5.1. Financial Market Scenarios

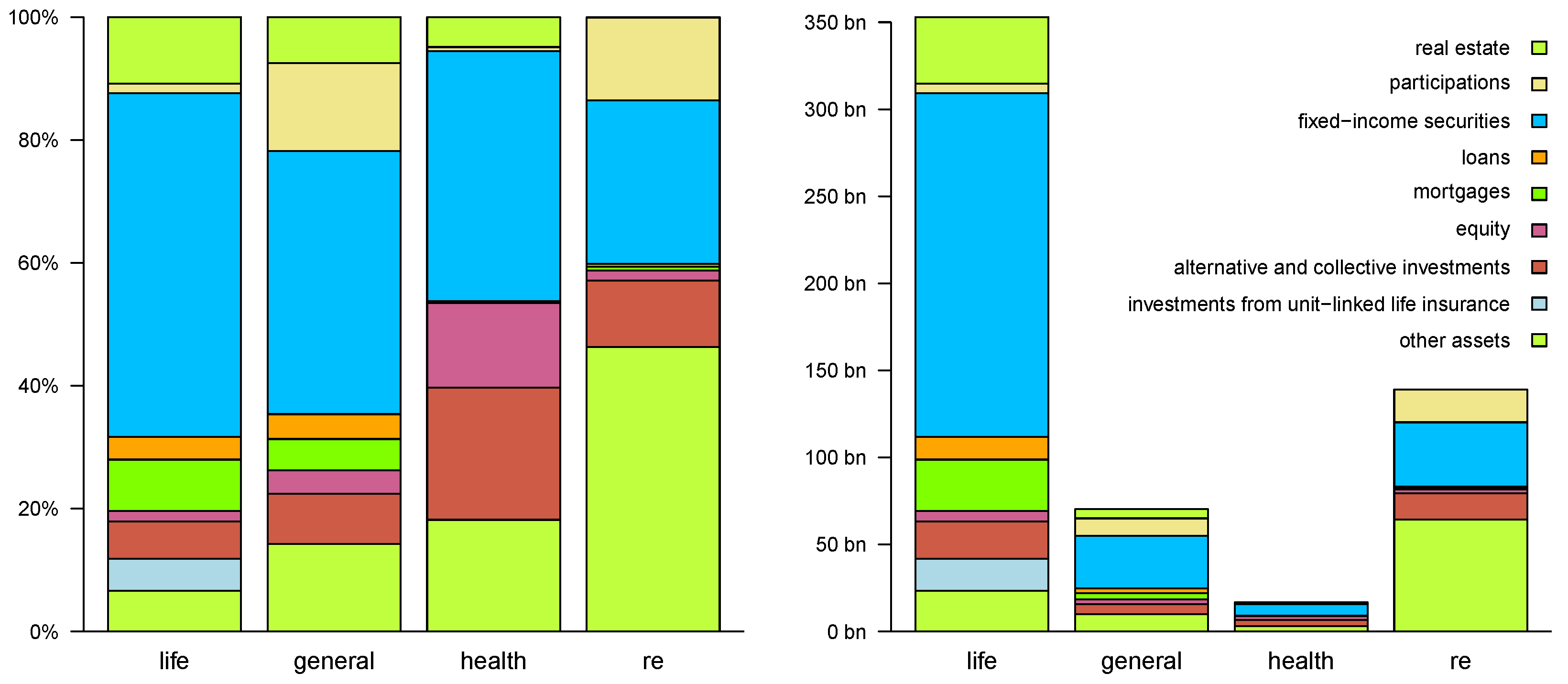

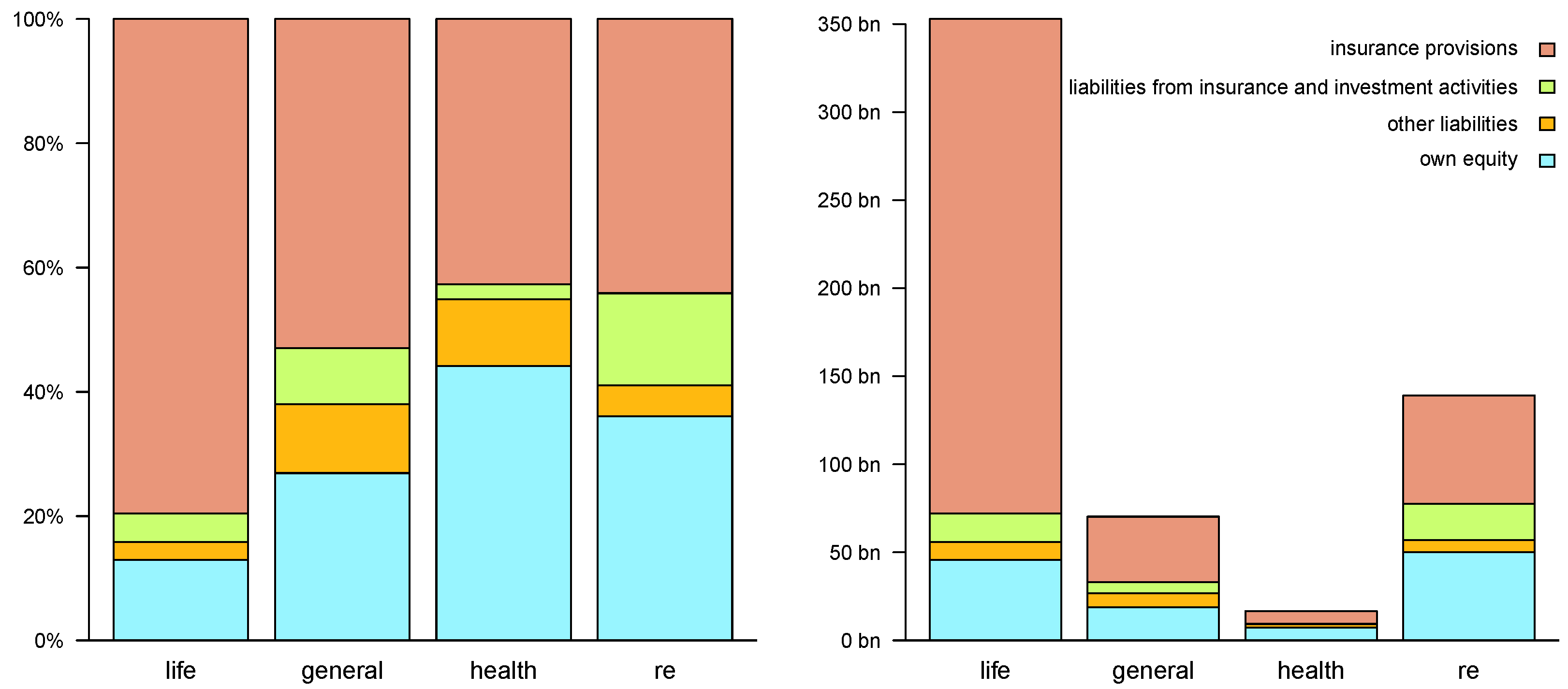

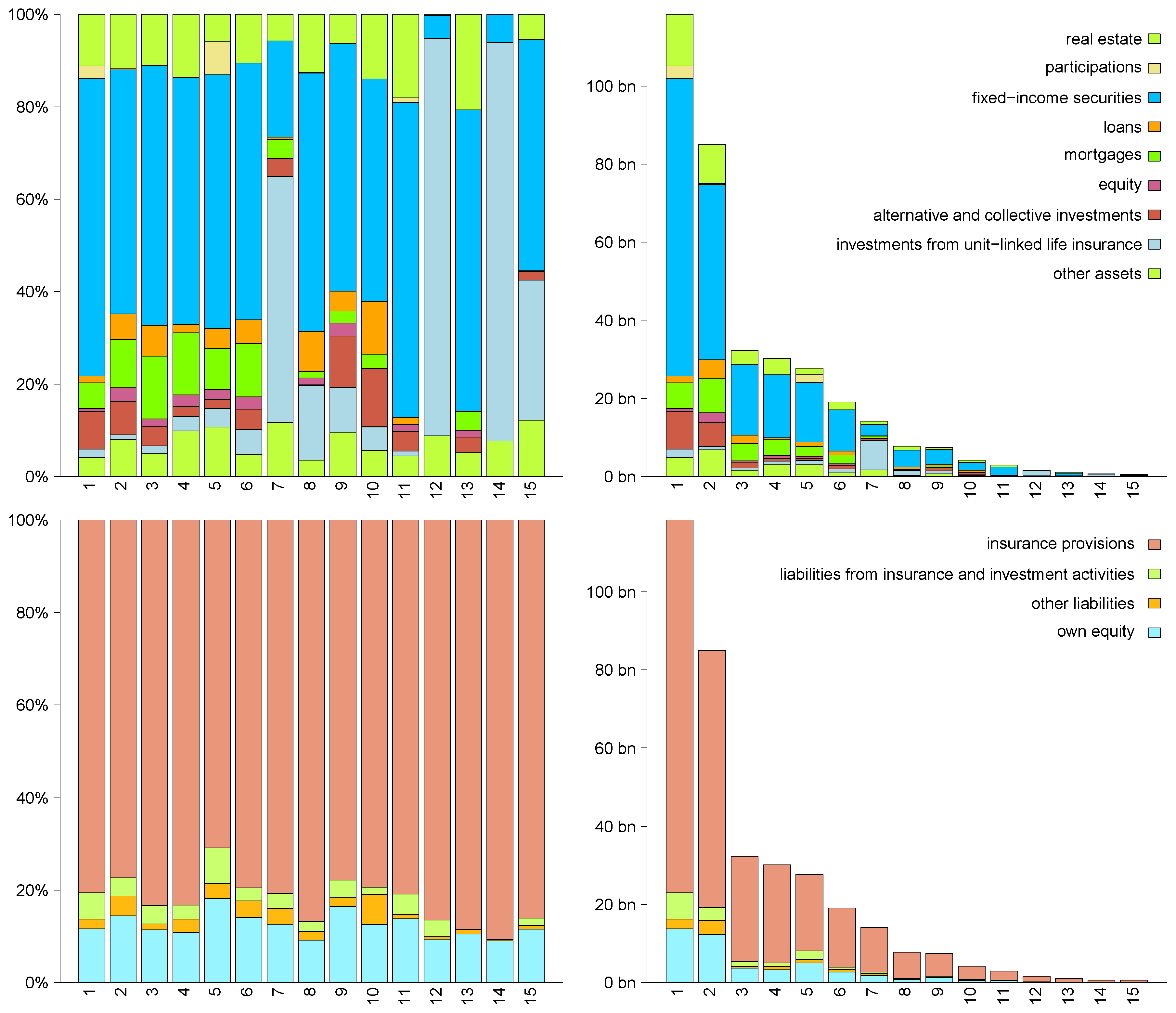

First we consider scenarios defined by changes in the market risk factors listed in

Table 2. For these scenarios we respectively predefine changes in some of the market risk factors. We then define the changes in the remaining factors, except

and

, to be the conditionally expected changes given by Lemma 1, see also Remark 2. If not predefined, we set

and

, throughout.

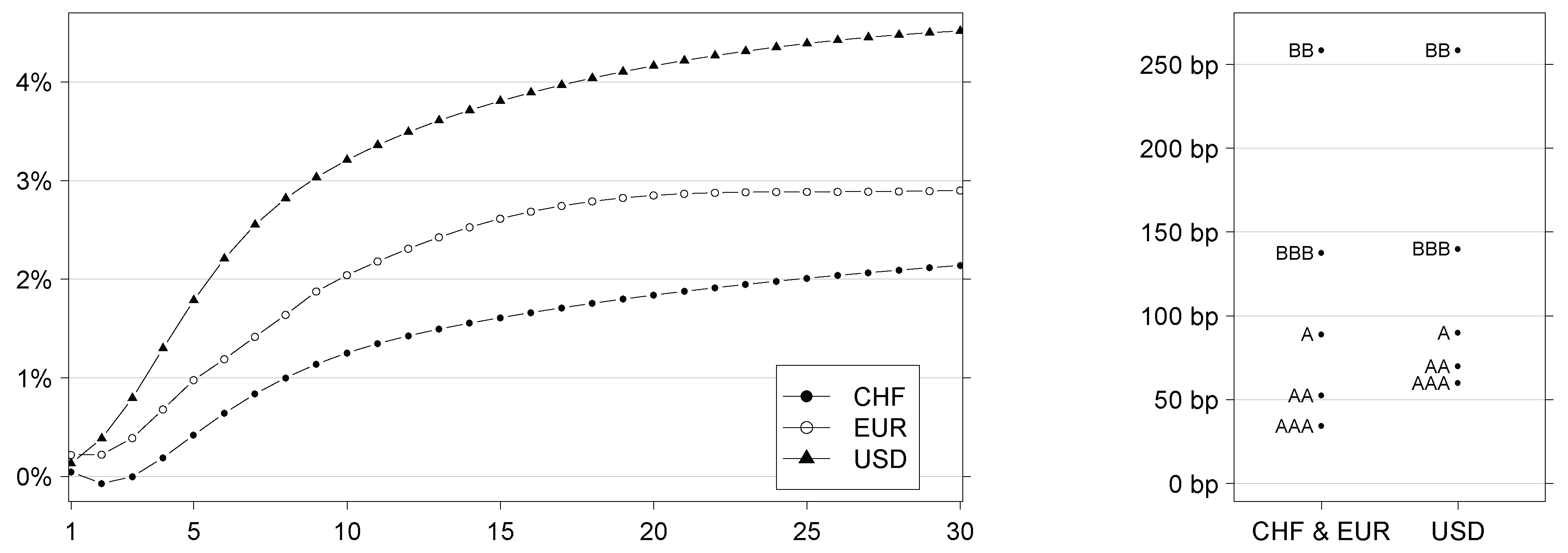

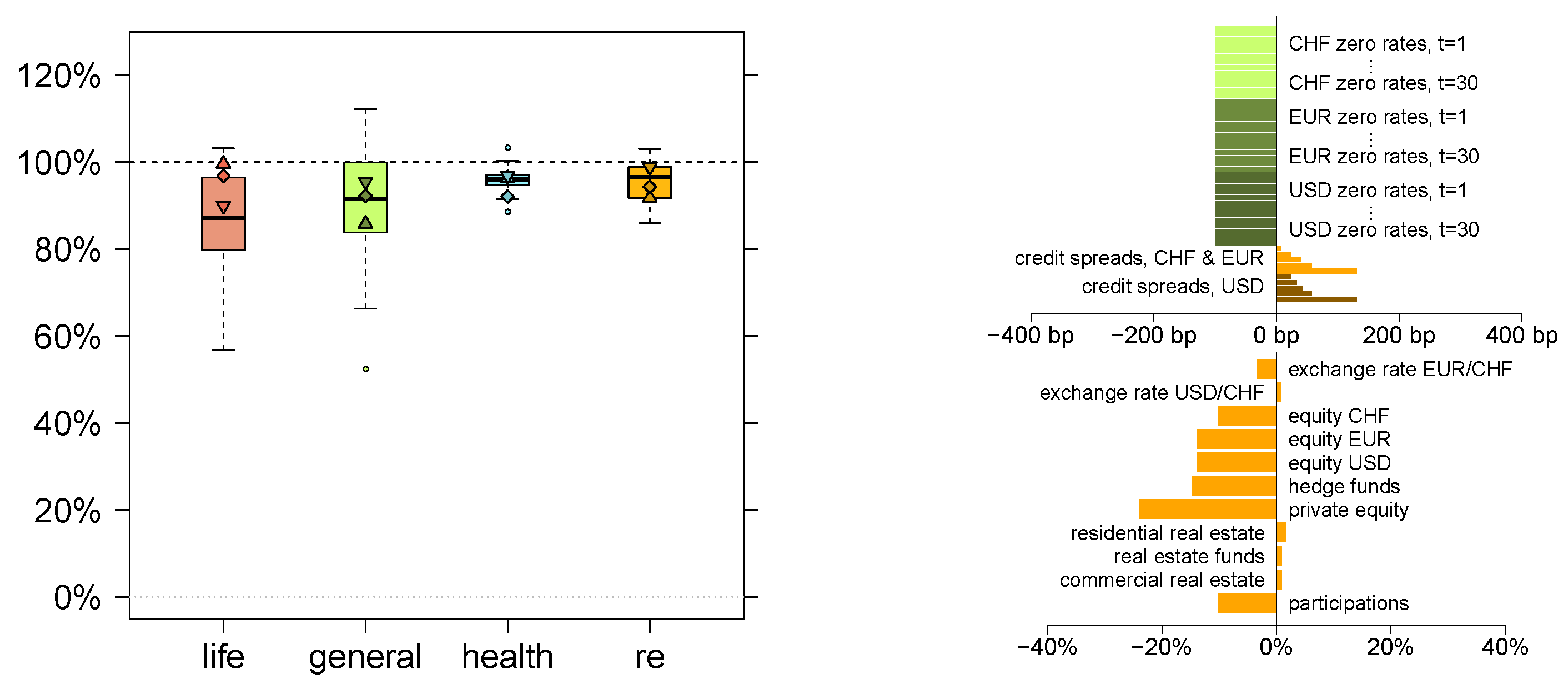

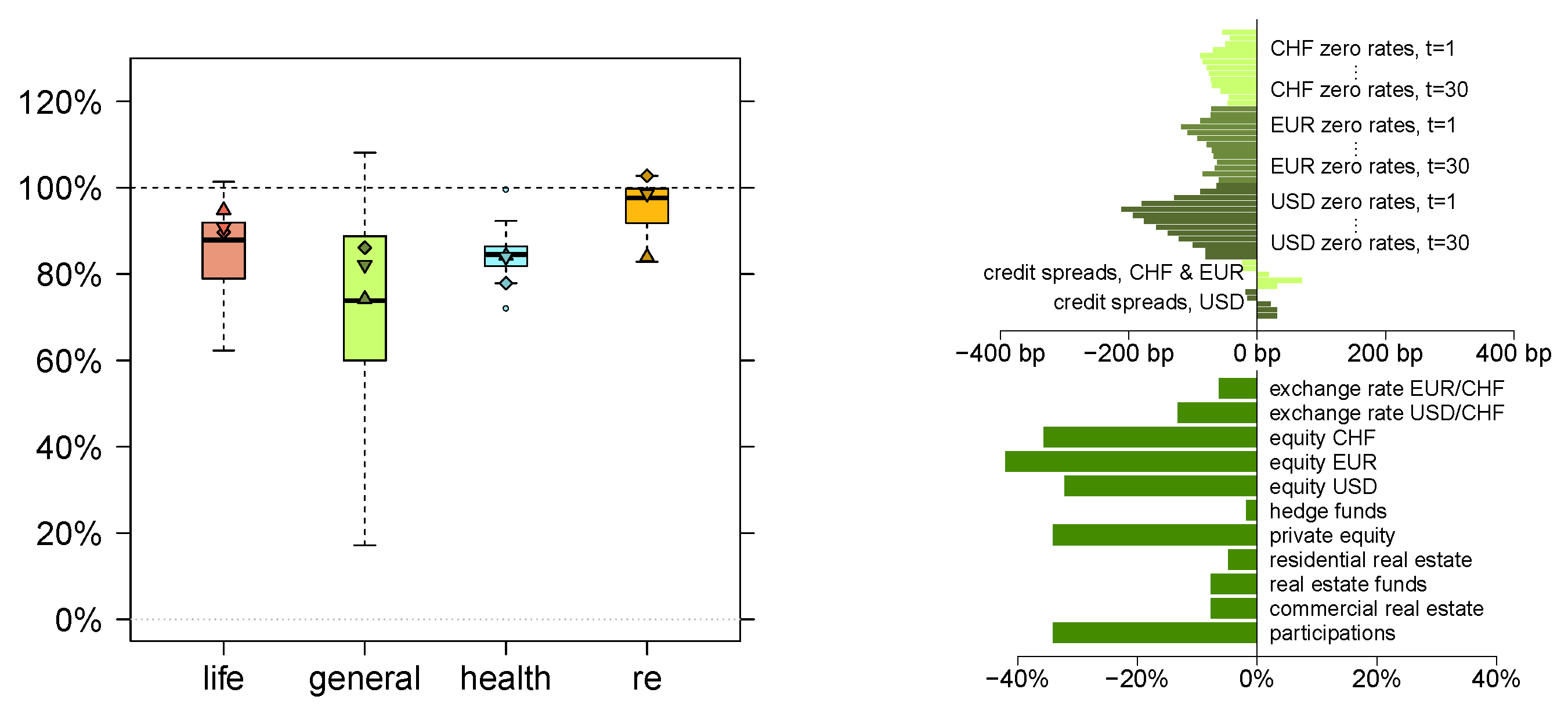

In the figures below we illustrate for each of these scenarios the changes in the market risk factors, see for example

Figure 5 (rhs). The predefined changes in market risk factors are colored green, while the conditionally expected changes in the remaining risk factors are colored orange. Absolute changes are shown in basis points (bp) and relative changes in percentages. For a given currency, changes in zero-coupon rates are sorted by maturity

, with maturity

year on top. Similarly, for a given currency, changes in credit spreads are sorted by rating

, with rating AAA on top. For better illustration in both cases, zero-coupon rates and credit spreads, we indicate different currencies with different saturations.

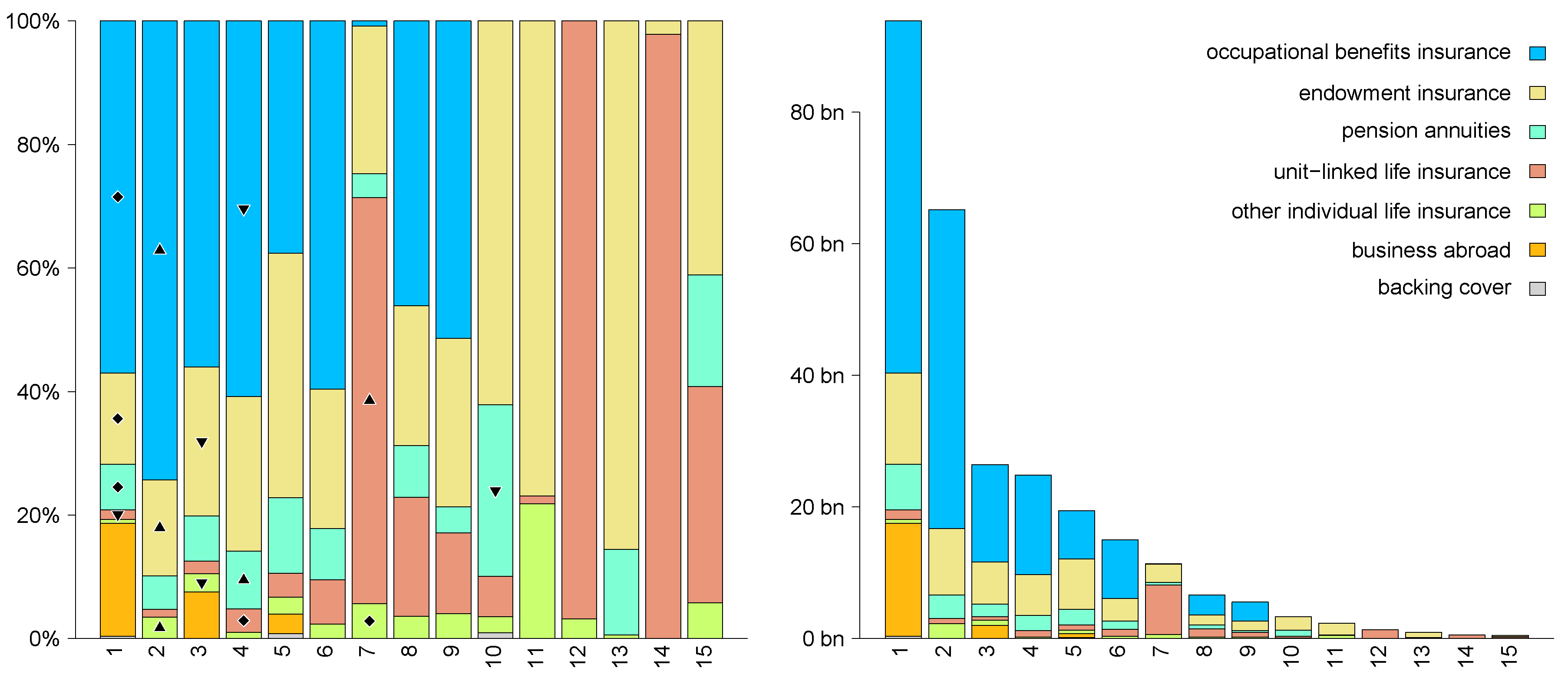

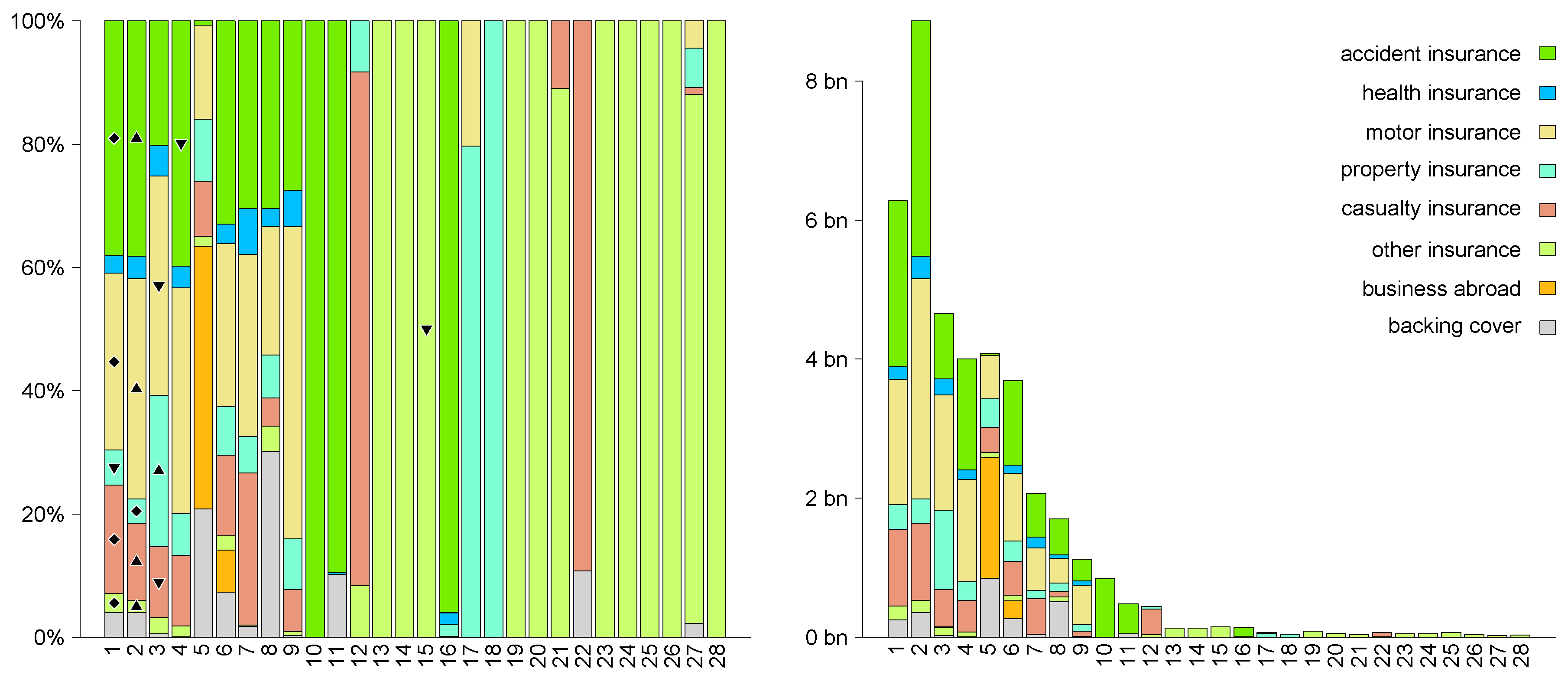

Further, for each stress scenario we present in the same figures box plots summarizing the impact on the CHF insurance market, see for instance

Figure 5 (lhs). Each box plot illustrates the impact ratios

of the companies in a given branch of insurance. The plots colored red correspond to life insurers; we choose green for general insurers, blue for health insurers and we choose orange for reinsurers. Moreover, in each box plot we indicate the impact ratios of the three largest insurers (in terms of balance sheet total) respectively by ▴, ⧫, ▾ in decreasing order, with ▴ indicating the largest insurer.

Decline in risk-free rates. We consider a decrease in each zero-coupon rate by 100 basis points, see green color in

Figure 5 (rhs). The market dependencies imply, in particular, an expected increase in credit spreads and an expected decrease in the total values of equity, hedge funds and private equity, see orange color in

Figure 5 (rhs).

Figure 5 (lhs) illustrates the resulting impact on the CHF insurance market.

The median impact ratio for life insurers is . The two insurers having almost solely insurance provisions for unit-linked life insurance benefit from this scenario. This is due to the low impact on their respective liability side.

The median impact ratio for general insurers is . The loss faced by the largest insurer mainly originates from its participation in the life insurer of the CHF insurance network that has an impact ratio of . The general insurers with an impact ratio over mainly have insurance provisions for other non-life insurance such as legal protection insurance.

The impact on health insurers and reinsurers is comparably low, with median impact ratios of and , respectively.

Conclusion. We observe that most of the insurance companies are able to absorb this stress scenario in an adequate way. Therefore, the scenario does not have a severe macroprudential effect on the CHF insurance market.

If, instead, we increase each zero-coupon rate by 100 basis points, we virtually get mirrored plots compared to

Figure 5. Note that a considerable rise in interest rates may additionally cascade an increase in lapse rates. This is analyzed separately in

Section 5.2.

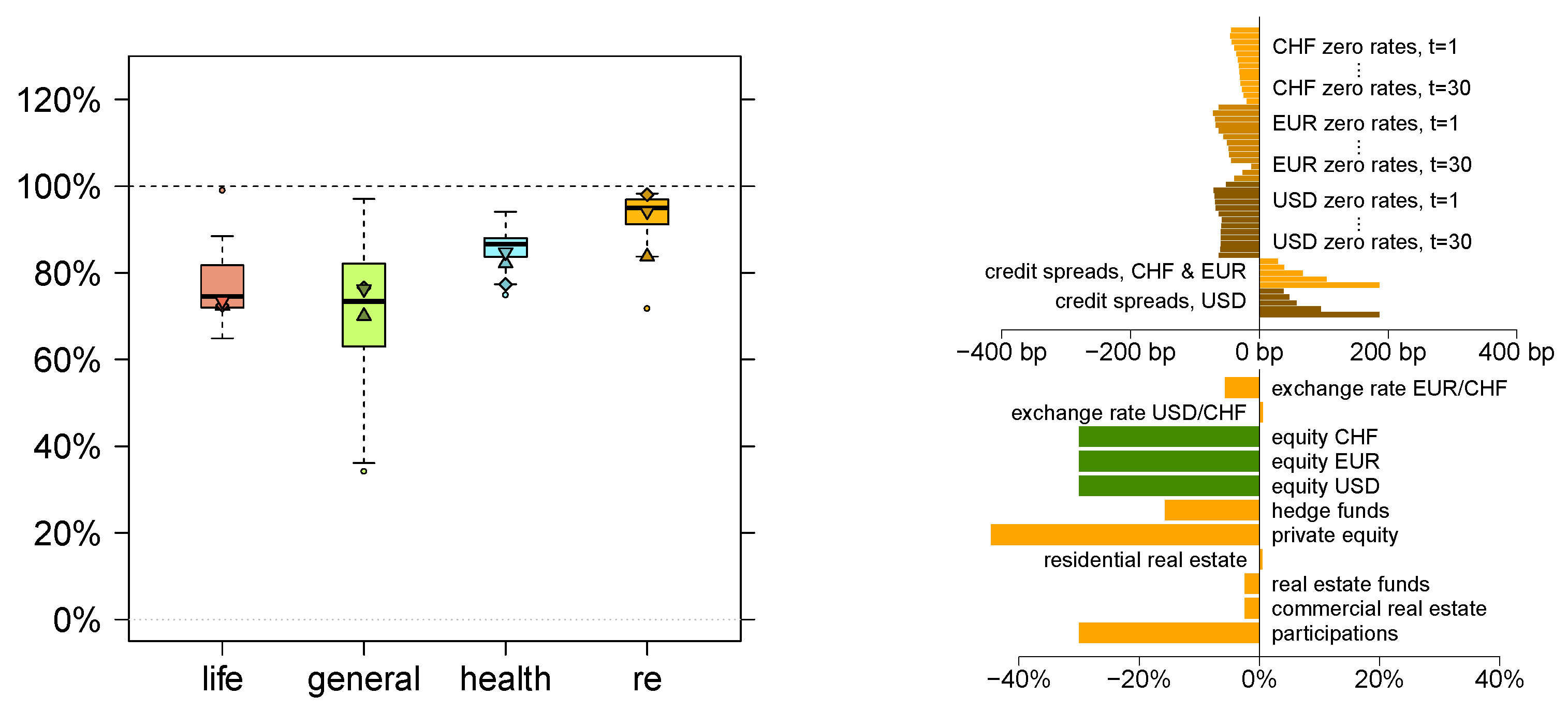

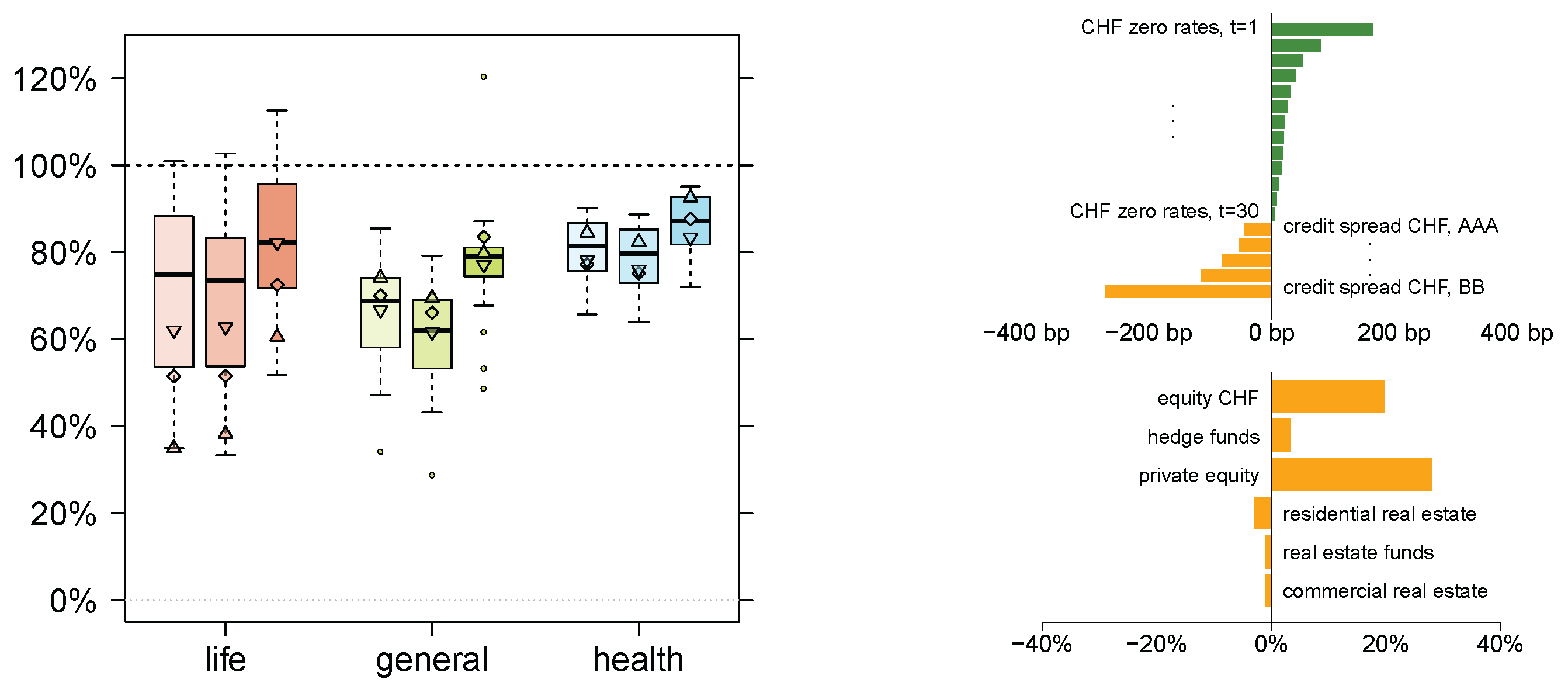

Fall of the equity market. We analyze the impact on the CHF insurance market when the total value in equity drops by

for all currencies, see green color in

Figure 6 (rhs). The market dependencies imply an expected drop of

in total value of private equity, an expected drop of

in total value of hedge funds and remarkable changes in risk-free rates and credit spreads, see orange color in

Figure 6 (rhs). The impact on the CHF insurance market is illustrated in

Figure 6 (lhs).

The median drop in risk bearing capital is for life insurers. This drop is mainly caused by the changes in the risk-free rates and credit spreads. Again, the two life insurers feeling nearly no impact mainly have insurance provisions for unit-linked life insurance.

The median drop in risk bearing capital is for general insurers. This drop mainly stems from losses in equity, collective and alternative investments and, if any, participations in life insurers of the CHF insurance network.

The picture is similar for health insurers, though the corresponding median drop of in own equity is less pronounced. However, the five lowest impact ratios belong to the five largest insurers. The impact is low for most reinsurers, with a median impact ratio of . The largest reinsurer suffers a loss amounting to of its initial risk bearing capital mainly due to its participations in companies (none of these is part of the CHF insurance network). The outlier with an impact ratio of suffers losses primarily because of its holdings in equity and alternative investments.

Conclusion. This stress scenario has a significant impact on the life insurers of the CHF insurance market. The weighted average of impact ratios is for these insurers. Assuming a weighted average of solvency ratios of , this scenario is a severe danger to the life insurance market. Special measures, like a temporary relaxation of solvency requirements, possibly need to be applied in order to ensure the continuous functionality of that market.

The stress scenario has a comparable impact on general insurers and a less severe impact on health insurers and reinsurers. Supported by the high average means of solvency ratios for these branches of insurance, we conclude that the scenario does not pose a great danger to these insurance sectors.

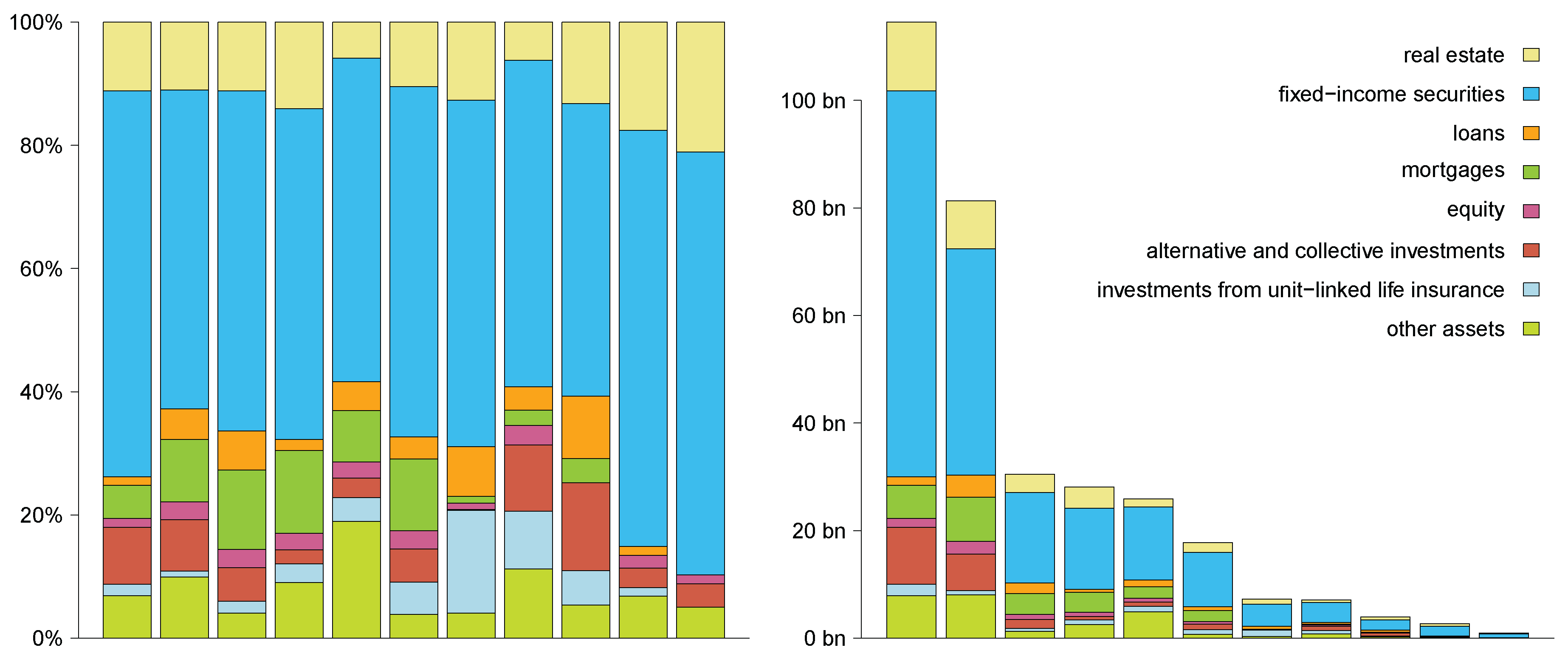

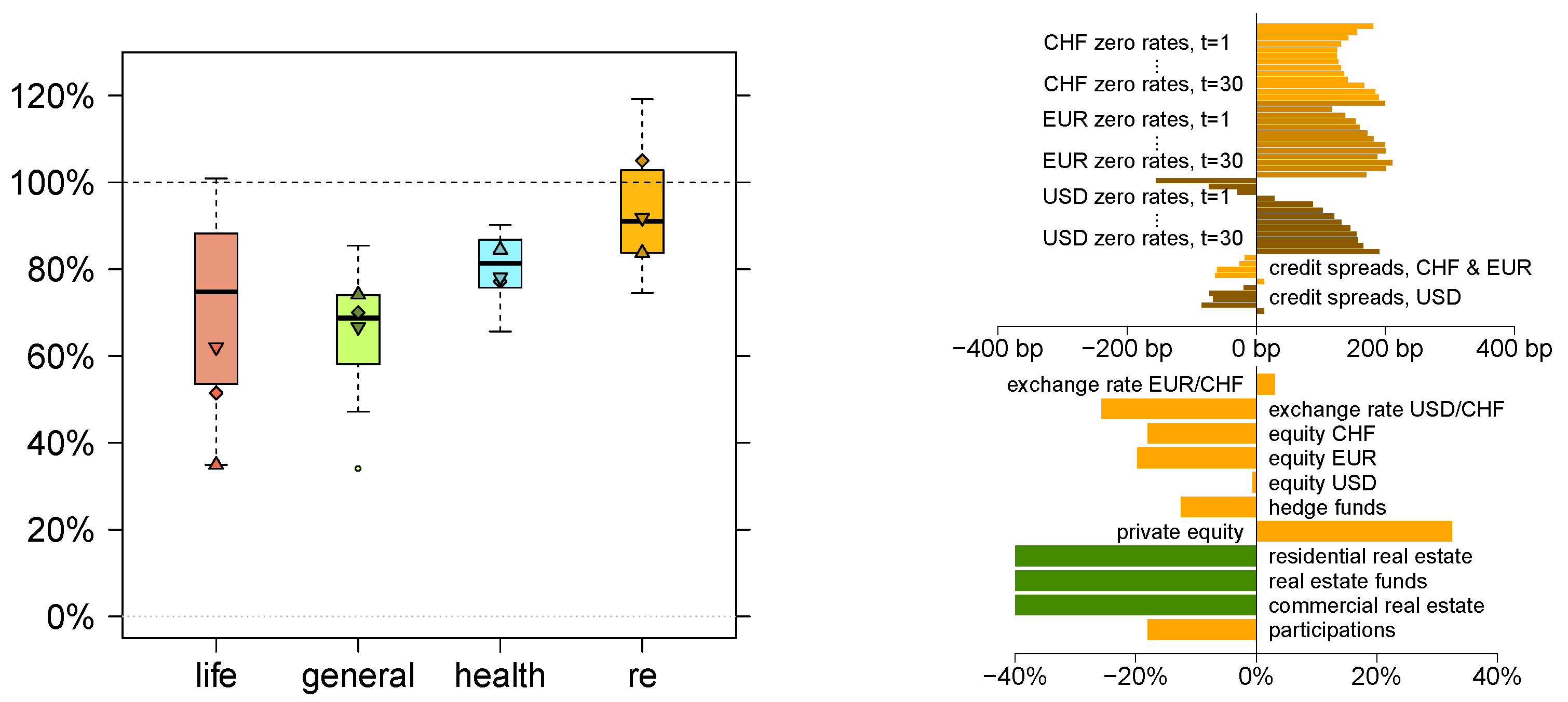

Real estate market crash. Next, we analyze the consequences of a real estate market crash for the CHF insurance market. For this, we set the changes in all real estate related market risk factors to

. This decrease can be compared to the real estate crisis in Switzerland in the 1990’s, in which real estate price indexes declined by more than

, see [

36]. The conditionally expected changes in the remaining risk factors and the resulting impact ratios

are illustrated in

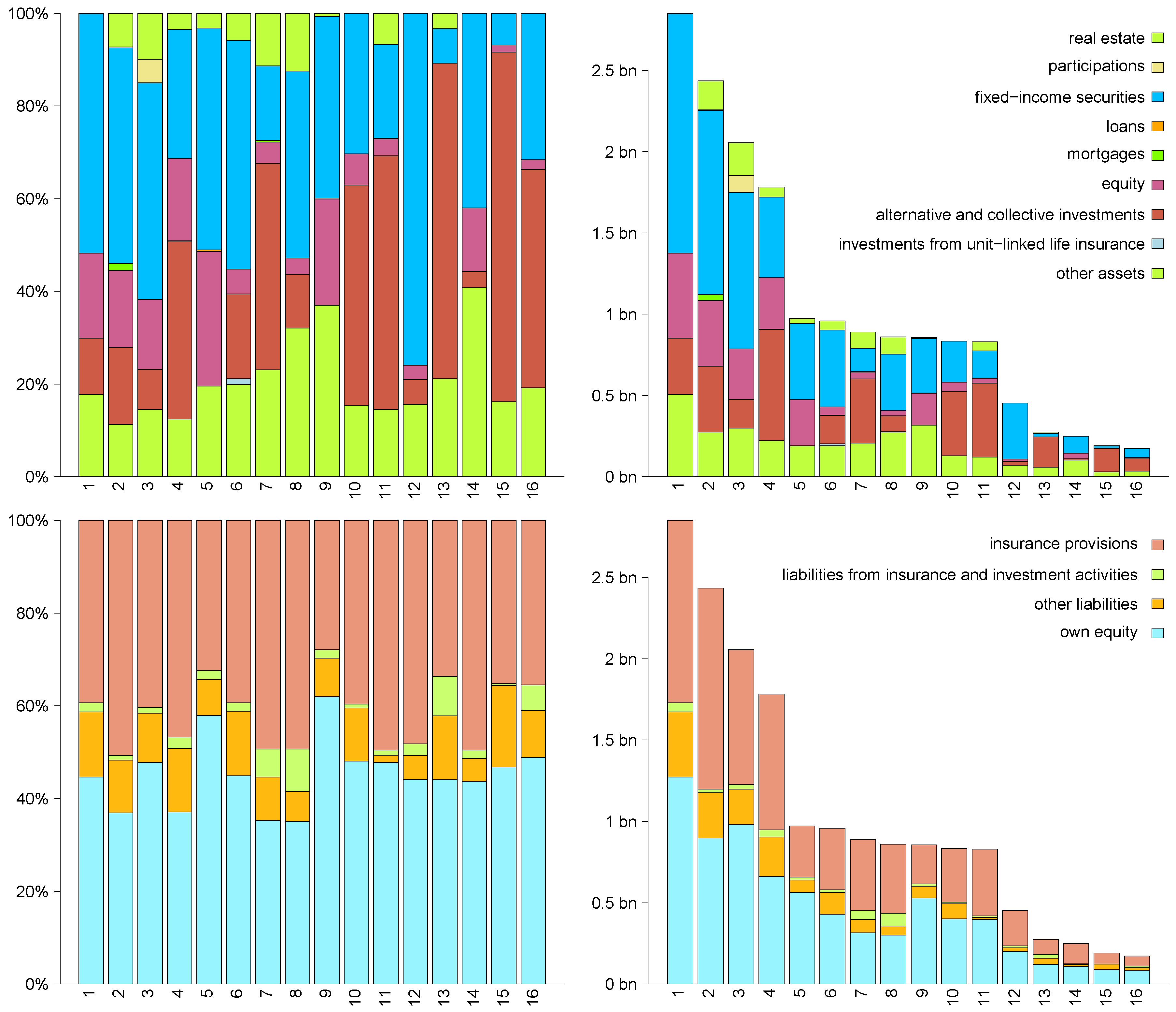

Figure 7.

The median impact ratio is for life insurers. In particular the large companies suffer high losses. These losses are mainly caused by real estate related investments. The losses on the asset side and the gains on the liability side due to the changes in interest rates practically compensate each other.

The median impact ratio is for general insurers. These insurers mainly face losses due to their participations (in life insurers of the network) and due to the drawdown of the equity market. For instance, the loss in participations of the largest general insurer contributes 20 percentage points to the drop of in its own equity.

The median impact ratio is

for health insurers. The losses primarily originate from real estate related investments and holdings in the equity market. The median impact ratio for reinsurers is

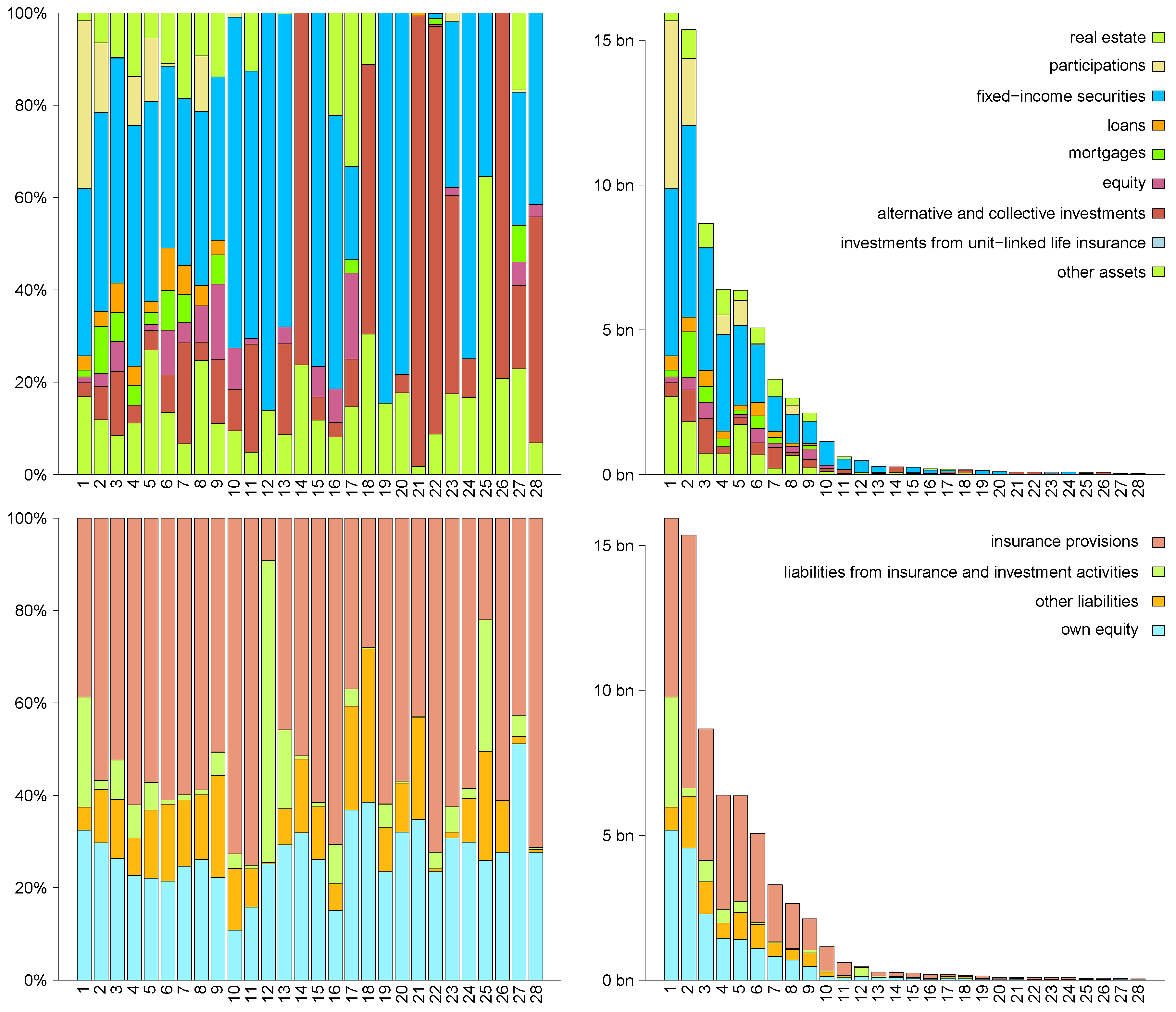

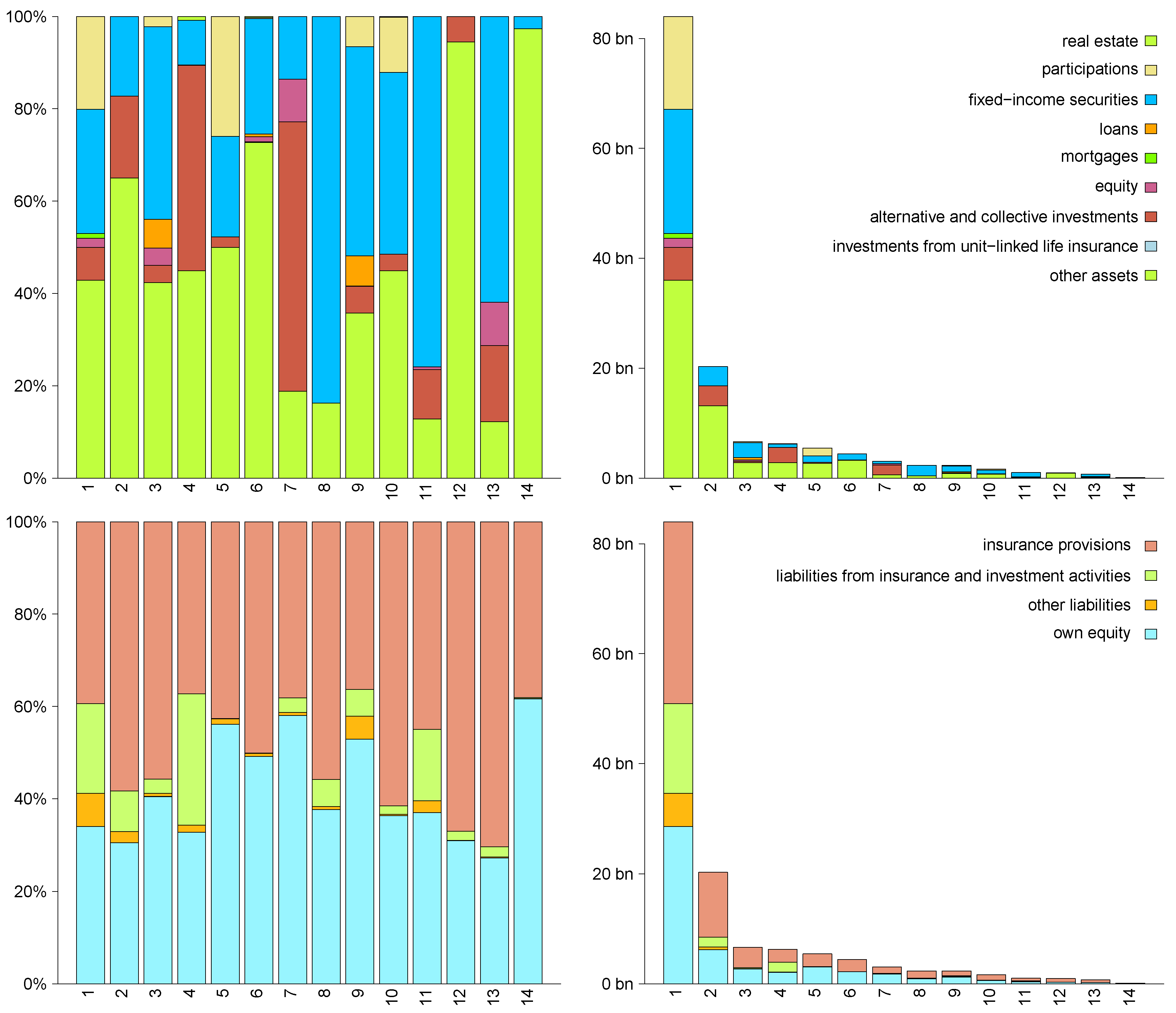

. Observe that these insurers do not have big investments in real estate, see their balance sheets in

Figure A5. Some reinsurers benefit from the scenario due to the increase in risk-free rates.

Conclusion. The real estate market crash defined above has a severe impact on the life insurance sector of the CHF insurance market. Especially the large companies are highly affected by the scenario, the life insurers’ weighted average of impact ratios is . Assuming a weighted average of solvency ratios of , we conclude that the life insurance market as a whole may not bear a real estate market crash in its current state. The analysis of this stress scenario illustrates that the real estate exposure of (large) life insurers poses a severe danger to the continuous functionality of the life insurance industry.

From a macroprudential point of view a real estate market crash has a severe impact on the general insurance market as well, with a weighted average of impact ratios given by . However, the weighted average of solvency ratios for general insurers is sufficiently high in order to appropriately absorb the losses resulting from the scenario.

The impact on health insurers and reinsurers is less pronounced. Additionally, their respective weighted averages of solvency ratios are sufficiently high in order to bear the consequences of a real estate market crash.

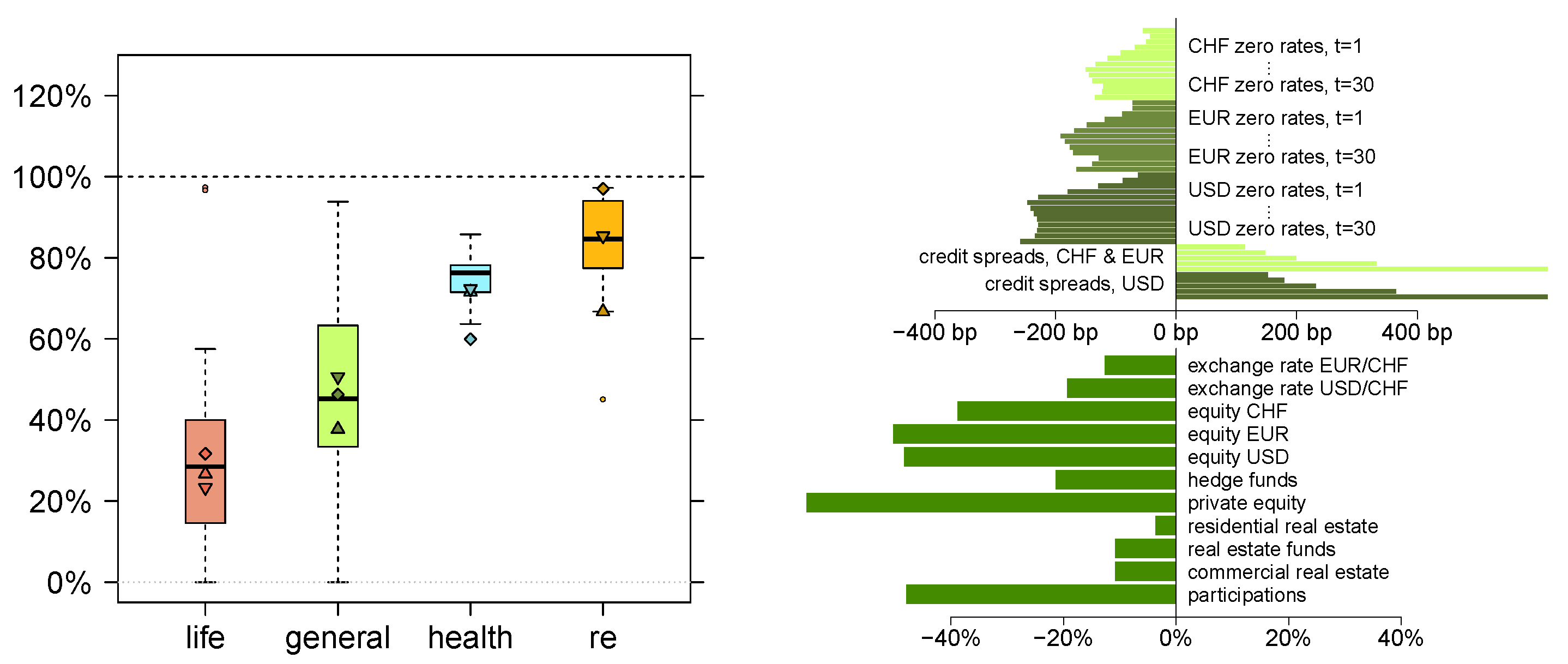

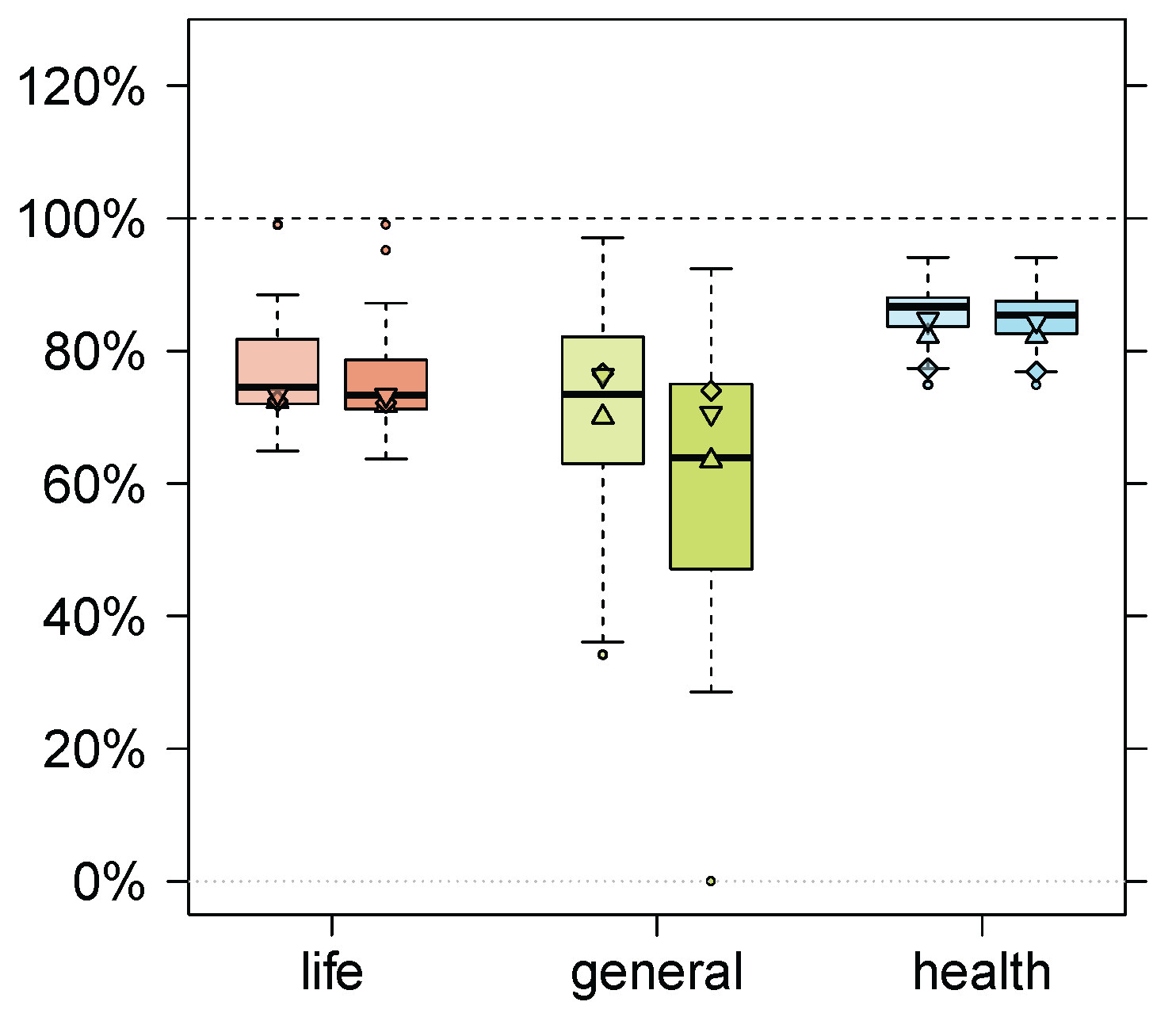

Financial crisis as of 2007/2008. We consider a scenario where the market risk factors are stressed according to the financial crisis of 2007/2008. The changes in the risk factors corresponding to this crisis are provided by FINMA [

37] and illustrated in

Figure 8 (rhs). Credit spreads increase, all other risk factors are negatively shocked. The resulting impact ratios are summarized in

Figure 8 (lhs).

The median impact ratio is for life insurers, while three companies face losses larger than their respective risk capacity. For each of these three companies, more than of insurance provisions correspond to reserves in endowment insurance which, in all three cases, increase by roughly due to the decline in risk-free rates. The increase in credit spreads dampen the corresponding gains on the asset side, which finally results in negative own equity for all three insurers. Similar effects hold for the other life insurers, but to a less extent. The two life insurers feeling nearly no impact mainly have insurance provisions for unit-linked life insurance.

The median impact ratio is for general insurers. Three insurers face losses larger than their respective risk bearing capital. For one of these three insurers this is due to the devaluation of holdings in collective investments, which represent of the insurer’s asset side. The other two insurers, as well as a further insurer having an impact ratio of , mainly have insurance provisions for (annuities in) accident insurance.

The impact on health insurers is comparably low. However, especially the large companies are highly affected. Generally, health insurers face losses mainly because of their investments in the equity market. The impact on reinsurers is comparably low as well. The loss of the largest reinsurer results from its participations. The outlier having an impact ratio of particularly suffers losses related to its investments in the equity market and holdings in alternative investments.

Conclusion. A financial crisis as of 2007/2008 has a severe impact on most life insurers of the CHF insurance market; the weighted average of impact ratios is for life insurers. Assuming a weighted average of solvency ratios of , such a crisis would highly disrupt the continuous functionality of the life insurance industry. We conclude that the life insurance industry in its current state would not survive a financial crisis of size 2007/2008. Of course, we may argue that this scenario is unlikely to happen twice in 10 years. In particular, the current low interest environment does not support another massive decline in the interest rates.

The general insurance market is hit to a less extent. The scenario results in a weighted average of impact ratios of . However, assuming a weighted average of solvency ratios of , we conclude that a financial crisis of size 2007/2008 is a severe danger to the continuous functionality of the general insurance market.

The impact on health insurers is less pronounced. Although the large insurers are hit particularly by the scenario, the weighted average of solvency ratios for health insurers is sufficiently high in order to appropriately absorb the consequences of a financial crisis as of 2007/2008. This conclusion also holds true for the reinsurance market.

Stock market crash as of 2000/2001. We consider a scenario where the market risk factors are stressed according to the stock market crash of 2000/2001. The changes in the risk factors corresponding to this crash are provided by FINMA [

37] and illustrated in

Figure 9 (rhs). Note that these changes are similar to the ones corresponding to the financial crisis 2007/2008, see

Figure 8 (rhs), but less extreme. Therefore, the losses on the asset side are smaller compared to the previous scenario. The impact ratios in turn look more comforting, see

Figure 9 (lhs).

Note that this historical scenario is also similar to the fall of the equity market scenario in

Figure 6 (rhs). This supports the choice of the covariance matrix (provided by FINMA) to evaluate Lemma 1, as well as the design of our scenarios.

Conclusion. We observe that the scenario impacts the CHF insurance market similarly to the fall of the equity market scenario, see

Figure 6. However, compared to the latter scenario, the life insurance market is hit considerably less extreme (which is due to the rather small changes in credit spreads). We therefore conclude that the CHF insurance market is able to absorb a stock market crash as of 2000/2001 in an adequate way.

5.2. Real Estate Market Crash Together with Cascade Effects

We revisit the real estate market crash scenario from

Figure 7. Given both the stressed market situation and the increase in risk-free rates, we additionally consider a cascading increase in lapse rate of 20 percentage points as well as a cascading decline in new business of

in life insurance and of

in non-life insurance. This first cascade effect implies a further cascade effect. This second cascade effect originates from the sale of assets by life insurers in order to raise the surrender values given by (2). We assume that asset prices are stressed so that they can only be sold at a price which is

of the corresponding value in the balance sheet. Moreover, we assume that each insurer raises the surrender values by selling fixed-income securities with currency CHF. The proportion of assets sold having maturity

and credit rating

is according to market liquidity. More precisely, the relative amount of sold fixed-income securities with currency CHF, maturity

and credit rating

is given by

(with a small modification if a company has not sufficiently many holdings in these assets). Here,

denotes the total market capitalization of fixed-income securities with currency CHF.

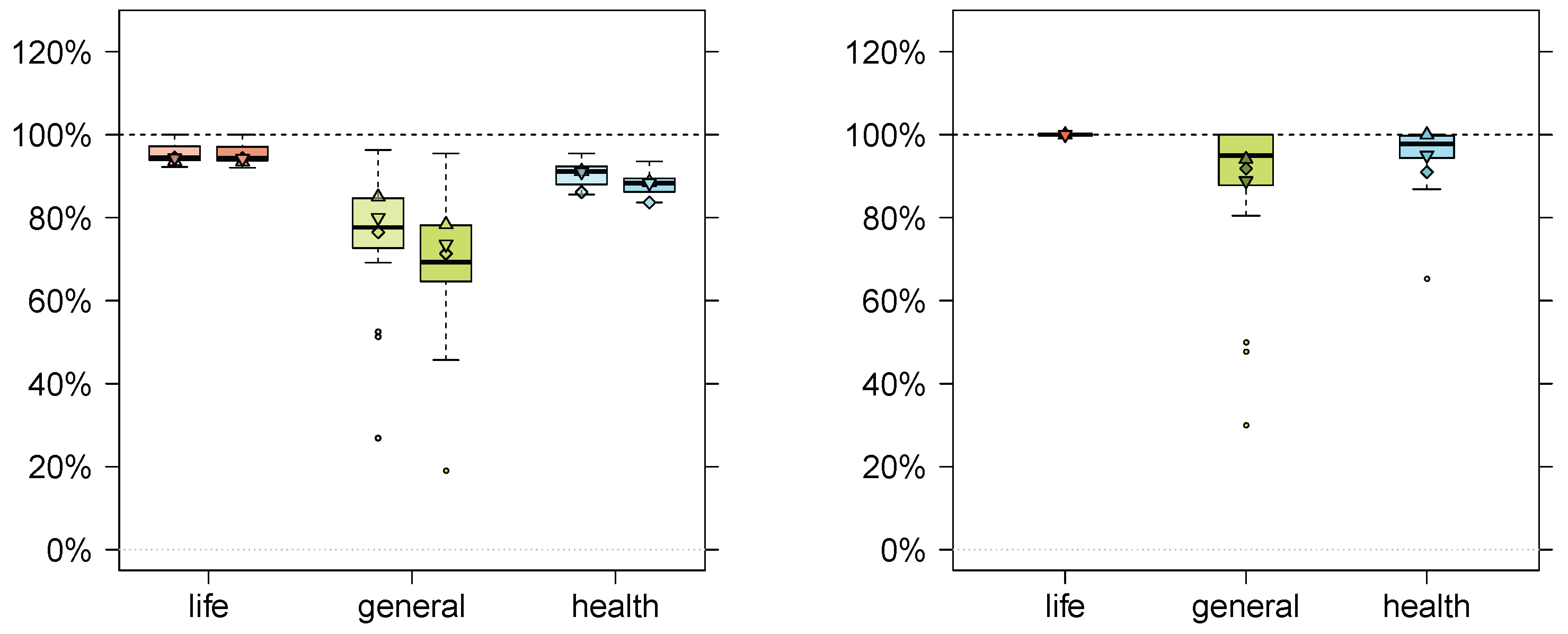

Figure 10 (lhs) illustrates the resulting impact ratios for primary insurers.

Figure 10 (rhs) shows the changes in the market risk factors in

Table 3 implied by the sale of assets (

second cascade effect). The changes caused by the price impact are colored green and the changes caused by market dependencies are colored orange.

The cascading surrenders and the cascading decline in new business (first cascade effect) do not substantially change the median impact ratio of (given by the real estate market scenario) for life insurers. The aggregated surrender value in endowment insurance amounts to (median value) of the corresponding insurance provisions. Despite the increase in risk-free rates of the base scenario, this is a peculiarity of the present low interest rate environment. To raise the surrender values, billion CHF are liquidated by selling fixed-income securities with currency CHF. This corresponds to roughly of the total market capitalization. The market impact caused by the sale of assets (second cascade effect) implies that some assets gain in value and in turn affect the impact ratios of most life insurers positively. The median impact ratio finally is , i.e., we observe an easing of the scenario.

For general insurers, considering the cascading decline in new business and the cascading increase in lapse rates in addition (first cascade effect), the median impact ratio drops to . However, due to the sale of assets by life insurers and the resulting changes in market risk factors (second cascade effect), the impact ratios of most general insurers increase again.

Similarly for health insurers, however, the cascading impact is less pronounced due to their higher risk margins, see their balance sheets in

Figure A4. The median impact ratio for these insurers is

.

Conclusion. The two cascade effects positively influence the solvency results of most life insurers of the CHF insurance market. Especially the market impact (

second cascade effect) improves the impact ratios. The resulting weighted average of impact ratios is

for life insurers. Recall from

Section 5.1 that the real estate market crash without cascade effects results in a weighted average of

. The cascade effects therefore significantly dampen the impact of a real estate market crash in our model. This is a peculiarity of the present low interest rate environment and should not be generalized to other market environments.

The market impact triggered by the sale of assets by life insurers (second cascade effect) positively affect the solvency results of most general and health insurers. In particular, despite the losses from the decline in new business (first cascade effect), the two cascade effects dampen the impact of a real estate market crash on the general and health insurance sector of the CHF insurance market.

5.3. Failure of Reinsurers in a Stressed Market Situation

In this section we analyze the consequences for the CHF insurance market of a cascading failure of reinsurers, given a disruption of the financial market. We consider the fall of the equity market scenario given in

Figure 6 (rhs) as a base scenario. Because of the stressed market situation, we assume that not every reinsurer is able to meet its obligations. As cascade effect we think of the

global reinsurer introduced in

Section 4 can only cover

of the total reinsured liabilities

of each company

i. We model the loss faced by primary insurer

i by

where

models the costs for buying new reinsurance coverages, which we assume to be available on the global reinsurance market. We also assume that there are no other open claims against reinsurers on the asset side of each insurer’s balance sheet.

Figure 11 recalls the impact ratios for the fall of the equity market, see also

Figure 6 (lhs), and additionally presents the impact ratios after the cascade effect.

The reinsured liabilities only amount to of the gross liabilities on average for life insurers. Therefore, the additional impact caused by the cascading failure of reinsurers is rater low. The median impact ratio drops by roughly one percentage point to for life insurers.

When considering the cascading failure of reinsurers additionally, the median of impact ratios drops from to for general insurers. These insurers of the CHF insurance market reinsure of gross liabilities on average. However, there are two insurers with reinsured liabilities that amount to and of gross liabilities, respectively. Their impact ratios of and , respectively, given by the base scenario drop to each because of the cascade effect.

Similarly to life insurers, the additional impact from the cascade effect is low for health insurers. This is due to the fact that reinsured liabilities only amount to of gross liabilities on average for the health insurers of the CHF insurance market.

Conclusion. This stress scenario illustrates that the failure of reinsurers does not impact the life and health insurance market to a great extent. In particular for the life insurance sector of the CHF insurance market, the cascading failure of reinsurers does not remarkably amplify the threatening impact of a fall of the equity market.

Many general insurers face significant losses caused by the cascading failure of reinsurers. The weighted average of impact ratios is for general insurers. However, assuming a weighted average of solvency ratios of , we conclude that a fall of the equity market combined with the cascading failure of reinsurers may still be absorbed by the general insurance industry. This stress scenario in particular illustrates to what extent a cascading failure of reinsurers amplifies the initial impact on the general insurance sector caused by a disruption of the financial market.

5.4. Longevity and Underreserving

In this section we analyze the impact on direct insurers when mortality rates are decreased and when insurance provisions for non-life insurance additionally have to be increased. A joint reserve strengthening may be motivated by changes in legislation. Furthermore, we assume that this reserve strengthening cascades a decline in new business. This might be motivated by mistrust in insurance companies or by an increase in price levels of premiums as a consequence of the reserve strengthening.

In the following we assume that the mortality rates

are changed according to (1) with

and with

for

and

, see also [

38]. Therefore, the insurance provisions of a company are revalued by using the new mortality rates given by

for

and

, and

, else. This change in mortality rates has comparable size to the longevity scenario considered for solvency requirements in the SST, see [

39]. Additionally, we increase the insurance provisions in non-life insurance by

for each company. As a cascade effect we consider a decline in new business of

in all lines of business.

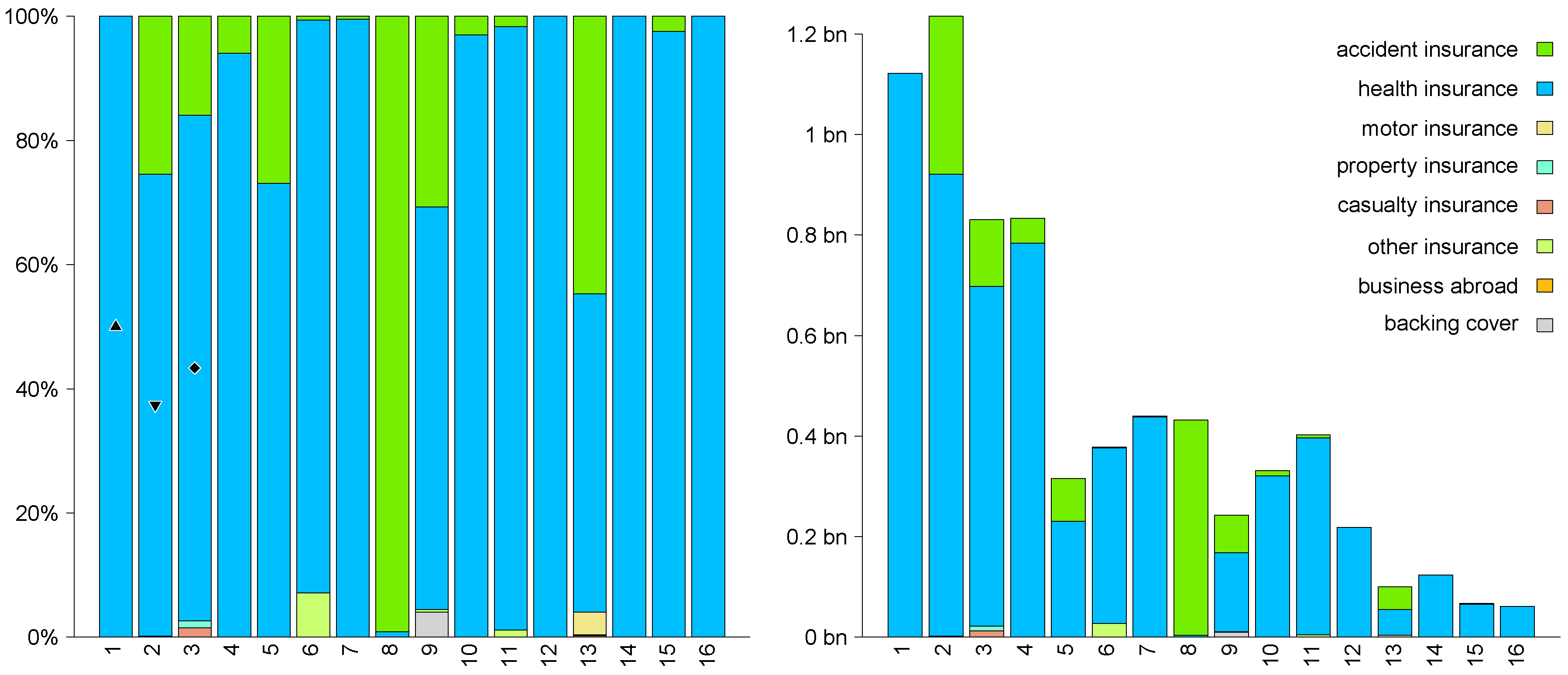

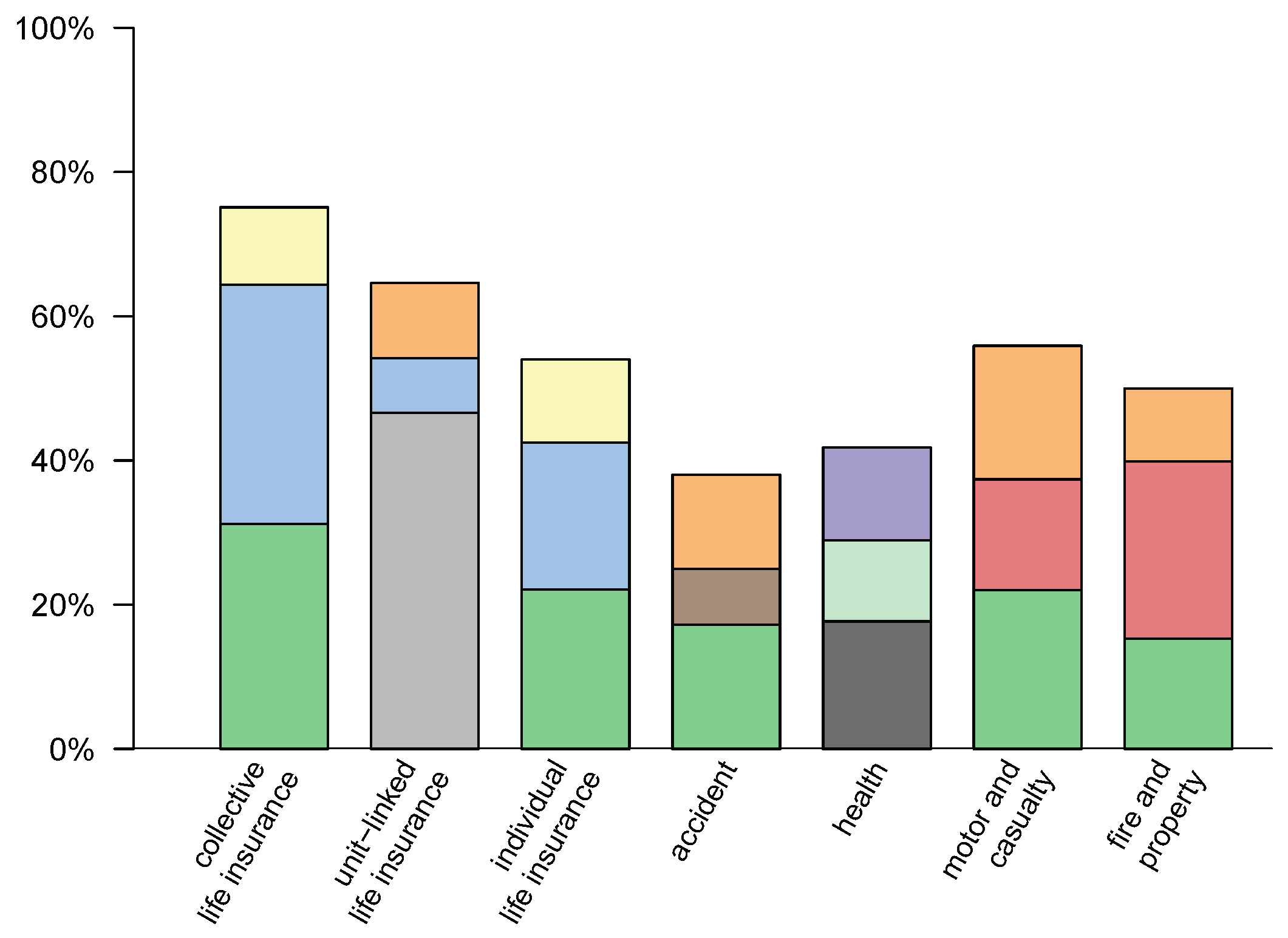

Figure 12 (lhs) illustrates the resulting impact ratios for primary insurers. The left plots only considers the decline in mortality rates and the reserve strengthening. The right plots additionally consider the cascading decline in new business.

For life insurers, the median of impact ratios is for the scenario considering only the decline in mortality rates. The impact of the cascading decline in new business is small. This is because the earned premium in new business is typically low compared to the total earned premium.

For general insurers, the median impact ratio is when considering the reserve strengthening and the decrease in mortality rates only. The lowest three impact ratios in general insurance belong to firms which considerably have insurance provisions for annuities in accident insurance. Hence, they face losses also because of the decrease in mortality rates. Considering the decline in new business as cascade effect, the median impact ratio drops to .

Similarly for health insurers, however, the impact is less pronounced due to their higher risk margins, see their balance sheets in

Figure A4. The median impact ratio for these insurers is

.

Conclusion. The life insurers of the CHF insurance market are able to absorb a reserve strengthening caused by a decrease in mortality rates in an appropriate way. The cascading decline in new business has a low additional impact on these insurers.

The reserve strengthening combined with the cascading decline in new business has a significant impact on most general insurers. However, we conclude that from a macroprudential point of view the general insurance market is able to absorb the reserve strengthening and its cascade effect in an adequate way. This is supported by the high solvency ratios of the general insurers.

The impacts of the reserve strengthening and the cascading decline in new business are less extreme for health insurers because of their high capital buffers.

5.5. Terrorist Attack

We consider an event that is motivated by a possible terrorist attack in Switzerland, for example, at Zurich central railway station with roughly 450,000 travelers a day, see [

40]. The attack together with the chaotic and disastrous situation results in many deaths as well as injured and disabled people.

We assume that 500 people die, 500 get fully disabled and 2,500 people additionally get injured. of the deaths leave a spouse behind, to which a yearly widow annuity of 32,000 CHF is paid on average. Female spouses are aged 38, while male spouses are aged 42. Moreover, every spouse has children on average, each of these children is aged 16 and receives a yearly orphan’s pension of 12,000 CHF on average. Each disabled person is aged 40 and receives a yearly disability annuity of 64,000 CHF on average. Moreover, we assume that the nominal value of all types of annuities above is increased by every year. Additionally, each injured person costs the corresponding insurance company 20,000 CHF. The resulting costs are then carried by general and health insurers proportional to their market shares in accident insurance, based on earned premiums. Finally, we consider a property damage of 600 million CHF (net of reinsurance) that is covered by these insurers proportional to their market shares in property and casualty insurance. Note that some of the affected people may have life insurance and there might be claims arising from interruption of business, which is not considered for this scenario. Additionally, we assume that the shock at the financial market evaporates quickly with no sustainable effect. Therefore, the total market capitalizations of assets are not affected by this scenario.

This scenario is comparable in size to a similarly motivated catastrophic event considered by the Swiss Federal Office for population protection, see [

41]. The total costs of the scenario above amount to

billion CHF.

Figure 12 (rhs) illustrates the impact ratios for primary insurers. By assumption there is no impact on life insurers. The median impact ratio restricted to those general insurers facing a loss is

. The three outliers with impact ratios

,

and

, respectively, have a combined market share in accident insurance of less than

.

For health insurers, the median impact ratio is when considering only those insurers facing a loss. The lowest impact ratio of belongs to the health insurer with the highest market share in accident insurance () among all health insurers.

Conclusion. The impact of the event described above does not disrupt the CHF insurance market to a great extent. The analysis illustrates that for the absorption of such an impact, the CHF insurance market has a sufficiently low market concentration and its companies have sufficiently high capital buffers. Recall that this is under the assumption that there is no sustainable disruption of the financial market and the economy.