Optimization of the Lateral Length of Shale-Gas Horizontal Wells Based on Geology–Engineering–Economy Integration

Abstract

1. Introduction

2. Problem Statement and Formulation

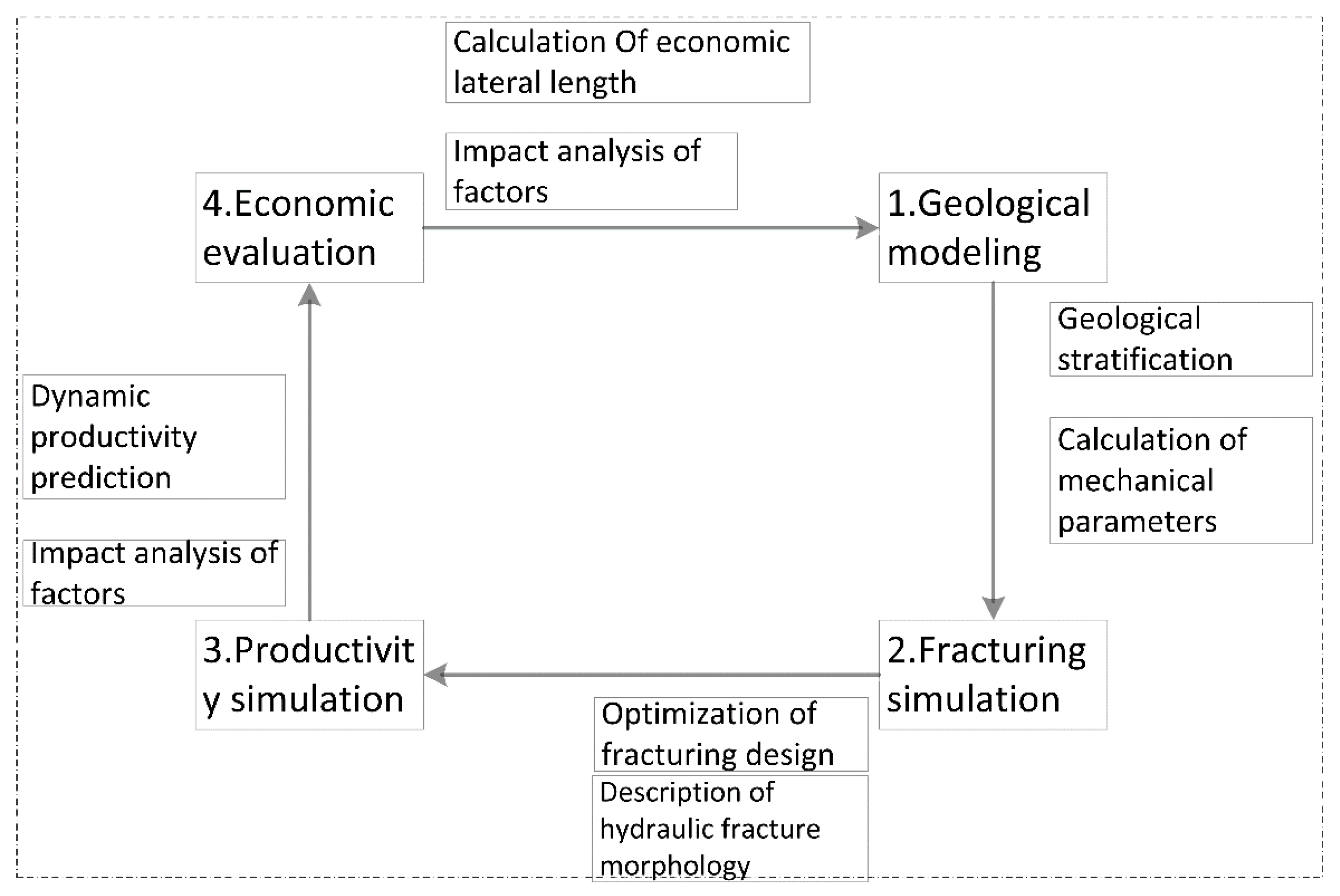

3. Model for Evaluating the Economic Lateral Length of Shale-Gas Horizontal Well

3.1. Input Analysis

3.1.1. Drilling Investment

3.1.2. Investment in Hydraulic Fracturing

3.1.3. Other Investments

3.2. Output Analysis

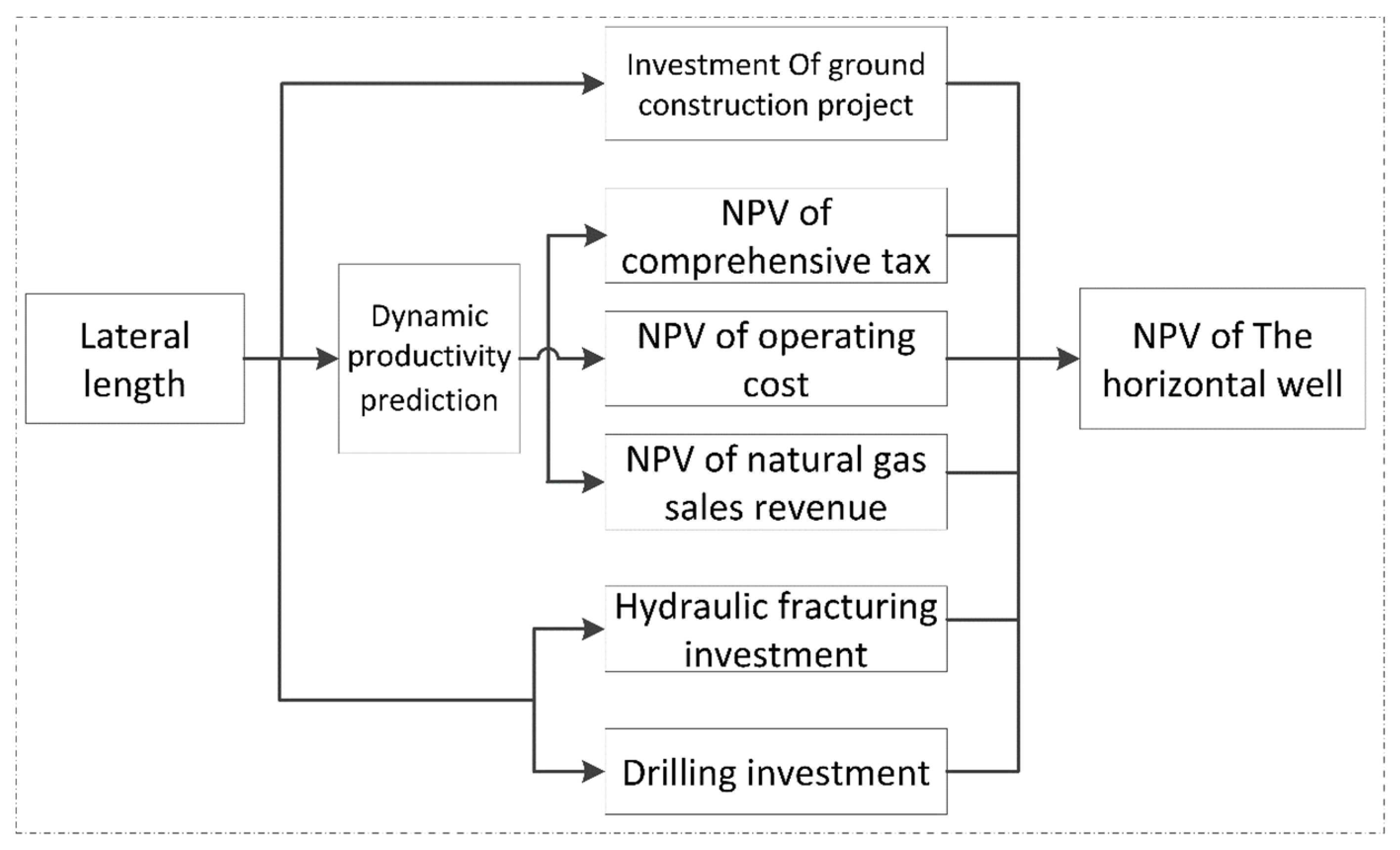

3.3. Evaluation Model of Economic Lateral Length

4. Calculation Results and Discussion

4.1. Calculation Example

4.1.1. Geological Modeling

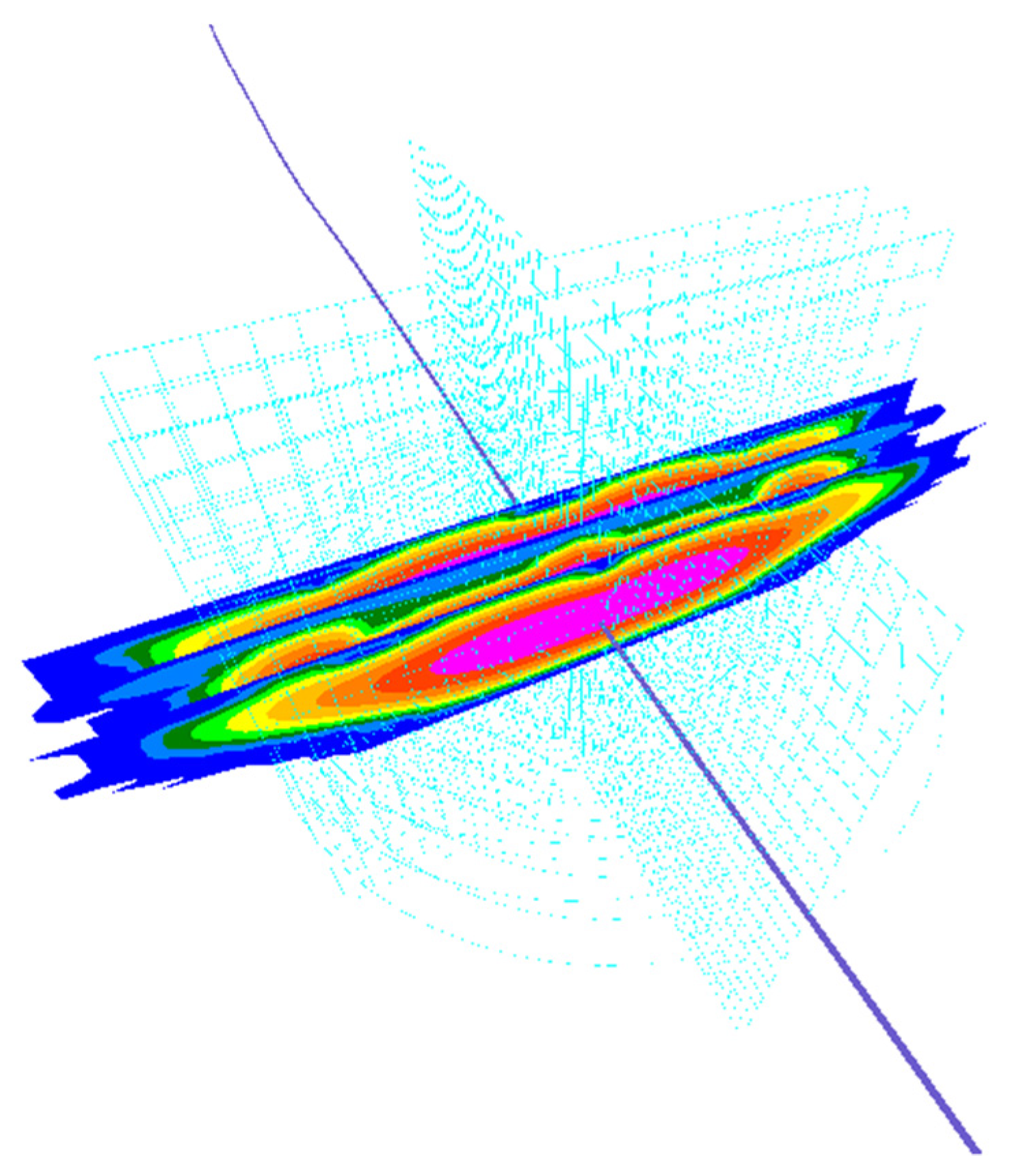

4.1.2. Fracturing Simulation

4.1.3. Capacity Simulation

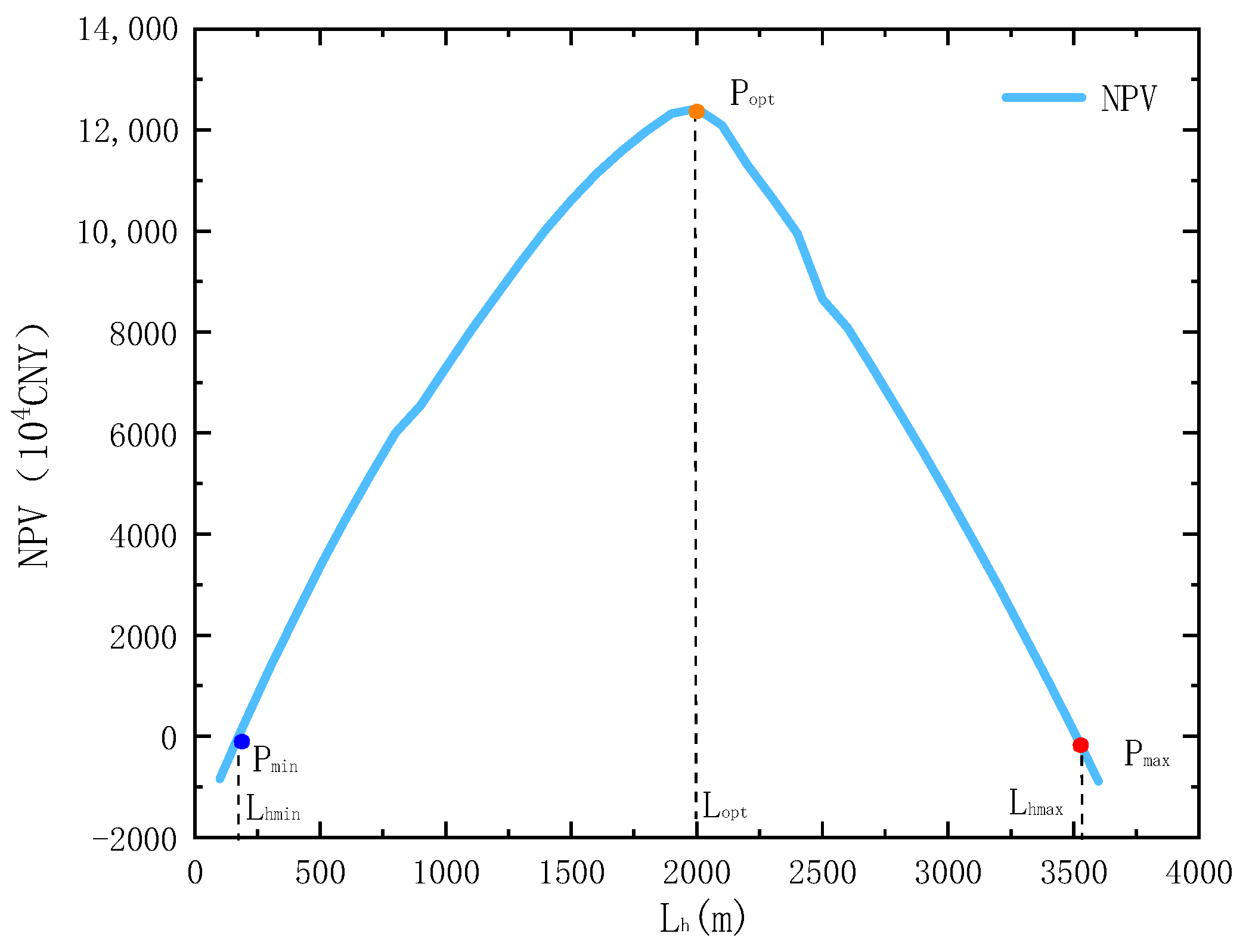

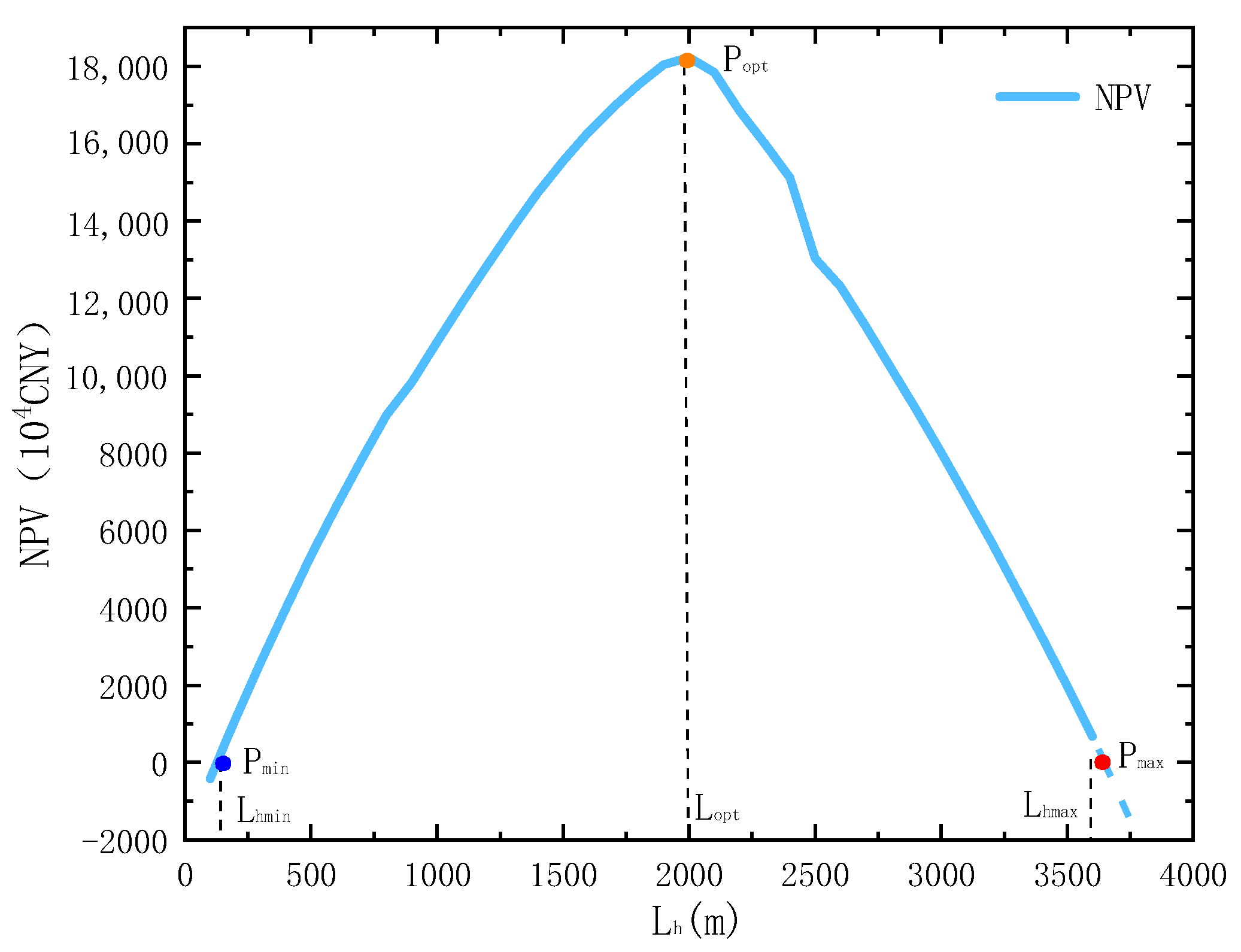

4.1.4. Calculation of the Economic Lateral Length

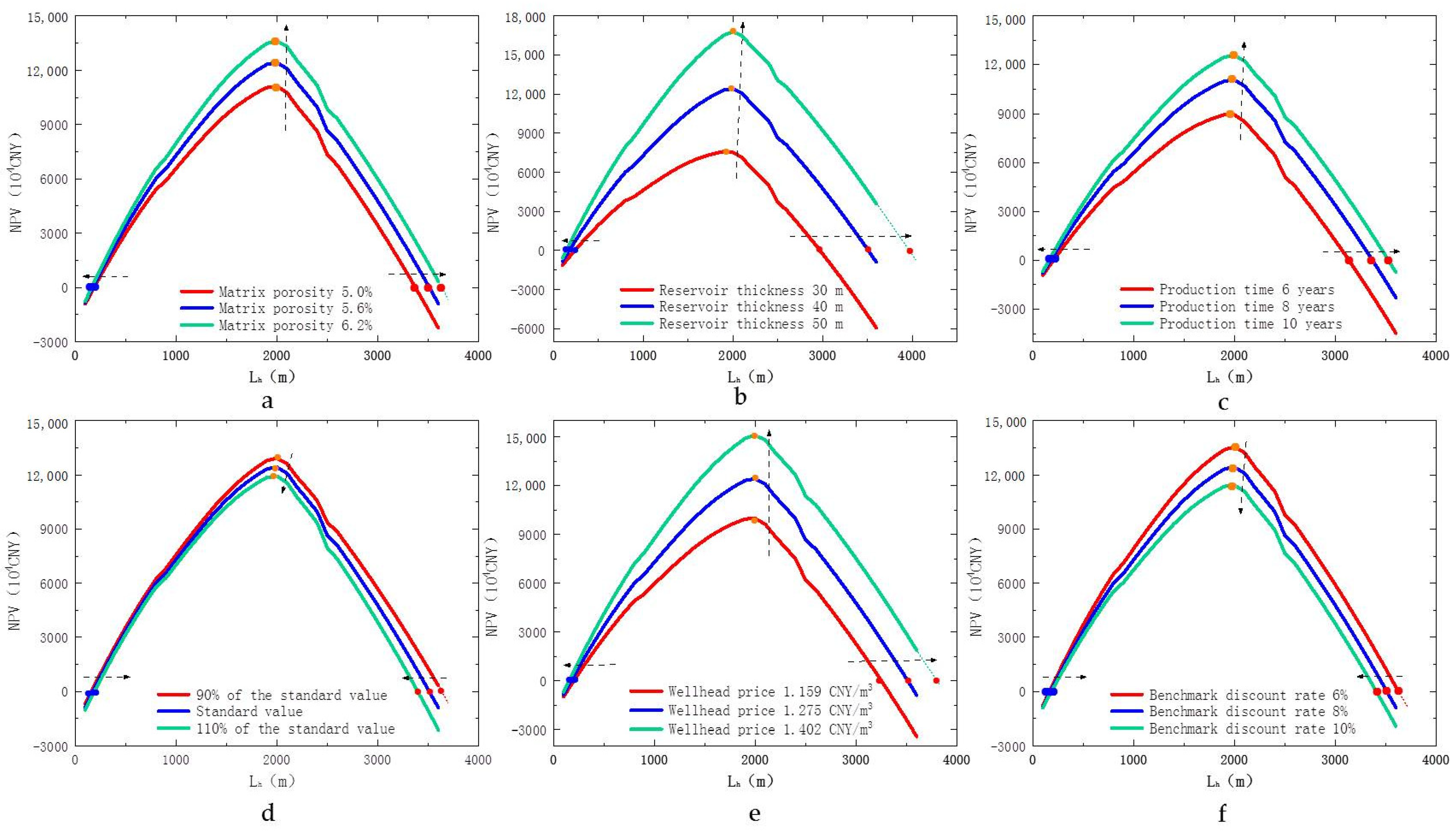

4.2. Sensitivity Analysis and Discussion

4.2.1. Sensitivity Analysis of Reservoir Matrix Porosity

4.2.2. Sensitivity Analysis of Reservoir Thickness

4.2.3. Sensitivity Analysis of Production Time

4.2.4. Sensitivity Analysis of Drilling Investment

4.2.5. Sensitivity Analysis of Natural-Gas Wellhead Price

4.2.6. Sensitivity Analysis of Benchmark Discount Rate

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Jiangtao, L.; Yuyan, W.; Chuncheng, Z. Talking about energy: China and the world. China Pow. Enter. Manag. 2021, 7, 47–50. [Google Scholar]

- Zhou, Q.; Dilmore, R.; Kleit, A.; Wang, J.Y. Evaluating gas production performances in marcellus using data mining technologies. J. Nat. Gas Sci. Eng. 2014, 20, 109–120. [Google Scholar] [CrossRef]

- Wu, Y.; Pan, Z.; Zhang, D.; Lu, Z.; Connell, L.D. Evaluation of gas production from multiple coal seams: A simulation study and economics. Int. J. Min. Sci. Technol. 2018, 28, 359–371. [Google Scholar] [CrossRef]

- Yusong, L.; Peiqing, L.; Dengke, T.; Ji, T. Optimization design of horizontal section length of horizontal well using genetic algorithm. J. Petrol. 2008, 2, 296–299. [Google Scholar]

- Xiaole, G.; Zhiming, W. The hydraulic extended limit of mega-extended-reach well at Liuhua Field in South China Sea. Oil Drill. Prod. Technol. 2009, 31, 10–13. [Google Scholar]

- Lu, N.; Zhang, B.; Wang, T.; Fu, Q. Modeling research on the extreme hydraulic extension length of horizontal well: Impact of formation properties, drilling bit and cutting parameters. J. Pet. Explor. Prod. Technol. 2021, 11, 1211–1222. [Google Scholar] [CrossRef]

- Kunji, X.; Jiyou, X.; Jun, C.; Dawei, Q.; Honglin, X. The evaluation and analysis of hydraulic extensions ability of horizontal section in deep horizontal wells. J. Southwest Pet. Univ. (Sci. Technol. Ed.) 2012, 34, 101–106. [Google Scholar]

- Xiuju, J.; Jianxia, B.; Honglei, L.; Xiuzhi, W.; Jiqiang, L. An optimal design of horizontal wells applied in the productivity construction of the Puguang gas field. Nat. Gas Ind. 2011, 31, 58–60. [Google Scholar]

- Yuan, J.; Zhao, K.; Feng, Y. Research on wellbore instability of shale formation in extremely complex geo-mechanical environment. Processes 2022, 10, 1060. [Google Scholar] [CrossRef]

- Yaohui, C.; Tie, Y.; Yin, L.; Xueliang, B. Research on the reasonable horizontal interval length of horizontal wells. Nat. Gas Geosci. 2006, 26, 151–153, 177–178. [Google Scholar]

- Yingjie, Z. Economic and technical policy limits of horizontal wells in thick bottom water fault block reservoirs in shengli oilfield. Petrol. Geol. Rec. Effic. 2007, 14, 59–61. [Google Scholar]

- Yingjie, Z. Technical and economic limits for horizontal well development of heavy oil reservoir in shengli oil field. Xinjiang Pet. Geol. 2008, 29, 76–78. [Google Scholar]

- Ariadji, T.; Aziz, P.A.; Soewono, E.; Syifa, A.A.; Riza, L.S.; Sidarto, K.A.; Sukarno, P. A robust method for determining the optimum horizontal well direction and length for a petroleum field development using genetic algorithm. In Proceedings of the 5th International Conference on Research and Education in Mathematics (Icrem5), Portland, OR, USA, 23–25 February 2012; Volume 1450, pp. 319–325. [Google Scholar]

- Xiaojing, Z.; Dengke, T. An improvement of the design method for optimal horizontal wellbore length. Pet. Explor. Dev. 2011, 38, 216–220. [Google Scholar]

- Junkun, H.; Zhibin, Z.; Xiaoping, L. A method of determining the horizontal-well lateral length with optimal economic value. Nat. Gas Ind. 2014, 34, 142–146. [Google Scholar]

- Rammay, M.H.; Awotunde, A.A. Stochastic optimization of hydraulic fracture and horizontal well parameters in shale gas reservoirs. J. Nat. Gas Sci. Eng. 2016, 36, 71–78. [Google Scholar] [CrossRef]

- Lin, H. Road Operation Safety Risk Analysis based on Data Mining. Ph.D. Thesis, Dalian Maritime University, Dalian, China, June 2012. [Google Scholar]

- Kalantari Dahaghi, A.; Mohaghegh, S.D. Economic impact of reservoir properties, horizontal well length and orientation on production from shale formations: Application to New Albany shale. In Proceedings of the SPE Eastern Regional Meeting 2009: Limitless Potential/Formidable Challenges, Charleston, WV, USA, 23–25 September 2009; Society of Petroleum Engineers (SPE): Charleston, WV, USA, 2009; pp. 312–324. [Google Scholar]

- Honglin, L. Research on the Technology and Economic Boundary of the Horizontal Well in Low Permeability Gas Reservoir. Ph.D. Thesis, Southwest Petroleum University, Chengdu, China, October 2017. [Google Scholar]

- Dawei, W.; Xiaohong, L.; Chunxiao, D.; Zhigang, G.; Zhennan, G. Research on horizontal well horizontal section length optimization and economic limit. Xinjiang Oil Gas 2017, 13, 19–24. [Google Scholar]

- Huachao, S.; Chunya, L.; Zeying, T.; Ruiyang, W. Determination of economic optimal lateral length in horizontal well development of gas reservoirs—A case study of cn gas reservoir in country a. Nat. Gas Technol. Econ. 2017, 11, 24–25, 39, 82. [Google Scholar]

- Wuguang, L.; Hong, Y.; Yongpeng, S.; Yu, G.; Tianpeng, W.; Nanqiao, Z.; Yue, C. Development evaluation and optimization of deep shale gas reservoir with horizontal wells based on production data. Geofluids 2021, 2021, 4815559. [Google Scholar]

- Chang, H.; Xiaoyan, G.; Yujin, W.; Yunhe, S.; Xiaowei, Z. Analysis on economic length of shale gas horizontal well. In Proceedings of the 32nd National Natural Gas Academic Annual Conference (2020), Chongqing, China, 13–14 November 2020; pp. 1280–1287. [Google Scholar]

- Chang, H.; Jinyu, W.; Nan, W.; Hang, Z.; Yunsheng, W.; Xiaowei, Z.; Yunhe, S. Optimization of horizontal well length in weiyuan shale gas field considering technical and economic conditions. Pet. Geol. Oilfield Dev. Daqing 2021, 40, 158–166. [Google Scholar]

- Zhang, J.; Hu, N.; Li, W. Rapid site selection of shale gas multi-well pad drilling based on digital elevation model. Processes 2022, 10, 854. [Google Scholar] [CrossRef]

- Rui, Y.; Cheng, C.; Jianfa, W.; Haoyong, H.; Daijiao, J.; Jian, Z. Optimization of shale-gas horizontal well spacing based on geology–engineering–Economy integration: A case study of Well block Ning 209 in the National Shale Gas Development Demonstration Area. Nat. Gas Ind. 2020, 40, 42–48. [Google Scholar]

- Opinions of the CPC Central Committee and the State Council on Completely, Accurately and Comprehensively Implementing the New Development Concept and Doing a Good Job in Carbon Peak and Carbon Neutralization. Available online: http://www.gov.cn/zhengce/2021-10/24/content_5644613.htm (accessed on 25 October 2022).

- Liehui, Z.; Xiao, H.; Xiaogang, L.; Kuncheng, L.; Jiang, H.; Zhi, Z.; Jingjing, G.; Yinan, C.; Wenshi, L. Shale gas exploration and development in the Sichuan Basin: Progress, challenge and countermeasures. Nat. Gas Ind. 2021, 41, 143–152. [Google Scholar]

- Mahdi, S.; Wang, X.; Shah, N. Interactions between the Design and Operation of Shale Gas Networks, Including CO2 Sequestration. Engineering 2017, 3, 244–256. [Google Scholar] [CrossRef]

- Dong, Z. Optimum Design of Horizontal Section Length of the Horizontal Wells in Sebei-2 Gas Field. Master’s Thesis, China University Pet, Beijing, China, May 2010. [Google Scholar]

- Jianchun, G.; Bo, L.; Cong, L.; Weigang, D.; Li, C.; Baoyun, J.; Yulong, Z.; Xin, X.; Senwen, X.; Mingming, Z. A Method for Optimizing the Stages of Stratified Fracturing in Low Permeability and Tight Reservoirs. CN 105735961 A, 6 June 2017. [Google Scholar]

- Cheng, S.; Jianfa, W.; Yongqiang, F.; Bo, Z. Integrated dynamic evaluation of long lateral fracturing in shale gas wells: A case study on the Changning National Shale Gas Demonstration Area. Nat. Gas Ind. 2022, 42, 123–132. [Google Scholar]

- Xiaoli, C.; Jie, Y.; Jiaojiao, X.; Long, D. Exploration and application of investment benefit evaluation method for shale gas exploration and development-taking A oil and gas engineering company as an example. China Chief Financ. Officer. 2019, 10, 59–61. [Google Scholar]

| No. | VD (m) | MD (m) | Formation Property | ||

|---|---|---|---|---|---|

| Top | Bottom | Top | Bottom | ||

| 1 | 3333.7 | 3336.6 | 3590.2 | 3600.7 | Gas |

| 2 | 3336.6 | 3338.7 | 3600.7 | 3608.3 | Gas |

| 3 | 3338.7 | 3339.7 | 3608.3 | 3611.8 | Gas |

| 4 | 3339.7 | 3341.2 | 3611.8 | 3615.3 | Gas |

| 5 | 3341.2 | 3342.8 | 3615.3 | 3622.2 | Gas |

| 6 | 3342.8 | 3345.1 | 3622.2 | 3631.5 | Gas |

| 7 | 3345.1 | 3347.0 | 3631.5 | 3645.4 | Gas |

| 8 | 3347.0 | 3349.9 | 3645.4 | 3657.5 | Gas |

| 9 | 3349.9 | 3351.5 | 3657.5 | 3670.0 | Gas |

| 10 | 3351.5 | 3353.6 | 3670.0 | 3789.3 | Gas |

| 11 | 3353.6 | 3355.9 | 3789.3 | 3818.2 | Gas |

| 12 | 3355.9 | 3358.0 | 3818.2 | 3832.5 | Gas |

| 13 | 3358.0 | 3360.3 | 3832.5 | 3975.0 | Gas |

| 14 | 3360.3 | 3363.8 | 3975.0 | 4975.0 | Gas |

| No. | Parameter Name | Quantity Sign | Unit | Value | ||

|---|---|---|---|---|---|---|

| 1 | Matrix permeability | mD | 0.0005 | 0.0010 | 0.0015 | |

| 2 | Matrix porosity | Dimensionless | 5.0% | 5.6% | 6.2% | |

| 3 | Reservoir thickness | m | 30 | 40 | 50 | |

| 4 | Reservoir temperature | K | 365.15 | |||

| 5 | Deviation factor of natural gas | Dimensionless | 0.87 | |||

| 6 | Relative density of natural gas | Dimensionless | 0.6 | |||

| 7 | Viscosity of natural gas | mPa.s | 0.025 | |||

| No. | Parameter Name | Quantity Sign | Unit | Value | ||

|---|---|---|---|---|---|---|

| 1 | Production time | year | 6 | 8 | 10 | |

| 3 | Production differential pressure | MPa | 3 | 5 | 7 | |

| 4 | Vertical length | m | 3000 | |||

| 5 | Inclined length | m | 1000 | |||

| 6 | Lateral length | m | 100~3600 | |||

| 7 | Cluster spacing | m | 20 | |||

| 8 | Number of perforating clusters | cluster | 3 | |||

| 9 | Well control radius | m | 400 | |||

| No. | Parameter Name | Quantity Sign | Unit | Value | ||

|---|---|---|---|---|---|---|

| 1 | Natural-gas wellhead price | CNY/m3 | 1.159 | 1.275 | 1.402 | |

| 2 | Annual growth rate of natural-gas wellhead price | Dimensionless | 5% | 10% | 15% | |

| 3 | Benchmark discount rate | Dimensionless | 6% | 8% | 10% | |

| 4 | Investment in surface engineering construction | 104 CNY | 100 | 200 | 350 | |

| 5 | Unit drilling investment in vertical section | 104 CNY/m | 0.36 | |||

| 6 | Unit drilling investment in inclined section | 104 CNY/m | 0.60 | |||

| 7 | Unit drilling investment in lateral section | 104 CNY | Equation (6) | |||

| 8 | Unit operating cost in the first year | CNY/m3 | 0.125 | 0.138 | 0.152 | |

| 9 | Annual growth rate of operating cost | Dimensionless | 5% | 10% | 15% | |

| 10 | Comprehensive tax rate | Dimensionless | 8% | 10% | 12% | |

| 11 | Hydraulic-fracturing investment | 104 CNY | Equation (8) | |||

| No. | Parameter | Value | Minimum Extreme Economic Length/m | Maximum Extreme Economic Length/m | Optimal Economic Length/m |

|---|---|---|---|---|---|

| 1 | Matrix porosity | 5% | 189 | 3373 | 1993 |

| 5.6% | 175 | 3508 | 2000 | ||

| 6.2% | 165 | 3633 | 2004 | ||

| 2 | Reservoir thickness | 30 m | 238 | 2972 | 1875 |

| 40 m | 175 | 3508 | 2000 | ||

| 50 m | 142 | 3962 | 2009 | ||

| 3 | Production time | 6 years | 203 | 3143 | 1957 |

| 8 years | 178 | 3350 | 1984 | ||

| 10 years | 175 | 3508 | 2000 | ||

| 4 | Drilling investment | 90% of the standard value | 159 | 3635 | 2015 |

| Standard value | 175 | 3508 | 2000 | ||

| 110% of the standard value | 191 | 3398 | 1980 | ||

| 5 | Natural-gas wellhead price | 1.159 CNY/m3 | 201 | 3229 | 1986 |

| 1.275 CNY/m3 | 175 | 3508 | 2000 | ||

| 1.402 CNY/m3 | 154 | 3787 | 2012 | ||

| 6 | Benchmark discount rate | 6% | 165 | 3626 | 2014 |

| 8% | 175 | 3508 | 2000 | ||

| 10% | 186 | 3408 | 1987 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhu, J.; He, S.; Lin, L. Optimization of the Lateral Length of Shale-Gas Horizontal Wells Based on Geology–Engineering–Economy Integration. Processes 2023, 11, 249. https://doi.org/10.3390/pr11010249

Zhu J, He S, Lin L. Optimization of the Lateral Length of Shale-Gas Horizontal Wells Based on Geology–Engineering–Economy Integration. Processes. 2023; 11(1):249. https://doi.org/10.3390/pr11010249

Chicago/Turabian StyleZhu, Jialin, Sha He, and Lin Lin. 2023. "Optimization of the Lateral Length of Shale-Gas Horizontal Wells Based on Geology–Engineering–Economy Integration" Processes 11, no. 1: 249. https://doi.org/10.3390/pr11010249

APA StyleZhu, J., He, S., & Lin, L. (2023). Optimization of the Lateral Length of Shale-Gas Horizontal Wells Based on Geology–Engineering–Economy Integration. Processes, 11(1), 249. https://doi.org/10.3390/pr11010249