options. The right panel in

Figure 1 illustrates this pricing function.

Through Propositions 3 and 4, the upper bounds on the option are derived for positive parameters (). However, it is unnecessary to require that a currency basket is constructed by only buying two currencies and selling another. This restriction is relaxed through the following statement.

Proposition 5. Given a triplet , the upper price bounds on the option b in (4) are achieved by the dollar-denominated options on X and Y as follows:If the X-denominated options on Y are traded, the bounds are further enforced as follows:where The proof of this proposition and the characterization of price functions are accomplished similarly, according to Propositions 3 and 4. In fact, upper valuation bounds on the option

in (

4) are derived from these results, which will be discussed later.

3.3. Lower Valuation Bounds

We have derived upper valuation bounds on currency basket options. Similarly, lower bounds on these options can be attained by solving LPs. From Hobson, Laurence and Wang (2005b) [

23], lower price bounds on basket options with two underlying assets are enforced by the so-called “STP” portfolios that involve calls and puts on individual underlying assets. The associated bivariate processes

should be counter-monotonic. Nevertheless, their lower valuation bounds are dependent on the number of disjoint intervals over

. We establish a lemma to simplify their result.

Lemma 3. Suppose that is partitioned into () disjoint intervals. Given a triplet , the lower bounds attained by Hobson, Laurence and Wang (2005b) [23] are the non-increasing functions of partition number . This lemma shows that the greatest lower bound is determined by setting . As a result, sub-replicating strategies are simplified.

Proposition 6. (1) Given a triplet , the lower price bounds on the option b in (4) are given by the dollar-denominated options on X and Y as follows:where . (2) Given a triplet , the lower price bounds on this option are attained as follows:where . The associated price density function is characterized as follows:where the strikes , and solve the problems (17) or (18). The first part of Proposition 6 directly comes from Lemma 3. Dominating strategies involve short selling puts and long buying calls on the Euro (Pound) with the strikes

(

) and

(

) so that in the regions both calls and puts are in the money and two sets of options replicate the option

exactly. Sub-replicating strategies are slightly different when all the parameters in (

4) are negative, and they involve trading more calls and puts. Like dominating strategies specified in Proposition 3, dominated strategies identified here are robust to both model and correlation mis-specification. Meanwhile, the dual provides information about the joint density of the variables

X and

Y at maturity. In order to minimize the option

’s price, the price density function

p in (

19) suggests that the process

should be counter-monotonic. The left panel of

Figure 2 illustrates this pricing function.

Now we derive tight valuation bounds when cross-currency options are traded. These valuation bounds are also enforced by static portfolios that consist of both dollar-denominated options and cross-currency options. Yet, the process that minimizes the option ’s price might not be counter-monotonic.

Proposition 7. (1) Given a triplet , the lower price bounds on the option b in (4) are achieved by the dollar-denominated options on X and Y and the X-denominated options on Y as follows:where (2) Given a triplet , the lower price bounds on this option are produced as follows:where

The associated price function is characterized as follows:where the strikes , and solve the problems (20) or (21). The existence of the strikes that satisfy the conditions in Proposition 7 imply that there at least exits one dominated trading strategy that consists of dollar-denominated options and cross-currency options. This strategy is independent of model specification. Note that the strategies identified in Proposition 6 can be viewed as particular cases of dominated strategies specified in Proposition 7 for

and

. Meanwhile, the joint density of the process

that minimizes the options

’s price is shown in the right panel of

Figure 2.

Since the strategies identified in Proposition 6 can be viewed as the portfolios without the cross-currency options in an augmented hedging instrument set, the bounds derived from the program in (

20) or (

21) should not be cheaper than the bounds attained from program in (

17) or (

18). Furthermore, we now establish the following statement that both the upper and lower valuation bounds on the option

with the general payoff are attainable.

Theorem 1. Given a triplet , the upper valuation bounds on the option b in (4) can be derived from Propositions 3, 4 and 5, while the lower valuation bounds are attained through Propositions 6 and 7. Proof. The signs of

have the following possible combinations:

| ♯ | | | | ♯ | | | |

| 1 | + | + | + | 5 | + | - | - |

| 2 | + | + | - | 6 | - | - | + |

| 3 | + | - | + | 7 | - | + | - |

| 4 | - | + | + | 8 | - | - | - |

For and , they are degenerate in the sense that the price of the option is always () or never () in the money. We have sought valuation bounds in (Propositions 3 and 4) and (Proposition 5). Valuation bounds in and can be attained from Proposition 3 in the appropriate currency bases. Similarly, Proposition 5 can be applied to and by changing currency bases. Similarly, the lower valuation bounds then can be attained from Propositions 6 and 7. □

4. Numerical Analysis

Given the prices of options on three currency pairs, we now numerically investigate arbitrage bounds on basket options, and put the problem into a discrete setup. Within this setup, the prices of call options on all currency pairs are generated and accordingly three price densities are constructed. From these price densities, a numerical procedure for seeking both upper bounds and dominating strategies is proposed. Finally, we qualify the tightness of valuation bounds, and investigate their sensitivity to relevant parameters.

4.1. Model Implementation

Suppose that the variables

X and

Y take values in the sets

for three positive real numbers

,

, and

(an integer number

N). The variable

Z is determined by

.

Now consider a basket option

that pays

dollars at maturity. In this finite-state model, the problems presented in

Section 3.1 are naturally expressed as finite-dimensional LPs. Let a

matrix

represent a pricing function. Let two

vectors

and

(

) represent the price densities of Arrow–Debreu claims implied from the dollar-denominated options on

X and

Y. To ensure that all three price densities are consistent in scale, a restriction on

P is imposed so that

if

. For the price density of Arrow–Debreu claims implied from cross-currency options, represented by a vector

, this restriction equivalently states

for

and zero otherwise.

To seek the least upper bound on this basket option, the primal problem in (

7) can be reexpressed as a finite LP

s.t.

- (1)

for ;

- (2)

for ;

- (3)

for ;

- (4)

for all m and n.

Assumption implies that there exists a price density P consistent with all option prices. So the solution set for LP1 is not empty. This program is bounded below by zero and above by . Therefore, this program must have a solution.

Consider a strategy

whose three components represent trading positions in currency options. Each component is represented by a

vector. To seek the cheapest dominating strategy, the hedging problem in (

9) is reexpressed as follows

s.t.

(1) for all ;

(2) for all .

Since the program LP1 has a solution, the LP Duality Theorem implies that the program LP2 must also have a solution.

4.2. Numerical Results

To attain insights into the tightness of arbitrage bounds, we use a method of the trinomial tree to simulate the dynamics of the Euro (X) and Pound (Y) exchange rates against the U.S. dollar. It is assumed that (i) these two exchange rate processes are correlated with coefficient over time, and have an identical annual volatility, e.g., ; and (ii) both the domestic and foreign interest rate are zero.

For the sets in (

22), the levels of the rate

X (

Y) are bounded in a range of

(

) where

. In this way, there are absorbing boundaries imposed on rate levels for computational convenience. For a large

J, these boundaries have no significant impact on numerical analysis.

All European option prices on

X and

Y are separately generated using the trinomial tree method over

time steps. The price densities

and

are calculated from these European options. For a set of option prices

, the price density

is calculated as follows:

for each

K in the set. By applying Boyle (1988)’s numerical procedure [

28], we generate a (feasible) price density

P which is consistent with initial option prices on

X and

Y. Finally, the price density

is constructed from the price density

P. The density

is calculated by

for

.

All relevant parameters are set by

These parameters are employed with the following considerations:

The exchange-rates of the Euro (X) and Pound (Y) against the U.S. dollar in the markets are higher than 1.0, and the former is relatively lower than the latter;

The correlation parameter is positive, as both the Euro- and Pound-exchange rates against the U.S. dollar are usually positively correlated;

Associated with the positive correlation between X and Y, it is assumed that they have the identical annualized volatility of without the loss of generality.

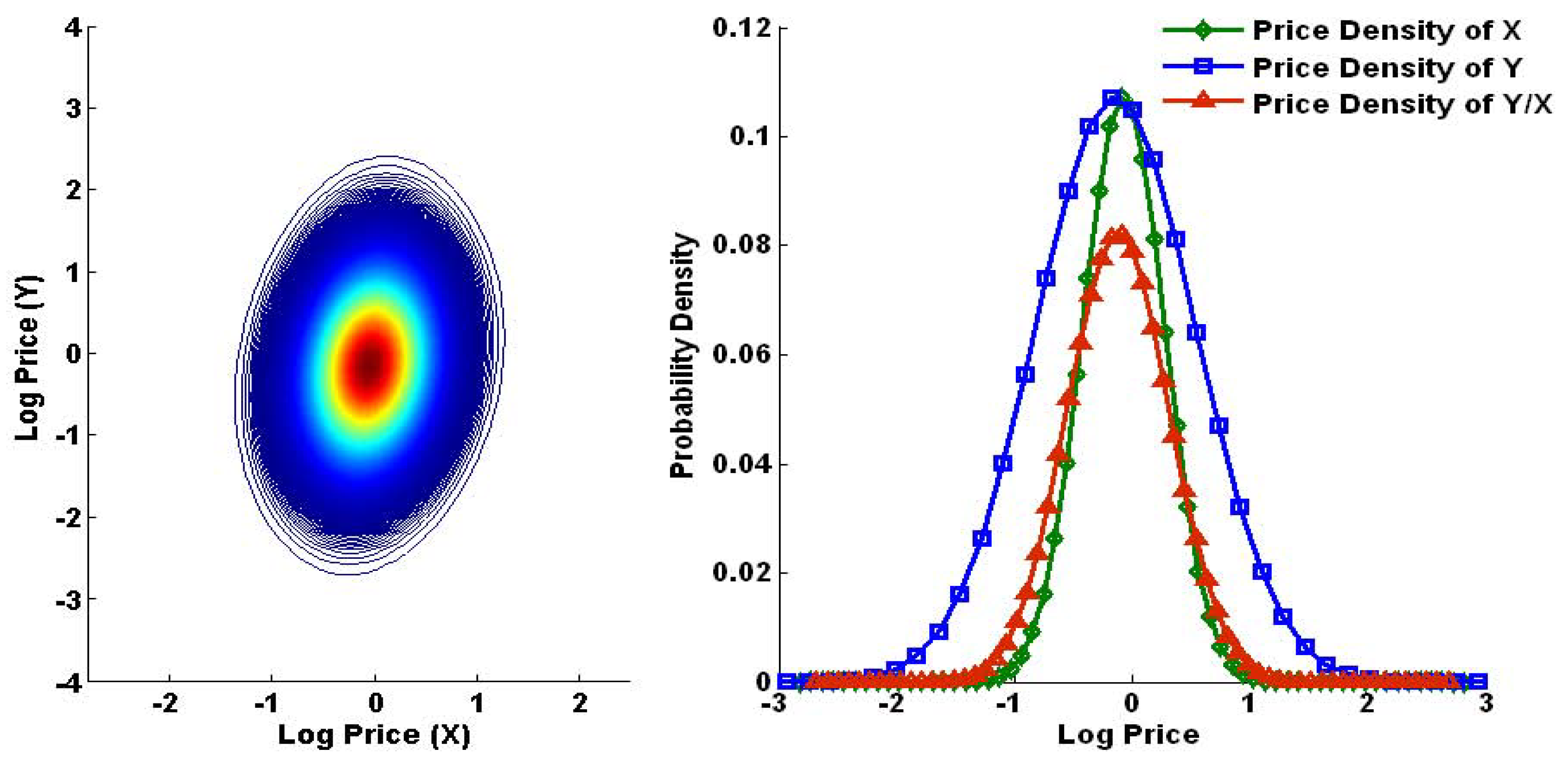

As such, the left panel in

Figure 3 illustrates the initial price density

P generated by Boyle’s procedure. Each contour line represents the positive prices of this density function. The right panel in

Figure 3 reports the price densities of Arrow–Debreu claims on three exchange rates.

The initial price density

P yields a price for a basket option. In order to measure the tightness of arbitrage bounds, this price can be viewed as a benchmark price, denoted as

. Let

and

stand for the upper and lower valuation bound on this basket option, enforced by the option prices on

X and

Y. Let

and

be valuation bounds if cross-currency options are traded as hedging instruments. These new instruments would tighten arbitrage bounds. To gauge the magnitude of the tightness, we consider the following measure:

4.2.1. Valuation Bounds and Hedging Strategies

Now consider a basket option that pays

dollars after one year. Given the different sets of hedging instruments, the price functions that maximize this option’s price have been characterized in

Figure 1, while

Figure 2 shows the price functions that minimize its price. Accordingly, the valuation bounds on this option are attained as follows:

In terms of tightness, the bounds are substantially improved by

when information about the prices of cross-currency options is incorporated.

We further investigate the associated hedging strategies that enforce these valuation bounds.

Figure 4 shows two dominating strategies that determine the upper bounds on the option

. First, the dominating strategy simply involves buying long

calls on

X with strike

and buying long

calls on

Y with strike

. This strategy delivers the bound

. To attain the tight upper valuation bound

, the dominating strategy involves buying dollar-denominated puts and calls on

X and

Y and selling puts and calls on

Z:

buying an option portfolio on X that consists of long puts with strike , long calls with strikes ;

buying an option portfolio on Y that consists of long puts with strike , long calls with strikes ;

selling an option portfolio on Z that consists of short puts with strike and short calls with strike .

The left panel in

Figure 4 reports the terminal payoff to this portfolio. As a result, this strategy is cheaper by about

dollars.

Accordingly,

Figure 5 shows the dominated strategies that determine the lower bounds on the option

. The left panel illustrates the sub-replicating strategy that involves selling short

puts and buying long

calls on

X with strikes

and

, and selling short

puts and buying long

calls on

Y with strikes

and

. The right panel presents the second sub-replicating strategy that leads to the tighter lower valuation bound. This dominated strategy can be described as follows:

buying an option portfolio on X that consists of long puts with strike short calls with strike ;

buying an option portfolio on Y that consists of long puts with strike , short calls with strike ;

selling a portfolio of the cross-currency options on Z that consists of short puts with strike and short calls with strike .

Equivalently, this strategy improves the lower bound by about dollars.

4.2.2. Sensitivity of Valuation Bounds

As shown in

Figure 3, an appropriate

J is chosen so that three price densities are close to zero when exchange rate levels reach the absorbing boundaries. In this way, valuation bounds on basket options are relatively independent of the number of price levels

. We now investigate the sensitivity of valuation bounds by varying the jump size

, as reported in

Table 1. In terms of the measure in (

23), all the numbers indicate that the price bounds on two options are significantly tightened by incorporating price information about cross-currency options. These numbers also show that these valuation bounds are relatively robust to changes in the jump size

u. The price bounds on the first (second) option can at least be improved by an average of

(

)

In order to investigate the sensitivity of valuation bounds to changes in correlation between the Euro and Pound exchange rates, we assume that the coefficient

varies in the range of

. The arbitrage bound

is independent of correlation coefficient, as this bound is enforced by a portfolio of dollar-denominated options. Nevertheless, changes in correlation coefficient have impact on the valuation bound

, as this bound depends on the density

that is constructed from an initial price density

P. For each

, we use Boyle’s procedure [

28] to generate a new price density

P.

Table 2 presents the sensitivity of valuation bounds when correlation coefficient varies. The bounds

on two options increase as the coefficient

increases. In particular, the bounds

approach

when the coefficient

increases to 1. However, the tightness of valuation bounds decreases as the the coefficient

increases from

to 0 or decreases from

to 0. For

, the valuation bounds on the first (second) option is substantially tightened by about

(

). Similarly, the bounds on these two options are also greatly tightened for

, compared with the tightness of bounds at

(

and

respectively).

Since the dependence between the Euro (

X) and Pound (

Y) has impact on the joint price density

P, the construction of the density

means that increasing (decreasing)

leads to increases (decreases) in the kurtosis of the density

. For a large

(close to 1), the density

with high kurtosis implies that cross-currency options have limited impact on the tightness of upper bounds but significantly improve lower bounds, as shown in

Table 2. This impact on both lower and upper price bounds may be substantial when the coefficient

decreases to

, as there are more Arrow–Debreu securities with non-zero prices for trading.

We further examine the sensitivity of price bounds against other parameters (i.e., maturity, volatility and non-zero yield rate).

Table 3 reports the sensitivity of valuation bounds to different maturities. In term of magnitude, the price bounds on the first (second) option are increasingly tightened from

(

) to

(

) as maturity increases from 6 months to 15 months. The similar result is observed in

Table 4. The price bounds on the first (second) option are increasingly improved from

(

) to

(

) as volatility level increases by

.

Table 5 shows that changing interest rates has different impact on two basket options. The tightness of the price bounds on the first option (

) is decreasing as the foreign interest rate

decreases, while the bounds on the second option (

) are increasingly improved. Overall, the valuation bounds on two options can be tightened by cross-currency options for different interest rate levels. The tightness of the price bounds on the first (second) option has an average of about

(

) when the domestic interest rate is set as

and the foreign interest rate varies in a range of

.

5. Conclusions

Basket options are traded as alternative instruments to manage risk exposure in multiple underlying assets. Despite their attractive features, pricing basket options poses a challenge to practitioners. Through this paper, we have studied the problem of valuing currency basket options. Instead of precise prices, we derive model-free valuation bounds on these options.

We identify a collection of tradable options on individual currency pairs as hedging instruments. Three currencies, the Euro, British pound and U.S. dollar are considered. We emphasize the role of price information about cross-currency options in pricing basket options. First of all, arbitrage bounds are derived from portfolios that involve only dollar-denominated options. If cross-currency options are additionally traded, price bounds on basket options can be further tightened. These bounds are enforced by static portfolios of both dollar-denominated options and cross-currency options.

We have derived both upper and lower bounds on currency basket options. These valuation bounds are enforced by static hedging strategies that are constructed from available hedging instruments, e.g., the options on individual currency pairs. Meanwhile, these strategies are associated with the joint densities of underlying currencies that can be characterized.