1. Introduction

One cornerstone of modern neoclassical finance is the fundamental theorem of asset pricing (FTAP). In its simplest form and if uncertainty is modeled by a probability measure , the theorem states equivalence between: part (a) the absence of -arbitrage; and part (b) the existence of a -equivalent martingale measure (EMM) . However, the microeconomic foundation of the FTAP relies on two further pillars: part (c) the price system within a viable equilibrium concept; and part (d) the preference-free valuation perspective.

As masterly elaborated by

Harrison and Kreps (

1979), part (c) can be directly connected to the infinite-dimensional equilibrium model à la Arrow–Debreu. On the other hand, as explained by

Ross (

1976), preference-free pricing (part (d)) boils down to risk-neutral pricing, when uncertainty boils down to risk. For an account of all four concepts under single-prior uncertainty, see

Dybvig and Ross (

2003).

This paper removes the underlying assumption of a given objective, physical, or reference probability measure

. Instead, a set of measures

describes the (Knightian) uncertainty, which is parameterized by different stochastic volatility models

. Such an approach deviates from models in which the term structures of volatilities, including stochastic volatility models such as that of

Heston (

1993), are described by another stochastic process. Doubts about the modeler’s ability to be aware of all relevant information lead to the view that knowing the true volatility regime is often impossible. As argued by

Epstein and Ji (

2013), the hypothetical confidence of a universal dependency between past and future is in question and modeling the volatility in terms of a stochastic process, in which the law of motion is exactly known, is avoided. In a similar vein,

Carr and Lee (

2009) argued that the choice of a particular model describing the short term volatility is problematic

because the quantity being modeled is not directly observable. Although an estimate for the initially unobserved state variable can be inferred from market prices of derivative securities, noise in the data generates noise in the estimate, raising doubts that a modeler can correctly select any parametric stochastic process from the menu of consistent alternatives.”This ambiguity about the true volatility model translates to a set priors that is no longer mutually equivalent but happens to be mutually singular. Singular priors live on disjoint supports, and , for an event A. This aspect, in particular, requires a reformulation of each of parts (a)–(d) and a careful reconnection of their relations. As such, this paper establishes a FTAP under volatility uncertainty and accounts for a sound microeconomic foundation.

Before introducing the main results of the paper, the new and adjusted parts (a)–(d) deserve some motivation and a detailed account.

(

a) Typical costless arbitrage is a non-negative contingent claim, that is with positive probability strictly positive. Such a definition clearly depends on the chosen objective prior that forms the law of the underlying asset price. The situation changes when uncertainty is described by a set of possibly mutually singular priors

. As in

Vorbrink (

2014), a robust form of arbitrage refers to a positive claim that is strictly positive under some prior in

. Geometrically, the set of arbitrage opportunities can be identified by the positive cone of the

-dependent space of contingent claims with a deleted zero.

(

b) Under sole risk and linear expectations, the martingale concept quantifies a fair game. This standard martingale notion can be extended to the multiple-prior uncertainty setting. Following

Peng (

2006), this paper considers a multiple-prior martingale notion that is based on a time-consistent conditional sublinear expectation

. Such an

-martingale is a supermartingale (unfair game) for all single prior conditional expectations and a martingale (fair game) for some maximizing expected value with respect to the related priors. Only if all the priors in

are maximal is an

-martingale called symmetric. This corresponds to a uniform notion of a fair game. Instead of the existence of an EMM

, under which the asset prices are martingales, the present objective multiple-prior uncertainty

now requires the existence of a set of measures

. This new set has to define a new multiple prior sublinear expectation

under which the asset price becomes a symmetric martingale. In that case,

is called an

equivalent symmetric martingale measure set (EsMM-set). The prior-by-prior equivalence to the objective world

, now relies on a family of state prices that creates a risk- and ambiguity-adjusted expectation

. The discussion about the role of

continues in part (d). The relation to viability as a model of equilibrium, stated in part (c), requires the notion of a particular nonlinear equilibrium price system that corresponds to

.

(

c) By accepting the modified notion of arbitrage in part (a) as a weak dominance principle, one crucial issue points to inconsistencies between the linear price system and the present concept of arbitrage. As in the single-prior setup, linear prices on the space of contingent claims are represented by a prior-dependent state-price density. Again, a risk-neutral measure

refers to the normalized version of a linear price system in the sense of Arrow–Debreu. However, under volatility uncertainty, priors in

can be mutually singular. On the one hand, linear and positive prices only capture strictly positive payoffs in events that are in the support of the representing prior. On the other hand, such price systems are blind to an “arbitrage event” outside their support. For this reason, the

-dependent linear prices are aggregated into a robust pricing scheme. The corresponding coherent price system is sublinear, and the new notion of viability (as a model of an economic equilibrium) no longer shares this problematic feature of linear price systems.

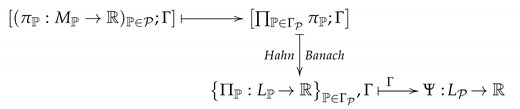

1(d) The EMM is often referred to as a description of the risk-neutral world. In fact, under this risk-neutral measure , the returns of a risk-free and a risky asset coincide. From this perspective, the valuation of any contingent claim does not depend directly on the agent’s preferences for risk. The obtained valuation is then preference-free. Departing from this basic insight under sole risk, the next natural step is to ask how the preference-free approach can be applied to an objective multiple prior uncertainty model . To see this connection, consider an EsMM-set from part (b). Preferences for uncertainty consist of risk and ambiguity preferences. The new component, preferences for ambiguity, becomes neutral when we move to the uncertainty-neutral world . The symmetry of -martingales, that is, the asset price is a -martingale under each with no ambiguity about the expected value, exactly corresponds to ambiguity-neutrality (in the mean). From this perspective, an EsMM-set is then a model of a risk- and ambiguity-neutral world. This reasoning qualifies the valuation principle to be called uncertainty neutral.

Based on parts (a)–(d), the FTAP of the present paper is established in a continuous-time setup, in which the risky and ambiguous asset price is driven by a Brownian motion

with uncertain volatility

. This is a zero-mean and stationary process with novel

-normally distributed independent increments. Such random variables are characterized by a nonlinear heat PDE. On the other hand,

-normally distributed random variables are the outcome of a robust central limit theorem for a given confidence interval

, see Chapter II of

Peng (

2010). The resulting process is a canonical generalization of the standard Brownian motion, such that the volatility

moves almost arbitrarily within

. A

Samuelson (

1965)-type model incorporates this kind of volatility uncertainty in a risky

and ambiguous asset price process that follows the stochastic differential equation

As in the classic single-prior setting, the increment

in Equation (

1) is divided into a locally certain part and a locally uncertain part

. The interpretation is

where

refers to the conditional variance under

. In abuse of notation, the issue in Equation (

2) is displayed by

. Under a standard Brownian motion, the description in Equation (

2) of Equation (

1) boils down to the textbook description

, see Chapter 5 in

Duffie (

2010).

Section 3 departs from the equivalence in

Section 2 of part (a) absence of

-arbitrage; and part (b) existence of an EsMM-set

. To provide a microeconomic foundation, we discuss the connection between EsMM-sets, coherent price systems and viability as a model of an economic equilibrium from part (c). As mentioned in part (d), the resulting price system is a risk- and ambiguity-neutral valuation.

2. Risk- and Ambiguity-Neutral Asset Pricing

For the whole section, is induced by volatility uncertainty about an underlying one-dimensional state process . Moreover, assume that , the path space of continuous functions with . For the construction of the ambiguous volatility model, consider the Wiener measure that makes the coordinate process into a Brownian motion. denotes the Borel -algebra on . Fix the filtration generated by , where denotes the collection of -null sets. Fix an adapted, -square integrable and positive volatility process .

Volatility uncertainty is then based upon martingale laws on

:

Via the construction in Equation (

3), a set

of volatility regimes builds the uncertainty model

. The quadratic variation

then describes the volatility of

under

. The leading Example 1 satisfies the following standing assumption for

. This allows to define in

Section 2.2 a sublinear conditional expectation that satisfies the law of iterated expectations. As in

Nutz and Soner (

2012), for each stopping time

, define

, which consists of all the priors in

that agree with a

in the events up to time

t.

2Assumption 1. The set of priors isstable under pasting, if for every , every -stopping time τ, and , we have , where , for all .

Example 1. Suppose that two volatility models and are consistent with a given dataset. Their respective implications for a trading decision may differ considerably. To address the possibility of different volatility regimes, define the universal extreme cases and . When thinking about reasonable uncertainty management, no scenario between and should be ignored. These boundaries result in: For

. define the upper expectation

and the norm

on

, the space of all bounded continuous real-valued functions on

, given by

. The completion of

under

is denoted by

, and let

be the quotient space of

with respect to the

-null elements

. The elements in

have finite variance under every

(see

Appendix A for a representation of

). Clearly,

is the standard Lebesgue space.

A property holds

-q.s. (quasi surely) if it holds

-almost surely for every

. A payoff

X is positive if

-q.s. This induces an order relation

, denoted by ≥, on

so that the classical arguments prove that

is a Banach lattice (see

Appendix A). In addition, set

. For questions of asset pricing,

-deflated claims

play a central role. To guarantee

, it suffices to assume

.

2.1. Arbitrage and Primitives of the Financial Market

For the sake of simplicity, the price of the riskless asset satisfies

, that is, the interest rate is zero. Fix a pair

on the filtered uncertainty space

, where the price process of the uncertain asset

satisfies

for each

t and is

-adapted. As in

Harrison and Kreps (

1979), trading strategies are simple and omit to exclude doubling strategies under some completion. A simple strategy is an

-adapted stochastic process

such that there is a finite sequence of dates

and

,

, and can be written as

, with

. The fraction invested in the riskless asset is denoted by

. A trading strategy

is

self-financing if

for all dates. The value of the portfolio

satisfies

for every

t. The set of self-financing trading strategies is denoted by

. This financial market

, taken together with

, is denoted by

.

Under model uncertainty, a robust notion of no-arbitrage notion is a basic step. The following arbitrage concept is a slight generalization of

Vorbrink (

2014).

Definition 1. Let . There is an -arbitrage opportunity in if an admissible pair exists such that

, -a.s. and for some .

The definition rests on the following thought experiment. An arbitrage strategy is riskless for each , and if the prior describes the dynamics of asset prices, one would gain a profit with a strictly positive probability. The -arbitrage notion can be seen as a rather weak arbitrage opportunity and one could argue that no -arbitrage is consistent with a weak dominance principle based on . If , the usual arbitrage concept under appears.

Remark 1. As originally discussed by Kreps (1981), the order structure of the underlying space of claims determines the natural candidate for a no-arbitrage condition. The order relation on defines the arbitrage cone by deleting the zero of . Every defines a weaker order relation and a larger arbitrage cone. The arbitrage concept in Definition 1 allows any subset to determine what an arbitrage is. 2.2. EsMM Sets and Ambiguity Neutrality

Let us move to the dynamics of a continuous-time, multiple-prior uncertainty model. The unique existence of sublinear conditional expectations

is provided through the following construction, which is based on the dynamic programming principle:

See Section 2 of

Epstein and Ji (

2014) for details and a list of properties. The sequence of conditioning satisfies the law of iterated expectations, that is, for every

the updating rule

holds.

A process

with

for each

, is an

-

martingale if

For an -martingale , its negative is in general not an -martingale again. If this is the case, the process is a symmetric -martingale, which is equivalent to the -martingale property of for every . Symmetry for a process implies no ambiguity about the expected value of under .

Definition 2. A set of probability measures on Ω is called an equivalent symmetric martingale measure set (EsMM-set) if the following conditions hold:

- 1.

For every , there is a that is equivalent via .

- 2.

is a symmetric -martingale where is the conditional sublinear expectation under which is stable under pasting.

The collection

denotes the collection of all EsMM-sets

, as in Equation (

14). The case

boils down to the well-known EMM. The first condition states a direct relation between an element

and a primitive prior in

. Integrability is a technical condition to guarantee the connection to viability and the commodity-price duality. The second part of Definition 2 points to the adjusted martingale condition. The idea of a fair gamble under

reflects the neutrality of preferences for both risk and ambiguity. The symmetric martingale property of

S implies, as discussed in the Introduction regarding part (c) and part (d), that the (expected) value of the claim is constant with respect to different measure in the EsMM-set. In other words, the valuation is mean-ambiguity free, i.e., preferences for ambiguity under

are neutral.

One can think of the ambiguity-neutral part in terms of risk-neutral maxmin preferences of

Gilboa and Schmeidler (

1989), i.e., the worst-case expected utility under

. For a claim

X on

,

is then constant on

. Similarly to pricing under risk, in which risk preferences are irrelevant, analogous reasoning remains valid for preferences for ambiguity. As such, uncertainty neutrality immediately leads to the uncertainty-neutral expectation

. The same reasoning remains valid for smooth ambiguity preferences of

Klibanoff et al. (

2005).

2.3. Existence of EsMM-sets

In this section, asset prices are driven by a

G-Brownian motion, in which the volatility uncertainty is contained in the quadratic variation (see

Appendix A.2 for an overview). This specific framework allows confirming the existence of EsMM-sets.

Again, the riskless asset

has an interest rate

of zero. Volatility uncertainty in the asset prices

means that every adapted stochastic process

taking values in

is a possible model for the volatility of the underlying state process. More precisely,

S is driven by a

G-Brownian motion

(see

Appendix A.2 for a detailed exposition). As a special case of Example 1,

is now induced by

. The asset price is determined by the following stochastic differential equation

where

-almost surely. The process

is strictly positive and bounded. Let

and

be processes such that a unique solution of Equation (

7) exists (see Part 5 of

Peng (

2010) for some classical Lipschitz continuity conditions on

and

V in the state variable).

Remark 2. As in the classic probabilistic framework, a Girsanov transformation of , with , guarantees the existence of a nontrivial EsMM-set . For this approach, define a new sublinear expectation on , via , The state price ψ in Equation (8) is now an aggregated object under the uncertainty model, i.e., -a.s. for all . This universal state-price density is the terminal value of a symmetric exponential martingale , with . The process is now the market price of risk and ambiguity. Similarities to the single-prior case are apparent. The results in Appendix A.2 allow us to write explicitly as Let the pricing kernel in Equation (

9) solve

. Define the symmetric

-martingale

(see the second result in

Appendix A.2), and assume

for some

. Under these conditions, we have the following FTAP under ambiguous volatility. The result corresponds to Theorem 3 of

Harrison and Kreps (

1979) where uncertainty is captured by a single objective probability measure.

Theorem 1. An EsMM-set exists if and only if -arbitrage in is absent.

Remark 3. Theorem 3.3 of Epstein and Ji (2013) obtains analogous state prices by using a consumption-based utility-gradient approach and assuming and . The local form of (7) would then be apparently governed by . The relation between the asset price processes, with pricing kernel , is as follows , where denotes the derivative of the ambiguous quadratic variation. We end this section with an example on option pricing under volatility uncertainty.

Example 2. Let be constant and be an option on the uncertain asset price from (7). If φ is convex, such as a European call for some strike price , the price from (8) then simplifies towhere, as a special of Equation (9) under , Similarly, for concave φ, such as a European put, we get (see Avellaneda et al. (1995) for a detailed discussion of both cases). In particular, the pricing then coincides with the pricing in a Black–Scholes model. Nonconvex payoff structures, such as Butterfly options3, yield a maximizing with such that the corresponding is no longer a constant process. Thus, there is no σ for the Black–Scholes model that matches with the pricing under volatility uncertainty. In Fouque and Ren (2014), with , the price of a butterfly option under Ψ is computed through approximation techniques of the corresponding nonlinear heat PDE (see also Appendix A.2 for the relation between PDE’s and G-Brownian motion).