Tail Dependence in Financial Markets: A Dynamic Copula Approach

Abstract

1. Introduction

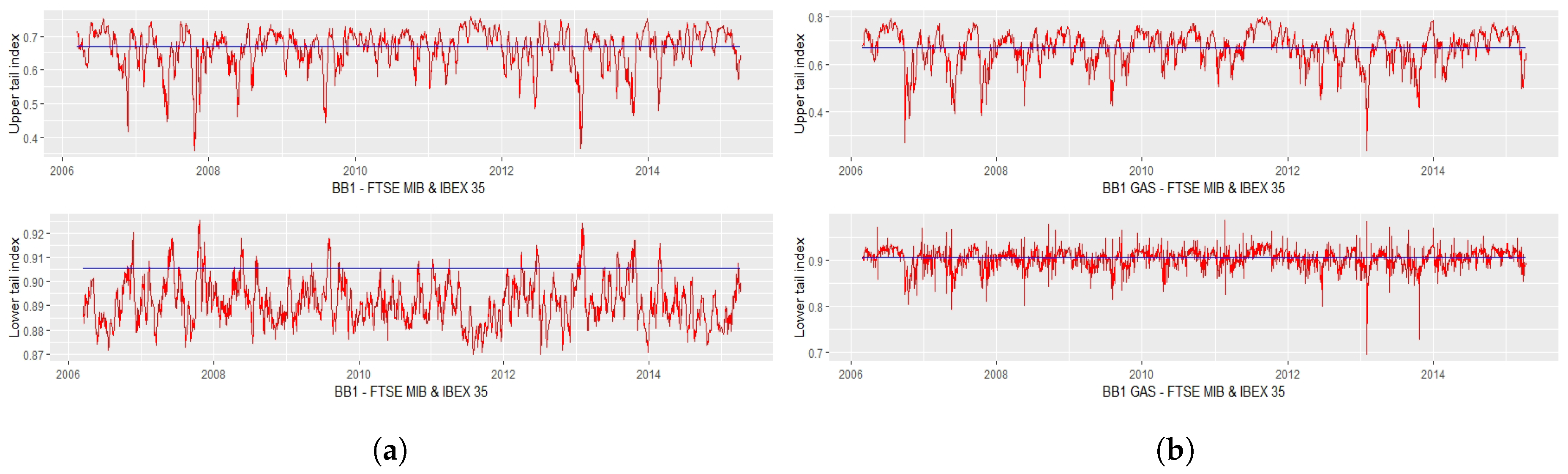

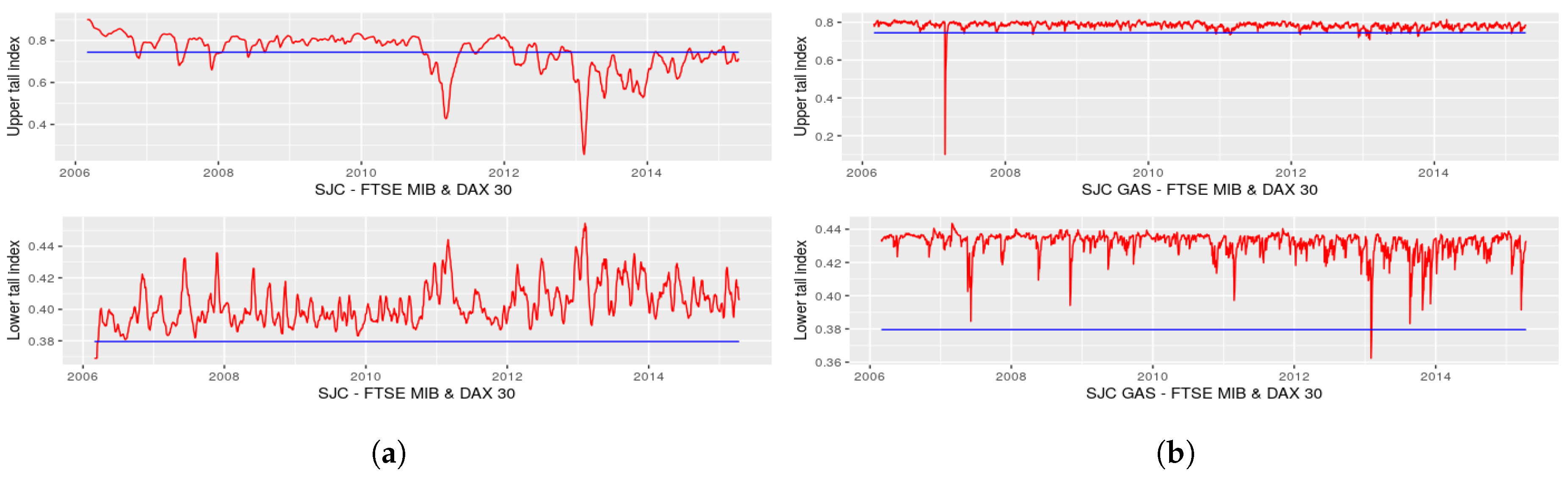

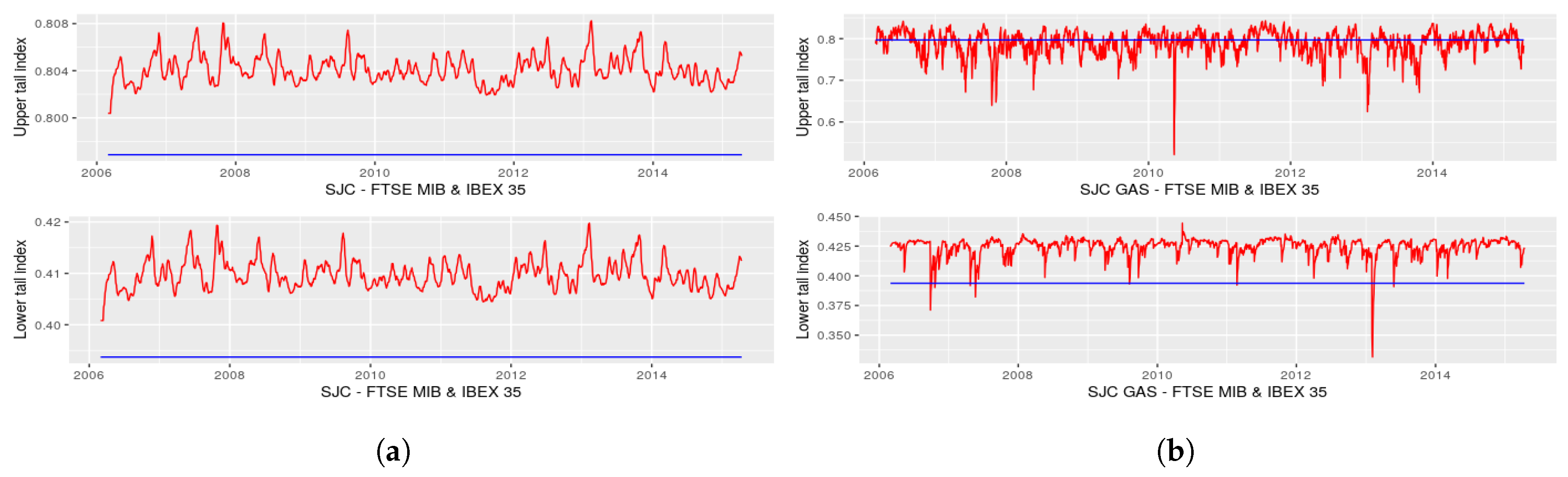

- Describe the evolution of the dependence in the tails via the computation of tail indices2.

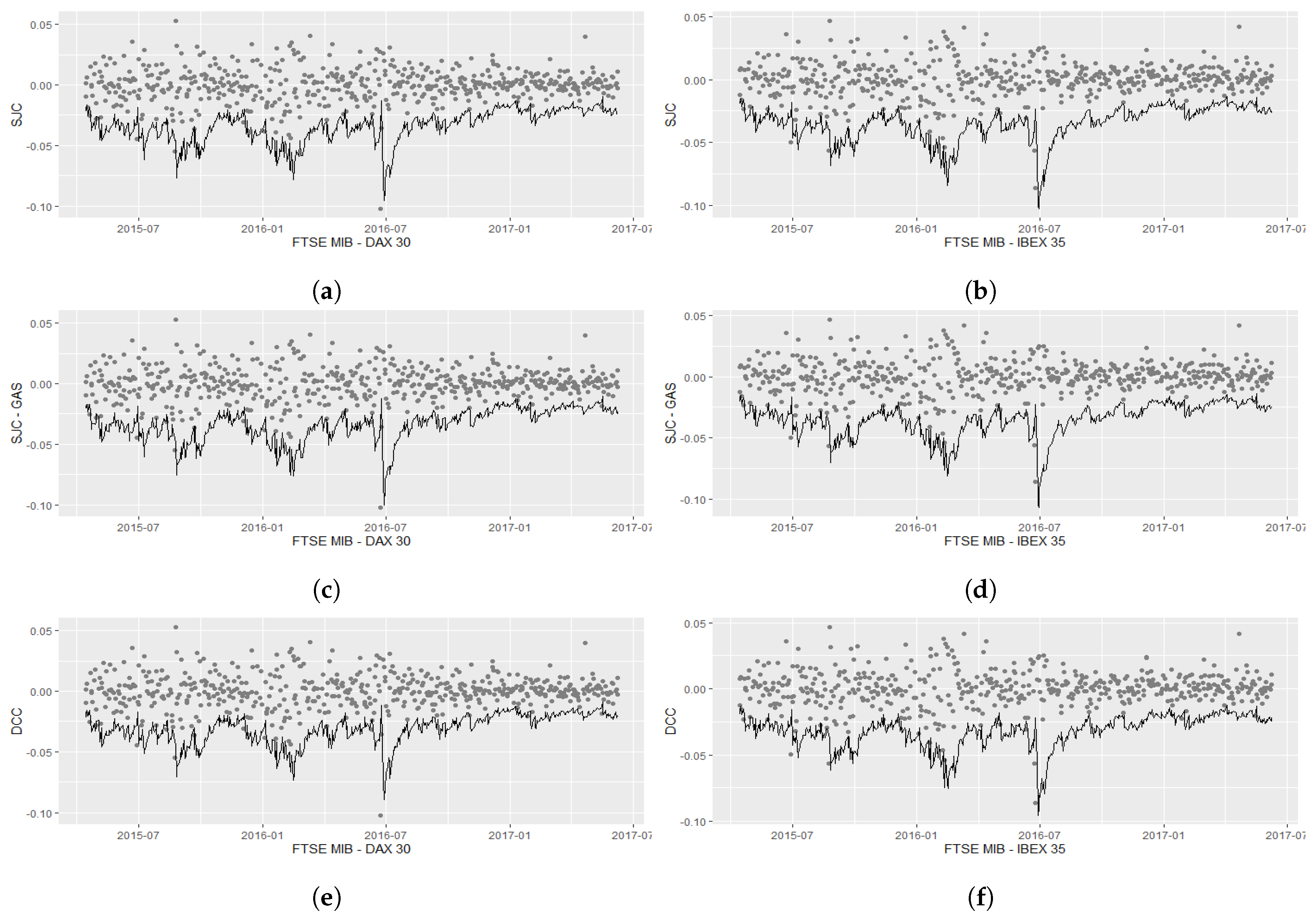

- Forecast capital losses, computing and then forecasting one popular risk measure, like Value-at-Risk (VaR).

2. Model

2.1. Data Description

2.2. Estimation

2.3. Marginal Distributions

2.4. Joint Distribution

- If , then we will set .

- If , we will set .

2.5. Value-at-Risk

- First, generate a random sample from the selected copula .

- Second, create shocks from the copula probabilities using the marginal inverse cumulative distribution functions on each asset.

- Third, create returns , from shocks using the dynamic volatility models.

- Generate two independent uniform rvs u and s.

- Set , where is the inverse of .

- The desired pair is .

3. Results

- Compute , the empirical copula, from the uniform transforms and estimate the vector of copula parameters θ, say θn, via maximum likelihood.

- Compute the t.s. Sn.

- For some large N, repeat the following steps, .

- (a)

- Generate a random sample from copula , then compute their associated rank vectors , .

- (b)

- Compute and letbe the empirical copula. Compute an estimate of from via maximum likelihood.

- (c)

- Compute an approximate realization of by

- An approximation for the p-value of the test is given byKojadinovic et al. (2010) suggest using the following formula for the computation of p-values:in order to ensure that they are in the open interval .

- Estimate the vector of parameters , say , via maximum likelihood.

- For some large N, say , repeat the following three steps, .

- Generate a random sample from copula .

- Estimate of from via maximum likelihood.

- Collect .

4. Concluding Remarks

Funding

Conflicts of Interest

Abbreviations

| rv | random variable |

| SJC | Symmetrized Joe-Clayton |

| GAS | Generalized Autoregressive Score |

| t.i. | tail index |

| cdf | cumulative distribution function |

| t.s. | test statistic |

| DCC | Dynamic Conditional Correlation |

References

- Christoffersen, Peter F. 1998. Evaluating interval forecasts. International Economic Review 39: 841–62. [Google Scholar] [CrossRef]

- Christoffersen, Peter. 2011. Elements of Financial Risk Management. Cambridge: Academic Press. [Google Scholar]

- Creal, Drew, Siem Jan Koopman, and André Lucas. 2013. Generalized autoregressive score models with applications. Journal of Applied Econometrics 28: 777–95. [Google Scholar] [CrossRef]

- Furman, Edward, Alexey Kuznetsov, Jianxi Su, and Ričardas Zitikis. 2016. Tail dependence of the gaussian copula revisited. Insurance: Mathematics and Economics 69: 97–103. [Google Scholar]

- Genest, Christian, Bruno Rémillard, and David Beaudoin. 2009. Goodness-of-fit tests for copulas: A review and a power study. Insurance: Mathematics and Economics 44: 199–213. [Google Scholar] [CrossRef]

- Hamilton, James D. 1989. A new approach to the economic analysis of nonstationary time series and the business cycle. Econometrica: Journal of the Econometric Society 57: 357–84. [Google Scholar] [CrossRef]

- Joe, Harry. 1997. Multivariate Models and Multivariate Dependence Concepts. Boca Raton: CRC Press. [Google Scholar]

- Jondeau, Eric, and Michael Rockinger. 2006. The copula-garch model of conditional dependencies: An international stock market application. Journal of International Money and Finance 25: 827–53. [Google Scholar] [CrossRef]

- Kojadinovic, Ivan, and Jun Yan. 2010. Modeling multivariate distributions with continuous margins using the copula r package. Journal of Statistical Software 34: 1–20. [Google Scholar] [CrossRef]

- Kupiec, Paul. 1995. Techniques for verifying the accuracy of risk measurement models. The Journal of Derivatives 3: 2. [Google Scholar] [CrossRef]

- McNeil, Alexander J., Rüdiger Frey, and Paul Embrechts. 2015. Quantitative Risk Management: Concepts, Techniques and Tools-Revised Edition. Princeton: Princeton University Press. [Google Scholar]

- Oh, Dong Hwan, and Andrew J Patton. 2018. Time-varying systemic risk: Evidence from a dynamic copula model of cds spreads. Journal of Business & Economic Statistics 36: 181–95. [Google Scholar]

- Patton, Andrew J. 2006. Modelling asymmetric exchange rate dependence. International Economic Review 47: 527–56. [Google Scholar] [CrossRef]

- Rodriguez, Juan Carlos. 2007. Measuring financial contagion: A copula approach. Journal of Empirical Finance 14: 401–23. [Google Scholar] [CrossRef]

- Sklar, A. 1959. Fonctions dé repartition à n dimension et leurs marges. Université Paris 8: 1–3. [Google Scholar]

| 1 | Uniform transforms can be defined in the following way: if x has cumulative distribution function and y has cumulative distribution function , then and are standard uniform distributed. |

| 2 | We make use of the classical tail dependence indices for simplicity; as will be seen later, they can be easily obtained using a closed form formula, once a particular copula function is settled, but the reader should be aware of the shortcomings in the use of classical tail indices when moving apart from the "Gaussian world". For details, see Furman et al. (2016), where the authors urge that the classical measures of tail dependence may underestimate the level of tail dependence in copulas. |

| FTSE MIB | IBEX 35 | DAX 30 | |

|---|---|---|---|

| Mean | −0.08599 | −0.00012 | 0.00020 |

| Median | 0.00028 | 0.00062 | 0.00089 |

| Maximum | 0.10874 | 0.13484 | 0.10797 |

| Minimum | −0.08599 | −0.09586 | −0.07433 |

| St. Deviation | 0.016844 | 0.01601 | 0.01463 |

| Skewness | −0.06100 | 0.01222 | 0.01011 |

| Kurtosis | 6.83680 | 8.4853 | 8.65864 |

| FTSE MIB | IBEX 35 | DAX 30 | FTSE MIB | IBEX 35 | DAX 30 | ||

|---|---|---|---|---|---|---|---|

| −0.043168 | 0.044679 | −0.026672 | −0.094826 | −0.166808 | −0.169652 | ||

| (0.004125) | (0.041526) | (0.005380) | (0.001587) | (0.005469) | (0.002550) | ||

| 0.944940 | 0.845535 | 0.955586 | −0.144421 | −0.152084 | −0.178421 | ||

| (0.001412) | ( 0.074948) | (0.005338) | (0.013629) | (0.018368) | (0.018107) | ||

| 0.020101 | −0.009836 | 0.056801 | 0.989424 | 0.980849 | 0.980906 | ||

| (0.008237) | (0.044879) | (0.000259) | (0.000032) | (0.0008379) | (0.000058) | ||

| −0.921542 | −0.848789 | −0.939253 | 0.094497 | 0.111731 | 0.118315 | ||

| (0.000008) | (0.083562) | (0.000007) | (0.014279) | (0.0173419) | (0.008174) | ||

| 0.053048 | - | - | 9.392484 | 8.374261 | 7.671721 | ||

| (0.008330) | - | - | (1.641448) | (0.901715) | (1.226093) |

| FTSE MIB | IBEX 35 | DAX 30 | |

|---|---|---|---|

| KS statistic | 0.022156 | 0.015969 | 0.018821 |

| p-value | 0.2089 | 0.6005 | 0.3891 |

| BB1 | SJC | ||||

|---|---|---|---|---|---|

| FTSE MIB–IBEX 35 | FTSE MIB–DAX 30 | FTSE MIB–IBEX 35 | FTSE MIB–DAX 30 | ||

| −0.30000567 | 0.40884762 | 0.24838033 | 0.09810473 | ||

| (0.03716655) | (−0.28192092) | (0.24721904) | (0.2551627) | ||

| 0.03950425 | −0.94995981 | 0.85179066 | 0.96073183 | ||

| (0.29152632) | (−0.19627552) ) | (0.85034764) | (0.8588131) | ||

| −4.94732447 | −16.59315866 | 0.02490790 | −0.31265168 | ||

| (3.35765376) | (7.20800344) | (0.02766444) | (−0.4735605) | ||

| 1.28118967 | 0.01167368 | −0.04173219 | −0.07179274 | ||

| (1.09177413) | (0.30021851) | (−0.04417824) | (−0.1359612) | ||

| 0.17951749 | 0.99249420 | 0.84924889 | 0.80251885 | ||

| (0.46726049) | (0.83081313) | (0.84873280) | (0.5257496) | ||

| −2.58514184 | −0.03026523 | 0.03121317 | 0.14441369 | ||

| (−2.39938572) | (−0.06393856) | (0.02994828) | (−0.1443658) | ||

| 0.2059648 | 0.2754048 | 0.01920454 | 0.3144344 | ||

| p-value | 0.0004995 | 0.0004995 | p-value | 0.6728272 | 0.2442557 |

| Log-Lik | 1576.834 | 1387.445 | Log-Lik | 1512.259 | 1343.717 |

| BB1–GAS | SJC–GAS | ||||

|---|---|---|---|---|---|

| FTSE MIB–IBEX 35 | FTSE MIB–DAX 30 | FTSE MIB–IBEX 35 | FTSE MIB–DAX 30 | ||

| −1.31443861 | −0.003463384 | 0.25368733 | 0.28971776 | ||

| (-0.89944562) | (−0.46987585) | (0.24816560) | (0.29316496) | ||

| −0.26458349 | 0.996577947 | 0.84285325 | 0.81958206 | ||

| (0.05733857) | (0.26361708) | (0.84930233) | (0.80452288) | ||

| 0.66099308 | 0.066533564 | 0.10302827 | 0.04663823 | ||

| (0.48235972) | (0.01623878) | (0.03045566) | (0.04545464) | ||

| 0.06892752 | 0.080316329 | −0.03158979 | −0.03777936 | ||

| (0.08599858) | (0.08656701) | (−0.04297152) | (−0.05679195) | ||

| 0.94315204 | 0.926766139 | 0.85087467 | 0.79993059 | ||

| (0.93582273) | (0.92903208) | (0.84992074) | (0.80080747) | ||

| 0.05274755 | 0.068472429 | 0.03762481 | 0.03008048 | ||

| (0.05108619) | (0.06695990) | (0.01961471) | (0.04271727) | ||

| 0.2372009 | 0.4471988 | 0.08591551 | 0.03982476 | ||

| p-value | 0.00075 | 0.000487 | p-value | 0.02147852 | 0.7787213 |

| Log-Lik | 1584.072 | 1413.833 | Log-Lik | 1542.525 | 1319.508 |

| FTSE MIB—IBEX 35 | ||

|---|---|---|

| Kupiec Test | Christoffersen Test | |

| (Unconditional Coverage) | (Conditional Coverage) | |

| SJC | 1.006591 | 3.670008 |

| (0.3157209) | (0.1596129) | |

| SJC - GAS | 0.3804048 | 3.774803 |

| (0.5373867) | (0.1514649) | |

| DCC | 72.16992 | 77.56573 |

| (0) | (0) | |

| FTSE MIB—DAX 30 | ||

| Kupiec Test | Christoffersen Test | |

| (Unconditional Coverage) | (Conditional Coverage) | |

| SJC | 4.304982 | 5.927579 |

| (0.03800091) | (0.05162293) | |

| SJC—GAS | 5.80171 | 7.142801 |

| (0.0160106) | (0.02811646) | |

| DCC | 64.669 | 74.18366 |

| (0) | (0) |

© 2019 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Cortese, F.P. Tail Dependence in Financial Markets: A Dynamic Copula Approach. Risks 2019, 7, 116. https://doi.org/10.3390/risks7040116

Cortese FP. Tail Dependence in Financial Markets: A Dynamic Copula Approach. Risks. 2019; 7(4):116. https://doi.org/10.3390/risks7040116

Chicago/Turabian StyleCortese, Federico Pasquale. 2019. "Tail Dependence in Financial Markets: A Dynamic Copula Approach" Risks 7, no. 4: 116. https://doi.org/10.3390/risks7040116

APA StyleCortese, F. P. (2019). Tail Dependence in Financial Markets: A Dynamic Copula Approach. Risks, 7(4), 116. https://doi.org/10.3390/risks7040116